Study on China’s Plastic Consumption Trend and Sustainable Development Countermeasures

Abstract

1. Introduction

2. Materials and Methods

3. Assessment of China’s Future Plastic Consumption Demand

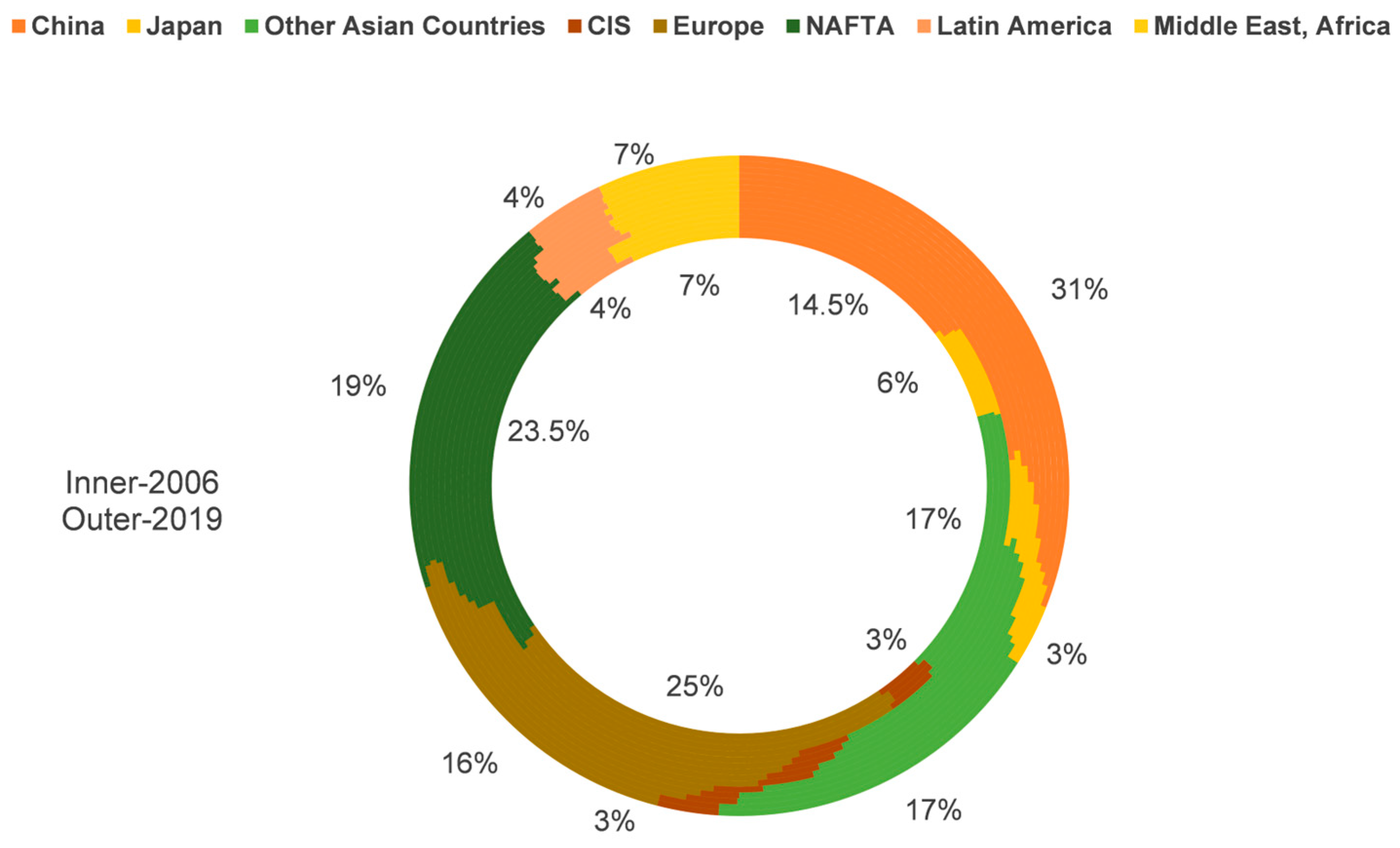

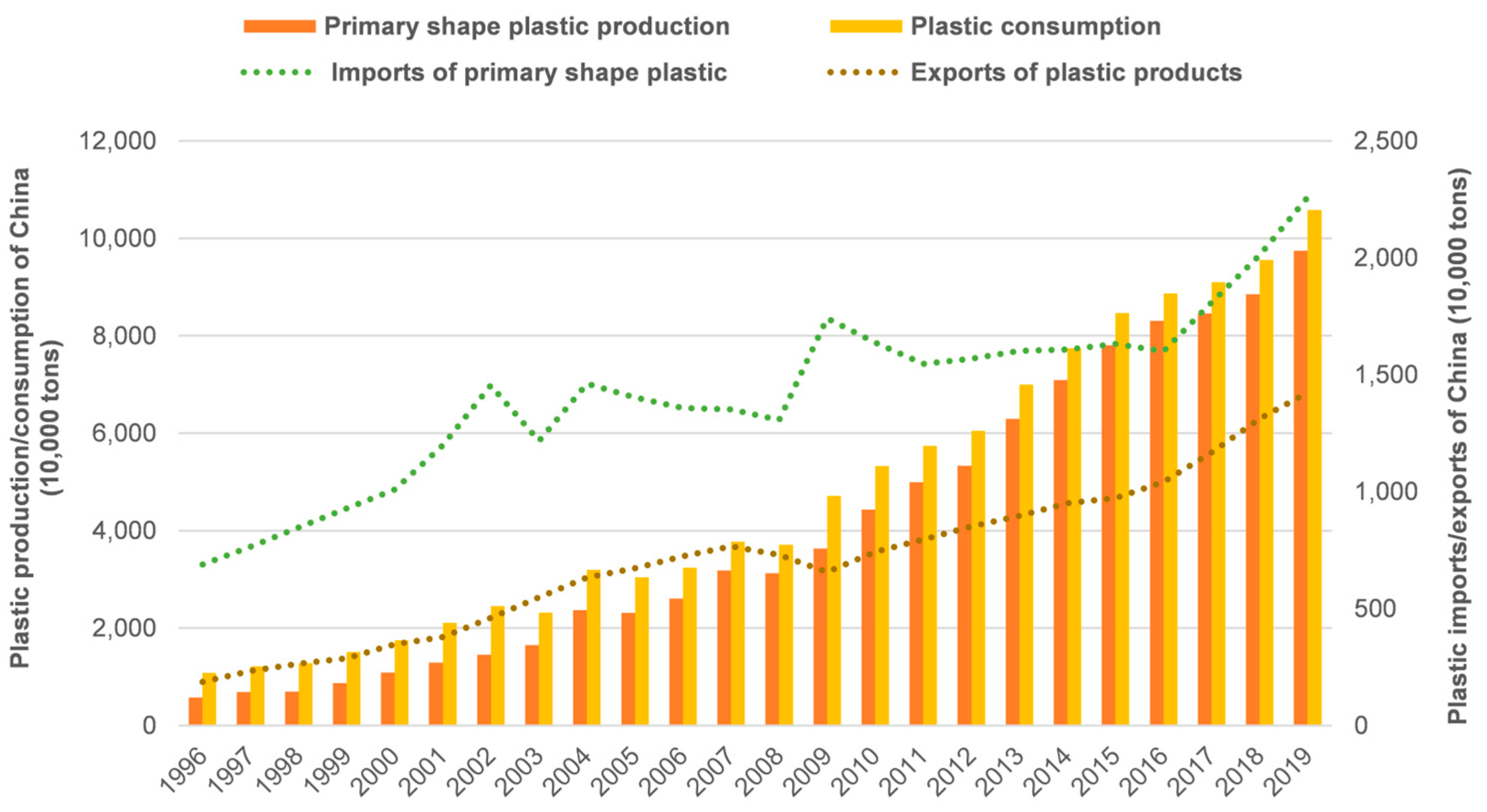

3.1. Global Plastic Production and Consumption Pattern

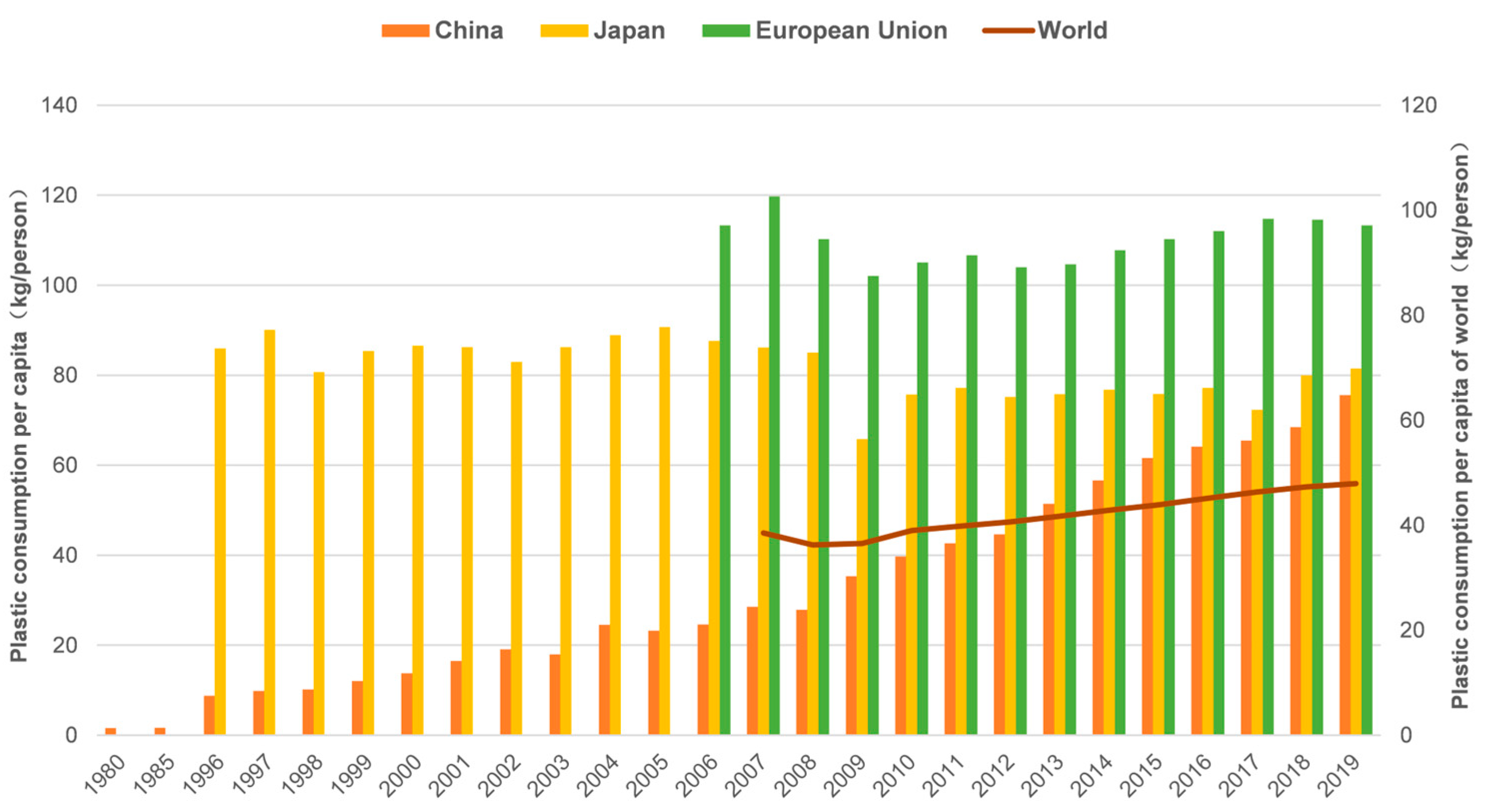

3.2. China’s per Capita Plastic Consumption Level

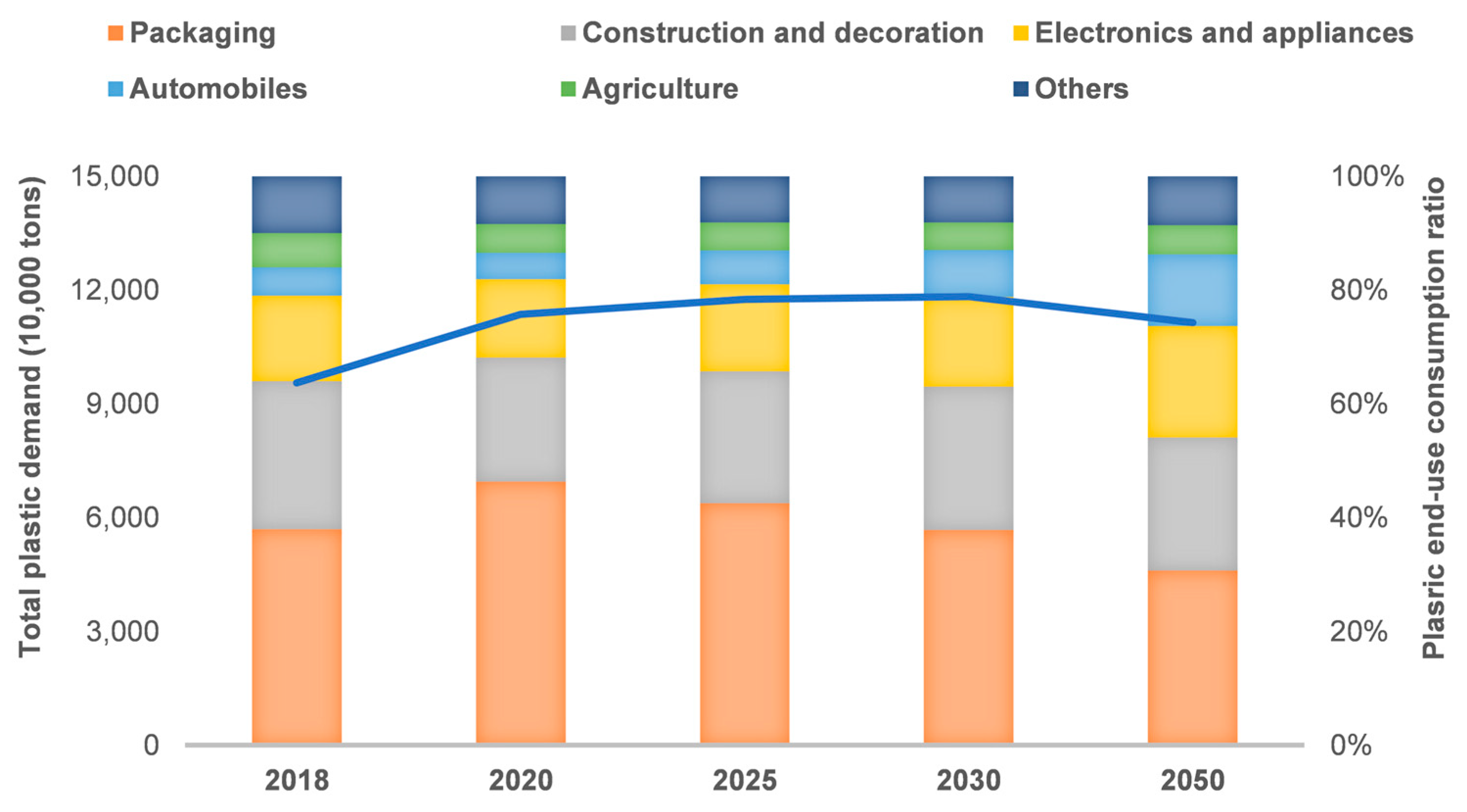

3.3. Forecast of Future Plastic Consumption Demand in China

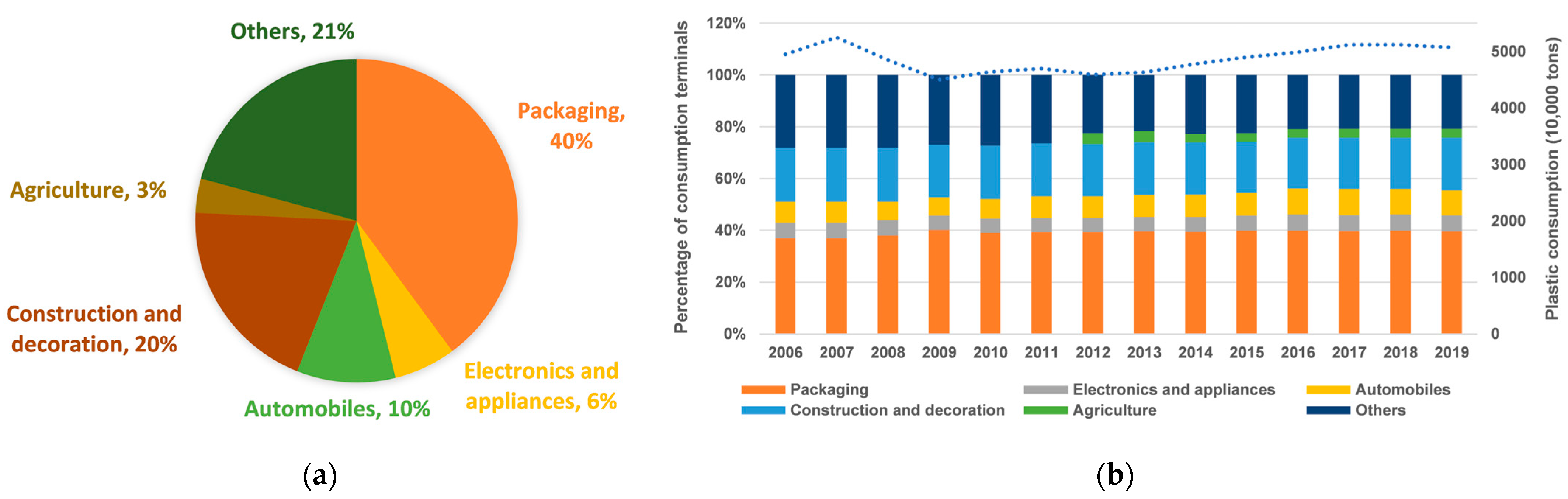

4. Analysis of Plastic Consumption Terminals Trends in China

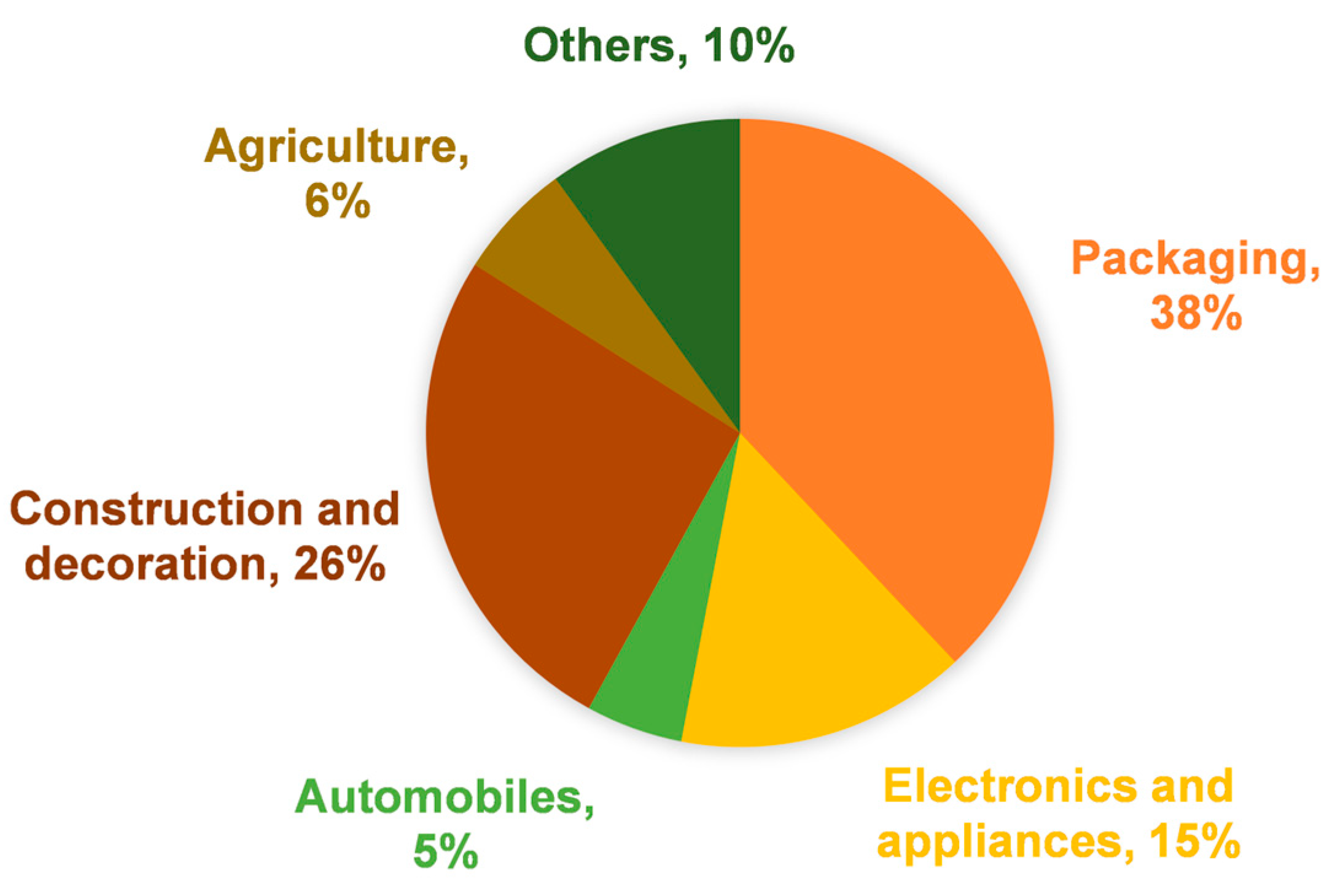

4.1. Analysis of Plastic Consumption Terminals Current Situation in Developed Countries

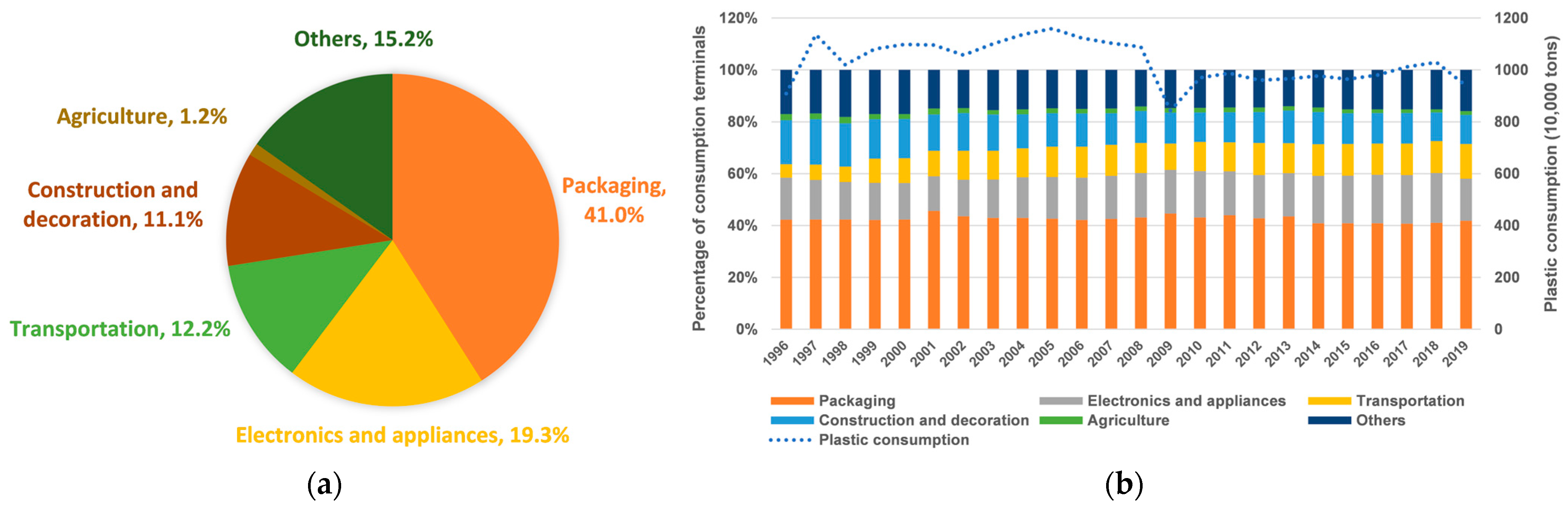

4.2. Analysis of Plastic Terminal Consumption Current Situation in China

4.3. Analysis of Terminal Consumption Trend in China

5. Countermeasures for the Sustainable Development of Plastics

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Rhodes, C.J. Solving the plastic problem: From cradle to grave, to reincarnation. Sci. Prog. 2019, 102, 218–248. [Google Scholar] [CrossRef] [PubMed]

- Plastic & Climate: The Hidden Costs of a Plastic Planet. Available online: https://www.ciel.org/project-update/plastic-climate-the-hidden-costs-of-a-plastic-planet (accessed on 8 December 2024).

- Zhang, Y.; Kang, S.; Allen, S.; Allen, D.; Gao, T.; Sillanpää, M. Atmospheric microplastics: A review on current status and perspectives. Earth-Sci. Rev. 2020, 203, 103118. [Google Scholar] [CrossRef]

- Ali, I.; Cheng, Q.; Ding, T.; Yiguang, Q.; Yuechao, Z.; Sun, H.; Peng, C.; Naz, I.; Li, J.; Liu, J. Micro- and nanoplastics in the environment: Occurrence, detection, characterization and toxicity—A critical review. J. Clean. Prod. 2021, 313, 127863. [Google Scholar] [CrossRef]

- Li, Y.; Chen, L.; Zhou, N.; Chen, Y.; Ling, Z.; Xiang, P. Microplastics in the human body: A comprehensive review of exposure, distribution, migration mechanisms, and toxicity. Sci. Total Environ. 2024, 946, 174215. [Google Scholar] [CrossRef]

- Summary of the Fifth Resumed Sessions of the Open Ended Committee of Permanent Representatives and the United Nations Environment Assembly and the Commemoration of UNEP@50: 21 February–4 March. Available online: https://enb.iisd.org/sites/default/files/2022-03/enb16166e.pdf (accessed on 8 December 2024).

- Notifications of Intergovernmental Negotiating Committee on Plastic Pollution. Available online: https://www.unep.org/inc-plastic-pollution/notifications (accessed on 8 December 2024).

- Invitation of Members of the Committee to the Second Part of the Fifth Session of the Intergovernmental Negotiating Committee on Plastic Pollution, Including in the Marine Environment (INC-5.2). Available online: https://wedocs.unep.org/bitstream/handle/20.500.11822/47193/Invitation_Letter_INC_Members_INC5.2.pdf (accessed on 8 December 2024).

- Abate, T.G.; Elofsson, K. Environmental taxation of plastic bags and substitutes: Balancing marine pollution and climate change. J. Environ. Manag. 2024, 359, 120868. [Google Scholar] [CrossRef]

- Plastics Strategy. Available online: https://environment.ec.europa.eu/strategy/plastics-strategy_en (accessed on 8 December 2024).

- Resource Circulation Strategy for Plastics May 2019. Available online: https://www.env.go.jp/content/000050297.pdf (accessed on 8 December 2024).

- France’s Antiwaste and Circular Economy Law: Eliminating Waste and Promoting Social Inclusion. Available online: https://circulareconomy.europa.eu/platform/sites/default/files/case_studies_-_french_anti_waste_law_aug21.pdf.pdf (accessed on 8 December 2024).

- The U.S. Plastics Pact. Available online: https://usplasticspact.org/ (accessed on 8 December 2024).

- The National Development and Reform Commission and the Ministry of Ecology and Environment Jointly Issued the Document on Further Strengthening the Control of Plastic Pollution. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk15/202001/t20200121_760620.html (accessed on 8 December 2024).

- The National Development and Reform Commission and the the Ministry of Ecology and Environment Jointly Issued the Notice on the “14th Five-Year Plan” Action Program on Plastic Pollution Control. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk10/202109/t20210916_945621.html (accessed on 8 December 2024).

- Summary Report, 25 November–1 December 2024. Available online: https://enb.iisd.org/plastic-pollution-marine-environment-negotiating-committee-inc5-summary (accessed on 8 December 2024).

- Jiang, X.; Wang, T.; Jiang, M.; Xu, M.; Yu, Y.; Guo, B.; Chen, D.; Hu, S.; Jiang, J.; Zhang, Y.; et al. Assessment of Plastic Stocks and Flows in China: 1978–2017. Resour. Conserv. Recy. 2020, 161, 104969. [Google Scholar] [CrossRef]

- Tan, Y.; Wang, Y.; Hu, Y.; Wen, Z.; Kosajan, V.; Zheng, K. Assessing plastics usage and its drivers from final demand perspectives: A case study from China. J. Clean. Prod. 2022, 376, 134277. [Google Scholar] [CrossRef]

- Ren, Y.; Zhu, H.; Jiang, M.; Cao, Y.; Li, C.; Yu, Y.; Chen, D.; Xu, M.; Guo, B.; Zhu, B. Filling the Gaps: Tracing 12 Types of Non-commodity Plastics in China’s Plastic Socioeconomic Metabolism. Environ. Sci. Technol. 2025, 59, 5001–5011. [Google Scholar] [CrossRef]

- Bolbakov, R.G.; Sinitsyn, A.; Tsvetkov, V.Y. Methods of comparative analysis. J. Phys. Confer. Ser. 2020, 1679, 052047. [Google Scholar] [CrossRef]

- A Short Introduction to Comparative Research. Available online: https://www.researchgate.net/publication/336278925_A_Short_Introduction_to_Comparative_Research (accessed on 23 April 2025).

- Roig-Tierno, N.; Gonzalez-Cruz, T.F.; Llopis-Martinez, J. An overview of qualitative comparative analysis: A bibliometric analysis. J. Innov. Knowl. 2017, 2, 15–23. [Google Scholar] [CrossRef]

- Plastics—The Facts 2006-2020. Available online: https://plasticseurope.org/resources/publications/ (accessed on 17 December 2024).

- Arijeniwa, V.F.; Akinsemolu, A.A.; Chukwugozie, D.C.; Onawo, U.G.; Ochulor, C.E.; Nwauzoma, U.M.; Kawino, D.A.; Onyeaka, H. Closing the loop: A framework for tackling single-use plastic waste in the food and beverage industry through circular economy—A review. J. Environ. Manag. 2024, 359, 120816. [Google Scholar] [CrossRef]

- Notice of the State Council on the Issuance of the National Population Development Plan (2016–2030). Available online: http://www.gov.cn/zhengce/content/2017-01/25/content_5163309.htm (accessed on 25 December 2024).

- Launch of the Green Paper on Population and Labor: Statement on Population and Labor in China No.19. Available online: http://iple.cass.cn/xshd_46047/201901/t20190107_4807400.shtml (accessed on 25 December 2024).

- Pottinger, A.S.; Geyer, R.; Biyani, N.; Martinez, C.C.; Nathan, N.; Morse, M.R.; Liu, C.; Hu, S.; de Bruyn, M.; Boettiger, C.; et al. Pathways to reduce global plastic waste mismanagement and greenhouse gas emissions by 2050. Science 2024, 386, 1168–1173. [Google Scholar] [CrossRef]

- Houssini, K.; Li, J.; Tan, Q. Complexities of the global plastics supply chain revealed in a trade-linked material flow analysis. Commun. Earth Environ. 2025, 6, 257. [Google Scholar] [CrossRef]

- Plastic Products, Plastic Waste and Resource Recovery [1996–2019]. Available online: https://www.pwmi.or.jp/english/ (accessed on 19 December 2024).

- Luan, X.; Liu, W.; Cui, Z.; Liu, Y.; Chen, Y.; Lu, S.; Wang, Y. Study on the metabolism of plastic resources in China based on material flow analysis. Resour. Sci. 2020, 42, 372–382. [Google Scholar]

- Dai, T.j.; Xiao, Q.F. Analysis of material metabolism of plastic packaging waste. Ecol. Econ. 2017, 33, 97–101. [Google Scholar]

- Deng, Y.X.; Wang, Y.P.; Zhang, C.L. Research on alternative management strategies for disposable plastic products. Environ. Sci. Res. 2020, 33, 1973–1978. [Google Scholar]

- Xu, Y.; Wang, D.M.; Ye, Q. Advanced plastics market has great room for growth in China. China Petrochem. 2021, 2, 44–47. [Google Scholar]

- Issifu, I.; Dahmouni, I.; Sumaila, U.R. Assessing the ecological and economic transformation pathways of plastic production system. J. Environ. Manag. 2025, 374, 124104. [Google Scholar] [CrossRef]

- Jiang, X.; Jiang, J.; Chen, D.; Zhou, W.; Zhu, B. Dynamic material flow analysis of passenger car plastics in China. Environ. Sci. China 2020, 40, 4106–4114. [Google Scholar]

- Jiang, H.; Chen, D.J.; Zhu, B. Systematic Quantification of Consumption and Disposal of Single-Use Plastic Products in China. Res. Environ. Sci. 2025, 38, 386–394. [Google Scholar]

- Issifu, I.; Deffor, E.W.; Sumaila, U.R. How COVID-19 could change the economics of the plastic recycling sector. Recycling 2021, 6, 64. [Google Scholar] [CrossRef]

- Jehanno, C.; Alty, J.W.; Roosen, M.; De Meester, S.; Dove, A.P.; Chen, E.Y.; Leibfarth, F.A.; Sardon, H. Critical advances and future opportunities in upcycling commodity polymers. Nature 2022, 603, 803–814. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chong, S.; Xiong, H. Study on China’s Plastic Consumption Trend and Sustainable Development Countermeasures. Sustainability 2025, 17, 4218. https://doi.org/10.3390/su17094218

Chong S, Xiong H. Study on China’s Plastic Consumption Trend and Sustainable Development Countermeasures. Sustainability. 2025; 17(9):4218. https://doi.org/10.3390/su17094218

Chicago/Turabian StyleChong, Shan, and Huawen Xiong. 2025. "Study on China’s Plastic Consumption Trend and Sustainable Development Countermeasures" Sustainability 17, no. 9: 4218. https://doi.org/10.3390/su17094218

APA StyleChong, S., & Xiong, H. (2025). Study on China’s Plastic Consumption Trend and Sustainable Development Countermeasures. Sustainability, 17(9), 4218. https://doi.org/10.3390/su17094218