1. Introduction

Similar to large businesses, micro- and small enterprises (MSEs) positively contribute to the economy and its gross domestic product through the creation of job opportunities and the generation of income in various parts of the world, including developing countries [

1,

2,

3]. Despite the positive role of MSEs in the economy, they are the most affected by uncertainties, instability, conflicts and diseases such as COVID-19 [

4]. MSEs are vulnerable and lack financial and managerial resources to use in unexpected situations and challenging times [

2]. As MSEs have a limited size and scope, they are more vulnerable to crises compared to other enterprises, such as big companies [

4,

5,

6,

7].

According to [

4], most MSEs go bankrupt due to the limited support provided by the government. Furthermore, MSEs have limited capability and resources to recover from crises and challenges, especially those countries with political instability, higher poverty rates and economic challenges. Different natural disasters influence MSEs, negatively impacting business activities, their survival and continuity [

4,

6,

7,

8,

9].

It should be noted that MSEs are less prepared for risks and receive less institutional support, particularly in developing countries that lack risk management and crisis management cultures [

8,

10]. Most MSEs lack the resources and expertise to deal with risks and uncertainties; thus, they are vulnerable to shocks. Hence, they need to be more aware of these risks and understand how to enhance their business continuity management [

8,

10]. The continuity of MSEs is a challenging issue. Hence, training and capacity-building programs are needed for micro- and small entrepreneurs, which strengthen their management skills, help them adapt to innovative practices and implement strategic planning processes, which, in turn, help their enterprises survive during economic challenges and ensure better resilience [

7].

More focus needs to be directed towards developing continuity strategies so that MSEs can continue operating during challenging times [

11], especially with the limited availability of previous research on such topics in the extant literature [

11,

12]. Most previous studies discussed only large-scale businesses and concentrated on problems caused by management [

11]. Limited attempts were made towards MSEs and in developing contexts with adverse conditions.

Accordingly, more attention and focus have recently been paid to how businesses can develop resilience to deal with crises and challenges [

9,

13]. Key factors contributing to resilience that have been investigated include personal characteristics and external factors, such as financial literacy, entrepreneurial competency, self-efficacy, locus of control, connection, communication and individual and organisational success [

14,

15,

16]. Other factors that examine the survival of businesses include innovation, the experience of the business, strategic networks, international trading and access to affordable finance [

17,

18,

19,

20]. Only a few studies have examined these factors during challenging times.

Notably, as MSEs are volatile and weak, they need to concentrate on developing competencies and skills that help them sustain themselves during complex scenarios and become capable of standing with high resilience to recover from crises effectively. In this case, MSEs may need to develop clear strategic clarity [

21] represented in a transparent defining core of purpose (DCP). This helps them understand their business well and accordingly set the achievable vision, mission and long-term plans that ensure good performance and survival of their business, as well as gain a better competitive advantage [

22].

It is important to note that the concept of a clear core purpose is similar to governance and strategic planning, which involves proper strategic planning, setting clear objectives and finding the best methods to achieve them to succeed in the business [

11,

23]. In other words, having clarity in the strategies of the business represented in the clear core purpose of the business helps entrepreneurs effectively utilise available resources, make informed decisions, remain resilient during challenging times and adverse conditions and continue operation [

11,

24].

Another significant factor needed for micro- and small entrepreneurs and their enterprises during crises and adverse conditions is coping with unexpected challenges (CUC), especially with the limited knowledge and understanding of how entrepreneurs manage their role expectations and the stress they receive during their business operations [

25]. Applying effective strategies in business, such as hiring temporary assistance and balancing work and family tasks, contributes to good business resilience (BR) and business economic sustainability (BES) [

26]. Having flexible coping strategies helps a business grow, sustain itself and face challenges, especially during conflict [

27].

More specifically, micro- and small entrepreneurs might need to understand the factors necessary for their resilience and businesses, which might reduce business risk [

28]. These strategies might include implementing precise risk management, developing strategic alliances, developing good networks and implementing digitalisation in the business [

29,

30]. Hence, this study aims to fill the available literature gap by focusing on MSEs that are mainly ignored in the literature, as most of the literature focuses on medium and large enterprises in developing countries. Second, it attempts to understand how CUC and DCP influence BR and BES among MSEs in Yemen.

Yemen is an emerging Arabic country suffering from various challenges, including poor infrastructure, a high poverty rate, unemployment and poor literacy [

31]. Yemen has been facing ongoing internal conflicts and instability since 2015, negatively influencing the MSE sector, which accounts for a large portion of the total enterprises in the country [

32]. This resulted in the closure of 26% of the total businesses operating in the MSE sector, making about 42% of women-owned enterprises less resilient [

31]. Huge losses have been incurred in the MSE sector, including the losses of many small enterprises’ assets and properties, resulting in halting their business operations. According to [

33,

34], Yemen’s MSE sector was severely affected by the ongoing internal conflict through the loss of production assets and available infrastructures, limited financial support and a shrinking consumer base. This, in turn, negatively influenced income, jobs, poverty mitigation, gender equality, local services and goods supply. This situation led to the poor resilience of MSEs. It required them to search for alternative mechanisms that could help them continue operating, remain resilient during crises and conflict and achieve their BES.

Additionally, this internal conflict resulted in the loss of the lives or injury of business owners, loss of business customers, loss of business demand and skilled personnel, poor electric services, unstable energy supplies, limited access to finance and many other challenges [

1]. In addition to all the previously mentioned challenges, MSEs in Yemen do not have a clear or specific standard definition for themselves [

1] to categorise them into other entities in the country and compare them globally. According to [

32], MSEs in Yemen are classified as micro for those with 1–3 employees and small for those with 4–9 employees, which we follow in this study. MSEs in Yemen operate in different sectors, such as fisheries, services, retail and wholesale [

32], and they need better access to resources and economic empowerment opportunities to allow their businesses to continue operating [

35].

Furthermore, the literature on Yemen’s enterprises and their influencing factors is limited, especially during challenging times and adverse conditions, such as key factors influencing BR and leading to BES. It is important to note that many studies in Yemen were about small and medium-sized enterprises (SMEs), leaving micro-enterprises unexplored, which makes this study a novel contribution. Among the limited literature irrelevant to this research, ref. [

36] focuses on market orientation and SME innovations, while [

37] concentrates on the benefits and barriers of e-businesses among SMEs. One study revealed poorly the current status of SMEs in Yemen and did not offer any solid recommendations for SMEs’ resilience and survival [

38]. Another study checked how human capital, SME performance and customer relationship management interact [

39].

Limited formal support systems, such as financial support and training, indicate that micro- and small entrepreneurs need to depend on internal factors, such as developing high resilience and a strong sense of purpose to survive and sustain their businesses. Additionally, this research allows for an understanding of key factors that contribute positively to reducing MSEs’ failure rates and strengthening resilience, ultimately leading to a better economy. This study is considered unique, as it is one of the limited attempts to investigate influential factors for MSEs’ resilience in Yemen, considering DCP and CUC as antecedents for MSEs. This research explicitly answers how CUC and DCP positively influence BR and BES among MSEs. This study is organised as follows. Following the introduction, the literature review and the development of hypotheses are reported, followed by the research methodology, analysis of data and interpretation. Finally, a discussion and conclusion follow.

5. Discussion and Implications

5.1. Interpretation of Findings

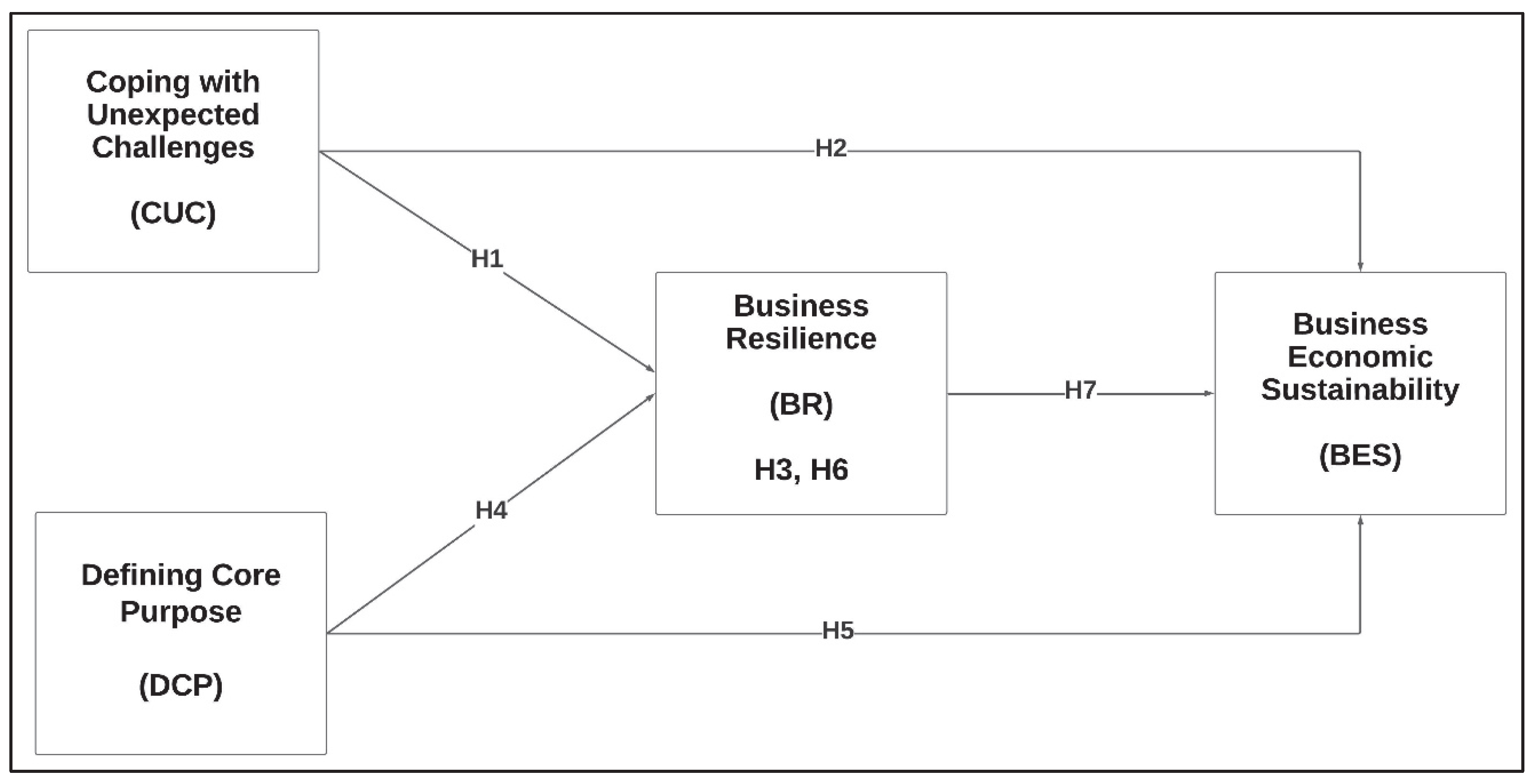

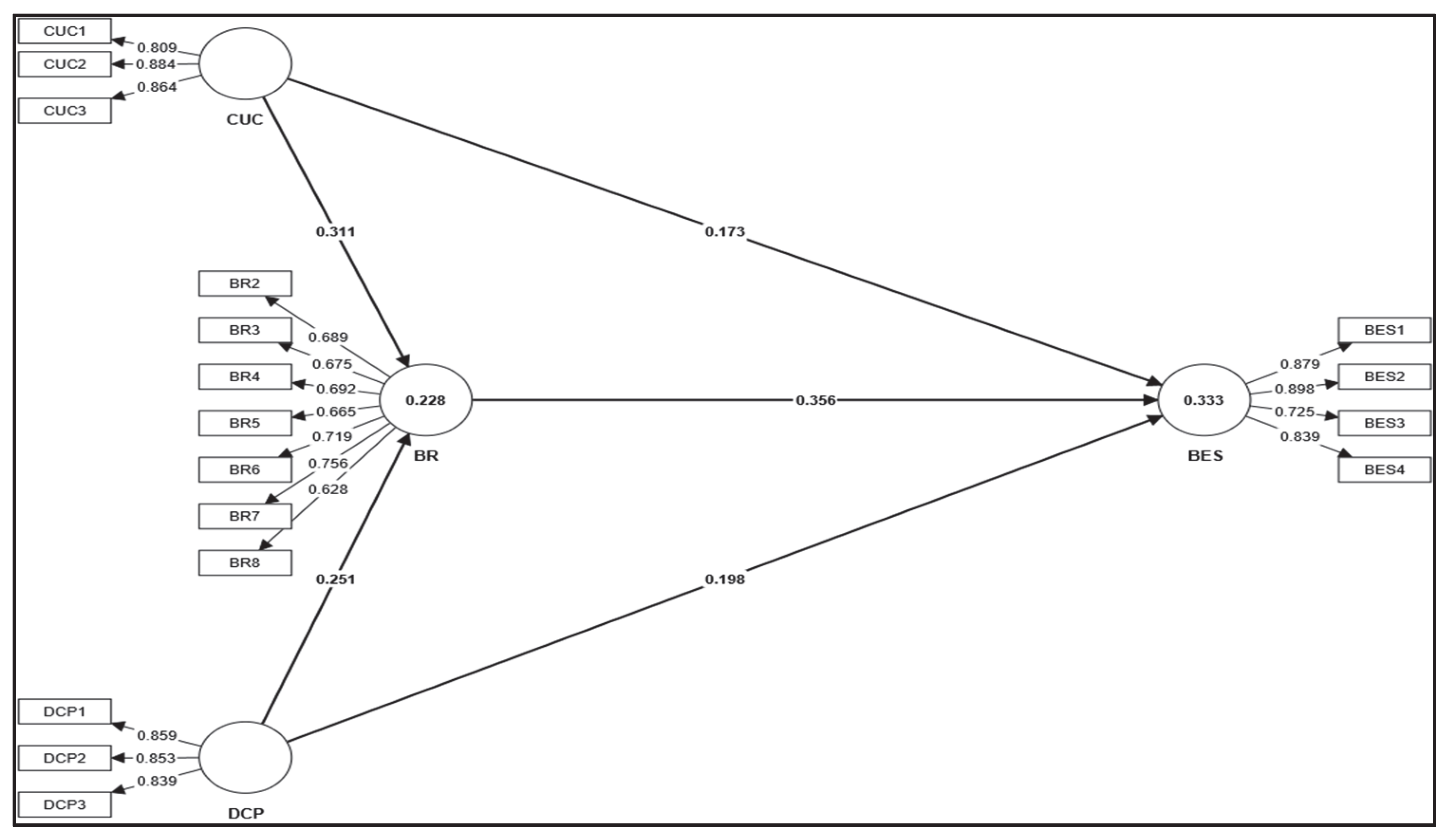

In this research, seven hypotheses were developed and tested, including the mediation hypothesis. The findings of these hypotheses are interesting. These are presented and discussed below.

The first hypothesis (H1) assumed the presence of a positive relationship between CUC and BR, which was confirmed (β = 0.311,

p < 0.05). This finding indicates that micro- and small entrepreneurs with the ability to cope with unexpected challenges can better develop resilient businesses capable of sustaining in challenging environments and overcoming available business challenges. In other words, high resilience helps businesses easily and quickly recover from setbacks, continue operating successfully during crises and adapt to changing conditions. When micro- and small entrepreneurs possess coping skills, they can develop necessary strategies encompassing contingency plans for managing common risks or economic downturns, dealing with resource limitations and expanding their business network. This enhances BR, enabling them to sustain and stabilise their operations despite adversity. This finding aligns with the statements of [

25,

26,

27].

The second hypothesis (H2) proposed a positive connection between CUC and BES, and the finding confirmed it (β = 0.173,

p < 0.05). This finding confirms that if micro- and small entrepreneurs have a remarkable ability to cope with unexpected challenges, they can contribute more positively to sustain their businesses, generate more profits and income and maybe create more employability. More precisely, individuals with excellent coping skills contribute to business sustainability by effectively managing available cash, making effective long-term decisions, quickly adapting to disruptions and reducing operational and financial losses and costs during challenging times. They can also maintain good relationships with customers, suppliers and other stakeholders. Finally, they can allocate resources and use them more effectively. This finding matches the arguments of [

1,

25,

29].

Concerning the third hypothesis (H3), it was assumed that BR can positively mediate the relationship between CUC and BES. The finding confirmed the existence of a significant positive relationship (β = 0.111,

p < 0.05). The approval of H3 confirms that when micro- and small entrepreneurs possess the ability to deal with unexpected challenges, it becomes easy for them to build resilience, which in turn leads to developing a resilient business using different strategies, such as managing cash, making solid decisions for their enterprises, learning from past bad experiences, adapting quickly to change and developing innovative methods, which lead to more profit and better business with long sustainability. The H3 findings confirm that CUC alone cannot fully determine economic sustainability. Instead, its impact is strengthened when BR is incorporated as a facilitator. BR reduces operational costs during crises, maintains profitability and financial stability and helps businesses grow despite challenges. This finding is supported by [

25,

47].

The findings related to the fourth hypothesis (H4) also reported the presence of a significant positive relationship between DCP and BR (β = 0.251,

p < 0.05). This finding indicates that micro- and small entrepreneurs capable of defining their core purpose tend to develop their business values, vision, mission and goals better and can develop clear strategies with sustainable orientations and more resilience. DCP guides entrepreneurs to work effectively, reduces confusion and provides a better business environment with more motivation to execute tasks effectively. Having a high level of DCP indicates a clear understanding of business strategies, which develops greater resilience through a clear sense of the business’s purpose. High DCP helps clarify business decision-making during crises, guides the proper use of available resources and helps create better alignment with stakeholders, customers and employees. In addition, clarity of purpose is considered an intrinsic motivation for micro- and small entrepreneurs, providing more commitment and determination to face challenges during adverse times. This aligns with the arguments of [

11,

49,

50].

With regard to the fifth hypothesis (H5), the findings reported a positive and significant influence of DCP on BES (β = 0.198,

p < 0.05). The finding is logical; the more micro- and small entrepreneurs develop clear core purpose, the more they develop clear goals, vision, mission and working strategies for their businesses, which help direct their business activities and decisions. This helps them make the right decisions that will translate into good relationships with customers and suppliers and reduced costs that generate more profits and maintain higher sustainability. In other words, higher levels of DCP allow MSEs to manage their budgets carefully and best utilise their available resources based on their decided mission, vision and objectives. DCP also ensures that business activities are executed per the plan set, leading to the implementation of the realistic decisions anticipated earlier. Furthermore, DCP contributes to developing a competitive advantage by focusing on specific areas, products or services and helping entrepreneurs think strategically and plan appropriately for the future. These statements align with [

11,

21,

49].

Concerning the sixth hypothesis (H6), it was found that BR positively and significantly partially mediated the connection between the assumed relationships (β = 0.089,

p < 0.05). This finding confirms that DCP has a direct influence on BES. Nevertheless, when BR is used as a mediator, the influence on BES further increases as a result of the influence of BR. In other words, DCP improves economic sustainability and enhances its effect by improving BR. Businesses with clear DCP tend to develop better BR, which in turn leads to better financial sustainability. DCP, through resilience, leads to better decision-making and better outcomes. This is in line with [

21,

49].

Finally, the seventh hypothesis (H7) confirmed that there exists a positive and significant association between ER and BES (β = 0.356,

p < 0.05). This finding highlights that BR is a key factor in the economic sustainability of MSEs. In other words, MSEs capable of developing more significant levels of resilience tend to achieve sustainability better and survive in the market, especially during crises. BR allows for new and innovative ways of reducing operational risks that lead to increasing profits and providing more job opportunities. Higher resilience means better risk management, the ability to develop contingency plans and the ability to recover from setbacks and disruptions; this is in line with [

2,

7,

47].

5.2. Theoretical Implications

The limited extant literature about MSEs and their survival, continuity and resilience in developing countries during adverse times makes this research a significant contribution. More specifically, this investigation is one of the minimal works contributing to the literature with a comprehensive model combining CUC, DCP, BR and BES to support MSEs’ economic sustainability and survival during challenging times and in unstable states such as Yemen. This study gives guidelines and suggestions to policymakers, entrepreneurs and various stakeholders on the importance of CUC, DCP, BR and BES for the sustainability of MSEs in adverse conditions. This article also provides a solid grounding and motivation for other researchers to continue investigating MSEs from different points of view by building on the model of this study.

This study also provides empirical evidence of BR’s ability to partially mediate CUC, DCP and BES. This confirms that BR is a dynamic capability linking external economic sustainability and internal practices. It also emphasises that having a clear purpose and skills for coping with challenges could lead to better MSEs’ resilience and better economic sustainability. This study further contributes to the theories of the coping business by confirming that adaptive behaviours and strategies for dealing with unexpected challenges are reactive and can also be proactive in enhancing resilience and long-term sustainability. Finally, the findings of this research add new insights into RBV theory by confirming that BR acts as a key resource that is considered essential for business continuity and sustainability.

5.3. Practical Implications

Based on this study’s findings, specific practical implications can be drawn. First, BR was found to be an effective determinant for enhancing BES. Accordingly, micro- and small entrepreneurs should focus on building resilience among themselves to help practise and apply the appropriate strategies necessary for managing resilient businesses during challenging times and ensuring better economic outcomes. Enhancing resilience among micro- and small entrepreneurs reflected in their enterprises can take different forms, including providing adequate business training on adaptive strategies and risk management. The provided training may also include enhancing the skills needed to develop contingency plans that assist entrepreneurs in dealing with uncertainties and challenging tasks that ultimately reflect the resilience of businesses. Furthermore, as CUC and DCP have been proven to positively influence resilience, micro- and small entrepreneurs, in cooperation with other developmental organisations, may work on developing coping strategies and their core business purposes. More specifically, entrepreneurs need to focus more on maintaining good relationships, networking and creating good industry connections to gain more knowledge and learn adequate strategies for managing business challenges effectively. They also need to learn from past failures and avoid repeating similar mistakes.

Additionally, micro- and small entrepreneurs need to focus more on defining clear values and goals for their businesses, regardless of their type or size, as this has proven to be an effective strategy for making the right decisions in the industry. They also need to set clear long-term strategies and operations that align with an explicit core purpose to get directions for their businesses. As a conclusion of this research, policymakers need to develop capacity-building programs to build entrepreneurs’ resilience and skills to face business challenges. They also need to provide logistical and financial support to help them align with their core purpose and strengthen sustainability during challenging times. Finally, there is a need to enhance best business practices among MSEs to reduce operational costs and increase success opportunities, especially in crises.

Additionally, policymakers in the context of this study need to focus on developing stability-focused public policies, providing emergency financial support for micro- and small enterprises and working on entrepreneurs’ capabilities by offering training workshops and mentorship initiatives. In cooperation with development programs, policymakers may also focus on enhancing microfinance programs to support micro- and small businesses and partner with other financial institutions, such as commercial banks. There is also a need to allow better business networks and public–private partnerships to enhance business growth. Policymakers must look at other countries’ long and successful experiences in the small and micro-sectors and apply their strategies supporting micro- and small enterprise sectors, such as Rwanda and Afghanistan, to ensure better resilience and economic sustainability for businesses. Saudi Arabia’s 2030 vision and policies implemented during COVID-19 were considered significant in supporting MSEs; hence, they must be assessed and replicated, if possible.

6. Conclusions, Limitations and Future Research

As stated earlier in the previous literature, MSEs make a significant contribution to the economy, especially in developing countries. Still, with this positive perception, it has always been noted that MSEs remain weak and volatile and may collapse at any time quickly, particularly in scenarios characterised by political instability and conflict zones. Hence, understanding how to enhance MSEs’ resilience to ensure continuity and sustainability is an attractive motive for research. To meet the objective of this research, a conceptual model combining CUC, DCP, BR and BES was developed to examine the interactions of these concepts in an unstable country such as Yemen, which is surrounded by many political and internal issues. The findings reposted were inspiring. All the assumed propositions were accepted, including the mediation hypotheses, which confirmed the presence of partial mediation between CUC, DCP and BES through BR. This study then concluded by providing vital theoretical and practical implications for policymakers, entrepreneurs and researchers. While this study offers insight for researchers, policymakers and stakeholders in general, the author acknowledges that it is not free of limitations. For example, the small sample size applied in this research may limit the possible generalisation of the findings.

Furthermore, snowball and convenience sampling might also be criticised for not being random despite their suitability for the research. Finally, future researchers are encouraged to continue investigating the key factors behind the survival and sustainability of MSEs during challenging times, especially in developing countries. The focus on exploring external factors such as community networks, institutional support interaction with CUC, DCP and BR, and sustainability will allow further clarity on essential steps to be taken by policymakers and other involved parties in the MSE sector.