1. Introduction

Currently, the sustainable development capability of enterprises [

1] has emerged as a crucial criterion for assessing their core competitiveness and long-term value creation within the global economic system. Confronted with the escalating challenges of climate change, resource limitations, and evolving social responsibility demands [

2], how enterprises should attain a dynamic equilibrium between profitability and financial sustainability [

3] has become a subject of extensive academic and practical investigation. Sustainable development capability indicates not only the financial stability of enterprises [

4] but also their overall performance across environmental, social, and governance (ESG) dimensions. Nevertheless, external investors’ evaluations of sustainable development often depend on information disclosure [

5], and the linguistic features of managerial communication during information transmission [

6], particularly the tone employed by executives [

7], are increasingly recognized as significant indicators influencing the capital market and the sustainable performance of enterprises.

In the practice of information disclosure, as a “non-financial information signal” [

8], executives’ tone carries management’s attitudes and tendencies toward enterprises’ prospects. Tone Manipulation not only affects the market’s perception of enterprises’ risks and prospects [

9] but also is closely related to outcomes such as investor confidence, stock liquidity, and financing costs [

10,

11]. It refers to the practice where corporate executives, when presenting annual reports, Management Discussion and Analysis (MD&A), or other public information, carefully select words and expression methods to shape the tone of the textual content. They increase the use of positive and optimistic vocabulary while reducing the use of pessimistic and negative vocabulary, thereby enhancing the overall optimism of the textual information. However, the subjectivity of tone information makes it easy for it to become a tool for “manipulation impression manipulation” [

12]. When executives use positive tone to exaggerate enterprise performance and downplay potential risks, it constitutes “executives’ tone manipulation.” This behavior may maintain the enterprise’s reputation and stock price stability in the short term [

13]; however, in the long term, it creates information distortion, inefficient resource allocation, and a decline in enterprises’ sustainable development capability.

Currently, because the “dual carbon goals” and ESG have become global mainstream [

14], enterprises are facing unprecedented pressure for sustainable transformation. Simultaneously, the capital market relies heavily on management textual communication to evaluate an enterprise’s long-term value. Therefore, the “authenticity” and “transparency” of management’s tone have become key factors affecting investment decisions and enterprises’ sustainable development. However, the academic community lacks systematic evidence on the long-term relationship between executives’ tone manipulation and enterprises’ sustainable development capability [

15]. Existing studies focus mainly on the impact of tone on short-term market reactions, earnings management, or enterprise reputation [

16], while ignoring the in-depth economic consequences of tone manipulation on sustainable development performance.

Furthermore, although existing literature acknowledges the significant role of corporate governance mechanisms in restricting management behavior, there remains a paucity of systematic analysis concerning how various governance elements—such as the quality of corporate social responsibility information disclosure, the shareholding ratio of institutional investors, and board independence—collectively influence the outcomes of tone manipulation [

17]. Current studies typically focus solely on the role of individual governance variables and fail to elucidate the interconnected effects of multi-dimensional governance mechanisms. Particularly within the Chinese context, the unique characteristics of the institutional environment and regulatory system confer substantial localized research value on the mechanisms linking corporate governance, tone manipulation, and sustainable corporate development.

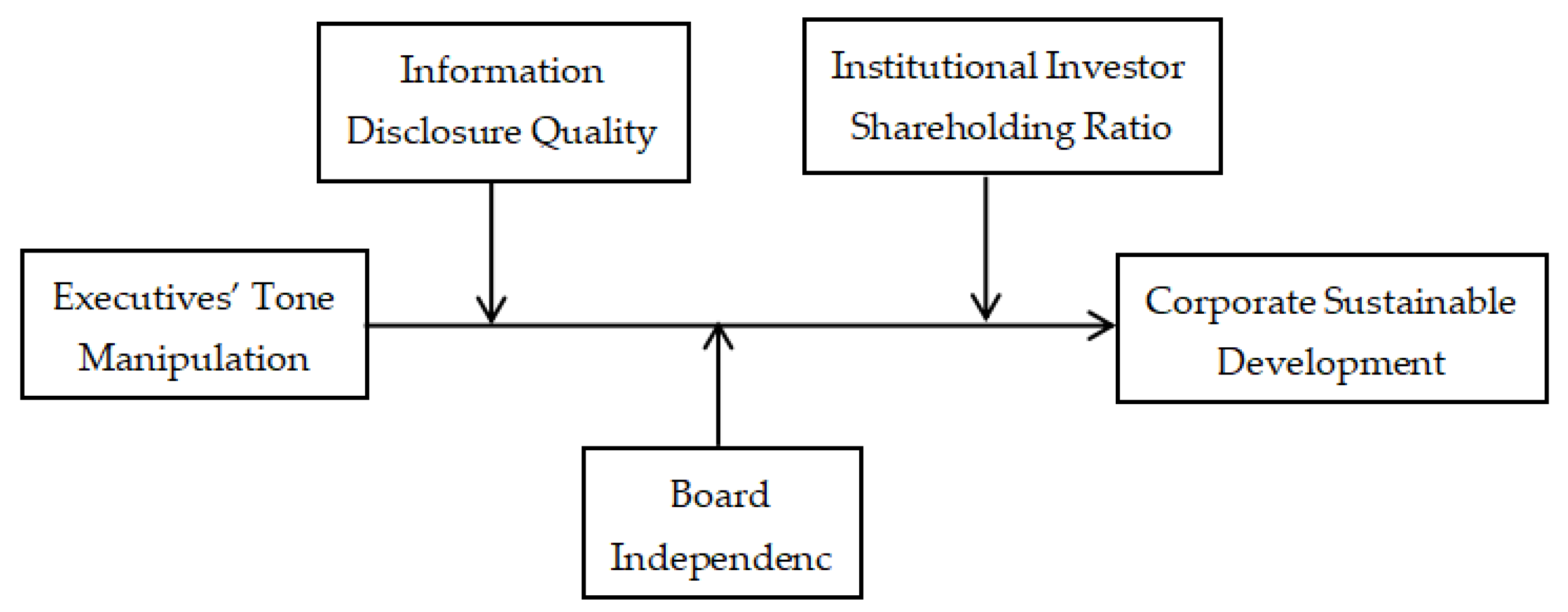

Therefore, this study focuses on the core question of “whether executives’ tone manipulation weakens enterprises’ sustainable development capability,” and explores whether three types of corporate governance factors—information disclosure quality, institutional investor shareholding ratio, and board independence—can mitigate the negative impact of tone manipulation. This study has three research objectives: first, to systematically identify the relationship between executives’ tone manipulation and enterprises’ sustainable development capabilities; second, to reveal how internal and external supervision mechanisms regulate this relationship from the perspective of corporate governance; and third, to provide empirical evidence and policy suggestions for enterprises’ information disclosure governance and sustainable development strategies.

It is important to clarify that existing research on sustainability exhibits significant differences in conceptual definition. Some studies conceptualize corporate sustainability as a broad-based performance encompassing environmental, social, and governance (ESG) dimensions, while others focus on a firm’s ability to maintain stable growth under financial policy constraints—namely, financial sustainability. Given that this study employs the sustainable growth rate as the dependent variable, an indicator rooted in financial metrics, it explicitly centers on financial sustainability rather than ESG-based comprehensive sustainability. This research differs from ESG-oriented sustainability studies both in theoretical foundations and measurement approaches. For instance, Sustainability Uncertainty and Supply Chain Financing: A Perspective Based on Divergent ESG Evaluations in China (Systems, 2025) [

18] regards ESG as the core indicator of sustainability. In contrast to the ESG perspective, therefore, this paper focuses on exploring how executive tone manipulation affects firms’ endogenous growth capacity and financial resilience, rather than sustainability performance in environmental or social dimensions.

To achieve these objectives, this study considers Chinese A-share listed companies from 2014 to 2023 as the sample and uses text analysis technology to quantify the degree of executives’ tone manipulation. It identifies positive and negative emotions in Management Discussion and Analysis (MD&A) and earnings conference call texts using the sentiment dictionary method to construct indicators and measure enterprises’ sustainable development capability through the sustainable growth rate. Based on multiple regression and interaction term models, it empirically tests the impact of executives’ tone manipulation on enterprises’ sustainable development capability and analyzes the moderating effects of information disclosure quality, institutional investor shareholding ratio, and board independence.

The research innovations of this study are mainly reflected in two aspects. First, while existing studies have predominantly focused on the relationship between executive tone and firms’ short-term market reactions or financial performance [

19,

20], research on the link between tone manipulation and corporate financial sustainability remains relatively scarce. Rather than deviating from the financial performance framework, this study further examines the association between executive linguistic bias and firms’ long-term endogenous growth capacity from the perspective of the sustainable growth rate. Although this perspective is not entirely novel, it has rarely been systematically discussed in tone-related research, thus providing a valuable supplement to understanding the long-term economic consequences of linguistic information.

Second, unlike previous studies that mainly explored the direct relationship between tone and performance [

21], this paper further investigates the moderating role of governance factors. By incorporating board independence, institutional investor ownership ratio, and the quality of corporate social responsibility information disclosure into the analytical framework, this study constructs an analytical path of “linguistic bias—governance constraints—financial sustainability.” This framework does not propose an entirely new theoretical model but rather represents an integrative extension of existing tone research and corporate governance literature, illustrating how governance mechanisms influence the economic consequences of linguistic information.

In addition, unlike studies that measure sustainability based on ESG performance, the definition of sustainability in this paper is rooted in the logic of financial growth, thus falling within the research framework of financial sustainability. This conceptual delineation avoids inconsistencies between indicators and concepts and also highlights the research value of examining executive tone behavior from the perspective of financial sustainability.

This study not only theoretically expands the research boundary between executives’ tone and corporate sustainable development but also provides a new basis for decision-making for regulatory authorities, investors, and corporate managers. The research concludes that linguistic information, as an important “soft constraint” of corporate governance, is directly related to enterprises’ long-term financial sustainability; and a sound corporate governance mechanism prevents tone manipulation, improves information transparency, and promotes sustainable development. This study deepens the understanding of the “language—governance—sustainable performance” mechanism through empirical evidence and provides a new direction for future research in the fields of sustainable finance and ESG.

Existing research on executive tone has mostly focused on its impact on investor behavior or short-term market reactions, yet systematic evidence regarding whether it affects firms’ long-term financial sustainability remains scarce. Meanwhile, the question of whether information manipulation is constrained by governance mechanisms has not been sufficiently examined. Therefore, this study attempts to address the following research questions:

(1) Does executive tone manipulation affect corporate financial sustainability? (2) What moderating roles do different corporate governance mechanisms play in this relationship? (3) Is the association between executive tone and firms’ long-term development robust?

To address these questions, this paper constructs a tone manipulation index based on the Management Discussion and Analysis (MD&A) text and conducts empirical analysis incorporating governance mechanisms. To avoid conceptual confusion, this study strictly distinguishes between “sustainability”, “social sustainability”, and “financial sustainability”. Specifically, social sustainability is typically associated with external indicators such as ESG (Environmental, Social, and Governance), corporate social responsibility, and environmental governance. In contrast, the sustainable growth rate adopted in this paper only measures the maximum growth level that a firm can achieve under established financial policies, thus falling within the scope of financial sustainability. Given this, this study does not claim to reveal firms’ sustainable performance in ESG or social dimensions. Instead, it focuses on the impact of tone manipulation on financial resilience, so as to ensure conceptual consistency and the accuracy of research delineation.

The differences from previous studies are as follows: first, most prior research focuses on short-term reactions, whereas this study emphasizes long-term financial sustainability; second, few previous studies have discussed governance-related moderating effects, while this study examines the interactive effects of governance mechanisms; third, existing literature predominantly uses ESG to measure sustainability, whereas this study adopts financial sustainability as the core indicator.

The remainder of this paper is organized as follows:

Section 1 presents the introduction;

Section 2 reviews the relevant literature;

Section 3 provides the theoretical background and hypothesis development;

Section 4 describes the research methodology and design;

Section 5 reports the empirical results; and

Section 6 offers discussion and conclusions.

4. Research Methodology and Design

4.1. Sample Selection and Data Sources

This study adopts a quantitative research approach and conducts empirical tests based on large-sample textual data and panel data models. This study uses Chinese A-share listed companies from 2014 to 2023 as the research sample. This study selects the period from 2014 to 2023 as the sample period based on the following considerations: Starting from 2014, the textual structure of the Management Discussion and Analysis (MD&A) section in listed companies’ annual reports has become increasingly standardized, laying a comparable foundation for textual analysis; corporate social responsibility reports have become significantly more prevalent during the same period, leading to a substantial improvement in the consistency and accessibility of social responsibility disclosure data; data on institutional investor ownership has also gradually improved since 2014; in addition, regulatory authorities have continuously strengthened requirements for information disclosure and corporate governance thereafter, providing a stable institutional environment for conducting research on executive tone manipulation [

72,

73]. Prior to 2014, relevant report data were not only outdated but also lacked sufficient standardization and comparability, making them inadequate to meet the data quality requirements of this study.

The sample scope encompasses non-financial and non-real estate enterprises listed on the Shanghai and Shenzhen stock markets, thereby minimizing the impact of industry-specific regulatory differences and asset structure characteristics on the research results. A-share listed companies are representative in terms of corporate governance structure, information disclosure mechanisms, and market reactions. Therefore, they can comprehensively reflect the linguistic characteristics and economic consequences of Chinese enterprises in different governance contexts.

To ensure the completeness and reliability of the data, this study retains only company data that continuously disclose annual reports during the sample period and whose MD&A text information is available. The relevant data are mainly from the CSMAR database and listed company announcement documents, which have high authority and consistency in empirical research.

Moreover, the sample selection of this study fully considers the institutional background and development stage of China’s capital markets. In recent years, the continuous improvement in corporate governance and information disclosure systems has increased the research value of nonfinancial information (e.g., tone and textual expression) in the capital market. Management tone in information disclosure is an important means for enterprises to transmit signals, which not only affect investor expectations and market trust but also reflect their strategic orientation and sustainable development capability to a certain extent. Therefore, selecting A-share listed companies in this time range as the research sample helps reveal the economic and practical significance of executives’ tone manipulation in the context of corporate governance and sustainable development.

To ensure the reproducibility of the study, the data processing procedures are detailed as follows:

MD&A Text Collection: Python 3.9.7 (Requests + BeautifulSoup) was used to crawl PDF/HTML files of listed companies’ annual reports, from which the MD&A sections were extracted.

Text Preprocessing: This included removing HTML tags, deleting punctuation marks, unifying encoding formats, word segmentation, removing stop words, and eliminating “templated statements” (e.g., standardized risk warnings) to reduce noise.

Calculation of Tone Index (TONE): Based on the Loughran–McDonald financial sentiment dictionary, the ratio of positive words to negative words was calculated to obtain the tone index. Tone manipulation was measured by the abnormal component of TONE.

Acquisition of Governance Variables: Data on social responsibility disclosure quality, institutional investor ownership ratio, and board independence were obtained from CSMAR, CNINFO, and companies’ social responsibility reports.

Sample Screening: Stata 16, developed by StataCorp LLC in Austin, TX, USA, was used for software operations. Observations of ST, *ST, PT companies, delisted companies, and those with missing key variables were excluded.

Outlier Handling: All continuous variables were winsorized at the 1% level to mitigate the impact of extreme values on regression results.

A final sample of 18,053 valid observations was obtained, which is sufficient to support large-sample panel data analysis. The data collection, variable construction, and preprocessing procedures of this study have been explicitly disclosed to ensure research reproducibility and methodological transparency.

4.2. Variable Definitions

4.2.1. Independent Variable

Executives’ tone manipulation [

74] refers to enterprise executives’ deliberate selection of words and expressions when stating annual reports, MD&A, or other public information to render the tone of the text, increase the use of positive words, and reduce the use of pessimistic words, thereby improving the overall optimism of text information. The annual report tone based on the LM dictionary is crawled from the official website of the Shanghai Stock Exchange using Python 3.9.7: Tone = (number of positive words−number of negative words)/(number of positive words + number of negative words) [

41]. Compared with traditional qualitative analysis methods, text analysis offers higher automation and stronger processing capabilities, making it particularly suitable for analyzing large-scale data. This enables us to efficiently analyze the tone characteristics of the annual reports and MD&A sections of hundreds of listed companies in the A-share market [

75], overcoming the time and resource constraints of traditional manual analysis.

4.2.2. Dependent Variable

The corporate sustainable development indicator is constructed according to the Van Horne sustainable development static model to measure the sustainable capabilities of listed companies. Corporate sustainable development [

76] = net profit margin on sales × retention ratio × (1 + debt-to-equity ratio)/(1/total asset turnover − net profit margin on sales × retention ratio × (1 + debt-to-equity ratio)) [

77,

78,

79].

4.2.3. Moderating Variables

Corporate Social Responsibility Information Disclosure Quality [

80]: This study selects 12 aspects from the “Listed Companies’ Social Responsibility Report Basic Information Table” in the Social Responsibility Research Sub-library of the Guotai’an database as the basic standards for measuring the quality of enterprises’ social responsibility information. These 12 standards are assigned scores of 0 or 1. The scores of these 12 standards for each company are then summed and divided by 12 to standardize the value, and the measurement indicator of social responsibility information quality is obtained. The larger the indicator, the higher the quality of social responsibility information disclosure [

81,

82].

Institutional Investor Shareholding Ratio: Drawing on the research of Yang [

83] (2025), to measure institutional investor shareholding ratio, this study selects the indicator of the proportion of tradable A-shares held by overall institutional investors at the end of the year to the total tradable A-shares of the listed company. This indicator includes the shareholding statuses of all types of institutional investors in the sample company during the accounting year. institutional investor shareholding ratio = the number of tradable A-shares held by institutional investors at the end of the year/total tradable A-shares of the company at the end of the year.

Board Independence: It is the proportion of independent directors, that is, the ratio of the number of independent directors to the total number of directors on the board [

84,

85].

4.2.4. Control Variables

To reduce the impact of any other possible variables, the following control variables are selected from different aspects: Enterprise Size [

86] (Size), Cash Holding Level (Cashflow) [

86], Return on Equity (ROE) [

87], Largest Shareholder Shareholding Ratio [

88] (TOP1), Enterprise Age (Age) [

87], and Operating Income Growth Rate [

88] (Growth). The explanations for all variables are shown in

Table 1.

4.3. Model Design

Model (1) is used to test Hypothesis 1. If β

1 is less than 0 and significant, executives’ tone manipulation has a negative impact on corporate sustainable development; that is, Hypothesis 1 is supported.

To verify the moderating effects of CSR information disclosure quality, the institutional investor shareholding ratio, and board independence, Models (2)–(4) are constructed.

In Model (2), if β3 is significantly positive, CSR information disclosure quality weakens the negative impact of executives’ tone manipulation on corporate sustainable development; that is, Hypothesis 2 holds. Models (3) and (4) are consistent with Model (2). Among them, SGR stands for corporate sustainable development, TONE for executives’ tone manipulation, CSR for CSR information disclosure quality, INST for institutional investor shareholding ratio, Indep for board independence, Control represents control variables, t is the year, and ε is the random error term.

Figure 1 is the schematic theoretical model.

5. Empirical Analysis Results

5.1. Descriptive Statistical Analysis

Table 2 presents the descriptive statistical results for the main variables in this study, including indicators such as the number of observations, mean, standard deviation, minimum value, median, and maximum value.

The mean value of executives’ tone manipulation is 0.365, with a standard deviation of 0.099, indicating that the degree of executives’ use of a positive tone in information disclosure is relatively moderate and that there are certain differences among the sample enterprises. The minimum value is 0.065, and the maximum value is 0.585, with a wide range of extreme values, indicating that the executives’ tone of some enterprises is relatively negative, whereas a few enterprises use a relatively positive tone. The median is 0.371, which is close to the mean, indicating that executives’ tone manipulation in most enterprises is at a relatively neutral level. The distribution of this variable is slightly skewed, indicating that there are notable differences in linguistic manipulation among executives across enterprises. However, most enterprises remain in a relatively conservative range of tone use.

The mean value of the corporate sustainable growth rate is 0.212 with a standard deviation of 0.154, minimum value of −0.332, and maximum value of 2.363. This indicates that the sustainable growth capability of some enterprises in the sample is low, with certain negative values; however, the sustainable growth rate of most enterprises is in the positive range. The median is 0.185, which is close to the mean, indicating that most enterprises in the sample maintain a positive sustainable growth capability; however, the sustainable development capability of some enterprises fluctuates significantly.

The mean value of CSR information disclosure quality is 0.502, with a standard deviation of 0.216, minimum value of 0, and maximum value of 0.833, indicating significant differences in the quality of CSR information disclosure among the sample enterprises. Some enterprises disclose almost no CSR information, whereas a few have a high degree of disclosure. The median is 0.583, close to the mean, indicating that most enterprises’ CSR disclosures are relatively moderate. P25 is 0.333 and P75 is 0.750, showing that there are obvious differences in the quality of CSR information disclosure among some enterprises.

The mean value of the institutional investor shareholding ratio is 44.487, with a standard deviation of 23.276, minimum value of 0.461, and maximum value of 90.979, indicating significant differences in institutional investor shareholding ratios among enterprises. The median is 46.358, close to the mean, indicating that most enterprises’ institutional investor shareholding ratios are relatively concentrated. P25 is 23.032, and P75 is 65.358, indicating that the institutional investor shareholding ratios of most enterprises are concentrated in the low-to-medium range, whereas a few enterprises have a high institutional investor shareholding ratio.

The mean value of board independence is 37.369, with a standard deviation of 5.022, minimum value of 33.330, and maximum value of 57.140, indicating differences in board independence. The board independence of most enterprises is concentrated within a relatively moderate range. The median is 35.710, P25 is 34.200, and P75 is 40.380, indicating that board independence in the sample has a certain concentration and that the board independence of most companies is relatively standardized.

In summary, the descriptive statistics of this study fully show the distribution characteristics of each variable, including the central tendency (mean and median), dispersion (standard deviation and coefficient of variation), and extreme values (minimum and maximum). These statistical characteristics provide a solid basis for subsequent regression analysis and model setting and offer theoretical support for further testing the moderating effect.

5.2. Correlation Analysis

The results of the sample correlation analyses are presented in

Table 3. The data indicate a significant negative correlation between the dependent variable (sustainable development capability) and independent variable (executives’ tone manipulation), with a correlation coefficient of 0.013 (at the 1% significance level). This supports Hypothesis 1 that executives’ tone manipulation (TONE) has a significant negative impact on corporate sustainable development capability (SGR). All variance inflation factor (VIF) values are less than 2, with a mean of 1.1, implying that multicollinearity is negligible for the main results of this study.

5.3. Baseline Regression

The results of the Hausman test show that the

p-value < 0.01. Therefore, this study adopts a fixed-effects model that controls for year and industry effects in the empirical analysis. The results of the baseline regression analyses are presented in

Table 4. In Column (1), without adding control variables, executives’ tone manipulation has a significantly negative impact on corporate sustainable development capability, with a coefficient of −0.050, significant at the 1% level. Column (2) adds the control variables to Column (1), showing that the negative impact of executives’ tone manipulation on corporate sustainable development capability remains significant, with a coefficient of −0.141, significant at the 1% significance level. This indicates that the negative driving effect of executives’ tone manipulation on corporate sustainable development capability is robust and highly consistent with the main regression conclusions, further verifying the research hypothesis and enhancing the reliability and generalizability of the research conclusions.

Compared with the model without control variables, R2 increases from 0.069 to 0.321, indicating that the addition of control variables affects the relationship between the dependent variable (corporate sustainable development capability) and the independent variable (executives’ tone manipulation). Therefore, Hypothesis 1 is again supported.

5.4. Regression Analysis

Moderating effect regression models are constructed to examine whether the moderating variables—board independence, institutional investor shareholding ratio, and CSR information disclosure quality—play moderating roles in the impact of executives’ tone manipulation on sustainable development capability. The regression results in

Table 5 show that the regression coefficient of executives’ tone manipulation is significantly negative.

In Column (1), the interaction term between the quality of CSR information disclosure and executives’ tone manipulation has a significantly positive effect on the dependent variable (sustainable development capability). This indicates that an improvement in the quality of CSR information disclosure strengthens the effect of executives’ tone manipulation on sustainable development capability, thus supporting Hypothesis 2.

In Column (2), the interaction term between institutional investor shareholding ratio and executives’ tone manipulation has a significantly positive impact on the dependent variable. This suggests that an increase in the institutional investor shareholding ratio enhances the effect of executives’ tone manipulation on sustainable development capability, thus supporting Hypothesis 3.

In Column (3), the interaction term between board independence and executives’ tone manipulation has a significantly positive effect on the dependent variable. This implies that an improvement in board independence enhances the effect of executives’ tone manipulation on sustainable development capability, supporting Hypothesis 4.

5.5. Robustness Tests

5.5.1. Excluding Pandemic Years

As shown in

Table 6, to eliminate the interference of the COVID−19 pandemic shock, this study excludes the 2020 sample and conducts regression verification on the remaining samples. From the regression results in Column (1), after excluding the pandemic’s impact, the regression coefficient between executives’ tone manipulation and sustainable development capability is significantly negative, indicating that the result passes the robustness test.

5.5.2. Replacing the Dependent Variable

To test whether the regression results are biased because of the different settings of financial health indicators, this study uses Tobin’s Q to replace the original dependent variable “sustainable development capability” for robustness testing. The corporate sustainable development measures the maximum growth rate an enterprise can achieve without relying on external equity financing and maintaining existing operational efficiency and financial policies, which mainly reflects the enterprise’s endogenous growth capability and financial stability. Tobin’s Q is the ratio of the enterprise’s market value to the replacement cost of assets, reflecting the market’s comprehensive expectations of its future profitability and growth potential, and is a comparative indicator of “market valuation” and “real asset value.”

If the regression results are consistent after replacing the dependent variable, the core conclusions of this study are robust. The results in Column (2) show that tone manipulation by executives has a significantly negative impact on Tobin’s Q, which is significant at the 1% level. This indicates that, even from the perspective of market valuation, executives’ tone manipulation still significantly weakens an enterprise’s sustainable development potential, which is consistent with the previous analysis conclusion based on corporate sustainable development. Regardless of the measurement method adopted, the negative impact of executives’ tone manipulation on corporate sustainable development capability is robustly supported, further verifying the reliability of our conclusions.

5.5.3. 2SLS Test

This study uses a fixed-effects regression model to explore the impact of executives’ tone manipulation on corporate sustainable development capability. However, reverse causality and omitted variables may have affected the accuracy of the results. To address potential endogeneity issues, this study draws on previous research, uses an instrumental variable (lTONE) for tone manipulation and employs the two-stage least squares (2SLS) method for robustness testing.

Table 7 presents the regression results of the 2SLS. In the first-stage regression, the regression coefficient of the instrumental variable lTONE on TONE is 0.665 *** (

t-value = 70.40), indicating a strong positive correlation at the 1% significance level. This indicates that the one-period lagged lTONE, as an instrumental variable, has extremely strong explanatory power for TONE. In the second-stage regression, the regression coefficient of executives’ tone manipulation (TONE) on sustainable development capability (corporate sustainable development) is −0.192 (

t-value = −8.54), which is significantly negative at the 1% significance level. This further verifies the negative inhibitory effect of executives’ tone manipulation on development capability. Additionally, the results of the Durbin-Wu-Hausman (DWH) test show that the Kleibergen-Paap rk LM statistic is 694.976, indicating that the instrumental variable is identifiable. Meanwhile, the Cragg-Donald Wald F statistic and Kleibergen-Paap rk Wald F statistic are 8546.388 and 4955.751, respectively, which are much larger than the critical values of the weak instrumental variable test. This indicates that there is no weak instrumental variable problem with the instrumental variable used in this study. Therefore, the 2SLS estimation results are robust and reliable, further supporting the negative role of executives’ tone manipulation in weakening corporate sustainable development capability.

5.6. Heterogeneity Analysis

Regarding the heterogeneity analysis, the results are presented in

Table 8.

Based on the type of industry, the sample is divided into non-high-tech and high-tech industries. As shown in Columns (1) and (2) of the table, executives’ tone manipulation has a significantly negative impact on sustainable development capability (corporate sustainable development) in both types of industries, and the negative impact is stronger in high-tech industries (the TONE coefficient is −0.195 *** for high-tech industries and −0.100 *** for non-high-tech industries). This result indicates that high-tech industries have higher requirements for information transparency, and that the market is more sensitive to signal transmission. The “disguised” behavior of executives’ tone manipulation is more likely to arouse the market’s doubts about the enterprise’s true sustainable development capability, thereby forming a stronger inhibitory effect on corporate sustainable development. By contrast, the information environment of non-high-tech industries is less sensitive, and the negative impact of tone manipulation is weaker.

According to industry pollution attributes, the sample is divided into heavy-polluting and non-polluting industries. As shown in Columns (3) and (4), executives’ tone manipulation has a significant negative impact on corporate sustainable development in both types. This may be because, regardless of pollution level, executives’ tone manipulation is essentially a “modification” of the enterprise’s true operation and sustainable development status. When the market identifies this “modification,” it will doubt the authenticity of the enterprise’s sustainable development, thereby exerting an inhibitory effect on corporate sustainable development. The negative impact is slightly higher in non-polluting industries (the TONE coefficient is −0.155 *** for non-polluting industries and −0.143 *** for heavily polluting industries). This may be because non-polluting industries face less environmental responsibility pressure in the ESG dimension and are more likely to conduct “image packaging” through tone manipulation. Once the “deceptiveness” of such behavior is exposed, the impact on sustainable development capability is more obvious.

Based on regional development differences, the sample is divided into the Eastern, Central, and Western Regions. As shown in Columns (5) and (6), executives’ tone manipulation has a significant negative impact on sustainable development capability (corporate sustainable development) in both regions, and the negative impact is stronger in the Central and Western Regions (the TONE coefficient is −0.152 *** for the Central and Western Regions and −0.149 *** for the Eastern Region). This phenomenon can be explained as follows. The Eastern Region has a high degree of marketization, and its information dissemination and market supervision mechanisms are better. The “loopholes” in executives’ tone manipulation are more likely to be quickly identified, and the negative impact on corporate sustainable development is relatively controlled. In contrast, the information environment in the Central and Western Regions is relatively backward, and the market’s ability to screen enterprise signals is weaker. Once a trust crisis caused by tone manipulation occurs, the impact on an enterprise’s sustainable development capabilities becomes more severe.

5.7. Further Test: Mediating Effect Analysis Based on Investor Sentiment

To further clarify the internal mechanism through which executive tone affects firms’ sustainable growth and respond to the reviewer’s suggestion of “supplementing mediating variable tests”, this study identifies investor sentiment (SENT) as a potential transmission channel and employs the classic three-step method to empirically analyze the mediating effect.

Table 9 presents the regression results.

First, Column (1) shows that executive tone (TONE) has a significantly negative impact on sustainable growth rate (corporate sustainable development) (β = −0.141, p < 0.01), indicating that a more negative tone used by management in information disclosure weakens firms’ subsequent growth capacity.

Second, Column (2) tests the impact of TONE on the mediating variable SENT. The coefficient of executive tone is significantly negative (β = −0.038, p < 0.05), meaning that a more negative tone leads to a weaker text sentiment orientation. This supports the mechanistic basis that “management tone can influence investor sentiment”.

Finally, when both TONE and SENT are included in the regression (Column (3)), SENT has a significantly positive effect on SGR (β = 0.013, p < 0.01), while the coefficient of TONE remains significantly negative (β = −0.137, p < 0.01) but slightly decreases in magnitude compared to Column (1).

Combining the above results, the mediating path of “TONE → SENT → SGR” is partially verified, indicating that investor sentiment is indeed a crucial transmission mechanism through which executive tone affects firms’ sustainable growth. Meanwhile, TONE remains significant after the inclusion of the mediating variable, suggesting that executive tone exerts both a direct effect on firms’ financial sustainability and an indirect effect through sentiment transmission.

5.8. Hypothesis Testing Results

Based on the empirical analysis, the following summary of test results is presented in

Table 10, where all hypotheses are supported.

6. Discussion and Conclusions

6.1. Discussion

The empirical results of this study support H1, indicating that executive tone manipulation significantly reduces corporate financial sustainability. This is consistent with the view of Cheng et al. (2024) [

89] that managerial textual sentiment affects long-term operating performance. Furthermore, the empirical results for H2–H4 are also supported, verifying the buffering role of governance mechanisms in curbing linguistic manipulation [

90,

91,

92].

Executives’ linguistic characteristics play an important role in signal transmission in corporate information disclosure. Tone positivity can boost market confidence and improve investor sentiment in the short term [

93,

94,

95]; however, it may also have negative effects, such as information distortion and market misjudgment [

96,

97,

98,

99]. However, existing studies mainly focus on the impact of tone on short-term market reactions (e.g., stock prices and trading volume) and pay insufficient attention to its long-term economic consequences and sustainable development performance [

100,

101]. Moreover, discussions on the linkage effect between tone manipulation and corporate governance mechanisms are relatively limited, especially empirical evidence in the institutional environment of emerging markets is still scarce [

102,

103].

Using Chinese A-share listed companies as the sample, this study systematically examines the long-term impact of executives’ tone manipulation on corporate sustainable development capability and introduces variables such as social responsibility information disclosure quality, institutional investor shareholding ratio, and board independence as moderating mechanisms from the perspective of corporate governance. The results show that executives’ tone manipulation significantly weakens corporate sustainable growth capability, indicating that impression management at the linguistic level damages the long-term competitiveness of enterprises by misleading market expectations and distorting resource allocation. A sound corporate governance mechanism can effectively alleviate this negative effect, reflecting the inhibitory effect of information transparency and supervision intensity on tone manipulation. Using a fixed-effects model, this study finds a significant negative correlation between tone manipulation and sustainable growth capacity. However, this research does not claim a strict causal effect of tone manipulation on the sustainable growth rate (corporate sustainable development). Instead, the results of this study are more inclined to reveal the statistical correlation between the two variables rather than a deterministic causal mechanism.

Compared with previous studies, this study makes progress and introduces new ideas in three ways. First, it broadens research on tone manipulation from short-term market reactions to the long-term perspective of corporate sustainable development, highlighting the enduring economic effects of behavioral biases. Second, by integrating corporate governance theory, it constructs an analytical framework of “tone manipulation—governance constraints—sustainable performance,” revealing how internal oversight interacts with external reputation constraints. Finally, using the institutional environment of emerging markets, it examines the contextual differences in governance mechanisms in restraining linguistic manipulation and enhancing information quality. Overall, the findings of this study enrich research on behavioral corporate governance and sustainable development and provide new theoretical insights into the relationship among “linguistic information—governance structure—corporate performance.”

6.2. Research Conclusions

Based on a sample of Chinese A-share listed companies from 2014 to 2023, this study systematically analyzes the impact of executives’ tone manipulation on corporate sustainable development capability and the moderating effect of governance mechanisms. The empirical results are as follows.

Executives’ tone manipulation significantly weakens corporate sustainable development capability. After controlling for industry and year effects, this negative impact remains significant. The regression coefficient of tone manipulation on the sustainable growth rate (corporate sustainable development) is −0.141 (p < 0.01), indicating that linguistic emotional manipulation not only is a short-term market signaling tool but also exerts substantial interference on enterprises’ long-term strategies and resource allocation.

Governance mechanisms also have a significant moderating effect. Social responsibility information disclosure quality, institutional investor shareholding ratio, and board independence can effectively mitigate the negative impact of tone manipulation on sustainable development capability. This suggests that a sound corporate governance structure can inhibit managers’ linguistic manipulation behavior and enhance enterprises’ long-term value orientation through information transparency, external supervision, and internal checks and balances.

The conclusions remain robust across different contexts. After replacing the dependent variable (with Tobin’s Q), excluding the pandemic-year sample, and using the 2SLS instrumental variable method to control for endogeneity, the core conclusions hold. After addressing endogeneity using the two-stage least squares (2SLS) instrumental variable method, the coefficient is −0.192 (p < 0.01), further verifying the reliability and generalizability of the research results.

In summary, this study not only expands the research boundary of corporate sustainable development from the perspective of “linguistic behavior” but also provides empirical support and policy implications for regulatory authorities to improve information disclosure systems, enterprises to optimize governance structures, and investors to identify non-financial risks. Future research could further explore the heterogeneous impacts of tone manipulation in different institutional environments, industry characteristics, and corporate cultural backgrounds to deepen our understanding of the relationship between linguistic governance and enterprises’ long-term performance.

6.3. Theoretical Implications

The theoretical implications of this study are mainly reflected in the following three aspects:

First, this paper incorporates executive tone manipulation into the analytical framework of Upper Echelons Theory, treating managerial tone as an explicit manifestation of managers’ cognitive structures, psychological biases, and strategic orientations. This provides a new research pathway for the application of Upper Echelons Theory in the fields of textual analysis and information disclosure.

Second, starting from the logical chain of “non-financial linguistic signals—corporate resource allocation—financial sustainability,” this study reveals the long-term adverse impacts of executive tone manipulation. It expands the theoretical explanations in behavioral corporate governance research regarding how executive behaviors affect firms’ long-term performance.

Third, this paper verifies the constraining roles of corporate social responsibility information disclosure quality, institutional investor ownership ratio, and board independence in the context of tone manipulation. It enriches research on the functional boundaries of external supervision mechanisms under information asymmetry within the framework of corporate governance theory.

6.4. Practical Implications

On a practical level, this study provides important implications for corporate governance and policy regulation. First, firms should focus on optimizing their internal governance structures and enhancing board independence, enabling independent directors to exert supervisory and checks-and-balances roles in information disclosure and strategic decision-making. This prevents management from manipulating tone due to short-term performance pressure, thereby safeguarding the authenticity of information disclosure and ensuring the stability of firms’ long-term strategies.

Second, external supervision mechanisms should be further strengthened to encourage institutional investors to actively participate in corporate governance and guide them to focus on firms’ long-term performance rather than short-term market fluctuations. This will foster an investment philosophy centered on long-term value in the capital market.

In addition, firms need to continuously improve the quality of corporate social responsibility information disclosure. By publishing high-quality social responsibility disclosure reports, they can enhance transparency and public trust and reduce management’s motivation for linguistic manipulation through reputational constraints.

Finally, from the perspective of the institutional environment, it is necessary for regulatory authorities to strengthen the supervision of board independence and the authenticity of information disclosure within the framework of the existing Company Law and Securities Law. Simultaneously, they should encourage institutional investors to engage in long-term corporate governance and, against the backdrop of the “dual carbon” strategy and green transformation, guide firms to improve their social responsibility disclosure standards. Such institutional arrangements will curb linguistic manipulation and promote the healthy development of the capital market.

In summary, enterprises should build a “linguistic transparency”-oriented governance system by improving governance transparency and external supervision levels to achieve long-term and stable development in the sustainable transformation.

6.5. Research Limitations and Future Directions

Although this study provides new theoretical perspectives and empirical evidence for the relationship between executives’ tone manipulation, corporate governance, and sustainable corporate development, it has certain limitations.

First, the research is based only on a sample of Chinese A-share listed companies and does not consider differences in the market environments of other countries or regions. Future research could expand the sample to other countries, especially developed markets or other emerging markets, to improve the generalizability and external validity of the conclusions.

Second, this study focuses only on executives’ tone manipulation as a single variable, whereas sustainable development capability is a multidimensional concept. Future research should consider the impact of additional variables. For example, it could explore the influence of factors such as executives’ management styles, enterprises’ innovation capabilities, and social capital on corporate sustainable development capabilities to form a more comprehensive theoretical framework.

Finally, future research could explore how corporate governance mechanisms interact with other factors (e.g., corporate culture and employee incentives) to affect executive behavior and long-term corporate financial sustainability. By exploring these multilevel interactive relationships, we can better understand the comprehensive impact of governance structure, leadership, and corporate culture on sustainable development.