1. Introduction

The potential of the digital economy, first recognized in the 1990s, has steadily evolved into a crucial economic model [

1]. In August 2024, the China Academy of Information and Communication Technology (CAICT) published the “China Digital Economy Development Research Report (2024)”; the scope of Chinese digital economy reached CNY 53.9 trillion in 2023, constituting 42.8% of GDP and establishing itself as a central driver of China’s economic progress. However, the considerable energy consumption, pollution, and digital information security concerns accompanying this rapid economic expansion have imposed constraints on growth [

2,

3] and triggered public crises, including public health emergencies. As a result, the Chinese government has officially put forward the objectives of reaching the carbon emission peak by 2030 and achieving carbon neutrality by 2060. These significant targets have effectively augmented the responsibilities that Chinese enterprises need to shoulder.

With growing emphasis on sustainable development, the ESG concept first introduced by the United Nations in 2004 has gained prominence, although some perspectives question the rationality of the ESG concept, arguing that it diverges from the original intention of enterprises and fails to create value for both enterprises and investors [

4,

5]. Furthermore, the high level of attention to ESG has, to a certain extent, exacerbated the “greenwashing” behavior of enterprises [

6,

7,

8]. However, given the positive impact of ESG on climate risk [

9], stock returns [

10] and investment returns [

11], and financial performance [

12], and in the absence of mandated legal disclosures for non-financial reporting in China, ESG reporting has emerged as a pivotal mechanism for evaluating the extent to which a company discharges its social responsibilities [

12]. Despite this, enterprises still face multiple practical obstacles in the process of promoting ESG, such as the difficulty in quantifying the long-term returns of sustainable development investments [

13], specific industry barriers [

14], and the disconnect between strategy and execution [

15]. Thus, delving into the means of promoting the ESG performance of enterprises still holds crucial importance for China in the pursuit of its ”2030” goal, for instance, Hyundai Motor leveraging its sound business philosophy and environmentally conscious products and prioritizing feedback from investors and other stakeholders, along with its ESG management practices. This has enabled the company to achieve global sales of 268,785 electric vehicles in 2023, a 28% year-over-year increase in an increasingly competitive automotive market. Consequently, for companies aiming at sustainable development, it has become an essential requirement to efficiently meet the various needs of stakeholders in the process of digital transformation implementation.

Digital transformation, which is also referred to as Industry 4.0 [

16,

17,

18], has been shown to facilitate the restructuring of existing procedures and business frameworks within companies, thereby enhancing their ESG performance. In digital transformation, businesses can optimize resource utilization, effectively facilitate the transition of traditional industries to low-energy and low-pollution operational models [

19], and strengthen their financial performance in accordance with green development principles [

20]. However, traditional businesses may experience a short-term decline in performance due to technological adaptation barriers [

21]. In addition, the increased reliance on digital infrastructure raises concerns about data security and privacy [

22,

23], making cybersecurity risks a key issue for businesses to address.

The relationship between corporate digital transformation and their ESG has attracted extensive academic attention; nevertheless, several research gaps remain. First, considering the above-mentioned importance of ESG development to Chinese society, digital transformation, as noted by Firk et al. [

24], may introduce risks by altering the existing operational models. These risks could potentially cause a decline in a company’s ESG performance, and the nature of this relationship calls for further verification. Second, further exploration is needed to clarify the underlying mechanisms through which digital transformation influences ESG performance. Existing research has analyzed potential pathways through the perspectives of environmental regulations [

25], corporate risk-taking [

26], and market performance [

27]. However, shifts in traditional business models or the misalignment of personnel structures can undermine transformation efforts. In fact, certain companies may pursue digital transformation due to pressure from external stakeholders [

28], prioritizing low-investment, high-return strategies. Developing transformation strategies aligned with a company’s specific context is, therefore, of significant research value. Third, as the extant literature on digitalization and sustainable development primarily focuses on large entities, such as listed companies and manufacturing firms [

29,

30,

31], the exploration of firm heterogeneity still requires more in-depth research.

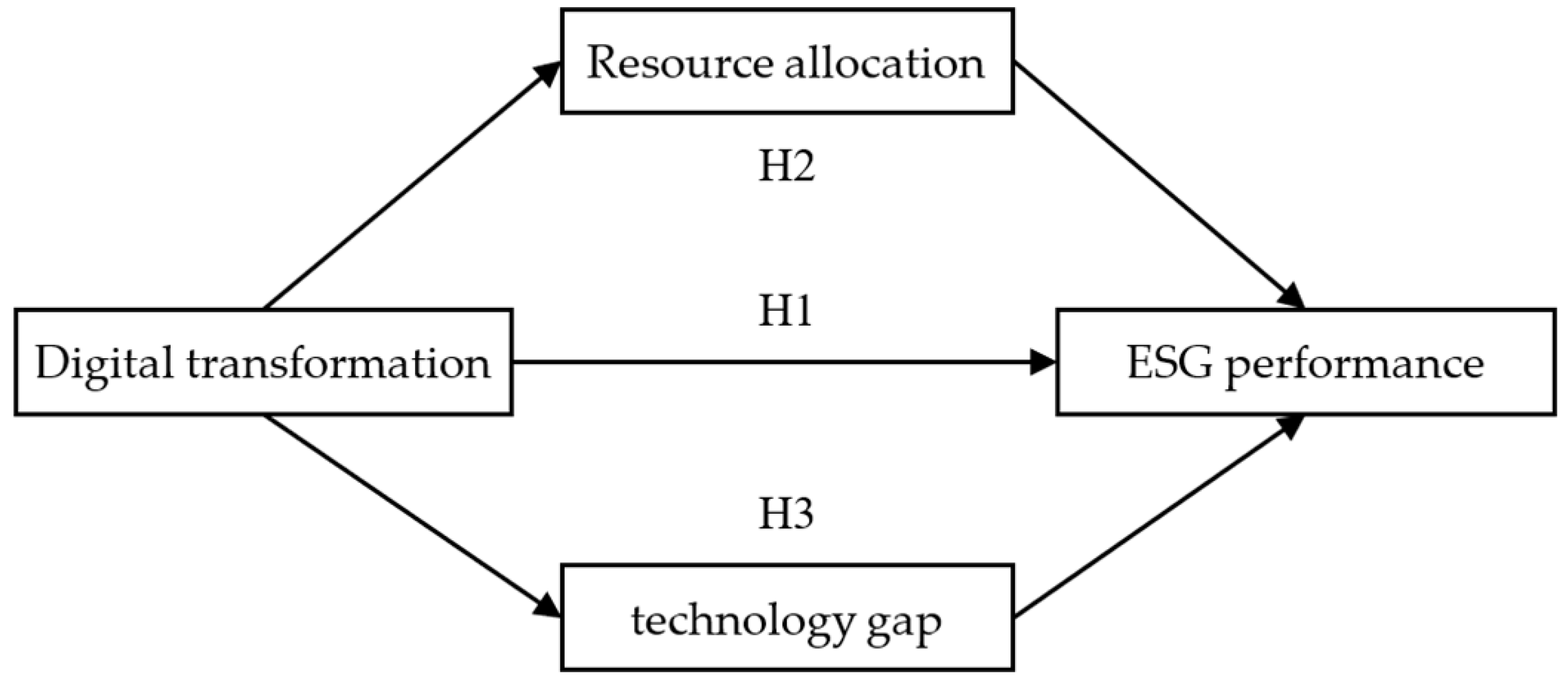

This study employs a two-way fixed-effects model to rigorously examine the relationship between digital transformation and corporate ESG performance, utilizing data from Chinese listed companies from 2014 to 2023. It makes three key contributions. First, it provides empirical evidence that digital transformation enhances ESG performance, underscoring its critical role in promoting corporate sustainability. Second, we propose that resource allocation efficiency and technological gaps constitute the “black box” of the mechanism linking between digital transformation and ESG—an unexplored pathway in the existing literature. By unveiling this underlying mechanism, our study enriches the theoretical framework in this field and introduces new variables and relationships for future research. Third, we identify the heterogeneous effects of digital transformation on ESG performance across firm sizes, industries, regions, and technological levels, emphasizing the necessity of context-specific strategies. Overall, this study provides important insights for both theory and practice, with valuable implications for corporate decision-making and sustainable development policy formulation in the context of digital transformation.

The remainder of the present study is structured as follows:

Section 2: Mechanism Analysis and Hypotheses;

Section 3: Data Sources and Model Construction;

Section 4: Empirical Results; and

Section 5: Summary, Discussion, Recommendations, and Limitations.

4. Empirical Result Analysis

4.1. Descriptive Statistics

Table 3 presents the results of the descriptive statistical analysis conducted for the core variables. Regarding the corporate ESG score, its average value was 4.117, with a standard deviation of 0.956. The scores were distributed within the range from 1 to 6.75. The wide range of values clearly demonstrates that there are significant variations in the ESG performance of the sample enterprises. For the Dig levels, the mean was 0.061, and the standard deviation was 0.101. Values spanned from a minimum of 0 to a maximum of 0.5577. This indicates that the proportion of digitally related content disclosed in company annual reports was generally low, while certain companies exhibited notably high levels of digital transformation performance. Resource allocation efficiency had a mean of 0.039 and a standard deviation of 0.051, reflecting an overall inefficiency in resource allocation among the firms. Furthermore, the variable TechGap presented an average value of 1.001, with a standard deviation of 0.778 and with values varying from 0.114 to a maximum of 4.8975. This wide distribution highlights the significant difference in the relative technological standing among the companies.

4.2. Correlation Analysis

The results of the correlation analysis in

Table 4 demonstrate that the correlation coefficient between Dig and ESG was 0.076, significant at the 1% level. This positive correlation offers supporting evidence for the following regression analysis. The correlation coefficient between resource allocation efficiency and the explained variable was −0.094, with a negative at level of 5%. As resource allocation efficiency is measured as a reverse index, this negative correlation indicates that lower resource allocation efficiency (i.e., less efficient resource allocation) corresponds with weaker ESG performance. Finally, the relatively small magnitudes of the correlation coefficients among the variables indicate a lack of significant multicollinearity issues, thereby supporting the planned robustness analysis of the model.

4.3. Benchmark Regression

The results of the benchmark regression are shown in

Table 5. In this model, the impact of Dig on corporate ESG is estimated. Control variables and fixed effects are successively included to verify the robustness of the results. Hypothesis 1 posits that digital transformation can significantly improve corporate ESG performance.

Column (1) isolates the direct effect of Dig level on firm ESG outcome. With a significance level of 1%, the regression coefficient derived from the analysis is 0.726. This value strongly suggests that there exists a positive association between digital transformation and ESG performance. Column (2) incorporates control variables, specifically company size, asset–liability ratio, and revenue growth rate. The regression coefficient for the digital transformation level rises to 0.980 and maintains its significance at the 1% level. This further confirms the positive effect of digital transformation on corporate ESG performance, controlling other potential influencing factors. Column (3) introduces industry and year fixed effects. The regression coefficient for the digital transformation level is 0.402 and remains significant and positive. This demonstrates that the positive effect of digital transformation on corporate ESG performance remains even after accounting for industry-specific and temporal characteristics, thereby supporting Hypothesis 1. Meanwhile, firm size and return on assets exhibit a significant positive correlation with ESG performance, indicating that larger firms and those with higher profitability have more resources and capabilities to advance ESG initiatives. In contrast, leverage and revenue growth show a significant negative correlation, suggesting that highly leveraged firms may face financial constraints that limit ESG investments, while rapidly growing firms may prioritize short-term profitability over ESG development. Additionally, governance factors such as the largest shareholder’s ownership ratio and board independence also influence ESG performance to some extent. Based on the data issued by the National Bureau of Statistics of China, the Gross Domestic Product (GDP) of China in 2023 witnessed an approximate 98% growth compared to that in 2014. This growth pattern is congruent with the developmental trajectory of ESG. To sum up, the outcomes of the benchmark regression validate that digital transformation is capable of substantially enhancing corporate ESG ranking. Moreover, even after accounting for relevant variables and fixed effects, this positive correlation remains stable and reliable.

4.4. Robustness Test

Table 6 displays the robustness checks performed on the benchmark regression. This paper conducts these robustness tests across three dimensions: alternative variables, sample processing, and fixed effects. The specific results are detailed below.

Substitute dependent variable:

The annual value of ESG ratings was substituted by Chinese Research Data Services Platform (CNRDS). As revealed by the regression results, the coefficient of Dig is 1.887, which is significant at the 1% level. This indicates that the positive effect of digital transformation on ESG performance remains robust when the dependent variable is substituted.

Substitute core explanatory variable 1:

Adopting the methodology detailed by Wu et al. [

86], the analysis replaces the digital transformation variable with an alternative measure. The findings show that the coefficient of the substitute variable (Dig1) is 0.457, and it is significant at the 1% level. This research result verifies the strong and positive connection between digital transformation and corporate ESG performance.

Substitute core explanatory variable 2:

Employing the method of Zhao et al. [

87], a second alternative digital transformation variable (Dig2) was incorporated into the regression analysis. The results indicate a coefficient of 0.383, significant at the 1% level. This offers further support for the conclusion that the positive effect of digital transformation on improving corporate ESG performance is indeed robust.

Exclusion of special samples:

After excluding the samples associated with the 2015 stock market plunge and the 2020–2022 epidemic period, the regression analysis produced a coefficient of 0.346 for digital transformation, again significant at the 1% level. This result demonstrates that sample fluctuations during these specific periods do not significantly influence the effect of digital transformation on ESG performance.

Addition of interactive fixed effects:

When industry–year, city–year, and city fixed effects are incorporated into the model, the regression outcomes reveal that the coefficient of digital transformation is 0.328. Notably, this coefficient still shows significance at the 1% level. This implies that, despite controlling for a more intricate array of fixed effects, the positive impact of digital transformation on corporate ESG performance persists.

Overall, with the exception of the first column, the results of the control variables in the robustness tests remain broadly consistent, which may be due to the use of alternative variables. Firm size and state ownership consistently show a significant positive correlation, suggesting that larger firms and state-owned enterprises have greater capacity to allocate resources or political advantages in the ESG domain. Return on assets is significantly positively correlated across several robustness tests, suggesting that firms with higher profitability are more likely to advance ESG strategies. In contrast, revenue growth consistently shows a significant negative correlation, suggesting that high-growth companies may prioritize short-term profits over sustainable investments. Meanwhile, ownership by the largest shareholder and other variables, such as board independence, are mostly positively correlated across robustness tests, supporting the positive influence of corporate governance structure on ESG performance. The results of these robustness checks increase the believability of the research findings. They show that digital transformation can significantly enhance corporate ESG amidst diverse alternative variable formulations, sample processing approaches, and model arrangements.

4.5. Endogenous Test

4.5.1. IV-2SLS

As presented in

Table 7, a two-stage least squares instrumental variable method (IV-2SLS) was employed to address the potential endogeneity issue between digital transformation and corporate ESG performance. The rationale for selecting the mean digital transformation level of other companies in the same city as an instrumental variable is twofold. First, companies located in the same city share similar policy environments, infrastructure, and digital resources. This commonality allows the mean digital transformation level of other companies in the same city to accurately reflect changes in the external digital environment and to significantly affect the digital transformation of the companies themselves. Second, the digital transformation activities of other companies do not directly influence the ESG performance of the target company, thereby satisfying the exogeneity assumption of instrumental variables. Its limitation lies in the possibility of broader industrial linkage effects between companies within the same region, such as common supply chains, market demand, or industry competitive dynamics. These factors may cause instrumental variables to influence ESG performance not only through the digital transformation pathway but also in conjunction with other external factors, potentially undermining its strict exogeneity.

In the initial phase of the regression analysis, the instrumental variable exhibited a regression coefficient of 0.533 with respect to digital transformation, achieving statistical significance at the 1% level. This finding underscores a robust association between the instrumental variable and the key explanatory factor. Additionally, the Cragg–Donald Wald F statistic, calculated at 1446.914, substantially exceeded the threshold for weak instrument concerns, confirming the strong explanatory capacity of the instrumental variables. In the subsequent stage of the analysis, the regression coefficient linking digital transformation to corporate ESG performance was 2.338, which was also statistically significant at the 1% level. This outcome suggests that the beneficial impact of digital transformation on ESG performance persists even after addressing potential endogeneity biases. Furthermore, the Anderson LM statistics, recorded at 1380.111, surpassed the required threshold, thereby reinforcing the appropriateness and validity of the selected instrumental variable.

In summary, the results of the endogeneity testing confirm a causal and significantly positive relationship, aligning with the findings of H1. This addresses potential endogeneity bias and strengthens the credibility of the research conclusions.

4.5.2. PSM Model

To further examine the stability of the influence exerted by digital transformation on corporate ESG performance, this research utilized propensity score matching (PSM), with the specific details elaborated in

Table 8. The analysis was executed in two consecutive stages. First, a binary variable was established based on the median value of the Dig score. Specifically, companies whose scores exceeded the median were classified into the treatment group and assigned a value of 1, while those with scores below the median were grouped into the control group and assigned a value of 0. Subsequently, a set of control variables was employed to estimate the propensity scores, and a 1:1 nearest-neighbor matching strategy was adopted. This approach effectively guaranteed the comparability of the treatment and control groups in terms of their fundamental characteristics, thus significantly reducing the impact of sample heterogeneity. Once the matching process was completed, a regression analysis was performed on the matched sample. The post-matching regression results demonstrated that the coefficient of digital transformation was 0.625, and it was statistically significant at the 1% level. This finding indicates that enterprises with higher degrees of digital transformation achieve notably better ESG performance compared to those with lower levels of digital transformation, thereby validating the results of hypothesis H1.

Moreover, even after addressing observable differences between the treatment and control groups, the link between digital transformation and ESG performance remains significant, reinforcing the reliability of the baseline regression results. The PSM method, designed to mitigate potential sample selection bias, enhances the credibility of the findings. However, it is important to acknowledge that PSM primarily accounts for observable factors, leaving the possibility that unobservable confounders may still influence the estimated effects. Despite this limitation, the consistency of results across multiple robustness checks reinforces confidence in the study’s conclusions.

4.5.3. PSM-DID

As demonstrated in

Table 9, propensity score matching difference in differences (PSM-DID) analysis with replacement was employed to account for potential endogeneity concerns between digital transformation and corporate ESG performance. Notably, in this method, we did not use calipers. In 2013, the State Council issued “Several Opinions on Promoting Information Consumption,” which explicitly highlighted the need to advance information consumption growth by stimulating demand, expanding market reach, and diversifying service provisions. That same year, the Ministry of Industry and Information Technology initiated the development of information consumption pilot cities, designating 104 pilot zones to advance information consumption, enhance infrastructure, and cultivate the development of novel business models through a pilot-led strategy. This policy creates quasi-experimental conditions for evaluating the digital transformation of companies. The specific procedures were implemented as follows. First, based on the 2013 establishment of information consumption pilot cities, companies in the pilot zones were assigned to the treatment group with other companies comprising the control group. Second, PSM was implemented to match these two groups of companies in a 1:1 ratio, ensuring that the treatment and control groups exhibited similar baseline characteristics prior to policy enactment. After post-matching, we applied a DID model to determine the causal effects of the pilot policy on corporate ESG performance and digital transformation.

The regression analysis indicates that the coefficient associated with the policy interaction term (DID) in the PSM-DID model is 0.088, significant at the 1% level, suggesting that the information consumption pilot policy advances companies’ digital transformation and significantly enhances their ESG performance. This finding provides strong causal evidence supporting H1, demonstrating that digital transformation positively impacts ESG outcomes within a well-defined policy environment. While the PSM-DID method helps control for observable factors and policy-induced selection bias, unobserved firm characteristics may still influence the results. Additionally, policy effects may vary across regions and industries. Despite these limitations, the consistency of results across robustness checks further reinforces the credibility of the findings, confirming that digital transformation enhances corporate ESG performance.

4.6. Mechanism Test

Table 10 displays the results of the mechanism tests analyzing resource allocation efficiency and technological gaps. To study how digital transformation enhances corporate ESG performance through internal mechanisms, hypotheses H2 and H3 were tested utilizing a two-step methodological approach. First, the significant positive correlation between enterprise digitalization and corporate ESG outcomes is evident. Next, resource allocation efficiency and technological gap were incorporated as mediating variables to analyze the indirect effect of digital transformation on corporate ESG performance. Hypothesis 2 proposes that digital transformation can indirectly improve corporate ESG performance by enhancing resource allocation efficiency. The mechanism regression outcomes suggest a clear negative linkage between the explanatory variable and resource allocation efficiency. Considering that resource allocation efficiency is an inverse measure, this suggests that digital transformation effectively reduces inefficient resource use and optimizes companies’ resource allocation. Digital practices improve the agility and accuracy of resource allocation in firms by optimizing internal management operations and increasing informational transparency. For instance, digital technologies can enable companies to optimize production schedules, curtail energy usage, and minimize waste, thus freeing up resources for environmental stewardship. In addition, digital tools can facilitate efficient capital allocation by, for instance, helping companies identify investment prospects, optimize their financial structures, and improve governance practices through big data analytics. Enhanced resource allocation, accordingly, offers robust support for corporate efforts in environmental protection, fulfilling social responsibilities, and strengthening governance capabilities, thereby contributing to improved corporate ESG performance. Therefore, resource allocation efficiency functions as a key mediating mechanism through which digital transformation affects corporate ESG performance, thus verifying the theoretical underpinnings of hypothesis H2.

Building upon hypothesis H3, digital transformation has the potential to expand a firm’s technological advantage when its technological level is above the industry average (positive technological gap) and reduce its technological disadvantage when its technological level is below the industry average (negative technological gap), thereby driving improvements in corporate ESG performance. Regression analysis of the underlying mechanism indicates that digital transformation significantly expands a company’s positive technological differential while simultaneously and significantly reducing its negative technological differential, which is calculated as an inverse measure. This suggests that digital practices strengthen a company’s competitive position in its industry by advancing its technological capabilities. More accurately, leveraging digital technologies allows companies to more effectively synthesize internal and external technological resources, finally reaching higher levels of innovation. For instance, intelligent manufacturing technologies can optimize production processes and enhance production efficiency, simultaneously minimizing carbon emissions and resource depletion. Furthermore, the technological advantages acquired during digitalization serve as a catalyst for eco-friendly product innovation, process refinement, and sustainability improvements. As firms narrow their technological disparity relative to industry benchmarks, they not only sustain their market edge but also strengthen their environmental and social responsibility capabilities. Thus, the change in technological gaps is a crucial avenue for the digital transformation to affect the ESG performance of companies through technological upgrading and innovation, which substantiates the theoretical inference of hypothesis H3.

In conclusion, digital transformation has not only a direct influence on the improvement of ESG performance but also can be achieved through two key mechanisms: improving resource allocation efficiency and narrowing the technological gaps. It suggests that digital transformation can comprehensively promote the sustainable development of companies from two aspects: resource optimization and technological upgrading, verifying the theoretical logic of hypotheses H2 and H3.

4.7. Heterogeneity Test

4.7.1. Heterogeneity of Company Size

To further verify the company size heterogeneity impact, we divided the sample into two groups in

Table 11, large-scale and small-scale enterprises, classified according to the median enterprise size. Separate regression analyses are then carried out to examine the differences in the effects of explanatory variable in enterprises of different scales.

The empirical results show that the regression coefficient of digital transformation on the ESG score of large-scale enterprises is 0.553, with a significance level of 1%. For small-scale enterprises, the regression coefficient is 0.259, which is also significant at the 1% level. The above results indicate that digital transformation has a stronger promoting effect on the ESG performance of large-scale enterprises. This phenomenon may be due to the fact that large-scale enterprises have greater advantages in terms of resource endowment, technological foundation, and organizational management capabilities, enabling them to more effectively implement and utilize digital transformation technologies. For instance, larger enterprises typically possess greater financial and human resources, enabling them to allocate more effectively toward developing IT infrastructure. At the same time, their complex organizational structures can more easily achieve resource optimization and technological innovation through digital practices, thus more significantly improving their ESG performance. In contrast, due to resources and technological constraints, although digital transformation still has a significant promoting effect on the ESG performance of small-scale enterprises, the effect is relatively weak. This may be because small-scale enterprises face higher costs and technical barriers during the implementation of digitalization. Meanwhile, they lack a complete governance structure and execution capabilities, resulting in the insufficient manifestation of the effects of digital practices.

4.7.2. Industry Heterogeneity

To analyze the industry heterogeneity in the impact of digital transformation on ESG performance, this study classifies the sample into technology-intensive, asset-intensive, and labor-intensive enterprises according to their industry attributes and conducts separate regression analyses in

Table 12 to explore the differences in the effects of digital transformation across different industries.

The regression results show that the regression coefficient of digital transformation on the ESG performance of technology-intensive enterprises is 0.488, which is significant at the 1% level, indicating that digitalization has a significant promoting effect on the ESG performance of technology-intensive enterprises. This may be because technology-intensive enterprises can more easily integrate digital technologies with their core businesses and significantly improve their performance in environmental protection, social responsibility, and corporate governance through technological innovation and process optimization. Digital practices in these enterprises can accelerate technological upgrading, promote green innovation, and enhance resource utilization efficiency, thereby promoting enterprises’ ESG performance.

For asset-intensive enterprises, the regression coefficient is 0.636, which is significant at the 5% level, showing that digital transformation has a relatively strong promoting effect on the ESG performance of these enterprises. Asset-intensive enterprises, including those in the manufacturing and energy industries, typically have substantial fixed-asset investments and high operational costs. Digital transformation serves as a key enabler for optimizing asset management in these enterprises by streamlining production processes, reducing resource wastage, and enhancing operational efficiency, thereby significantly improving ESG performance. Moreover, the stringent environmental regulations imposed on asset-intensive industries provide strong incentives for firms to adopt digital technologies to optimize carbon emissions management and strengthen environmental compliance. By contrast, labor-intensive enterprises, such as those in the textile and retail industries, primarily rely on human input, making their production models less adaptable to rapid digital transformation. As a result, the adoption of digital technologies in these industries remains relatively low, and digital transformation has a limited direct impact on their core business operations. This is reflected in the regression results, where the coefficient of digital transformation for labor-intensive enterprises is 0.073 and fails to pass the significance test, indicating that its impact on ESG performance is relatively insignificant. Furthermore, these enterprises typically face lower technological barriers and operate with narrower profit margins, leading them to adopt a more cautious approach to digital investments. Their strategic priorities often focus on cost control and short-term profitability rather than long-term sustainability goals. Consequently, digital transformation has a weaker impact on the ESG performance of labor-intensive enterprises.

4.7.3. Geographic Heterogeneity

To conduct a regional heterogeneity test, we categorize the locations of enterprises into the western region and the central–eastern region in

Table 13. Empirical results show that the regression coefficient of digital transformation on the ESG performance of central–eastern enterprises is 0.410, significant at the 1% level, while that of western enterprises is 0.124 and not significant. This indicates a stronger promoting effect in the central and eastern regions. This is likely because the relatively developed central–eastern regions have complete information infrastructure, giving local enterprises technological and information advantages. Thus, they can easily access and apply digital technologies to production, management, and service. The central–eastern regions serve as focal points for government-led digital economy development, with various policy initiatives such as tax incentives, subsidies, and targeted funding programs aimed at fostering enterprise digital transformation. For instance, in the Yangtze River Delta, the government has implemented measures including low-interest loans and direct financial subsidies to alleviate financial constraints, thereby facilitating technological advancement and innovation. Meanwhile, these regions have larger market scales and diverse digital application scenarios, enabling companies to more effectively improve operational efficiency through digital means, thus having a greater impact on ESG performance.

In contrast, western enterprises face capital and technology challenges in digital transformation. Digital transformation needs large upfront investment, but limited regional financing makes it hard for western enterprises to raise enough funds. Insufficient funds restrict transformation ability and may shrink investment scale or extend the cycle, affecting efficiency. Technically, western enterprises face information asymmetry, making it hard to access advanced technologies. With fewer R&D institutions and technical services, they lack technical support, exacerbating technology-acquisition difficulties. So, even with financial support, technical constraints may slow down digital transformation and limit ESG performance improvement.

4.7.4. Technological Heterogeneity

Following the Industry Classification Guidelines for Listed Companies (2012 Revision), the total sample was divided into a high-tech enterprise group and a non-high-tech enterprise group. Regression analyses were conducted separately in

Table 14 to examine the differences in the effects of digital transformation on enterprises with different technological levels.

The empirical results indicate that the regression coefficient of digital transformation on the ESG score of high-tech enterprises is 0.468, significant at the 1% level. However, for non-high-tech enterprises, the regression coefficient is 0.212 and is not significant.

This phenomenon might be attributed to the fact that high-tech enterprises are typically at the forefront of technological innovation. They have a leading edge in R&D and the application of new technologies, enabling them to perceive and seize industry trends earlier and integrate the latest digital technologies sooner. As a result, high-tech enterprises can utilize digital tools more effectively, thereby enhancing their ESG performance across multiple dimensions. In terms of environmental efficiency, high-tech enterprises optimize production processes through digital technologies, reducing energy consumption and waste emissions. When it comes to optimizing social responsibility practices, high-tech enterprises can implement social responsibility projects more precisely and efficiently by leveraging digital means. Regarding corporate governance, high-tech enterprises enhance transparency and decision-making efficiency through digital technologies.

Conversely, non-high-tech enterprises may operate in markets with relatively less competitive pressure. Consequently, they may lack market impetus to improve their ESG performance through digital transformation. These enterprises may consider their existing business models sufficient to meet market demands and thus may not actively pursue ESG improvements via digital transformation. This leads to a lack of the necessary impetus for non-high-tech enterprises to enhance their ESG performance.

5. Conclusions and Recommendations

This research focused on Chinese A-share listed firms spanning 2014–2023 as the empirical sample. A multidimensional evaluation framework was developed by integrating the Huazheng ESG rating with textual analysis quantifying digital transformation-related disclosures in annual reports, systematically assessing organizational digitalization’s influence on ESG outcomes. A two-way fixed-effects model was employed to rigorously investigate the mechanisms through which digital transformation shapes corporate ESG performance. The empirical findings substantiate the previously postulated hypotheses and specifically demonstrate that the following:

First, carrying out digital transformation may significantly enhance ESG performance. Moreover, after conducting a series of robustness tests and the endogeneity tests by IV-2SLS method, PSM method, and PSM-DID method, this conclusion remains robust. This conclusion is consistent with studies from Lu, Xu, Zhu and Sun [

31], Wang and Esperança [

27], Yang et al. [

88], and Ding et al. [

89], which confirms the mechanism through which companies pursue that of achieving ESG targets through digital transformation.

Second, this paper evaluates the mediating processes of resource allocation efficiency as well as technological gaps whereby digital transformation indirectly promotes the improvement of corporate ESG performance through enhancing resource allocation efficiency (reducing inefficient investment) coupled with narrowing the technological gap (enhancing technological competitiveness), thus indirectly promoting corporate ESG performance. Previous studies have explored other mediating pathways, such as internal control [

31], firm market performance [

27], analysts’ attention [

90], and mitigating agency conflicts [

91]. However, our study provides a novel perspective. In comparison to most existing studies that use R&D investment [

92] as well as patent quantity [

93] to measure the technological level of companies, this research innovatively selected the technological gap across companies, providing more references from a new dimension on how enterprises can achieve ESG in the future.

Third, through heterogeneity analysis, it is found that the impact of digital transformation on enterprises ESG varies significantly in multiple aspects. Research findings indicate that large-scale, technology-intensive, asset-intensive, central–eastern regions, and high-tech enterprises can reap benefits from digital transformation. This finding aligns with Yang, Liu, Meng, Feng, and Chen [

57] that organizational structure, company size, and business orientation are crucial internal variables that affect the scope and extent of digital transformation.

This research not only contributes to the theoretical understanding of digital transformation and its multi-dimensional influence on the sustainable development capabilities of companies but also clarifies the practical perspectives for the companies in realizing the importance of technological gaps and resource allocation during digital transformation procedures. It assists companies in making better decisions with respect to the formulation of digital strategies in accordance with existing circumstances, hence offering a theoretical framework to policymakers for more accurate support measures. First and foremost, for company management, it is evident that ESG goals should not be merely focused on but should be regarded as part of the broader strategy of the company’s development. Accordingly, we propose that corporate oversight bodies institute a framework concerning corporate ESG and designate seasoned executives to oversee related activities, for instance, prioritizing the development of personnel with digital expertise and sustainability principles to contribute to corporate ESG goal attainment. Second, firms should produce digital transformation blueprints aligned with ESG objectives for distributing corporate resources and strengthening interdepartmental collaboration. The sales and marketing division can partner with the information technology department to capitalize on the benefits of big data to accurately identify target markets and augment business development capacities. In addition, the compliance department and the planning department can work in close coordination, integrating evolving environmental regulations with corporate development strategies to nimbly address the effects of such policies, effectively reduce financial burdens, and capture market interest. Third, governments should optimize the subsidy framework for ESG policies. For firms with limited willingness or capacity to undergo transformation, “incentive measures” should be implemented to lower entry barriers, providing direct financial support such as green loan interest subsidies or tax reductions, thereby mitigating the high risks associated with the transformation process. For resource-rich firms, policy incentives such as preferential access to government procurement contracts should be implemented to encourage them to drive the technological advancement of lagging firms within their industry’s value chain.

The study has several inherent limitations that warrant attention. First, the measurement of digital adoption predominantly relies on textual indicators derived from corporate disclosures, which may not comprehensively capture the multifaceted nature of enterprise digitalization processes. Future investigations should adopt multidimensional measurement frameworks that integrate technical infrastructure investments, digital talent metrics, and supply chain connectivity indices to enhance construct validity. Similarly, there are certain limitations in the measurement of resource allocation efficiency. The residual may be affected by various factors and is not necessarily entirely caused by inefficient investment. For instance, sudden changes in the market environment may lead to a deviation between the actual and estimated values of an enterprise’s originally reasonable investment plan in the short term. However, this does not necessarily imply that there are issues with the enterprise’s resource allocation. Second, while the empirical analysis focuses on Chinese listed firms—a context with significant sustainability challenges—the generalizability of findings to other institutional environments remains unexplored. Given the global imperative for sustainable development, extending this research agenda to cross-national contexts (e.g., emerging markets versus developed economies) or conducting comparative regional analyses (e.g., Asia-Pacific versus European regulatory regimes) could yield critical insights into boundary conditions and policy adaptability. Finally, it is important to note that the scope of this study does not extend to non-listed enterprises and small and medium-sized enterprises (SMEs). These enterprises are numerous, and their resource endowments, governance models, and policy applicability may differ significantly from those of listed companies. In future research, therefore, the scope of the sample could be expanded to include SMEs and unlisted companies, and the similarities and differences in digital transformation and ESG practices across different types of companies could be explored to provide more comprehensive insights.