Abstract

Mitigating carbon emissions in the construction sector is crucial for attaining the objectives of “carbon peak” and “carbon neutrality”. This research utilizes panel data from 30 Chinese provinces spanning 2011 to 2020, employing a two-way fixed-effect model and a mediation-effect model to quantitatively assess the impact of digital industrialization (DI) on carbon emissions within this industry. The findings indicate that DI notably decreases carbon emissions; however, its effectiveness is structurally imbalanced. Digital services (DI-S) have a more pronounced effect on reducing emissions than digital technologies (DI-T). Notably, DI significantly lowers indirect carbon emissions but has a minimal positive impact on direct emissions in construction. Mediation analysis shows that DI greatly enhances green innovation capabilities (GIC) and green financial services (GFS), indirectly contributing to emission reductions, evidencing a full mediation effect. This process underscores the role of DI in promoting green technological innovation and financial development, thereby supporting the sector’s low-carbon transformation.

1. Introduction

In the context of global climate change, the world is witnessing a dramatic population expansion and rapid economic development, leading to an increase in greenhouse gas emissions, whose severe impacts are increasingly recognized by the public. In 2016, China was responsible for 28% of global carbon emissions, nearly twice that of the United States, positioning it as the leading global emitter [1]. Post-economic reforms, China’s swift industrialization and urbanization have driven the expansion of its construction industry, a fundamental component of the national economy [2]. This industry not only provides essential infrastructure for various sectors but also stands as a significant source of greenhouse gas emissions in China due to the energy consumed in producing building materials, as well as during construction and maintenance [3]. According to the China Building Energy Consumption Annual Report 2020, buildings’ lifecycle carbon emissions represent 51% of the nation’s total, highlighting a substantial potential for reduction [4]. In the 21st century, advancements in digital technologies such as the internet, artificial intelligence, and big data have profoundly influenced all sectors [5]. The digital economy, highlighted in China’s 14th Five-Year Plan and Vision 2035, plays a pivotal role in the nation’s strategy to achieve carbon neutrality, focusing on the digital economy, new energy, and innovation [6]. The recognition that digitalization is an optimal tool for promoting sustainable development has grown among governments and industries.

DI, which encompasses products, services, and economic activities based on digital information and technology, is vital in providing necessary services, infrastructure, and new production factors for the digital transformation of traditional industries [7,8]. This process encompasses the deep integration and application of digital technologies across industries, thereby driving the digital transformation of traditional industries. It spans multiple domains, including hardware manufacturing, such as chips and sensors; software development, like artificial intelligence, big data, and cloud computing; information services, including digital content and the platform economy; and digital infrastructure, such as smart terminals and communication base stations. Functionally, DI provides essential technical support and service assistance for the digital transformation of traditional industries. First, it reduces the barriers and costs of digital transformation for traditional industries by delivering efficient digital infrastructure and services. Second, DI fosters novel business models and formats, such as platforms and sharing economies, injecting new vitality into traditional industries. Finally, through developing and utilizing data resources, DI promotes the refinement of production, management, and marketing processes in traditional industries, thereby enhancing overall efficiency and competitiveness. The construction industry, known for its substantial energy consumption, is a focal point for DI-driven transformation. This study differentiates between the direct and indirect carbon emissions of the industry, where direct emissions (CEC-D) predominantly arise from energy consumption in buildings, and indirect emissions (CEC-I) derive from the manufacture and processing of building materials [9,10]. These emissions constitute the majority of the lifecycle carbon emissions in construction. By analyzing the effect of DI on these emissions and fostering the industry’s green transformation, the study aims to diminish the sector’s carbon footprint and contribute to achieving national goals of “carbon peak” and “carbon neutrality”.

For most enterprises, enhancing energy efficiency through digital elements remains the most effective strategy for sustainable development [11]. Research indicates that DI has a “spillover effect” on the real economy, particularly the construction industry [12,13]. Changes in production relationships have led to a decline in the economic share of the construction industry and other sectors with high labor productivity growth, a phenomenon known as “Baumol’s disease” [14]. The pervasive adoption and network externalities of digital solutions can significantly alleviate Baumol’s disease [15]. The spillover effects of DI can reduce production costs [16], enhance demand structures [17], and stimulate the high-quality development of the construction industry [18]. “The digital transformation of the construction industry” refers to a systematic reengineering of the entire lifecycle of construction projects, driven by the integration of digital technologies and service innovation. Through data integration, process optimization, and intelligent decision-making, it aims to achieve efficient resource allocation and precise control of energy consumption within the sector. As the digital transformation progresses, academic inquiry increasingly focuses on the empowering effects of digital technologies, such as the Internet of Things (IoT) and Building Information Modeling (BIM), on traditional construction practices. This research analyzes how these technologies enhance the capabilities of the construction industry [19]. Studies have demonstrated that BIM technology can optimize building energy management by predicting carbon emissions, energy consumption, and resource use at the project’s early stages through accurate design and simulation [20,21]. IoT technology enables real-time monitoring of building equipment operations, facilitating precise energy scheduling [22,23]. As global efforts to reach a “carbon peak” and “carbon neutrality” intensify, the construction sector, as a major carbon emitter, faces significant pressures and challenges [24]. The integration of digital technologies throughout the construction lifecycle has been shown to improve efficiency in design, construction, and management [25] and to reduce the costs associated with carbon emission reduction by optimizing resource use and minimizing material waste [26]. The diversity and complexity of carbon emission sources in the construction industry suggest substantial potential for further leveraging digital technologies to reduce emissions [27,28]. As a developing country, China’s construction industry began its digitalization process relatively late, hindered by low technology levels and funding shortages [29,30]. Reducing the costs of digital transformation [31], along with strengthening policy guidance and financing support [32,33], will be crucial in promoting the transformation of China’s construction industry toward low-carbon development. In summary, the relationship between digital transformation in the construction industry and carbon emissions involves a combination of technology-driven innovation, systemic synergy, and limitations related to scale. However, the current scalability of technological applications is hindered by regional disparities and bottlenecks in technology and capital, which require policy guidance and financial innovation to overcome cost barriers. At its core, digital transformation reduces carbon emissions in construction through two main approaches: precision intervention, such as data-driven optimization, and systematic reengineering, such as redesigning lifecycle processes. However, successfully implementing these strategies depends on lowering technological costs and fostering coordination among institutions, ultimately leading to significant breakthroughs in the industry’s transition to low-carbon practices.

While existing research extensively examines the role of digital technologies in advancing high-quality development and reducing carbon emissions in the construction industry (CEC), much of this literature focuses predominantly on the digital transformation processes within the sector. Specifically, they examine how digitalization optimizes carbon emissions within the construction sector, with fewer studies addressing the specific impacts and mechanisms of DI on reducing carbon emissions. This gap hinders current research from fully explaining how the development of the digital economy facilitates energy savings and emission reductions in the construction industry. The mediation-effect model, which analyzes how an explanatory variable influences an explained variable through a mediating variable, is suitable for exploring phenomena with complex, indirect mechanisms [34]. This study analyzes panel data from 30 Chinese provinces from 2011 to 2020, employing both the two-way fixed-effect model and the mediation-effect model to comprehensively evaluate how DI influences CEC through mediating variables, thereby revealing the underlying mechanisms that facilitate emission reductions via DI. This analysis aims to offer theoretical support for policy formulation and implementation.

Besides the introduction, the paper is structured into four sections. Section 2 constructs a framework to explore the potential connections between DI, GIC, GFS, and CEC. Section 3 details the employed models, the criteria for variable selection, and the origins of the data used. In Section 4, the impact of DI on carbon emissions is dissected, with a particular focus on the mediating roles of GIC and GFS, utilizing both aforementioned models. Section 5 reflects on the interrelationships and causal dynamics between DI and carbon emissions in the construction sector, underscoring the relevance of this study to strategies for carbon emission reduction.

2. Conceptual Framework and Research Hypotheses

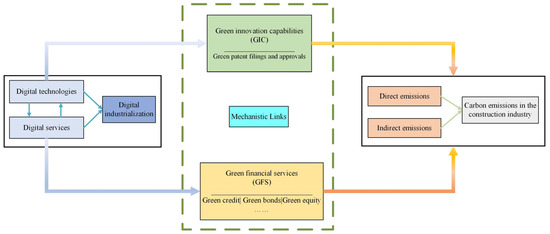

The conceptual framework depicted in Figure 1 outlines the potential impact pathways through which DI affects CEC via green innovation capabilities (GIC) and green financial services (GFS).

Figure 1.

Conceptual framework for the potential pathways.

DI-T and DI-S together constitute the core features of DI.

DI entails the integration of digital technologies, services, and solutions to transform traditional industries. It encompasses all economic activities reliant on digital elements [7]. Based on differences in functional attributes and pathways of influence, this study categorizes DI into two complementary dimensions: digital services (DI-S) and digital technologies (DI-T). DI-S activities derived from digital elements reduce resource waste in the construction industry and optimize carbon footprint management in upstream supply chains by integrating supply chain and financial resources. DI-T provides technical support and minimizes energy and material consumption throughout buildings’ lifecycle through optimized construction processes and energy-efficient designs. These two dimensions offer distinct digital driving forces for low-carbon transformation in the construction industry through respective technological and service empowerment pathways. Therefore, based on the above analysis, this study puts forward the following hypothesis:

Hypothesis 1.

DI has a significant negative impact on CEC.

The development of DI promotes the advancement of GIC and GFS through the widespread adoption of DI-T and DI-S.

GIC is defined as the capacity for technological innovation aimed at supporting low-carbon, environmentally friendly, and sustainable development [35]. This research predominantly showcases capabilities through the development, research, and implementation of green technologies, products, and processes, as evidenced by metrics such as green patent applications and authorizations [36]. The advancement of DI has facilitated the widespread adoption of cutting-edge DI-T and services in traditional sectors, enhancing the R&D process for green technologies. Utilizing capabilities like information sharing, data integration, and real-time interaction [37], DI empowers firms to address challenges in energy efficiency and environmental impacts effectively [38], promoting the development and market adaptation of green technologies [39]. The term “GFS” refers to financial tools and services that support low-carbon, environmentally friendly, and sustainable development [40], encompassing various forms such as green credit, green bonds, and carbon trading [41,42]. DI introduces tools like blockchain and big data analysis, which provide precise data and decision-making support to financial institutions [43,44]. This technological support boosts the awareness and confidence of financial institutions in green projects, driving the innovation of green financial products and services [45] and drawing more investment into projects aimed at energy conservation, emission reduction, and sustainable development. The robust integration of digital elements and the cost-effectiveness of digital platforms facilitate the efficient pooling of financial resources, providing tailored financial solutions for the greening and low-carbon transformation of the real economy and supporting the implementation and application of green technologies [46]. Based on the above analysis, this study puts forward the following hypothesis:

Hypothesis 2.

DI has a significant positive impact on GIC and GFS.

Enhanced GIC and the evolution of GFS play critical roles in reducing carbon emissions within the construction industry.

The enhancement of green innovation capacity introduces efficient energy technologies, environmentally friendly building materials, and intelligent management systems to the construction sector [47,48], reducing the reliance on fossil fuels and thereby optimizing the carbon emissions throughout the entire lifecycle of buildings [49]. Green finance lowers the cost of financing for companies by providing financial support and incentives for low-carbon building projects, encourages the use of environmentally friendly materials and energy-saving technologies [50,51,52], and supports the construction industry in implementing more sustainable construction and maintenance practices across the building lifecycle, thus facilitating the industry’s shift toward greener and decarbonized practices [53]. Based on the above analysis, this study puts forward the following hypothesis:

Hypothesis 3.

DI can indirectly suppress CEC by enhancing GIC and GFS.

CEC includes direct emissions from energy use during construction activities and indirect emissions from the manufacture and processing of building materials [9,10]. Achieving carbon emission reduction targets in this sector requires a holistic approach, encompassing energy mix optimization, reduced energy consumption during construction phases, and the adoption of eco-friendly building materials to minimize waste [54]. Given the cross-sectoral nature of carbon emission reduction in construction [55], it is reliant on the synergistic progress of green technology and financial backing for environmental protection [48,50,51]. DI not only enhances GIC but also supports the development of GFS, offering an indirect route to address the technological and financial challenges in reducing carbon emissions within the construction industry.

3. Materials and Methods

3.1. Model

3.1.1. Calculation Model of CEC

The complexity of CEC stems from its lifecycle, which encompasses multiple stages such as building material production, construction, and operational maintenance. This complexity also poses challenges for carbon emission accounting in the sector. This study categorizes construction industry carbon emissions into direct and indirect emissions based on their sources. In this study, CEC-D refers to CO2 generated from directly consuming energy sources such as diesel, gasoline, and raw coal during construction activities. CEC-I refers to CO2 produced during the manufacturing and processing of key building materials such as steel and cement for construction, covering upstream carbon emission sources in the construction supply chain. This classification method helps to identify hidden sources of emissions while simplifying the accounting process.

This study calculates CEC-D using an energy-based method that estimates emissions based on fuel consumption. This approach references the net calorific value (NCV) and carbon content (CC) of various fuels from the research conducted by Shan et al. [56] and the oxidation rate (O) data from the “2006 IPCC Guidelines for National Greenhouse Gas Inventories (2019 Refinement)” [57]. The formula used is as follows:

In Equation (1), CEC-D represents the direct carbon emissions in the construction industry; Ei is the consumption of fuels i (pre-conversion physical quantity); NCVi is the net calorific value of fuels i; CCi is the carbon content of energy i; Oi represents the oxidation rate of fuels i; f is the ratio of the mass of carbon dioxide to the mass of carbon, valued at 44/12. The net calorific values, carbon contents, and oxidation rates of various fuels are detailed in Table 1.

Table 1.

Net calorific value, carbon content, and oxidation rate coefficients for various types of fuels.

This study calculates CEC-I by employing the sectoral greenhouse gas emission structures researched by Ji et al. [58] and the calculation methods developed by Ma [59]. Five principal building materials in the construction industry—steel, wood, cement, glass, and aluminum—are considered. The carbon dioxide emissions produced during the manufacturing and processing of these materials are categorized as CEC-I. Notably, as inherently recyclable materials, steel and aluminum have their emissions calculated using the recycling coefficient method, yielding more realistic and precise emission estimates. The formula is as follows:

In Equation (2), CEC-I signifies the indirect carbon emissions in the construction industry; Mj denotes the consumption of material j; Vj represents the carbon emission coefficient of material j; Kj represents the recycling utilization coefficient of material j. The carbon emission coefficients and recycling utilization coefficients of various materials are itemized in Table 2.

Table 2.

Carbon emission and recycling utilization coefficients of various materials.

In Equation (3), CEC comprises both CEC-D and CEC-I:

3.1.2. Two-Way Fixed-Effect Regression Model

To assess the impact of DI on CEC, with CEC as the explained variable and DI as the explanatory variable, a two-way fixed-effect (TWFE) model incorporating individual (provincial) and temporal (yearly) effects is employed. Unobservable provincial and temporal characteristics in the panel data may confound the relationship between DI and CEC. By incorporating provincial and time-fixed effects, the model mitigates omitted variable bias caused by inherent provincial differences such as energy structures, policy traditions, and global temporal shocks such as macroeconomic fluctuations.

The model is expressed as follows:

In Equation (4), CECit is the explained variable, representing the carbon emissions from the construction industry in province i in year t. DIit is the explanatory variable, representing the level of DI in province i in year t. α0 is the constant term, and α1 represents the impact of DI on promoting carbon emission reduction in the construction industry. Controlit includes the control variables. ωi denotes the provincial fixed effects. γt represents the time-fixed effects. εit represents the random error term.

Subsequent analyses further validate the superiority of the TWFE model over Ordinary Least Squares (OLS) and Random Effect (RE) models through BP-LM and Hausman tests. Additionally, the instrumental variable (IV) method is introduced to address endogeneity issues, ensuring the robustness of the estimation results. This approach enables the precise identification of the net effect of DI on carbon emissions in the construction industry.

3.1.3. Mediation-Effect Model

The mediation-effect model analyzes how one variable influences another through mediators. It is beneficial for exploring complex phenomena that operate indirectly through these mediating variables [34]. This study constructs a mediation-effect model to examine the transmission pathways of GIC and GFS and reveal the mechanism through which DI affects CEC. Using the three-step method proposed by Wen and Ye [65], the model first verifies the total effect of DI on CEC, then analyzes its impact on the mediating variables (GIC and GFS), and finally examines the changes in effects after incorporating the mediating variables. Building on Equation (1), the mediation-effect model is constructed as follows:

In Equation (5), MEDit represents the mediating variable. β0 is the constant term, and β1 represents the impact of DI on the mediating variable.

In Equation (6), δ0 is the constant term. δ1 quantifies the influence of DI on carbon emission reduction in the construction industry, considering the mediating variable. δk (k = 2, 3) measure the impact of GIC and GFS on reducing CEC, respectively.

3.2. Variable Selection

3.2.1. Explained Variable

In this research, carbon emissions from the construction industry serve as the explained variable. These emissions comprehensively include all emissions related to construction activities, such as the production of building materials, transportation, the construction process itself, operational phases of buildings, demolition, and the transportation of waste. As shown in Table 3, carbon emissions from the construction industry comprise both direct emissions from the energy consumption of construction activities and indirect emissions from the consumption of building materials [24]. Specifically, direct CEC refers to the carbon dioxide produced by the direct consumption of energy sources such as diesel, gasoline, and raw coal, while indirect emissions are generated during the production and processing of the five principal building materials, such as cement and steel [9,10]. The total carbon emissions from the construction industry thus encompass both these direct and indirect sources.

Table 3.

Structure of CEC.

3.2.2. Explanatory Variable

The explanatory variable under study is DI. To evaluate DI’s impact on the construction industry’s carbon emissions effectively, this study utilizes criteria from the Classification of China’s Digital Economy and its Core Industries (2021), ratified by the National Bureau of Statistics (NBS) in its 10th executive meeting on 14 May 2021 [66]. DI encompasses the application of DI-T, products, services, infrastructure, and digital solutions across various sectors [7], signifying all economic activities that depend on digital components [8]. As shown in Table 4, two primary indicators were selected to characterize DI: DI-S and DI-T. Six secondary indicators represent DI-S: per capita telecommunications service volume, mobile phone penetration rate, proportion of internet users to the resident population, mobile phone base station density, e-commerce transaction volume, and proportion of enterprises engaged in e-commerce transactions. DI-T is quantitatively assessed using four secondary indicators: revenue from the electronic information manufacturing industry, the number of enterprises in this sector, revenue generated from software services, and employment figures in the information transmission, software, and information technology services sector. The entropy method is utilized to derive a comprehensive evaluation of DI from these indicators.

Table 4.

Indicator system for DI.

3.2.3. Mediating Variables

To examine the pathway through which DI promotes carbon emission reductions in the construction industry, as summarized in Table 5, this study selects two mediating variables: GIC and GFS.

Table 5.

Indicator system for mediating variables.

Drawing from Song et al.’s research [67] on green innovation capacity and their construction of an indicator system, green innovation capacity in this study is represented by two primary indicators: green patent applications and green patent authorizations. For green patent applications, the indicators include the number of green invention patent applications, the number of green utility model patent applications, and the aggregate number of green patent applications. In the context of green patent authorizations, the breakdown includes the number of green invention patent authorizations, the number of green utility model patent authorizations, and the total number of green patent authorizations. The entropy value method is employed to conduct a thorough assessment of GIC using this intermediary variable index system.

Synthesizing the construction of a green financial indicator system by Wang et al. [68], Liu, and He [69], the GFS in this study are structured around seven primary indicators, each with corresponding secondary indicators. GFS is evaluated through several indicators: green credit, represented by the ratio of environmental protection project credits to total credits within the province; green investment, measured by the investment ratio in environmental pollution control to GDP; green insurance, quantified by the share of environmental pollution liability insurance income relative to total premium income; green bonds, indicated by the proportion of green bond issuances to total bond issuances; green support, defined as the fiscal environmental protection expenditure’s proportion to the general budgetary expenditure; green funds, measured by the market value ratio of green funds to total funds; and green equity, which includes the proportion of transactions in carbon trading, energy rights trading, and emission rights trading within the total equity market. Utilizing the entropy value method with this indicator system, a comprehensive evaluation of GFS is conducted.

3.2.4. Control Variables

To comprehensively analyze the impact of DI on carbon emission reduction in the construction industry, it is essential to select control variables that may influence carbon emissions. Economic development and urbanization levels, which reflect regional prosperity, have been shown to significantly affect the construction industry’s growth [70] and, consequently, its carbon emissions [71]. Industrial economic output and the level of industrialization form the backbone of the modern construction industry and significantly influence both the development of the industry and its carbon emission efficiency [72]. Governmental efforts in environmental protection and technological advancement reflect the degree of policy intervention in these areas, affecting the level of environmental protection technology in construction projects [73,74]. Additionally, investment intensity in the real estate industry indicates the sector’s prosperity and has a considerable impact on the construction industry’s carbon emissions [75]. The control variables described above are detailed in Table 6.

Table 6.

Control variables.

3.3. Research Region and Data Sources

The statistical data for the DI-related indicators in this study cover the period from 2011 to 2020. Due to limitations in data completeness and availability, data from regions including Hong Kong, Macau, Taiwan, and Tibet were excluded. Statistical data encompassing 30 provinces (including autonomous regions and municipalities directly under the central government) were employed, yielding 300 balanced provincial-level panel observations. Descriptive statistics for key variables are detailed in Table 7.

Table 7.

Descriptive statistics for key variables.

The data used in this study are categorized into four main parts:

- (1)

- Explanatory variables (DI): These indicators were derived from the “China Statistical Yearbook [76]”, “ China Statistical Yearbook of the Tertiary Industry [77]”, and the “Yearbook of China Information Industry [78]”.

- (2)

- Dependent variable (construction industry carbon emissions): This variable incorporates data on various types of energy consumption from the “China Energy Statistical Yearbook [79]” and information on consumption of different building materials from the “China Statistical Yearbook on Construction [80]”. The coefficients for carbon emissions and recycling rates for these materials were determined through a comprehensive review of relevant literature [60,61,62,63,64].

- (3)

- Mediating variables (GIC and GFS): Data on GIC were obtained from the China National Research Data Services Platform (CNRDS), while information on GFS was gathered from the “China Statistical Yearbook of Science and Technology [81]”, “Almanac of China’s Finance and Banking [82]”, and “China Third Industry Statistical Yearbook”.

- (4)

- Other variable data: These data were sourced from the “China Statistical Yearbook”, “China Industry Statistical Yearbook [83]”, and “China Statistical Yearbook on Construction”.

To ensure uniform data dimensions, variables related to quantities and amounts in the other variables section were logarithmically transformed (for indicators measured in currency, the GDP deflator was first used for adjustment). Ratio variables retained their original form. For missing data, supplementary information was obtained from other sources, or interpolation methods were employed where appropriate for data imputation.

4. Results

4.1. Temporal Evolutionary Pattern of DI and CEC

4.1.1. Temporal Evolution of DI and CEC

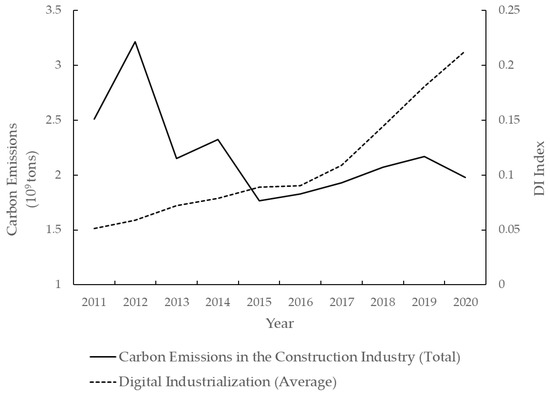

Figure 2 displays the trend of China’s DI and carbon emissions from the construction industry from 2011 to 2020 using a line graph. The graph shows that while the overall level of China’s DI was initially modest, it exhibited continuous growth, averaging an annual increase of approximately 18%. The growth rate accelerated from 2016 to 2020 after a slower period from 2011 to 2016. Concurrently, carbon emissions from China’s construction industry demonstrated a fluctuating decline, averaging an annual decrease of about 2%. Notably, carbon emissions declined significantly from 2012 to 2015 and rebounded slightly from 2015 to 2019. Based on these observations, this paper suggests that enhancing DI levels may be a significant factor in reducing carbon emissions from the construction industry.

Figure 2.

Trends of CEC and DI in China.

4.1.2. Spatial Distribution Characteristics of DI and Carbon Emission in the Construction Industry

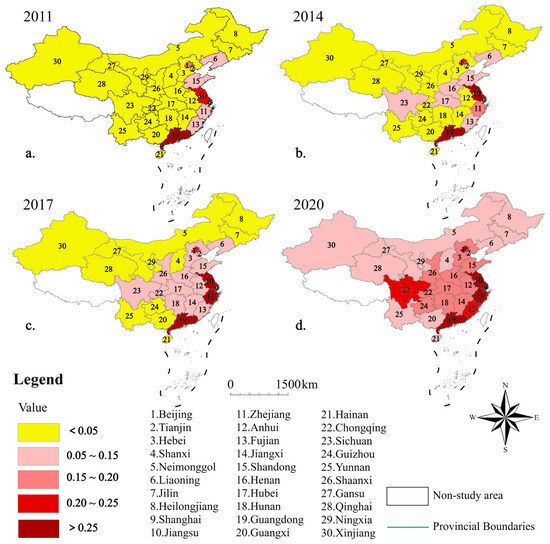

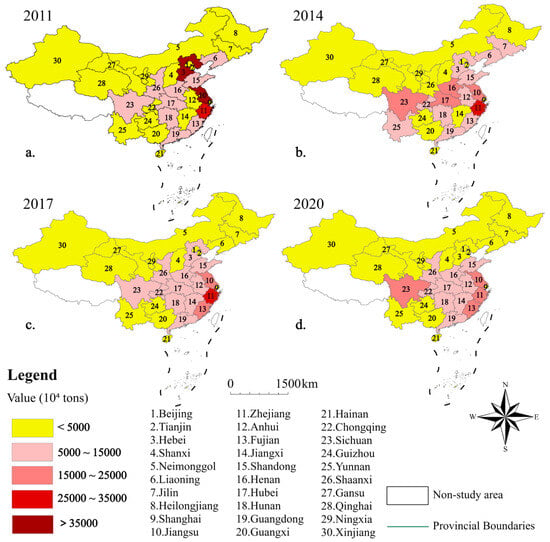

This study examines the spatial distribution characteristics of DI and carbon emissions from the construction industry on a provincial scale in China, visualized using ArcGIS 10.7 software (Figure 3 and Figure 4). As shown in Figure 3, from 2011 to 2020, the level of DI in China continuously improved, with the spatial pattern expanding progressively from the southeastern coast to the northwestern inland. The development of DI was spatially unbalanced, with southeastern coastal provinces consistently leading, central provinces catching up with the eastern region, and northeastern and northwestern provinces lagging. By 2020, this spatial imbalance had lessened, as evidenced by the expansion of high-value regions and contraction of low-value regions, indicating nationwide diffusion and gradient enhancement of DI. Figure 4 reveals that the spatial pattern of carbon emissions from China’s construction industry from 2011 to 2020 exhibited clear regional differences and dynamic changes. Carbon emissions were predominantly concentrated in the eastern coastal and central core provinces, while emissions in the western and northeastern provinces were relatively low. Over the decade, carbon emissions generally declined, with significant reductions in high-emission areas and fluctuating emissions in some central provinces. Comparing the spatial characteristics of DI and construction carbon emissions at the provincial scale in China reveals a notable trend: provinces with higher levels of DI experienced significant reductions in construction carbon emissions, demonstrating a negative spatial correlation between the development of DI and the level of construction carbon emissions.

Figure 3.

Spatial–temporal evolution pattern of DI in China.

Figure 4.

Spatial–temporal evolution of CEC in China.

4.2. The Mechanism of DI Promoting Carbon Emission Reduction in the Construction Industry

4.2.1. Baseline Regression

This study initially compared the results of the Ordinary Least Squares (OLS), Random Effects (RE), Fixed Effects (FE), and two-way fixed-effect (TWFE) models to validate the appropriateness of the chosen model. The results are shown in Table 8.

Table 8.

Baseline regression results under different models.

The BP-LM test was conducted to compare the OLS model with the RE model, indicating that at a significance level of p < 0.001, the OLS model failed to effectively control for inter-group random effects, leading to its rejection. The Hausman test, contrasting the RE model with the FE model and indicating a significant p < 0.001, highlighted endogeneity concerns within the RE model, leading to its rejection. Subsequently, a TWFE model was developed, integrating fixed effects at the provincial level and time effects to manage cross-provincial heterogeneity and negate unobserved standard shocks and systematic biases across the temporal axis. This adjustment significantly enhanced the robustness and explanatory capacity of the estimation results. The regression outcomes of the TWFE model aligned with those of the FE model in terms of significance and the direction of effects, confirming the appropriateness of the model selection for this analysis.

Further assessments based on the baseline regression outcomes from the TWFE model examined the influence of DI on CEC. The model estimated that DI’s impact on reducing CEC was significant, with a coefficient of −1.570 at the 5% significance level, indicating that DI effectively reduces carbon emissions in this sector. Thus, Hypothesis 1 is verified.

4.2.2. Structural Effects Analysis

This study’s evaluation system for DI includes two dimensions: DI-S and DI-T. The carbon emission indicators encompass both direct and indirect CEC. Based on these indicators, the study explores the structural effects of DI on carbon emissions. Model (1) in Table 9 presents the baseline regression results, while Models (2) and (3) analyze the impact of DI-S and DI-T, respectively, on carbon emissions. Models (4) and (5) assess the effects of DI on direct and indirect carbon emissions, respectively. The findings indicate that DI-S significantly reduces carbon emissions, whereas DI-T has a non-significant negative impact. Additionally, DI shows a non-significant positive impact on direct carbon emissions and a significant negative impact on indirect carbon emissions.

Table 9.

Results of the structural effects test.

4.2.3. Mediation Effects Analysis

Regression analysis based on the mediated-effect model, with the results displayed in Table 10, examines the influence of DI on GIC and GFS and their subsequent effects on CEC. Model (1) outlines the baseline regression results, Model (2) details the impact of DI on GIC, and Model (3) assesses the combined effects of DI and GIC on carbon emissions. Models (4) and (5) follow a similar structure for GFS. The results demonstrate that DI significantly boosts both GIC and GFS. Therefore, Hypothesis 2 is valid. In Models (4) and (5), while the direct impact of DI on carbon emissions becomes non-significant, both GIC and GFS significantly decrease carbon emissions, suggesting a complete mediation effect of DI on carbon emissions through GIC and GFS as mediating variables. Therefore, Hypothesis 3 is established.

Table 10.

Results of the mediation-effect test.

4.2.4. Robustness Test

Given the potential presence of outliers in panel data—such as abnormal fluctuations in DI levels or extreme values in CEC across certain provinces/years—this paper employs two methods to verify the robustness of the results: applying 1% winsorization to the variables and shortening the research period. Initially, all variables underwent 1% winsorization to remove extreme outliers, with the regression results presented in Table 11, Model (2). Subsequently, data from the periods 2013–2020 and 2011–2018 were extracted and subjected to regression analysis separately, with the results displayed in Table 11, Models (3)–(4). According to the regression outcomes shown in Table 11, the core explanatory variable’s estimated coefficient in Model (2) is positively significant at the 5% level, demonstrating an increase in effect size compared to the baseline regression without altering its significance, which aligns with expectations after removing extreme outliers, thus confirming that these outliers do not drive the observed relationships. As shown in Models (3)–(4) of Table 11, the regression results for the 2013–2020 and 2011–2018 subsamples demonstrate statistically significant coefficients at the 5% and 10% levels, respectively, with consistent effect directions, confirming the robustness of our findings. This design explicitly tests the sensitivity of conclusions to policy environments and external shocks. The 2013–2020 subsample covers the late phase of China’s 12th Five-Year Plan through the 13th Five-Year Plan period when the government vigorously implemented the “Internet Plus” strategy and carbon emission trading pilots. This interval validates the resulting robustness during intensive policy intervention. The 2011–2018 subsample excludes abnormal disruptions to the construction industry from the COVID-19 outbreak in late 2019, such as construction halts and supply chain breakdowns. The test results of both models are statistically significant, with effect directions consistent with the baseline model, demonstrating that the suppressive effect of DI on CEC remains robust against disturbances from period-specific policies or economic fluctuations.

Table 11.

Results of the robustness test.

To address potential endogeneity issues with DI as an explanatory variable, this study introduces the instrumental variable (IV) method for re-evaluation. In alignment with established practices in the literature [84,85], this study employs DI lagged by one period as an instrumental variable, using the two-stage least squares method for analysis. Diagnostic tests for this instrumental variable regression confirm robust model identification and the validity of the instrumental variables. Notably, the Kleibergen–Paap rk LM statistic is significantly high at 10.376 with a p-value of 0.0013, indicating no under-identification issues. Furthermore, the strength of the instrumental variables is substantiated by a Kleibergen–Paap rk Wald F statistic of 1191.313, which substantially surpasses the Stock–Yogo weak identification test threshold of 16.38 at the 10% level, thereby ruling out any weak identification concerns. The regression results presented in Table 11, Model (5), confirm that DI’s impact on carbon emissions remains significantly negative at the 10% level. These tests collectively affirm the rationale behind selecting DI lagged by one period as an instrumental variable.

The robustness of this study’s findings across varying time periods and model specifications demonstrates that DI constitutes a sustainable pathway for promoting carbon emission reductions in the construction industry, rather than being a product of short-term fluctuations or data noise.

5. Discussion and Conclusions

5.1. The Impact of DI on CEC

This study rigorously analyzes the structural effects and mechanisms through which DI influences carbon emission reduction in the construction industry, using panel data from 30 provinces in China from 2011 to 2020. As illustrated in Table 8, regression outcomes from the OLS, RE, FE, and TWFE models consistently show a significant negative impact of DI on carbon emissions. Specifically, in the TWFE model, after adjusting for provincial and temporal effects, DI’s influence on carbon emissions is quantified at −1.570, significant at the 5% level, validating the substantial role of DI in mitigating carbon emissions in this sector.

Further analysis explores the impacts of the two primary components of DI—DI-S and DI-T—on carbon emissions, differentiating between their effects on direct and indirect emissions. According to Table 9, the impacts of DI-S and DI-T on carbon emissions are quantified at −1.429 and −1.115, respectively, with the impact of DI-S being significant at the 5% level. This suggests that DI-S, which directly enhances operational management and information sharing within the construction industry and facilitates the investment of green technology and capital [86,87], is more crucial in reducing carbon emissions than DI-T. This finding contradicts the intuition that “technology-driven emission reduction” should dominate. DI-S can rapidly reduce transaction costs, facilitating resource integration and low-carbon decision-making in the construction industry while accelerating green technology diffusion. In contrast, DI-T requires alignment with construction-specific technical standards and industry norms and complementary technical training and equipment upgrades to drive CEC reduction effectively. Therefore, governments should prioritize support for developing digital service platforms in construction to enhance the role of DI-S in resource allocation. Simultaneously, they should strengthen tax incentives and technology subsidies for DI-T applications, using policy tools to shorten technology adoption cycles. Also presented in Table 9, the estimated impact of DI on indirect carbon emissions is −1.571, which is significant at the 10% level. In contrast, its effect on direct carbon emissions is insignificant and slightly positive. This indicates that the predominant negative impact of DI on carbon emissions primarily concerns the reduction in indirect emissions, which are sourced mainly from the production and manufacturing of building materials. Indirect carbon emissions account for a much larger share of CEC than direct carbon emissions. This result aligns with the conclusions drawn from the life cycle theory and process analysis cited by Zhang and Wang [88]. In contrast, direct emissions, which arise from various energy consumption by the construction sector, are more affected by regional energy consumption patterns and economic conditions [9,10]. The production of building materials involves multiple industries and supply chains, offering more significant potential and feasibility for emission reductions through innovations in environmental technology, the optimization of resource allocation, and enhanced supply chain management compared to the reduction in direct emissions [24].

5.2. The Mechanism of DI on CEC: The Mediating Role of GIC and GFS

Mediation analysis examines the roles of GIC and GFS as mediators in the relationship between DI and CEC. As detailed in Models (2) and (4) of Table 10, the findings show that DI’s estimated coefficients on GIC and GFS are 1.104 and 0.316, respectively, both significant at the 1% level, demonstrating that DI significantly enhances GIC and GFS. However, when these mediators are introduced in Models (3) and (5), DI’s direct impact on carbon emissions becomes non-significant, with GIC and GFS’ coefficients on carbon emissions at −1.362 and −1.239, respectively, both significant at the 5% level. This indicates that GIC and GFS fully mediate DI’s effect on reducing CEC. In essence, DI indirectly reduces carbon emissions by enhancing GIC and GFS. The advancement of DI, marked by the proliferation of DI-T and services, has been shown to optimize enterprise technology R&D processes, enhance cross-enterprise and cross-industry collaboration [37], and facilitate the sharing and market transformation of green patented technologies [38,39]. The widespread adoption of DI-S also expands financing channels for green projects, reduces transaction costs, and increases the transparency and traceability of green investments, thereby advancing the maturity of the green financial market [44,45]. The enhancements in GIC provide a technical foundation for energy conservation and emission reduction across the construction industry and related sectors [89]. Concurrently, the expansion of green finance provides essential financial support for adopting low-carbon technologies and promoting green building practices [46]. DI must leverage a synergistic “technology-capital” pathway to promote the reduction in CEC. GIC and GFS thus act as both a ‘bridge’ and a ‘catalyst’ in DI’s role in reducing CEC.

5.3. Impact on Carbon Emission Reduction in the Construction Industry

- 1.

- The findings underscore that DI significantly curtails carbon emissions in the construction sector, suggesting that construction enterprises should leverage the rapid development of the digital economy to advance the digitalization of carbon emission management in this industry. For example, construction enterprises can adopt Building Information Modeling (BIM) to optimize project planning and resource allocation, thereby reducing material waste during construction. Building material manufacturers may utilize Internet of Things (IoT) sensors to monitor and optimize production processes, minimizing carbon emissions derived from fossil energy consumption.

- 2.

- DI-S has a more pronounced role in reducing carbon emissions. The impact of DI-T on carbon emissions is less marked, likely due to the underutilized potential of DI-T in the construction processes [27,28,90]. The government should continue to guide the advanced DI-T in carbon emission management to unlock its carbon reduction potential gradually. The government should continue to promote the deep integration of emerging DI-T in carbon emission management within the construction industry, unlocking their potential for reducing emissions. Construction enterprises can collaborate with digital service providers to develop customized solutions, such as AI-based carbon emission monitoring systems. Building material manufacturers can leverage blockchain technology to monitor energy consumption and carbon emissions during production, thus enhancing carbon footprint management in the construction industry.

- 3.

- This study concludes that bolstering the digital infrastructure and enhancing DI-T and service platforms are imperative. The government should create special funds to support the research and development of green technologies, promoting the adoption of green patented technologies in construction. Simultaneously, the government should utilize financial instruments like green loans and bonds to support the low-carbon transition in the construction industry. Strengthening the digital oversight of green financial services to minimize financial risks is also essential [91]. For construction enterprises, this means actively pursuing green financing and innovating sustainable materials and construction technologies to tackle challenges related to carbon emission management. Additionally, they should enhance digital skills training for industry professionals and actively implement AI systems to improve efficiency in managing carbon emissions and optimizing resources throughout all stages of operation.

Author Contributions

Conceptualization, Y.-L.L. and J.-R.Z.; methodology, Y.-L.L.; software, J.-R.Z.; formal analysis, Y.-L.L.; resources, J.-R.Z. and H.-B.L.; writing—original draft preparation, Y.-L.L. and J.-R.Z.; writing—review and editing, J.-R.Z. and H.-B.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research is funded by the National Natural Science Foundation of China, grant number 41871179.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets used or analyzed during the current study are available from the corresponding author on reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| DI | Digital industrialization |

| DI-S | Digital services |

| DI-T | Digital technologies |

| CEC | Carbon emissions in the construction industry |

| CEC-D | Direct carbon emissions in the construction industry |

| CEC-I | Indirect carbon emissions in the construction industry |

| GIC | Green innovation capabilities |

| GFS | Green financial services |

| EDL | Economic development levels |

| IEO | Industrial economic output |

| GEP | Governmental efforts in environmental protection |

| GTA | Governmental efforts in technological advancement |

| IRE | Investment intensity in the real estate industry |

| URB | Urbanization levels |

| IND | Industrialization levels |

References

- Li, J.F.; Ma, Z.Y.; Zhang, Y.X.; Wen, Z.C. Analysis on energy demand and CO2 emissions in China following the Energy Production and Consumption Revolution Strategy and China Dream target. Adv. Clim. Change Res. 2018, 1, 16–26. [Google Scholar] [CrossRef]

- Zhang, X.; Skitmore, M.; Peng, Y. Exploring the challenges to industrialized residential building in China. Habitat Int. 2014, 41, 176–184. [Google Scholar] [CrossRef]

- Du, Q.; Zhou, J.; Pan, T.; Sun, Q.; Wu, M. Relationship of carbon emissions and economic growth in China’s construction industry. J. Clean. Prod. 2019, 220, 99–109. [Google Scholar] [CrossRef]

- China Association of Building Energy Efficiency, News, China Building Energy Consumption Annual Report 2020#3. 2021. Available online: https://cabee.org/site/content/24020.html (accessed on 27 October 2024).

- Yang, Y.; Pan, H. The Digital Economy’s Impact on the High-Quality Development of the Manufacturing Industry in China’s Yangtze River Economic Belt. Sustainability 2024, 16, 6480. [Google Scholar] [CrossRef]

- The National People’s Congress of the People’s Republic of China. Outline of the 14th Five-Year Plan (2021–2025) for National Economic and Social Development and Vision 2035 of the People’s Republic of China #5&11. 2021. Available online: http://www.npc.gov.cn/npc/c2/kgfb/202103/t20210313_310753.html (accessed on 21 October 2024).

- Zhang, Y.J.; Du, M. Greening through digitalisation? Evidence from cities in China. Reg. Stud. 2023, 7, 2215824. [Google Scholar] [CrossRef]

- Andreoni, A.; Chang, H.J.; Labrunie, M. Natura Non Facit Saltus: Challenges and Opportunities for Digital Industrialisation Across Developing Countries. Eur. J. Dev. Res. 2021, 33, 330–370. [Google Scholar] [CrossRef]

- Qi, Y.; Xia, Y. Research on Accounting and Transfer Pathways of Embodied Carbon Emissions from Construction Industry in China. Sustainability 2022, 14, 15165. [Google Scholar] [CrossRef]

- Yuan, Y.X.; Qu, M.; Li, Q.; Umer, M. Analysis of the non-equilibrium and evolutionary driving forces of carbon emissions in China’s construction industry. J. Build. Eng. 2024, 97, 110834. [Google Scholar]

- Deng, H.; Bai, G.; Shen, Z.; Xia, L. Digital economy and its spatial effect on green productivity gains in manufacturing: Evidence from China. J. Clean. Prod. 2022, 378, 134539. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. Automation and New Tasks: How Technology Displaces and Reinstates Labor. J. Econ. Perspect. 2019, 33, 3–29. [Google Scholar] [CrossRef]

- Agrawal, A.; Gans, J.; Goldfarb, A. Economic Policy for Artificial Intelligence. Innov. Policy Econ. 2019, 19, 139–159. [Google Scholar]

- Hartwig, J. What drives health care expenditure? Baumol’s model of ‘unbalanced growth’ revisited. J. Health Econ. 2008, 27, 603–623. [Google Scholar] [PubMed]

- Lindstedt, C.; Naurin, D. Transparency is not Enough: Making Transparency Effective in Reducing Corruption. Int. Polit. Sci. Rev. 2010, 31, 301–322. [Google Scholar]

- Acemoglu, D.; Restrepo, P. Robots and Jobs: Evidence from US Labor Markets. J. Polit. Econ. 2020, 128, 2188–2244. [Google Scholar]

- Zhang, W.; Zhao, S.; Wan, X.; Yao, Y. Study on the effect of digital economy on high-quality economic development in China. PLoS ONE 2021, 16, e0257365. [Google Scholar]

- Musarat, M.A.; Sadiq, A.; Alaloul, W.S.; Wahab, M.M.A. A Systematic Review on Enhancement in Quality of Life through Digitalization in the Construction Industry. Sustainability 2023, 15, 0202. [Google Scholar]

- Timchuk, O.G.; Evloeva, M.V. Difficulties in transforming the construction industry under the digital economy. IOP Conf. Ser. Mater. Sci. Eng. 2020, 880, 012082. [Google Scholar]

- Pereira, V.; Santos, J.; Leite, F.; Escórcio, P. Using BIM to improve building energy efficiency—A scientometric and systematic review. Energy Build. 2021, 250, 111292. [Google Scholar]

- Chen, C.J.; Chen, S.Y.; Li, S.H.; Chiu, H.T. Green BIM-based building energy performance analysis. Comput. Aided Des. Appl. 2017, 14, 650–660. [Google Scholar]

- Ghosh, A.; Edwards, D.J.; Hosseini, M.R. Patterns and trends in Internet of Things (IoT) research: Future applications in the construction industry. Eng. Constr. Archit. Manag. 2021, 28, 457–481. [Google Scholar]

- Khurshid, K.; Danish, A.; Salim, M.U.; Bayram, M.; Ozbakkaloglu, T.; Mosaberpanah, M.A. An In-Depth Survey Demystifying the Internet of Things (IoT) in the Construction Industry: Unfolding New Dimensions. Sustainability 2023, 15, 1275. [Google Scholar] [CrossRef]

- Wu, P.; Song, Y.; Zhu, J.; Chang, R. Analyzing the influence factors of the carbon emissions from China’s building and construction industry from 2000 to 2015. J. Clean. Prod. 2019, 221, 552–566. [Google Scholar]

- Craveiro, F.; Duarte, J.P.; Bartolo, H.; Bartolo, P.J. Additive manufacturing as an enabling technology for digital construction: A perspective on Construction 4.0. Autom. Constr. 2019, 103, 251–267. [Google Scholar]

- Sepasgozar, S.M.E. Differentiating Digital Twin from Digital Shadow: Elucidating a Paradigm Shift to Expedite a Smart, Sustainable Built Environment. Buildings 2021, 11, 151. [Google Scholar] [CrossRef]

- Ali, K.A.; Ahmad, M.I.; Yusup, Y. Issues, Impacts, and Mitigations of Carbon Dioxide Emissions in the Building Sector. Sustainability 2020, 12, 7427. [Google Scholar] [CrossRef]

- Sun, C.S.; Jiang, S.H.; Skibniewski, M.J.; Man, Q.P.; Shen, L.Y. A literature review of the factors limiting the application of BIM in the construction industry. Technol. Econ. Dev. Econ. 2017, 23, 764–779. [Google Scholar]

- Zhang, Y.; Li, H.; Yao, Z. Intellectual capital, digital transformation and firm performance: Evidence based on listed companies in the Chinese construction industry. Eng. Constr. Archit. Manag. 2023. ahead-of-print. [Google Scholar]

- Luo, G.; Serrao, C.; Liang, D.C.; Zhou, Y. A Relevance-Based Technology-Organisation-Environment Model of Critical Success Factors for Digital Procurement Adoption in Chinese Construction Companies. Sustainability 2023, 15, 12260. [Google Scholar] [CrossRef]

- Zhang, J.; Chen, M.; Ballesteros-Pérez, P.; Ke, Y.; Gong, Z.; Ni, Q. A new framework to evaluate and optimize digital transformation policies in the construction industry: A China case study. J. Build. Eng. 2023, 70, 106388. [Google Scholar] [CrossRef]

- Zhu, Z.; Ning, S. Corporate digital transformation and strategic investments of construction industry in China. Heliyon 2023, 9, e17879. [Google Scholar]

- Chen, Z.S.; Liang, C.Z.; Xu, Y.Q.; Pedrycz, W.; Skibniewski, M.J. Dynamic collective opinion generation framework for digital transformation barrier analysis in the construction industry. Inf. Fusion 2024, 103, 102096. [Google Scholar] [CrossRef]

- Chen, Z.X.; Aryee, S.; Lee, C. Test of a mediation model of perceived organizational support. J. Vocat. Behav. 2005, 66, 457–470. [Google Scholar] [CrossRef]

- Takalo, S.K.; Tooranloo, H.S.; Parizi, Z.S. Green innovation: A systematic literature review. J. Clean. Prod. 2021, 279, 122474. [Google Scholar] [CrossRef]

- Tolliver, C.; Fujii, H.; Keeley, A.R.; Managi, S. Green Innovation and Finance in Asia. Asian Econ. Policy. Rev. 2021, 16, 67–87. [Google Scholar] [CrossRef]

- Yin, S.; Yu, Y. An adoption-implementation framework of digital green knowledge to improve the performance of digital green innovation practices for industry 5.0. J. Clean. Prod. 2022, 363, 132608. [Google Scholar] [CrossRef]

- Yin, S.; Zhang, N.; Ullah, K.; Gao, S. Enhancing Digital Innovation for the Sustainable Transformation of Manufacturing Industry: A Pressure-State-Response System Framework to Perceptions of Digital Green Innovation and Its Performance for Green and Intelligent Manufacturing. Systems 2022, 10, 72. [Google Scholar] [CrossRef]

- Luo, S.; Yimamu, N.; Li, Y.; Wu, H.; Irfan, M.; Hao, Y. Digitalization and sustainable development: How could digital economy development improve green innovation in China? Bus. Strateg. Environ. 2023, 32, 1847–1871. [Google Scholar] [CrossRef]

- Akomea-Frimpong, I.; Adeabah, D.; Ofosu, D.; Tenakwah, E.J. A review of studies on green finance of banks, research gaps and future directions. J. Sustain. Financ. Investig. 2022, 12, 1241–1264. [Google Scholar] [CrossRef]

- Ozili, P.K. Green finance research around the world: A review of literature. Int. J. Green Econ. 2022, 16, 56–75. [Google Scholar] [CrossRef]

- Afzal, A.; Rasoulinezhad, E.; Malik, Z. Green finance and sustainable development in Europe. Econ. Res.-Ekon. Istr. 2022, 35, 5150–5163. [Google Scholar] [CrossRef]

- Safi, A.; Kchouri, B.; Elgammal, W.; Nicolas, M.K.; Umar, M. Bridging the green gap: Do green finance and digital transformation influence sustainable development? Energy Econ. 2024, 134, 107566. [Google Scholar] [CrossRef]

- Xu, T.; Yang, G.; Chen, T. The role of green finance and digital inclusive finance in promoting economic sustainable development: A perspective from new quality productivity. J. Environ. Manag. 2024, 370, 122892. [Google Scholar]

- Tian, X.Y.; Zhang, Y.X.; Qu, G.H. The Impact of Digital Economy on the Efficiency of Green Financial Investment in China’s Provinces. Int. J. Environ. Res. Public Health 2022, 19, 8884. [Google Scholar] [CrossRef] [PubMed]

- Hossain, M.R.; Rao, A.; Sharma, G.D.; Dev, D.; Kharbanda, A. Empowering energy transition: Green innovation, digital finance, and the path to sustainable prosperity through green finance initiatives. Energy Econ. 2024, 136, 107736. [Google Scholar]

- Li, X.; Qin, Q.; Yang, Y. The Impact of Green Innovation on Carbon Emissions: Evidence from the Construction Sector in China. Energies 2023, 16, 4529. [Google Scholar] [CrossRef]

- Dong, T.; Yin, S.; Zhang, N. The Interaction Mechanism and Dynamic Evolution of Digital Green Innovation in the Integrated Green Building Supply Chain. Systems 2023, 11, 122. [Google Scholar] [CrossRef]

- Dong, T.; Yin, S.; Zhang, N. New Energy-Driven Construction Industry: Digital Green Innovation Investment Project Selection of Photovoltaic Building Materials Enterprises Using an Integrated Fuzzy Decision Approach. Systems 2023, 11, 11. [Google Scholar]

- Gholipour, H.F.; Arjomandi, A.; Yam, S. Green property finance and CO2 emissions in the building industry. Glob. Financ. J. 2022, 51, 100696. [Google Scholar]

- Huo, D.; Zhang, X.; Meng, S.; Wu, G.; Li, J.; Di, R. Green finance and energy efficiency: Dynamic study of the spatial externality of institutional support in a digital economy by using hidden Markov chain. Energy Econ. 2022, 116, 106431. [Google Scholar]

- Guo, J.; Zhang, K.; Liu, K. Exploring the Mechanism of the Impact of Green Finance and Digital Economy on China’s Green Total Factor Productivity. Int. J. Environ. Res. Public Health 2022, 19, 16303. [Google Scholar] [CrossRef]

- Li, Z.; Wu, L.; Zhang, Z.; Chen, R.; Jiang, Y.; Peng, Y.; Zheng, K.; Jiang, W. The Transformative Impacts of Green Finance Governance on Construction-Related CO2 Emissions. Sustainability 2022, 14, 9853. [Google Scholar] [CrossRef]

- Onat, N.C.; Kucukvar, M. Carbon footprint of construction industry: A global review and supply chain analysis. Renew. Sust. Energ. Rev. 2020, 124, 109783. [Google Scholar]

- Sizirici, B.; Fseha, Y.; Cho, C.S.; Yildiz, I.; Byon, Y.-J. A Review of Carbon Footprint Reduction in Construction Industry, from Design to Operation. Materials 2021, 14, 6094. [Google Scholar] [CrossRef] [PubMed]

- Shan, Y.; Guan, D.; Zheng, H.; Ou, J.; Li, Y.; Meng, J.; Mi, Z.; Liu, Z.; Zhang, Q. China CO2 emission accounts 1997–2015. Sci. Data 2018, 5, 170201. [Google Scholar]

- Intergovernmental Panel on Climate Change (IPCC). 2006 IPCC Guidelines for National Greenhouse Gas Inventories: 2019 Refinement. Available online: https://www.ipcc-nggip.iges.or.jp/public/2006gl/index.html (accessed on 2 December 2024).

- Ji, J.P.; Liu, L.; Ma, X.M. Greenhouse gas emissions by Chinese economy: An assessment based on EIO-LCA model. Acta Sci. Nat. Univ. Pekin. 2011, 47, 741–749. [Google Scholar]

- Ma, P. Study on the Correlation of Carbon Dioxide Emission and Its Influence Factors in China Based on Kaya Model Taking Anhui Province as an Example. Master’s Thesis, Anhui Jianzhu University, Anhui, China, 2017. [Google Scholar]

- Wang, L. Revisiting CO2 emission reduction in China’s cement industry. China Cement. 2008, 2, 36–39. [Google Scholar]

- Li, X.F.; Xu, H. Life Cycle Assessment of Steel Based on GaBi Software. Environ. Prot. Circ. Econ. 2009, 29, 15–18. [Google Scholar]

- Chen, W.J.; Nie, Z.R.; Wang, Z.H. Life cycle inventory and characterization of flat glass in China. China Build. Mater. Sci. Technol. 2006, 3, 54–58. [Google Scholar]

- Wang, X. Life Cycle Assessment for Carbon Emission of Residential Building. Master’s Thesis, Tianjin University, Tianjin, China, 2012. [Google Scholar]

- Li, Z.J. Study on the life cycle consumption of energy and resource of air conditioning in urban residential buildings in China. Ph.D. Thesis, Tsinghua University, Beijing, China, 2007. [Google Scholar]

- Wen, Z.L.; Ye, B.J. Analyses of mediating effects: The development of methods and models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar]

- National Bureau of Statistics of China. Statistical Classification of the Digital Economy and Its Core Industries (2021 Edition). Available online: http://www.stats.gov.cn (accessed on 4 December 2024).

- Song, M.L.; Wang, S.H.; Ru, H.P.; Wang, G. Analysis of green innovation capability based on panel data in China. China Soft Sci. 2010, 5, 143–151. [Google Scholar]

- Wang, Y.; Pan, D.Y.; Zhang, X. Research on green finance’s contribution to China’s economic development. Comp. Econ. Soc. Syst. 2016, 6, 33–42. [Google Scholar]

- Liu, H.K.; He, C. Mechanisms and tests for green finance to promote urban economic high-quality development. Rev. Investig. Stud. 2021, 40, 37–52. [Google Scholar]

- Li, B.; Yao, R. Urbanisation and its impact on building energy consumption and efficiency in China. Renew. Energy 2009, 34, 1994–1998. [Google Scholar]

- Zhao, P.; Zhang, M. The impact of urbanisation on energy consumption: A 30-year review in China. Urban CLim. 2018, 24, 940–953. [Google Scholar]

- Meng, G.; Guo, Z.; Li, J. The dynamic linkage among urbanisation, industrialisation and carbon emissions in China: Insights from spatiotemporal effect. Sci. Total Environ. 2021, 760, 144042. [Google Scholar]

- Zhang, W.; Li, G. Environmental decentralization, environmental protection investment, and green technology innovation. Environ. Sci. Pollut. Res. 2022, 29, 12740–12755. [Google Scholar]

- Lin, B.; Zhang, A. Can government environmental regulation promote low-carbon development in heavy polluting industries? Evidence from China’s new environmental protection law. Environ. Impact Assess. Rev. 2023, 99, 106991. [Google Scholar]

- Li, B.; Han, S.; Wang, Y.; Wang, Y.; Li, J.; Wang, Y. Feasibility assessment of the carbon emissions peak in China’s construction industry: Factor decomposition and peak forecast. Sci. Total Environ. 2020, 706, 135716. [Google Scholar]

- National Bureau of Statistics of China. China Statistical Yearbook. China Statistics Press: Beijing, China. Available online: https://www.stats.gov.cn/sj/ndsj/ (accessed on 11 September 2024).

- National Bureau of Statistics of China. China Statistical Yearbook of the Tertiary Industry. China Statistics Press: Beijing, China. Available online: https://www.shujuku.org/china-statistical-yearbook-of-the-tertiary-industry.html (accessed on 11 September 2024).

- Ministry of Industry and Information Technology of China. Yearbook of China Information Industry. Publishing House of Electronics Industry: Beijing, China. Available online: https://www.shujuku.org/china-information-industry-yearbook.html (accessed on 11 September 2024).

- National Bureau of Statistics of Energy of China. China Energy Statistical Yearbook. China Statistics Press: Beijing, China. Available online: https://www.shujuku.org/china-energy-statistical-yearbook.html (accessed on 11 September 2024).

- National Bureau of Statistics of China. China Statistical Yearbook on Construction. China Statistics Press: Beijing, China. Available online: https://navi.cnki.net/knavi/detail?p=FzP9s9nothMLfiCsT3-J_ZwpevZdTiGIjm_yTV_Uv1GEaQCsVwdnOHlm_UpD6aS7kQDcWdQMIiLXWDMmsZnToOTKyp98xvIjMLzW8ZEgBFMV_e3414liCriWGfj669t5&uniplatform=NZKPT (accessed on 11 September 2024).

- National Bureau of Statistics of China. China Statistical Yearbook of Science and Technology. China Statistics Press: Beijing, China. Available online: https://www.shujuku.org/china-statistical-yearbook-on-science-and-technology.html (accessed on 11 September 2024).

- The People’s Bank of China. Almanac of China’s Finance and Banking. Almanac of China’s Finance and Banking Magazine Co.: Beijing, China. Available online: https://www.shujuku.org/china-finance-and-banking-yearbook.html (accessed on 11 September 2024).

- National Bureau of Statistics of China. China Industry Statistical Yearbook. China Statistics Press: Beijing, China. Available online: https://www.shujuku.org/china-industry-statistical-yearbook.html (accessed on 11 September 2024).

- Zaefarian, G.; Kadile, V.; Henneberg, S.C.; Leischnig, A. Endogeneity bias in marketing research: Problem, causes and remedies. Ind. Mark. Manag. 2017, 65, 39–46. [Google Scholar]

- Ullah, S.; Akhtar, P.; Zaefarian, G. Dealing with endogeneity bias: The generalized method of moments (GMM) for panel data. Ind. Mark. Manag. 2018, 71, 69–78. [Google Scholar]

- de la Calle, A.; Freije, I.; Oyarbide, A. Digital Product–Service Innovation and Sustainability: A Multiple-Case Study in the Capital Goods Industry. Sustainability 2021, 13, 6342. [Google Scholar] [CrossRef]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar]

- Zhang, Z.; Wang, B. Research on the life-cycle CO2 emission of China’s construction sector. Energy Build. 2016, 112, 244–255. [Google Scholar]

- Lai, X.; Liu, J.; Shi, Q.; Georgiev, G.; Wu, G. Driving forces for low carbon technology innovation in the building industry: A critical review. Renew. Sustain. Energy Rev. 2017, 74, 299–315. [Google Scholar]

- Jalaei, F.; Masoudi, R.; Guest, G. A framework for specifying low-carbon construction materials in government procurement: A case study for concrete in a new building investment. J. Clean. Prod. 2022, 345, 131056. [Google Scholar]

- Chen, H.; Zhao, X. Green financial risk management based on intelligence service. J. Clean. Prod. 2022, 364, 132617. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).