Sweet Liquid Gold Facing Climate Change and Sour Market Conditions: A Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis of the United States Maple Syrup Sector

Abstract

:1. Introduction

2. Data Sources and Analysis Methods

3. Major Challenges Faced by the U.S. Maple Syrup Industry

3.1. Weather and Climate Change

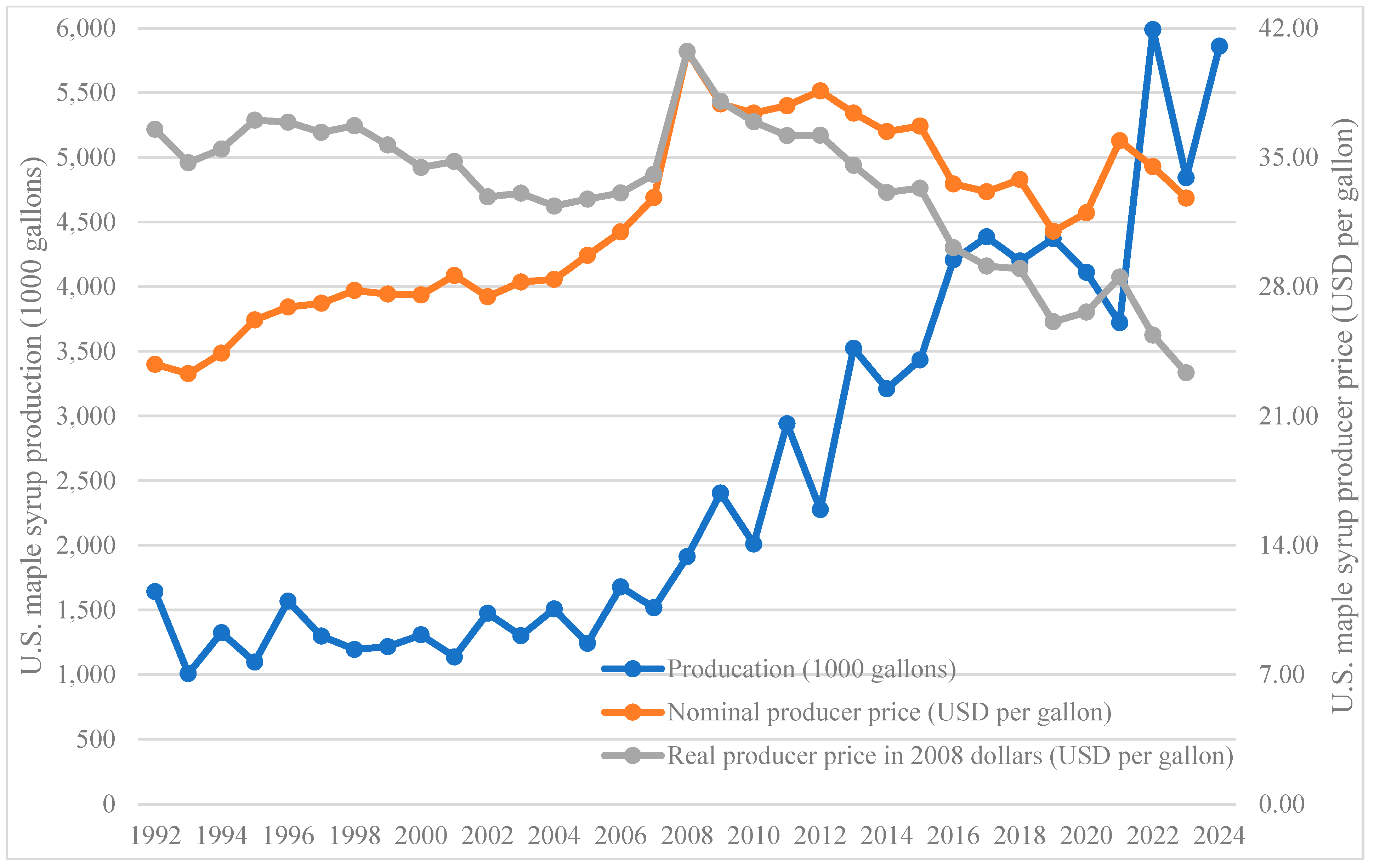

3.2. Downward Trends in Producer Price

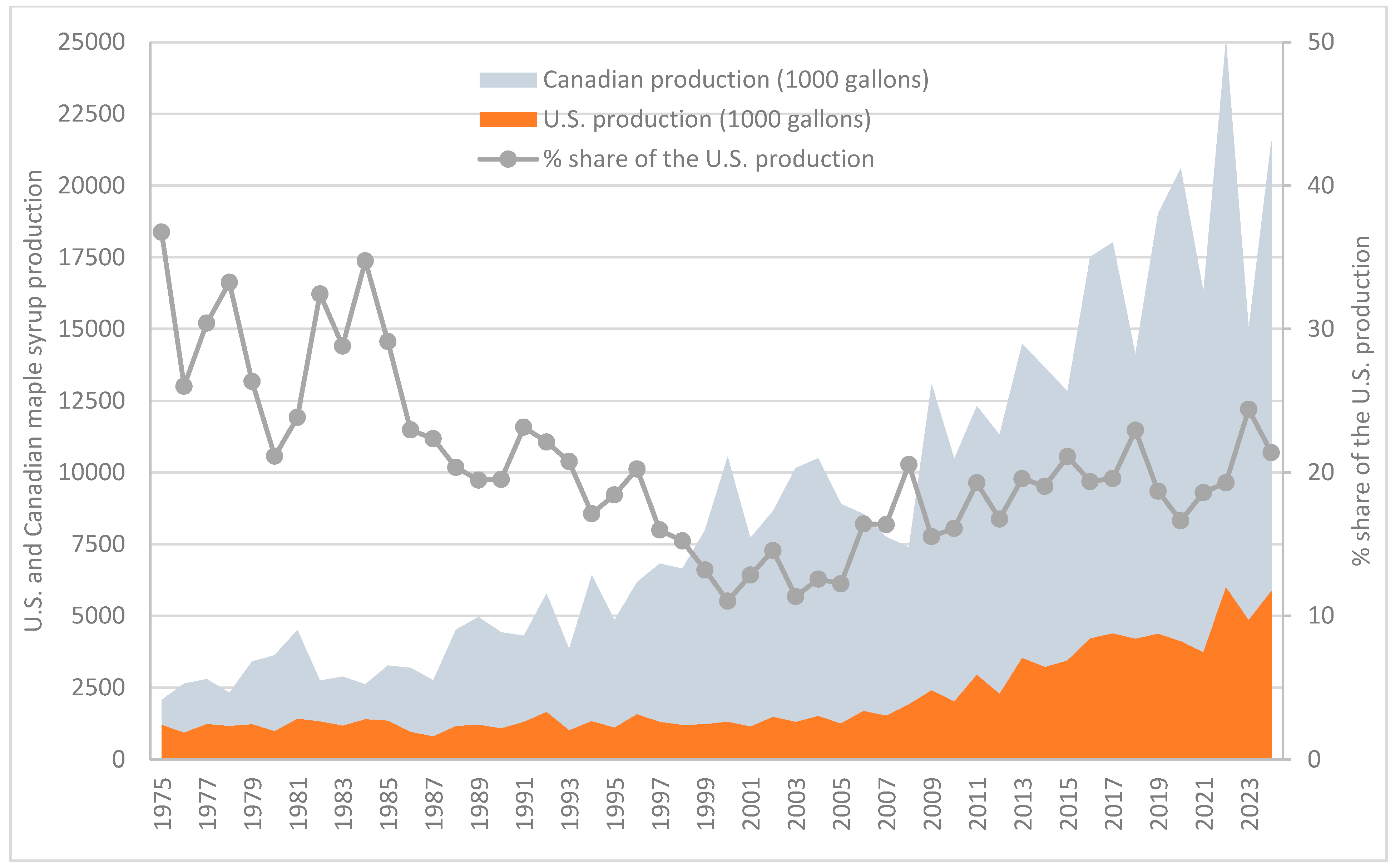

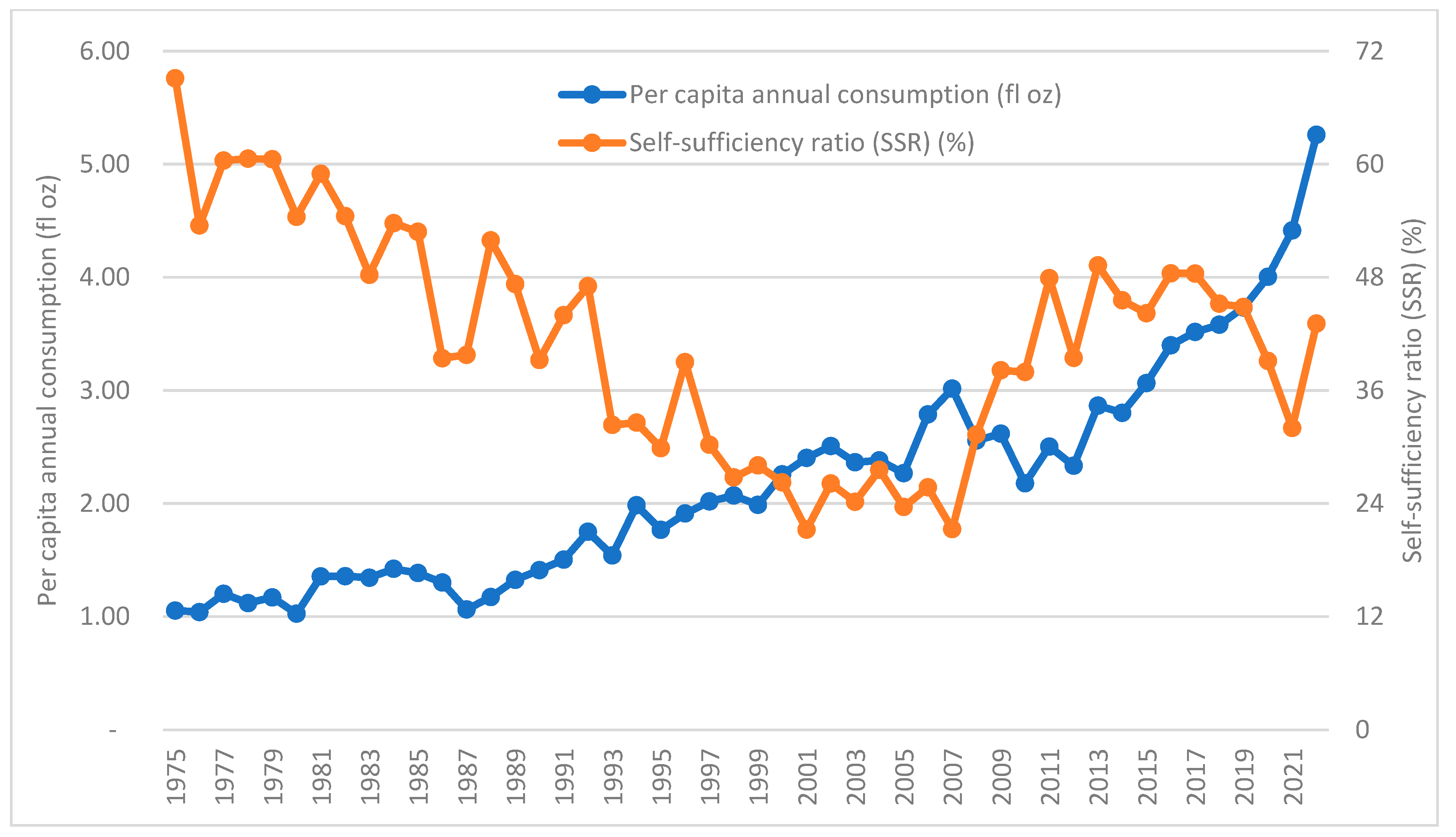

3.3. Dependence on Imports

3.4. Lack of Market Power for U.S. Maple Syrup Producers

4. A SWOT Analysis of the U.S. Maple Syrup Industry

4.1. Strengths

4.2. Weaknesses

4.3. Opportunities

4.4. Threats

5. Discussion of Potential Strategies for the U.S. Maple Syrup Industry

6. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Houle, D.; Duchesne, L. The “sweet spot” for maple syrup production proposed by Rapp et al. (2019) is not that sweet. For. Ecol. Manag. 2020, 458, 117662. [Google Scholar] [CrossRef]

- Murphy, B.L.; Chretien, A.R.; Brown, L.J. Non-timber forest products, maple syrup and climate change. J. Rural. Community Dev. 2012, 7, 42–64. Available online: https://journals.brandonu.ca/jrcd/article/view/601 (accessed on 3 March 2025).

- Bal, T.L.; Storer, A.J.; Jurgensen, M.F.; Doskey, P.V.; Amacher, M.C. Nutrient stress predisposes and contributes to sugar maple dieback across its northern range: A review. For. Int. J. For. Res. 2015, 88, 64–83. [Google Scholar] [CrossRef]

- Becot, F.; Kolodinsky, J.; Conner, D. Center for Rural Studies; University of Vermont: Burlington, VT, USA, 2015. [Google Scholar]

- Bishop, D.A.; Beier, C.M.; Pederson, N.; Lawrence, G.B.; Stella, J.C.; Sullivan, T.J. Regional growth decline of sugar maple (Acer saccharum) and its potential causes. Ecosphere 2015, 6, 179. [Google Scholar] [CrossRef]

- Farrell, M.; Chabot, B. Assessing the growth potential and economic impact of the U.S. maple syrup industry. J. Agric. Food Syst. Community Dev. 2012, 2, 11–27. [Google Scholar] [CrossRef]

- McConnell, T.E.; Graham, G.W. History of Northeastern US maple syrup price trends. For. Prod. J. 2016, 66, 106–112. [Google Scholar] [CrossRef]

- Perry, J.J.; Nile, K.; Martel, A.; Fiore, M.; Davis-Dentici, K.; Hopkins, K.; Calder, B. Pasteurized and fermented beverages for valorization of maple sap. J. Food Process. Preserv. 2020, 44, e14623. [Google Scholar] [CrossRef]

- Wang, Q.; Cannella, M.; Zou, Y. China’s emerging market for maple syrup: Opportunities and challenges for U.S. exports. Food Distrib. Res. 2024, 55, 46–61. Available online: https://openurl.ebsco.com/EPDB%3Agcd%3A1%3A25568769/detailv2?sid=ebsco%3Aplink%3Ascholar&id=ebsco%3Agcd%3A177614552&crl=c&link_origin=scholar.google.com.hk (accessed on 3 March 2025).

- Quebec Maple Syrup Producers Association (QMSP). 2024. Available online: https://ppaq.ca/en/ (accessed on 3 March 2025).

- U.S. Department of Agriculture National Agricultural Statistics Service [USDA NASS]. Maple Syrup Quick Stats. 2024. Available online: https://quickstats.nass.usda.gov/ (accessed on 3 March 2025).

- Gabe, T. Economic Impacts of Maine’s Maple Industry; Munich Personal RePEc Archive (MPRA): Munich, Germany, 2014; p. 65962. Available online: https://mpra.ub.uni-muenchen.de/65962/ (accessed on 3 March 2025).

- Hershberger, S.; Shaw, B.; Gorby, T.; Solin, J.; Robinson, P.; Tiles, K.; Cook, C.; Chang, C.-T. Comparing motivations, learning interests, and barriers to expansion among non-commercial and commercial maple syrup producers in Wisconsin. Small-Scale For. 2023, 23, 127–157. [Google Scholar] [CrossRef]

- Whitney, G.G.; Upmeyer, M.M. Sweet trees, sour circumstances: The long search for sustainability in the North American maple products industry. For. Ecol. Manag. 2004, 200, 313–333. [Google Scholar] [CrossRef]

- Hinrichs, C.C. Sideline and Lifeline: The Cultural Economy of Maple Syrup Production. Rural. Sociol. 1998, 63, 507–532. [Google Scholar] [CrossRef]

- Lange, M. Meanings of Maple: An Ethnography of Sugaring; University of Arkansas Pres: Fayetteville, AR, USA, 2017. [Google Scholar]

- Saraiva, A.; Carrascosa, C.; Ramos, F.; Raheem, D.; Lopes, M.; Raposo, A. Maple syrup: Chemical analysis and nutritional profile, health impacts, safety and quality control, and food industry applications. Int. J. Environ. Res. Public Health 2022, 19, 13684. [Google Scholar] [CrossRef] [PubMed]

- Yahoo Finance. Dsm-Firmenich Unveils ‘Milky Maple’ as the Flavor of the Year 2025, Bringing Comfort and Connection with Every Sip and Bite; Food Ingredients First: Arnhem, The Netherlands, 2024. [Google Scholar]

- Statistics Canada. Maple Products; Statistics Canada: Ottawa, Canada, 2024. Available online: https://www150.statcan.gc.ca/n1/daily-quotidien/241212/dq241212d-eng.htm (accessed on 3 March 2025).

- Huyler, N.K. Cost of Maple Sap Production for Various Size Tubing Operations; Department of Agriculture, Forest Service, Northeastern Research Station: Broomall, PA, USA, 2000. [Google Scholar] [CrossRef]

- Kelley, J.W.; Staats, L.J. High-vacuum pumping effects on maple sap sugar yield. North. J. Appl. For. 1989, 6, 126–129. [Google Scholar] [CrossRef]

- Perkins, T.D.; van den Berg, A.K. Relationships Between Tubing System Component Age and Sap Yield: A Preliminary Assessment. Maple Syrup Dig. 2012. Available online: https://mapleresearch.org/pub/m0212tubingagesapyield/ (accessed on 3 March 2025).

- Staats, L.J.; Kelley, J.W. Field evaluation of the IPL VacuSpout for maple sap collection. Nothern J. Appl. For. 1996, 13, 171–174. Available online: https://academic.oup.com/njaf/article/13/4/171/4802306 (accessed on 3 March 2025). [CrossRef]

- Thomas, M.M. From pails to pipelines: The origins and early adoption of plastic tubing in the maple syrup industry. Vt. Hist. 2021, 89, 52–78. Available online: https://vermonthistory.org/journal/89/VH8901FromPailsToPipelines.pdf (accessed on 3 March 2025).

- Checkoway, S.M. A Simple Model of a Vacuum-Tubing System for Collecting Maple Sap; Center for Sustainable Systems, University of Michigan: Ann Arbor, MI, USA, 2024. [Google Scholar] [CrossRef]

- Perkins, T.D.; Heiligmann, R.; Koeling, M.; van den Berg, A.K. North American Maple Syrup Producers Manual, 3rd ed.; University of Vermont: Burlington, VT, USA, 2022; Available online: https://mapleresearch.org/pub/manual/ (accessed on 3 March 2025).

- Huyler, N.K.; Garrett, L.D. A Cost Analysis: Processing Maple Syrup Products; Department of Agriculture, Forest Service, Northeastern Forest Experiment Station: Broomall, PA, USA, 1979. Available online: https://research.fs.usda.gov/treesearch/14964 (accessed on 3 March 2025).

- Caughron, A.; Legault, S.; Haut, C.; Houle, D.; Reynolds, T.W. A changing climate in the maple syrup industry: Variation in Canadian and U.S.A. producers’ climate risk perceptions and willingness to adapt across scales of production. Small-Scale For. 2020, 20, 73–95. [Google Scholar] [CrossRef]

- Larue, B.; Criado, C.O.; González, P.; Nangue, C.K. Zeros, Near-Zeros and Gravity with Endogenous Market Structure: The Case of Maple Syrup Exports; Department of Agri-food Economics and Consumer Sciences, University of Laval: Quebec, Canada, 2019; Available online: https://crem.univ-rennes.fr/sites/crem.univ-rennes.fr/files/medias/files/_mainbc06_carlos-1.pdf (accessed on 3 March 2025).

- Benzaghta, M.A.; Elwalda, A.; Mousa, M.; Erkan, I.; Rahman, M. SWOT analysis applications: An integrative literature review. J. Glob. Bus. Insights 2021, 6, 55–73. [Google Scholar] [CrossRef]

- Gürel, E.; Tat, M. Swot Analysis: A Theoretical Review. J. Int. Soc. Res. 2017, 10, 994–1006. [Google Scholar] [CrossRef]

- Brown, L.J.; Lamhonwah, D.; Murphy, B.L. Projecting a spatial shift of Ontario’s sugar maple habitat in response to climate change: A GIS approach. Can. Geogr. 2015, 59, 369–381. [Google Scholar] [CrossRef]

- Legault, S.; Houle, D.; Plouffe, A.; Ameztegui, A.; Kuehn, D.; Chase, L.; Blondlot, A.; Perkins, T.D. Perceptions of U.S. and Canadian maple syrup producers toward climate change, its impacts, and potential adaptation measures. PLoS ONE 2019, 14, e0215511. [Google Scholar] [CrossRef]

- Garcia, E.J.; McDowell, T.; Ketola, C.; Jennings, M.; Miller, J.D.; Renaud, J.B. Metabolomics reveals chemical changes in Acer saccharum sap over a maple syrup production season. PLoS ONE 2020, 15, e0235787. [Google Scholar] [CrossRef]

- Guilbert, J.; Beckage, B.; Winter, J.M.; Horton, R.M.; Perkins, T.; Bomblies, A. Impacts of projected climate change over the Lake Champlain Basin in Vermont. J. Appl. Meteorol. Climatol. 2014, 53, 1861–1875. [Google Scholar] [CrossRef]

- Logan, T.; Charron, I.; Chaumont, D.; Houle, D. Atlas of Climate Scenarios for Québec Forests. Ouranos for Ministère des Ressources Naturelles and de la Faune du Québec; March, 2011. Available online: https://www.researchgate.net/publication/267670685_Atlas_of_Climate_Scenarios_for_Quebec_Forests (accessed on 3 March 2025).

- Skinner, C.B.; DeGaetano, A.T.; Chabot, B.F. Implications of twenty-first century climate change on Northeastern United States maple syrup production: Impacts and adaptations. Clim. Change 2010, 100, 685–702. [Google Scholar] [CrossRef]

- Barton, A.M.; Brewster, L.B.; Cox, A.N.; Prentiss, N.K. Non-indigenous woody invasive plants in a rural New England town. Biol. Invasions 2004, 6, 205–211. [Google Scholar] [CrossRef]

- Haynes, K.J.; Liebhold, A.M.; Lefcheck, J.S.; Morin, R.S.; Wang, G. Climate affects the outbreaks of a forest defoliator indirectly through its tree hosts. Oecologia 2022, 198, 407–418. [Google Scholar] [CrossRef] [PubMed]

- Janowiak, M.K.; Iverson, L.R.; Fosgitt, J.; Handler, S.D.; Dallman, M.; Thomasma, S.; Hutnik, B.; Swanston, C.W. Assessing stand-level climate change risk using forest inventory data and species distribution models. J. For. 2017, 115, 222–229. [Google Scholar] [CrossRef]

- Wade, D.D.; Brock, B.L.; Brose, P.H.; Hoch, G.A.; Patterson, W.A., III. Fire in eastern ecosystems. In Wildland Fire in Ecosystems: Effects of Fire on Flora; Brown, J.K., Smith, J.K., Eds.; General Technical Report RMRS-GTR-42-4; Department of Agriculture, Forest Service, Rocky Mountain Research Station: Ogden, UT, USA, 2000; pp. 53–96. [Google Scholar]

- Cotnoir, A. The End of Maple? Maple Sugaring Amid a Changing Climate; Audubon Vermont: Huntington, VT, USA, 2021. [Google Scholar]

- Buckley, D.S.; Crow, T.R.; Nauertz, E.A.; Schulz, K.E. Influence of skid trails and haul roads on understory plant richness and composition in managed forest landscapes in upper Michigan, USA. For. Ecol. Manag. 2003, 175, 509–520. [Google Scholar] [CrossRef]

- Lundgren, M.R.; Small, C.J.; Dreyer, G.D. Influence of land use and site characteristics on invasive plant abundance in the Quinebaug Highlands of Southern New England. Northeast. Nat. 2004, 11, 313–332. [Google Scholar] [CrossRef]

- Garske, S. Risk Assessment from Emerald Ash Borer and other Forest Pests upon Commonly Harvested Forest Trees (Ash, Balsam, Birch, Maple, and Oak) in the Ojibwe Ceded Territories; Great Lakes Indian Fish Wildlife Commission: Odanah, WI, USA, 2013; Available online: https://glifwc.org/Forest_Pests/EAB.html (accessed on 3 March 2025).

- Houle, D.; Duchesne, L.; Boutin, R. Effects of a spruce budworm outbreak on element export below the rooting zone: A case study for a balsam fir forest. Ann. For. Sci. 2009, 66, 707. [Google Scholar] [CrossRef]

- Lewis, G.P. Response of Stream Chemistry to Forest Insect Defoliation on the Allegheny High Plateau, Pennsylvania. Unpublished dissertation, Cornell University, Ithaca, NY, USA, 1998. Available online: https://www.proquest.com/docview/304416452?fromopenview=true&pq-origsite=gscholar&sourcetype=Dissertations%20&%20Theses (accessed on 3 March 2025).

- Lovett, G.M.; Christenson, L.M.; Groffman, P.M.; Jones, C.G.; Hart, J.E.; Mitchell, M.J. Insect defoliation and nitrogen cycling in forests. BioScience 2002, 52, 335–341. [Google Scholar] [CrossRef]

- National Centers for Environmental Information (NCEI) 2020. National Climate Report. Available online: https://www.ncei.noaa.gov/access/monitoring/monthly-report/national/202013 (accessed on 3 March 2025).

- Czyżewski, B.; Matuszczak, A.; Miśkiewicz, R. Public goods versus the farm price-cost squeeze: Shaping the sustainability of the EU’s common agricultural policy. Technol. Econ. Dev. Econ. 2019, 25, 82–101. [Google Scholar] [CrossRef]

- U.S. Bureau of Labor Statistics. Consumer Price Index Summary. 2024. Available online: https://www.bls.gov//cpi/ (accessed on 3 March 2025).

- Federation of Quebec Maple Syrup Producers Association (FQMSP). Tap Allocation. 2022. Available online: https://ppaq.ca/en/maple-production-quotas/emission-entailles-2021/ (accessed on 3 March 2025).

- Cannella, M.; Laughton, C. Maple Syrup Outlook. Farm Credit. East Knowl. Exch. 2023, 17. Available online: https://www.farmcrediteast.com/en/resources/Industry-Trends-and-Outlooks/Reports/20230301KEP_MapleSyrupOutlook (accessed on 3 March 2025).

- Gagné, I. Maple Syrup Production in Quebec: Farmer Self-determination for Market Control (Regoverning Markets Innovative Policy Series); International Institute for Environment and Development (IIED): London, UK, 2008; Available online: https://www.iied.org/sites/default/files/pdfs/migrate/G03274.pdf (accessed on 3 March 2025).

- Baek, J.; Xu, J. Exchange rate effects on the U.S.-Canada forest product trade: Are the effects asymmetric? J. Agric. Resour. Econ. 2022, 47, 114–127. [Google Scholar] [CrossRef]

- Quebec Ministry of Agriculture, Fisheries and Food. Industry Acéricole in Quebec: Portrait- Sectoral Diagnosis; Quebec Ministry of Agriculture, Fisheries and Food: Saint-Hyacinthe, QC, Canada, 2021.

- Abdel-Basset, M.; Mohamed, M.; Smarandache, F. An extension of neutrosophic AHP–SWOT analysis for strategic planning and decision-making. Symmetry 2018, 10, 116. [Google Scholar] [CrossRef]

- Ghazinoory, S.; Abdi, M.; Azadegan-Mehr, M. SWOT methodology: A state-of-the-art review for the past, a framework for the future. J. Bus. Econ. Manag. 2011, 12, 24–48. [Google Scholar] [CrossRef]

- Lagoudakis, A.; McKendree, M.G.S.; Malone, T.; Caputo, V. Incorporating producer opinions into a SWOT analysis of the U.S. tart cherry industry. Int. Food Agribus. Manag. Rev. 2020, 23, 547–561. [Google Scholar] [CrossRef]

- Snyder, S.A.; Kilgore, M.A.; Emery, M.R.; Schmitz, M. Maple syrup producers of the Lake States, USA: Attitudes towards and adaptation to social, ecological, and climate conditions. Environ. Manag. 2019, 63, 185–199. [Google Scholar] [CrossRef]

- Ramadan, M.F.; Gad, H.A.; Farag, M.A. Chemistry, processing, and functionality of maple food products: An updated comprehensive review. J. Food Biochem. 2021, 45, e13832. [Google Scholar] [CrossRef]

- Cannella, M.U.S. Maple Syrup Outlook. Farm Credit. East Knowl. Exch. 2022, 16. Available online: https://www.farmcrediteast.com/en/resources/Industry-Trends-and-Outlooks/Reports/us-maple-syrup-outlook (accessed on 3 March 2025).

- St-Pierre, P.; Pilon, G.; Dumais, V.; Dion, C.; Dubois, M.-J.; Dubé, P.; Desjardins, Y.; Marette, A. Comparative analysis of maple syrup to other natural sweeteners and evaluation of their metabolic responses in healthy rats. J. Funct. Foods 2014, 11, 460–471. [Google Scholar] [CrossRef]

- Morissette, A.; André, D.M.; Agrinier, A.-L.; Varin, T.V.; Pilon, G.; Flamand, N.; Houde, V.P.; Marette, A. The metabolic benefits of substituting sucrose for maple syrup are associated with a shift in carbohydrate digestion and gut microbiota composition in high-fat high-sucrose diet-fed mice. Am. J. Physiol.-Endocrinol. Metab. 2023, 325, E661–E671. [Google Scholar] [CrossRef] [PubMed]

- Rana, J.; Paul, J. Consumer behavior and purchase intention for organic food: A review and research agenda. J. Retail. Consum. Serv. 2017, 38, 157–165. [Google Scholar] [CrossRef]

- van den Berg, A.K.; Perkins, T.D.; Isselhardt, M.L.; Wilmot, T.R. Growth rates of sugar maple trees tapped for maple syrup production using high-yield sap collection practices. For. Sci. 2015, 62, 107–114. [Google Scholar] [CrossRef]

- U.S. Department of Agriculture (USDA) Agricultural Marketing Service. USDA Market. News. 2024. Available online: https://www.ams.usda.gov/market-news (accessed on 3 March 2025).

- Bernsen, N.; Crandall, M.; Leahy, J. An educational needs assessment of workforce supply and readiness in Maine’s forest products industry. For. Prod. J. 2020, 70, 22–27. [Google Scholar] [CrossRef]

- Cannella, M.; Lindgren, C.; Isselhardt, M. Northeastern United States Maple Syrup Production and Economics: A 2019 Survey of Producers; UVM Extension Faculty Publications No 30. 2022. Available online: https://scholarworks.uvm.edu/extfac/30 (accessed on 3 March 2025).

- Federation of Quebec Maple Syrup Producers Association (FQMSP). 2019. Available online: https://ppaq.ca/en/news/2019-annual-and-activity-reports-now-online/ (accessed on 3 March 2025).

- Golin Group. ACER Research Phase I Findings: US Consumer Profile. 2023. Available online: https://sugarmakers.nysmaple.com/nys-maple-syrup-research-findings/ (accessed on 3 March 2025).

- Farrell, M. The Economics of managing maple trees for syrup or sawtimber production. North. J. Appl. For. 2012, 29, 165–172. [Google Scholar] [CrossRef]

- Cannella, M. Maple Finances and Business Viability. In Proceedings of the 2018 NAMSC Annual Conference, Concord, NH, USA, 2018; Available online: https://www.nhgfoa.org/presentations/pages/2018-annual-conference-presentation-materials (accessed on 3 March 2025).

- Li, L.; Seeram, N.P. Maple syrup phytochemicals include lignans, coumarins, a stilbene, and other previously unreported antioxidant phenolic compounds. J. Agric. Food Chem. 2010, 58, 11673–11679. [Google Scholar] [CrossRef] [PubMed]

- Atlantic Corporation. Identifying Market Opportunities for Vermont Maple Syrup Producers. State of Vermont Agency of Agriculture, Food and Markets. 2021. Available online: https://agriculture.vermont.gov/sites/agriculture/files/doc_library/VAAFM_Maple%20Syrup%20SCBG_Final%20Technical%20Report_20210930_external.pdf (accessed on 3 March 2025).

- Duchesne, L.; Houle, D.; Côté, M.A.; Logan, T. Modelling the effect of climate on maple syrup production in Québec, Canada. For. Ecol. Manag. 2009, 258, 2683–2689. [Google Scholar] [CrossRef]

- Houle, D.; Paquette, A.; Côté, B.; Logan, T.; Power, H.; Charron, I.; Duchesne, L. Impacts of climate change on the timing of the production season of maple syrup in Eastern Canada. PLoS ONE 2015, 10, e0144844. [Google Scholar] [CrossRef]

- MacIver, D.C.; Karsh, M.; Comer, N.; Klaassen, J.; Auld, H.; Fenech, A. Atmoshperic Influences on the Sugar Maple Industry in North America. Adaption and Impacts Research Division (AIRD) of the Environment Canada. 2006. Available online: https://publications.gc.ca/collections/collection_2011/ec/En57-41-7-2006-eng.pdf (accessed on 3 March 2025).

- Matthews, S.N.; Iverson, L.R. Managing for delicious ecosystem service under climate change: Can United States sugar maple (Acer saccharum) syrup production be maintained in a warming climate? Int. J. Biodivers. Sci. Ecosyst. Serv. Manag. 2017, 13, 40–52. [Google Scholar] [CrossRef]

- Burakowski, E.A.; Contosta, A.R.; Grogan, D.; Nelson, S.J.; Garlick, S.; Casson, N. Future of winter in Northeastern North America: Climate indicators portray warming and snow loss that will impact ecosystems and communities. Northeast. Nat. 2022, 28, 180–207. [Google Scholar] [CrossRef]

- Eggleston, G.; Aita, G.; Triplett, A. Circular sustainability of sugarcane: Natural, nutritious, and functional unrefined sweeteners that meet new consumer demands. Sugar Tech 2021, 23, 964–973. [Google Scholar] [CrossRef]

- Prasara-A, J.; Gheewala, S.H.; Silalertruksa, T.; Pongpat, P.; Sawaengsak, W. Environmental and social life cycle assessment to enhance sustainability of sugarcane-based products in Thailand. Clean Technol. Environ. Policy 2019, 21, 1447–1458. [Google Scholar] [CrossRef]

- Paudel, B.; Zhou, M. Are consumers “green” enthusiasts or skeptics? Evidence from nontimber forest products. For. Policy Econ. 2024, 168, 103302. [Google Scholar] [CrossRef]

- Cannella, M.; Ziegler, S.; Wang, Q.; Peabody, M.; Leahey, T.; Darby, H.M. Farm Benchmarking: The Application of Business, Conservation and Labor Indicators; USDA Agricultural Research Service: Washington, DC, USA, 2021. [Google Scholar]

- Desjardins, L. Funding will Boost Maple Syrup Exports. Radio Canada International. 2019. Available online: https://www.rcinet.ca/en/2019/04/12/canada-market-maple-syrup-boost/ (accessed on 3 March 2025).

Strengths

| Weaknesses

|

Opportunities

| Threats

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Q.; Shore, A.; Abah, E.O.; Cannella, M. Sweet Liquid Gold Facing Climate Change and Sour Market Conditions: A Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis of the United States Maple Syrup Sector. Sustainability 2025, 17, 4101. https://doi.org/10.3390/su17094101

Wang Q, Shore A, Abah EO, Cannella M. Sweet Liquid Gold Facing Climate Change and Sour Market Conditions: A Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis of the United States Maple Syrup Sector. Sustainability. 2025; 17(9):4101. https://doi.org/10.3390/su17094101

Chicago/Turabian StyleWang, Qingbin, Amrita Shore, Emmanuel Owoicho Abah, and Mark Cannella. 2025. "Sweet Liquid Gold Facing Climate Change and Sour Market Conditions: A Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis of the United States Maple Syrup Sector" Sustainability 17, no. 9: 4101. https://doi.org/10.3390/su17094101

APA StyleWang, Q., Shore, A., Abah, E. O., & Cannella, M. (2025). Sweet Liquid Gold Facing Climate Change and Sour Market Conditions: A Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis of the United States Maple Syrup Sector. Sustainability, 17(9), 4101. https://doi.org/10.3390/su17094101