The Impact of AI Policy on Corporate Green Innovation: The Chain-Mediated Role of Industrial Agglomeration and Knowledge Diversity

Abstract

1. Introduction

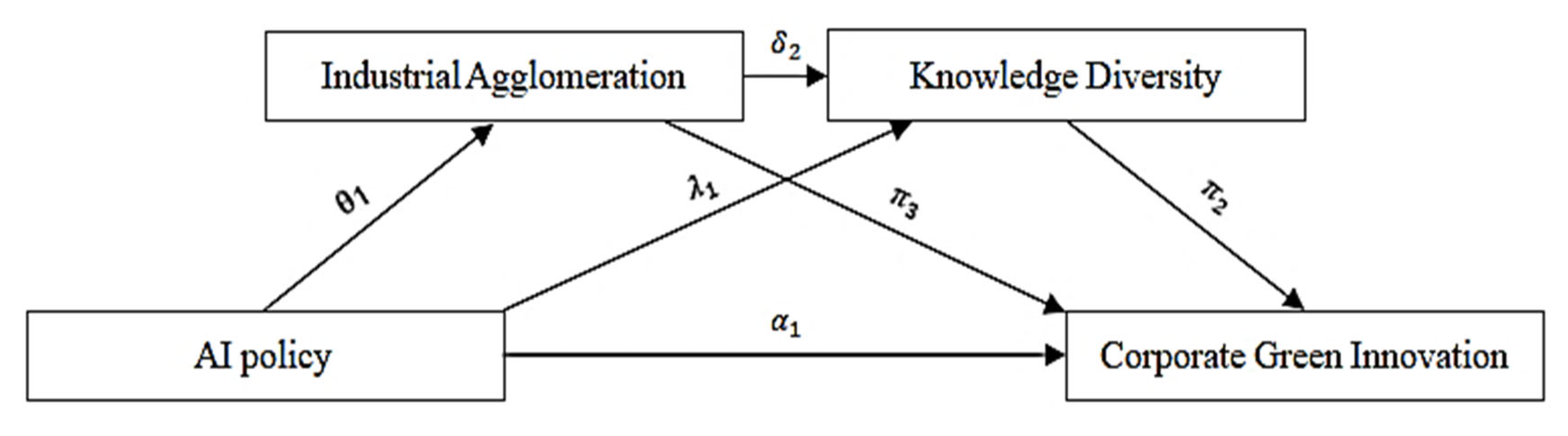

2. Literature Framework and Research Hypotheses

2.1. AI Policy and Corporate Green Innovation

2.2. The Mediating Role of Industrial Agglomeration

2.3. The Mediating Role of Knowledge Diversity

2.4. Chain-Mediated Effect of Industrial Agglomeration and Knowledge Diversity

3. Results

3.1. Sample and Data

3.2. Reference Model and Variable Measurement

3.3. Mediated Effect Model

4. Empirical Test

4.1. Descriptive Statistics

4.2. Baseline Regression

4.3. Endogeneity Test

4.3.1. Incorporating Reference Variables to Mitigate Selection Bias

4.3.2. Instrumental Variable

4.3.3. PSM-DID

4.4. Robustness Tests

4.4.1. Parallel Trend Test

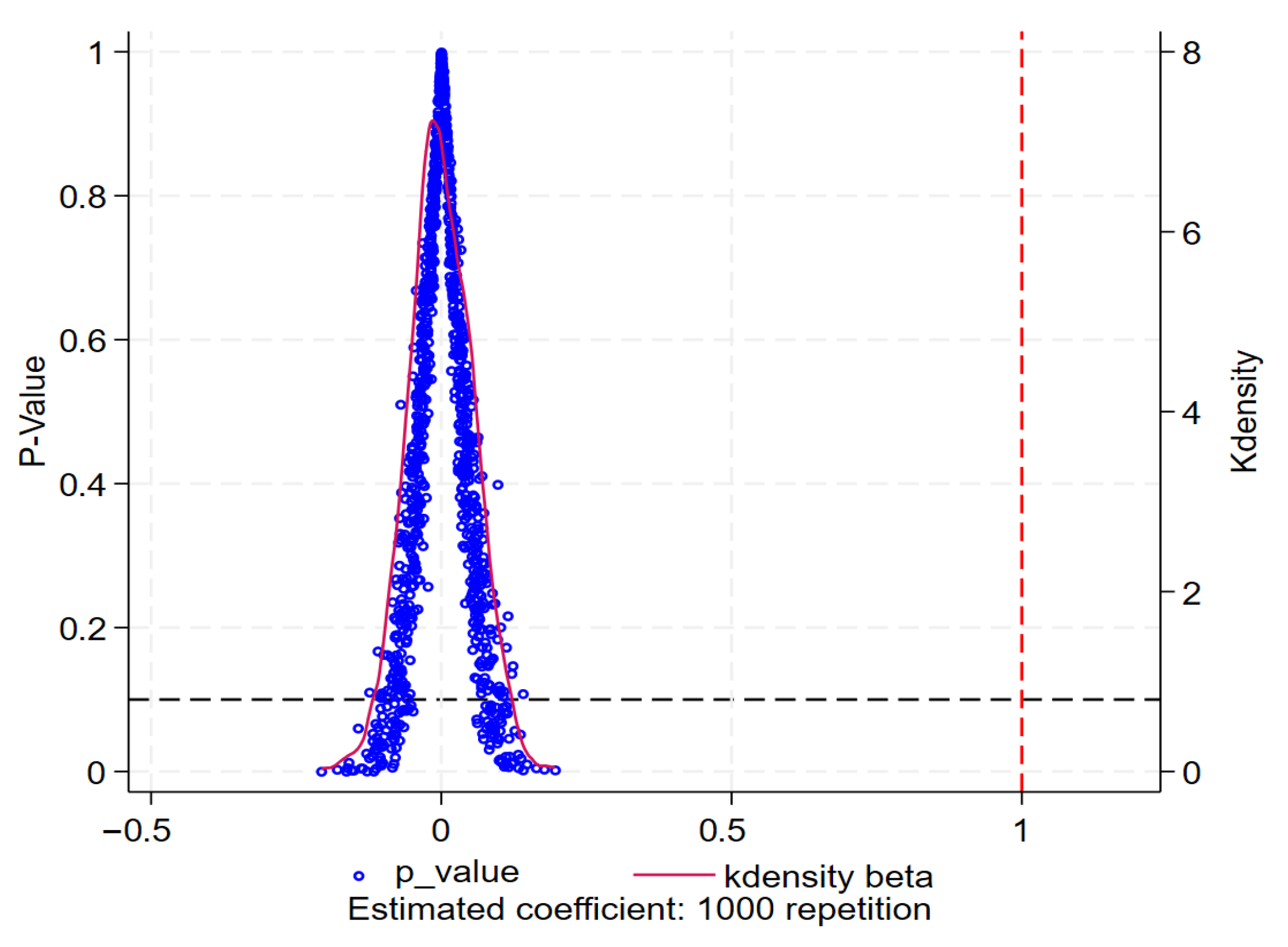

4.4.2. Placebo Test

4.4.3. Other Robustness Tests

5. Mechanism Analysis and Heterogeneity Analysis

5.1. Testing the Mediating Effect of a Single Factor

5.1.1. The Intermediary Effect of Industrial Agglomeration

5.1.2. Mediating Effect of Knowledge Diversity

5.2. Testing for Chain-Mediated Effect

5.3. Heterogeneity Analysis

5.3.1. Enterprise Size

5.3.2. Nature of Property Rights

5.3.3. Industry Attributes

5.3.4. Industry Competitiveness

6. Conclusions and Implications

6.1. Conclusions

6.2. Implications

6.2.1. Theoretical Implications

6.2.2. Policy Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| Green | Corporate Green Innovation |

| IA | Industrial Agglomeration |

| K-diversity | Knowledge Diversity |

References

- Wang, Z.; Zhang, T.; Ren, X.; Shi, Y. AI Adoption Rate and Corporate Green Innovation Efficiency: Evidence from Chinese Energy Companies. Energy Econ. 2024, 132, 107499. [Google Scholar] [CrossRef]

- Zhou, C.; Zhang, H.; Ying, J.; He, S.; Zhang, C.; Yan, J. Artificial Intelligence and Green Transformation of Manufacturing Enterprises. Int. Rev. Financ. Anal. 2025, 104, 104330. [Google Scholar] [CrossRef]

- Mijit, R.; Hu, Q.; Xu, J.; Ma, G. Greening through AI? The Impact of Artificial Intelligence Innovation and Development Pilot Zones on Green Innovation in China. Energy Econ. 2025, 146, 108507. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M. Corporate Governance and Green Innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Cho, T.S.; Chen, M.J. The Influence of Top Management Team Heterogeneity on Firms’ Competitive Moves. Adm. Sci. Q. 1996, 41, 659–684. [Google Scholar] [CrossRef]

- Galbreath, J. Drivers of Green Innovations: The Impact of Export Intensity, Women Leaders, and Absorptive Capacity. J. Bus. Ethics 2019, 158, 47–61. [Google Scholar] [CrossRef]

- Li, Q.; Maqsood, U.S.; Zahid, R.M.A.; Anwar, W. Regulating CEO Pay and Green Innovation: Moderating Role of Social Capital and Government Subsidy. Environ. Sci. Pollut. Res. 2024, 31, 46163–46177. [Google Scholar] [CrossRef] [PubMed]

- Wu, S.; Cheng, J.; Ding, X. Impact of the Top Management Teams’ Environmental Attention on Dual Green Innovation in Chinese Enterprises: The Context of Government Environmental Regulation and Absorptive Capacity. Sustainability 2025, 17, 8574. [Google Scholar] [CrossRef]

- He, K.; Chen, W.; Zhang, L. Senior Management’s Academic Experience and Corporate Green Innovation. Technol. Forecast. Soc. Change 2021, 166, 120664. [Google Scholar] [CrossRef]

- Silva, M.J.; Leitão, J. Cooperation in innovation practices among firms in Portugal: Do external partners stimulate innovative advances? Int. J. Entrep. Small Bus. 2009, 7, 391–403. [Google Scholar] [CrossRef]

- Yalabik, B.; Fairchild, R.J. Customer, regulatory, and competitive pressure as drivers of environmental innovation. Int. J. Prod. Econ. 2011, 131, 519–527. [Google Scholar] [CrossRef]

- Slavova, K.; Jong, S. University Alliances and Firm Exploratory Innovation: Evidence from Therapeutic Product Development. Technovation 2021, 107, 102310. [Google Scholar] [CrossRef]

- Prencipe, A.; Corsi, C.; Rodríguez-Gulías, M.J. Influence of the regional entrepreneurial ecosystem and its knowledge spillovers in developing successful university spin-offs. Socio-Econ. Plan. Sci. 2020, 72, 100814. [Google Scholar] [CrossRef]

- Yao, N.C.; Guo, Q.; Tsinopoulos, C. The bright and dark sides of institutional intermediaries: Industry associations and small-firm innovation. Res. Policy 2022, 51, 104370. [Google Scholar] [CrossRef]

- Cui, J.; Dai, J.; Wang, Z.; Zhao, X. Does Environmental Regulation Induce Green Innovation? A Panel Study of Chinese Listed Firms. Technol. Forecast. Soc. Change 2022, 176, 121492. [Google Scholar] [CrossRef]

- Liu, F.; Wang, Z.; Liu, F.; Wang, Z. Can Green Credit Interest Subsidy Policy Promote Corporate Green Innovation?—From the Perspective of Fiscal and Financial Policy Coordination. Sustainability 2025, 17, 9750. [Google Scholar] [CrossRef]

- Yuan, D.; Wu, X.; Shang, D.; Pan, L. How Government Environmental Attention Influences Corporate Green Innovation: A Chain Mediating Model. Technol. Forecast. Soc. Change 2025, 218, 124195. [Google Scholar] [CrossRef]

- Dong, X.; Zhou, N.; Zhao, X.; Yang, S. The Impact of Artificial Intelligence on Corporate Green Innovation: Can “Increasing Quantity” and “Improving Quality” Go Hand in Hand? J. Environ. Manag. 2025, 376, 124439. [Google Scholar] [CrossRef]

- Feng, F.; Li, J.; Zhang, F.; Sun, J. The Impact of Artificial Intelligence on Green Innovation Efficiency: Moderating Role of Dynamic Capability. Int. Rev. Econ. Financ. 2024, 96, 103649. [Google Scholar] [CrossRef]

- Tang, M.; Liu, Y.; Hu, F.; Wu, B. Effect of Digital Transformation on Enterprises’ Green Innovation: Empirical Evidence from Listed Companies in China. Energy Econ. 2023, 128, 107135. [Google Scholar] [CrossRef]

- Liu, Y.; Shen, F.; Guo, J.; Hu, G.; Song, Y. Can Artificial Intelligence Technology Improve Companies’ Capacity for Green Innovation? Evidence from Listed Companies in China. Energy Econ. 2025, 143, 108280. [Google Scholar] [CrossRef]

- Jiang, L.; Bai, Y. Strategic or Substantive Innovation?—The Impact of Institutional Investors’ Site Visits on Green Innovation Evidence from China. Technol. Soc. 2022, 68, 101904. [Google Scholar] [CrossRef]

- Xu, C.; Lin, B. The AI-Sustainability Nexus: How Does Intelligent Transformation Affect Corporate Green Innovation? Int. Rev. Financ. Anal. 2025, 102, 104107. [Google Scholar] [CrossRef]

- Hussain, M.; Yang, S.; Maqsood, U.S.; Zahid, R.M.A. Tapping into the Green Potential: The Power of Artificial Intelligence Adoption in Corporate Green Innovation Drive. Bus. Strategy Environ. 2024, 33, 4375–4396. [Google Scholar] [CrossRef]

- Mariani, M.M.; Machado, I.; Magrelli, V.; Dwivedi, Y.K. Artificial Intelligence in Innovation Research: A Systematic Review, Conceptual Framework, and Future Research Directions. Technovation 2023, 122, 102623. [Google Scholar] [CrossRef]

- Cicerone, G.; Faggian, A.; Montresor, S.; Rentocchini, F. Regional Artificial Intelligence and the Geography of Environmental Technologies: Does Local AI Knowledge Help Regional Green-Tech Specialization? Reg. Stud. 2023, 57, 330–343. [Google Scholar] [CrossRef]

- Mubarak, M.F.; Petraite, M. Industry 4.0 Technologies, Digital Trust and Technological Orientation: What Matters in Open Innovation? Technol. Forecast. Soc. Change 2020, 161, 120332. [Google Scholar] [CrossRef]

- Imran, R.; Alraja, M.N.; Khashab, B. Sustainable Performance and Green Innovation: Green Human Resources Management and Big Data as Antecedents. IEEE Trans. Eng. Manag. 2023, 70, 4191–4206. [Google Scholar] [CrossRef]

- Canhoto, A.I.; Clear, F. Artificial Intelligence and Machine Learning as Business Tools: A Framework for Diagnosing Value Destruction Potential. Bus. Horiz. 2020, 63, 183–193. [Google Scholar] [CrossRef]

- Mubarak, M.F.; Tiwari, S.; Petraite, M.; Mubarik, M.; Raja Mohd Rasi, R.Z. How Industry 4.0 Technologies and Open Innovation Can Improve Green Innovation Performance? Manag. Environ. Qual. Int. J. 2021, 32, 1007–1022. [Google Scholar] [CrossRef]

- Babina, T.; Fedyk, A.; He, A.; Hodson, J. Artificial Intelligence, Firm Growth, and Product Innovation. J. Financ. Econ. 2024, 151, 103745. [Google Scholar] [CrossRef]

- Marshall, A. Principles of Economics; Macmillan: London, UK, 1890. [Google Scholar]

- Baptista, R.; Swann, P. Do Firms in Clusters Innovate More? Res. Policy 1998, 27, 525–540. [Google Scholar] [CrossRef]

- Huang, J.; Balezentis, T.; Shen, S.; Streimikiene, D. Human capital mismatch and innovation performance in high-technology enterprises: An analysis based on the micro-level perspective. J. Innov. Knowl. 2023, 8, 100452. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. The Race between Man and Machine: Implications of Technology for Growth, Factor Shares, and Employment. Am. Econ. Rev. 2018, 108, 1488–1542. [Google Scholar] [CrossRef]

- Ellison, G.; Glaeser, E.L.; Kerr, W. What Causes Industry Agglomeration? Evidence from Coagglomeration Patterns. Am. Econ. Rev. 2010, 100, 1195–1213. [Google Scholar] [CrossRef]

- Kokovin, S.; Molchanov, P.; Bykadorov, I. Increasing Returns, Monopolistic Competition, and International Trade: Revisiting Gains from Trade. J. Int. Econ. 2022, 137, 103595. [Google Scholar] [CrossRef]

- Helm, I. National Industry Trade Shocks, Local Labour Markets, and Agglomeration Spillovers. Rev. Econ. Stud. 2020, 87, 1399–1431. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Kallal, H.D.; Scheinkman, J.A.; Shleifer, A. Growth in Cities. J. Political Econ. 1992, 100, 1126–1152. [Google Scholar] [CrossRef]

- Helmers, C. Choose the Neighbor before the House: Agglomeration Externalities in a UK Science Park. J. Econ. Geogr. 2019, 19, 31–55. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a Knowledge-based Theory of the Firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Kogut, B.; Zander, U. Knowledge of the Firm, Combinative Capabilities, and the Replication of Technology. Organ. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Bonner, J.M.; Walker, O.C. Selecting influential business-to-business customers in new product development: Relational embeddedness and knowledge heterogeneity considerations. J. Prod. Innov. Manag. 2004, 21, 155–169. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The Relational View: Cooperative Strategy and Sources of Interorganizational Competitive Advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef]

- Zhao, Y.; Qi, N.; Li, L.; Li, Z.; Han, X.; Xuan, L. How Do Knowledge Diversity and Ego-Network Structures Affect Firms’ Sustainable Innovation: Evidence from Alliance Innovation Networks of China’s New Energy Industries. J. Knowl. Manag. 2023, 27, 178–196. [Google Scholar] [CrossRef]

- Dabić, M.; Posinković, T.O.; Vlačić, B.; Gonçalves, R. A configurational approach to new product development performance: The role of open innovation, digital transformation and absorptive capacity. Technol. Forecast. Soc. Change 2023, 194, 122720. [Google Scholar] [CrossRef]

- Carnabuci, G.; Operti, E. Where Do Firms’ Recombinant Capabilities Come from? Intraorganizational Networks, Knowledge, and Firms’ Ability to Innovate Through Technological Recombination. Strateg. Manag. J. 2013, 34, 1591–1613. [Google Scholar] [CrossRef]

- Pollok, P.; Amft, A.; Diener, K.; Lüttgens, D.; Piller, F.T. Knowledge Diversity and Team Creativity: How Hobbyists Beat Professional Designers in Creating Novel Board Games. Res. Policy 2021, 50, 10417. [Google Scholar] [CrossRef]

- Aghion, P.; Dechezleprêtre, A.; Hemous, D. Carbon taxes, path dependency and directed technical change: Evidence from the auto industry. J. Political. Econ. 2016, 124, 1–51. [Google Scholar] [CrossRef]

- Li, Y.H.; Lin, Y.X.; Li, D.D. How Does the Application of Artificial Intelligence Technology Affect Corporate Innovation? China Ind. Econ. 2024, 41, 155–173. [Google Scholar] [CrossRef]

- Chatterjee, S.; Blocher, J.D. Measurement of Firm Diversification: Is It Robust? Acad. Manag. J. 1992, 35, 874–888. [Google Scholar] [CrossRef]

- Song, H.; Sun, Y.J.; Chen, D.K. Evaluating the Effects of Government Air Pollution Control: An Empirical Study from China’s “Low-Carbon City” Development. Manag. World 2019, 35, 95–108+195. [Google Scholar] [CrossRef]

- Huang, Q.H.; Yu, Y.Z.; Zhang, S.L. Internet Development and Manufacturing Productivity Enhancement: Internal Mechanisms and Chinese Experience. China Ind. Econ. 2019, 36, 5–23. [Google Scholar] [CrossRef]

- Jacobson, L.S.; LaLonde, R.J.; Sullivan, D.G. Earnings Losses of Displaced Workers. Am. Econ. Rev. 1993, 83, 685–709. [Google Scholar]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Irfan, M.; Razzaq, A.; Sharif, A.; Yang, X. Influence Mechanism between Green Finance and Green Innovation: Exploring Regional Policy Intervention Effects in China. Technol. Forecast. Soc. Change 2022, 182, 121882. [Google Scholar] [CrossRef]

- Yao, J.Q.; Zhang, K.P.; Guo, L.P.; Feng, X. How Does Artificial Intelligence Enhance Corporate Productivity?—A Perspective Based on Labor Skill Structure Adjustment. Manag. World 2024, 40, 101–116+133+117–122. [Google Scholar] [CrossRef]

- Aghion, P.; Bloom, N.; Blundell, R. Competition and innovation: An inverted-U relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar]

- Lin, B.; Zhu, Y. The impact of artificial intelligence policy on green innovation of firms. Energy Econ. 2025, 148, 108524. [Google Scholar] [CrossRef]

| Variables | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| Green | 26,024 | 1.141 | 3.702 | 0.000 | 27.000 |

| Treat × Post | 26,024 | 0.207 | 0.405 | 0.000 | 1.000 |

| Size | 26,024 | 3.311 | 1.001 | 2.879 | 8.537 |

| Indep | 26,024 | 0.378 | 0.056 | 0.143 | 0.800 |

| Board | 26,024 | 2.097 | 0.194 | 1.386 | 2.890 |

| Dual | 26,024 | 0.338 | 0.473 | 0.000 | 1.000 |

| Growth | 26,024 | 0.289 | 7.979 | −1.445 | 944.100 |

| Cash flow | 26,024 | 0.051 | 0.071 | −0.658 | 0.839 |

| Variable | Green (1) | Green (2) |

|---|---|---|

| Treat × Post | 0.563 *** (0.157) | 0.589 *** (0.157) |

| Constant | 1.024 *** (0.032) | −5.911 *** (1.109) |

| Controls | NO | YES |

| Province FE | YES | YES |

| Year FE | YES | YES |

| Observations | 26,024 | 26,024 |

| Adjusted R2 | 0.015 | 0.025 |

| Variable | Add the Benchmark Variable | Instrumental Variable | PSM-DID | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Treat × Post | 0.425 *** (0.093) | 0.559 *** (0.177) | 0.425 *** (0.093) | 2.017 *** (0.514) | 0.692 *** (0.216) | |

| IV | 0.206 *** (0.035) | |||||

| Constant | −6.519 *** (1.226) | −6.573 *** (1.562) | −6.751 *** (1.317) | |||

| Capital City × Time Trend | YES | NO | YES | |||

| Southeast of the Hu Huanyong Line × Time Trend | NO | YES | YES | |||

| Controls | YES | YES | YES | YES | YES | YES |

| Province FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| Observations | 22,361 | 22,361 | 22,361 | 21,157 | 21,157 | 8974 |

| Adjusted R2 | 0.026 | 0.025 | 0.026 | 0.023 | ||

| Variable | Control Other Policies (1) | Reduce the Sample Size (2) | Replace Explanatory Variables (3) |

|---|---|---|---|

| Treat × Post | 0.567 ** (0.223) | 0.577 ** (0.223) | |

| didW | 0.220 (0.143) | ||

| AI | 0.104 *** (3.993) | ||

| Controls | YES | YES | YES |

| Province FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| Observations | 18,529 | 18,529 | 16,612 |

| Adjusted R2 | 0.029 | 0.029 | 0.693 |

| Variable | Industrial Agglomeration | Knowledge Diversity | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| M | Green | M | Green | |

| Treat × Post | 0.108 ** (0.045) | 0.522 ** (0.235) | 0.937 *** (0.386) | 0.541 *** (0.175) |

| M | 0.936 ** (0.372) | 0.135 *** (0.033) | ||

| Controls | YES | YES | YES | YES |

| Province FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Observations | 10,981 | 10,981 | 14,524 | 14,524 |

| Adjusted R2 | 0.189 | 0.035 | 0.003 | 0.152 |

| Coefficient | SE | Z | P > |Z| | |

|---|---|---|---|---|

| Sobel | 0.15121175 | 0.03026824 | 4.996 | 0.000 |

| Goodman-1 (Aroian) | 0.15121175 | 0.03028688 | 4.993 | 0.000 |

| Goodman-2 | 0.15121175 | 0.03024959 | 4.999 | 0.000 |

| Coefficient | SE | Z | P > |Z| | |

|---|---|---|---|---|

| Sobel | 0.27667153 | 0.03272999 | 8.453 | 0.000 |

| Goodman-1 (Aroian) | 0.27667153 | 0.03273755 | 8.451 | 0.000 |

| Goodman-2 | 0.27667153 | 0.03272243 | 8.455 | 0.000 |

| Variable | Chain-Mediated Effect | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| IA | K-Diversity | Green | |

| Treat × Post | 0.108 ** (0.045) | 0.582 ** (0.297) | 0.442 ** (0.185) |

| IA | 0.567 ** (0.289) | 0.875 * (0.532) | |

| K-diversity | 0.138 *** (0.032) | ||

| Controls | YES | YES | YES |

| Province FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| Observations | 10,981 | 10,981 | 10,981 |

| Adjusted R2 | 0.189 | 0.032 | 0.162 |

| Variable | Coefficient | SE | Z | P > |Z| | 95% Confidence Interval |

|---|---|---|---|---|---|

| AI policy → IA → Grenn | 0.0944346 | 0.0436681 | 2.16 | 0.031 | [0.0088468, 0.1800225] |

| AI policy → K-diversity → Green | 0.1066955 | 0.0385451 | 2.77 | 0.006 | [0.0311485, 0.1822424] |

| AI policy → IA →K-diversity → Green | 0.6433868 | 0.1709240 | 3.76 | 0.000 | [0.3083819, 0.9783916] |

| Variable | Enterprise Scale | SOE | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| LSEs | SMEs | SOEs | Non-SOEs | |

| Treat × Post | 0.635 (0.447) | 0.417 ** (0.154) | 0.781 (0.509) | 0.546 ** (0.209) |

| Controls | YES | YES | YES | YES |

| Province FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Observations | 8311 | 8308 | 4794 | 11,440 |

| Adjusted R2 | 0.034 | 0.024 | 0.064 | 0.024 |

| Variable | Industry Attributes | Level of Industry Competition | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| High-Tech Company | Non-High-Tech Enterprises | Competitive Industries | Regulated Industries | |

| Treat × Post | 0.555 *** (0.238) | 0.038 (0.105) | 0.455 ** (0.200) | 1.144 (0.676) |

| Controls | YES | YES | YES | YES |

| Province FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Observations | 13,106 | 3513 | 14,275 | 2344 |

| Adjusted R2 | 0.037 | 0.041 | 0.022 | 0.137 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Liu, J.; Yan, C. The Impact of AI Policy on Corporate Green Innovation: The Chain-Mediated Role of Industrial Agglomeration and Knowledge Diversity. Sustainability 2026, 18, 286. https://doi.org/10.3390/su18010286

Liu J, Yan C. The Impact of AI Policy on Corporate Green Innovation: The Chain-Mediated Role of Industrial Agglomeration and Knowledge Diversity. Sustainability. 2026; 18(1):286. https://doi.org/10.3390/su18010286

Chicago/Turabian StyleLiu, Jiahui, and Chun Yan. 2026. "The Impact of AI Policy on Corporate Green Innovation: The Chain-Mediated Role of Industrial Agglomeration and Knowledge Diversity" Sustainability 18, no. 1: 286. https://doi.org/10.3390/su18010286

APA StyleLiu, J., & Yan, C. (2026). The Impact of AI Policy on Corporate Green Innovation: The Chain-Mediated Role of Industrial Agglomeration and Knowledge Diversity. Sustainability, 18(1), 286. https://doi.org/10.3390/su18010286