Weather Change and Spillover Effects of China’s Energy Futures Market: Based on Different Market Conditions

Abstract

1. Introduction

2. Methodology

2.1. QVAR Spillover Index

2.2. Regression Model for the Impact of Weather Change on Spillover Effects of Energy Futures

2.3. Return Calculation

3. Data

- Temperature (TE): This indicator is the temperature of air at 2 m above the surface of land, sea or inland waters. It is calculated by interpolating between the lowest model level and the earth’s surface, taking account of the atmospheric conditions.

- Cooling Degree Days (CDD): This indicator reflects the extent to which the temperature exceeds the cooling base temperature (26 °C). It is calculated using the following expression: , where is the cooling degree days on day , and is the daily average temperature on that day.

- Heating Degree Days (HDD): This indicator reflects the extent to which the temperature falls below the heating base temperature (18 °C). It is calculated using the following expression: , where is the heating degree days on day , and is the daily average temperature on that day.

- Total Precipitation (TP): This indicator is the accumulated liquid and frozen water, comprising the rain and snow that falls to the earth’s surface. It is the sum of large-scale precipitation and convective precipitation.

4. Empirical Analysis

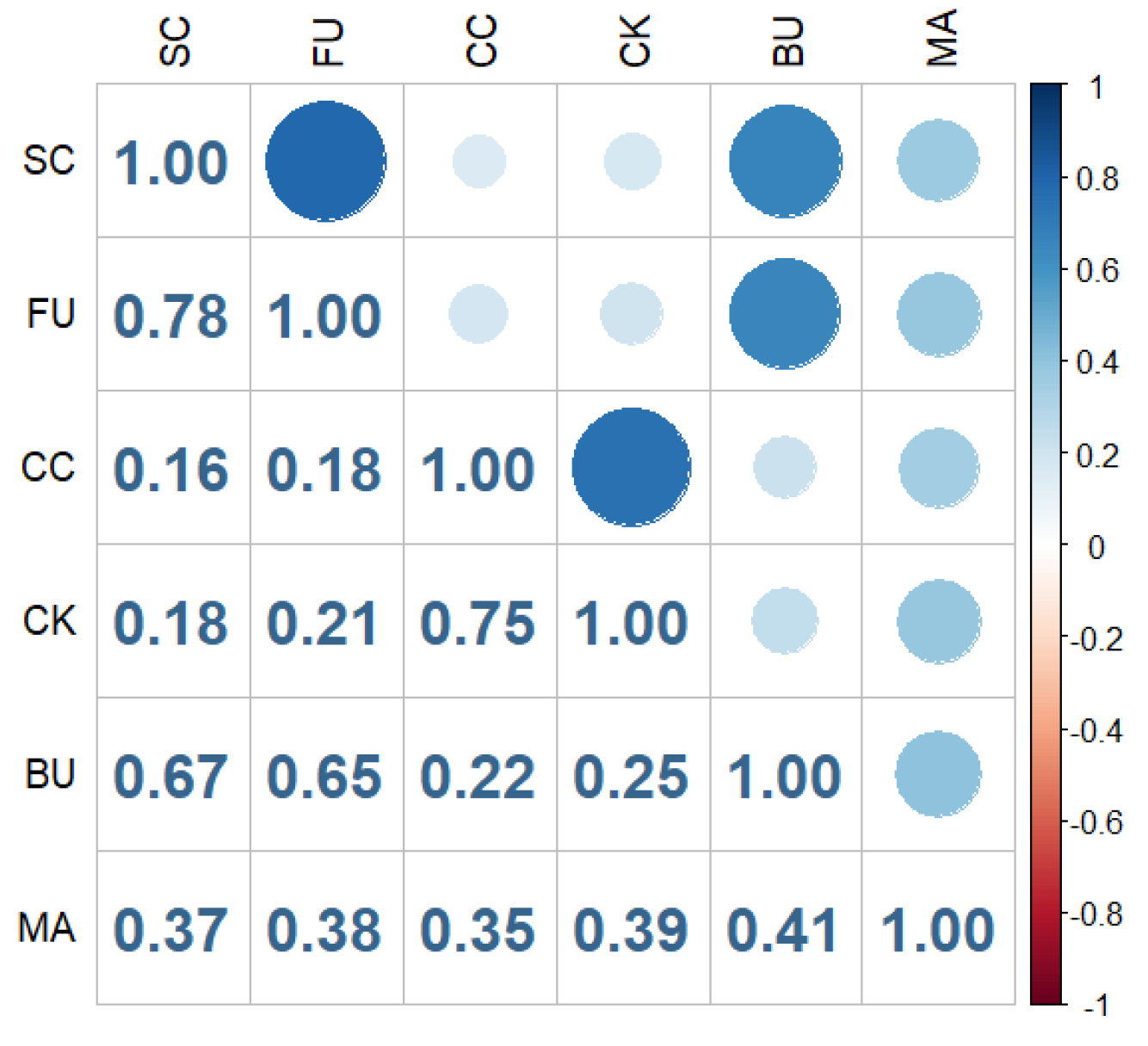

4.1. Static Spillover Results

4.2. Dynamic Spillover Results

4.3. The Impact of Weather Change on Spillover Effects of China’s Energy Futures

4.4. Robustness Check

5. Conclusions and Limitations

5.1. Conclusions

5.2. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Model | Extreme-Risk Capture | Time-Varying Effect | Direction Identification | Computational Complexity | Energy-Futures Applicability |

|---|---|---|---|---|---|

| GARCH-based spillover | Weak (no tail dependence) | Weak (needs rolling windows) | Cannot (needs extensions) | Low–medium | Moderate (misses tail spillovers) |

| TVP-VAR spillover | Moderate | Strong (handles time-varying) | Can identify direction | High | Good (may smooth extremes) |

| QVAR spillover | Strong (tail/quantile) | Strong (state-dependent) | Clear (across quantiles) | Medium–high | Very high (normal/extreme markets) |

Appendix B

| SC | FU | CC | CK | BU | MA | FROM | |

|---|---|---|---|---|---|---|---|

| 0.1 quantile | |||||||

| SC | 25.19 | 20.16 | 10.88 | 11.73 | 18.29 | 13.75 | 74.81 |

| FU | 20.19 | 25.25 | 11.11 | 11.9 | 18 | 13.55 | 74.75 |

| CC | 11.83 | 11.98 | 28.84 | 20.71 | 12.44 | 14.21 | 71.16 |

| CK | 12.29 | 12.51 | 19.98 | 27.48 | 12.74 | 14.99 | 72.52 |

| BU | 18.31 | 17.94 | 11.65 | 12.22 | 25.71 | 14.16 | 74.29 |

| MA | 14.75 | 14.6 | 13.54 | 15 | 14.84 | 27.28 | 72.72 |

| TO | 77.37 | 77.2 | 67.16 | 71.55 | 76.31 | 70.67 | TSI |

| NET | 2.56 | 2.45 | −4.01 | −0.97 | 2.02 | −2.06 | 73.38 |

| 0.9 quantile | |||||||

| SC | 26.06 | 20.59 | 10.19 | 11.22 | 18.56 | 13.36 | 73.94 |

| FU | 20.6 | 26.09 | 10.31 | 11.63 | 17.91 | 13.46 | 73.91 |

| CC | 11.13 | 11.18 | 29.57 | 21.37 | 12.4 | 14.35 | 70.43 |

| CK | 11.72 | 12.14 | 20.34 | 27.98 | 12.7 | 15.11 | 72.02 |

| BU | 18.7 | 18.23 | 11.13 | 12.17 | 25.85 | 13.93 | 74.15 |

| MA | 14.31 | 14.2 | 13.7 | 15.01 | 14.8 | 27.97 | 72.03 |

| TO | 76.47 | 76.35 | 65.67 | 71.4 | 76.38 | 70.21 | TSI |

| NET | 2.54 | 2.44 | −4.76 | −0.62 | 2.22 | −1.82 | 72.75 |

Appendix C

| 1 | 2 | 3 | |

|---|---|---|---|

| TE | 0.0003 (1.005) | ||

| CDD | 0.0031 ** (3.006) | ||

| HDD | 0.0006 (0.668) | ||

| GPR | 0.0772 *** (10.583) | 0.0795 *** (10.885) | 0.0762 *** (10.505) |

| VOX | 0.0037 (0.221) | 0.0120 (0.721) | 0.0022 (0.133) |

| VIX | 0.1041 *** (6.157) | 0.0994 *** (5.886) | 0.1064 *** (6.333) |

| Rate | −0.4718 *** (−3.602) | −0.4578 *** (−3.511) | −0.4557 *** (−3.466) |

| CSI300 | −0.2389 *** (−5.034) | −0.2291 *** (−4.829) | −0.2391 *** (−5.036) |

| Constant | 6.2547 *** (9.711) | 6.1182 *** (9.502) | 6.2338 *** (9.653) |

| R-squared | 0.1106 | 0.1103 | 0.1106 |

| 1 | 2 | 3 | |

|---|---|---|---|

| TE | −0.00005 (−1.616) | ||

| CDD | 0.0003 *** (2.648) | ||

| HDD | 0.0002 ** (2.542) | ||

| GPR | 0.0054 *** (7.988) | 0.0058 *** (8.522) | 0.0055 *** (8.138) |

| OVX | 0.0074 *** (4.484) | 0.0086 *** (5.535) | 0.0080 *** (5.221) |

| VIX | 0.0144 *** (9.197) | 0.0136 *** (8.658) | 0.0143 *** (9.154) |

| Rate | −0.0552 *** (−4.532) | −0.0557 *** (−4.592) | 0.0531 *** (−4.358) |

| CSI300 | −0.0335 *** (−7.598) | −0.0324 *** (−7.330) | −0.0328 *** (−7.454) |

| Constant | 4.8208 *** (80.574) | 4.8073 *** (80.259) | 4.8083 *** (80.284) |

| R-squared | 0.3604 | 0.3625 | 0.3623 |

| 1 | 2 | 3 | |

|---|---|---|---|

| TE | −0.0002 *** (−6.868) | ||

| CDD | −0.0005 *** (−5.059) | ||

| HDD | 0.0004 *** (4.802) | ||

| GPR | 0.0053 *** (7.576) | 0.0054 *** (7.538) | 0.0058 *** (8.147) |

| OVX | −0.0049 *** (−3.068) | −0.0054 *** (7.538) | −0.0058 * (−1.961) |

| VIX | 0.0099 *** (6.050) | 0.0098 *** (5.861) | 0.0088 *** (5.373) |

| Rate | −0.0156 (−1.234) | −0.0215 (−1.691) | −0.0143 (−1.116) |

| CSI300 | 0.0043 (0.948) | 0.0035 (0.748) | 0.0062 (1.343) |

| Constant | 4.4474 *** (72.093) | 4.4949 *** (71.608) | 4.4492 *** (70.834) |

| R-squared | 0.1313 | 0.1175 | 0.1159 |

References

- Mao, X.; Wei, P.; Ren, X. Climate Risk and Financial Systems: A Nonlinear Network Connectedness Analysis. J. Environ. Manag. 2023, 340, 117878. [Google Scholar] [CrossRef] [PubMed]

- van Benthem, A.A.; Crooks, E.; Giglio, S.; Schwob, E.; Stroebel, J. The Effect of Climate Risks on the Interactions between Financial Markets and Energy Companies. Nat. Energy 2022, 7, 690–697. [Google Scholar] [CrossRef]

- Zhong, J.; Zhao, Y.; Li, Y.; Yan, M.; Peng, Y.; Cai, Y.; Cao, Y. Synergistic Operation Framework for the Energy Hub Merging Stochastic Distributionally Robust Chance-Constrained Optimization and Stackelberg Game. IEEE Trans. on Smart Grid 2025, 16, 1037–1050. [Google Scholar] [CrossRef]

- Zhou, S.; Yuan, D.; Zhang, F. Multiscale Systemic Risk Spillovers in Chinese Energy Market: Evidence from a Tail-Event Driven Network Analysis. Energy Econ. 2025, 142, 108151. [Google Scholar] [CrossRef]

- Zhao, G.; Yu, B.; An, R.; Wu, Y.; Zhao, Z. Energy System Transformations and Carbon Emission Mitigation for China to Achieve Global 2 °C Climate Target. J. Environ. Manag. 2021, 292, 112721. [Google Scholar] [CrossRef]

- Chen, Y.; Zhu, M.; Chen, M. Comprehensive Experimental Research on Wrapping Materials Influences on the Thermal Runaway of Lithium-Ion Batteries. Emerg. Manag. Sci. Technol. 2025, 5, e007. [Google Scholar] [CrossRef]

- Zhang, J.; Long, T.; Sun, X.; He, L.; Yang, J.; Wang, J.; Wang, Z.; Huang, Y.; Zhang, L.; Zhang, Y. Mechanism Investigation on Microstructure Degradation and Thermal Runaway Propagation of Batteries Undergoing High-Rate Cycling Process. J. Energy Chem. 2026, 113, 1013–1029. [Google Scholar] [CrossRef]

- Wang, L.; Ahmad, F.; Luo, G.; Umar, M.; Kirikkaleli, D. Portfolio Optimization of Financial Commodities with Energy Futures. Ann. Oper. Res. 2022, 313, 401–439. [Google Scholar] [CrossRef]

- Ren, Y.; Wang, N.; Zhu, H. Dynamic Connectedness of Climate Risks, Oil Shocks, and China’s Energy Futures Market: Time-Frequency Evidence from Quantile-on-Quantile Regression. N. Am. J. Econ. Financ. 2025, 75, 102263. [Google Scholar] [CrossRef]

- Shao, M.; Hua, Y. Price Discovery Efficiency of China’s Crude Oil Futures: Evidence from the Shanghai Crude Oil Futures Market. Energy Econ. 2022, 112, 106172. [Google Scholar] [CrossRef]

- Wang, J.; Qiu, S.; Yick, H.Y. The Influence of the Shanghai Crude Oil Futures on the Global and Domestic Oil Markets. Energy 2022, 245, 123271. [Google Scholar] [CrossRef]

- Dai, X.; Xiao, L.; Li, M.C.; Wang, Q. Toward Energy Finance Market Transition: Does China’s Oil Futures Shake up Global Spots Market? Front. Eng. Manag. 2022, 9, 409–424. [Google Scholar] [CrossRef]

- Chiaramonte, L.; Mecchia, F.; Paltrinieri, A.; Sclip, A. Geopolitical Risk and Energy Markets: Past, Present, and Future. J. Econ. Surv. 2025, 39, 2233–2253. [Google Scholar] [CrossRef]

- Baumeister, C.; Korobilis, D.; Lee, T.K. Energy Markets and Global Economic Conditions. Rev. Econ. Stat. 2022, 104, 828–844. [Google Scholar] [CrossRef]

- Liu, F.; Shao, S.; Li, X.; Pan, N.; Qi, Y. Economic Policy Uncertainty, Jump Dynamics, and Oil Price Volatility. Energy Econ. 2023, 120, 106635. [Google Scholar] [CrossRef]

- Wang, Q.; Li, R. Cheaper Oil: A Turning Point in Paris Climate Talk? Renew. Sustain. Energy Rev. 2015, 52, 1186–1192. [Google Scholar] [CrossRef]

- Fahmy, H. The Rise in Investors’ Awareness of Climate Risks after the Paris Agreement and the Clean Energy-Oil-Technology Prices Nexus. Energy Econ. 2022, 106, 105738. [Google Scholar] [CrossRef]

- Curcio, D.; Gianfrancesco, I.; Vioto, D. Climate Change and Financial Systemic Risk: Evidence from US Banks and Insurers. J. Financ. Stab. 2023, 66, 101132. [Google Scholar] [CrossRef]

- Ginglinger, E.; Moreau, Q. Climate Risk and Capital Structure. Manag. Sci. 2023, 69, 7492–7516. [Google Scholar] [CrossRef]

- Bressan, G.; Đuranović, A.; Monasterolo, I.; Battiston, S. Asset-Level Assessment of Climate Physical Risk Matters for Adaptation Finance. Nat. Commun. 2024, 15, 5371. [Google Scholar] [CrossRef]

- Steinberg, D.C.; Mignone, B.K.; Macknick, J.; Sun, Y.; Eurek, K.; Badger, A.; Livneh, B.; Averyt, K. Decomposing Supply-Side and Demand-Side Impacts of Climate Change on the US Electricity System through 2050. Clim. Change 2020, 158, 125–139. [Google Scholar] [CrossRef]

- Wen, F.; Chen, M.; Zhang, Y.; Miao, X. Oil Price Uncertainty and Audit Fees: Evidence from the Energy Industry. Energy Econ. 2023, 125, 106852. [Google Scholar] [CrossRef]

- Fant, C.; Boehlert, B.; Strzepek, K.; Larsen, P.; White, A.; Gulati, S.; Li, Y.; Martinich, J. Climate Change Impacts and Costs to U.S. Electricity Transmission and Distribution Infrastructure. Energy 2020, 195, 116899. [Google Scholar] [CrossRef] [PubMed]

- Loureiro, M.L.; Alló, M. Sensing Climate Change and Energy Issues: Sentiment and Emotion Analysis with Social Media in the U.K. and Spain. Energy Policy 2020, 143, 111490. [Google Scholar] [CrossRef]

- Chen, R.; Wei, B.; Jin, C.; Liu, J. Returns and Volatilities of Energy Futures Markets: Roles of Speculative and Hedging Sentiments. Int. Rev. Financ. Anal. 2021, 76, 101748. [Google Scholar] [CrossRef]

- Zhang, L.; Liang, C.; Huynh, L.D.T.; Wang, L.; Damette, O. Measuring the Impact of Climate Risk on Renewable Energy Stock Volatility: A Case Study of G20 Economies. J. Econ. Behav. Organ. 2024, 223, 168–184. [Google Scholar] [CrossRef]

- Hu, L.; Song, M.; Wen, F.; Zhang, Y.; Zhao, Y. The Impact of Climate Attention on Risk Spillover Effect in Energy Futures Markets. Energy Econ. 2025, 141, 108044. [Google Scholar] [CrossRef]

- Zhou, D.; Siddik, A.B.; Guo, L.; Li, H. Dynamic Relationship among Climate Policy Uncertainty, Oil Price and Renewable Energy Consumption—Findings from TVP-SV-VAR Approach. Renew. Energy 2023, 204, 722–732. [Google Scholar] [CrossRef]

- Xue, J.; Dai, X.; Zhang, D.; Nghiem, X.-H.; Wang, Q. Tail Risk Spillover Network among Green Bond, Energy and Agricultural Markets under Extreme Weather Scenarios. Int. Rev. Econ. Financ. 2024, 96, 103707. [Google Scholar] [CrossRef]

- Seok, S.; Cho, H.; Ryu, D. Intraday Analyses on Weather-Induced Sentiment and Stock Market Behavior. Q. Rev. Econ. Financ. 2024, 98, 101929. [Google Scholar] [CrossRef]

- Mosquera-López, S.; Uribe, J.M.; Joaqui-Barandica, O. Weather Conditions, Climate Change, and the Price of Electricity. Energy Econ. 2024, 137, 107789. [Google Scholar] [CrossRef]

- Man, Y.; Zhang, S.; He, Y. Dynamic Risk Spillover and Hedging Efficacy of China’s Carbon-Energy-Finance Markets: Economic Policy Uncertainty and Investor Sentiment Non-Linear Causal Effects. Int. Rev. Econ. Financ. 2024, 93, 1397–1416. [Google Scholar] [CrossRef]

- Li, J.; Liu, R.; Yao, Y.; Xie, Q. Time-Frequency Volatility Spillovers across the International Crude Oil Market and Chinese Major Energy Futures Markets: Evidence from COVID-19. Resour. Policy 2022, 77, 102646. [Google Scholar] [CrossRef]

- Jiang, W.; Zhang, Y.; Wang, K.-H. Analyzing the Connectedness among Geopolitical Risk, Traditional Energy and Carbon Markets. Energy 2024, 298, 131411. [Google Scholar] [CrossRef]

- Ben Salem, L.; Zayati, M.; Nouira, R.; Rault, C. Volatility Spillover between Oil Prices and Main Exchange Rates: Evidence from a DCC-GARCH-Connectedness Approach. Resour. Policy 2024, 91, 104880. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yılmaz, K. On the Network Topology of Variance Decompositions: Measuring the Connectedness of Financial Firms. J. Econom 2014, 182, 119–134. [Google Scholar] [CrossRef]

- Baruník, J.; Křehlík, T. Measuring the Frequency Dynamics of Financial Connectedness and Systemic Risk. J. Financ. Econ. 2018, 128, 181–208. [Google Scholar] [CrossRef]

- Balcilar, M.; Gabauer, D.; Umar, Z. Crude Oil Futures Contracts and Commodity Markets: New Evidence from a TVP-VAR Extended Joint Connectedness Approach. Resour. Policy 2021, 73, 102219. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Gabauer, D. Refined Measures of Dynamic Connectedness Based on Time-Varying Parameter Vector Autoregressions. J. Risk Financ. Manag. 2020, 13, 84. [Google Scholar] [CrossRef]

- Ando, T.; Greenwood-Nimmo, M.; Shin, Y. Quantile Connectedness: Modeling Tail Behavior in the Topology of Financial Networks. Manag. Sci. 2022, 68, 2401–2431. [Google Scholar] [CrossRef]

- Bulut, E.; Marangoz, C. Exploring the Impact of Economic Recession Indicators on Global Financial Markets: A QVAR Analysis. Int. Rev. Financ. Anal. 2025, 99, 103966. [Google Scholar] [CrossRef]

- Jiang, D.; Jia, F.; Han, X. Quantile Return and Volatility Spillovers and Drivers among Energy, Electricity, and Cryptocurrency Markets. Energy Econ. 2025, 144, 108307. [Google Scholar] [CrossRef]

- Shao, S.F.; Cheng, J. Quantile Connectedness between Clean Energy Metals and China’s New Energy Market Segments. Appl. Econ. Lett. 2025, 1, 1–6. [Google Scholar] [CrossRef]

- Wei, Y.; Zhang, J.; Bai, L.; Wang, Y. Connectedness among El Niño-Southern Oscillation, Carbon Emission Allowance, Crude Oil and Renewable Energy Stock Markets: Time- and Frequency-Domain Evidence Based on TVP-VAR Model. Renew. Energy 2023, 202, 289–309. [Google Scholar] [CrossRef]

- Liu, W.; Tang, M.; Zhao, P. The Effects of Attention to Climate Change on Carbon, Fossil Energy and Clean Energy Markets: Based on Causal Network Learning Algorithms. Energy Strat. Rev. 2025, 59, 101717. [Google Scholar] [CrossRef]

- Lucidi, F.S.; Pisa, M.M.; Tancioni, M. The Effects of Temperature Shocks on Energy Prices and Inflation in the Euro Area. Eur. Econ. Rev. 2024, 166, 104771. [Google Scholar] [CrossRef]

- Zhao, Y.; Dai, X.; Zhang, D.; Wang, Q.; Cao, Y. Do Weather Conditions Drive China’s Carbon-Coal-Electricity Markets Systemic Risk? A Multi-Timescale Analysis. Financ. Res. Lett. 2023, 51, 103432. [Google Scholar] [CrossRef]

- Gonçalves, A.C.R.; Costoya, X.; Nieto, R.; Liberato, M.L.R. Extreme Weather Events on Energy Systems: A Comprehensive Review on Impacts, Mitigation, and Adaptation Measures. Sustain. Energy Res. 2024, 11, 4. [Google Scholar] [CrossRef]

- Wang, X.; Rong, X.; Yin, L. Discerning the Impact of Global Geopolitical Risks on China’s Energy Futures Market Spillovers: Evidence from Higher-Order Moments. Energy Econ. 2024, 140, 107981. [Google Scholar] [CrossRef]

- Almeida, D.; Ferreira, P.; Dionísio, A.; Aslam, F. Exploring the Connection between Geopolitical Risks and Energy Markets. Energy Econ. 2024, 141, 108113. [Google Scholar] [CrossRef]

- Gu, Q.; Li, S.; Tian, S.; Wang, Y. Climate, Geopolitical, and Energy Market Risk Interconnectedness: Evidence from a New Climate Risk Index. Financ. Res. Lett. 2023, 58, 104392. [Google Scholar] [CrossRef]

- Hong, Y.; Luo, K.; Xing, X.; Wang, L.; Huynh, L.D.T. Exchange Rate Movements and the Energy Transition. Energy Econ. 2024, 136, 107701. [Google Scholar] [CrossRef]

- Zhang, H.; Chen, J.; Shao, L. Dynamic Spillovers between Energy and Stock Markets and Their Implications in the Context of COVID-19. Int. Rev. Financ. Anal. 2021, 77, 101828. [Google Scholar] [CrossRef] [PubMed]

- Chen, Y.; Zhu, H.; Liu, Y. Measuring Multi-Scale Risk Contagion between Crude Oil, Clean Energy, and Stock Market: A MODWT-Vine-Copula Method. Res. Int. Bus. Financ. 2025, 75, 102790. [Google Scholar] [CrossRef]

- Shi, Y.; Zhang, D.F.; Xu, Y.; Zhou, B.-T. Changes of Heating and Cooling Degree Days over China in Response to Global Warming of 1.5 °C, 2 °C, 3 °C and 4 °C. Adv. Clim. Change Res. 2018, 9, 192–200. [Google Scholar] [CrossRef]

- Guo, Y.Y.; Teng, M.X.; Zhang, C.; Wang, S.N.; Wei, Y.M. Climatic Impacts on Electricity Consumption of Urban Residential Buildings in China. Adv. Clim. Change Res. 2025, 16, 25–34. [Google Scholar] [CrossRef]

- Shen, H.; Wen, X.; Trutnevyte, E. Accuracy Assessment of Energy Projections for China by Energy Information Administration and International Energy Agency. Energy Clim. Change 2023, 4, 100111. [Google Scholar] [CrossRef]

- Gong, X.L.; Zhao, M.; Wu, Z.C.; Jia, K.W.; Xiong, X. Research on Tail Risk Contagion in International Energy Markets—The Quantile Time-Frequency Volatility Spillover Perspective. Energy Econ. 2023, 121, 106678. [Google Scholar] [CrossRef]

- Le, T.H. Quantile Time-Frequency Connectedness between Cryptocurrency Volatility and Renewable Energy Volatility during the COVID-19 Pandemic and Ukraine-Russia Conflicts. Renew. Energy 2023, 202, 613–625. [Google Scholar] [CrossRef]

- Jin, Y.; Zhao, H.; Bu, L.; Zhang, D. Geopolitical Risk, Climate Risk and Energy Markets: A Dynamic Spillover Analysis. Int. Rev. Financ. Anal. 2023, 87, 102597. [Google Scholar] [CrossRef]

| Mean | Std.dev | Skewness | Kurtosis | JB | ADF | |

|---|---|---|---|---|---|---|

| SC | 0.0128 | 2.3399 | −0.2516 | 5.7791 | 527.5 *** | −12.3542 *** |

| FU | 0.0104 | 2.4647 | −0.2889 | 7.4398 | 1325.5 *** | −12.1755 *** |

| CC | −0.0002 | 2.5086 | −0.7624 | 10.0877 | 3475.5 *** | −12.0878 *** |

| CK | −0.0072 | 2.2970 | −0.7025 | 7.5733 | 1513.5 *** | −11.8625 *** |

| BU | 0.0084 | 1.9274 | −0.1073 | 7.2264 | 1184.2 *** | −11.3918 *** |

| MA | −0.0072 | 1.7339 | −0.0226 | 5.8586 | 540.5 *** | −12.0544 *** |

| SC | FU | CC | CK | BU | MA | FROM | |

|---|---|---|---|---|---|---|---|

| SC | 44.18 | 26.91 | 1.52 | 1.95 | 19.78 | 5.67 | 55.82 |

| FU | 26.94 | 44.37 | 2.02 | 2.73 | 17.79 | 6.16 | 55.63 |

| CC | 1.91 | 2.3 | 57.31 | 28.32 | 3.37 | 6.8 | 42.69 |

| CK | 2.27 | 3.01 | 27.28 | 55.49 | 3.89 | 8.06 | 44.51 |

| BU | 20.74 | 18.96 | 2.78 | 3.43 | 46.91 | 7.18 | 53.09 |

| MA | 7.63 | 8.26 | 7.17 | 9.06 | 9.13 | 58.75 | 41.25 |

| TO | 59.5 | 59.43 | 40.76 | 45.48 | 53.95 | 33.86 | TSI |

| NET | 3.68 | 3.8 | −1.93 | 0.97 | 0.86 | −7.38 | 48.83 |

| SC | FU | CC | CK | BU | MA | FROM | |

|---|---|---|---|---|---|---|---|

| SC | 44.88 | 26.75 | 1.42 | 1.87 | 19.46 | 5.62 | 55.12 |

| FU | 26.79 | 45.04 | 1.9 | 2.65 | 17.58 | 6.03 | 54.94 |

| CC | 1.68 | 2.25 | 58.82 | 27.69 | 3.04 | 6.51 | 41.18 |

| CK | 2.34 | 3.05 | 26.71 | 55.78 | 3.91 | 8.21 | 44.22 |

| BU | 20.67 | 18.81 | 2.58 | 3.29 | 47.46 | 7.19 | 52.54 |

| MA | 7.43 | 8.13 | 7.08 | 9.09 | 8.91 | 59.35 | 40.65 |

| TO | 58.92 | 59 | 39.7 | 44.59 | 52.89 | 33.57 | TSI |

| NET | 3.79 | 4.05 | −1.48 | 0.37 | 0.36 | −7.08 | 48.11 |

| SC | FU | CC | CK | BU | MA | FROM | |

|---|---|---|---|---|---|---|---|

| 0.05 quantile | |||||||

| SC | 21.9 | 18.68 | 13.41 | 13.99 | 17.39 | 14.64 | 78.1 |

| FU | 18.84 | 21.96 | 13.22 | 13.88 | 17.33 | 14.78 | 78.04 |

| CC | 13.85 | 13.71 | 23.82 | 19.63 | 13.74 | 15.26 | 76.18 |

| CK | 14.27 | 14.2 | 18.99 | 23.08 | 14.06 | 15.41 | 76.92 |

| BU | 17.86 | 17.2 | 13.67 | 14.04 | 21.98 | 15.25 | 78.02 |

| MA | 15.51 | 15.55 | 14.64 | 15.52 | 15.6 | 23.18 | 76.82 |

| TO | 80.33 | 79.33 | 73.93 | 77.06 | 78.11 | 75.33 | TSI |

| NET | 2.22 | 1.3 | −2.26 | 0.13 | 0.09 | −1.49 | 77.35 |

| 0.95 quantile | |||||||

| SC | 23.32 | 19.3 | 12 | 12.93 | 17.91 | 14.54 | 76.68 |

| FU | 19.21 | 23.04 | 12.16 | 13.33 | 17.56 | 14.7 | 76.96 |

| CC | 12.83 | 12.98 | 25.48 | 19.72 | 13.65 | 15.35 | 74.52 |

| CK | 13.25 | 13.71 | 18.9 | 24.2 | 13.93 | 16.01 | 75.8 |

| BU | 18.2 | 18.05 | 12.67 | 13.69 | 22.71 | 14.69 | 77.29 |

| MA | 15.25 | 15.11 | 14.62 | 15.79 | 15.18 | 24.05 | 75.95 |

| TO | 78.74 | 79.14 | 70.35 | 75.46 | 78.23 | 75.29 | TSI |

| NET | 2.06 | 2.18 | −4.17 | −0.34 | 0.93 | −0.66 | 76.20 |

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| TE | 0.0003 (0.725) | |||

| CDD | 0.0110 *** (3.141) | |||

| HDD | 0.0000 (0.048) | |||

| TP | 0.0212 (0.485) | |||

| GPR | 0.7698 *** (10.550) | 0.0791 *** (10.869) | 0.0764 *** (10.497) | 0.0769 *** (10.495) |

| OVX | 0.0030 (0.181) | 0.0115 (0.688) | 0.0156 (0.095) | 0.0029 (0.173) |

| VIX | 0.1046 *** (6.187) | 0.0999 *** (5.927) | 0.1062 *** (6.289) | 0.1052 *** (6.223) |

| Rate | −0.4699 *** (−3.586) | −0.4603 *** (−3.531) | −0.4640 *** (−3.536) | −0.4642 *** (−3.548) |

| CSI300 | −0.2391 *** (−5.036) | −0.2279 *** (−4.804) | −0.2404 *** (−5.066) | −0.2389 *** (−5.025) |

| Constant | 6.2566 *** (9.712) | 6.1158 *** (9.503) | 6.2640 *** (9.721) | 6.2456 *** (9.678) |

| R-squared | 0.1992 | 0.2047 | 0.1988 | 0.1990 |

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| TE | −0.00007 ** (−2.276) | |||

| CDD | 0.0010 *** (2.748) | |||

| HDD | 0.0002 *** (3.237) | |||

| TP | −0.0051 (−1.261) | |||

| GPR | 0.0054 *** (7.922) | 0.0057 *** (8.502) | 0.0054 *** (7.966) | 0.0054 *** (7.951) |

| OVX | 0.0073 *** (4.794) | 0.0086 *** (5.523) | 0.0075 *** (4.922) | 0.0074 *** (4.823) |

| VIX | 0.0146 *** (9.285) | 0.0136 *** (8.702) | 0.0147 *** (9.375) | 0.0144 *** (9.151) |

| Rate | −0.0547 *** (−4.497) | −0.0559 *** (−4.610) | −0.0533 *** (−4.385) | −0.0563 *** (−4.634) |

| CSI300 | −0.0337 *** (−7.639) | −0.0323 *** (−7.308) | −0.0335 *** (−7.618) | −0.0336 *** (−7.613) |

| Constant | 4.8220 *** (80.663) | 4.8072 *** (80.286) | 4.8150 *** (80.695) | 4.8239 *** (80.454) |

| R-squared | 0.3616 | 0.3628 | 0.3642 | 0.3599 |

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| TE | −0.0002 *** (−7.094) | |||

| CDD | −0.0015 *** (−4.257) | |||

| HDD | 0.0003 *** (6.473) | |||

| TP | −0.0291 *** (−6.916) | |||

| GPR | 0.0053 *** (7.559) | 0.0055 *** (7.741) | 0.0055 (7.846) | 0.0052 *** (−6.916) |

| OVX | −0.0048 *** (−3.047) | −0.0048 *** (−2.976) | −0.0041 ** (−2.574) | −0.0053 *** (−3.297) |

| VIX | 0.0099 *** (6.090) | 0.0094 *** (5.689) | 0.0096 *** (5.892) | 0.0098 *** (6.021) |

| Rate | −0.0153 (−1.213) | −0.0210 (−1.645) | −0.0142 (−1.122) | −0.0208 (−1.652) |

| CSI300 | 0.0041 (0.897) | 0.0037 (0.790) | 0.0049 (1.070) | 0.0033 (0.722) |

| Constant | 4.4780 *** (72.190) | 4.4906 *** (71.353) | 4.4612 *** (71.682) | 4.4971 *** (72.300) |

| R-squared | 0.1333 | 0.1126 | 0.1280 | 0.1318 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Ma, L.; Cao, G.; Zhou, L. Weather Change and Spillover Effects of China’s Energy Futures Market: Based on Different Market Conditions. Sustainability 2026, 18, 196. https://doi.org/10.3390/su18010196

Ma L, Cao G, Zhou L. Weather Change and Spillover Effects of China’s Energy Futures Market: Based on Different Market Conditions. Sustainability. 2026; 18(1):196. https://doi.org/10.3390/su18010196

Chicago/Turabian StyleMa, Lekun, Guangxi Cao, and Lei Zhou. 2026. "Weather Change and Spillover Effects of China’s Energy Futures Market: Based on Different Market Conditions" Sustainability 18, no. 1: 196. https://doi.org/10.3390/su18010196

APA StyleMa, L., Cao, G., & Zhou, L. (2026). Weather Change and Spillover Effects of China’s Energy Futures Market: Based on Different Market Conditions. Sustainability, 18(1), 196. https://doi.org/10.3390/su18010196