1. Introduction

The novel coronavirus (COVID-19) has profoundly transformed daily life across the globe, impacting nearly every aspect of society. With its rapid spread and unpredictable transmission patterns, the virus triggered unprecedented disruptions, including significant energy-related implications that reshaped the global energy landscape both directly and indirectly. The first known case of COVID-19 was identified in Wuhan, Hubei Province, China, on 8 December 2019. From there, the virus spread rapidly, with cases reported in nearly every country by early 2020. Faced with the threat of overwhelmed healthcare systems, governments worldwide implemented strict measures to curb the virus’s spread, including lockdowns, travel restrictions, and social distancing protocols. These measures, while essential for public health, led to historic shifts in energy demand and supply, fundamentally altering the global energy scene.

The pandemic has left an indelible mark on the global energy sector, reshaping energy demand, supply chains, and market dynamics in unprecedented ways. In 2020, wholesale electricity prices plummeted sharply, driven by a dramatic decline in energy demand, falling fuel prices, and the rapid expansion of renewable energy sources with near-zero marginal costs. According to the International Energy Agency (IEA), the wholesale electricity price index, which tracks trends in major advanced economies, had already declined by 12% in 2019 before experiencing an average drop of 28% in 2020 [

1]. This unprecedented decline was a direct consequence of the pandemic’s economic disruptions, which forced industries to scale back operations and households to adapt to new patterns of energy consumption. As the global economy began to recover in 2021, electricity demand rebounded modestly, growing by approximately 3%. However, this growth paled in comparison to the 7.2% surge observed during the 2010 global financial crisis, underscoring the lingering effects of the pandemic on energy consumption patterns. Emerging markets and developing economies, particularly China and India, emerged as key drivers of this recovery, reflecting their growing influence on global energy trends. Meanwhile, the share of renewable energy in electricity production continued to rise, contributing to a historic 4% decline in coal consumption in 2020 [

1]. This shift was fueled by lower energy demand during the pandemic and the accelerating global transition toward cleaner energy sources. However, the easing of pandemic-related restrictions in 2021 and 2022 led to a significant rebound in coal consumption, triggering energy crises across regions from Asia to Europe. These crises highlighted the fragility of global energy systems and the challenges of balancing short-term energy needs with long-term sustainability goals.

This taxonomy examines the multifaceted impact of the COVID-19 pandemic on global energy markets, analyzing its short-, medium-, and long-term effects across various sectors. It explores shifts in energy demand, the acceleration of renewable energy projects, the adoption of new technologies, and the evolving dynamics of the upstream energy industry (oil, coal, and natural gas). Additionally, it investigates market trends in electric vehicles (EVs) and internal combustion vehicles (ICVs), the transformation of the aerial transportation sector, and the growing emphasis on energy security and cybersecurity. The study also evaluates the supportive government initiatives implemented as countermeasures during the pandemic, providing a comprehensive roadmap for understanding the pandemic’s enduring impact on the global energy landscape.

Figure 1 presents a visual overview of the taxonomy’s structure and content.

2. The Impact of COVID-19 on the Global Energy-Related Markets and Industries

2.1. Electricity Demand

The pandemic did profoundly influence residential energy demand, with effects ranging from immediate disruptions to potential long-term transformations. Initially, the widespread imposition of lockdowns led to a surge in residential energy consumption. This shift was driven by the increased use of heating and cooling systems, lighting, electronics, and appliances. However, the medium- and long-term outlook reveals a more nuanced picture, shaped by evolving work patterns, consumer behavior, and policy responses.

In the short term, the pandemic forced countries worldwide to implement lockdowns, drastically altering energy consumption patterns. With more people confined to their homes, residential energy demand surged. According to the International Energy Agency, while global energy demand fell by 3.8% in 2020 due to lockdowns, the residential sector was the only sector to experience growth, with a 1.5% increase worldwide [

1]. In the United States, residential energy consumption rose by an average of 10–15%, with some states recording spikes of up to 30% [

1]. This trend was mirrored in China, where residential electricity use increased by 6.4% annually in the first quarter of 2020, offsetting declines in industrial and commercial demand [

1]. The IEA characterized the overall drop in energy demand during lockdowns as “Sunday Energy-Demand Levels”, reflecting the sharp reduction in industrial and commercial activity, partially offset by higher residential use [

1]. As restrictions eased, energy demand began to recover unevenly across regions. For example, the European Energy Council noted an unexpected surge in demand in May 2020 as countries relaxed measures [

2]. By August 2020, energy demand in Europe had rebounded to pre-pandemic levels, despite ongoing restrictions, and continued to rise into 2021, surpassing 2018 figures by year-end [

2]. This recovery highlighted the resilience of energy systems but also underscored the complexity of managing demand in a post-pandemic world.

The medium-term effects of the pandemic on residential energy demand are shaped by the lasting adoption of remote work, changes in consumer behavior, and policy initiatives aimed at promoting energy efficiency. The shift to remote work has reduced energy demand in commercial spaces while increasing it in residential settings. The National Renewable Energy Laboratory (NREL) predicts a slight overall reduction in U.S. electricity demand due to this trend, even as residential consumption rises [

3]. Consumer attitudes toward energy use are also evolving, with a growing emphasis on energy-saving practices and the adoption of efficient appliances. The American Council for an Energy-Efficient Economy (ACEEE) reports that many individuals have reduced their energy usage and expressed interest in upgrading to more efficient technologies [

4]. This behavioral shift, supported by government policies promoting energy efficiency and renewable energy, signals a move toward reducing the residential sector’s reliance on fossil fuels. Initiatives such as incentives for solar and wind energy adoption are expected to play a crucial role in this transition, accelerating the push for energy-efficient homes and sustainable energy sources [

5].

The long-term repercussions of the pandemic on residential energy demand highlight a fundamental shift in how energy systems are conceptualized and managed, with energy efficiency and sustainability becoming central to future energy strategies. The crisis has not only exposed the vulnerabilities of existing energy consumption patterns but also underscored the urgent need for systemic changes to promote energy-saving measures and sustainable practices. According to an IEA report, improving energy efficiency in buildings could reduce energy consumption by up to 30% by 2040, even as the global housing stock continues to grow [

1]. This finding underscores a critical insight: energy efficiency is not just a tool for reducing consumption but a cornerstone for decoupling economic growth from environmental degradation. Policy shifts are already reflecting this paradigm change, with governments worldwide rolling out financial incentives for energy-efficient upgrades, such as LED lighting and rooftop solar panels. These measures are not merely reactive but strategic, aiming to achieve dual objectives: reducing household energy consumption and lowering carbon footprints over the long term. For example, the integration of smart technologies—such as occupancy sensors and automated energy management systems—enables real-time optimization of energy use, particularly in underutilized spaces. This technological advancement is not just an incremental improvement but a transformative step toward creating adaptive and responsive energy systems that align with user behavior and environmental goals. Governments are also navigating a complex balancing act between fostering economic development and advancing environmental sustainability. This challenge is particularly acute in the residential sector, where energy demand is closely tied to economic activity and quality of life. Policies must therefore address immediate economic recovery needs while simultaneously laying the groundwork for long-term climate resilience. The interplay between economic priorities, technological advancements, and environmental preservation is creating a dynamic and interconnected energy landscape, where energy efficiency is increasingly seen as a non-negotiable component of sustainable development. The pandemic has acted as a catalyst, accelerating the transition toward more sustainable and resilient energy systems. The lessons learned during this period—such as the importance of proactive policymaking, technological innovation, and consumer engagement—are shaping the future of residential energy demand. As we move forward, the integration of these elements will be crucial in ensuring that energy systems are not only efficient and reliable but also aligned with broader sustainability goals. This is evident in the widespread adoption of energy-saving measures during the pandemic, which has set a precedent for future policy frameworks and technological innovations.

The pandemic has also profoundly disrupted energy demands across industrial sectors worldwide, triggering a sharp decline in economic activity and, consequently, industrial energy consumption in the short term. The crisis exposed the vulnerability of industrial energy systems to global shocks, with energy demand plummeting as factories, construction sites, and transportation networks scaled back operations due to lockdowns and social distancing measures [

6]. The manufacturing and construction sectors were among the hardest hit, experiencing significant reductions in energy utilization as production slowed or halted entirely. Similarly, the transportation sector, including aviation and shipping, faced a stark decline in energy demand due to travel restrictions and reduced economic activity. The impact of the pandemic on industrial energy demand varied significantly across regions, reflecting differences in policy responses and the severity of restrictions. For example, China experienced a 9% decline in industrial energy demand during the first half of 2020, while Europe saw a slightly less severe reduction of 6% [

7]. In contrast, the United States recorded a 3% decline in industrial energy consumption, attributed to less stringent lockdown measures and a more diversified industrial base [

7]. These regional disparities highlight the complex interplay between public health policies, economic structures, and energy consumption patterns.

The medium- and long-term impacts of the pandemic on industrial energy demand will be shaped by a combination of economic recovery rates, structural changes, and policy responses. One of the most significant shifts has been the accelerated adoption of remote work and the expansion of e-commerce, which are reshaping industrial energy consumption patterns. For instance, the rise of e-commerce and home delivery services has increased energy demand in warehousing and logistics sectors, while reduced business travel and commuting have led to a sustained decline in transportation energy consumption. The pandemic has also accelerated the adoption of renewable energy technologies and energy efficiency measures in industrial settings. Companies are increasingly prioritizing resilience and energy security, driven by the lessons learned during the crisis. This has led to greater investments in renewable energy and energy storage systems, as well as the rapid adoption of building automation and other energy-efficient technologies [

8]. These technologies not only reduce energy consumption but also enhance the resilience of industrial facilities, making them better equipped to withstand future disruptions. Furthermore, the pandemic has underscored the importance of diversifying energy sources and improving energy management practices. Industries are now more likely to integrate renewable energy into their operations, supported by government policies and incentives aimed at promoting sustainability. This shift is expected to drive long-term reductions in carbon emissions and energy costs, while also contributing to broader climate goals. In summary, the pandemic has acted as a prompt for transformative changes in industrial energy demand. While the short-term effects were characterized by sharp declines in consumption, the medium- and long-term outlook points to a more resilient and sustainable industrial energy landscape.

Like the industrial sectors, commercial consumers have also experienced significant impacts on energy demand due to the COVID-19 pandemic. The resultant economic downturn led to reduced energy consumption in commercial buildings, though the degree of impact varied across building types and regions, with recovery being uneven [

8]. In the immediate response, many non-essential businesses shut down or moved operations online, leading to decreased energy use in offices, hotels, and retail spaces. The International Energy Coregency reported a 7% drop in global commercial energy demand for the first half of 2020, particularly in the United States and Europe [

1]. Specific commercial establishments like hotels and restaurants experienced notable demand decreases due to travel limits and economic slowdowns. Similarly, retail spaces faced significant reductions in energy use due to decreased foot traffic and widespread closures. Additionally, the pandemic spurred increased governmental involvement in energy markets, which could potentially affect commercial energy users. Various measures introduced to support energy companies and address energy security may have long-term implications for commercial energy consumers, possibly leading to increased taxation or higher regulatory costs.

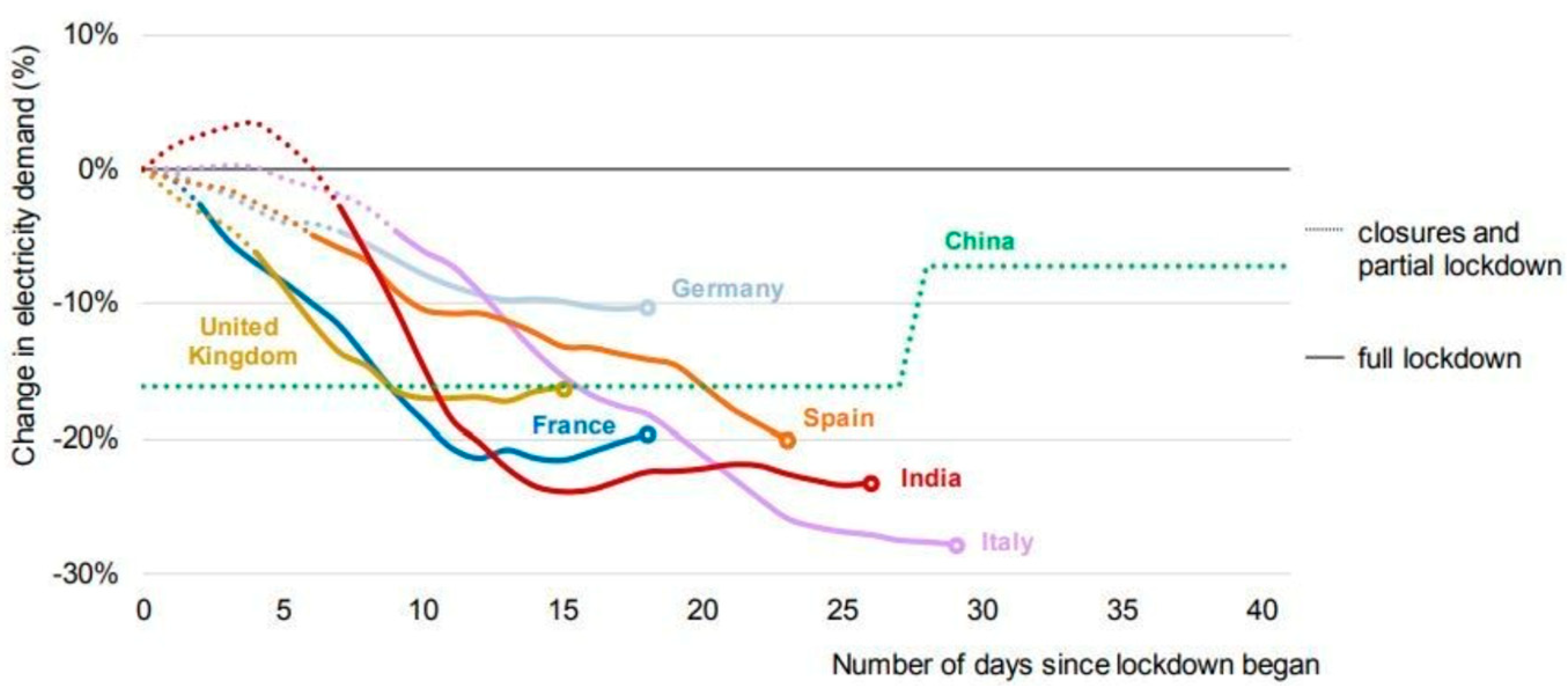

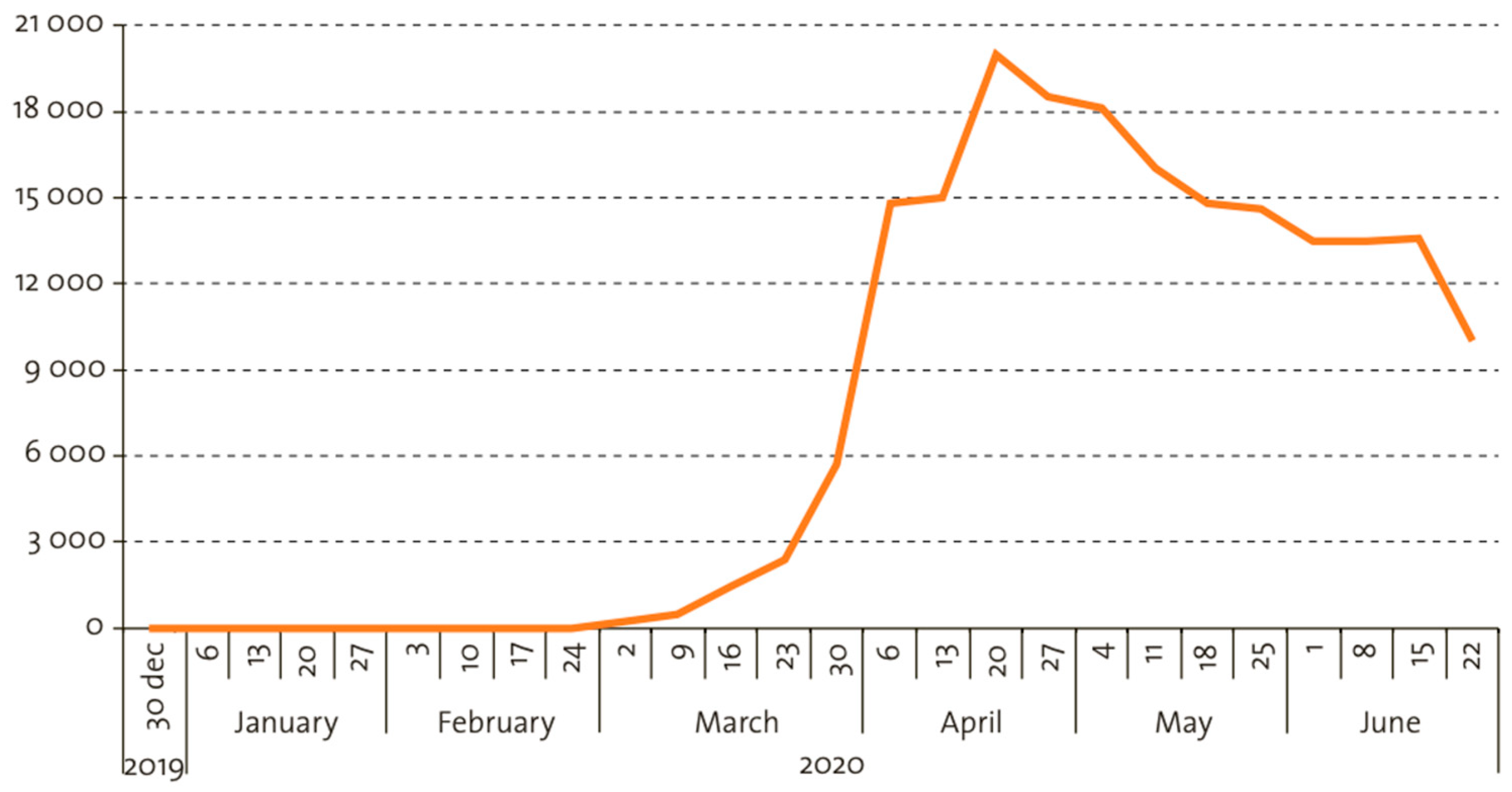

Figure 2 illustrates the initial decline in electricity demand during lockdowns, as reported by the IEA [

9].

2.2. Renewable Energy

Renewable energy sources demonstrated remarkable resilience during the COVID-19 pandemic, outperforming traditional energy sectors in the face of unprecedented global challenges. Data on monthly installations, awarded auctions, and project announcements reveal that renewables not only weathered the crisis but also achieved record growth, underscoring their critical role in the global energy transition [

10]. Despite the widespread economic disruptions caused by the pandemic, over 260 GW of renewable capacity was integrated worldwide in 2020, surpassing the previous record by more than 50% [

11]. This growth was driven by several key factors, including declining operational costs, uninterrupted access to networks and infrastructure during lockdowns, and robust governmental support for green energy transitions. These elements collectively highlighted the strategic importance of renewables in ensuring energy security and sustainability during the crisis.

The pandemic-induced economic shutdowns led to a significant reduction in global energy demand, particularly in the transportation and electricity sectors. By mid-April 2020, countries under full lockdown experienced a 25% decline in energy use compared to 2019, accelerating the closure of fossil fuel power plants and reducing coal-based power generation [

12]. Renewable energy generation, however, proved more resilient, growing faster than overall electricity demand due to its lower operational costs and priority grid access in many regions. This resilience was particularly evident in wind and solar energy, which continued to expand despite the global economic downturn.

However, the renewable energy sector was not entirely immune to short-term disruptions. Solar energy investments, for example, faced significant challenges due to supply chain dependencies on China for key components and raw materials, which affected the industry for over a year during the pandemic [

13]. Despite these hurdles, global renewable energy usage and generation increased by 1.5% and nearly 3%, respectively, in early 2020, even as fossil fuel consumption declined sharply. This shift contributed to a 17% reduction in global carbon emissions by early April 2020, largely driven by reduced transportation demand and industrial activity [

14]. However, this decline in emissions may be temporary, as increased remote work and other pandemic-driven changes alone are insufficient to achieve the annual 7.6% emissions reduction required to limit global warming to 1.5 °C, as outlined by the UN Environment Programme [

15].

The pandemic marked a turning point for renewable energy, accelerating the global shift away from fossil fuels. The historic shock to energy demand, exacerbated by the Saudi–Russian oil price war and a 65% drop in oil prices during the first half of 2020 [

15], created a unique set of challenges and opportunities for the energy sector. Unlike previous crises, which were often supply-driven, the COVID-19 energy shock was primarily demand-driven, leading to a rapid reconfiguration of energy systems. Renewable energy sources emerged as a reliable and cost-effective alternative, with utilities prioritizing them over less efficient thermal power sources to cut costs and maintain stability. The resilience of renewables during the crisis has reinforced their role as a cornerstone of the global energy transition. Despite a rebound in fossil fuel demand as restrictions eased, the pandemic underscored the reliability, security, and affordability of renewable energy, even under crisis conditions. This enduring lesson has significant implications for the future, signaling a potential long-term shift toward greener energy sources.

The United States and China played pivotal roles in driving renewable energy growth during the pandemic. The U.S. added 22.5 GW of renewable capacity in 2020, while China doubled its 2019 installations with an impressive 118 GW [

11]. This surge elevated renewables to nearly 30% of the global electricity mix, marking a significant milestone in the transition to sustainable and carbon-free energy resources. Despite initial setbacks, such as a 12% decline in renewable installations in the first half of 2020 compared to 2019, the year overall saw substantial growth in renewable energy capacity. Hydropower, however, faced unique challenges during the pandemic. While hydroelectric generation increased modestly by 1.6%, growth fell short of expectations due to supply chain disruptions and reduced capital investment [

16]. Moreover, the trend of fewer approvals for new hydroelectric dams, which began before the pandemic, continued in 2020, with 2019 recording the lowest level of approvals in a decade [

16]. This context highlights the importance of complementing hydroelectric development with advancements in energy storage technologies, which are critical for balancing intermittent renewable energy sources and ensuring grid stability.

2.3. Energy Industry

2.3.1. Transition to New Technologies in Energy Industry

The pandemic has accelerated the adoption of remote monitoring and management technologies across the energy sector, marking a significant shift in how energy systems are operated and maintained. According to a recent report by Navigant Research, the market for these technologies is projected to grow from 12.1 billion in 2020 to 12.1 billion by 2029, reflecting their increasing importance in ensuring operational continuity and resilience. One prominent example is the deployment of smart meters, which utilize IoT sensors to collect real-time data on energy consumption and transmit it to energy companies for analysis and optimization. The International Energy Agency reports that over 900 million smart meters have been installed globally, with installations increasing by 13% in 2020 despite the pandemic [

17]. This growth underscores the critical role of digital technologies in maintaining energy systems during periods of disruption.

Another key development is the use of cloud computing for remote energy management. Platforms like Schneider Electric’s EcoStruxure enable energy companies to monitor and control energy systems from centralized locations, leveraging real-time data and advanced analytics to optimize energy consumption. Schneider Electric reports that its EcoStruxure program has helped customers save over 1.8 billion kWh of energy since its inception, demonstrating the tangible benefits of these technologies. In the short term, the rapid adoption of these solutions was driven by the urgent need to maintain operational continuity and enhance system resilience amid lockdowns and social distancing measures. The pandemic also accelerated the integration of these technologies in the renewable energy sector, where remote monitoring is particularly critical due to the often remote and distributed nature of renewable energy installations.

In the medium term, the reliance on remote monitoring and management technologies is expected to stabilize, becoming a standard component of energy industry operations. This transition not only supports ongoing efficiency improvements but also enables energy companies to better respond to fluctuating energy demands and environmental goals. The adoption of these technologies reflects a broader shift toward digital transformation in the energy sector, driven by the necessity to adapt to pandemic-induced challenges. For example, wind and solar power plants, often located in remote or hard-to-access areas, have benefited significantly from IoT sensors and remote monitoring systems. These technologies reduce the need for on-site maintenance, enhance system reliability, and lower operational costs, making renewable energy projects more viable and scalable.

Over the long term, the integration of advanced technologies is expected to revolutionize energy management practices. As these systems become more sophisticated, they will enable predictive maintenance, enhance energy efficiency, and facilitate the seamless integration of renewable energy sources into the grid. This evolution is particularly significant as the energy sector transitions toward decentralized and sustainable models, leveraging technology to address the dual challenges of climate change and resource management. The ability to remotely monitor and optimize energy systems will be critical in achieving carbon neutrality and building resilient energy infrastructures capable of withstanding future disruptions.

The integration of remote monitoring and management technologies has become indispensable for the energy sector, particularly in the context of the COVID-19 pandemic. These technologies allow energy companies to oversee and optimize energy systems remotely, reducing the need for on-site maintenance and improving operational efficiency. Given the projected growth in this market, these technologies are poised to play an increasingly central role in the energy sector’s evolution. The sustainable transition driven by these innovations not only addresses immediate operational challenges but also aligns with long-term strategic goals for resilience, sustainability, and carbon neutrality in the energy sector.

2.3.2. Upstream Energy Industry (Oil, Coal and Natural Gas)

The COVID-19 pandemic triggered unprecedented disruptions in the upstream energy industry, leading to significant reductions in energy demand, CO

2 emissions, and fossil fuel production. In April 2020, global CO

2 emissions fell by an astonishing 18% compared to 2019 levels, driven by a sharp decline in electricity consumption and transportation activity. This reduction was largely attributed to the widespread lockdowns and restrictive measures implemented to curb the virus’s spread, which drastically reduced industrial production, manufacturing, and vehicular and aerial transportation. Additionally, the renewable energy share of global electricity generation increased slightly during lockdowns, reaching 4%, partly due to the commissioning of new solar and wind projects in late 2019. While this increase was modest, it reinforced the resilience and reliability of renewable energy, bolstering confidence in its role as a cornerstone of a greener future. As restrictions eased and economies began to recover, electricity demand rebounded, leading to a resurgence in generation from thermal power plants and a gradual return of CO

2 emissions. However, despite lower fossil fuel prices in 2020, the crisis did not dampen enthusiasm for renewable energy projects or policy support. Instead, the pandemic highlighted the vulnerabilities of fossil fuel-dependent energy systems, accelerating the shift toward renewables and cleaner energy sources. Another critical factor during the pandemic was the severe disruption of global energy supply chains, exacerbated by border closures and geopolitical tensions. On 12 March 2020, the failure of OPEC to agree on production quotas triggered a stock market crash and intensified volatility in the oil market. This was further compounded by the oil price war between Saudi Arabia and Russia, which led to a collapse in oil prices and created severe demand shocks [

18,

19,

20]. These events underscored the fragility of global energy markets and the need for more resilient and diversified energy systems.

The pandemic also had a profound impact on natural gas production, with significant declines observed in many countries due to operational challenges caused by lockdowns, travel restrictions, and social distancing requirements. In the United States, natural gas production fell by approximately 6% in 2020 compared to the previous year, driven by reduced drilling activity, declining associated gas production, and lower output from shale gas wells. However, the impact of COVID-19 on gas markets varied significantly across regions. For instance, while the U.S. gas market demonstrated resilience and continued to grow, Italy experienced a dramatic decline in natural gas demand and production. By late February 2020, Italy had become the epicenter of the pandemic in Europe, prompting the government to implement stringent protective measures on March 10, 2020. These measures paralyzed the country’s economy and led to a 10% year-on-year reduction in natural gas demand in Q1 2020, equivalent to over 6 billion cubic meters (BCM). The sharp decline in demand resulted in more than 25% of Italy’s gas-fired power generation capacity remaining unused during the lockdown period. This was particularly significant given Italy’s status as Europe’s largest market for natural-gas-fueled vehicles (NGVs), with an estimated 1.1 million NGV cars on the road prior to the pandemic [

21]. The protective measures placed an extraordinary burden on Italy’s gas industry, highlighting the sector’s vulnerability to sudden demand shocks.

Another critical aspect of the COVID-19 pandemic’s impact on the upstream energy markets was the unprecedented surge in coal and natural gas prices during the post-lockdown period, which culminated in the historic energy crisis that gripped Europe in the summer of 2021. The turbulence in energy markets began in mid-May 2021, as gas prices skyrocketed, occasionally surpassing 600% of pre-pandemic levels, while coal prices rose by nearly 270% [

22]. This dramatic increase in fossil fuel prices was primarily driven by the strong rebound in energy demand following the historic lows experienced during the early months of the pandemic. As economies reopened and restrictive measures were lifted, energy consumption surged, outpacing the supply capacity of coal and natural gas markets. Compounding this recovery was an unusually cold and prolonged winter in the Northern Hemisphere, which further strained energy supplies and exacerbated price volatility.

A third factor contributing to the energy crisis was the disruption in coal production in Asia, particularly in China and India, the world’s largest coal producers. In China, extreme heatwaves and stringent supply control measures, implemented after a series of fatal mining accidents in June 2021, led to significant coal shortages and a sharp rise in global coal prices. By August 2021, the China Electricity Council reported that over ten coal-fired power plants had requested increases in bulk electricity prices to offset losses caused by soaring coal costs. Similarly, India, which relies on coal for 70% of its electricity generation, faced a severe energy crisis as post-pandemic economic recovery drove electricity demand to record levels. From August to October 2021, India’s electricity demand surged by 17% compared to 2019 levels, with generation increasing by 16.4% year-on-year in August alone [

23]. However, this demand spike coincided with a severe coal shortage, forcing coal-fired power plants to increase output by nearly 24% year-on-year, further driving up coal prices [

24]. By October 2021, half of India’s coal-fired power plants had less than a week’s supply of coal, with six plants completely running out [

24]. The crisis was exacerbated by an uneven monsoon season, which slowed coal production and reduced hydroelectric power generation due to lower rainfall [

25].

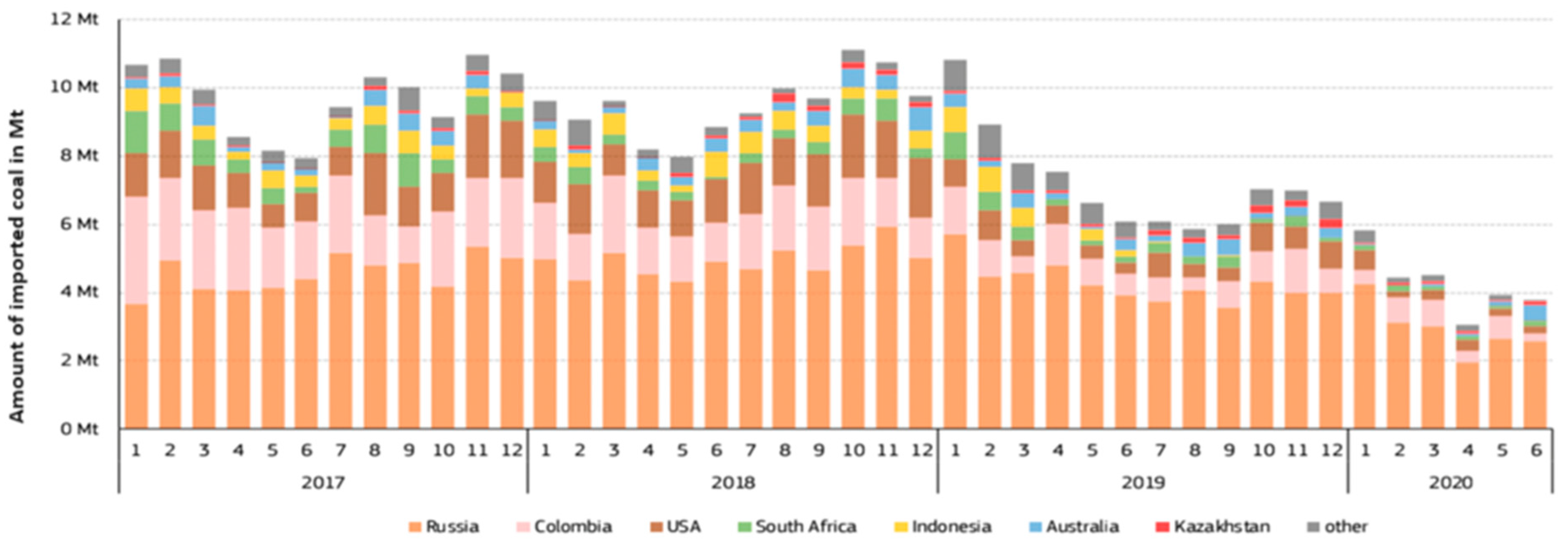

Despite being the world’s fourth-largest holder of coal reserves, India was forced to increase coal imports to meet its energy needs, further inflating global coal prices. Australian coal from the Newcastle mine, for instance, reached record highs of USD 240 per tonne [

26]. In response to Asia’s coal supply shortages, Russia increased its coal exports by 43% [

27], which had significant implications for Europe’s energy markets. During the second quarter of 2020, European coal imports had plummeted by 47% year-on-year to 10.6 million tonnes, reducing the import bill to EUR 0.75 billion, a 56% decline from the previous year, as shown in

Figure 3 [

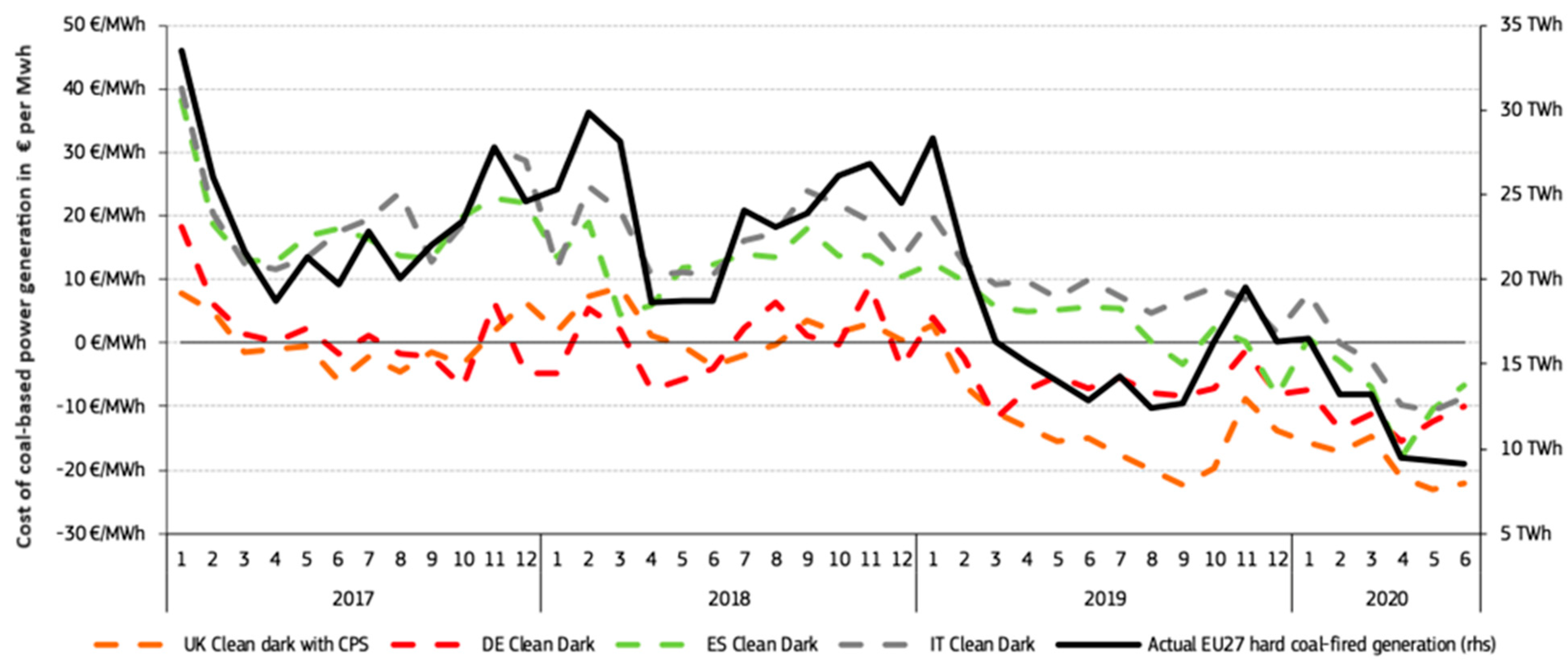

28]. However, as Europe sought to secure energy supplies for the winter of 2021, the continent faced soaring gas and coal prices, with the European Power Benchmark averaging 105 EUR/MWh in Q3 2021—a 165% increase from the previous year. This price surge led to a temporary reversal of clean energy initiatives, as coal-fired power generation increased despite rising carbon prices. Nuclear power generation partially offset these emissions, with its share increasing by 28 TWh (around 20%) in the second half of 2021.

Figure 4 highlights the trends in coal-based power generation from 2017 to 2020, illustrating the sector’s volatility during this period.

In contrast to Europe and Asia, the United States coal market experienced a pre-pandemic boost due to increased global demand. With approximately 22% of the world’s coal reserves, the U.S. maintained a stable and thriving coal market, despite the pandemic’s initial disruptions. The U.S. Energy Information Administration (EIA) projected a domestic coal production increase of 100 million tons in 2021, primarily for power generation. However, federal restrictions under the Biden administration posed challenges for coal producers, limiting their ability to meet this demand. Despite these constraints, U.S. coal exports reached record levels, particularly in the third quarter of 2020, as the market recovered from the pandemic’s impact. In the first half of 2021, exports surpassed 42 million short tons, reaching a two-year high. This growth was driven by strong demand from China for coking and metallurgical coal, following China’s ban on Australian coal imports due to political tensions. In the second quarter of 2021, China imported 2.4 million tons of U.S. coal, a significant increase from the previous year. Similarly, U.S. coal exports to India surged, with thermal coal shipments reaching four times the previous year’s levels in the third quarter of 2021. European demand also supported the U.S. coal market, despite nearly half of Europe’s coal imports traditionally coming from Russia. Political tensions and the European energy crisis further boosted U.S. coal exports, with thermal coal imports from the U.S. increasing by 69% in the first half of 2021.

The pandemic has prompted a fundamental reassessment of strategies in the upstream energy sector, emphasizing resilience, sustainability, and innovation. Major energy companies have shifted their practices, adopting advanced technologies and prioritizing investments that align with Environmental, Social, and Governance (ESG) standards. This shift reflects a broader industry trend away from traditional operational models and toward more sustainable and diversified energy portfolios. For example, Shell has announced plans to increase renewable energy investments and reduce oil production by up to 2% annually, addressing vulnerabilities in global supply chains exposed during the pandemic [

29]. Similarly, BP aims to cut oil and gas production by 40% by 2030 while ramping up investments in low-carbon technologies [

30], a response to the demand shocks caused by the pandemic and a recognition of the need to adapt to a rapidly changing energy landscape.

Financially, the upstream sector has seen a significant realignment of capital toward sustainable and resilient projects. The rise in green bonds and sustainable finance products in 2020 [

31] highlights this strategic shift, as investors increasingly prioritize projects that offer long-term environmental and economic benefits. This transition underscores the growing recognition that the future of energy lies in diversification, innovation, and sustainability, lessons that have been reinforced by the challenges of the pandemic.

2.4. Vehicle Markets

Globally, the COVID-19 pandemic has had a significant impact on the vehicle market. This section provides a comprehensive review of the related reports that discuss the sales of conventional vehicles and EV sales. A summary of the incentives provided by different countries to boost EV sales during the pandemic is also discussed.

2.4.1. Conventional Vehicle Markets

The conventional vehicle market was already facing challenges before the COVID-19 pandemic, with global car sales declining in 2019. According to the IEA, global car sales fell by 5% in 2019, with sharp declines in major markets such as India (12%) and China (9%) [

32]. The U.S. market also saw a modest decline of 1.8%, signaling a broader slowdown in the automotive industry. This pre-pandemic downturn can be attributed to several factors, including a global shift toward public transportation infrastructure, the rise of shared mobility services, and the early stages of transportation electrification. These trends indicated that the automotive industry was in a transitional phase, even before the pandemic exacerbated existing challenges.

The COVID-19 pandemic had a profound and immediate impact on the conventional vehicle market, causing a significant decline in sales and reshaping consumer behavior worldwide. In 2020, the pandemic led to a sharp drop in conventional vehicle sales across major markets, with China, the United States, and Europe experiencing declines of 6.3%, 14%, and 28%, respectively [

32,

33,

34]. This decline was driven by a combination of economic lockdowns, reduced consumer spending, and widespread job losses, which collectively weakened purchasing power and demand for new vehicles.

The reduction in conventional vehicle sales had a notable environmental impact, contributing to a decline in CO

2 emissions from the transport sector. According to the IEA, the transport sector accounts for approximately 24% of global CO

2 emissions, with conventional vehicles being the largest contributor [

35]. In 2020, global CO

2 emissions from the transport sector fell by 14%, largely due to the pandemic-induced drop in conventional vehicle sales [

7]. While this reduction is a positive development in the context of climate change, it is important to recognize that it is likely temporary. As economies recover and demand for conventional vehicles rebounds, CO

2 emissions are expected to rise again unless sustained efforts are made to transition to cleaner transportation alternatives.

The pandemic’s impact on the conventional vehicle market varied across regions, with distinct trends and policy responses emerging in China, the United States, and Europe. In China, the pandemic accelerated the transition toward EVs, with EV sales increasing by 8% in 2020 despite the overall decline in conventional vehicle sales [

36]. This shift was supported by government policies, including subsidies and the expansion of charging infrastructure, which have positioned China as a global leader in EV adoption [

37]. The move toward EVs has the potential to significantly reduce CO

2 emissions from the transport sector, aligning with China’s broader climate goals. In the United States, the pandemic led to a decline in conventional vehicle sales and a corresponding increase in demand for used vehicles. According to iSeeCars, used vehicle sales rose by 11.8% in 2020 compared to the previous year [

38]. This shift was driven by economic uncertainty, as consumers sought more affordable transportation options. However, the increased reliance on older, less fuel-efficient vehicles poses environmental challenges, as these vehicles tend to emit higher levels of CO

2. To address this issue, the U.S. government has introduced policies to encourage the retirement of older vehicles and promote the purchase of newer, more fuel-efficient models [

39]. In Europe, the pandemic had a significant impact on the automotive industry, which is a key contributor to the region’s economy. The decline in conventional vehicle sales led to job losses and economic uncertainty, but it also provided an opportunity to accelerate the transition toward sustainable mobility. In 2020, the European Union (EU) announced its Green Deal, which aims to make the region carbon-neutral by 2050 [

40]. The Green Deal includes policies to promote electric and hydrogen-powered vehicles, as well as the development of a comprehensive charging infrastructure, setting the stage for a long-term shift away from conventional vehicles.

The COVID-19 pandemic has had a profound and multifaceted impact on the conventional vehicle market, exposing its vulnerabilities while also creating opportunities for sustainable transformation. The decline in sales and corresponding reduction in CO2 emissions highlight the urgent need to address climate change, but these gains are likely temporary without sustained policy action. Governments and manufacturers must prioritize sustainable mobility solutions, such as electric vehicles and improved fuel efficiency, to ensure long-term environmental benefits. The examples of China, the United States, and Europe demonstrate the diverse ways in which the pandemic has influenced the conventional vehicle market and the innovative strategies being implemented to promote a cleaner, more resilient transportation future.

2.4.2. Electric Vehicles Market

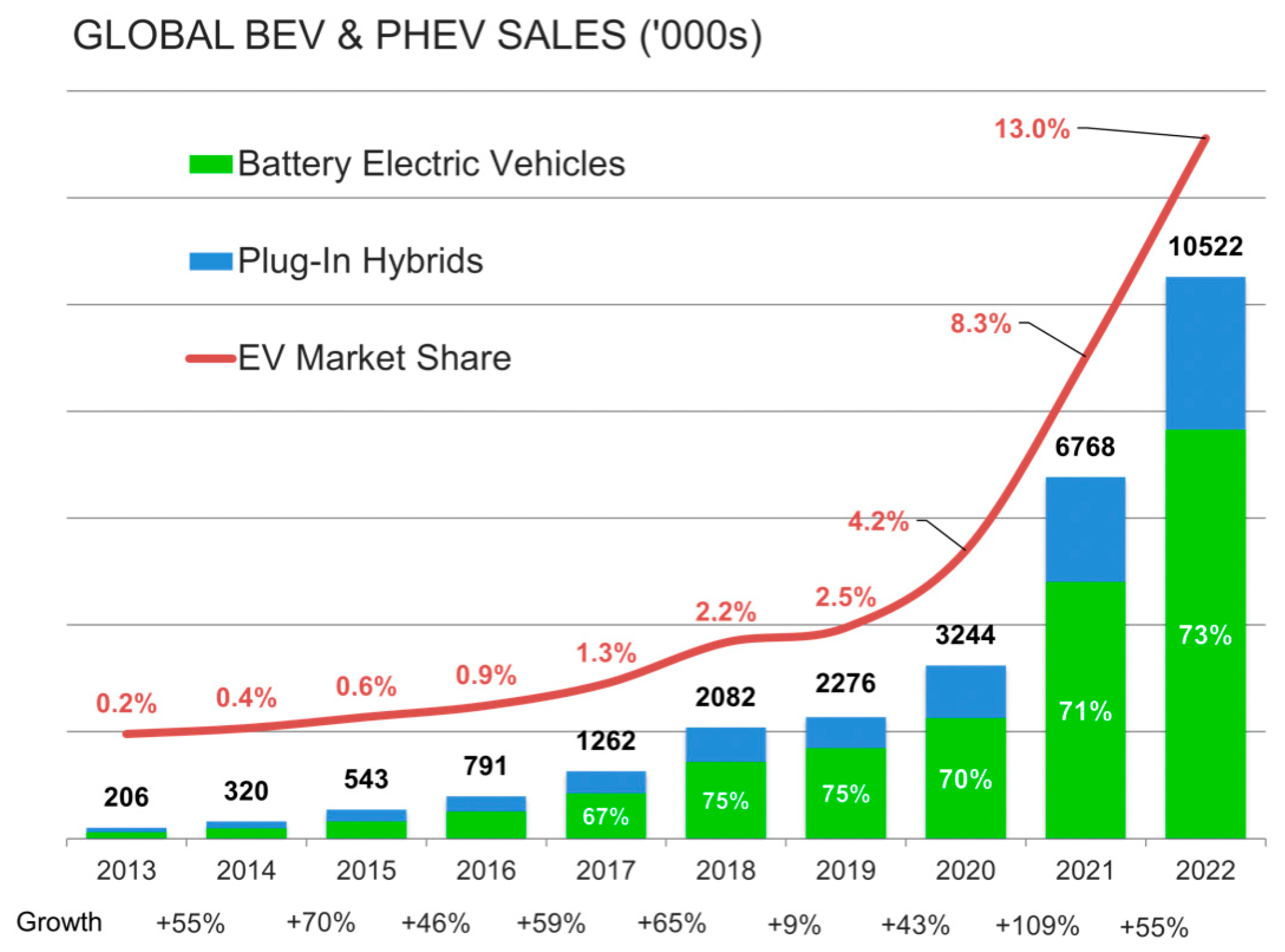

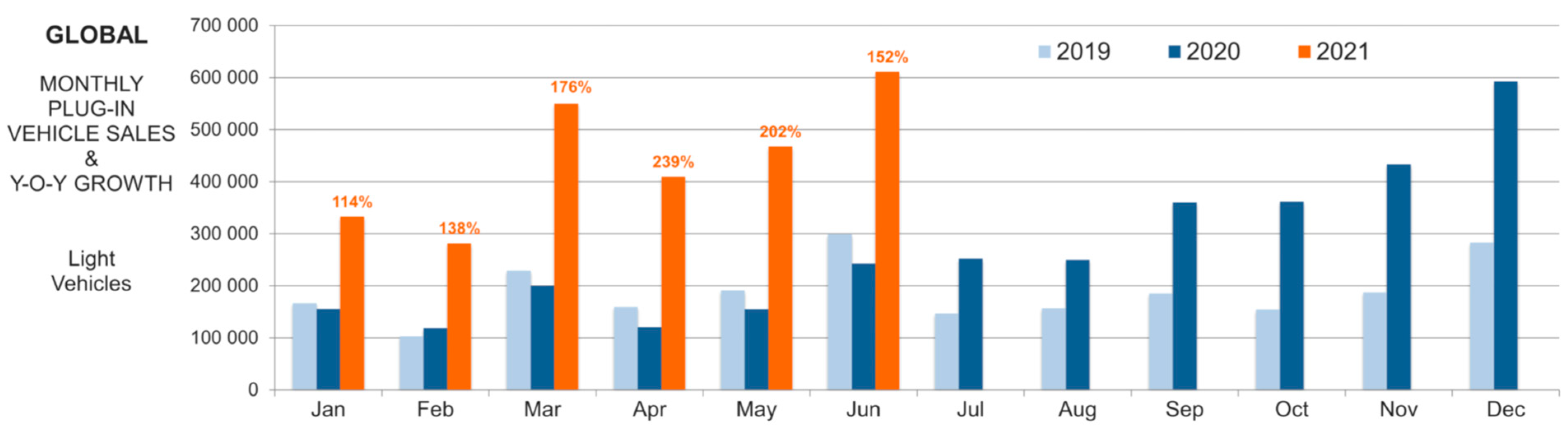

Global EV sales demonstrated remarkable resilience and growth during the COVID-19 pandemic, defying the challenges posed by supply chain disruptions and economic uncertainties. In 2022, 10.5 million new battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were delivered worldwide, representing a 55% increase compared to 2021 [

41]. This growth underscores the accelerating global shift toward electrification, even as the broader automotive industry struggled with pandemic-related setbacks.

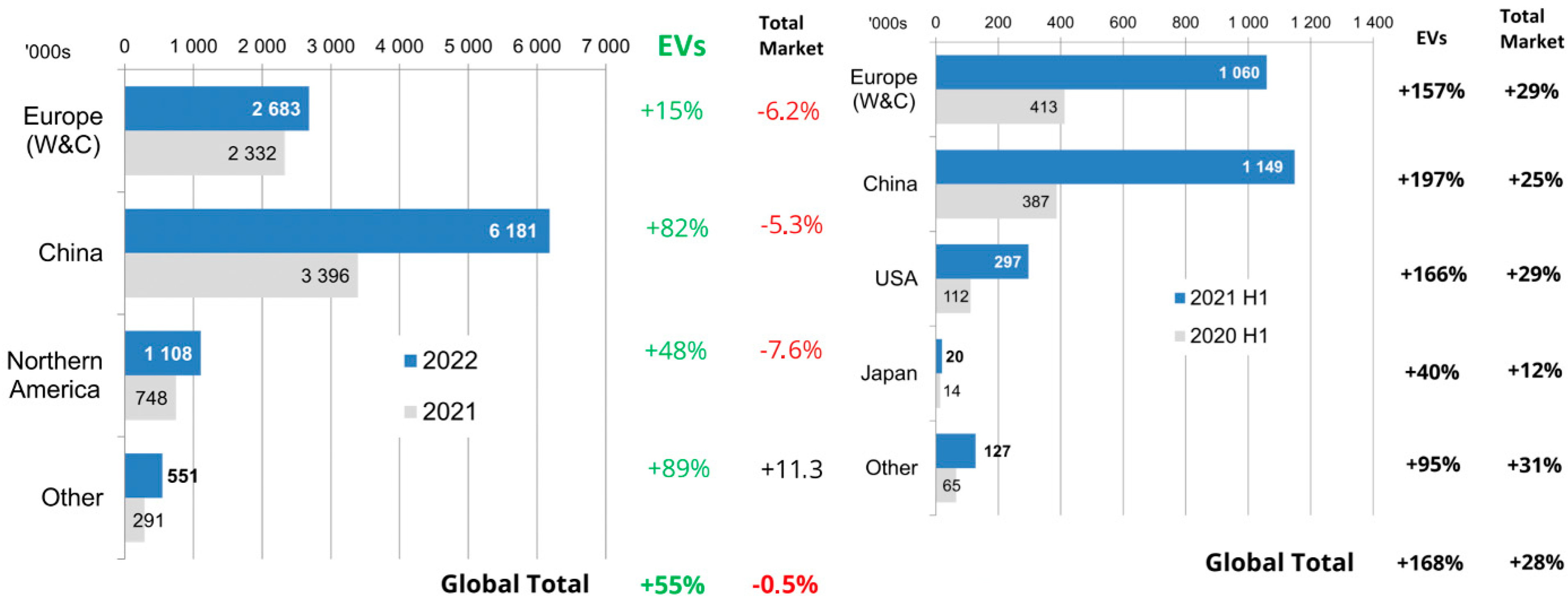

Regional disparities in EV sales growth were evident, reflecting varying market conditions and policy environments. In Europe, EV sales grew by a more modest 15%, constrained by weak overall vehicle markets and persistent component shortages exacerbated by the pandemic. In contrast, the United States and Canada saw a 48% increase in EV sales, despite an 8% decline in the overall light vehicle market. China, however, emerged as the standout performer, achieving an 82% surge in EV sales in 2022, as illustrated in

Figure 5 and

Figure 6 [

41]. This exceptional growth highlights China’s dominant role in the global EV market, driven by strong government support, a robust manufacturing base, and increasing consumer demand for cleaner transportation options.

The resilience of the EV market during the pandemic is a testament to its growing prominence in the automotive industry. While overall car markets remained below pre-pandemic levels, EV sales rebounded at an extraordinary pace, far outpacing the 26% growth in the global car market. This recovery was fueled by the relaxation of COVID-19 restrictions, improved economic conditions, and the restoration of government incentives for green technologies, such as the introduction of the 95g CO2/km mandate in Europe. These factors created a favorable environment for EV adoption, even as the broader automotive industry faced significant challenges.

The automotive industry experienced an uneven recovery between 2020 and 2022, with mature and developing economies following divergent trajectories. In mature economies, such as those in Europe and North America, auto sales declined by 5–10% in 2022, following a modest 5% recovery in 2021. This downturn was driven by ongoing supply chain disruptions, economic uncertainties, and the lingering effects of the pandemic. In contrast, developing economies, particularly India and the ASEAN countries, displayed remarkable resilience, sustaining a robust recovery trajectory. This divergence highlights the varying impacts of the pandemic on different regions and the importance of local economic conditions in shaping market outcomes. Despite these challenges, EV sales exhibited exceptional resilience, outperforming conventional vehicles across all regions. In Europe, EV sales exceeded expectations by 21%, while China saw an impressive 87% surge. Northern America recorded a 55% increase in EV sales, and non-Triad markets (excluding Europe, North America, and Japan) witnessed a notable 78% growth. In contrast, global light vehicle sales experienced a slight decline of 0.5% year-on-year, underscoring the relative strength of the EV market. The combined growth in BEVs and PHEVs reached 55%, reflecting the increasing consumer preference for electrified vehicles [

41].

The slower growth in EV sales in Europe can be attributed to the significant surge in demand during 2020 and 2021, as well as the economic and logistical challenges posed by the Ukrainian conflict. In comparison, China solidified its position as the global leader in EV production and sales, accounting for 59% of global EV sales in 2022. China’s EV manufacturing output reached approximately 6.7 million units, representing 64% of global production. Notably, China exported nearly 580,000 EVs, with 407,000 being Western brands, further cementing its role as a key player in the global EV supply chain [

41].

Figure 7 and

Figure 8 illustrate the resilience of the EV market in the years following the pandemic, highlighting its growing importance in the automotive industry.

Compared with the conventional car market, the EV market performed better during the pandemic, losing only 15% during the first half of 2020, in comparison to a 42% reduction in the regular car market. Yet, not all EV markets witnessed drastic losses during the first half of 2020. Contrary to the global performance, the European EV market experienced unprecedented growth, where EV sales were 54% higher than pre-pandemic levels. Such amazing growth is largely due to the recent European policies that aimed to boost the acquisition of EVs, which contributed to the astonishing growth that continued even when economic conditions received multiple shocks at the peak of the pandemic [

42]. Moreover, the EV market rebounded significantly, achieving five to eight times higher sales growth than regular car markets, reaching a total market share of nearly 5%. This has made 2020 a record-breaking and exceptional year toward achieving transportation electrification. Specifically, data show that nearly over 3 million EVs have been sold during the first half of 2021, constituting a staggering 175% increase from the total sales in 2020. Such resiliency in the EV market during the pandemic could be attributed to the low base of the first half of 2020 around the globe (apart from the European market), in addition to two main factors. The first is due to strong governmental support for green technologies, especially in Europe where tax rebates and consumer incentives were largely supported by governmental policies. The second is attributed to the continuous decline in battery cost coupled with innovative equipment manufacturers in both model choice and performance, which set the ground for exponential EV uptake.

It is widely expected that the EV market will continue to grow at hyper-levels in the coming years. This is due to additional countries extending their EV governmental support policies beyond 2020, despite some programs being tightened (e.g., gradual reduction in tax rebates and subsidies based on income). Another key driver for the EV market’s growth is the recent CO

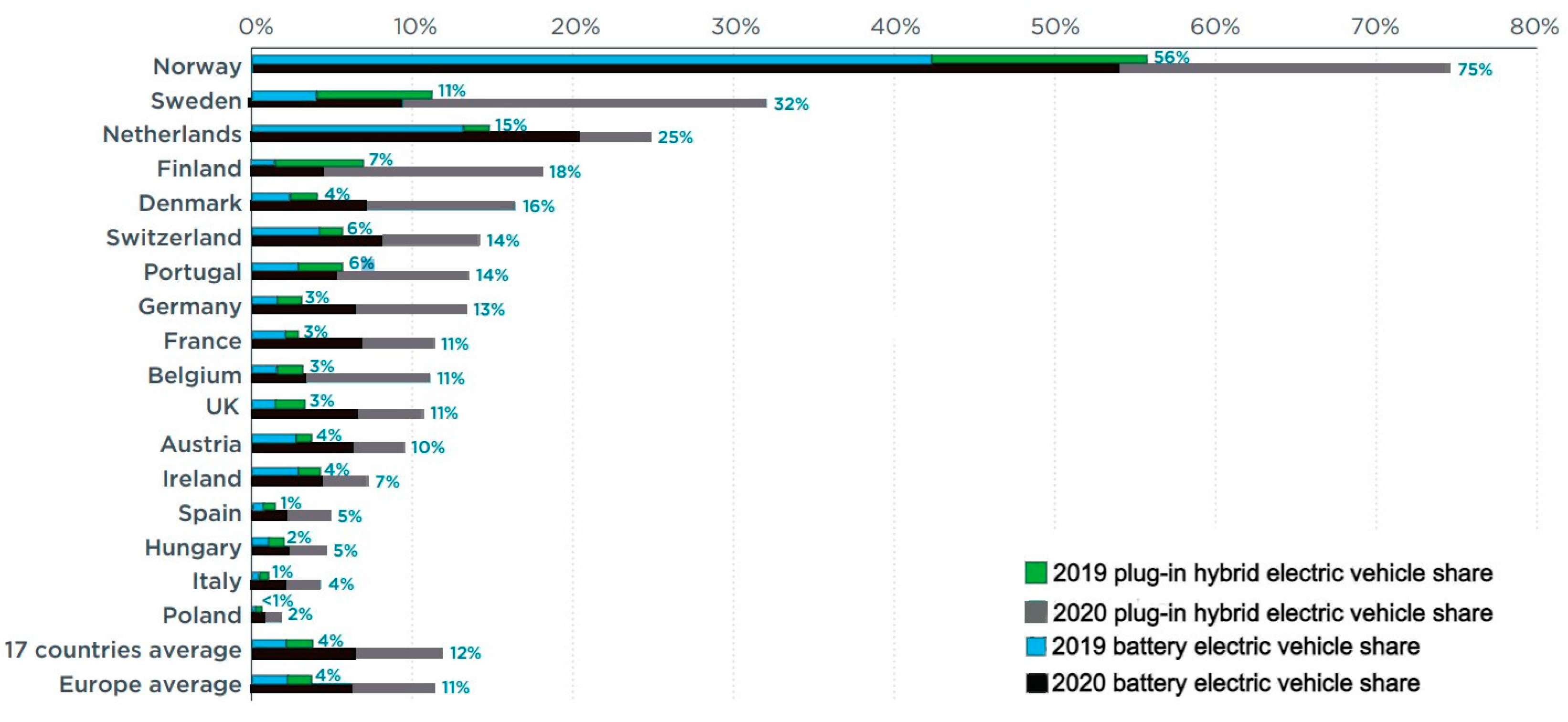

2 regulations in European countries aimed at 2025 and 2030 goals, alongside the new U.S. administration’s efforts to enforce stricter emissions regulations, significantly boosting the U.S. EV market share. The Biden administration’s USD 174 billion investment plan aims to re-establish the U.S. as an EV market leader, counterbalancing the European and Chinese markets’ dominance, which represented 87% of total EV sales in 2020. The European EV market’s growth is primarily policy-driven, with tax rebates and incentives spurring consumer acceptance and substantial research and development funding advancing EV technology. Despite a 20% drop in new automobile sales in Europe due to COVID-19, the EV market share rose to 11% [

43], with some countries achieving even higher rates, including Norway at 75% [

44].

Table 1 illustrates global incentives boosting EV sales amid the COVID-19 crisis. In China, an EV incentive program propelled sales in 2020’s second half to record levels, despite initial pandemic impacts. June 2020 saw a reduction to 100,000 vehicles from June 2019’s 196,000, a modest 4.4% market increase. The announcement of CO

2 emission policies in Europe spurred EV manufacturers to meet targets by launching forty-four PHEV and BEV models in early 2020 [

45,

46]. In the U.S., the EV market’s dynamics diverge from Europe and China, influenced by the economic downturn and reduced consumer spending during the pandemic. With the U.S.’s low gasoline taxes and decreased oil demand lowering ICE vehicle operational costs, the EV market share dipped from 2% in late 2019 to 1.3% by April 2020, before recovering to 2.4% by June 2020. Forecasts for the U.S. EV market share in 2022 anticipate a 3% to 6% shortfall from pre-pandemic projections [

47].

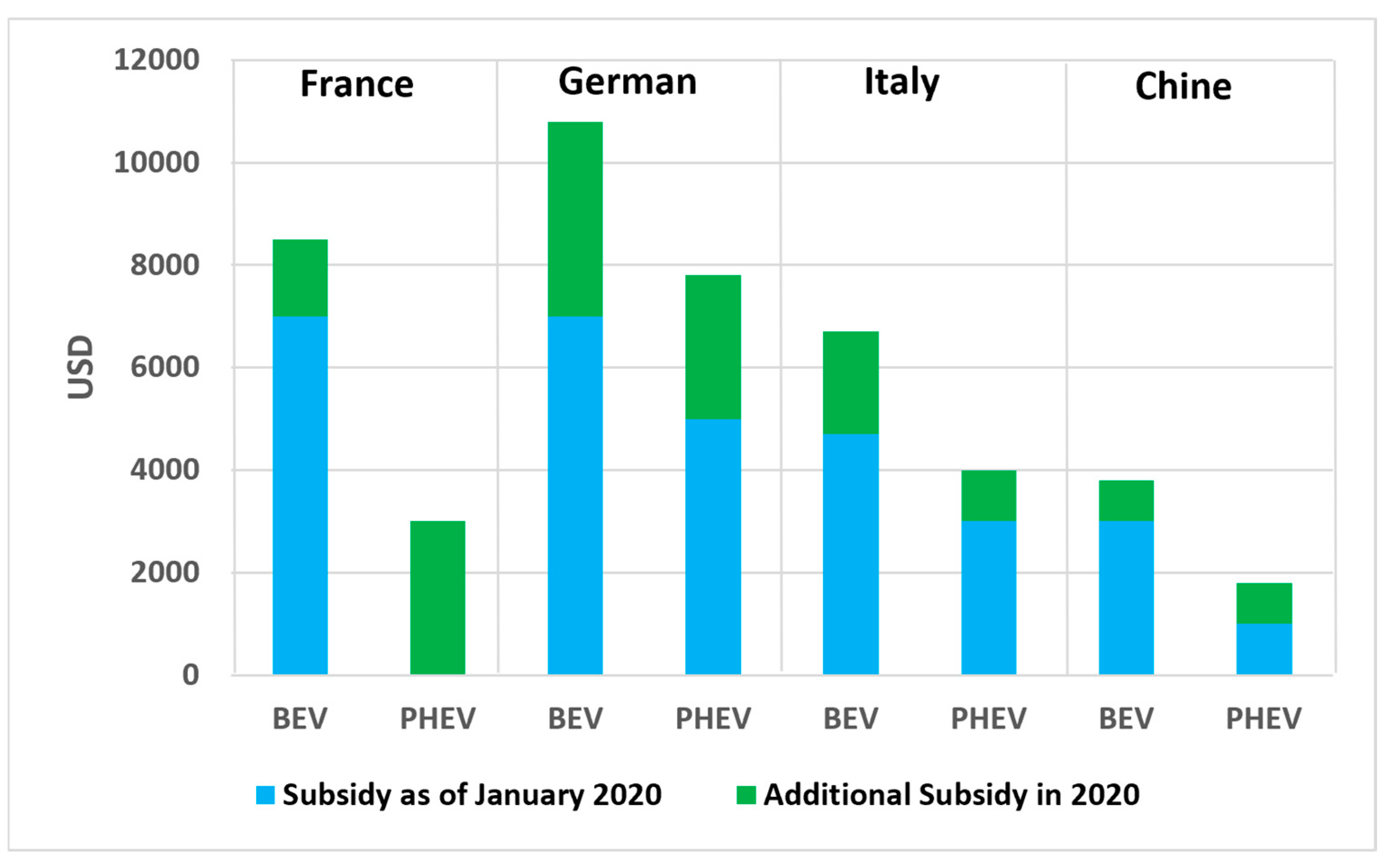

Figure 9 outlines the global EV purchase subsidies before and amidst the pandemic [

48].

In all, European Union countries significantly responded to the COVID-19 crisis with increased subsidies. France, Germany, and Italy provided an additional USD 13,414 for BEV and PHEV subsidies, starkly contrasting China’s USD 565. While Germany, Italy, and China focused more on BEV sales, France prioritized PHEV, introducing a USD 2854 subsidy after initially providing none for PHEV by January 2020 [

49]. Despite economic stimulus measures targeting green recovery, the pandemic’s long-term impact on the EV market is still uncertain. Nonetheless, the consensus suggests a positive outlook for EVs, bolstered by pandemic-driven investments in charging infrastructure and battery technology, improving EV reliability and consumer accessibility.

2.5. Conventional Power Generation

The COVID-19 pandemic triggered significant shifts in the global power generation mix, with renewable energy sources gaining prominence during lockdowns due to their low operating costs and priority grid access. As electricity demand plummeted, renewables outpaced coal and other conventional sources in many regions. However, as lockdowns eased and demand rebounded, the generation mix began to revert to pre-pandemic patterns, though with notable changes in the long-term trajectory of energy systems.

In the United States, the power generation mix experienced significant fluctuations during the pandemic. When the first lockdown measures were implemented in March 2020, electricity demand dropped sharply, and renewable energy sources surpassed coal-fired power plants in contribution. Natural gas remained the dominant source of electricity, but renewables gained ground due to their lower marginal costs and regulatory support. By June 2020, as restrictions eased, natural gas maintained its lead, while coal and nuclear power saw a resurgence in July and August to meet rising demand. Renewable generation, however, declined during this period due to seasonal reductions in wind and hydro output. In August, higher temperatures drove up electricity demand, which was met by increased coal and wind generation. By September, cooler temperatures reduced cooling demand, leading to lower overall generation, particularly from coal. In October, generation levels stabilized, with seasonal trends favoring wind over natural gas. However, by December, the share of renewables decreased due to reduced wind and solar output [

1].

In India, the initial lockdown measures led to a rapid convergence in the shares of coal and renewables in the power generation mix. By mid-August 2020, renewables accounted for over 30% of electricity generation, but this margin narrowed by the end of the month as seasonal patterns reasserted themselves. By November, the share of renewables had fallen to just under 20%, aligning with pre-pandemic levels. Electricity demand began to recover in late May 2020, and by late July, generation levels exceeded those of 2019 for four consecutive weeks. However, demand dipped again in late August due to a combination of seasonal factors, such as the Diwali holidays, and episodic events, such as agricultural strikes. Generation resumed an upward trend in September and October but declined again in mid to late November, returning to 2018 levels. By December, demand began to rise once more, reflecting the complex interplay of seasonal and economic factors [

1].

In China, the lockdown led to a sharp decline in electricity demand, significantly reducing coal-fired power generation. As lockdown measures were gradually lifted in the second half of March 2020, coal’s share in the generation mix recovered slightly, while renewables maintained a strong presence. By June and July, the share of renewables increased further, driven by higher hydroelectric output due to heavy rains and new capacity additions. However, as hydro generation declined in the fall due to seasonal limitations, coal production increased to meet rising demand [

1].

In the short term, the pandemic caused an unprecedented decline in electricity demand, particularly from industrial and commercial sectors, leading to reduced generation from conventional sources like coal and natural gas. The operational challenges of maintaining large-scale power plants under social distancing regulations further compounded this decline, resulting in temporary closures or reduced capacity. This period highlighted the vulnerability of conventional power generation to sudden demand shocks and underscored the importance of flexible and resilient energy systems.

As restrictions eased and economic activity resumed, demand for conventional power generation partially recovered. However, this recovery was accompanied by an accelerated integration of renewable energy sources into the power mix. Many regions expedited the approval and commissioning of renewable projects as part of broader economic stimulus packages aimed at sustainable recovery. This trend reflects a growing recognition of the economic and environmental benefits of renewables, supported by policy incentives and declining technology costs.

The pandemic is likely to catalyze a long-term structural transformation in the power generation sector. While the shift toward renewables is expected to continue, driven by stringent environmental policies and societal preferences for sustainability, conventional power generation will remain a critical component of the energy mix. However, the focus is likely to shift toward cleaner, dispatchable sources like nuclear power, which can provide stable output without the intermittency issues associated with some renewables. This evolution reflects a nuanced approach to balancing energy security, sustainability, and economic efficiency. A key enabler of this transition is the growing interest in energy storage technologies, which are essential for addressing the intermittency of renewable energy sources like solar and wind. Energy storage systems, such as grid-scale batteries and pumped hydro storage, allow excess renewable energy to be stored during periods of high generation and released when demand is high, or generation is low. This capability not only enhances grid stability but also maximizes the utilization of renewable energy, reducing reliance on fossil fuels for backup power. The pandemic has accelerated investments in energy storage, as governments and utilities recognize its critical role in building resilient and flexible energy systems. The decreasing costs of renewable technologies, coupled with the operational savings and emission reductions they offer, will further drive this transition. Additionally, the pandemic exposed vulnerabilities in global supply chains, prompting a strategic realignment toward more localized and diversified energy systems. The future energy landscape will likely feature a coexistence of traditional and new energy sources, with an emphasis on scalability, efficiency, and resilience to meet global energy demands sustainably. Energy storage will play a pivotal role in this transition, enabling the integration of higher shares of renewables while ensuring grid reliability and energy security.

2.6. Aerial Transportation

As COVID-19 began spreading exponentially, governments recognized air transportation as a potential vector for the virus. Since January 23, 2020, the pandemic has led to a global lockdown and a sharp decline in travel. This led to reduced fuel usage, impacting airline energy consumption and profits. Airlines’ fuel consumption dropped from a peak of 95 billion gallons in 2019 to 52 billion gallons in 2020 and 57 billion gallons in 2021 [

50]. The U.S. Energy Information Administration (EIA) reported a decrease in aviation fuel use to one million barrels per day (b/d) in April, down from 4.3 million b/d between January and February. In the first two weeks of July, fuel consumption was 69% lower than the previous year, averaging 1.6 million b/d. The most significant reduction occurred between March and April, as governments implemented measures to contain the virus. Despite slight increases in May and June, global fuel consumption dropped by 0.7 million b/d from February to March and by 2.4 million b/d from March to April. Regional recovery has varied, with consumption decreasing significantly worldwide, especially in Europe (87%) and the Americas (88%). A study [

51] showed fuel usage at China airports dropped by over 60% in early 2020 but recovered to less than 20% below previous levels by year’s end.

2.7. Energy Security

Energy security, defined as the availability of affordable, reliable, and sustainable energy sources for national development, has been profoundly reshaped by the COVID-19 pandemic. The crisis has highlighted both the vulnerabilities and opportunities within global energy systems, with immediate, medium-term, and long-term implications for energy security. This section examines these impacts, with a particular focus on the 2021–2023 European energy crises as a case study of the challenges and strategies for ensuring energy security in a post-pandemic world.

In the short term, the pandemic caused a dramatic decline in energy demand as commercial activities were halted and remote work became widespread. This sudden shift led to a sharp drop in energy prices, with Brent crude oil prices falling to under USD 20 per barrel in April 2020—a two-decade low [

52,

53]. The financial strain on the energy sector was exacerbated by disruptions in global supply chains, which created a surplus of oil and other energy commodities [

54]. These disruptions underscored the fragility of energy markets and the risks associated with over-reliance on fossil fuels.

As the pandemic progressed, the medium-term focus shifted toward diversifying energy sources and accelerating the transition to renewable energy. In Europe, stringent CO2 regulations and ambitious climate targets have driven significant investments in renewable energy infrastructure. Similarly, the United States has adopted more rigorous emissions standards and launched initiatives to bolster the electric vehicle (EV) market, signaling a strategic shift away from fossil fuels. These efforts reflect a growing recognition that energy security in the 21st century requires a diversified energy portfolio, with renewables playing a central role.

The European energy crises in the summers of 2021–2023 further highlighted the importance of this transition. Triggered by a combination of reduced natural gas supplies, soaring energy prices, and supply chain disruptions, the crises exposed the vulnerabilities of Europe’s energy system during times of geopolitical tensions. The reliance on a single energy source—natural gas—and the lack of sufficient storage and grid flexibility left the region particularly susceptible to external shocks. In response, European governments have prioritized investments in renewable energy, energy storage, and grid modernization to enhance resilience and reduce dependence on fossil fuels [

55,

56].

In the long term, the pandemic is likely to reshape global energy geopolitics, diminishing the dominance of traditional energy giants and elevating regions that lead to renewable energy production. China and the European Union, for example, have made significant strides in renewable energy deployment, positioning themselves as key players in the global energy transition. This shift reflects a broader trend toward decentralized and sustainable energy systems, which are less vulnerable to geopolitical disruptions and more aligned with climate goals. However, the transition to a renewable energy future is not without challenges. Building energy storage infrastructure and enhancing grid flexibility are critical to addressing the intermittency of renewable energy sources and ensuring a stable energy supply. The European energy crises demonstrated that without adequate storage and grid elasticity, even regions with high renewable energy capacity can face significant energy security risks. As such, governments must prioritize investments in these areas to sustain the energy transition and ensure long-term energy security.

The COVID-19 pandemic has underscored the critical importance of energy security as a cornerstone of national security and economic development. The crisis has accelerated the transition toward renewable energy and highlighted the need for diversified, resilient energy systems. However, the challenges revealed by the European energy crises—such as the risks of over-reliance on single energy sources and the importance of energy storage and grid flexibility—serve as a stark reminder that the path to energy security is complex and requires sustained investment and innovation.

Ultimately, the pandemic has reshaped global energy geopolitics, bringing regions like China and the European Union to the forefront of the energy transition. As governments increasingly fund strategies to ensure energy availability, accessibility, reliability, and affordability, the lessons learned from the pandemic will play a crucial role in shaping a more secure and sustainable energy future.

2.8. Energy Cybersecurity

Cyberattacks against critical infrastructures, especially energy systems, have increased rapidly in recent years. These attacks, mainly aimed to achieve political, social or economic agenda, have successfully led to severe disturbances [

57,

58]. The transition toward remote working during the pandemic has increased cyber threats against global power utilities. Managing critical infrastructure like energy grids from home, while reducing the danger of the pandemic, significantly increases the risk of cyberattacks. The acceleration of remote working and system automation requires interoperable defense layers and a robust overall architecture to mitigate these threats. Cyberattacks, including pandemic-related malware and ransomware, have surged, with attacks against IoT devices crucial for digitalizing and automating energy infrastructure, seeing an up to 835% increase [

59].

With more countries implementing lockdowns and travel restrictions, energy demand has decreased, leading to lower prices and reduced revenues for energy companies. Consequently, the risk of cyber threats has intensified:

Increase in cyber threats: The pandemic has provided cybercriminals with new opportunities to exploit weaknesses in energy systems. Phishing and other cyberattacks have skyrocketed, with attackers using COVID-19 themes to lure victims [

60].

Budget cuts affecting cybersecurity: Economic strains have forced energy companies to make difficult budgetary decisions, potentially neglecting cybersecurity investments despite escalating cyber threats [

61]. A typical example is the significant increase in the cost of ransomware attacks on energy companies in recent years, with the average payout to attackers reaching

$4.4 million in 2020 [

62].

Remote work vulnerabilities: The shift to remote work has opened up new vulnerabilities, increasing the risk of cyber threats. During the pandemic, many employees have used personal or less secure networks, amplifying the potential for cyberattacks.

Regulatory compliance challenges: Remote work complicates adherence to regulatory standards like NERC CIP, with delays in compliance audits further heightening cyber risks.

Need for increased cybersecurity investment: The pandemic underscores the need for significant investment in cybersecurity to protect critical infrastructure and data. This includes implementing multi-factor authentication, conducting regular security audits, and training employees [

63].

Several high-profile cyberattacks during the pandemic have highlighted the increased risk to energy utilities. For instance, Italy’s Enel Group and the USA’s Colonial Pipeline suffered significant cyberattacks that disrupted their operations and demonstrated the severe implications of such security breaches during the pandemic [

62].

Figure 10 illustrates the rise in reported cyberattacks during the initial lockdowns, highlighting the vulnerabilities introduced by rapid automation to facilitate remote work.

These instances underscore the heightened risk of cyberattacks during the pandemic, driven by the shift to remote work, budget cuts, and compliance delays. Energy companies must adopt stringent cybersecurity measures, including comprehensive audits and robust employee training, to ensure the resilience of critical infrastructure in these challenging times.

2.9. Governmental Supportive Measurers

The ban on service disconnections was the most extensive measure introduced by the government during the pandemic. The obvious rationale is to ensure that a home’s basic energy needs during lockdown are met, taking into consideration the massive layout of employees in different industries and that electric energy is considered a human right. The bans shutdowns are usually associated with other supportive actions. The governments had to establish specific rules for unpaid bills, as discussed in the next subsection.

- (b)

Payment extension plans

Many countries have introduced energy bill deferment until containment measures are lifted for residential customers who are in financial difficulties due to the pandemic. In some cases, the government also sets the financial terms for how these deferred payment programs are defined. Most countries have decided that no interest rate should be charged on unpaid bills. Additionally, such deferment plans vary significantly from one country to another, from 3 months in Germany to 6 months in Italy, up to 24 months in Peru, or even up to 36 months in Colombia. The main difference in the design of this measure is its targeting strategy. Most countries state that payment extension plans are only available to end users who are financially affected by COVID-19, but in most cases, they do not implement a validation phase. However, this does not apply to Latin American jurisdictions where claim deferrals apply. For example, in Peru, a 24-month renewal plan is only granted to residential customers with monthly consumption of less than 100 kWh (a strategy commonly known as quantity targeting or self-targeting). In Colombia, only Tier 1 and 2 consumers, low-income households that are already subsidized, are eligible for a 36-month payment plan at a 0% interest rate. On the other hand, Tier 3 and 4 customers are eligible for the 24-month plan, but interest rates are set by the provider. Finally, there are significant differences in the governance of these interventions. In Central and Southern Europe and Latin America, renewal schedules are centrally set by regulators, but in other jurisdictions (UK, Ireland, and many states in the United States and Australia), such measures are reached after energy suppliers have reached an agreement. Energy consumers who have problems paying invoices in these jurisdictions are expected to report their issues to the supplier to arrange an alternative payment method.

- (c)

Energy Bill reduction or cancellation

Another class of measures includes reducing energy tariffs for all customers under lockdowns, or even waiving energy bills in some cases. Unlike the measures proposed in the previous subsection, these cuts are not based on any social and economic goal but benefit all consumers. Cyprus (10%), Dubai (10%), Nepal (20% for monthly consumption below 150 kWh), Florida (25%), and the Maldives. Additionally, governments provided discounts by removing any tax hikes imposed pre-pandemic. For example, the Ontario government, Canada, suspended peak energy pricing for one and a half months, keeping tariffs at CAD 0.101/kWh (half peak load). Similarly, Slovenia removed some regulated tariffs from the prices of electricity used during the pandemic. Austin, Texas, reduced volumetric electricity prices and eliminated some regulated taxes on electricity prices. Chile and Poland have not explicitly cut energy prices but have banned any upward price adjustments as part of containment measures. At certain locations, some have eliminated energy bills. For instance, the governments of Chad, Bahrain, and Bolivia paid the electricity bills for three months during the outbreak, but only within a certain consumption limit. In Ghana, the government pays electricity bills for customers who use less than 50 kWh per month and offers a 50% discount to the remaining end users. In Thailand, electricity is not charged to end users whose energy meters do not exceed 5 A, with an estimation that around 10 million households have benefited from this policy.

Many governments have offered tax relief to households to offset the expenses incurred for utility bills. Tax credits or deductions for energy-efficient upgrades or rebates for households that invest in renewable energy systems are prime examples of such relief. Tax rebates are particularly useful in cases where extra bills are incurred for various purposes. Among the tax incentives, the United States Federal Government introduced the CARES Act, which allowed taxpayers to receive a credit for 30% of the expenses incurred to install certified residential solar energy systems or small wind energy systems. Additionally, the act allowed businesses to benefit from an enhanced bonus depreciation allowance for qualified property placed in service during the year [

63]. In South Korea, the government offered a tax credit for households that purchased energy-efficient home appliances during the COVID-19 pandemic. This credit provided a rebate of up to 40% on the purchase price of qualifying appliances, such as refrigerators, washing machines, and air conditioners [

64], encouraging investment in energy-efficient appliances that reduce energy costs and lower carbon emissions. Similarly, in Ireland, the government implemented a temporary reduction in the value-added tax (VAT) rate for the tourism and hospitality sectors, from 13.5% to 9%. This reduction included energy costs associated with operating businesses in these sectors and lasted for six months, providing substantial cost savings [

65]. New Zealand’s government also offered a temporary increase in the low-value asset threshold for businesses, allowing them to immediately deduct the full cost of eligible assets, such as computers and office equipment, from their taxable income [

66]. This measure provided cash flow benefits, including for those in the energy and power sectors, during the pandemic.

3. Recommendations in Case of Future Major Crisis

The COVID-19 pandemic has exposed critical vulnerabilities in global energy systems, underscoring the urgent need for frameworks that prioritize resilience, flexibility, and sustainability. To address these challenges, strategies must focus on diversifying energy portfolios, with a significant shift toward renewable energy sources to reduce reliance on fossil fuels. This transition is not only essential for meeting immediate energy needs during disruptions but also aligns with broader environmental and climate goals. Key investments should target the modernization of energy infrastructure, incorporating advanced storage solutions, intelligent grid systems, and innovative technologies to effectively manage demand and supply dynamics. Such innovations are critical for ensuring energy systems can adapt to sudden shocks, such as pandemics or natural disasters while maintaining stability and reliability.

Global collaboration is indispensable for addressing energy challenges cohesively. By fostering resource sharing and the exchange of best practices, countries can develop more robust crisis management strategies and accelerate the adoption of sustainable energy technologies. Equally important is the need to strengthen the regulatory environment to support energy innovation, including the adoption of EVs, renewable energy projects, and energy efficiency improvements. Policies that incentivize clean energy investments, streamline permitting processes, and promote research and development will be crucial for driving the energy transition. Developing detailed emergency protocols that integrate energy security will enable faster, more coordinated responses to future crises, ensuring that energy systems remain operational even under extreme conditions. These measures will not only enhance energy security but also contribute to a more sustainable and resilient global energy landscape.

In addition to policy and infrastructure improvements, the adoption of advanced technologies will play a pivotal role in building resilient energy systems. For example, digital technologies such as artificial intelligence (AI) and the Internet of Things (IoT) can optimize energy distribution, predict demand patterns, and enhance grid stability. Smart grids, enabled by these technologies, can dynamically balance supply and demand, integrating renewable energy sources more effectively and reducing waste. Energy storage systems, such as grid-scale batteries and pumped hydro storage, are also critical for addressing the intermittency of renewables and ensuring a stable energy supply during disruptions.

Blockchain technology, while not a panacea, offers unique advantages that can complement these efforts. Its decentralized and transparent nature can enhance the integrity of energy supply chains, facilitate secure and efficient energy trading, and support the integration of distributed energy resources [

67,

68]. For instance, blockchain-enabled platforms can allow households and businesses with solar panels to sell excess energy back to the grid or within microgrid networks, promoting the use of renewables and improving grid resilience [

69]. However, the adoption of blockchain and other digital technologies must be part of a broader strategy that includes policy support, infrastructure investment, and capacity building.

The pandemic has also highlighted the importance of demand-side management and behavioral changes in achieving energy resilience. During the crisis, shifts in energy consumption patterns—such as increased residential use and reduced industrial demand—revealed the need for flexible and adaptive energy systems. Policies that encourage energy efficiency, demand response programs, and the adoption of smart appliances can help balance supply and demand, reducing the strain on energy infrastructure during crises. Another critical strategy for enhancing energy resilience is the implementation of High-Voltage Direct Current (HVDC) interconnections between international grids. HVDC technology enables the efficient transmission of electricity over long distances with minimal losses, making it an ideal solution for connecting regions with abundant renewable energy resources to areas with high demand. During times of crisis, such as pandemics or natural disasters, HVDC interconnections can provide critical support by enabling cross-border energy sharing and balancing supply shortages in affected regions. For example, during the European energy crisis, HVDC links between countries could have mitigated the impact of gas supply disruptions by facilitating the transfer of renewable energy from regions with surplus generation to those facing shortages. Expanding HVDC infrastructure, particularly in regions with high renewable energy potential, should be a priority for enhancing global energy security.

Decentralized energy systems, such as virtual power plants (VPPs) and microgrids, also play a vital role in building resilience. VPPs aggregate distributed energy resources, such as rooftop solar panels, home batteries, and EVs, into a single network that can be managed as a unified power plant. This approach not only enhances grid flexibility but also provides backup power during outages, making energy systems more resilient to disruptions. Microgrids, which operate independently or in conjunction with the main grid, offer similar benefits by enabling localized generation and consumption of energy. During the pandemic, microgrids demonstrated their value by ensuring uninterrupted power supply to critical facilities, such as hospitals and emergency response centers, even when the main grid was under stress. By promoting the adoption of VPPs and microgrids, governments can enhance energy security, reduce transmission losses, and support the integration of renewable energy sources.

In summary, the lessons learned from the COVID-19 pandemic underscore the need for a comprehensive approach to energy resilience, combining policy innovation, technological advancement, and global collaboration. By diversifying energy sources, modernizing infrastructure, and leveraging digital technologies, the global energy sector can build systems that are not only resilient to shocks but also aligned with long-term sustainability goals. Future research should focus on developing and testing these strategies in real-world scenarios, assessing their impact on energy security, efficiency, and environmental outcomes. As the global energy landscape continues to evolve, the integration of policies, technologies, and collaborative efforts will be critical for building a more resilient and secure energy future.

4. Summary of Major Findings

The COVID-19 pandemic has precipitated unprecedented disruptions across the global energy markets, instigating profound changes with varying temporal implications. This extensive review reveals critical insights into how the pandemic has reshaped energy consumption patterns, accelerated technological adoptions, and underscored the necessity for robust cybersecurity measures.