1. Introduction

Climate change, global warming, environmental degradation, and increasing environmental concerns have led academics, policymakers, and many stakeholders to maintain a strong focus on sustainable development—particularly its environmental sustainability component [

1,

2,

3,

4,

5]. The United Nations COP-27 conference, emphasizing key goals such as climate finance, carbon neutrality, and sustainable growth, aims to reduce the global temperature by 1.5 degrees Celsius and achieve the 2030 sustainable development targets [

6]. In line with this and earlier international conferences, conventions, and summits on environmental protection, the world is taking rapid steps toward building a greener and more sustainable economy.

Against this backdrop, green finance is recognized as one of the most crucial factors in achieving a sustainable environment and development [

7,

8,

9]. Green finance encompasses financial products and services—such as green bonds, green loans, and carbon pricing—that promote environmentally friendly initiatives, sustainable development, and environmental sustainability [

10]. A key characteristic that differentiates green finance from other types of finance is its focus on channeling public- and private-sector funds toward green entrepreneurs who foster sustainable development and improve the environment [

11].

Research addressing green finance often centers on its determinants or its impacts. In one strand of the literature, scholars examine the factors driving green finance [

12,

13,

14]. Another strand explores the effects of green finance, highlighting, for instance, how it guides financial resources into renewable energy investments and projects, thereby helping develop that sector [

15]. The diversification and growth of green financial products—such as green funds and insurance—can also foster and enhance green innovations [

16]. Moreover, green finance improves energy efficiency by reducing excessive energy inputs that contribute to environmental pollution, supports the green manufacturing sector by boosting green total factor productivity [

17], and positively influences employment and new business creation by promoting effective resource use [

18]. Because green finance and related strategies can affect the supply, demand, and availability of natural resources such as coal, oil, and natural gas, some researchers claim a positive relationship between a country’s (green) financial development and its natural resources [

19]. Finally, green loans—an important subset of green finance—can advance green economic growth by strengthening the financial performance of banks and other financial institutions and channeling capital to green entrepreneurs [

20].

In recent years, several studies have examined the relationship between green finance and environmental degradation or environmental sustainability [

8,

21,

22,

23,

24]. Because financial institutions direct some of their loans and funds toward green projects and investments, green finance can be viewed as an important tool to combat environmental pollution. Sharif et al. [

21], Wei and Bai [

9], and Li [

24] find that green finance bolsters environmental sustainability by reducing CO

2 emissions, whereas Numan et al. [

22] report that green finance curbs environmental pollution by lowering the ecological footprint. Taken together, these results suggest that green financial practices can play a significant role in designing environmental policy. Green economic growth—an integral element of a sustainable environment—also helps reduce pollution [

25], a finding corroborated by Hao et al. [

26], Dong et al. [

27], and Li [

24]. Meanwhile, researchers highlight that the growing or diminishing effect of financial globalization on environmental degradation remains a topic of debate [

28]. Some studies posit that economic growth and capital formation create a scale effect in the economy, increase energy demand, and exacerbate pollution [

29,

30]. Consequently, because these variables often appear in environmental pollution regressions, they too warrant policy consideration alongside green finance.

This study analyzes the relationship between green finance and the ecological footprint from 1994 to 2020 across 13 countries identified as leaders in green financial development. According to the IFF Global Finance and Development Report [

31], France, the UK, Germany, China, the Netherlands, Japan, Sweden, Denmark, Spain, the USA, Norway, Austria, and Italy rank highest in the Global Finance and Development Index, making them ideal subjects for studying the impact of green finance. Except for China, all are OECD members. These nations also perform strongly on the OECD green growth indicators (e.g., CO

2 productivity and energy productivity) for 2021 [

32]. Nevertheless, in terms of environmental pollution, China remains the world’s largest emitter of greenhouse gases, and OECD countries also display high emission levels. Specifically, while total global CO

2 emissions in 2021 were 33.9 billion tons, the collective OECD total reached 11.3 billion tons—accounting for 34% of the global figure. Meanwhile, China alone produced 30% of total CO

2 emissions [

33]. Regarding ecological footprint, China leads with 5.1 billion global hectares, followed by the USA (2.1 billion global hectares) and Japan (533 million global hectares). Many of the remaining countries likewise rank high. These data underscore that policies aimed at reducing environmental pollution and enhancing environmental sustainability remain urgent for these nations.

In light of the above, this study explores several research questions: (1) Can green finance help combat environmental pollution by reducing the ecological footprint? (2) Does green economic growth reduce environmental pollution through its impact on the ecological footprint? (3) What roles do economic growth, financial globalization, and capital formation play in shaping the ecological footprint? (4) Given the results, what effective policies might help curb environmental pollution?

The study makes several contributions to the literature. First, it examines the impact of green finance on the ecological footprint while integrating green economic growth, financial globalization, economic growth, and capital formation as control variables, a combination rarely explored together. Second, it focuses on the 13 countries with the strongest green financial development—an understudied group in previous analyses. Third, it uses ecological footprint as an environmental sustainability metric, which is a more comprehensive measure of environmental degradation incorporating the planet’s biocapacity. Fourth, the study employs the Augmented Mean Group (AMG) estimator, a dynamic panel method that yields robust results even under slope heterogeneity and cross-sectional dependence. It also applies the Dumitrescu–Hurlin bootstrap causality test, which is seldom used in many panel studies, thereby providing more reliable causal insights for policy recommendations. Finally, by modeling green growth, financial globalization, economic growth, and capital formation, the study explains multiple causes of environmental degradation and can help inform a wide range of policies to mitigate it.

The remainder of this paper is structured as follows.

Section 2 reviews the theoretical and empirical literature.

Section 3 presents the empirical model, data, and methods.

Section 4 discusses the empirical findings. Finally, we present the conclusion, policy implications and limitations.

4. Findings and Discussion

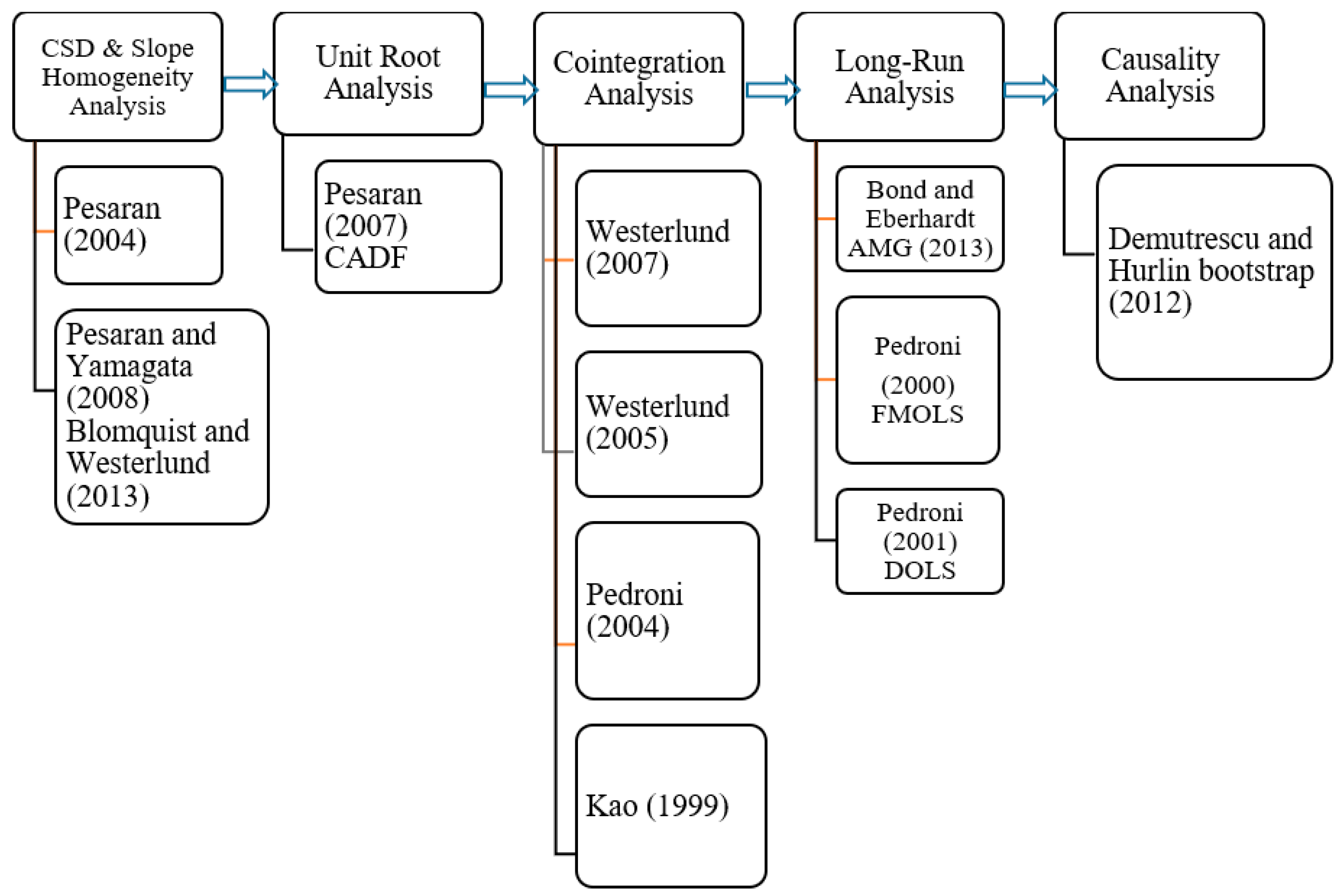

This section presents the empirical findings obtained from the methodological procedures outlined above. Specifically, the results seek to answer four key research questions posed in the introduction. To address these questions, the section initially presents the descriptive statistics, the results from cross-sectional dependence and slope homogeneity tests, followed by the outcomes of unit root and cointegration analyses. Subsequently, long-run coefficient estimates from AMG, FMOLS, and DOLS methods are interpreted, and the section concludes with a detailed discussion of causal relationships among the variables and their policy implications.

Table 2 presents descriptive statistics, summarizing key characteristics of the panel dataset utilized in this study, which covers 13 countries over the period from 1994 to 2020. The descriptive statistics inform the subsequent methodological steps by highlighting key characteristics of the dataset that require special consideration. Specifically, the significant deviations from normality identified through the Jarque–Bera test for variables such as lnGF and lnFGL indicate potential outliers or non-linearities. Additionally, the varying levels of skewness and kurtosis, especially the high kurtosis in lnGF and lnFGL, suggest heterogeneity across the panel.

Given these statistical features, the next step of the methodology—testing for cross-sectional dependence and slope homogeneity—is critical. Identifying cross-sectional dependence is important due to potential spillover effects or common shocks across countries, while testing for slope homogeneity is essential to determine whether the relationships among variables differ significantly across countries. Furthermore, these preliminary findings reinforce the necessity of employing second-generation unit root and cointegration tests, as well as robust estimators such as the AMG estimator, which effectively address data heterogeneity, cross-sectional dependence, and potential endogeneity issues identified in the descriptive statistics.

Table 3 presents the correlation matrix illustrating the strength and direction of linear relationships among the variables analyzed. Contrary to theoretical expectations, the results show that green finance (lnGF) and green growth (lnGGDP) exhibit positive correlations with ecological footprint (lnEF), at 0.030 and 0.547, respectively. This finding suggests that, in this preliminary analysis, increases in green finance and green growth unexpectedly coincide with a higher ecological footprint.

On the other hand, the findings align with theoretical predictions for economic growth (lnGDP = 0.415), financial globalization (lnFGL = 0.241), and capital formation (lnCAP = 0.058), which all display positive correlations with ecological footprint. The correlation values among independent variables remain relatively low (all below 0.25), indicating minimal multicollinearity concerns. This supports their combined use in subsequent econometric procedures.

Additionally, we test multicollinearity using Variance Inflation Factors [

84], which reveal severe multicollinearity among lnGDP, lncCAP, and lnFGL, with values exceeding 400 and a mean VIF above 300. This suggests that these variables are highly collinear, which may affect the precision of individual coefficient estimates. However, the direction and magnitude of the coefficients remain broadly in line with theoretical expectations. To address this, we conducted robustness checks using alternative specifications and found that the main conclusions hold.

Furthermore, we applied the Modified Wald test [

85] for groupwise heteroskedasticity in the fixed-effects panel model. The test results indicate the presence of heteroskedasticity across panel units (χ

2(13) = 365.04,

p < 0.01), confirming that the variance of the error term is not constant. To account for heteroskedasticity in our panel data, we employed the Westerlund [

78] error-correction-based cointegration test with robust and bootstrap options. This allows for panel-specific heteroskedasticity and cross-sectional dependence, providing more reliable inference.

The results of Pesaran’s CD test, used to examine the presence of cross-sectional dependence among the variables, are reported in

Table 4. The CD-test statistics and corresponding

p-values reveal significant cross-sectional dependence for each variable at the 1% significance level (

p-value = 0.000). According to these results, the null hypothesis of no cross-sectional dependence is rejected for all variables, confirming significant cross-sectional dependence within the panel. This implies that a shock occurring in one country can potentially propagate and affect other countries within the panel.

The results of slope homogeneity tests developed by Pesaran and Yamagata and Blomquist and Westerlund are presented in

Table 5. According to these findings, the null hypothesis of slope homogeneity is rejected, indicating that slope coefficients differ significantly across countries. This implies that the analysis allows for the use of estimation techniques suitable for heterogeneous panel data, which are capable of capturing variations in slope coefficients across countries—an important consideration given the structural and policy differences among the 13 nations analyzed.

To assess the stationarity properties of the variables, Pesaran’s CADF test is applied under both constant and constant-trend specifications. The unit root test results, presented in

Table 6, indicate that none of the variables are stationary at the level, but all become stationary after first differencing. This confirms that the variables are integrated of order one, I(1). Establishing the same order of integration across variables is essential for proceeding with cointegration analysis in the next step.

The results of the unit root analysis allow for the application of the Kao, Pedroni, and Westerlund cointegration tests. The empirical findings, shown in

Table 7, provide robust evidence in favor of cointegration among the variables, as the null hypothesis of no cointegration is rejected in most cases. In the Westerlund test, two of the four test statistics—Gt (−9.076,

p = 0.000) and Pt (−15.393,

p = 0.000)—are statistically significant at the 1% level, indicating strong evidence of cointegration. Although the Ga and Pa statistics are not significant, the significant Gt and Pt values are sufficient to support the presence of a long-run relationship. The additional variance ratio test also supports cointegration at the 5% level (−1.668,

p = 0.047).

Similarly, the Pedroni test results show that the Phillips–Perron t-statistic (−8.311) and the Augmented Dickey–Fuller t-statistic (−8.625) are highly significant at the 1% level (p = 0.000), confirming cointegration. Although the modified Phillips–Perron t-statistic is not significant, the strong results from the other two tests reinforce the cointegration evidence. The Kao test further supports these findings, with the modified Dickey–Fuller t-statistic (−5.614), Dickey–Fuller t-statistic (−5.854), and unadjusted Dickey–Fuller t-statistics (−13.518 and −8.145) all significant at the 1% level. Only the Augmented Dickey–Fuller t-statistic (−0.220, p = 0.413) fails to reject the null, but the overall evidence remains overwhelmingly in favor of a long-run relationship.

These results confirm the existence of a cointegrated system among green finance, green growth, economic growth, financial globalization, capital formation, and ecological footprint. This implies that these variables move together over the long term and that any disequilibrium is likely to be temporary. Establishing cointegration justifies the estimation of long-run coefficients and allows for meaningful interpretation of both the direction and magnitude of these relationships.

The findings obtained from the AMG estimator, which was applied to estimate the long-run coefficients of the model variables, are presented in

Table 8. Although

Table 3 reports preliminary positive correlations between ecological footprint and both green finance (GF) (0.030) and green growth (GGDP) (0.547), these reflect simple bivariate associations that do not account for the influence of other explanatory variables. Once key controls such as economic growth, financial globalization, and capital formation are included in the multivariate model, the expected negative and statistically significant relationships clearly emerge.

The coefficient for green finance is found to be −0.023 and statistically significant, indicating that a 1% increase in green finance leads to a 0.023% decrease in the ecological footprint. The long-run elasticity of green finance with respect to the ecological footprint is statistically significant but numerically modest for several reasons. First, the sample consists of 13 economies that already lead the world in green-finance development. Because these countries have largely exhausted “low-hanging-fruit” opportunities, additional increments of green finance deliver smaller proportional gains—a classic diminishing-returns effect. Second, the ecological footprint is a broad, composite indicator that aggregates land use, resource extraction, and carbon absorption. Changes in a single policy instrument, such as green finance, translate into relatively small movements in the overall footprint. Finally, the elasticity captures an average effect over the 1994–2020 period. Policy impacts accumulate gradually, so the long-run coefficient reflects both implementation lags and inertia in consumption patterns, further tempering the magnitude of the estimated effect.

This outcome implies that the countries included in the study have made significant progress in green financial development, actively prioritizing environmentally responsible financing practices as a means of addressing ecological challenges. The finding aligns with theoretical expectations and is consistent with previous empirical research. In particular, it supports the results of Tariq and Hassan [

86], who examined 70 countries using the GMM approach, and Udeagha and Ngepah [

87], who analyzed environmental sustainability determinants in BRICS countries using the CS-ARDL method and Jóźwik et al. [

88], who analyzed the USA and leaders of nuclear energy consumers [

89]. These parallels reinforce the credibility and generalizability of the current study’s results in the broader literature on green finance and environmental sustainability.

In the long run, the coefficient for green growth is found to be −0.133 and statistically significant, indicating that a 1% increase in green growth leads to a 0.133% reduction in the ecological footprint. This negative relationship suggests that green growth contributes to lowering environmental degradation, confirming the effectiveness of green growth practices in the sampled countries. These findings highlight those policies focused on green growth—such as improving CO

2 productivity, promoting renewable energy efficiency, and adopting cleaner technologies—have yielded substantial environmental benefits. The result is consistent with Lin and Ullah [

25], who, using ARDL and DOLS methods, found that green growth reduces CO

2 emissions in Pakistan in both the short and long run. Further support comes from Lin and Ullah [

90], who employed the DARDL approach and confirmed a long-run negative relationship between green growth and environmental degradation, reinforcing the present study’s conclusion.

Conversely, the coefficient for economic growth is 0.359 and statistically significant, meaning that a 1% increase in economic growth results in a 0.359% rise in the ecological footprint. This suggests that, for the countries analyzed, higher levels of economic activity are associated with greater environmental pressure. This finding supports the view that economic growth—particularly when driven by industrial production and increased energy consumption—can lead to higher demand for fossil fuels, thus exacerbating environmental degradation. The result aligns with Luo et al. [

91], who found that economic growth intensifies environmental pollution in low- and middle-income Asian countries, based on panel MG estimations. However, it contrasts with the findings of Qamri et al. [

92], who reported that economic growth reduces environmental pollution in a study of 21 Asian countries, highlighting the regional and structural differences that may influence the nature of this relationship.

Another important long-term finding is that financial globalization has a positive and significant coefficient of 0.237, suggesting that a 1% increase in financial globalization leads to a 0.237% increase in the ecological footprint. This result indicates a positive relationship between financial globalization and environmental degradation, implying that increased financial integration—through foreign direct investment or cross-border capital flows—may be contributing to pollution, especially if financial resources are allocated to high-emission or resource-intensive industries. This outcome highlights a potential unintended consequence of financial openness, where environmental considerations may be secondary to economic or investment objectives. The result is consistent with the findings of Ahmad et al. [

93], who, using CS-ARDL and CCEMG techniques, showed that financial globalization negatively impacts environmental quality in G-11 countries.

In addition, the capital formation coefficient is also positive and significant, with a value of 0.202, indicating that a 1% increase in capital leads to a 0.202% increase in the ecological footprint. This result suggests that capital accumulation contributes to environmental degradation by driving up production, industrial activity, and demand for energy—particularly fossil fuels. As capital investment often supports infrastructure and manufacturing expansion, it may unintentionally raise environmental pressure if not directed toward sustainable or low-carbon projects. This finding is in line with the results of Mujtaba et al. [

30], who observed a similar relationship in OECD countries, and Li et al. [

24], who reported that capital formation exacerbates ecological footprints in G20 economies. It should be added, however, that Capital formation, particularly through foreign direct investment (FDI), can influence the environment in both positive and negative ways [

94]. Together, these results underscore the need for environmentally conscious investment strategies, even in the context of economic development.

The findings of the FMOLS and DOLS estimators, which are employed to verify the robustness of the AMG long-run estimates, are presented in

Table 9. Both estimation techniques yield results that are consistent with the AMG findings, thereby reinforcing the reliability and stability of the empirical results. Specifically, green finance and green growth are found to have a negative and significant impact on the ecological footprint, indicating their effectiveness in mitigating environmental degradation. In contrast, economic growth, financial globalization, and capital formation exhibit positive and significant coefficients, confirming their roles in increasing the ecological footprint and contributing to environmental pressure.

Although the AMG, FMOLS, and DOLS estimators provide valuable insights into the long-run effects of each independent variable on the ecological footprint, they do not offer evidence regarding the direction of causality between variables. To address this, the Dumitrescu–Hurlin panel bootstrap causality test is employed, and the results are presented in

Table 10.

The causality analysis reveals several important findings. First, there is unidirectional causality running from green finance to the ecological footprint, indicating that changes in green finance Granger-cause changes in environmental sustainability. This result is consistent with Numan et al. [

22], who found similar evidence in their study of 13 countries. Second, the results indicate a bidirectional causality between green growth and ecological footprint, suggesting a mutual relationship in which green growth affects environmental outcomes, and environmental pressures may also influence the adoption of green growth strategies. This aligns with the findings of Ahmad and Wu [

47] for OECD countries and Lin and Ullah [

90], who reported a similar two-way relationship between green growth and CO

2 emissions in Pakistan.

Additionally, the analysis shows that economic growth causes the ecological footprint, confirming that rising income levels contribute to environmental degradation. This result is in line with Bakry et al. [

23], who documented a similar causal effect across 76 developing countries. Moreover, a unidirectional causality is identified from financial globalization to ecological footprint, highlighting the environmental consequences of increased financial openness. This finding supports the results of Wang et al. [

95], who observed the same direction of causality for countries involved in the One Belt One Road (OBOR) initiative.

Finally, the results show a one-way causality from capital formation to the ecological footprint, suggesting that increases in capital accumulation drive environmental degradation. However, this finding contrasts with Li et al. [

24], who found no causal relationship between capital and ecological footprint, indicating that the effect of capital formation on environmental outcomes may vary depending on the country group or methodology used.

5. Conclusions and Policy Implications

Global warming, climate change, and environmental degradation pose serious ecological threats worldwide, underscoring the urgency of pursuing a sustainable environment. In this context, the role of green finance has become increasingly significant. This study investigates the relationship between green finance and the ecological footprint in 13 countries with the highest levels of green financial development, while also examining the impact of green growth, economic growth, financial globalization, and capital on environmental degradation. Long-term effects are estimated using AMG, FMOLS, and DOLS methods, and causality relationships are analyzed with the Dumitrescu–Hurlin panel bootstrap technique.

The findings confirm that all variables are cointegrated. In the long run, green finance and green growth reduce the ecological footprint—and thus environmental degradation—whereas economic growth, financial globalization, and capital exert a positive effect, increasing environmental pressure. The causality analysis shows a bidirectional relationship between green growth and the ecological footprint, while green finance, economic growth, financial globalization, and capital are found to cause the ecological footprint unidirectionally.

These empirical results have direct implications for policymakers. Of particular importance is the observation that green finance and green growth effectively mitigate environmental pollution. As Chin et al. [

36] suggest, policymakers can subsidize green loan interest rates, reduce corporate taxes, and establish green loan guarantee schemes. They can also provide green loans to firms for projects that mitigate environmental damage and encourage these companies to adopt environmentally friendly raw materials and green technologies. Expanding the market for green bonds—an essential green finance tool—further supports green growth and enhances environmental quality.

The damage caused by traditional economic growth to the environment elevates the significance of green growth strategies. As emphasized by Mujtaba et al. [

30], policymakers should prioritize cleaner investments, provide additional incentives for businesses and industries that generate and use renewable energy, and concentrate on developing ecosystem-friendly renewable energy sources, adhering to a realistic green growth and green economy approach.

Because financial globalization can exacerbate environmental degradation, foreign direct investments and other financial flows—the core components of financial globalization—should be redirected toward ecological innovations and renewable energy, thus mitigating negative environmental impacts. Well-developed financial markets can offer more extensive funding for green initiatives and the transfer and production of eco-friendly technologies. Similarly, measures to minimize the adverse effects of capital formation should be implemented, such as supporting green technological innovations and renewable energy investments in firms with significant capital.

While this study contributes to the understanding of how green finance and macroeconomic factors influence the ecological footprint in countries with advanced green financial development, several limitations should be acknowledged. First, the analysis is restricted to 13 countries with the highest levels of green financial development. It limits the generalizability of the findings to countries with less mature or emerging green finance systems. Future studies could consider comparative analyses between high- and low-performing countries in green finance to capture broader global patterns. Second, some key explanatory variables—such as green innovation, institutional quality, environmental policy stringency, and geopolitical risk—are omitted from the model. These factors could influence both the ecological footprint and the effectiveness of green finance, suggesting potential omitted variable bias. Third, due to data availability constraints, the study period is limited to 1994–2020. In addition, this study does not consider the potential impact of major global events such as the COVID-19 pandemic, which may have influenced both environmental outcomes and green financial flows. Fourth, future research should also investigate whether the impact of green finance on the ecological footprint varies by country characteristics, particularly levels of economic development and population size. Lastly, although the study applies robust econometric techniques, dynamic causality structures and feedback loops over longer time periods are not explored in depth. Methods such as CS-ARDL or CS-DL could be employed in future research for a deeper understanding of these dynamics. Future research could build on the current study by directly addressing its limitations.