How Do Core Management Team Network Ties Affect Green Innovation? Evidence from the Chinese ICT Industry

Abstract

1. Introduction

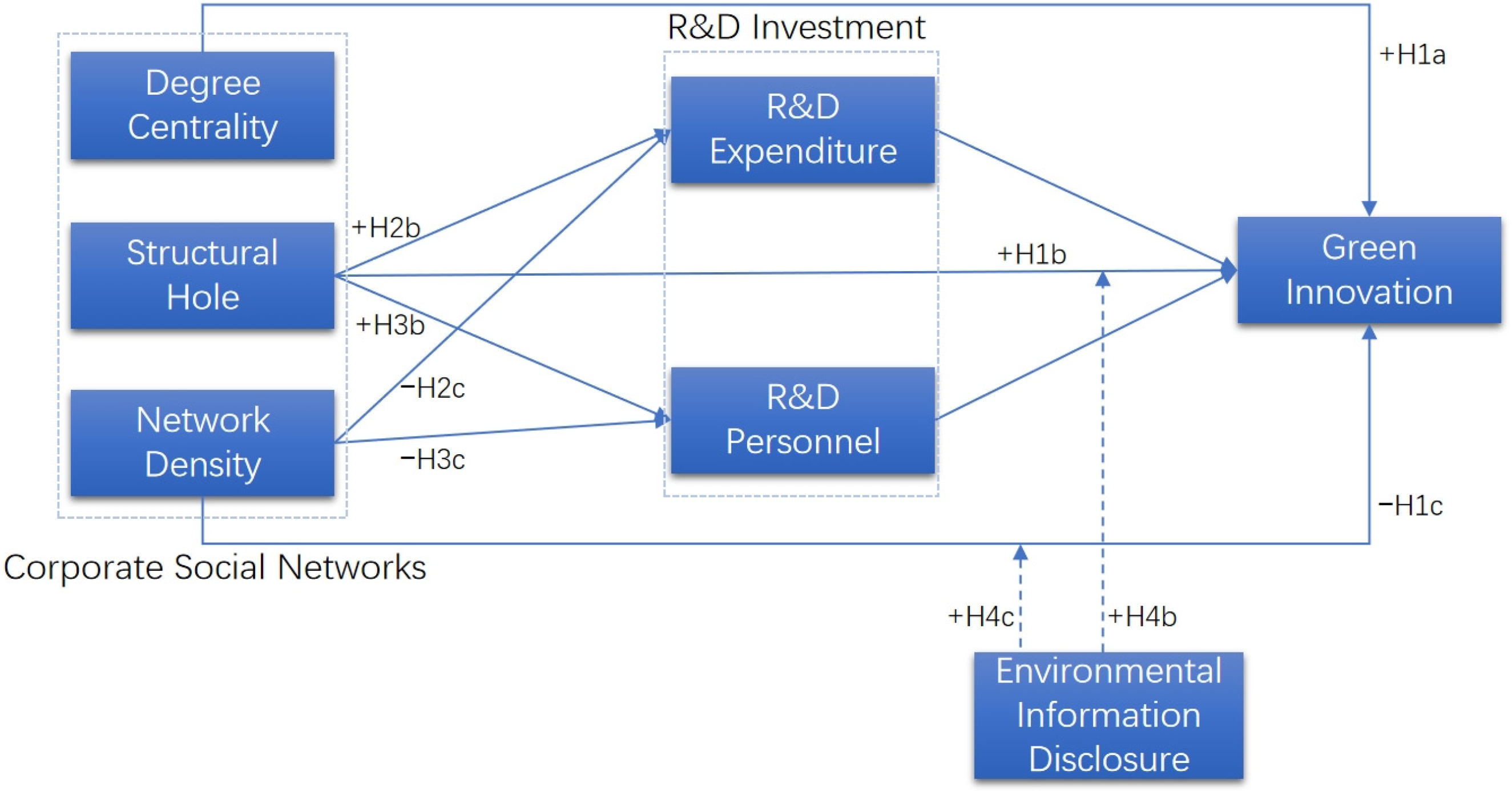

2. Theoretical Analysis and Hypothesis Development

2.1. Enterprise Social Networks

2.2. Enterprise Social Networks and Green Innovation

2.2.1. Degree Centrality and Green Innovation

2.2.2. Structural Holes and Green Innovation

2.2.3. Network Density and Green Innovation

2.3. Mediating Effect of R&D Investment

2.3.1. The Mediating Role of R&D Investment Between Degree Centrality and Green Innovation

2.3.2. The Mediating Role of R&D Investment Between Structural Holes and Green Innovation

2.3.3. The Mediating Role of R&D Investment Between Network Density and Green Innovation

2.4. Moderating Effect of Environmental Information Disclosure

3. Methods

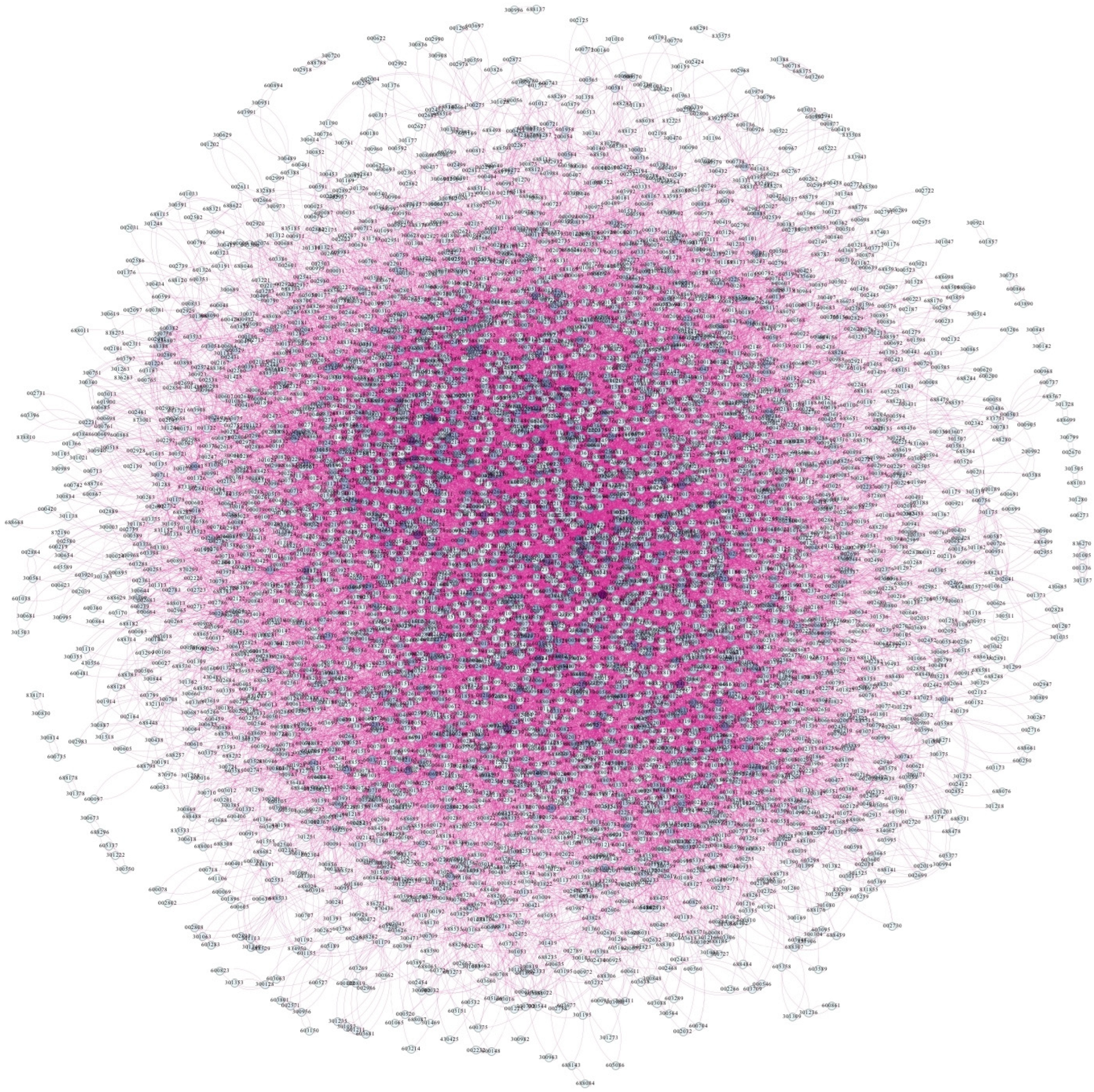

3.1. Sample and Data Collection

3.2. Variables and Measurements

3.2.1. Dependent Variable

3.2.2. Independent Variables

- (1)

- Degree centrality (Deg)

- (2)

- Structural holes (SH)

- (3)

- Network density (Density)

3.2.3. Mediating Variables

3.2.4. Moderating Variable

3.2.5. Control Variables

3.3. Models and Measures

3.3.1. Basic Regression Model

3.3.2. Mediating Effect Model

3.3.3. Moderating Effect Model

4. Results

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Basic Regression Results

4.4. Mediation Effect Regression

4.5. Moderation Effect Regression

4.6. Robustness Checks

- (1)

- Replacing the dependent variable

- (2)

- Lagged Independent Variable

- (3)

- Instrumental Variable Method

5. Conclusions and Implications

5.1. Discussion

5.2. Theoretical and Policy Implications

6. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, Y.; Guo, C.; Chen, X.; Jia, L.; Guo, X.; Chen, R.; Zhang, M.; Chen, Z.; Wang, H. Carbon Peak and Carbon Neutrality in China: Goals, Implementation Path and Prospects. China Geol. 2021, 4, 720–746. [Google Scholar] [CrossRef]

- Wang, X.; Li, J.; Song, R.; Li, J. 350 Cities of China Exhibited Varying Degrees of Carbon Decoupling and Green Innovation Synergy. Energy Rep. 2022, 8, 312–323. [Google Scholar] [CrossRef]

- Qiu, Q.; Yu, J. Impact of Independent Director Network on Corporate Green Innovation: Evidence from Chinese Listed Companies. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 3271–3293. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the Mother of ‘Green’ Inventions: Institutional Pressures and Environmental Innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Li, W.; Dai, H.; Zhao, L.; Zhao, D.; Sun, Y. Noise-Induced Consensus of Leader-Following Multi-Agent Systems. Math. Comput. Simul. 2023, 203, 1–11. [Google Scholar] [CrossRef]

- Fan, Y.; Liu, X.; Li, J.; Chang, T. A Miniaturized Circularly-Polarized Antenna for In-Body Wireless Communications. Micromachines 2019, 10, 70. [Google Scholar] [CrossRef]

- Afeltra, G.; Alerasoul, S.A.; Strozzi, F. The Evolution of Sustainable Innovation: From the Past to the Future. Eur. J. Innov. Manag. 2023, 26, 386–421. [Google Scholar] [CrossRef]

- Barforoush, N.; Etebarian, A.; Naghsh, A.; Shahin, A. Green Innovation a Strategic Resource to Attain Competitive Advantage. Int. J. Innov. Sci. 2021, 13, 645–663. [Google Scholar] [CrossRef]

- Huang, J.-W.; Li, Y.-H. Green Innovation and Performance: The View of Organizational Capability and Social Reciprocity. J. Bus. Ethics 2017, 145, 309–324. [Google Scholar] [CrossRef]

- Xie, J.; Abbass, K.; Li, D. Advancing Eco-Excellence: Integrating Stakeholders’ Pressures, Environmental Awareness, and Ethics for Green Innovation and Performance. J. Environ. Manag. 2024, 352, 120027. [Google Scholar] [CrossRef]

- Ullah, S.; Ahmad, T.; Lyu, B.; Sami, A.; Kukreti, M.; Yvaz, A. Integrating External Stakeholders for Improvement in Green Innovation Performance: Role of Green Knowledge Integration Capability and Regulatory Pressure. Int. J. Innov. Sci. 2024, 16, 640–657. [Google Scholar] [CrossRef]

- Xu, J.; Hu, W. How Do External Resources Influence a Firm’s Green Innovation? A Study Based on Absorptive Capacity. Econ. Model. 2024, 133, 106660. [Google Scholar] [CrossRef]

- Zheng, Y.; Wang, B.; Sun, X.; Li, X. ESG Performance and Corporate Value: Analysis from the Stakeholders’ Perspective. Front. Environ. Sci. 2022, 10, 1084632. [Google Scholar] [CrossRef]

- Li, Z.; Zhang, T.; Zhao, X.; Zhu, Y. Monitoring or Colluding? Institutional Investors’ Heterogeneity and Environmental Information Disclosure Behavior. Front. Psychol. 2022, 13, 911901. [Google Scholar] [CrossRef]

- Burt, R.S. A Note on Social Capital and Network Content. Soc. Netw. 1997, 19, 355–373. [Google Scholar] [CrossRef]

- Gu, W.; Yuan, W. Research on the Influence of Chain Shareholder Network on Enterprise Green Innovation. J. Bus. Res. 2024, 172, 114416. [Google Scholar] [CrossRef]

- Cheng, J.; Xu, N.R.; Khan, N.U.; Singh, H.S.M. The Impacts of Artificial Intelligence Literacy, Green Absorptive Capacity, and Green Information System on Green Innovation. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 2375–2389. [Google Scholar] [CrossRef]

- Amaranti, R.; Govindaraju, R.; Irianto, D. Do Green Dynamic Capabilities and Absorptive Capacity Affect Green Innovation Performance? A Study on Companies in Indonesia. J. Ind. Eng. Manag. 2024, 17, 424–444. [Google Scholar] [CrossRef]

- Liao, Z.; Wu, Y. CEO Background Experience and Firms’ Environmental Innovation: The Moderating Effect of Tenure. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 5801–5814. [Google Scholar] [CrossRef]

- Guo, R.; Zhao, J. CEO’s Financial Background and Corporate Green Innovation. Sustainability 2024, 16, 4129. [Google Scholar] [CrossRef]

- Pan, J.; Bao, H.; Cifuentes-Faura, J.; Liu, X. CEO’s IT Background and Continuous Green Innovation of Enterprises: Evidence from China. Sustain. Account. Manag. Policy J. 2024, 15, 807–832. [Google Scholar] [CrossRef]

- Zhang, Y.; Wu, J.; Chen, M. The Influence of Executives’ Education Background on Corporate Green Innovation: A Dual Perspective of Risk Bearing and Social Responsibility. Sustainability 2024, 16, 8382. [Google Scholar] [CrossRef]

- Cheng, P.; Zhang, J.; Chen, J.; Zheng, Y.; Li, Z. Stakeholder Attention and Ambidextrous Green Innovation: Evidence from China. Bus. Strategy Environ. 2025, 34, 1007–1026. [Google Scholar] [CrossRef]

- Ma, Y.; Chen, B. Impact of Stakeholder Pressure on Green Innovation: A Moderated Mediation Model. J. Environ. Plan. Manag. 2025, 68, 1165–1186. [Google Scholar] [CrossRef]

- Zhao, Z.; Zhao, Y.; Lv, X.; Li, X.; Zheng, L.; Fan, S.; Zuo, S. Environmental Regulation and Green Innovation: Does State Ownership Matter? Energy Econ. 2024, 136, 107762. [Google Scholar] [CrossRef]

- Song, W.; Han, X.; Liu, Q. Patterns of Environmental Regulation and Green Innovation in China. Struct. Change Econ. Dyn. 2024, 71, 176–192. [Google Scholar] [CrossRef]

- Zhang, X.; Zhao, W.; Xie, D. Environmental Regulation, Academic Top Managers and Green Innovation: Evidence from China. Financ. Res. Lett. 2024, 69, 106129. [Google Scholar] [CrossRef]

- Fang, X.; Liu, M.; Li, G. Can the Green Credit Policy Promote Green Innovation in Enterprises? Empirical Evidence from China. Technol. Econ. Dev. Econ. 2024, 30, 899–932. [Google Scholar] [CrossRef]

- Li, W.; Cheng, H.; He, J.; Song, Y.; Bu, H. The Impacts of Green Credit Policy on Green Innovation of High-Polluting Enterprises in China. Financ. Res. Lett. 2024, 62, 105167. [Google Scholar] [CrossRef]

- He, J.; Xue, H.; Yang, W.; Zhong, Y.; Fan, B. Green Credit Policy and Corporate Green Innovation. Int. Rev. Econ. Financ. 2025, 99, 104031. [Google Scholar] [CrossRef]

- Duan, Y.; Xi, B.; Xu, X.; Xuan, S. The Impact of Government Subsidies on Green Innovation Performance in New Energy Enterprises: A Digital Transformation Perspective. Int. Rev. Econ. Financ. 2024, 94, 103414. [Google Scholar] [CrossRef]

- Han, F.; Mao, X.; Yu, X.; Yang, L. Government Environmental Protection Subsidies and Corporate Green Innovation: Evidence from Chinese Microenterprises. J. Innov. Knowl. 2024, 9, 100458. [Google Scholar] [CrossRef]

- Zhao, S.; Abbassi, W.; Hunjra, A.I.; Zhang, H. How Do Government R&D Subsidies Affect Corporate Green Innovation Choices? Perspectives from Strategic and Substantive Innovation. Int. Rev. Econ. Financ. 2024, 93, 1378–1396. [Google Scholar] [CrossRef]

- Chen, W.; Zhu, C.; Cheung, Q.; Wu, S.; Zhang, J.; Cao, J. How Does Digitization Enable Green Innovation? Evidence from Chinese Listed Companies. Bus. Strategy Environ. 2024, 33, 3832–3854. [Google Scholar] [CrossRef]

- Fang, L.; Li, Z. Corporate Digitalization and Green Innovation: Evidence from Textual Analysis of Firm Annual Reports and Corporate Green Patent Data in China. Bus. Strategy Environ. 2024, 33, 3936–3964. [Google Scholar] [CrossRef]

- Zhang, K.; Deborah, G. Digitalization, Internationalization and Green Innovation in China: An Analysis Based on Threshold and Mediation Effects. J. Technol. Transf. 2024. [Google Scholar] [CrossRef]

- Zhao, J.; Zhao, L.; Yan, T. Does Interlocking Directors’ Green Experience Richness Enhance the Green Innovation Efficiency of Chinese Listed Companies? Sustainability 2025, 17, 2122. [Google Scholar] [CrossRef]

- Hu, Y.; Li, Z.; Guo, J. Does Independent Directors’ Interlocking Network Position Affect Green Innovation? Sustainability 2024, 16, 1089. [Google Scholar] [CrossRef]

- Yousaf, U.B.; Ullah, I.; Jiang, J.; Wang, M. The Role of Board Capital in Driving Green Innovation: Evidence from China. J. Behav. Exp. Financ. 2022, 35, 100714. [Google Scholar] [CrossRef]

- Ren, S.; Wang, Y.; Hu, Y.; Yan, J. CEO Hometown Identity and Firm Green Innovation. Bus. Strategy Environ. 2021, 30, 756–774. [Google Scholar] [CrossRef]

- Quan, X.; Ke, Y.; Qian, Y.; Zhang, Y. CEO Foreign Experience and Green Innovation: Evidence from China. J. Bus. Ethics 2023, 182, 535–557. [Google Scholar] [CrossRef]

- Huang, M.; Li, M.; Liao, Z. Do Politically Connected CEOs Promote Chinese Listed Industrial Firms’ Green Innovation? The Mediating Role of External Governance Environments. J. Clean. Prod. 2021, 278, 123634. [Google Scholar] [CrossRef]

- Li, G.; Xue, Q.; Qin, J. Environmental Information Disclosure and Green Technology Innovation: Empirical Evidence from China. Technol. Forecast. Soc. Chang. 2022, 176, 121453. [Google Scholar] [CrossRef]

- Feng, E.; Siu, Y.L.; Wong, C.W.; Li, S.; Miao, X. Can Environmental Information Disclosure Spur Corporate Green Innovation? Sci. Total Environ. 2024, 912, 169076. [Google Scholar] [CrossRef]

- Liao, Z.; Liu, P.; Bao, P. Environmental Information Disclosure, Environmental Innovation, and Firms’ Growth Performances: The Moderating Role of Media Attention. Sustain. Dev. 2024, 32, 425–437. [Google Scholar] [CrossRef]

- Ding, J.; Lu, Z.; Yu, C.-H. Environmental Information Disclosure and Firms’ Green Innovation: Evidence from China. Int. Rev. Econ. Financ. 2022, 81, 147–159. [Google Scholar] [CrossRef]

- Rauf, F.; Wanqiu, W.; Naveed, K.; Zhang, Y. Green R & D Investment, ESG Reporting, and Corporate Green Innovation Performance. PLoS ONE 2024, 19, e0299707. [Google Scholar] [CrossRef]

- Xu, J.; Liu, F.; Shang, Y. R&D Investment, ESG Performance and Green Innovation Performance: Evidence from China. Kybernetes 2021, 50, 737–756. [Google Scholar] [CrossRef]

- Fan, J.; Teo, T. Will China’s R&D Investment Improve Green Innovation Performance? An Empirical Study. Env. Sci. Pollut. Res. 2022, 29, 39331–39344. [Google Scholar] [CrossRef]

- Fracassi, C.; Tate, G. External Networking and Internal Firm Governance. J. Financ. 2012, 67, 153–194. [Google Scholar] [CrossRef]

- Larcker, D.F.; So, E.C.; Wang, C.C. Boardroom Centrality and Firm Performance. J. Account. Econ. 2013, 55, 225–250. [Google Scholar] [CrossRef]

- Conyon, M.J.; Muldoon, M.R. The Small World of Corporate Boards. Bus. Financ. Account. 2006, 33, 1321–1343. [Google Scholar] [CrossRef]

- Cai, Y.; Sevilir, M. Board Connections and M&A Transactions. J. Financ. Econ. 2012, 103, 327–349. [Google Scholar] [CrossRef]

- Peng, M.W.; Luo, Y. Managerial Ties and Firm Performance in a Transition Economy: The Nature of a Micro-Macro Link. Acad. Manag. J. 2000, 43, 486–501. [Google Scholar] [CrossRef]

- Zaheer, A.; Bell, G.G. Benefiting from Network Position: Firm Capabilities, Structural Holes, and Performance. Strateg. Manag. J. 2005, 26, 809–825. [Google Scholar] [CrossRef]

- Powell, W.W.; Koput, K.W.; Smith-Doerr, L. Interorganizational Collaboration and the Locus of Innovation: Networks of Learning in Biotechnology. Adm. Sci. Q. 1996, 41, 116–145. [Google Scholar] [CrossRef]

- Zhang, J.; Luo, Y. Degree Centrality, Betweenness Centrality, and Closeness Centrality in Social Network. In Proceedings of the 2017 2nd International Conference on Modelling, Simulation and Applied Mathematics (MSAM2017), Bangkok, Thailand, 26–27 March 2017; Atlantis Press: Dordrecht, The Netherlands, 2017; pp. 300–303. [Google Scholar]

- Tsai, W. Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Acad. Manag. J. 2001, 44, 996–1004. [Google Scholar] [CrossRef]

- Freeman, L.C. Centrality in Social Networks: Conceptual Clarification. Soc. Netw. Crit. Concepts Sociol. 2002, 1, 238–263. [Google Scholar] [CrossRef]

- Ahuja, G. Collaboration Networks, Structural Holes, and Innovation: A Longitudinal Study. Adm. Sci. Q. 2000, 45, 425–455. [Google Scholar] [CrossRef]

- Burt, R.S. The Contingent Value of Social Capital. Adm. Sci. Q. 1997, 42, 339–365. [Google Scholar] [CrossRef]

- Burt, R.S. The Social Structure of Competition. In Structural Holes: The Social Structure of Competition; Harvard University Press: Cambridge, MA, USA, 1995. [Google Scholar] [CrossRef]

- Zinkhan, G.M.; Reingen, P.H. Book Review: Structural Holes: The Social Structure of Competition; SAGE Publications Sage CA: Los Angeles, CA, USA, 1994. [Google Scholar]

- Hua, L.; Yang, Z.; Shao, J. Impact of Network Density on the Efficiency of Innovation Networks: An Agent-Based Simulation Study. PLoS ONE 2022, 17, e0270087. [Google Scholar] [CrossRef]

- Wang, C.; Rodan, S.; Fruin, M.; Xu, X. Knowledge Networks, Collaboration Networks, and Exploratory Innovation. Acad. Manag. J. 2014, 57, 484–514. [Google Scholar] [CrossRef]

- Gnyawali, D.R.; Madhavan, R. Cooperative Networks and Competitive Dynamics: A Structural Embeddedness Perspective. Acad. Manag. Rev. 2001, 26, 431–445. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Bodin, Ö.; Crona, B.I. The Role of Social Networks in Natural Resource Governance: What Relational Patterns Make a Difference? Glob. Environ. Change 2009, 19, 366–374. [Google Scholar] [CrossRef]

- Dangelico, R.M. Green Product Innovation: Where We Are and Where We Are Going. Bus. Strategy Environ. 2016, 25, 560–576. [Google Scholar] [CrossRef]

- Song, M.; Yang, M.X.; Zeng, K.J.; Feng, W. Green Knowledge Sharing, Stakeholder Pressure, Absorptive Capacity, and Green Innovation: Evidence from Chinese Manufacturing Firms. Bus. Strategy Environ. 2020, 29, 1517–1531. [Google Scholar] [CrossRef]

- Henriksen, L.F.; Ponte, S. Public Orchestration, Social Networks, and Transnational Environmental Governance: Lessons from the Aviation Industry. Regul. Gov. 2018, 12, 23–45. [Google Scholar] [CrossRef]

- Nassani, A.A.; Javed, A.; Radulescu, M.; Yousaf, Z.; Secara, C.G.; Tolea, C. Achieving Green Innovation in Energy Industry through Social Networks, Green Dynamic Capabilities, and Green Organizational Culture. Energies 2022, 15, 5925. [Google Scholar] [CrossRef]

- Chuluun, T.; Prevost, A.; Upadhyay, A. Firm Network Structure and Innovation. J. Corp. Financ. 2017, 44, 193–214. [Google Scholar] [CrossRef]

- Steinfield, C.; Scupola, A.; López-Nicolás, C. Social Capital, ICT Use and Company Performance: Findings from the Medicon Valley Biotech Cluster. Technol. Forecast. Soc. Chang. 2010, 77, 1156–1166. [Google Scholar] [CrossRef]

- Kim, H.-S. How a Firm’s Position in a Whole Network Affects Innovation Performance. Technol. Anal. Strateg. Manag. 2019, 31, 155–168. [Google Scholar] [CrossRef]

- Mazzola, E.; Perrone, G. A Strategic Needs Perspective on Operations Outsourcing and Other Inter-Firm Relationships. Int. J. Prod. Econ. 2013, 144, 256–267. [Google Scholar] [CrossRef]

- Liu, T.; Wang, Q.; Yang, S.; Shi, Q. The Impact of Shareholder and Director Networks on Corporate Technological Innovation: A Multilayer Networks Analysis. Systems 2024, 12, 41. [Google Scholar] [CrossRef]

- Ramia, G.; Patulny, R.; Marston, G.; Cassells, K. The Relationship between Governance Networks and Social Networks: Progress, Problems and Prospects. Political Stud. Rev. 2018, 16, 331–341. [Google Scholar] [CrossRef]

- González-Moreno, Á.; Triguero, Á.; Sáez-Martínez, F.J. Many or Trusted Partners for Eco-Innovation? The Influence of Breadth and Depth of Firms’ Knowledge Network in the Food Sector. Technol. Forecast. Soc. Chang. 2019, 147, 51–62. [Google Scholar] [CrossRef]

- Martin-Rios, C.; Erhardt, N. Small Business Activity and Knowledge Exchange in Informal Interfirm Networks. Int. Small Bus. J. 2017, 35, 285–305. [Google Scholar] [CrossRef]

- Burt, R.S.; Kilduff, M.; Tasselli, S. Social Network Analysis: Foundations and Frontiers on Advantage. Annu. Rev. Psychol. 2013, 64, 527–547. [Google Scholar] [CrossRef]

- Marlow, S.; McAdam, M. Incubation or Induction? Gendered Identity Work in the Context of Technology Business Incubation. Entrep. Theory Pract. 2015, 39, 791–816. [Google Scholar] [CrossRef]

- Thomaz, F.; Swaminathan, V. What Goes around Comes around: The Impact of Marketing Alliances on Firm Risk and the Moderating Role of Network Density. J. Mark. 2015, 79, 63–79. [Google Scholar] [CrossRef]

- Tortoriello, M.; McEvily, B.; Krackhardt, D. Being a Catalyst of Innovation: The Role of Knowledge Diversity and Network Closure. Organ. Sci. 2015, 26, 423–438. [Google Scholar] [CrossRef]

- Li, X.; Liu, X. The Impact of the Collaborative Innovation Network Embeddedness on Enterprise Green Innovation Performance. Front. Environ. Sci. 2023, 11, 1190697. [Google Scholar] [CrossRef]

- Wang, H.; Zhao, J.; Li, Y.; Li, C. Network Centrality, Organizational Innovation, and Performance: A Meta-analysis. Can. J. Adm. Sci. 2015, 32, 146–159. [Google Scholar] [CrossRef]

- Bloodgood, J.M.; Hornsby, J.S.; Rutherford, M.; McFarland, R.G. The Role of Network Density and Betweenness Centrality in Diffusing New Venture Legitimacy: An Epidemiological Approach. Int. Entrep. Manag. J. 2017, 13, 525–552. [Google Scholar] [CrossRef]

- Swaminathan, V.; Moorman, C. Marketing Alliances, Firm Networks, and Firm Value Creation. J. Mark. 2009, 73, 52–69. [Google Scholar] [CrossRef]

- McFadyen, M.A.; Semadeni, M.; Cannella, A.A. Value of Strong Ties to Disconnected Others: Examining Knowledge Creation in Biomedicine. Organ. Sci. 2009, 20, 552–564. [Google Scholar] [CrossRef]

- Wen, J.; Qualls, W.J.; Zeng, D. To Explore or Exploit: The Influence of Inter-Firm R&D Network Diversity and Structural Holes on Innovation Outcomes. Technovation 2021, 100, 102178. [Google Scholar] [CrossRef]

- Yang, J.; Yu, G.; Liu, M.; Rui, M. Improving Learning Alliance Performance for Manufacturers: Does Knowledge Sharing Matter? Int. J. Prod. Econ. 2016, 171, 301–308. [Google Scholar] [CrossRef]

- Parra-Requena, G.; Ruiz-Ortega, M.J.; García-Villaverde, P.M.; Rodrigo-Alarcón, J. The Mediating Role of Knowledge Acquisition on the Relationship Between External Social Capital and Innovativeness. Eur. Manag. Rev. 2015, 12, 149–169. [Google Scholar] [CrossRef]

- Roper, S.; Love, J.H.; Bonner, K. Firms’ Knowledge Search and Local Knowledge Externalities in Innovation Performance. Res. Policy 2017, 46, 43–56. [Google Scholar] [CrossRef]

- Cheng, C.C.J.; Hsu, S.-H.; Sheu, C. How Can Green Innovation from Manufacturers Benefit from Supplier Networks? SCM 2023, 28, 559–575. [Google Scholar] [CrossRef]

- Rogan, M.; Mors, M.L. A Network Perspective on Individual-Level Ambidexterity in Organizations. Organ. Sci. 2014, 25, 1860–1877. [Google Scholar] [CrossRef]

- Opper, S.; Burt, R.S. Social Network and Temporal Myopia. AMJ 2021, 64, 741–771. [Google Scholar] [CrossRef]

- Coccia, M. What Is the Optimal Rate of R&D Investment to Maximize Productivity Growth? Technol. Forecast. Soc. Chang. 2009, 76, 433–446. [Google Scholar] [CrossRef]

- Dalziel, T.; Gentry, R.J.; Bowerman, M. An Integrated Agency–Resource Dependence View of the Influence of Directors’ Human and Relational Capital on Firms’ R&D Spending. J Manag. Stud. 2011, 48, 1217–1242. [Google Scholar] [CrossRef]

- Knight, F.H. Risk, Uncertainty, and Profit. In The Economic Nature of the Firm; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar] [CrossRef]

- Simon, H.; March, J. Administrative Behavior and Organizations. In Organizational Behavior 2; Routledge: London, UK, 2015; pp. 41–59. [Google Scholar]

- Nahapiet, J.; Ghoshal, S. Social Capital, Intellectual Capital, and the Organizational Advantage. Acad. Manag. Rev. 1998, 23, 242. [Google Scholar] [CrossRef]

- Rusanen, H.; Halinen, A.; Jaakkola, E. Accessing Resources for Service Innovation–the Critical Role of Network Relationships. J. Serv. Manag. 2014, 25, 2–29. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Tsang, E.W.K. Social Capital, Networks, and Knowledge Transfer. AMR 2005, 30, 146–165. [Google Scholar] [CrossRef]

- Peng, H.; Shen, N.; Liao, H.; Wang, Q. Multiple Network Embedding, Green Knowledge Integration and Green Supply Chain Performance——Investigation Based on Agglomeration Scenario. J. Clean. Prod. 2020, 259, 120821. [Google Scholar] [CrossRef]

- Iyer, S.R.; Sankaran, H.; Hoffman, J. The Relationship between Director Centrality and R&D Investment: High-Tech Firms and Non-High-Tech Firms. Editor. Policy 2020, 32, 255–273. [Google Scholar]

- Helmers, C.; Patnam, M.; Rau, P.R. Do Board Interlocks Increase Innovation? Evidence from a Corporate Governance Reform in India. J. Bank. Financ. 2017, 80, 51–70. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, H.; He, Z. Environmental Regulation, R&D Investment, and Green Technology Innovation in China: Based on the PVAR Model. PLoS ONE 2022, 17, e0275498. [Google Scholar] [CrossRef]

- Sánchez-Sellero, P.; Bataineh, M.J. How R&D Cooperation, R&D Expenditures, Public Funds and R&D Intensity Affect Green Innovation? Technol. Anal. Strateg. Manag. 2022, 34, 1095–1108. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Can Environmental Investment and Expenditure Enhance Financial Performance of US Electric Utility Firms under the Clean Air Act Amendment of 1990? Energy Policy 2009, 37, 4819–4826. [Google Scholar] [CrossRef]

- Sánchez-Sellero, P.; Rosell-Martínez, J.; García-Vázquez, J.M. Absorptive Capacity from Foreign Direct Investment in Spanish Manufacturing Firms. Int. Bus. Rev. 2014, 23, 429–439. [Google Scholar] [CrossRef]

- Kim, T.H.; Kim, B. Firm’s Environmental Expenditure, R&D Intensity, and Profitability. Sustainability 2018, 10, 2071. [Google Scholar] [CrossRef]

- Bronzini, R.; Piselli, P. Determinants of Long-Run Regional Productivity with Geographical Spillovers: The Role of R&D, Human Capital and Public Infrastructure. Reg. Sci. Urban Econ. 2009, 39, 187–199. [Google Scholar] [CrossRef]

- Subramaniam, M.; Youndt, M.A. The Influence of Intellectual Capital on the Types of Innovative Capabilities. AMJ 2005, 48, 450–463. [Google Scholar] [CrossRef]

- Hora, M.; Klassen, R.D. Learning from Others’ Misfortune: Factors Influencing Knowledge Acquisition to Reduce Operational Risk. J. Oper. Manag. 2013, 31, 52–61. [Google Scholar] [CrossRef]

- Cao, Y.; Dhaliwal, D.; Li, Z.; Yang, Y.G. Are All Independent Directors Equally Informed? Evidence Based on Their Trading Returns and Social Networks. Manag. Sci. 2015, 61, 795–813. [Google Scholar] [CrossRef]

- Lin, Z.; Yang, H.; Arya, B. Alliance Partners and Firm Performance: Resource Complementarity and Status Association. Strateg. Manag. J. 2009, 30, 921–940. [Google Scholar] [CrossRef]

- Polidoro, F.; Ahuja, G.; Mitchell, W. When the Social Structure Overshadows Competitive Incentives: The Effects of Network Embeddedness on Joint Venture Dissolution. AMJ 2011, 54, 203–223. [Google Scholar] [CrossRef]

- Ahuja, G.; Polidoro, F.; Mitchell, W. Structural Homophily or Social Asymmetry? The Formation of Alliances by Poorly Embedded Firms. Strateg. Manag. J. 2009, 30, 941–958. [Google Scholar] [CrossRef]

- Mazzola, E.; Perrone, G.; Kamuriwo, D.S. Network Embeddedness and New Product Development in the Biopharmaceutical Industry: The Moderating Role of Open Innovation Flow. Int. J. Prod. Econ. 2015, 160, 106–119. [Google Scholar] [CrossRef]

- Guler, I.; Guillén, M.F. Home Country Networks and Foreign Expansion: Evidence from the Venture Capital Industry. AMJ 2010, 53, 390–410. [Google Scholar] [CrossRef]

- Yang, H.; Lin, Z.; Lin, Y. A Multilevel Framework of Firm Boundaries: Firm Characteristics, Dyadic Differences, and Network Attributes. Strateg. Manag. J. 2010, 31, 237–261. [Google Scholar] [CrossRef]

- Jensen, M. The Use of Relational Discrimination to Manage Market Entry: When Do Social Status and Structural Holes Work Against You? AMJ 2008, 51, 723–743. [Google Scholar] [CrossRef]

- Koka, B.R.; Prescott, J.E. Designing Alliance Networks: The Influence of Network Position, Environmental Change, and Strategy on Firm Performance. Strateg. Manag. J. 2008, 29, 639–661. [Google Scholar] [CrossRef]

- Faems, D.; De Visser, M.; Andries, P.; Van Looy, B. Technology Alliance Portfolios and Financial Performance: Value-Enhancing and Cost-Increasing Effects of Open Innovation. J. Prod. Innov. Manag. 2010, 27, 785–796. [Google Scholar] [CrossRef]

- Wassmer, U.; Li, S.; Madhok, A. Resource Ambidexterity through Alliance Portfolios and Firm Performance. Strateg. Manag. J. 2017, 38, 384–394. [Google Scholar] [CrossRef]

- Wang, M.; Lin, H.; Huang, Y. Structural Holes and R&D Investment: Evidence from Top Management Teams of China’s A-Share Listed Firms. Appl. Econ. 2021, 53, 4985–4999. [Google Scholar] [CrossRef]

- Hao, J.; Li, C.; Yuan, R.; Ahmed, M.; Khan, M.A.; Oláh, J. The Influence of the Knowledge-Based Network Structure Hole on Enterprise Innovation Performance: The Threshold Effect of R&D Investment Intensity. Sustainability 2020, 12, 6155. [Google Scholar] [CrossRef]

- Burt, R.S. Structural Holes and Good Ideas. Am. J. Sociol. 2004, 110, 349–399. [Google Scholar] [CrossRef]

- Brüderl, J.; Preisendörfer, P.; Ziegler, R. Survival Chances of Newly Founded Business Organizations. Am. Sociol. Rev. 1992, 57, 227–242. [Google Scholar] [CrossRef]

- Tortoriello, M. The Social Underpinnings of Absorptive Capacity: The Moderating Effects of Structural Holes on Innovation Generation Based on External Knowledge. Strateg. Manag. J. 2015, 36, 586–597. [Google Scholar] [CrossRef]

- Rosenkopf, L.; Almeida, P. Overcoming Local Search Through Alliances and Mobility. Manag. Sci. 2003, 49, 751–766. [Google Scholar] [CrossRef]

- Rosenkopf, L.; Nerkar, A. Beyond Local Search: Boundary-spanning, Exploration, and Impact in the Optical Disk Industry. Strateg. Manag. J. 2001, 22, 287–306. [Google Scholar] [CrossRef]

- Gilsing, V.; Nooteboom, B.; Vanhaverbeke, W.; Duysters, G.; Van Den Oord, A. Network Embeddedness and the Exploration of Novel Technologies: Technological Distance, Betweenness Centrality and Density. Res. Policy 2008, 37, 1717–1731. [Google Scholar] [CrossRef]

- Gilsing, V.; Nooteboom, B. Density and Strength of Ties in Innovation Networks: An Analysis of Multimedia and Biotechnology. Eur. Manag. Rev. 2005, 2, 179–197. [Google Scholar] [CrossRef]

- Carnabuci, G.; Operti, E. Where Do Firms’ Recombinant Capabilities Come from? Intraorganizational Networks, Knowledge, and Firms’ Ability to Innovate through Technological Recombination. Strateg. Manag. J. 2013, 34, 1591–1613. [Google Scholar] [CrossRef]

- Coleman, J.S. Social Capital in the Creation of Human Capital. Am. J. Sociol. 1988, 94, S95–S120. [Google Scholar] [CrossRef]

- Kraatz, M.S. Learning by association? Interorganizational networks and adaptation to environmental change. Acad. Manag. J. 1998, 41, 621–643. [Google Scholar] [CrossRef]

- Gulati, R.; Nohria, N.; Zaheer, A. Strategic Networks. Strateg. Manag. J. 2000, 21, 203–215. [Google Scholar] [CrossRef]

- Duysters, G.; Lemmens, C. Alliance Group Formation Enabling and Constraining Effects of Embeddedness and Social Capital in Strategic Technology Alliance Networks. Int. Stud. Manag. Organ. 2003, 33, 49–68. [Google Scholar] [CrossRef]

- Nooteboom, B. Interfirm Alliances: International Analysis and Design; Routledge: London, UK, 2008. [Google Scholar]

- Afuah, A. Are Network Effects Really All about Size? The Role of Structure and Conduct. Strateg. Manag. J. 2013, 34, 257–273. [Google Scholar] [CrossRef]

- Oh, H.; Labianca, G.; Chung, M.-H. A Multilevel Model of Group Social Capital. AMR 2006, 31, 569–582. [Google Scholar] [CrossRef]

- Batjargal, B.; Hitt, M.A.; Tsui, A.S.; Arregle, J.-L.; Webb, J.W.; Miller, T.L. Institutional Polycentrism, Entrepreneurs’ Social Networks, and New Venture Growth. AMJ 2013, 56, 1024–1049. [Google Scholar] [CrossRef]

- Wang, Y.; Delgado, M.S.; Khanna, N.; Bogan, V.L. Good News for Environmental Self-Regulation? Finding the Right Link. J. Environ. Econ. Manag. 2019, 94, 217–235. [Google Scholar] [CrossRef]

- Lu, Z.; Li, H. Does Environmental Information Disclosure Affect Green Innovation? Econ. Anal. Policy 2023, 80, 47–59. [Google Scholar] [CrossRef]

- Wang, L.; Li, M.; Wang, W.; Gong, Y.; Xiong, Y. Green Innovation Output in the Supply Chain Network with Environmental Information Disclosure: An Empirical Analysis of Chinese Listed Firms. Int. J. Prod. Econ. 2023, 256, 108745. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of Ownership and Control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, M.; Qiao, Y.; Li, X.; Li, S. Does Improvement of Environmental Information Transparency Boost Firms’ Green Innovation? Evidence from the Air Quality Monitoring and Disclosure Program in China. J. Clean. Prod. 2022, 357, 131921. [Google Scholar] [CrossRef]

- Zhang, Z.; Su, Z.; Wang, K.; Zhang, Y. Corporate Environmental Information Disclosure and Stock Price Crash Risk: Evidence from Chinese Listed Heavily Polluting Companies. Energy Econ. 2022, 112, 106116. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M.; Zhao, X. Confession or Justification: The Effects of Environmental Disclosure on Corporate Green Innovation in China. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2735–2750. [Google Scholar] [CrossRef]

- Casciaro, T.; Piskorski, M.J. Power Imbalance, Mutual Dependence, and Constraint Absorption: A Closer Look at Resource Dependence Theory. Adm. Sci. Q. 2005, 50, 167–199. [Google Scholar] [CrossRef]

- Kim, Y.; Choi, T.Y.; Yan, T.; Dooley, K. Structural Investigation of Supply Networks: A Social Network Analysis Approach. J. Oper. Manag. 2011, 29, 194–211. [Google Scholar] [CrossRef]

- Bellamy, M.A.; Dhanorkar, S.; Subramanian, R. Administrative Environmental Innovations, Supply Network Structure, and Environmental Disclosure. J. Oper. Manag. 2020, 66, 895–932. [Google Scholar] [CrossRef]

- Shi, W.; Markoczy, L.; Dess, G.G. The Role of Middle Management in the Strategy Process: Group Affiliation, Structural Holes, and Tertius Iungens. J. Manag. 2009, 35, 1453–1480. [Google Scholar] [CrossRef]

- Batjargal, B. The Effects of Network’s Structural Holes: Polycentric Institutions, Product Portfolio, and New Venture Growth in China and Russia. Strateg. Entrep. 2010, 4, 146–163. [Google Scholar] [CrossRef]

- Gulati, R.; Dialdin, D.A.; Wang, L. Organizational Networks. In The Blackwell Companion to Organizations; Baum, J.A.C., Ed.; Wiley: Hoboken, NJ, USA, 2017; pp. 281–303. ISBN 978-0-631-21694-0. [Google Scholar]

- Zhao, S.; Li, J. Impact of Innovation Network on Regional Innovation Performance: Do Network Density, Network Openness and Network Strength Have Any Influence? J. Sci. Technol. Policy Manag. 2022, 14, 982–999. [Google Scholar] [CrossRef]

- GB/T4754-2011; Industrial Classification for National Economic Activities. Chinese Standard: Beijing, China, 2011.

- Xia, G.; Kaihua, C. The Complex Network Analysis of the Structure Evolution of Collaborative Innovation Networks: An Example of the Industry-University-Research Collaboration of Chinese ICT Industry. Sci. Res. Manag. 2015, 36, 28. [Google Scholar]

- Nepelski, D.; De Prato, G. The Structure and Evolution of ICT Global Innovation Network. Ind. Innov. 2018, 25, 940–965. [Google Scholar] [CrossRef]

- Zhang, H.; Xiong, H.; Wang, Q.; Gu, Y. The Impact of Enterprise Niche on Dual Innovation Performance: Moderating Role of Innovation Openness. Eur. J. Innov. Manag. 2023, 26, 1547–1569. [Google Scholar] [CrossRef]

- Huang, X.; Liu, W.; Zhang, Z.; Zou, X.; Li, P. Quantity or Quality: Environmental Legislation and Corporate Green Innovations. Ecol. Econ. 2023, 204, 107684. [Google Scholar] [CrossRef]

- Fang, Z.; Kong, X.; Sensoy, A.; Cui, X.; Cheng, F. Government’s Awareness of Environmental Protection and Corporate Green Innovation: A Natural Experiment from the New Environmental Protection Law in China. Econ. Anal. Policy 2021, 70, 294–312. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M. Corporate Governance and Green Innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Dosi, G.; Marengo, L.; Pasquali, C. How Much Should Society Fuel the Greed of Innovators?: On the Relations between Appropriability, Opportunities and Rates of Innovation. Res. Policy 2006, 35, 1110–1121. [Google Scholar] [CrossRef]

- Hall, B.H.; Harhoff, D. Recent Research on the Economics of Patents. Annu. Rev. Econ. 2012, 4, 541–565. [Google Scholar] [CrossRef]

- Bloch, F.; Jackson, M.O.; Tebaldi, P. Centrality Measures in Networks. Soc. Choice Welf. 2023, 61, 413–453. [Google Scholar] [CrossRef]

- Cheng, H.; Xu, X.; Li, Z.; Zhang, Z. The Synergy of Inventor Cooperative Network Dual Embeddedness and Firm Innovation: The Mediating Role of Ambidextrous Learning. Technol. Anal. Strateg. Manag. 2024, 36, 89–104. [Google Scholar] [CrossRef]

- Martin, G.; Gözübüyük, R.; Becerra, M. Interlocks and Firm Performance: The Role of Uncertainty in the Directorate Interlock-Performance Relationship. Strateg. Manag. J. 2015, 36, 235–253. [Google Scholar] [CrossRef]

- Mazzola, E.; Perrone, G.; Handfield, R. Change Is Good, But Not Too Much: Dynamic Positioning in the Interfirm Network and New Product Development. J. Prod. Innov. Manag. 2018, 35, 960–982. [Google Scholar] [CrossRef]

- Oliver, C. Strategic Responses to Institutional Processes. Acad. Manag. Rev. 1991, 16, 145–179. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Dou, W.; Hao, Y. How Does Economic Policy Uncertainty Affect Corporate Green Innovation? Evidence from China. J. Environ. Plan. Manag. 2025, 68, 1363–1389. [Google Scholar] [CrossRef]

- Wiseman, J. An Evaluation of Environmental Disclosures Made in Corporate Annual Reports. Account. Organ. Soc. 1982, 7, 53–63. [Google Scholar] [CrossRef]

- Wang, S.; Wang, H.; Wang, J.; Yang, F. Does Environmental Information Disclosure Contribute to Improve Firm Financial Performance? An Examination of the Underlying Mechanism. Sci. Total Environ. 2020, 714, 136855. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xu, X.D.; Dong, Z.Y.; Tam, V.W. Towards Corporate Environmental Information Disclosure: An Empirical Study in China. J. Clean. Prod. 2010, 18, 1142–1148. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M. The Role of Environmental Disclosures as Tools of Legitimacy: A Research Note. Account. Organ. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Xu, Q.; Li, X.; Guo, F. Digital Transformation and Environmental Performance: Evidence from Chinese Resource-based Enterprises. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1816–1840. [Google Scholar] [CrossRef]

- ISO 14001:2015; Environmental Management Systems—Requirements with Guidance for Use. ISO: Geneva, Switzerland, 2015.

- ISO 9001:2015; Quality Management Systems—Requirements. ISO: Geneva, Switzerland, 2015.

- Damanpour, F. An Integration of Research Findings of Effects of Firm Size and Market Competition on Product and Process Innovations. Br. J Manag. 2010, 21, 996–1010. [Google Scholar] [CrossRef]

- Coad, A.; Segarra, A.; Teruel, M. Innovation and Firm Growth: Does Firm Age Play a Role? Res. Policy 2016, 45, 387–400. [Google Scholar] [CrossRef]

- Huggins, R.; Johnston, A. Knowledge Flow and Inter-Firm Networks: The Influence of Network Resources, Spatial Proximity and Firm Size. Entrep. Reg. Dev. 2010, 22, 457–484. [Google Scholar] [CrossRef]

- Balsmeier, B.; Fleming, L.; Manso, G. Independent Boards and Innovation. J. Financ. Econ. 2017, 123, 536–557. [Google Scholar] [CrossRef]

- Sierra-Morán, J.; Cabeza-García, L.; González-Álvarez, N.; Botella, J. The Board of Directors and Firm Innovation: A Meta-Analytical Review. BRQ Bus. Res. Q. 2024, 27, 182–207. [Google Scholar] [CrossRef]

- Zhai, Y.; Cai, Z.; Lin, H.; Yuan, M.; Mao, Y.; Yu, M. Does Better Environmental, Social, and Governance Induce Better Corporate Green Innovation: The Mediating Role of Financing Constraints. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1513–1526. [Google Scholar] [CrossRef]

- Ferris, S.P.; Javakhadze, D.; Rajkovic, T. The International Effect of Managerial Social Capital on the Cost of Equity. J. Bank. Financ. 2017, 74, 69–84. [Google Scholar] [CrossRef]

- Chuluun, T.; Prevost, A.; Puthenpurackal, J. Board Ties and the Cost of Corporate Debt. Financ. Manag. 2014, 43, 533–568. [Google Scholar] [CrossRef]

- Feng, Y.; Song, K.; Tian, Y.S. Director Networks and Initial Public Offerings. J. Bank. Financ. 2019, 106, 246–264. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

| Disclosure Type | Disclosure Item | Score Explanation |

|---|---|---|

| Environmental Management Disclosure | Environmental Protection Concept | Disclosure: 2 points; None: 0 points |

| Environmental Goals | ||

| Environmental Management System | ||

| Environmental Education and Training | ||

| Environmental Special Actions | ||

| Environmental Emergency Mechanism | ||

| Environmental Honors or Awards | ||

| “Three Simultaneities” System | ||

| Environmental Certification Disclosure | Whether ISO14001 [178] certification is obtained | Yes: 2 points; No: 0 points |

| Whether ISO9001 [179] certification is obtained | ||

| Environmental Information Disclosure Medium | Listed Company Annual Report | Disclosure: 2 points; None: 0 points |

| Corporate Social Responsibility Report | ||

| Environmental Report | ||

| Environmental Liability Disclosure | Wastewater Discharge Volume | Quantitative and qualitative description: 2 points; Only qualitative: 1 point; None: 0 points |

| COD Emissions | ||

| SO2 Emissions | ||

| CO2 Emissions | ||

| Smoke and Dust Emissions | ||

| Industrial Solid Waste Emissions | ||

| Environmental Performance and Governance Disclosure | Air Emission Reduction Governance | |

| Water Emission Reduction Governance | ||

| Dust and Smoke Governance | ||

| Utilization and Disposal of Solid Waste | ||

| Governance of Noise, Light Pollution, Radiation, etc. | ||

| Implementation of Clean Production |

| Variable Type | Variable Name | Variable Code | Variable Definition |

|---|---|---|---|

| Dependent variables | green innovation | GI | ln (the number of green patent applications + 1) |

| Independent variables | degree centrality | Deg | Number of directly connected enterprises |

| structural holes | SH | Degree of unconstrained “freedom” | |

| network density | Density | Observable actual connections/All potential connections | |

| Mediating variables | R&D expenditure | Expenditure | The logarithm of R&D investment amount |

| R&D personnel | Personnel | Proportion of R&D personnel | |

| Moderating variables | environmental information disclosure | EID | Monetized information: quantitative and qualitative description: 2 points; only qualitative: 1 point; none: 0 points Non-monetized information: disclosure: 2 points; none: 0 points |

| Control variables | firm size | Fir | Natural logarithm of the total assets of the enterprise for the current year. |

| independent directors | Ind | The proportion of independent directors among the board of directors. | |

| firm age | age | The difference between the fiscal year’s end and the company’s founding year. | |

| return on assets | ROA | Net profit/the ending balance of total assets |

| VarName | Obs | Mean | SD | Min | Median | Max | P25 | P75 |

|---|---|---|---|---|---|---|---|---|

| GI | 4556 | 13.814 | 43.697 | 1.000 | 4.000 | 1179.000 | 2.000 | 11.000 |

| Deg | 4556 | 0.003 | 0.002 | 0.000 | 0.002 | 0.012 | 0.001 | 0.004 |

| SH | 4556 | 0.619 | 0.282 | −0.125 | 0.704 | 1.000 | 0.481 | 0.827 |

| Density | 4556 | 0.484 | 0.330 | 0.000 | 0.400 | 1.000 | 0.228 | 0.750 |

| EID | 4556 | 2.208 | 0.875 | 0.000 | 2.303 | 3.850 | 1.609 | 2.890 |

| Personnel | 4556 | 13.584 | 13.068 | 0.000 | 11.550 | 86.180 | 3.530 | 18.130 |

| Expenditure | 4556 | 18.595 | 1.462 | 11.580 | 18.571 | 25.025 | 17.755 | 19.429 |

| Fir | 4556 | 22.704 | 1.286 | 17.954 | 22.569 | 29.303 | 21.809 | 23.425 |

| Ind | 4556 | 0.375 | 0.058 | 0.000 | 0.333 | 0.714 | 0.333 | 0.429 |

| age | 4556 | 20.075 | 6.357 | 4.420 | 20.000 | 43.920 | 15.500 | 24.330 |

| ROA | 4556 | 0.029 | 0.127 | −2.071 | 0.032 | 6.365 | 0.012 | 0.060 |

| Deg | SH | Density | GI | EID | Expenditure | Personnel | Fir | Ind | Age | ROA | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Deg | 1 | ||||||||||

| SH | 0.620 *** | 1 | |||||||||

| Density | −0.511 *** | −0.856 *** | 1 | ||||||||

| GI | 0.079 *** | 0.073 *** | −0.081 *** | 1 | |||||||

| EID | −0.045 *** | −0.039 *** | 0.060 *** | 0.133 *** | 1 | ||||||

| Expenditure | 0.196 *** | 0.118 *** | −0.133 *** | 0.343 *** | 0.336 *** | 1 | |||||

| Personnel | 0.172 *** | 0.130 *** | −0.156 *** | 0.059 *** | −0.00800 | 0.267 *** | 1 | ||||

| Fir | 0.00200 | −0.0110 | 0.036 *** | 0.332 *** | 0.384 *** | 0.589 *** | −0.044 *** | 1 | |||

| Ind | −0.0120 | −0.00600 | −0.045 *** | 0.0190 | −0.0210 | 0.039 *** | 0.024 * | 0.028 ** | 1 | ||

| age | −0.068 *** | −0.064 *** | 0.072 *** | 0.061 *** | 0.160 *** | 0.095 *** | 0.089 *** | 0.274 *** | 0.038 ** | 1 | |

| ROA | −0.0100 | −0.0150 | 0.00800 | 0.023 * | 0.043 *** | 0.044 *** | −0.037 *** | 0.00700 | −0.0170 | −0.071 *** | 1 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| GI | Personnel | GI | GI | Personnel | GI | GI | Personnel | GI | |

| Deg | 1610.494 *** | 1121.244 *** | 1169.084 *** | ||||||

| (293.715) | (76.121) | (301.209) | |||||||

| SH | 13.349 *** | 6.217 *** | 11.043 *** | ||||||

| (2.354) | (0.630) | (2.424) | |||||||

| Density | −13.742 *** | −6.205 *** | −11.096 *** | ||||||

| (2.020) | (0.537) | (2.085) | |||||||

| Personnel | 0.324 *** | 0.334 *** | 0.320 *** | ||||||

| (0.059) | (0.058) | (0.058) | |||||||

| Fir | 12.712 *** | −1.579 *** | 14.218 *** | 12.772 *** | −1.508 *** | 14.310 *** | 12.832 *** | −1.483 *** | 14.333 *** |

| (0.530) | (0.146) | (0.570) | (0.530) | (0.148) | (0.569) | (0.529) | (0.147) | (0.568) | |

| Ind | 5.720 | 3.923 | 8.396 | 4.718 | 3.489 | 7.716 | −0.383 | 1.093 | 3.481 |

| (11.224) | (2.960) | (11.433) | (11.223) | (3.000) | (11.425) | (11.239) | (2.996) | (11.447) | |

| age | −0.143 | −0.131 *** | −0.153 | −0.142 | −0.137 *** | −0.148 | −0.130 | −0.130 *** | −0.138 |

| (0.118) | (0.031) | (0.119) | (0.118) | (0.031) | (0.119) | (0.118) | (0.031) | (0.119) | |

| ROA | 9.059 | −2.642 | 8.753 | 9.011 | −2.871 | 8.837 | 8.506 | −2.869 | 8.799 |

| (7.012) | (1.910) | (7.377) | (7.010) | (1.935) | (7.372) | (6.998) | (1.927) | (7.365) | |

| _cons | −278.839 *** | 47.378 *** | −316.594 *** | −283.516 *** | 45.455 *** | −322.223 *** | −268.323 *** | 52.466 *** | −309.028 *** |

| (12.501) | (3.414) | (13.473) | (12.569) | (3.482) | (13.519) | (12.497) | (3.451) | (13.529) | |

| Firm controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 |

| r2 | 0.122 | 0.080 | 0.135 | 0.123 | 0.055 | 0.136 | 0.125 | 0.063 | 0.138 |

| r2_a | 0.119 | 0.077 | 0.132 | 0.120 | 0.052 | 0.133 | 0.122 | 0.059 | 0.135 |

| F | 126.486 | 75.305 | 112.881 | 126.960 | 50.581 | 113.973 | 130.154 | 57.981 | 115.429 |

| Sobel | |Z| = 4.115, p = 0.00003872 | |Z| = 4.17, p = 0.00003043 | |Z| = 4.876, p = 0.00266071 | ||||||

| (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | |

|---|---|---|---|---|---|---|---|---|---|

| GI | Expenditure | GI | GI | Expenditure | GI | GI | Expenditure | GI | |

| Deg | 1610.494 *** | 120.510 *** | 698.231 ** | ||||||

| (293.715) | (7.707) | (300.040) | |||||||

| SH | 13.349 *** | 0.566 *** | 9.106 *** | ||||||

| (2.354) | (0.064) | (2.394) | |||||||

| Density | −13.742 *** | −0.598 *** | −8.927 *** | ||||||

| (2.020) | (0.055) | (2.063) | |||||||

| Expenditure | 7.091 *** | 7.114 *** | 6.997 *** | ||||||

| (0.577) | (0.566) | (0.568) | |||||||

| Fir | 12.712 *** | 0.686 *** | 8.859 *** | 12.772 *** | 0.694 *** | 8.889 *** | 12.832 *** | 0.696 *** | 9.006 *** |

| (0.530) | (0.015) | (0.685) | (0.530) | (0.015) | (0.682) | (0.529) | (0.015) | (0.683) | |

| Ind | 5.720 | 0.251 | 8.638 | 4.718 | 0.191 | 8.097 | −0.383 | −0.041 | 4.683 |

| (11.224) | (0.300) | (11.353) | (11.223) | (0.305) | (11.340) | (11.239) | (0.305) | (11.366) | |

| age | −0.143 | −0.024 *** | −0.010 | −0.142 | −0.025 *** | −0.003 | −0.130 | −0.025 *** | 0.004 |

| (0.118) | (0.003) | (0.119) | (0.118) | (0.003) | (0.119) | (0.118) | (0.003) | (0.119) | |

| ROA | 9.059 | 1.514 *** | −2.681 | 9.011 | 1.482 *** | −2.528 | 8.506 | 1.485 *** | −2.360 |

| (7.012) | (0.193) | (7.346) | (7.010) | (0.196) | (7.334) | (6.998) | (0.195) | (7.330) | |

| _cons | −278.839 *** | 3.071 *** | −324.088 *** | −283.516 *** | 2.950 *** | −328.868 *** | −268.323 *** | 3.604 *** | −318.266 *** |

| (12.501) | (0.345) | (13.202) | (12.569) | (0.354) | (13.260) | (12.497) | (0.351) | (13.237) | |

| Firm controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 |

| r2 | 0.122 | 0.376 | 0.158 | 0.123 | 0.353 | 0.160 | 0.125 | 0.359 | 0.161 |

| r2_a | 0.119 | 0.374 | 0.155 | 0.120 | 0.350 | 0.157 | 0.122 | 0.356 | 0.158 |

| F | 126.486 | 519.625 | 135.109 | 126.960 | 469.299 | 136.898 | 130.154 | 481.938 | 137.742 |

| Sobel | |Z| = 2.54, p = 0.01109756 | |Z| = 3.581, p = 0.0003419 | |Z| = 4.102, p = 0.00004094 | ||||||

| (19) | (20) | (21) | (22) | (23) | (24) | |

|---|---|---|---|---|---|---|

| GI | GI | GI | GI | GI | GI | |

| Deg | 1621.713 *** | 1552.324 *** | ||||

| (293.817) | (294.557) | |||||

| EID × Deg | 945.898 *** | |||||

| (327.052) | ||||||

| SH | 13.451 *** | 13.075 *** | ||||

| (2.355) | (2.356) | |||||

| EID × SH | 8.035 *** | |||||

| (2.686) | ||||||

| Density | −13.904 *** | −13.364 *** | ||||

| (2.023) | (2.028) | |||||

| EID × Density | −7.564 *** | |||||

| (2.341) | ||||||

| EID | 1.085 | 0.919 | 1.105 | 0.974 | 1.253 | 1.071 |

| (0.829) | (0.830) | (0.829) | (0.829) | (0.828) | (0.829) | |

| Fir | 12.461 *** | 12.407 *** | 12.516 *** | 12.466 *** | 12.542 *** | 12.486 *** |

| (0.564) | (0.564) | (0.564) | (0.564) | (0.563) | (0.563) | |

| Ind | 6.391 | 7.166 | 5.394 | 5.608 | 0.321 | 0.021 |

| (11.235) | (11.229) | (11.233) | (11.224) | (11.247) | (11.235) | |

| age | −0.139 | −0.171 | −0.138 | −0.166 | −0.126 | −0.146 |

| (0.118) | (0.118) | (0.118) | (0.118) | (0.118) | (0.118) | |

| ROA | 8.306 | 8.226 | 8.244 | 8.058 | 7.633 | 7.735 |

| (7.035) | (7.029) | (7.033) | (7.027) | (7.021) | (7.013) | |

| _cons | −275.855 *** | −273.632 *** | −280.513 *** | −278.272 *** | −264.765 *** | −262.658 *** |

| (12.706) | (12.719) | (12.768) | (12.779) | (12.715) | (12.718) | |

| Firm controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year controls | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 |

| r2 | 0.123 | 0.124 | 0.123 | 0.125 | 0.126 | 0.128 |

| r2_a | 0.120 | 0.121 | 0.120 | 0.121 | 0.123 | 0.125 |

| F | 105.707 | 91.948 | 106.114 | 92.393 | 108.873 | 95.006 |

| (25) | (26) | (27) | (28) | (29) | (30) | (31) | (32) | (33) | |

|---|---|---|---|---|---|---|---|---|---|

| grantedGI | Personnel | grantedGI | grantedGI | Personnel | grantedGI | grantedGI | Personnel | grantedGI | |

| Deg | 475.449 *** | 1121.244 *** | 273.625 | ||||||

| (165.609) | (76.121) | (169.505) | |||||||

| SH | 5.580 *** | 6.217 *** | 4.533 *** | ||||||

| (1.326) | (0.630) | (1.364) | |||||||

| Density | −5.999 *** | −6.205 *** | −4.798 *** | ||||||

| (1.139) | (0.537) | (1.173) | |||||||

| Personnel | 0.123 *** | 0.119 *** | 0.112 *** | ||||||

| (0.033) | (0.033) | (0.033) | |||||||

| Fir | 6.697 *** | −1.579 *** | 7.615 *** | 6.713 *** | −1.508 *** | 7.628 *** | 6.739 *** | −1.483 *** | 7.637 *** |

| (0.299) | (0.146) | (0.321) | (0.299) | (0.148) | (0.320) | (0.298) | (0.147) | (0.320) | |

| Ind | 7.527 | 3.923 | 6.631 | 7.125 | 3.489 | 6.418 | 4.882 | 1.093 | 4.580 |

| (6.329) | (2.960) | (6.434) | (6.323) | (3.000) | (6.427) | (6.334) | (2.996) | (6.441) | |

| age | −0.153 ** | −0.131 *** | −0.166 ** | −0.149 ** | −0.137 *** | −0.162 ** | −0.144 ** | −0.130 *** | −0.157 ** |

| (0.067) | (0.031) | (0.067) | (0.066) | (0.031) | (0.067) | (0.066) | (0.031) | (0.067) | |

| ROA | 5.356 | −2.642 | 3.982 | 5.431 | −2.871 | 4.103 | 5.225 | −2.869 | 4.099 |

| (3.953) | (1.910) | (4.151) | (3.949) | (1.935) | (4.147) | (3.944) | (1.927) | (4.144) | |

| _cons | −145.265 *** | 47.378 *** | −166.379 *** | −147.696 *** | 45.455 *** | −168.677 *** | −141.222 *** | 52.466 *** | −163.093 *** |

| (7.049) | (3.414) | (7.582) | (7.081) | (3.482) | (7.605) | (7.044) | (3.451) | (7.612) | |

| Firm controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 |

| r2 | 0.104 | 0.080 | 0.119 | 0.106 | 0.055 | 0.121 | 0.108 | 0.063 | 0.122 |

| r2_a | 0.102 | 0.077 | 0.116 | 0.103 | 0.052 | 0.118 | 0.105 | 0.059 | 0.119 |

| F | 105.925 | 75.305 | 97.797 | 108.034 | 50.581 | 99.393 | 110.275 | 57.981 | 100.468 |

| Sobel | |Z| = 3.327, p = 0.00087677 | |Z| = 2.123, p = 0.03377012 | |Z| = 4.002, p = 0.00006287 | ||||||

| (34) | (35) | (36) | (37) | (38) | (39) | (40) | (41) | (42) | |

|---|---|---|---|---|---|---|---|---|---|

| grantedGI | Expenditure | grantedGI | grantedGI | Expenditure | grantedGI | grantedGI | Expenditure | grantedGI | |

| Deg | 475.449 *** | 120.510 *** | −17.198 | ||||||

| (165.609) | (7.707) | (168.882) | |||||||

| SH | 5.580 *** | 0.566 *** | 3.260 ** | ||||||

| (1.326) | (0.064) | (1.348) | |||||||

| Density | −5.999 *** | −0.598 *** | −3.424 *** | ||||||

| (1.139) | (0.055) | (1.162) | |||||||

| Expenditure | 3.607 *** | 3.496 *** | 3.444 *** | ||||||

| (0.325) | (0.319) | (0.320) | |||||||

| Fir | 6.697 *** | 0.686 *** | 4.920 *** | 6.713 *** | 0.694 *** | 4.998 *** | 6.739 *** | 0.696 *** | 5.048 *** |

| (0.299) | (0.015) | (0.385) | (0.299) | (0.015) | (0.384) | (0.298) | (0.015) | (0.385) | |

| Ind | 7.527 | 0.251 | 6.749 | 7.125 | 0.191 | 6.673 | 4.882 | −0.041 | 5.357 |

| (6.329) | (0.300) | (6.390) | (6.323) | (0.305) | (6.385) | (6.334) | (0.305) | (6.401) | |

| age | −0.153 ** | −0.024 *** | −0.085 | −0.149 ** | −0.025 *** | −0.081 | −0.144 ** | −0.025 *** | −0.078 |

| (0.067) | (0.003) | (0.067) | (0.066) | (0.003) | (0.067) | (0.066) | (0.003) | (0.067) | |

| ROA | 5.356 | 1.514 *** | −1.632 | 5.431 | 1.482 *** | −1.254 | 5.225 | 1.485 *** | −1.164 |

| (3.953) | (0.193) | (4.135) | (3.949) | (0.196) | (4.129) | (3.944) | (0.195) | (4.128) | |

| _cons | −145.265 *** | 3.071 *** | −171.468 *** | −147.696 *** | 2.950 *** | −173.375 *** | −141.222 *** | 3.604 *** | −169.444 *** |

| (7.049) | (0.345) | (7.431) | (7.081) | (0.354) | (7.466) | (7.044) | (0.351) | (7.455) | |

| Firm controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 |

| r2 | 0.104 | 0.376 | 0.140 | 0.106 | 0.353 | 0.141 | 0.108 | 0.359 | 0.142 |

| r2_a | 0.102 | 0.374 | 0.137 | 0.103 | 0.350 | 0.138 | 0.105 | 0.356 | 0.139 |

| F | 105.925 | 519.625 | 116.951 | 108.034 | 469.299 | 118.082 | 110.275 | 481.938 | 118.633 |

| Sobel | |Z| = 0.2653, p = 0.79078957 | |Z| = 2.51, p = 0.01208412 | |Z| = 2.989, p = 0.00279575 | ||||||

| (43) | (44) | (45) | (46) | (47) | (48) | |

|---|---|---|---|---|---|---|

| grantedGI | grantedGI | grantedGI | grantedGI | grantedGI | grantedGI | |

| Deg | 484.584 *** | 463.507 *** | ||||

| (165.633) | (166.159) | |||||

| EID × Deg | 287.329 | |||||

| (184.489) | ||||||

| SH | 5.664 *** | 5.508 *** | ||||

| (1.326) | (1.328) | |||||

| EID × SH | 3.339 ** | |||||

| (1.513) | ||||||

| Density | −6.126 *** | −5.905 *** | ||||

| (1.140) | (1.143) | |||||

| EID × Density | −3.087 ** | |||||

| (1.320) | ||||||

| EID | 0.883 * | 0.833 * | 0.908 * | 0.854 * | 0.976 ** | 0.902 * |

| (0.467) | (0.468) | (0.467) | (0.467) | (0.467) | (0.468) | |

| Fir | 6.492 *** | 6.476 *** | 6.503 *** | 6.482 *** | 6.514 *** | 6.491 *** |

| (0.318) | (0.318) | (0.318) | (0.318) | (0.317) | (0.317) | |

| Ind | 8.074 | 8.309 | 7.681 | 7.770 | 5.431 | 5.308 |

| (6.334) | (6.334) | (6.327) | (6.325) | (6.338) | (6.335) | |

| age | −0.150 ** | −0.160 ** | −0.146 ** | −0.158 ** | −0.140 ** | −0.148 ** |

| (0.067) | (0.067) | (0.066) | (0.067) | (0.066) | (0.066) | |

| ROA | 4.743 | 4.719 | 4.801 | 4.724 | 4.544 | 4.586 |

| (3.966) | (3.965) | (3.961) | (3.960) | (3.956) | (3.954) | |

| _cons | −142.835 *** | −142.159 *** | −145.228 *** | −144.297 *** | −138.450 *** | −137.590 *** |

| (7.163) | (7.175) | (7.192) | (7.201) | (7.165) | (7.171) | |

| Firm controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year controls | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 4556 | 4556 | 4556 | 4556 | 4556 | 4556 |

| r2 | 0.105 | 0.106 | 0.107 | 0.108 | 0.109 | 0.110 |

| r2_a | 0.102 | 0.102 | 0.104 | 0.105 | 0.106 | 0.107 |

| F | 88.916 | 76.584 | 90.714 | 78.517 | 92.693 | 80.311 |

| (49) | (50) | (51) | (52) | (53) | (54) | |

|---|---|---|---|---|---|---|

| GI | GI | GI | GI | GI | GI | |

| L.Deg | 1837.490 *** | |||||

| (391.393) | ||||||

| L2.Deg | 1889.963 *** | |||||

| (443.736) | ||||||

| L.SH | 17.287 *** | |||||

| (3.253) | ||||||

| L2.SH | 18.751 *** | |||||

| (3.690) | ||||||

| L.Density | −17.568 *** | |||||

| (2.821) | ||||||

| L2.Density | −18.865 *** | |||||

| (3.184) | ||||||

| Fir | 16.192 *** | 17.915 *** | 16.240 *** | 17.990 *** | 16.321 *** | 18.090 *** |

| (0.732) | (0.838) | (0.732) | (0.836) | (0.731) | (0.835) | |

| Ind | 2.667 | 3.140 | 1.365 | 2.162 | −4.517 | −5.117 |

| (15.122) | (17.165) | (15.107) | (17.140) | (15.117) | (17.156) | |

| age | −0.289 * | −0.293 * | −0.292 * | −0.296 * | −0.278 * | −0.282 * |

| (0.150) | (0.171) | (0.149) | (0.171) | (0.149) | (0.171) | |

| ROA | 9.802 | 6.957 | 10.467 | 7.851 | 9.671 | 6.612 |

| (9.112) | (9.840) | (9.106) | (9.830) | (9.088) | (9.809) | |

| _cons | −353.676 *** | −392.929 *** | −359.682 *** | −400.452 *** | −340.571 *** | −379.725 *** |

| (17.118) | (19.577) | (17.212) | (19.682) | (17.033) | (19.501) | |

| Firm controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year controls | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 3218.000 | 2794.000 | 3218.000 | 2794.000 | 3218.000 | 2794.000 |

| r2 | 0.142 | 0.151 | 0.144 | 0.154 | 0.147 | 0.157 |

| r2_a | 0.141 | 0.150 | 0.142 | 0.152 | 0.145 | 0.155 |

| F | 106.435 | 99.527 | 107.872 | 101.328 | 110.310 | 103.502 |

| (55) | (56) | (57) | (58) | (59) | (60) | |

|---|---|---|---|---|---|---|

| First Stage | Second Stage | First Stage | Second Stage | First Stage | Second Stage | |

| VARIABLES | Degree | GI | SH | GI | Density | GI |

| Deg | 5785.6971 *** | |||||

| (1642.648) | ||||||

| SH | 50.9433 *** | |||||

| (13.779) | ||||||

| Density | −50.7925 *** | |||||

| (11.314) | ||||||

| avgDeg | 1.3790 *** | |||||

| (0.186) | ||||||

| avgSH | 0.6612 *** | |||||

| (0.099) | ||||||

| avgDen | 0.4715 *** | |||||

| (0.082) | ||||||

| FirmNum | 0.0000 *** | 0.0000 *** | −0.0000 *** | |||

| (0.000) | (0.000) | (0.000) | ||||

| Fir | 0.0001 *** | 12.4966 *** | 0.0047 | 12.6700 *** | −0.0002 | 12.8935 *** |

| (0.000) | (0.537) | (0.003) | (0.538) | (0.004) | (0.544) | |

| Ind | 0.0000 | 6.1380 | 0.0531 | 2.3059 | −0.3990 *** | −16.3756 |

| (0.001) | (11.462) | (0.070) | (11.553) | (0.081) | (12.581) | |

| age | −0.0000 *** | −0.0984 | −0.0030 *** | −0.1048 | 0.0038 *** | −0.0682 |

| (0.000) | (0.118) | (0.001) | (0.117) | (0.001) | (0.118) | |

| ROA | −0.0005 | 10.6552 | −0.0617 | 10.8329 | 0.0356 | 8.8091 |

| (0.000) | (7.159) | (0.043) | (7.198) | (0.050) | (7.216) | |

| Constant | −0.0023 *** | −287.3889 *** | 0.3737 *** | −304.8774 *** | 0.2567 ** | −247.6969 *** |

| (0.001) | (13.272) | (0.080) | (15.511) | (0.112) | (13.572) | |

| Observations | 4553 | 4553 | 4553 | 4553 | 4553 | 4553 |

| R-squared | 0.038 | 0.086 | 0.035 | 0.076 | 0.045 | 0.063 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Li, Z. How Do Core Management Team Network Ties Affect Green Innovation? Evidence from the Chinese ICT Industry. Sustainability 2025, 17, 3217. https://doi.org/10.3390/su17073217

Wang Y, Li Z. How Do Core Management Team Network Ties Affect Green Innovation? Evidence from the Chinese ICT Industry. Sustainability. 2025; 17(7):3217. https://doi.org/10.3390/su17073217

Chicago/Turabian StyleWang, Youxuan, and Zhuohang Li. 2025. "How Do Core Management Team Network Ties Affect Green Innovation? Evidence from the Chinese ICT Industry" Sustainability 17, no. 7: 3217. https://doi.org/10.3390/su17073217

APA StyleWang, Y., & Li, Z. (2025). How Do Core Management Team Network Ties Affect Green Innovation? Evidence from the Chinese ICT Industry. Sustainability, 17(7), 3217. https://doi.org/10.3390/su17073217