Abstract

According to the U.S. Department of Commerce, there is strong evidence of a significant bounce in global e-commerce sales following the paradigm shift caused by COVID-19 in everyday life. The global e-commerce market size is projected to reach $6.33 trillion in 2024, with the top five countries being China, the United States, the United Kingdom, Japan, and the Republic of Korea (hereafter, Korea). Among the top five global players, two countries, Korea and Japan, are particularly noteworthy because Korea has the lowest retail e-commerce sales among the top five countries despite a high penetration rate while Japan shows the lowest penetration rate while maintaining a similar level of retail e-commerce sales. The e-commerce industry in Korea and Japan is facing a new inflection point regarding sustainable growth and survival. However, the sustainability of e-commerce firms in Korea and Japan has not yet been investigated from a comparative perspective. In the context of an extremely challenging global business environment, this study focuses on a representative e-commerce firm from each country: Coupang in Korea and Rakuten in Japan. By examining these cases, this study provides important insights into sustainable management practices in the e-commerce industry from a comparative perspective.

1. Introduction

According to the U.S. Department of Commerce, there is strong evidence of a significant bounce in global e-commerce sales following the paradigm shift caused by COVID-19 in everyday life [1]. The global retail e-commerce market size is projected to reach $6.33 trillion in 2024, compared to $3.4 trillion in 2019, with the top five countries being China, the United States, the United Kingdom, Japan, and the Republic of Korea (hereafter, Korea) as presented in Table 1 [2,3,4,5]. Among the top five global players, two countries, Korea and Japan, are particularly noteworthy because Korea has the lowest retail e-commerce sales ($136.07 billion) among the top five countries despite a high penetration rate (30.1%), while Japan shows the lowest penetration rate (12.9%) while maintaining a similar level of retail e-commerce sales of $168.78 billion [4,5].

Table 1.

Top Five Countries, Ranked by Retail e-Commerce Sales of 2024 and their Penetration Rate of 2022.

In both Korea and Japan, e-commerce has contributed to the creation of economic value in their markets. This includes innovation in consumption patterns, reorganization of the domestic market, revitalization of the local economies and related industries, job creation, and global competitiveness. Leveraging digital technology and the platform economy, e-commerce companies in both countries have improved the convenience of mobile shopping and promoted personalized consumption trends. The number of companies that emphasize sustainability and social responsibility is growing, especially with the spread of value-driven consumption among Millennials and Gen Z. However, with rapid changes in the global e-commerce market and the arrival of a new e-commerce era with strong emerging players from China (e.g., AliExpress and Temu) that are armed with substantial capital and cutting-edge technology, the two countries, Korea and Japan, are facing a new inflection point regarding sustainable growth and survival. However, to the best of our knowledge, there have been no other studies that have examined the theoretical and managerial aspects of the sustainability of e-commerce firms in Korea and Japan from a comparative perspective.

In the context of an extremely challenging global business environment, this study focuses on a representative e-commerce firm from each country: Coupang in Korea and Rakuten in Japan (see Table 2), mainly based on the companies’ official FY 2024 reports on sustainable management as well as PR (public relations) and IR (investor relations) materials on their sustainable management. By examining these business cases, this study provides important insights into sustainable management practices in the e-commerce industry from a comparative perspective. The research question of this study is what are the key elements of sustainable management practices of a representative e-commerce firm from Korea and Japan, Coupang and Rakuten? It is expected that this research question will address fundamental issues that have not been sufficiently explored in previous research.

Table 2.

Profile of Companies.

The remainder of this study is organized as follows. The next section presents theoretical development within the relevant literature, followed by the business cases of Coupang and Rakuten. Finally, this study provides conclusions, managerial implications, limitations, and directions for future research.

2. Sustainable Management

The terminology “sustainability” originally appeared in the Brundtland report titled “Our common future,” published by the United Nations’ World Commission on Environment and Development (WCED) in 1987 [6]. Sustainability can be defined as long-term viability [7]. Thus, sustainability can be a research topic across various academic fields, including engineering, sciences, and social sciences, addressing topics such as the atmosphere, chemical pollution, climate change, consumption, energy, food, hazardous substances, human rights, poverty, resources, safety, social justice, soil, waste, and water [8,9]. From the perspective of sustainable management, sustainability has become increasingly important owing to its significant impact on the national economy, employees, suppliers, local communities, and other stakeholders. As the traditional and minimum condition for a company’s sustainability is its financial performance, such as revenue and profit, priorities were mainly given to financial performance in the past. However, with the recent emergence of ESG (environment, social, and corporate governance) as a comprehensive key paradigm of corporate sustainable management in global management, there has been increasing attention to non-financial aspects of firm performance [10].

ESG first appeared in the 2004 United Nations Global Compact report titled “Who cares wins.” It promotes sustainable management by integrating environmental improvement, social responsibility, and corporate governance into business activities [11]. Unlike other concepts of sustainable management, such as CSR (corporate social responsibility) and CSV (creating shared value), ESG is not primarily grounded in academic research but has been adopted by international organizations and investors. In 2005, Kofi Annan, Secretary General of the United Nations, urged global institutions and investors to participate in the development of the United Nations Principles for Responsible Investment (UNPRI) as a joint initiative. Since its launch in 2006, the social responsibility of global investors and companies promoting sustainable development has become increasingly important. In addition, many financial institutions worldwide now use ESG as a key investment criterion, and global companies have actively implemented ESG strategies and guidelines [12]. Thus, ESG has become an important criterion for evaluating an organization’s value through indicators based on non-financial factors, and for assessing its commitment to sustainable management. In other words, the focus of firm evaluations has evolved to achieve sustainable management rather than growth through revenue and profit.

As explained earlier, since the concept of ESG started to develop guidelines and recommendations on how to better integrate environmental, social, and corporate governance issues for sustainable management from the perspective of international organizations and investors, rather than through rigorous academic research, the concept of ESG is still evolving and not yet fully established. Thus, understanding ESG in detail requires examining ESG evaluation indicators. The most widely used global ESG indicator is the Global Reporting Initiative (GRI) Sustainability Reporting Standard. The GRI has been continuously developed since its initial announcement in 2016. The organization itself was founded in 1977 by the United Nations Environment Program. The GRI Sustainability Reporting Standards consist of seven economic topics (economic performance, market presence, indirect economic impact, procurement practices, anti-corruption, anti-competitive behavior, and tax), eight environmental topics (materials, energy, water, biodiversity, emissions, effluents, waste, and supplier environmental assessment), and 17 social topics (employment, labor/management relations, occupational health and safety, training and education, diversity and equal opportunity, non-discrimination, freedom of association and collective bargaining, child labor, forced or compulsory labor, security practices, rights of indigenous peoples, local communities, supplier social assessment, public policy, customer health and safety, marketing and labeling, and customer privacy) [13]. In addition to the GRI, other widely used international standards include the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD). As shown in Table 3, although international standards cover the dimensions of economic, environmental, social, and governance, the specific metrics vary depending on the industry and index. Based on these indices, ESG rating agencies evaluate companies’ ESG performance by applying their own evaluation methods and standards. Major global ESG agencies include MSCI, Sustainalytics, Bloomberg ESG, and S&P Global.

Table 3.

Comparison of GRI, SASB, and TCFD.

A study based on Financial Times Stock Exchange (FTSE) 350 companies listed on the London Stock Exchange (LSE) found a statistically significant positive correlation between the level of ESG efforts and firm value [14]. The results align with the United Nations’ objectives for ESG in sustainable management, indicating that improved environmental responsibility, corporate social responsibility, and management transparency enhance corporate value. However, each dimension of ESG has a different effect on corporate value. Among the three dimensions of ESG, the dimension of society (S) has the greatest impact on corporate value, followed by the dimension of governance (G). Interestingly, the dimension of environment (E) has an insignificant effect on corporate value [15,16,17]. As the dimension of E is relatively easier to implement with a large capital injection and can yield tangible results more quickly, targeting their investors, consumers, government, and stakeholders, compared to the dimensions of S and G, many companies tend to focus on activities related to the dimension of E. However, the results from previous studies provide important guidance for companies regarding ESG practices in that the dimension of E has a statistically insignificant impact on corporate value.

3. The Cases of ESG Management: Coupang and Rakuten

3.1. Methods

This study focuses on a representative e-commerce firm from each country: Coupang in Korea and Rakuten in Japan. We selected Coupang and Rakuten as representative e-commerce firms from Korea and Japan, as they are the top local e-commerce firms from each country with new track records in their countries. (For this reason, we do not include Amazon Japan. For more details regarding each company’s track record, please see the following subsections). We analyzed the ESG management of Coupang and Rakuten, mainly based on the companies’ official FY 2024 reports on sustainable management as well as PR (public relations) and IR (investor relations) materials released in FY 2024 and FY 2025 on their sustainable management via their official homepages by verifying them with major newspapers and reports from ESG evaluation agencies (detailed sources are indicated in the following subsections and references).

3.2. The Case of Coupang’s ESG Management

Founded in Seoul, Korea, in August 2010, Coupang was the No. 1 unicorn in Korea, recognized for its corporate value of KRW 100 trillion (about USD 72 billion) immediately after being listed on the New York Stock Exchange (NYSE) in March 2021 [18]. In addition, Coupang leads the Korean e-commerce market with several indicators such as sales, transaction volume, repurchase rate, and warehouse size, with a record of USD 30.3 billion in FY 2024 revenue, USD 1.4 billion in FY 2024 EBITDA (earnings before interest, taxes, depreciation, and amortization), and a market cap of USD 59.2 billion [18,19]. Coupang’s main business can be summarized as the following seven areas: (1) Rocket Delivery, a prompt delivery service for millions of items with its advanced technology and logistics/fulfillment infrastructure (Amazon-like B2C Model); (2) Rocket Fresh, a fresh food delivery service in eco-friendly “Fresh Bags” with the motto of “order before midnight, arrive at dawn;” (3) Rocket Direct Purchase, an overseas purchase service with the innovation of overseas delivery process; (4) Coupang Eats, a food delivery service from restaurants and cafes; (5) Coupang Play, an entertainment streaming service for sports games, movies, and Coupang’s original contents; (6) Coupang Pay, a mobile/electronic payment system; and (7) CPLB (Coupang Private Label Brands) [20].

While there may be high concerns about Coupang’s dimension of E, especially regarding packaging and delivery due to the nature of the industry, Coupang has proactively contributed to creating value for the environment through AI (artificial intelligence)-powered fulfillment centers using advanced technology and custom robotics. To explain in detail, Coupang has reduced carbon emissions by (1) streamlining logistics with optimized shipping routes and direct-to-customers delivery through direct purchase and direct employment called “end-to-end;” (2) adopting AI-based packaging system called “singulation” for optimal packaging with paper boxless delivery for 85% of Coupang’s Rocket Delivery, eco-friendly and recyclable packaging; and (3) deploying electric trucks since 2020 and hydrogen trucks since 2022 to reduce air pollution [20].

Of these three dimensions of ESG, the dimension of S is the area in which Coupang most actively expresses its efforts to investors and stakeholders. By hiring over 800,000 employees (the second largest number in Korea), Coupang has contributed to the national economy. Regarding the dimension of S, Coupang has focused on (1) social welfare by actively hiring women and people with disabilities; (2) welfare of employees through supporting employee through The Health Program and Management Center (with the investment of over KRW 10 billion) as well as the support for the childbirth of employees via parental leave and reduced work hours for childcare flexibility; (3) SME (small and medium-sized enterprise) supplier support systems by providing opportunities through innovative fulfillment system and monetary incentives for SME suppliers (about 75% of total Coupang partners with 230,000 suppliers) as well as jointly developing PB products called Coupang Private Label Brands (CPLBs) with SME suppliers (about 30,000 items); and (4) investment on local areas other than Seoul Metropolitan area (85% of logistics and fulfillment infrastructures are located in rural areas) as well as job creation in rural areas (95% of delivery and logistics workers work in local areas) for the balanced development of local economy [20].

Regarding the last dimension of ESG, governance, Coupang organized its board of directors that embraces diversity in terms of nationality, gender, and specialty. In addition, for transparency and ethical management, Coupang implements a code of business conduct and ethics and policy on stakeholder communication as well as committees for transparent management decision making (corporate governance committee, audit committee, and compensation committee) [20]. While Coupang is actively engaged in activities to create value through the dimensions of E and S, respectively, it is analyzed that more active and continuous efforts related to the dimension of G will be required.

3.3. The Case of Rakuten’s ESG Management

Rakuten was founded in Tokyo, Japan, in February 1997 and is familiar and trusted by Japanese consumers, boasting a long history with FY 2024 revenue of JPY 2.3 trillion (about USD 15.6 billion), FY 2024 EBITDA of JPY 326 billion (about USD 2.2 billion), and a market cap of JPY 2.0 trillion (about USD 13.5 billion). Rakuten is a large e-commerce platform with more than 100 million members in Japan. Approximately 80% of the Japanese population uses Rakuten. Rakuten operates a wide range of online and offline businesses, including e-commerce, travel, fintech, digital content, communications, credit cards, banking, securities, insurance, and sports. Rakuten provides its own loyalty program, Rakuten Points, through which Rakuten card users can earn points, increase customer loyalty and establish the Rakuten Ecosystem [21].

While Coupang and Rakuten are representative e-commerce firms in Korea and Japan, respectively, they have different business models: Coupang’s main business is retail, whereas Rakuten aligns more closely with the software and services industry. Thus, while Coupang has built an “Amazon Model (B2C)” that is responsible for direct purchase and delivery of products, launched its Rocket Delivery system in 2014, and has deployed the Rocket Delivery logistics networks nationwide, Rakuten mainly follows a traditional open market model that entrusts delivery to individual sellers (called B2B2C, an e-commerce model where intermediary platforms connect customers with businesses). As these sellers mainly rely on the delivery network of the Japan Post, a Japanese state-owned company, Rakuten does not require large-scale investment in logistics and fulfillment. Rakuten’s model has gained popularity in Japan over the past decade because it allows sellers to open online stores at low cost [21].

Regarding the dimension of E, compared to Coupang, Rakuten carries less burden on this dimension, as Rakuten mainly deploys an open market model rather than a direct purchase and delivery B2C model. However, Rakuten still addresses environmental issues through (1) achieving maximal renewable electricity adoption (100%); (2) implementing environment friendly packaging (i.e., using minimal, optimally sized packaging, utilizing shipping boxes made from 90% to 95% recycled paper, cushioning materials derived from eco-friendly sources, and reusable packaging); and (3) promoting circular economies through Rakuten Rakuma, which is a C2C market (an e-commerce model where intermediary platforms connect private individuals together) for second hand goods [21].

Like Coupang, Rakuten most actively makes its efforts for the dimension of S. Rakuten tries to seamlessly integrate diversity, equity, and inclusion (the number of about 30,000 Rakuten employees’ nationalities spans over 100 countries, with 23.6% non-Japanese, 40.7% female employees, and 32.7% of female managers). In addition, to grow with its employees, Rakuten adopted three management indicators: (1) a scoring system of employee engagement to promote individual development by offering various growth opportunities across diverse businesses (i.e., diverse education, volunteer activities and seminars, social empowerment community, and social accelerator program); (2) that of communication satisfaction to build solid organizational foundations and responsible labor practices through honest dialog about work environment; and (3) that of well-being to provide work environments that support the well-being of employees (i.e., regularly conducting well-being surveys). In addition, Rakuten operates an in-house clinic for employee health management. Moreover, Rakuten has developed robust relationships with suppliers to ensure the realization of supply chains free from negative impacts on the environment and human rights through suppliers’ participation in briefings and study sessions, monitoring systems, and surveys. Not only for employees and suppliers, but also for its users (customers), Rakuten offers fair and reliable content that is free from discriminatory language. To support this goal, Rakuten established internal guidelines for responsible advertising, marketing and labeling through improving accessibility and providing fair and reliable content [21].

With regard to governance, through a system called the AI Code of Ethics and AI Governance, Rakuten provides stakeholders with safe and reliable services and establishes a robust governance structure by prioritizing the protection and management of personal and confidential information, including customers’ personal data. In addition, Rakuten has sought to mitigate the impact of natural catastrophes, accidents, financial uncertainty, and macroeconomic factors to avoid catastrophic outcomes and maximize opportunities through its robust management system that identifies potential threats and addresses risks. Moreover, Rakuten places emphasis on the diversity of its board of directors in terms of gender and nationality (two women and three foreign nationals among its nine directors, and two women and three foreign nationals among its six outside directors) [21]. Compared to Coupang, Rakuten is more active in communicating and promoting its efforts regarding the dimension of G.

4. Results

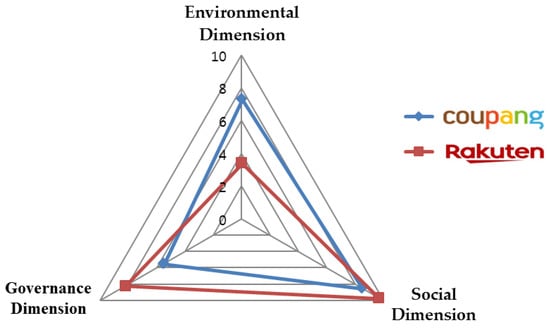

The ESG management of Coupang and Rakuten are summarized in Table 4. In examining the ESG risk ratings, as in Table 5 and Figure 1, the ESG risk ratings of Coupang and Rakuten by Sustainalytics (The lower the score, the lower the risk (1 = lowest risk)) are very close: 21.2 for Coupang and 21.3 for Rakuten, respectively. However, their scores for each of the ESG dimensions are not the same. Thus, in this section, we investigate the ESG management of two companies from a comparative perspective.

Table 4.

Summary of ESG Management of Coupang and Rakuten.

Table 5.

2025 ESG Rating by Sustainalytics: Coupang vs. Rakuten.

Figure 1.

Comparison of ESG Risk Rating of Coupang vs. Rakuten.

Regarding the dimension of E, to deal with concerns, Coupang and Rakuten proactively deploy eco-friendly systems and efforts as summarized in Table 4. As explained earlier, because of packaging and delivery due to the nature of the retail industry, Coupang had a higher environmental risk score (7.3 for Coupang vs. 3.4 for Rakuten). However, regarding the dimension of S, the risk scores are similar (8.5 for Coupang vs. 9.7 for Rakuten) as both of the companies have made significant efforts and tried to communicate their initiatives to investors and stakeholders as explained in the previous section and summarized in Table 4, which is in line with the findings from previous academic studies that the dimension of S among the three dimensions of ESG has the greatest impact on corporate value [10,14,15,16,17]. To explain more in detail, while E is the dimension that shows the largest difference between Coupang and Rakuten, as E has not been found to have a statistically significant effect on corporate value [10,14,15,16,17], there is no significant difference in the overall ESG risk rating of the two companies. While this study is not a form of empirical research, the findings from this research confirm the previous literature that the relative significance of the dimension of S and the relative insignificance of the dimension of E apply to sustainable management practices of a representative e-commerce firm in Korea and Japan, respectively. The growth rate of the two companies has been significant, while there was a gap in their business histories (15 years for Coupang since 2010 vs. 28 years for Rakuten since 1997). Rakuten surpassed the JPY 1 trillion mark in revenue for the first time in 2018 and grew by 52 percent over the past four years in a country where e-commerce’s penetration is very low (12.9%) while the e-commerce market is the top 4 in the world ($168.78 billion) [2,3,4,5]. However, Coupang quadrupled its sales during the same period in a country where the penetration rate of e-commerce is high (30.1%) and the market size is similar to Japan ($136.07 billion) [2,3,4,5]. Coupang’s employment also stands at 80,000 employees, which is more than double that of Rakuten (30,000 employees). On the other hand, Coupang’s financial losses had been large, as it made aggressive investments in the logistics and fulfillment system for its Rocket Delivery. Thus, the EBITDA margin of FY2024 (4.62%) was also much lower than that of Rakuten (14.17%) [20,21,22].

Regarding the dimension of G, the two companies have made some efforts, but the companies are relatively less active in this dimension compared to the dimensions of E and S, as summarized in Table 4. Sustainalytics rated Rakuten’s governance risk much higher than that of Coupang (5.5 for Coupang vs. 8.2 for Rakuten). Rakuten’s lower governance score can be explained by its high-risk appetite in the industry, particularly ongoing losses and significant investments in its mobile business [23]. From the viewpoint of the ESG evaluation agency, this may raise concerns about the management’s ability to execute strategies effectively and maintain liquidity. However, considering the rapid changes in the global e-commerce market and the arrival of a new e-commerce era with strong emerging players having huge capital and cutting-edge technology, risky challenges are indispensable. In particular, for Rakuten, without risky investment, the upside market potential for sustainable survival and growth could be constrained by the low penetration rate of e-commerce, even though the population of Japan (125 million) and the number of its users (over 100 million) are large. On the other hand, there are also limitations to Coupang, as the Korean market has already reached a high penetration rate of e-commerce with a relatively small population (approximately 52 million). To break through the limits of development for sustainable survival and growth, Coupang entered the Taiwanese market in 2022, which has been successful. However, Coupang knocked on the door of the Japanese market in June 2021 with its Quick Commerce service, where a customer places an order with a mobile phone and a delivery person delivers it within 10 to 20 min by bicycle. Coupang announced its withdrawal from the Japanese market after approximately two years. Then, Coupang has been challenged again with high risk in the Japanese market with Rocket Now (a kind of Uber Eats model) since January 2025.

5. Conclusions and Discussion

In both Korea and Japan, e-commerce has contributed to the creation of economic value in their markets, including innovation in consumption patterns, reorganization of the domestic market, revitalization of the local economies and related industries, job creation, and global competitiveness. To address the research question “what are the key elements of sustainable management practices of a representative e-commerce firm from Korea and Japan, Coupang and Rakuten?” this study reviews sustainable management, focusing on ESG, and analyzes the ESG practices of Coupang and Rakuten, representative e-commerce firms in Korea and Japan, respectively.

This study contributes by providing important managerial and theoretical insights into sustainable management practices in the e-commerce industry from a comparative perspective as follows: (1) by reviewing each dimension of ESG when the two representative e-commerce companies face inflection points that force them to make various attempts in domestic and overseas markets for sustainable survival and growth; (2) by comparatively analyzing how the two e-commerce companies take risks to make a breakthrough for sustainable survival and growth in a situation where the global business environment has become more difficult than ever while they make efforts regarding all three dimensions of ESG; and (3) by providing theoretical implications. Previous studies have found a statistically significant positive correlation between ESG activities and firm value. The ESG dimension that has the greatest impact on corporate value is the item related to society (S), followed by the item related to governance (G), while the environment (E) has not been found to have a statistically significant effect on corporate value [10,14,15,16,17]. The findings from this research confirm the previous literature that the relative significance of the dimension of S and the relative insignificance of the dimension of E apply to sustainable management practices of a representative e-commerce firm in Korea and Japan, respectively. Considering these findings, Coupang and Rakuten need to invest more effort in the dimension of G, as the dimension of G still has the second-largest impact on firm value and is an area where the two companies can still afford to develop.

There are some limitations in conducting this research. While this research focused on investigating the sustainability of e-commerce firms in Korea and Japan, it mainly relies on the case study of Coupang and Rakuten. Thus, future research will require more quantitative approaches incorporating diverse companies to generalize e-commerce firms’ sustainable management. Future research may also develop more rigorous theories and comprehensive empirical studies on the dimensions of environmental, social, and governance across diverse e-commerce firms from diverse countries.

Author Contributions

Conceptualization, A.I. and M.Y.K.; literature review, A.I. and M.Y.K.; analysis and investigation, A.I. and M.Y.K.; writing—original draft preparation, A.I. and M.Y.K.; writing—review and editing, A.I. and M.Y.K.; visualization, A.I. and M.Y.K.; project administration, A.I. and M.Y.K.; funding acquisition, A.I. and M.Y.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Keio Global Engagement Fund and Soongsil University Research Fund.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Acknowledgments

The authors thank Keio University for providing the opportunity for this joint research by appointing Kang as a Global Professor at Keio University. In addition, they appreciate Soongsil University for allowing her a sabbatical year and joint appointment. This research would have been unavailable without the generous support from these two schools.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- U.S. Department of Commerce. Impact of COVID Pandemic on eCommerce. Available online: https://www.trade.gov/impact-covid-pandemic-ecommerce (accessed on 1 September 2025).

- Ferger, A. Worldwide Ecommerce Sales to Break $6 Trillion, Make Up a Fifth of Total Retail Sales. Available online: https://www.emarketer.com/content/worldwide-ecommerce-sales-break-6-trillion (accessed on 1 September 2025).

- Lebow, S. Worldwide Ecommerce Continues Double-Digit Growth Following Pandemic Push to Online. Available online: https://www.emarketer.com/content/worldwide-ecommerce-continues-double-digit-growth-following-pandemic-push-online (accessed on 1 September 2025).

- Lebow, S. The Global Ecommerce Share Breakdown. Available online: https://www.emarketer.com/content/global-ecommerce-share-breakdown (accessed on 1 September 2025).

- Cramer-Flood, E. The Top 10 Countries for Digital Sales in 2024 Remain the Same as in 2023. Available online: https://www.emarketer.com/content/top-10-countries-digital-sales-2024-remain-same-2023 (accessed on 1 September 2025).

- United Nation’s World Commission on Environment and Development. Report of the World Commission on Environment and Development: Our Common Future. Available online: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf (accessed on 1 September 2025).

- Kuhlman, T.; Farrington, J. What is sustainability? Sustainability 2010, 2, 3436–3448. [Google Scholar] [CrossRef]

- James, P. Urban Sustainability in Theory and Practice; Routledge: London, UK, 2014. [Google Scholar]

- Magee, L.; Scerri, A.; James, P.; Thom, J.A.; Padgham, L.; Hickmott, S.; Deng, H.; Cahill, F. Reframing social sustainability reporting: Towards an engaged approach. Environ. Dev. Sustain. 2013, 15, 225–243. [Google Scholar] [CrossRef]

- Kang, M.Y. Korean Templestay as a Sustainable Global Cultural Product: The Case of Manggyeongsansa. Sustainability 2024, 16, 9905. [Google Scholar] [CrossRef]

- United Nations Global Compact. Who Cares Wins. Available online: https://www.unglobalcompact.org/docs/issues_doc/Financial_markets/who_cares_who_wins.pdf (accessed on 1 September 2025).

- United Nations Principles for Responsible Investment. Available online: https://www.unpri.org (accessed on 1 September 2025).

- Global Reporting Initiative. Available online: https://www.globalreporting.org/ (accessed on 1 September 2025).

- Li, Y.; Gong, M.; Zhang, X.; Koh, L. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 2018, 50, 60–75. [Google Scholar] [CrossRef]

- Min, J.H.; Kim, B.S.; Ha, S. The impact of firms’ environmental, social, and governancial factors for sustainability on their stock returns and values. Korean Manag. Sci. Rev. 2014, 39, 33–49. [Google Scholar] [CrossRef]

- Oh, S. A study on the effect of agency rating and ESG rating on corporate value. Tax Account. Res. 2021, 69, 125–144. [Google Scholar]

- Lim, W. Effect of non-financial information on firm performance: Focusing on ESG score. Korea Int. Account. Rev. 2019, 86, 119–144. [Google Scholar]

- Kim, W. Coupang Becomes a Dinosaur Beyond ‘Korea’s No. 1 Unicorn’. Available online: https://www.joongang.co.kr/article/23672620 (accessed on 1 September 2025).

- Jeon, S. Popularity of Coupang: Purchases Per Person and Repurchase Rate Are Both No. 1. Available online: https://www.yna.co.kr/view/AKR20250417048400030?input=copy (accessed on 1 September 2025).

- Coupang. Available online: https://www.aboutcoupang.com/ (accessed on 1 September 2025).

- Rakuten. Available online: https://global.rakuten.com/corp/ (accessed on 1 September 2025).

- Lee, B. Coupang, Which Has Quadrupled Over the Past Four Years. Available online: https://www.chosun.com/economy/tech_it/2022/03/06/QXKFFKXVDNBTRPN3BCRL643HOQ/?utm_source=naver&utm_medium=referral&utm_campaign=naver-news (accessed on 1 September 2025).

- S&P Global. Research Update: Rakuten Group ‘BB’ Rating Affirmed on Performance Recovery; Outlook Remains Negative. Available online: https://www.spglobal.com/ratings/jp/regulatory/article/-/view/sourceId/13012608 (accessed on 1 September 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).