Abstract

ESG washing, as an organizational decoupling behavior, refers to enterprises strategically disclosing environmental information to obscure their actual ESG performance, which not only elevates audit risks but also increases uncertainty in audit pricing. Based on a sample of Chinese listed companies from 2014 to 2023, this study introduces excess executive compensation and executive myopia as mediators to investigate the mechanisms through which ESG washing influences abnormal audit fees via chain mediating effects. Additionally, market structure is considered a moderating variable to examine its moderating role within the model. The empirical results demonstrate that ESG washing in listed companies significantly increases abnormal audit fees. Both excess executive compensation and executive myopia exert positive individual mediating effects as well as a chain mediating effect. Furthermore, the moderating effect of market structure attenuates the mediating role of excess executive compensation but amplifies that of executive myopia. This research proposes an integrated framework combining organizational decoupling theory and transaction cost theory, thereby clarifying the underlying pathways through which ESG washing influences abnormal audit fees. The study offers policy implications for government authorities to strengthen ESG regulations, enhance supervisory mechanisms, and promote a more sustainable business environment. In addition, it provides guidance for enterprises in mitigating ESG washing, optimizing audit-related costs, and enhancing their capacity to address ESG challenges, improve corporate governance, and strengthen competitiveness.

1. Introduction

The report of the 20th Communist Party of China (CPC) National Congress emphasized the importance of “improving the modern environmental governance system” and “closely preventing and controlling environmental risks.” Influenced by environmental regulation policies, numerous enterprises have actively engaged in external environmental information disclosure. Against this backdrop, the concept of ESG (Environmental, Social, and Governance) has attracted widespread attention and recognition across various sectors, rapidly gaining prominence in China. Today, practicing ESG has become a key initiative for enterprises pursuing green and low-carbon development. In April 2022, the China Securities Regulatory Commission (CSRC) issued the “Guidelines on Investor Relations Management for Listed Companies,” which incorporated ESG-related information into investor relations management and elevated the disclosure of ESG performance by listed companies to a new level.

However, as highlighted by Standard & Poor’s, some enterprises often respond to governmental regulation through strategic environmental information disclosure, and more than 44% of investors cite greenwashing as their primary concern in ESG investments. Existing literature further distinguishes between greenwashing and brownwashing. Greenwashing refers to the extensive disclosure of ESG information without substantive implementation, while brownwashing describes the situation where firms undertake substantial ESG practices but disclose relatively little corresponding information. Both phenomena reflect ESG washing, understood as an organizational decoupling behavior in which symbolic disclosure diverges from substantive practices. These practices introduce potential environmental risks and exacerbate information asymmetry, which poses challenges for achieving the “dual-carbon” goals [1,2,3,4].

Along with the continuous expansion of ESG disclosures, an important question arises as to whether such disclosures can faithfully reflect a firm’s substantive practices and how their credibility influences audit outcomes. Although existing studies have examined the association between ESG disclosure quality and investor responses, limited attention has been paid to its implications for audit pricing. Audit fees, particularly abnormal audit fees, represent auditors’ assessments of client risk and audit effort. When ESG washing in the form of greenwashing or brownwashing reduces the reliability of non-financial disclosures, auditors face greater challenges in identifying inherent and control risks, which may lead to increased audit procedures and adjustments in assessed risk premiums, thereby affecting abnormal audit fees. Therefore, examining the influence of ESG washing on abnormal audit fees is essential to reveal how distorted non-financial disclosures reshape audit resource allocation and risk identification. This perspective bridges the literature on ESG disclosure and auditing and provides practical implications for audit practice and regulatory governance.

The audit contract serves as a critical regulatory safeguard for ensuring the quality of corporate financial reporting and constitutes a fundamental line of defense in corporate information governance. The audit work performed by Certified Public Accountants (CPAs) represents a systematic institutional arrangement that integrates assurance functions, information value, and the insurance-like value of risk mitigation. By reducing information asymmetry and reinforcing contractual integrity, the audit process facilitates the efficient allocation of market resources and the optimal functioning of capital markets. Audit fees reflect the economic value of CPA professional services, and their determination is fundamentally shaped by the bargaining dynamics between audit service providers and clients. At the same time, audit fees are subject to a multitude of internal and external factors, such as firm size, business complexity, industry competitiveness, and macroeconomic conditions, all of which jointly influence their equilibrium level.

Following the professional standards for Certified Public Accountants (CPAs) in China, auditors are obligated to evaluate the presence of material misstatement risks associated with environmental matters pertaining to the audited entity. During the audit process, it is imperative that auditors further identify and assess strategic environmental information disclosure behaviours and their implications for audit risk. Any alteration in the auditor’s assessment of risk premiums can directly translate into adjustments in audit fees [5], thereby resulting in abnormal audit fees that deviate from market expectations. Extant literature demonstrates that impression management practices, such as ESG greenwashing and brownwashing, can disrupt auditors’ professional judgment, leading to mispricing in audit services and undermining the credibility of financial reporting [5,6]. These distortions indicate that when environmental information disclosure is shaped by ESG washing, it may obscure the true economic performance of the firm and increase the difficulty of effective audit risk identification. Consequently, a rigorous and systematic investigation into the impact of ESG washing on risk-premium-induced abnormal audit fees is essential, not only for optimizing the allocation of market resources but also for safeguarding the integrity of capital markets and promoting the sustainable and high-quality development of the broader economy.

The contributions of this paper are threefold. First, while prior studies have often examined ESG greenwashing and brownwashing separately, this study integrates both phenomena within a unified analytical framework. By conceptualizing ESG washing as an organizational decoupling strategy and linking it to abnormal audit fees, the analysis provides a comprehensive understanding of how distorted ESG disclosure generates spillover effects in the audit context. Second, drawing on the perspective of information asymmetry, the paper introduces excess executive compensation and executive myopia as mediating variables to reveal the internal mechanisms through which ESG washing influences audit pricing. This approach deepens the understanding of how managerial incentives and behavioral biases shape audit outcomes and contributes to refining governance practices. Third, the study further examines how variations in external market structure condition these mediating effects, thereby highlighting the differentiated outcomes that arise under distinct competitive environments. This integrated framework not only clarifies the internal and external channels through which ESG washing affects audit outcomes but also provides a foundation for regulatory strategies that account for heterogeneity across industries. Collectively, the findings enrich the literature on ESG disclosure and audit pricing, offer policy implications for guiding listed companies in achieving the “dual-carbon” goals, and promote the alignment of audit fees with their economic fundamentals. Ultimately, this work aims to mitigate audit fee volatility arising from the strategic manipulation of ESG disclosures, thereby contributing to the high-quality and sustainable development of capital markets.

2. Literature Review, Theoretical Analysis, and Research Hypotheses

2.1. Literature Review

2.1.1. Abnormal Audit Fees

Audit serves as an effective external governance mechanism for corporations, acting as an informational bridge between controlling shareholders and minority shareholders, and providing the market with both “information and assurance” through institutional arrangements [7,8]. Audit fees represent the consideration paid by firms for audit services and are influenced by a variety of factors, including fundamental firm characteristics, corporate governance attributes, material weaknesses in internal controls, directors’ and officers’ liability insurance, corporate reputation, auditor expertise, managerial overconfidence, and CEO narcissism. A substantial body of research has demonstrated that these factors significantly affect audit fees [9,10,11,12,13,14]. Audit services can timely correct potential corporate irregularities, identify hidden risks, and enhance transparency in accounting information, thereby mitigating information asymmetry.

Since the comprehensive adoption of risk-based auditing theory in the Chinese CPA Professional Standards, auditors have increasingly focused on information risk related to significant matters, far exceeding their attention to factual risk [15,16,17]. In this context, to ensure audit quality, auditors not only undertake additional audit procedures but also seek to compensate for audit risk premiums by increasing audit fees [18,19]. Song Y. et al. (2023) [20] revised Simunic’s (1980) [21] audit pricing model, identifying audit effort, the audit risk premium, and normal audit firm profit as the key determinants of audit fees. In this framework, incremental audit fees attributable to audit risk, commonly referred to as abnormal audit fees, represent the agency or transaction costs that firms incur as a result of their potential risks. Currently, research on abnormal audit fees remains relatively limited. Existing studies have primarily examined financial risk, corporate governance risk, legal risk, and earnings management as key drivers of abnormal audit fees [22,23,24]. Fundamentally, abnormal audit fees arise from the bargaining dynamics between audit service providers and clients, and signal to the market the underlying risk premium faced by the firm.

2.1.2. ESG Washing

The launch of the “dual-carbon” goals underscores the Chinese government’s commitment to building a green, low-carbon, and circular economy, and to driving a comprehensive green transformation across both economic and social domains. Amid increasingly stringent environmental regulations, ESG information disclosure, despite its broad scope, continues to rely on outdated standards and remains largely voluntary for most firms.

From a contractual perspective, there exists an implicit social contract between corporate operations and the surrounding environment. If firms neglect the legitimate needs of key stakeholder groups, their external reputation is likely to be adversely affected. Consequently, companies frequently employ information disclosure as a strategic tool to cultivate an image of transparency, accountability, and proactive engagement in ESG practices, thereby shaping a favorable external environment for sustainable development. Empirical evidence further demonstrates that board characteristics, such as board size, the proportion of female and independent directors, CEO duality, and board meeting frequency, positively influence the extent of ESG information disclosure.

However, when internal controls are weak and the cost of violating ESG disclosure requirements is low, corporate management may manipulate the frequency of ESG disclosures out of self-interest to achieve impression management objectives [25,26]. Faced with institutional legitimacy pressures, firms are prone to organizational decoupling, selectively disclosing ESG information according to their own circumstances. This selective disclosure leads to a disconnect between reported ESG information and the company’s actual ESG performance [27,28,29], manifesting as organizational decoupling in which symbolic actions are separated from substantive practices. This practice not only undermines the reliability of ESG disclosures and fails to meet the diverse needs of information users [30] but also increases the likelihood of suboptimal decision-making. Variations arising from strategic disclosure give rise to “greenwashing,” which involves excessive symbolic disclosure without substantive action, and “brownwashing,” which is marked by limited disclosure despite substantial action. These two phenomena represent two sides of the same coin, reflecting the extreme responses of firms to environmental regulation [31,32] and illustrating their attempts to achieve impression management by manipulating the quantity of ESG disclosures [33].

In the literature on ESG greenwashing, firms frequently employ quantitative manipulation and selective disclosure to overstate their ESG achievements [34] and conceal negative information [35], thereby engaging in impression management to address institutional legitimacy pressures [28,33]. Research on the drivers of ESG greenwashing has identified several important perspectives, including the government’s emphasis on the “dual-carbon” goals [36], regulatory pressure [37], external financing needs [1], and corporate governance structures [34]. Meanwhile, factors such as the degree of industry competition, the proportion of independent directors, and the level of institutional ownership have been found to be key in constraining ESG greenwashing.

With regard to research on ESG brownwashing, the primary motivations include stabilizing stock prices [38], lowering excessive expectations among stakeholder groups [39], and preemptively compensating for potential negative news in the future [40]. These motivations may cause firms to lose support from environmentally sensitive customers [41], diminish profitability, and thereby strengthen incentives for risk avoidance [31,42].

2.1.3. Main Contributions

The literature review reveals two principal findings. First, research on abnormal audit fees remains relatively scarce. While existing studies examine the determinants of audit fees from various perspectives, it is often difficult to disentangle whether these effects truly capture the spillover of audit risk. Second, most studies on ESG washing focus primarily on greenwashing [1,28,29,32,34,43]. In practice, however, both greenwashing and brownwashing represent managerial inconsistencies between rhetorical commitments and substantive actions regarding environmental issues, and both fall within the purview of audit risk. Examining only one form of washing in isolation thus provides an incomplete understanding of the mechanisms at play. Consistent with this view, recent bibliometric analysis of the ESG washing literature highlights that future research should move beyond descriptive categorization and pay greater attention to its implications for audit pricing and corporate governance [44]. Building on these gaps, this paper contributes to the literature by integrating greenwashing and brownwashing into a unified analytical framework and linking them to abnormal audit fees, thereby offering new insights into how ESG washing shapes audit pricing and broadening the evidence base for understanding its governance implications.

2.2. Theoretical Analysis and Research Hypotheses

2.2.1. ESG Washing and Abnormal Audit Fees: Analytical Framework

From the perspective of information asymmetry, firms may selectively disclose ESG information to maintain stakeholder support and stabilize market performance [45]. Such selective disclosure can mitigate financing constraints and agency problems [46,47,48], and in some cases improve perceived organizational resilience and short-term performance [43,49]. However, selective disclosure increases auditors’ verification burden because auditors must expend additional effort and procedures to assess the authenticity of ESG claims and to anticipate potential contingent risks.

From a transaction-cost perspective, once ESG washing is detected, firms risk reputational loss, consumer backlash, or investor flight, which raises ex post transaction costs and incentives for corrective action [5]. In anticipation of these consequences, auditors typically intensify substantive testing and other verification procedures; this raises engagement complexity and justifies higher audit fees as compensation for increased audit risk.

Regulatory scrutiny of ESG disclosures has also intensified, increasing auditors’ responsibilities in detecting and addressing misleading disclosures; failure to identify material misstatements related to environmental matters may expose auditors to professional sanctions. Prior work further suggests that regulatory exposure and risk-sharing considerations can influence audit pricing [5].

Drawing on organizational decoupling theory, ESG washing can be understood as a form of symbolic compliance in which external rhetoric diverges from substantive firm behaviour. Managerial opportunism may motivate selective compliance and rhetorical reporting [50]. Although such decoupling can temporarily preserve legitimacy or market standing, it increases information processing costs for auditors and elevates audit risk.

Taken together, the foregoing arguments imply that ESG washing increases information asymmetry and raises auditors’ transaction and verification costs. These effects elevate auditors’ risk assessments and ultimately lead to higher abnormal audit fees. Accordingly, we propose:

Hypothesis 1.

ESG washing has a positive effect on abnormal audit fees.

2.2.2. The Mediating Role of Excess Executive Compensation

Executive compensation represents a typical agency cost that arises when managers exploit their discretion in fulfilling fiduciary responsibilities. Excess executive compensation, defined as remuneration substantially exceeding industry norms, may result from executives leveraging their influence to secure pay levels beyond those achievable under arm’s-length bargaining [51], or it may be justified on the basis of perceived superior managerial ability [52]. From the perspective of agency theory, such excess pay distorts incentive alignment and increases the likelihood of opportunistic behaviour. It strengthens executives’ propensity to manipulate information [53], particularly when combined with cognitive biases that undermine judgment and decision-making. To preserve favourable market perceptions and protect their compensation, executives may resort to ESG washing by overstating environmental achievements (e.g., carbon emission reductions), exaggerating social contributions (e.g., philanthropic activities), or fabricating governance improvements (e.g., internal control mechanisms). These practices help sustain excess pay and corporate legitimacy in the short term, but they simultaneously deepen information asymmetry and aggravate moral hazard. As a result, auditors are compelled to intensify verification procedures and devote greater resources to mitigate the heightened risks, which ultimately translates into higher abnormal audit fees. Accordingly, this paper proposes the following hypothesis:

Hypothesis 2.

Excess executive compensation mediates the relationship between ESG washing and abnormal audit fees.

2.2.3. The Mediating Role of Executive Myopia

Language provides a comprehensive reflection of individual cognition, preferences, and personality [54]. Analyses of linguistic patterns, such as word choice and frequency, offer an effective means to capture managerial traits and underlying orientations [55,56]. Within agency relationships, cognitive biases and bounded rationality frequently induce short-term preferences, while insights from upper echelons theory underscore the role of executives’ personal traits in shaping firm-level outcomes [57,58]. These tendencies shorten managerial horizons and strengthen the pursuit of immediate gains and short-term rewards [59]. Executive myopia, once entrenched, can profoundly affect strategic decision-making. It undermines the sustainability of corporate performance, heightens operational risks, and compromises firms’ long-term resilience [59,60,61]. Empirical research provides clear evidence: Graham et al. (2005) [62] document that more than three-quarters of executives would forgo long-term value to achieve short-term earnings smoothing.

Selective ESG disclosure provides a practical vehicle through which executives act on these short-term incentives. By overstating environmental progress, embellishing social contributions, or presenting cosmetic improvements in governance, managers can stabilize reported outcomes, signal regulatory compliance, and secure temporary social legitimacy. Such practices not only reinforce myopic tendencies but also serve to protect immediate managerial benefits. However, these behaviours erode the credibility of accounting information [8], aggravate moral hazard, and complicate auditors’ assessment of risk. Faced with heightened uncertainty, auditors are compelled to extend verification procedures and expand audit effort, ultimately leading to higher abnormal audit fees. Accordingly, the following hypothesis is proposed:

Hypothesis 3.

Executive myopia mediates the relationship between ESG washing and abnormal audit fees.

2.2.4. The Chain Mediating Role of Excess Executive Compensation and Executive Myopia

Anchored in principal–agent theory and the concept of fiduciary responsibility, executive compensation is closely intertwined with a firm’s reputation and short-term performance outcomes. The pursuit of excess executive compensation provides strong incentives for managers to adopt strategies that stabilize immediate results and enhance public recognition, even at the expense of long-term value creation and sustained competitiveness. Such practices increase the likelihood that auditors will identify weaknesses in governance and internal controls, thereby raising audit risk and ultimately leading to higher abnormal audit fees.

Within this framework, excess executive compensation and executive myopia interact as sequential mechanisms linking ESG washing to abnormal audit fees. ESG washing can stimulate compensation arrangements that reward executives disproportionately, which in turn fosters managerial short-termism. Myopic decision-making then encourages opportunistic disclosure and earnings manipulation, intensifying information asymmetry and audit complexity. Empirical evidence supports these pathways: compensation structures that emphasize short-term performance are shown to amplify managerial short-term orientation (Flammer & Bansal, 2017) [63], while opportunistic behavior and accrual manipulation significantly elevate audit effort and fees (Gul, Chen & Tsui, 2003) [64]. Taken together, these dynamics illustrate how ESG washing influences abnormal audit fees not only directly but also indirectly through internal governance mechanisms. Understanding this chain mediating effect provides important insights into how incentive misalignments and managerial short-termism jointly shape audit outcomes. Accordingly, this paper proposes the following hypothesis:

Hypothesis 4.

Excess executive compensation and executive myopia serve as chain mediators in the relationship between ESG washing and abnormal audit fees.

2.2.5. The Moderating Role of Market Structure

The market structure associated with different products reflects heterogeneity in competitive intensity, which shapes the operating environment and entry barriers within industries. Its influence on audit pricing primarily manifests through two channels: agency costs and business risk [3,65,66]. Within the analytical framework linking ESG washing to audit pricing, excess executive compensation functions as an indicator of agency costs, while executive myopia reflects heightened business risk. The transmission effects of these mediating variables on audit fees are contingent upon the degree of market concentration, producing distinct outcomes under different competitive environments.

In markets characterized by low concentration, where firm differentiation is limited and competition is intense, companies tend to rely more heavily on superior ESG performance to build legitimacy and secure competitive advantage. Such reliance not only helps sustain stable performance and social recognition but also justifies for executives to obtain higher compensation and to attract investors and consumers. However, heightened competitive pressure can foster dysfunctional governance, escalating agency costs, encouraging organizational decoupling in ESG practices, and ultimately increasing abnormal audit fees. In this context, ESG washing is more likely to intensify abnormal executive compensation, which compels auditors to expand their verification procedures in response to greater risk exposure.

In markets with high concentration, firms generally operate within a more structured regulatory environment and tend to maintain stronger governance mechanisms. Companies place greater emphasis on reputation management, and regulatory agencies conduct closer scrutiny of ESG disclosures, particularly those concerning environmental risks, to guard against adverse outcomes such as loss of market share or diminished societal trust when ESG washing is exposed. Under such conditions, agency costs are more effectively contained, which dampens the upward pressure on abnormal audit fees. Accordingly, this paper proposes the following hypothesis:

Hypothesis 5.

As market concentration increases, the effect of ESG washing on abnormal audit fees, mediated by excess executive compensation, is attenuated.

When executive myopia acts as a mediating variable, higher market concentration places greater pressure on executives to preserve competitive advantage and stable performance. Empirical evidence indicates that short-sighted executives are more likely to engage in ESG washing, such as concealing environmental governance costs or overstating the benefits of social contributions, in order to meet market expectations and satisfy shareholder demands. These practices have been shown to substantially elevate audit and reputation risks, resulting in a pronounced increase in abnormal audit fees and a corresponding decline in accounting conservatism [8]. Accordingly, as market concentration rises, ESG washing intensifies executive myopia, which, by further increasing audit and reputation risks, amplifies its impact on abnormal audit fees.

Conversely, in low-concentration markets, firms find it difficult to obtain substantial short-term benefits through ESG washing, as achieving credible ESG performance requires long-term strategic planning and significant financial investment, and false ESG disclosures are readily detected. This context effectively curbs executive myopia and, in turn, serves to moderate excessive audit fees. Accordingly, this paper proposes the following hypothesis:

Hypothesis 6.

As market concentration increases, the impact of ESG washing on abnormal audit fees through executive myopia is strengthened.

3. Research Design

3.1. Sample Selection and Data Sources

Since 2016 marked a pivotal milestone in China’s implementation of the Guidelines on Corporate Social Responsibility Reporting, when listed companies began voluntarily issuing CSR reports and signaling the onset of comprehensive ESG development, this study selects all A-share listed firms on the Shanghai and Shenzhen Stock Exchanges from 2014 to 2023 as the initial sample. The time frame is selected because systematic ESG disclosure practices in China began to take shape after 2014, which provides a reliable starting point for capturing the evolution of ESG washing and its implications. The selection period allows for a two-year pre-policy window and a seven-year post-policy observation horizon, thereby capturing both anticipatory and long-term effects. The sample is subsequently refined by excluding: (1) firms under Special Treatment (ST and *ST); (2) firms in the finance and insurance sectors; (3) firms delisted or newly listed via IPO during the study period; and (4) firms with missing data. This screening process yields a final balanced panel comprising 940 listed companies and 9400 firm-year observations.

This study utilizes data on financial indicators, corporate governance characteristics, audit reports, and executive myopia for Chinese listed companies. Data on executive myopia are obtained from the WinGo Financial Text Data Platform, while all other variables are sourced from the China Stock Market & Accounting Research (CSMAR) Database. To address the influence of extreme values and potential multicollinearity, all continuous variables are winsorized at the 1st and 99th percentiles. All interaction terms are mean-centered before multiplication.

This study integrates the use of EXCEL 2021, STATA 18.0, and SPSS 25 software to ensure both the efficiency of the research process and the accuracy of the results.

3.2. Variable Definitions

3.2.1. Independent Variable: ESG Washing (ESGW)

Drawing on organizational decoupling theory, ESG washing denotes the misalignment between a firm’s disclosed performance in the environmental, social, and governance (ESG) domains and its substantive practices, reflecting a structural gap between rhetoric and action. Within this construct, greenwashing refers to the extensive disclosure of ESG-related initiatives, particularly in environmental matters, without commensurate substantive implementation, thereby prioritizing symbolic communication over actual conduct. In contrast, brownwashing describes situations in which firms undertake substantial ESG initiatives but disclose little corresponding information, thus prioritizing actions over disclosure.

From the perspective of institutional theory, the measurement of ESG washing should be restricted to the firm’s industry. Restricting the scope in this manner minimizes distortions caused by heterogeneity in ESG expectations across industries [66] and mitigates measurement bias arising from variations in evaluation methodologies among different rating agencies [33].

Consistent with Yu et al. (2020) [33], this study operationalizes ESG washing by employing ESG disclosure scores to represent the “words” and ESG performance ratings to represent the “deeds” of firms. Both measures are standardized within each industry, and the difference between disclosure and performance is calculated to yield the ESG washing indicator (ESGW), as defined in Equation (1):

where is the industry-standardized ESG disclosure score published by Bloomberg, representing the “words” (disclosure) of listed companies’ ESG activities; is the industry-standardized ESG performance rating published by Huazheng, representing the “actions” (performance) of listed companies’ ESG practices. ESGW is defined as the difference between and , reflecting the relative degree of ESG washing for company i in period t compared to industry peers. If ESGW > 0, the firm is exhibiting greenwashing behavior, indicating that, relative to its industry peers, the company tends to disclose a large volume of ESG information to obscure its shortcomings in actual ESG performance. A higher ESGW value reflects a greater degree of greenwashing within the industry. If ESGW < 0, the firm demonstrates brownwashing behavior, meaning that it achieves superior ESG performance compared to other companies in the same industry, yet discloses relatively less ESG information; a lower ESGW value corresponds to a greater degree of brownwashing. If ESGW equals zero, the company’s ESG disclosure is well-aligned with its actual ESG performance, indicating consistency between words and actions.

3.2.2. Dependent Variable: Abnormal Audit Fees (ABAUFE)

This study employs the audit pricing model proposed by Simunic (1980) [21] to estimate the expected audit fee, with the regression residual representing abnormal audit fees, that is, the difference between actual audit fees and normal (expected) audit fees. Furthermore, drawing on the approaches of Song Y et al. (2015) [20], Reid L C et al. (2019) [67], and Cao J et al. (2024) [3], this paper constructs the following audit pricing model, as presented in Equation (2).

where AUFE denotes the actual audit fee paid by firm i in period t, expressed as the natural logarithm. Abnormal audit fees (ABAUFE) are calculated as the difference between the actual audit fee (AUFE) and the normal audit fee () estimated from Equation (2), as specified in Equation (3). In addition, control variables are included to capture key factors that may influence fluctuations in audit fees, such as firm size (SIZE), inventory ratio (INRA), accounts receivable ratio (RERA), current ratio (CURA), financing constraints (FICO), ownership nature (NPR), loss indicator (LOSS), big Four auditor engagement (AUDIT), auditor change indicator (CHANGE), issuance of a standard unqualified audit opinion (OPIN), as well as industry (Ind) and year (Year) fixed effects. In addition, represents the random disturbance term.

3.2.3. Mediating Variables: Excess Executive Compensation and Executive Myopia

(1) Excess executive compensation (EXPAY): For the measurement of excess executive compensation (EXPAY), this study follows the approach of Bisht et al. (2025) [51], Lee et al. (2019) [68], Zhang et al. (2024) [69], and Chung et al. (2015) [70]. First, a model for determining executive compensation is constructed (Equation (4)), and regression analysis is performed using the sample data to estimate the expected executive pay (). Next, as shown in Equation (5), the actual total compensation of the top three directors and executives (PAY) is subtracted by the expected compensation () to obtain excess executive compensation (EXPAY). The detailed procedure is described as follows:

where PAY denotes the natural logarithm of the actual total compensation received by the top three directors and senior executives of firm i in year t. The model also controls for key factors that may influence executive compensation decisions, including firm size (SIZE), financing constraints (FICO), return on assets (ROA), ownership nature, number of employees, proportion of male executives, average age of executives, industry (Ind), and year (Year), represents the random error term.

(2) Executive myopia (MSSB). This study builds on the findings of Brochet et al. (2015) [71] and draws extensively on the methodological approaches of Schuster et al. (2024) [8]. The Management Discussion and Analysis (MD&A) sections disclosed in annual reports of listed companies are selected as the core analytical text. Using the WinGo Financial Text Data Platform, the study extracts executive intrinsic myopia traits from these disclosures to characterize executive myopia (MSSB) in contexts not driven by external pressure. A higher MSSB value indicates a more pronounced tendency toward short-termism among company executives.

3.2.4. Moderating Variable: Market Structure (MAST)

Based on existing literature, there are three common indicators for measuring market structure (MAST): the number of firms within an industry, industry concentration, and the industry Lerner Index. To more accurately capture the level of concentration in each industry, this study employs industry concentration as the primary metric. Specifically, market structure (MAST) is defined as the proportion of total industry revenue accounted for by the four largest firms in the industry. A higher MAST value indicates a more concentrated market structure and the presence of some degree of monopoly, whereas a lower value reflects a more competitive market environment.

3.2.5. Control Variables

To more clearly identify the effect of ESG washing on abnormal audit fees and its underlying mechanisms, while eliminating the influence of other factors, this study selects the following control variables according to the research theme: executive shareholding ratio (EXSH), return on assets (ROA), gross profit margin (GPM), financing constraints (FICO), asset turnover (ASTU), firm size (SIZE), shareholding balance (SHBA), employee intensity (EMIN), book-to-market ratio (B/M), accounting conservatism (ACRO), as well as year (Year) and industry (Ind). The specific definitions of the variables are presented in Table 1.

Table 1.

Variable definitions.

3.3. Model Specification and Empirical Strategy

This paper develops an integrated framework that combines organizational decoupling theory and transaction cost theory, introducing excess executive compensation and executive myopia as mediating variables representing internal management factors, and incorporating market structure as a moderating variable to capture external market competition. Based on this framework, the study systematically examines the transmission pathways between ESG washing and abnormal audit fees. Models (6) through (10) are employed to empirically test hypotheses Hypothesis 1 through Hypothesis 6, respectively:

In this paper, the Bootstrap method (with 5000 resamples) is employed, and the testing is conducted sequentially as follows:

First, the impact of ESG washing on abnormal audit fees (Hypothesis 1) is verified by examining the significance of coefficient in Model (6).

Second, the mediating effect of excess executive compensation proposed in Hypothesis 2 is tested by the significance of the product in Models (7) and (9).

Third, the mediating effect of executive myopia described in Hypothesis 3 is verified by the significance of in Models (8) and (9).

Fourth, the chain mediating effect of excess executive compensation and executive myopia, as proposed in Hypothesis 4, is tested by the significance of across Models (7) to (9).

Fifth, the moderating effect of market structure on the mediating effect of excess compensation, as described in Hypothesis 5, is tested by the significance of in Models (7) and (10).

Sixth, the moderating effect of market structure on the mediating effect of executive myopia (Hypothesis 6) is tested by the significance of in Models (8) and (10).

4. Empirical Results and Analysis

4.1. Descriptive Statistics

Table 2 reports the descriptive statistics. Abnormal audit fees (ABAUFE) have a mean of 0, a median of 0.0170, and a standard deviation of 0.7833, revealing that there are significant differences in abnormal audit fees among the sample firms. For ESG washing (ESGW), the mean is 0.3911, indicating that ESG washing is generally present among the sample firms. However, there is substantial variation in the degree of ESG washing across listed companies. The minimum value of ESGW is less than zero, indicating that some sample firms engage in brownwashing. Moreover, since the median of ESGW is lower than the mean, it suggests that only a minority of sample firms exhibit brownwashing behavior. The mean value of excess executive compensation (EXPAY) is 0.0497, which is lower than the median of 0.0729, indicating that although instances of excessive pay exist among sample firms, such cases are not prevalent overall. The distribution of executive myopia (MSSB) shows that senior executives of listed companies generally exhibit varying degrees of short-sightedness, with considerable heterogeneity in this trait across the sample. Regarding market structure (MAST), the data indicate a moderate level of industry concentration, suggesting that most sectors in China maintain an appropriate level of competition. Although both monopoly and intense competition can be observed in certain cases, overall market differentiation remains relatively limited.

Table 2.

Descriptive Statistical Analysis.

4.2. Analysis of Regression Results

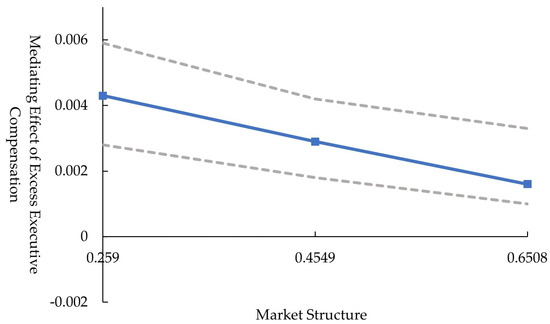

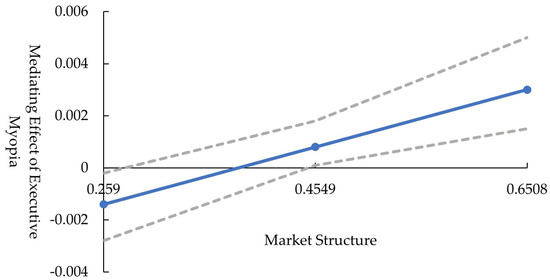

Table 3 and Table 4 precisely present the models and path effect values for the mediating effect and chain mediating effects, respectively, providing a comprehensive and detailed analysis of the test results. Table 5 details the empirical results for all relevant models concerning the moderated mediating effects. Table 6 reports the results of the moderated mediating index for market structure (MAST). Table 7 summarizes the heterogeneous impacts of market structure (MAST) at different levels of concentration on the various mediating pathways. Additionally, Figure 1 and Figure 2 plot the moderating trends of market structure across different mediating effects, further clarifying how MAST influences the mediating effects of excess executive compensation (EXPAY) and executive myopia (MSSB), respectively.

Table 3.

Results of Model Tests for Chain Mediating Effects.

Table 4.

Bootstrap Test Results for the Effect Values of Chain Mediating Paths.

Table 5.

Test Results of Moderated Mediating Models.

Table 6.

Test Results of the Mediating Moderation Index for Market Structure (MAST).

Table 7.

Bootstrap Test Results of the Moderated Mediating Effects.

Figure 1.

Moderating Effect of Market Structure on the Mediating Effect of Excess Executive Compensation.

Figure 2.

Moderating Effect of Market Structure on the Mediating Effect of Executive Myopia.

4.2.1. Total Effect Path Analysis

As shown in column (1) of Table 3, ESG washing (ESGW) exerts a significant positive effect on abnormal audit fees (ABAUFE), with a coefficient of (λ = 0.0196, p < 0.001). Meanwhile, the confidence interval for the total effect path in Table 4 does not include zero, indicating that the total effect of ESGW on ABAUFE is statistically significant. This finding suggests that organizational decoupling behaviors related to ESG among listed companies do increase audit risk in practice, thereby leading to an upward trend in audit fees. Therefore, Hypothesis 1 is supported.

4.2.2. Direct Effect Path Analysis

According to column (4) of Table 3, ESG washing (ESGW) exhibits a significant positive direct effect on abnormal audit fees (ABAUFE), with a coefficient of (λ′ = 0.0165, p < 0.05). Meanwhile, the confidence interval for the direct effect path in Table 4 does not include zero, indicating that the direct effect of ESGW on ABAUFE is highly significant. This result demonstrates that executives display a marked preference for ESG washing, which directly drives fluctuations in audit fees and exerts a non-negligible influence on firms’ audit costs and related financial decision-making.

4.2.3. Mediating Effect and Chain Mediating Effect Path Analysis

Based on columns (2) and (4) of Table 3, ESG washing (ESGW) exerts a significant positive indirect effect on abnormal audit fees (ABAUFE) through the mediating variable of excess executive compensation (EXPAY). As shown in Table 4, the mediating effect value for EXPAY is 0.0021 (= = 0.0513 × 0.0408), and its confidence interval does not include zero, indicating that the mediating effect is statistically significant. This finding suggests that strategic ESG disclosure enables executives to obtain higher compensation, and the resulting chain reaction further increases audit fees. In other words, the agency costs arising from excess compensation serve as a significant partial mediator in this relationship. Therefore, Hypothesis 2 is supported.

According to columns (3) and (4) of Table 3, ESG washing (ESGW) exerts a significant positive indirect effect on abnormal audit fees (ABAUFE) via the mediating transmission mechanism of executive myopia (MSSB). As reported in Table 4, the mediating effect value for MSSB is 0.0009 (= = −0.0033 × (−0.2726)), and the confidence interval test confirms the statistical significance of this mediating effect. This finding demonstrates that ESG washing promotes myopic behavior among executives, which in turn indirectly increases abnormal audit fees. In other words, the potential benefits of misleading ESG disclosures do incentivize executives to make short-sighted decisions in pursuit of short-term gains, ultimately resulting in higher audit costs. Therefore, Hypothesis 3 is supported.

Further analysis of columns (3) and (4) in Table 3 demonstrates significant chain mediating effects through both excess executive compensation (EXPAY) and executive myopia (MSSB) in the relationship between ESG washing (ESGW) and abnormal audit fees (ABAUFE), with the estimated indirect effect (= = 0.0001). This result indicates that the impact of ESG washing on abnormal audit fees is further amplified and transmitted through the chain pathway: ESGW → EXPAY → MSSB → ABAUFE. Thus, the chain mediating mechanism amplifies and extends the impact of ESG washing on abnormal audit fees. These results provide robust empirical support for Hypothesis 4.

4.2.4. Moderated Mediating Effect Test

As shown in columns (2) and (5) of Table 5 and in Table 6, market structure (MAST) significantly suppresses the mediating effect of excess executive compensation (EXPAY) between ESG washing (ESGW) and abnormal audit fees (ABAUFE). Specifically, as market concentration increases, the mediating effect of ESGW on ABAUFE through EXPAY declines by 0.69%. According to Table 7, after grouping MAST by the Mean and ±1SD, the mediating effect of EXPAY remains significant across different levels of market concentration, as the confidence intervals for the effect value do not include zero. Meanwhile, as shown in Figure 1, the effect value of the ESGW → EXPAY → ABAUFE path decreases from 0.0043 to 0.0016 as MAST rises. These results confirm that market concentration weakens the role of excess compensation in transmitting the effect of ESG washing to abnormal audit fees. Thus, Hypothesis 5 is supported.

According to the empirical results in columns (3) and (5) of Table 5 and in Table 6, market structure (MAST) significantly strengthens the mediating effect of executive myopia (MSSB). As market concentration increases, the indirect effect of ESGW on ABAUFE via MSSB rises by 1.12%. Table 7 further shows that this mediating effect remains significant across concentration groups, with the confidence intervals excluding zero. As illustrated in Figure 2, the effect value of the ESGW → MSSB →ABAUFE path increases from −0.0014 to 0.0030 as MAST rises. These findings indicate that higher market concentration enhances the mediating role of executive myopia in the relationship between ESG washing and abnormal audit fees. Therefore, Hypothesis 6 is supported.

It is important to note that the sequential design of the empirical strategy implies particularly stringent tests of explanatory power. Specifically, the chain-mediation approach first accounts for the variation in abnormal audit fees explained by prior predictors and then examines whether the mediating variables further explain the remaining, unexplained variance. By construction, the residual variation available for subsequent equations is smaller than the original variance of the dependent variable. As a result, the adjusted R2 values reported for the mediation and chain mediation models are modest, which is consistent with expectations rather than indicative of model misspecification. Importantly, despite the relatively low R2 values, the estimated path coefficients remain statistically significant and economically meaningful across specifications. This consistency confirms the validity of the mediation and chain mediation mechanisms and highlights their substantive explanatory power in clarifying how ESG washing translates into abnormal audit fees.

4.3. Robustness Test

4.3.1. Alternative Dependent Variable

To further strengthen the robustness of the analysis, this study replaces the dependent variable with its lagged form by using abnormal audit fees lagged one period (ABAUFEt+1) as an alternative dependent variable. This approach helps to mitigate concerns about reverse causality and to verify whether the observed relationships are sensitive to variable specification. The robustness tests focus on the mediating effects of excess compensation (EXPAY) and executive myopia (MSSB), as moderated by market structure (MAST) (see Table 8, column (4), as well as Table 9 and Table 10 for detailed results). The empirical results indicate that the moderating index of market structure continues to exert a significant influence on the mediating effects of both EXPAY and MSSB, and these mediating effects remain consistent with the baseline findings. This evidence suggests that the study’s conclusions are robust to this alternative explained-variable specification and continue to strongly support hypotheses H5 and H6, thereby reinforcing the reliability and validity of the study’s conclusions.

Table 8.

Robustness Test Results of the Relationship between ESG Washing and Abnormal Audit Fees.

Table 9.

Robustness Test of Mediating Moderation Index for Market Structure (MAST).

Table 10.

Bootstrap Robustness Test for Moderated Mediating Effects of Market Structure.

4.3.2. Lagged Explanatory Variable

To account for potential time-lagged effects between corporate ESG washing and its impact on abnormal audit fees, this study incorporates the one-period lagged explanatory variable (ESGWt−1) into the chain mediating analysis. This approach enables a more precise examination of the dynamic influence of ESG washing on abnormal audit fees. The results are reported in Columns (1)–(3) of Table 8 and in Table 11. The results indicate that even after fully accounting for potential lagged effects, the lagged ESG washing variable (ESGWt−1) continues to exert a significant positive influence on abnormal audit fees. Moreover, the mediating variables, excess executive compensation (EXPAY) and executive myopia (MSSB), continue to exhibit significant mediating and chain mediating effects in the relationship between ESG washing and abnormal audit fees. These findings provide robust evidence for the temporal validity and persistence of the paper’s primary conclusions, substantially enhancing the overall robustness of the research framework and the credibility of the results. Furthermore, the analysis helps to mitigate concerns regarding potential endogeneity of the explanatory variables.

Table 11.

Bootstrap Robustness Test Results for Path Effects of the Chain Mediating Model.

4.3.3. Grouped Test by Managerial Tone

To further examine the robustness of our findings, this study divides the sample into two groups according to managerial tone, namely positive tone and negative tone, and separately investigates the relationship between ESG washing and abnormal audit fees (see Table 12). The results show that ESG washing is significantly and positively related to abnormal audit fees in both groups, while the effect is stronger in the negative tone group, with a coefficient of 0.025 that is significant at the 1% level, compared with a coefficient of 0.015 that is significant at the 5% level in the positive tone group. This indicates that when managerial tone is more negative, auditors tend to demand higher risk premiums to address potential information distortion, which leads to an increase in abnormal audit fees. In this setting, managerial tone serves as a practical proxy for the board’s tone at the top, as it conveys how governance priorities are communicated and reinforced within the organization. These findings confirm that the positive association between ESG washing and abnormal audit fees remains robust under different tonal contexts, and they further reveal the heterogeneity of managerial tone. At the same time, the evidence provides additional support for the governance logic reflected in executive myopia.

Table 12.

Robustness Test of Grouped test by managerial tone.

5. Discussion

5.1. Discussion of the Total Effect

The significant total effect of ESG washing on abnormal audit fees highlights the audit market’s sensitivity to managerial misrepresentation in ESG disclosure. This result aligns with prior evidence that symbolic ESG actions weaken information reliability and heighten auditors’ risk assessments [25,28]. Our findings extend this line of research by showing that, when both greenwashing and brownwashing are jointly incorporated into the analysis, the upward pressure on audit fees becomes more pronounced. In this sense, ESG washing represents not merely a reputational concern but also a substantive driver of audit pricing, as auditors respond to disclosure distortions with greater effort and risk premiums.

5.2. Discussion of the Direct Effect

The direct effect of ESG washing on abnormal audit fees remains significant even after accounting for managerial characteristics such as excess executive compensation and executive myopia. This finding indicates that auditors perceive ESG misrepresentation itself as a distinct source of risk that cannot be fully explained by observable incentive structures. In practice, disclosure distortions are likely to trigger expanded audit procedures, including more extensive substantive testing and reliance on independent verification, which in turn increase audit effort and cost. These dynamics suggest that ESG washing not only reflects managerial opportunism but also introduces direct uncertainties into the audit process, thereby exerting an independent influence on audit pricing [73]. This interpretation is consistent with prior evidence that ambiguity in ESG information disclosure heightens audit risk and leads to higher audit fees.

5.3. Discussion of Mediating and Chain Mediating Effects

The mediation results confirm that ESG washing influences abnormal audit fees through managerial incentives, particularly excess executive compensation. This finding reflects that symbolic ESG disclosure can serve as a mechanism for executives to justify higher pay, which in turn elevates agency costs [74]. From the perspective of auditors, rising agency costs signal heightened governance risks, leading to additional verification procedures and greater effort requirements. As a result, abnormal audit fees increase not only because of disclosure distortion itself but also through the incentive structures it creates within the firm.

The mediating role of executive myopia provides further evidence of how ESG washing reshapes managerial behavior. When managers prioritize short-term gains from favorable ESG disclosure, they often pursue decisions that raise uncertainty around long-term performance and compliance [53]. Such short-termism complicates the audit process by increasing the difficulty of assessing financial sustainability and reliability, thereby prompting auditors to expand substantive testing and to rely more heavily on independent assurance. These adjustments are ultimately reflected in higher audit costs.

The chain mediating effect highlights how excess compensation and executive myopia interact to amplify the influence of ESG washing on audit pricing. Elevated compensation strengthens short-term orientations, which then magnify the governance and operational risks faced by auditors. In this way, ESG misrepresentation initiates a sequential mechanism that links distorted incentives with behavioral biases, producing compounded effects on audit complexity and cost. This pathway underscores that ESG washing does not operate through a single channel but rather through interconnected managerial and organizational mechanisms [63,64], each of which intensifies audit effort and drives abnormal audit fees.

5.4. Discussion of Moderated Mediating Effects

The results on moderated mediation highlight the complex role of market structure in shaping how ESG washing translates into abnormal audit fees. The evidence that higher market concentration weakens the mediating role of excess executive compensation suggests that firms with stronger market power are subject to more established governance and compensation oversight arrangements [58]. Under these conditions, the room for opportunistic pay increases narrows, and the contribution of compensation-induced agency costs to abnormal audit fees diminishes. This mechanism explains why the mediating effect of excess compensation becomes weaker as market concentration rises.

In contrast, the finding that market concentration strengthens the mediating role of executive myopia reveals a different channel. In more concentrated industries, where external scrutiny and compliance requirements are more demanding, executives may experience heightened pressure to demonstrate short-term ESG achievements [75]. This pressure fosters myopic behaviors, which amplify disclosure distortions and complicate the audit process. As a result, auditors must devote additional effort to verification and substantive testing, thereby driving up abnormal audit fees.

Taken together, these findings illustrate a dual effect of market structure. On the one hand, concentrated markets mitigate opportunism embedded in compensation practices; on the other, they intensify short-termism in managerial decision-making. This duality clarifies why market structure simultaneously attenuates one mediating channel while reinforcing another, enriching our understanding of how external governance environments shape the audit consequences of ESG washing.

6. Conclusions and Implications

6.1. Research Conclusions

Extraction of Principal Components

With the growing institutionalization of Environmental, Social, and Governance (ESG) frameworks, the phenomenon of ESG washing, where firms strategically align disclosure practices to satisfy environmental regulations or stakeholder expectations without commensurate substantive actions, has become increasingly salient. Such opportunistic behavior has drawn heightened scrutiny from academia, regulators, and market participants, as it exacerbates audit risk assessment complexity and exerts sustained upward pressure on audit fees. To address this issue, this study develops an integrative analytical framework that combines organizational decoupling theory with transaction cost theory. Leveraging both chain mediating analysis and moderated mediating analysis, we conduct a systematic investigation into the impact of ESG washing on abnormal audit fees and its underlying transmission mechanisms, using data on Chinese listed companies over the period 2014–2023. The main research findings are summarized below:

First, ESG washing is widely prevalent among Chinese listed companies, substantially increasing the complexity of audit risk identification and exerting upward pressure on audit fees. These effects undermine firms’ long-term sustainability and erode their social legitimacy.

Second, excessive executive compensation serves as a critical mediating channel through which ESG washing escalates abnormal audit fees, while executive myopia, manifesting as a pronounced short-term orientation, further magnifies this impact. ESG washing fosters unwarranted compensation incentives and intensifies short-sighted managerial behavior, both of which weaken long-term governance discipline and elevate audit as well as reputational risks. These dynamics not only help explain the adoption of ill-conceived compensation schemes but also establish a persistent link between ESG washing and the continual rise in audit costs. From an internal governance perspective, excessive executive compensation and executive myopia function as two interdependent “keys” that unlock the black-box mechanism by which ESG washing drives up abnormal audit fees, representing highly effective mediating forces in this process.

Third, market concentration exerts a heterogeneous moderating influence on the mediating roles of excess executive compensation and executive myopia in the relationship between ESG washing and abnormal audit fees. Specifically, higher market concentration significantly suppresses the mediating effect transmitted through excess executive compensation. Firms operating in more concentrated markets face tighter regulatory oversight and stronger governance discipline, which constrain unwarranted growth in executive pay and thereby attenuate the compensation-based channel from ESG washing to elevated abnormal audit fees. By contrast, greater market concentration amplifies the mediating effect of executive myopia. In more concentrated structures, the reputational benefits and heightened social standing potentially conferred by ESG washing can induce executives to adopt a narrowly focused, short-term orientation in decision-making, which strengthens the transmission pathway through which ESG washing escalates abnormal audit fees. Taken together, market concentration generates asymmetric conditional indirect effects: it dampens the compensation pathway yet reinforces the myopia pathway, so the ESG washing–abnormal audit fee linkage becomes increasingly driven by managerial short-termism as concentration rises.

6.2. Managerial Implications

First, it is imperative to integrate and refine the legal framework governing corporate ESG disclosure by formulating standards that are aligned not only with China’s environmental regulatory regime but also with widely recognized international reporting and assurance frameworks. Such standards should establish a comprehensive, enforceable system that ensures transparency, comparability, and credibility in corporate sustainability reporting. By incorporating unified definitions, sector-calibrated metrics, and assurance mechanisms, the scope for organizational decoupling, where disclosure commitments diverge from actual practices, can be reduced. Strengthening statutory requirements in this way would not only curb ESG washing and enhance market trust domestically but also promote convergence with global disclosure initiatives, thereby improving the international credibility of Chinese firms.

Second, it is crucial to strengthen the regulatory capacity of industry associations, professional bodies, institutional investors, and other civil-society organizations so as to establish an effective system of market-based checks and balances. The findings of this study suggest that one underlying reason for overt ESG washing is the limited role of such organizations in China’s environmental governance framework. Inadequate oversight and weak verification mechanisms create space for ESG misrepresentation, undermining the authority of regulatory mandates. To address this gap, regulators should cultivate and empower these actors by developing enforceable, sector-specific disclosure standards, expanding their statutory mandates, and reinforcing their social legitimacy. International experience further suggests that independent third-party monitoring, when supported by credible sanctioning mechanisms, can effectively complement governmental oversight, compress information asymmetry, and create a more resilient ESG system.

Third, regulatory authorities should intensify oversight of internal governance in leading firms and institutionalize a formal ESG whistleblower mechanism. This study shows that, under high market concentration, regulatory controls over executive compensation effectively restrain excessive pay increases; however, measures targeting executive myopia remain largely ineffective, thereby amplifying its mediating role. These findings underscore that external market structures and internal governance factors jointly shape the mechanisms through which ESG washing affects abnormal audit fees. Accordingly, interventions should act directly on these channels. For instance, executive pay can be tied to independently verified, outcome-based ESG targets, supported by deferrals or clawback clauses to discourage opportunistic short-termism. At the same time, an ESG whistleblower system with safe-harbor protections and auditor access would provide early warning signals and counteract managerial myopia at its root. Firms should also integrate sustainability risks into enterprise risk management and strengthen board-level ESG competence, ensuring that governance structures are equipped to anticipate and mitigate audit risks arising from ESG washing.

Finally, fostering orderly competition within industries and optimizing the business environment are essential to reducing ESG washing. This study demonstrates that the degree of market competition profoundly shapes the prevalence of ESG misrepresentation. A fair and appropriately competitive market setting deters opportunistic behaviors, enabling genuinely responsible firms to secure competitive advantages and sustainable growth, while those that inflate or misstate ESG performance should face proportionate sanctions. Regulators should therefore adopt tiered and risk-based oversight strategies calibrated to industry-specific conditions. In less concentrated markets, priority may be placed on pay governance and related-party scrutiny, while in highly concentrated industries, emphasis should be given to horizon-lengthening tools such as multi-period ESG performance measures and disclosure of long-term investment pipelines. At the same time, a sound and transparent business environment can mitigate “bandwagon” and “herd” effects, providing systemic safeguards for sustainable corporate development. Embedding these principles within broader global governance frameworks will encourage firms to engage in compliant and orderly competition while contributing to the long-term stability and credibility of global sustainable markets. Moreover, the findings of this study offer useful insights for other developing economies, including BRICS countries and members of BIMSTEC. Similar to China, these economies often face uneven institutional development, limited regulatory capacity, and varying levels of corporate governance maturity. Under such conditions, ESG washing can distort the pricing of audit services and erode market trust. The empirical evidence from the Chinese context, particularly the importance of strengthening disclosure standards, enhancing third-party verification, and ensuring that audit fees reflect firms’ true risk profiles, provides valuable references for developing nations that aim to establish credible ESG disclosure systems and mitigate audit risks arising from strategic ESG misrepresentation.

6.3. Research Limitations and Future Directions

As research on corporate environmental, social, and governance (ESG) washing remains at a nascent stage, existing studies are largely concentrated on theoretical exploration and case-based discussion. This paper also has several limitations, which provide meaningful directions for future research. First, the accurate measurement of ESG washing still warrants substantial refinement. Future studies should endeavor to develop multi-dimensional and methodologically rigorous metrics to achieve more precise and reliable quantification. Second, given that listed companies experienced significant external shocks during the study period, this study does not account for industry-specific differences in ESG-related environmental regulations. Subsequent research should incorporate heterogeneity analyses across industries and conduct in-depth case studies of representative firms, thereby enhancing both the contextual relevance and the practical implications of the findings. Third, the adoption of a chain mediating model in this study may affect the stability of the conclusions. Future research should refine and diversify statistical methodologies to further enhance the robustness, reliability, and applicability of the results. Finally, because the sequential empirical design focuses on explaining the residual variation of abnormal audit fees after controlling for prior predictors, the adjusted R2 values of individual models remain modest. Future studies may improve explanatory power by incorporating additional auditor-level characteristics or alternative measures of ESG washing, which would provide a more comprehensive understanding of the mechanisms underlying abnormal audit fees.

Author Contributions

Validation, X.S., Y.Y. and J.H.; Writing review, X.S., Y.Y. and J.H.; Editing, X.S. and Y.Y.; Methodology, X.S. and J.H.; Funding acquisition, X.S.; Data collection, Y.Y.; Conceptualization, X.S.; Writing original draft, X.S. and Y.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research has received funding from the Shandong Provincial Social Science Planning: Grant No. 23BGLJ08.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author(s).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Walker, K.; Wan, F. The harm of symbolic actions and green-washing: Corporate actions and communications on environmental performance and their financial implications. J. Bus. Ethics 2012, 109, 227–242. [Google Scholar] [CrossRef]

- Kudłak, R. Greenwashing or Striving to Persist: An Alternative Explanation of a Loose Coupling Between Corporate Environmental Commitments and Outcomes. J. Bus. Ethics 2025, 197, 355–370. [Google Scholar] [CrossRef]

- Cao, J.; Ee, M.S.; Hasan, I.; Huang, H. Asymmetric reactions of abnormal audit fees jump to credit rating changes. Br. Account. Rev. 2024, 56, 101205. [Google Scholar] [CrossRef]

- Delmas, M.A.; Montes-Sancho, M.J. Voluntary agreements to improve environmental quality: Symbolic and substantive cooperation. Strateg. Manag. J. 2010, 31, 575–601. [Google Scholar] [CrossRef]

- Testa, F.; Miroshnychenko, I.; Barontini, R.; Frey, M. Does it pay to be a greenwasher or a brownwasher? Bus. Strategy Environ. 2018, 27, 1104–1116. [Google Scholar] [CrossRef]

- Lawson, B.P.; Wang, D. The earnings quality information content of dividend policies and audit pricing. Contemp. Account. Res. 2016, 33, 1685–1719. [Google Scholar] [CrossRef]

- Bushman, R.M.; Smith, A.J. Financial accounting information and corporate governance. J. Account. Econ. 2001, 32, 237–333. [Google Scholar] [CrossRef]

- Schuster, C.L.; Nicolai, A.T.; Covin, J.G. Are founder-led firms less susceptible to managerial myopia? Entrep. Theory Pract. 2020, 44, 391–421. [Google Scholar] [CrossRef]

- Porumb, V.A.; Zengin-Karaibrahimoglu, Y.; Lobo, G.J.; Hooghiemstra, R.; De Waard, D. Expanded auditor’s report disclosures and loan contracting. Contemp. Account. Res. 2021, 38, 3214–3253. [Google Scholar] [CrossRef]

- Hogan, C.E.; Wilkins, M.S. Evidence on the audit risk model: Do auditors increase audit fees in the presence of internal control deficiencies? Contemp. Account. Res. 2008, 25, 219–242. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, C.W. Directors’ and officers’ liability insurance and the sensitivity of directors’ compensation to firm performance. Int. Rev. Econ. Financ. 2016, 45, 286–297. [Google Scholar] [CrossRef]

- Bills, K.L.; Cunningham, L.M.; Myers, L.A. Small audit firm membership in associations, networks, and alliances: Implications for audit quality and audit fees. Account. Rev. 2016, 91, 767–792. [Google Scholar] [CrossRef]

- Fung, H.G.; Qiao, P.; Yau, J.; Zeng, Y. Leader narcissism and outward foreign direct investment: Evidence from Chinese firms. Int. Bus. Rev. 2020, 29, 101632. [Google Scholar] [CrossRef]

- Zhu, D.H.; Chen, G. CEO narcissism and the impact of prior board experience on corporate strategy. Adm. Sci. Q. 2015, 60, 31–65. [Google Scholar] [CrossRef]

- Johnston, J.; Soileau, J. Enterprise risk management and accruals estimation error. J. Contemp. Account. Econ. 2020, 16, 100209. [Google Scholar] [CrossRef]

- Gul, F.A.; Wu, D.; Yang, Z. Do individual auditors affect audit quality? Evidence from archival data. Account. Rev. 2013, 88, 1993–2023. [Google Scholar] [CrossRef]

- Li, C.; Raman, K.K.; Sun, L.; Wu, D. The effect of ambiguity in an auditing standard on auditor independence: Evidence from nonaudit fees and SOX 404 opinions. J. Contemp. Account. Econ. 2017, 13, 37–51. [Google Scholar] [CrossRef]

- DeFond, M.L.; Subramanyam, K.R. Auditor changes and discretionary accruals. J. Account. Econ. 1998, 25, 35–67. [Google Scholar] [CrossRef]

- Copley, P.; Douthett, E.; Zhang, S. Venture capitalists and assurance services on initial public offerings. J. Bus. Res. 2021, 131, 278–286. [Google Scholar] [CrossRef]

- Song, Y.; Wu, H.; Ma, Y. Does ESG performance affect audit pricing? Evidence from China. Int. Rev. Financ. Anal. 2023, 90, 102890. [Google Scholar] [CrossRef]

- Simunic, D.A. The pricing of audit services: Theory and evidence. J. Account. Res. 1980, 18, 161–190. [Google Scholar] [CrossRef]

- Putra, I.; Sulistiyo, U.; Diah, E.; Rahayu, S.; Hidayat, S. The influence of internal audit, risk management, whistleblowing system and big data analytics on the financial crime behavior prevention. Cogent Econ. Financ. 2022, 10, 2148363. [Google Scholar] [CrossRef]

- Doxey, M.M.; Lawson, J.G.; Lopez, T.J.; Swanquist, Q.T. Do investors care who did the audit? Evidence from Form AP. J. Account. Res. 2021, 59, 1741–1782. [Google Scholar] [CrossRef]

- Lohwasser, E.; Zhou, Y. Earnings Management, Auditor Changes and Ethics: Evidence from Companies Missing Earnings Expectations: E. Lohwasser, Y. Zhou. J. Bus. Ethics 2024, 191, 551–570. [Google Scholar] [CrossRef]

- Christensen, D.M.; Serafeim, G.; Sikochi, A. Why is corporate virtue in the eye of the beholder? The case of ESG ratings. Account. Rev. 2022, 97, 147–175. [Google Scholar] [CrossRef]

- Dutta, S.; Nezlobin, A. Information disclosure, firm growth, and the cost of capital. J. Financ. Econ. 2017, 123, 415–431. [Google Scholar] [CrossRef]

- Oliver, C. Strategic responses to institutional processes. Acad. Manag. Rev. 1991, 16, 145–179. [Google Scholar] [CrossRef]

- Lee, M.T.; Raschke, R.L. Stakeholder legitimacy in firm greening and financial performance: What about greenwashing temptations? J. Bus. Res. 2023, 155, 113393. [Google Scholar] [CrossRef]

- Arouri, M.; El Ghoul, S.; Gomes, M. Greenwashing and product market competition. Financ. Res. Lett. 2021, 42, 101927. [Google Scholar] [CrossRef]

- Chen, Z.; Lan, H. Dynamics of public opinion: Diverse media and audiences’ choices. J. Artif. Soc. Soc. Simul. 2021, 24, 4552. [Google Scholar] [CrossRef]

- Kim, E.H.; Lyon, T.P. Greenwash vs. brownwash: Exaggeration and undue modesty in corporate sustainability disclosure. Organ. Sci. 2015, 26, 705–723. [Google Scholar] [CrossRef]

- Huang, Y.; Francoeur, C.; Brammer, S. What drives and curbs brownwashing? Bus. Strategy Environ. 2022, 31, 2518–2532. [Google Scholar] [CrossRef]

- Yu, E.P.Y.; Van Luu, B.; Chen, C.H. Greenwashing in environmental, social and governance disclosures. Res. Int. Bus. Financ. 2020, 52, 101192. [Google Scholar] [CrossRef]

- Kirk, M.P.; Vincent, J.D. Professional investor relations within the firm. Account. Rev. 2014, 89, 1421–1452. [Google Scholar] [CrossRef]

- Li, D.; Huang, M.; Ren, S.; Chen, X.; Ning, L. Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. J. Bus. Ethics 2018, 150, 1089–1104. [Google Scholar] [CrossRef]

- Marquis, C.; Toffel, M.W.; Zhou, Y. Scrutiny, norms, and selective disclosure: A global study of greenwashing. Organ. Sci. 2016, 27, 483–504. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Thorburn, K.S. Voluntary corporate environmental initiatives and shareholder wealth. J. Environ. Econ. Manag. 2011, 62, 430–445. [Google Scholar] [CrossRef]

- Heyes, A.; Lyon, T.P.; Martin, S. Salience games: Private politics when public attention is limited. J. Environ. Econ. Manag. 2018, 88, 396–410. [Google Scholar] [CrossRef]

- Shiu, Y.M.; Yang, S.L. Does engagement in corporate social responsibility provide strategic insurance-like effects? Strateg. Manag. J. 2017, 38, 455–470. [Google Scholar] [CrossRef]

- Testa, F.; Boiral, O.; Iraldo, F. Internalization of environmental practices and institutional complexity: Can stakeholders pressures encourage greenwashing? J. Bus. Ethics 2018, 147, 287–307. [Google Scholar] [CrossRef]

- Zhao, Y.; Su, K. Economic policy uncertainty and corporate financialization: Evidence from China. Int. Rev. Financ. Anal. 2022, 82, 102182. [Google Scholar] [CrossRef]

- Fan, R.; Xu, Y.; Yu, L.; Qiu, R. Sustainability needs trust: The role of social trust in driving corporate ESG performance. Econ. Anal. Policy. 2025, 86, 1492–1509. [Google Scholar] [CrossRef]

- Ferreira-Quilice, T.; Hernández-Maestro, R.M.; Duarte, R.G. Corporate sustainability transitions: Are there differences between what companies say and do and what ESG ratings say companies do? J. Clean. Prod. 2023, 414, 137520. [Google Scholar] [CrossRef]

- Bhullar, P.S.; Joshi, M.; Sharma, S.; Kaur, A.; Phan, D. Greenwashing and ESG: Bibliometric analysis and future research agenda. Pac.-Basin Financ. J. 2025, 93, 102846. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Matousek, R.; Meyer, M.; Tzeremes, N.G. Does corporate social responsibility impact firms’ innovation capacity? The indirect link between environmental & social governance implementation and innovation performance. J. Bus. Res. 2020, 119, 99–110. [Google Scholar] [CrossRef]