1. Introduction

Energy services are fundamental to modern economies and lifestyles, making energy security a crucial priority for nations. The Asia Pacific Energy Research Center has defined energy security as an economy’s ability to ensure a sustainable and timely energy supply while maintaining prices at levels that do not hinder economic performance [

1]. From 2000 to 2019, global energy consumption rose steadily alongside economic growth, increasing from 402.08 to 600.90 trillion Btu. However, this surge in energy demand has exacerbated air pollution and climate change [

2], posing significant challenges to energy security amid the broader shift toward a low-carbon economy. Furthermore, volatility in global energy markets and prices can destabilize macroeconomic and fiscal conditions. Given these risks, it is important to scientifically evaluate the effect of external factors on energy security by developing robust methods.

Financial globalization influences multiple dimensions of energy security. Previous studies have explored its effects on key variables such as technological advancement, energy consumption, environmental quality, and economic growth [

3,

4,

5,

6,

7,

8,

9,

10,

11]. As financial globalization continues to evolve, its implications for energy security remain a critical area of investigation. Empirical research indicates that financial globalization increases the consumption of both fossil fuels and renewable energy [

3,

4]. While many studies suggest that financial globalization may exacerbate environmental degradation [

6,

12,

13], others highlight its potential to enhance technological efficiency and improve energy affordability for households [

14,

15,

16].

Financial globalization affects multiple dimensions of energy security. Previous studies have explored its effects on key variables such as technical advancement, energy consumption, environmental quality, and economic growth [

3,

4,

5,

6,

7,

8,

9,

10,

11]. As financial globalization continues to evolve, its implications for energy security remain a critical area of investigation. Empirical research has shown that financial globalization raises the consumption of both fossil energy and renewable energy [

3,

4]. Many studies suggested that financial globalization can reduce environmental quality [

6,

12,

13], improve technological efficiency, and enhance energy affordability of residents [

14,

15,

16]. Energy security is typically characterized by four key dimensions: availability, affordability, accessibility, and acceptability. Financial globalization exerts diverse effects on each of these dimensions. For instance, it influences affordability through investment flows and price mechanisms while shaping acceptability via the transfer of clean energy technologies. Given these multifaceted interactions, financial globalization likely has a comprehensive impact on energy security—one that warrants further in-depth investigation.

From an empirical perspective, it is necessary to consider that the effect of financial globalization on variables of energy security possibly follows a nonlinear pattern according to the changes of financial globalization itself. Most studies that examined how financial globalization affected factors related to energy security utilized traditional parametric regression models, mainly in the form of linear functions [

3,

7,

13,

17,

18]. Existing research often adopts an oversimplified approach to energy security, reducing it to mere supply adequacy while neglecting its multidimensional nature. Additionally, many studies employ narrow or incomplete measures of financial globalization. Further methodological limitations include the following: (1) insufficient consideration of geographical boundaries, intermediary variables, and regulatory influences and (2) a reliance on static analytical frameworks that fail to account for potential time-varying dynamics in the relationship between financial globalization and energy security. Halkos and Polemis [

19] and Ivanovski et al. [

20] pointed out that traditional parametric regression models that are based on the assumption of the mean may generate inaccurate empirical results. Financial globalization may affect energy security indirectly by affecting other factors such as financial development and technological innovation [

6,

14,

15], both of which change over time. In addition, the traditional linear regression model cannot clarify the regime-switching effect financial globalization has on energy security [

21]. The panel smooth transition regression (PSTR) model is more flexible than the traditional linear model. The PSTR model cannot only examine linear and nonlinear relationships but also accurately capture the regime-switching, time trend, and regional heterogeneity of the effect.

Regarding the measurement of financial globalization, the KOF Swiss Economic Institute has defined de facto financial globalization as foreign direct investment (FDI), portfolio investment, international debt, international reserves, and international income payments. They have defined de jure financial globalization as investment restrictions, capital account openness, and international investment agreements. However, most studies used de facto and single variables such as FDI and trade openness to represent financial globalization [

4,

13,

22]. This paper employs the financial globalization (de facto) index for enhanced cross-country comparability. Because of the distinctions in energy demand, energy supply structure, and energy dependence between different countries, financial globalization may have heterogeneous effects in energy resource-based countries and other types of countries [

23]. Thus, taking on a global perspective, this paper includes 123 countries as a research sample to explore the heterogeneity of this effect.

The PSTR model is applied to analyze the nonlinear effect of financial globalization on energy security in 123 countries for the period of 2000–2018. The control variables include armed forces, industrialization rate, trade value share, and urbanization rate, and as the transition variable, the next period financial globalization index is adopted. To explore the financial globalization effects in countries with different energy resource endowments, the effect is estimated for the countries of the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC countries. The results of this paper can reveal the following issues: Does financial globalization have a nonlinear effect on energy security? In this case, what are the structural features and degree of the nonlinear effect at different levels of financial globalization? What are the spatial and temporal variations of the effect? What is the difference of this effect between OPEC countries and non-OPEC countries?

This study makes two significant contributions to the existing literature. First, it pioneers the use of a comprehensive financial globalization index to examine its relationship with energy security. Unlike prior studies that rely on oversimplified unitary indicators, this approach provides a more holistic and comparable measure, thereby yielding more robust and scientifically sound empirical findings. Second, the analysis adopts a global and nonlinear perspective to assess the linkage between financial globalization and national energy security. By employing the PSTR model, the study captures the dynamic effects of financial globalization on energy security. Furthermore, a comparative regression analysis between OPEC and non-OPEC countries reveals regional heterogeneity tied to energy resource endowments. These findings offer valuable insights for policymakers in countries with similar resource profiles seeking to enhance their energy security strategies.

The rest of this paper is structured as follows:

Section 2 reviews the relevant literature about financial globalization and energy security.

Section 3 introduces the PSTR model, variables, and data.

Section 4 shows and analyzes the empirical result of the effect of financial globalization on energy security.

Section 5 summarizes the results and explains the limitations of this paper.

2. Literature Review

Many scholars studied the influencing factors of energy security when issues such as energy price fluctuations and energy supply shortages occurred. Previous studies centered on the impact of financial globalization on various dimensions of energy security, but their relationship was not examined. However, it is widely assumed that energy security can be enhanced with certain measures, such as increasing forest storage and carbon sinks, improving energy transition efficiency, optimizing industrial structure, decreasing energy consumption, enhancing energy utilization efficiency, reducing energy intensity, and improving energy service quality [

24,

25,

26]. Financial globalization is a vital economic factor that affects energy security by impacting energy technology, energy consumption, the environment, and the energy economy. Previous studies hold different views on how financial globalization affects the above four aspects of energy security.

2.1. Financial Globalization and Energy Consumption

The development of financial globalization can promote the global consumption of fossil energy, increasing the consumption of renewable energy. Some studies suggested that there is a weak decoupling connection between financial globalization and energy consumption. Acheampong et al. [

3] applied an instrumental variable generalized method based on data from 23 countries and found that economic globalization increased energy consumption under the condition of economic growth. Zhang et al. [

4] took total trade, import, and export as indicators of trade openness and found that renewable energy consumption is positively impacted by trade openness in Organization for Economic Cooperation and Development countries. Ghazouani [

5] found a time-varying connection between globalization and renewable energy planning in 15 countries based on the local linear dummy variable estimation method. He suggested that increasing trade and FDI can provide technology patent transfer, thus promoting the consumption of renewable energy and technology transformation. Mohammad et al. [

27] analyzed the macroeconomic determinants of non-renewable and renewable energy consumption in India, including the roles of international trade, innovative technologies, financial globalization, carbon emissions, financial development, and urbanization.

2.2. Financial Globalization and the Environment

Financial globalization reduces environmental quality by promoting trade activities. However, it has been suggested that technology and management knowledge introduced by financial globalization can improve environmental quality. Meng et al. [

12] suggested that the globalization trend increases trade among developing countries, which seriously undermines international efforts to reduce global emissions. Sadip et al. [

8] used two multivariate log-transform models and found that while financial globalization contributed to the development of BRICS countries, it reduced their atmospheric quality. Baek [

9], Mahalik et al. [

13], and Kivyiro and Arminen [

17] used linear models and found that carbon dioxide emissions are increased by FDI, which supports the “pollution haven hypothesis”. However, Samuel and Vladimir [

28] used a panel regression method and found that greenhouse gas emissions could be improved by FDI in developing countries. Teng et al. [

29] examined potential intersections between economic growth and financial globalization on the marine ecosystem of the G-20 countries from 2000. Ozkan et al. [

30] analyzed the time-quantile impact of foreign direct investment, financial development, and financial globalization on green growth in BRICS economies.

2.3. Financial Globalization and Energy Technology

It has been suggested that financial globalization promotes technological innovation and improves the innovation and management abilities of enterprises. Bekaert et al. [

6] used ordinary least squares and the system generalized method of moment (Syst-GMM) based on data from 95 countries. They found that financial globalization was able to connect local financial markets with the global financial market, providing advanced technology and management experience for local markets. Zheng et al. [

14] found that financial globalization improves national technological innovation based on data from 110 countries, using a two-step Syst-GMM. Other studies suggested that the positive effect of financial globalization on technology development is heterogeneous. Through heterogeneity analysis, even if financial resources are significant to innovation, by analyzing industry-level data of 55 countries, Friedrich et al. [

7] found that the allocation of limited funds to innovative enterprises in real financial markets may not be effective, especially in emerging economies.

2.4. Financial Globalization and Energy Economy

Financial globalization not only promotes economic development by promoting financial development [

15] but also decreases the cost of obtaining energy to improve the affordability of energy for residents. Usman et al. [

18] found that financial development and globalization promoted the economic growth of Arctic countries. Shahbaz et al. [

10] included financial development, capital, and international trade as key factors of China’s production function; by using an autoregressive distributed lag model bounds testing approach, they explored the connection between energy consumption and economic growth. The results showed that economic growth was positively affected by the above key factors. The growth effects of openness are likely to be significantly improved. Koyama and Krane [

16] identified Japan’s FDI for the energy sector in the Middle East as an important way to establish strategic economic relations between Japan and resource-rich countries. In this way, the cost of energy materials in Japan could be reduced. However, it was also found that the positive impact of trade openness on economic development was decided by whether complementary reforms (those that are based on international competitive advantages) were utilized to supplement policies [

22].

In summary, there are still several aspects that need to be addressed in the research. First, while many research results on how financial globalization affects energy security have been reported, most studies used a single indicator, such as FDI or trade openness, to explore specific dimensions of energy security, such as energy consumption, the environment, energy economy, and energy technology. The connection between the financial globalization index and the energy security index has not been examined to date. Second, existing research on financial globalization’s influence on energy security sub-dimensions has been geographically limited, typically focusing on individual countries or small samples. This approach overlooks potential heterogeneity—particularly in how financial globalization differentially affects technology adoption and environmental outcomes across nations. A global perspective is urgently needed to address this oversight. Third, the multifaceted and dynamic nature of financial globalization’s impact on energy security dimensions cannot be adequately captured by traditional linear regression models. The direction and magnitude of these effects may evolve alongside financial globalization itself, necessitating nonlinear or threshold-based analytical frameworks.

5. Conclusions

In this paper, the PSTR model is employed to explore the impacts of financial globalization on energy security in 123 countries. A method that combines GPCA and entropy-TOPSIS is used to calculate the energy security index. The FGI (de facto) represents financial globalization. Control variables include armed forces, industrialization rate, trade value share, and urbanization rate. A two-step Syst-GMM estimation approach is used to verify the robustness of the obtained results. The different impacts of financial globalization on energy security between OPEC and non-OPEC countries are also discussed.

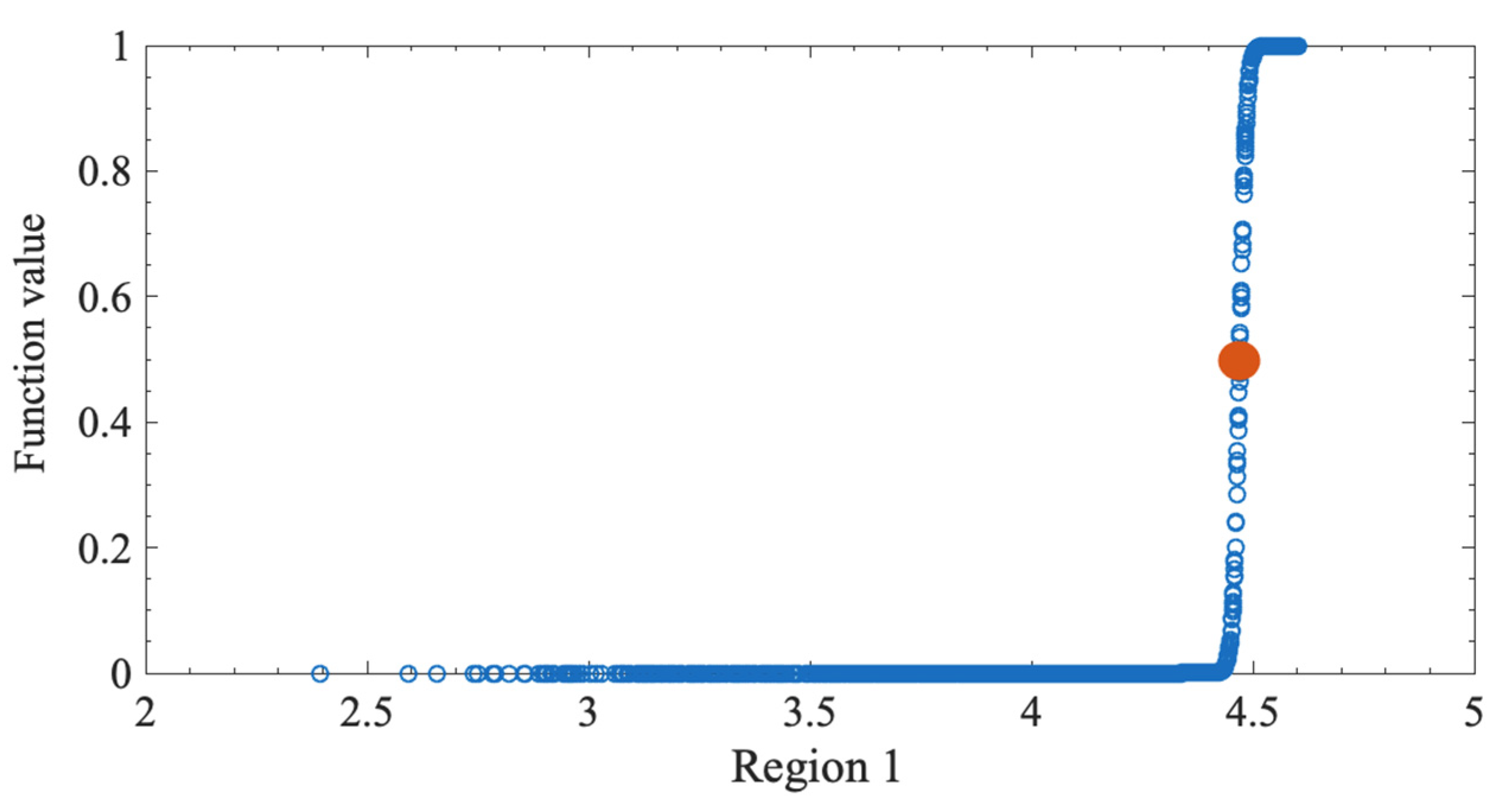

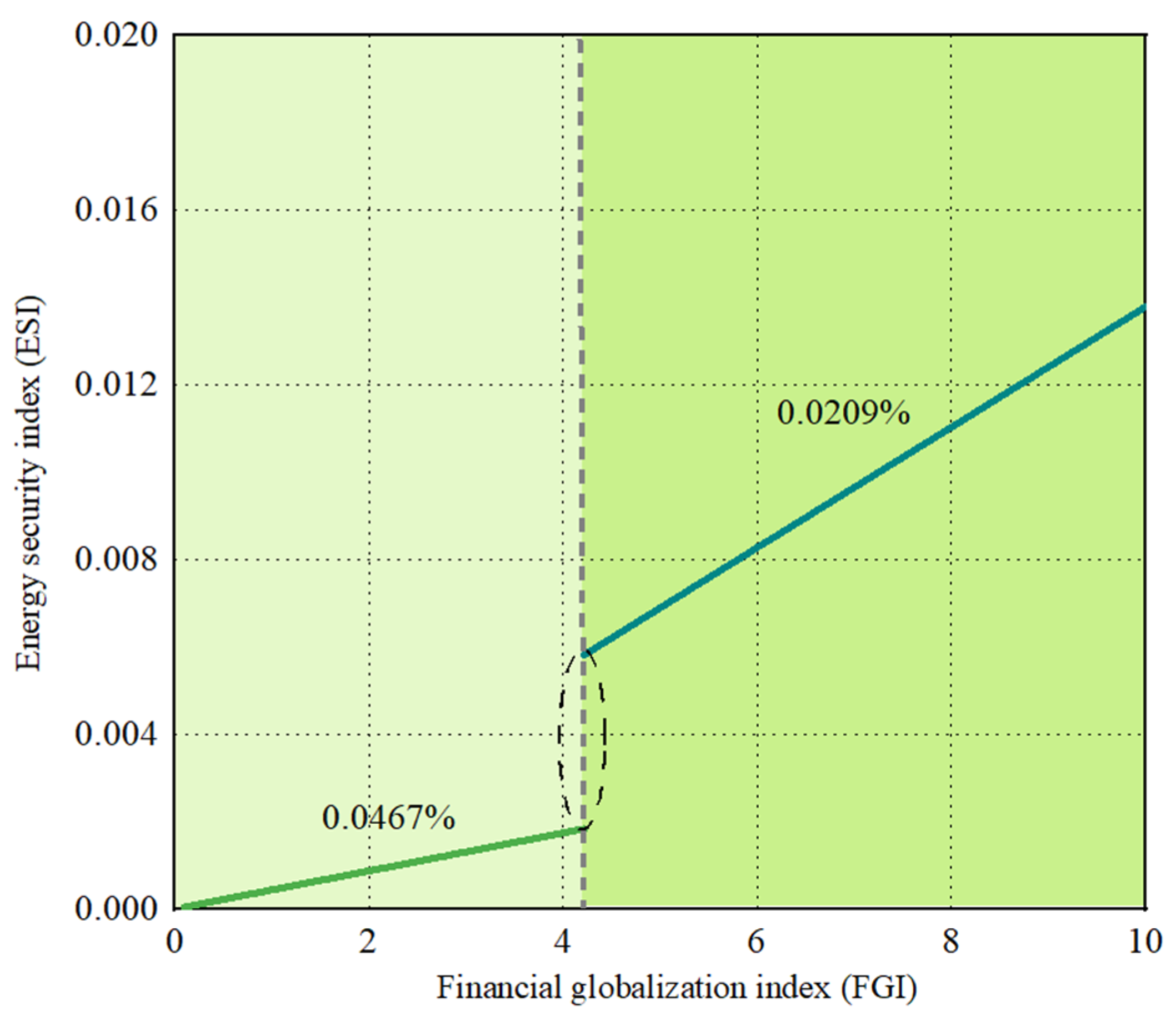

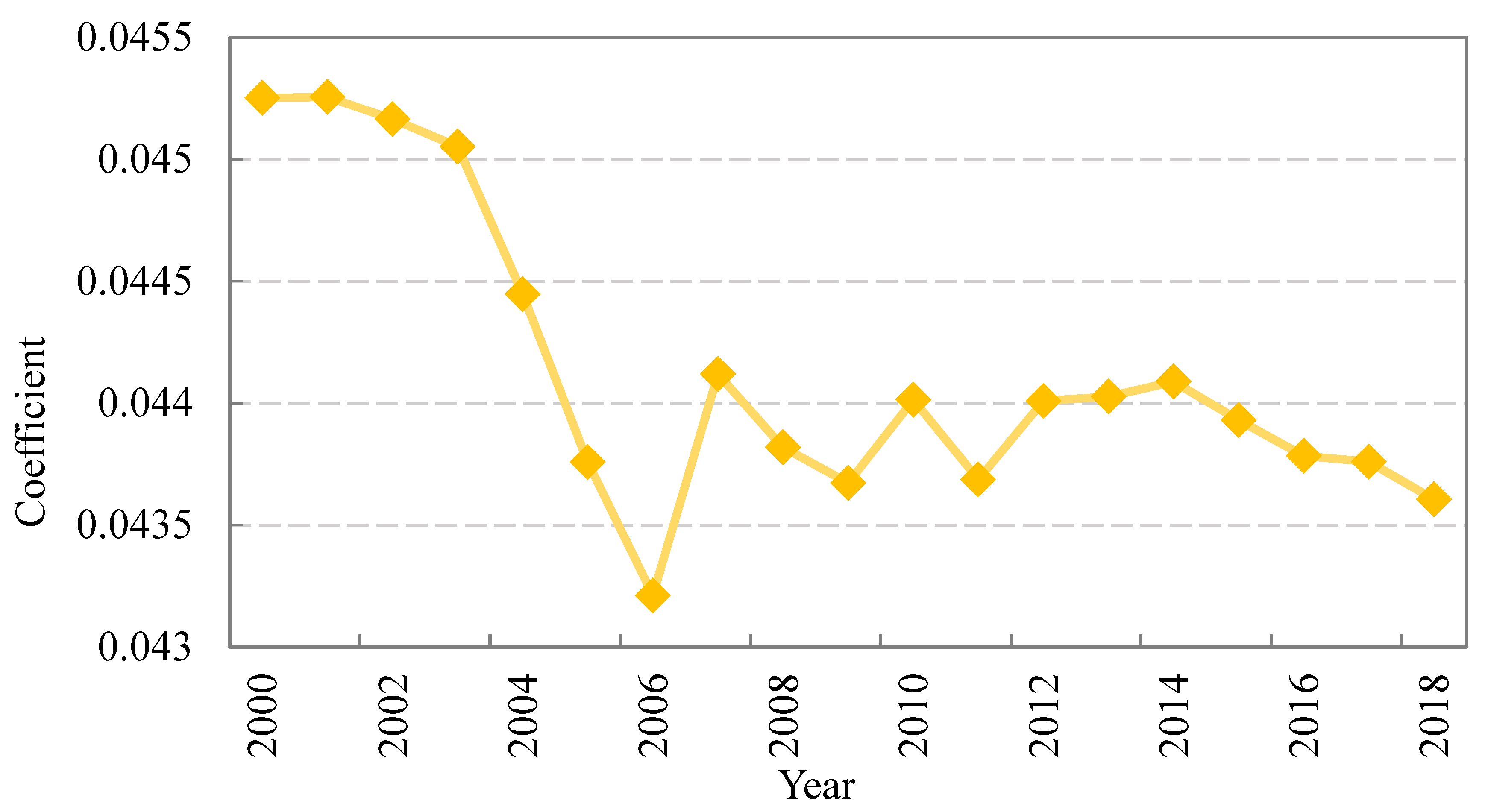

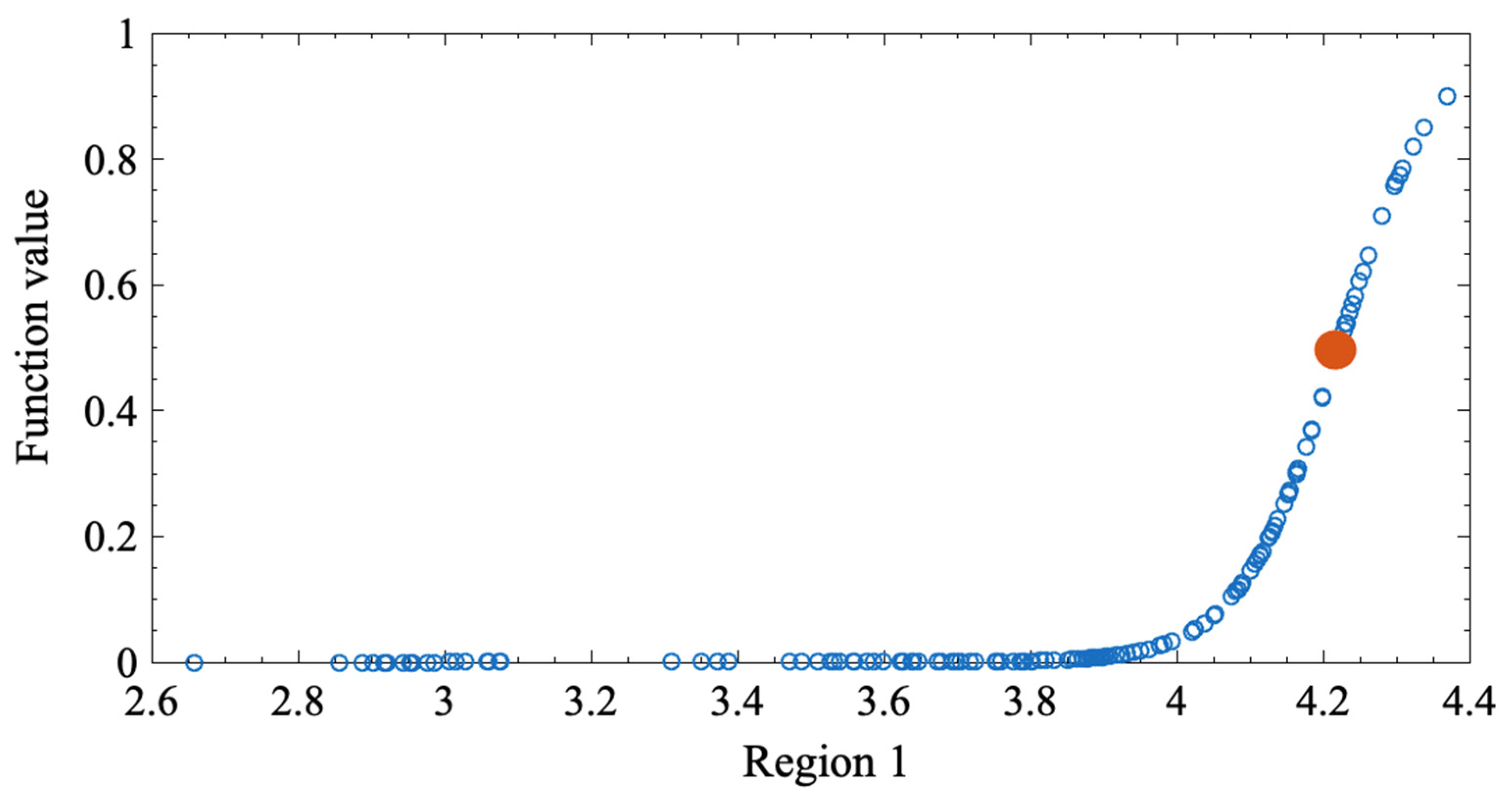

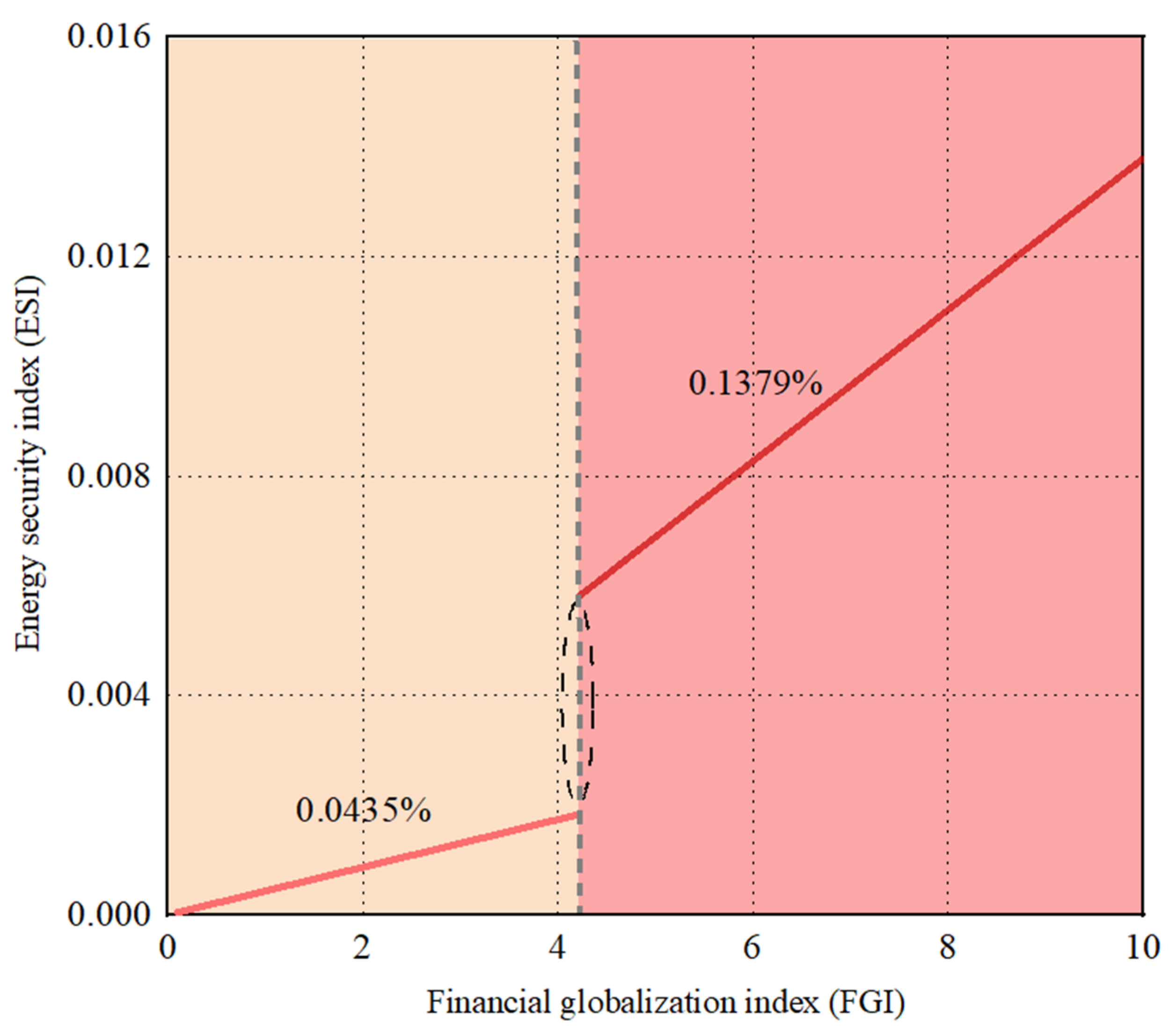

The PSTR model result shows that financial globalization can promote energy security. Both linear and nonlinear impacts are highly significant. If the logarithm of financial globalization in the previous period exceeds 0.0467, the impact coefficient declines from 0.0467 to 0.0209. This decline suggests that the increase in financial globalization can decrease its positive impact on energy security. For the temporal and spatial results, the positive effect follows a “decrease, increase, decrease” trend from 2000 to 2018. Financial globalization has the greatest effect on the energy security of Oceania and the Americas, with an effect coefficient of 0.0467, and the smallest impact in Europe, with an effect coefficient of 0.0391.

In addition, the same linear and nonlinear influence directions are found in the results of Syst-GMM and PSTR models, which proves the robustness of the PSTR model results. Financial globalization exerts significant linear and nonlinear impacts on energy security in OPEC countries, the effect coefficient of which exceeds the global level. However, financial globalization only exerts a linear impact on energy security in non-OPEC countries, and its positive effect is lower than that of OPEC countries. Regarding control variables, armed forces have a negative nonlinear impact on energy security. Other variables, such as industrialization rate, share of trade value, and urbanization rate, have positive linear and nonlinear impacts on energy security.

Based on the above findings, several policy recommendations are proposed to enhance energy security through financial globalization. First, it is suggested to promote financial globalization with targeted policies. Policymakers should encourage cross-border financial flows to enhance energy security, particularly in regions where the effect is most pronounced. However, since the positive impact diminishes beyond a certain threshold, excessive financial globalization should be monitored to avoid over-reliance. Complementary policies should be implemented to sustain long-term benefits. Second, it is essential to strengthen financial integration in OPEC countries. Given that financial globalization exerts a stronger positive influence on energy security in OPEC nations, these countries should capitalize on financial openness by attracting investments in energy infrastructure and diversification. Developing robust financial markets can further facilitate capital inflows for renewable energy and efficiency projects. Third, it is needed to adopt long-term monitoring and adaptive policies. Due to the fluctuating temporal effects of financial globalization on energy security, governments should adopt dynamic policy frameworks. Continuous assessment and timely adjustments will be crucial to maintaining and enhancing energy security gains over time.

The limitations of this paper emerge because financial globalization has a complex effect mechanism on energy security. First, in this paper, the next period FGI is used as a threshold variable. However, the financial globalization effect may also depend on other factors, such as financial development and technological innovation. Future studies can use these variables as threshold variables to further clarify the impact path. Second, financial globalization is part of economic globalization, which has a certain impact on trade activities. According to the theory of trade environmental effects, financial globalization effects mainly include scale effects, structural effects, and technological effects. Future studies can establish empirical models based on these effects. Third, it suggested improving the rationality of model assumptions according to the actual conditions and the development of methodology in the future. Finally, data limitation could also be improved in the future study. For example, if the data limitation could be improved, a more detailed grouping analysis may be achieved for different regions.