Digital–Physical Integration and Carbon Productivity: An Empirical Assessment from China

Abstract

1. Introduction

2. Literature Review

2.1. Research on Digital–Real Integration

2.2. Research on the Determinants of Carbon Productivity

2.3. Research on the Impact of Digital–Real Integration on Carbon Productivity

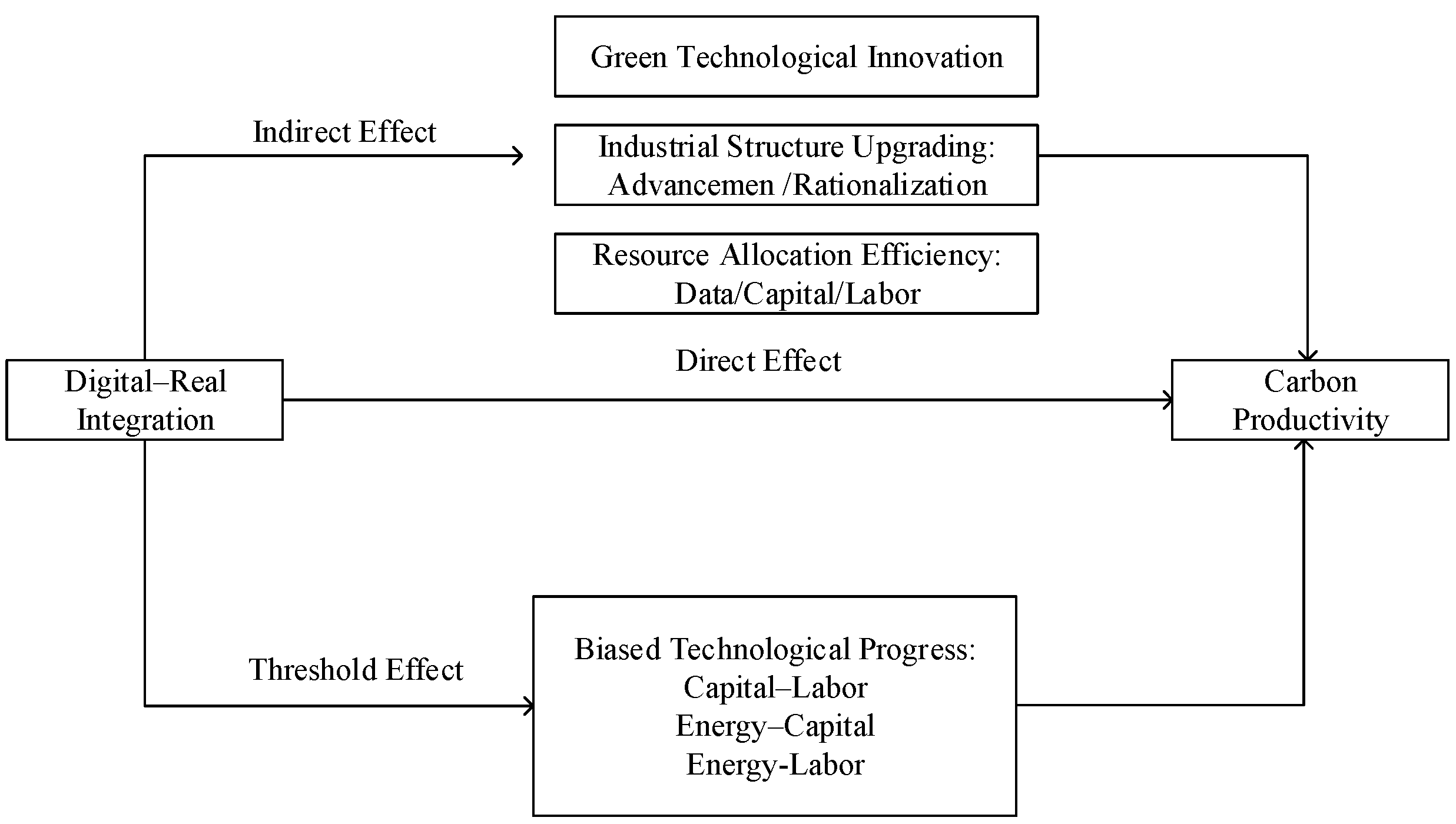

3. Theoretical Framework and Research Hypotheses

3.1. The Direct Effect of Digital–Real Integration on Carbon Productivity

3.2. Indirect Impact of Digital–Real Integration on Carbon Productivity

3.2.1. Green Technological Innovation Effect

3.2.2. Industrial Structure Upgrading Effect

3.2.3. Resource Allocation Effect

3.3. Threshold Effects of Digital–Real Integration on Carbon Productivity

4. Research Design

4.1. Model Setup

4.1.1. Baseline Econometric Specification

4.1.2. Mechanism Model

4.1.3. Threshold Model

4.2. Variable Description

4.2.1. Dependent Variable: Carbon Productivity

4.2.2. Explanatory Variable: Digital–Real Integration

4.2.3. Mechanism Variables

4.2.4. Threshold Variable: Biased Technological Progress

4.2.5. Control Variables

4.3. Data Sources and Descriptive Statistics

5. Empirical Analysis

5.1. Baseline Test

5.2. Robustness Test

5.3. Mechanism Test

5.3.1. Green Technological Innovation

5.3.2. Industrial Structure Upgrading

5.3.3. Resource Allocation Efficiency

6. Further Discussion

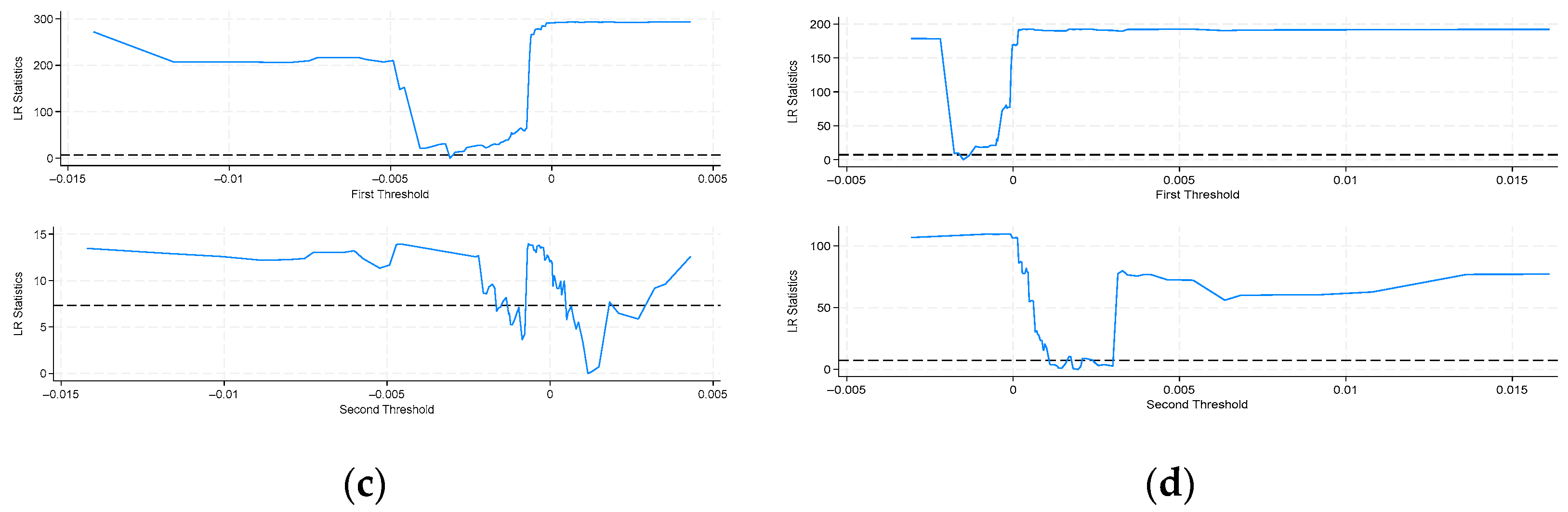

6.1. Overall Biased Technological Progress

6.2. Biased Technological Progress by Factor Type

7. Conclusions and Policy Implications

7.1. Conclusions

7.2. Discussion

7.3. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | DRI | MDI | DEDI | REDI | DEI_CA | DEI_TI |

|---|---|---|---|---|---|---|

| DRI | 1.0000 | |||||

| MDI | 0.7782 | 1.0000 | ||||

| DEDI | 0.9056 | 0.9125 | 1.0000 | |||

| REDI | 0.8046 | 0.9349 | 0.8619 | 1.0000 | ||

| DEI_CA | 0.3955 | 0.3681 | 0.3713 | 0.2469 | 1.0000 | |

| DEI_TI | 0.3404 | 0.2542 | 0.2814 | 0.1671 | 0.9546 | 1.0000 |

| Variable Type | Variable Name | Indicator | Specific Measure | Deflator | |

|---|---|---|---|---|---|

| Explained Variable | Digital–Real Integration (DRI) | — | Patent co-classification analysis | — | |

| Core Explanatory Variable | Carbon Productivity | — | Regional gross output/Carbon emissions | — | |

| Mediating Variables | Green Technological Innovation (GTE) | — | Number of authorized green patents per region/Regional population | — | |

| Industrial Structure (IND) | Structural upgrading | Output value of tertiary industry/Output value of secondary industry | — | ||

| Structural rationalization | Theil index | — | |||

| Resource Allocation Efficiency | Data factor allocation efficiency (Dmc) | Software business sales revenue | — | ||

| Capital Misallocation Index(Kmis)/Labor Misallocation Index(Lmis) | Output (Y) | R&D output | Deflated by GDP deflator | ||

| Capital (K) | Actual R&D expenditure | Deflated by GDP deflator | |||

| Labor (L) | R&D personnel | — | |||

| Threshold Variable | Biased Technological Progress (BTECH) | Capital (K) | Net value of industrial fixed assets | Deflated by fixed asset investment price index | |

| Labor (L) | Average number of industrial employees by region | — | |||

| Energy (E) | Energy consumption per unit of GDP | — | |||

| Desired output (Yg) | Industrial value added | Deflated by producer price index | |||

| Undesired output (Yb) | Environmental pollution index (entropy method) based on: total industrial wastewater discharge (10,000 tons), industrial smoke and dust emissions (10,000 tons), general industrial solid waste generation (10,000 tons), and industrial SO2 emissions (10,000 tons) | — | |||

| Province | DRI | CP | |||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Mean | SD | Min | Max | Mean | SD | Min | Max | |

| Beijing | 24 | 68.0154 | 73.542 | 2.4022 | 227.6915 | 5595.0738 | 1639.7977 | 3236.5579 | 9375.2266 |

| Tianjin | 24 | 11.2442 | 12.6463 | 0.216 | 39.2868 | 2243.6757 | 316.5193 | 1623.7842 | 2782.5277 |

| Hebei | 24 | 8.4297 | 12.1373 | 0.1238 | 36.6392 | 1161.9514 | 264.6863 | 877.3545 | 1868.2028 |

| Shanxi | 24 | 2.8729 | 4.3416 | 0.0456 | 13.9796 | 462.4271 | 73.7765 | 341.5846 | 579.1537 |

| Inner Mongolia | 24 | 1.7409 | 2.9771 | 0.0154 | 10.5919 | 530.986 | 325.6471 | 205.0371 | 1270.6649 |

| Liaoning | 24 | 8.7404 | 10.2186 | 0.381 | 31.8322 | 1498.2051 | 313.9967 | 1068.9821 | 2142.3563 |

| Jilin | 24 | 4.538 | 6.494 | 0.244 | 22.6187 | 1720.1221 | 247.6613 | 1325.9672 | 2160.088 |

| Heilongjiang | 24 | 4.0246 | 4.9896 | 0.0917 | 16.5338 | 1590.9416 | 446.5651 | 986.7488 | 2457.5572 |

| Shanghai | 24 | 37.8487 | 38.6245 | 1.0679 | 116.7996 | 3444.0658 | 435.9065 | 2946.7437 | 4722.5145 |

| Jiangsu | 24 | 77.8537 | 102.244 | 1.0908 | 287.9265 | 2293.1297 | 775.7811 | 1712.97 | 4214.0837 |

| Zhejiang | 24 | 45.6979 | 56.2487 | 0.458 | 164.4807 | 2706.1657 | 624.4173 | 2303.4512 | 4359.5201 |

| Anhui | 24 | 22.1303 | 31.2859 | 0.1219 | 90.7304 | 1427.874 | 371.8202 | 1081.2868 | 2335.9243 |

| Fujian | 24 | 17.3296 | 23.021 | 0.1311 | 68.0403 | 2904.088 | 1365.4895 | 2021.1878 | 6711.9557 |

| Jiangxi | 24 | 7.3966 | 11.0443 | 0.0386 | 33.3354 | 1817.538 | 594.566 | 1340.6807 | 3313.5168 |

| Shandong | 24 | 24.8052 | 34.5137 | 0.2687 | 101.5082 | 1758.3315 | 699.8248 | 1170.4272 | 3891.8218 |

| Henan | 24 | 12.1915 | 16.3944 | 0.0982 | 45.8099 | 1571.9815 | 419.8039 | 1198.6602 | 2722.8078 |

| Hubei | 24 | 21.1519 | 30.3491 | 0.2501 | 90.5158 | 1840.1315 | 341.2107 | 1415.7946 | 2930.7898 |

| Hunan | 24 | 12.2061 | 16.2487 | 0.1025 | 43.724 | 2139.9385 | 695.1969 | 1731.1638 | 4348.4646 |

| Guangdong | 24 | 135.7188 | 146.987 | 1.8852 | 441.0297 | 3351.6825 | 735.2328 | 2760.7966 | 5242.4471 |

| Guangxi | 24 | 4.4861 | 6.0956 | 0.049 | 17.3623 | 2058.0374 | 674.0843 | 1361.7017 | 3580.1241 |

| Hainan | 24 | 0.954 | 1.7082 | 0.0037 | 5.4805 | 2562.6821 | 1312.359 | 1648.583 | 6096.7782 |

| Chongqing | 24 | 8.6445 | 12.5237 | 0.0561 | 39.3126 | 1728.6277 | 347.4216 | 1331.5799 | 2389.4713 |

| Sichuan | 24 | 18.2655 | 23.2495 | 0.2221 | 73.7571 | 1869.9383 | 440.1934 | 1421.7267 | 3058.3598 |

| Guizhou | 24 | 3.1503 | 4.7844 | 0.0144 | 15.8107 | 739.6405 | 119.0006 | 623.9591 | 1043.2008 |

| Yunnan | 24 | 3.2378 | 5.1854 | 0.0224 | 17.4815 | 1433.0066 | 409.4314 | 1101.9901 | 2598.5527 |

| Shaanxi | 24 | 13.8352 | 18.6093 | 0.126 | 58.3505 | 1253.1974 | 566.6472 | 730.5105 | 2545.7319 |

| Gansu | 24 | 1.8789 | 2.831 | 0.0218 | 9.1013 | 1103.6632 | 298.8345 | 770.3087 | 1707.4884 |

| Qinghai | 24 | 0.6989 | 1.1468 | 0.0055 | 4.1915 | 1128.1957 | 410.8315 | 740.7208 | 2222.063 |

| Ningxia | 24 | 1.0735 | 1.8313 | 0.0029 | 7.2644 | 680.8526 | 884.2229 | 210.5389 | 4346.9169 |

| Xinjiang | 24 | 1.4097 | 2.248 | 0.0195 | 7.7969 | 1008.7403 | 572.4705 | 419.3448 | 2041.9394 |

Appendix B

References

- Zhang, L.; Mu, R.; Zhan, Y.; Yu, J.; Liu, L.; Yu, Y.; Zhang, J. Digital economy, energy efficiency, and carbon emissions: Evidence from provincial panel data in China. Sci. Total Environ. 2022, 852, 158403. [Google Scholar] [CrossRef] [PubMed]

- Kong, T.; Sun, R.; Sun, G.; Song, Y. Effects of Digital Finance on Green Innovation considering Information Asymmetry: An Empirical Study Based on Chinese Listed Firms. Emerg. Mark. Financ. Trade 2022, 58, 4399–4411. [Google Scholar] [CrossRef]

- Sai, R.; Lin, B.; Liu, X. The impact of clean energy development finance and financial agglomeration on carbon productivity in Africa. Environ. Impact Assess. Rev. 2023, 98, 106940. [Google Scholar] [CrossRef]

- Guo, D.; Li, L.; Pang, G. Does the integration of digital and real economies promote urban green total factor productivity? Evidence from China. J. Environ. Manag. 2024, 370, 122934. [Google Scholar] [CrossRef]

- Liu, B.; Huang, Y.; Chen, M.; Lan, Z. Towards sustainability: How does the digital–real integration affect regional green development efficiency? Econ. Anal. Policy 2024, 83, 42–59. [Google Scholar] [CrossRef]

- Hong, Y.; Ren, B. Connotation and approach of deep integration of the digital economy and the real economy. China Ind. Econ. 2023, 2, 5–16. [Google Scholar]

- Tianren, L.; Sufeng, H. Does digital-industrial technology integration reduce corporate carbon emissions? Environ. Res. 2024, 257, 119313. [Google Scholar] [CrossRef] [PubMed]

- Xu, Z.; Xu, W.; Xin, D. Digital–real economy integration and urban low-carbon development in China. Econ. Anal. Policy 2025, 86, 606–621. [Google Scholar] [CrossRef]

- Yu, H.; Liu, H. Impact of digitization on carbon productivity: An empirical analysis of 136 countries. Sci. Rep. 2024, 14, 5094. [Google Scholar] [CrossRef]

- Quttainah, M.A.; Ayadi, I. The impact of digital integration on corporate sustainability: Emissions reduction, environmental innovation, and resource efficiency in the European. J. Innov. Knowl. 2024, 9, 100525. [Google Scholar] [CrossRef]

- Xia, J.; Zhang, Y. Restructuring the Institutional Environment for Integration of Digital and Real Economies: Logic and Path. Acad. Forum 2024, 47, 77–88. [Google Scholar]

- Sun, C.; Luo, Y.; Yao, X. The effects of transportation infrastructure on air quality: Evidence from empirical analysis in China. Econ. Res. J. 2019, 54, 136–151. [Google Scholar]

- Yoo, Y.; Henfridsson, O.; Lyytinen, K. Research Commentary: The New Organizing Logic of Digital Innovation: An Agenda for Information Systems Research. Inf. Syst. Res. 2010, 21, 724–735. [Google Scholar] [CrossRef]

- Bröring, S.; Leker, J. Industry Convergence and Its Implications for the Front End of Innovation: A Problem of Absorptive Capacity. Creat. Innov. Manag. 2007, 16, 165–175. [Google Scholar] [CrossRef]

- Meng, X.-N.; Xu, S.-C.; Hao, M.-G. Can digital–real integration promote industrial green transformation: Fresh evidence from China’s industrial sector. J. Clean Prod. 2023, 426, 139116. [Google Scholar] [CrossRef]

- Pang, G.; Li, L.; Guo, D. Does the integration of the digital economy and the real economy enhance urban green emission reduction efficiency? Evidence from China. Sust. Cities Soc. 2025, 122, 106269. [Google Scholar] [CrossRef]

- Sun, G.; Fang, J.; Li, J.; Wang, X. Research on the impact of the integration of digital economy and real economy on enterprise green innovation. Technol. Forecast. Soc. Chang. 2024, 200, 123097. [Google Scholar] [CrossRef]

- Liu, Z.; Zhao, Y.; Guo, C.; Xin, Z. Research on the Impact of Digital–Real Integration on Logistics Industrial Transformation and Upgrading under Green Economy. Sustainability 2024, 16, 6173. [Google Scholar] [CrossRef]

- Xin, Y.; Song, H.; Shen, Z.; Wang, J. Measurement of the integration level between the digital economy and industry and its impact on energy consumption. Energy Econ. 2023, 126, 106988. [Google Scholar] [CrossRef]

- Mielnik, O.; Goldemberg, J. The evolution of thecarbonization indexin developing countries. Energy Policy 1999, 27, 307–308. [Google Scholar] [CrossRef]

- Kaya, Y.; Yokobori, K. Environment, Energy and Economy: Strategies for Sustainability; United Nations University Press: Tokyo, Japan, 1997. [Google Scholar]

- Meng, S.; Sun, R.; Guo, F. Does the use of renewable energy increase carbon productivity? An empirical analysis based on data from 30 provinces in China. J. Clean Prod. 2022, 365, 132647. [Google Scholar] [CrossRef]

- Wang, D.; Yu, Z.; Liu, H.; Cai, X.; Zhang, Z. Impact of capital and labour based technological progress on carbon productivity. J. Clean Prod. 2024, 467, 142827. [Google Scholar] [CrossRef]

- Han, D.; Ding, Y.; Shi, Z.; He, Y. The impact of digital economy on total factor carbon productivity: The threshold effect of technology accumulation. Environ. Sci. Pollut. Res. 2022, 29, 55691–55706. [Google Scholar] [CrossRef]

- Du, K.R.; Li, J.L. Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 2019, 131, 240–250. [Google Scholar] [CrossRef]

- Liao, T.; Yan, J.; Zhang, Q. The impact of green technology innovation on carbon emission efficiency: The intermediary role of intellectual capital. Int. Rev. Econ. Financ. 2024, 92, 520–532. [Google Scholar] [CrossRef]

- Zhang, X.; Yao, S.; Zheng, W.; Fang, J. On industrial agglomeration and industrial carbon productivity --- impact mechanism and nonlinear relationship. Energy 2023, 283, 129047. [Google Scholar] [CrossRef]

- Xu, H.; Liu, W.; Zhang, D. Exploring the role of co-agglomeration of manufacturing and producer services on carbon productivity: An empirical study of 282 cities in China. J. Clean Prod. 2023, 399, 136674. [Google Scholar] [CrossRef]

- Wang, Y.; Yin, S.; Fang, X.; Chen, W. Interaction of economic agglomeration, energy conservation and emission reduction: Evidence from three major urban agglomerations in China. Energy 2022, 241, 122519. [Google Scholar] [CrossRef]

- Yang, J.; Jin, M.; Chen, Y. Has the synergistic development of urban cluster improved carbon productivity? --Empirical evidence from China. J. Clean Prod. 2023, 414, 137535. [Google Scholar] [CrossRef]

- Wang, Y.; Shi, M.; Liu, J.; Zhong, M.; Ran, R. The impact of digital–real integration on energy productivity under a multi-governance framework: The mediating role of AI and embodied technological progress. Energy Econ. 2025, 142, 108167. [Google Scholar] [CrossRef]

- Sharma, M.; Kumar, A.; Luthra, S.; Joshi, S.; Upadhyay, A. The impact of environmental dynamism on low-carbon practices and digital supply chain networks to enhance sustainable performance: An empirical analysis. Bus. Strateg. Environ. 2022, 31, 1776–1788. [Google Scholar] [CrossRef]

- OECD. OECD Digital Economy Outlook 2024 (Volume 2): Strengthening Connectivity, Innovation and Trust; OECD Publishing: Paris, France, 2024. [Google Scholar]

- Kwilinski, A.; Lyulyov, O.; Pimonenko, T. Environmental Sustainability within Attaining Sustainable Development Goals: The Role of Digitalization and the Transport Sector. Sustainability 2023, 15, 11282. [Google Scholar] [CrossRef]

- Soto, G.H.; Nghiem, X.-H.; Martinez-Cobas, X. Analyzing the role of main energy transition policies upon renewable energy penetration in the EU: An assessment of energy productivity and low carbon economies. Environ. Sustain. Indic. 2025, 25, 100573. [Google Scholar] [CrossRef]

- Li, Z.; Chen, X.; Ye, Y.; Wang, F.; Liao, K.; Wang, C. The impact of digital economy on industrial carbon emission efficiency at the city level in China: Gravity movement trajectories and driving mechanisms. Environ. Technol. Innov. 2024, 33, 103511. [Google Scholar] [CrossRef]

- Cheng, C.; Ren, X.; Dong, K.; Dong, X.; Wang, Z. How does technological innovation mitigate CO2 emissions in OECD countries? Heterogeneous analysis using panel quantile regression. J. Environ. Manag. 2021, 280, 111818. [Google Scholar] [CrossRef]

- Yavuz, O.; Uner, M.M.; Okumus, F.; Karatepe, O.M. Industry 4.0 technologies, sustainable operations practices and their impacts on sustainable performance. J. Clean Prod. 2023, 387, 135951. [Google Scholar] [CrossRef]

- Nham, N.T.H.; Ha, L.T. An Integration of Environmental Innovation and Digitalization in Promoting TFP of the Agriculture Sector in Vietnam. Int. J. Energy Econ. Policy 2024, 14, 457–469. [Google Scholar] [CrossRef]

- Radulescu, M.; Barut, A.; Si Mohammed, K.; Nassani, A.A.; Cutcu, I. Insights of resources productivity and green technologies impact on renewable energy consumption: Novel MMQR approach. Geol. J. 2024, 59, 3033–3047. [Google Scholar] [CrossRef]

- Habib, Y.; Abd Rahman, N.R.; Hashmi, S.H.; Ali, M. Green finance and environmental decentralization drive OECD low carbon transitions. Sci. Rep. 2025, 15, 28140. [Google Scholar] [CrossRef]

- Gao, L.; Wen, H. Digital Economy and Environmental Sustainability: Analysis of Cross-Country Coordination. Sustainability 2025, 17, 1840. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous Technological Change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. A Model of Growth Through Creative Destruction. Econometrica 1992, 60, 323–351. [Google Scholar] [CrossRef]

- Huang, X.; Gao, Y. Technology convergence of digital and real economy industries and enterprise total factor productivity: Research based on Chinese enterprise patent information. China Ind. Econ. 2023, 11, 118–136. [Google Scholar]

- Yousaf, A.U.; Hussain, M.; Schoenherr, T. Achieving carbon neutrality with smart supply chain management: A CE imperative for the petroleum industry. Ind. Manag. Data Syst. 2023, 123, 2551–2576. [Google Scholar] [CrossRef]

- Ling, X.; Luo, Z.; Feng, Y.; Liu, X.; Gao, Y. How does digital transformation relieve the employment pressure in China? Empirical evidence from the national smart city pilot policy. Hum. Soc. Sci. Commun. 2023, 10, 617. [Google Scholar] [CrossRef]

- Zhang, M.; Chen, X.; Xie, H.; Esposito, L.; Parziale, A.; Taneja, S.; Siraj, A. Top of tide: Nexus between organization agility, digital capability and top management support in SME digital transformation. Heliyon 2024, 10, e31579. [Google Scholar] [CrossRef]

- Baden-Fuller, C.; Haefliger, S. Business Models and Technological Innovation. Long Range Plan. 2013, 46, 419–426. [Google Scholar] [CrossRef]

- Zheng, Y.; Tang, J.; Huang, F. The impact of industrial structure adjustment on the spatial industrial linkage of carbon emission: From the perspective of climate change mitigation. J. Environ. Manag. 2023, 345, 118620. [Google Scholar] [CrossRef]

- Wu, L.; Lou, B.; Hitt, L. Data Analytics Supports Decentralized Innovation. Manag. Sci. 2019, 65, 4863–4877. [Google Scholar] [CrossRef]

- Cai, J.; Li, N. Growth Through Inter-sectoral Knowledge Linkages. Rev. Econ. Stud. 2019, 86, 1827–1866. [Google Scholar] [CrossRef]

- Huang, J.; Liu, Q.; Cai, X.; Hao, Y.; Lei, H. The effect of technological factors on China’s carbon intensity: New evidence from a panel threshold model. Energy Policy 2018, 115, 32–42. [Google Scholar] [CrossRef]

- Sharif, A.; Raza, S.A.; Ozturk, I.; Afshan, S. The dynamic relationship of renewable and nonrenewable energy consumption with carbon emission: A global study with the application of heterogeneous panel estimations. Renew. Energy 2019, 133, 685–691. [Google Scholar] [CrossRef]

- Rehman, A.; Ma, H.; Ahmad, M.; Irfan, M.; Traore, O.; Chandio, A.A. Towards environmental Sustainability: Devolving the influence of carbon dioxide emission to population growth, climate change, Forestry, livestock and crops production in Pakistan. Ecol. Indic. 2021, 125, 107460. [Google Scholar] [CrossRef]

- Feng, S.L.; Sui, B.; Liu, H.M.; Li, G.X. Environmental decentralization and innovation in China. Econ. Model. 2020, 93, 660–674. [Google Scholar] [CrossRef]

- Xie, X.M.; Zhu, Q.W.; Wang, R.Y. Turning green subsidies into sustainability: How green process innovation improves firms’ green image. Bus. Strategy Environ. 2019, 28, 1416–1433. [Google Scholar] [CrossRef]

- Yang, X.; Wang, H.; Yan, T.; Cao, M.; Han, Y.; Pan, Y.; Feng, Y. The road to inclusive green growth in China: Exploring the impact of digital–real economy integration on carbon emission efficiency. J. Environ. Manag. 2024, 370, 122989. [Google Scholar] [CrossRef]

- Solow, R.M. A Contribution to the Theory of Economic Growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Stiglitz, J.E. Information and Economic Analysis: A Perspective. Econ. J. 1985, 95, 21–41. [Google Scholar] [CrossRef]

- Zheng, H.; He, Y. How does industrial co-agglomeration affect high-quality economic development? Evidence from Chengdu-Chongqing Economic Circle in China. J. Clean Prod. 2022, 371, 133485. [Google Scholar] [CrossRef]

- Liu, X.; Sun, T.; Feng, Q.; Zhang, D. Dynamic environmental regulation threshold effect of technical progress on China’s environmental pollution. J. Clean Prod. 2020, 272, 122780. [Google Scholar] [CrossRef]

- Acemoglu, D. Directed technical change. Rev. Econ. Stud. 2002, 69, 781–809. [Google Scholar] [CrossRef]

- Jiang, T. Mediating effects and moderating effects in causal inference. China Ind. Econ. 2022, 5, 100–120. [Google Scholar]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Zhou, B.; Wang, Y.-L.; Bin, H. The nonlinear effects of digital finance on carbon performance: Evidence from China. J. Innov. Knowl. 2024, 9, 100484. [Google Scholar] [CrossRef]

- Zhu, D.; Ren, L.; Liu, Y. Financial inclusive development, economic growth and carbon emissions in China. China Popul. Resour. Environ. 2018, 28, 66–76. [Google Scholar]

- Kwon, O.; An, Y.; Kim, M.; Lee, C. Anticipating technology-driven industry convergence: Evidence from large-scale patent analysis. Technol. Anal. Strategy Manag. 2020, 32, 363–378. [Google Scholar] [CrossRef]

- Zhou, M.; Wang, L.; Guo, J. Measurement and Temporal-Spatial Comparison of the Integration of the Digital Economy and the Real Economy in the Context of New Quality Productivity: Based on the Patent Co-classification Method. J. Quant. Technol. Econ. 2024, 41, 5–27. [Google Scholar]

- Muganyi, T.; Yan, L.; Sun, H.-p. Green finance, fintech and environmental protection: Evidence from China. Env. Sci. Ecotechnol. 2021, 7, 100107. [Google Scholar] [CrossRef]

- Gan, C.; Zheng, R.; Yu, D. An empirical study on the effects of industrial structure on economic growth and fluctuations in China. Econ. Res. J. 2011, 46, 4–16. [Google Scholar]

- Bai, J.; Liu, Y. Can outward foreign direct investment improve the resource misallocation of China. China Ind. Econ. 2018, 1, 60–78. [Google Scholar]

- Zhang, L.; Hu, Z. Research on the Influence of Data Factorization on the Degree of Common Prosperity. Soft Sci. 2024, 38, 18–25+33. [Google Scholar]

- Yang, X.; Li, X.; Zhong, C. Study on the evolution trend and influencing factors of China’s industrial directed technical change. J. Quant. Technol. Econ. 2019, 36, 101–119. [Google Scholar]

- Fukuyama, H.; Weber, W.L. A directional slacks-based measure of technical inefficiency. Socioecon. Plan. Sci. 2009, 43, 274–287. [Google Scholar] [CrossRef]

- Fare, R.; GrifellTatje, E.; Grosskopf, S.; Lovell, C.A.K. Biased technical change and the Malmquist productivity index. Scand. J. Econ. 1997, 99, 119–127. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Norris, M.; Zhang, Z. Productivity Growth, Technical Progress, and Efficiency Change in Industrialized Countries. Am. Econ. Rev. 1994, 84, 66–83. [Google Scholar]

- Chung, Y.H.; Fare, R.; Grosskopf, S. Productivity and undesirable outputs: A directional distance function approach. J. Environ. Manag. 1997, 51, 229–240. [Google Scholar] [CrossRef]

- Weber, W.L.; Domazlicky, B.R. Total factor productivity growth in manufacturing: A regional approach using linear programming. Reg. Sci. Urban Econ. 1999, 29, 105–122. [Google Scholar] [CrossRef]

- Chao, X.; Wang, C.; Wang, C. Mechanism and Path of Cultivating New Quality Productivity under the Cycle of Digital Technology Revolution. J. Zhejiang Gongshang Univ. 2024, 4, 87–97. [Google Scholar]

- Gu, D. Empowering High Quality and Full Employment with Digital Technology:Mechanism and Path Selection. Economist. 2025, 4, 24–35. [Google Scholar]

- Toptal, A.l.; Özlü, H.; Konur, D. Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 2013, 52, 243–269. [Google Scholar] [CrossRef]

- Unruh, G.C. Understanding carbon lock-in. Energy Policy 2000, 28, 817–830. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S. Power and Progress: Our Thousand-Year Struggle Over Technology and Prosperity; Winners of the 2024 Nobel Prize for Economics; Hachette UK: London, UK, 2023. [Google Scholar]

| Variable | Definition | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|---|

| DRI | Digital–Real Integration | 720 | 19.3857 | 48.5392 | 0.0029 | 441.0297 |

| CP | Carbon Productivity | 720 | 1854.1630 | 1207.5816 | 205.0371 | 9375.2266 |

| GTE | Green Technological Innovation | 720 | 0.5705 | 1.0545 | 0.0037 | 8.8518 |

| RIS | Rationalization of Industrial Structure | 720 | 1.1040 | 0.6330 | 0.4944 | 5.6898 |

| AIS | Upgrading of Industrial Structure | 720 | 0.2030 | 0.1353 | −0.2142 | 0.7139 |

| Dmc | Data factor allocation efficiency | 720 | 0.1290 | 0.2861 | 0.0000 | 2.6693 |

| Kmis | Capital Misallocation Index | 720 | 0.5738 | 0.5399 | 0.0010 | 6.1671 |

| Lmis | Labor Misallocation Index | 720 | 0.3316 | 0.2917 | 0.0004 | 2.3815 |

| BTECH | Biased Technological Progress | 690 | 1.0564 | 0.1069 | 1.0000 | 1.6316 |

| BiasKL | Capital–Labor Bias Index | 660 | 0.0094 | 0.0832 | −0.2981 | 1.9884 |

| BiasEK | Energy–Capital Bias Index | 660 | −0.0024 | 0.0122 | −0.0851 | 0.1130 |

| BiasEL | Energy–Labor Bias Index | 660 | 0.0060 | 0.0723 | −0.3073 | 1.7720 |

| INV | Investment Intensity | 720 | 2.6304 | 2.6685 | −10.5821 | 12.7774 |

| PS | Population Size, log of urban residents | 720 | 75.1076 | 7.7485 | 51.9040 | 91.6775 |

| FDI | Foreign Direct Investment | 720 | 0.2639 | 4.6485 | 0.0004 | 124.5472 |

| OPEN | Degree of Openness | 720 | 5.9848 | 2.5024 | −1.2894 | 10.5097 |

| Variable | CP | ||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| DRI | 2.5886 ** | 2.5495 ** | 2.5102 ** | 2.4828 ** | 2.4956 ** |

| (2.2169) | (2.2083) | (2.2132) | (2.1906) | (2.2191) | |

| INV | −38.1519 *** | −30.9847 *** | −30.6175 *** | −33.0308 *** | |

| (−4.0708) | (−3.4932) | (−3.4344) | (−3.5704) | ||

| PS | −62.8993 *** | −62.5502 ** | −67.5107 *** | ||

| (−2.6014) | (−2.5822) | (−2.7252) | |||

| FDI | −3.9206 ** | −3.9513 ** | |||

| (−2.1429) | (−2.1476) | ||||

| OPEN | 47.4856 ** | ||||

| (2.3837) | |||||

| Constant | 1803.9807 *** | 1905.0949 *** | 6611.2233 *** | 6585.6039 *** | 6680.0877 *** |

| (72.8418) | (66.6081) | (3.6425) | (3.6220) | (3.6656) | |

| Province Effect | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| N | 720 | 720 | 720 | 720 | 720 |

| R2 | 0.8374 | 0.8404 | 0.8419 | 0.8421 | 0.8427 |

| Variable | 2SLS | Lagged Independent Variables | |||

|---|---|---|---|---|---|

| First Stage | Second Stage | Lagged by 1 Period | Lagged by 2 Periods | Lagged by 3 Periods | |

| (1) | (2) | (3) | (4) | (5) | |

| IV1_DRI | 6.8683 *** | ||||

| (11.7854) | |||||

| IV2_DRI | 35.2655 * | ||||

| (1.8948) | |||||

| DRI | 5.9325 *** | 2.6379 ** | 2.9529 ** | 3.2850 ** | |

| (3.4363) | (2.1658) | (2.2261) | (2.1402) | ||

| INV | 1.1488 *** | −28.1050 *** | −28.6415 *** | −25.0038 *** | −21.7342 *** |

| (3.5224) | (−3.7451) | (−3.3133) | (−3.0802) | (−2.9127) | |

| PS | 6.9242 *** | −66.0689 *** | −70.5653 *** | −71.1557 ** | −56.9682 ** |

| (4.9494) | (−2.6874) | (−2.6044) | (−2.3885) | (−2.2454) | |

| FDI | 0.0802 | −2.1540 | −3.3028 * | −2.2114 | −1.0121 |

| (1.0501) | (−1.3194) | (−1.8717) | (−1.4934) | (−0.9181) | |

| OPEN | −3.9740 *** | 50.3392 ** | 48.0202 ** | 45.0480 ** | 32.5772 ** |

| (−3.1942) | (2.5377) | (2.5109) | (2.4631) | (2.1503) | |

| Constant | −700.5436 *** | 9584.7947 *** | 6863.4682 *** | 6879.5382 *** | 5841.1569 *** |

| (−6.2937) | (4.8534) | (3.4262) | (3.1122) | (3.0773) | |

| Kleibergen–Paap rk LM Statistic | 62.94 *** | 62.937 *** | |||

| [0.0000] | [0.0000] | ||||

| Kleibergen–Paap rk Wald F Statistic | 69.63 | 69.631 | |||

| {19.93} | {19.93} | ||||

| Hansen J statistic | 0.791 | ||||

| [0.3738] | |||||

| Province Effect | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| N | 690 | 690 | 690 | 660 | 630 |

| R2 | 0.7738 | 0.8526 | 0.8604 | 0.8758 | 0.8970 |

| Variable | Restricted Sample | Additional Controls | Interaction Fixed Effects |

|---|---|---|---|

| (1) | (2) | (3) | |

| DRI | 2.7887 *** | 1.6334 * | 3.5407 *** |

| (3.0751) | (1.6580) | (6.5454) | |

| INV | 3.4886 | −21.5379 *** | 27.4234 *** |

| (0.9968) | (−2.6380) | (3.3789) | |

| PS | −71.3235 | −74.2600 *** | −79.5055 ** |

| (−0.9932) | (−3.0845) | (−2.4461) | |

| FDI | 0.0076 | −4.7679 *** | 4.1117 * |

| (0.0112) | (−2.6330) | (1.7282) | |

| OPEN | 111.4146 *** | 32.8650 * | −0.0948 |

| (2.6708) | (1.7832) | (−0.0036) | |

| FD | 421.3340 * | ||

| (1.7134) | |||

| INF | −153.8061 *** | ||

| (−5.6317) | |||

| Constant | 6280.5383 | 7813.9838 *** | 7684.3427 *** |

| (1.1612) | (4.3110) | (3.1570) | |

| Province Effect | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Province-Year FE | No | No | Yes |

| N | 300 | 720 | 720 |

| R2 | 0.9653 | 0.8588 | - |

| Null Hypothesis | Test Statistic | p-Value | Result |

|---|---|---|---|

| DRI fails to Granger-cause CP | 3.499 *** | 0.0005 | Reject |

| CP fails to Granger-cause DRI | 0.557 | 0.5776 | Accept |

| Variable | Med1 | Med2 | Med3 | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DRI | 0.0114 *** | 0.0013 ** | 0.0004 *** | 0.0048 *** | −0.0010 *** | −0.0011 *** |

| (7.21) | (2.39) | (4.97) | (11.92) | (−2.73) | (−3.05) | |

| INV | −0.0454 *** | −0.0164 ** | −0.0055 *** | −0.0069 *** | 0.0070 | 0.0167 *** |

| (−3.72) | (-2.26) | (−3.98) | (−2.78) | (1.37) | (4.85) | |

| PS | −0.0882 *** | −0.0753 *** | −0.0081 | −0.0160 ** | −0.0350 ** | −0.0013 |

| (−3.20) | (-5.92) | (−1.46) | (−2.27) | (−2.31) | (−0.13) | |

| FDI | 0.0022 * | 0.0060 *** | 0.0005 *** | −0.0005 | 0.0001 | −0.0039 *** |

| (1.69) | (6.68) | (3.91) | (-1.12) | (0.03) | (−4.05) | |

| OPEN | 0.0008 | −0.0351 *** | 0.0125 *** | 0.0045 | 0.0079 | 0.0144 |

| (0.05) | (-3.46) | (3.51) | (1.22) | (0.41) | (1.35) | |

| Constant | 7.0906 *** | 6.9823 *** | 0.7412 * | 1.2275 ** | 3.1543 *** | 0.3181 |

| (3.44) | (7.36) | (1.80) | (2.35) | (2.89) | (0.45) | |

| Province Effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 720 | 720 | 720 | 696 | 720 | 720 |

| R2 | 0.810 | 0.857 | 0.775 | 0.872 | 0.529 | 0.451 |

| Threshold Variable | Number of Thresholds | F-Statistic | 10% | 5% | 1% | Threshold Value | p-Value | 95% Confidence Interval |

|---|---|---|---|---|---|---|---|---|

| Biased Technological Progress | Single | 336.41 *** | 73.142 | 108.218 | 242.083 | 1.0156 *** | 0.000 | [1.0137, 1.0161] |

| Double | 56.58 * | 54.016 | 76.271 | 138.434 | 1.0382 * | 0.090 | [1.0362, 1.0387] | |

| Triple | 17.53 | 65.350 | 79.005 | 100.464 | 0.860 | |||

| Capital–Labor-Biased Technological Progress | Single | 212.59 *** | 20.029 | 39.671 | 155.904 | 0.0019 *** | 0.000 | [0.0016, 0.0020] |

| Double | 15.27 ** | 11.075 | 12.752 | 19.115 | 0.0061 ** | 0.027 | [0.0050, 0.0066] | |

| Triple | 32.32 | 66.969 | 77.943 | 111.653 | 0.487 | |||

| Energy–Capital-Biased Technological Progress | Single | 285.13 *** | 40.887 | 71.759 | 290.216 | −0.0031 *** | 0.013 | [−0.0033, −0.0030] |

| Double | 14.12 * | 13.189 | 15.990 | 22.313 | 0.0012 * | 0.077 | [0.0007, 0.0013] | |

| Triple | 14.24 | 38.495 | 45.388 | 61.477 | 0.783 | |||

| Energy–Labor-Biased Technological Progress | Single | 114.95 *** | 23.124 | 36.434 | 78.730 | −0.0015 *** | 0.007 | [−0.0016, −0.0013] |

| Double | 111.10 *** | 18.201 | 23.458 | 110.876 | 0.0020 *** | 0.010 | [0.0018, 0.0020) | |

| Triple | 10.55 | 32.614 | 36.234 | 45.047 | 0.720 |

| Variable | Dependent Variables: CP | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| BTECH | BiasKL | BiasEK | BiasEL | |

| 0.1695 | 0.6594 | 23.2586 *** | 21.2282 *** | |

| (0.3918) | (0.6100) | (18.9080) | (16.1261) | |

| 9.5628 *** | 15.7752 *** | 0.5491 | 0.5675 | |

| (4.4095) | (3.2589) | (0.5493) | (0.5212) | |

| ) | 22.1572 *** | 22.8575 *** | 10.7214 *** | 15.7239 *** |

| (14.6365) | (10.0142) | (5.0366) | (3.4485) | |

| INV | −11.1064 | −6.2898 | 2.5956 | −16.6882 |

| (−0.6697) | (−0.2765) | (0.1142) | (−0.7365) | |

| PS | −144.4184 *** | −145.4366 *** | −139.2783 *** | −133.8236 *** |

| (−6.2853) | (−6.0537) | (−5.4692) | (−5.3752) | |

| FDI | −1.4808 ** | 427.6695 | 263.9529 | 461.2048 |

| (−2.3041) | (0.8562) | (0.5534) | (0.8875) | |

| OPEN | −119.7202 ** | −107.2205 ** | −100.5573 ** | −104.0785 ** |

| (−2.5845) | (−2.4375) | (−2.2358) | (−2.3889) | |

| Constant | 13,287.6400 *** | 13,271.3441 *** | 12,783.8124 *** | 12,420.7911 *** |

| (7.7679) | (7.3890) | (6.6136) | (6.6703) | |

| Province Effect | Yes | Yes | Yes | Yes |

| Year FE | No | No | No | No |

| N | 690 | 660 | 660 | 660 |

| R2 | 0.5677 | 0.4908 | 0.5300 | 0.4983 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shen, R.; Geng, Y.; Gong, X.; Guo, W. Digital–Physical Integration and Carbon Productivity: An Empirical Assessment from China. Sustainability 2025, 17, 10598. https://doi.org/10.3390/su172310598

Shen R, Geng Y, Gong X, Guo W. Digital–Physical Integration and Carbon Productivity: An Empirical Assessment from China. Sustainability. 2025; 17(23):10598. https://doi.org/10.3390/su172310598

Chicago/Turabian StyleShen, Rui, Yeqiang Geng, Xiaoqin Gong, and Wei Guo. 2025. "Digital–Physical Integration and Carbon Productivity: An Empirical Assessment from China" Sustainability 17, no. 23: 10598. https://doi.org/10.3390/su172310598

APA StyleShen, R., Geng, Y., Gong, X., & Guo, W. (2025). Digital–Physical Integration and Carbon Productivity: An Empirical Assessment from China. Sustainability, 17(23), 10598. https://doi.org/10.3390/su172310598