3.1. Policy Background

The Chinese government has consistently demonstrated strong concern for environmental issues and has formulated a series of green regulations and policies. For example, the 13th National People’s Congress formally enshrined ecological civilization in the Constitution in 2018. The Law of the People’s Republic of China on the Protection of the Yangtze River came into force in 2021. The Wetland Protection Law of the People’s Republic of China came into force in 2022. In February 2019, the National Development and Reform Commission (NDRC) and other ministries and commissions jointly issued the Green Industry Guidance Catalog. In April 2019, the NDRC and the Ministry of Science and Technology (MOST) issued the Guiding Opinions on the Construction of a Market-Oriented Green Technology Innovation System.

We chose the Energy Conservation and Emission Reduction Fiscal Policy (ECER) pilot, jointly conducted by China’s Ministry of Finance and NDRC in 2011, as the policy context, with the aim of exploring its impact effect on urban GTFP. ECER selected a total of 30 cities for the pilot in 2011, 2013, and 2014. The three batches of pilots were distributed in the eastern, central, and western regions of China, and these cities have significant differences in terms of city size, level of economic development, and geographic characteristics and are therefore highly representative, typical, and demonstrative (as shown in

Table 1). ECER requires that energy conservation and emission reduction be promoted systematically and holistically with the goals of industrial decarbonization, transportation cleanliness, building greening, service intensification, pollution reduction, and energy regeneration. Concurrently, it set up clear assessment indexes around the effect of reducing energy consumption, the effect of pollutant emission reduction, the construction of long-term mechanisms, the cultivation of supervisory capacity, etc., links the results of the assessment with the allocation of the comprehensive incentive funds for the next year, and makes strict provisions for the issuance and use of the comprehensive incentive funds. In addition, an exit mechanism is established. Cities that fail to complete tasks or misappropriate financial funds would be disqualified from the pilot program and all incentive funds would be withdrawn. It is foreseeable that ECER will trigger changes in the economic and social development model and have a significant and far-reaching impact on the sustainable development of the country by creating exemplary pilot cities and popularizing the advanced working experience for the whole country.

3.2. Research Hypothesis

A key challenge for sustainable development is how to overcome market failures and externalities, which require long-term and sustained intervention by well-designed government policies [

24], and the government’s ability to intervene plays a crucial role in enhancing urban GTFP [

17]. In terms of the actual implementation of ECER in China, government policies have mainly intervened to overcome market failures and externalities through two mechanisms: the first is the “punishment mechanism”. On the one hand, it internalizes the costs of negative externalities, such as pollution, by strengthening local governments’ taxes and fines. This forces all industry players to reduce pollution emissions and carry out green and clean production, thus eliminating high-pollution and high-emission projects in the pilot cities of ECER and developing low-energy-consumption and low-pollution projects instead. On the other hand, local governments are urged to establish stricter regulatory mechanisms and local policies to fulfill the performance and binding targets set by the central government for the ECER pilot cities, which will have a significant impact on cities’ industries in seeking cleaner and more efficient ways of production and operation [

4] and thus reducing the use of fossil energy. The second is the “reward mechanism”, that is to say, on the one hand, the government employs various methods, including subsidies, direct investment, preferential policies, funding guidance, and tax regulation, and offering sustained investment and support for green, low-carbon, and environmentally friendly projects. This encourages more funds and resources to flow into areas such as low-carbon initiatives, clean production, and new energy. As a result, demonstration cities can achieve a smooth transition when engaging in the production of green products that involve high risks, significant investments, and long cycles, as well as in their transformation and upgrading processes. On the other hand, fiscal policies that invest in and support education and human capital can cultivate and attract more relevant innovative talents. This contributes to enhancing the quality of the regional workforce and also the research and development of green technologies, as well as to improving energy efficiency. It also fosters the optimization and upgrading of the cities’ industrial structure, serving as an essential catalyst in facilitating the cities’ transition toward green development [

25]. Based on the above, this paper advances the subsequent hypothesis:

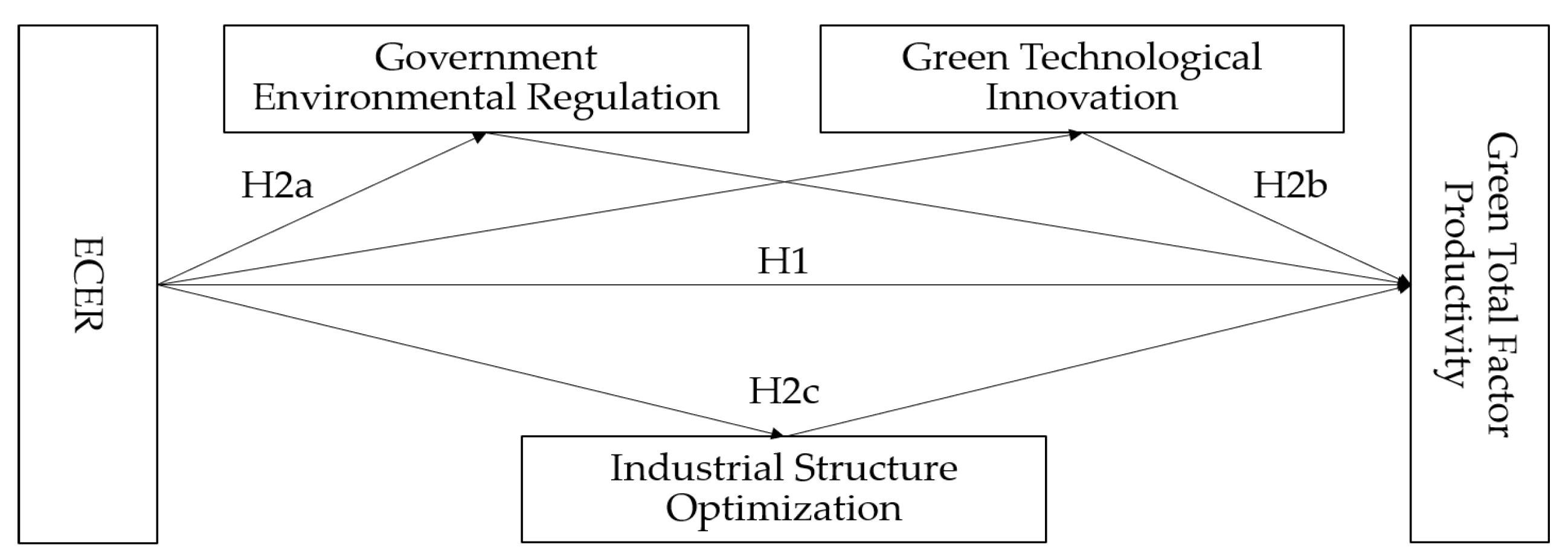

H1. ECER can significantly increase urban GTFP.

The interaction between the central government and local governments constitutes the institutional environment for local governments’ decision making, and the central government’s orders and administrative means are important reasons for local governments’ actions [

26]. The central government has established stringent rules and regulations governing the environmental protection efforts of ECER pilot cities, such as the accountability system and the “one-vote veto” system, which take the fulfillment of energy-saving and emission reduction targets as part of the assessment of local governments. Local governments failing to complete their tasks are notified, criticized, and disqualified from being evaluated and selected for excellence in the current year. Therefore, in response to the orders and policies of the central government, local governments are willing to implement stricter environmental regulations at the cost of slow economic growth to balance economic growth and environmental protection and to meet the performance appraisal targets issued by the central government [

27]. Furthermore, according to Porter’s hypothesis, the core competitiveness of industries is a dynamic paradigm based on innovation, which pursues the goals of high productivity, lower production costs than those of competitors, more valuable products, and greener and lower-carbon production and management methods. Only when industries can innovate, optimize, and upgrade within constraints can they achieve sustainable development and long-term irreplaceable competitiveness in the marketplace [

28,

29]. Therefore, environmental regulations influence production costs and enhance urban GTFP by improving green technology innovation capacity and optimizing resource allocation efficiency across industries. Based on this, this paper proposes the following hypothesis:

H2a. ECER can enhance urban GTFP by strengthening environmental regulations.

Green technological innovation can provide endogenous forces for the sustainable development of ECER pilot cities. On the one hand, being selected as a pilot city releases a policy signal, highlighting the need for technological transformation, upgrading, and increased support for green production technologies. These signals help ECER pilot cities establish more research centers and industrial innovation centers, whereby more innovative talents can be attracted to gather in the city, which contributes to the continuous improvement in the innovation capacity and green production technology level of ECER pilot cities, reduces pollutant and carbon emissions, and thus enhances the city’s GTFP [

30]. On the other hand, ECER’s support for innovative R&D projects can form a “depression effect”, making pilot cities gradually become a cluster of high-tech and service industries, along with other eco-friendly and low-carbon industries. The knowledge and technology spillover mechanism, transaction cost-saving mechanism, infrastructure, and public service sharing mechanism included in industrial agglomeration can realize the aggregation of innovation factors to a greater extent [

30]. With the agglomeration of innovation factors and new industries, more multinational companies and excellent domestic companies will be attracted, and the healthy competition among these companies will help to maximize the optimization of resource allocation, promote green technological innovation, and enhance the overall efficiency of the city’s resource use, which in turn will enhance the city’s GTFP. Based on this, this paper puts forward the following hypothesis:

H2b. ECER can enhance urban GTFP by encouraging technological innovation.

Under the ECER policy, high-pollution and high-energy-consumption industries (‘two high’ industries) are expected to transition into green and low-carbon industries. This is because if the “two high” industries fail to transform and upgrade, they would face high taxes and fines, which inevitably increase their costs and reduce their profits, and then go bankrupt or move to other cities. In addition, the performance appraisal system formulated by ECER sets strict binding targets for local governments. In order to fulfill the assessment, local governments would strictly control the number of polluting enterprises and raise the production and operation standards of the industry, preventing “two high” industries unable to survive or even unable to enter. Based on this, this paper puts forward the following hypothesis:

H2c. ECER can enhance urban GTFP by restructuring industries.

The conceptual model based on the above analysis is shown in

Figure 1.