1. Introduction

Green development is an essential requirement for advancing new quality productive forces and has become a critical pathway for nations to achieve sustainable development. In January 2024, the General Secretary emphasized that “green development is the fundamental attribute of high-quality development, and new quality productive forces are inherently green productive forces” [

1]. This statement profoundly elucidates the intrinsic connection and unity between green development and high-quality development, as well as between new quality productive forces and green productive forces [

2]. The evolution of new quality productive forces inherently embodies a commitment to green, low-carbon, and circular principles. Its developmental process drives the transformation of productive forces toward greater sustainability and environmental friendliness [

3]. Developing new quality productive forces, in essence, entails fostering green productive forces, thereby providing theoretical guidance and practical direction for building an ecological civilization under socialism with Chinese characteristics in the new era [

4]. Hence, in-depth research on the underlying green effect of new quality productive holds significant practical and policy implications.

As the core of the modern economy and the hub of resource allocation, the financial sector must develop diversified financial products and services to channel social capital into emerging and future industries, thereby directing advanced and high-quality production factors toward the development of new quality productive forces [

5]. The Central Financial Work Conference in 2023 emphasized the importance of executing the “Five Major Financial Articles”—technology finance, green finance, inclusive finance, pension finance, and digital finance—highlighting the critical role of green finance in environmental protection and sustainable development [

6]. This underscores the need for financial institutions to focus on green industries and project development, promoting the transition toward a greener economy and achieving a win-win outcome in both economic and ecological benefits [

7].

In recent years, China’s green finance market has developed rapidly and achieved remarkable progress. According to the latest data from the People’s Bank of China, the outstanding balance of green loans in domestic and foreign currencies reached RMB 35.75 trillion by the end of the third quarter of 2024, representing a year-on-year increase of 25.1%—17.5 percentage points higher than the growth rate of conventional loans [

8]. Notably, 66.8% of these green loans were allocated to projects with direct or indirect carbon reduction benefits. The industries of infrastructure green upgrading, clean energy, and energy conservation and environmental protection also exhibited varying degrees of year-on-year growth in loan balances [

9]. In terms of the green bond market, statistics from the Climate Bonds Initiative (CBI) show that from 2016 to 2023, China accounted for 15% of global green bond issuance. Moreover, over the past two years, China has ranked first globally in green bond issuance [

10]. These developments demonstrate that green finance is already playing a significant role in promoting industrial green upgrading and transformation and in serving the real economy.

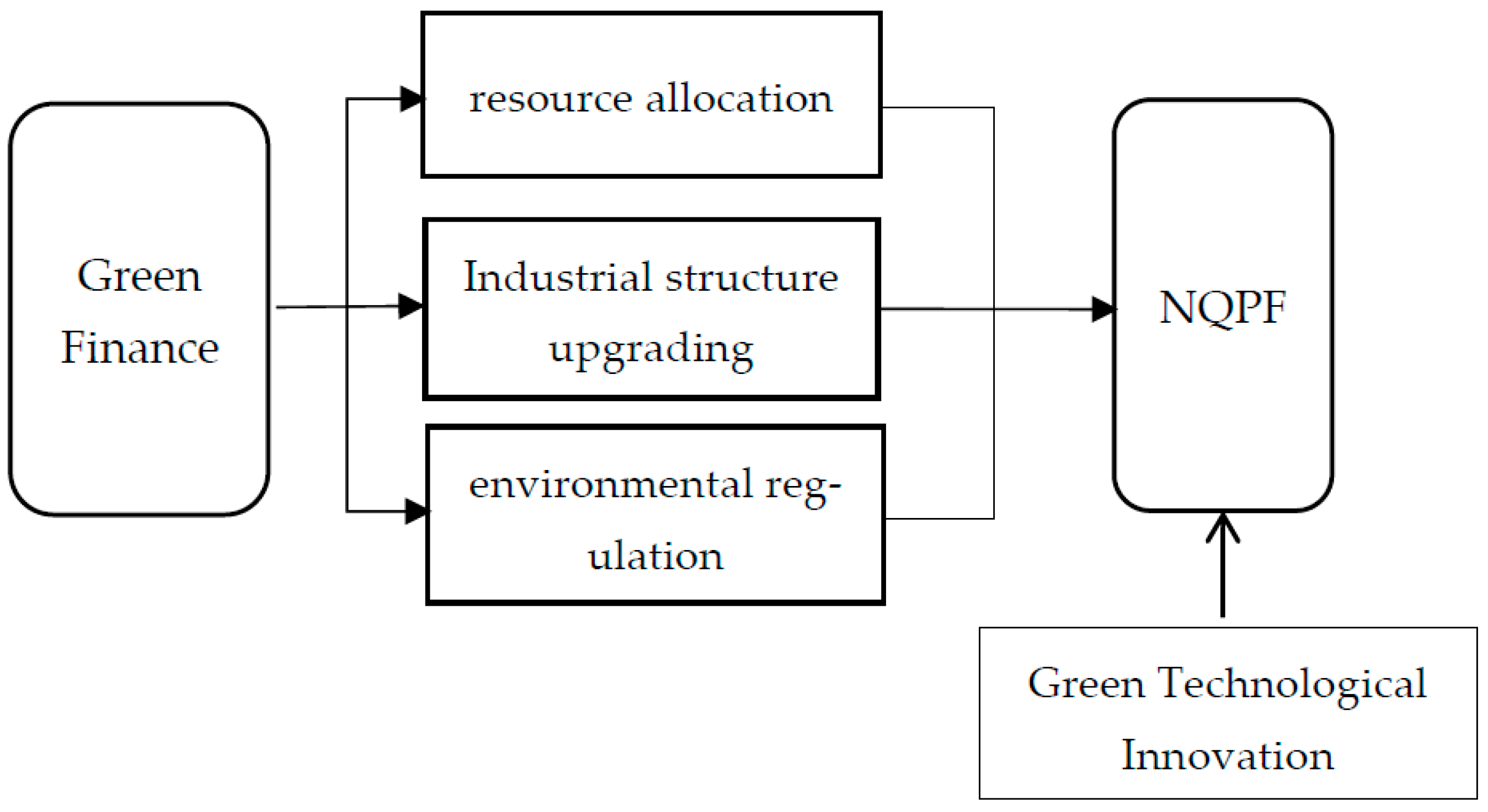

A relevant question is whether the practice of green finance can enhance the underlying green effect of new quality productive forces. However, few studies have examined how green finance influences the green development of new quality productive forces. Clarifying this relationship would not only enrich and expand the theoretical foundation of green productive forces and improve the theoretical system of green finance but also provide valuable insights for the green practices of new quality productive forces.

In summary, this study utilizes macro-level data from 31 Chinese provinces (municipalities and autonomous regions) from 2011 to 2023 to empirically examine the impact and mechanisms through which green finance and green technology innovation influence the green development of new quality productive forces. This is achieved by constructing an indicator system to measure the green development level of new quality productive forces.

2. Literature Review

The synergistic development of green finance and technological innovation is widely recognized as a crucial driver for achieving a green economic transformation [

11]. Under the “dual carbon” goals, understanding how these forces collectively empower the green effect of New Quality Productive Forces (NQPF) has become a pressing theoretical and practical issue. This section reviews the existing literature along three key lines: the conceptual and measurement evolution of NQPF, the economic impacts of green finance, and the research gap that this study aims to fill.

2.1. Conceptual Evolution and Measurement of New Quality (Green) Productive Forces

The concept of NQPF represents an advanced form of productivity that integrates ecological, economic, and social dimensions, embodying both a continuation and an expansion of traditional productivity theories [

12]. Its core lies in deeply integrating ecological principles and technologies into all aspects of production to achieve greener and more sustainable economic activities [

13]. From a conceptual standpoint, scholars have analyzed NQPF through various lenses. Some examined it through historical, practical, value, and functional dimensions, arguing that it signifies a qualitative leap beyond traditional productive forces [

14]. Some emphasized that NQPF should align with the new development philosophy, meet the people’s growing needs for a better life, and ultimately contribute to building a beautiful China characterized by harmonious coexistence between humanity and nature [

15]. Some further elaborated that the essential connotation of NQPF lies in the greening and optimization of the basic elements of productivity by integrating ecological principles and technologies on the foundation of traditional productive forces [

16].

Regarding the measurement of green productive forces, two predominant approaches exist in the literature. One common method employs Data Envelopment Analysis (DEA) based on input-output analysis, measuring the ratio between green inputs (e.g., resources, energy, environmental protection investments) and green outputs (e.g., the value of green products and services) [

17]. Another method utilizes an indicator system, constructing a series of metrics reflecting green productivity—such as energy efficiency, resource recycling rate, and waste treatment rate—and then applies comprehensive evaluation techniques to determine the level of green productivity [

18]. However, a significant portion of existing studies approaches the measurement from the perspectives of technological or digital productivity, often lacking a dedicated and systematic framework centered on the green attribute of NQPF. This study seeks to address this gap by constructing a specific evaluation system focused on “resource conservation” and “environmental friendliness.”

2.2. The Economic Impacts of Green Finance and the Identified Research Gap

Green finance, as a market-based instrument, is recognized for its role in promoting sustainable development. Existing research has extensively explored its impacts [

19], primarily through three mechanisms:

First, in terms of resource allocation, green finance addresses “market failure” by directing capital toward environmentally friendly industries and projects [

20]. Based on externality theory, it internalizes environmental costs through differentiated pricing (e.g., preferential green credit rates) and risk management, thereby incentivizing firms to reduce pollution and invest in green technologies [

21].

Second, concerning environmental regulation, the Porter Hypothesis suggests that appropriate environmental regulations can spur technological innovation [

22]. As a market-based regulatory tool, green finance encourages enterprises to adopt clean technologies and green processes. Empirical studies, such as that by using a difference-in-differences model on green finance reform pilot zones, have found that such policies significantly promote green process innovation, providing technical support for green productivity [

23].

Third, regarding industrial structure, green finance facilitates the transition to a low-carbon economy by supporting strategic emerging sectors like new energy and environmental protection [

24]. For instance, studies focusing on specific regions like the Yangtze River Delta have shown that green finance can curb carbon emissions by fostering green technology innovation and industrial upgrading [

25].

Furthermore, the interplay between green finance and technological innovation has garnered attention. Studies indicate that green finance can optimize the risk-return profile of green innovation for different industries, using financial instruments to disperse the risks associated with long R&D cycles, thereby stimulating innovation motivation [

26]. Scholars also highlight that green finance improves both the quantity and quality of technological innovation investments [

27].

2.3. Research Gap and the Contribution of the Study

Despite the growing body of literature, a critical gap remains. While existing research has explored the impact of finance on NQPF from perspectives such as financial agglomeration and financial risks [

28,

29], few studies have directly and empirically examined how green finance specifically influences the green development of NQPF [

30]. The underlying mechanisms and boundary conditions of this relationship are underexplored. Specifically:

There is a lack of a unified analytical framework that integrates green finance, technological innovation, and the green effect of NQPF.

The intermediary role of industrial structure upgrading in this context requires more robust empirical testing.

The potential moderating effect of green technological innovation, which might amplify the effectiveness of green finance, is not sufficiently investigated.

Regional heterogeneity in the impact of green finance on NQPF’s green effect needs further clarification to inform differentiated policies.

This study aims to fill these gaps. By constructing a comprehensive indicator system for the green development level of NQPF and utilizing macroeconomic data from China’s provinces, we empirically test the direct impact of green finance, the mediating role of industrial structure upgrading, and the moderating role of green technological innovation. Furthermore, we conduct heterogeneity analyses across regions and economic development levels. In doing so, this research not only enriches the theoretical foundation of green productive forces and green finance but also provides valuable empirical insights for policymakers and financial institutions in formulating targeted strategies to accelerate the development of NQPF and promote a comprehensive green transformation.

4. Methods and Data

4.1. Variable Selection

The construction of the indicator systems for the core variables in this study follows a principle of being theory-guided while constrained by data availability. The primary dimensions (first-level indicators) are derived from established theoretical concepts to ensure content validity. The specific measurement indicators (second-level indicators) are then selected based on their theoretical relevance and their consistent availability in official statistical yearbooks across all provinces and the entire study period (2011–2023).

4.1.1. Explained Variable: New Quality (Green) Productivity (GP)

The measurement system for New Quality (Green) Productivity is constructed to capture its essential emphasis on “improving total factor productivity” and “green development.” Unlike studies that measure NQPF from technological or digital perspectives [

47], our system centers on the dual cores of “greenness” and “quality-efficiency.”

The two first-level indicators, “Resource-Saving Productivity” and “Environmentally Friendly Productivity,” are grounded in the fundamental definition of green development, which seeks to decouple economic growth from resource depletion and environmental degradation.

Under these dimensions, the five second-level indicators were selected based on the following criteria:

Theoretical Relevance: Each indicator directly measures a key aspect of green production performance. Energy Intensity and Water Use Intensity are classic inverse proxies for resource efficiency. The Solid Waste Utilization Rate reflects circular economy performance, while Wastewater and SO2 Emission Intensities are central measures of industrial pollution control.

Policy Salience: These indicators align with the core monitoring metrics of China’s “Dual Carbon” goals and ecological civilization construction, ensuring policy relevance.

Data Availability and Consistency: These five indicators are systematically reported in the China Statistical Yearbook and the China Environmental Statistical Yearbook, allowing for the construction of a balanced panel dataset. While other potential indicators (e.g., CO2 emission intensity) were considered, the selected set provides a comprehensive and consistent measurement across all provinces and years.

The entropy weight method was applied to these five indicators to compute the comprehensive index

GP. A detailed description of all variables is provided in

Table 1.

4.1.2. Explanatory Variable: Green Finance (GF)

Drawing on the approach in empirical research [

48], the green finance index is constructed as a multi-dimensional composite index. This approach is theoretically grounded in the diverse functions of the financial system, which encompasses various instruments and markets.

The seven first-level indicators were selected to provide a holistic view of green finance development:

Theoretical Coverage: The indicators cover major green financial tools: Green Credit and Green Investment represent the core banking and capital allocation functions. Green Insurance, Green Bonds, Green Funds, and Green Rights & Allowances represent market-based financing and risk-trading mechanisms. Green Support (government expenditure) captures the crucial role of public fiscal policy in leveraging private finance.

Practical Comprehensiveness: This system captures not only the scale of financial resource allocation but also reflects the diverse functions of financial instruments in risk pricing, term transformation, and incentive guidance.

Data Constraints: A perfect, fully comprehensive measure of green finance is limited by data disclosure. Our system utilizes the most consistently available proxies for each dimension at the provincial level in China. For instance, while ideal data on all green financial product volumes would be preferable, the selected ratios (e.g., credit balance for environmental projects/total credit balance) effectively normalize for economic size and allow for meaningful inter-provincial comparison.

The entropy weight method is employed to aggregate these seven dimensions into the comprehensive green finance development index (

GF). A detailed description of all variables is provided in

Table 2.

4.1.3. Mediating Variables

Following the past approach [

49], this study measures industrial structure upgrading (

Upgrade) using two dimensions: the advancement of industrial structure and the heightening of industrial structure. The former reflects the trend toward a service-oriented and low-carbon economy, while the latter captures the enhancement of overall technological sophistication and added value across industries. Together, they constitute the key structural transmission channels through which green finance influences green productivity. Specifically, the advancement of industrial structure is represented by the ratio of the value-added of the tertiary industry to that of the secondary industry. The heightening of industrial structure is measured by introducing an industrial structure level coefficient, calculated as the weighted sum of the proportions of the primary, secondary, and tertiary industries in the regional GDP, each multiplied by their respective structural level coefficients.

This study uses the total number of green patent applications and grants in each province to represent the level of green technological innovation (GPAT). Given the large magnitude of the raw data, logarithmic transformation is applied. Compared with the number of green patent applications, the number of green patent grants better reflects a province’s innovation capacity, emphasizes the final output quality and market value of technological innovations, and more accurately captures a region’s ability to translate green ideas into tangible productive forces. In contrast, the number of applications primarily indicates the emphasis placed on green technology at the regional level.

4.1.4. Control Variables

To mitigate the impact of omitted variables on green productivity, this study incorporates a set of control variables that may influence the development of green productivity [

50].

Economic development level (pgdp): Measured by the logarithm of per capita GDP to capture regional economic disparities.

Degree of government intervention (gov): Represented by the proportion of public fiscal expenditure to regional GDP.

Openness to the global economy (open): Calculated as the ratio of total import and export value (converted to RMB using the annual average exchange rate) to GDP.

Labor force level (labor): Measured by the natural logarithm of the number of employed persons in each province.

Transport infrastructure level (traffic): Represented by the logarithm of the total road mileage in each province.

4.2. Model Specification

To empirically examine the impact of green finance on the green effect of New Quality Productive Forces, we construct a two-way fixed effects panel regression model. This model is chosen for its ability to control for unobserved, time-invariant heterogeneity across provinces (e.g., geographic conditions, long-term cultural or institutional factors) and common temporal shocks affecting all provinces simultaneously (e.g., nationwide policy changes or global economic cycles). By including both province fixed effects (ui) and year fixed effects (vt), we can isolate the net relationship between green finance and green productivity, which is more likely to reflect a causal influence.

To examine the impact of green finance on new quality (green) productive forces, the following benchmark regression model is constructed:

Here, GP denotes the development index of new quality (green) productive forces, GF represents the green finance development index, and Controls refers to a set of control variables. The subscripts i and t denote province and time, respectively. The terms and represent region and time fixed effects, and is the random error term. The primary focus of this study is the significance and sign (positive or negative) of the coefficient .

4.3. Methodological Considerations and Limitations

While our empirical strategy is designed to be robust, we acknowledge several methodological limitations inherent in the characteristics of our data and modeling choices.

First, concerning measurement error, our core variables, GP and GF, are composite indices constructed from secondary data. Although we followed a rigorous, theory-guided process for indicator selection and used the entropy weight method for aggregation, these indices remain proxies for complex, multi-dimensional concepts. Any imperfection in this measurement could lead to attenuation bias, potentially causing us to underestimate the true effect sizes. We have sought to mitigate this through robustness checks using alternative measurements for GF (e.g., green credit ratio, entropy-weighted TOPSIS), which yielded consistent results.

Second, despite the use of fixed effects and control variables, the potential for omitted variable bias persists. There may be time-varying, province-specific factors (e.g., subtle changes in local environmental enforcement intensity or social awareness) that are correlated with both green finance development and green productivity but are not fully captured by our controls. While the inclusion of a comprehensive set of controls and fixed effects alleviates this concern, we cannot rule it out completely. To address the more severe endogeneity concern of reverse causality, we employed the Two-Stage Least Squares (2SLS) estimator with instrumental variables, as detailed in

Section 5.2. The validity of our instruments supports a causal interpretation of our main findings.

Third, our data structure presents limitations. We utilize provincial-level macro data, which aggregates micro-level behaviors of firms and individuals. This aggregation might mask heterogeneous effects at the firm or industry level—a phenomenon known as the ecological fallacy. Furthermore, our sample period (2011–2023) captures a specific phase of China’s green transition, and the relationships we identify may evolve over a longer time horizon or may not be directly generalizable to other national contexts with different institutional settings.

In summary, while we have employed a robust empirical framework and multiple identification strategies to bolster our conclusions, the results should be interpreted with these considerations in mind. They represent strong and consistent associative evidence at the provincial macro-level, supported by causal inference techniques, for the period under study.

4.4. Descriptive Statistics

Table 3 presents the descriptive statistics of the main variables. The results indicate that:

First, the mean value of the new quality (green) productive forces index is 0.594, suggesting that the overall green development level of new quality productive forces at the provincial level in China is in the medium to upper medium range. This reflects that the promotion of the “Dual-Carbon” goals and green development strategies has preliminarily facilitated the green transformation of productive forces. However, the standard deviation is 0.17, with a minimum value of 0.14 and a maximum of 0.975, indicating significant disparities in the development of green productive forces across provinces (municipalities and autonomous regions).

Second, the mean value of the green finance index is 0.322, which remains relatively low. This implies that although China’s green finance market has begun to develop, there is still considerable room for improvement in both the scale and efficiency of financial resource allocation toward green sectors. The standard deviation is 0.130, with a minimum value of only 0.09 and a maximum of 0.654, suggesting that some provinces exhibit notably underdeveloped green finance systems, further highlighting interregional imbalances.

Third, the mean value of green technological innovation is 8.374, with a standard deviation of 1.558, a minimum of 1.792, and a maximum of 11.46, indicating pronounced divergence in provincial-level green technological innovation capabilities.

Furthermore, the control variables are generally consistent with the realities of regional development in China and findings in the relevant literature, showing no significant anomalies.

4.5. Correlation Analysis

Table 4 presents the correlation analysis results among the major variables. As shown in the table, the explained variable, new quality (green) productive forces (

GP), is significantly positively correlated with the core explanatory variable, green finance (

GF), at the 1% level, providing preliminary support for the research hypothesis of this study. The absolute values of correlation coefficients between the explanatory variable and the control variables are mostly below 0.5, indicating no significant multicollinearity concerns among the variables based on statistical results. Furthermore, variance inflation factor (VIF) tests were conducted to further assess multicollinearity. The results show that the mean VIF value for all variables is 3.04, with a maximum value of 5.15—both well below the threshold of 10—confirming that no severe multicollinearity issue exists in the baseline regression model.

5. Empirical Results and Discussion

5.1. Benchmark Regression Results

Table 5 reports the baseline regression results of the impact of green finance (

GF) on new quality (green) productive forces (

GP). Column (1) presents the results including only the core variable without controlling for region or year fixed effects. The results show that the coefficient estimate of green finance (

GF) is significantly positive at the 1% level. After gradually introducing control variables and maintaining region and year fixed effects in columns (2) to (4), the coefficient estimates of green finance remain significantly positive at the 1% level. These findings indicate that green finance significantly enhances the green effect of new quality productive forces, thus supporting Hypothesis H1.

From a managerial perspective, the underlying mechanism can be interpreted as follows: green finance alleviates financing constraints for green technology R&D and environmental facility upgrades by providing low-cost, long-term dedicated funds. This enables firms to break away from the “pollute first, treat later” development path and proactively engage in green process innovation and environmental investments. Consequently, resource utilization efficiency improves at the micro level while regional emission intensity decreases at the macro level, ultimately strengthening the green foundation of new quality productive forces.

The results of the control variables are generally consistent with existing literature. The estimated coefficient of government intervention (gov) is significantly positive at the 1% level, suggesting that increased government involvement promotes the development of regional green productivity. A possible explanation is that governments can guide industrial transformation, upgrading, and technological innovation through environmental regulations and fiscal leverage, thereby enhancing the green development of new quality productive forces.

5.2. Endogeneity Test

We acknowledge the significant challenge in identifying valid instrumental variables (IVs) to address endogeneity concerns, a common limitation in empirical economic studies. As discussed in

Section 4.3, potential reverse causality and omitted variable bias are key threats to our identification. To credibly establish a causal effect, we employ a Two-Stage Least Squares (2SLS) approach. Below, we detail our rigorous process for IV selection and present a comparative analysis of the results.

5.2.1. Instrumental Variable Selection and Validity

We pursued and tested several potential instruments based on economic reasoning and data availability. Our primary criterion was that the instruments must be correlated with the endogenous variable, GF, but plausibly uncorrelated with the error term in the main equation (i.e., affect GP only through their impact on GF).

After testing various candidates, we report results for the two most defensible instruments:

The one-period lag of the green finance index (L.GF): The past level of green finance development is likely a strong predictor of its current level due to path dependency in financial system evolution. However, it is plausibly exogenous to current shocks affecting the green effect of NQPF, conditional on province and year fixed effects which control for time-invariant factors and common trends. We also tested higher-order lags (e.g., L2.GF), but the first lag provided the strongest first-stage results without compromising the over-identification tests.

The interaction between green finance and coastal distance (IV): This instrument is constructed as the product of the green finance index and the logarithm of the nearest distance from each province’s capital to a major coastal port. Geographic distance to ports is a time-invariant, historical factor that influences regional financial development and openness—coastal regions typically have more developed financial markets, including green finance (satisfying relevance). However, after controlling for time-varying economic factors (our control variables) and fixed effects, the interaction of this geographic feature with the national-level development of green finance is unlikely to directly determine a province’s contemporary green productivity level, except through its effect on local green finance development (satisfying the exclusion restriction).

The first-stage regression results, presented in Columns (1) and (3) of

Table 6, confirm the relevance of our instruments. The coefficients for both

L.GF and

IV are positive and statistically significant at the 1% level. The Kleibergen-Paap rk Wald F-statistics (407.85 and 512.44) far exceed the Stock-Yogo critical value of 16.38, allowing us to reject the null hypothesis of weak instruments.

5.2.2. Comparative Analysis: Before and After IV Estimation

Table 6 presents a crucial comparison. Column (2) and (4) report the second-stage results of the 2SLS estimation. It is particularly instructive to compare these IV estimates with the benchmark fixed effects (FE) estimate from

Table 5, Column (4) (α

1 = 0.642).

For IV1 (L.GF): The coefficient on GF in Column (2) is 0.764, which is larger than the FE estimate. This pattern is common in IV estimation; if the OLS/FE estimate was biased downward due to measurement error, a consistent IV estimator would correct this and produce a larger coefficient. The fact that the coefficient remains positive and significant (at the 1% level) reinforces the robustness of our core finding.

For IV2 (IV): The coefficient on GF in Column (4) is 1.35, significantly larger than both the FE and the first IV estimate. While the magnitude differs, the fundamental conclusion is unchanged: there is a statistically significant positive effect (significant at the 5% level). The difference in magnitude highlights the sensitivity of IV estimates to the choice of instrument but, critically, not the direction or significance of the effect.

The consistency of the sign and significance across both the FE and the two different IV specifications, despite variations in point estimates, provides strong, triangulated evidence supporting Hypothesis H1. It suggests that the positive relationship is not merely a correlation but likely reflects a causal impact of green finance on the green effect of NQPF.

Furthermore, the under-identification test (LM statistic) is rejected (p = 0.000) for both models, confirming that the instruments are relevant.

5.3. Robustness Test

To ensure the reliability of the conclusions, robustness tests were conducted from the following three aspects:

First, replacing the core explanatory variable. Green credit was used as a proxy indicator for green finance to re-estimate the original model. Green credit was measured using the “intensity of credit allocation to environmental projects,” defined as the ratio of the loan balance in provincial environmental sectors to the total regional credit stock. Furthermore, the green finance indicator system was re-evaluated using the entropy-weighted TOPSIS comprehensive evaluation method. The entropy weight method provides objective weight allocation for the TOPSIS method, improving the accuracy of the comprehensive evaluation results. Meanwhile, the TOPSIS method fully incorporates the comprehensive influence of multiple indicators by applying the weights derived from the entropy weight method, leading to more holistic and reasonable evaluation outcomes.

Second, excluding municipalities. Given the unique economic characteristics of municipalities, data from Beijing, Shanghai, Tianjin, and Chongqing were excluded from the sample to mitigate their potential impact on the findings. Regression analysis was subsequently performed on the remaining sub-sample.

Third, incorporating additional control variables. Factors such as social consumption level and human capital level may also influence the development of green productivity. To address potential omitted variable bias, these aspects were further controlled in the model.

Columns (1) to (4) in

Table 7 present the results of the robustness tests. The results show that the regression coefficient of green finance remains significantly positive after remeasuring the green finance index using green credit and the entropy-weighted TOPSIS method, excluding municipalities, and adding more control variables. This confirms the robustness of the conclusion that green finance promotes the green development of new quality productive forces.

5.4. Mediating Effect Test—Industrial Structure Upgrading

To further examine the mediating role of industrial structure upgrading in the process through which green finance affects the green effect of new quality productive forces, the following mediating effect model was constructed:

The stepwise regression coefficient method, commonly used for testing mediating effects, posits that if the coefficient in Model (2) is statistically significant, and the coefficient in Model (3) is also significant, then the mediating effect is considered significant. Furthermore, if the coefficient is not significant, the mediating variable exhibits a full mediating effect. If is significant but smaller than the coefficient in the baseline regression Model (1), then plays a partial mediating role, and the product of coefficients represents the magnitude of the indirect effect.

Enhancing the effect of new quality productive forces hinges on the synergy between economic growth and ecological environmental protection, which largely depends on the transformation of the industrial structure toward low-carbon, high-efficiency, and eco-friendly development. According to industrial structure theory, a decline in the proportion of high-pollution and high-energy-consumption industries alongside a rise in green industries directly reduces resource consumption and pollution emissions per unit of output, forming the structural foundation for the enhancement of new quality (green) productive forces.

Meanwhile, the core function of green finance is to optimize capital allocation through price mechanisms and policy guidance. Its impact on new quality (green) productive forces is difficult to achieve directly and must be realized through the medium of industrial structure—that is, by guiding capital away from high-carbon industries and toward green sectors, thereby driving the green transformation of the industrial structure, which in turn affects new quality (green) productive forces. Based on this, the heightening index and the advancement index of industrial structure are used to measure industrial upgrading, and mediating effect tests are conducted accordingly.

The regression results of the mediating effects are presented in

Table 8. Column (2) reports the results of green finance (

GF) on the advancement of industrial structure (

Upgrade1). The estimated coefficient of green finance (

GF) is significantly positive at the 1% level, indicating that the development of green finance contributes to industrial structure upgrading. The results in Column (3) show that both the advancement of industrial structure (

Upgrade1) and green finance (

GF) have significantly positive coefficients, suggesting that industrial structure upgrading serves as a channel through which green finance drives the underlying green effect of new quality productive forces. The results in Columns (4) and (5) further support this conclusion, confirming Hypothesis H2.

This implies that financial institution managers should look beyond simple project financing and approach asset allocation from a strategic perspective aimed at transforming the regional economic structure. By offering comprehensive financial services such as differentiated interest rates, preferential green credit quotas, and underwriting of green bonds, they should prioritize support for high-technology, low-pollution advanced manufacturing and modern service industries while consciously restricting financial supply to high-pollution and high-energy-consumption sectors. In doing so, they can actively yet indirectly shape regional new quality productive forces by facilitating the “greening” and “softening” (service-oriented transition) of the industrial structure.

5.5. Moderating Effect Test—Green Technological Innovation

To examine the moderating role of green technological innovation in enhancing regional new quality (green) productive forces, Model (4) is constructed as follows:

Specifically, green technological innovation (GPAT) is introduced as a moderating variable, and an interaction term between green finance and green technological innovation (interact) is added to the model. Here, X denotes the control variables, while all other variables remain consistent with previous definitions. The primary focus lies on the significance and direction of the coefficient of the interaction term.

The regression results are presented in

Table 9. The findings show that, regardless of whether control variables and fixed effects are included, the coefficient of the interaction term is significantly positive at least at the 5% level. This indicates that green technological innovation enhances the ability of green finance to promote the underlying green effect of new quality productive forces, thus supporting Hypothesis H3.

This can be explained by the fact that a higher level of green technological innovation implies the presence of more promising green technology projects that require funding for conversion or scaling. In this context, green finance provides capital that can more directly and effectively alleviate the financing constraints faced by these high-quality green technology projects, enabling their smooth implementation and commercialization. As a result, the enhancement of new quality (green) productive forces is achieved more rapidly and effectively. When more mature and applicable green technological innovations are available in the market, such financial support can more efficiently incentivize firms to abandon outdated, high-pollution, and high-energy-consumption technologies in favor of new technologies that substantially boost green productivity.

Furthermore, the observed effectiveness of green finance in supporting technology adoption and transformation encourages firms—especially those facing financing constraints—to invest more resources in green technology R&D. This creates expectations of easier future financing and enhanced market competitiveness, ultimately forming a virtuous cycle.

5.6. Heterogeneity Analysis

China’s vast territory and significant regional disparities in development levels mean that different provinces possess distinct resource endowments and exhibit varying degrees of economic modernization. As a result, the impact of green finance on new quality (green) productive forces may also differ across geographical locations and levels of economic development.

To examine regional geographical heterogeneity, the common approach was adopted by dividing the country into eastern, central, and western regions. Regression was performed using interaction terms between green finance (

GF) and regional dummy variables (

east,

middle,

west). The results in columns (1) to (3) of

Table 10 show that the coefficient for the eastern region is significantly positive (

p < 0.1), the coefficient for the central region is positive but not significant, and the coefficient for the western region is significantly negative at the 1% level. This suggests that the green development of new quality productive forces in the eastern region is more prominently driven by green finance.

This may be attributed to several reasons. First, the eastern region generally possesses a stronger economic foundation, with substantial capital accumulation enabling sufficient investment in the R&D, production, and promotion of green industries. Moreover, these regions have well-developed financial markets, a high concentration of financial institutions, and diverse financial products and services. Green financial instruments such as green bonds and green credit are more readily accepted by the market and investors in these areas. In contrast, green finance policies started relatively later in the central and western regions, and financial development has progressed more slowly, resulting in a less pronounced effect of green finance on new quality (green) productive forces.

Furthermore, the industrial structure in the eastern region tends to be more oriented toward high-tech industries and services, which are characterized by low pollution and high value-added. These industries have a smaller environmental footprint and are more receptive to adopting and applying green technologies and concepts. Policy support through green finance can further facilitate the optimization and upgrading of these industries, enhance resource utilization efficiency, and thereby more effectively boost the green effect of new quality productive forces.

Moreover, regions were categorized by economic development level based on the annual median GDP per capita. Areas with values above the median were classified as the high economic development level group, while the rest were classified as the medium-to-low (general) economic development level group. The grouped regression results are presented in

Table 10. As shown in columns (4) and (5), the coefficient for regions with medium-to-low economic development is significantly positive at the 1% level, while the coefficient for high economic development regions is not significant. This indicates that the promoting effect of green finance is more pronounced in regions with medium-to-low (general) economic development levels.

The reason may be that industries in less developed regions are often dominated by traditional sectors characterized by high energy consumption, high pollution, and low efficiency. Environmental protection facilities (such as wastewater treatment and exhaust gas control) are generally inadequate or outdated, and the application of green technologies remains limited. In this context, introducing relatively mature and accessible green technologies and equipment can lead to significant marginal improvements in resource efficiency and pollution reduction, thereby directly and rapidly enhancing productivity.

In contrast, highly developed regions, after years of intensive pollution control, already exhibit relatively high performance in indicators such as pollution emission intensity and resource utilization efficiency. Further enhancing productivity in these regions requires substantially higher marginal technological and management costs. Under the current framework, the input from green financial instruments and simple technological upgrades or facility improvements yields limited effects and is insufficient to cover the high costs associated with this advanced stage of development.

6. Conclusions, Theoretical Implications, and Practical Implications

6.1. Conclusions

This study empirically examines the impact of green finance on the green development of New Quality Productive Forces using provincial-level data from China from 2011 to 2023. The findings robustly demonstrate that green finance is a significant driver of the green effect of NQPF. This relationship is partially channeled through the mediation of industrial structure upgrading and is substantially strengthened by the level of green technological innovation. Furthermore, the promoting effect is more pronounced in eastern regions and areas with medium levels of economic development. These conclusions hold significant value for both theoretical advancement and practical policy and managerial decision-making, as detailed above.

6.2. Theoretical Implications

This study makes several salient contributions to the theoretical literature on green finance, technological innovation, and New Quality Productive Forces (NQPF).

First, it enriches the measurement methodology for NQPF by moving beyond conceptual discourse. While existing research predominantly focuses on the conceptual definition and value implications of NQPF, few studies have attempted to quantify its green development level. This paper constructs and validates a novel evaluation system centered on the dual cores of “resource conservation” and “environmental friendliness.” This quantitative framework provides a replicable tool for future empirical research, facilitating the transition of NQPF studies from qualitative philosophical discussions to robust quantitative analysis.

Second, it constructs and validates an integrated theoretical framework for the green effect of NQPF. By incorporating green finance, industrial structure upgrading, and green technological innovation within a unified model, this research theoretically elaborates and empirically tests the direct (H1), mediating (H2), and moderating effects (H3). The findings confirm that the green development of NQPF is not a spontaneous process but is driven by a synergistic “capital-technology-structure” trinity. This framework extends the research scope of NQPF beyond technological or digital dimensions, offering a more holistic understanding of its green underpinnings and providing a theoretical basis for subsequent mechanism analyses.

Third, it reveals critical boundary conditions, thereby refining the application of externality theory and the Porter Hypothesis in the Chinese context. The heterogeneity analysis demonstrates that the efficacy of green finance is not uniform but is significantly shaped by regional economic development levels and geographical locations. This finding introduces important nuances to theories that often assume uniform effects. It suggests that the ability of green finance to internalize environmental externalities (externality theory) and to stimulate innovation (Porter Hypothesis) is contingent upon local absorptive capacity and industrial structure, thereby refining these established theories for complex, transitioning economies like China.

6.3. Practical Implications

Our findings offer actionable insights for policymakers, financial institutions, and corporate managers to accelerate the development of green NQPF.

- ①

For Policymakers and Regulatory Bodies:

Promote Differentiated and Place-Based Green Finance Strategies: Given the pronounced regional heterogeneity, one-size-fits-all policies are suboptimal. In developed eastern regions, regulators should pilot sophisticated market-based instruments (e.g., integrated carbon-green credit products, green securitization). In contrast, central and western regions may benefit more from enhanced policy support, such as provincial green development funds, higher tolerance for non-performing green loans, and government-backed risk compensation mechanisms.

Strengthen the Institutional Synergy between Finance and Technology: To bridge the mismatch between the long-term, high-risk nature of green R&D and the short-term return expectations of financial capital, policymakers should establish tripartite risk-sharing mechanisms involving government, financial institutions, and enterprises. Concrete measures include providing interest subsidies on R&D loans for firms with strong green patent performance and treating granted green patents as a key eligibility criterion for green bond issuance.

Facilitate Cross-Regional Coordination: Encourage paired assistance between eastern and less-developed regions to facilitate the transfer of green technologies, management expertise, and cross-regional green investments. Establishing a mutual recognition system for carbon reduction credits can guide eastern capital toward high-impact green projects in central and western China.

- ②

For Financial Institutions:

Transition from Project Financing to Strategic, Structure-Oriented Asset Allocation: Financial institutions should look beyond individual project appraisal and adopt a strategic perspective aimed at transforming the regional economic structure. This involves offering comprehensive financial services—such as differentiated interest rates, preferential green credit quotas, and underwriting of green bonds—to proactively support high-technology, low-pollution advanced manufacturing and modern service industries.

Develop Innovative Financial Products for the Green Transition: Introduce specialized financial instruments to address specific market failures. For instance, create asset-backed securities based on the future cash flows of green technology projects, supported by public credit guarantees to lower issuance costs. Pilot insurance products that cover the risks of technology commercialization, with fiscal subsidies to reduce premiums for adopting firms.

Enhance Risk Assessment and Monitoring for Greenwashing: As green finance scales up, institutions must bolster their capabilities to identify and mitigate “greenwashing” risks. Integrating environmental performance data and leveraging financial technology for real-time monitoring can ensure that green funds lead to verifiable environmental benefits.

- ③

For Enterprises, especially in Traditional Sectors:

Proactively Integrate into the Green Industrial Chain: Firms should strategically position themselves within emerging green industrial chains supported by green finance. SMEs, in particular, can leverage cluster-based credit solutions backed by core enterprises to enhance their financing accessibility.

View Green Innovation as a Strategic Imperative, Not a Compliance Cost: The moderating role of green technological innovation underscores its value. Enterprises should increase investment in green R&D, aiming not only for patent applications but for high-quality, commercially viable innovations that can attract preferential financing and secure a competitive advantage in the evolving green market.

Utilize Transition Finance Facilities: Capital-intensive traditional industries undergoing green upgrades should actively seek out and utilize special transition funds designed to provide debt refinancing and new loans, thereby alleviating short-term financial pressures during the transformation process.