1. Introduction

With the seriousness of environmental problems, a large number of countries began to carry out green transformation. Among them, industrial pollution accounts for the largest proportion, and the economic intensity of industrial activities is stronger. Governments should promote the green transformation (GT) of industrial companies to see high-quality green economic growth [

1]. Given that the world’s resources are dwindling and the environment is changing, this is essential. China has prioritized transitioning to a more sustainable industrial process over the past few years [

2]. There is an immediate need to reorganize China’s industrial sector and significantly reduce energy consumption and pollution levels; this is something that the Made in China (2025) program recognizes. Theoretically sound and pragmatically orientated, these development plans provide the groundwork for the long-term success of China’s manufacturing sector. Increasing the GT of manufacturing companies is crucial from a strategic perspective, which should not be surprising. From a macroeconomic perspective, global trade is advantageous since it encourages both strong economic growth and global environmental protection [

3], it satisfies the desire for sustainable social and economic development on a worldwide scale, and it gives national governments more influence in international ecological governance [

4]. Also, manufacturing companies’ GT promotes innovation and facilitates entry into new worldwide markets [

5]. From a macro perspective, GT in manufacturing strengthens the labor market and creates good jobs. The fact that GT creates employment lends credence to this. Eliminating industrial pollution can substantially improve people’s quality of life. At the micro level, GT helps industrial firms reduce production-related pollutants and energy usage. This has several benefits, including increased resource efficiency, better market competitiveness, more straightforward company collaboration, and fewer environmental costs [

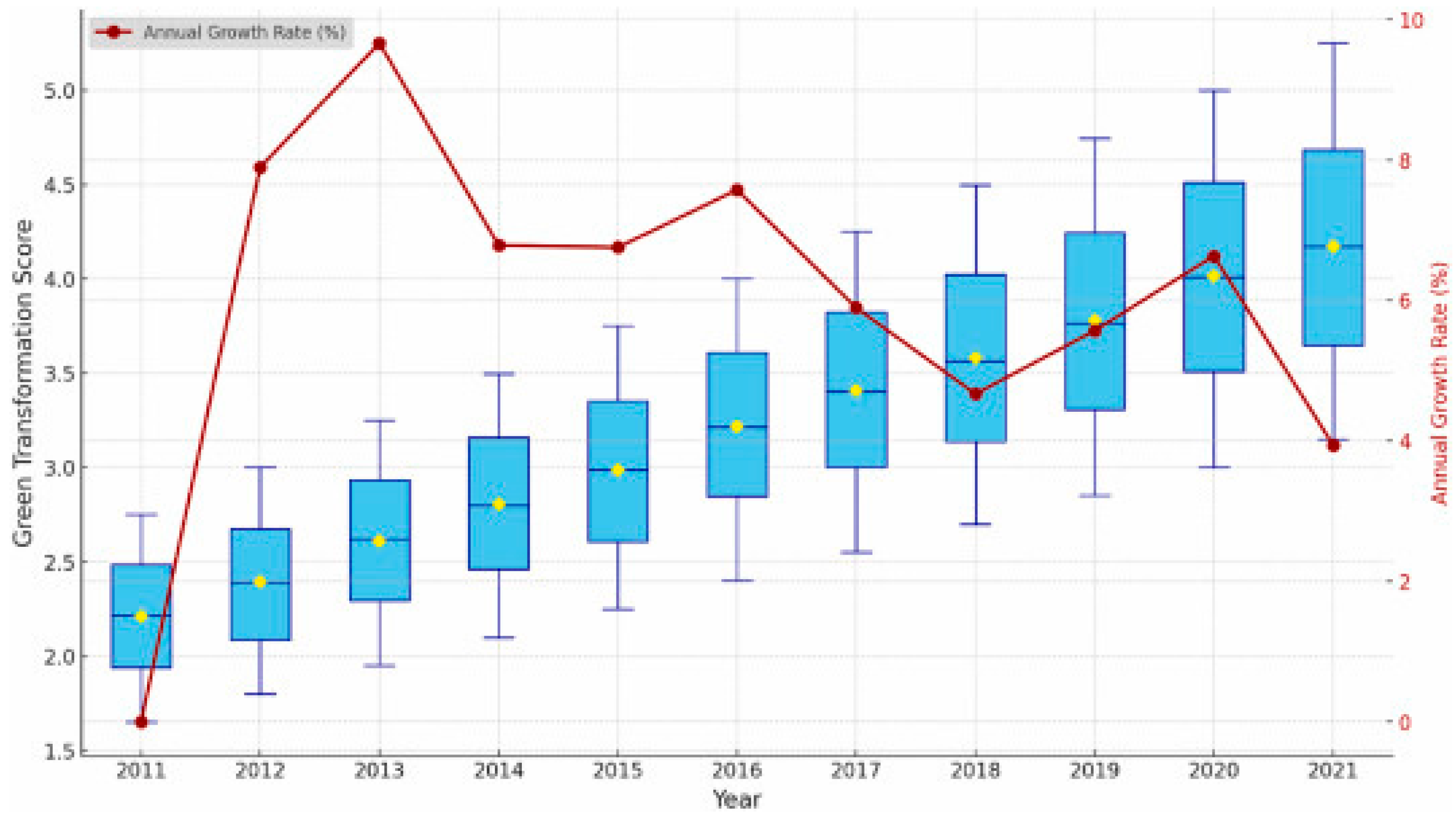

6]. While the GT of Chinese manufacturing companies has been on a significant upward trend in recent years, the annual growth rate peaked in 2013 and has since seen a string of downward fluctuations (see

Figure 1). We should be very concerned about this. The shift from “crude” low-quality growth to “intensive” high-quality development in China’s industrial sector may be the driving force behind this phenomenon. After rapid growth, this change has caused GT to gradually “bottleneck”. A significant issue is motivating Chinese manufacturing businesses to attain further GT.

The definition of DT has changed from its first restricted use to its current broader usage. At the onset, electronic transactions were the primary focus of DT [

7]. Conversely, its statistical rigor has evolved in tandem with contemporary developments. In 2017, the United States prioritized digital transformation services that may enhance smart manufacturing, data exchanges within global value chains, and other relevant platforms and applications. Digital technology encompasses unsold digital services, essential digital services, digital ordering, and digital delivery, as defined by the United Nations in 2022. Manufacturing enterprises are significantly impacted by digital transformation (DT), and many organizations and professionals believe that DT should be regarded as a comprehensive and broad concept.

Furthermore, green technology innovation (GTI) is crucial for examining GT and enhancing manufacturing organizations [

8]. The advent of DT has revitalized this inventive approach with new opportunities. Hervas-Drane asserts that the core premise of GTI is to develop goods, processes, or management to attain long-term environmental sustainability [

9]. External factors often support this innovation model’s successful implementation and widespread adoption. However, they frequently entail substantial investment, risk, and an extended payback period. The significant rise in DT offers an unprecedented broad platform for the increasing use of GTI. Barykin said that the intelligent and efficient attributes of digital technology, together with its interconnection and availability of information, have facilitated real-time information sharing across trade partners and enhanced operational efficiency [

10]. This adjustment enhances resource allocation, reducing the likelihood of information asymmetry during GTI and assisting organizations in minimizing innovation expenses. Publications from the Fu and Wei groups in 2023 and 2024 are referenced herein.

In this context, China has also accelerated the process of sustainable transformation of the manufacturing industry and has made extensive use of digital technology for support. In March 2025, China’s Ministry of Industry and Information Technology, and three other departments jointly issued the implementation plan for the digital transformation of light industry. By 2027, the popularity of digital R&D and design tools in key light industry enterprises will reach about 90%, and the NC rate of key processes will reach about 75%. About 100 typical scenarios will be created to accelerate the comprehensive development of light industry enabled by digital technology. In addition, the traditional manufacturing industry is the base of the modern industrial system. Accelerating the digital transformation, promoting advanced and applicable technologies [

11], and striving to improve the level of high-end, intelligent, and green technologies are important characteristics of modern manufacturing industry. China is leading other developing countries to seize the opportunity of digital, networked, and intelligent integration. It aims to give artificial intelligence and digital technology a role in the reform of the manufacturing industry and improve green total factor productivity. With the promotion of China’s sustainable development and the support of digital technology, China has built the world’s largest and most complete industrial system and information and communication infrastructure, with leading technology and the widest coverage. Many developing countries are in a major period of opportunity to promote high-quality industrial development through digital transformation. But in the process of using complex digital technology, most developing countries cannot expand the real benefits. Firstly, the large investment in digital technology has put too much pressure on enterprises [

12]. At the same time, the transformation effect of digital technology is not clear, and there is a lack of evidence to support its contribution in the specific manufacturing industry. Secondly, with the process of globalization and the goal of green sustainable development means that an effective application of digitalization for green activities must be sought. The aforementioned developmental patterns raise significant concerns: Can Chinese manufacturing businesses expedite their progression towards globalization by using digital transformation, a novel and continually growing framework, for international trade? In what ways do the two complement each other? What is the significance of GTI in this relationship? Examining these queries produces substantial practical insights applicable to governmental and corporate strategic planning for digital transformation and industrial advancement, with considerable theoretical importance.

Contemporary research is deficient in examining the influence of digital transformation on manufacturing enterprises’ growth trajectory. The below variables are generally used to investigate the impact of DT. Initially, DT optimizes the use of corporate resources. We assert that this fosters sustainable manufacturing methodologies and technologies while enhancing operational efficiency and facilitating the growth of Global Supply Chains (GSCs). Digital transformation enhances corporate social responsibility by rendering corporations more transparent and responsive to market demands. A significant increase in demand for eco-friendly products has been seen due to digital platforms substantially diminishing information asymmetries between producers and customers. Yi discovered that this transition enables enterprises to gain a competitive advantage by using breakthroughs in green technology and enhancing their environmental protection strategies [

13]. Moreover, DT can modify the competitive strategy and market positioning of enterprises. According to Sharifi [

14], digitalization has transformed product marketing strategies, customer behaviors, and purchase choices. Martin asserts that for firms to secure a competitive advantage in the digital economy [

15], they must integrate sustainability into their fundamental principles and strategic framework. While several studies have examined the consequences of digital transformation, few have thoroughly elucidated its relationship with green transformation and the operational dynamics of upgrading industrial enterprises. This article seeks to rectify the deficiency in research.

This essay raises many minor points. The primary objective of this article is to elucidate the function of digital transformation in enhancing the growth trajectory of manufacturing enterprises. Consequently, traditional trade ideas may be used for DT. The article emphasizes the importance of GTI in DT for promoting GT throughout the industrial sector. We can use these new insights to formulate digital transformation policies to advance sustainable development. This research elucidates how GIT sustainability, as a threshold variable, demonstrates the nonlinear impact of DT on the GT of industrial organizations. A novel perspective on the relationship between digital transformation (DT) and green transformation (GT) in the industrial sector is presented conceptually and experimentally.

5. Further Analysis

The heterogeneity tests indicate disparities in the influence of digital transformation (DT) on green transformation (GT) based on several business factors, such as industry type, competitive intensity, and phases of the organization’s life cycle. The influence of digital transformation on green technology is seen in both new energy and non-new energy enterprises, with a somewhat more significant effect observed in non-new energy organizations (0.0218 ** vs. 0.0226). This indicates that whereas new energy businesses intrinsically align with environmental goals, existing organizations receive more advantages from digital transformation in advancing their ecological transition. Secondly, industrial competition significantly influences the DT-GT connection. Companies in highly competitive industries exhibit a more significant impact (0.0259 **) than those in low-competition sectors (0.0190). This discovery supports the idea that market pressure drives companies to pursue efficiency and innovation via digital transformation, confirming its function as a strategic catalyst for growth in volatile market environments.

Ultimately, the impact of digital transformation fluctuates throughout various phases of the company life cycle. Companies in the maturity phase have the most significant effect (0.0334 **), suggesting that established enterprises with robust structures and resources are more adept at using digital transformation for growth transformation. The impact is negligible throughout the growth (0.0030) and decline (0.0019) phases, indicating that nascent organizations may be deficient in the infrastructure necessary to leverage digital transformation whilst decreasing enterprises face resource limitations that hinder their green transformation initiatives. The findings suggest that DT’s impact on GT varies across sectors and company attributes. Its efficacy depends on market factors and the developmental phases of organizations, underscoring the need for customized digital transformation adoption methods to optimize growth trajectory results.

When comparing organizations operating in high-competition sectors to those operating in low-competition industries, it is clear that the industry’s competitive climate significantly influences the link between digital transformation (DT) and green transformation (GT) in manufacturing enterprises. After dividing the sample into two groups according to the yearly median of the Herfindahl index for the industry, it was shown that DT had a more significant beneficial influence on GT in highly competitive sectors. To begin with, businesses operating in highly competitive marketplaces are required to continually search for operational solutions that are both efficient and cost-effective to preserve their market position. DT plays a significant part in the optimization of supply chain management, the reduction in resource waste, and the enhancement of energy efficiency. These qualities allow businesses to quickly adjust to the market’s needs while simultaneously spurring innovation, ultimately driving GT.

Secondly, businesses are required to investigate new market prospects because of the growing number of environmental rules and the changing tastes of consumers toward environmentally friendly goods. DT reduces the information gap in the market, enabling businesses to more correctly evaluate the demand that consumers have for environmentally friendly goods. Consequently, companies are far more likely to incorporate environmentally friendly technology, improve manufacturing procedures, and maintain their dedication to green innovation.

Last but not least, DT makes it easier to access cutting-edge green technologies and management techniques using worldwide networks that promote technology interchange and information sharing. By exposing companies to a wide variety of technical solutions and worldwide best practices, they can expedite their technological learning, enabling them to develop more quickly and improve their graphics processing skills. These results, taken as a whole, shed light on the fact that DT acts as a strategic facilitator of GT, especially in highly competitive sectors where the need for efficiency, market responsiveness, and continual innovation is more acute.

This article depends on this cash flow segmentation. As seen in

Table 7, the empirical findings indicate that DT is more successful in boosting GT for firms in the maturity stage than organizations in the development and decline phases. This phenomenon may be investigated from a variety of different points of view. In the first place, digital transformation necessitates that businesses possess a specific technical foundation and make a financial investment to integrate sophisticated information systems and data management technologies successfully. Secondly, well-established companies have a comprehensive understanding of the consumer services that they provide and the related market activities. Consequently, this enables companies to use data analytics tools more intelligently, allowing them to use digital commerce’s opportunities better.

Last but not least, GT mandates that businesses implement environmentally friendly practices in various aspects of sustainability, such as the management of supply chains, the design of products, and the technology used in manufacturing, in addition to the production processes. More mature businesses often have supply chain management systems that are more effective and have greater operational efficiency, both of which may be further optimized via digital trade opportunities. For instance, blockchain technology enhances the transparency and traceability of supply chains, making it easier to use resources effectively and adhere to environmental regulations [

26].

Table 8 presents compelling evidence that digital transformation (DT) facilitates green transformation (GT) in manufacturing firms via three primary mechanisms: green innovation (GIN), green innovation quality (GIQ), and the cumulative impact of sustainable technology innovation (SLGI). Among them, GIN, GIQ, and SLGN indicators are calculated from the original indicators before the weight. The data are from the annual reports of enterprises, the statistical yearbook of China’s green innovation and the guotai’an database. In Column (1), the interaction term GIN × DT has a coefficient of 0.1923, significant at the 1% level, suggesting that DT amplifies GT via green innovation. This indicates that digital transformation promotes the development and implementation of green technology, enabling companies to incorporate digital tools into their sustainability initiatives. In Column (2), the coefficient of GIQ×DT is 0.3194 and is statistically significant at the 1% level, indicating that DT substantially enhances the quality of green innovation. This underscores the idea that digital transformation promotes information interchange, resource accessibility, and technical spillovers, improving green technology innovation quality. Notwithstanding the negative coefficient for GIQ (−0.0319), the robust interaction effect indicates that DT is pivotal in mitigating possible issues in green innovation quality. Column (3) indicates that digital transformation (DT) enhances green technology (GT) via the cumulative impact of green technology innovation, shown by the coefficient of SLGI×DT at 0.0121, significant at the 1% level. This discovery corroborates that digital transformation enables companies to perpetually amass innovative experiences, establishing a self-reinforcing loop that bolsters their enduring green transformation. Although the coefficient for SLGI is negative (−0.0012), the positive interaction with DT indicates that firms with a more advanced green innovation system obtain substantial advantages from digital technology [

27].

In all three models, the coefficient for DT consistently exhibits a positive and substantial value, hence reaffirming its contribution to the advancement of GT. The incorporation of company and year-fixed effects, together with control variables, guarantees the robustness of these results. The models have robust explanatory power, shown by an adjusted R

2 of 0.635. These findings highlight that digital transformation is a crucial facilitator of green transformation in manufacturing. It enhances the quality and overall effect of green innovation while promoting the widespread adoption of sustainable practices [

28].

According to the data shown in

Table 8, digital transformation (DT) plays a significant part in fostering green transformation (GT) in manufacturing organizations. Given that the coefficient of 0.3194 for the interaction term GIQ × DT in Column (2) is significant at the 1% level, it can be concluded that Hypothesis H3 is shown to be correct. Based on this outcome, it can be concluded that DT improves the quality of GTI, making implementing innovative, environmentally friendly technologies easier by encouraging the flow of knowledge and technical information. The enhanced quality of GTI helps businesses transition to a more environmentally friendly business model. It boosts their added value and market competitiveness, encouraging them to participate in ecologically responsible technical innovation [

29].

Similarly, the interaction term SLGI × DT in Column 3 has a coefficient of 0.0121, which is equally significant at the 1% level, thus validating Hypothesis H4. It can be deduced from this that DT has a cumulative impact on GTI, which enables businesses to constantly amass technical knowledge and experience in the field of innovation. Using DT platforms, industrial companies can develop a self-sustaining cycle of environmentally friendly technical breakthroughs, steadily strengthening their innovation capacity. This accumulation effect not only helps to promote the development of ecologically friendly technologies over the long term, but it also helps to increase the market positioning of businesses, which ensures that they will remain competitive in the ever-changing industrial landscape. In the end, these findings underscore that DT acts as both a catalyst for high-quality innovation and a driver of persistent technical advancement, ultimately resulting in a more comprehensive and long-lasting green transformation in the industrial sector.

The findings of the SLGI threshold effects test in

Table 9 demonstrate the existence of a single threshold effect, with an F-statistic of 15.80 and a corresponding

p-value of 0.000, indicating statistical significance at the 1% level. The determined threshold value is 11.609, demonstrating that the influence of digital transformation (DT) on green technology innovation changes after SLGI crosses this level. The double threshold test, however, reveals an F-statistic of 5.87 with a

p-value of 0.167, showing that a second threshold is not statistically significant [

30].

Table 10 provides the findings of the SLGI threshold regression, illustrating the effect of several business characteristics on green innovation. Leverage (Lev) shows a substantial negative impact (Coef. = −0.6301,

p < 0.01), showing that increased financial leverage constrains green technology innovation. Firm size (Size) has a positive influence (Coef. = 0.1842,

p < 0.01), suggesting that more significant enterprises possess more capacity for the adoption of green technology owing to their resource availability. Tobin’s Q adversely affects innovation (Coef. = −0.0187,

p < 0.05), suggesting that firms with elevated market valuations may favor financial returns over environmentally sustainable investments. Other economic factors, including growth, return on assets (ROA), and state ownership (SOE), have no substantial influence. Firm age (FirmAge) has a significant favorable influence (Coef. = 2.6791,

p < 0.01), indicating that older enterprises use accumulated expertise and stability to foster green technology innovation [

31].

Comparison between DT and SLGI elucidates threshold effects. When SLGI is below 2.6039, DT has a minor influence on green innovation (Coef. = −0.0008, p = 0.318), suggesting that digital transformation fails to provide considerable advantages at diminished levels of green innovation potential. Once SLGI surpasses the threshold of 2.6039, DT has a substantial positive impact (Coef. = 0.0022, p < 0.05), indicating that digital transformation fosters green innovation solely when firms possess a robust foundation in green innovation. This affirms that digital transformation is inadequate on its own; instead, it augments and improves green innovation initiatives after companies attain a certain degree of technical maturity.

The expansion of market access, the enhancement of information availability, and the improvement of transaction efficiency are three ways that digital transformation (DT) contributes to the spread and use of green technology in industrial firms. However, its catalytic impact becomes noticeable only when companies’ green technology innovation (measured by the SLGI index) goes beyond a certain point. Technology developments may be inconsistent and unstable at lower SLGI levels because enterprises may not have a well-established green innovation framework. Businesses can make steady strides in green technology through R&D, manufacturing, and sales when the SLGI passes the barrier because they have established better organized and long-lasting infrastructure for green innovation. Businesses with superior SLGI also have an advantage in the market since they can better address the need for eco-friendly goods, which are growing in popularity. Green technology innovation is sped up with the use of DT, which enables businesses to track market trends, change product strategies, and optimize production planning in reaction to changing customer demands [

32].