1. Introduction

Improving the financial vulnerability of rural households is a crucial component for achieving sustainable growth and a key means of promoting common prosperity [

1]. At present, agriculture and rural areas remain the weakest link in China’s modernization process, and the financial risks faced by rural households not only reflect the welfare levels of these households, but also pose a significant hidden danger that could trigger systemic risks. These risks impede the high-quality development of agriculture and rural areas [

2]. Unlike traditional financial risk assessments, household financial vulnerability is based on the changes in household assets and liabilities, considers the correlation and interdependence of risks, and can serve as a predictor of potential financial crises in the future [

3]. Compared to urban households, those in rural China generally have lower incomes, a more limited income structure, and face greater uncertainty [

4]. In recent years, the percentage of financially vulnerable households in rural areas has been significantly higher than that in urban areas, with this gap showing signs of gradual expansion [

5]. The lack of sufficient financial services, a widespread financial exclusion, and the reliance on a single-industry structure in rural areas make it difficult for rural residents to effectively cope with risk shocks, such as natural disasters or public health emergencies. This deepens the financial vulnerability of rural households and exacerbates the regional financial risks posed by rural areas [

6]. Therefore, addressing rural household financial vulnerability has become a critical focus for both academic research and policy formulation, particularly within the broader context of financial sustainability.

The digital economy is widely recognized as a key driver of high-quality economic growth, with the development of digital infrastructure becoming a global priority [

7,

8]. Being among the most important components of digital infrastructure, broadband Internet is expanding rapidly worldwide and is considered a critical accelerator of economic growth and innovation [

9,

10,

11,

12]. However, the impact of broadband Internet development on rural household financial vulnerability remains inconclusive. On one hand, existing studies suggest that Internet development and adoption may increase employment rates and wages, particularly benefiting the high-skilled workforce, while the low-skilled workforce may be displaced, leading to employment polarization and greater income inequality [

13,

14,

15,

16]. On the other hand, broadband Internet can reduce information asymmetry and searching costs, which may increase job opportunities [

17]. Furthermore, the development of a digital infrastructure can help bridge the urban–rural income gap by promoting digital finance in rural areas. This, in turn, boosts the demand for low-skilled labor, facilitates the workers’ participation in digital economy-related jobs, and enhances the wages and asset incomes [

6,

18,

19,

20]. These conflicting findings highlight the need for further research in this area, especially considering the gap in understanding how the digital infrastructure impacts financial vulnerability at the household level.

In the past two decades, the Chinese government has made significant efforts to provide basic social security, such as pensions, healthcare, and employment support, for rural residents. The existing literature has examined the effects of welfare policies such as the New Rural Pension Schemes (NRPS) and New Rural Cooperative Medical Schemes (NRCMS) on health outcomes, financial protection, and poverty alleviation [

21,

22,

23]. However, unlike these welfare policies, which are based on the urban–rural household registration system and aim to narrow the urban–rural financial gap, the impact of a digital infrastructure is more inclusive and widespread. Digital infrastructure not only addresses financial vulnerability but also bridges the divide between urban and rural areas in a more comprehensive and sustainable manner.

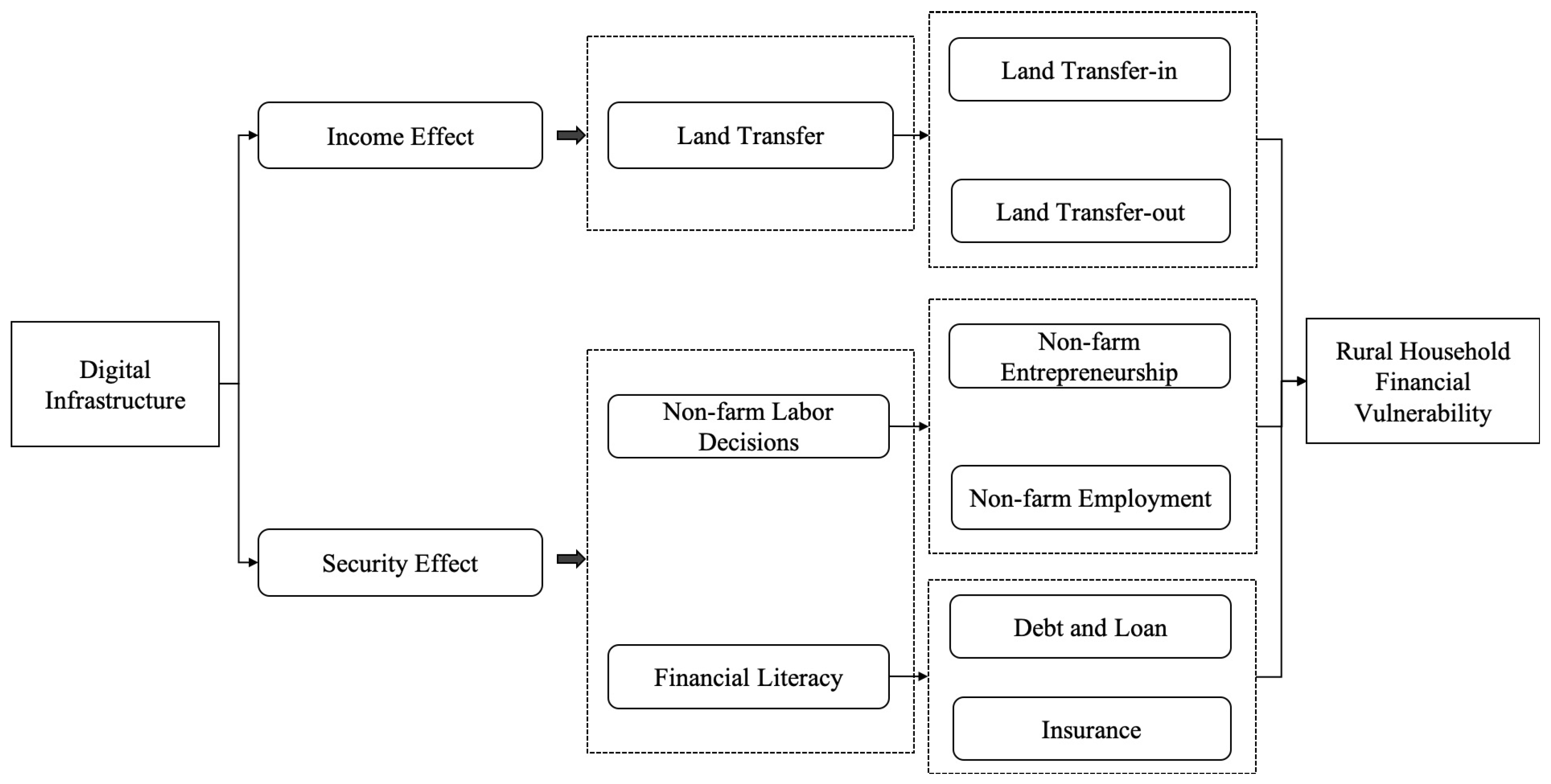

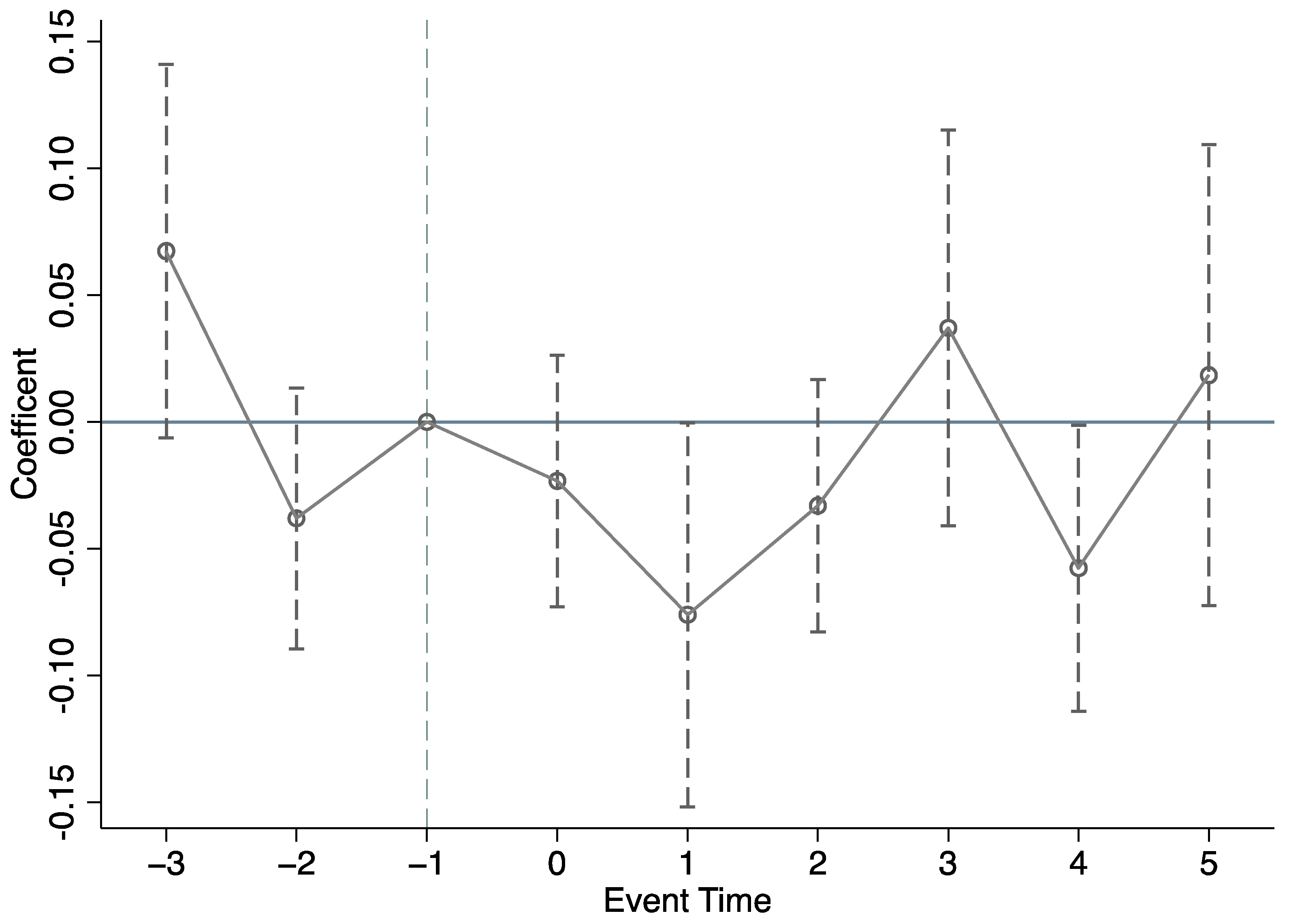

In light of the Broadband China pilot policy, which aims to enhance the efficiency of digital resource allocation and unlock the value of digital infrastructure, this paper utilizes data from five waves of the China family panel studies (CFPS)—2012, 2014, 2016, 2018, and 2020—to construct an indicator of rural household financial vulnerability. By employing a difference-in-differences (DID) approach, the study assesses the effects of a digital infrastructure on rural household financial vulnerability, uncovering two key mechanisms: the income effect (increasing the likelihood of land transfer) and the security effect (promoting non-farm entrepreneurship and financial literacy). Additionally, this paper explores the long-term effects of a digital infrastructure on reducing rural household financial vulnerability.

This paper contributes to the existing literature in three main aspects. First, it extends the research on the economic impact of a policy-driven digital infrastructure by focusing on micro-level household outcomes. As a regional macroeconomic policy tool, the Broadband China pilot policy effectively leverages the benefits of a digital infrastructure. While previous studies have primarily focused on policy outcomes at the regional and industrial level, such as productivity revival [

11], labor market outcomes [

15,

16,

18], and economic growth [

9,

10] there has been limited empirical evidence on the welfare improvements at the micro-household level. Specifically, the enhancement of household financial vulnerability, which best reflects the impact of government digital infrastructure policies on household-level sustainability, has been largely overlooked. Therefore, this paper fills the research gap by providing theoretical evidence on the impact of the Broadband China pilot policy on household financial vulnerability. Second, this paper contributes to the literature examining the impact of digital infrastructure on employment polarization and inequality [

13,

14,

15,

16,

19,

20]. Existing studies have yet to reach a consensus on the role of a digital infrastructure in this context. In contrast, we provide evidence that a digital infrastructure reduces rural household financial vulnerability through the income and security effects. This paper confirms the inclusive role of a digital infrastructure in rural areas and complements the theoretical framework of the digital infrastructure policy effects. Third, we provide empirical evidence from China, the world’s largest developing economy, addressing the scarcity of such studies in developing countries due to data limitations [

10]. By merging CFPS data with regions benefiting from the Broadband China pilot policy, this paper presents new insights into the role of digital infrastructure in mitigating rural household financial vulnerability.

The remaining sections of this paper are arranged as follows: The institutional background and literature review is outlined in

Section 2. The research design is presented in

Section 3.

Section 4 reports the empirical results. The mechanism analysis and time-effects test are discussed in

Section 5. We draw the conclusions and implications in

Section 6.

6. Conclusions and Policy Implications

6.1. Conclusions

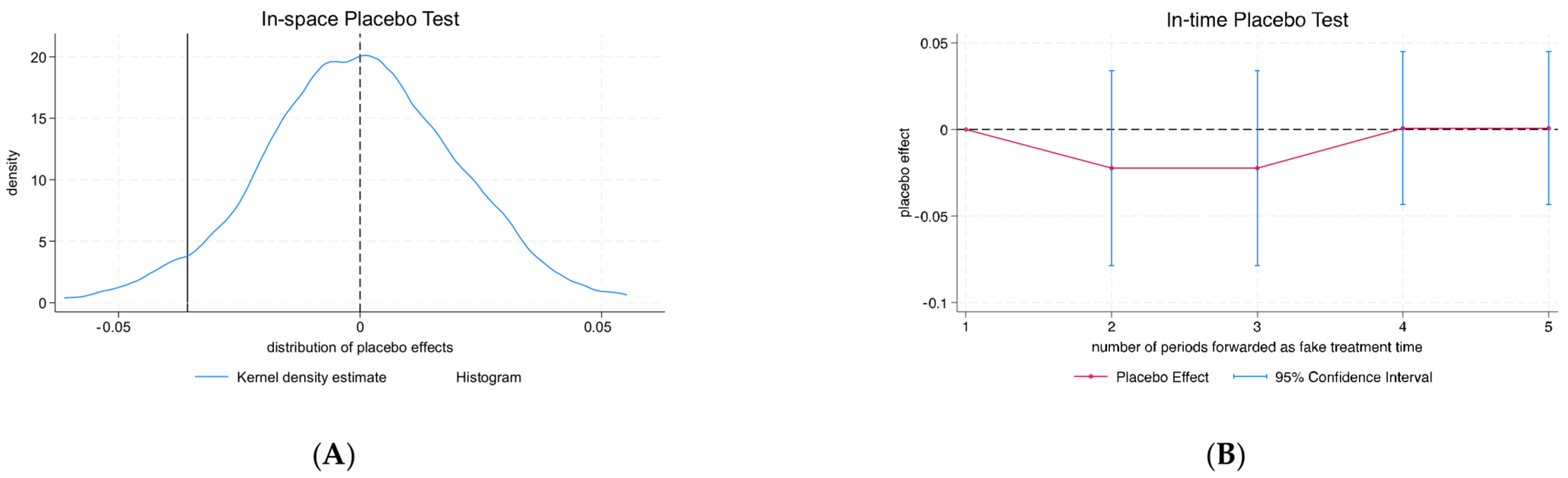

This paper examines the impact of digital infrastructure on the rural household financial vulnerability using five periods of CFPS data from 2012, 2014, 2016, 2018, and 2020. Leveraging a quasi-natural experiment of the Broadband China pilot, we explore the heterogeneous effects on various household head characteristics and different household types. Additionally, we analyze the mechanisms and time effects of digital infrastructure in alleviating rural household financial vulnerability. Our findings suggest that the Broadband China pilot policy significantly reduces the financial vulnerability of rural households, with robust results across a series of sensitivity tests. We also observe that the ameliorating effects of a digital infrastructure are more pronounced in female-, and spousal-headed households, households in northern and eastern regions, and households with inadequate traditional or advanced digital finance infrastructure. In a further analysis, we identify two primary mechanisms at play. First, the income effect: the Broadband China pilot policy increases the probability of land transfer, facilitating land outflow and increasing rental income from land. Second, the security effect: the policy promotes non-farm entrepreneurship, enhances financial literacy, and improves the ability of rural households to manage financial risks. These combined effects lead to a reduction in the financial vulnerability of rural households. Furthermore, the alleviating impact of a digital infrastructure intensifies as the duration of the pilot increases, highlighting the growing benefits over time.

6.2. Policy Implications

The findings of this study offer several important policy recommendations:

- (1)

Nationwide Rollout of the Broadband China pilot: Given the proven effectiveness of a digital infrastructure in reducing financial vulnerability, policymakers should consider expanding the Broadband China pilot nationwide. This would enhance the digitalization of rural areas, support agricultural development, and bridge the gap in digital literacy. It is essential not only to improve digital access, but also to address the digital divide in terms of Internet usage and literacy, ensuring that rural households are equipped with the skills to fully leverage digital tools for income generation and risk management.

- (2)

Targeted and Diversified Digital Inclusion Policies: Our analysis reveals that the effects of the policy vary by household characteristics, particularly in terms of gender, marital status, and region. Policymakers should design targeted programs that cater to households headed by women, those without spouses, and households in economically disadvantaged regions. Providing specific policy incentives and support mechanisms for these groups will maximize the impact of digital infrastructure on reducing financial vulnerability.

- (3)

Enhancing the Mechanism of Digital Infrastructure for Poverty Alleviation: The study underscores the income and security effects of digital infrastructure in improving financial outcomes for rural households. Policymakers should strengthen the role of a digital infrastructure in poverty alleviation by enhancing protections for vulnerable households and promoting scalable farming operations and non-farm entrepreneurship. A continued investment in digital infrastructure, alongside efforts to improve financial literacy, can help break the systemic barriers rural residents face in career choices and financial management. This, in turn, will contribute to high-quality employment opportunities, improve household financial literacy, and reduce the financial vulnerability of rural communities.

By leveraging the full potential of digital infrastructure, China can take a significant step towards reducing the financial vulnerability of rural households, promoting sustainable agricultural development, and improving the overall well-being of rural populations.

6.3. Limitations and Future Research Directions

This study has certain limitations that warrant further investigation. First, while this study has carefully addressed and mitigated a potential selection bias, future research should consider broader and more diverse samples. Specifically, it would be valuable to investigate rural households that migrate to urban areas for work or other reasons, as well as households in the transitional areas between urban and rural regions. These groups may experience distinct dynamics in relation to digital infrastructure and financial vulnerability, and their inclusion could provide deeper insights into the broader impact of digital infrastructure. Second, future research should explore how digital infrastructure affects digital adaptation, particularly among vulnerable groups, such as the elderly, and those with lower educational levels, to assess the potential digital inequality. The digital literacy of the workforce in the agricultural sector is generally lower than that of employees in other industries. Therefore, it is worth paying attention to the extent to which digitalization has improved the financial vulnerability of households in these groups. Additionally, the external validity of the findings across different national or regional contexts should be examined. While this study focuses on China, it remains important to investigate whether the benefits of digital infrastructure can be generalized to other countries or regions, with different socio-economic and technological contexts, especially considering varying levels of digital literacy and infrastructure.