New Energy Demonstration City Policy and Corporate Green Innovation: From the Perspective of Industrial and Regional Spillover Effect

Abstract

:1. Introduction

2. Policy Background and Theoretical Analysis

2.1. Policy Background

2.2. Theoretical Analysis and Hypothesis

3. Research Design

3.1. Model Setting

3.2. Variable Selection

3.2.1. Dependent Variable

3.2.2. Core Explanatory Variable

3.2.3. Mediation Variables

3.2.4. Control Variables

3.3. Data Sources

4. Empirical Analysis

4.1. Baseline Results

4.2. Parallel Trend Analysis

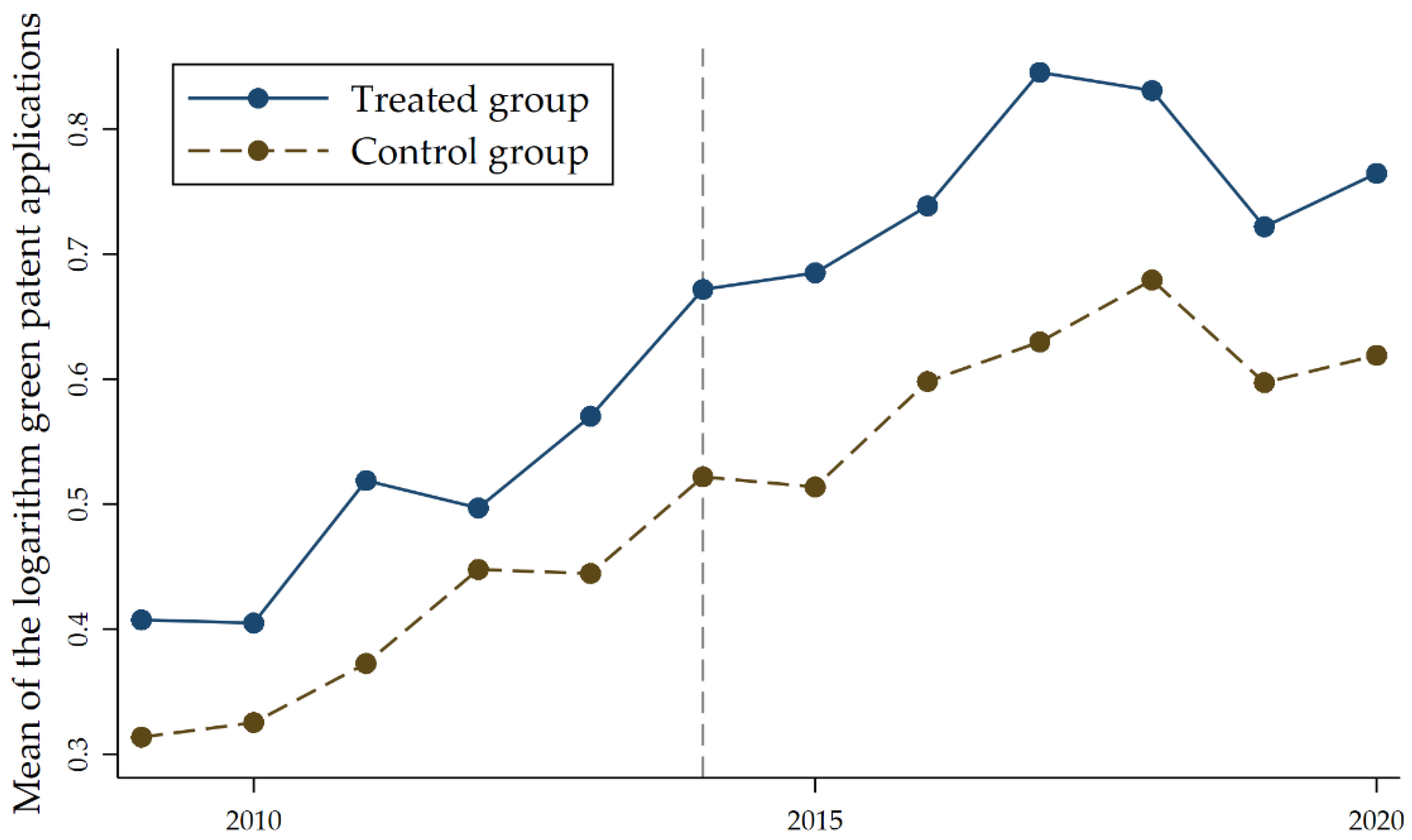

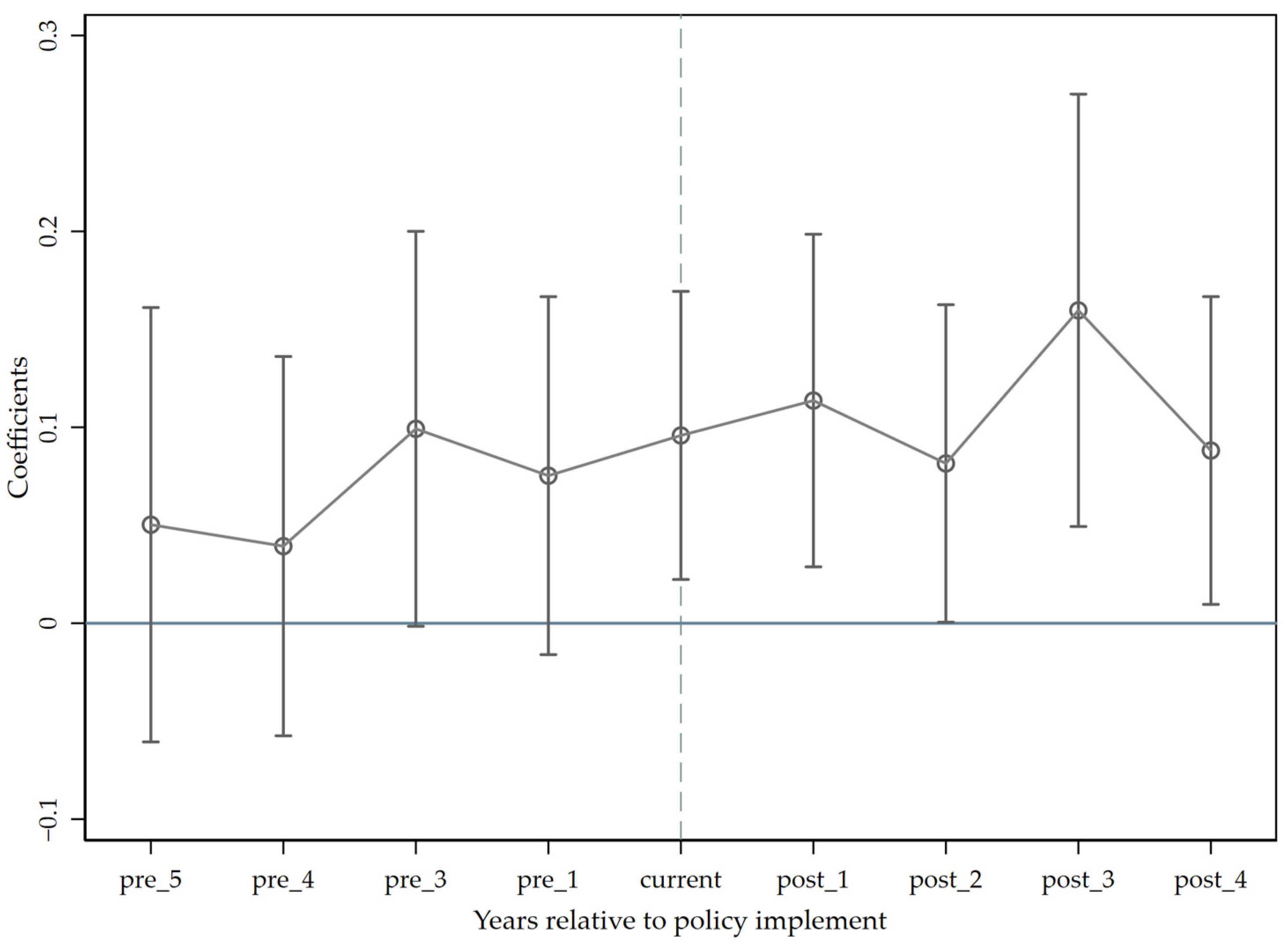

4.2.1. Parallel Trend Test

4.2.2. Policy Dynamic Effects

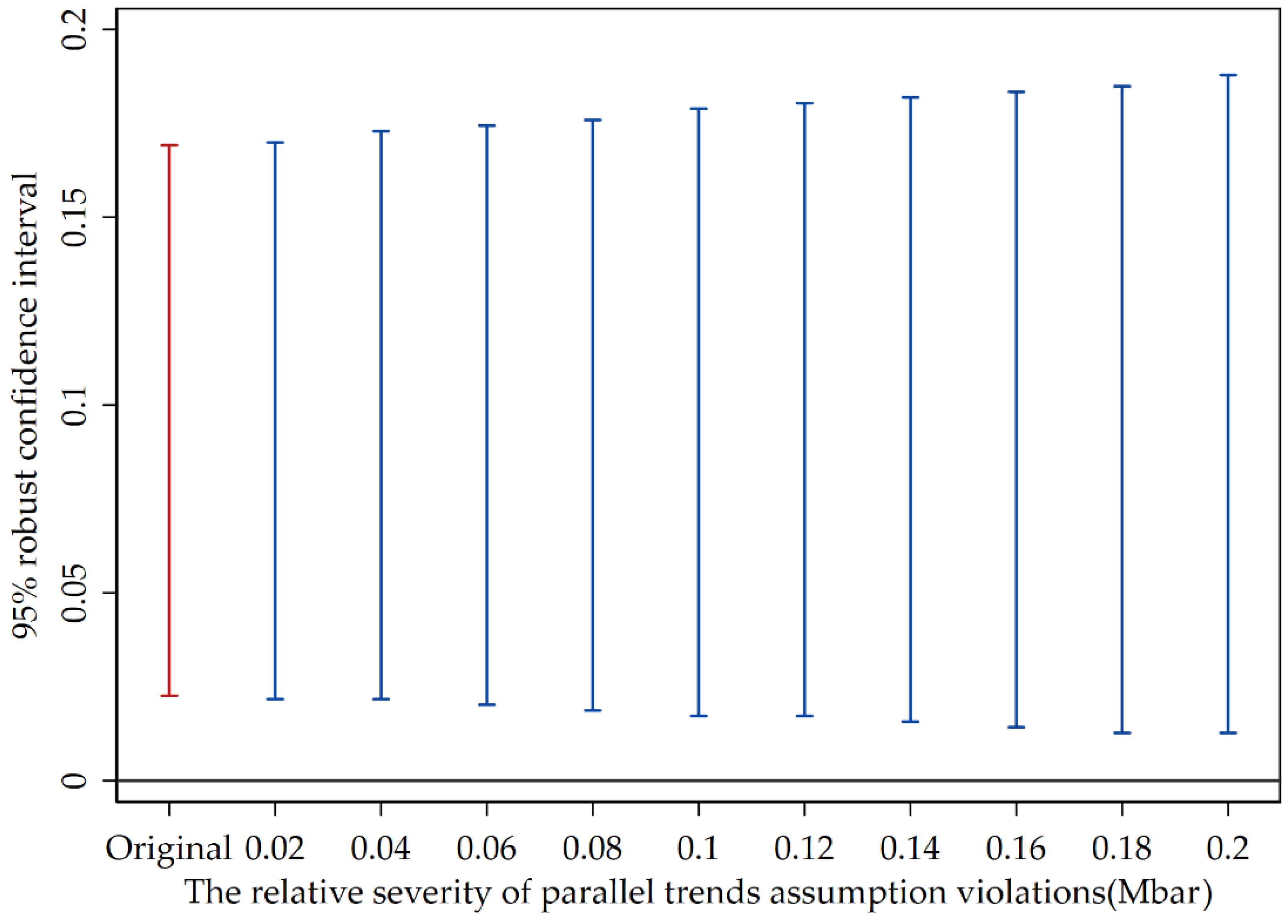

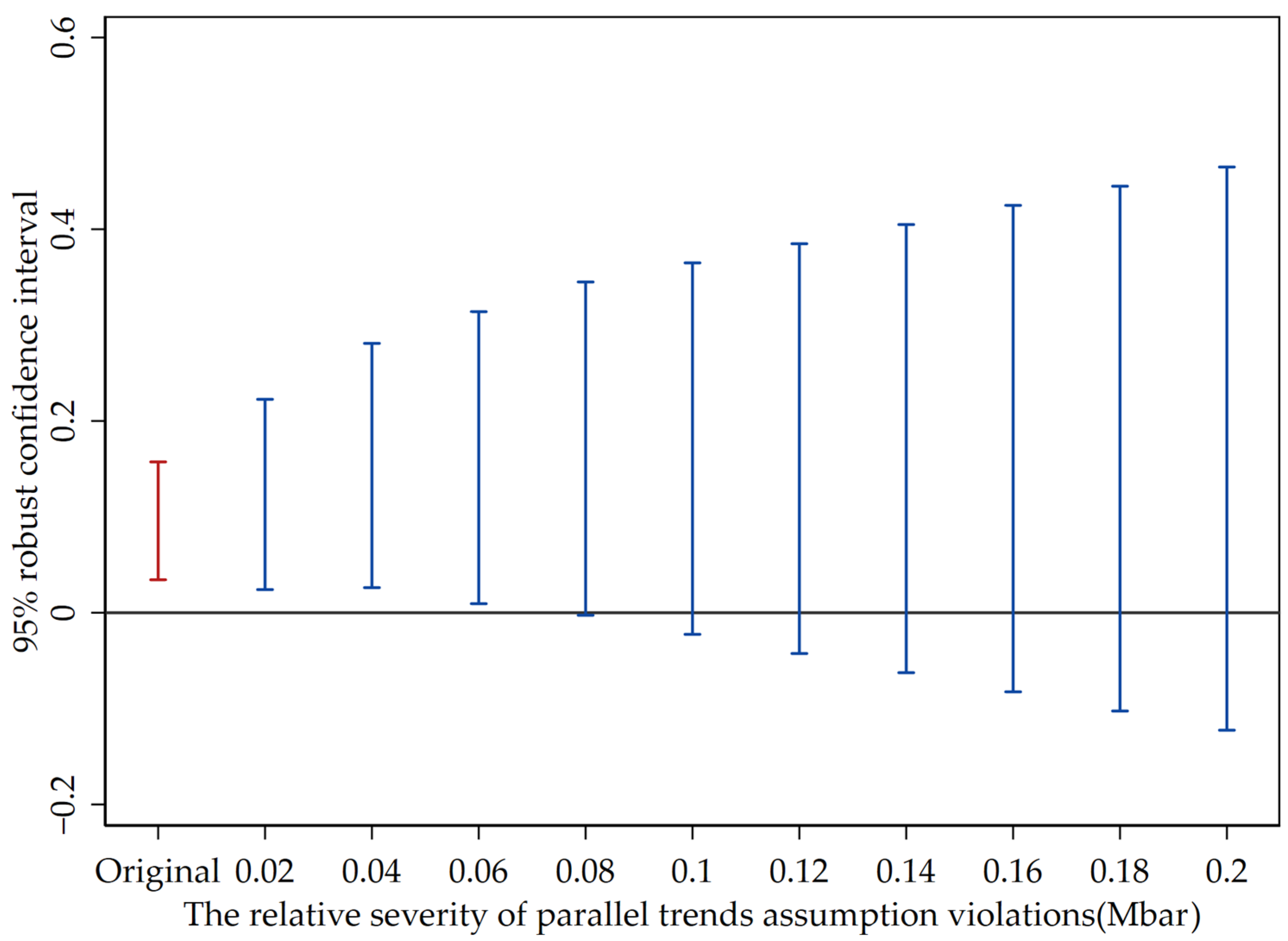

4.2.3. Sensitivity Analysis

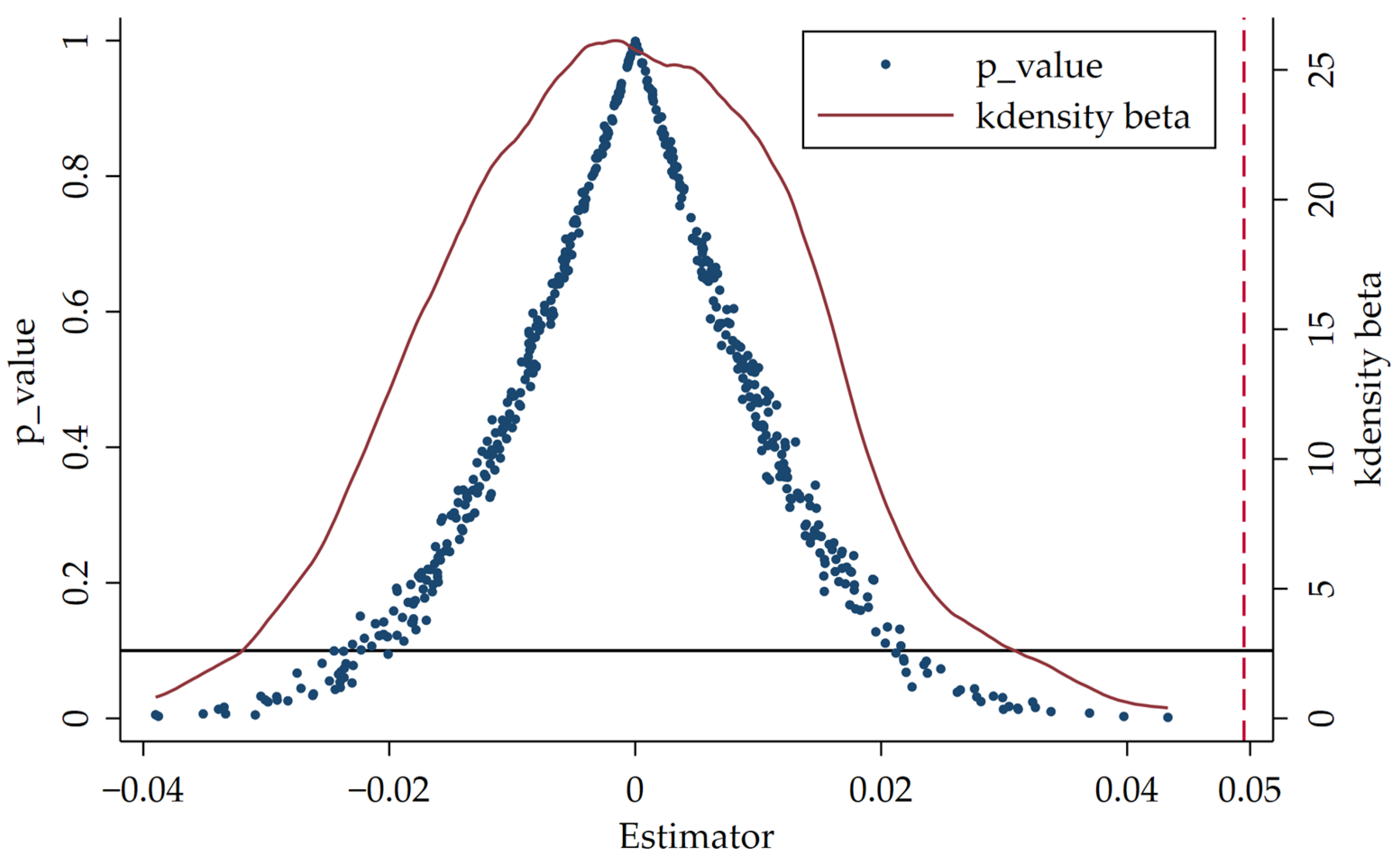

4.2.4. Placebo Test

4.3. Robustness Tests

4.3.1. PSM-DID

4.3.2. System GMM

4.3.3. Variable Exchange

4.3.4. Adjustment of Research Samples

4.3.5. Excluding Interference from Other Policies

4.4. Heterogeneity Analysis

4.4.1. Heterogeneity of Corporate Attributes

4.4.2. Heterogeneity of Corporate Location Characteristics

4.5. Mechanism Analysis

5. Spillover Effects Analysis

5.1. Regional Spillover Effects

5.2. Industrial Spillover Effects

6. Conclusions and Implications

6.1. Conclusions

6.2. Policy Implications

- (1)

- The scope of the policy should be expanded and institutional systems improved. The NEDC policy redounds to a green transition of energy production and consumption at the city level, as well as the application of green technologies at an enterprise level. Based on the existing practical experiences, successful cases to form replicable models for more cities should be shared. Demonstration cities should vigorously supervise to ensure that policy tilt measures such as special funds, subsidies, and tax reductions are implemented. They should also actively introduce talent exchange programs, continuously improve market investing and financing mechanisms, and increase transparency and accessibility of financing channels to stimulate more investments in green technologies.

- (2)

- Empirical results indicate that the green innovation effects and spillover effects of the NEDC policy are highly sensitive to corporate attributes and location characteristics. Corporate characteristics and their external environments should therefore be fully considered when formulating and implementing differentiated policies that meet local characteristics and enterprise realities. This would maximize the effectiveness of the NEDC policy on GI. There should be an improvement in the policy’s monitoring and evaluation system to continually enhance policy flexibility and applicability.

- (3)

- The NEDC policy has negative regional spillover effects and positive industrial spillover effects. Therefore, when formulating the policy, the “beggar-thy-neighbor” effect should be avoided whilst leveraging the role model effect to form cooperation mechanisms between the demonstration and surrounding cities. Such an approach would promote regional coordinated green development. There should be a consolidation and expansion of the advantages formed by the NEDC policy. By radiating and promoting the experiences and practices to other sectors, a multiplier effect on corporate GI would be produced.

6.3. Limitation and Further Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, Y.; Li, X.; Xing, C. How Does China’s Green Credit Policy Affect the Green Innovation of High Polluting Enterprises? The Perspective of Radical and Incremental Innovations. J. Clean. Prod. 2022, 336, 130387. [Google Scholar] [CrossRef]

- Li, Y.; Chu, E.; Nie, S.; Peng, X.; Yi, Y. Fintech, Financing Constraints and Corporate Green Innovation. Int. Rev. Financ. Anal. 2024, 96, 103650. [Google Scholar] [CrossRef]

- Wang, S.; Ma, L. Does New Energy Demonstration City Policy Curb Air Pollution? Evidence from Chinese Cities. Sci. Total Environ. 2024, 918, 170595. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, J.; Ren, S.; Ran, Q. Can the New Energy Demonstration City Policy Reduce Environmental Pollution? Evidence from a Quasi-Natural Experiment in China. J. Clean. Prod. 2021, 287, 125015. [Google Scholar] [CrossRef]

- Chai, J.; Tian, L.; Jia, R. New Energy Demonstration City, Spatial Spillover and Carbon Emission Efficiency: Evidence from China’s Quasi-Natural Experiment. Energy Policy 2023, 173, 113389. [Google Scholar] [CrossRef]

- Che, S.; Wang, J.; Chen, H. Can China’s Decentralized Energy Governance Reduce Carbon Emissions? Evidence from New Energy Demonstration Cities. Energy 2023, 284, 128665. [Google Scholar] [CrossRef]

- Lin, B.; Xu, C. Reaping Green Dividend: The Effect of China’s Urban New Energy Transition Strategy on Green Economic Performance. Energy 2024, 286, 129589. [Google Scholar] [CrossRef]

- Wang, Q.; Yi, H. New Energy Demonstration Program and China’s Urban Green Economic Growth: Do Regional Characteristics Make a Difference? Energy Policy 2021, 151, 112161. [Google Scholar] [CrossRef]

- Cheng, Z.; Yu, X.; Zhang, Y. Is the Construction of New Energy Demonstration Cities Conducive to Improvements in Energy Efficiency? Energy 2023, 263, 125517. [Google Scholar] [CrossRef]

- Liu, X.; Wang, C.; Wu, H.; Yang, C.; Albitar, K. The Impact of the New Energy Demonstration City Construction on Energy Consumption Intensity: Exploring the Sustainable Potential of China’s Firms. Energy 2023, 283, 128716. [Google Scholar] [CrossRef]

- Zhou, A.; Wang, S.; Chen, B. Impact of New Energy Demonstration City Policy on Energy Efficiency: Evidence from China. J. Clean. Prod. 2023, 422, 138560. [Google Scholar] [CrossRef]

- Hou, Y.; Yang, M.; Ma, Y.; Zhang, H. Study on City’s Energy Transition: Evidence from the Establishment of the New Energy Demonstration Cities in China. Energy 2024, 292, 130549. [Google Scholar] [CrossRef]

- Zhang, Q.; Huang, X.; Xu, Y.; Bhuiyan, M.A.; Liu, P. New Energy Demonstration City Pilot and Green Energy Consumption: Evidences from China. Energy Rep. 2022, 8, 7735–7750. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Song, Y.; Pang, X.; Zhang, Z.; Sahut, J.-M. Can the New Energy Demonstration City Policy Promote Corporate Green Innovation Capability? Energy Econ. 2024, 136, 107714. [Google Scholar] [CrossRef]

- Liu, C.; Tang, C.; Liu, Y. Does the Transformation of Energy Structure Promote Green Technological Innovation? A Quasi–Natural Experiment Based on New Energy Demonstration City Construction. Geosci. Front. 2024, 15, 101615. [Google Scholar] [CrossRef]

- Chen, M.; Su, Y.; Piao, Z.; Zhu, J.; Yue, X. The Green Innovation Effect of Urban Energy Saving Construction: A Quasi-Natural Experiment from New Energy Demonstration City Policy. J. Clean. Prod. 2023, 428, 139392. [Google Scholar] [CrossRef]

- Zhang, Z.; Luo, C.; Zhang, G.; Shu, Y.; Shao, S. New Energy Policy and Green Technology Innovation of New Energy Enterprises: Evidence from China. Energy Econ. 2024, 136, 107743. [Google Scholar] [CrossRef]

- Abban, O.J.; Rajaguru, G.; Acheampong, A.O. The Spillover Effect of Economic Institutions on the Environment: A Global Evidence from Spatial Econometric Analysis. J. Environ. Manag. 2025, 373, 123645. [Google Scholar] [CrossRef]

- Nikou, V. Spatial Interdependence and Cross-Border Spillover Effects in the Ecological Footprint of Consumption: The Role of Inclusive Policies and Public Procurement. J. Clean. Prod. 2025, 494, 144992. [Google Scholar] [CrossRef]

- Stiewe, C.; Xu, A.L.; Eicke, A.; Hirth, L. Cross-Border Cannibalization: Spillover Effects of Wind and Solar Energy on Interconnected European Electricity Markets. Energy Econ. 2025, 143, 108251. [Google Scholar] [CrossRef]

- Attílio, L.A. Spillover Effects of Climate Policy Uncertainty on Green Innovation. J. Environ. Manag. 2025, 375, 124334. [Google Scholar] [CrossRef]

- Wang, X.; Long, R.; Sun, Q.; Chen, H.; Jiang, S.; Wang, Y.; Li, Q.; Yang, S. Spatial Spillover Effects and Driving Mechanisms of Carbon Emission Reduction in New Energy Demonstration Cities. Appl. Energy 2024, 357, 122457. [Google Scholar] [CrossRef]

- Yang, J.; Wang, J.; Wang, W.; Wu, H. Exploring the Path to Promote Energy Revolution: Assessing the Impact of New Energy Demonstration City Construction on Urban Energy Transition in China. Renew. Energy 2024, 236, 121437. [Google Scholar] [CrossRef]

- Nesta, L.; Vona, F.; Nicolli, F. Environmental Policies, Competition and Innovation in Renewable Energy. J. Environ. Econ. Manag. 2014, 67, 396–411. [Google Scholar] [CrossRef]

- Yang, Y.; Nie, P. Subsidy for Clean Innovation Considered Technological Spillover. Technol. Forecast. Soc. Change 2022, 184, 121941. [Google Scholar] [CrossRef]

- Li, T.; Shi, Z.; Han, D.; Zeng, J. Agglomeration of the New Energy Industry and Green Innovation Efficiency: Does the Spatial Mismatch of R&D Resources Matter? J. Clean. Prod. 2023, 383, 135453. [Google Scholar] [CrossRef]

- Wu, J.; Zuidema, C.; Gugerell, K. Experimenting with Decentralized Energy Governance in China: The Case of New Energy Demonstration City Program. J. Clean. Prod. 2018, 189, 830–838. [Google Scholar] [CrossRef]

- Lin, B.; Zhu, J. Determinants of Renewable Energy Technological Innovation in China under CO2 Emissions Constraint. J. Environ. Manag. 2019, 247, 662–671. [Google Scholar] [CrossRef]

- Qi, X.; Guo, Y.; Guo, P.; Yao, X.; Liu, X. Do Subsidies and R&D Investment Boost Energy Transition Performance? Evidence from Chinese Renewable Energy Firms. Energy Policy 2022, 164, 112909. [Google Scholar] [CrossRef]

- Hu, G.-G. Is Knowledge Spillover from Human Capital Investment a Catalyst for Technological Innovation? The Curious Case of Fourth Industrial Revolution in BRICS Economies. Technol. Forecast. Soc. Change 2021, 162, 120327. [Google Scholar] [CrossRef]

- Ozcan, B.; Danish; Temiz, M. An Empirical Investigation between Renewable Energy Consumption, Globalization and Human Capital: A Dynamic Auto-Regressive Distributive Lag Simulation. Renew. Energy 2022, 193, 195–203. [Google Scholar] [CrossRef]

- Yu, C.H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for Green Finance: Resolving Financing Constraints on Green Innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Luo, G.; Liu, Y.; Zhang, L.; Xu, X.; Guo, Y. Do Governmental Subsidies Improve the Financial Performance of China’s New Energy Power Generation Enterprises? Energy 2021, 227, 120432. [Google Scholar] [CrossRef]

- Wen, H.; Lee, C.-C.; Zhou, F. How Does Fiscal Policy Uncertainty Affect Corporate Innovation Investment? Evidence from China’s New Energy Industry. Energy Econ. 2022, 105, 105767. [Google Scholar] [CrossRef]

- Lu, Y.; Wang, J.; Zhu, L. Place-Based Policies, Creation, and Agglomeration Economies: Evidence from China’s Economic Zone Program. Am. Econ. J. Econ. Policy 2019, 11, 325–360. [Google Scholar] [CrossRef]

- Ciżkowicz, P.; Ciżkowicz, M.; Pękała, P.; Rzońca, A. The Effects of Polish Special Economic Zones on Employment and Investment: Spatial Panel Modelling Perspective. J. Econ. Geogr. 2017, 17, 571–605. [Google Scholar] [CrossRef]

- Jiang, M.; Yu, X.; Xu, J.; Wu, Z.; Shen, X.; Zhong, G. Exploring the Emission Spillover Effects in Production Networks under Carbon Trading Market: Insights into Complementary and Competitive Industries. Environ. Impact Assess. Rev. 2025, 110, 107720. [Google Scholar] [CrossRef]

- Yang, F.; Cheng, Y.; Yao, X. Influencing Factors of Energy Technical Innovation in China: Evidence from Fossil Energy and Renewable Energy. J. Clean. Prod. 2019, 232, 57–66. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, T.; Ren, X.; Shi, Y. AI Adoption Rate and Corporate Green Innovation Efficiency: Evidence from Chinese Energy Companies. Energy Econ. 2024, 132, 107499. [Google Scholar] [CrossRef]

- Peng, D.; Kong, Q. Corporate Green Innovation under Environmental Regulation: The Role of ESG Ratings and Greenwashing. Energy Econ. 2024, 140, 107971. [Google Scholar] [CrossRef]

- Zhao, M.; Fu, X.; Du, J.; Cui, L. Optimal Environmental Investment Strategies for Enterprise Green Technology Innovation: An Empirical Study Based on Multiple Drive Models. J. Environ. Manag. 2024, 370, 122624. [Google Scholar] [CrossRef]

- Zhong, Z.; Peng, B. Can Environmental Regulation Promote Green Innovation in Heavily Polluting Enterprises? Empirical Evidence from a Quasi-Natural Experiment in China. Sustain. Prod. Consum. 2022, 30, 815–828. [Google Scholar] [CrossRef]

- Li, H.; Su, Y.; Ding, C.J.; Tian, G.G.; Wu, Z. Unveiling the Green Innovation Paradox: Exploring the Impact of Carbon Emission Reduction on Corporate Green Technology Innovation. Technol. Forecast. Soc. Change 2024, 207, 123562. [Google Scholar] [CrossRef]

- Deschênes, O.; Greenstone, M.; Shapiro, J.S. Defensive Investments and the Demand for Air Quality: Evidence from the NOx Budget Program. Am. Econ. Rev. 2017, 107, 2958–2989. [Google Scholar] [CrossRef]

- Roth, J.; Sant’Anna, P.H.C.; Bilinski, A.; Poe, J. What’s Trending in Difference-in-Differences? A Synthesis of the Recent Econometrics Literature. J. Econom. 2023, 235, 2218–2244. [Google Scholar] [CrossRef]

- Rambachan, A.; Roth, J. A More Credible Approach to Parallel Trends. Rev. Econ. Stud. 2023, 90, 2555–2591. [Google Scholar] [CrossRef]

- Biasi, B.; Sarsons, H. Flexible Wages, Bargaining, and the Gender Gap. Q. J. Econ. 2022, 137, 215–266. [Google Scholar] [CrossRef]

- Tan, X.; Yan, Y.; Dong, Y. Peer Effect in Green Credit Induced Green Innovation: An Empirical Study from China’s Green Credit Guidelines. Resour. Policy 2022, 76, 102619. [Google Scholar] [CrossRef]

| Variable | Symbol | Definition | |

|---|---|---|---|

| Dependent variables | Green technology innovation | GI | Natural logarithm of the number of green patent applications plus one |

| GIP | Natural logarithm of the number of green invention patent applications plus one | ||

| GUP | Natural logarithm of the number of green utility model patent applications plus one | ||

| Independent variable | NEDC policy variable | NEDC | If the enterprise is located at a new energy demonstration city, the value is 1, and vice versa is 0 |

| Mediation variables | R&D investment | RDI | Natural logarithm of corporate R&D expenditures |

| Human capital | Tech | Natural logarithm of the technical personnel count | |

| Financing constraint | FC index | A synthetic index built from firm size, profitability, liquidity, cash flow generating ability, solvency, trade credit over total assets, net tangible asset ratio | |

| Control variables | Firm size | size | Natural logarithm of total assets |

| Cash asset ratio | cash | Proportion of net cash flow to total assets | |

| Return on assets | roa | Proportion of net profit to average total assets | |

| Asset-liability ratio | lev | Proportion of total liabilities to total assets | |

| Asset structure | asset | Proportion of fixed assets to total assets | |

| Tobin’s Q value | tobin | Proportion of market value to replacement cost of capital. | |

| Operating capacity | revenue | Natural logarithm of operating income |

| Variables | Obs | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| GP | 14,280 | 0.540 | 0.950 | 0 | 7.070 |

| GIP | 14,280 | 0.370 | 0.790 | 0 | 6.620 |

| GUP | 14,280 | 0.330 | 0.700 | 0 | 6.050 |

| NEDC | 14,280 | 0.159 | 0.366 | 0 | 1 |

| size | 14,280 | 22.11 | 1.270 | 16.41 | 27.55 |

| cash | 14,280 | 0.170 | 0.140 | −0.020 | 0.950 |

| roa | 14,280 | 0.060 | 0.070 | −1.030 | 0.770 |

| lev | 14,280 | 0.410 | 0.200 | 0.010 | 0.990 |

| asset | 14,280 | 0.230 | 0.150 | 0 | 0.950 |

| tobin | 14,280 | 2 | 1.400 | 0.030 | 31.40 |

| revenue | 14,280 | 21.47 | 1.430 | 14.35 | 27.53 |

| RDI | 14,280 | 17.68 | 1.630 | 7.720 | 23.67 |

| Tech | 14,280 | 5.950 | 1.240 | 0 | 10.49 |

| FC index | 14,280 | 0.510 | 0.280 | 0 | 1 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| NEDC | 0.059 ** (2.42) | 0.050 ** 2.07) | 0.051 ** (2.08) | 0.051 ** (2.08) | 0.051 ** (2.09) | 0.050 ** (2.07) | 0.051 ** (2.07) | 0.049 ** (2.03) |

| size | 0.111 *** (6.95) | 0.112 *** (7.00) | 0.112 *** (6.99) | 0.113 *** (6.67) | 0.115 *** (6.75) | 0.112 *** (6.51) | 0.092 *** (4.35) | |

| cash | 0.048 (0.91) | 0.048 (0.90) | 0.045 (0.76) | 0.065 (1.04) | 0.057 (0.91) | 0.062 (0.98) | ||

| roa | 0.013 (0.18) | 0.012 (0.17) | 0.017 (0.24) | 0.023 (0.32) | 0.005 (0.07) | |||

| lev | −0.007 (−0.11) | −0.009 (−0.14) | −0.015 (−0.23) | −0.024 (−0.38) | ||||

| asset | 0.089 (1.10) | 0.091 (1.12) | 0.087 (1.07) | |||||

| tobin | −0.009 ** (−1.98) | −0.010 ** (−2.13) | ||||||

| revenue | 0.023 * (1.70) | |||||||

| Constants | 0.532 *** (83.84) | −1.931 *** (−5.45) | −1.959 *** (−5.51) | −1.959 *** (−5.51) | −1.966 *** (−5.38) | −2.044 *** (−5.47) | −1.941 *** (−5.15) | −2.015 *** (−5.38) |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 14,280 | 14,280 | 14,280 | 14,280 | 14,280 | 14,280 | 14,280 | 14,280 |

| Adjusted R2 | 0.648 | 0.650 | 0.650 | 0.650 | 0.650 | 0.650 | 0.650 | 0.650 |

| PSM-DID (1) | System GMM (2) | Add Regional Variables (3) | Change Dependent Variable (4) | |

|---|---|---|---|---|

| NEDC | 0.064 ** (2.19) | 0.200 *** (1.99) | 0.052 ** (2.18) | 0.009 * (1.96) |

| Constants | −2.050 *** (−4.22) | −4.125 (−0.55) | −1.988 *** (−4.06) | 0.014 (0.16) |

| Control variables | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes | Yes |

| Observations | 7790 | 13,090 | 14,280 | 14,280 |

| Adjusted R2 | 0.648 | 0.650 | 0.404 |

| Change Time Scope (2) | Remove Special Samples (3) | Data Truncation (4) | |

|---|---|---|---|

| NEDC | 0.060 ** (2.32) | 0.072 ** (2.18) | 0.052 ** (2.16) |

| Constants | −2.580 *** (−4.90) | −1.025 ** (−2.36) | −1.824 *** (−4.51) |

| Control variables | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes |

| Observations | 10,701 | 8716 | 14,280 |

| Adjusted R2 | 0.681 | 0.625 | 0.636 |

| (1) | (2) | (3) | |

|---|---|---|---|

| NEDC | 0.049 ** (2.01) | 0.045 * (1.92) | 0.048 * (1.96) |

| ERT | 0.030 (1.27) | ||

| CIR | 0.069 *** (3.27) | ||

| ECER | 0.028 (0.86) | ||

| Constants | −2.016 *** (−5.38) | −1.985 *** (−5.36) | −2.020 *** (−5.39) |

| Control variables | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes |

| Observations | 14,280 | 14,280 | 14,280 |

| Adjusted R2 | 0.650 | 0.651 | 0.650 |

| Non-State-Owned (1) | State-Owned (2) | Clean (3) | High Energy Consuming (4) | |

|---|---|---|---|---|

| NEDC | 0.083 *** (3.12) | −0.012 (−0.26) | 0.029 (1.04) | 0.140 ** (2.44) |

| Constants | −2.963 *** (−6.71) | −1.580 ** (−2.36) | −2.492 *** (−5.77) | 0.386 (0.41) |

| Control variables | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes | Yes |

| Observations | 9130 | 5150 | 11,807 | 2473 |

| Adjusted R2 | 0.600 | 0.713 | 0.666 | 0.553 |

| Eastern (1) | Mid-West (2) | Non-Resource-Based (3) | Resource-Based (4) | |

|---|---|---|---|---|

| NEDC | 0.018 (0.66) | 0.115 *** (2.65) | 0.055 ** (1.99) | −0.002 (−0.03) |

| Constants | −2.504 *** (−5.79) | −0.705 (−1.12) | −2.414 *** (−6.03) | 1.226 (1.20) |

| Control variables | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes | Yes |

| Observations | 9617 | 4663 | 12,337 | 1943 |

| Adjusted R2 | 0.660 | 0.630 | 0.665 | 0.528 |

| (1) R&D Investment | (2) Human Capital | (3) Financing Constraint | |

|---|---|---|---|

| NEDC | 0.065 ** (2.43) | 0.034 * (1.67) | −0.009 ** (−1.97) |

| Constants | 1.507 *** (2.65) | −8.660 *** (−21.03) | 4.215 *** (33.96) |

| Bootstrap: d | 0.092 *** | 0.141 *** | 0.161 *** |

| Bootstrap: r | 0.073 *** | 0.025 *** | 0.004 *** |

| Control variables | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes |

| Observations | 14,280 | 14,280 | 14,280 |

| Adjusted R2 | 0.844 | 0.874 | 0.868 |

| (1) GI | (2) GIP | (3) GUP | |

|---|---|---|---|

| SPILLOVER | −0.063 *** (−2.60) | −0.044 ** (−2.21) | −0.056 *** (−3.05) |

| Constants | −1.050 ** (−2.57) | −1.250 *** (−3.78) | −0.592 * (−1.93) |

| Control variables | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes |

| Observations | 10,385 | 10,385 | 10,385 |

| Adjusted R2 | 0.642 | 0.639 | 0.572 |

| Eastern | Mid-west | |||||

|---|---|---|---|---|---|---|

| (1) GI | (2) GIP | (3) GUP | (4) GI | (5) GIP | (6) GUP | |

| SPILLOVER | −0.081 *** (−2.84) | −0.069 *** (−2.93) | −0.045 ** (−2.09) | −0.008 (−0.19) | 0.030 (0.87) | −0.075 ** (−2.39) |

| Constants | −1.411 *** (−3.05) | −1.710 *** (−4.53) | −0.713 ** (−2.00) | 0.219 (0.28) | 0.408 (0.68) | −0.209 (−0.35) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 7157 | 7157 | 7157 | 3228 | 3228 | 3228 |

| Adjusted R2 | 0.654 | 0.647 | 0.592 | 0.614 | 0.622 | 0.518 |

| Non-Resource-Based | Resource-Based | |||||

|---|---|---|---|---|---|---|

| (1) GI | (2) GIP | (3) GUP | (4) GI | (5) GIP | (6) GUP | |

| SPILLOVER | −0.057 ** (−2.06) | −0.047 ** (−2.13) | −0.049 ** (−2.37) | −0.077 (−1.24) | −0.002 (−0.03) | −0.092 * (−1.87) |

| Constants | −1.564 *** (−3.60) | −1.517 *** (−4.24) | −1.033 *** (−3.19) | 2.536 * (1.85) | 0.579 (0.63) | 2.492 ** (2.23) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 8836 | 8836 | 8836 | 1549 | 154 | 1549 |

| Adjusted R2 | 0.656 | 0.654 | 0.587 | 0.549 | 0.515 | 0.482 |

| Variables | (1) GI | (2) GIP | (3) GUP |

|---|---|---|---|

| INDRATIO | 1.770 *** (5.32) | 1.345 *** (4.52) | 1.221 *** (4.95) |

| Constants | −1.268 *** (−3.05) | −1.413 *** (−4.19) | −0.753 ** (−2.42) |

| Control variables | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes |

| Observations | 10,385 | 10,385 | 10,385 |

| Adjusted R2 | 0.643 | 0.640 | 0.573 |

| Non-State-Owned | State-Owned | |||||

|---|---|---|---|---|---|---|

| (1) GI | (2) GIP | (3) GUP | (4) GI | (5) GIP | (6) GUP | |

| INDRATIO | 2.489 *** (4.94) | 1.838 *** (4.19) | 1.681 *** (4.25) | 1.252 *** (3.09) | 1.046 *** (2.70) | 0.803 *** (2.80) |

| Constants | −2.033 *** (−3.99) | −1.905 *** (−5.04) | −1.458 *** (−3.44) | −1.469 * (−1.86) | −2.275 *** (−3.24) | 0.119 (0.21) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 6443 | 6443 | 6443 | 3942 | 3942 | 3942 |

| Adjusted R2 | 0.662 | 0.535 | 0.507 | 0.726 | 0.717 | 0.641 |

| Clean | High Energy Consuming | |||||

|---|---|---|---|---|---|---|

| (1) GI | (2) GIP | (3) GUP | (4) GI | (5) GIP | (6) GUP | |

| INDRATIO | 1.720 *** (4.94) | 1.300 *** (4.12) | 1.233 *** (4.67) | 2.042 ** (2.07) | 1.666 ** (2.17) | 0.796 (1.07) |

| Constants | −1.701 *** (−3.55) | −1.716 *** (−4.73) | −1.127 *** (−2.95) | 0.975 (0.86) | 0.583 (0.61) | 0.838 (1.00) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| City-industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 8456 | 8456 | 8456 | 1929 | 1929 | 1929 |

| Adjusted R2 | 0.660 | 0.656 | 0.590 | 0.556 | 0.551 | 0.479 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chai, M.; Wu, C.; Luo, Y.; Mensah, C.N. New Energy Demonstration City Policy and Corporate Green Innovation: From the Perspective of Industrial and Regional Spillover Effect. Sustainability 2025, 17, 3179. https://doi.org/10.3390/su17073179

Chai M, Wu C, Luo Y, Mensah CN. New Energy Demonstration City Policy and Corporate Green Innovation: From the Perspective of Industrial and Regional Spillover Effect. Sustainability. 2025; 17(7):3179. https://doi.org/10.3390/su17073179

Chicago/Turabian StyleChai, Mao, Chao Wu, Yusen Luo, and Claudia Nyarko Mensah. 2025. "New Energy Demonstration City Policy and Corporate Green Innovation: From the Perspective of Industrial and Regional Spillover Effect" Sustainability 17, no. 7: 3179. https://doi.org/10.3390/su17073179

APA StyleChai, M., Wu, C., Luo, Y., & Mensah, C. N. (2025). New Energy Demonstration City Policy and Corporate Green Innovation: From the Perspective of Industrial and Regional Spillover Effect. Sustainability, 17(7), 3179. https://doi.org/10.3390/su17073179