Abstract

The high-quality development of specialized, refined, distinctive, and innovative enterprises (SRDIEs) is essential for advancing an innovation-driven strategy. This paper investigates the impact of financial technology (Fintech) on sustainable innovation within SRDIEs that face financing challenges, analyzing it from supply-side, demand-side, and environmental perspectives. We utilize fuzzy-set Qualitative Comparative Analysis (fSQCA) and Necessary Condition Analysis (NCA) to explore the configurational paths and complex causal effects of Fintech in facilitating the innovation of SRDIEs amid financing challenges. By employing a combination of NCA and fsQCA, this study identifies several effective pathways through which Fintech enhances the innovation efficiency of SRDIEs. We develop an integrative model to enhance innovation inputs, outputs, and sustainability. The key findings include the following: (1) Fintech significantly enhances innovation output, supported by business efficiency and digital intelligence; (2) two distinct pathways for achieving high-innovation inputs are identified, driven by Fintech intensity and effective credit allocation, with specialization and financial mismatches serving as auxiliary factors; (3) the core conditions of Fintech intensity and the financing environment, along with competitive banking, promote innovation motivation and sustainability in highly specialized enterprises. The conclusions of this study provide both theoretical and practical insights for SRDIEs to tackle innovation challenges characterized by an “inability to innovate”, a “lack of willingness to innovate”, and “ineffectiveness in innovation”, enabling their transition from merely being “able to innovate” and “daring to innovate” to becoming “proficient in sustainable innovation”. These findings offer differentiated sustainable innovation solutions for enterprises through three avenues: capacity building on the demand side, channel optimization on the supply side, and ecological cultivation on the environmental side.

1. Introduction

SRDIEs are typical representatives of innovative small and medium-sized enterprises (SMEs) with four characteristics: specialization, refinement, distinctiveness, and innovation. They play a crucial role in promoting industrial innovation through technological innovation (Liu et al., 2019) [1]. Additionally, they are also important carriers for implementing innovation-driven strategies. While the number and scale of these enterprises are growing rapidly, they also face several development bottlenecks and practical challenges (Le et al., 2021) [2]. Despite the advantages associated with being labeled as “specialized, refined, distinctive, and innovative”, such as light asset operations, insufficient collateral, information asymmetry, and non-standard financial data expose these enterprises to greater risks, making it difficult to alleviate their financing challenges (Zhang et al., 2022) [3]. Problems like insufficient financing, high financing costs, and slow financing processes have impeded their innovation activities (Yang and Ren, 2021) [4]. Furthermore, due to their weak independent research and development and original innovation capabilities, and their relatively weak innovation sustainability, issues such as “fear of innovating, inability to innovate, and lack of innovation ability” are prevalent.

Fintech leverages foundational technologies such as big data, artificial intelligence (AI), mobile computing, cloud computing, the Internet of Things (IoT), and blockchain (Assarzadeh and Aberoumandl, 2018; Soni et al., 2022) [5,6]. It enhances the breadth and depth of financial services by integrating, optimizing, and innovating financial business processes, product offerings, and business models (Ng and Pan, 2022) [7]. Consequently, in the context of the digital and intelligent evolution of finance (Kangwa et al., 2021) [8], it is essential to explore new mechanisms for aligning industrial technology with financial innovation. Additionally, strategically deploying the capital chain in conjunction with the innovation chain can alleviate the challenges faced by SRDIEs in achieving high-quality development and bolster their continuous innovation capabilities (Lai et al., 2023) [9].

What pathways does Fintech use to influence the innovation activities of SRDIEs? This study explores the mechanisms and pathways through which Fintech facilitates innovation for SRDIEs facing financing difficulties. From the three dimensions of the demand side, the supply side, and the environmental side, it analyzes how Fintech helps enterprises to transform from wanting financing to being capable of financing and ultimately excelling in financing. This transformation is achieved by enhancing their financing capabilities, broadening their financing channels, and stimulating their financing willingness. Consequently, these improvements bolster their innovation capabilities, consolidate innovation resources, stimulate their innovation enthusiasm, and improve their innovation sustainability. The study’s conclusions not only assist SRDIEs in accessing appropriate financial services through Fintech (AboAlsamh et al., 2023) [10] but also provide valuable insights for policymakers and regulatory agencies. It clarifies the institutional mechanisms and practical pathways through which Fintech can facilitate innovation in SRDIEs. This understanding allows for the precise implementation of policies, the formulation of effective strategies, and the maximization of Fintech’s positive impact on upgrading the manufacturing industry chain. Ultimately, this study aims to foster a conducive innovation environment and establish a new development model characterized by the deep integration of “industry + science and technology + finance”, thereby achieving the drip irrigation of financial resources to the real economy (Lai et al., 2023) [9].

The remainder of this paper is organized as follows: Section 2 discusses the theoretical foundation and research framework, including the relationship between Fintech, financing capacity, and innovation in SRDIEs. Section 3 outlines the research design, detailing the data sources, measurement methods, and research concepts. Section 4 presents the empirical results, including necessary condition tests, fsQCA analysis, and robustness tests. Section 5 concludes with the research findings, practical implications, theoretical contributions, limitations, and suggestions for future research directions.

2. Theoretical Foundation and Research Framework

2.1. How Fintech and Financing Capacity Influence the “Able to Innovate” of SRDIEs

According to the resource-based view theory, the innovative capacity of enterprises relies on the effective allocation and optimal combination of existing resources (Dooley and David, 2007) [11]. SRDIEs must enhance their resource acquisition capabilities through financial technology to overcome bottlenecks caused by resource constraints. Although SRDIEs are selected from outstanding SMEs, they still face challenges typical of traditional SMEs: they are generally small in scale, most are in the expansion phase, and their innovative characteristics lead to a significant and concentrated demand for capital (Pensel et al.;2023) [12]. Constrained by a lack of credit, collateral, industry fragmentation, information opacity, non-standard financial data, and other factors, it is easy to become a “long-tailed enterprise” (Austin and Rahman, 2022) [13], which is often overlooked by traditional financial investors. Financing difficulties make the SRDIEs face financing constraints during the innovation process. As the demand side of financial resources, SRDIEs can improve their operational fundamentals with the assistance of Fintech (Karim, et al., 2022) [14], thereby improving their financing ability and squeezing out the funds for innovation. Fintech can deeply mine high-frequency data, optimize the integration and monitoring of corporate financial and non-financial data in combination with machine learning and other algorithms, and improve the transparency of internal and external information. High-quality information disclosure helps external stakeholders to comprehend the real financial and profitability status of enterprises, track the progress of innovative projects in real time, inhibit irrational management behavior, mitigate agency conflicts, and improve the scientific and reasonableness of management’s investment and financing decisions (Bonsu et al., 2023; He et al., 2023) [15,16]. On the other hand, the application of blockchain technology and cloud computing enhances the verifiability of information, making it easier for the market to detect management information manipulation, which can lead to severe penalties. The increased costs associated with information manipulation impose constraints on opportunistic behavior (Lee et al., 2021) [17], compelling enterprises to improve the quality of their information disclosure [4]. With the improvement of the internal and external information transparency of SRDIEs, the costs related to information collection, negotiation, and decision-making caused by information asymmetry, bounded rationality, and opportunism are significantly reduced [5]. This enhancement improves the operational fundamentals of enterprises, strengthens their financing capabilities, and frees up additional funds for innovation (Dong and Yu, 2023) [18]. In addition, Fintech can help SRDIEs more accurately assess and grasp the opportunities and risks of technological innovation through real-time monitoring of data from the upstream and downstream segments of the industry chain (Gomber et al., 2018) [19]. By enabling enterprises to effectively identify innovation opportunities and comprehend the key trajectories and development prospects of emerging technologies, Fintech helps reduce the risks of innovation activities and enhances their capacity to bear risks proactively. Consequently, it mitigates the exclusion of technological innovation activities (Ye et al., 2024) [20] and reallocates more resources to innovation projects. The expansion of market boundaries also provides enterprises with the innovative impetus to meet the diversified product and service needs of consumers, creating additional opportunities for technological advancement.

As the demand side of financial resources, SRDIEs can also rely on the underlying technology and scenario application of Fintech to facilitate their digital transformation, thereby enhancing their financing ability and capturing innovation opportunities. Compared to large enterprises, the “digital divide” of SRDIEs is more prominent. Fintech, a new financial industry emerging from the convergence of traditional finance and digital technology, provides essential support for enabling enterprises to undergo digital transformation (Hu et al., 2024) [21]. On the one hand, by leveraging cutting-edge digital technologies, Fintech absorbs social idle funds at a low cost, improves the efficiency of enterprise financing through intelligent credit rating systems and risk early warning systems, and provides financial support for digital intelligent transformation.

On the other hand, the advancements in digital technology driven by the development of Fintech have generated significant positive externalities (Liu et al., 2023) [22]. The resulting technology spillover plays a demonstrative role in the digital intelligence transformation of enterprises, which is inherently a form of innovation. Furthermore, SRDIEs can utilize digital transformation to optimize their organizational structures and improve production efficiency. Through digital transformation, enterprises can establish differentiated competitive advantages in niche markets, enhance their core competitiveness, and strengthen their influence and advantages in both upstream and downstream competition, thereby improving their capacity for innovation.

To summarize, Fintech improves the financing ability of enterprises through these two paths and satisfies their willingness to “want to finance”. The improvement of fundamental operations enables enterprises to better capitalize on opportunities for innovation, while increased operational efficiency liberates additional resources for innovation. Ultimately, this improvement in innovation capacity is facilitated by digital and intellectual transformation, allowing SRDIEs to overcome the initial stages of the innovation dilemma and achieve a state of “capable of innovation”.

2.2. How Fintech and Financing Channels Influence the “Daring to Innovate” of SRDIEs

Although advancements in the fundamentals of SRDIEs facilitate innovation, the lack of streamlined financing channels and adequate funding sources compels them to scale back their technological innovations. According to transaction cost theory, the efficiency of enterprise financing is closely associated with transaction costs. Fintech alleviates the financing constraints faced by enterprises by reducing funding costs and improving access to capital, thereby enhancing innovation capacity and enabling SRDIEs to “dare to innovate”.

As key providers of financial resources, commercial banks can leverage Fintech to overcome temporal and spatial constraints, reduce the marginal costs of credit services, rectify financial mismatches, and enhance the efficiency of credit resource allocation. In pre-credit investigations, the characteristics of SRDIEs make it difficult to standardize and batch-process their credit business. Instead, credit evaluations often rely on non-standard information collected by branch offices and account managers’ field investigations and judgments. Information asymmetry diminishes banks’ willingness to lend to high-risk, innovation-driven enterprises, resulting in adverse selection (Berger et al., 2011) [23]. Fintech allows banks to build a digital profile of SRDIEs, accurately identify customer types, expand service boundaries, and enhance differentiated services (Mapanje et al., 2023) [24]. In the loan approval process, banks can leverage digital technologies to achieve real-time monitoring of key stages while utilizing algorithms and models for processing unstructured data to support credit evaluation and decision-making (Liu, 2022) [25]. Expanding the customer base enables extensive data aggregation, which serves as the foundation for developing targeted credit models and risk control systems. These systems facilitate detailed customer management and expedite credit approvals, thereby enhancing business efficiency and reducing financing costs. In post-credit supervision, banks employ digital technology for real-time risk monitoring throughout the loan cycle (Wang et al., 2023) [26]. The reduction in monitoring difficulty and costs mitigates loan risks and improves financing accessibility for SRDIEs.

In addressing financial mismatches, Fintech mitigates adverse selection and moral hazards caused by information asymmetry between banks and enterprises (Bonsu et al., 2023) [15]. It corrects irrational loan pricing and directs credit resources toward SRDIEs, thereby improving innovation investment and technological advancement (Chen et al., 2022) [27]. Furthermore, Fintech improves the risk management and resource allocation capabilities of financial institutions. This fosters a fairer financial environment, enabling SRDIEs to efficiently mobilize innovation resources and increase their research and development (R&D) investments. By enhancing the efficiency of credit resource allocation, Fintech allows financial institutions to better align the expected returns of funds with the risk profiles of SRDIEs’ innovation projects. Fintech conducts comprehensive assessments of enterprise characteristics, allowing financial institutions to identify those with high innovation potential (Zhu, 2019) [28]. Additionally, Fintech identifies opportunities for innovation and provides data-driven support for enterprises’ R&D investment decisions. This not only enhances the willingness to innovate but also increases the intensity of R&D investments. Furthermore, Fintech facilitates government fiscal and tax policies designed to alleviate financing difficulties and implement innovation incentives that stimulate enterprise innovation.

In summary, from the perspective of capital supply, Fintech expands SRDIEs’ financing channels by addressing financial mismatches and enhancing credit resource allocation efficiency. It enables SRDIEs to transition from merely seeking financing to actively accessing it, thereby efficiently pooling innovation resources and advancing from “being able to innovate” to “daring to innovate”.

2.3. How Fintech and Financing Willingness Influence the “Excelling in Innovation” of SRDIEs

The distinctive feature of SRDIEs is their deep engagement in specialized niche fields, necessitating sustained investment in innovation. To meet the demand for continuous high levels of innovation from SRDIEs, a fundamental improvement in the financing environment and optimization of the macro-financial ecosystem is required. The innovation of financial products helps enterprises along the path of a financing idea (“want to finance”)—financing ability (“can finance”)—financing method (“good at financing”) to break through the financing difficulties, foster the willingness to finance, and then stimulate enthusiasm for innovation and enhance the sustainability of innovation. According to the theory of technology diffusion, this type of innovation extends beyond individual enterprises; it also bolsters the innovative capabilities of related enterprises and the entire industrial chain through the dissemination and diffusion of technology, further optimizing the overall financial ecosystem.

In terms of innovative financial products, Fintech has leveraged artificial intelligence and machine learning to improve the efficiency of smart customer service and facilitate the rapid development of smart banks and internet financial platforms. Additionally, it has utilized blockchain technology, big data analytics, and cloud computing to optimize credit collection systems and accelerate the growth of digital inclusive finance, smart contracts, and online loans. By precisely matching and designing credit products with the strategy of “one enterprise, one policy”, it enables SRDIEs to access differentiated credit services (Karim et al., 2022) [14]. Fintech can also achieve the integration of end-to-end business flow, capital flow, information flow, and logistics within the supply chain by establishing a supply chain finance platform. This integration improves the credit approval rate, revitalizes liquidity within the chain, and alleviates the financing pressures faced by SRDIEs in the supply chain (Sahoo and Thakur, 2024) [29]. Supply chain finance also offers a broader array of financial services, including investment and loan linkage, as well as the utilization of science and innovation funds to address the personalized financial needs of SRDIEs and enhance their innovative capabilities.

In terms of optimizing the financial ecology, Fintech’s efficient information and market transaction mechanisms enhance the quality of corporate information disclosure at the micro level, improve the efficiency of government subsidy allocation at the meso level, and increase the operational efficiency of the capital market at the macro level, ultimately optimizing the financial ecology (Senyo et al., 2021) [30]. Long-tail groups constrained by traditional finance are gaining attention and can articulate their capital needs with the assistance of Fintech, thereby alleviating financial mismatches and improving the efficiency of the financial market. This development stimulates stronger financing willingness in SRDIEs and enhances the sustainability of innovation. On the other hand, Fintech has introduced competitive pressures and challenges to the banking industry, which has traditionally maintained a monopoly. This has prompted banks to accelerate the adoption of Fintech solutions to increase loans for SRDIEs (Forcadell et al., 2020) [31]. By establishing data interfaces with banks, Fintech companies and non-bank internet platforms provide financial services such as payment processing, credit, investment, and lending to both enterprises and individuals. The entry of potential competitors directly intensifies competition among banks (He et al., 2023) [32], dismantling entry barriers and data monopolies within the banking sector. This competition compels banks to include long-tail groups in their business strategies to enhance their risk-bearing capacity. To compete for and retain high-quality customers, commercial banks have proactively adjusted their credit structures, innovated financial products, improved internal governance, and increased the efficiency of credit allocation (Ahelegbey et al., 2019) [33]. In recent years, larger banks have established Fintech departments, while smaller banks have chosen to collaborate with technology companies. The demonstration effect of Fintech is gradually expanding, leading to the optimization of the financial ecosystem across the entire market (Forcadell et al., 2020) [31].

The resource surplus generated by Fintech can enhance the innovation risk tolerance of SRDIEs, enabling them to meet the increasing demands for development and innovation capabilities. By innovating financial products and optimizing the financial ecosystem, SRDIEs will exhibit a stronger and more proactive willingness to raise funds. Ample funding sources can stimulate the innovative potential of SRDIEs, increase investment in innovation (Dong and Yu, 2023) [18], and improve the sustainability of their innovations. With the empowerment of Fintech, consumer identification, new consumption demand forecasting, and business model development provide a robust market orientation for SRDIEs. This support facilitates the complete innovation process, from research and development to the transformation of innovative results (Allen et al., 2022) [34], thereby fostering sustained innovation.

In summary, from the environmental perspective, Fintech stimulates the financing willingness of SRDIEs through innovative financial products and an optimized financial ecology. A reasonable allocation of financial resources, coupled with a supportive financial ecological environment, empowers SRDIEs to transition from merely “being able to finance” to “being good at financing”, stimulating the enthusiasm for innovation and facilitating the sustainability of their innovation activities. The third level of the innovation dilemma can be broken through by realizing the progression in ability from “daring to innovate” to “excelling in innovation”.

2.4. Capability Progression: From “Able to Innovate” to “Daring to Innovate” and Finally to “Excelling in Innovation”

The progression of capabilities in SRDIEs from “able to innovate” to “daring to innovate” and ultimately to “excelling in innovation” is fundamentally driven by the progressive development of Fintech. This integration enhances financing capacity, expands financing channels, and optimizes the innovation environment. Initially, Fintech establishes a foundation of financial capacity, alleviating the financing challenges faced by enterprises by providing essential financial support. Subsequently, it optimizes the innovation environment. This process allows enterprises to evolve from initial technological exploration to sustained innovation practices, continuously improving the quality and effectiveness of their innovation activities. Ultimately, the innovation capabilities of SRDIEs are enhanced, leading to the establishment of a sustainable innovation mechanism. The concept of “sustainable innovation” defined in this paper is a progressive process that encompasses three dimensions: “able to innovate”, “daring to innovate”, and “innovation enthusiasm and sustainability”. We have examined the impact of Fintech and its collaborative factors on these three progressive dimensions of sustainable innovation through three perspectives: the supply side, the demand side, and the environmental side. Consequently, sustainable innovation is not solely represented in the third part of the configurational analysis; rather, it is reflected in each component, illustrating the relationship between the whole and its individual dimensions.

2.5. Research Framework

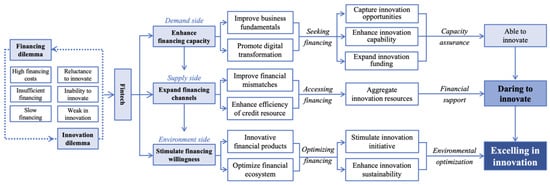

Based on the previous analysis, this paper constructs the following research framework to explore how the combination of multiple factors, including Fintech, creates a complex causal mechanism that affects the innovation activities of SRDIEs. As an integral part of the structural reform of the financial supply side, Fintech drives progress from the demand, supply, and environmental perspectives, helping SRDIEs overcome financing challenges such as “expensive financing”, “limited financing”, and “slow financing”. By improving financing capabilities, broadening financing channels, and stimulating financing willingness, Fintech supports enterprises in transitioning from “seeking financing” to “accessing financing” and ultimately to “excelling in financing”. This progression enhances innovation capacity, aggregates innovation resources, stimulates enthusiasm for innovation, and improves the sustainability of innovation. It helps enterprises break through the innovation challenges of “unable to innovate”, “afraid to innovate”, and “ineffective innovation”, achieving the leap from “able to innovate” to “daring to innovate” to “excelling in innovation”. The research structure of this paper is illustrated in Figure 1.

Figure 1.

Research framework.

The three paths are interconnected through the progressive logic of “resource optimization—smooth channels—ecological adaptation”: the demand side breaks through the resource bottleneck of innovation, the supply side establishes a solid financial foundation for investment, and the environmental side cultivates a long-term development mechanism. Driven by these paths, Fintech not only enhances firms’ innovation capabilities on the supply side and stimulates innovation motivation on the demand side but also provides stable support for firms on the environmental side, thus promoting the gradual realization of sustainable innovation.

3. Results

3.1. Date

Referring to the research conducted by Zhang and Chen (2024) [35], this study focuses on the 63 enterprises listed in the TOP 100 List of SRDIEs for 2022–2023, as published by Internet Weekly. After excluding 4 enterprises that reported negative operating profits more than twice during the period from 2021 to 2023, the final sample consists of 59 enterprises. The exclusion of these four enterprises was primarily based on considerations of financial stability. We aimed to ensure that the selected enterprises possess a certain level of financial health and sustained innovation potential. This decision reflects our focus on firms with sustainable operations and strong innovation capabilities—characteristics that closely align with our research objectives. The patent data used in this study were obtained from the patent database of the State Intellectual Property Office. Industry-related data were sourced from research reports released by industry associations and market research institutes. Data pertaining to innovation performance and financial metrics were extracted from the annual reports of enterprises in the China Stock Market and Accounting Research (CSMAR) database, while any missing data were supplemented through manual collection.

3.2. Measurement and Calibration

3.2.1. Outcome Variables

Following research conventions, this study takes the sum of annual invention patents, utility model applications, and design applications, lagged by one period of SRDIEs. It then adds one and takes the logarithm (Ain, et al., 2021) [36]. This measure serves as an indicator of innovation output for the current year and is used to assess the degree of enterprises’ “ability to innovate”. The ratio of current-year R&D investment to year-end operating income or beginning total assets is used as a proxy variable for innovation input in the current year to measure the extent to which enterprises “dare to innovate” (Du et al., 2024) [37]. Additionally, the ratio of the annual increase in intangible assets to total assets at the beginning of the year is used as a measure of innovation enthusiasm and sustainability (Liu and Hua, 2023) [38], reflecting the firm’s “efficiency in innovation”.

3.2.2. Selection of Conditional Variables

(1) Deconstruction and quantification of Fintech intensity

Fintech is a comprehensive field that drives the improvement of financial service efficiency, focusing on technology-driven transformations in financial services. Unlike digital transformation, which emphasizes the overall optimization of enterprise operating models and processes, Fintech specifically concentrates on the application and innovation of technology in financial services. The existing literature typically measures the level of Fintech development using four methods: first, text mining; second, the “Digital Inclusive Finance Index” published by the Peking University Fintech Research Center; third, the scale of third-party payments as a proxy indicator for the Fintech level of internet companies; and fourth, the number of Fintech companies or patents as a measure of development. In contrast to the research theme of this paper, most of the literature measures the level of Fintech development at the regional or commercial bank level, while this paper aims to assess the intensity of Fintech application at the enterprise level.

Referring to the research conducted by Li et al. (2020) [39], this study is first based on the content of Chapter 15 of the 14th Five-Year Plan, the Financial Technology Development Plan (2022–2025) issued by the People’s Bank of China, the Financial Technology Operation Report (2023) published by the Institute of Finance of the Chinese Academy of Social Sciences, and China’s Fintech Development Report (2023), along with other relevant reading materials to establish a thesaurus of Fintech keywords.

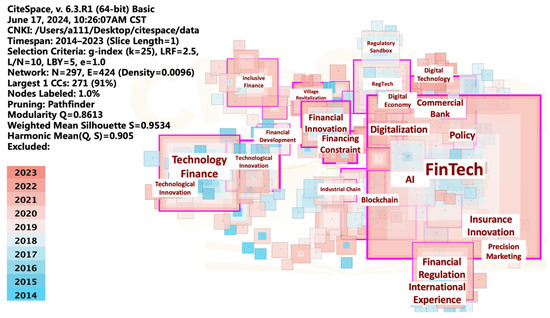

To enhance the robustness of keyword selection, CiteSpace mapping was employed to analyze the hotspots of Fintech-related research, serving as a mutual verification of the previously mentioned thesaurus. The selected literature was sourced from the China Knowledge Network database, the China Social Science Citation Index database, and the Science Citation Index database. By searching for work related to the research topics “financial technology” and “science and technology finance”, duplicates and invalid data were eliminated, resulting in a total of 604 valid entries. CiteSpace was utilized to analyze the co-occurrence of keywords, producing the knowledge map displayed in Figure 2.

Figure 2.

Knowledge map of co-occurring keywords in Fintech research.

Each node in the graph represents a keyword. The larger the text of the keyword, the more frequently it occurs. The overlap in range between nodes indicates the co-occurrence relationship between keywords. Table 1 presents the results of the citation space analysis concerning keyword occurrence frequency.

Table 1.

Keyword knowledge groups of high-frequency words.

After a review, the Fintech keyword thesaurus was finalized, as presented in Table 2. The corpus consisted of annual reports (including Management Discussion and Analysis), board of directors’ reports, internal control reports, and other financial documents from SRDIEs. Python (PyCharm 2024.1.2) was utilized to analyze the text and count the frequency of keywords appearing in the annual reports. For sections that were unrecognizable due to variations in disclosure formats, the information was manually extracted and supplemented, thereby obtaining the Fintech keyword frequencies at the enterprise level.

Table 2.

Fintech keyword construction and statistical results.

The entropy weight method is used to reduce the dimensionality of the word frequencies, and the results are shown in Table 3. Based on the entropy weight results, the keywords of each enterprise in each year are multiplied by the corresponding entropy weights and then summed up to obtain the FinTech intensity index of each enterprise for each year.

Table 3.

Keyword entropy weighting results.

(2) Return on Assets: Since the return on assets of an enterprise can comprehensively reflect its fundamental situation, this study uses profitability indicators, such as return on total assets and return on net assets, as proxy variables for the operating fundamentals of SRDIEs.

(3) Digital intelligence level: This research referenced the construction method of enterprise digital transformation indicators from the CSMAR database. Utilizing Python, the study crawled keywords related to the level of digital intelligence found in the annual reports of the SRDIEs. The Jieba word segmentation library was employed to segment the text, count the frequency of terms, and perform logarithmic normalization. Additionally, this study attempts to use variables such as input relative to the total cost of the enterprise’s business (equipment), the establishment of a digital platform, and the proportion of the enterprise’s fixed and intangible assets allocated to digital resources as proxy variables for assessing the enterprise’s level of digital intelligence in the robustness test.

(4) Capital structure: Capital structure is measured by the ratio of the total annual liabilities to the total assets of the firm.

(5) Degree of financial mismatch: The degree of financial mismatch is measured by the deviation of a firm’s cost of capital relative to the industry average cost of capital. The firm’s cost of funds is calculated as the firm’s interest expense divided by the difference between the firm’s total liabilities and accounts payable (Liu and Hua, 2023) [38].

(6) Credit resource allocation efficiency: The FC index serves as a proxy variable for assessing the efficiency of credit resource allocation. A higher FC index indicates a more severe financing constraint faced by the enterprise, resulting in lower efficiency in its credit resource allocation.

(7) Information disclosure efficiency: The information disclosure quality ratings of the Shanghai Stock Exchange and the Shenzhen Stock Exchange are used as measures of corporate information disclosure efficiency.

(8) Banking competition: The degree of banking competition is measured by the Herfindahl–Hirschman Index (HHI) for the urban banking industry (Prayoonrattana et al., 2020) [40]. The proxy indicator variable is multiplied by −1. Consequently, a larger transformed HHI value indicates a higher level of structural competition among banks in the prefecture-level city, reflecting a more favorable financial ecological environment.

(9) Financing environment: A favorable financing environment can indicate the financial ecosystem in which an enterprise operates and indirectly reflect the variety of financial products available to the enterprise in the capital market. In this study, the ratio of cash inflow from financing activities to cash and cash equivalents is used to measure the cash security that enterprises provide for innovative activities (Zhang et al., 2024) [35].

(10) Degree of specialization: According to national standards for identifying the specialization level of SRDIEs, the annual growth rate of the primary business income of the enterprise is selected to measure the degree of specialization for SRDIEs.

3.2.3. Variable Calibration

According to the direct calibration method commonly employed in academia, the 95th, 50th, and 5th percentiles of each condition factor and outcome are designated as the threshold values for the three qualitative anchors. The calibrated data were adjusted by adding 0.001 to the three affiliation scores. The resulting raw data were then calibrated to fuzzy-set data using FSQCA 3.0 software, and the calibration details are presented in Table 4.

Table 4.

Calibration information of results and each antecedent condition.

3.3. Research Ideas

Since the innovative development of SRDIEs is influenced by multiple factors, this paper employs fSQCA and NCA to explore the configurational paths and complex causal effects of Fintech in facilitating the innovation of SRDIEs amid financing challenges. This exploration is conducted from three dimensions: the demand side, the supply side, and the environmental side. The specific steps involve first using NCA to test whether conditional factors, such as Fintech, serve as necessary conditions (bottleneck factors) that constrain the innovation of SRDIEs. This analysis provides quantitative support for the conclusions drawn from the subsequent fSQCA necessary condition analysis. On this basis, from the perspective of configuration, fsQCA is applied to test, through three driving paths, whether Fintech helps enterprises progress from “wanting to finance” and “being able to finance” to “being proficient in financing” by improving their financing capabilities, broadening their financing channels, and stimulating their willingness to finance.

The theoretical framework illustrated in Figure 3 summarizes the analytical steps and emphasizes the roles of Fintech in alleviating financing constraints, enhancing operational efficiency, and improving market competitiveness. The ultimate goal is to enhance innovation ability, pool innovation resources, stimulate enthusiasm for innovation, and improve the sustainability of innovation. This approach aims to overcome the innovation dilemma and transition from “ability to innovate” and “daring to innovate” to “efficiency in innovation”.

Figure 3.

Theoretical framework of Fintech-driven innovation pathways for SRDIEs.

4. Empirical Results and Analysis

4.1. Fintech, Financing Capacity, and the “Able to Innovate” of SRDIEs

4.1.1. Necessary Condition Test (NCA)

NCA was employed to identify the upper ranges and corresponding bottleneck levels of conditional variables that constrain innovation. It also calculated the effect sizes of the upper ranges and necessity levels of these conditional factors on the outcome, allowing for the assessment of whether they are individually necessary for innovation output. Since the data used in this paper are continuous, the upper range is mainly estimated using the CR method, while the values calculated under the CE method are provided as a control. Following the research paradigm, the calibrated fuzzy-set data were imported into R-Studio (2024.09.0+375) software to conduct necessity tests for each antecedent condition, thereby establishing a connection with the subsequent fsQCA analysis. The results of this analysis are presented in Table 5.

Table 5.

Results of NCA method: necessity condition analysis.

According to the results, all variables have p-values greater than 0.05, indicating that the antecedent conditions are not statistically significant. Consequently, the individual condition variables do not serve as necessary conditions for the outcome variables. Therefore, there is no need to be concerned about the emergence of bottleneck levels during subsequent data processing. Table 6 presents the results of the bottleneck level analysis using the NCA method.

Table 6.

Results of the analysis of bottleneck levels (%) for the NCA approach.

4.1.2. FSQCA Configuration Path Analysis About “Able to Innovate”

(1) Necessity Test

The standardized fuzzy-set data were imported into fsQCA 3.0 for the necessity test, and the results are presented in Table 7. The criteria for identifying necessity include a consistency level greater than 0.9 and coverage greater than 0.5. It is noteworthy that none of the data in the table meet the criteria for identifying a single necessary condition, which aligns with the findings of the NCA; thus, the two methods can mutually validate each other.

Table 7.

Necessity analysis of single conditions.

(2) Analysis of Group Effects of Condition Combinations

The consistency threshold was set at 0.8, the frequency threshold at 1, and the PRI value at 0.8. Setting a threshold of 0.8 for a variable implies that cases scoring at or above 0.8 are classified as “high-level”, while those below are categorized as “low-level”. The fsQCA 3.0 software was utilized to analyze how the combination of Fintech and various conditions influences the innovation output of SRDIEs. This analysis identifies effective configurations and explores the sufficient causality between the configurations formed by different combinations of conditions and outcomes. In this paper, we primarily report the intermediate solution, supplemented by the parsimonious solution to identify the core conditions within the conditional groupings. The results of the analysis are presented in Table 8.

Table 8.

Results of configuration analysis about “Able to Innovate”.

Table 8 presents four types of condition configurations that influence the innovation output of SRDIEs. The analysis of the configuration with “high-innovation output” as the result obtains two types of results. The consistency of each configuration exceeds 0.8, with an overall consistency of 0.92005 and an overall coverage of 0.837408, indicating a high level of reliability.

Configuration 1: Fintech intensity × digital intelligence level × firm size × ~ capital structure × degree of specialization. High Fintech intensity and a high degree of specialization are the core conditions. The utilization of high Fintech intensity by SRDIEs ensures effective management and a quick response to capital and resources to meet the financial demands of innovative activities. A high level of digital intelligence indicates that the enterprise is equipped with advanced digital technologies and intelligent systems, which enhance decision-making quality and optimize customer service, thereby improving the overall competitiveness of the organization. Additionally, a lower level of indebtedness mitigates an enterprise’s financial risk and facilitates the consistent implementation of long-term strategies and ongoing investments. Furthermore, a high degree of specialization enhances the enterprise’s innovative capacity and competitiveness in its core business areas, ensuring the efficiency and relevance of its innovation efforts. Through this combination, firms can significantly increase their innovation output within a stable financial and technological environment by adopting a digital intelligence business model and a specialized innovation pathway. This configuration suggests that the balance and coordination of Fintech, digital intelligence, and specialization among larger specialized firms can positively enhance innovation output. Typical firms exemplifying this configuration include EPR Technology (688301) and Jinhong Gas (688106).

Configuration 2: Fintech intensity × firm size × return on assets × capital structure × ~ degree of specialization. High Fintech intensity and large firm size are the core conditions, while high return on assets and high capital structure serve as auxiliary conditions. This indicates that, regardless of the level of digital intelligence, firms can leverage Fintech to efficiently manage resources and capital, allowing them to concentrate on innovation within their core business. This is facilitated by strong fundamentals and aggressive funding policies, which significantly enhance innovation output. The lower level of digital intelligence avoids high costs and technological risks, allowing firms to innovate steadily within the existing technological framework. This low level of specialization enables companies to flexibly adjust their resources and strategies, thereby diversifying risks and exploring various innovation pathways and opportunities across different business sectors. This configuration indicates that a combination of Fintech, return on assets, and capital structure can positively enhance innovation output. Representative companies in this category include Guanghe Tong (300638) and Jinpan Technology (688676).

Configurations 3 and 4: We conducted an examination of the non-high-innovation output group of SRDIEs and successfully obtained two configurational paths. The lack of Fintech intensity and digital intelligence level are both sufficient conditions for low innovation output. It is evident that in the absence of high Fintech intensity, even if an enterprise possesses a high gearing ratio, strong business fundamentals, and a high degree of specialization, it is still difficult to achieve high-innovation output. This underscores the significant impact of Fintech utilization on the innovation capabilities of SRDIEs.

4.2. Fintech, Financing Channels, and the “Daring to Innovate” of SRDIEs

4.2.1. Necessity Test for NCA

In accordance with previous practices, the calibrated fuzzy-set data were imported into R-Studio software to conduct a necessity test for each antecedent condition, thereby establishing a link with the subsequent fsQCA analysis. The results indicate that the p-values for all variables exceed 0.05, suggesting that the necessity of the antecedent conditions is not significant, and no single condition variable serves as a necessary condition for the outcome variable. Due to space limitations, the NCA data will not be presented separately.

4.2.2. FSQCA Configuration Path Analysis About “Daring to Innovate”

(1) Necessity Test

The normalized fuzzy-set data were imported into FSQCA 3.0 for a necessity test, and the results are presented in Table 9. None of the data met the identification criteria for a single necessary condition, which aligns with the findings of the NCA. Therefore, the two methods can be cross-verified.

Table 9.

Individual condition necessity analysis.

(2) Analysis of Group Effects of Condition Combinations

The consistency threshold is set at 0.8, the frequency threshold at 1, and the PRI value at 0.65. Additionally, 0.65 is employed as an alternative threshold for robustness testing (specifically, the thresholds were adjusted for specific subsets). This approach aims to analyze how the interplay between Fintech and various conditions influences the innovation input of SRDIEs, identify effective group states, and explore the sufficient causality between the antecedents and outcomes. The results of the group effect analysis are presented in Table 10.

Table 10.

Results of configuration analysis about “Daring to Innovate”.

Table 10 presents the four types of condition configurations that influence the innovation input of SRDIEs. Two results are obtained from the group analysis, with “high-innovation input” as the outcome. The consistency of each grouping exceeds 0.8, with an overall consistency of 0.86771 and an overall coverage of 0.440592, indicating a better level of performance.

Configuration 1: Fintech intensity × disclosure quality × financial mismatch × credit resource allocation efficiency. High Fintech intensity and efficient credit resource allocation are essential conditions that, along with the quality of information disclosure and the degree of financial mismatch, serve as auxiliary conditions. Together, these factors significantly enhance firms’ investment in innovation. Enterprises leverage Fintech to improve technological innovation and market adaptability, while the efficient allocation of credit resources allows them to better utilize external funding to foster innovation and development. The extent of financial mismatch indicates how effectively firms manage their capital costs. This path is mainly applicable to enterprises with advanced Fintech applications, strong cost control, and high-quality information disclosure. Notable examples of such enterprises include Aide Bio (300685) and Kemet Gas (002549).

Configuration 2: Fintech intensity × disclosure quality × credit resource allocation efficiency × specialization. High Fintech intensity and efficient credit resource allocation are crucial factors that indicate the potential for high-intensity Fintech, particularly when paired with effective credit resource allocation, to enhance the financial and technical support available to enterprises throughout the innovation process. Additionally, high-quality information disclosure serves as an auxiliary condition that fosters market trust, while a high degree of specialization enables enterprises to concentrate on their core technological areas, thereby minimizing resource dispersion and improving the efficiency of innovation investments. These conditions collectively ensure that SRDIEs can access more financing opportunities, allowing them to respond swiftly to market demands and increase their investments in innovative projects. This path is mainly applicable to SRDIEs with a high degree of specialization and superior information disclosure, which can quickly pool innovation resources and promote high-level innovation input through efficient resource allocation. A typical enterprise that exemplifies this configuration is Forhan Micro (300613).

Configurations 3 and 4: The lack of Fintech intensity and insufficient specialization makes enterprises lack precise innovation direction and efficient technical support. Inefficient allocation of resources leads to a low level of innovation investment in SRDIEs. This situation indicates that SRDIEs, which exhibit a limited degree of business focus and Fintech application, struggle to achieve strong performance in capital cost control. Consequently, they face greater challenges in securing external funding to support technological innovation, which impedes their ability to invest at a high level in innovation.

4.3. FinTech, Financing Willingness, and the “Excelling in Innovation” of SRDIEs

4.3.1. NCA Necessity Test

The results of the necessity test for each antecedent condition indicate that the p-values for all variables are greater than 0.05, suggesting that necessity is not significant. Consequently, no single conditional variable can be regarded as a necessary condition for the outcome variable. Due to space constraints, the NCA data will not be presented separately.

4.3.2. FSQCA Configuration Path Analysis About “Excelling in Innovation”

(1) Necessity Test

The normalized fuzzy-set data were imported into FSQCA 3.0 for a necessity test, and the results are presented in Table 11. None of the data in the table meet the identification criteria for single necessity conditions, which is consistent with the results of the NCA. The two methods further corroborate each other.

Table 11.

Individual condition necessity analysis.

(2) Analysis of Group Effects of Condition Combinations

We set the consistency threshold at 0.8, the frequency threshold at 1, and the PRI value at 0.70. Moreover, we used 0.70 as the alternative threshold for the robustness test. With these settings, we analyzed how the combination of Fintech and various conditions influences the innovation enthusiasm and sustainability of SRDIEs, identified effective configurations, and explored the sufficient causal relationships involved. The results of the configurational effect analysis are presented in Table 12.

Table 12.

Results of configuration analysis about “Excelling in Innovation”.

Table 12 presents the four types of condition configurations that influence the innovation motivation and sustainability of SRDIEs. The consistency of all groupings exceeds 0.8, with an overall consistency of 0.876348 and an overall coverage of 0.494986, indicating a high level of reliability.

Configuration 1: Fintech intensity × financing environment × degree of specialization × ~ firm size × ~ capital structure. High Fintech intensity and a favorable financing environment are essential conditions that effectively enhance the motivation for innovation and the sustainability of enterprises. Despite their relatively small scale and low debt ratios, companies can improve their financing efficiency and levels of technological innovation by leveraging Fintech within a supportive financing environment. Firms with a high degree of specialization concentrate on their core business, which is more beneficial for sustaining innovation. This configuration is primarily applicable to small-scale specialized enterprises characterized by high Fintech intensity, a favorable financing environment, a significant degree of specialization, and low levels of debt. Typical enterprises that exemplify this configuration include Kemet Gas (002549), Pure Science and Technology (603690), and Zhongke Electric (300035).

Configuration 2: Fintech intensity × banking competition × financing environment × ~ degree of specialization × ~ enterprise size × capital structure. High Fintech intensity, competitive banking, a favorable financing environment, and an effective capital structure are essential conditions. Despite their low degree of specialization and small size, the application of high Fintech and a well-balanced financial ecosystem enable firms to better utilize external funding for continuous innovation. This configuration primarily applies to SRDIEs that operate within a robust financial ecosystem characterized by a diverse supply of financial products, high Fintech intensity, low specialization, small scale, and high debt scale. Typical enterprises belonging to this configuration include Shandong Heda (002810), Pai Neng Technology (688063), and Delphi Nano (300769).

Configurations 3 and 4: High Fintech intensity, high competition in banking, and the lack of a supportive financing environment are the core conditions for low innovation incentives and sustainability. Despite the impressive performance of larger SRDIEs in specialization, their inadequate access to a favorable financing environment and their limited utilization of Fintech to expand innovation funding sources result in a persistent lack of enthusiasm for innovation and sustainability among enterprises. Furthermore, the financial risks associated with high leverage exacerbate these challenges. The complex interplay of these factors ultimately diminishes enterprises’ motivation for innovation and obstructs the sustainable development of innovative practices.

4.4. Robustness Tests

The robustness tests presented in this paper are categorized into three distinct types. The first category involves altering the measurement methods for certain conditional variables. For example, Peking University’s “Digital Financial Inclusion Index” is used to measure the intensity of Fintech in the region where the enterprise is located, while the number of Fintech-related patents serves as an indicator of the enterprise’s level of Fintech development. Regarding the digital intelligence level of the enterprise, we use alternative variables such as the ratio of the enterprise’s digital investment in its business (equipment) to its total cost, whether the enterprise has established a digital platform, and the proportion of digital resources in the enterprise’s fixed and intangible assets. We adopt the KZ index to measure financing constraints. To measure the degree of enterprise specialization, we have developed an evaluation system based on the scientific rigor, comprehensiveness, and data feasibility of the indicators. This system centers on four core principles—specialization, refinement, distinctiveness, and innovation—and encompasses eight specific indicators. Data from 2023 were selected, and the entropy-weight method was employed to calculate the specialization, refinement, distinctiveness, and innovation development indexes of small and medium-sized enterprises, thereby quantifying their level of development.

The second category involves modifying the data dimensionality reduction method, specifically by applying principal component analysis to the frequency of Fintech-related keywords. When changing the data dimensionality reduction method, we employed principal component analysis (PCA) to reduce the dimensionality of the frequency of Fintech-related keywords. After processing the data with PCA and conducting subsequent analyses, we found that the configurational paths and influencing mechanisms of Fintech enabling innovation in SRDIEs were largely consistent with those of the original study. This indicates that our research results are not influenced by the data dimensionality reduction method.

The third category includes adjusting the frequency of cases, increasing the consistency threshold value, and modifying the PRI value in the fSQCA test. We employed various calibration methods for comparison to ensure the scientific integrity of the variable calibration process. The calibration in fsQCA strictly adheres to the principle of integrating theoretical anchors with data distribution. The threshold setting guarantees cross-sample robustness through quantile tests.

All three types of robustness tests indicate that the overall results of this paper remain stable, thereby enhancing the reliability of the conclusions.

5. Conclusions and Implications

5.1. Research Conclusions

This paper develops a theoretical framework to explore the mechanisms and pathways of Fintech-enabled innovation in SRDIEs facing financing dilemmas from three dimensions: the supply side, the demand side, and the environmental side. By employing a combination of NCA and fsQCA, this study identifies several effective pathways through which Fintech enhances the innovation efficiency of SRDIEs. It also clarifies the complex causal configurational effects among Fintech, enterprise financing behavior, and innovation activities. The following conclusions are drawn:

(1) High-innovation output pathways

There are two pathways to achieve high-innovation output in SRDIEs, with the intensity of Fintech playing a key role in both pathways and having a universal impact on improving the innovation output of these enterprises. As auxiliary conditions, business efficiency and the levels of digitization and intelligence, in conjunction with Fintech, collectively empower the innovation of SRDIEs. Consequently, Fintech enhances the financing and innovation capabilities of SRDIEs by improving operational efficiency and promoting digital transformation, thereby enabling enterprises to “be able to innovate”.

(2) High-innovation input pathways

There are two pathways to achieve a high level of innovation input in SRDIEs. High Fintech intensity and efficient allocation of credit resources serve as core conditions, while financial mismatch and the degree of specialization are auxiliary conditions that influence the configurational state. The advantages of specialization and capital cost control in SRDIEs can partially offset the lack of investment in innovation. Additionally, the quality of information disclosure is a crucial configurational factor. By improving financial mismatches and enhancing the efficiency of credit resource allocation, Fintech has expanded the financing channels available to SRDIEs, effectively pooling innovation resources and enabling enterprises to “dare to innovate”.

(3) High-innovation motivation and sustainability pathways

There are two pathways to achieve high levels of innovation motivation and sustainability in SRDIEs. The intensity of Fintech and the financing environment serve as core conditions, complemented by a high degree of competition within the banking industry. These factors jointly contribute to the improvement of innovation sustainability for SRDIEs that possess a high degree of specialization, focus on their main business, or excel at utilizing financial leverage. This indicates that no single factor can independently stimulate a firm’s willingness to innovate. Fintech can encourage SRDIEs to raise funds through innovative financial products and an optimized financial ecosystem, which, in turn, fosters enthusiasm for innovation and enables enterprises to be “good at innovation”.

5.2. Practical Implications

The findings of this paper have the following practical implications:

(1) For SRDIEs: SRDIEs at various stages of development and of different types can leverage Fintech through diverse configuration paths to obtain appropriate financial services that promote innovation. The integration and alignment of Fintech with various elements of innovation can collectively empower SRDIEs to break through the innovation dilemma. Potential pathways include enhancing financing capacity on the demand side to improve innovation capabilities, broadening financing channels on the supply side to pool innovation resources, and stimulating the willingness to finance on the environmental side to foster innovation motivation and enhance sustainability. Each of these approaches can reduce financing costs, control financial risks, and create a favorable financial ecosystem and environment for innovation, ultimately improving innovation performance. Therefore, SRDIEs must actively explore pathways for digital transformation, establish a robust digital foundation for utilizing Fintech, and strengthen their financial capabilities. Additionally, enterprise managers should recognize that relying on a single element is insufficient to elevate the level of innovation; rather, multiple elements must be interconnected and synergized to achieve a high level of innovation. Consequently, the synergy of innovation elements from various perspectives should be the focal point of future endeavors.

(2) In terms of boosting the resilience of the industrial chain: The concept of SRDIEs is designed to reflect the government’s intention to guide SMEs in concentrating on specific industry and value chain segments. This approach encourages these enterprises to refine, deepen, and specialize their operations to address existing gaps and deficiencies within the industrial chain, as well as to resolve “bottleneck” challenges. This paper examines the challenges and new circumstances faced by SRDIEs in enhancing their innovative capabilities. It explores the configuration pathways to achieve high levels of innovation output, input, enthusiasm, and sustainability. It aims to bolster their economic resilience by complementing and strengthening the supply chain, ensuring the security and stability of industrial supply chains, and positioning them as the backbone of high-quality development within SME groups.

(3) For financial institutions: In the face of the impact of digital transformation, financial institutions must enhance their digital infrastructure for financial technology and accelerate the transformation process. They should strive to digitalize products, business operations, and services comprehensively. By doing so, they can optimize the financial ecosystem, innovate financial products, and provide all-round accurate financing and customized package solutions to SRDIEs. This approach will promote their innovation investment, enhance their innovation output, and increase both enthusiasm and sustainability of innovation. With the help of artificial intelligence and machine learning technologies, financial institutions deeply analyze the business models, financial status, and innovation needs of SRDIEs and design more differentiated and personalized financial products.

(4) For the government: The findings of this paper will assist policymakers and regulators in clarifying the institutional mechanisms and practical pathways for Fintech-enabled innovation in SRDIEs. This clarity will enable the accurate implementation of policies and the formulation of appropriate strategies to foster innovation and development within SRDIEs. Based on the configuration path for achieving high levels of innovation output, input, enthusiasm, and sustainability, the government can focus on increasing support and enhancing the financial innovation policy support system. It is essential to leverage the positive impact of Fintech on the upgrading of the manufacturing industry chain, thereby creating a new development pattern of “industry + science and technology + finance”, to channel financial resources effectively into the real economy, ensuring a precise drip irrigation of financial resources to the real economy.

5.3. Research Contribution

The marginal contributions of this paper are as follows.

Firstly, it expands the theoretical framework from “technology–economic consequences” to “technology change–acting mechanism–economic consequences”, opens the black box, and explores the pathways through which Fintech empowers the innovation of SRDIEs. This framework enhances our understanding of how technological change influences enterprise resource integration and innovation activities within the context of digitalization. This expansion represents a significant advancement in the technology–economy paradigm and contributes to enriching the theoretical underpinnings of both the theory of technological foundations and the theory of resource dependence in the context of digitalization. Secondly, the current academic community has conducted preliminary research on the mechanisms through which Fintech promotes enterprise innovation. This research primarily focuses on science-and-technology-based SMEs and conglomerates, as well as state-owned and private companies. However, there is a scarcity of literature focusing on SRDIEs. SRDIEs exhibit heterogeneity in their financing models and innovation behaviors, and the research perspective on reshaping the financial support system for SRDIEs amid the transformation of the financial sector through digital intelligence remains largely unexplored. This paper explores the complex linkage mechanisms of Fintech-enabled innovation of SRDIEs under the financing dilemma, thereby providing an incremental contribution to the understanding of the mechanisms and pathways that influence the innovation of SRDIEs from a microeconomic perspective. Thirdly, the current academic community primarily investigates the relationship between Fintech and enterprise innovation from a holistic perspective, employing traditional regression analysis to examine the net effects of individual variables on outcomes. This paper explores the complex causal effects among variables by integrating NCA and fsQCA. It aims to elucidate the impact of the alignment between Fintech and other factors on enterprise innovation and refines the configuration path of Fintech-enabled innovation in SRDIEs based on this analysis. This approach represents a significant advancement in research methodology within this field.

5.4. Research Limitations and Prospects

There are still some limitations in this study.

First, numerous factors influence the innovation activities of SRDIEs. Future research could benefit from synthesizing findings from other fields to more comprehensively examine the complex causal relationships among various sets of variables. Although we tried our best to cover the main influencing factors, such as Fintech and financing capabilities, we are indeed aware that in the complex process of corporate innovation, there may be other factors (such as greenwashing behaviors, industry characteristics, corporate culture, etc.) that have not been fully incorporated into our research. We will further refine and explain the reasons for our selection of specific factors and configurations and explore the impact of other potentially unconsidered factors on the research results.

Second, according to the gradient cultivation approach for high-quality SMEs, SRDIEs are categorized into three echelons: innovative SMEs, SRDIEs, and small-giant enterprises. Each of these enterprise types exhibits distinct developmental characteristics and scale strengths, and the pathways through which Fintech empowers their innovation will also differ. In future studies, further refinement of the categories of SRDIEs could lead to more robust findings and contribute to a more comprehensive research framework.

Third, this study focuses on the 63 enterprises listed in the TOP 100 List of SRDIEs for 2022–2023, as published by Internet Weekly. Although these enterprises are somewhat representative in the field of SRDIEs, the sample size is relatively small, and all are listed companies. This makes it possible that the research results may not be applicable to all SRDIEs. Non-listed companies may have significant differences from listed companies in terms of scale, financial status, innovation capabilities, and access to Fintech services. Therefore, when generalizing our research results to a wider group of SRDIEs, caution should be exercised. Due to the limited listing time of SRDIEs, the sample will be continuously expanded during the follow-up phase. We will continue to track and expand the sample in the future.

In addition, concerning data limitations, although we manually collected and supplemented the missing data, the integrity of the dataset may still be compromised to some extent. This may not fully capture the long-term dynamic relationship between Fintech and the innovation of SRDIEs, thereby limiting the stability and reliability of the research conclusions. Regarding potential biases, despite our best efforts to adhere to scientific research methods throughout the study, some unavoidable biases may still exist. These issues present opportunities for further in-depth research in the future.

Author Contributions

Conceptualization, F.J. and J.W.; methodology, F.J.; software, J.W.; validation, F.J., J.W., and Y.L.; formal analysis, F.J.; investigation, Y.L.; resources, Y.L.; data curation, J.W.; writing—original draft preparation, F.J.; writing—review and editing, F.J.; visualization, J.W.; supervision, F.J.; project administration, F.J.; funding acquisition, F.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Humanities and Social Sciences Research Youth Fund Project of the Ministry of Education, grant number 24YJC630085; the Social Sciences Planning Project of Chongqing Municipality, grant number 2024NDQN049; the Humanities and Social Sciences Research Planning Project of the Chongqing Education Commission, grant number 24SKGH293; and the Graduate Innovation and Entrepreneurship Project of Chongqing University of Science and Technology, grant number YKJCX2420918.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data supporting the reported results are publicly available and can be accessed through the sources provided.

Acknowledgments

The authors would like to express their gratitude to the anonymous referees for their invaluable comments on an earlier version of this manuscript.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

References

- Liu, L.X.; Huang, Y.S.; Zhan, X.L. The evolution of collective strategies in SMEs’ innovation: A tripartite game analysis and application. Complexity 2019, 2019, 9326489. [Google Scholar] [CrossRef]

- Le, T.T.; Huan, N.Q.; Hong, T.T.T.; Tran, D.K. The contribution of corporate social responsibility on SMEs performance in emerging country. J. Clean. Prod. 2021, 322, 129103. [Google Scholar] [CrossRef]

- Zhang, X.M.; Zhao, T.Y.; Wang, L.H.; Dong, Z.Q. Does Fintech benefit financial disintermediation? Evidence based on provinces in China from 2013 to 2018. J. Asian Econ. 2022, 82, 101516. [Google Scholar] [CrossRef]

- Yang, H.X.; Ren, W.R. Research on the influence mechanism and configuration path of Network relationship characteristics on SMEs’ innovation—The mediating effect of supply chain dynamic capability and the moderating effect of geographical proximity. Sustainability 2021, 13, 9919. [Google Scholar] [CrossRef]

- Assarzadeh, A.H.; Aberoumand, S. FinTech in Western Asia: Case of Iran. J. Ind. Integr. Manag. 2018, 3, 1850006. [Google Scholar] [CrossRef]

- Soni, G.J.; Kumar, S.; Mahto, R.V.; Mangla, S.K.; Mittal, M.L.; Lim, W.M. A decision-making framework for Industry 4.0 technology implementation: The case of FinTech and sustainable supply chain finance for SMEs. Technol. Forecast. Soc. Chang. 2022, 180, 121686. [Google Scholar] [CrossRef]

- Ng, E.; Pan, S.L. Competitive strategies for ensuring Fintech platform performance: Evidence from multiple case studies. Inf. Syst. J. 2022, 34, 616–641. [Google Scholar] [CrossRef]

- Kangwa, D.; Mwale, J.K.; Shaikh, J.M. The social production of financial inclusion of generation Z in digital banking ecosystems. Australas. Account. Bus. Financ. J. 2021, 15, 95–118. [Google Scholar] [CrossRef]

- Lai, X.B.; Yue, S.J.; Guo, C.; Zhang, X.H. Does FinTech reduce corporate excess leverage? evidence from China. Econ. Anal. Policy 2023, 77, 281–299. [Google Scholar] [CrossRef]

- AboAlsamh, H.M.; Khrais, L.T.; Albahussain, S.A. Pioneering perception of green Fintech in promoting sustainable digital services application within smart cities. Sustainability 2023, 15, 11440. [Google Scholar] [CrossRef]

- Dooley, L.; O’Sullivan, D. Managing within distributed innovation networks. Int. J. Innov. Manag. 2007, 11, 397–416. [Google Scholar] [CrossRef]

- Pensel, F.H.; Winkler, H.; Brückner, A.; Wölke, M.; Jabs, I.; Mayan, I.J.; Kirschenbaum, A.; Friedrich, J.; Wehlmann, C.Z. Maturity assessment for Industry 5.0: A review of existing maturity models. J. Manuf. Syst. 2023, 66, 200–210. [Google Scholar] [CrossRef]

- Austin, A.; Rahman, I.U. A triple helix of market failures: Financing the 3Rs of the circular economy in European SMEs. J. Clean. Prod. 2022, 361, 132284. [Google Scholar] [CrossRef]

- Karim, S.; Naz, F.; Naeem, M.A.; Vigne, S.A. Is FinTech providing effective solutions to small and medium enterprises (SMEs) in ASEAN countries? Econ. Anal. Policy 2022, 75, 335–344. [Google Scholar] [CrossRef]

- Bonsu, M.O.A.; Wang, Y.; Guo, Y.S. Does fintech lead to better accounting practices? empirical evidence. Account. Res. J. 2023, 36, 129–147. [Google Scholar] [CrossRef]

- He, C.Y.; Geng, X.X.; Tan, C.; Guo, R.J. Fintech and corporate debt default risk: Influencing mechanisms and heterogeneity. J. Bus. Res. 2023, 164, 113923. [Google Scholar] [CrossRef]

- Lee, S.H.; Lee, S.; Ryu, J.Y. Do competent managers hoard bad news? Self-regulation theory and Korean evidence. Financ. Res. Lett. 2021, 41, 101836. [Google Scholar] [CrossRef]

- Dong, X.; Yu, M.Z. Does FinTech development facilitate firms’ innovation? evidence from China. Int. Rev. Financ. Anal. 2023, 89, 102805. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B. On the Fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Ye, X.; Pan, Y.; Wu, F. Fintech and corporate green technological innovation: Structural characteristics, impact identification, and gap-filling effects. South. Financ. 2024, 571, 95–110. [Google Scholar]

- Hu, J.Y.; Yu, L.; Liu, Y.W. Research on the incentive effect of Fintech on corporate green transformation: A dual-enabling perspective of digitalization and green governanc. Mod. Financ. 2024, 413, 97–109. [Google Scholar] [CrossRef]

- Liu, C.; Pan, H.F.; Li, P.; Feng, Y.X. The impact and mechanism of digital transformation on green innovation efficiency in manufacturing enterprises. China Soft Sci. 2023, 33, 121–129. [Google Scholar]

- Berger, A.N.; Frame, W.S.; Ioannidou, V. Tests of exante versus expost theories of collateral using private and public information. J. Financ. Econ. 2011, 100, 85–97. [Google Scholar] [CrossRef]

- Mapanje, O.; Karuaihe, S.; Machethe, C.; Amis, M. Financing sustainable agriculture in Sub-Saharan Africa: A review of the role of financial technologies. Sustainability 2023, 15, 4587. [Google Scholar] [CrossRef]

- Liu, M. Assessing human information processing in lending decisions: A machine learning approach. J. Account. Res. 2022, 60, 607–651. [Google Scholar] [CrossRef]

- Wang, H.J.; Mao, K.Y.; Wu, W.; Luo, H.H. Fintech inputs, non-performing loans risk reduction and bank performance improvement. Int. Rev. Financ. Anal. 2023, 90, 102849. [Google Scholar] [CrossRef]

- Chen, T.; Huang, Y.; Lin, C.; Sheng, Z. Finance and firm volatility: Evidence from small business lending in China. Manag. Sci. 2022, 68, 2226–2249. [Google Scholar] [CrossRef]

- Zhu, C. Big data as a governance mechanism. Rev. Financ. Stud. 2019, 32, 2021–2061. [Google Scholar] [CrossRef]

- Sahoo, P.S.B.B.; Thakur, V. The factors obstructing the blockchain adoption in supply chain finance: A hybrid fuzzy DELPHI-AHP-DEMATEL approach. Int. J. Qual. Reliab. Manag. 2024, 41, 2292–2310. [Google Scholar] [CrossRef]

- Senyo, P.K.; Karanasios, S.; Gozman, D.; Baba, M. FinTech ecosystem practices shaping financial inclusion: The case of mobile money in Ghana. Eur. J. Inf. Syst. 2021, 31, 112–127. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E.; Úbeda, F. Using reputation for corporate sustainability to tackle banks digitalization challenges. Bus. Strategy Environ. 2020, 29, 2181–2193. [Google Scholar] [CrossRef]

- He, Z.G.; Huang, J.; Zhou, J.C. Open banking: Credit market competition when borrowers own the data. J. Financ. Econ. 2023, 147, 449–474. [Google Scholar] [CrossRef]

- Ahelegbey, D.F.; Giudici, P.; Misheva, B.H. Latent factor models for credit scoring in P2P systems. Phys. A Stat. Mech. Appl. 2019, 522, 112–121. [Google Scholar] [CrossRef]

- Allen, L.; Shan, Y.; Shen, Y. Do FinTech mortgage lenders fill the credit gap? evidence from natural disasters. J. Financ. Quant. Anal. 2022, 58, 3342–3383. [Google Scholar] [CrossRef]

- Zhang, S.F.; Chen, Y.Q. Research on the Path to Improving the Innovation Performance of “Specialized, Refined, Distinctive, and Innovative” Small and Medium-sized Enterprises. Sci. Sci. Manag. S.&T 2024, 42, 873–884. [Google Scholar] [CrossRef]

- Ain, Q.U.; Yuan, X.H.; Javaid, H.M. The impact of board gender diversity and foreign institutional investors on firm innovation: Evidence from China. Eur. J. Innov. Manag. 2021, 25, 813–837. [Google Scholar] [CrossRef]

- Du, Y.S.; Guo, H.Y.; Li, T.T. A Study on the relationship between digital finance, financing constraints, and technological innovation in small and micro enterprises: Empirical evidence from new third board listed companies. Price Theory Pract. 2024, 12, 151–157. [Google Scholar] [CrossRef]

- Liu, Y.C.; Hua, G.H. Can financial technology promote the sustainability of enterprise innovation by alleviating financial mismatch?—Empirical evidence from listed companies in strategic emerging industries. China Sci. Technol. Forum 2023, 4, 122–132. [Google Scholar] [CrossRef]