Abstract

This paper investigates the impact of green credit policy (GCP) on the green technological innovation capacity of heavily polluting enterprises (HPEs) from the perspectives of external financing and internal concerns. Using data from companies in China’s A-share market from 2008 to 2021, we study the shocks of Green Credit Guidelines to the green technological innovation in HPEs based on the difference-in-differences (DID) model. The baseline regression result reveals that the GCP significantly motivates HPEs to engage in green technological innovation. Moreover, the efficiency of capital utilization has an adverse moderating effect on the impact of GCP, while commercial credit financing has a positive moderating effect. Mechanism analysis shows that the GCP stimulates green technological innovation in HPEs by reinforcing short-term loan dependence and strengthening executive green awareness. In a further study, the policy effects are heterogeneous for enterprises with different characteristics. Regionally, green credit policy affects enterprises in China’s eastern region more strongly. The effect is also more pronounced for Chinese domestic enterprises and those with low financial background heterogeneity within top management teams. Overall, the findings in this study have important implications for policymakers in implementing green finance policies.

1. Introduction

The environmental pollution problem caused by economic growth has become increasingly severe in recent years [1]. Environmental degradation and rising pollution emissions present significant obstacles to sustainable development. As the primary sources of industrial exhaust emissions, HPEs optimize the production processes through green technological innovation, which not only effectively mitigates the environmental damage but also helps promote green transformation [2]. Therefore, green technological innovation is of great significance in solving environmental problems.

However, green technological innovation often requires substantial capital and involves uncertain outcomes [3]. In contrast, companies with little social responsibility may perform better in the market. As a result, companies have low motivation to engage in green technological innovation. However, green credit policy effectively promotes green technological innovation in enterprises by reducing credit rationing for HPEs and providing financial support for green industries [4]. As the largest carbon emitter, the Chinese government announced a ‘dual-carbon’ goal in September 2020, and green technological innovation plays a crucial role in realizing it [5]. Therefore, examining whether GCP can promote green technological innovation among Chinese HPEs is of great significance for global environmental governance.

Although scholars have conducted extensive research on the effectiveness of GCP, there are still several important gaps in the following areas: first, when assessing the external impact of GCP from the perspective of corporate financing, scholars have focused primarily on the cost [6] while overlooking the financing mode. Second, there is a lack of an examination of the internal mechanisms. Scholars have focused more on external mechanisms, particularly financing constraints [7]; however, the financing constraints of listed companies are not always apparent. Corporate recognition of environmental social responsibility should also be examined as an essential internal mechanism. Finally, the moderating variables in existing literature have mainly depicted the influence of the external environment on policy effects [8], failing to capture the behavioral choices of enterprises.

To fill the gap in existing research, this paper takes the implementation of the Green Credit Guidelines (hereafter referred to as the Guidelines) in China as a quasi-natural experiment, using data from companies in China’s A-share market from 2008 to 2021 to explore the effects of GCP on green technological innovation in HPEs based on a difference-in-differences model. The results show that GCP promotes green technological innovation in HPEs by enhancing short-term loan dependence and strengthening executive green awareness. Moreover, the efficiency of capital utilization has an adverse moderating effect on the implementation of GCP, while commercial credit financing exhibits a positive effect. Our study offers the following contributions: first, it enriches the research perspective on the micro-level effects of GCP by introducing corporate dependence on financing methods and increasing attention to short-term financing. Second, it synthesizes the internal and external mechanisms to comprehensively explore the channels through which GCP affects enterprises’ green technological innovation. Third, it conducts a profound examination of corporate behavior under GCP. Specifically, it combines two possible corporate responses, including enhancing the efficiency of capital utilization and commercial credit financing, to explore the impact of corporate behavior on policy effects, thus providing rich micro-level evidence of the interaction between corporate and environmental policy.

The remainder of this paper is organized as follows. Section 2 reviews the relevant literature. Section 3 presents the background and theoretical analysis. Section 4 introduces the research design. Section 5 presents the results of the empirical analysis. Section 6 and Section 7 demonstrate the mechanism analysis and heterogeneity tests, respectively. Section 8 offers conclusions and policy implications.

2. Literature Review

2.1. Research on Green Credit Policy

Green credit is generally defined as a financial service that incorporates environmental standards into credit decisions and contributes to sustainable development [9]. Specifically, it forces financial institutions to support projects or businesses that meet environmental protection and social responsibility standards, fostering the development of environmentally friendly industries and steering economic growth toward greater sustainability. In terms of its informational value, green credit enables financial institutions to determine loan allocations based on firms’ environmental awareness and their fulfillment of social responsibility [10]. Therefore, green credit can effectively reduce information asymmetry, curbing opportunistic behavior during environmental financing transactions [11].

Regarding the impact of green credit policy, scholars mainly study it from both macro and micro perspectives.

From a macroeconomic perspective, scholars have posited that green credit policy can optimize industrial structure and promote economic growth. Studies found that implementing green credit policy restricts the expansion of highly polluting industries and supports the growth of environmental protection industries, fostering high-quality economic development [12]. Similarly, Liu and He [13], employing a DSGE model, demonstrated that green credit policy can facilitate a transition toward environmentally sustainable growth, achieving the dual objective of economic development and environmental protection.

At the micro level, studies on the effects of green credit policy have typically focused on the perspectives of corporate entities or banking institutions. The implementation of GCP has guided capital flows toward resource-efficient and environmentally friendly enterprises, improving the production efficiency of such firms and imposing financing constraints on HPEs [14]. Furthermore, this policy affects corporate environmental information disclosure and investment–financing decisions and positively influences firms’ ecological and social responsibility performance [15]. For commercial banks, green credit services facilitate business transformation and upgrading, enhance profitability and market competitiveness, and promote sustainable development [16].

2.2. Research on Green Technological Innovation

Braun and Wield [17] first proposed the concept of green technological innovation. In 2019, China’s National Development and Reform Commission and the Ministry of Science and Technology further defined the connotation of green technology by “Guiding Opinions on Building a Market-Oriented Green technological Innovation System”. On the one hand, green technology possesses commercial characteristics that enhance firms’ market competitiveness. On the other hand, it carries social attributes such as environmental protection and energy conservation, serving as a key means to reconcile the tension between China’s economic development and energy conservation goals. Accordingly, green technology plays an indispensable role in advancing sustainable economic development.

Research on the drivers of green technological innovation has evolved along several key dimensions, particularly focusing on external regulatory pressures and internal firm-specific capabilities.

From an environmental regulatory perspective, the relationship between environmental governance and corporate green innovation has long been a focal point in academic and policy discussions. Traditional institutional economics posits that stringent environmental regulation crowds out firms’ productive resources and increases production costs, inhibiting technological innovation [18]. In contrast, the Porter Hypothesis argues that well-designed environmental regulations can stimulate and guide firms to identify inefficiencies in resource allocation and uncover potential innovation opportunities, thus promoting green technological innovation. With the increasing number of relevant studies, scholars have further recognized that the effect of environmental regulation on green technological innovation may exhibit a nonlinear relationship. Specifically, weak regulations fail to impose effective constraints. However, overly stringent regulations may suppress technological progress in the short term due to rising compliance costs [19].

From a firm’s characteristics perspective, internal technological capability and organizational structure constitute the foundation for enterprises to engage in green technological innovation and achieve a competitive advantage. Financial, human, technical, and knowledge resources are critical in shaping a firm’s innovation capacity [20]. Du et al. [21] emphasized that firm size influences ecological and technological innovation, as larger firms generally possess richer R&D resources and more active environmental engagement. Xin et al. [22] further demonstrated a strong positive association between firms’ cash flow and their level of green technological innovation.

2.3. Research on the Impact of Green Credit Policy on Green Technological Innovation

With the progressive implementation of the green credit policy, many theoretical and empirical studies have examined whether such policy can effectively stimulate firms’ green innovation. However, there is no scholarly consensus on whether these policies facilitate green technological innovation in heavily polluting industries.

Some studies argue that green credit policy generates significant positive impacts on firms’ green technological innovation. Song et al. [23] found that, following the implementation of green credit policy, the agency costs of heavy-polluting firms decline, and their participation in green innovation activities becomes more proactive. Du et al. [24] suggested that green credit strengthens heavy-polluting firms’ intrinsic motivation to transition toward green innovation by providing low-cost financing options and increasing liquidity for enterprises with excellent environmental performance. Some scholars contend that the positive effects of green credit policy are mainly limited to environmentally friendly enterprises. Since these firms align more closely with the policy’s objectives, they can better leverage credit incentives to enhance innovation performance [25].

Conversely, some scholars argue that green credit policy may actually inhibit firms’ green technological innovation. Zhang et al. [26] found that green credit policy suppresses innovation by increasing financing costs for polluting enterprises and crowding out their R&D expenditures. Similarly, Ding et al. [27] noted that the reduction in both credit availability and information asymmetry induced by green credit policy diminishes heavily polluting firms’ access to credit resources, adversely affecting technological innovation. Lu et al. [28] further demonstrated that green credit policy significantly constrains technological innovation in high-pollution enterprises by restricting long-term debt financing and encouraging equity financing. These firms often respond by seeking additional funding or reducing R&D investment rather than pursuing strategic technological innovation to enhance total factor productivity.

In summary, research on green credit policy and green technological innovation has deepened, but the mechanisms through which such policy drives green innovation in heavily polluting firms remain underexplored. Existing studies mainly assess green credit policy through financing costs, paying little attention to financing structures or modes. Moreover, most analyses emphasize external mechanisms, especially financing constraints, which are difficult to observe directly and overlook firms’ internal motivations for green innovation.

This study incorporates executive green awareness as an internal mechanism, combining external financing and internal cognitive factors to analyze how green credit policy affects firms’ green innovation. This dual-perspective approach enriches the theoretical understanding of green credit’s role in promoting sustainable transformation and offers policy insights for guiding firms toward low-carbon, sustainable development.

3. Policy Context and Theoretical Analysis

3.1. Background of the Guidelines

GCP’s evolution has transitioned from preliminary exploration to standardized implementation. In 2007, the Chinese government issued “Opinions on Implementing Environmental Protection Policies and Regulations to Prevent Credit Risks”, which for the first time integrated environmental risks into credit management, marking the inception of green credit practices. However, constrained by the lack of mandatory requirements and specific implementation standards in the document, the policy’s effectiveness was limited, resulting in funding gaps between the supply and demand of green finance. In 2012, the former China Banking Regulatory Commission issued the Green Credit Guidelines, which clarified the responsibilities of financial institutions in customer selection and risk management. It provided clear standards for assessing green projects. Therefore, as a milestone document, the Green Credit Guidelines remedied the shortcomings of previous policies and broadly promoted the development of the green credit system.

3.2. Green Credit Policy and Green Technological Innovation in HPEs

Regarding the impact of green credit on enterprises, some scholars have found that for HPEs, green credit has apparent investment-inhibition and financing-penalty effects, leading to a significant decline in business performance [29]. In contrast, environmentally friendly enterprises are effectively incentivized by green credit [30]. This is because green finance converts external environmental pollution into internal financing costs and forces funds from high-polluting industries to flow to low-emission industries through the guiding role of the financial market [31]. Therefore, HPEs will face greater financial pressure, which motivates them to conduct green technological innovation to meet the requirements of GCP. Based on this, we propose the following hypothesis.

Hypothesis 1.

The implementation of the Guidelines will motivate HPEs to engage in green technological innovation.

3.3. Mediating Effect of the Reliance on Short-Term Loans

For HPEs, the most crucial financing method is bank loans [32]. The GCP has significantly impacted the financing strength of HPEs in the capital market, decreasing long-term loans [33]. To ease financial pressure, enterprises will seek alternative financing and increase demand for short-term loans. Established studies have found that, compared to long-term debt, short-term debt mitigates information asymmetry and agency conflicts between shareholders, managers, and creditors, thereby inhibiting inefficient corporate investment behavior [34]. Therefore, this paper argues that the micro-governance function of debt maturity structure will be strengthened by firms’ increased reliance on short-term loans, which incentivizes GCP’s effectiveness. Based on the above analysis, we propose the following hypothesis.

Hypothesis 2.

The implementation of the Guidelines will enhance corporate reliance on short-term loans, incentivizing enterprises to engage in green technological innovation.

3.4. Mediating Effect of Executive Green Awareness

According to the theory of strategic cognition, executives make decisions based on their awareness of the external environment, which influences corporate behavior [35]. Research has shown that when managers are responsible and willing to implement environmental values, they can affect companies’ energy-saving and environmentally friendly behavior [36]. As environmental regulations become stricter and consumer demand for green products grows, executives will be motivated to overcome challenges such as high investment and innovation risks. They will redirect corporate resources towards green technological innovation to establish a positive image. Based on the above analysis, we propose the following hypothesis.

Hypothesis 3.

The implementation of the Guidelines can strengthen executive green awareness, which will promote enterprises to engage in green technological innovation.

3.5. Moderating Mechanisms

GCP may not always play an incentive role in corporate green technological innovation [37] because enterprises can weaken or strengthen the policy’s actual impact through buffering mechanisms. Therefore, this paper will examine the effects of corporate behavior on GCP from two perspectives: improving the efficiency of capital utilization and broadening financing channels.

First, enterprises may improve the efficiency of capital utilization under GCP [38]. Before the implementation of GCP, due to the lack of regulation and assessment pressure, enterprises tended to sacrifice environmental efficiency to improve production efficiency [39]. However, with the advancement of GCP, stricter regulations and the weaker availability of funds have reduced the probability that enterprises invest in polluting production [40]. In this case, on the one hand, enterprises may reduce their funding needs by improving the efficiency of capital utilization, thus avoiding regulatory pressure, resulting in a lack of green innovation motivation. On the other hand, as green projects receive greater policy support, enterprises may allocate funds more efficiently and use the savings to support green technological innovation.

Similarly, enterprises’ commercial credit financing also affects GCP’s effectiveness. On the one hand, some scholars have found that commercial credit is a common form of informal funding, and it serves as an essential option when enterprises face financial constraints [41]. Companies can avoid the increased costs associated with the GCP by obtaining commercial credit financing, for example, through advance receipts and delayed deliveries. On the other hand, researchers have identified the signaling role of commercial credit. Commercial credit changes reflect the risk level of corporate operations [42], thereby reducing information asymmetry between banks and enterprises and facilitating adequate supervision of enterprises. Therefore, out of careful consideration, enterprises may engage in green technological innovation to build a green reputation. Based on the above analysis, we propose the following hypothesis.

Hypothesis 4.

The effectiveness of the Guidelines may be affected by the moderating effects of commercial credit financing and efficiency of capital utilization, but the exact impact is uncertain.

4. Research Design

This paper selects all A-share-listed companies from 2008 to 2021 as the initial research sample. Data on green patents of listed companies are from the CNRDS database. This database identifies green utility model and green invention patents by classifying patent data from the China National Intellectual Property Administration against the “IPC Green Inventory” published by the World Intellectual Property Organization. Data on corporate characteristics are from the CSMAR and Wind databases. We use Stata 19 for data cleaning and regression analysis, and the sample selection procedure is as follows: First, we eliminate ST, ST*, and PT enterprises. Second, we remove delisted companies. Third, we exclude financial enterprises. Fourth, we eliminate data with missing key variables. Fifth, we set missing values in green patent variables to zero and employ linear interpolation to handle other missing values. Finally, we winsorize all control variables at the 1st and 99th percentiles to mitigate the impact of extreme outliers. After the above processing, this paper obtains data from 873 listed companies, including 576 HPEs and 297 non-heavily polluting enterprises.

4.1. Variable Definitions

4.1.1. Explained Variables

Following the practices of previous scholars [43], we select the number of annual green utility model patent applications (GUP) to measure the capability of corporate green technological innovation. We also choose the number of annual green invention patent applications (GIP) and authorizations (GIA) as the variables for the robustness test. The main reason for selecting the above indicators is that, under the Chinese patent system, invention patents have the highest novelty and technical creativity, followed by utility model patents and design patents. Therefore, this paper excludes design patents and only discusses green utility model patents and green invention patents.

4.1.2. Explanatory Variable

The core explanatory variable in this paper is the interaction term of the group dummy and time dummy (), as it can capture the net effect of GCP by isolating the change in the treated group relative to the control group before and after the policy implementation [24]. Regarding the definition of , since GCP primarily impacts HPEs, we assign a value of 1 to HPEs and 0 to all other enterprises. We draw on the definitions of HPEs in two documents: the CSRC’s 2012 revision of the Guidelines for the Classification of Listed Companies by Industry, and the 2008 Notice of the Ministry of Ecology and Environment on Printing and Distributing the Administrative Directory of Listed Companies for Environmental Protection Verification Industry (In this paper, the industry codes of the HPEs are defined as B06, B07 B08, B09, C15, C17, C18, C19, C22, C25, C26, C27, C28, C29, C30, C31, C32, C33, C39, D44, D45, E48, F51, I64, I65, and P82). Regarding the definition of , this paper sets the year 2012 as the policy shock timing. This is because the Guidelines marked the beginning of GCP’s substantive impact on corporate behavior. Moreover, this nationwide unified time point helps mitigate endogeneity issues caused by regional disparities. Therefore, is set to 0 for the pre-2012 period, and it is set to 1 for the post-2012 period.

4.1.3. Intermediary Variables

This paper selects corporate reliance on short-term loans (RSL) as the external mechanism variable. Following the practice of scholars [44], this paper uses the proportion of short-term liabilities to total assets to measure RSL. In addition, executive green awareness (EGA) is selected as an internal mechanism variable. Acknowledging the credibility of textual analysis in capturing individual awareness [45], this study measured EGA with reference to the method of Liu and Chen [46] by using Python 3.12 to quantify the frequency of 19 relevant keywords in annual reports of listed companies, which were selected based on green competitive advantage, corporate social responsibility, and external environmental pressure. The specific keywords are in Table A1.

4.1.4. Moderators

The efficiency of capital utilization (EFF) and the scale of commercial credit financing (SCF) are the moderators. Drawing on the practices of existing scholars [47], this paper uses the turnover rate of fixed assets to measure the efficiency of capital utilization. In addition, the scale of corporate commercial credit financing is calculated as the sum of the nominal values of accounts payable, notes payable, and advances. This study applies a natural logarithmic transformation to the aggregate values to mitigate the right-skewness in financial data.

4.1.5. Control Variables

This paper selects ROA, Size, DS, RDR, Age, OC, and Employee as control variables to eliminate the influence of external factors on the results. Table 1 shows the meaning of each variable:

Table 1.

Meaning of variables.

4.2. Model Setting

This paper treats the Guidelines issued in 2012 as a quasi-natural experiment and uses the difference-in-differences model to examine the impact of the GCP on corporate green technological innovation. To test Hypothesis 1, we construct the following model (in order to simplify the expression, this paper uses in the formula to represent the green technological innovation of enterprises):

where represents the green technological innovation of enterprise in year , represents control variables, and represents the enterprise-fixed effects, while denotes the year-fixed effect, and represents the stochastic disturbance term.

The descriptive statistics are shown in Table 2. The mean value of GUP is 1.49, with the maximum and minimum values being 6.77 and 0, respectively. In addition, the standard deviation is greater than 1. The distribution of green patent data is uneven across enterprises, which indicates that investigating the impact of GCP on corporate green technological innovation is of practical significance. Moreover, there are significant gaps in executive green awareness (EGA), the efficiency of capital utilization (EFF), and the scale of commercial credit financing (SCF) among different enterprises by observing the standard deviation. As for the control variables, values are in a reasonable range, indicating that the data meet the research requirements.

Table 2.

Descriptive statistics.

5. Empirical Analysis

5.1. Parallel Trend Test

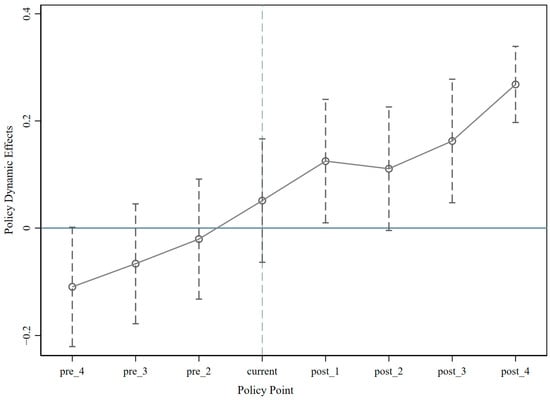

Figure 1 plots the time trend of the difference in the number of green utility patent applications (GUP) between the experimental group and the control group. The confidence intervals for the estimated coefficients of the interaction terms all contain 0 before the implementation of GCP. However, after 2012, the estimated coefficients largely display positive values. These findings indicate that there was no significant difference in the level of green technological innovation between the experimental and control groups before the implementation of the Guidelines in 2012, which suggests that the study meets the parallel trend assumption.

Figure 1.

The parallel trend test. Note: The horizontal axis represents time relative to the policy implementation year. Pre_4 to pre_2 denote the fourth to second years before policy implementation, while post_1 to post_4 denote the first to fourth years after policy implementation. The vertical axis shows the estimated coefficient of the difference in green innovation capacity between the treatment and control groups, with vertical lines indicating the 95% confidence interval.

5.2. Baseline Regression Results

This paper conducts a baseline regression on the panel data according to Equation (1), and the regression results are shown in Table 3. Columns (1), (3), and (5) represent the regression results without control variables, and columns (2), (4), and (6) represent the regression results with control variables. GCP significantly positively affects corporate green technological innovation at the 1% level. This indicates that the Guidelines drive green technological innovation in HPEs, thereby validating Hypothesis 1.

Table 3.

GCP and corporate green technological innovation.

5.3. Robustness Tests

5.3.1. Placebo Test

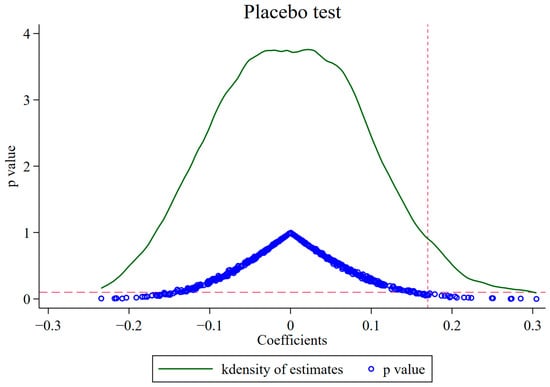

After referring to the practices of previous scholars [48], this paper generates an experimental group randomly for a placebo test to determine whether other random factors cause the empirical results. Specifically, 192 enterprises were randomly selected from the original sample as the experimental group affected by the Guidelines, while the remaining enterprises were categorized into the control group. Regression analysis is then conducted after the above processing. To ensure the robustness of the experiment, this paper repeats the random sampling process 500 times and produces a scatter plot of the estimated coefficient and its corresponding p-value.

In Figure 2, the coefficients are centrally distributed around 0, but are significantly different from the true value. Moreover, most scatters are above 0.1, indicating that most estimates are insignificant at the 10% confidence level. The above results show that the improvement of green technological innovation in HPEs is not driven by random factors, confirming that the empirical results in the previous section are robust.

Figure 2.

Placebo test. Note: the horizontal axis of the figure shows the regression coefficients generated from randomized experiments, while the vertical axis displays the statistical significance corresponding to each estimate. The red vertical line indicates the actual coefficient from the baseline regression, and the red horizontal line indicates the 10% significance level.

5.3.2. PSM-DID

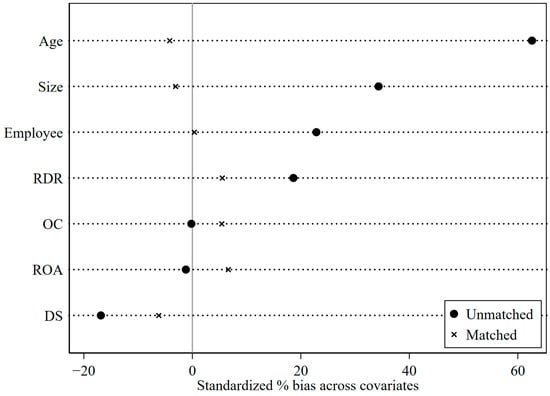

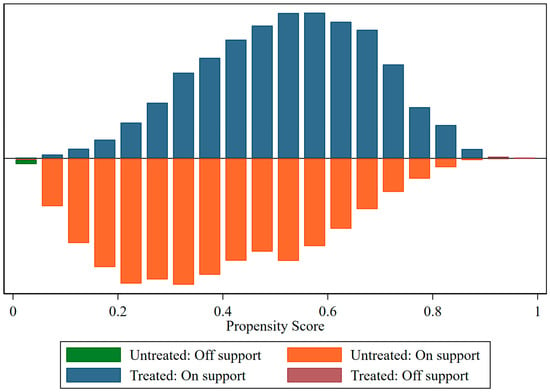

Before the implementation of the Guidelines, there were differences in basic characteristics between enterprises affected by the Guidelines and those not affected, which might result in inherent disparities in green technological innovation between the two groups, reducing the accuracy of the DID estimates. Therefore, this study employs the PSM-DID method to reanalyze the policy effect. Following the matching approach of previous studies [49], this study uses control variables as matching covariates. It conducts a nearest-neighbor matching with replacement at a ratio of 1:3 yearly.

This paper conducts balance tests and the standard support hypothesis test to validate the quality of propensity score matching. The balance test results in Table 4 indicate a significant reduction in the absolute values of standardized deviations of matched feature variables. Moreover, in Figure 3, the vertical axis represents the selected covariates, while the horizontal axis displays the standardized bias across covariates. The standardized deviations of all covariates are below 10% after matching. What is more, Figure 4 presents the results of the common support hypothesis test. The horizontal axis displays propensity scores, while the vertical axis shows density. The blue column indicates successfully matched treatment group samples, and the orange column represents selected control group samples. The blue and orange columns exhibit high overlap in the mid-range of propensity scores. The results above indicate a satisfactory matching effect.

Table 4.

Balance test of variables before and after PSM.

Figure 3.

Comparison of the standard deviation before and after matching.

Figure 4.

Propensity score distribution.

Table 5 displays the estimated results of the difference-in-differences model after matching. The coefficients on for GUP, GIP, and GIA remain positive and statistically significant at the 1% level, confirming the robustness of the previous conclusions.

Table 5.

PSM-DID test results.

5.3.3. Adjustment to the Implementation Time of GCP

This paper conducts further robustness tests by adjusting the implementation time of GCP. Specifically, the publication time of the Guideline is postponed by one year, the time node of is set to 2013, and regression analysis is conducted based on the above adjustment. The results are presented in Table 6. The coefficients on are all positive and statistically significant at the 1% level for GUP, GIP, and GIA, further confirming the robustness of the previous conclusions.

Table 6.

Robustness test results for adjusting the implementation time of GCP.

5.3.4. Excluding Periods of Extreme Events

To exclude the disruption caused by the global financial crisis and the COVID-19 pandemic, this paper adjusts the sample period to 2009–2019. Table 7 shows that after excluding data from 2008, 2020, and 2021, the coefficients on for the dependent variables all remain positive and statistically significant at the 1% level, indicating that the benchmark regression results are unaffected by external shocks.

Table 7.

Robustness test results for excluding periods of extreme events.

5.3.5. Eliminating Interference from Other Policies

To eliminate interference from other green finance policies, this paper excluded enterprise samples registered in pilot zones for green finance reform and innovation, including Zhejiang, Jiangxi, Guangdong, Guizhou, Xinjiang, and Gansu. Regression results in Table 8 show that the coefficients on the core variable remain positive and statistically significant at the 1% level across all models, indicating that after controlling for similar policy effects, the promoting role of GCP on corporate green technological innovation remains robust.

Table 8.

Robustness test results for excluding observations from pilot zones for green finance reform and innovation.

6. Mechanism Analysis

6.1. Intermediatory Channels Analysis

To explore how GCP promotes green technological innovation in HPEs, this paper conducts intermediatory mechanism tests from the perspectives of external financing and internal concerns.

6.1.1. The Mediating Effect of External Financing

To verify Hypothesis 2, this paper examines the mediating role of corporate reliance on short-term loans (RSL) using a two-step approach [50]. Specifically, Equation (2) tests whether the GCP has a significant effect on RSL. Equation (3) then assesses the effect of GCP on green technological innovation while accounting for the potential mediating effect of external financing. If the coefficients of and are all significantly positive, this indicates that GCP promotes green technological innovation among HPEs by enhancing their reliance on short-term loans (RSL).

The regression results are shown in Table 9. The coefficients on are positive and statistically significant at the 1% level for RSL, GUP, GIP, and GIA. These indicate that after implementing the Guidelines, HPEs use short-term loans to mitigate capital constraints under regulatory restrictions to conduct green technological innovation. Thus, Hypothesis 2 is verified.

Table 9.

The mediating effect of reliance on short-term loans.

6.1.2. The Mediating Effect of Internal Concerns

The impact of GCP on corporate green technological innovation is reflected in corporate internal environmental concerns. Thereby, this paper constructs the following models to verify Hypothesis 3:

Table 10 reports the results of the mechanism test for internal concerns. The coefficients of are positive and statistically significant at the 1% level for all dependent variables. These indicate that GCP promotes corporate green technological innovation by strengthening executive green awareness, validating Hypothesis 3.

Table 10.

The mediating effect of executive green awareness.

6.2. Tests of Moderating Effects

To verify Hypothesis 4, this paper constructs the following models to examine the moderating effects of capital utilization efficiency (EFF) and commercial credit financing (SCF) on GCP:

Table 11 reports the results of the moderating effects. Columns (1)–(3) show that high capital utilization efficiency suppresses corporate green technological innovation. This suggests that firms with more efficient use of funds prioritize investment returns, allocating resources to short-term projects with quick payoffs rather than long-cycle R&D activities. In terms of commercial credit financing, columns (4)–(6) show that those enterprises with a higher scale of commercial credit financing will enhance green technological innovation. This implies that the penalties and deterrence from the Guidelines outweigh the short-term benefits of avoiding social responsibility.

Table 11.

Tests for moderating effects.

7. Heterogeneity Test

7.1. Region Heterogeneity

Regions with different developmental foundations exhibit different capacities to support corporate green transitions. To examine the effectiveness of GCP across various areas, this paper categorizes sample enterprises into the eastern region and the combined central and western regions based on the National Bureau of Statistics classification standards. 64% of sample observations are from the eastern region and 36% are from the combined central and western regions. This distribution is consistent with the high concentration of China’s A-share listed companies in the east.

Table 12 shows that the coefficients on are all significantly positive at the 1% level in the eastern region, but are insignificant in the central and western regions. This difference can be attributed to disparities in regional resources and industrial structures [51]. The eastern region promotes corporate innovation effectively by developing financial markets and advanced industries. In contrast, enterprises in central and western regions, constrained by weaker financial and industrial foundations, face challenges in allocating resources efficiently for green innovation under financing constraints.

Table 12.

Heterogeneity of regions.

7.2. Property Rights Heterogeneity

Given that firms with different property rights exhibit varying flexibility in policy responses [52], this study examines the property rights heterogeneity in the implementation effect of GCP.

Table 13 shows that the GCP promotes green technological innovation in both state-owned and private HPEs in China at the 1% significance level. In contrast, the estimated coefficients on for foreign enterprises are not significant. This may be due to foreign enterprises not being as good as Chinese firms at understanding policies and responding quickly, and Chinese enterprises facing fewer financing constraints [53,54]. As a result, the policy has a positive effect on green innovation in Chinese enterprises but no significant impact on foreign enterprises.

Table 13.

Heterogeneity of property rights.

7.3. Financial Background Heterogeneity

Senior executives with financial backgrounds usually possess specialized risk identification and resource integration capabilities. They are more inclined to view green technological innovation as a key approach to managing long-term environmental risks and securing strategic financing. Therefore, differences in the financial backgrounds of executive teams may influence corporate responses to GCP. Based on the above analysis, this paper examines the heterogeneity of financial backgrounds within executive teams.

This paper defines senior executives as deputy general managers or above in the empirical design (executives are composed of deputy general managers, general managers, vice chairmen, and chairmen of the board). A financial background is defined as prior work experience in any of 11 types of financial institutions (financial institutions include policy banks, commercial banks, insurance companies, securities companies, fund management companies, securities depository and clearing corporations, futures companies, investment banks, trust companies, investment management companies, and exchanges). The heterogeneity of senior executives’ financial backgrounds is measured by the Herfindahl–Hirschman Index (HHI). Then, the sample is divided into low and high heterogeneity groups based on the median HHI value for regression analysis.

The results in Table 14 indicate that the promoting effect of GCP on green technological innovation is significant in the low-heterogeneity group but not in the high-heterogeneity group. This is because teams with homogeneous financial backgrounds are more likely to reach consensus on green innovation, thereby increasing policy response efficiency [55]. In contrast, teams with high heterogeneity are more likely to experience disagreements due to different professional perspectives, thus increasing coordination costs and weakening policy effectiveness.

Table 14.

Heterogeneity of financial background.

8. Conclusions and Implications

This paper uses data from China’s A-share listed companies to assess the impact of GCP on corporate green technological innovation, and the main findings are as follows. First, the implementation of GCP promotes the green technological innovation of HPEs in China, but this effect will be affected by the behavior of enterprises. Specifically, the efficiency of capital use plays a negative moderating role, while commercial credit financing exerts a positive moderating effect. Second, mechanism analysis shows that GCP promotes corporate green technological innovation by enhancing their reliance on short-term loans and strengthening executive green awareness. Third, the heterogeneity test shows that the effect of GCP is more efficient for enterprises located in economically advanced regions, and compared to foreign enterprises, GCP has a more pronounced effect on promoting green technological innovation among domestic enterprises in China. What is more, in terms of the characteristics of corporate executives, teams with similar financial backgrounds are more likely to be motivated by GCP. Based on these conclusions, this paper draws the following implications for GCP:

At the enterprise level, firms should improve their internal green governance structure by integrating environmental performance into executive evaluation systems and establishing green decision-making committees to strengthen the implementation of green strategies at the organizational level. Firms are encouraged to integrate credit resources with green R&D incentive mechanisms by signing green credit agreements with banks, establishing special funds for green R&D, and adopting green project financing models to ensure targeted credit support for innovation activities. Additionally, enterprises can recruit senior executives with financial backgrounds to enhance the team’s capabilities to respond to green finance policies, integrate resources, and make innovative decisions, thereby further promoting green technological innovation.

At the government level, differentiated green financial policies should be formulated based on each region’s economic foundations and industrial structures. For the west and central regions, a public service platform for green technological innovation should be established to provide enterprises with technical consulting, talent training, and shared R&D resources. In addition, fiscal subsidies and tax incentives should be introduced to reduce R&D costs and enhance firms’ green innovation capabilities. Meanwhile, eastern regions should strengthen support for green innovation leaders and encourage these firms to continue playing a pioneering role in technological advancement and environmental protection.

Although this study empirically verifies the effect of green credit policy on green technological innovation among heavily polluting enterprises, several aspects warrant further improvement. First, the dataset used in this study includes only A-share-listed firms, without accounting for the policy effects on non-listed enterprises, which may also somewhat bias the findings. Second, this study explores the heterogeneity of the impact of green credit policy from regional characteristics, ownership structure, and executive characteristics perspectives, but the micro-level heterogeneity arising from firm-specific characteristics can still be further investigated. Future analyses may differentiate the effects according to firm size, industry attributes, and organizational capabilities to better understand how green credit policy influences green technological innovation under varying corporate contexts.

Author Contributions

Substantial contributions to the conception or design of the work, Y.S. and L.D.; the acquisition, analysis or interpretation of data for the work, S.H. and X.L.; drafting the work or revising it critically for important intellectual content, X.L. and L.D.; providing approval for the publication of the content, Y.S. and L.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Hunan Provincial Social Science Fund Project, grant number NO.20JD022.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Executive green awareness keyword search.

Table A1.

Executive green awareness keyword search.

| Dimension | Keywords |

|---|---|

| Green Competitive Advantage Perception | Environmental Protection Philosophy, Environmental Strategy, Environmental Education, Environmental Training, Environmental Facilities, Environmental Technology Development |

| Corporate Social Responsibility Perception | Energy Conservation and Emissions Reduction, Low-Carbon and Environmental Protection, Environmental Protection Work, Energy Saving and Environmental Protection, Pollution Control and Environmental Treatment, Environmental Governance |

| External Environmental Pressure Perception | Environmental Protection Department, Environmental Inspection, Environmental Management Agencies, Environmental Laws and Regulations, Environmental Policy, Environmental Audit |

References

- Ye, X.; Zhang, Z.; Qiu, Y. Review of application of high frequency smart meter data in energy economics and policy research. Front. Sustain. Energy Policy 2023, 2, 1171093. [Google Scholar] [CrossRef]

- Du, K.; Cheng, Y.; Yao, X. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Prokopenko, O.; Kurbatova, T.; Khalilova, M.; Zerkal, A.; Prause, G.; Binda, J.; Berdiyorov, T.; Klapkiv, Y.; Sanetra-Półgrabi, S.; Komarnitskyi, I. Impact of investments and R&D costs in renewable energy technologies on companies’ profitability indicators: Assessment and forecast. Energies 2023, 16, 1021. [Google Scholar] [CrossRef]

- Xiong, X.; Wang, Y.; Liu, B.; He, W.; Yu, X. The impact of green finance on the optimization of industrial structure: Evidence from China. PLoS ONE 2023, 18, e0289844. [Google Scholar] [CrossRef]

- Guo, L.; Tan, W. Analyzing the synergistic influence of green credit and green technology innovation in driving the Low-Carbon transition of the energy consumption structure. Sustain. Energy Technol. Assess. 2024, 63, 103633. [Google Scholar] [CrossRef]

- Liu, F.; Xia, Z.; Lee, C.-C. Does green credit benefit the clean energy technological innovation and how? The policy catering behavior of enterprises. J. Clean. Prod. 2024, 444, 141256. [Google Scholar] [CrossRef]

- Tian, C.; Li, X.; Xiao, L.; Zhu, B. Exploring the impact of green credit policy on green transformation of heavy polluting industries. J. Clean. Prod. 2022, 335, 130257. [Google Scholar] [CrossRef]

- Wang, H.; Qi, S.; Zhou, C.; Zhou, J.; Huang, X. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- An, S.; Li, B.; Song, D.; Chen, X. Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur. J. Oper. Res. 2020, 292, 125–142. [Google Scholar] [CrossRef]

- Baron, D. Private Politics, Corporate Social Responsibility, and Integrated Strategy. J. Econ. Manag. Strategy 2004, 10, 7–45. [Google Scholar] [CrossRef]

- Meyer, C.A. Public-Nonprofit Partnerships and North-South Green Finance. J. Environ. Dev. 1997, 6, 123–146. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Liu, L.; Ling-Yun, H.E. Output and Welfare Effect of Green Credit in China: Evidence from an estimated DSGE model. J. Clean. Prod. 2021, 294, 126326. [Google Scholar] [CrossRef]

- Gao, D.; Mo, X.; Duan, K.; Li, Y. Can green credit policy promote firms’ green innovation? Evidence from China. Sustainability 2022, 14, 3911. [Google Scholar] [CrossRef]

- Li, S.; Liu, Q.; Lu, L.; Zheng, K. Green policy and corporate social responsibility: Empirical analysis of the Green Credit Guidelines in China. J. Asian Econ. 2022, 82, 101531. [Google Scholar] [CrossRef]

- Cilliers, E.J.; Diemont, E.; Stobbelaar, D.J.; Timmermans, W. Sustainable green urban planning: The workbench spatial quality method. J. Place Manag. Dev. 2011, 4, 214–224. [Google Scholar] [CrossRef]

- Braun, E.; Wield, D. Regulation as a means for the social control of technology. Technol. Anal. Strateg. Manag. 1994, 6, 259–272. [Google Scholar] [CrossRef]

- Gollop, F.M.; Roberts, M.J. Environmental regulations and productivity growth: The case of fossil-fueled electric power generation. J. Political Econ. 1983, 91, 654–674. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Wang, Z.J.B.S.; Environment, T. A nonlinear relationship between corporate environmental performance and economic performance of green technology innovation: Moderating effect of government market-based regulations. Bus. Strategy Environ. 2023, 32, 3119–3138. [Google Scholar] [CrossRef]

- Schoenecker, T.; Swanson, L. Indicators of firm technological capability: Validity and performance implications. IEEE Trans. Eng. Manag. 2002, 49, 36–44. [Google Scholar] [CrossRef]

- Du, C.; Zhang, Q.; Huang, D. Environmental protection subsidies, green technology innovation and environmental performance: Evidence from China’s heavy-polluting listed firms. PLoS ONE 2023, 18, e0278629. [Google Scholar] [CrossRef]

- Xin, K.; Chen, X.; Zhang, R.; Sun, Y. R&D intensity, free cash flow, and technological innovation: Evidence from high-tech manufacturing firms in China. Asian J. Technol. Innov. 2019, 27, 214–238. [Google Scholar] [CrossRef]

- Song, C.; Jiao, S.; Sun, Z. Can the green credit guidelines effectively deter enterprise inefficient investment of innovation?-evidence from heavy polluting enterprises in China. PLoS ONE 2024, 19, e0298097. [Google Scholar] [CrossRef]

- Du, M.; Zhang, R.; Chai, S.; Li, Q.; Sun, R.; Chu, W.J.S. Can green finance policies stimulate technological innovation and financial performance? Evidence from Chinese listed green enterprises. Sustainability 2022, 14, 9287. [Google Scholar] [CrossRef]

- Sun, G.; Feng, Q.; Wu, S.; Xia, C. The impact of China’s green credit policy on the innovation of manufacturing enterprises. J. Innov. Knowl. 2025, 10, 100714. [Google Scholar] [CrossRef]

- Zhang, Y.; Xie, H.; Li, J. Does green credit policy mitigate financialization? Evidence from Chinese heavily polluting enterprises. Environ. Sci. Pollut. Res. 2023, 30, 7380–7401. [Google Scholar] [CrossRef]

- Ding, X.; Jing, R.; Wu, K.; Petrovskaya, M.V.; Li, Z.; Steblyanskaya, A.; Ye, L.; Wang, X.; Makarov, V.M. The impact mechanism of green credit policy on the sustainability performance of heavily polluting enterprises—Based on the perspectives of technological innovation level and credit resource allocation. Environ. Res. Public Health 2022, 19, 14518. [Google Scholar] [CrossRef]

- Lu, Q.; Deng, Y.; Wang, X.; Wang, A. The impact of China’s green credit policy on enterprise digital innovation: Evidence from heavily-polluting Chinese listed companies. China Financ. Rev. Int. 2024, 14, 103–121. [Google Scholar] [CrossRef]

- Liu, J.-Y.; Xia, Y.; Fan, Y.; Lin, S.-M.; Wu, J. Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J. Clean. Prod. 2017, 163, 293–302. [Google Scholar] [CrossRef]

- Guo, S.; Zhang, Z. Green credit policy and total factor productivity: Evidence from Chinese listed companies. Energy Econ. 2023, 128, 107115. [Google Scholar] [CrossRef]

- Wu, S.; Zhou, X. A theoretical framework for modeling dual-track granting orientation in green credit policy. Econ. Anal. Policy 2024, 81, 249–268. [Google Scholar] [CrossRef]

- Liu, P.J.; Song, C.; Xin, J. Does green governance affect financing constraints? Evidence from China’s heavily polluting enterprises. China J. Account. Res. 2022, 15, 100267. [Google Scholar] [CrossRef]

- Yang, Y.; Zhang, Y. The impact of the green credit policy on the short-term and long-term debt financing of heavily polluting enterprises: Based on PSM-DID method. Int. J. Environ. Res. Public Health 2022, 19, 11287. [Google Scholar] [CrossRef]

- D’Mello, R.; Miranda, M. Long-term debt and overinvestment agency problem. J. Bank. Financ. 2010, 34, 324–335. [Google Scholar] [CrossRef]

- Liu, T.; Cao, X. Going green: How executive environmental awareness and green innovation drive corporate sustainable development. J. Knowl. Econ. 2024, 15, 6577–6604. [Google Scholar] [CrossRef]

- Sarhan, A.A.; Al-Najjar, B. The influence of corporate governance and shareholding structure on corporate social responsibility: The key role of executive compensation. Int. J. Financ. Econ. 2023, 28, 4532–4556. [Google Scholar] [CrossRef]

- Wang, H.; Wang, S.; Zheng, Y. China green credit policy and corporate green technology innovation: From the perspective of performance gap. Environ. Sci. Pollut. Res. 2023, 30, 24179. [Google Scholar] [CrossRef]

- Wu, G.; Sun, M.; Feng, Y. How does the new environmental protection law affect the environmental social responsibility of enterprises in Chinese heavily polluting industries? Humanit. Soc. Sci. Commun. 2024, 11, 168. [Google Scholar] [CrossRef]

- Bu, W.; Ren, S. Does economic growth target constraint put pressure on green energy efficiency? Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 31171. [Google Scholar] [CrossRef]

- Abbas, J.; Sağsan, M. Impact of knowledge management practices on green innovation and corporate sustainable development: A structural analysis. J. Clean. Prod. 2019, 229, 611–620. [Google Scholar] [CrossRef]

- Tsuruta, D.; Uchida, H. The real driver of trade credit. Pac.-Basin Financ. J. 2019, 57, 101183. [Google Scholar] [CrossRef]

- Cook, L.D. Trade credit and bank finance: Financing small firms in Russia. J. Bus. Ventur. 1999, 14, 493–518. [Google Scholar] [CrossRef]

- Xu, A.; Song, M.; Xu, S.; Wang, W. Accelerated green patent examination and innovation benefits: An analysis of private economic value and public environmental benefits. Technol. Forecast. Soc. Change 2024, 200, 123105. [Google Scholar] [CrossRef]

- Chen, L.; Gao, F.; Guo, T.; Huang, X. Mixed ownership reform and the short-term debt for long-term investment of non-state-owned enterprises: Evidence from China. Int. Rev. Financ. Anal. 2023, 90, 102861. [Google Scholar] [CrossRef]

- Storey, V.C.; O’Leary, D.E. Text analysis of evolving emotions and sentiments in COVID-19 Twitter communication. Cogn. Comput. 2022, 16, 1834–1857. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, Y. Executives’ green cognition and corporate green innovation: Evidence from China. Total Qual. Manag. Bus. Excell. 2024, 35, 1054–1075. [Google Scholar] [CrossRef]

- Si, L.; Cao, H. Does green credit policies improve corporate environmental social responsibility: The perspective of external constraints and internal concerns. China Ind. Econ. 2022, 4, 137–155. [Google Scholar] [CrossRef]

- Xu, P.; Ye, P.; Jahanger, A.; Huang, S.; Zhao, F. Can green credit policy reduce corporate carbon emission intensity: Evidence from China’s listed firms. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2623–2638. [Google Scholar] [CrossRef]

- Luo, C.; Qiang, W.; Lee, H.F. Does the low-carbon city pilot policy work in China? A company-level analysis based on the PSM-DID model. J. Environ. Manag. 2023, 337, 117725. [Google Scholar] [CrossRef]

- Wen, Z.; Ye, B. Analyses of mediating effects: The development of methods and models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Lei, N.; Miao, Q.; Yao, X. Does the implementation of green credit policy improve the ESG performance of enterprises? Evidence from a quasi-natural experiment in China. Econ. Model. 2023, 127, 106478. [Google Scholar] [CrossRef]

- Lyu, Y.; Bai, Y.; Zhang, J. Green finance policy and enterprise green development: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 414–432. [Google Scholar] [CrossRef]

- Ma, X.; Ma, W.; Zhang, L.; Shi, Y.; Shang, Y.; Chen, H. The impact of green credit policy on energy efficient utilization in China. Environ. Sci. Pollut. Res. 2021, 28, 52514. [Google Scholar] [CrossRef]

- Cheng, Y.; Xu, Z. Fiscal policy promotes corporate green credit: Experience from the construction of energy conservation and emission reduction demonstration cities in China. Green Financ. 2024, 6, 1–23. [Google Scholar] [CrossRef]

- Duan, J.; Liu, T.; Yang, X.; Yang, H.; Gao, Y. Financial asset allocation and green innovation. Green Financ. 2023, 5, 512–534. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).