Carbon Revenue Recycling: The Cornerstone of the Carbon Pricing Mechanism Within the Shipping Industry

Abstract

1. Introduction

- RQ1: What are the potential strategies and methods for allocating carbon revenue within the shipping industry?

- RQ2: What are the key barriers and challenges associated with the revenue distribution mechanism?

1.1. Insights from Other Sectors and CPMs on Carbon Revenue Recycling

1.2. An Estimate of Carbon Revenue in the Shipping Industry

2. Method and Materials

3. Results: Classified Approaches to Carbon Revenue Distribution in Other CPMs

3.1. Mitigating the Impact on Affected Groups

3.2. Promoting Renewable Energy and Energy Efficiency

3.3. Offsets

3.4. Funding Climate and Environmental Projects

3.5. Utilization of Advanced Technologies and Modernization of Existing Infrastructure

3.6. Administration Costs

3.7. Funding Research and Development (R&D)

3.8. Adaptation to the Impacts of Climate Change

| Other Sectors and CPMs | Future Maritime CPM |

|---|---|

|

|

|

|

| Technology transfer to SIDS and LDCs |

|

|

|

|

| Implementation costs of the maritime CPM |

| Maritime R&D initiatives |

| Out of sector expenditure |

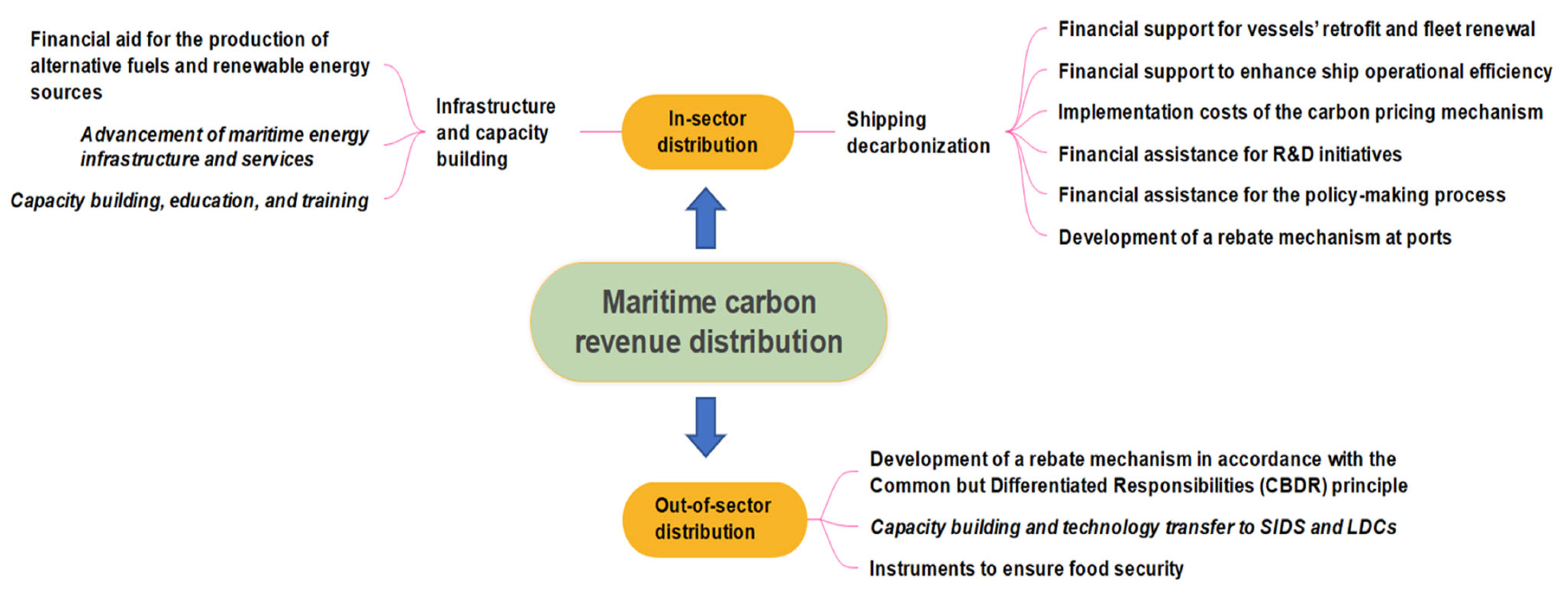

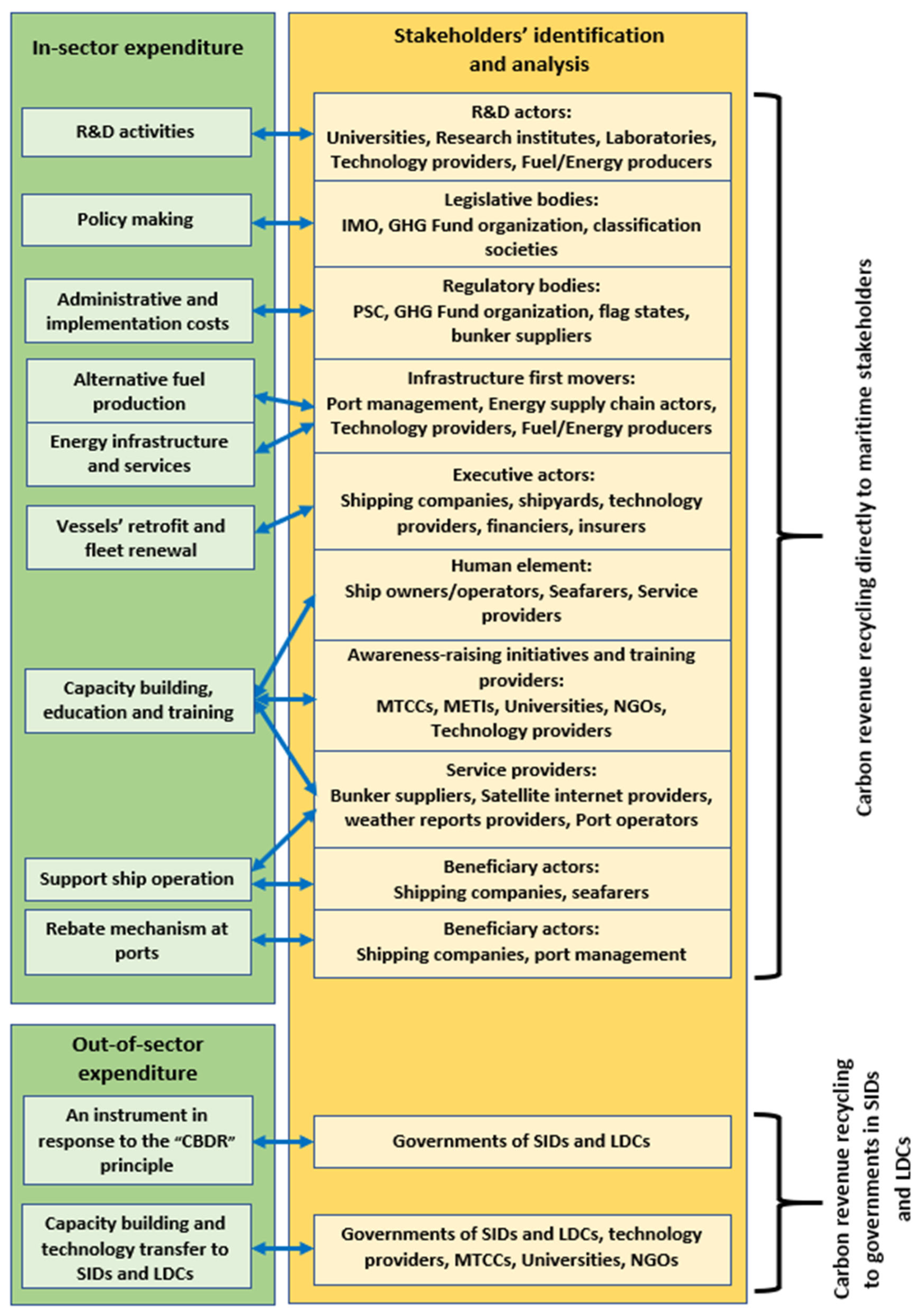

4. Results: Strategies for Carbon Revenue Distribution in the Maritime Industry

4.1. In- Sector Distribution

- Financial support for vessels’ retrofit and fleet renewal

- Financial support to enhance ship operational efficiency

- Implementation costs of the carbon pricing mechanism

- Financial assistance for R&D initiatives

- Financial assistance for the policy-making process

- Development of a rebate mechanism at ports

- Financial aid for the production of alternative fuels and renewable energy sources

- Advancement of maritime energy infrastructure and services

- Capacity building, education, and training

4.2. Out-of-Sector Distribution

- Development of a rebate mechanism in accordance with the CBDR principle

- Capacity building and technology transfer to SIDS and LDCs

- Instruments to ensure food security

5. Discussion: The Complexities of Carbon Revenue Disbursements

5.1. The Interface Between In-Sector and Out-of-Sector Expenditure

5.2. Risk of Split Incentives

5.3. Stability of Carbon Revenue

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Styhre, L.; Winnes, H. Energy efficient shipping–between research and implementation. In Proceedings of the IAME 2013 Conference, Marseille, France, 3–5 July 2013; pp. 3–5. [Google Scholar]

- Armstrong, V.N.; Banks, C. Integrated approach to vessel energy efficiency. Ocean Eng. 2015, 110, 39–48. [Google Scholar] [CrossRef]

- Poulsen, R.T.; Johnson, H. The logic of business vs. the logic of energy management practice: Understanding the choices and effects of energy consumption monitoring systems in shipping companies. J. Clean. Prod. 2016, 112, 3785–3797. [Google Scholar] [CrossRef]

- Walsh, C.; Mander, S.; Larkin, A. Charting a low carbon future for shipping: A UK perspective. Mar. Policy 2017, 82, 32–40. [Google Scholar] [CrossRef]

- Mander, S. Slow steaming and a new dawn for wind propulsion: A multi-level analysis of two low carbon shipping transitions. Mar. Policy 2017, 75, 210–216. [Google Scholar] [CrossRef]

- Wan, Z.; El Makhloufi, A.; Chen, Y.; Tang, J. Decarbonizing the international shipping industry: Solutions and policy recommendations. Mar. Pollut. Bull. 2018, 126, 428–435. [Google Scholar] [CrossRef]

- Gu, Y.; Wallace, S.W.; Wang, X. Can an Emission Trading Scheme really reduce CO2 emissions in the short term? Evidence from a maritime fleet composition and deployment model. Transp. Res. Part D Transp. Environ. 2019, 74, 318–338. [Google Scholar] [CrossRef]

- Kachi, A.; Mooldijk, S.; Warnecke, C. Carbon Pricing Options for International Maritime Emissions; New Climate-Institute for Climate Policy and Global Sustainability gGmbH: Berlin, Germany, 2019. [Google Scholar]

- Adamowicz, M. Decarbonisation of maritime transport–European Union measures as an inspiration for global solutions? Mar. Policy 2022, 145, 105085. [Google Scholar] [CrossRef]

- Miola, A.; Ciuffo, B.; Marra, M.; Giovine, E. Analytical Framework to Regulate Air Emissions from Maritime Transport; European Commission Joint Research Centre Institute for Environment and Sustainability: Ispra, Italy, 2010. [Google Scholar]

- Heitmann, N.; Khalilian, S. Accounting for carbon dioxide emissions from international shipping: Burden sharing under different UNFCCC allocation options and regime scenarios. Mar. Policy 2011, 35, 682–691. [Google Scholar] [CrossRef]

- Psaraftis, H.N. Market-based measures for greenhouse gas emissions from ships: A review. WMU J. Marit. Aff. 2012, 11, 211–232. [Google Scholar] [CrossRef]

- Lee, T.C.; Chang, Y.T.; Lee, P.T. Economy-wide impact analysis of a carbon tax on international container shipping. Transp. Res. Part A Policy Pract. 2013, 58, 87–102. [Google Scholar] [CrossRef]

- Wang, K.; Fu, X.; Luo, M. Modeling the impacts of alternative emission trading schemes on international shipping. Transp. Res. Part A Policy Pract. 2015, 77, 35–49. [Google Scholar] [CrossRef]

- Shi, Y. Reducing greenhouse gas emissions from international shipping: Is it time to consider market-based measures? Mar. Policy 2016, 64, 123–134. [Google Scholar] [CrossRef]

- Fan, L.; Xu, Y.; Luo, M.; Yin, J. Modeling the interactions among green shipping policies. Marit. Policy Manag. 2022, 49, 62–77. [Google Scholar] [CrossRef]

- Psaraftis, H.N. Green Maritime Transportation: Market Based Measures. In Green Transportation Logistics: The Quest for Win-Win Solutions; Springer International Publishing: Cham, Switzerland, 2016; pp. 267–297. [Google Scholar]

- De Mooij, R.A.; Keen, M.M.; Parry, I.W. Fiscal Policy to Mitigate Climate Change: A Guide for Policymakers; International Monetary Fund: Washington, DC, USA, 2012. [Google Scholar]

- World Bank. Using Carbon Revenues; World Bank: Washington, DC, USA, 2019. [Google Scholar]

- World Bank. Distributing carbon revenues from shipping. Ariz. Law Rev. 2023, 65, 1–58. [Google Scholar]

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef]

- Raymond, L. Reclaiming the Atmospheric Commons: The Regional Greenhouse Gas Initiative and a New Model of Emissions Trading; MIT Press: Cambridge, MA, USA, 2016. [Google Scholar]

- World Bank. What Are the Options for Using Carbon Pricing Revenues? (Executive Briefing); World Bank: Washington, DC, USA, 2016. [Google Scholar]

- European Commission. Report from the Commission to the European Parliament and the Council: Report on the Functioning of the European Carbon Market. Publications Office of the European Union, Luxembourg, 2017. Available online: https://commission.europa.eu/system/files/2017-11/report-functioning-carbon-market_en.pdf (accessed on 23 December 2017).

- Ramseur, J.L. The Regional Greenhouse Gas Initiative: Lessons Learned and Issues for Congress; Library of Congress, Congressional Research Service: Washington, DC, USA, 2016. [Google Scholar]

- California Climate Investments CCI. Annual Report to the Legislature on California Climate Investments Using Cap-and-Trade Auction Proceeds (Annual Report); California Climate Investments (CCI): Sacramento, CA, USA, 2017. [Google Scholar]

- Carl, J.; Fedor, D. Tracking global carbon revenues: A survey of carbon taxes versus cap-and-trade in the real world. Energy Policy 2016, 96, 50–77. [Google Scholar] [CrossRef]

- Parry, I.; Heine, M.D.; Kizzier, K.; Smith, T. Carbon Taxation for International Maritime Fuels: Assessing the Options; International Monetary Fund: Washington, DC, USA, 2018. [Google Scholar]

- Psaraftis, H.N.; Zis, T.; Lagouvardou, S. A comparative evaluation of market based measures for shipping decarbonization. Marit. Transp. Res. 2021, 2, 100019. [Google Scholar] [CrossRef]

- Christodoulou, A.; Cullinane, K. The prospects for, and implications of, emissions trading in shipping. Marit. Econ. Logist. 2024, 26, 168–184. [Google Scholar] [CrossRef]

- Chai, K.H.; Lee, X.N.; Gaudin, A. A systems perspective to market–based mechanisms (MBM) comparison for international shipping. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- ClassNK. Pathway to Zero-Emission in International Shipping: Understanding the 2023 IMO GHG Strategy; ClassNK: Tokyo, Japan, 2023. [Google Scholar]

- Euractiv. Maersk Favours Carbon Tax for Shipping. Available online: https://www.euractiv.com/section/shipping/news/maersk-favours-carbon-tax-for-shipping/ (accessed on 3 June 2021).

- Trafigura. A Proposal for an IMO-Led Global Shipping Industry Decarbonisation Programme; Trafigura: Singapore, 2020. [Google Scholar]

- Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping. We Show the World it Is Possible. Industry Transition Strategy. Available online: https://www.zerocarbonshipping.com/files/industry-transition-strategy.pdf (accessed on 10 October 2021).

- Lagouvardou, S.; Psaraftis, H.N.; Zis, T. Impacts of a bunker levy on decarbonizing shipping: A tanker case study. Transp. Res. Part D Transp. Environ. 2022, 106, 103257. [Google Scholar] [CrossRef]

- Baresic, D.; Rojon, I.; Shaw, A.; Rehmatulla, N. Closing the Gap: An Overview of the Policy Options to Close the Competitiveness Gap and Enable an Equitable Zero-Emission Fuel Transition in Shipping; UMAS: London, UK, 2022. [Google Scholar]

- Smith, T. The Cost of Reducing Greenhouse Gas Emissions in Shipping, International Transport Forum Discussion Papers; No. 2020/18; OECD Publishing: Paris, France, 2020. [Google Scholar]

- Dominioni, G.; Englert, D.; Salgmann, R.; Brown, J. Carbon Revenues From International Shipping: Enabling an Effective and Equitable Energy Transition—Summary for Poli-cymakers. ©World Bank. 2022. Available online: http://hdl.handle.net/10986/37241 (accessed on 3 June 2021).

- Klerings, I.; Robalino, S.; Booth, A.; Escobar-Liquitay, C.M.; Sommer, I.; Gartlehner, G.; Devane, D.; Waffenschmidt, S. Rapid reviews methods series: Guidance on literature search. BMJ Evid. Based Med. 2023, 28, 412–417. [Google Scholar] [CrossRef]

- Mangat, G.; Sharma, S. MSR36 how does the use of different targeted literature review (TLR) methodologies impact the research output? A case study of structured vs. focused vs. pearl growing approach. Value Health 2023, 26 (Suppl. S284). [Google Scholar] [CrossRef]

- IMF. Fiscal Policies for Paris Climate Strategies—From Principle to Practice. Policy Paper No. 19/010. 2019. Available online: https://www.imf.org/en/publications/policy-papers/issues/2019/05/01/fiscal-policies-for-paris-climate-strategies-from-principle-to-practice-46826 (accessed on 1 May 2019).

- Sumner, J.; Bird, L.; Dobos, H. Carbon taxes: A review of experience and policy design considerations. Clim. Policy 2011, 11, 922–943. [Google Scholar] [CrossRef]

- Wiese, C.; Cowart, R.; Rosenow, J. The strategic use of auctioning revenues to foster energy efficiency: Status quo and potential within the European Union Emissions Trading System. Energy Effic. 2020, 13, 1677–1688. [Google Scholar] [CrossRef]

- Thema, J.; Suerkemper, F.; Couder, J.; Mzavanadze, N.; Chatterjee, S.; Teubler, J.; Thomas, S.; Ürge-Vorsatz, D.; Hansen, M.B.; Bouzarovski, S.; et al. The multiple benefits of the 2030 EU energy efficiency potential. Energies 2019, 12, 2798. [Google Scholar] [CrossRef]

- Green, J.F. Does carbon pricing reduce emissions? A review of ex-post analyses. Environ. Res. Lett. 2021, 16, 043004. [Google Scholar] [CrossRef]

- Baranzini, A.; Carattini, S. Effectiveness, earmarking and labeling: Testing the acceptability of carbon taxes with survey data. Environ. Econ. Policy Stud. 2017, 19, 197–227. [Google Scholar] [CrossRef]

- European Environment Agency. Use of Auctioning Revenues Generated Under the EU Emissions Trading System. Available online: https://www.eea.europa.eu/en/analysis/indicators/use-of-auctioning-revenues-generated (accessed on 19 December 2024).

- ITF. Decarbonization and the Pricing of Road Transport: Summary and Conclusions; ITF Roundtable Reports, No. 191; OECD Publishing: Paris, France, 2023. [Google Scholar]

- ICS and Intercargo. A Levy-Based MBM, Per Tonne of CO2 Emissions, to Expedite the Uptake and Deployment of Zero-Carbon Fuels. International Maritime Organization, Intersessional Working Group for the Reduction of GHG Emissions from Ships, ISWG-GHG 10/5/2 (accessible to IMO delegates). 2021. Available online: https://www.ics-shipping.org/wp-content/uploads/2021/09/ISWG-GHG-10-5-2-A-levy-based-MBM-per-tonne-of-CO2-emissions-to-expedite-the-uptake-and-deployment-of-zer...-ICS-and-INTERCARGO.pdf (accessed on 19 December 2024).

- Pomerleau, K.; Asen, E. Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications. Fiscal Fact 2019, 674, 1–13. [Google Scholar]

- Carbon Market Watch. Sailing Towards a Global Carbon Price in the Maritime Industry? Available online: https://carbonmarketwatch.org/wp-content/uploads/2021/03/Sailing-towards-a-global-carbon-price-in-the-maritime-industry.pdf (accessed on 10 March 2021).

- Englert, D.; Losos, A.; Raucci, C.; Smith, T. The Potential of Zero-Carbon Bunker Fuels in Developing Countries; World Bank: Washington, DC, USA, 2021. [Google Scholar]

- OECD/ITF. Carbon Pricing in Shipping; International Transport Forum Policy Papers, No. 110; OECD: Paris, France, 2022. [Google Scholar]

- Krantz, R.; Laffineur, L.; Faber, L.; Rehmatulla, N.; Bonello, J.M.; Jakobsen, L.; Olafsen, G.; Johnson, H. The Role of Data in Maximising Operational Efficiency in Shipping; Global Maritime Forum: Copenhagen, Denmark, 2023. [Google Scholar]

- Ghaforian Masodzadeh, P. Policy Innovation as the Cornerstone of Energy Transition: An Analysis of Energy Policy in the Shipping Economy and Operations. Ph.D. Thesis, World Maritime University, Malmö, Sweden, 2023. [Google Scholar]

- Masodzadeh, P.G.; Ölçer, A.I.; Ballini, F.; Christodoulou, A. How to bridge the short-term measures to the Market Based Measure? Proposal of a new hybrid MBM based on a new standard in ship operation. Transp. Policy 2022, 118, 123–142. [Google Scholar] [CrossRef]

- Masodzadeh, P.G.; Ölçer, A.I.; Ballini, F.; Dalaklis, D. The contribution of ports to shipping decarbonization: An analysis of port incentive programmes and the executive role of port state control. Transp. Econ. Manag. 2024, 2, 191–202. [Google Scholar] [CrossRef]

- Bach, H.; Hansen, T. IMO off course for decarbonisation of shipping? Three challenges for stricter policy. Mar. Policy 2023, 147, 105379. [Google Scholar] [CrossRef]

- Toluwanimi, A.; Fantini, C.; Morgan, G.; Thacker, S.; Ceppi, P.; Bhikhoo, J.; Kumar, N.; Crosskey, S.; O’Regan, N. Infrastructure for Small Island Developing States; United Nations Office for Project Services: Copenhagen, Denmark, 2020. [Google Scholar]

- Houtven, G.; Van, M.; Gallaher, J.W.; Decker, E. Act Now or Pay Later: The Costs of Climate Inaction for Ports and Shipping; Environmental Defense Fund: New York, NY, USA, 2022. [Google Scholar]

- DNV. The Future of Seafarers 2030: A Decade of Transformation. 2023. Available online: https://www.dnv.com/maritime/publications/the-future-of-seafarers-2030-a-decade-of-transformation.html (accessed on 1 November 2022).

- Ölçer, A.I.; Kitada, M.; Lagdami, K.; Ballini, F.; Alamoush, A.S.; Masodzadeh, P.G. (Eds.) Transport 2040: Impact of Technology on Seafarers—The Future of Work; World Maritime University: Malmö, Sweden, 2023. [Google Scholar]

- ITF/ICS/LR. Mapping a Maritime Just Transition for seafarers—Maritime Just Transition Task Force. Available online: https://www.itfglobal.org/en/resources/mapping-maritime-just-transition-seafarers-maritime-just-transition-task-force-2022 (accessed on 1 November 2022).

- IMO. 2023 IMO Strategy on Reduction of GHG Emissions from Ships. 2023. MEPC 80/WP.12. ANNEX 1. Available online: https://docs.imo.org/Search.aspx?keywords=MEPC%2080%2FWP.12 (accessed on 6 July 2023).

- Wemaëre, M.; Vallej, L.; Colombier, M. Designing a Greenhouse Gases (GHG) Levy Supporting an Equitable Low-Carbon and Resilient Transition of International Shipping Under the IMO; IDDR: Paris, France, 2023. [Google Scholar]

- IMO. Reduction of GHG Emissions from Ships. Further Work on Food Security. MEPC 83/7/20. Available online: https://docs.imo.org/Search.aspx?keywords=MEPC%2083%2F7%2F20 (accessed on 31 January 2025).

- Koesler, S.; Achtnicht, M.; Köhler, J. Course set for a cap? A case study among ship operators on a maritime ETS. Transp. Policy 2015, 37, 20–30. [Google Scholar] [CrossRef]

- Krantz, R.; Søgaard, K.; Smith, T. The Scale of Investment Needed to Decarbonize International Shipping. Getting to Zero Coalition Insight Series. 3–6 January 2020. Available online: https://globalmaritimeforum.org/insight/the-scale-of-investment-needed-to-decarbonize-international-shipping/ (accessed on 20 January 2020).

- Ciplet, D.; Falzon, D.; Uri, I.; Robinson, S.A.; Weikmans, R.; Roberts, J.T. The unequal geographies of climate finance: Climate injustice and dependency in the world system. Political Geogr. 2022, 99, 102769. [Google Scholar] [CrossRef]

- Frank, A.G. Lumpenbourgeoisie: Lumpendevelopment; Monthly Review Press: New York City, NY, USA, 1974; Volume 285. [Google Scholar]

- Climate Bonds Initiative. ASEAN Green Financial Instruments Guide. Available online: https://www.climatebonds.net/files/documents/publications/ASEAN-Green-Financial-Instruments-Guide.pdf (accessed on 20 January 2019).

- NGFS. Synthesis Report on the Greening of the Financial System. Available online: https://www.ngfs.net/sites/default/files/medias/documents/ngfs_synthesis_report_on_the_greening_of_the_financial_system.pdf (accessed on 20 November 2024).

| Proposed by | Carbon Price (USD)/Tonne CO2 | Yearly Revenue | Cumulative Revenue Range | |

|---|---|---|---|---|

| 2030 | 2040 | 2025–2050 | ||

| Marshall Islands and Solomon Islands proposal | Starting with 100 $ in 2025 and from 2030 onward 250–300 $ | 146–175 b$ | 55–66 b$ | - |

| Maersk [33] | 150 $ | 88 b$ | 33 b$ | - |

| Trafigura [34] | 250–300 $ | 146–175 b$ | 55–66 b$ | - |

| MMM Center for Zero Carbon Shipping [35] | 230 $ | 135 b$ | 50 b$ | $1.8 trillion (after deduction of green fuel production cost) |

| Lagouvardou et al. [36] | 150–400 $ | 88–234 b$ | 33–88 b$ | - |

| Baresic et al. [37] | 191 $ (zero emission in 2050) | 112 b$ | 42 b$ | $1 trillion–$2.6 trillion |

| Smith [38] | 50–250 $ (50% emission reduction by 2050, in case of fully re-investing in zero-carbon fuels and technologies) | 29–146 b$ | 11–55 b$ | - |

| A conclusion of previous studies by Dominioni et al. [39] and World bank [20] | Yearly average 40–60 b$ | $1 trillion—$3.7 trillion | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ghaforian Masodzadeh, P.; Ölcer, A.I.; Ballini, F. Carbon Revenue Recycling: The Cornerstone of the Carbon Pricing Mechanism Within the Shipping Industry. Sustainability 2025, 17, 10599. https://doi.org/10.3390/su172310599

Ghaforian Masodzadeh P, Ölcer AI, Ballini F. Carbon Revenue Recycling: The Cornerstone of the Carbon Pricing Mechanism Within the Shipping Industry. Sustainability. 2025; 17(23):10599. https://doi.org/10.3390/su172310599

Chicago/Turabian StyleGhaforian Masodzadeh, Peyman, Aykut I. Ölcer, and Fabio Ballini. 2025. "Carbon Revenue Recycling: The Cornerstone of the Carbon Pricing Mechanism Within the Shipping Industry" Sustainability 17, no. 23: 10599. https://doi.org/10.3390/su172310599

APA StyleGhaforian Masodzadeh, P., Ölcer, A. I., & Ballini, F. (2025). Carbon Revenue Recycling: The Cornerstone of the Carbon Pricing Mechanism Within the Shipping Industry. Sustainability, 17(23), 10599. https://doi.org/10.3390/su172310599