U.S. Monetary Policy and Capital Flows to Emerging Markets: The Role of Capital Controls in Financial Stability

Abstract

1. Introduction

2. Theoretical Background

2.1. U.S. Monetary Policy and Cross-Border Capital Flows in EMEs

2.2. The Moderating Effect of Capital Control

3. Data and Empirical Strategy

3.1. Data and Variables

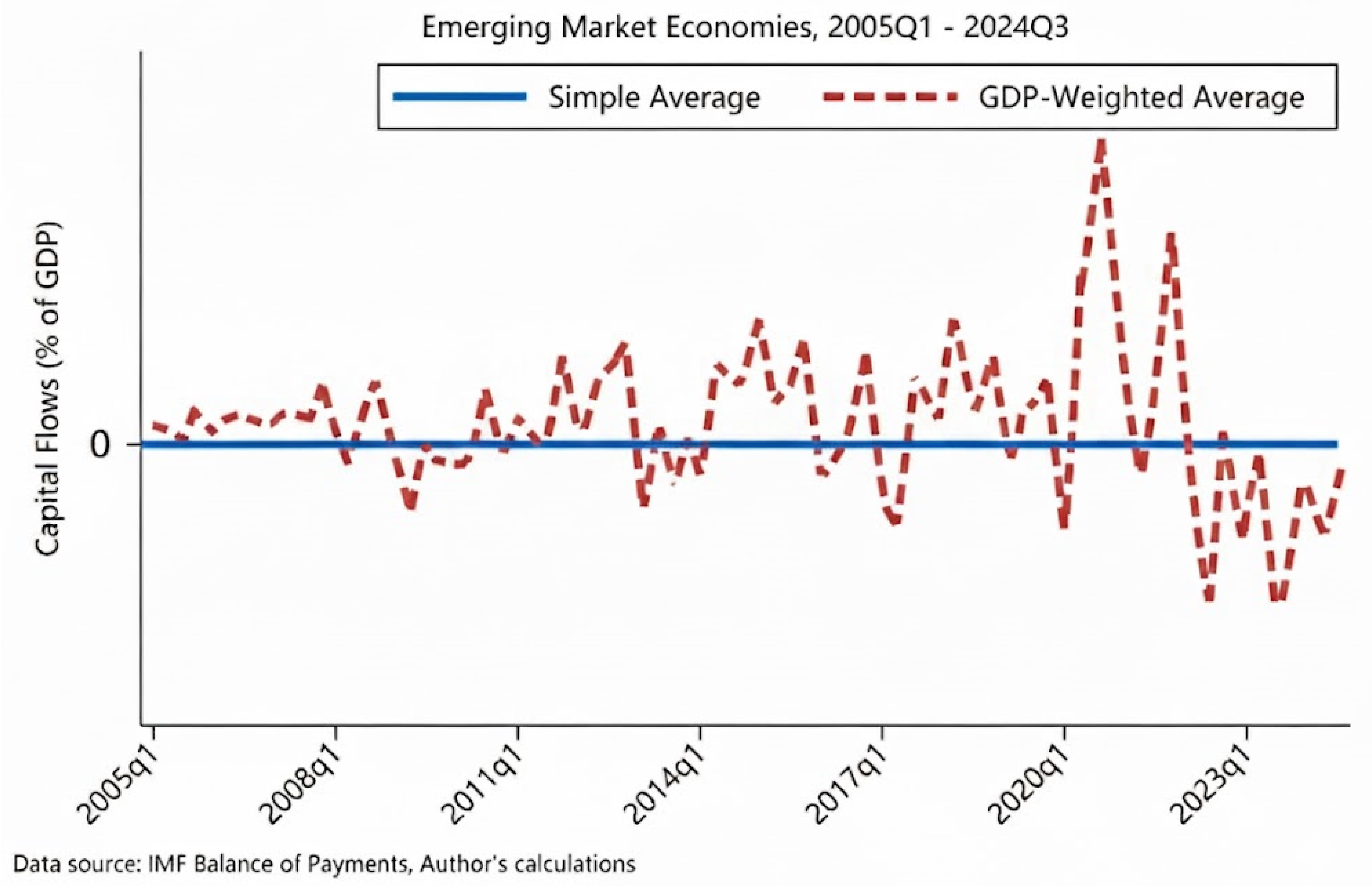

3.1.1. The Dependent Variable

3.1.2. The Key Independent Variable

3.1.3. Control Variables

3.1.4. The Moderating Variable

3.2. Empirical Strategy

3.2.1. Baseline Regression Model

3.2.2. Moderating Effect Model

4. Empirical Results

4.1. Baseline Results

4.2. Robustness Tests

4.3. Moderating Effect Results

4.4. Heterogeneity Results

5. Conclusions and Implications

5.1. Conclusions

5.2. Implications

6. Discussion

6.1. Overview and Contribution

6.2. Economic Magnitudes and Heterogeneity

6.3. Capital-Control Moderation: De Jure Measurement and Endogeneity

6.4. Policy Implications and Sustainable Financial Stability

6.5. Limits of Causal Interpretation and Avenues for Improvement

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| EMEs | Multidisciplinary Digital Publishing Institute |

| UMP | unconventional monetary policy |

| CMP | conventional monetary policy |

| NCF | Ner Capital Flows |

References

- Bhattarai, S.; Chatterjee, A.; Park, W.Y. Effects of US Quantitative Easing on Emerging Market Economies. J. Econ. Dyn. Control 2021, 122, 104031. [Google Scholar] [CrossRef]

- Villamizar-Villegas, M.; Arango-Lozano, L.; Castelblanco, G.; Fajardo-Baquero, N.; Ruiz-Sanchez, M.A. The Effects of Monetary Policy on Capital Flows: An Emerging Market Survey. Emerg. Mark. Rev. 2024, 62, 101167. [Google Scholar] [CrossRef]

- Federal Reserve Bank of Dallas Economic Letter 2021. Available online: https://www.dallasfed.org/research/economics/2021/0810 (accessed on 3 February 2025).

- Rey, H. International Channels of Transmission of Monetary Policy and the Mundellian Trilemma; NBER Working Paper 21852; National Bureau of Economic Research: Cambridge, MA, USA, 2016. [Google Scholar]

- Miranda-Agrippino, S.; Rey, H. US monetary policy and the global financial cycle. Rev. Econ. Stud. 2020, 87, 2754–2776. [Google Scholar] [CrossRef]

- Federal Reserve Bank of St. Louis. Why did Turkey and Argentina seek IMF assistance in 2018? Econ. Synop. 2019, 9. [Google Scholar]

- Bhattarai, S.; Eggertsson, G.B.; Gafarov, B. Effects of US Quantitative Easing on Emerging Market Economies; Federal Reserve Bank of Dallas location: Dallas, TX, USA, 2018. [Google Scholar] [CrossRef]

- Adrian, T.; Xie, W. Monetary Policy Spillovers and the Global Financial Cycle; IMF Working Paper WP/22/114; International Monetary Fund: Washington, DC, USA, 2022. [Google Scholar]

- Ha, J.; Kose, M.A.; Ohnsorge, F. Inflation in Emerging and Developing Economies: Evolution, Drivers, and Policies; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- International Monetary Fund. Global Financial Stability Report: Preempting a Legacy of Vulnerabilities; IMF: Washington, DC, USA, 2021. [Google Scholar]

- Gelos, G.; Miyajima, K.; Zhang, Y. Capital Flows at Risk: Taming the Ebb and Flow; IMF Working Paper WP/22/140; International Monetary Fund: Washington, DC, USA, 2022. [Google Scholar]

- Chamon, M.; Kaplan, E. The iceberg theory of campaign contributions: Political threats and interest group behavior. Am. Econ. J. Econ. Policy 2013, 5, 1–31. [Google Scholar] [CrossRef]

- Patnaik, I.; Shah, A.; Singh, N. Foreign investors under stress: Evidence from India. Int. Financ. 2013, 16, 213–244. [Google Scholar] [CrossRef]

- Ostry, J.; Ghosh, A.R.; Habermeier, K.; Chamon, M.; Qureshi, M.S.; Reinhardt, D.B. Capital Inflows: The Role of Controls; International Monetary Fund: Washington, DC, USA, 2010; Volume 10. [Google Scholar]

- Rey, H. Dilemma Not Trilemma: The Global Financial Cycle and Monetary Policy Independence; NBER Working Paper 21162; National Bureau of Economic Research: Cambridge, MA, USA, 2015. [Google Scholar]

- Forbes, K.J.; Warnock, F.E. Capital flow waves—Or ripples? Extreme capital flow movements since the crisis. J. Int. Money Financ. 2021, 116, 102394. [Google Scholar] [CrossRef]

- Aizenman, J.; Jinjarak, Y.; Park, D. Fundamentals and sovereign risk of emerging markets. Pac. Econ. Rev. 2016, 21, 151–177. [Google Scholar] [CrossRef]

- Obstfeld, M. Financial flows, financial crises, and global imbalances. J. Int. Money Financ. 2012, 31, 469–480. [Google Scholar] [CrossRef]

- Scheubel, B.; Stracca, L.; Tille, C. The global financial cycle and capital flows: Taking stock. J. Econ. Surv. 2025, 39, 219–252. [Google Scholar] [CrossRef]

- Gelos, G.; Patelli, P.; Shim, I. The US dollar and capital flows to EMEs. BIS Q. Rev. 2024, 51–68. [Google Scholar]

- International Monetary Fund. Emerging Market Resilience: Good Luck or Good Policies? World Economic Outlook 2025. Available online: https://www.imf.org/-/media/Files/Publications/WEO/2025/October/English/ch2.ashx (accessed on 3 February 2025).

- Forbes, K.J.; Warnock, F.E. Capital flow waves: Surges, stops, flight, and retrenchment. J. Int. Econ. 2012, 88, 235–251. [Google Scholar] [CrossRef]

- Klein, M.W.; Shambaugh, J.C. Rounding the corners of the policy trilemma: Sources of monetary policy autonomy. Am. Econ. J. Macroecon. 2015, 7, 33–66. [Google Scholar] [CrossRef]

- Fernandez, R.; Aalbers, M.B. Financialization and housing: Between globalization and varieties of capitalism. Compet. Change 2016, 20, 71–88. [Google Scholar] [CrossRef]

- Fratzscher, M. Capital flows, push versus pull factors and the global financial crisis. J. Int. Econ. 2012, 88, 341–356. [Google Scholar] [CrossRef]

- Ahmed, S.; Akinci, O.; Queralto, A. U.S. Monetary Policy Spillovers to Emerging Markets: Both Shocks and Vulnerabilities Matter; International Finance Discussion Papers 1321r1; Board of Governors of the Federal Reserve System: Washington, DC, USA, 2024.

- Akinci, O.; Queralto, A. U.S. Monetary Policy Spillovers to Emerging Markets: Both Shocks and Vulnerabilities Matter; Staff Report No. 972; Federal Reserve Bank of New York: New York, NY, USA, 2024. [Google Scholar]

- Cavallaro, E.; Cutrini, E. Institutional quality and cross-border asset trade: Are banks less worried about diversification abroad? In Università degli Studi di Roma-La Sapienza Collana WP-Dipartimento di Economia Pubblica; La Sapienza: Rome, Italy, 2018; ISSN 1974–2940. [Google Scholar]

- Ranciere, R.; Tornell, A.; Vamvakidis, A. A New Index of Currency Mismatch and Systemic Risk; IMF Working Paper WP/10/263; International Monetary Fund: Washington, DC, USA, 2010. [Google Scholar]

- Fisera, B.; Workie Tiruneh, M.; Yin, H. Currency depreciations in emerging economies: A blessing or a curse for external debt management? Int. Econ. 2021, 168, 132–165. [Google Scholar] [CrossRef]

- Hoek, J.; Kamin, S.; Yoldas, E. Are higher U.S. interest rates always bad news for emerging markets? J. Int. Econ. 2022, 137, 103585. [Google Scholar] [CrossRef]

- Lakdawala, A. The growing impact of US monetary policy on emerging financial markets: Evidence from India. J. Int. Money Financ. 2021, 119, 102482. [Google Scholar] [CrossRef]

- Singh, D.; Prabheesh, K.P. Do capital controls absorb global financial shocks? Evidence from emerging market economies. Int. Rev. Appl. Econ. 2024, 39, 21–46. [Google Scholar] [CrossRef]

- Liao, J.; Meng, J.; Ren, J.; Zhang, L. The impact of capital inflow’s features on the effectiveness of capital controls—Evidence from multinational data. Int. Rev. Econ. Financ. 2024, 93, 273–284. [Google Scholar] [CrossRef]

- Erten, B.; Korinek, A.; Ocampo, J.A. Capital controls: Theory and evidence. J. Econ. Lit. 2021, 59, 45–89. [Google Scholar] [CrossRef]

- International Monetary Fund. Balance of Payments Statistics. Available online: https://data.imf.org/?sk=7A51304B-6426-40C0-83DD-CA473CA1FD52 (accessed on 3 February 2025).

- Federal Reserve Bank of St. Louis. Federal Reserve Economic Data (FRED): Effective Federal Funds Rate. Available online: https://fred.stlouisfed.org/series/EFFR (accessed on 3 February 2025).

- Krippner, L. Measuring the stance of monetary policy in zero lower bound environments. Econ. Lett. 2013, 118, 135–138. [Google Scholar] [CrossRef]

- Chicago Board Options Exchange (CBOE). VIX Index Historical Data. Available online: https://www.cboe.com/tradable-products/vix/vix-historical-data (accessed on 3 February 2025).

- World Bank. World Development Indicators. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 3 February 2025).

- International Monetary Fund. International Financial Statistics. Available online: https://data.imf.org/IFS (accessed on 3 February 2025).

- Hamilton, J.D. The daily market for federal funds. J. Polit. Econ. 1996, 104, 26–56. [Google Scholar] [CrossRef]

- Bernanke, B.S.; Mihov, I. The liquidity effect and long-run neutrality. In Carnegie-Rochester Conference Series on Public Policy; North-Holland: Amsterdam, The Netherlands, 1998; Volume 49, pp. 149–194. [Google Scholar]

- Anaya, P.; Hachula, M.; Offermanns, C.J. Spillovers of US unconventional monetary policy to emerging markets: The role of capital flows. J. Int. Money Financ. 2017, 73, 275–295. [Google Scholar] [CrossRef]

- Davis, J.S.; Zlate, A. Real Exchange Rates and the Global Financial Cycle; Working Paper No. 2416; Federal Reserve Bank of Dallas: Dallas, TX, USA, 2024. [Google Scholar]

- Ilzetzki, E.; Reinhart, C.M.; Rogoff, K.S. The Country Chronologies to Exchange Rate Arrangements into the 21st Century: Will the Anchor Currency Hold? NBER Working Paper 23135; National Bureau of Economic Research: Cambridge, MA, USA, 2017.

- Chui, M.; Kuruc, E.; Turner, P. Leverage and currency mismatches: Non-financial companies in the emerging markets. World Econ. 2018, 41, 3269–3287. [Google Scholar] [CrossRef]

- Davis, J.S.; Zlate, A. Monetary policy divergence and net capital flows: Accounting for endogenous policy responses. J. Int. Money Financ. 2019, 94, 15–31. [Google Scholar] [CrossRef]

- Chinn, M.D.; Ito, H. What matters for financial development? Capital controls, institutions, and interactions. J. Dev. Econ. 2006, 81, 163–192. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2010. [Google Scholar]

- Cerdeiro, D.A.; Komaromi, A. Financial openness and capital inflows to emerging markets: In search of robust evidence. Int. Rev. Econ. Financ. 2021, 73, 444–458. [Google Scholar] [CrossRef]

- Matschke, J.; von Ende-Becker, A.; Sattiraju, S.A. Capital flows and monetary policy in emerging markets around Fed tightening cycles. Econ. Rev. 2023, 108, 1–25. [Google Scholar] [CrossRef]

- Dahlhaus, T.; Vasishtha, G. Monetary policy news in the US: Effects on emerging market capital flows. J. Int. Money Financ. 2020, 109, 102251. [Google Scholar] [CrossRef]

- Koepke, R. Fed policy expectations and portfolio flows to emerging markets. J. Int. Financ. Mark. Inst. Money 2018, 55, 170–194. [Google Scholar] [CrossRef]

- Our World in Data. Available online: https://ourworldindata.org/ (accessed on 3 February 2025).

- OECD. Supporting Emerging Markets and Developing Economies in Developing Their Local Capital Markets; OECD Policy Briefs No. 24; OECD Publishing: Paris, France, 2025. [Google Scholar]

- OECD. G20/OECD Report on Assessing and Promoting Capital Flow Resilience in Emerging Markets and Developing Economies; OECD Publishing: Paris, France, 2024. [Google Scholar]

- Alessi, L.; Di Girolamo, E.F.; Pagano, A.; Giudici, M.P. Accounting for climate transition risk in banks’ capital requirements. J. Financ. Stab. 2024, 73, 101269. [Google Scholar] [CrossRef] [PubMed]

| Variable | Definition | Source |

|---|---|---|

| Key explanatory variable | ||

| Interest Rate | EFFR during non-QE periods; SSR during QE periods (2008Q4–2014Q4, 2020Q1–2022Q2), | FRED for EFFR; Krippner (2013) [38] |

| Dependent variable | ||

| NCF | (Net FDI + Net Ptf.Inv. + Net Oth.Inv.)/GDP | IMF Balance of Payments Statistics. |

| Control variable | ||

| VIX | Chicago Board Options Exchange Market Volatility Index | Chicago Board Options Exchange |

| CRB | Commodity price index reflecting global price movements | Commodity Research Bureau |

| Exchange Rate | Nominal exchange rate against U.S. dollar | IMF International Financial Statistics |

| External Debt | Total external debt (logarithmically transformed) | World Bank International Debt Statistics |

| GDP Deflator | (Nominal GDP/Real GDP) × 100 | World Bank World Development 2005–2024 Indicators. |

| Moderating variable | ||

| KAOPEN | Index of capital account openness based on de jure controls | Chinn and Ito (2006) [49] |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Variables | N | Mean | Sd | Min | Max | Skew | Kurt |

| NCF | 1501 | 4540.19 | 21,462.52 | −191,029.50 | 231,267.40 | 2.86 | 35.06 |

| Interest Rate | 1501 | 0.91 | 2.72 | −3.74 | 5.35 | 0.17 | 1.97 |

| CRB | 1501 | 445.45 | 77.84 | 292.45 | 631.45 | 0.08 | 2.51 |

| VIX | 1501 | 19.17 | 7.78 | 10.31 | 58.60 | 2.28 | 10.63 |

| GDP Deflator | 1501 | 13.84 | 27.92 | −18.84 | 267.17 | 3.73 | 19.40 |

| Exchange rate | 1501 | 1929.52 | 5231.41 | 1.00 | 24,220.32 | 2.95 | 10.61 |

| External Debt | 1501 | 270,067.47 | 349,379.13 | 1.00 | 2,746,600.00 | 4.31 | 25.69 |

| KAOPEN | 1501 | −0.17 | 1.17 | −1.93 | 2.30 | 0.89 | 2.77 |

| NCF | Interest Rate | VIX | CRB | Exchange Rate | External Debt | GDP Deflator | |

|---|---|---|---|---|---|---|---|

| NCF | 1.0000 | ||||||

| Interest Rate | −0.1535 *** | 1.0000 | |||||

| VIX | −0.0545 * | −0.1908 * | 1.0000 | ||||

| CRB | 0.0573 * | −0.2211 * | −0.0250 | 1.0000 | |||

| Exchange Rate | −0.0829 * | 0.0781 * | 0.0915 * | 0.0036 | 1.0000 | ||

| External Debt | 0.1129 * | 0.0047 | 0.0303 | −0.0043 | −0.0970 * | 1.0000 | |

| GDP Deflator | −0.0579 * | −0.1184 * | 0.1544 * | 0.0014 | 0.2246 * | 0.0720 * | 1.0000 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | NCF | NCF | NCF | NCF | NCF | NCF |

| Interest Rate | −0.0073 ** | −0.0070 ** | −0.0087 ** | −0.0087 ** | −0.0087 ** | −0.0087 ** |

| (−3.17) | (−3.09) | (−3.25) | (−3.22) | (−3.24) | (−3.24) | |

| CRB | −0.0001 * | −0.0003 * | −0.0003 * | −0.0003 * | −0.0003 * | |

| (−1.58) | (−2.05) | (−2.05) | (−2.04) | (−2.05) | ||

| VIX | −0.0010 | −0.0010 | −0.0010 | −0.0010 | ||

| (−1.74) | (−1.74) | (−1.75) | (−1.75) | |||

| GDP Deflator | −0.0001 | 0.0000 | 0.0000 | |||

| (−0.70) | (−0.56) | (−0.59) | ||||

| Exchange Rate | 0.0000 | 0.0000 | ||||

| (0.93) | (0.95) | |||||

| External Debt | 0.0009 | |||||

| (0.70) | ||||||

| _cons | 0.0507 *** | 0.0921 ** | 0.1510 * | 0.1520 ** | 0.1490 * | 0.1400 * |

| (4.35) | (3.02) | (2.88) | (2.89) | (2.87) | (2.46) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1501 | 1501 | 1501 | 1501 | 1501 | 1501 |

| Aju-R2 | 0.3513 | 0.3513 | 0.3515 | 0.3514 | 0.3514 | 0.3514 |

| Variables | (1) NCF | (2) NCF | (3) NCF | (4) NCF |

|---|---|---|---|---|

| Interest Rate | −0.0086 ** | −0.0090 ** | ||

| (−3.25) | (−3.43) | |||

| Interest Rate (T−1) | −0.0091 * | |||

| (−2.64) | ||||

| SSR | −0.0106 ** | |||

| (−3.92) | ||||

| CRB | −0.0002 | −0.0003 * | −0.0003 * | −0.0003 |

| (−1.98) | (−2.11) | (−2.16) | (−2.06) | |

| VIX | −0.0007 | −0.0010 | −0.0010 | −0.0010 |

| (−1.35) | (−1.82) | (−1.79) | (−1.77) | |

| GPR | 0.0002 | |||

| (1.71) | ||||

| Short-term Interest Rate | 0.0005 | |||

| (1.65) | ||||

| GDP Deflator | −0.0001 | −0.0000 | −0.0001 | −0.0000 |

| (−1.10) | (−0.54) | (−1.55) | (−0.44) | |

| Exchange Rate | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| (0.77) | (0.97) | (1.10) | (1.43) | |

| External Debt | 0.0010 | 0.0009 | 0.0008 | 0.0007 |

| (0.77) | (0.70) | (0.64) | (0.57) | |

| _cons | 0.1330 * | 0.0644 ** | 0.1250 ** | 0.0868 |

| (2.27) | (2.44) | (2.12) | (1.16) | |

| Year FE | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes |

| Observations | 1482 | 1501 | 1501 | 1501 |

| Aju-R2 | 0.1980 | 0.3570 | 0.3513 | 0.3534 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | NCF | NCF | NCF | NCF | NCF | NCF |

| Interest Rate | −0.0075 ** | −0.0072 ** | −0.0089 ** | −0.0089 ** | −0.0089 ** | −0.0089 ** |

| (−3.30) | (−3.22) | (−3.34) | (−3.30) | (−3.33) | (−3.33) | |

| KAOPEN× Interest Rate | −0.0012 ** (−1.19) | −0.0012 ** (−1.18) | −0.0012 ** (−1.19) | −0.0012 ** (−1.19) | −0.0012 ** (−1.21) | −0.0012 ** (−1.21) |

| KAOPEN | −0.0012 | −0.0012 | −0.0012 | −0.0012 | −0.0012 | −0.0011 |

| (−0.19) | (−0.19) | (−0.19) | (−0.19) | (−0.19) | (−0.17) | |

| CRB | −0.0001 | −0.0003 | −0.0003 | −0.0003 | −0.0003 | |

| (−1.57) | (−2.05) | (−2.05) | (−2.04) | (−2.04) | ||

| VIX | −0.0010 | −0.0010 | −0.0010 | −0.0010 | ||

| (−1.76) | (−1.76) | (−1.76) | (−1.77) | |||

| GDP Deflator | −0.0007 | −0.0001 | −0.0001 | |||

| (−0.85) | (−0.70) | (−0.73) | ||||

| Exchange Rate | 0.0000 | 0.0000 | ||||

| (0.99) | (1.00) | |||||

| External Debt | 0.0011 | |||||

| (0.82) | ||||||

| _cons | 0.0509 *** | 0.0919 ** | 0.1510 ** | 0.1520 ** | 0.1490 ** | 0.1370 * |

| (4.38) | (3.05) | (2.90) | (2.91) | (2.88) | (2.36) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1501 | 1501 | 1501 | 1501 | 1501 | 1501 |

| Aju-R2 | 0.3667 | 0.3570 | 0.3534 | 0.3534 | 0.3630 | 0.3653 |

| Period | Net Capital Inflow Components | Income Level | |||||

|---|---|---|---|---|---|---|---|

| CMP | UMP | Net FDI | Net Ptf.Inv. | Net Oth.Inv. | High income | Low income | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Variables | NCF | NCF | Net FDI | Net Ptf.Inv. | Net Oth.Inv. | NCF | NCF |

| Interest Rate | −0.002 * | −0.008 ** | −0.0007 | −0.0025 ** | −0.0055 ** | −0.0068 ** | −0.0148 ** |

| (−1.44) | (−2.45) | (−1.19) | (−2.39) | (−2.89) | (−2.07) | (−4.66) | |

| CRB | −0.0004 | −0.0004 * | 0.0000 | −0.0001 | −0.0002* | −0.0003 | −0.0001 |

| (−1.89) | (−2.20) | (0.41) | (−1.15) | (−2.37) | (−1.87) | (−1.23) | |

| VIX | 0.0000 | −0.0010 | 0.0002 | −0.0011 * | −0.0001 | −0.0013 | −0.0002 |

| (0.04) | (−0.91) | (0.85) | (−2.56) | (−0.21) | (−1.76) | (−0.15) | |

| GDP Deflator | −0.0001 | 0.0003 | 0.0001 * | −0.0001 | −0.0001 | −0.0001 | 0.0000 |

| (−1.76) | (0.84) | (2.22) | (−1.79) | (−0.49) | (−0.77) | (0.08) | |

| Exchange Rate | 0.0000 | 0.0000 | 0.0000 | −0.0000 | 0.0000 | 0.0000 | 0.0000 |

| (0.94) | (0.49) | (0.72) | (−1.23) | (0.77) | (0.97) | (1.70) | |

| External Debt | 0.0001 | 0.0303 * | −0.0010 | 0.0019 | 0.0000 | 0.0027 | −0.0014 |

| (0.08) | (2.63) | (−1.20) | (1.28) | (0.04) | (0.98) | (−1.12) | |

| _cons | 0.1810 * | −0.1520 | 0.0249 | 0.0304 | 0.0845 * | 0.1360 | 0.1220 * |

| (2.43) | (−0.88) | (1.28) | (0.97) | (2.26) | (1.65) | (3.12) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 836 | 665 | 1501 | 1501 | 1501 | 375 | 1126 |

| Aju-R2 | 0.2047 | 0.3257 | 0.0642 | 0.3827 | 0.3237 | 0.1955 | 0.3507 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, T.; Liu, L.; Liang, X. U.S. Monetary Policy and Capital Flows to Emerging Markets: The Role of Capital Controls in Financial Stability. Sustainability 2025, 17, 11369. https://doi.org/10.3390/su172411369

Lin T, Liu L, Liang X. U.S. Monetary Policy and Capital Flows to Emerging Markets: The Role of Capital Controls in Financial Stability. Sustainability. 2025; 17(24):11369. https://doi.org/10.3390/su172411369

Chicago/Turabian StyleLin, Tianyou, Linxuan Liu, and Xin Liang. 2025. "U.S. Monetary Policy and Capital Flows to Emerging Markets: The Role of Capital Controls in Financial Stability" Sustainability 17, no. 24: 11369. https://doi.org/10.3390/su172411369

APA StyleLin, T., Liu, L., & Liang, X. (2025). U.S. Monetary Policy and Capital Flows to Emerging Markets: The Role of Capital Controls in Financial Stability. Sustainability, 17(24), 11369. https://doi.org/10.3390/su172411369