Impact of COP26 and COP27 Events on Investor Attention and Investor Yield to Green Bonds

Abstract

:1. Introduction

2. Literature Review and Hypothesis Development

2.1. Investor Yield

2.2. Green Bond Issuance

2.3. COP 26 and COP27

2.4. Investor Attention

2.5. Market Risk

3. Data and Methodology

3.1. Research Data

- Bond characteristics and financial data from Refinitiv Eikon, providing detailed information on coupon rates, issue size, and yields, and capturing financial metrics (e.g., Return on Assets (ROA), Debt-to-Assets ratio (D/A), and total assets) of companies issuing the bonds.

- Market returns from S&P Global 1200 Index data, representing global equity market trends.

- Investor attention data from Google Trends, measuring public interest or searching activity for terms related to green bonds or specific environmental themes.

- Yield Spread Model

bonds)/Number of bond issues in a month

- Remove duplicates: rows with duplicated entries across data sources are eliminated.

- Exclude missing data: observations missing any critical information (e.g., bond yields, issuer financials, or government bond interest rates) are removed.

- Filter based on plausibility criteria: observations with unrealistic or implausible values are excluded, including the following:

- –

- Bonds with yield spread lower than 0 (indicating nonsensical pricing).

- –

- Bonds with negative interest rates exceeding 30% (highly unrealistic scenarios).

- –

- Government bonds with negative interest rates (a rare and extreme condition).

- –

- Issuer financials with

- –

- Tangible Index greater than 1, reflecting inconsistencies in financial reporting.

- –

- Total assets below USD 100,000, excluding small or atypical enterprises.

- –

- ROA below −50% or above 50%, capturing extreme financial performance.

- –

- Debt-to-Assets (D/A) ratio greater than 1, indicating excessive leverage beyond feasible financial structures.

- Bond characteristics: coupon rate, maturity, issue size, and whether the bond is green or conventional.

- Issuer financial metrics: ROA, total assets, D/A ratio.

- Investor attention: Google Trends data, particularly around significant events like COP26 and COP27.

- Event dummy variables: indicators for COP26 and COP27 to capture their impact on yield spreads.

- CAR Model

date + ε

- α: constant term representing the baseline return.

- β: coefficient capturing the trend in cumulative returns over the estimation window.

- ϵ: residual term accounting for unexplained variations.

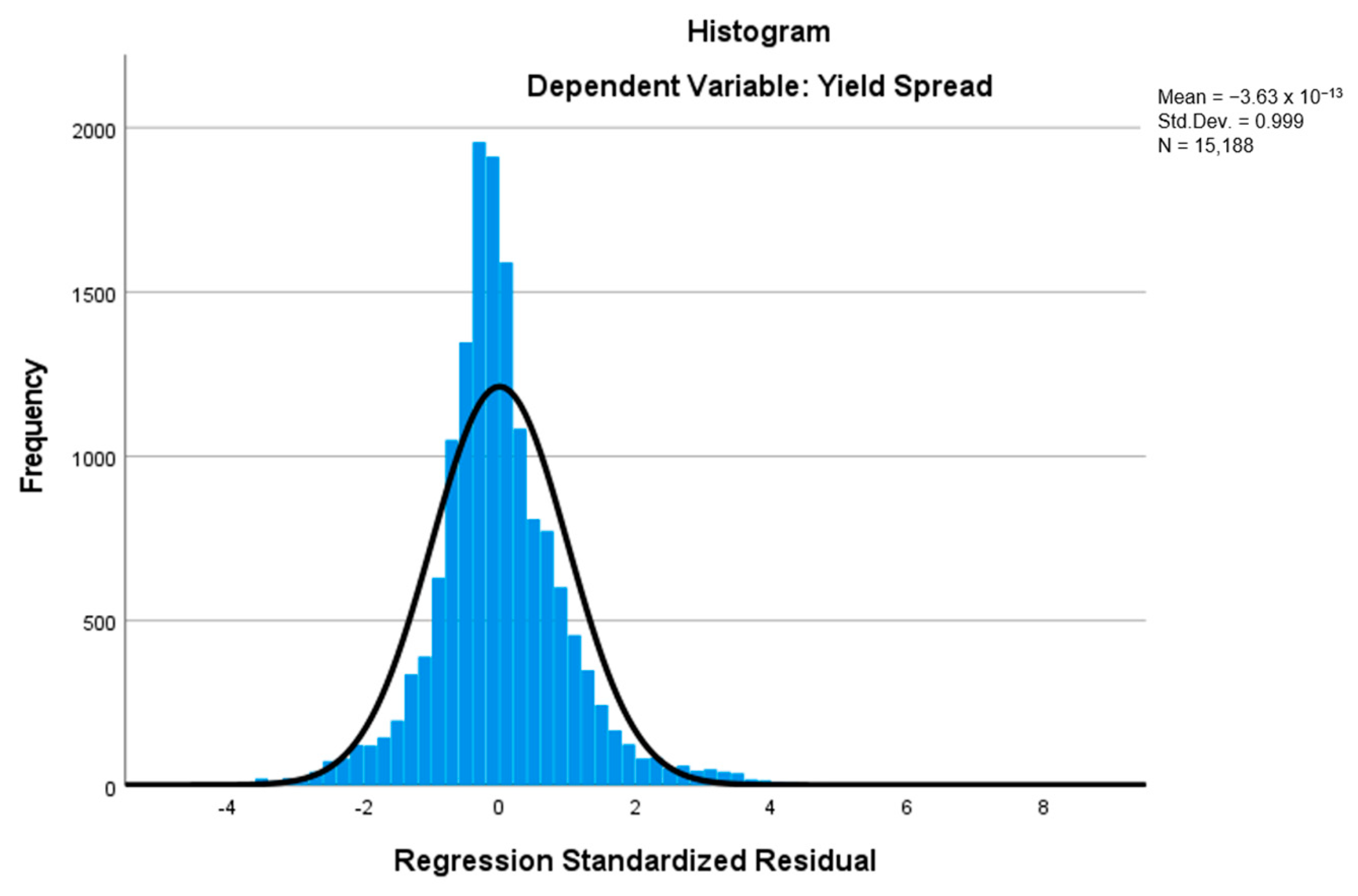

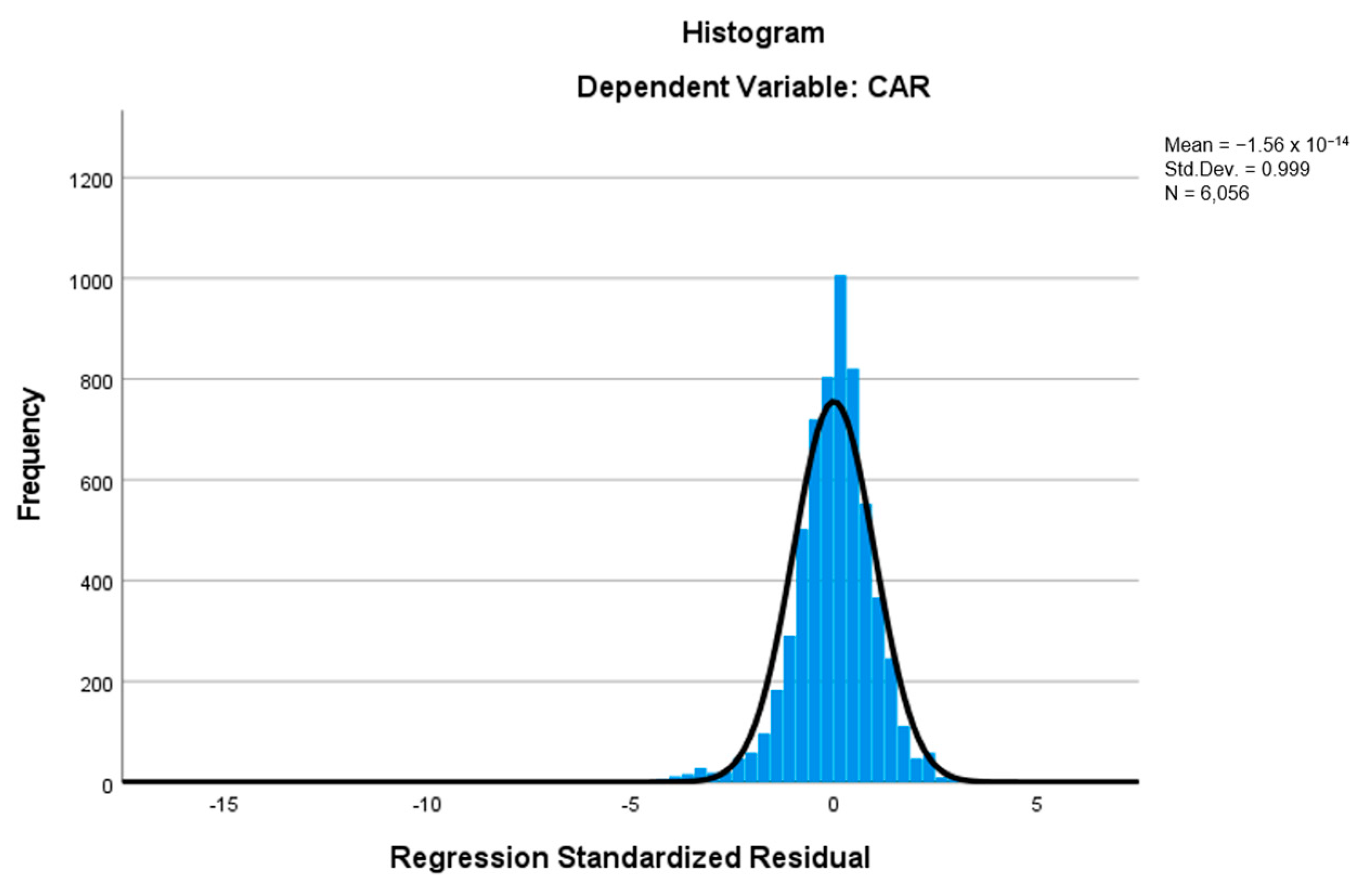

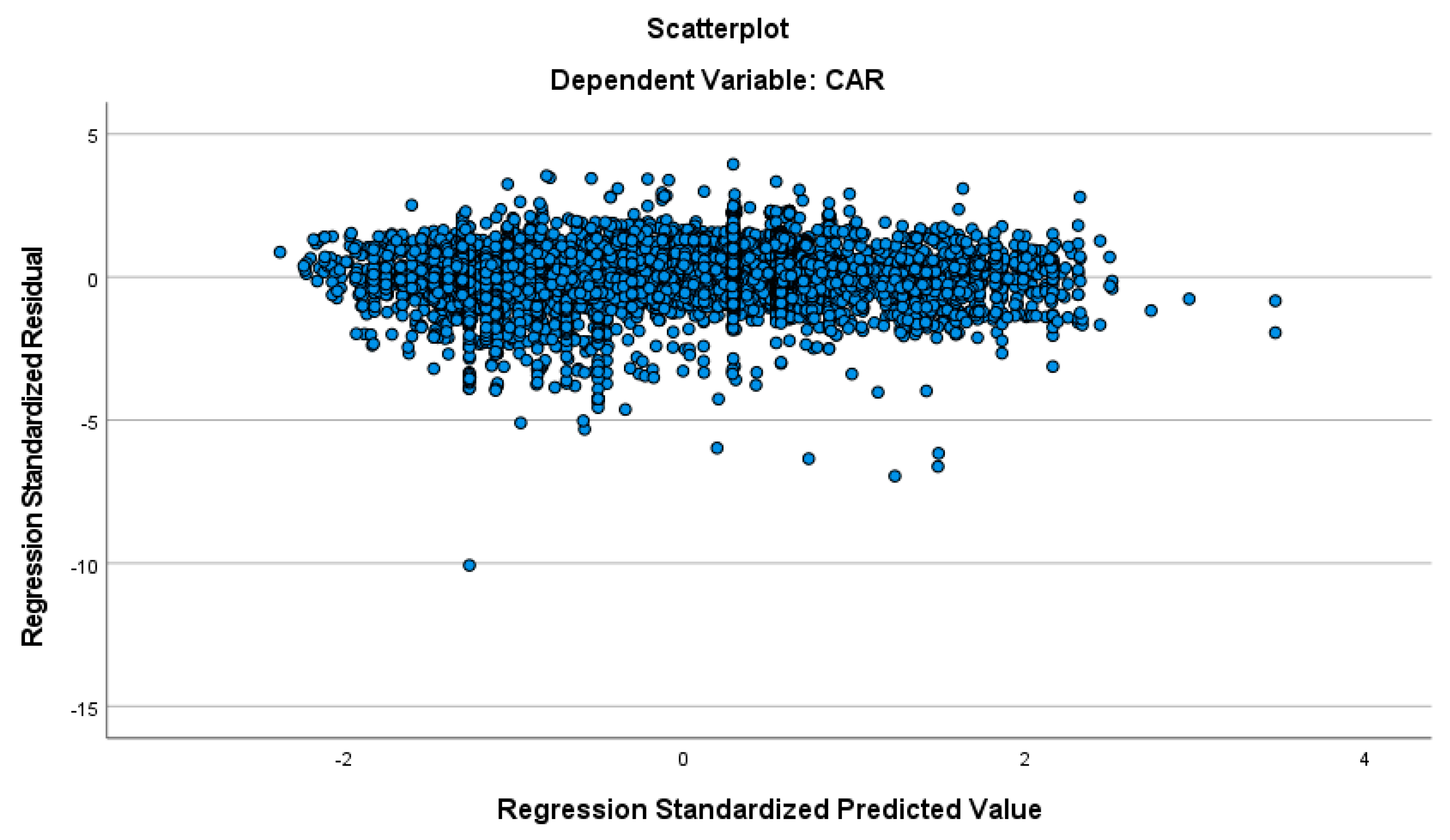

3.2. Research Model

- Yield Spread Model and Variables

- CAR Model and Variables

β6 Tangibility + β7 Leverage + β8 lsize + β9 COP26 + β10 COP27 +

β11 GreenxCOP26 + β12 GreenxCOP27 + ε

3.3. Hypothesis Testing Methods

4. Results

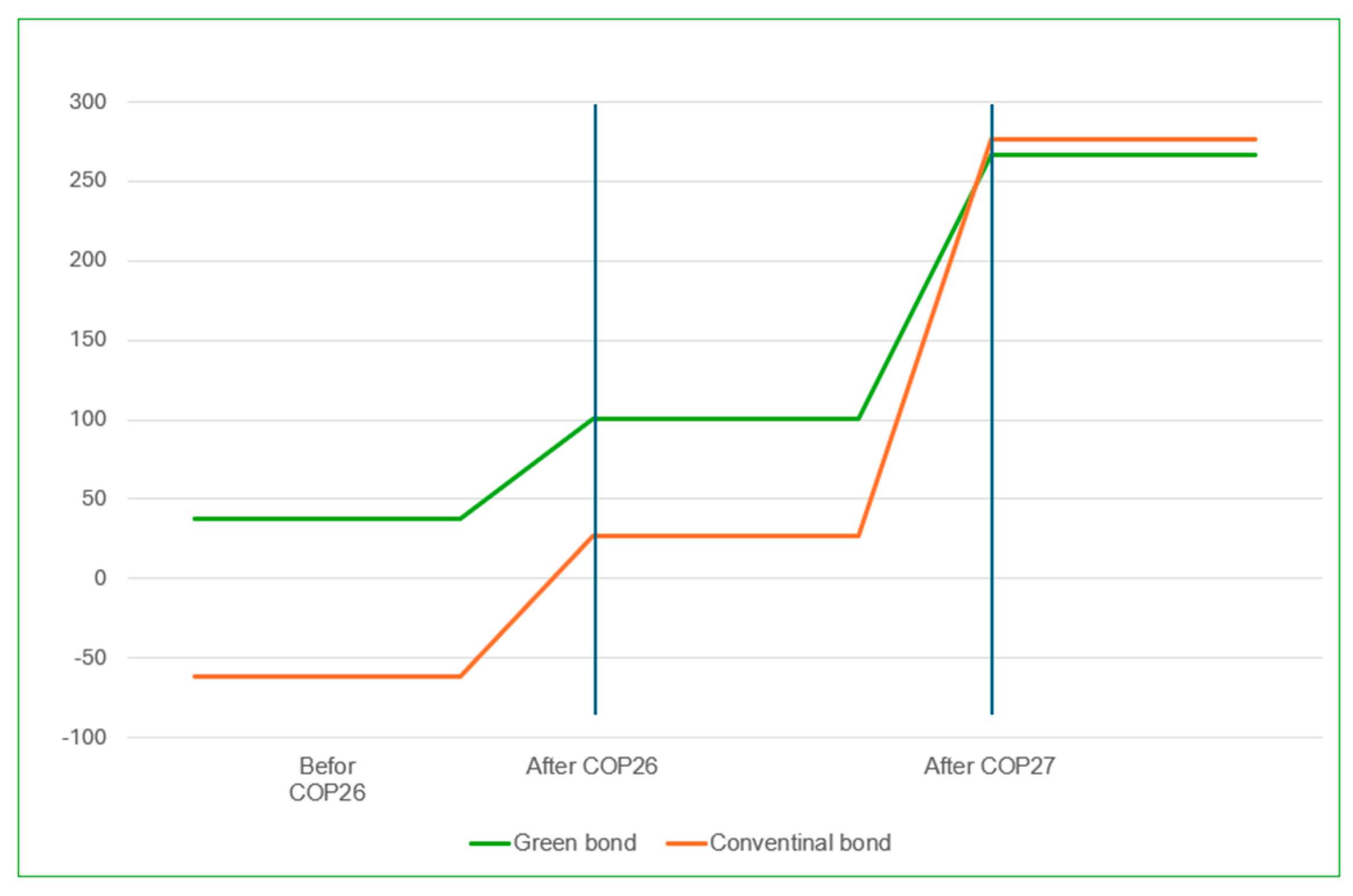

4.1. Impact of COP26 and COP27 on Investor Attention

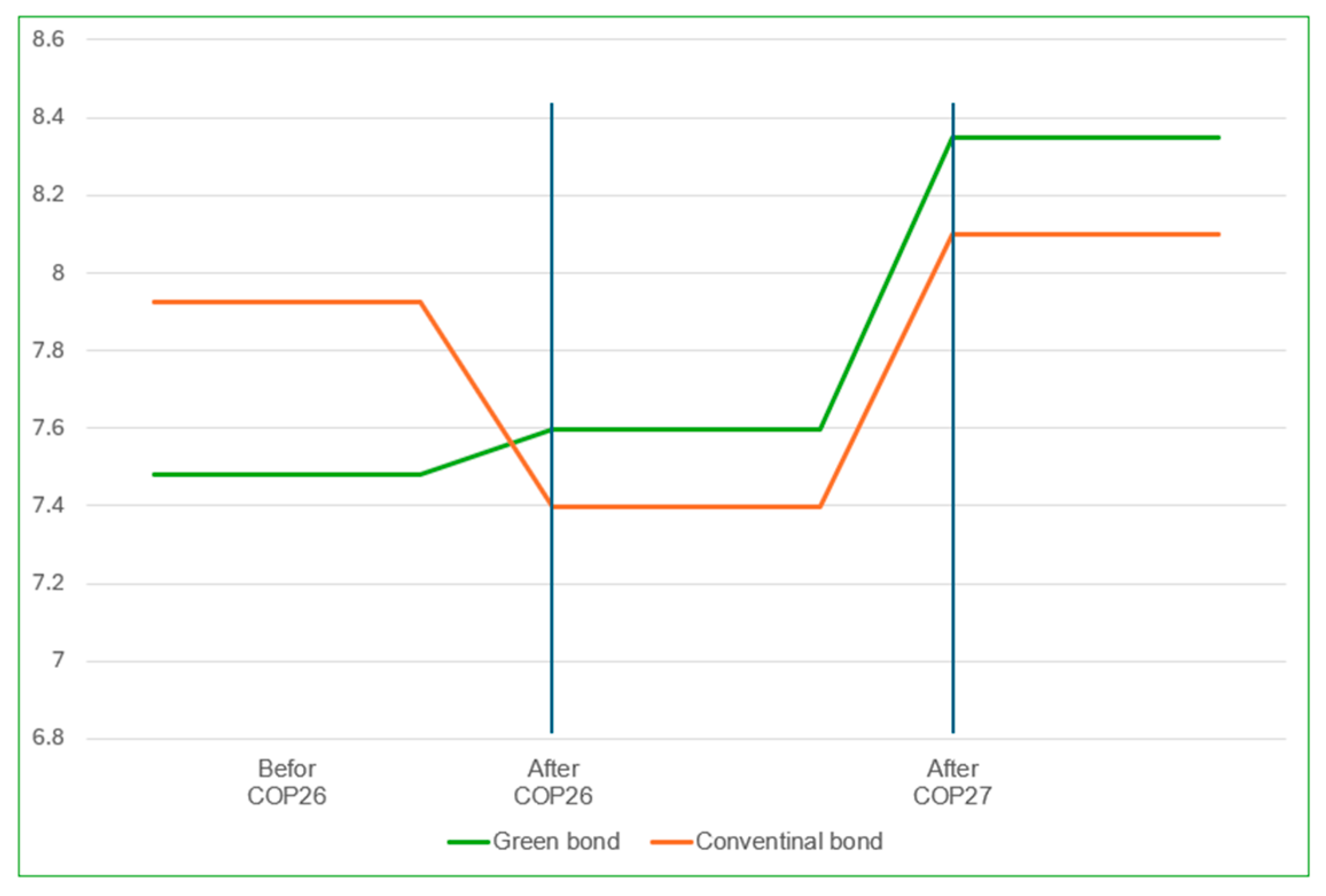

4.2. Impact of Green Bond Issuance on Yield Spread Before and After COP26 and COP27

4.3. Impact of Green Bond Issuance on Cumulative Abnormal Return and After COP26 and COP27

5. Discussion

5.1. Impact of Green Bond Issuance on Investor Yield Before and After COP26, COP27

5.1.1. Impact of Green Bond Issuance on Yield Spread Before COP26

5.1.2. Impact of Green Bond Issuance on Cumulative Abnormal Return Before COP26

5.1.3. Impact of Green Bond Issuance on Investor Yield After COP26 and COP27

5.2. Impact of Investor Attention on Investor Yield

5.3. Impact of Market Risk on Investor Yield

5.4. Impact of Callable and Putable Bond on Investor Yield

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|

| Yield spread | 15,188 | 0.002 | 27.364 | 7.847 | 4.168 |

| Green | 15,188 | 0.000 | 1.000 | 0.051 | 0.221 |

| IA | 15,188 | 1.000 | 233.000 | 9.049 | 29.298 |

| Market risk | 15,188 | 31.597 | 216.749 | 94.594 | 36.645 |

| Maturity | 15,188 | 0.000 | 77.000 | 2.334 | 4.094 |

| ln AmountIssue | 15,188 | 3.611 | 22.918 | 13.473 | 2.968 |

| Guaranteed | 15,188 | 0.000 | 1.000 | 0.023 | 0.150 |

| Callable | 15,188 | 0.000 | 1.000 | 0.129 | 0.335 |

| Putable | 15,188 | 0.000 | 1.000 | 0.002 | 0.040 |

| ROA | 15,188 | −0.141 | 0.496 | 0.012 | 0.019 |

| Tangibility | 15,188 | 0.396 | 1.000 | 0.993 | 0.037 |

| D/A | 15,188 | 0.000 | 0.910 | 0.165 | 0.089 |

| Isize | 15,188 | 18.934 | 29.379 | 24.909 | 1.846 |

| COP26 | 15,188 | 0.000 | 1.000 | 0.169 | 0.374 |

| COP27 | 15,188 | 0.000 | 1.000 | 0.762 | 0.426 |

Appendix B

| N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|

| CAR | 6056 | −3198.752% | 1140.707% | −62.137% | 321.771% |

| Green | 6056 | 0.000 | 1.000 | 0.143 | 0.350 |

| COP27 | 6056 | 0.000 | 1.000 | 0.440 | 0.496 |

| COP26 | 6056 | 0.000 | 1.000 | 0.357 | 0.479 |

| GreenxCOP27 | 6056 | 0.000 | 1.000 | 0.045 | 0.207 |

| GreenxCOP26 | 6056 | 0.000 | 1.000 | 0.030 | 0.169 |

| IA | 6056 | 1.000 | 233.000 | 28.335 | 54.449 |

| GreenxIA | 6056 | 0.000 | 233.000 | 6.664 | 29.385 |

| Market risk | 6056 | 31.597 | 216.749 | 104.315 | 44.616 |

| ROA | 6056 | −0.088 | 0.496 | 0.014 | 0.025 |

| Tangible | 6056 | 0.436 | 1.000 | 0.986 | 0.056 |

| Leverage | 6056 | 0.000 | 0.910 | 0.182 | 0.120 |

| Isize | 6056 | 18.934 | 29.342 | 25.588 | 2.131 |

References

- ICMA. Green Bond Principles. 2018. Available online: https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/green-bond-principles-gbp/?fbclid=IwY2xjawIWw6xleHRuA2FlbQIxMAABHexFn-Zw0_qQLoV65YzzYiLCFWAD13D65kRZnEY67CLqlPNFSR-nM2mhSg_aem_kwWPDKTi2XcROctryBpEbg (accessed on 15 July 2024).

- Ehlers, T.; Packer, F. Green Bond Finance and Certification. BIS Quarterly Review September. 2017. Available online: https://www.bis.org/publ/qtrpdf/r_qt1709h.htm (accessed on 18 January 2025).

- Minh, H. Vietnam Need 21 Billion USD from Greenbond for Next 10 Years. J. Financ. 2023. Available online: https://tapchitaichinh.vn/viet-nam-can-21-ty-usd-trai-phieu-xanh-cho-10-nam-toi.html (accessed on 9 December 2024).

- Brown, S.J.; Warner, J.B. Using daily stock returns: The case of event studies. J. Financ. Econ. 1985, 14, 3–31. [Google Scholar] [CrossRef]

- Cowan, A.R. Tests for cumulative abnormal returns over long periods: Simulation evidence. Int. Rev. Financ. Anal. 1993, 2, 51–68. [Google Scholar] [CrossRef]

- Armitage, S. Event study methods and evidence on their performance. J. Econ. Surv. 1995, 9, 25–52. [Google Scholar] [CrossRef]

- Mai, D. COP26 adopted the Glasgow Climate Pact. J. Nat. Resour. Environ. 2021. Available online: https://baotainguyenmoitruong.vn/hoi-nghi-cop26-thong-qua-hiep-uoc-khi-hau-glasgow-333572.html (accessed on 9 December 2024).

- Linh, K. COP27: Expectations Surpass Reality. Communist Party of Vietnam Online. 2022. Available online: https://dangcongsan.vn/the-gioi/tin-tuc/hoi-nghi-cop27-ky-vong-vuot-qua-thuc-tai-626125.html#:~:text=H%E1%BB%99i%20ngh%E1%BB%8B%20COP27%20%C4%91%C6%B0%E1%BB%A3c%20t%E1%BB%95,nh%E1%BA%A5t%20t%E1%BB%AB%20tr%C6%B0%E1%BB%9Bc%20%C4%91%E1%BA%BFn%20nay (accessed on 9 December 2024).

- Kothari, S.P.; Warner, J.B. Econometrics of event studies. In Handbook of Empirical Corporate Finance; Elsevier: Amsterdam, The Netherlands, 2007; pp. 3–36. [Google Scholar] [CrossRef]

- UNDP. Identifying the ‘Greenium’. 2022. Available online: https://www.undp.org/blog/identifying-greenium (accessed on 9 December 2024).

- Maltais, A.; Nykvist, B. Understanding the role of green bonds in advancing sustainability. J. Sustain. Financ. Investig. 2020, 1–20. [Google Scholar] [CrossRef]

- Agliardi, E.; Agliardi, R. Financing environmentally-sustainable projects with green bonds. Environ. Dev. Econ. 2019, 24, 608–623. [Google Scholar] [CrossRef]

- Zerbib, O.D. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. J. Bank. Financ. 2019, 98, 39–60. [Google Scholar] [CrossRef]

- Gianfrate, G.; Peri, M. The green advantage: Exploring the convenience of issuing green bonds. J. Clean. Prod. 2019, 219, 127–135. [Google Scholar] [CrossRef]

- Fatica, S.; Panzica, R.; Rancan, M. The pricing of green bonds: Are financial institutions special? J. Financ. Stab. 2021, 54, 100873. [Google Scholar] [CrossRef]

- Kapraun, J.; Scheins, C. (In)-credibly green: Which bonds trade at a green bond premium? In Proceedings of the Paris December 2019 Finance Meeting EUROFIDAI-ESSEC, Paris, France, 19 December 2019. [Google Scholar] [CrossRef]

- Tang, D.Y.; Zhang, Y. Do shareholders benefit from green bonds? J. Corp. Financ. 2020, 61, 101427. [Google Scholar] [CrossRef]

- Larcker, D.F.; Watts, E.M. Where’s the greenium? J. Account. Econ. 2020, 69, 101312. [Google Scholar] [CrossRef]

- Wang, J.; Chen, X.; Li, X.; Yu, J.; Zhong, R. The market reaction to green bond issuance: Evidence from China. Pac.-Basin Financ. J. 2020, 60, 101294. [Google Scholar] [CrossRef]

- Su, T.; Lin, B. The liquidity impact of Chinese green bonds spreads. Int. Rev. Econ. Financ. 2022, 82, 318–334. [Google Scholar] [CrossRef]

- Hachenberg, B.; Schiereck, D. Are green bonds priced differently from conventional bonds? J. Asset Manag. 2018, 19, 371–383. [Google Scholar] [CrossRef]

- Bachelet, M.J.; Becchetti, L.; Manfredonia, S. The green bonds premium puzzle: The role of issuer characteristics and third-party verification. Sustainability 2019, 11, 1098. [Google Scholar] [CrossRef]

- Nanayakkara, M.; Colombage, S. Do investors in Green Bond market pay a premium? Global evidence. Appl. Econ. 2019, 51, 4425–4437. [Google Scholar] [CrossRef]

- Löffler, K.U.; Petreski, A.; Stephan, A. Drivers of green bond issuance and new evidence on the “greenium”. Eurasian Econ. Rev. 2021, 11, 1–24. [Google Scholar] [CrossRef]

- Sheng, Q.; Zheng, X.; Zhong, N. Financing for sustainability: Empirical analysis of green bond premium and issuer heterogeneity. Nat. Hazards 2021, 107, 2641–2651. [Google Scholar] [CrossRef]

- Bark, J.; Lundberg, M. Shareiholder Wealth: An Event Study of Green and Non-Green Bond Issuance in Scandinavia. Bachelor’s Thesis, Lund University School of Economics and Management, Lund, Sweden, 27 May 2020. [Google Scholar]

- Verma, R.K.; Bansal, R. Stock market reaction on green-bond issue: Evidence from Indian green-bond issu-ers. Vision 2023, 27, 264–272. [Google Scholar] [CrossRef]

- Yi, X.; Bai, C.; Lyu, S.; Dai, L. The impacts of the COVID-19 pandemic on China’s green bond market. Financ. Res. Lett. 2021, 42, 101948. [Google Scholar] [CrossRef] [PubMed]

- Eckbo, B.E. Valuation effects of corporate debt offerings. J. Financ. Econ. 1986, 15, 119–151. [Google Scholar] [CrossRef]

- Jian, J.; Fan, X.; Zhao, S. The green incentives and green bonds financing under the belt and road initiative. Emerg. Mark. Financ. Trade 2022, 58, 1430–1440. [Google Scholar] [CrossRef]

- Kahneman, D. Attention and Effort (Experimental Psychology); Prentice-Hall: Englewood Cliffs, NJ, USA, 1973. [Google Scholar]

- Barber, B.M.; Odean, T.; Zhu, N. Do retail trades move markets? Rev. Financ. Stud. 2008, 22, 151–186. [Google Scholar] [CrossRef]

- Dinh, H.P.; Tran, K.N.; Van Cao, T.; Vo, L.T.; Ngo, T.Q. Role of eco-financing in COP26 goals: Empirical evidence from ASEAN countries. Cuad. Econ. 2022, 45, 24–33. [Google Scholar]

- Ma, Q.; Liu, X.; Wang, W.G.; Xue, J. Natural resources extraction and COP26 target: Evaluating the role of green finance. Resour. Policy 2023, 82, 103432. [Google Scholar] [CrossRef]

- Sajjad, S.; Bhuiyan, R.A.; Dwyer, R.J.; Bashir, A.; Zhang, C. Balancing prosperity and sustainability: Unraveling financial risks and green finance through a COP27 lens. Stud. Econ. Financ. 2024, 41, 545–570. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A. Price connectedness between green bond and financial markets. Econ. Model. 2020, 88, 25–38. [Google Scholar] [CrossRef]

- Nayak, S. Investor sentiment and corporate bond yield spreads. Rev. Behav. Financ. 2010, 2, 59–80. [Google Scholar] [CrossRef]

- Da, Z.; Engelberg, J.; Gao, P. In search of attention. J. Financ. 2011, 66, 1461–1499. [Google Scholar] [CrossRef]

- Liu, L.X.; Sherman, A.E.; Zhang, Y. The long-run role of the media: Evidence from initial public offerings. Manag. Sci. 2014, 60, 1945–1964. [Google Scholar] [CrossRef]

- Liu, L.X.; Lu, R.; Sherman, A.E.; Zhang, Y. IPO underpricing and limited attention: Theory and evidence. J. Bank. Financ. 2023, 154, 106932. [Google Scholar] [CrossRef]

- Yang, D.; Ma, T.; Wang, Y.; Wang, G. Does investor attention affect stock trading and returns? Evidence from publicly listed firms in China. J. Behav. Financ. 2021, 22, 368–381. [Google Scholar] [CrossRef]

- Pham, L.; Cepni, O. Extreme directional spillovers between investor attention and green bond markets. Int. Rev. Econ. Financ. 2022, 80, 186–210. [Google Scholar] [CrossRef]

- MacAskill, S.; Roca, E.; Liu, B.; Stewart, R.A.; Sahin, O. Is there a green premium in the green bond market? Systematic literature review revealing premium determinants. J. Clean. Prod. 2021, 280, 124491. [Google Scholar] [CrossRef]

- Pham, L.; Huynh, T.L.D. How does investor attention influence the green bond market? Financ. Res. Lett. 2020, 35, 101533. [Google Scholar] [CrossRef]

- Mayo, H.B. Investments: An introduction; Cengage Learning: Singapore, 2014. [Google Scholar]

- Dong, X.; Xiong, Y.; Nie, S.; Yoon, S.M. Can bonds hedge stock market risks? Green bonds vs conventional bonds. Financ. Res. Lett. 2023, 52, 103367. [Google Scholar] [CrossRef]

- Jin, J.; Han, L.; Wu, L.; Zeng, H. The hedging effect of green bonds on carbon market risk. Int. Rev. Financ. Anal. 2020, 71, 101509. [Google Scholar] [CrossRef]

- Ejaz, R.; Ashraf, S.; Hassan, A.; Gupta, A. An empirical investigation of market risk, dependence structure, and portfolio management between green bonds and international financial markets. J. Clean. Prod. 2022, 365, 132666. [Google Scholar] [CrossRef]

- Collin-Dufresn, P.; Goldstein, R.S.; Martin, J.S. The determinants of credit spread changes. J. Financ. 2001, 56, 2177–2207. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Taksler, G.B. Equity volatility and corporate bond yields. J. Financ. 2003, 58, 2321–2350. [Google Scholar] [CrossRef]

- Thu, T.T.K. Principle of Statistics; National Economics University: Hanoi, Vietnam, 2015. [Google Scholar]

- Nguyen, N.M.; Luu, N.H.; Hoang, A.; Nguyen MT, N. Environmental impacts of green bonds in cross-countries analysis: A moderating effect of institutional quality. J. Financ. Econ. Policy 2023, 15, 313–336. [Google Scholar] [CrossRef]

- Hyun, S.; Park, D.; Tian, S. The price of going green: The role of greenness in green bond markets. Account. Financ. 2020, 60, 73–95. [Google Scholar] [CrossRef]

- Zhang, R.; Li, Y.; Liu, Y. Green bond issuance and corporate cost of capital. Pac.-Basin Financ. J. 2021, 69, 101626. [Google Scholar] [CrossRef]

- Zhou, X.; Cui, Y. Green bonds, corporate performance, and corporate social responsibility. Sustainability 2019, 11, 6881. [Google Scholar] [CrossRef]

- Trompeter, L. Green is good: How green bonds cultivated into wall street’s environmental paradox. Sustain. Dev. Law Policy Brief 2017, 17, 3. [Google Scholar]

- Guntay, L.; Prabhala, N.; Unal, H. Callable bonds, interest-rate risk, and the supply side of hedging. Interest-Rate Risk Supply Side Hedging 2004. [Google Scholar] [CrossRef]

- Dunetz, M.L.; Mahoney, J.M. (Using duration and convexity in the analysis of callable bonds. Financ. Anal. J. 1988, 44, 53–72. [Google Scholar] [CrossRef]

- Chen, Z.; Mao, C.X.; Wang, Y. Why firms issue callable bonds: Hedging investment uncertainty. J. Corp. Financ. 2010, 16, 588–607. [Google Scholar] [CrossRef]

- Qiu, X.; Su, Z.Q.; Xiao, Z. Do social ties matter for corporate bond yield spreads? Evidence from China. Corp. Gov. Int. Rev. 2019, 27, 427–457. [Google Scholar] [CrossRef]

- Liu, M.; Magnan, M. Conditional conservatism and the yield spread of corporate bond issues. Rev. Quant. Financ. Account. 2016, 46, 847–879. [Google Scholar] [CrossRef]

| Variables | Description | Data Source |

|---|---|---|

| Green (dummy variable) | Green = 1 if the green bond Green = 0 if a conventional bond | Refinitiv Eikon |

| IA (lagged variable) | Investor attention: attention of investors to green bond | Google Trend |

| GreenxIA | Interaction variable between green bond and IA | |

| Market risk | Market risk measured by the standard deviation of the S&P Global 1200 index | S&P Global |

| Maturity | Maturity of the bond | Refinitiv Eikon |

| ln AmountIssue | Natural logarithm of the issued bond volume | Refinitiv Eikon |

| Guaranteed (dummy variable) | Guaranteed = 1 if the bond is a guaranteed bond Guaranteed = 0 if the bond is not a guaranteed bond | Refinitiv Eikon |

| Callable (dummy variable) | Callable = 1 if the bond is a callable bond Callable = 0 if the bond is not a callable bond | Refinitiv Eikon |

| Putable (dummy variable) | Putable = 1 if the bond is a Putable bond Putable = 0 if the bond is not a Putable bond | Refinitiv Eikon |

| ROA (lagged variable) | Return on Assets | Refinitiv Eikon |

| Tangibility (lagged variable) | Tangible Assets to Total Assets | Refinitiv Eikon |

| D/A (lagged variable) | Debt to Total Assets | Refinitiv Eikon |

| lsize (lagged variable) | Natural Logarithm of Total Assets | Refinitiv Eikon |

| COP26 (dummy variable) | Period = 0 if the firm issues green bonds before COP26 or after COP27 Period = 1 if the firm issues green bonds during or after COP26 | |

| COP27 (dummy variable) | Period = 0 if the firm issues green bonds before COP27 Period = 1 if the firm issues green bonds during or after COP27 | |

| Green×COP26 | Interaction variable between green bond and COP26 | |

| Green×COP27 | Interaction variable between green bond and COP27 |

| Variables | Description | Data Source |

|---|---|---|

| Green (dummy variable) | Green = 1 if the green bond Green = 0 if a conventional bond | Refinitiv Eikon |

| IA (lagged variable) | Investor attention: attention of investors to green bond | Google Trend |

| GreenxIA | Interaction variable between green bond and IA | |

| Market risk | Market risk measured by the standard deviation of the S&P Global 1200 index | S&P Global |

| ROA (lagged variable) | Return on Assets | Refinitiv Eikon |

| Tangibility (lagged variable) | Tangible Assets to Total Assets | Refinitiv Eikon |

| Leverage = D/A (lagged variable) | Debt to Total Assets | Refinitiv Eikon |

| lsize (lagged variable) | Natural Logarithm of Total Assets | Refinitiv Eikon |

| COP26 (dummy variable) | Period = 0 if the firm issues green bonds before COP26 or after COP27 Period = 1 if the firm issues green bonds during or after COP26 | |

| COP27 (dummy variable) | Period = 0 if the firm issues green bonds before COP27 Period = 1 if the firm issues green bonds during or after COP27 | |

| GreenxCOP26 | Interaction variable between green bond and COP26 | |

| GreenxCOP27 | Interaction variable between green bond and COP27 |

| N | Range | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|---|

| Investor attention to green bonds (worldwide) | 157 | 94 | 6 | 100 | 23.83 | 12.985 |

| Valid N (listwise) | 157 |

| B | Std. Error | Beta | VIF | ||

|---|---|---|---|---|---|

| (Constant) | 28.981 *** | 0.746 | |||

| Green bond | −0.445 ** | 0.217 | −0.024 | 5.291 | |

| IA-1 | −0.012 *** | 0.001 | −0.085 | 1.377 | |

| GreenxIA | 0.003 | 0.002 | 0.006 | 1.222 | |

| Market risk | 0.009 *** | 0.001 | 0.077 | 1.558 | |

| Maturity | −0.095 *** | 0.007 | −0.093 | 1.763 | |

| ln amount | −0.490 *** | 0.010 | −0.349 | 1.887 | |

| Guaranteed | 1.942 *** | 0.145 | 0.070 | 1.088 | |

| Callable | −1.250 *** | 0.081 | −0.101 | 1.708 | |

| Putable | −1.226 ** | 0.533 | −0.012 | 1.035 | |

| ROA | −0.162 *** | 0.012 | −0.074 | 1.145 | |

| Tangibility | 3.355 *** | 0.647 | 0.029 | 1.293 | |

| D/A | −8.188 *** | 0.272 | −0.174 | 1.341 | |

| Isize | −0.672 *** | 0.017 | −0.298 | 2.162 | |

| COP26 | −0.528 *** | 0.116 | −0.047 | 4.371 | |

| COP27 | 0.176 * | 0.100 | 0.018 | 4.154 | |

| GreenxCOP26 | 0.646 ** | 0.272 | 0.021 | 3.014 | |

| GreenxCOP27 | 0.692 ** | 0.259 | 0.025 | 3.397 | |

| a. Dependent variable: yield spread b. ***, **, and * indicate significance levels at 1%, 5%, and 10%, respectively c. Durbin–Watson: 1.301 d. F statistic: 1468.353 *** | |||||

| B | Std. Error | Beta | VIF | ||

|---|---|---|---|---|---|

| (Constant) | −1014.939 *** | 99.890 | |||

| Green bond | 99.058 *** | 20.856 | 0.108 | 3.688 | |

| Period COP27 | 338.284 *** | 13.825 | 0.522 | 3.268 | |

| Period COP26 | 87.910 *** | 14.802 | 0.131 | 3.488 | |

| GreenxCOP27 | −109.659 *** | 26.979 | −0.071 | 2.174 | |

| GreenxCOP26 | −24.445 | 29.760 | −0.013 | 1.763 | |

| IA | 0.456 *** | 0.088 | 0.077 | 1.594 | |

| GreenxIA | −0.629 *** | 0.178 | −0.057 | 1.890 | |

| Market risk | 0.828 *** | 0.102 | 0.115 | 1.426 | |

| ROA | 699.748 *** | 166.061 | 0.055 | 1.218 | |

| Tangibility | 114.707 | 75.110 | 0.020 | 1.233 | |

| Leverage | 164.410 *** | 36.647 | 0.062 | 1.350 | |

| Isize | 20.170 *** | 2.164 | 0.134 | 1.475 | |

| a. Dependent variable: CAR b. *** indicate significance levels at 1% c. Durbin–Watson: 1.441 d. F statistic: 95.021 *** | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hong, N.D.; Nguyen, V.P.; Hong, Q.L.; Duc, M.N.N.; Hien, H.N.P.; Yen, N.H.; Mai, V.T. Impact of COP26 and COP27 Events on Investor Attention and Investor Yield to Green Bonds. Sustainability 2025, 17, 1574. https://doi.org/10.3390/su17041574

Hong ND, Nguyen VP, Hong QL, Duc MNN, Hien HNP, Yen NH, Mai VT. Impact of COP26 and COP27 Events on Investor Attention and Investor Yield to Green Bonds. Sustainability. 2025; 17(4):1574. https://doi.org/10.3390/su17041574

Chicago/Turabian StyleHong, Nhung Do, Vu Pham Nguyen, Quy Le Hong, Minh Nguyen Nhu Duc, Hau Nguyen Phan Hien, Nhi Han Yen, and Van Trinh Mai. 2025. "Impact of COP26 and COP27 Events on Investor Attention and Investor Yield to Green Bonds" Sustainability 17, no. 4: 1574. https://doi.org/10.3390/su17041574

APA StyleHong, N. D., Nguyen, V. P., Hong, Q. L., Duc, M. N. N., Hien, H. N. P., Yen, N. H., & Mai, V. T. (2025). Impact of COP26 and COP27 Events on Investor Attention and Investor Yield to Green Bonds. Sustainability, 17(4), 1574. https://doi.org/10.3390/su17041574