Abstract

This study investigates the relationship between educational economic factors and institutional sustainability performance in Saudi public universities, examining the mediating role of green management practices. Using data from 168 respondents across three Saudi public universities, we employed a quantitative approach through structured questionnaires measuring educational economic factors, green management practices, and institutional sustainability performance. PLS-SEM analysis revealed significant direct effects of educational economic factors on sustainability performance, with economic incentive programs demonstrating the strongest influence (β = 0.465, p < 0.001). Green management practices exhibited significant mediating effects, notably between financial resource allocation and sustainability performance (β = 0.191, p < 0.001). The model explains 61.6% of the variance in sustainability performance. The findings provide insights into the dynamics of sustainability implementation in Saudi higher education institutions, particularly highlighting the crucial mediating role of green management practices in translating economic initiatives into sustainability outcomes. While the study’s focus on three Saudi public universities may limit generalizability, it contributes to understanding sustainability implementation within Saudi Vision 2030’s environmental framework. Future research opportunities include expanding to private institutions, incorporating additional geographical regions, and implementing longitudinal studies to track sustainability performance evolution.

1. Introduction

Sustainability in higher education has become increasingly critical as institutions worldwide grapple with environmental challenges and economic constraints. Educational economic factors play a vital role in shaping institutional sustainability performance, particularly through resource allocation, cost efficiency, green technology investments, and incentive programs [1,2]. This relationship becomes especially significant in developing countries where resources must be carefully balanced against environmental objectives, as highlighted by recent studies on sustainable management practices in higher education [3,4,5].

Contemporary educational systems increasingly recognize the importance of integrating sustainability principles into institutional frameworks [3,4,6]. Recent research on Education 4.0 examines the relationship between environmental awareness and professional competencies in modern educational contexts [2,7]. Studies have documented the role of educational institutions in shaping labor market outcomes through the development of sustainability-oriented skills and knowledge [1,8,9]. Building on this literature, this research investigates the relationship between economic factors and sustainability performance in educational institutions, with particular attention paid to the implementation of Vision 2030’s educational development objectives in Saudi Arabia [5,10,11].

The integration of sustainability practices into educational institutions involves complex interactions between economic resources and environmental initiatives. Ref. [12] emphasize that universities face unique challenges in adapting to sustainability requirements while maintaining operational efficiency. This adaptation process is further complicated by the need to implement green technology solutions, as discussed by ref. [13], who highlight the importance of environmentally clean energy technologies in educational settings.

The role of economic factors in driving sustainability performance has gained increased attention with the emergence of Industry 4.0. Ref. [7] demonstrates how the implementation of green principles in institutional systems requires substantial economic support and strategic planning. This is particularly relevant in the context of Saudi Arabia’s Vision 2030, which emphasizes environmental sustainability as a key pillar of national development. Recent research [8] suggests that entrepreneurship education and resource-based approaches are crucial for fostering green initiatives in educational institutions.

Moreover, the financial aspects of sustainability implementation extend beyond mere resource allocation. As ref. [14] argues, higher education institutions play a crucial role in local sustainability initiatives, necessitating careful consideration of economic factors in their environmental strategies. This alignment between financial resources and environmental objectives requires sophisticated management approaches, as demonstrated by ref. [15], who examine how institutional resources can be strategically leveraged through proper management frameworks. The integration of economic considerations with sustainability goals has become particularly relevant as universities seek to optimize their environmental impact while maintaining financial viability [16].

While previous research has examined various aspects of sustainability in higher education, the mediating role of green management practices between economic factors and sustainability performance remains underexplored, particularly in the Saudi Arabian context. Studies [17,18] have highlighted the importance of management practices in sustainability outcomes, but the specific mechanisms through which economic factors influence these relationships require further investigation. This gap is particularly significant given the increasing emphasis on environmental performance in higher education institutions [10,19].

The transformation of educational institutions toward sustainability requires a comprehensive understanding of how economic factors interact with management practices. Recent research [20] indicates that green intellectual capital significantly influences environmental performance, while ref. [21] demonstrates the crucial mediating role of environmental performance in the relationship between management practices and financial outcomes.

This research contributes to the sustainability literature in several meaningful ways. The study examines the mediating role of green management practices between educational economic factors and institutional sustainability performance in Saudi public universities, addressing a gap in current research. It develops an integrated framework that combines a resource-based view and institutional theory to analyze sustainability performance in higher education institutions. The research provides insights into the implementation of Vision 2030’s environmental objectives through institutional economic mechanisms in Saudi universities. Additionally, the study examines how specific economic factors, including financial resource allocation, cost efficiency measures, green technology investments, and economic incentive programs, influence sustainability outcomes through green management practices.

The primary objective is to investigate the impact of educational economic factors on institutional sustainability performance, examining the mediating role of green management practices. This objective extends current literature responding to calls from refs. [10,22] for research linking economic investments to sustainability outcomes in educational contexts. The study provides evidence-based insights for implementing Vision 2030’s sustainability directives through integrated economic and management approaches.

2. Literature Review and Hypothesis

2.1. Educational Economic Factors in Higher Education Sustainability

Sustainability in higher education institutions is increasingly influenced by various educational economic factors, particularly financial resource allocation, profitability, green technological investments, and economic incentives. Ref. [1] demonstrates how organizational resources significantly impact sustainable energy practices in higher education, especially in developing countries. Ref. [2] further emphasizes the importance of integrating these economic factors through a whole-institution approach to sustainability.

The allocation of financial resources plays a crucial role in determining the sustainability initiatives’ scope and longevity. Ref. [23] highlights the necessity of adequate financial support for implementing sustainable practices in Portuguese higher education institutions. This is complemented by ref. [12], who discuss how institutions must balance operational costs while implementing sustainability measures that often require significant initial investments.

Investments in green technology are essential to promote a sustainable educational environment. Ref. [13] argues that education on clean energy technologies improves the ability of institutions to adopt sustainable practices, which aligns more with the conclusions of ref. [24] concerning the positive relationship between green innovation and performance, supported by financial development and appropriate regulatory executives. In addition, ref. [7] illustrates how the implementation of the principles of green chemistry can help achieve sustainability objectives, in particular thanks to a circular economic approach.

Economic incentives serve as an engine for institutions to adopt sustainability initiatives. Ref. [14] highlights the local impacts of sustainability initiatives facilitated by economic incentives, which can encourage institutions to actively participate in community sustainability efforts. Awareness of students of sustainability initiatives can be improved thanks to effective economic strategies that promote involvement. In summary, the integration of these economic factors of education is essential to advance sustainability in higher education establishments, and meeting the challenges inherent in these fields can lead to the more effective implementation of sustainable practices [3,4,25].

2.2. Green Management Practices in Educational Institutions

Ecological management practices in higher education institutions (IEIs) are increasingly recognized as vital components to improve sustainability performance. The use of resource-based vision view (RBV) and institutional theory provides a robust lens through which to analyze these practices. The RBV postulates that unique resources and capabilities can lead to competitive advantages, which is particularly highlighted for IEIs with the aim of implementing effective green initiatives [8,26]. For example, ref. [15] illustrates how specific institutional abilities allow universities to adopt sustainable practices that transcend mere fulfillment, thus improving environmental performance.

In addition, institutional theory emphasizes the role of external pressures in the configuration of institutional behaviors. Ref. [27] highlights that compliance with environmental regulations can significantly influence organizational performance metrics in emerging economies. This statement supports the notion that IEIs, through the lens of institutional theory, systematically respond to these pressures, thus improving their sustainability results [21,28,29,30].

Ref. [31] underline the interaction between institutional promoters and sustainability practices, suggesting that the integration of RBV with institutional theory can create a more comprehensive understanding of green management. Similarly, ref. [32] proposes a model that highlights the complex dynamic in biomass energy supply chains, offering relevant ideas for IEI resource management strategies.

2.3. Educational Economic Factors and Institutional Sustainability Performance

The financial foundations of educational institutions significantly influence their sustainability services, particularly through financing mechanisms and resource allocation strategies. Recent research [1] demonstrates how institutional pressures and organizational resources affect sustainable energy orientation in higher education institutions, especially in developing countries. This perspective is reinforced by ref. [2], who advocate for a whole-institution approach to sustainability integration, emphasizing the importance of systems thinking in higher education institutions.

Ref. [33] highlights the role of e-learning services in promoting sustainable learning outcomes, suggesting that adequate financing for technological integration can improve academic performance and sustainability. Additionally, ref. [34] underscores the need for strategic resource allocation toward sustainability initiatives in higher education, emphasizing that investments in sustainability practices can enhance institutional resilience.

In the financial sector, ref. [35] show that green finance is essential for its sustainability services, illustrating parallels in educational contexts in which funding can facilitate ecological practices. Ref. [16] support this notion by showing that good government in the allocation of resources is related to improved sustainability results.

In addition, the emphasis on corporate sustainability extends to educational environments, in which ref. [36] claims that education for leadership models institutional services regarding sustainability efforts. Ref. [37] discusses how green entrepreneurial orientation improves organizational performance, which is relevant when considering how educational entities can adopt similar approaches. Finally, ref. [20] indicates that intellectual capital significantly influences environmental performance, strengthening the idea that educational institutions must exploit knowledge for the results of sustainability. Through these objectives, it is evident that educational economic factors are fundamental to support services in institutional contexts.

The present study examines the relationship between Educational Economic Factors (EEFs) and Institutional Sustainability Performance (ISP) through the subsequent primary and secondary hypotheses:

H1:

Educational Economic Factors (EEFs) positively influence the Institutional Sustainability Performance (ISP) of public universities in the KSA.

H1a:

Financial Resource Allocation (FRA) positively influences the Institutional Sustainability Performance (ISP) of public universities in the KSA.

H1b:

Cost Efficiency Measures (CEMs) positively influence the Institutional Sustainability Performance (ISP) of public universities in the KSA.

H1c:

Investment in Green Technology (IGT) positively influences the Institutional Sustainability Performance (ISP) of public universities in the KSA.

H1d:

Economic Incentive Programs (EIPs) positively influence the Institutional Sustainability Performance (ISP) of public universities in the KSA.

2.4. Educational Economic Factors and Green Management Practices

The adoption of green management practices is intricately linked to various educational and economic factors that inform organizational strategies balancing financial profitability and environmental sustainability. Ref. [22] demonstrates that environmental management positively correlates with stable economic performance, highlighting green innovation’s crucial mediating role. Similarly, ref. [38] emphasizes that green human resources practices significantly improve business sustainability through enhanced environmental performance.

The advent of Industry 4.0 has necessitated new sustainability approaches in institutional management. Ref. [39] emphasizes that strategic orientations form the foundation for successful green supply chain management implementation. This is further supported by ref. [40], who provide empirical evidence linking green supply chain practices to improved organizational performance among Indian manufacturers.

In the higher education context specifically, ref. [17] found that management support and green culture significantly mediate environmental performance outcomes in universities. Ref. [18] identified key strategies for developing sustainable communities within higher education institutions, while ref. [10] demonstrated how environmental and employee performance mediates the relationship between green practices and organizational sustainability.

The present study examines the relationship between Educational Economic Factors (EEFs) and Green Management Practices (GMPs) through the subsequent primary and secondary hypotheses:

H2:

Educational Economic Factors (EEFs) positively influence the Green Management Practices (GMPs) of public universities in the KSA.

H2a:

Financial Resource Allocation (FRA) positively influences the Green Management Practices (GMPs) of public universities in the KSA.

H2b:

Cost Efficiency Measures (CEMs) positively influence the Green Management Practices (GMPs) of public universities in the KSA.

H2c:

Investment in Green Technology (IGT) positively influences the Green Management Practices (GMPs) of public universities in the KSA.

H2d:

Economic Incentive Programs (EIPs) positively influence the Green Management Practices (GMPs) of public universities in the KSA.

2.5. Green Management Practices Have a Mediating Effect on Institutional Sustainability Performance

Green management practices (GMPs) play a crucial role in the mediation of the relationship between the financial allocation of resources and the performance of institutional sustainability. Effective allocation of financial resources to environmental sustainability initiatives often improves the performance of the sustainability of an organization, with GMPs acting as a pivot bridge in this relationship [41]. The alignment of financial investments in green practices not only promotes compliance with environmental regulations but also improves the reputation of businesses, which is increasingly vital for long-term performance [42]. In addition, the integration of green practices leads to an improvement in efficiency and cost savings, contributing positively to financial results while supporting the objectives of sustainability [43].

In addition, GMPs’ mediation role is still aggravated by the non-linear dynamics between business environmental performance and economic performance, which suggests that the effectiveness of green technological innovation rests considerably on the strategic allocation of resources financial [19]. Ref. [44] points out that companies that adopt robust environmental management practices tend to experience higher financial performance, partly due to improved ESG (environmental, social, and governance) disclosure. Thus, this literature suggests that organizations seeking to optimize their performance of institutional sustainability must strategically align their allocation of financial resources with effective green management practices to facilitate environmental and economic advantages.

The present study examines the mediating role of Green Management Practices (GMPs) between Educational Economic Factors (EEFs) and Institutional Sustainability Performance (ISP) through the subsequent primary and secondary hypotheses:

H3:

Green Management Practices (GMPs) mediate the relationship between Educational Economic Factors (EEFs) and the Institutional Sustainability Performance (ISP) of public universities in the KSA.

H3a:

Green Management Practices (GMPs) mediate the relationship between Financial Resource Allocation (FRA) and the Institutional Sustainability Performance (ISP) of public universities in the KSA.

H3b:

Green Management Practices (GMPs) mediate the relationship between Cost Efficiency Measures (CEMs) and the Institutional Sustainability Performance (ISP) of public universities in the KSA.

H3c:

Green Management Practices (GMPs) mediate the relationship between Investment in Green Technology (IGT) and the Institutional Sustainability Performance (ISP) of public universities in the KSA.

H3d:

Green Management Practices (GMPs) mediate the relationship between Economic Incentive Programs (EIPs) and the Institutional Sustainability Performance (ISP) of public universities in the KSA.

2.6. Research Framework

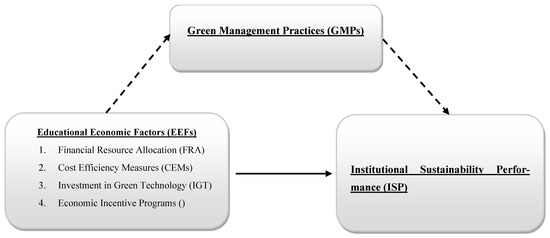

The framework of this study, including the variables examined, is aligned with the study objectives (Figure 1). Although prior studies have addressed the relationship between economic factors and sustainability performance in various sectors, little attention has been paid to the mediating role of green management practices in educational institutions, and such information is lacking for the KSA. The present study is among the first to comprehensively examine the influence of educational economic factors on institutional sustainability performance and the mediating effect of green management practices in Saudi public universities.

Figure 1.

Research framework: The model illustrates that Educational Economic Factors (EEFs) directly influence Institutional Sustainability Performance (ISP) (indicated by the solid arrow). Additionally, Green Management Practices (GMPs) act as a mediating variable. This mediating relationship is influenced by factors within Educational Economic Factors, such as Financial Resource Allocation (FRA), Cost Efficiency Measures (CEMs), Investment in Green Technology (IGT), and Economic Incentive Programs (EIPs). The dashed arrows indicate that GMPs mediate the indirect effect of EEFs on ISP.

This framework investigates:

- The direct relationship between Educational Economic Factors (EEFs) and Institutional Sustainability Performance (ISP)

- The influence of EEFs on Green Management Practices (GMPs)

- The mediating role of GMPs in the relationship between EEFs and ISP

The framework specifically examines four key economic factors: Financial Resource Allocation (FRA), Cost Efficiency Measures (CEMs), Investment in Green Technology (IGT), and Economic Incentive Programs (EIPs).

3. Materials and Methods

3.1. Subjects

The study sample included 168 respondents from leadership positions and faculty members at three Saudi public universities: Jouf University, Hail University, and Northern Border University. A combination of purposive and stratified random sampling methods ensured representative distribution across leaders, department heads, faculty members, financial managers, sustainability officers, and facility managers. Initial purposive sampling targeted key positions involved in sustainability and financial decision-making, followed by stratified random sampling based on position, university affiliation, and management level.

Sample size determination followed both statistical and practical considerations. A priori power analysis using G*Power 3.1 software indicated a minimum requirement of 129 respondents to detect medium effect sizes (f2 = 0.15) with 80% power at a 5% significance level for the model’s four predictor variables. The final sample of 168 respondents (72% response rate from 233 distributed questionnaires) exceeded this requirement, ensuring adequate statistical power for hypothesis testing.

Partial Least Squares Structural Equation Modeling (PLS-SEM) was employed for data analysis using SmartPLS software version 4.0. This method was chosen for several compelling reasons: (1) its ability to handle complex models with multiple mediating relationships and latent variables, (2) its effectiveness with relatively smaller sample sizes while maintaining statistical power, (3) its robustness in managing non-normal data distributions, and (4) its prediction-oriented nature aligning with our research objectives of understanding determinants of sustainability performance. The analysis followed a two-stage approach: first assessing the measurement model through reliability and validity tests (Cronbach’s alpha, AVE, HTMT) and then evaluating the structural model through bootstrapping with 5000 resamples to test path coefficients and indirect effects. Additionally, PLS-SEM is particularly appropriate for theory development and testing in exploratory research contexts such as sustainability performance in higher education.

3.2. Survey

The questionnaire was distributed electronically between September and November 2024 across three Saudi public universities. Survey implementation followed rigorous protocols to ensure data quality and respondent confidentiality, with all responses being anonymized during collection. The target population comprised university administrators, department heads, financial managers, sustainability officers, and facility managers at Jouf University, Hail University, and Northern Border University.

The questionnaire consisted of two main sections. The first section gathered demographic information about respondents, including their position, institutional affiliation, years of experience, and departmental association (Table 1). The second section contained validated measurement items examining three key constructs: Educational Economic Factors (EEFs), Green Management Practices (GMPs), and Institutional Sustainability Performance (ISP).

Table 1.

Questionnaire respondent sample characteristics (N = 168).

The EEF construct was measured using items adapted from several validated scales in the recent literature [1,2,17,33,34]. These items assessed four dimensions: Financial Resource Allocation (FRA), Cost Efficiency Measures (CEMs), Investment in Green Technology (IGT), and Economic Incentive Programs (EIPs).

The GMP construct utilized measurement items adapted from established research [18,22,38,39], focusing on environmental management practices and green initiatives within educational institutions.

The ISP construct incorporated items from recent sustainability performance studies [10,19,41,42] measuring various aspects of institutional environmental performance and sustainability achievements.

All measurement items employed a five-point Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree). The questionnaire underwent validation through expert panel review and pilot testing with 20 participants from the target institutions to ensure content validity, clarity, and cultural appropriateness.

4. Results

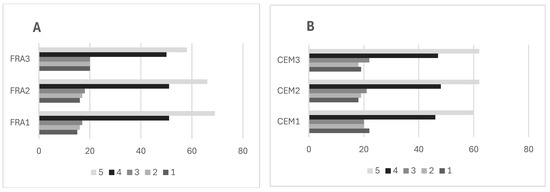

The means and standard deviations of responses to each EEF/GMP/ISP questionnaire item are reported in Table 2. Among the EEF subconstructs, Financial Resource Allocation (FRA) yielded the highest average rating, while Cost Efficiency Measures (CEMs) showed the lowest average rating. The distributions of Likert-type responses to all questionnaire items are illustrated in Figure 2.

Table 2.

Descriptive statistics summary (all rows, N = 168).

Figure 2.

Questionnaire distributions. The exact number of Likert 1, 2, 3, 4, and 5 responses for each item appears in curly brackets. (A–F) Educational Economic Factors (EEFs) variables: Financial Resource Allocation items in (A) {FRA 1: 15, 16, 17, 51, 69} {FRA 2: 16, 17, 18, 51, 66} {FRA 3: 20, 20, 20, 50, 58}; Cost Efficiency Measures items in (B) {CEM1: 22, 20, 20, 46, 60} {P2: 18, 19, 21, 48, 62} {CEM3: 19, 18, 22, 47, 62}; Investment in Green Technology items in (C) {IGT1: 21, 21, 20, 45, 61} {IGT2: 18, 18, 21, 49, 62} {IGT3: 20, 19, 21, 48, 60}; Economic Incentive Programs items in (D) {EIP1: 22, 20, 19, 45, 62} {EIP2: 19, 20, 20, 46, 63} {EIP3: 20, 21, 19, 47, 61}; Green Management Practices items in (E) {GMP1: 19, 18, 22, 48, 61} {GMP2: 20, 19, 21, 47, 61} {GMP3: 18, 20, 21, 50, 59} {GMP4: 21, 20, 19, 48, 60} {GMP5: 22, 20, 18, 46, 62}; Institutional Sustainability Performance items in (F) {ISP1: 18, 19, 20, 49, 62} {ISP2: 20, 20, 20, 48, 60} {ISP3: 21, 19, 20, 46, 62} {ISP4: 19, 20, 21, 48, 60} {ISP5: 18, 19, 22, 50, 59} {ISP6: 21, 20, 18, 46, 63} {ISP7: 20, 21, 19, 47, 61}.

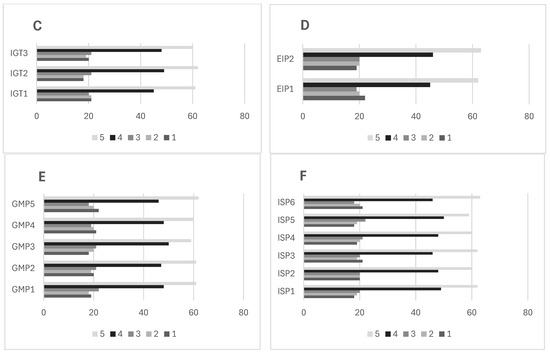

Figure 3 presents the measurement model results, illustrating the relationships between Educational Economic Factors (EEFs), Green Management Practices (GMPs), and Institutional Sustainability Performance (ISP). The coefficient of determination (R2) values indicate that the model explains 55.4% of the variance in GMPs (R2 = 0.554) and 61.6% of the variance in ISP (R2 = 0.616), demonstrating moderate-to-substantial predictive power according to the thresholds of [45], who suggest that R2 values of 0.25, 0.50, and 0.75 represent weak, moderate, and substantial levels of predictive accuracy, respectively.

Figure 3.

Measurement Model. Legend: FRA = Financial Resource Allocation; CEMs = Cost Efficiency Measures; IGT = Investment in Green Technology; EIPs = Economic Incentive Programs; GMPs = Green Management Practices; ISP = Institutional Sustainability Performance. Numbers on paths represent standardized path coefficients; numbers in circles represent R2 values.

Table 3 presents a comprehensive analysis of the measurement model’s psychometric properties. Following established validation criteria [46], the internal consistency measures demonstrate exceptional reliability, with Cronbach’s Alpha values (0.828–0.951) and Composite Reliability scores (0.831–0.952) exceeding the recommended threshold of 0.7 [45].

Table 3.

Constructs’ reliability and convergent validity.

The convergent validity indicators align with standards outlined by [47]., showing strong factor loadings predominantly above 0.8 (0.633–0.937) and Average Variance Extracted (AVE) values mostly above the 0.5 benchmark (0.594–0.855). Institutional Sustainability Performance (ISP) demonstrates the highest reliability (α = 0.951, CR = 0.952), while Financial Resource Allocation (FRA) shows the strongest convergent validity (AVE = 0.855).

Following [46] guidelines, the Variance Inflation Factor (VIF) values (1.475–4.486) confirm the absence of serious multicollinearity issues. While Green Management Practices (GMPs) show slightly lower but acceptable metrics (AVE = 0.594, lowest loading = 0.633), these values remain within acceptable thresholds established by [45], supporting the overall measurement model’s robustness for subsequent hypothesis testing.

Table 4 demonstrates discriminant validity through two established approaches [46]. The heterotrait–monotrait ratio (HTMT) analysis shows correlation values between 0.384 and 0.821, with key relationships between IGT-CEMs (0.821), IGT-EIPs (0.814), and ISP-EIPs (0.803). Following ref. [47] criteria, these values fall within acceptable thresholds, indicating construct distinctiveness.

Table 4.

Discriminant validity.

The Fornell–Larcker criterion, as recommended by ref. [45], provides further validation through square root AVE values (diagonal elements: 0.870–0.925) consistently exceeding inter-construct correlations. EIPs show the highest square root AVE (0.925), with FRA (0.924) and ISP (0.897) following. Off-diagonal correlations range from 0.363 (ISP-FRA) to 0.732 (CEMs-FRA), meeting established thresholds [46].

Both approaches confirm the measurement model’s discriminant validity, with HTMT ratios below recommended thresholds and Fornell–Larcker criterion demonstrating unique variance captured by each construct, aligning with methodological standards [47].

Table 5 presents an analysis of the hypothesized direct relationships within the research model, examining both the impact of Educational Economic Factors on Institutional Sustainability Performance (H1a-H1d) and Green Management Practices (H2a–H2d). The analysis revealed several significant findings that warranted detailed discussion.

Table 5.

Hypotheses testing (direct effects).

In examining the direct effects on Institutional Sustainability Performance (ISP), three out of four hypothesized relationships showed significant positive impacts. Economic Incentive Programs (EIPs) demonstrated the strongest influence on ISP (β = 0.465, t = 4.800, p < 0.001), followed by Investment in Green Technology (IGT) (β = 0.374, t = 3.776, p < 0.001), and Financial Resource Allocation (FRA) (β = 0.291, t = 3.344, p < 0.01). However, the hypothesized relationship between Cost Efficiency Measures (CEMs) and ISP was not supported (β = 0.260, t = 1.804, p = 0.071), leading to the rejection of H1b.

Regarding the influence on Green Management Practices (GMPs), the results revealed a mixed pattern of relationships. Both FRA (β = 0.402, t = 3.288, p < 0.01) and IGT (β = 0.405, t = 3.715, p < 0.001) showed strong positive effects on GMPs, with nearly identical coefficient magnitudes. EIPs demonstrated a weaker but still significant relationship with GMPs (β = 0.188, t = 1.762, p < 0.05). Notably, the hypothesized relationship between CEMs and GMPs was not only non-significant but showed a negative coefficient (β = −0.136, t = 0.916, p = 0.360), leading to the rejection of H2b.

These findings suggest that while most Educational Economic Factors play roles in driving both sustainability performance and green management practices, Cost Efficiency Measures do not demonstrate the expected influence on either outcome variable.

Table 6 presents a mediation analysis examining the indirect effects of Educational Economic Factors on Institutional Sustainability Performance (ISP) through Green Management Practices (GMPs). The results reveal a consistent pattern of significant mediating relationships across all hypothesized pathways, providing robust evidence for the intermediary role of green management practices in translating economic initiatives into sustainable outcomes.

Table 6.

Mediation analysis (indirect effects).

The strongest mediating effect is observed in the relationship between Financial Resource Allocation (FRA) and ISP through GMPs (β = 0.191, t = 4.248, p < 0.001). This finding suggests that when universities allocate financial resources to sustainability initiatives, these resources are most effectively translated into performance improvements when they are channeled through structured green management practices. The magnitude of this effect underscores the critical importance of having proper management systems in place to optimize the impact of financial investments on sustainable outcomes.

Investment in Green Technology (IGT) demonstrates the second strongest indirect effect on ISP through GMPs (β = 0.173, t = 4.553, p < 0.001). This result indicates that technological investments contribute to sustainable performance most effectively when they are integrated into comprehensive green management frameworks. The high significance level (p < 0.001) reinforces the reliability of this mediation pathway.

Interestingly, Cost Efficiency Measures (CEMs) show a significant positive indirect effect through GMPs (β = 0.164, t = 3.972, p < 0.01), despite their non-significant direct effects as observed in Table 5. This finding reveals the crucial mediating role of GMPs in realizing the benefits of cost-efficiency initiatives, suggesting that such measures require proper management frameworks to translate into meaningful sustainable outcomes.

Economic Incentive Programs (EIPs) exhibit the smallest, though still significant, indirect effect through GMPs (β = 0.145, t = 3.919, p < 0.05). This result, when considered alongside its strong direct effect from Table 5, suggests that while incentive programs can influence sustainability performance both directly and indirectly, their impact is partially mediated by green management practices.

The multigroup analysis in Table 7 demonstrates significant variations across institutions and experience levels. Jouf University consistently shows stronger relationships, notably in FRA -> ISP and EIPs -> ISP (both β = 0.465, p < 0.01), with significant differences particularly evident in the EIPs -> ISP relationship between Jouf and Northern universities (difference = 0.184, p < 0.01).

Table 7.

Multigroup analysis results: Path coefficient comparison across universities and experience levels.

Professional experience positively influences relationship strength, with R2 values increasing from 0.584 (<5 years) to 0.608 (>10 years). While CEMs show consistently weak effects, EIPs maintain a strong influence across all segments, suggesting the robust role of economic incentives in driving sustainability performance regardless of institutional context or experience level.

5. Discussion

This study presents several findings regarding the relationship between Educational Economic Factors (EEFs), Green Management Practices (GMPs), and Institutional Sustainability Performance (ISP) in Saudi public universities. The results demonstrate both direct and indirect effects that warrant detailed discussion.

The main findings of this study reveal that Educational Economic Factors significantly influence both Institutional Sustainability Performance and Green Management Practices. The model explains 61.6% of the variance in ISP and 55.4% of the variance in GMPs, indicating predictive power according to established thresholds. Economic Incentive Programs emerged as the strongest direct predictor of sustainability performance, followed by Investment in Green Technology and Financial Resource Allocation.

The influence of Economic Incentive Programs on sustainability performance suggests that Saudi universities effectively utilize financial incentives to drive environmental initiatives. This finding aligns with institutional theory, which emphasizes the role of organizational incentives in shaping behavior. Interestingly, Cost Efficiency Measures showed non-significant direct effects on both ISP and GMPs but demonstrated significant indirect effects through GMP mediation, indicating that cost-related initiatives require proper management frameworks to translate into meaningful outcomes.

This study’s findings demonstrate significant alignment and divergence with the recent literature on sustainability in higher education. Building on the measurement framework adapted from [1,2,17], our results reveal complex relationships between economic factors and sustainability performance. The strong positive relationship between financial resource allocation and sustainability performance particularly reinforces [1] findings on how organizational resources influence sustainable practices in developing countries’ higher education institutions, while also adding nuanced insights about the mediating role of management practices.

Our findings on green management practices, measured using validated scales from [18,22], show interesting parallels with recent research. The mediating effects we identified align with [17] work on green HRM impact, though our study reveals stronger direct effects from economic incentives. This enhancement suggests that the Saudi context emphasizes economic motivators more strongly in driving sustainability initiatives, supporting [38] findings on the relationship between green practices and organizational sustainability.

Regarding institutional sustainability performance, our measurements drew from recent work by [10,19], revealing some notable divergences. Unlike [41] findings on the direct impact of green practices on environmental performance, our results suggest a more complex relationship mediated through management systems. This complexity is particularly evident in our findings on cost efficiency measures, which showed non-significant direct effects—contrasting with [42] conclusions about direct relationships between environmental management and financial performance.

A particularly interesting finding emerges when comparing our results to [39] work on strategic orientations and green management implementation. While they found direct relationships between strategic approaches and sustainability outcomes, our study reveals more nuanced relationships in the Saudi higher education context, particularly in alignment with Vision 2030’s sustainability goals. This national transformation program emphasizes environmental sustainability as a key pillar, and our findings suggest that economic factors work through multiple pathways to influence sustainability performance in ways that support these national objectives. The difference between our findings and previous studies highlights the unique characteristics of Saudi educational institutions, where formal management structures, guided by Vision 2030’s environmental priorities, play a crucial role in translating economic initiatives into sustainable outcomes. This alignment with national strategic objectives suggests that universities are effectively integrating sustainability practices within the broader framework of Saudi Arabia’s economic and environmental transformation goals.

Our findings both align with and extend previous research on sustainability performance in higher education institutions. The strong positive relationship between financial resource allocation and sustainability performance (β = 0.291, p < 0.001) corroborates findings by [1,2] regarding the crucial role of resource management in institutional sustainability. However, an unexpected finding emerged regarding cost efficiency measures, which showed non-significant direct effects on sustainability performance (β = 0.260, p = 0.071), contrasting with previous studies such as [16] in which the authors found direct positive relationships between cost management and sustainability outcomes.

The findings of this study reveal important implications for sustainability implementation in higher education institutions. The analysis demonstrates that economic incentive programs significantly influence sustainability performance (β = 0.465, p < 0.001), aligning with [17] findings while suggesting that Saudi universities emphasize financial motivators more heavily than institutions in other contexts. Green management practices exhibit meaningful mediating effects, particularly in the relationship between financial resource allocation and sustainability outcomes (β = 0.191, p < 0.001). Additionally, the robust relationship between Investment in Green Technology and sustainability performance (β = 0.374, p < 0.001) directly supports Vision 2030’s focus on technological advancement and environmental stewardship in educational institutions. The research model accounts for 61.6% of the variance in institutional sustainability performance, indicating good explanatory power for understanding sustainability dynamics in educational settings. These results offer practical insights for Saudi universities working to align their sustainability practices with Vision 2030’s environmental objectives through the strategic integration of economic incentives with well-structured green management practices while carefully considering resource allocation decisions.

The findings of this study reflect the specific context of Saudi public universities and their distinctive characteristics. Public institutions operate under government funding structures and regulatory frameworks that shape their sustainability initiatives. Regional factors, including Saudi Vision 2030’s influence and local economic conditions, affect how institutions implement sustainability practices. Additionally, variations in institutional resources, infrastructure capabilities, and environmental management capacity influence sustainability performance outcomes. These contextual elements suggest that while the findings provide insights for Saudi public universities, their application may vary across different institutional settings.

From a practical perspective, the findings of this study offer guidance for university administrators and policymakers in Saudi Arabia and similar contexts. The strong positive effect of economic incentive programs on sustainability performance suggests that universities should prioritize the development and implementation of well-structured reward systems for sustainability initiatives. This might include departmental funding bonuses for achieving sustainability targets, recognition programs for green initiatives, and resource allocation priorities for environmentally conscious projects.

The study also underscores the importance of integrating green management practices into financial decision-making processes. Universities should consider establishing dedicated sustainability offices that participate in budgetary planning, ensuring that financial resources are allocated with clear environmental objectives in mind. The significant mediating effect of green management practices suggests that even well-funded initiatives may fall short without proper management frameworks to guide their implementation.

Theoretically, this study makes several contributions to the existing body of knowledge. By extending resource-based view theory to the specific context of sustainability in Saudi higher education, we demonstrate how institutional resources and capabilities can be leveraged for environmental performance. The identification of dual pathways—both direct and indirect—through which economic factors influence sustainability performance adds nuance to existing theoretical frameworks, suggesting a more complex relationship than previously recognized.

6. Conclusions

This study demonstrates the significant impact of educational economic factors on institutional sustainability performance in Saudi public universities, both directly and through green management practices. The findings reveal that economic incentives and green technology investments are particularly effective drivers of sustainability performance, while the success of cost-efficiency measures depends largely on proper management frameworks. These relationships align with Vision 2030’s sustainability objectives, suggesting that Saudi universities are progressing toward national environmental goals through structured economic and management approaches.

The research contributes to both theory and practice by identifying specific pathways through which economic factors influence sustainability outcomes in higher education. The evidence supports a dual-pathway model where financial resources and incentives can both directly impact sustainability performance and work through green management practices to enhance environmental outcomes.

7. Limitations and Suggestions for Future Studies

This study presents several limitations that suggest directions for future research. The scope encompasses three Saudi public universities, which may affect the generalizability of the findings. The cross-sectional nature of data collection and the self-reported measures also warrant consideration when interpreting the results. Future research could extend to private universities across Saudi Arabia, incorporate longitudinal approaches, and include objective performance metrics. Additional research opportunities lie in exploring digital transformation impacts and organizational culture influences on sustainability outcomes, along with examining the relationship between Vision 2030 objectives and institutional practices. Comparative studies of educational and corporate sustainability approaches may enhance our understanding of how institutions can effectively utilize resources while supporting national development goals.

Author Contributions

Software, H.B. and N.F.S.A.; Formal analysis, H.B. and N.F.S.A.; Investigation, H.B.; Data curation, H.B. and N.F.S.A.; Writing—original draft, N.F.S.A.; Project administration, N.F.S.A. All authors have read and agreed to the published version of the manuscript.

Funding

The Deanship of Scientific Research funded this work at Jouf University through the Fast-track Research Funding Program.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Bagire, V.; Arinaitwe, A.; Kakooza, J.; Aikiriza, F. Sustainable energy orientation in higher educational institutions: The effect of institutional pressures and organizational resources in a developing country context. Int. J. Energy Sect. Manag. 2024, 18, 999–1013. [Google Scholar] [CrossRef]

- Christou, O.; Manou, D.B.; Armenia, S.; Franco, E.; Blouchoutzi, A.; Papathanasiou, J. Fostering a Whole-Institution Approach to Sustainability through Systems Thinking: An Analysis of the State-of-the-Art in Sustainability Integration in Higher Education Institutions. Sustainability 2024, 16, 2508. [Google Scholar] [CrossRef]

- Abad-Segura, E.; González-Zamar, M.; Infante-Moro, J.C.; García, G.R. Sustainable Management of Digital Transformation in Higher Education: Global Research Trends. Sustainability 2020, 12, 2107. [Google Scholar] [CrossRef]

- Aleixo, A.M.; Azeiteiro, U.; Leal, S. The implementation of sustainability practices in Portuguese higher education institutions. Int. J. Sustain. High. Educ. 2018, 19, 146–178. [Google Scholar] [CrossRef]

- Almawishir, N.F.S.; Benlaria, H. Using the PLS-SEM Model to Measure the Impact of the Knowledge Economy on Sustainable Development in the Al-Jouf Region of Saudi Arabia. Sustainability 2023, 15, 6446. [Google Scholar] [CrossRef]

- Cáceres-Reche, M.P.; Tallón-Rosales, S.; Navas-Parejo, M.R.; De La Cruz-Campos, J.C. Influence of sociodemographic factors and knowledge in pedagogy on the labor market insertion of education science professionals. Educ. Sci. 2022, 12, 200. [Google Scholar] [CrossRef]

- Chen, T.; Kim, H.; Pan, S.; Tseng, P.; Lin, Y.; Chiang, P. Implementation of green chemistry principles in circular economy system towards sustainable development goals: Challenges and perspectives. Sci. Total Environ. 2020, 716, 136998. [Google Scholar] [CrossRef]

- Hameed, I.; Zaman, U.; Waris, I.; Shafique, O. A Serial-Mediation Model to Link Entrepreneurship Education and Green Entrepreneurial Behavior: Application of Resource-Based View and Flow Theory. Int. J. Environ. Res. Public Health 2021, 18, 550. [Google Scholar] [CrossRef]

- Alanazi, A.S.; Benlaria, H. Bridging Higher education outcomes and labour Market needs: A study of JOUF University graduates in the context of Vision 2030. Soc. Sci. 2023, 12, 360. [Google Scholar] [CrossRef]

- Amjad, F.; Abbas, W.; Zia-Ur-Rehman, M.; Baig, S.A.; Hashim, M.; Khan, A.; Rehman, H. Effect of green human resource management practices on organizational sustainability: The mediating role of environmental and employee performance. Environ. Sci. Pollut. Res. 2021, 28, 28191–28206. [Google Scholar] [CrossRef]

- Sančanin, B.; Penjišević, A.; Simjanović, D.J.; Ranđelović, B.M.; Vesić, N.O.; Mladenović, M. A fuzzy AHP and PCA approach to the role of media in improving education and the labor market in the 21st century. Mathematics 2024, 12, 3616. [Google Scholar] [CrossRef]

- Mian, S.H.; Salah, B.; Ameen, W.; Moiduddin, K.; Alkhalefah, H. Adapting universities for sustainability education in Industry 4.0: Channel of challenges and opportunities. Sustainability 2020, 12, 6100. [Google Scholar] [CrossRef]

- Nowotny, J.; Dodson, J.; Fiechter, S.; Gür, T.M.; Kennedy, B.; Macyk, W.; Bak, T.; Sigmund, W.; Yamawaki, M.; Rahman, K.A. Towards global sustainability: Education on environmentally clean energy technologies. Renew. Sustain. Energy Rev. 2018, 81, 2541–2551. [Google Scholar] [CrossRef]

- Filho, W.L.; Vargas, V.R.; Salvia, A.L.; Brandli, L.L.; Pallant, E.; Klavins, M.; Ray, S.; Moggi, S.; Maruna, M.; Conticelli, E.; et al. The role of higher education institutions in sustainability initiatives at the local level. J. Clean. Prod. 2019, 233, 1004–1015. [Google Scholar] [CrossRef]

- Patnaik, S.; Munjal, S.; Varma, A.; Sinha, S. Extending the resource-based view through the lens of the institution-based view: A longitudinal case study of an Indian higher educational institution. J. Bus. Res. 2022, 147, 124–141. [Google Scholar] [CrossRef]

- Tjahjadi, B.; Soewarno, N.; Mustikaningtiyas, F. Good corporate governance and corporate sustainability performance in Indonesia: A triple bottom line approach. Heliyon 2021, 7, e06453. [Google Scholar] [CrossRef] [PubMed]

- Al-Alawneh, R.; Othman, M.; Zaid, A.A. Green HRM impact on environmental performance in higher education with mediating roles of management support and green culture. Int. J. Organ. Anal. 2024, 32, 1141–1164. [Google Scholar] [CrossRef]

- Biancardi, A.; Colasante, A.; D’Adamo, I.; Daraio, C.; Gastaldi, M.; Uricchio, A.F. Strategies for developing sustainable communities in higher education institutions. Sci. Rep. 2023, 13. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Wang, Z. A nonlinear relationship between corporate environmental performance and economic performance of green technology innovation: Moderating effect of government market-based regulations. Bus. Strategy Environ. 2023, 32, 3119–3138. [Google Scholar] [CrossRef]

- Mansoor, A.; Jahan, S.; Riaz, M. Does green intellectual capital spur corporate environmental performance through green workforce? J. Intellect. Cap. 2021, 22, 823–839. [Google Scholar] [CrossRef]

- Ma, X.; Akhtar, R.; Akhtar, A.; Hashim, R.A.; Sibt-E-Ali, M. Mediation effect of environmental performance in the relationship between green supply chain management practices, institutional pressures, and financial performance. Front. Environ. Sci. 2022, 10. [Google Scholar] [CrossRef]

- Zhang, Q.; Ma, Y. The Impact of Environmental Management on Firm Economic Performance: The Mediating Effect of Green Innovation and the Moderating Effect of Environmental Leadership. J. Clean. Prod. 2021, 292, 126057. [Google Scholar] [CrossRef]

- Aleixo, A.M.; Leal, S.; Azeiteiro, U.M. Conceptualization of sustainable higher education institutions, roles, barriers, and challenges for sustainability: An exploratory study in Portugal. J. Clean. Prod. 2016, 172, 1664–1673. [Google Scholar] [CrossRef]

- Hsu, C.; Quang-Thanh, N.; Chien, F.; Li, L.; Mohsin, M. Evaluating green innovation and performance of financial development: Mediating concerns of environmental regulation. Environ. Sci. Pollut. Res. 2021, 28, 57386–57397. [Google Scholar] [CrossRef]

- Song, M.; Peng, L.; Shang, Y.; Zhao, X. Green technology progress and total factor productivity of resource-based enterprises: A perspective of technical compensation of environmental regulation. Technol. Forecast. Soc. Change 2022, 174, 121276. [Google Scholar] [CrossRef]

- Vasudevan, H. Resource-based view theory application on the educational service quality. Int. J. Eng. Appl. Sci. Technol. 2021, 6, 174–186. [Google Scholar] [CrossRef]

- Gupta, A.K.; Gupta, N. Environment Practices Mediating the Environmental Compliance and firm Performance: An Institutional Theory Perspective from Emerging Economies. Glob. J. Flex. Syst. Manag. 2021, 22, 157–178. [Google Scholar] [CrossRef]

- Khan, S.a.R.; Tabish, M.; Zhang, Y. Embracement of industry 4.0 and sustainable supply chain practices under the shadow of practice-based view theory: Ensuring environmental sustainability in corporate sector. J. Clean. Prod. 2023, 398, 136609. [Google Scholar] [CrossRef]

- Arda, O.A.; Montabon, F.; Tatoglu, E.; Golgeci, I.; Zaim, S. Toward a holistic understanding of sustainability in corporations: Resource-based view of sustainable supply chain management. Supply Chain Manag. 2021, 28, 193–208. [Google Scholar] [CrossRef]

- Makhloufi, L.; Laghouag, A.A.; Meirun, T.; Belaid, F. Impact of green entrepreneurship orientation on environmental performance: The natural resource-based view and environmental policy perspective. Bus. Strategy Environ. 2021, 31, 425–444. [Google Scholar] [CrossRef]

- Farrukh, A.; Mathrani, S.; Sajjad, A. A natural resource and institutional theory-based view of green-lean-six sigma drivers for environmental management. Bus. Strategy Environ. 2022, 31, 1074–1090. [Google Scholar] [CrossRef]

- Nandi, S.; Gonela, V.; Awudu, I. A resource-based and institutional theory-driven model of large-scale biomass-based bioethanol supply chains: An emerging economy policy perspective. Biomass Bioenergy 2023, 174, 106813. [Google Scholar] [CrossRef]

- Dahleez, K.A.; El-Saleh, A.A.; Al Alawi, A.M.; Abdel Fattah, F.A.M. Student Learning Outcomes and Online Engagement in Time of Crisis: The Role of E-Learning System Usability and Teacher Behavior. Int. J. Inf. Learn. Technol. 2021, 38, 473–492. [Google Scholar] [CrossRef]

- Budihardjo, M.A.; Ramadan, B.S.; Putri, S.A.; Wahyuningrum, I.F.S.; Muhammad, F.I. Towards Sustainability in Higher-Education Institutions: Analysis of Contributing Factors and Appropriate Strategies. Sustainability 2021, 13, 6562. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering Green Development with Green Finance: An Empirical Study on the Environmental Effect of Green Credit Policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Ghardallou, W. Corporate Sustainability and Firm Performance: The Moderating Role of CEO Education and Tenure. Sustainability 2022, 14, 3513. [Google Scholar] [CrossRef]

- Ameer, F.; Khan, N.R. Green entrepreneurial orientation and corporate environmental performance: A systematic literature review. Eur. Manag. J. 2022, 41, 755–778. [Google Scholar] [CrossRef]

- Jamal, T.; Zahid, M.; Martins, J.M.; Mata, M.N.; Rahman, H.U.; Mata, P.N. Perceived Green Human Resource Management Practices and Corporate Sustainability: Multigroup Analysis and Major Industries Perspectives. Sustainability 2021, 13, 3045. [Google Scholar] [CrossRef]

- Habib, M.A.; Bao, Y.; Nabi, N.; Dulal, M.; Asha, A.A.; Islam, M. Impact of Strategic Orientations on the Implementation of Green Supply Chain Management Practices and Sustainable Firm Performance. Sustainability 2021, 13, 340. [Google Scholar] [CrossRef]

- Sahoo, S.; Vijayvargy, L. Green supply chain management practices and its impact on organizational performance: Evidence from Indian manufacturers. J. Manuf. Technol. Manag. 2021, 32, 862–886. [Google Scholar] [CrossRef]

- Asiaei, K.; Bontis, N.; Alizadeh, R.; Yaghoubi, M. Green intellectual capital and environmental management accounting: Natural resource orchestration in favor of environmental performance. Bus. Strategy Environ. 2021, 31, 76–93. [Google Scholar] [CrossRef]

- Ivascu, L.; Domil, A.; Sarfraz, M.; Bogdan, O.; Burca, V.; Pavel, C. New insights into corporate sustainability, environmental management and corporate financial performance in European Union: An application of VAR and Granger causality approach. Environ. Sci. Pollut. Res. 2022, 29, 82827–82843. [Google Scholar] [CrossRef] [PubMed]

- Chen, P. Curse or blessing? The relationship between sustainable development plans for resource cities and corporate sustainability—Evidence from China. J. Environ. Manag. 2023, 341, 117988. [Google Scholar] [CrossRef] [PubMed]

- Ali, Q.; Salman, A.; Parveen, S. Evaluating the effects of environmental management practices on environmental and financial performance of companies in Malaysia: The mediating role of ESG disclosure. Heliyon 2022, 8, e12486. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Ringle, C.M. Rethinking some of the rethinking of partial least squares. Eur. J. Mark. 2019, 53, 566–584. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R; Classroom Companion: Business; Springer: Berlin/Heidelberg, Germany, 2021. [Google Scholar] [CrossRef]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data Syst. 2016, 116, 2–20. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).