1. Introduction

The Global Risks Report, released by the World Economic Forum in 2023, highlights that global efforts to address climate change have been slow and have not met expectations, posing a significant risk for the future. Climate change has impacted ecosystems, human production, and living conditions, prompting countries to take more actions to cope with climate change [

1]. Over the past years, various countries’ governments have enacted many climate- and environment-related policies to mitigate climate change by reducing pollutant emissions [

2,

3]. However, reducing pollutant emissions and slowing down the speed of climate change require time and many policy adjustments [

4].

From a practical perspective, China has announced some policies to cope with climate change and has enacted numerous climate and environmental governance policies, such as low-carbon transition policies [

5,

6], renewable energy subsidy policies [

7,

8,

9,

10], and carbon trading market policies [

11], promoting green consumption [

12] and the use of low-carbon technologies [

13]. Specifically, China implemented carbon market pilot policies in 2013, and multiple pilot programs have been carried out between 2013 and 2024. The carbon trading market has expanded during this time, effectively reducing corporate emissions [

11]. From 2006 to 2020, the Chinese government introduced many renewable energy subsidy policies [

14], and research has found that the government subsidies have improved firms’ energy transition performance [

8].

The above policies indicate that China’s climate policies have effectively reduced carbon emissions and promoted progress toward carbon neutrality. However, it is not easy for companies to cope with climate policy changes, which may introduce uncertainty for enterprises. Once a policy is implemented, firms that have just received the information may need to rapidly modify their production processes to comply with relevant climate policy requirements. This could alter the product types and the length of their production cycles. The criteria of climate policies may also affect firms’ sales activities, thereby influencing the efficiency of working capital management.

From an empirical research perspective, studies on the impact of policy uncertainty on supply chain management have found that domestic policy uncertainty prompts firms to seek suppliers internationally [

15]. When policy uncertainty is high, companies tend to accumulate more inventory [

16]. Other research has shown that firms with predominantly domestic sales will reduce their number of foreign suppliers when U.S. trade policy uncertainty increases. In contrast, firms with predominantly foreign sales will increase their number of foreign suppliers [

17]. Research on policy uncertainty has found that economic policy uncertainty significantly reduced financial stability and increased firms’ voluntary disclosure [

18,

19]. Other studies have shown that political and regulatory uncertainty diminishes corporate merger and acquisition activities [

20]. Furthermore, economic policy uncertainty has been found to decrease corporate investment [

21].

Overall, economic policy uncertainty, much like climate policy uncertainty, tends to decrease firms’ investment [

21,

22,

23]. However, unlike other forms of uncertainty, climate policy uncertainty tends to impact firms’ production and operational activities directly [

24]. Some research has found that climate policy uncertainty may increase material costs, extend delivery times for goods, and upgrade production facilities [

25,

26]. These factors may affect firms’ working capital management. Furthermore, a relatively large amount of research on economic policy uncertainty covers many topics [

18,

19,

20,

21]. In contrast, studies focusing on climate policy uncertainty are comparatively scarce, which leaves an opportunity for our research.

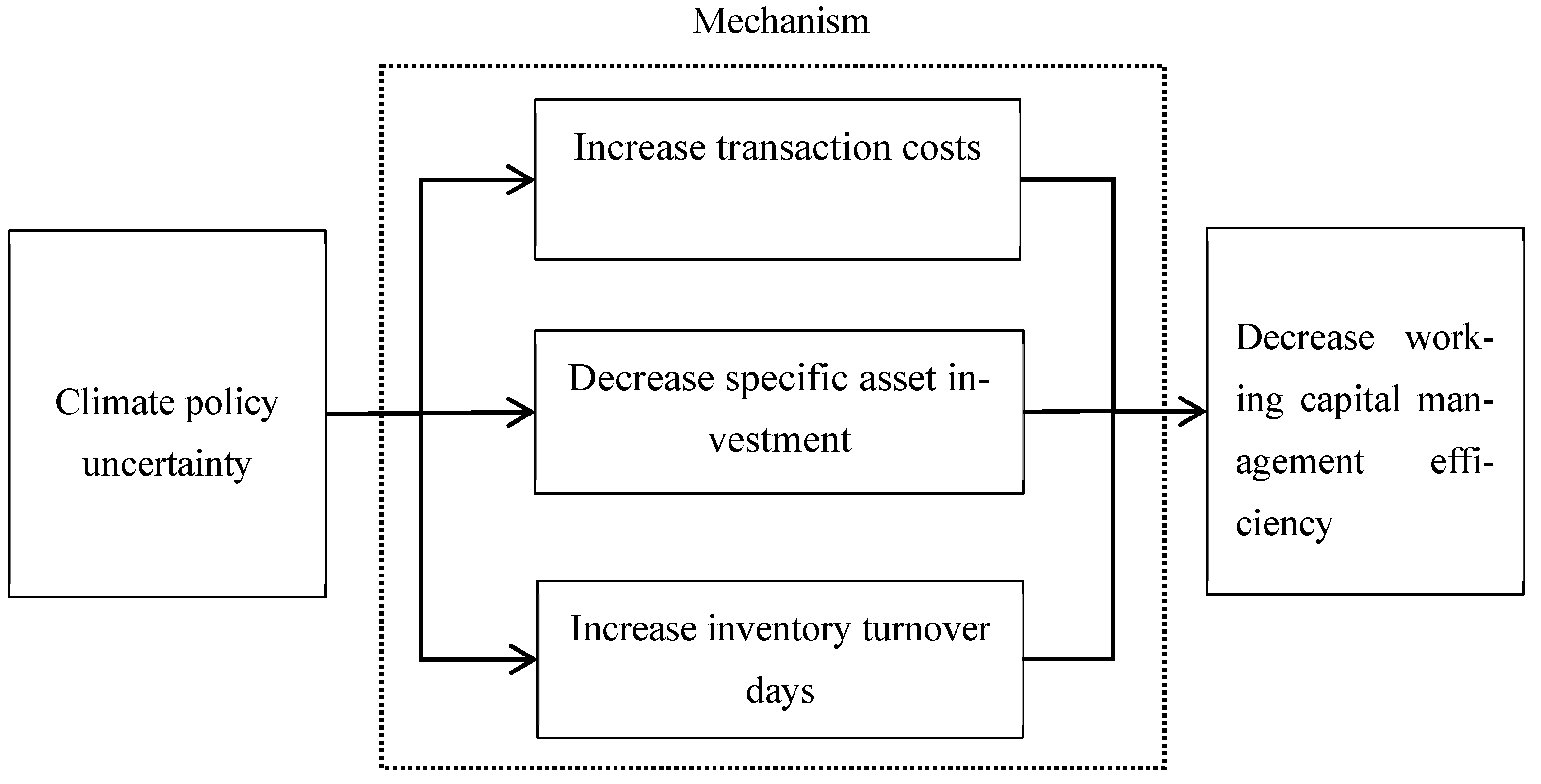

Our study’s primary question is whether climate policy uncertainty affects corporate working capital management efficiency. How does climate policy uncertainty impact corporations’ production and operational activities? We used data from Chinese A-share listed companies from 2007 to 2023 to explore these questions. The results reveal that climate policy uncertainty reduces a firm’s working capital management efficiency. Mechanism testing reveals that climate policy uncertainty raises transaction costs, prolongs inventory turnover periods, and reduces specific asset investment, thereby decreasing firms’ working capital management efficiency. Heterogeneity analysis reveals that the effect of climate policy uncertainty on corporate working capital management efficiency is more pronounced in firms located in the western and central regions, areas with lower levels of marketization, and regions with lower highway density. Based on the above results, the government should enhance the transparency of climate policies and avoid frequent policy fluctuations within short periods. On the other hand, enterprises should strengthen communication with customers and suppliers to stabilize production and sales, thereby reducing the impact of climate policy uncertainty on their operations.

Our research has three significant contributions. First, we expand the scope of studies about working capital management efficiency. Existing research has found that the corporation’s characteristics [

27], supply chain’s features [

28,

29], and relationships with suppliers and customers can influence working capital management efficiency [

30]. However, research has focused little on how climate policy uncertainty affects working capital management efficiency. Our study extends the boundaries to the dimension of the business environment in which enterprises operate, thereby enriching research about working capital management efficiency.

Second, by extending the focus of climate policy uncertainty beyond corporate financing [

31], investment [

22,

32], production [

24], and asset returns to include companies’ working capital management efficiency [

33], our study enriches the understanding of its impact on corporations. Few studies examining the impact of climate policy uncertainty on company operations highlight the need for this research, which expands and supplements the existing literature. Overall, we have expanded the scope of research on the impact of climate policy uncertainty on firms and provided advice for climate policy.

Third, our study examines how climate policy uncertainty affects the efficiency of corporate working capital management. We find that climate policy uncertainty increases firms’ transaction costs, reduces specific assets investment, and lengthens inventory turnover periods. These factors collectively influence the transactional activities between firms, their customers, and suppliers, thereby impacting the efficiency of working capital management. Our research offers advice to mitigate the impact of climate policy uncertainty on enterprises. In the face of such uncertainty, companies can improve their working capital management efficiency by rationally organizing production, reducing costs, and actively maintaining customer relationships.

2. Literature Review

Existing research has extensively examined the impact of climate policy uncertainty on corporate investment, financing, production, asset returns, and risk spillovers across markets. Regarding financing, some research affirms that climate policy uncertainty has increased companies’ financing costs [

2,

31]. However, the conclusions about investment are inconsistent. Some studies assert that climate policy uncertainty can reduce companies’ investment [

22,

32,

34,

35,

36], while others argue that it stimulates investment [

37]. From the perspective of companies’ production and operational activities, studies have found that climate policy uncertainty may lead to changes in consumption and production behaviors [

24], significantly impact energy-related industries, as well as affect companies’ operations and increase the uncertainty of future project returns [

38]. Furthermore, climate policy uncertainty has been found to decrease returns on fossil energy assets and influence stock returns and market volatility [

33,

39,

40]. It also exacerbates extreme risk spillover effects [

41]. In summary, while there is some research about the impact of climate policy uncertainty on various corporate activities, there remains a relative paucity of studies focusing on its effects on production and operations, and there is a lack of research about corporate working capital management efficiency. Production, sales, and operation are important parts of working capital management. Therefore, it is essential for companies to explore the influence of working capital management from the perspective of climate policy uncertainty.

In studies on the efficiency of working capital management, the proxy variables for working capital management efficiency have undergone a series of changes. Mao (1995) explored the optimal levels of various working capital items [

42], while Knight (1972) examined the overall optimal level of multiple working capital components [

43]. Subsequently, more research focused on using the operating cycle, working capital requirements, net trade cycle, and cash conversion cycle to measure the efficiency of working capital management. As cash conversion is a key process in working capital management, Wang (2019) defines the cash conversion cycle (CCC) as the period between the outflow of cash for purchasing material and the inflow of cash from product sales [

44]. Therefore, many studies use the cash conversion cycle to measure working capital management efficiency [

45].

From the perspective of the impact of working capital management efficiency on corporates, early research primarily explores the impact of working capital management efficiency on corporate profitability [

46]. A study suggests an optimal level of working capital management efficiency. Achieving this optimal level can enhance companies’ performance [

47]. Similarly, Habib and Dalwai (2024) have found that working capital management efficiency can increase a firm’s performance [

48].

Some literature focuses on the impact of firm characteristics, suppliers and customers, and supply chain characteristics on corporate working capital management. Existing studies have examined how corporate characteristics and business decision-making behaviors influence working capital management efficiency in firms [

27,

49]. Other research has revealed that managers’ loss aversion, overconfidence, stubbornness, and self-serving behaviors can prevent working capital management efficiency from reaching optimal levels [

50]. Sawarni et al. (2023) found that earnings management negatively affected the working capital management efficiency in Indian firms [

45]. Banerjee and Guha (2024) found that managerial capabilities can enhance a corporation’s working capital management efficiency [

51].

From the perspective of suppliers and customers, the close relationships between companies within a supply chain are more likely to become competitive due to conflicts of interest or constraints caused by sunk costs, which can adversely affect the efficiency of capital allocation within companies [

52]. In such situations, customers may leverage their market power to demand that companies adopt credit sales as a core transaction model, which can encroach upon their working capital [

53]. According to Cunat (2007) [

54], customers with higher bargaining power may leverage their advantageous position in commercial transactions to increase the coercion and resource encroachment on companies at a competitive disadvantage. Similarly, aiming to convey high-quality signals or provide quality assurance to customers, companies producing differentiated products offer more commercial credit to customers, which can decrease the performance of finance [

55]. To maintain product–market relationships and the stability of the supply chain, companies typically strive to meet the commercial credit requirements of their key customers whenever possible [

30]. In real-world scenarios, the circulation of corporate working capital often involves stakeholders such as customers [

56]. Gosman and Kohlbeck (2009) argue that customer digital transformation has not effectively improved corporate working capital management efficiency [

57]. However, Luo and Kumar (2013) suggest that customer digital transformation may leverage digital technologies to strengthen inter-company connections, positively impacting firms’ working capital management efficiency [

58].

From the perspective of the supply chain characteristics, Hofmann (2010) proposed collaborative ways to increase companies’ working capital management efficiency [

28]. Peng and Zhou (2019) found that inter-firm collaborative management can affect enterprises’ working capital management efficiency [

29].

In summary, the existing literature has explored the factors that could influence corporate working capital management efficiency, including corporate and supply chain characteristics and supplier and customer relationships. However, there is a lack of analyses from the perspective of policy uncertainty, particularly concerning climate policy. Overall, the policy environment could influence companies’ operations and production. Climate policy uncertainty, which has been focused on recently, could influence companies’ working capital management from production to operation. Therefore, our study is meaningful and valuable.

3. Theoretical Analysis and Hypotheses

Existing research finds that companies’ relationships with customers and suppliers influence working capital management efficiency [

54,

56,

57]. Specifically, a firm and its customers and suppliers achieve production specialization through the input and output of intermediate goods, thereby providing channels for transmitting internal and external risks [

59]. Therefore, when companies within the supply chain face uncertainty regarding climate policies, such uncertainty may impact their production processes and workforce management. It could also expose companies to transition risks [

8,

13], compelling them to adapt their production methods to reduce carbon emissions and produce sustainable goods. Consequently, changes may occur in their production, sales, and procurement activities. A firm’s relationship with its customers and suppliers is inseparable; so, company production changes may impact the relationship. When a company’s production changes, it can decrease the stability of procurement and sales activities. As a result, the company’s relationship with its suppliers and customers is less close than before, which increases the transaction cost and prolongs the transaction period, thereby decreasing the efficiency of working capital management. Furthermore, due to uncertainties in climate policy, a company’s sales activities may be affected by policy requirements, leading to a decrease in the inventory turnover rate, thereby impacting the firm’s working capital management efficiency. After the above analysis, we propose Hypothesis 1.

H1: Climate policy uncertainty can reduce corporate working capital management efficiency.

In terms of transaction costs, companies must promptly respond to potential changes brought about by such uncertainties when faced with high uncertainty in climate policies. These changes may include producing products required or encouraged by production policies or undergoing a green transformation [

10,

13]. For example, research suggests that policy uncertainty can increase companies’ management costs [

60]. Furthermore, market segmentation is continuously refined and deepened in the modern social division of the labor system. Domestic and international enterprises form interdependent and closely connected supply chain networks by distributing production stages [

59,

61]. Once there is a strong impact from external uncertainty risks, disruptions in key customer relationships within the supply chain can cause significant losses to enterprises [

59]. Working capital management involves obtaining receivables from companies’ customers. Changes and increased complexity in management processes related to production can affect a company’s communication and interaction with its customers and suppliers, thereby impacting the transaction costs.

In transaction cost theory, transactions between supply chain members are regarded as specific units of analysis [

62]. Transaction uncertainty may influence a firm’s decision-making regarding future transactions. Increasing transaction uncertainty can lead to higher supervision and bargaining costs, raising the firm’s costs. Studies have found that reducing transaction costs, such as coordination costs within firms, can lead to changes in production, management, sales, and procurement models [

63], thereby effectively enhancing corporate governance and operational efficiency. Therefore, as the degree of climate policy uncertainty rises, it may increase the complexity of production and management, affecting communication between companies and their customers and suppliers. This situation can lead to higher procurement, production, and sale transaction costs. In this situation, transactions between companies, their customers, and suppliers may be impacted, increasing the complexity of companies’ operations and management and reducing firms’ working capital management efficiency. Based on our analysis, we propose Hypothesis 2.

H2: Climate policy uncertainty can reduce companies’ working capital management efficiency by increasing the transaction costs.

Specific asset investment refers to highly specialized and durable investments made by a company to establish contracts with partners in the supply chain. Companies could use specific assets to produce goods that customers want and strengthen their relationships with them. Williamson (2007) reported that specific assets are one of the coordination mechanisms to ensure smooth transactions [

64]. They are important for enhancing operational efficiency and adding value to the supply chain [

65]. Increasing investments in specific assets can signal to the outside world that a company is committed to building long-term collaborations. This behavior helps enhance customer trust and satisfaction, which is beneficial for maintaining stable relationships between companies and customers [

66].

According to the real options theory, companies often reduce investment when uncertainty is high [

67]. When companies obtain more information, they may make decisions about future development. Research suggests that corporations may reduce investment when climate policy uncertainty is high [

32,

34]. Furthermore, climate policy uncertainty may pose risks related to production transformation [

8,

13]. Therefore, when climate policy uncertainty increases, companies may reduce specialized asset investments to mitigate the risks associated with potential product transformation. Reducing such investments may weaken the stability of a company’s relationship with customers. Customers may buy products from other companies. This situation can make it difficult for the company to sell products in time and collect customer receivables, leading to decreased working capital management efficiency. Based on the real options theory and our analysis, we propose Hypothesis 3.

H3: Climate policy uncertainty can reduce firms’ working capital management efficiency by decreasing specific asset investment.

From the perspective of inventory turnover days, changes in climate policies may expose companies to transition risks, such as requirements to use low-carbon technologies in production or the imposition of carbon taxes on corporations [

11,

13]. These policies may alter enterprises’ production processes, affecting product production and sales. An efficient inventory flow from companies to customers is a core aspect of supply chain management [

68]. It has a big impact on companies’ working capital management. Furthermore, when companies face uncertainty in climate policies, they may encounter the risk of supply chain disruptions. For instance, existing research suggests that when companies are exposed to risks, their partners may reduce product transactions with the affected companies, leading to a decline in sales performance and a deterioration in their supply chain position [

69,

70]. Therefore, climate policy uncertainty may impact production and sales throughout the supply chain.

According to the supply chain management theory, rational planning and coordination of material flows, information transmission, and financial transactions among enterprises can effectively enhance operational efficiency [

71]. During production and operating activities, companies purchase raw materials from suppliers, process them into goods, and then sell them to customers. A company’s inventory turnover days represent the cycle speed of this process. Research has found that climate policy uncertainty increases fluctuations in raw material supply [

72], which may affect firms’ inventory turnover days. When climate policy uncertainty is high, such uncertainty may compel companies to upgrade the production processes, reduce pollutant emissions, and face delays in delivering intermediate goods [

25]. Under these circumstances, companies’ production speed may decrease, potentially impacting product sales and extending the sale cycle. Consequently, this could increase firms’ inventory turnover days, thereby reducing working capital management efficiency. Based on our analysis, we propose Hypothesis 4.

H4: Climate policy uncertainty can reduce firms’ working capital management efficiency by increasing inventory turnover days.

Based on the above analysis and hypothesis, we drew

Figure 1 to illustrate the mechanism proposed in this paper.

6. Conclusions

This study used data from Chinese A-share listed companies from 2007 to 2023 to investigate the impact of climate policy uncertainty on firms’ working capital management efficiency. Our results demonstrate that climate policy uncertainty significantly diminished the working capital management efficiency. Mechanism analyses suggested that this reduction in efficiency was attributable to increased transaction costs, inventory turnover days, and reduced investment in specific assets. Furthermore, the heterogeneity analysis revealed that the negative effects of climate policy uncertainty on working capital management efficiency were more pronounced in companies located in regions with lower levels of marketization, in the western and central areas, and in regions with lower highway density.

Previous studies have found that climate policy uncertainty can reduce corporate investment [

22,

32,

34,

35,

36], increase firms’ financing costs [

2,

31], and alter corporate production behaviors [

24], e.g., by raising raw material costs and prompting upgrades to production equipment [

25,

26]. We further extended this research from the perspective of corporate production and operations. By focusing on the production process, our study revealed that climate policy uncertainty, by reducing investment in production activities and increasing operational and managerial costs, ultimately decreases the efficiency of firms’ working capital management. Overall, our empirical results validated our hypothesis. We found that a 1-unit increase in climate policy uncertainty led to a 0.027-unit decrease in firms’ working capital management efficiency. Our study extends the existing research about climate policy uncertainty and the efficiency of corporate working capital management and offers advice for formulating and implementing climate policies. Furthermore, it provides advice for companies on how to cope with the challenges of climate policy uncertainty.

Based on the above results and analysis, we propose the following advice. The government should recognize that while climate change significantly impacts society, future climate-related policies should fully consider the potential effects of policy uncertainty on companies. For example, the frequency change in climate change-related policies may influence companies’ products and business environment, thereby influencing companies’ production activities and working capital management. The government should minimize policy fluctuations and avoid significant changes quickly, thereby creating a more stable policy environment for company operational management and promoting company development. Furthermore, the government needs to increase the transparency of its climate policy to reduce the information asymmetry between firms and government, which could help companies better deal with the uncertainty of climate policies.

In terms of enterprises, companies should closely monitor climate policies relevant to their operations and promptly adjust production and management decisions to minimize the impact of climate policy uncertainties. Furthermore, companies should communicate closely with their customers and suppliers to stabilize supply chain relationships, reducing the impact of climate policy uncertainties on the supply chain, thereby alleviating their effect on working capital management efficiency.

There are some limitations to our research. For instance, we only examined the impact of climate policy uncertainty on the working capital management efficiency of Chinese listed companies without considering the effects of foreign climate policy uncertainty. Additionally, our study did not investigate non-listed companies. In the future, researchers could continue to explore the impact of climate policy uncertainty on corporate working capital and supply chains and pay attention to non-listed companies.