Climate Risk Disclosure and Financial Analysts’ Forecasts: Evidence from China

Abstract

1. Introduction

2. Related Literature and Hypothesis Development

2.1. The Information Hypothesis

2.2. The Opportunistic Hypothesis

3. Research Design

3.1. Data and Sample

3.2. Regression Model

3.3. Independent Variable

3.4. Dependent Variable

3.5. Control Variable

4. Empirical Analyses

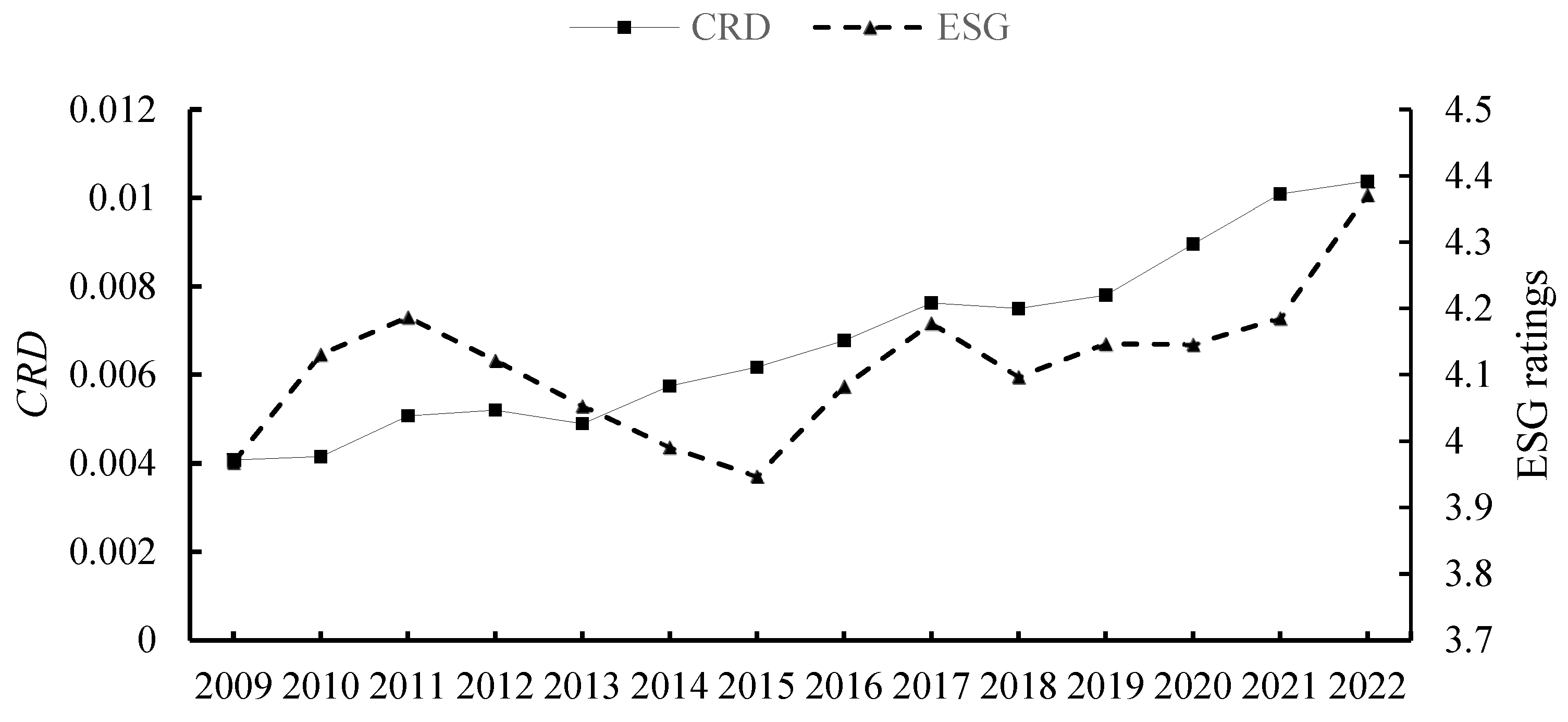

4.1. Descriptive Statistics

4.2. Baseline Results

4.3. Robustness Tests

4.4. Heterogeneity Tests

4.5. Tests of Moderating Effect

4.5.1. Moderating Effect of Earnings Quality

4.5.2. Moderating Effect of Long-Term Institutional Investors

5. Mechanism Analyses

5.1. Mechanism Analysis of Information Asymmetry

5.2. Mechanism Analysis of Analysts’ Climate-Related On-Site Visits

6. Further Analyses

6.1. Region Heterogeneity Analysis: Regions with High Climate Awareness vs. Regions with Low Climate Awareness

6.2. Industry Heterogeneity Analysis: Carbon-Intensive Industries vs. Non-Carbon-Intensive Industries

6.3. Firm Heterogeneity Analysis: State-Owned Enterprises vs. Non-State-Owned Enterprises

6.4. Effect of PCRD and TCRD on Analysts’ Forecasts

7. Conclusions

7.1. Conclusion and Discussion

7.2. Policy Implications

7.3. Future Research Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Regulation | The Enhancement and Standardization of Climate-Related Disclosures: Final Rules | International Financial Reporting Standards Sustainability Disclosure Standard 2—Climate-Related Disclosures (IFRS S2) | Guidelines for Self-Regulation of Listed Companies—Sustainability Reporting (Trial) |

|---|---|---|---|

| Issuing Authority | U.S. SEC | ISSB | SSE, SZSE and BSE of China |

| Applicable Entity | Companies listed in the U.S. | Global entities adopting IFRS Sustainability Standards | Listed companies in China |

| Mandator | Mandatory for all SEC registrants | Mandatory at the jurisdictional level by local regulators | Mandatory only for companies included in the SSE 180 Index, STAR 50 Index, SZSE 100 Index, and ChiNext Index, and those listed both domestically and overseas |

| Formal Regulation | Yes | Yes | No (Trial) |

| Specialized Regulation | Yes | Yes | No |

| Framework Basis | Based on TCFD, including governance, strategy, risk management, metrics, and targets | Based on TCFD, including governance, strategy, risk management, metrics, and targets | Based on TCFD, ISSB, and Chinese policies, including governance, strategy, impacts, risk, and opportunity management, metrics, and targets |

| Materiality Principle | Financial materiality | Financial materiality | Financial materiality and impact materiality |

| Climate-Related Content | Mandatory disclosure of material financial impacts | Disclosure of impacts on cash flow, assets, and liabilities | Disclosure of climate-related risks, opportunities, and responses |

| Mandatory Disclosure of GHG Emissions | Scope 1 and 2 | Scope 1, 2, and 3 | No |

| Qualitative or Quantitative Analysis | Qualitative and quantitative analyses | Qualitative and quantitative analyses | Qualitative and quantitative analyses, but the latter with limited requirements |

| Mandatory Scenario analysis | No | Yes | No |

| Mandatory External Assurance | Limited assurance is required for Scope 1 and 2 | No | No |

Appendix B

| Word Type | Word Set |

|---|---|

| Seed word | New energy, electric vehicles, wind energy, hydropower, nuclear energy, solar energy, photovoltaic, wind power generation, hydropower, nuclear energy, hydrogen energy, energy storage, carbon sink, forest, ocean, technology, innovation, battery, infrastructure, energy efficiency, carbon neutrality, carbon emissions peak, emission reduction, carbon trading market, climate change, ecology, air temperature, precipitation, drought, flood disasters, natural disasters, pollution control, exhaust gas, wastewater, dust, cleanliness, low-carbon, energy saving, environmental protection, efficiency, optimization, new type, industrial structure, energy structure, green, R&D, green bonds |

| Augmented word | New energy, electric vehicles, wind energy, water energy, nuclear energy, solar energy, photovoltaic, wind power generation, hydropower, nuclear energy, hydrogen energy, energy storage, carbon sink, forest, ocean, technology, innovation, battery, infrastructure, energy efficiency, carbon neutrality, carbon emission peak, emission reduction, carbon trading market, climate change, ecology, air temperature, precipitation, drought, flood disasters, natural disasters, pollution prevention and control, exhaust gas, wastewater, dust, clean, low carbon, energy saving, environmental protection, high efficiency, optimization, new type, industrial structure, energy structure, green, research and development, green bonds, ammonia nitrogen, ammonia gas, environmental protection, heavy rain, sun exposure, sultry, warming, charging, odor, energy storage, standard emission, atmosphere, heavy fog, rainwater, nitrogen oxides, ground temperature, low energy consumption, electric vehicle, electricity, power battery, power system, freezing rain, rainy, sulfur dioxide, power generation, waste, wastewater treatment, dust, wind power, wind sensation, wind force, fluoride, high energy consumption, industrial wastewater, solid waste, solid waste, energy consumption, flood, environmentally friendly, air pressure, carbon reduction, energy consumption reduction, carbon reduction, snowfall, rainfall, energy saving and consumption reduction, energy saving, resource-saving type, slag formation, particulate matter, renewable, zero emissions, zero carbon, zero carbon emissions, hydrogen sulfide, hydrogen chloride, energy consumption, energy efficiency, energy, inverter, emissions, total emissions, oxygen emissions, climate, meteorological elements, heavy rain, hydrogen energy, fuel cell, heat diffusion, three wastes, heat dissipation, production wastewater, dual carbon, acid mist, carbon peak, weather, external discharge, exhaust gas, pollution, sewage, no dust emission, infiltration, smoke dust, pollution control, heavy metals, resource-saving type, total nitrogen, dust capacity. |

Appendix C

References

- Huang, H.H.; Kerstein, J.; Wang, C. The Impact of Climate Risk on Firm Performance and Financing Choices. J. Int. Bus. Stud. 2018, 49, 633–656. [Google Scholar]

- Ding, R.; Liu, M.; Wang, T.; Wu, Z. The Impact of Climate Risk on Earnings Management: International Evidence. J. Account. Public Policy 2021, 40, 106818. [Google Scholar] [CrossRef]

- Carvalho, V.M.; Nirei, M.; Saito, Y.U.; Tahbaz-Salehi, A. Supply Chain Disruptions: Evidence from the Great East Japan Earthquake. Q. J. Econ. 2021, 136, 1255–1321. [Google Scholar] [CrossRef]

- Park, Y.; Hong, P.; Roh, J.J. Supply Chain Lessons from the Catastrophic Natural Disaster in Japan. Bus. Horiz. 2013, 56, 75–85. [Google Scholar] [CrossRef]

- Addoum, J.M.; Ng, D.T.; Ortiz-Bobea, A. Temperature Shocks and Establishment Sales. Rev. Financ. Stud. 2020, 33, 1331–1366. [Google Scholar] [CrossRef]

- Zhang, L.; Kanagaretnam, K. Climate Disasters and Analysts’ Earnings Forecasts: Evidence from the United States. Eur. Account. Rev. 2024, 1–28. [Google Scholar] [CrossRef]

- Kong, D.; Lin, Z.; Wang, Y.; Xiang, J. Natural Disasters and Analysts’ Earnings Forecasts. J. Corp. Financ. 2021, 66, 101860. [Google Scholar] [CrossRef]

- Ben-Amar, W.; Herrera, D.C.; Martinez, I. Do Climate Risk Disclosures Matter to Financial Analysts? Bus. Financ. Account. 2024, 51, 2153–2180. [Google Scholar] [CrossRef]

- Lin, B.; Wu, N. Climate Risk Disclosure and Stock Price Crash Risk: The Case of China. Int. Rev. Econ. Financ. 2023, 83, 21–34. [Google Scholar] [CrossRef]

- Wang, W.; Yuan, D. Earnings Quality and Forward-Looking Information Disclosures: Positive Complement or Negative Substitution? J. Audit Econ. 2014, 29, 48–57. (In Chinese) [Google Scholar]

- Cohen, S.; Kadach, I.; Ormazabal, G. Institutional Investors, Climate Disclosure, and Carbon Emissions. J. Account. Econ. 2023, 76, 101640. [Google Scholar] [CrossRef]

- Hsu, C.; Novoselov, K.E.; Wang, R. Does Accounting Conservatism Mitigate the Shortcomings of CEO Overconfidence? Account. Rev. 2017, 92, 77–101. [Google Scholar] [CrossRef]

- Ilhan, E.; Krueger, P.; Sautner, Z.; Starks, L.T. Climate Risk Disclosure and Institutional Investors. Rev. Financ. Stud. 2023, 36, 2617–2650. [Google Scholar] [CrossRef]

- Cui, X.; Ding, Q.; Yang, L.; Yu, C. Environmental Protection Tax Reform and Corporate Climate Risk Disclosure. J. Clean. Prod. 2024, 478, 143931. [Google Scholar] [CrossRef]

- Matsumura, E.M.; Prakash, R.; Vera-Muñoz, S.C. Climate-Risk Materiality and Firm Risk. Rev. Account. Stud. 2024, 29, 33–74. [Google Scholar] [CrossRef]

- Li, Y.; Wang, D.; Meng, D.; Hu, Y. Peer Effect on Climate Risk Information Disclosure. China J. Account. Res. 2024, 17, 100375. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Radhakrishnan, S.; Tsang, A.; Yang, Y.G. Nonfinancial Disclosure and Analyst Forecast Accuracy: International Evidence on Corporate Social Responsibility Disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Shao, J.; Wu, Y.; Ye, Z. Does Carbon Disclosure Levels Affect Analyst Forecasts? Evidence from China. Sustainability 2025, 17, 1152. [Google Scholar] [CrossRef]

- Muslu, V.; Radhakrishnan, S.; Subramanyam, K.R.; Lim, D. Forward-Looking MD&A Disclosures and the Information Environment. Manag. Sci. 2015, 61, 931–948. [Google Scholar] [CrossRef]

- Wang, X.; Li, Y.; Xiao, M. Do Risk Disclosures in Annual Reports Improve Analyst Forecast Accuracy? China J. Account. Stud. 2017, 5, 527–546. [Google Scholar] [CrossRef]

- Huang, X.; Teoh, S.H.; Zhang, Y. Tone Management. Account. Rev. 2014, 89, 1083–1113. [Google Scholar] [CrossRef]

- Krueger, P.; Sautner, Z.; Starks, L.T. The Importance of Climate Risks for Institutional Investors. Rev. Financ. Stud. 2020, 33, 1067–1111. [Google Scholar] [CrossRef]

- Zhang, Y.; He, M.; Liao, C.; Wang, Y. Climate Risk Exposure and the Cross-Section of Chinese Stock Returns. Fin. Res. Lett. 2023, 55, 103987. [Google Scholar] [CrossRef]

- Huang, H.H.; Kerstein, J.; Wang, C.; Wu, F. (Harry) Firm Climate Risk, Risk Management, and Bank Loan Financing. Strateg. Manag. J. 2022, 43, 2849–2880. [Google Scholar] [CrossRef]

- Ginglinger, E.; Moreau, Q. Climate Risk and Capital Structure. Manag. Sci. 2023, 69, 7492–7516. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Z. Corporate Climate Risk Exposure and Capital Structure: Evidence from Chinese Listed Companies. Fin. Res. Lett. 2023, 51, 103488. [Google Scholar] [CrossRef]

- Hope, O. Disclosure Practices, Enforcement of Accounting Standards, and Analysts’ Forecast Accuracy: An International Study. J. Account. Res. 2003, 41, 235–272. [Google Scholar] [CrossRef]

- Schipper, K. Analysts’ Forecasts. Account. Horiz. 1991, 5, 105–121. [Google Scholar]

- Amiram, D.; Landsman, W.R.; Owens, E.L.; Stubben, S.R. How Are Analysts’ Forecasts Affected by High Uncertainty? J. Bus. Financ. Account. 2018, 45, 295–318. [Google Scholar] [CrossRef]

- Cheng, Q.; Du, F.; Wang, X.; Wang, Y. Seeing Is Believing: Analysts’ Corporate Site Visits. Rev. Account. Stud. 2016, 21, 1245–1286. [Google Scholar] [CrossRef]

- Han, B.; Kong, D.; Liu, S. Do Analysts Gain an Informational Advantage by Visiting Listed Companies? Contemp. Account. Res. 2018, 35, 1843–1867. [Google Scholar] [CrossRef]

- Wang, H.; Wang, K. Accrual Management and Tone Management. Acct. Res. 2018, 4, 45–51. (In Chinese) [Google Scholar]

- Li, F. Annual Report Readability, Current Earnings, and Earnings Persistence. J. Account. Econ. 2008, 45, 221–247. [Google Scholar] [CrossRef]

- Lo, K.; Ramos, F.; Rogo, R. Earnings Management and Annual Report Readability. J. Account. Econ. 2017, 63, 1–25. [Google Scholar] [CrossRef]

- Wang, K.; Wang, H.; Li, D.; Dai, X. Complexity of Annual Report and Management Self-interest: Empirical Evidence from Chinese Listed Firms. J. Manag. World. 2018, 34, 120–132. (In Chinese) [Google Scholar] [CrossRef]

- Lu, D.; Song, X.; Gong, Y. Controlling Shareholder’s Shares Pledge and Readability of Annual Reports. Fin. Trade Res. 2020, 31, 77–96. (In Chinese) [Google Scholar] [CrossRef]

- Du, J.; Xu, X.; Yang, Y. Does Corporate Climate Risk Affect the cost of equity? Evidence from Textual analysis with Machine learning. China Rev. Fin. Stud. 2023, 15, 19–46. (In Chinese) [Google Scholar]

- Plumlee, M.; Brown, D.; Hayes, R.M.; Marshall, R.S. Voluntary Environmental Disclosure Quality and Firm Value: Further Evidence. J. Account. Public Policy 2015, 34, 336–361. [Google Scholar] [CrossRef]

- Ni, Y.; Chen, Z.; Li, D.; Yang, S. Climate Risk and Corporate Tax Avoidance: International Evidence. Corp. Gov. Int. Rev. 2022, 30, 189–211. [Google Scholar] [CrossRef]

- Yang, X.; Wei, L.; Deng, R.; Cao, J.; Huang, C. Can Climate-Related Risks Increase Audit Fees?–Evidence from China. Fin. Res. Lett. 2023, 57, 104194. [Google Scholar] [CrossRef]

- Balli, H.O.; Sørensen, B.E. Interaction Effects in Econometrics. Empir. Econ. 2013, 45, 583–603. [Google Scholar] [CrossRef]

- Zhou, S.; Zhan, Q.; Hu, L. Can Institutional Investors Promote M&A Performance of State-owned Enterprises? Discussion on Institutional Investors Heterogeneity in China. Account. Res. 2017, 6, 67–74. (In Chinese) [Google Scholar]

- Hou, K.; Moskowitz, T.J. Market Frictions, Price Delay, and the Cross-Section of Expected Returns. Rev. Financ. Stud. 2005, 18, 981–1020. [Google Scholar] [CrossRef]

- Zhao, L.; Parhizgari, A.M. Climate Change, Technological Innovation, and Firm Performance. Int. Rev. Econ. Financ. 2024, 93, 189–203. [Google Scholar] [CrossRef]

| Variable | Definition |

|---|---|

| FERROR | The average absolute difference between the actual EPS and forecasted EPS, divided by the stock price of last year. |

| FDISP | The standard deviation of forecasted EPS, divided by the stock price of last year. |

| CRD | Climate risk disclosure, measured as the ratio of the climate risk words to the total words in annual reports. |

| SIZE | The natural logarithm of total assets. |

| ROA | Return on assets, calculated as net income divided by total assets. |

| LEV | Leverage, calculated as total debts divided by total assets. |

| GROWTH | Sales growth, calculated as the change in revenue in the current year divided by revenue in the prior year |

| BOD | The number of directors on the board. |

| ID | The proportion of the independent directors of the board. |

| DUAL | A dummy variable equals 1 if the CEO is also the chairman and 0 otherwise. |

| TOP1 | The proportion of shares held by the controlling stockholders. |

| BIG4 | A dummy variable equals 1 if the audit firm is one of the international “BIG Four” and 0 otherwise. |

| FCOVER | The natural logarithm of the number of analysts following the firm plus 1. |

| Variable | N | Mean | SD | Min | p50 | Max |

|---|---|---|---|---|---|---|

| FERROR | 24,564 | 0.014 | 0.021 | 0.000 | 0.007 | 0.139 |

| FDISP | 24,564 | 0.009 | 0.011 | 0.000 | 0.005 | 0.068 |

| CRD | 24,564 | 0.007 | 0.005 | 0.001 | 0.006 | 0.027 |

| SIZE | 24,564 | 22.400 | 1.340 | 20.000 | 22.200 | 26.500 |

| ROA | 24,564 | 0.053 | 0.050 | −0.120 | 0.047 | 0.214 |

| LEV | 24,564 | 0.433 | 0.200 | 0.056 | 0.432 | 0.865 |

| GROWTH | 24,564 | 0.233 | 0.449 | −0.467 | 0.150 | 3.040 |

| BOD | 24,564 | 10.100 | 2.530 | 5.000 | 9.000 | 18.000 |

| ID | 24,564 | 0.381 | 0.071 | 0.250 | 0.364 | 0.600 |

| DUAL | 24,564 | 0.270 | 0.444 | 0.000 | 0.000 | 1.000 |

| TOP1 | 24,564 | 0.356 | 0.152 | 0.089 | 0.338 | 0.754 |

| BIG4 | 24,564 | 0.085 | 0.279 | 0.000 | 0.000 | 1.000 |

| FCOVER | 24,564 | 2.130 | 0.861 | 0.000 | 2.080 | 3.850 |

| Variables | (1) | (2) |

|---|---|---|

| FERROR | FDISP | |

| CRD | −0.183 *** | −0.065 *** |

| (−5.77) | (−4.17) | |

| SIZE | 0.003 *** | 0.002 *** |

| (19.65) | (22.00) | |

| ROA | −0.032 *** | −0.007 *** |

| (−10.08) | (−4.47) | |

| LEV | 0.011 *** | 0.006 *** |

| (11.85) | (13.47) | |

| GROWTH | −0.001 * | −0.000 |

| (−1.87) | (−0.30) | |

| BOD | −0.000 ** | −0.000 |

| (−2.40) | (−1.48) | |

| IDRATE | −0.003 | −0.002 * |

| (−1.52) | (−1.78) | |

| DUAL | 0.000 | −0.000 |

| (0.80) | (−1.17) | |

| TOP1 | −0.008 *** | −0.001 *** |

| (−8.34) | (−3.17) | |

| BIG4 | −0.003 *** | −0.002 *** |

| (−6.75) | (−6.63) | |

| FCOVER | −0.003 *** | −0.000 *** |

| (−18.77) | (−3.38) | |

| Constant | −0.039 *** | −0.022 *** |

| (−11.97) | (−14.01) | |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| N | 24,564 | 24,564 |

| R2 | 0.105 | 0.107 |

| F | 61.410 | 62.270 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| FERROR | FDISP | FERROR | FDISP | FERROR | FDISP | |

| STDCRD | −0.001 *** | −0.000 *** | ||||

| (−5.89) | (−4.35) | |||||

| LNCRD | −0.001 *** | −0.000 *** | ||||

| (−6.10) | (−4.06) | |||||

| CRD | −0.166 *** | −0.050 *** | ||||

| (−5.19) | (−3.08) | |||||

| SIZE | 0.003 *** | 0.002 *** | 0.003 *** | 0.002 *** | 0.003 *** | 0.002 *** |

| (19.67) | (22.02) | (19.79) | (22.03) | (19.34) | (21.17) | |

| ROA | −0.032 *** | −0.007 *** | −0.032 *** | −0.007 *** | −0.032 *** | −0.009 *** |

| (−10.08) | (−4.48) | (−10.25) | (−4.58) | (−10.11) | (−5.58) | |

| LEV | 0.011 *** | 0.006 *** | 0.011 *** | 0.006 *** | 0.011 *** | 0.006 *** |

| (11.86) | (13.48) | (11.65) | (13.33) | (11.47) | (12.49) | |

| GROWTH | −0.001 * | −0.000 | −0.001 * | −0.000 | −0.000 | −0.000 |

| (−1.87) | (−0.29) | (−1.76) | (−0.24) | (−1.34) | (−0.71) | |

| BOD | −0.000 ** | −0.000 | −0.000 ** | −0.000 | −0.000 * | −0.000 |

| (−2.41) | (−1.49) | (−2.32) | (−1.43) | (−1.78) | (−0.60) | |

| IDRATE | −0.003 | −0.002* | −0.002 | −0.002* | −0.001 | −0.002 * |

| (−1.53) | (−1.78) | (−1.34) | (−1.65) | (−0.79) | (−1.95) | |

| DUAL | 0.000 | −0.000 | 0.000 | −0.000 | 0.000 | −0.000 |

| (0.82) | (−1.16) | (1.00) | (−1.05) | (0.42) | (−1.12) | |

| TOP1 | −0.008 *** | −0.001 *** | −0.008 *** | −0.001 *** | −0.006 *** | −0.001 ** |

| (−8.32) | (−3.16) | (−8.44) | (−3.23) | (−7.04) | (−2.02) | |

| BIG4 | −0.003 *** | −0.002 *** | −0.003 *** | −0.002 *** | −0.003 *** | −0.002 *** |

| (−6.77) | (−6.65) | (−6.51) | (−6.45) | (−6.71) | (−6.09) | |

| FCOVER | −0.003 *** | −0.000 *** | −0.003 *** | −0.000 *** | −0.003 *** | −0.000 *** |

| (−18.77) | (−3.38) | (−18.56) | (−3.25) | (−16.98) | (−3.12) | |

| Constant | −0.040 *** | −0.023 *** | −0.035 *** | −0.021 *** | −0.042 *** | −0.023 *** |

| (−12.30) | (−14.22) | (−10.69) | (−13.10) | (−12.84) | (−14.34) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 24,564 | 24,564 | 24,564 | 24,564 | 21,399 | 21,399 |

| R2 | 0.105 | 0.107 | 0.105 | 0.107 | 0.113 | 0.118 |

| F | 61.450 | 62.300 | 61.500 | 62.250 | 60.540 | 63.200 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| FERROR | FDISP | FERROR | FDISP | FERROR | FDISP | FERROR | FDISP | |

| CRD | −0.183 *** | −0.065 *** | −0.087 ** | −0.043 ** | −0.186 ** | −0.719 *** | ||

| (−5.78) | (−4.13) | (−2.14) | (−2.16) | (−2.04) | (−15.26) | |||

| TREAT | 0.002 | 0.001 | ||||||

| (1.04) | (0.96) | |||||||

| POST | 0.012 *** | −0.002 ** | ||||||

| (7.48) | (−2.02) | |||||||

| TREAT × POST | −0.005 *** | −0.002 *** | ||||||

| (−5.70) | (−3.39) | |||||||

| SIZE | 0.001 | 0.005 *** | 0.003 *** | 0.001 *** | 0.004 *** | 0.002 *** | 0.004 *** | 0.002 *** |

| (0.27) | (3.32) | (11.98) | (11.28) | (22.84) | (27.02) | (18.11) | (18.43) | |

| ROA | −0.016 | −0.029 *** | −0.028 *** | −0.003 | −0.000 | 0.000 | 0.000 | 0.000 |

| (−0.75) | (−2.80) | (−5.51) | (−1.16) | (−0.73) | (0.04) | (0.02) | (0.40) | |

| LEV | 0.014 *** | 0.002 | 0.010 *** | 0.008 *** | 0.007 *** | 0.004 *** | 0.005 *** | 0.002 *** |

| (3.51) | (1.03) | (6.36) | (10.03) | (11.56) | (12.08) | (5.67) | (5.16) | |

| GROWTH | −0.002 | 0.002 ** | −0.001 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (−1.04) | (2.09) | (−1.11) | (−0.51) | (−0.88) | (−0.93) | (−0.59) | (−0.49) | |

| BOD | −0.000 * | 0.000 | −0.000 * | 0.000 | −0.000 *** | −0.000 *** | −0.000 ** | −0.000 |

| (−1.93) | (1.05) | (−1.83) | (1.06) | (−3.60) | (−2.70) | (−2.33) | (−1.44) | |

| IDRATE | 0.004 | −0.010 ** | 0.000 | −0.001 | −0.004 ** | −0.003 *** | −0.005 * | −0.003 * |

| (0.43) | (−2.49) | (0.16) | (−0.49) | (−2.06) | (−3.36) | (−1.77) | (−1.88) | |

| DUAL | −0.001 | 0.002 * | 0.000 | −0.001 *** | 0.001 ** | 0.000 | 0.001 ** | 0.000 |

| (−0.64) | (1.92) | (0.21) | (−2.58) | (2.05) | (0.97) | (2.00) | (0.69) | |

| TOP1 | −0.004 | −0.006 *** | −0.010 *** | −0.000 | −0.010 *** | −0.003 *** | −0.009 *** | 0.000 |

| (−0.90) | (−2.74) | (−6.52) | (−0.16) | (−10.33) | (−5.32) | (−5.86) | (0.34) | |

| BIG4 | 0.000 | −0.006 *** | −0.004 *** | −0.002 *** | −0.004 *** | −0.003 *** | −0.004 *** | −0.002 *** |

| (0.01) | (−2.89) | (−5.12) | (−3.79) | (−7.29) | (−9.27) | (−5.22) | (−4.83) | |

| FCOVER | −0.004 *** | 0.001 | −0.004 *** | −0.000 * | −0.004 *** | −0.001 *** | −0.005 *** | −0.000 *** |

| (−4.25) | (1.49) | (−12.31) | (−1.68) | (−26.61) | (−7.07) | (−17.99) | (−3.26) | |

| IMR | −0.030 | 0.041 ** | ||||||

| (−0.78) | (2.15) | |||||||

| Constant | 0.028 | −0.114 *** | −0.040 *** | −0.014 *** | −0.062 *** | −0.037 *** | −0.052 *** | −0.026 *** |

| (0.33) | (−2.68) | (−6.52) | (−5.22) | (−17.18) | (−20.00) | (−11.59) | (−11.71) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 24,564 | 24,564 | 9402 | 9402 | 24,564 | 24,564 | 12,730 | 12,730 |

| R2 | 0.105 | 0.107 | 0.095 | 0.096 | 0.077 | 0.085 | 0.099 | 0.098 |

| F | 60.140 | 61.080 | 20.850 | 21.970 | 66.530 | 60.250 | 28.910 | 28.770 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| FERROR | FDISP | FERROR | FDISP | |

| CRD | −0.171 *** | −0.065 *** | −0.180 *** | −0.064 *** |

| (−5.69) | (−4.39) | (−6.04) | (−4.30) | |

| EQ | −0.002 *** | −0.000 ** | ||

| (−4.51) | (−2.40) | |||

| CRD × EQ | −0.401 *** | −0.105 ** | ||

| (−4.48) | (−2.39) | |||

| LINS | −0.053 *** | −0.008 *** | ||

| (−10.96) | (−3.55) | |||

| CRD × LINS | −2.244 *** | 0.477 | ||

| (−2.64) | (1.13) | |||

| SIZE | 0.003 *** | 0.002 *** | 0.003 *** | 0.002 *** |

| (19.97) | (22.14) | (17.29) | (21.00) | |

| ROA | −0.031 *** | −0.007 *** | −0.031 *** | −0.007 *** |

| (−9.83) | (−4.23) | (−9.96) | (−4.38) | |

| LEV | 0.011 *** | 0.006 *** | 0.012 *** | 0.006 *** |

| (11.78) | (13.50) | (12.65) | (13.71) | |

| GROWTH | −0.001 * | −0.000 | −0.001 ** | −0.000 |

| (−1.94) | (−0.46) | (−2.00) | (−0.34) | |

| BOD | −0.000 ** | −0.000 | −0.000 ** | −0.000 |

| (−2.46) | (−1.43) | (−2.50) | (−1.51) | |

| IDRATE | −0.003 | −0.002* | −0.003 | −0.002 * |

| (−1.39) | (−1.74) | (−1.52) | (−1.81) | |

| DUAL | 0.000 | −0.000 | 0.000 | −0.000 |

| (0.78) | (−1.17) | (0.73) | (−1.20) | |

| TOP1 | −0.007 *** | −0.001 *** | −0.008 *** | −0.002 *** |

| (−8.18) | (−3.03) | (−9.36) | (−3.50) | |

| BIG4 | −0.003 *** | −0.002 *** | −0.004 *** | −0.002 *** |

| (−6.64) | (−6.57) | (−7.07) | (−6.78) | |

| FCOVER | −0.003 *** | −0.000 *** | −0.003 *** | −0.000 * |

| (−18.83) | (−3.54) | (−13.87) | (−1.90) | |

| Constant | −0.042 *** | −0.024 *** | −0.034 *** | −0.022 *** |

| (−12.68) | (−14.48) | (−10.29) | (−13.43) | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 24,248 | 24,248 | 24,564 | 24,564 |

| R2 | 0.106 | 0.107 | 0.110 | 0.107 |

| F | 59.490 | 60.630 | 61.710 | 60.100 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | FERROR | DELAY | FERROR | FDISP | FDISP |

| CRD | −0.163 *** | −0.777 *** | −0.153 *** | −0.066 *** | −0.063 *** |

| (−4.27) | (−5.16) | (−4.00) | (−3.62) | (−3.44) | |

| DELAY | 0.013 *** | 0.004 *** | |||

| (6.94) | (4.68) | ||||

| SIZE | 0.003 *** | −0.004 *** | 0.003 *** | 0.002 *** | 0.002 *** |

| (16.42) | (−5.92) | (16.73) | (19.20) | (19.40) | |

| ROA | −0.031 *** | −0.016 | −0.031 *** | −0.008 *** | −0.008 *** |

| (−7.93) | (−1.00) | (−7.89) | (−4.08) | (−4.05) | |

| LEV | 0.011 *** | 0.037 *** | 0.010 *** | 0.007 *** | 0.006 *** |

| (9.59) | (8.22) | (9.16) | (11.99) | (11.69) | |

| GROWTH | −0.001 ** | 0.002 | −0.001 ** | −0.000 | −0.000 |

| (−2.04) | (1.16) | (−2.11) | (−1.59) | (−1.63) | |

| BOD | −0.000 *** | −0.000 | −0.000 *** | −0.000 ** | −0.000 ** |

| (−3.30) | (−0.83) | (−3.26) | (−2.01) | (−1.98) | |

| IDRATE | −0.003 | −0.013 | −0.003 | −0.001 | −0.001 |

| (−1.58) | (−1.46) | (−1.51) | (−1.27) | (−1.22) | |

| DUAL | 0.000 | −0.002 | 0.000 | −0.000 | −0.000 |

| (0.37) | (−1.35) | (0.44) | (−1.07) | (−1.02) | |

| TOP1 | −0.007 *** | 0.016 *** | −0.008 *** | −0.001 | −0.001 |

| (−6.70) | (3.69) | (−6.90) | (−1.11) | (−1.24) | |

| BIG4 | −0.003 *** | 0.001 | −0.003 *** | −0.002 *** | −0.002 *** |

| (−5.37) | (0.51) | (−5.40) | (−5.64) | (−5.66) | |

| FCOVER | −0.003 *** | −0.005 *** | −0.003 *** | −0.000 * | −0.000 * |

| (−15.60) | (−5.58) | (−15.32) | (−1.86) | (−1.66) | |

| Constant | −0.030 *** | 0.175 *** | −0.032 *** | −0.020 *** | −0.021 *** |

| (−7.41) | (11.13) | (−7.97) | (−10.58) | (−10.94) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| N | 17,898 | 17,898 | 17,898 | 17,898 | 17,898 |

| R2 | 0.103 | 0.230 | 0.105 | 0.110 | 0.111 |

| F | 49.780 | 130.200 | 49.870 | 54.000 | 53.290 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| FERROR | SURVEY | FERROR | FDISP | FDISP | |

| CRD | −0.183 *** | 0.403 *** | −0.178 *** | −0.120 *** | −0.118 *** |

| (−5.77) | (7.59) | (−5.63) | (−7.80) | (−7.64) | |

| SURVEY | −0.011 *** | −0.004 ** | |||

| (−2.77) | (−1.98) | ||||

| SIZE | 0.003 *** | −0.002 *** | 0.003 *** | 0.001 *** | 0.001 *** |

| (19.65) | (−7.10) | (19.51) | (18.54) | (18.49) | |

| ROA | −0.032 *** | −0.015 *** | −0.032 *** | −0.008 *** | −0.008 *** |

| (−10.08) | (−2.91) | (−10.13) | (−4.99) | (−5.02) | |

| LEV | 0.011 *** | −0.008 *** | 0.011 *** | 0.007 *** | 0.007 *** |

| (11.85) | (−5.10) | (11.75) | (16.03) | (15.92) | |

| GROWTH | −0.001 * | 0.001 * | −0.001 * | −0.000 | −0.000 |

| (−1.87) | (1.66) | (−1.84) | (−0.52) | (−0.50) | |

| BOD | −0.000 ** | 0.000 | −0.000 ** | −0.000 | −0.000 |

| (−2.40) | (0.63) | (−2.39) | (−1.13) | (−1.12) | |

| IDRATE | −0.003 | 0.010 *** | −0.003 | −0.002 *** | −0.002 *** |

| (−1.52) | (3.29) | (−1.47) | (−2.66) | (−2.61) | |

| DUAL | 0.000 | 0.003 *** | 0.000 | −0.000 *** | −0.000 ** |

| (0.80) | (5.19) | (0.89) | (−2.61) | (−2.53) | |

| TOP1 | −0.008 *** | −0.012 *** | −0.008 *** | −0.001 * | −0.001 * |

| (−8.34) | (−7.72) | (−8.47) | (−1.69) | (−1.81) | |

| BIG4 | −0.003 *** | −0.000 | −0.003 *** | −0.001 *** | −0.001 *** |

| (−6.75) | (−0.36) | (−6.76) | (−5.92) | (−5.94) | |

| FCOVER | −0.003 *** | 0.006 *** | −0.003 *** | −0.000 | −0.000 |

| (−18.77) | (19.18) | (−18.30) | (−1.32) | (−1.10) | |

| Constant | −0.039 *** | 0.032 *** | −0.038 *** | −0.016 *** | −0.016 *** |

| (−11.97) | (5.90) | (−11.85) | (−10.09) | (−10.03) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| N | 24,564 | 24,564 | 24,564 | 24,564 | 24,564 |

| R2 | 0.105 | 0.116 | 0.106 | 0.096 | 0.097 |

| F | 61.410 | 68.660 | 60.310 | 58.160 | 56.990 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Regions with High Climate Awareness | Regions with Low Climate Awareness | Regions with High Climate Awareness | Regions with Low Climate Awareness | |

| FERROR | FERROR | FDISP | FDISP | |

| CRD | −0.222 *** | −0.124 *** | −0.068 ** | −0.046 ** |

| (−3.97) | (−2.87) | (−2.52) | (−2.36) | |

| SIZE | 0.004 *** | 0.003 *** | 0.002 *** | 0.001 *** |

| (13.70) | (12.65) | (15.44) | (14.90) | |

| ROA | −0.029 *** | −0.035 *** | −0.003 | −0.007 *** |

| (−5.17) | (−7.75) | (−1.04) | (−3.47) | |

| LEV | 0.015 *** | 0.007 *** | 0.008 *** | 0.004 *** |

| (9.33) | (5.46) | (10.68) | (7.11) | |

| GROWTH | −0.001 *** | 0.000 | −0.000 | 0.001 ** |

| (−2.61) | (0.96) | (−1.51) | (2.32) | |

| BOD | −0.000 *** | −0.000 * | −0.000 * | −0.000 |

| (−2.76) | (−1.73) | (−1.73) | (−1.22) | |

| IDRATE | −0.007 ** | 0.000 | −0.003 | 0.000 |

| (−2.14) | (0.03) | (−1.61) | (0.28) | |

| DUAL | 0.001 | −0.000 | −0.000 | −0.000 |

| (1.08) | (−0.33) | (−0.30) | (−1.16) | |

| TOP1 | −0.008 *** | −0.008 *** | 0.000 | −0.003 *** |

| (−5.18) | (−6.35) | (0.12) | (−4.65) | |

| BIG4 | −0.003 *** | −0.004 *** | −0.002 *** | −0.002 *** |

| (−3.55) | (−5.04) | (−3.72) | (−5.24) | |

| FCOVER | −0.003 *** | −0.004 *** | −0.000 * | −0.000 *** |

| (−10.80) | (−14.25) | (−1.79) | (−3.09) | |

| Constant | −0.049 *** | −0.020 *** | −0.033 *** | −0.011 *** |

| (−8.90) | (−4.06) | (−12.52) | (−4.78) | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 11,735 | 9559 | 11,730 | 9557 |

| R2 | 0.107 | 0.114 | 0.106 | 0.117 |

| F | 32.590 | 28.370 | 32.200 | 29.410 |

| Empirical p-values | 0.072 * | 0.245 | ||

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Carbon-Intensive Industries | Non-Carbon-Intensive Industries | Carbon-Intensive Industries | Non-Carbon-Intensive Industries | |

| FERROR | FERROR | FDISP | FDISP | |

| CRD | −0.184 *** | −0.109 | −0.077 *** | 0.008 |

| (−5.92) | (−1.56) | (−4.92) | (0.22) | |

| SIZE | 0.003 *** | 0.003 *** | 0.002 *** | 0.002 *** |

| (16.21) | (11.00) | (20.53) | (10.62) | |

| ROA | −0.027 *** | −0.038 *** | −0.007 *** | −0.005 * |

| (−7.43) | (−5.90) | (−3.60) | (−1.72) | |

| LEV | 0.011 *** | 0.004 ** | 0.006 *** | 0.003 *** |

| (11.22) | (2.40) | (11.47) | (3.64) | |

| GROWTH | −0.001 | −0.000 | −0.000 | −0.000 |

| (−1.44) | (−0.45) | (−0.03) | (−0.26) | |

| BOD | −0.000 | −0.000 ** | −0.000 | −0.000 |

| (−1.63) | (−2.10) | (−0.75) | (−0.84) | |

| IDRATE | −0.001 | −0.006 | −0.001 | −0.003 * |

| (−0.41) | (−1.46) | (−1.29) | (−1.68) | |

| DUAL | 0.000 | 0.001 | −0.000 | −0.000 |

| (0.42) | (0.79) | (−0.68) | (−1.14) | |

| TOP1 | −0.006 *** | −0.010 *** | −0.001 *** | −0.001 |

| (−6.27) | (−5.69) | (−2.77) | (−0.86) | |

| BIG4 | −0.003 *** | −0.005 *** | −0.002 *** | −0.002 *** |

| (−5.93) | (−4.59) | (−6.21) | (−3.59) | |

| FCOVER | −0.003 *** | −0.004 *** | −0.000 *** | −0.000 |

| (−15.56) | (−10.28) | (−3.70) | (−0.71) | |

| Constant | −0.041 *** | −0.047 *** | −0.027 *** | −0.023 *** |

| (−12.18) | (−7.83) | (−16.30) | (−7.84) | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 18,199 | 6365 | 18,199 | 6365 |

| R2 | 0.096 | 0.116 | 0.111 | 0.069 |

| F | 71.510 | 30.710 | 84.240 | 17.370 |

| Empirical p-values | 0.090 * | 0.000 *** | ||

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| SOEs | Non-SOEs | SOEs | Non-SOEs | |

| FERROR | FERROR | FDISP | FDISP | |

| CRD | −0.253 *** | −0.129 *** | −0.122 *** | −0.027 |

| (−4.26) | (−3.48) | (−3.89) | (−1.51) | |

| SIZE | 0.003 *** | 0.003 *** | 0.002 *** | 0.002 *** |

| (11.76) | (15.45) | (13.04) | (16.40) | |

| ROA | −0.035 *** | −0.027 *** | −0.012 *** | −0.002 |

| (−5.77) | (−7.39) | (−3.79) | (−1.36) | |

| LEV | 0.016 *** | 0.008 *** | 0.010 *** | 0.004 *** |

| (9.77) | (6.98) | (11.24) | (7.90) | |

| GROWTH | −0.002 *** | −0.000 | −0.001 ** | 0.000 |

| (−3.21) | (−0.12) | (−2.31) | (1.30) | |

| BOD | −0.000 * | −0.000 | −0.000 | −0.000 |

| (−1.93) | (−0.31) | (−0.20) | (−1.01) | |

| IDRATE | −0.004 | −0.004 * | −0.002 | −0.002 ** |

| (−1.23) | (−1.87) | (−0.88) | (−2.41) | |

| DUAL | −0.000 | 0.000 | −0.000 | −0.000 * |

| (−0.61) | (0.24) | (−0.87) | (−1.88) | |

| TOP1 | −0.004 ** | −0.008 *** | −0.000 | −0.002 *** |

| (−2.57) | (−6.58) | (−0.08) | (−3.52) | |

| BIG4 | −0.004 *** | −0.003 *** | −0.002 *** | −0.002 *** |

| (−5.25) | (−4.39) | (−4.66) | (−5.41) | |

| FCOVER | −0.003 *** | −0.003 *** | −0.000 * | −0.000 *** |

| (−10.41) | (−15.92) | (−1.69) | (−3.38) | |

| Constant | −0.050 *** | −0.036 *** | −0.033 *** | −0.015 *** |

| (−9.31) | (−8.00) | (−11.69) | (−7.28) | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 9343 | 14,733 | 9343 | 14,733 |

| R2 | 0.117 | 0.112 | 0.128 | 0.099 |

| F | 26.810 | 39.460 | 29.620 | 34.220 |

| Empirical p-values | 0.022 ** | 0.001 *** | ||

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| FERROR | FDISP | FERROR | FDISP | |

| PCRD | −0.688 | 0.265 | ||

| (−1.23) | (0.95) | |||

| TCRD | −0.193 *** | −0.071 *** | ||

| (−5.98) | (−4.42) | |||

| SIZE | 0.003 *** | 0.002 *** | 0.003 *** | 0.002 *** |

| (19.17) | (21.45) | (19.66) | (22.02) | |

| ROA | −0.031 *** | −0.007 *** | −0.032 *** | −0.007 *** |

| (−9.94) | (−4.35) | (−10.08) | (−4.48) | |

| LEV | 0.011 *** | 0.006 *** | 0.011 *** | 0.006 *** |

| (11.78) | (13.41) | (11.85) | (13.47) | |

| GROWTH | −0.001 ** | −0.000 | −0.001 * | −0.000 |

| (−2.16) | (−0.54) | (−1.87) | (−0.29) | |

| BOD | −0.000 ** | −0.000 | −0.000 ** | −0.000 |

| (−2.36) | (−1.46) | (−2.40) | (−1.49) | |

| IDRATE | −0.003 | −0.001 | −0.003 | −0.002 * |

| (−1.38) | (−1.63) | (−1.53) | (−1.78) | |

| DUAL | 0.000 | −0.000 | 0.000 | −0.000 |

| (0.69) | (−1.26) | (0.80) | (−1.17) | |

| TOP1 | −0.007 *** | −0.001 *** | −0.008 *** | −0.001 *** |

| (−8.23) | (−3.10) | (−8.34) | (−3.18) | |

| BIG4 | −0.003 *** | −0.002 *** | −0.003 *** | −0.002 *** |

| (−6.44) | (−6.32) | (−6.75) | (−6.64) | |

| FCOVER | −0.003 *** | −0.000 *** | −0.003 *** | −0.000 *** |

| (−18.87) | (−3.50) | (−18.78) | (−3.38) | |

| Constant | −0.038 *** | −0.022 *** | −0.039 *** | −0.023 *** |

| (−11.62) | (−13.67) | (−11.98) | (−14.03) | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 24,564 | 24,564 | 24,564 | 24,564 |

| R2 | 0.104 | 0.106 | 0.105 | 0.107 |

| F | 60.660 | 61.880 | 61.470 | 62.320 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Han, J. Climate Risk Disclosure and Financial Analysts’ Forecasts: Evidence from China. Sustainability 2025, 17, 3178. https://doi.org/10.3390/su17073178

Liu Y, Han J. Climate Risk Disclosure and Financial Analysts’ Forecasts: Evidence from China. Sustainability. 2025; 17(7):3178. https://doi.org/10.3390/su17073178

Chicago/Turabian StyleLiu, Yaoyao, and Jie Han. 2025. "Climate Risk Disclosure and Financial Analysts’ Forecasts: Evidence from China" Sustainability 17, no. 7: 3178. https://doi.org/10.3390/su17073178

APA StyleLiu, Y., & Han, J. (2025). Climate Risk Disclosure and Financial Analysts’ Forecasts: Evidence from China. Sustainability, 17(7), 3178. https://doi.org/10.3390/su17073178