1. Introduction

With increasingly prominent environmental and climate challenges, green innovation is considered to be a fundamental way to transcend the contradiction between the environment and the economy and a fundamental driving force to achieve environmental and economic sustainable development [

1,

2]. Given the importance of green innovation, how to effectively incentivize green-oriented technological innovation becomes the crux of the matter. Existing studies have shown that green innovation faces not only insufficient market incentives due to “double externalities” on the demand side [

3,

4,

5] but also path dependence formed by carbon lock-in on the supply side [

6,

7,

8], which leads to a lack of motivation for firms to engage in green innovation. Clearly, this requires policies, especially environmental policies, to comprehensively consider and address these impediments in order to effectively promote green innovation [

1,

3,

9,

10].

Market-oriented carbon emissions trading (CET) has become the most widely used environmental policy around the world [

11,

12]. Also known as cap and trade, it works by setting a total cap on emissions, issuing emission permits to firms, and allowing firms to trade the permits as commodities. As a result, it can raise production costs, lower the competitiveness of high-emission firms, and accelerate investments in low-carbon technology innovation [

11]. China, as the world’s largest carbon emitter, has implemented carbon emissions trading, energy trading, and water trading, etc., among which highly valued carbon emissions trading was piloted in seven provinces and cities in 2013, with a national carbon market being started in 2018. It is evident that this market-oriented CET has become an important tool to cope with environmental and climate challenges and promote green economic development. In this context, the impact of CET on green innovation has become an important issue that we must consider.

Although large numbers of studies have investigated the impact of CET on green innovation e.g., Refs. [

2,

11,

12,

13,

14], etc., the mechanism of CET unlocking green innovation still faces theoretical disputes and practical challenges: On the one hand, environmental economists advocate using price signals to provide incentives for firms’ green innovation. This is because the market-based environmental policy (e.g., carbon taxes and CET) can internalize the social costs of environmental degradation (i.e., market externalities), thereby providing more balanced price incentives for green innovation. However, this “demand–pull” approach often faces market failures, e.g., inelastic price signals and information asymmetry, etc. [

5,

10,

15]. For this, evolutionary scholars argue that price signals are necessary, yet insufficient to assure innovative responses on the supply side [

15]. They suggest taking the factors into account that shape innovative activity on the supply side (e.g., search routines, knowledge capabilities, technology paradigms, and regimes, etc.) [

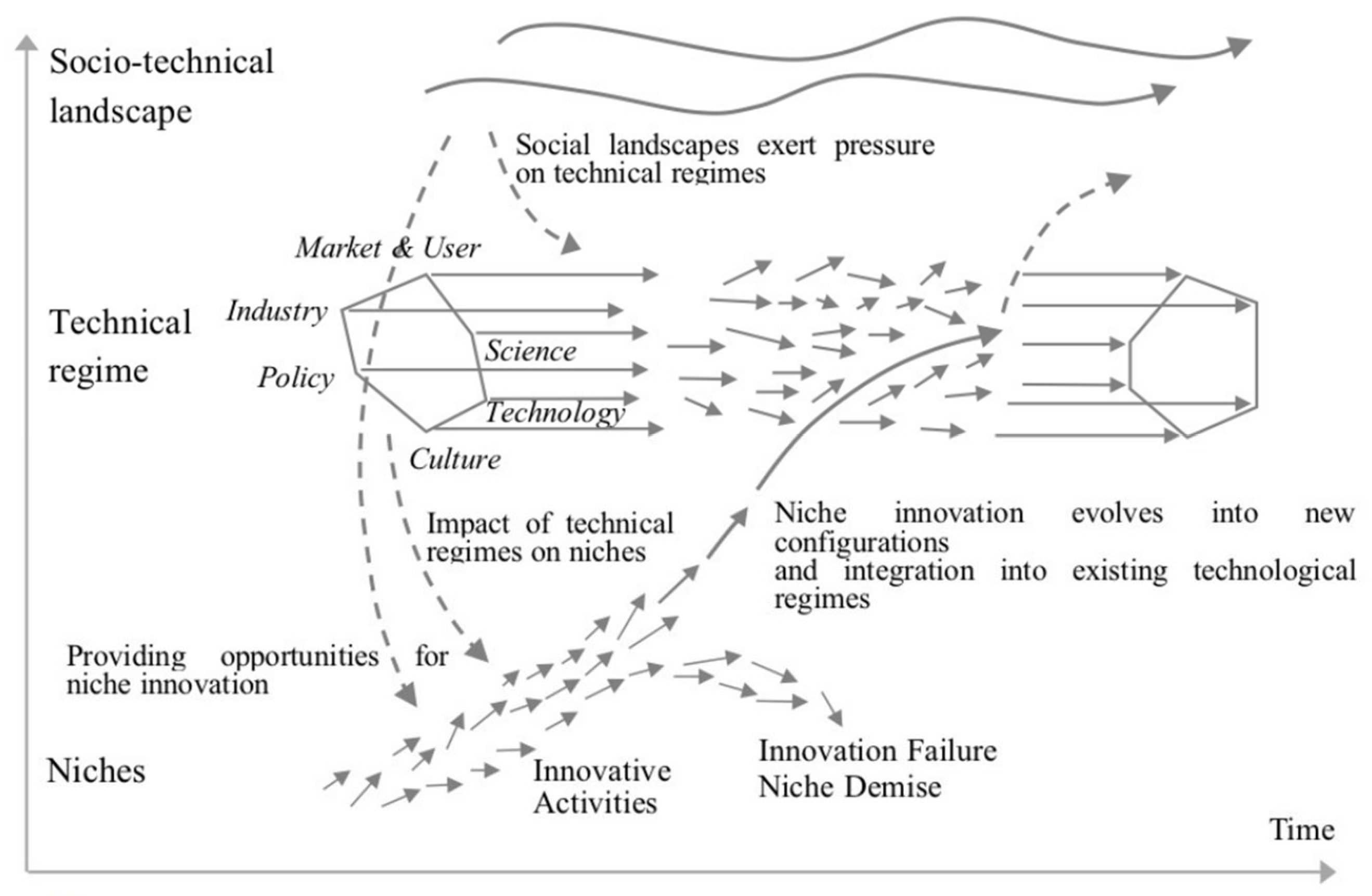

15,

16]. It is not difficult to see that different theories have different approaches to stimulate green innovation, and it requires a broader analytical framework to include these theoretical perspectives in an analysis.

On the other hand, research on environmental regulation and green innovation has mainly focused on the direct impacts of environmental policies on firms, ignoring the impacts of market participants [

17,

18,

19]. How market-oriented environmental policies interact with market participants has failed to attract sufficient attention, and few studies have incorporated it into a unified analytical framework. Obviously, these market participants, such as investors, financial institutions, and competitors, are equally affected by policies and further influence firms’ green innovation. Further research on the synergistic effects of CET and market participants can help us to fully understand the policy’s effects and deepen the research into the drivers of green innovation.

The above research gaps provide an opportunity to further explore the mechanisms by which CET unlocks green innovation. This paper takes China’s CET pilot policy as the background, and it is of great significant to see whether CET can break the carbon “lock-in” and further stimulate green innovation in such a coal-energy-dominated country. Combining the perspectives of environmental economics and evolutionary theory, we focus on firm-level technological regimes and reveal the intrinsic mechanism of CET unlocking green innovation. Using a sample of listed companies from 2006 to 2018, the evidence suggests that China’s CET has a significantly positive impact on firms’ green innovation, and it promotes firms’ green innovation mainly through economic and environmental legitimacy. Further analysis shows that market participants such as investors, financial institutions and competition can strengthen the positive relationship between CET and high-carbon firms’ green innovation.

The marginal contributions of this study to the existing research are as follows: First, this paper provides a new explanation for the impact of CET on green innovation based on different theoretical perspectives. Existing studies explore the impact of CET from the perspectives of cost or price based on neoclassical economic theory [

18,

19,

20,

21,

22], ignoring factors such as supply-side carbon lock-in and path dependence [

15]. By integrating evolutionary theory, this paper reveals the intrinsic mechanism of CET that breaks carbon lock-in and incentivizes green innovation through economic and environmental legitimacy, which deepens the mechanism study of CET. Second, our study reveals the interaction between environmental policy and market participants and their synergistic effects on green innovation. Previous studies on environmental regulation and green innovation were mainly focused on the policies’ direct impact on firms, ignoring the impact of market participants [

17]. In this paper, while considering the direct impacts of policies on green innovation, we further investigate the synergistic impacts of market participants such as investors, financial institutions, and competitors on green innovation, which helps us to comprehensively understand the effects of these policies and deepen the research into the drivers of green innovation; Third, our study enriches the empirical evidence of multilevel analysis (MLP) at the micro-firm level. Existing studies based on the multilevel perspective (MLP) have mainly used case study methodology and lacked large-sample empirical evidence [

6,

23,

24]. This paper empirically analyzes the impact of CET on green innovation by conceptualizing firm-level technological regimes, including social landscapes, technological regimes, and niches, which extends the empirical research of the multilevel analysis framework (MLP).

3. Methodology

3.1. Sample and Data

To investigate the impact of CET on green innovation, this study takes the background of China’s CET pilot policy launched in 2013 and selects listed companies in the chemical, paper, nonferrous, petrochemical, iron and steel, building materials, aviation, and electric power industries covered by the policy as our initial sample. Considering that national carbon trading was started in 2018, we restricted the sample period to 2006–2018 and ensured that there was a five-year window before and after the implementation of the pilot policy. The detailed sample selection is described below:

First, according to the CET pilot policy, our sample is limited to pilot policy-covered industries, including chemical, paper, nonferrous, petrochemical, steel, building materials, aviation, and power industries. These industries are not only the main industries of carbon emissions but also an important part of the innovation system [

81]. Second, given the availability of data, we take listed companies in the above industries as our initial sample. The treatment group of the sample is identified by matching the list of pilot firms participating in emissions trading with the names of listed companies and their subsidiaries, while other firms not covered by the policy constitute the control group; finally, considering the completeness and continuity of the data, ST and *ST firms are excluded, as well as firms with serious missing data, and finally 6418 firm-year observations are obtained.

The data sources are as follows: the financial and accounting data are obtained from the China Stock Market and Accounting Research (CSMAR) database; green patent data, including patent category, patent number, year, and other information, are from CSMAR and the State Intellectual Property Office (SIPO). Finally, we merge the data from different sources.

3.2. Empirical Model

The existing studies usually adopt the difference in difference (DID) model based on a quasi-natural experiment to identify policy treatment effects, such as in Hu et al. (2020) [

18] and Ren et al. (2020) [

19], which helps to eliminate unobservable time-invariant confounding factors. Following these studies, we also use the DID model to investigate the impact of CET on corporate green innovation:

in Equation (1), where i indexes firms, and t indexes years.

is green innovation, measured by the logarithm of green patents in year t of firm i.

is the explanatory variable of our interest, and

captures the difference in green innovation between pilot and non-pilot firms before and after policy implementation.

includes a set of control variables defined in the next section. In addition, the model also controls for firm fixed effects

and year fixed effects

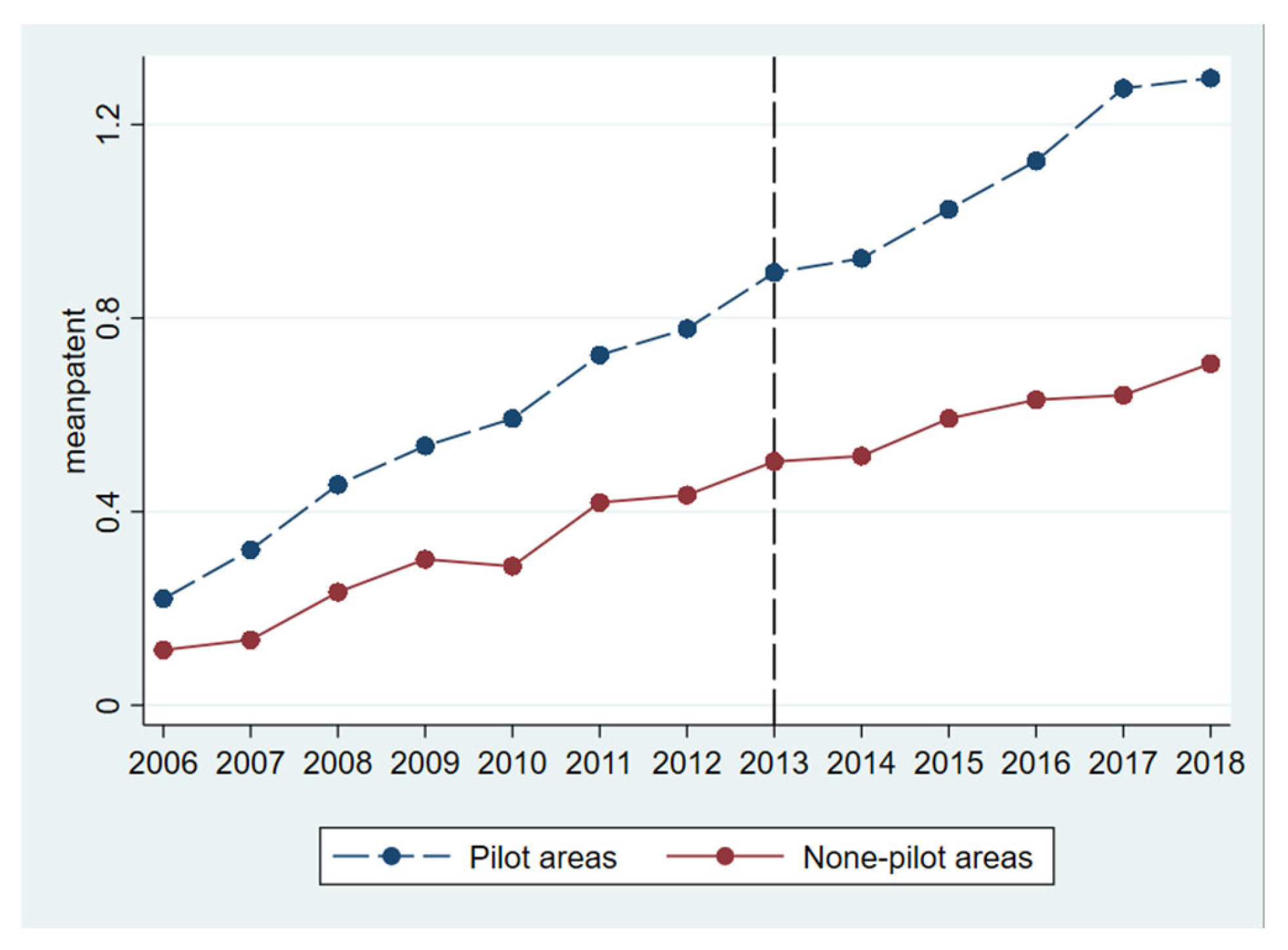

to obtain robust estimation results. Our study employs a difference in difference (DID) approach to assess the impact of CET on green innovation using Chinese listed companies. The DID method is particularly suitable for evaluating the causal effect of policy interventions by comparing changes in outcomes between treatment and control groups over time [

82]. The analysis process is shown in

Figure 2.

3.3. Variable Measurement

Dependent Variable. Green innovation (Gre_PAT): we use the logarithm of the number of green patents plus 1 to measure green innovation (Gre_PATlog). Green patents are identified according to the IPC classification in the “International Patent Green Classification List” proposed by the WIPO. In addition, we further use the number of green invention patents and green utility model patents as alternative measures for robustness tests. The data are obtained from CSMAR database and State Intellectual Property Office database.

Independent Variable. Carbon emissions trading (CET × POST) is the independent variable of our interest, where CET is a dummy variable assigned a value of 1 if a firm is covered by the pilot policy and 0 otherwise; POST is a dummy variable that takes the value of 1 if after 2012 and 0 otherwise. The coefficient of CET × POST captures the difference in green innovation between pilot and non-pilot firms before and after policy implementation.

Mechanism Variables. Economic legitimacy (Eco_Leg) can be measured using the economic or cost pressures imposed by CET, which are often reflected in firms’ environmentally relevant inputs or outputs. First, economic legitimacy is measured with the logarithm of the firm’s investment in environmental governance (Eco_Leg

Invest), which captures a firms’ environmental inputs as a result of the policy; and second, we further measure economic legitimacy (Eco_Leg

Fee) with their output-based sewage charges [

20].

Environmental legitimacy (Env_Leg) adopts two measurements in this paper. Environmental responsibility scores usually reflect the environmental pressures faced by firms (Env_Leg

CSR), and we firstly use environmental responsibility scores to measure firms’ environmental legitimacy; second, following Li et al. (2018) [

83], the firm’s environmental legitimacy (Env_Leg

J-F) is measured with the J-F index calculated based on media coverage data. Specifically, this paper selects media reports related to the sample firms and codes them according to the content of the reports (positive, neutral, and negative) so that the measured J-F index take values ranging from −1 to 1; if the value is close to 1, the article is more popular, and if the value is close to −1, the article is less popular.

Market Participants. Investor (Inv) is measured with the proportion of institutional investors’ holdings in the total shares of the listed firm, including the sum of the shareholding ratios of securities brokerages, insurance companies, fund management companies, and qualified foreign investors.

Financial institution (Fin): we use the ratio of total loans (including long-term loans and short-term loans) to operating income to measure the impact of financial institutions, mainly because financial institutions have an impact on firms through financing.

Market competition (HHI): the Herfindahl index has been used to measure market competition. In this paper, 1 minus the Herfindahl index is used to measure the market competition faced by firms.

Control Variables. We further control for other affecting green innovation variables in the model. Firm size (Asset) is measured with the logarithm of the firm’s assets at the end of the year [

84]. Firm age (Age) is the number of years since the firm was established. Leverage (Lev) is the ratio of debt to total assets [

85], and Revenue is measured using the logarithm of a firm’s total operating income in a year plus one. Cash is measured with the logarithm of the firm’s cash and cash equivalents at the end of a year [

86]. R&D is the proportion of R&D investment to total assets. Top_holding uses the proportion of shares held by the largest shareholder [

81], and State is the proportion of state investors’ shareholdings to the total amount of share capital of the firm. In addition, unobservable confounders are further considered in the model by controlling for firm and year fixed effects.

3.4. Descriptive Statistics

To avoid spurious regression, we use the Levin–Lin–Chu test to check the station-arity of our data, and the results are reported in

Table 2. Column 1 controls for time trend. The results show that our variables are stationary.

Table 3 reports the descriptive statistical analysis of variables. The mean values of the Gre_PAT

log is 0.59, and the median value is 0. It can be seen that more than half of the sample firms do not have green innovation outputs. This indicates a low level of green innovation in high-carbon industries, which is mainly due to the lack of economic incentives and insufficient technological innovation capacity [

5]. The mean value of CET is 0.33, indicating that 33% of the firms in our sample are covered by the policy. This ratio shows that the coverage of the carbon emissions trading pilot policy is still limited [

12]. The descriptive statistics of the remaining control variables are basically consistent with existing studies.

5. Conclusions and Policy Implications

Stimulating green innovation is an important issue of great concern to scholars, and differentiated mechanisms and methods have been used to incentivize green innovation from different theoretical perspectives. This paper reveals the mechanism of CET in unlocking green innovation, combining the perspectives of neoclassical economy theory and evolutionary theory. In the context of China’s CET pilot policy, based on a sample of listed companies from 2006 to 2018, we find that the CET pilot policy significantly promotes pilot firms’ green innovation, and economic and environmental legitimacy are the mechanisms through which CET promotes green innovation. Further analysis shows that market participants such as investors, financial institutions, and competition can strengthen the positive relationship between CET and high-carbon firms’ green innovation. Our findings are consistent with those of Chen et al. (2021) [

2] where we extend their study by including market participants. CET contributes significantly to green innovation, especially through economic and environmental legitimacy mechanisms. Moreover, market participants play an important synergistic role in this process, further amplifying the effect of the policy. These findings provide important insights into understanding how CET policies can drive green transformation through multifaceted mechanisms. Future studies could further explore the heterogeneity of these mechanisms across industries and regions and how market forces can be better used through policy design to drive green innovation.

This study has the following implications in the context of green transformation: First, existing studies on CET and green innovation mostly focus on whether to innovate or not and lack an in-depth understanding of the process of green innovation. This paper combines the theory of environmental economics with evolutionary theory to reveal the intrinsic mechanism of CET in unlocking green innovation from the supply and demand sides through legitimacy pressure. It can be seen that among the incentives for green innovation, in addition to the demand-side economic incentives for green innovation, supply-side R&D inputs, knowledge, practices, and corresponding resource inputs are equally important; Second, we find that market participants also play an important role in the green transition process of high-carbon firms. The synergistic effects between CET and market participants further reinforce that the government should guide market participants to promote high-carbon firms’ green innovation through resource allocation, compliance pressure, etc., so as to comprehensively promote green technological innovation as a priority during the transition window. In general, the analysis of green innovation under the framework of MLP is helpful to further broaden the analysis framework of green innovation.