1. Introduction

Climate change is no longer a future threat but a present crisis, with extreme weather events, such as the 2022 Yangtze River Basin drought that caused CNY 50 billion in direct economic losses, which are inflicting severe damage and raising financial risks [

1,

2]. The World Economic Forum’s (WEF) Global Risks Report 2025 [

3] identifies climate and environmental risks as top long-term threats, and financial authorities worldwide, including the People’s Bank of China, have integrated climate analysis into their regulatory frameworks [

4]. While financial markets have begun pricing these physical climate risks into sovereign and corporate debt, a critical gap remains in understanding their impact on sub-sovereign public finance, particularly through the channel of compound extreme events. This study investigates how compound physical climate risks, particularly those arising from the interaction of extreme temperature and precipitation, affect the financing costs of China’s Local Government Financing Vehicle (LGFV) bonds.

Existing research has established that climate risks can elevate municipal bond yields. International studies primarily examine the relationship between climate risks and municipal bonds. Painter [

5] pioneered this field, demonstrating that regions exposed to sea-level rise face significantly higher underwriting fees and yields for long-term municipal bonds, though short-term bonds show no significant climate risk premium. Chen and Chu [

6] found that climate risks exacerbate fiscal imbalances and increase default probabilities for local governments. Acharya et al. [

7] revealed that heat stress raises municipal bond credit spreads by increasing energy costs and reducing labor productivity in high-risk sectors, with lower-rated, longer-term, and revenue-dependent bonds being more sensitive. Goldsmith-Pinkham et al. [

8] showed that sea-level rise elevates credit spreads, particularly for long-term bonds, reflecting pricing of future climate uncertainty and imposing economic costs on exposed governments.

In China, research on climate risks and local government financing costs primarily focuses on LGFV bonds, a unique financing instrument heavily reliant on land revenue and implicit government guarantees. Recent years have seen rapid LGFV bond expansion alongside lingering concerns over implicit debt risks. Climate change may further elevate financing costs by damaging infrastructure and increasing maintenance expenditures. For instance, Guo et al. [

9] found that both physical and transition climate risks raise LGFV bond issuance costs. Zhang et al. [

10] constructed a climate risk index using principal component analysis (PCA) and linked its increase to wider LGFV bond spreads, particularly in regions with stringent environmental regulations, high climate risk awareness, or advanced green finance development. Focusing on specific risks, Song and Wang [

11] identified that each additional day above 32 °C raises LGFV bond spreads by 2.48 basis points, attributing this to production losses and fiscal deficits. Gu and Qiu [

12] examined drought risks, showing they increase credit spreads and yields by heightening investor climate concerns and fiscal pressures, especially in agriculturally intensive or less-developed regions.

Despite establishing a “physical–transition” dual-risk framework, the existing literature has three limitations: First, conceptual oversimplification, often equating climate risks with single hazard types. Second, fragmented analyses focus on isolated hazards like sea-level rise or extreme heat, as exemplified by Song and Wang [

11], whose study exclusively focused on extreme heat, and Gu and Qiu [

12], in their examination of drought as a single factor. While these studies have significantly advanced our understanding of individual climate hazards, their isolated approaches inherently overlook the non-linear impacts arising from compound extreme events, particularly the critical interaction between extreme precipitation and temperature. Third, a mechanistic disconnection persists; there is a lack of systematic examination of how compound climate shocks, such as the synergistic interaction between extreme precipitation and temperature, transmit their impacts.

Our research addresses this gap by pioneering an explicit focus on compound physical climate risks in public finance. Based on a comprehensive sample of 19,761 LGFV bonds from 2014 to 2023, we demonstrate that the financing cost impact of compound extremes is significantly greater than the sum of their individual parts. We further elucidate the underlying mechanisms, namely, heightened local fiscal risk and deteriorating debt sustainability, and explore critical heterogeneity. We find that bonds with shorter terms, lower credit ratings, and those issued in China’s eastern region are more sensitive. By quantifying this “climate–fiscal–financial” nexus within China’s distinctive institutional context, our findings offer a granular, large-scale empirical template. This provides crucial insights not only for Chinese policymakers but also for municipalities and national governments globally grappling with the urgent task of financing climate-resilient infrastructure.

2. Theoretical Analysis and Hypotheses

Consistent with risk premium theory, the pricing of financial assets reflects not only the discounted value of future cash flows but also incorporates additional compensation above the risk-free rate to account for investor exposure to uncertainty and risk, a premium typically manifested in elevated risk spreads. As a non-diversifiable systemic risk factor, physical climate risks represent an inescapable threat to the broader economic system. The rising frequency and severity of extreme weather events directly undermine regional economic stability while amplifying market apprehensions regarding local governments’ debt servicing capacity.

For LGFV bonds, whose creditworthiness hinges crucially on local fiscal credibility, heightened exposure to physical climate risks within a jurisdiction elevates investors’ perceived uncertainty about issuers’ repayment capacity, thereby increasing implied default probabilities. Ji et al. [

13] demonstrate that these bonds (primarily financing infrastructure and public utilities) embed climate risks directly into their credit spreads: intensified extreme weather raises default expectations, compelling investors to demand higher risk premiums. Crucially, even absent actual defaults, risk-averse investors systematically require elevated expected returns to offset potential losses, translating into wider issuance spreads between bond yields and risk-free rates and an effective increase in financing costs. In other words, climate risk heightens market sensitivity to local government credit risk. Even a slight change in the probability of future losses may trigger an upward adjustment in risk premium requirements, thereby increasing financing pressure on debt issuers. Furthermore, the compound risk impacts formed by different types of extreme weather events, characterized by their concurrent, cascading, and systemic destructive features, exert multidimensional erosion on the repayment foundation of LGFV bonds. Simultaneously, through the “expectation channel” that severely deteriorates the information environment and reinforces long-term recession expectations, they profoundly undermine market confidence. Collectively, these effects drive a surge in risk premiums, ultimately leading to a substantial widening of LGFV bond issuance spreads. Accordingly, this paper proposes the following hypotheses:

H1a. An increase in physical climate risk leads to higher financing costs of LGFV bonds in the affected region.

H1b. Compound risks will produce a synergistic effect, significantly amplifying the impact of individual climate risks on the financing costs of LGFV bonds.

In public finance theory, escalating climate risks pose dual fiscal pressures on local governments, creating a precarious asymmetry between revenue and expenditure dynamics. On the expenditure front, heightened frequency and intensity of extreme weather events compel governments to allocate substantial resources to post-disaster reconstruction, infrastructure reinforcement, and enhancement of public services (e.g., healthcare, emergency response, and social protection), thereby inflating fiscal outlays. Conversely, on the revenue side, climate risks erode the tax base by suppressing corporate productivity, disrupting supply chains, and dampening regional economic vitality, resulting in diminished fiscal inflows. This “rigid expenditure growth versus elastic revenue contraction” imbalance exacerbates fiscal deficits and budgetary strain, necessitating delicate policy trade-offs between risk mitigation and resource allocation to preserve fiscal sustainability. Stroebel and Wurgler [

14] found that physical climate risks caused by extreme weather events can directly lead to economic losses for regional businesses, such as infrastructure damage, supply chain disruptions, and productivity declines. This damage poses significant challenges to urban development and creates unavoidable fiscal pressures for governments. Bachner and Bednar-Friedl [

15] concluded that extreme climate events can also disrupt production processes, reducing aggregate output and tax revenues, thereby further straining local government finances.

Existing research also confirms that local fiscal risks influence LGFV bond financing costs. Zhong and Lu [

16] found that an increase in per capita central government fiscal transfers leads to higher LGFV bond issuance by local financing platforms, suggesting that stronger fiscal capacity provides a solid foundation for LGFV bond issuance. Additionally, Zhong et al. [

17] argue that local fiscal revenue levels are a factor in the “implicit guarantee” of LGFV bonds. The higher the fiscal risk of a local government, the lower investors’ expectations of its ability and willingness to bail out LGFVs, leading to increased default risk expectations for LGFV bonds. Accordingly, this paper proposes the following hypothesis:

H2. Physical climate risk directly increases fiscal pressure on the government, thereby amplifying the default risk of LGFV bonds, which in turn translates into higher financing costs for these bonds.

According to fiscal decentralization theory, local governments enjoy a degree of fiscal autonomy but are also constrained by central government macro-control and legal regulations. For instance, Article 35 of China’s new Budget Law explicitly requires local budgets to “balance revenues and expenditures” and prohibits deficits, allowing local governments to issue bonds only within limits approved by the State Council and strictly for public welfare capital expenditures. This demonstrates tight constraints on local government debt behavior.

However, as climate risks intensify, frequent extreme weather events and natural disasters accelerate infrastructure aging, damage, and renewal needs, forcing local governments to increase spending on disaster prevention and public construction. In such cases, conventional budget revenues are often insufficient to cover surging expenditures, leaving most local governments reliant on bond issuance to ensure liquidity for emergency spending and basic public services.

While bond financing can temporarily alleviate fiscal pressure, it leads to accumulating government debt, gradually increasing the debt burden. Over time, debt levels may exceed repayment capacity, adversely affecting fiscal sustainability and creditworthiness in the long run. Liu et al. [

18] analyzed the relationship between regional implicit debt levels and LGFV bond spreads by constructing a local government implicit debt burden ratio indicator. Their study found that regions with heavier implicit debt burdens typically require higher risk premiums for LGFV bond issuance. Thus, government debt financing burdens can widen LGFV bond spreads by increasing default risks. Accordingly, this paper proposes the following hypothesis:

H3. Physical climate risks elevate regional governments’ debt financing burdens, which in turn increases LGFV bond financing costs.

These theoretical mechanisms may exhibit heterogeneity across different bond types and regions. The empirical analysis of these heterogeneous characteristics will be discussed in detail in

Section 4.4.

4. Empirical Analysis

4.1. Regression Results

The baseline regression results for the number of extreme temperature days and extreme precipitation days in relation to the issuance spread of LGFV bonds are presented in

Table 3 below. The core explanatory variable in Columns (1) and (2) is the number of extreme temperature days, while that in Columns (3) and (4) is the number of extreme precipitation days. The core explanatory variable in Columns (5) and (6) is the interaction term (Comp_Risk) between the number of extreme temperature days and the number of extreme precipitation days. Additionally, Columns (1), (3), and (5) present the regression results with only the core variables included, while Columns (2), (4), and (6) show the regression results after incorporating control variables at three levels: bond, company, and prefecture-level city.

The results show that regardless of whether a series of control variables are incorporated into the regression or not, the regression coefficients of the number of extreme temperature days or extreme precipitation days on the issuance spread of LGFV bonds are all significant at the 1% significance level. Moreover, after incorporating the control variables, the R-squared increases significantly. These results show that for every 1% increase in the number of extreme temperature days, the issuance spread of LGFV bonds rises by 0.228 bp; for every 1% increase in the number of extreme precipitation days, the issuance spread increases by 0.126 bp. To quantify the economic significance of these effects, we estimate the additional interest costs for a typical LGFV bond with the median issuance size of CNY 600 million and a 5-year maturity. A 1% increase in extreme temperature days generates approximately CNY 6840 in additional interest costs, while a similar increase in extreme precipitation days adds about CNY 3780 in costs. The rise in physical climate risks leads investors to demand a higher risk premium for LGFV bonds, i.e., an increase in the financing cost of LGFV bonds. Therefore, Hypothesis H1a is verified.

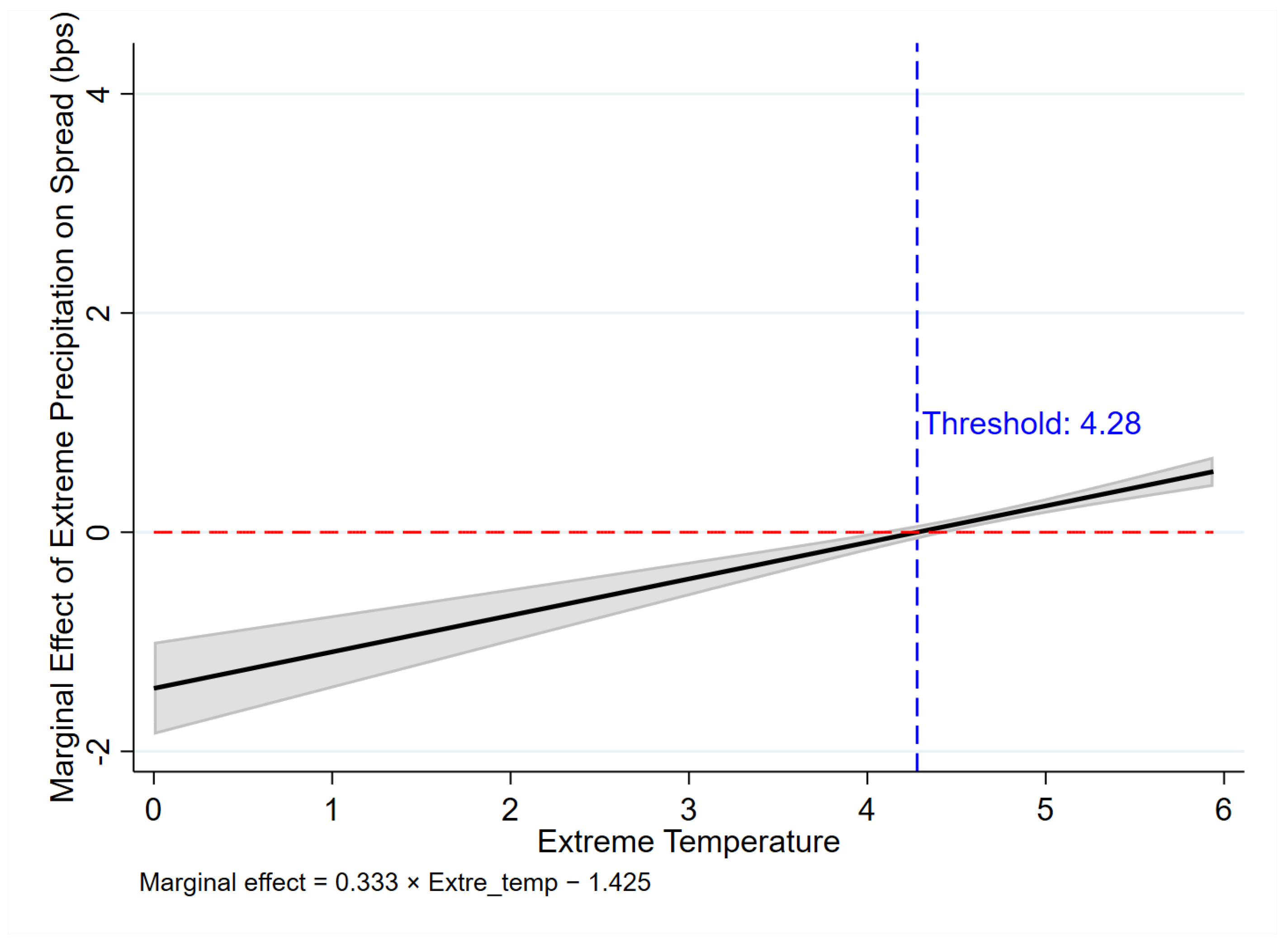

The coefficient of the interaction term (Comp_Risk) is significantly positive at the 1% significance level. This suggests that when the two extreme climate events occur simultaneously, their negative impact on the issuance cost of LGFV bonds is far greater than the sum of their independent effects. The synergistic effect (coefficient of 0.333 bp) further adds approximately CNY 9990 in costs for the median bond issuance. Furthermore, an analysis of the marginal effect of extreme precipitation on spreads (see

Appendix B.2 for details) reveals that extreme precipitation only increases the issuance cost after the number of extreme temperature days reaches a certain threshold. This reflects that investors are not particularly concerned about “rain during cool weather”; instead, the type of compound extreme event that is more likely to cause anxiety and prompt them to demand a high-risk premium is “heavy rainfall accompanied by extreme heat”. Heavy rainfall following extreme high temperatures is more prone to triggering floods; the alternation of hot droughts and heavy rains is extremely destructive to agriculture and infrastructure, and can cause the most catastrophic, non-linear physical damage and operational disruptions. The above results verify Hypothesis H1b. Additionally, the control variables generally demonstrate expected effects on bond issuance spreads.

4.2. Endogeneity Treatment

Although the baseline regressions already include controls for variables likely to confound the link between physical climate risk and the cost of LGFV bonds, as well as two-way fixed effects at the province and year levels, unobserved factors may still correlate with the regressors, extreme temperature or extreme precipitation, and the error term, giving rise to endogeneity. Instrumental variable (IV) estimation is a standard remedy: by introducing instruments that are correlated with the endogenous variables but orthogonal to the error term, the exogenous variation in the regressors can be isolated, yielding consistent and more accurate estimates. We therefore adopt this strategy.

For extreme temperature, following Auffhammer and Mansur [

27], we use the natural logarithm of altitude (Altitude) as an instrument. High-altitude regions are systematically cooler, satisfying the relevance condition, while altitude is plausibly exogenous to bond characteristics or regional development, satisfying the exclusion restriction.

For extreme precipitation, we use the ten-year mean annual precipitation (MAP_10y) of each city. According to the IPCC (2021) report Climate Change 2021: The Physical Science Basis [

28], areas with higher long-run annual precipitation experience more active hydrological cycles and, consequently, a greater likelihood of extreme rainfall events. Mean annual precipitation is largely determined by atmospheric circulation and topography and can thus be treated as exogenous.

Table 4 presents the test results of the IV method. Columns (1) and (2) show the regression results obtained using altitude (Altitude) as the instrumental variable. The regression coefficient of altitude on the number of extreme temperature days in the first stage is significant at the 1% level, indicating that the relevance requirement is satisfied. In the second-stage regression, the positive effect of the number of extreme temperature days on the issuance spread of LGFV bonds is also significant at the 1% level.

Consistent with the test results in the first two columns, Columns (3) and (4) report the regression results obtained using the 10-year average precipitation (MAP_10y) of prefecture-level cities as the instrumental variable. The regression coefficient of the 10-year average precipitation on the number of extreme precipitation days in the first stage is significant at the 1% level, meeting the relevance requirement. The coefficient of the number of extreme precipitation days on the issuance spread of LGFV bonds in the second stage is also significant.

Additionally, referring to the method proposed by Ebbes et al. [

29], the instrumental variable for the interaction term of endogenous variables is constructed by taking the interaction (Comp_IV) of the instrumental variables corresponding to the endogenous variables. Columns (5) and (6) present the regression results using the interaction term of the instrumental variables, altitude (Altitude) and the 10-year average precipitation (MAP_10y) of prefecture-level cities. Here, we report only the first-stage results for the compound risk; the complete two-stage regression outputs are provided in

Appendix A.3. The regression coefficient of the interaction term of instrumental variables on compound risk (Comp_Risk) in the first stage is significant at the 1% level, satisfying the relevance requirement. In the second-stage regression, compound risk (Comp_Risk) still shows a significantly positive effect on the issuance spread of LGFV bonds at the 1% level.

The above results indicate that even after considering potential omitted variables and endogeneity issues, physical climate risks still have a significant impact on the financing costs of LGFV bonds. Specifically, the increase in physical climate risks will make investors demand higher risk premiums, thereby leading to an increase in the financing costs of LGFV bonds. This result further verifies Hypothesis H1.

Furthermore, to ensure the exogeneity of the instrumental variable for extreme precipitation days, this study additionally selects the global annual El Niño index as an instrumental variable for this variable. The ENSO (El Niño–Southern Oscillation) phenomenon is widely recognized as one of the primary climatic forces that drive significant changes in global extreme precipitation patterns. Through large-scale ocean–atmosphere interactions, it exogenously influences the probability and intensity of extreme precipitation events in China; this ensures a strong correlation between the instrumental variable and the endogenous variable. Specifically, we introduce an El Niño-based instrument following Wang [

30], where the El Niño index interacts with firm geographic coordinates: Nino_index = (Longitude/Latitude) × Nino/1000, and Nino represents the annualized weighted El Niño index (NinoZ), which is calculated as the area-weighted average of the Nino1 + 2, Nino3, and Nino4 indices corresponding to their respective three oceanic regions (referring to the National Climate Centre (NCC):

https://cmdp.ncc-cma.net/pred/cn_enso.php?product=cn_enso_nino_indices (accessed on 10 March 2025)). For the detailed methodology, please refer to

Appendix A.1. Detailed regression results using this alternative instrument are presented in

Appendix A.4 and

Appendix A.5, where the positive effect of extreme precipitation and compound risk on bond spreads remains statistically significant, further supporting the robustness of our findings.

4.3. Robustness Checks

4.3.1. Redefining the Baseline Period for Extreme Temperature and Extreme Precipitation

In the main specification we use a 10-year rolling window to calculate extreme thresholds, partly because the meteorological series for some cities are short. However, global warming has accelerated climate change, so thresholds calculated over 2004–2013 may understate actual climate risk. To ensure that the choice of baseline does not mask climate signals, we redefine the baseline period as 1994–2013 and recompute the numbers of extreme temperature and extreme precipitation days accordingly.

Table 5 presents the regression results for the recalculated extreme temperature (

Extre_temp1) and extreme precipitation days (

Extre_precip1) and their derived compound risks, all of which exhibit statistically significant coefficients at the 1% level, which confirms that the effect of physical climate risks in terms of increasing the financing costs of LGFV bonds is robust.

4.3.2. Alternative Measure of Issuance Spread

This study conducts robustness checks by adopting an alternative measure of issuance spreads, where the yield-to-maturity of LGFV bonds at issuance is recalculated against the contemporaneous 5-year ChinaBond Treasury yield. This approach follows Wang and Gao’s [

31] methodology, which demonstrates that the average duration of corporate bonds approximates five years. Using 5-year Treasury yields better captures risk premiums associated with long-term economic expectations while mitigating distortions from short-term market volatility.

Table 6 presents regression results for extreme temperature and precipitation days against the redefined spread measure (Spread1). The coefficients of core explanatory variables remain statistically significant at the 1% level, reaffirming both the explanatory power of baseline results and the robustness of our primary conclusions.

4.3.3. Excluding Regions with Atypical Temperature Characteristics

Because climatic conditions differ markedly across China, we re-estimate the model after dropping regions whose extreme temperature events rarely translate into material damages. For example, extreme heat in the northeast and on the Tibetan Plateau, or extreme cold in parts of the South, seldom disrupt local economic activity or infrastructure. Following Pan et al. [

22], we therefore exclude Guangdong, Guangxi, Hainan, Heilongjiang, Jilin, Liaoning, Tibet, Qinghai, Yunnan, and Guizhou from the sample to reduce noise.

Table 7 presents regression results after excluding these special cases. The coefficients of core climate variables remain statistically significant at the 1% level, robustly confirming that physical climate risks elevate LGFV bond financing costs.

4.3.4. Incorporating Risk Exposure Index

To further verify the robustness of the baseline results, this study uses the entropy method to construct a comprehensive physical climate risk exposure index (Score) at the prefecture-level city, which includes three dimensions: population exposure, economic and asset exposure, and agricultural and production exposure. See

Appendix A.2 for detailed indicator definitions and data sources. This index is then interacted with the number of extreme temperature days, the number of extreme precipitation days, and the compound risk variable to form more precise core variables of physical climate risk: Temp_Risk, Precip_Risk, and Comp_Risk3. These variables allow for a more accurate assessment of the impacts caused by regional physical climate risks. The specific model construction is as follows:

where

Table 8 presents the regression results after variable reconstruction. After incorporating the regional physical climate risk exposure index, the impact of physical climate risks, Temp_Risk and Precip_Risk, and compound risk, Comp_Risk3, on the financing costs of LGFV bonds still remains positively significant. Furthermore, the higher the level of regional physical climate risk exposure, the greater the negative impact caused by extreme climates.

4.3.5. Additional Robustness Tests

We provide further robustness checks in the online

Appendix A, including (1) constructing the compound risk variable using different pre-issuance windows (60, 90, and 180 days) (see

Appendix A.6); (2) controlling for province × year fixed effects and issuer fixed effects (see

Appendix A.7); and (3) employing two-way clustered standard errors at the province and year levels (see

Appendix A.7). All these tests support our core findings.

4.4. Heterogeneity Analysis

4.4.1. Maturity-Based Heterogeneity

This study examines the heterogeneous impact of physical climate risks on the issuance spreads of LGFV bonds by distinguishing between bond tenures (short-term vs. long-term). Considering the issuance structure of China’s bond market and the maturity distribution characteristics of the sample, the 3-year tenure is chosen as the cutoff point for the heterogeneity analysis of bond tenures.

As shown in

Table 9, Columns (1) and (2) present the results of grouped regressions for extreme temperature, while Columns (3) and (4) report those for extreme precipitation. For short-term bonds, the coefficients of both extreme temperature days and extreme precipitation days are significant at the 1% level; for long-term bonds, however, the coefficient of extreme temperature is insignificant, and although the coefficient of extreme precipitation remains significant, its magnitude decreases to 0.071. The results in Columns (5) and (6) indicate that short-term bonds are also more sensitive to compound risk compared to long-term bonds.

These findings suggest that the positive effect of physical climate risks on the financing costs of LGFV bonds exhibits significant tenure heterogeneity, with short-term bonds being significantly more sensitive to physical climate risks than long-term bonds. This result may arise because investors in short-term bonds pay more attention to short-term cash flow fluctuations and default risks induced by physical climate risks, whereas long-term bonds may absorb part of the risks through term premiums, or because investors have lower pricing sensitivity to the immediate default risks of long-term bonds, leading to a reduced marginal impact of physical climate risks.

4.4.2. Credit-Rating-Based Heterogeneity

This study further conducts a heterogeneity test based on the issuer’s credit ratings. International rating agencies typically regard AA and above as high ratings. Considering the comparability of the divided samples, AA+ is used as the cutoff for classifying issuer credit ratings.

As shown in

Table 10, Columns (1) and (2) present the grouped regression results for extreme temperature, while Columns (3) and (4) show those for extreme precipitation. Columns (5) and (6) report the grouped regression results for compound risk. In the low-rated sample, the coefficients of both extreme temperature and extreme precipitation are significant at the 1% level. In the high-rated sample, the coefficient of extreme temperature decreases to 0.048 and becomes insignificant; although the coefficient of extreme precipitation remains significant, its magnitude reduces to 0.123; and the impact of compound risk also relatively decreases.

The regression results indicate that the impact of physical climate risks on the financing costs of LGFV bonds exhibits a significant rating stratification effect, with low-rated bonds being significantly more sensitive to physical climate risks than high-rated bonds. A possible reason is that enterprises with low credit ratings, due to weaker financial resilience and insufficient risk buffer capacity, are more vulnerable to the marginal impact of climate shocks. In contrast, enterprises with high credit ratings can effectively mitigate the negative impact of physical climate risks through their robust debt-servicing capacity and risk management mechanisms.

4.4.3. Region-Based Heterogeneity

Finally, we assess whether the pricing effect of climate risk on bond spreads differs across regions. Following Liu and Wakasi [

32], and aiming to keep subsamples reasonably balanced, we adopt the National Bureau of Statistics’ definition of eastern, central, and western regions to divide the sample into eastern and central–western groups. As shown in

Table 11, Columns (1) and (2) present the grouped regression results for extreme temperature, Columns (3) and (4) present the results for extreme precipitation, and Columns (5) and (6) present the results for compound risk.

The regression results indicate that the pricing effect of physical climate risks exhibits significant regional divergence, with LGFV bonds in eastern China being far more sensitive to physical climate risks than those in central and western regions. In the eastern region sample, the coefficients of extreme temperature, extreme precipitation, and compound risk are all significant at the 1% level. In the central and western regions sample, the coefficient of extreme temperature decreases to 0.171 and is only significant at the 5% level, while the coefficients of extreme precipitation and compound risk are insignificant.

This suggests that the amplifying effect of physical climate risks on the financing costs of LGFV bonds is more pronounced in eastern China, whereas central and western regions are constrained by differences in regional economic structures and asymmetry in climate-adaptation capacities.

5. Further Investigation

Building on the theoretical discussion, our analysis suggests that physical climate risk influences the financing cost of LGFV bonds primarily through two channels: local fiscal risk and the burden of local government debt financing. To test these hypotheses empirically, this study adopts the mediation effect analysis framework proposed by Imai et al. [

33] and employs the non-parametric bootstrap method (with 1000 replications) to estimate the indirect effects of extreme temperatures, extreme precipitation, and their compound risk on the financing costs of LGFV bonds through the channels of fiscal risk and debt burden. The model is specified as follows:

where the risk variables include physical climate risks (Extre_temp and Extre_precip) and the compound risk (Comp_Risk) formed by their interaction term;

measures the effect of climate risk on the mediator variable;

represents the effect of the mediator variable on bond issuance spreads after controlling for climate risk;

is the direct effect of climate risk on bond issuance spreads after controlling for the mediator variable; and

is the indirect effect, representing the pathway through which climate risk affects bond issuance spreads via the mediator variable, M.

5.1. Local Fiscal Risk Transmission Channel

The local fiscal risk channel takes the “local fiscal deficit ratio” as the mediating variable. The transmission effects of the three types of climate risks are presented in the section “A. Via Fiscal Deficit Channel” in

Table 12. A key characteristic of this channel is that the

coefficient is stable around 0.045 across all models, meaning that a 1% increase in the local fiscal deficit ratio leads to a 0.045% increase in bond spreads, reflecting the consistent sensitivity of the market to local fiscal risks.

Starting with extreme precipitation, the coefficient of 0.266 reveals that a 1% increase in actual extreme precipitation days raises the local fiscal deficit ratio by 0.266 bp. This reflects how disaster-induced spending hikes and revenue declines worsen fiscal health. The indirect fiscal effect, 0.012, accounts for only 9.426% of the total effect, and 0.126 indicates that the fiscal deficit channel is an important transmission mechanism. The direct effect, = 0.114, dominates at 90.57%; the market may primarily price precipitation risks through other paths, such as direct asset losses or fluctuations in economic output, rather than relying solely on fiscal deterioration as the transmission channel.

Compound risk, measured as the logarithmic interaction of extreme temperature and precipitation, exhibits a far stronger fiscal impact, with an coefficient of 1.846. This indicates that compound risk still exhibits a synergistic effect in increasing the fiscal deficit, a non-linear amplification driven by cascading disaster effects that exceed the sum of individual risk impacts. This robust fiscal sensitivity translates to a more impactful indirect effect, 0.082, which explains 24.54% of the total effect, 0.333, more than double that of extreme precipitation, confirming the fiscal channel as the primary transmission path for compound risk.

Extreme temperature presents a counterintuitive fiscal pattern, with an coefficient of −1.023. Specifically, a 1% increase in the number of actual extreme temperature days results in a 1.023 bp decrease in the local fiscal deficit ratio, likely due to adaptive policies or economic adjustments. This translates to a negative indirect effect, −0.046, that offsets 20.35% of the total effect, 0.228. However, the direct effect remains dominant; = 0.274 accounts for 120.35% of the total effect after offsetting the negative indirect impact, showing the market still prices temperature risks heavily through other channels like long-term economic restructuring costs or agricultural productivity losses.

5.2. Local Government Debt Financing Burden Transmission Channel

The local government debt financing burden channel takes “LGFV interest-bearing debt scale/GDP” as the mediating variable. The transmission effects of the three types of climate risks are presented in the section “B. Via Debt Burden Channel” in

Table 12. A key characteristic of this channel is that the β coefficient is stable around 0.22 across all models, meaning that a 1% increase in the debt scale leads to a 0.22% increase in bond spreads, reflecting the stable sensitivity of the market to local government debt risks.

For extreme precipitation, the coefficient of 0.051 shows that a 1% increase in actual precipitation days boosts debt by 0.051 bp, as local governments rely on debt to cover disaster reconstruction costs beyond regular fiscal capacity. The indirect debt effect, 0.011, accounts for 8.80% of the total effect, 0.126, slightly less than the fiscal channel’s 9.43%. Once again, the direct effect ( = 0.115) leads at 91.20%, reinforcing that physical damage and economic disruptions remain the main drivers of spread pricing for precipitation risk.

Extreme temperature, by contrast, exerts a more pronounced impact on debt: its coefficient of 0.166 is over three times that of extreme precipitation, meaning that a 1-unit log increase in temperature days raises debt by 0.166 units, likely due to funding of adaptive infrastructure (e.g., high-temperature protection projects) or energy system upgrades. This debt sensitivity translates to a meaningful indirect effect, 0.039, which explains 17.25% of the total effect, 0.228. Unlike the fiscal channel, which had a negative offset, the debt channel fills this gap, becoming a key transmission path for temperature risk. The direct effect, 0.189, still contributes 82.75%, but its reduced share relative to the fiscal channel highlights the debt channel’s complementary role.

Compound risk’s debt impact falls between extreme temperature and precipitation, with an coefficient of 0.148: a 1-unit increase in the temperature–precipitation interaction raises debt by 0.148 units, reflecting the need for debt to cover multi-crisis rescue costs. The indirect debt effect, 0.028, accounts for 8.33% of the total effect, 0.333, complementing the fiscal channel’s 24.54% contribution. The direct effect, 0.305, still leads at 91.67%, but its persistence indicates that other factors, such as systemic risk or expectations of future fiscal pressure, remain part of compound risk pricing, even after accounting for both fiscal and debt channels.

5.3. Comparison of the Two Channels and Key Conclusions

Across the two channels, clear patterns emerge regarding how climate risks transmit to bond spreads, shaped by both risk type and transmission mechanism.

First, channel importance varies sharply by risk. In the fiscal channel, compound risk dominates with a 24.54% indirect effect share, followed by extreme precipitation (9.43%), while extreme temperature acts as a fiscal buffer (−20.35% offset). In the debt channel, extreme temperature takes the lead (17.25% indirect effect), with compound risk (8.33%) and extreme precipitation (8.80%) trailing. This variation underscores that each risk type interacts differently with fiscal and debt systems, requiring tailored assessment rather than one-size-fits-all analysis.

Second, direct effects remain universally dominant: all coefficients are positive and account for over 75% of the total effects. This highlights that while fiscal and debt channels matter, non-channel mechanisms, like direct physical damage or revised economic expectations, are still critical to spread pricing, suggesting room for further research into unmeasured transmission paths.

Collectively, these results provide evidence for Hypotheses H2 and H3.

6. Conclusion

6.1. Principal Findings

Our empirical analysis of China’s Local Government Financing Vehicle (LGFV) bonds from 2014 to 2023 yields four principal findings.

First, physical climate risks significantly increase LGFV bond issuance spreads. This effect is particularly pronounced for compound risks arising from the interaction of extreme temperature and precipitation. This conclusion remains valid after controlling for micro- and macro-level influencing factors and performing a series of robustness tests. Second, physical climate risks amplify local fiscal risks by intensifying the structural contradiction between fluctuating fiscal revenues and rigid emergency expenditures, thereby driving up LGFV bond financing costs. However, the effects of different risks are heterogeneous, so response measures must also be adapted to local conditions. Third, physical climate risks aggravate local governments’ debt financing burdens, magnifying the climate risk premium in LGFV bond financing costs through the pathway of deteriorating debt sustainability. Fourth, the impact of physical climate risks on LGFV bond financing costs exhibits multidimensional heterogeneity: short-term bonds demonstrate higher vulnerability due to greater liquidity and higher sensitivity to physical climate risks; lower-rated bonds show heightened sensitivity owing to weaker risk buffer capacity; and eastern regions display more pronounced pricing effects because of their higher economic concentration and greater asset exposure.

6.2. Policy Implications

Our findings, while contextualized in China, reveal a “climate–fiscal–financial” nexus with global relevance. The mechanism, whereby climate shocks erode public finances and amplify debt burdens, is critical for sub-national governments worldwide, particularly in rapidly urbanizing economies. Accordingly, we propose the following:

Integrate climate risk into public financial management. Governments should systematically incorporate physical climate risk assessments into fiscal planning and debt sustainability frameworks. Mandating robust climate risk disclosures for municipal financing vehicles is essential to improve market transparency and price risk accurately.

Develop climate-adaptive financial instruments. To fund resilient infrastructure and hedge against fiscal losses, policymakers should promote specialized green credit products, climate catastrophe insurance, and the issuance of “climate-resilience bonds”. The prudent use of weather derivatives can further help manage short-term liquidity risks.

Strengthen equitable global standards. The international community must foster cooperation to develop global climate risk disclosure standards. These standards must be equitable and responsive to the distinct challenges faced by developing economies.

Effectively managing these climate-induced fiscal pressures is indispensable for achieving key UN Sustainable Development Goals (SDGs), particularly those related to sustainable cities (SDG 11) and climate action (SDG 13).

6.3. Future Research Agenda

Building on the limitations of this study, we propose the following promising directions for future research: first, analyzing climate transition risks by examining how policy changes and technological shifts affect the debt sustainability of local government financing vehicles; second, investigating differences in financing costs between the primary and secondary markets to reveal how different markets price climate risk; third, decomposing risk premiums by breaking down credit spreads into default risk and liquidity premium components to identify which element is more significantly affected by climate risk. These directions will help establish a more comprehensive analytical framework for climate financial risks.