Abstract

Cryptocurrencies have gained global recognition, yet their rapid expansion is accompanied by significant environmental concerns due to their energy-intensive operations. This study employs novel system thinking and system dynamics approaches to examine the impact of cryptocurrencies on energy use, water consumption, and carbon emissions. The findings underscore the significant negative environmental impact resulting from cryptocurrency mining. According to our results, in 2023, the water consumption and carbon emissions of cryptocurrencies amounted to 1859 × 106 m3 and 90.6 × 106 tons CO2e (0.25% of global CO2 emissions), respectively, linked to the consumption of 119.7 × 106 MWh of electricity (0.5% of global electricity consumption). To provide context, this volume of water could fulfill the basic drinking water and sanitation needs of a global population that lacks access. Similarly, the electricity consumption equates to supplying a country like Argentina, which has a population of nearly 46 million. Without intervention, these figures are projected to increase sixfold by 2030. We recommend the adoption of renewable energy curtailment for Proof-of-Work cryptocurrency mining. Alternatively, technologies like the Pi network, based on the Stellar Consensus Protocol, offer a sustainable and energy-efficient solution.

1. Introduction

Cryptocurrencies have garnered significant attention, with numerous major corporations and entire nations, such as El Salvador, embracing them as legitimate forms of payment [1]. The adoption of cryptocurrencies represents a paradigm shift in the traditional financial landscape, offering benefits such as decentralized transactions, increased financial inclusion, and reduced transaction costs [2,3,4]. This revolutionary technology facilitates cross-border movement by increasing transaction speed, but its true power lies in empowering individuals in places with no or poor access to traditional banking infrastructure [5,6]. Interest in the underlying blockchain technology of cryptocurrencies has also been sparked across different industries other than payment systems. The transparency and immutability of blockchain allow for greater security and accountability even for fields beyond finance [7]. Blockchain is used in diverse fields like healthcare, supply chain management, and voting systems, as it promises increased transparency, traceability, and efficiency [8,9]. Moreover, the increasing acceptance of cryptocurrencies is reshaping investment strategies. Institutional investors are adding digital assets to their portfolios and viewing them as alternative stores of value. Decentralized finance (DeFi) platforms have also become exemplars of cryptocurrencies, enabling decentralized lending, borrowing, and trading [10].

However, the adoption of cryptocurrencies comes with some challenges. Continued discussions and debates have been spurred by regulatory uncertainties, concerns over illicit activities, and the environmental impact of mining operations [11,12,13]. It is crucial to strike a balance between encouraging innovation, regulatory concerns, and the environmental impact of mining operations for the sake of the healthy growth of cryptocurrencies in the global financial ecosystem. Cryptocurrency mining processes, especially the ones that use Proof-of-Work mechanisms, consume large amounts of energy and water [14]. For example, the average energy consumption for mining Bitcoin, Ethereum, Litecoin, and Monero is around 5, 2, 2, and 4 kWh to generate USD 1 [15]. Bitcoin alone is responsible for 0.5 to 0.6% of global electricity consumption [16]. Therefore, the increasing energy requirements of cryptocurrency mining and their implications have raised concerns about environmental sustainability.

Many studies have looked into worries about cryptocurrencies; however, a fundamental error has been discovered in the energy consumption index, leading to a significant overestimation of electricity use [17]. The primary inaccuracies discovered are the assumptions regarding power pricing and the expected ratio of electricity expenses to total mining income. For example, in a study by the authors of [18], a fixed rate of 5 cents/kWh is assumed for power expenses, which differs from the global average of USD 0.15/kWh [19]. This assumption leads to an overestimation of the electricity consumption of cryptocurrencies [17] and has comprehensively detailed various other flaws in their study, shedding light on the intricacies of these issues. Table 1 provides an overview of how cryptocurrencies affect both the global financial system and the environment. It highlights key research gaps, such as the limited data on overall resource use and the need for sustainable approaches, which are areas this study aims to address, using a unique approach that integrates systems thinking and dynamics to model these impacts in detail. By doing so, it sets the foundation for exploring effective, sustainable strategies to reduce the environmental footprint of cryptocurrency mining.

Table 1.

Overview of the financial position and environmental challenges of cryptocurrency.

This paper aims to investigate the comprehensive environmental impacts of cryptocurrencies, addressing not only their energy consumption and carbon emissions but also their water consumption. Through this comprehensive analysis, our objective is to gain deeper insights into the ecological impact of various cryptocurrencies in the market, offering a nuanced understanding of their environmental implications. Exploring the multifaceted dimensions of environmental impact, such as energy use, water consumption, and carbon emissions, is of paramount importance. By considering these critical environmental factors, we aim to contribute to a more holistic evaluation of the sustainability of cryptocurrencies, thus enhancing our ability to propose targeted and effective sustainable strategies.

2. Methods

To achieve the aim of this study, we use both systems thinking and system dynamics methodologies. Systems thinking paints a complete picture of intricate interdependence, whereas system dynamics provides a thorough framework for modeling and studying dynamic systems over time [27]. This methodology carefully examines a system’s interdependence and feedback loops, helping us comprehend how various components interact and influence one another. System dynamics allows for the examination of dynamic links, making it perfect for investigating the environmental impact of cryptocurrencies, which have complex and evolving relationships.

Main Data Used in the Model

Table 2 provides a comprehensive overview of the pivotal parameters and variables that form the backbone of the model. Each parameter and variable play a vital role in shaping the behavior and outcomes of the model, serving as the foundation upon which the analysis is built. For a thorough understanding, including equations and units for all model parameters, Appendix A provides a comprehensive set of details.

Table 2.

Key parameters and variables for the model.

3. Results and Discussion

3.1. System Dynamics Analysis

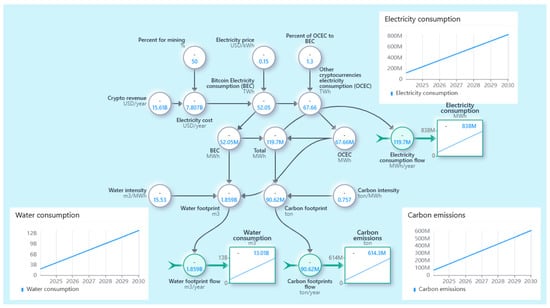

The study reveals a significant adverse environmental impact stemming from cryptocurrency mining. Our findings for 2023 indicate that the water consumption and carbon emissions of cryptocurrencies total 1859 × 106 m3 and 90.6 × 106 tons CO2e (0.25% of global CO2 emissions), respectively, linked to the consumption of 119.7 × 106 MWh of electricity (0.5% of global electricity consumption), as illustrated in Figure 1 and Table 3. This highlights a substantial impact, particularly considering that the volume of water could meet the basic drinking water and sanitation needs of a global population that lacks access. Furthermore, the electricity consumption is equivalent to supplying a country the size of Argentina, with a population of nearly 46 million. Without intervention, these figures are projected to increase sixfold by 2030. This is a significant concern as the world aims to decarbonize, presenting a call to action for interventions. This projected escalation underscores the urgent need for implementing intervention strategies to mitigate the growing environmental consequences associated with cryptocurrency mining.

Figure 1.

System dynamics model depicting the environmental impact of cryptocurrencies.

Table 3.

Environmental impact of cryptocurrencies mining: energy, water, and carbon emissions.

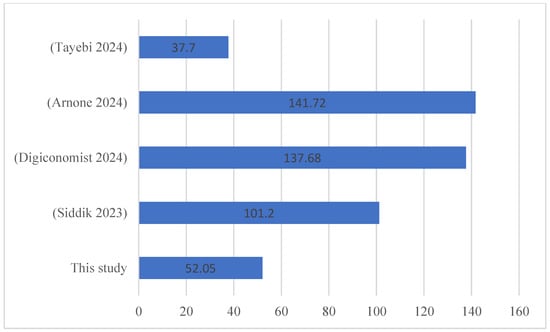

Figure 2 and Figure 3 offer a comparative overview of our study’s findings in relation to other studies. Figure 2 specifically delves into studies focused on investigating Bitcoin’s electricity consumption. For example, ref. [1] reported 101.2 TWh, while refs. [18,29] (representing some of the most cited studies) reported electricity consumption figures of 137.63 TWh and 141.72 TWh, respectively. In contrast, ref. [30] estimated it at 4.3 GW (equivalent to 37.7 TWh). Notably, a noticeable discrepancy exists between the findings of these studies and our current study. We attribute this inconsistency to several factors. Most of these studies rely on an underestimated electricity price assumption, such as the studies by refs. [18,29], where it is assumed to be USD 0.05/KWh, leading to an overestimation of electricity consumption, as depicted in the figure. Additionally, the methodologies employed in other studies ([1,30]) lack clarity, particularly in utilizing market share to estimate electricity consumption. Moreover, certain studies, like ref. [1], employ a carbon density aligned with oil, whereas the majority of power stations globally rely on coal and natural gas. This discrepancy significantly impacts the accuracy and relevance of their findings.

Figure 2.

Electricity consumption—comparison of findings with other studies [1,18,22,23].

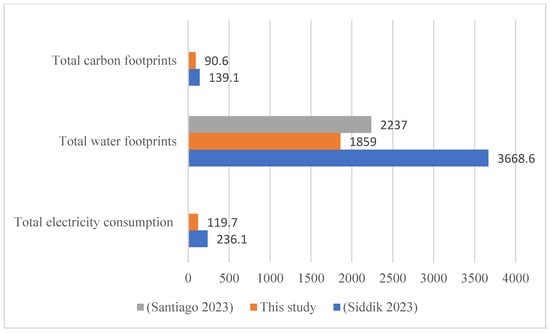

Figure 3.

Comparison of electricity consumption, water consumption, and carbon emissions with findings from another study [1,24].

Unlike other studies, we use realistic assumptions about electricity prices and carbon density, better capturing the current global energy landscape, where coal and natural gas are major power sources. This approach provides a more accurate estimate of cryptocurrency mining’s environmental impact, making our findings especially useful for policymakers and industry leaders looking to tackle these challenges.

Figure 3 presents a comparative analysis with select smaller-scale studies that have explored the collective impact of cryptocurrencies on energy consumption, water consumption, and carbon emissions. In a study by the authors of [1], total electricity consumption, water consumption, and carbon emissions for cryptocurrencies (including Bitcoin) were reported as 236.1 × 106 MWh (236.1 TWh), 3668.6 × 106 m3, and 139.1 × 106 tons CO2e, respectively. In contrast, our current study reveals figures of 119.7 × 106 MWh, 1859 × 106 m3, and 90.6 × 106 tons CO2e for the same parameters. We explicated potential reasons for the observed discrepancies in a previous section. Another study, conducted by the authors of [26], exclusively delved into Bitcoin’s water consumption, estimating it to be 2237 × 106 m3.

3.2. Systems Thinking Analysis

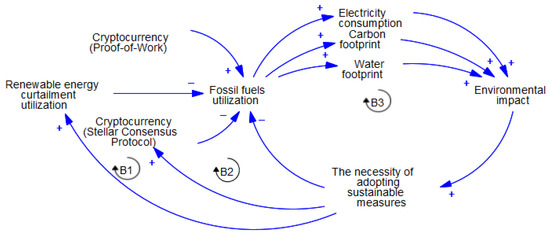

In Figure 4, we observe the presence of three balancing loops, which are feedback mechanisms aimed at maintaining equilibrium within a system. Balancing loops counteract changes and stabilize the system. Loop B1 illustrates the inter-relationships among several variables: renewable energy (RE) curtailment utilization, fossil fuel utilization, environmental impact, and the necessity of adopting sustainable measures. This loop suggests that as RE curtailment utilization increases, there is a corresponding decrease in fossil fuel utilization, leading to a reduction in environmental impact. Loop B2 emphasizes the links between cryptocurrency mining, the Stellar Consensus Protocol (SCP), fossil fuel use, environmental impact, and implementing sustainable measures. Adopting a more energy-efficient protocol like SCP reduces fossil fuel use and its environmental impact. Loop B3 examines the relationship between fossil fuel use, environmental damage, and implementing sustainable measures. This loop emphasizes the direct impact of fossil fuel use on environmental degradation and the importance of practicing sustainable measures.

Figure 4.

Causal loops for cryptocurrency mining sustainability.

These loops shed light on the complex interplay of factors impacting the long-term profitability of cryptocurrency mining operations. This understanding is crucial for establishing effective approaches for decreasing environmental impact and supporting long-term sustainability in the cryptocurrency business.

3.3. Proposed Sustainable Solutions

3.3.1. Renewable Energy Curtailment

In light of the high carbon emissions and energy consumption associated with cryptocurrency mining operations, using RE sources is a promising path for mitigating these environmental implications. As a result, we advocate implementing RE curtailment, which faces economic and environmental issues while also losing valuable energy [31] to channel excess RE output to cryptocurrency mining operations during periods of overgeneration when the grid does not require full capacity. RE curtailment practices enable cryptocurrency mining operations to leverage surplus clean energy, diminishing reliance on non-renewable sources and concurrently reducing carbon emissions. This sustainable approach aligns with the broader global agenda to transition towards greener technologies, addressing environmental concerns within the cryptocurrency industry. Despite the potential of RE curtailment, a challenge arises as many miners prioritize continuous mining for maximum profits. To address this, surplus/wasted energy could be converted into alternative forms, such as hydrogen, allowing for on-demand utilization. Furthermore, our proposed integrated RE-driven hydrogen system for energy independence and self-sufficiency, as suggested in the study by the authors of [32], provides a comprehensive solution to further enhance the environmentally conscious and ecologically responsible ecosystem. For this proposed solution, we consider cost-effectiveness and challenges. As shown in our previous research [31], when there is a surplus of RE, it can be redirected to sustainable applications—for instance, to generate green ammonia, making it viable and cheaper than other times.

3.3.2. Stellar Consensus Protocol

An alternative and highly favored solution to address the environmental impact of cryptocurrency mining is the adoption of SCP, exemplified by the Pi network [33]. SCP is gaining recognition as an efficient and environmentally friendly consensus algorithm, particularly in contrast to the energy-intensive Proof-of-Work mechanisms commonly associated with cryptocurrencies like Bitcoin. SCP ensures decentralization, security, and scalability without requiring significant processing capacity and lowers the energy usage related to cryptocurrency transactions and mining. The Pi network is an example built on SCP that has grown in prominence due to its focus on sustainability, providing an energy-efficient alternative. By utilizing SCP, Pi network users contribute to the network’s security and consensus process while avoiding the environmental costs associated with traditional mining methods. Adopting SCP is a critical step towards promoting a greener and more sustainable future for the cryptocurrency sector, in line with the growing global emphasis on environmentally sensitive technologies.

4. Conclusions

This study’s aim is to investigate the environmental consequences of cryptocurrencies through systems thinking and system dynamics methodologies. The research revealed significant negative environmental implications associated with cryptocurrency mining. In 2023, cryptocurrency consumed 1859 × 106 m3 of water and emitted 90.6 × 106 tons of CO2e, resulting in 119.7 × 106 MWh of electricity consumption.

These findings carry crucial policy implications for the cryptocurrency industry and environmental regulators. The study underscores the urgency for adopting sustainable practices, emphasizing the importance of balancing technological advancements in cryptocurrencies with environmental responsibility. To encourage such practices, we propose the following: First, promote the use of RE for mining with tax breaks, and encourage energy miners and energy providers to work together. The shift to low-energy consensus protocols, like SCP, could be encouraged by diverting research funding to reduce energy intensity. Also bringing in environmental reporting requirements and carbon pricing (for example, carbon taxes) increases accountability. Funding research and development for energy-efficient blockchain technologies could mitigate energy costs and spur further innovation. Making efficient use of excess RE during periods of high energy availability is critical, and establishing carrier water use standards (with efficient cooling requirements) may help with the footprint in areas where water availability is an issue. These targeted efforts give policymakers a framework to advance a sustainable cryptocurrency sector. The move to sustainable mining represents a socio-economic shift that guarantees savings, generates green jobs, enhances the economy, and lowers environmental impact. Subsequent research should focus on other consensus mechanisms, geographic and regulatory variance, and smart grid connectivity. Life cycle assessments and economic models of positive and negative impacts will determine costs versus benefits, while social impact studies will demonstrate effects on local energy access, employment, and public health that can guide equitable growth to advance sustainability.

Author Contributions

Conceptualization, M.L. and R.A.; methodology, M.L. and R.A.; software, M.L.; validation, M.L.; formal analysis, M.L.; writing—original draft preparation, M.L. and S.G.; writing—review and editing, M.L. and S.G.; visualization, M.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Parameters employed in the system dynamics model.

Table A1.

Parameters employed in the system dynamics model.

| Variable Name | Value | Unit |

|---|---|---|

| Crypto revenue | 15,614,241,260 | $/year |

| Percent for mining | 50 | % |

| Electricity cost | “Crypto revenue”*“Percent for mining”/100 | $/year |

| Bitcoin Electricity consumption (BEC) | (“Electricity cost”/“Electricity price”)/1,000,000,000 | TWh |

| Electricity price | 0.15 | $/kWh |

| BEC | “Bitcoin Electricity consumption (BEC)”*1,000,000 | MWh |

| Other cryptocurrencies electricity consumption (OCEC) | “Bitcoin Electricity consumption (BEC)”*“Percent of OCEC to BEC” | TWh |

| Percent of OCEC to BEC | 1.3 | |

| OCEC | “Other cryptocurrencies electricity consumption (OCEC)”*1,000,000 | MWh |

| Total | “BEC”+“OCEC” | MWh |

| Water footprint | (“BEC”+“OCEC”)*“Water intensity” | m3 |

| Water intensity | 15.53 | m3/MWh |

| Carbon footprint | “Carbon intensity”*“Total” | ton |

| Carbon intensity | 0.59 | ton/MWh |

| Water footprint flow | “Water footprint” | m3/year |

| Water footprints | 1,859,083,611.8864667 | m3 |

| Carbon footprints flow | “Carbon footprint” | ton/year |

| Carbon footprints | 70,628,417.96606667 | ton |

| Electricity consumption flow | “Total” | MWh/year |

| Electricity consumption | 119,709,182.99333334 | MWh |

References

- Siddik, M.A.B.; Amaya, M.; Marston, L.T. The water and carbon footprint of cryptocurrencies and conventional currencies. J. Clean. Prod. 2023, 411, 137268. [Google Scholar] [CrossRef]

- Rejeb, A.; Rejeb, K.; Keogh, J.G. Cryptocurrencies in modern finance: A literature review. Etikonomi 2021, 20, 93–118. [Google Scholar] [CrossRef]

- Rodima-Taylor, D.; Grimes, W.W. Cryptocurrencies and digital payment rails in networked global governance: Perspectives on inclusion and innovation. In Bitcoin and Beyond; Routledge: London, UK, 2017; pp. 109–132. [Google Scholar]

- Pantin, L.P. Financial Inclusion, Cryptocurrency, and Afrofuturism. Northwestern Univ. Law Rev. 2023, 118, 621–690. [Google Scholar]

- Barreto, P.I.B.; Maggia, P.J.A.U.; Acevedo, P.S.I. Cryptocurrencies and blockchain in tourism as a strategy to reduce poverty. Retos 2019, 9, 18. [Google Scholar]

- Scott, B. How Can Cryptocurrency and Blockchain Technology Play a Role in Building Social and Solidarity Finance? UNRISD Working Paper; UNRISD: Geneva, Switzerland, 2016. [Google Scholar]

- Herlihy, M.; Moir, M. Enhancing accountability and trust in distributed ledgers. arXiv 2016, arXiv:1606.07490. [Google Scholar]

- Anusha, R. Blockchain Technology for Supply Chain, Health Care, Intellectual Property Rights, E-voting. Turk. J. Comput. Math. Educ. (TURCOMAT) 2021, 12, 1873–1878. [Google Scholar]

- Ahmad, M.S.; Shah, S.M. Moving beyond the crypto-currency success of blockchain: A systematic survey. Scalable Comput. Pract. Exp. 2021, 22, 321–346. [Google Scholar] [CrossRef]

- Schueffel, P. DeFi: Decentralized Finance-An Introduction and Overview. J. Innov. Manag. 2021, 9, I–XI. [Google Scholar] [CrossRef]

- Cumming, D.J.; Johan, S.; Pant, A. Regulation of the crypto-economy: Managing risks, challenges, and regulatory uncertainty. J. Risk Financ. Manag. 2019, 12, 126. [Google Scholar] [CrossRef]

- Arsi, S.; Ben Khelifa, S.; Ghabri, Y.; Mzoughi, H. Cryptocurrencies: Key risks and challenges. In Cryptofinance: A New Currency for a New Economy; World Scientific: Singapore, 2022; pp. 121–145. [Google Scholar]

- Wendl, M.; Doan, M.H.; Sassen, R. The environmental impact of cryptocurrencies using proof of work and proof of stake consensus algorithms: A systematic review. J. Environ. Manag. 2023, 326, 116530. [Google Scholar] [CrossRef]

- Islam, M.R.; Rashid, M.M.; Rahman, M.A.; Mohamad, M.H.S.B. A comprehensive analysis of blockchain-based cryptocurrency mining impact on energy consumption. Int. J. Adv. Comput. Sci. Appl. 2022, 13. [Google Scholar] [CrossRef]

- Krause, M.J.; Tolaymat, T. Quantification of energy and carbon costs for mining cryptocurrencies. Nat. Sustain. 2018, 1, 711–718. [Google Scholar] [CrossRef]

- Chohan, U.W. Cryptocurrencies: A Brief Thematic Review. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3024330 (accessed on 1 September 2024).

- Bevand, M. Serious faults in Digiconomist’s Bitcoin Energy Consumption Index. 2017. Available online: http://blog.zorinaq.com/serious-faults-in-beci (accessed on 22 January 2024).

- Digiconomist. Bitcoin Energy Consumption Index. Available online: https://digiconomist.net/bitcoin-energy-consumption#validation (accessed on 22 January 2024).

- Globalpetrolprices. Electricity Prices. Available online: https://www.globalpetrolprices.com/electricity_prices/ (accessed on 22 January 2024).

- Tetiana, Z.; Volodymyr, S.; Oleksandr, D.; Vasyl, B.; Tetiana, D. Investment Models on Centralized and Decentralized Cryptocurrency Markets; Scientific Bulletin of National Mining University: Kyiv, Ukraine, 2022. [Google Scholar]

- Makarov, I.; Schoar, A. Cryptocurrencies and decentralized finance (DeFi). Brook. Pap. Econ. Act. 2022, 2022, 141–215. [Google Scholar] [CrossRef]

- Arnone, G. The Future of Cryptocurrencies and Digital Currencies. In Navigating the World of Cryptocurrencies: Technology, Economics, Regulations, and Future Trends; Springer: Berlin/Heidelberg, Germany, 2024; pp. 103–111. [Google Scholar]

- Tayebi, S.; Amini, H. The flip side of the coin: Exploring the environmental and health impacts of proof-of-work cryptocurrency mining. Environ. Res. 2024, 252, 118798. [Google Scholar] [CrossRef] [PubMed]

- Santiago, N.G.; Gonzales, A.L.; Damilig, A.D. Minding Modern Mining: An Analysis of the Energy-Intensiveness of Proof-of-Work Consensus Mechanism and its Violation Against the Right to a Balanced & Healthful Ecology. J. ReAttach Ther. Dev. Divers. 2023, 6, 1250–1276. [Google Scholar]

- Siddique, I.; Smith, E.; Siddique, A. Assessing the sustainability of bitcoin mining: Comparative review of renewable energy sources. J. Altern. Renew. Energy Sources 2023, 10, 46610. [Google Scholar] [CrossRef]

- de Vries, A. Bitcoin’s growing water footprint. Cell Rep. Sustain. 2024, 1, 100004. [Google Scholar] [CrossRef]

- Azar, A.T. System dynamics as a useful technique for complex systems. Int. J. Ind. Syst. Eng. 2012, 10, 377–410. [Google Scholar] [CrossRef]

- Norway, I. Conversion Guidelines—Greenhouse Gas Emissions. Available online: https://www.eeagrants.gov.pt/media/2776/conversion-guidelines.pdf (accessed on 23 January 2024).

- UC. Cambridge Bitcoin Electricity Consumption Index. Available online: https://ccaf.io/cbnsi/cbeci (accessed on 23 January 2024).

- Gallersdörfer, U.; Klaaßen, L.; Stoll, C. Energy consumption of cryptocurrencies beyond bitcoin. Joule 2020, 4, 1843–1846. [Google Scholar] [CrossRef]

- Laimon, M.; Goh, S. Unlocking potential in renewable energy curtailment for green ammonia production. Int. J. Hydrogen Energy 2024, 71, 964–971. [Google Scholar] [CrossRef]

- Laimon, M.; Yusaf, T. Towards energy freedom: Exploring sustainable solutions for energy independence and self-sufficiency using integrated renewable energy-driven hydrogen system. Renew. Energy 2024, 222, 119948. [Google Scholar] [CrossRef]

- Network, P. The First Digital Currency You Can Mine on Your Phone. Available online: https://minepi.com/ (accessed on 23 January 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).