Digital Economy, Entrepreneurship of Small and Medium-Sized Manufacturing Enterprises, and Regional Carbon Emissions: Evidence from Chinese Provinces

Abstract

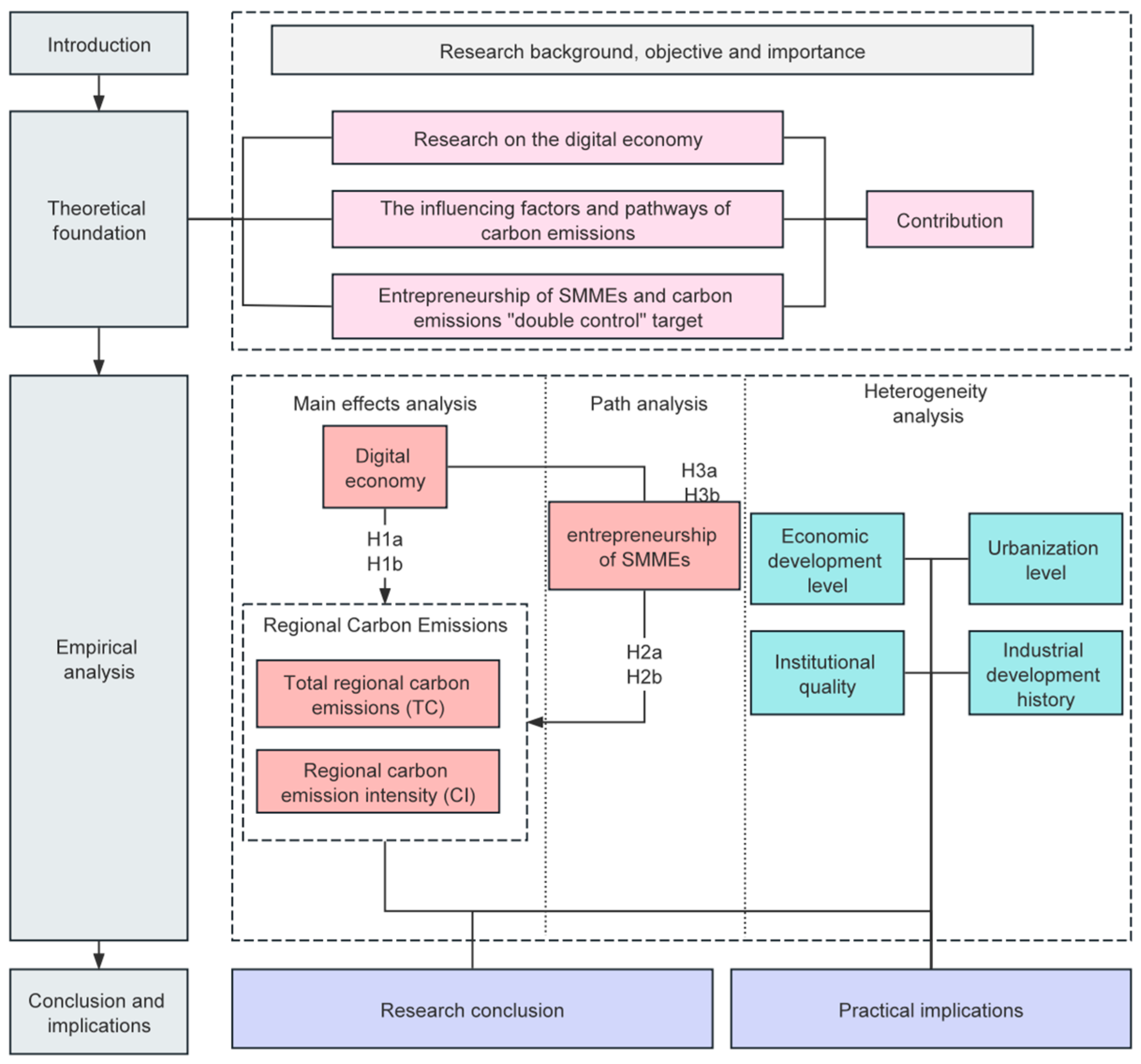

1. Introduction

2. Literature Review and Research Hypotheses

2.1. Literature Review

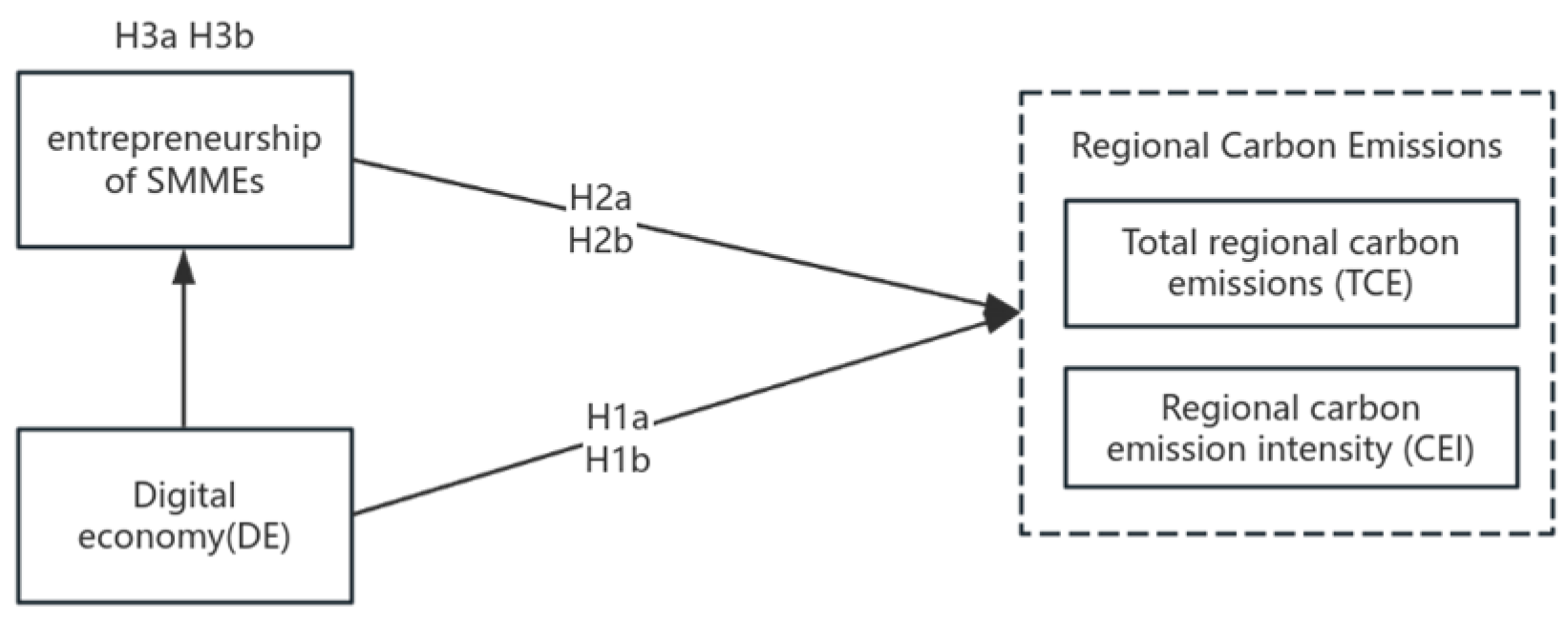

2.2. Research Hypotheses

2.2.1. Digital Economy and Regional Carbon Emissions

2.2.2. Entrepreneurship of SMMEs and Regional Carbon Emissions

2.2.3. The Mediating Role of the Entrepreneurship of SMMEs

3. Materials and Methods

3.1. Econometric Model Specification

3.2. Measurement of Variables

3.2.1. Dependent Variables

3.2.2. Core Independent Variables

3.2.3. Control Variables

3.3. Data Sources and Description

4. Empirical Analysis

4.1. Descriptive Statistics of Variables

4.2. Regression Results and Analysis

4.3. Endogeneity Test

4.4. Robustness Test

4.5. Heterogeneity Analysis

4.5.1. Economic Development Level

4.5.2. Urbanization Level

4.5.3. Institutional Quality

4.5.4. Industrial Development History

4.6. Mediation Test

5. Discussion

5.1. Theoretical Implications

5.2. Practical Implications

5.3. Managerial Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tan, N.N.; Ngan, H.T.T.; Hai, N.S.; Anh, L.H. The Impact of Digital Transformation on the Economic Growth of the Countries. In Prediction and Causality in Econometrics and Related Topics; Ngoc Thach, N., Ha, D.T., Trung, N.D., Kreinovich, V., Eds.; Springer International Publishing: Cham, Switzerland, 2022; pp. 670–680. [Google Scholar]

- Kormaniková, E.; Senková, A. Analysis of the Implementation of the Sustainable Development Goals (SDGs) in V4 Countries and Their Impact on Competitiveness. Polish J. Environ. Stud. 2024, 33, 5757–5766. [Google Scholar] [CrossRef] [PubMed]

- Shrimali, G. Making India’s Power System Clean: Retirement of Expensive Coal Plants. Energy Policy 2020, 139, 111305. [Google Scholar] [CrossRef]

- Nordhaus, W. Climate Change: The Ultimate Challenge for Economics. Am. Econ. Rev. 2019, 109, 1991–2014. [Google Scholar] [CrossRef]

- Sun, P.S.; Nisar, U.; Qiao, Z.Y.; Ahmad, S.; Kathuria, K.; Al Bahir, A.; Ahmad, M. Digital economy, technology, and urban carbon emissions nexus: An investigation using the threshold effects and mediation effects tests. Front. Environ. Sci. 2024, 12, 1454256. [Google Scholar] [CrossRef]

- Wang, J.; Dong, K.; Dong, X.; Taghizadeh-Hesary, F. Assessing the Digital Economy and Its Carbon-Mitigation Effects: The Case of China. Energy Econ. 2022, 113, 14. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Tan, L.; Gao, D.; Liu, X. Can Environmental Information Disclosure Improve Energy Efficiency in Manufacturing? Evidence from Chinese Enterprises. Energies 2024, 17, 2342. [Google Scholar] [CrossRef]

- Zhang, H.K.; Wu, J.C.; Mei, Y.; Hong, X.Y. Exploring the relationship between digital transformation and green innovation: The mediating role of financing modes. J. Environ. Manag. 2024, 356, 120558. [Google Scholar] [CrossRef]

- Barrage, L. Optimal Dynamic Carbon Taxes in a Climate–Economy Model with Distortionary Fiscal Policy. Rev. Econ. Stud. 2019, 87, 1–39. [Google Scholar] [CrossRef]

- Shapiro, J.S. The Environmental Bias of Trade Policy. Q. J. Econ. 2020, 136, 831–886. [Google Scholar] [CrossRef]

- Bui Minh, T.; Nguyen Ngoc, T.; Bui Van, H. Relationship between Carbon Emissions, Economic Growth, Renewable Energy Consumption, Foreign Direct Investment, and Urban Population in Vietnam. Heliyon 2023, 9, e17544. [Google Scholar] [CrossRef] [PubMed]

- Galeotti, M.; Salini, S.; Verdolini, E. Measuring environmental policy stringency: Approaches, validity, and impact on environmental innovation and energy efficiency. Energy Policy 2020, 136, 111052. [Google Scholar] [CrossRef]

- Yi, M.; Liu, Y.F.; Sheng, M.S.; Wen, L. Effects of Digital Economy on Carbon Emission Reduction: New Evidence from China. Energy Policy 2022, 171, 19. [Google Scholar] [CrossRef]

- Yin, S.; Yu, Y.Y. An Adoption-Implementation Framework of Digital Green Knowledge to Improve the Performance of Digital Green Innovation Practices for Industry 5.0. J. Clean. Prod. 2022, 363, 132608. [Google Scholar] [CrossRef]

- Duan, L.; Sun, W.; Zheng, S. Transportation network and venture capital mobility: An analysis of air travel and high-speed rail in China. J. Transp. Geogr. 2020, 88, 102852. [Google Scholar] [CrossRef]

- Zhuo, R.; Zhang, Y.; Zheng, J. Digitalization transformation and enterprise green innovation: Empirical evidence from Chinese listed companies. Front. Environ. Sci. 2024, 12, 1361576. [Google Scholar] [CrossRef]

- Bo, Q.; Liu, H.; Zheng, J. Research on the Mechanism of the Green Innovation of Enterprises Empowered by Digital Technology from the Perspective of Value Co-Creation. Sustainability 2024, 16, 9065. [Google Scholar] [CrossRef]

- Wang, S.; Song, Y.; Min Du, A.; Liang, J. The digital economy and entrepreneurial dynamics: An empirical analysis of urban regions in China. Res. Int. Bus. Financ. 2024, 71, 102459. [Google Scholar] [CrossRef]

- Yang, D.; Yang, Z.; Wu, H. Effects and mechanisms of digital economy development on corporate carbon emission intensity: Empirical evidence from cross-country data. Digit. Econ. Sustain. Dev. 2025, 3, 3. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. The Dynamic Impact of Digital Economy on Carbon Emission Reduction: Evidence City-level Empirical Data in China. J. Clean. Prod. 2022, 351, 131570. [Google Scholar] [CrossRef]

- Liu, M.; Zhao, J.; Liu, H. Digital transformation, employee and executive compensation, and sustained green innovation. Int. Rev. Financ. Anal. 2025, 97, 103873. [Google Scholar] [CrossRef]

- Gao, D.; Tan, L.; Duan, K. Forging a path to sustainability: The impact of Fintech on corporate ESG performance. Eur. J. Financ. 2024, 1–19. [Google Scholar] [CrossRef]

- Zhang, J.N.; Lyu, Y.W.; Li, Y.T.; Geng, Y. Digital Economy: An Innovation Driving Factor for Low-Carbon Development. Environ. Impact Assess. Rev. 2022, 96, 15. [Google Scholar] [CrossRef]

- Tapscott, D. The Digital Economy: Promise and Peril in the Age of Networked Intelligence. Educom. Rev. 1996, 10, 342. [Google Scholar] [CrossRef]

- Yin, S.; Gao, Z.; Mahmood, T. Artificial Intelligence-Driven Bioenergy System: Digital Green Innovation Partner Selection of Bioenergy Enterprises Based on Interval Fuzzy Field Model. Kybernetes 2023, 54, 1344–1372. [Google Scholar] [CrossRef]

- Safi, A.; Kchouri, B.; Elgammal, W.; Nicolas, M.K.; Umar, M. Bridging the Green Gap: Do Green Finance and Digital Transformation Influence Sustainable Development? Energy Econ. 2024, 134, 107566. [Google Scholar] [CrossRef]

- Zhang, C.; Fang, J.; Ge, S.; Sun, G. Research on the Impact of Enterprise Digital Transformation on Carbon Emissions in the Manufacturing Industry. Int. Rev. Econ. Financ. 2024, 92, 211–227. [Google Scholar] [CrossRef]

- Cheng, Y.; Zhang, Y.; Wang, J.J.; Jiang, J.X. The Impact of the Urban Digital Economy on China’s Carbon Intensity: Spatial Spillover and Mediating Effect. Res. Conserv. Recycl. 2023, 189, 106762. [Google Scholar] [CrossRef]

- Li, G.C.; Wei, W.X. Financial Development, Openness, Innovation, Carbon Emissions, and Economic Growth in China. Energy Econ. 2021, 97, 105194. [Google Scholar] [CrossRef]

- Abu Karaki, B.; Al-kasasbeh, O.; Alassuli, A.; Alzghoul, A. The Impact of the Digital Economy on Carbon Emissions Using the Stirpat Model. Int. J. Energy Econ. Pol. 2023, 13, 139–143. [Google Scholar] [CrossRef]

- Yu, H.Y.; Wei, W.; Li, J.H.; Li, Y. The Impact of Green Digital Finance on Energy Resources and Climate Change Mitigation in Carbon Neutrality: Case of 60 Economies. Resour. Pol. 2022, 79, 103116. [Google Scholar] [CrossRef]

- Bai, L.; Guo, T.R.; Xu, W.; Liu, Y.B.; Kuang, M.; Jiang, L. Effects of Digital Economy on Carbon Emission Intensity in Chinese Cities: A Life-Cycle Theory and the Application of Non-Linear Spatial Panel Smooth Transition Threshold Model. Energy Policy 2023, 183, 113792. [Google Scholar] [CrossRef]

- Sun, Y.A.; You, X.T. Do Digital Inclusive Finance, Innovation, and Entrepreneurship Activities Stimulate Vitality of the Urban Economy? Empirical Evidence from the Yangtze River Delta, China. Technol. Soc. 2023, 72, 102200. [Google Scholar] [CrossRef]

- Yin, S.; Zhao, Y. Digital Green Value Co-Creation Behavior, Digital Green Network Embedding and Digital Green Innovation Performance: Moderating Effects of Digital Green Network Fragmentation. Humanit. Soc. Sci. Commun. 2024, 11, 228. [Google Scholar] [CrossRef]

- Wang, M.; Zhu, X.; Yin, S. Spatial–Temporal Coupling Coordination and Interaction between Digitalization and Traditional Industrial Upgrading: A Case Study of the Yellow River Basin. Sci. Rep. 2023, 13, 17997. [Google Scholar] [CrossRef] [PubMed]

- Gao, D.; Zhou, X.; Wan, J. Unlocking Sustainability Potential: The Impact of Green Finance Reform on Corporate Esg Performance. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 4211–4226. [Google Scholar] [CrossRef]

- Kuang, Y.; Fan, Y.; Bin, J.; Fan, M. Impact of the Digital Economy on Carbon Dioxide Emissions in Resource-Based Cities. Sci. Rep. 2024, 14, 16514. [Google Scholar] [CrossRef]

- Gao, D.; Feng, H.; Cao, Y. The Spatial Spillover Effect of Innovative City Policy on Carbon Efficiency: Evidence from China. Singap. Econ. Rev. 2024, 1–23. [Google Scholar] [CrossRef]

- Romero, I.; Mammadov, H. Digital Transformation of Small and Medium-Sized Enterprises as an Innovation Process: A Holistic Study of its Determinants. J. Knowl. Econ. 2024, 52, 96–120. [Google Scholar] [CrossRef]

- Meng, B.; Liu, Y.; Andrew, R.; Zhou, M.; Hubacek, K.; Xue, J.; Peters, G.; Gao, Y. More Than Half of China’s Co2 Emissions Are from Micro, Small and Medium-Sized Enterprises. Appl. Energy 2018, 230, 712–725. [Google Scholar] [CrossRef]

- Tan, Q.; Tan, J. Analysis of the Carbon Emission Law of the Transportation Industry in Beijing Based Oninput-Output Model. Ecolog. Econ. 2016, 32, 73–78. [Google Scholar] [CrossRef]

- Li, Z.; Miao, S.; Xu, L. Digital transformation and environmental, social, and governance greenwashing: Evidence from China. J. Environ. Manag. 2024, 365, 121460. [Google Scholar] [CrossRef]

- Xu, P.Y. Micro, Small and Medium-Sized Enterprises (Msmes) Have Exceeded 52 Million. People’s Daily Overseas Edition, 20 June 2023; p. 011. [Google Scholar]

- Elia, G.; Margherita, A.; Passiante, G. Digital entrepreneurship ecosystem: How digital technologies and collective intelligence are reshaping the entrepreneurial process. Technol. Forecast. Soc. Chang. 2020, 150, 119791. [Google Scholar] [CrossRef]

- Wang, Y.; Zhao, Z.; Zhang, S.; Su, Y. Research on the impact of digital inclusive finance on regional carbon emissions: Based on the sustainable green innovation of small and medium-sized enterprises. J. Clean. Prod. 2023, 428, 139513. [Google Scholar] [CrossRef]

- Ehrlich, P.R.; Holdren, J.P. Impact of Population Growth. Science 1971, 171, 1212–1217. [Google Scholar] [CrossRef]

- Pei, H.F.; Chen, J.R. Research on the Relationship between Technological Innovation and Carbon Productivity Based on Provincial Panel Data. Rev. Econ. Manag. 2023, 39, 109–119. [Google Scholar] [CrossRef]

- Liu, J.; Yang, Y.J.; Zhang, S.F. Research on the Measurement and Driving Factors of China’s Digital Economy. Shanghai J. Econ. 2020, 6, 81–96. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.Y.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z.Y. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Quart. 2020, 19, 1401–1418. [Google Scholar] [CrossRef]

- Wang, H.; Dong, Z.Q. How China’s Industrial Intelligence Is Reshaping the Distribution of Manufacturing Enterprises. Seek. Truth 2022, 49, 84–93. [Google Scholar] [CrossRef]

- Yan, Q.W.; Da, T.F.; Du, X.Y. Digital Financial Inclusion and Shared Prosperity—Empirical Evidence and Analyses from Entrepreneurial Activism. Wuhan Financ. 2023, 5, 70–81. [Google Scholar] [CrossRef]

- Lin, S.; Winkler, C.; Wang, S.; Chen, H. Regional Determinants of Poverty Alleviation through Entrepreneurship in China. Entrep. Reg. Devel. 2019, 32, 41–62. [Google Scholar] [CrossRef]

- Shao, S.; Zhang, K.; Dou, J.M. Effects of Economic Agglomeration on Energy Saving and Emission Reduction: Theoryand Empirical Evidence from China. J. Manag. World 2019, 35, 36–60+226. [Google Scholar] [CrossRef]

- Xiong, H.; Jiang, P.; Ju, C.; Peng, K.L. The Mechanism Underlying Farmers’spontaneous Land Transfer: Simulation, Validation and Application. J. Manag. World 2023, 39, 71–85+99+86-89. [Google Scholar] [CrossRef]

- Chishti, M.Z.; Alam, N.; Murshed, M.; Rehman, A.; Balsalobre-Lorente, D. Pathways Towards Environmental Sustainability: Exploring the Influence of Aggregate Domestic Consumption Spending on Carbon Dioxide Emissions in Pakistan. Environ. Sci. Pollut. Res. 2022, 29, 45013–45030. [Google Scholar] [CrossRef]

- Yin, C.Y.; Sun, S.Q.; Chen, M.M. The High-Quality Patent Development Trend and Driving Mechanism of Technological Innovation. J. Intell. 2022, 41, 70–76+97. [Google Scholar] [CrossRef]

- Ding, F.L. Effects of Digital Inclusive Finance on Carbon Intensity of China. Wuhan Univ. J. (Philos. Soc. Sci.) 2022, 75, 110–120. [Google Scholar] [CrossRef]

- Wang, J.M.; Yu, Z.L. Multiple Heterogeneity of Carbon Emission Reduction Driven by Low?Carbon Technology Progress in Resource-Based Cities. China Popul. Res. Env. 2022, 32, 156–170. [Google Scholar] [CrossRef]

- Wu, F.; Hu, H.Z.; Lin, H.Y.; Ren, X.Y. Corporate Digital Transformation and Capital Market Performance—Empirical Evidence from Equity Liquidity. J. Manag. World 2021, 37, 130–144+110. [Google Scholar] [CrossRef]

- Gu, J.; Liu, Z. A study of the coupling between the digital economy and regional economic resilience: Evidence from China. PLoS ONE 2024, 19, e0296890. [Google Scholar] [CrossRef]

- Sun, X.; Meng, Z.; Zhang, X.; Wu, J. The role of institutional quality in the nexus between green financing and sustainable development. Res. Int. Bus. Financ. 2025, 73, 102531. [Google Scholar] [CrossRef]

- Chen, X.Q.; Liu, X.W.; Zhu, Q.Y. Comparative analysis of total factor productivity in China’s high-tech industries. Technol. Forecast. Soc. Change 2022, 175, 121332. [Google Scholar] [CrossRef]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach; Guilford Press: New York, NY, USA, 2013; p. xvii, 507. [Google Scholar]

- Chen, M.; Zhao, S.; Wang, J. The Impact of the Digital Economy on Regional Carbon Emissions: Evidence from China. Sustainability 2023, 15, 14863. [Google Scholar] [CrossRef]

- Ge, W.; Xu, Y.; Liu, G.; Shen, B.; Su, X.; Liu, L.; Yang, X.; Ran, Q. Exploring the Impact of the Digital Economy on Carbon Emission Efficiency under Factor Misallocation Constraints: New Insights from China. Front. Environ. Sci. 2022, 10, 953070. [Google Scholar] [CrossRef]

| Variable | Symbol | Measurement | Unit | Ref. | |

|---|---|---|---|---|---|

| Dependent variables | Total carbon emissions | lnTC | Total carbon emissions in each region | 10,000 tons | [48] |

| Carbon emission intensity | lnCI | Carbon emissions per unit of GDP in each region | tons/10,000 RMB | ||

| Independent variables | Digital economy level | DL | Digitization index | / | [50] |

| Mediating/Independent variables | Entrepreneurship of SMMEs | lnmanu | Number of newly established SMMEs | No. | [53] |

| Control Variables (CVs) | Urbanization rate | lnurban | Urban population/total population | % | [55] |

| Per capita GDP | lnperGDP | per capita GDP in each region | 100 million RMB/10,000 people | [56] | |

| Patents | lnpatent | Number of patent applications/total population | units/10,000 people | [57] | |

| Degree of openness | lnED | Total import and export value | 10,000 USD | [58] | |

| Industrial structure | lninstru | Tertiary industry/total GDP of the region | % | [59] | |

| Variable | Expected Value | SD | Min. | Max. | |

|---|---|---|---|---|---|

| TC | Overall | 42,319.94 | 29,467.64 | 4885.54 | 149,307.00 |

| Between | 29,610.00 | 5909.02 | 131,885.00 | ||

| Within | 4155.61 | 20,520.16 | 59,741.87 | ||

| CI | Overall | 2.35 | 1.68 | 0.38 | 8.25 |

| Between | 1.67 | 0.56 | 7.52 | ||

| Within | 0.35 | 1.13 | 3.79 | ||

| DL | Overall | 263.53 | 116.65 | 7.58 | 453.66 |

| Between | 7.22 | 250.91 | 286.12 | ||

| Within | 116.43 | 15.27 | 450.46 | ||

| manu | Overall | 297.70 | 450.64 | 5.00 | 274 6 |

| Between | 449.61 | 14.38 | 2028.88 | ||

| Within | 82.73 | −156.18 | 1014.83 | ||

| urban | Overall | 57.11 | 12.30 | 34.96 | 89.60 |

| Between | 12.16 | 41.11 | 88.64 | ||

| Within | 2.80 | 50.96 | 63.52 | ||

| perGDP | Overall | 52,817.84 | 24,792.26 | 16,413.00 | 140,211.20 |

| Between | 23,230.12 | 25,773.27 | 107,209.50 | ||

| Within | 9530.10 | 27,266.31 | 85,819.55 | ||

| patent | Overall | 18.02 | 19.89 | 1.29 | 98.06 |

| Between | 18.68 | 3.43 | 68.56 | ||

| Within | 7.56 | −11.92 | 50.98 | ||

| ED | Overall | 13,500,000 | 21,900,000 | 66,839 | 109,000,000 |

| Between | 22,200,000 | 125,543 | 102,000,000 | ||

| Within | 2,037,604 | 3,123,617 | 22,900,000 | ||

| instru | Overall | 45.48 | 9.54 | 29.70 | 81.00 |

| Between | 8.45 | 37.53 | 78.61 | ||

| Within | 4.66 | 33.99 | 55.50 | ||

| Model (1) lnTC | Model (2) lnCI | Model (3) lnTC | Model (4) lnCI | |

|---|---|---|---|---|

| DL | −0.001 *** (0.000) | −0.002 *** (0.000) | −0.001 ** (0.000) | −0.001 ** (0.000) |

| lnmanu | 0.074 *** (0.023) | 0.076 ** (0.034) | 0.081 *** (0.028) | 0.076 *** (0.025) |

| lnurban | 0.267 (0.353) | 0.398 (0.368) | ||

| lnperGDP | −0.282 (0.176) | −1.311 *** (0.171) | ||

| lnpatent | 0.019 (0.046) | 0.008 (0.045) | ||

| lnED | 0.010 (0.048) | 0.014 (0.044) | ||

| lninstru | −0.449 * (0.240) | −0.397 (0.238) | ||

| Constant | 10.045 *** (0.127) | 0.601 *** (0.183) | 13.365 *** (2.284) | 13.986 *** (2.355) |

| Time fixed effect (TFE) | √ | √ | √ | √ |

| Region fixed effect (RFE) | √ | √ | √ | √ |

| N | 240 | 240 | 240 | 240 |

| Adjusted-R2 | 0.162 | 0.741 | 0.198 | 0.870 |

| F | 8.189 | 31.256 | 15.979 | 88.535 |

| Variable | Stage 1 | Stage 2 | |

|---|---|---|---|

| Model (1) lnmanu | Model (2) lnTC | Model (3) lnCI | |

| Instrumental | 0.141 ** (0.052) | ||

| DL | −0.001 (0.001) | −0.001 ** (0.000) | −0.001 * (0.000) |

| lnmanu | 0.183 ** (0.072) | 0.183 *** (0.070) | |

| Constant | −8.654 ** (4.230) | 14.310 *** (2.224) | 14.970 *** (2.256) |

| CV | √ | √ | √ |

| TFE | √ | √ | √ |

| RFE | √ | √ | √ |

| N | 240 | 240 | 240 |

| Adjusted-R2 | 0.386 | ||

| Within-R2 | 0.173 | 0.865 | |

| F | 19.486 | ||

| Variable | 1% Winsorization | Dependent Variable lnperC Replaced | |

|---|---|---|---|

| Model (1) lnTC | Model (2) lnCI | Model (3) | |

| DL | −0.001 *** (0.000) | −0.001 ** (0.000) | −0.001 ** (0.000) |

| lnmanu | 0.091 *** (0.028) | 0.084 *** (0.025) | 0.074 *** (0.025) |

| Constant | 13.666 *** (2.176) | 14.304 *** (2.277) | 4.971 ** (2.324) |

| CV | √ | √ | √ |

| TFE | √ | √ | √ |

| RFE | √ | √ | √ |

| N | 210 | 210 | 240 |

| Adjusted-R2 | 0.231 | 0.879 | 0.143 |

| F | 9.916 | 61.246 | 9.215 |

| Variable | Core Independent Variable Replaced with lnpack | Core Independent Variable Replaced with fi | ||

|---|---|---|---|---|

| Model (1) lnTC | Model (2) lnCI | Model (3) lnTC | Model (4) lnCI | |

| lnpack | −0.067 * (0.038) | −0.063 * (0.033) | ||

| fi | 0.006 *** (0.002) | 0.005 ** (0.002) | ||

| lnmanu | 0.083 *** (0.027) | 0.078 *** (0.024) | 0.083 *** (0.029) | 0.078 *** (0.025) |

| Constant | 13.453 *** (2.231) | 14.053 *** (2.307) | 13.544 *** (2.284) | 14.141 *** (2.344) |

| CV | √ | √ | √ | √ |

| TFE | √ | √ | √ | √ |

| RFE | √ | √ | √ | √ |

| N | 240 | 240 | 240 | 240 |

| Adjusted-R2 | 0.192 | 0.870 | 0.182 | 0.868 |

| F | 6.995 | 71.812 | 5.262 | 147.424 |

| Variable | Risk Factor Samples Deleted | Municipality Samples Deleted | ||

|---|---|---|---|---|

| Model (1) lnTC | Model (2) lnCI | Model (3) lnTC | Model (4) lnCI | |

| DL | −0.001 *** (0.000) | −0.001 ** (0.000) | −0.001 ** (0.000) | −0.001 ** (0.000) |

| lnmanu | 0.089 *** (0.027) | 0.083 *** (0.025) | 0.081 *** (0.028) | 0.076 *** (0.025) |

| Constant | 13.712 *** (2.194) | 14.351 *** (2.293) | 13.365 *** (2.284) | 13.986 *** (2.355) |

| CV | √ | √ | √ | √ |

| TFE | √ | √ | √ | √ |

| RFE | √ | √ | √ | √ |

| N | 210 | 210 | 240 | 240 |

| Adjusted-R2 | 0.231 | 0.879 | 0.198 | 0.870 |

| F | 9.852 | 61.104 | 15.979 | 88.535 |

| Variable | Higher Economic Development Level | Lower Economic Development Level | ||

|---|---|---|---|---|

| Model (1) lnTC | Model (2) lnCI | Model (3) lnTC | Model (4) lnCI | |

| DL | −0.000 ** (0.000) | −0.000 (0.000) | −0.001 (0.001) | −0.001 (0.001) |

| lnmanu | 0.052 ** (0.024) | 0.057 ** (0.025) | 0.036 (0.047) | 0.021 (0.039) |

| Constant | 13.898 *** (2.664) | 14.223 *** (3.006) | 16.978 *** (5.419) | 17.829 *** (4.850) |

| CV | √ | √ | √ | √ |

| TFE | √ | √ | √ | √ |

| RFE | √ | √ | √ | √ |

| N | 120 | 120 | 120 | 120 |

| Adjusted-R2 | 0.465 | 0.920 | 0.149 | 0.863 |

| F | 44.443 | 187.872 | 505.349 | 185 0.262 |

| Variable | Higher Urbanization Level | Lower Urbanization Level | ||

|---|---|---|---|---|

| Model (1) lnTC | Model (2) lnCI | Model (3) lnTC | Model (4) lnCI | |

| DL | −0.000 * (0.000) | −0.000 (0.000) | −0.001 ** (0.000) | −0.001 ** (0.000) |

| lnmanu | 0.057 ** (0.020) | 0.065 *** (0.021) | −0.003 (0.035) | −0.013 (0.033) |

| Constant | 12.953 *** (2.897) | 13.619 *** (3.182) | 25.374 *** (3.971) | 24.799 *** (3.799) |

| CV | √ | √ | √ | √ |

| TFE | √ | √ | √ | √ |

| RFE | √ | √ | √ | √ |

| N | 120 | 120 | 120 | 120 |

| Adjusted-R2 | 0.415 | 0.926 | 0.452 | 0.897 |

| F | 134.520 | 193.446 | 52.759 | 497.727 |

| Variable | Higher Institutional Quality | Lower Institutional Quality | ||

|---|---|---|---|---|

| Model (1) lnTC | Model (2) lnCI | Model (3) lnTC | Model (4) lnCI | |

| DL | 0.000 (0.000) | 0.000 (0.000) | −0.001 ** (0.000) | −0.001 ** (0.000) |

| lnmanu | 0.083 *** (0.022) | 0.091 *** (0.019) | 0.062 (0.057) | 0.044 (0.049) |

| Constant | 14.521 *** (1.573) | 14.909 *** (1.738) | 8.159 (5.084) | 9.971 * (4.818) |

| CV | √ | √ | √ | √ |

| TFE | √ | √ | √ | √ |

| RFE | √ | √ | √ | √ |

| N | 120 | 120 | 120 | 120 |

| Adjusted-R2 | 0.334 | 0.937 | 0.253 | 0.785 |

| F | 12.135 | 123 4.426 | 443.349 | 273.643 |

| Variable | Non-Industrial Pilot Area | Industrial Pilot Area | ||

|---|---|---|---|---|

| Model (1) lnTC | Model (2) lnCI | Model (3) lnTC | Model (4) lnCI | |

| DL | 0.000 (0.001) | 0.000 (0.001) | −0.001 ** (0.000) | −0.001 ** (0.000) |

| lnmanu | 0.100 *** (0.030) | 0.111 *** (0.030) | 0.063 (0.046) | 0.046 (0.039) |

| Constant | 12.738 *** (2.979) | 13.578 *** (3.392) | 15.743 *** (3.551) | 16.994 *** (3.223) |

| CV | √ | √ | √ | √ |

| TFE | √ | √ | √ | √ |

| RFE | √ | √ | √ | √ |

| N | 88 | 88 | 152 | 152 |

| Adjusted-R2 | 0.289 | 0.930 | 0.200 | 0.844 |

| F | 63.368 | 48.170 | ||

| Variable | TC | lnmanu | TC | CI | CI |

|---|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | |

| DL | −0.001 *** (0.000) | −0.001 (0.001) | −0.001 ** (0.000) | −0.001 ** (0.000) | −0.001 * (0.000) |

| lnmanu | 0.081 *** (0.028) | 0.076 ** (0.025) | |||

| Constant | 12.615 *** (2.423) | −9.258 (5.035) | 13.365 *** (2.283) | 13.279 *** (2.500) | 13.986 *** (2.355) |

| CV | √ | √ | √ | √ | √ |

| TFE | √ | √ | √ | √ | √ |

| RFE | √ | √ | √ | √ | √ |

| N | 240 | 240 | 240 | 240 | 240 |

| F | 4.98 | 15.25 | 15.98 | 54.47 | 15.98 |

| 95% Confidence Interval | Significance | ||||||

|---|---|---|---|---|---|---|---|

| Effect | Path | Estimate | Uncorrected | Bias-Corrected | |||

| Lower Limit | Upper Limited | Lower Limit | Upper Limited | ||||

| Direct | DL-TC | 0.0006 | 0.0002 | 0.001 | 0.0002 | 0.001 | Significant |

| DL-CI | 0.0002 | 0.00003 | 0.0005 | 0.00002 | 0.0005 | Insignificant | |

| Indirect | DL-TC | 0.0005 | −0.0002 | 0.001 | −0.0002 | 0.001 | Significant |

| DL-CI | −0.0005 | −0.001 | −0.00001 | −0.001 | −0.00001 | Insignificant | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tan, J.; Liu, R.; Lu, J.; Tan, Q. Digital Economy, Entrepreneurship of Small and Medium-Sized Manufacturing Enterprises, and Regional Carbon Emissions: Evidence from Chinese Provinces. Sustainability 2025, 17, 2133. https://doi.org/10.3390/su17052133

Tan J, Liu R, Lu J, Tan Q. Digital Economy, Entrepreneurship of Small and Medium-Sized Manufacturing Enterprises, and Regional Carbon Emissions: Evidence from Chinese Provinces. Sustainability. 2025; 17(5):2133. https://doi.org/10.3390/su17052133

Chicago/Turabian StyleTan, Juan, Rui Liu, Jianle Lu, and Qiong Tan. 2025. "Digital Economy, Entrepreneurship of Small and Medium-Sized Manufacturing Enterprises, and Regional Carbon Emissions: Evidence from Chinese Provinces" Sustainability 17, no. 5: 2133. https://doi.org/10.3390/su17052133

APA StyleTan, J., Liu, R., Lu, J., & Tan, Q. (2025). Digital Economy, Entrepreneurship of Small and Medium-Sized Manufacturing Enterprises, and Regional Carbon Emissions: Evidence from Chinese Provinces. Sustainability, 17(5), 2133. https://doi.org/10.3390/su17052133