1. Introduction

This study investigates the role of green finance in promoting environmentally friendly technologies while balancing financial performance and sustainability impact. By applying GA-FL optimization techniques within MATLAB r2021b, this research evaluates investment strategies under uncertain market and policy conditions. This study also incorporates the author’s original insights, highlighting innovative opportunities, practical recommendations, and strategic implications for investors and decision-makers.

1.1. Sustainable Development and Environmental Pressures

Over recent decades, global economic expansion has substantially improved living standards and spurred technological progress. However, this growth has frequently occurred at the cost of environmental integrity, resulting in ecosystem degradation, resource depletion, and escalating greenhouse gas emissions. Heightened awareness of climate change and its long-term consequences has driven governments, financial institutions, and private investors to pursue strategies that reconcile economic development with environmental sustainability [

1,

2,

3,

4].

Over the past two decades, the pursuit of sustainability has shifted from a normative ideal to a structural imperative essential for the continuity of global economic and social systems. The escalating impacts of climate change, biodiversity loss, and resource depletion have compelled governments, corporations, and investors to confront a fundamental reality: economic growth and ecological stability can no longer be addressed as separate objectives. Within this context, financial systems have assumed a strategic role—not merely as intermediaries of capital but as active agents shaping environmental outcomes.

The emergence of green finance signifies a paradigm shift in the understanding of the relationship between capital and sustainability. Initially regarded as a niche investment approach, green finance has evolved into a multifaceted policy and market domain that mobilizes resources toward renewable energy, clean technologies, and sustainable infrastructure. Nevertheless, despite its rapid expansion, the global green finance landscape remains fragmented. Capital flows to sustainable assets are frequently hindered by inconsistent regulatory frameworks, volatile risk perceptions, and technological uncertainties. Consequently, the potential of financial mechanisms to drive systemic sustainability transitions remains underexploited.

1.2. The Emergence of Green Finance

Green finance has emerged as a transformative mechanism that directs capital toward projects delivering both environmental and social benefits while preserving financial viability. Key instruments include green bonds, sustainability-linked loans, and climate-focused investment funds, all of which facilitate investments in environmentally friendly technologies such as renewable energy systems, energy efficiency enhancements, and electric mobility. The integration of environmental, social, and governance (ESG) criteria into investment decision-making enables investors to mitigate ecological risks, enhance portfolio resilience, and support long-term profitability [

5,

6,

7,

8].

1.3. Opportunities and Challenges in Environmentally Friendly Investments

Investing in low-carbon technologies provides opportunities for cost-effective energy solutions, access to emerging green markets, and favorable risk-adjusted returns. Nevertheless, these investments face challenges such as high initial capital requirements, long payback periods, uncertain technological performance, and regulatory instability. Strategic diversification and alignment with supportive policies are essential for ensuring both financial and environmental success [

9,

10,

11,

12].

1.4. Risk and Return Considerations

Sustainable investments entail multidimensional risks spanning technological, regulatory, market, and financial domains. Empirical studies indicate that incorporating sustainability criteria into investment portfolios can improve risk-adjusted returns while mitigating exposure to carbon-related liabilities [

13,

14,

15]. Furthermore, green assets typically demonstrate low correlation with conventional energy sectors, offering significant diversification benefits. Early adoption of low-carbon technologies has the potential to generate compounded financial gains, concurrently supporting global decarbonization objectives [

16,

17,

18,

19].

The disconnect between financial potential and environmental performance raises a critical theoretical and empirical question: what types of interactions among the finance, innovation, and policy domains generate stable, self-reinforcing dynamics of sustainability? Existing models in environmental economics and sustainable finance often assume unidirectional causality—where finance drives innovation and innovation drives environmental outcomes. However, empirical evidence suggests a more complex reality characterized by feedback loops, adaptation, and mutual reinforcement.

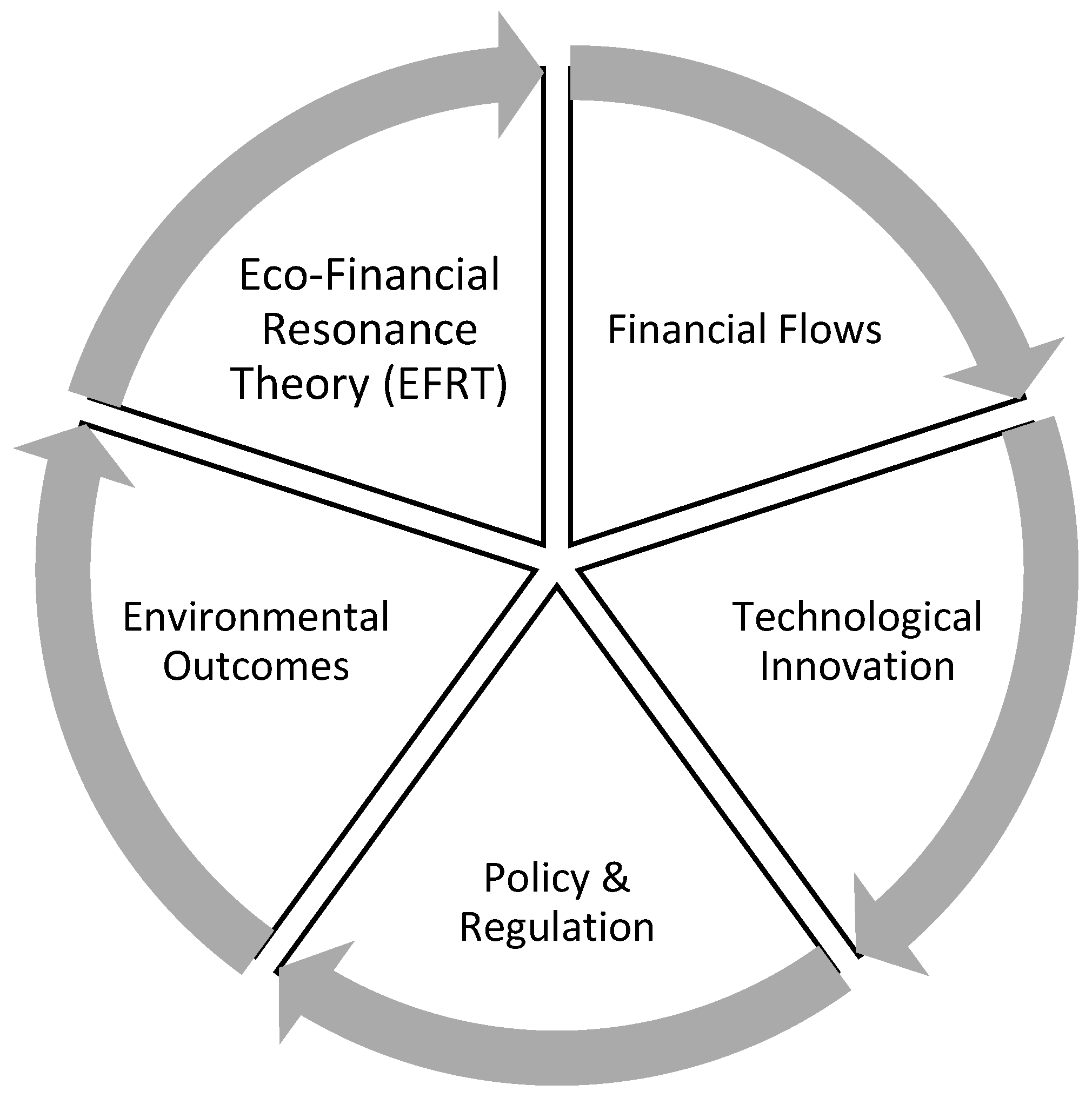

To address this analytical gap, the present study introduces the Eco-Financial Resonance Theory (EFRT), a novel theoretical framework designed to explain the systemic synchronization of financial, technological, and policy mechanisms within sustainability transitions. EFRT conceptualizes the sustainable economy as a resonant system, wherein economic and ecological subsystems interact through dynamic feedback loops. Rather than focusing on isolated cause-and-effect chains, EFRT emphasizes co-evolution: when financial flows, innovation capabilities, and regulatory structures align temporally, the system enters a state of “resonance,” thereby amplifying both profitability and ecological performance.

This theory draws on interdisciplinary foundations, integrating perspectives from complex systems theory, ecological economics, and computational finance. By interpreting sustainable finance through the lens of resonance, EFRT bridges the micro-level mechanics of investment behavior with macro-level environmental outcomes. It posits that stability and innovation emerge not from equilibrium but through adaptive synchronization—a principle that parallels the functioning of resilient ecosystems in nature.

1.5. Advanced Computational Approaches: Genetic Algorithms and Fuzzy Logic

To manage uncertainties and multi-objective challenges in green investment, this study incorporates genetic algorithms (GA) and fuzzy logic (FL). Fuzzy logic captures qualitative uncertainties, such as policy volatility, market dynamics, and technological readiness, through membership functions and linguistic variables [

20,

21,

22]. Genetic algorithms optimize portfolio allocations by simulating evolutionary processes, iteratively selecting and combining candidate solutions to achieve optimal trade-offs between financial returns, environmental impact, and risk [

23,

24].

Building upon this foundation, the primary objective of this research is to formulate, operationalize, and empirically validate the Eco-Financial Resonance Theory (EFRT) as a novel analytical paradigm for sustainable finance. This study aims to demonstrate that the alignment—or resonance—among financial, technological, and policy domains can quantitatively elucidate why certain sustainability transitions succeed while others falter. Specifically, EFRT posits that financial systems and environmental outcomes are linked not through linear causation but via dynamic feedback loops that enhance systemic coherence.

1.6. MATLAB-Based Implementation and Simulation

The hybrid Genetic Algorithm–Fuzzy Logic (GA-FL) approach is implemented in MATLAB r2021b, utilizing the Fuzzy Logic Toolbox to define inference systems and membership functions for uncertain variables. The Global Optimization Toolbox enables GA operations such as selection, crossover, and mutation, optimizing investment strategies across renewable energy, energy efficiency, and electric mobility technologies. MATLAB’s visualization and simulation capabilities facilitate scenario analysis, sensitivity testing, and performance evaluation under diverse regional and market conditions.

To empirically test this theoretical proposition, this study employs a Hybrid GA–FL methodology implemented in MATLAB. The genetic algorithm component optimizes the parameters of the resonance model by simulating adaptive learning and evolutionary convergence while the fuzzy logic module captures the nonlinear and uncertain dynamics inherent in sustainability interactions. This integrated computational framework enables the measurement and visualization of resonance intensity among domains over time. The empirical analysis spans the period from 2000 to 2025, providing a long-term temporal perspective that reflects both the maturation and volatility of green finance markets.

Ultimately, the methodological framework serves not only as a tool for validation but also as a proof of concept for EFRT itself: demonstrating that sustainable financial systems can be mathematically modeled, dynamically simulated, and strategically optimized. By combining theoretical insight with computational rigor, this study seeks to establish EFRT as a foundational framework for future interdisciplinary research on sustainability.

1.7. Strategic Implications and Policy Relevance

Integrating green finance with advanced computational models provides investors and policymakers a comprehensive tool for decision-making. Scenario-based analyses identify regions and sectors where environmentally friendly technologies offer maximum financial and ecological benefits. The results inform strategic policies such as subsidies, carbon pricing, and renewable energy incentives, ensuring public interventions effectively support sustainable investments [

25,

26,

27].

To complement the structured discussion,

Table 1 presents the author’s contributions and perspectives, highlighting original insights, strategic observations, and innovative approaches incorporated throughout this study. This table emphasizes how multi-source data, hybrid GA-FL methodology, and MATLAB simulations are leveraged to optimize investment strategies and enhance both financial and environmental outcomes.

1.8. Research Question and Study Objective

The primary focus of this study is to investigate how eco-financial feedback mechanisms influence the long-term stability and performance of sustainable investments. Grounded in the Eco-Financial Resonance Theory (EFRT), we propose that financial flows, technological innovation, policy coherence, and ecological performance interact through dynamic resonance effects, which can either amplify or dampen systemic stability.

The central research question guiding this inquiry is as follows: “How does synchronized financial, technological, and policy feedback generate resonance effects that shape the risk–return dynamics of sustainable portfolios between 2000 and 2025?”

To address this question, this study pursues three interrelated objectives:

1. Empirical quantification: Analyze the temporal evolution of risk-adjusted returns in green and conventional portfolios using long-term, multi-frequency financial data.

2. Methodological innovation: Operationalize EFRT through a hybrid Genetic Algorithm–Fuzzy Logic (GA–FL) model that captures the nonlinear, uncertain, and adaptive dynamics within eco-financial systems.

3. Theoretical contribution: Demonstrate that sustainable finance can be conceptualized as a resonance system, wherein aligned eco-financial feedback enhances long-term stability, efficiency, and sustainability.

By integrating these components, this study aims to deliver a comprehensive, data-driven validation of EFRT while providing actionable insights for policymakers, investors, and researchers engaged in sustainable finance and systemic risk management.

2. Conceptual Framework and Literature Review

2.1. Background and Motivation

The twenty-first century is marked by an unprecedented dual challenge: sustaining economic growth while respecting the ecological limits of the planet. Rapid globalization and industrial expansion have accelerated wealth creation, trade, and technological advancement; however, these developments have concurrently intensified resource depletion, biodiversity loss, and anthropogenic climate change [

28,

29]. The long-held assumption that unchecked economic growth can coexist with environmental stability is increasingly questioned, particularly in light of the planetary boundaries framework, which delineates critical thresholds for key Earth system processes such as carbon emissions, freshwater use, and land-system change. Transgressing these thresholds risks destabilizing Earth’s systems, potentially resulting in irreversible consequences for human societies.

From an economic standpoint, the costs of inaction have been extensively documented. The Stern Review on the Economics of Climate Change posited that delaying mitigation efforts could incur costs equivalent to a permanent annual reduction of at least 5% of global GDP, in stark contrast to the approximately 1% investment required for immediate intervention [

30,

31,

32]. This economic rationale underscores the imperative of integrating sustainability considerations into investment decisions. Within this context, green finance has emerged as a pivotal mechanism for aligning financial flows with climate objectives and mobilizing capital toward low-carbon technologies.

A primary motivation behind green finance is its capacity to redirect investment toward environmentally friendly technologies. Renewable energy systems, energy storage solutions, and efficiency-enhancing innovations are particularly critical, as they contribute directly to emissions reduction while fostering resilience and energy security [

33,

34]. Nonetheless, these technologies often face significant barriers, including high upfront costs, uncertain long-term profitability, and dependency on supportive policy frameworks. Such challenges highlight the importance of innovative financial instruments—such as green bonds, climate funds, and blended finance—in de-risking investments and creating favorable market conditions.

The European Investment Bank [

35,

36], self-styled as the “EU Climate Bank,” exemplifies the catalytic role public financial institutions can play by channeling billions of euros into climate-aligned projects and mobilizing private capital. Similarly, regional development banks like the Asian Development Bank have emphasized green finance’s essential role in meeting both climate and development goals, particularly within emerging economies [

37,

38,

39,

40]. These developments signal a growing recognition that financial systems must evolve to address climate imperatives while continuing to support economic growth.

Beyond environmental imperatives, the social dimension further motivates green investment. Such investments can generate employment opportunities, alleviate energy poverty, and stimulate innovation-driven economic growth. Empirical studies demonstrate that renewable energy sectors typically create more jobs per unit of investment than fossil-fuel-based industries [

41,

42,

43,

44,

45]. Consequently, the transition to sustainable energy systems represents not only an environmental necessity but also a significant socioeconomic opportunity.

In sum, the background and motivation for examining the role of green finance in environmentally friendly technologies lie at the intersection of ecological urgency, economic rationality, and social opportunity. The period from 2000 to 2025 is especially instructive, reflecting the institutionalization of sustainability frameworks and the scaling-up of practical efforts. This research situates itself at the nexus of finance, technology, and sustainability, aiming to explore how green finance can effectively manage risks, generate returns, and enable the systemic transformations essential for long-term sustainable development.

2.2. Sustainable Development and Global Frameworks

The conceptual roots of sustainable development are deeply embedded in global governance and international policy discourse. Since the 1987 Brundtland Report, which defined sustainable development through the lens of intergenerational equity, the concept has matured into a guiding principle for governments, international organizations, and financial institutions alike. Central to this evolution is the recognition that environmental, economic, and social dimensions are inherently interconnected, necessitating governance frameworks that reflect their interdependence [

46,

47,

48].

The global community’s first concerted attempt to translate sustainability into measurable targets emerged with the Millennium Development Goals (MDGs) in 2000. While the MDGs achieved significant progress in poverty reduction, they largely marginalized climate change and broader ecological concerns. This gap led to the formulation of the Sustainable Development Goals (SDGs) in 2015, which broadened the agenda to integrate environmental stewardship alongside social and economic objectives. Scholars widely regard the SDGs as the most comprehensive framework devised to date for embedding sustainability within global governance structures [

49,

50,

51,

52,

53].

Complementing the SDGs, specific international treaties have reinforced the global sustainability agenda. The Paris Agreement, adopted in 2015, marked a pivotal shift toward a more decentralized governance architecture, wherein nations submit nationally determined contributions (NDCs) to collectively pursue the goal of limiting global warming to 1.5 °C [

54,

55]. Crucially, the Paris framework explicitly links climate policy with financial flows, mandating that investments align with pathways toward low-carbon development.

Regional development institutions have also been instrumental in embedding sustainability into governance. For example, the Asian Development Bank [

56] underscores the dual imperative of achieving economic growth while safeguarding ecological integrity, particularly within emerging economies. Similarly, the World Resources Institute [

57,

58] advocates for transformative approaches that harness data, technology, and finance to accelerate sustainability transitions. These perspectives emphasize the importance of region-specific contexts and institutional diversity in shaping viable pathways toward sustainable development.

Private governance frameworks further complement public initiatives. The integration of Environmental, Social, and Governance (ESG) metrics into investment decision-making signals a paradigm shift in global finance. ESG frameworks, reinforced by initiatives such as the Principles for Responsible Investment (PRI), offer tools to assess corporate alignment with sustainability objectives [

59]. Importantly, these private-sector instruments serve as bridges between global sustainability frameworks and investment practices, facilitating the operationalization of abstract principles.

Nonetheless, achieving sustainable development remains complex and fraught with challenges. Critics argue that the SDGs are overly ambitious and at times internally contradictory, highlighting tensions between growth-oriented targets and ecological limits [

60,

61,

62,

63,

64,

65]. Furthermore, disparities in institutional capacity and financial resources impede uniform progress across regions, raising pressing concerns about equity in global sustainability governance. These challenges underscore the necessity of financial innovations, such as green finance, which can reconcile developmental aspirations with ecological constraints.

Global frameworks like the SDGs and the Paris Agreement have institutionalized sustainability as a core governance principle. However, their ultimate success depends on effective implementation mechanisms that align financial systems with sustainability objectives. By mobilizing capital toward environmentally friendly technologies, green finance stands out as one of the most practical avenues for translating these global commitments into tangible and measurable outcomes.

2.3. The Eco-Financial Resonance Theory (EFRT): Concept and Novelty

The Eco-Financial Resonance Theory (EFRT) offers a novel conceptual framework for understanding sustainable finance as an emergent phenomenon arising from multi-domain feedback and synchronization. Unlike static models that treat financial, technological, and ecological dimensions of economic activity in isolation, EFRT posits that resonance—the dynamic alignment of signals across these domains—is the central mechanism driving both stability and transformation within complex systems.

Drawing on systems theory and ecological economics, EFRT explains how financial and ecological subsystems co-evolve through adaptive cycles of amplification and attenuation. When the timing of financial incentives, policy interventions, and technological innovations align, resonance emerges, generating reinforcing feedback loops that amplify positive sustainability outcomes. Conversely, when these signals become misaligned—for example, when policy uncertainty disrupts financial flows—de-resonance arises, leading to increased volatility and systemic fragility.

EFRT’s originality is encapsulated in four key theoretical contributions. First, it introduces temporal resonance as a critical explanatory variable, shifting analytical focus from static relationships to dynamic phase alignment. Second, it conceptualizes bidirectional feedback between eco-innovation and finance: investment flows accelerate technological adoption, while technological progress reshapes investor expectations and portfolio dynamics. Third, EFRT incorporates cross-domain coupling, recognizing that environmental performance is both a driver and an outcome of financial and policy behaviors. Fourth, it offers operationalizability, enabling the quantitative measurement of resonance through hybrid artificial intelligence models that simulate feedback-driven adaptation.

By integrating these features, EFRT bridges a critical gap between theoretical abstraction and empirical measurability. It advances beyond existing frameworks such as Green Finance Theory, which emphasizes policy-driven capital allocation, and Ecological Modernization Theory, which centers on institutional adaptation. EFRT’s distinctive contribution lies in its ability to explain why some sustainability transitions succeed while others falter—primarily because the underlying financial and policy rhythms either resonate or conflict.

EFRT diverges from traditional sustainability models in four key respects:

1. Temporal Resonance: EFRT highlights the importance of timing and frequency in interactions. When financial incentives, technological adoption rates, and policy cycles align temporally, resonance occurs, amplifying sustainability outcomes.

2. Bidirectional Feedback: Rather than treating finance as a passive capital allocator, EFRT conceptualizes it as an adaptive and reflexive mechanism that both responds to and shapes eco-innovation trajectories.

3. Cross-Domain Coupling: EFRT bridges the divide between economic and ecological subsystems, positing that sustainable performance emerges from co-evolution rather than isolated actions.

4. Operationalizability through Hybrid AI: The theory is empirically testable via hybrid computational models, such as Genetic Algorithm–Fuzzy Logic (GA–FL), which embody its core characteristics of non-linearity, uncertainty, and feedback-driven optimization.

Within the scope of this study, EFRT provides the conceptual foundation for modeling how resonance intensity influences financial performance and systemic stability. It is operationalized through the GA–FL hybrid model, which captures EFRT’s essential attributes—non-linearity, uncertainty, and adaptive dynamics—thereby translating abstract theoretical constructs into quantifiable empirical outcomes.

The Eco-Financial Resonance Theory (EFRT) is structured around four interdependent domains that collectively define the systemic architecture of sustainable finance:

(1) Financial Flows,

(2) Technological Innovation,

(3) Policy and Regulation, and

(4) Environmental Outcomes.

Each domain represents a distinct functional layer within the sustainability ecosystem; however, their interactions generate higher-order effects that cannot be adequately explained through linear causality alone. Resonance among these domains arises when financial incentives, innovation capabilities, policy instruments, and ecological responses become temporally synchronized. This alignment initiates a reinforcing cycle that simultaneously enhances profitability and ecological integrity.

By articulating EFRT through a categorical and visual framework, the theory transcends abstract conceptualization to provide a practical lens for understanding how systemic coherence drives sustainable transformation. Beyond its theoretical sophistication, EFRT offers a concrete explanatory mechanism elucidating how sustainability transitions unfold via interlinked feedback systems. For instance, a green investment policy triggers a reallocation of capital toward low-carbon sectors, which in turn stimulates technological innovation and accelerates the development of cleaner production methods. These technological advances yield measurable environmental improvements—such as emission reductions and resource efficiency gains—which subsequently bolster regulatory confidence and attract further financial engagement.

This sequence of causation and feedback constitutes a resonance loop—a dynamic process in which each domain amplifies the effectiveness of the others. The greater the synchronization among financial, technological, policy, and environmental domains, the more resilient and self-sustaining the system becomes. Thus, EFRT transforms the abstract notion of sustainability into a quantifiable and actionable framework, offering a novel approach to understanding and managing the systemic coherence essential for green economic growth.

2.4. The Rise of Green Finance

Green finance has emerged over the past two decades as a pivotal mechanism for aligning capital flows with environmental sustainability objectives. Initially regarded as a niche segment within the broader financial system, green finance has since evolved into a mainstream tool that facilitates investments in environmentally friendly technologies such as renewable energy, energy efficiency infrastructure, electric mobility, and low-carbon industrial processes [

66,

67,

68,

69]. This evolution reflects growing awareness of climate-related financial risks alongside a widespread recognition that traditional investment models must adapt to support global sustainability targets.

The early 2000s marked the gradual development of financial instruments explicitly designed to advance environmental objectives. Notably, green bonds—first issued by the European Investment Bank in 2007 and later adopted by various multilateral development banks—established a dedicated channel for investors seeking to fund projects with demonstrable environmental benefits [

70,

71,

72]. These instruments combined transparency, certification mechanisms, and the potential for moderate financial returns, addressing the dual challenges of environmental impact and investor confidence. Over time, the green bond market expanded rapidly, surpassing USD 500 billion in annual issuance by the mid-2020s, underscoring the scale and viability of environmentally targeted finance.

Beyond green bonds, the rise of blended finance has further catalyzed investment in environmentally friendly technologies. By combining public and private capital, blended finance reduces risk exposure for private investors while ensuring funds are directed toward projects with significant social and environmental outcomes [

73,

74]. For instance, government-backed guarantees, concessional loans, and development grants have been instrumental in de-risking renewable energy investments in emerging economies, where market uncertainties and regulatory volatility often hinder private participation. This approach highlights the increasing recognition that effective environmental investment requires not only capital but also innovative financial architecture.

Parallel to these instruments, policy-driven initiatives have played a crucial role in accelerating the adoption of green finance. National and regional regulations—including carbon pricing schemes, renewable energy subsidies, and mandatory disclosure requirements—have incentivized the integration of environmental criteria into financial decision-making [

75,

76,

77,

78]. Climate-related financial disclosure standards adopted by several G20 countries, for example, have enhanced transparency regarding corporate carbon footprints, facilitating the identification of investment opportunities aligned with environmentally friendly technologies. Such regulatory frameworks, in conjunction with market-based instruments, have bolstered the credibility and appeal of green finance among institutional and retail investors alike.

The implications of green finance for the risk-return profile of environmentally friendly investments are significant. Empirical studies indicate that although renewable energy projects and other low-carbon initiatives often involve higher upfront capital expenditures and longer payback periods, they frequently deliver competitive or superior risk-adjusted returns over time, especially when externalities such as carbon emissions and energy security are internalized [

79,

80,

81]. Portfolio-level analyses further suggest that incorporating green assets can mitigate exposure to climate-related financial risks, including regulatory shifts, stranded assets, and market volatility triggered by environmental shocks. Thus, green finance not only supports the deployment of sustainable technologies but also enhances the resilience and stability of investment portfolios.

Finally, the global expansion of green finance reflects a convergence between environmental objectives and financial innovation. By 2025, the market for green bonds, sustainable investment funds, and blended finance instruments is projected to exceed several trillion dollars annually, signaling a transformative shift in capital allocation structures [

82,

83]. This trajectory demonstrates that environmentally friendly technologies are not only technologically viable but are increasingly attractive from a financial perspective, provided that risks are adequately managed and returns are comprehensively evaluated.

In summary, the rise of green finance represents a structural transformation in global investment practices, bridging environmental sustainability and economic profitability. Its development has been driven by market innovation, regulatory incentives, and heightened awareness of climate-related risks. For investors and policymakers alike, green finance offers a practical mechanism for scaling environmentally friendly technologies, managing associated risks, and delivering acceptable returns—thereby operationalizing the global sustainability agenda in tangible financial terms.

2.5. Risks and Returns: Financial Perspective

Investing in environmentally friendly technologies through green finance mechanisms presents a complex landscape of risks and opportunities. Unlike traditional investments, these projects are characterized by multifaceted uncertainties spanning technological, regulatory, market, and environmental dimensions. Effective risk identification and management are essential for institutional and individual investors aiming to balance financial performance with sustainability objectives [

84,

85,

86,

87,

88].

Technological risk is a primary concern. Emerging renewable energy technologies—such as advanced photovoltaic cells, offshore wind turbines, and next-generation battery storage—often entail uncertainties related to performance, durability, and scalability [

89]. These factors can lead to cost overruns, operational delays, or suboptimal energy output, thereby impacting projected cash flows and project viability. Furthermore, rapid innovation cycles may render early-stage technologies obsolete, exposing investors to losses if projects cannot adapt to evolving technological standards.

Regulatory and policy risks constitute another critical dimension. Environmentally friendly investments frequently depend on supportive policy frameworks, including feed-in tariffs, tax incentives, renewable energy mandates, and carbon pricing mechanisms [

90,

91,

92,

93]. Policy instability, inconsistent enforcement, or abrupt incentive withdrawals can significantly undermine investment returns. For example, sudden subsidy reductions in certain solar energy markets have historically precipitated project cancellations and heightened market volatility. Consequently, investors must thoroughly assess both domestic and international regulatory landscapes.

Market and financial risks also influence the attractiveness of green investments. Energy markets are subject to fluctuating commodity prices, competition from conventional energy sources, and shifting demand patterns. Currency volatility, interest rate fluctuations, and limited liquidity in some green financial instruments further complicate risk management [

94,

95,

96,

97]. Nevertheless, innovative financing structures—such as green bonds, yieldcos, and blended finance—offer mechanisms to mitigate these risks by providing predictable cash flows and credit enhancements that appeal to risk-averse investors.

Despite these challenges, the return potential of environmentally friendly investments is increasingly compelling. Empirical evidence suggests that incorporating sustainability criteria can enhance risk-adjusted returns by reducing exposure to stranded assets, carbon liabilities, and market shocks linked to fossil fuel dependence [

98,

99,

100]. Additionally, projects that generate positive environmental externalities—such as emissions reductions, energy efficiency improvements, and social co-benefits—may unlock supplementary revenue streams, including carbon credits, green certifications, and government incentives. While some returns are indirect or non-monetary, they contribute meaningfully to the overall value proposition of green investments.

From a portfolio management perspective, inclusion of environmentally friendly assets can improve diversification and resilience. Climate-aligned investments often exhibit low correlations with traditional energy and industrial sectors, thereby reducing portfolio volatility and providing a hedge against climate-related market shocks [

101,

102]. Long-term projections indicate that early adoption of renewable and low-carbon technologies may yield compounded financial benefits as global decarbonization policies strengthen and carbon-intensive sectors face increasing regulatory costs.

In summary, investments in green finance targeting environmentally friendly technologies involve a broad spectrum of risks—technological, regulatory, and market-related—while simultaneously offering substantial opportunities for competitive financial returns. Strategic risk assessment, diversification, and alignment with supportive policy frameworks are critical to optimizing the risk-return balance. From a financial standpoint, green finance not only facilitates the adoption of sustainable technologies but also contributes to the construction of resilient and profitable portfolios, effectively channeling capital toward the dual objectives of environmental sustainability and economic growth.

2.6. Integrating Genetic Algorithms and Fuzzy Logic in Green Finance Analysis

Investing in environmentally friendly technologies via green finance mechanisms involves considerable complexity, driven by multiple sources of uncertainty such as technological performance variability, regulatory shifts, market fluctuations, and environmental dynamics. Conventional analytical methods frequently fall short in capturing these uncertainties and the intricate interdependencies among investment criteria. Within this context, the integration of genetic algorithms (GA) and fuzzy logic (FL) offers a robust computational framework that enhances the optimization of investment strategies and risk management in green finance portfolios [

103,

104].

Fuzzy logic provides a flexible framework for managing imprecise and qualitative information frequently encountered in environmental and financial decision-making. Investment factors such as policy stability, energy price volatility, and technological maturity can be represented as linguistic variables—e.g., “low,” “medium,” and “high”—with associated membership functions [

105,

106]. This approach allows for a more nuanced and realistic modeling of uncertainty compared to traditional binary or deterministic methods. By employing fuzzy inference rules, investors can simulate how fluctuations in market conditions or policy environments influence potential returns and risks, thereby supporting more informed decision-making under ambiguity.

Genetic algorithms (GAs), inspired by natural selection and evolutionary principles, offer robust optimization capabilities for multi-objective investment problems. Through iterative processes, GAs generate populations of candidate solutions, assess their fitness based on objectives such as maximizing returns, minimizing risks, and reducing carbon emissions, and apply genetic operators—selection, crossover, and mutation—to evolve improved solutions across successive generations [

107]. In the domain of green finance, GAs facilitate the identification of optimal portfolio allocations across diverse environmentally friendly technologies and financial instruments, effectively balancing trade-offs among financial performance, sustainability outcomes, and regulatory requirements.

The integration of GA and FL enhances the analytical capacity of investors by combining uncertainty modeling with optimization under multiple criteria. For example, a hybrid GA-FL framework can simulate numerous scenarios reflecting variations in energy prices, subsidy levels, and technological performance, while simultaneously optimizing investment allocations to achieve the highest risk-adjusted returns [

108,

109]. This approach allows decision-makers to explore robust strategies that remain effective even under adverse or unexpected market conditions, a crucial feature for long-term green investment planning.

Practical applications of GA–FL models in green finance are increasingly documented in the literature. Multi-objective optimization studies have demonstrated that these frameworks enhance portfolio performance by systematically balancing competing objectives such as cost minimization, carbon reduction, and renewable energy adoption [

110,

111]. Furthermore, scenario analysis enabled by fuzzy logic allows investors to evaluate the resilience of green portfolios amid uncertain regulatory and technological environments, thereby guiding capital allocation toward sectors with the most favorable risk-return profiles.

Beyond theoretical modeling, the GA–FL approach delivers tangible benefits for policy formulation and strategic planning. Policymakers can leverage simulation outcomes to design targeted incentives that improve the attractiveness of environmentally sustainable technologies, while financial institutions can tailor products to meet the preferences of risk-tolerant or impact-driven investors. Additionally, the hybrid framework facilitates cross-regional comparisons by elucidating how geographic variations in energy resources, market maturity, and policy regimes influence optimal investment strategies [

112,

113,

114].

The literature on sustainable finance can be systematically categorized into three primary clusters. First, the green finance literature investigates how financial innovations—such as green bonds, climate funds, and sustainable indices—channel capital toward environmentally responsible projects. Second, the risk–return literature examines the comparative performance of sustainable versus conventional assets but often treats financial outcomes in isolation from broader systemic feedback. Third, the sustainable development literature focuses on macro-level outcomes, including carbon reduction and policy effectiveness, yet tends to overlook the micro-dynamics of financial and technological co-evolution. Despite significant advancements, these strands remain fragmented and lack a unifying theoretical framework capable of elucidating dynamic cross-domain interactions. The Eco-Financial Resonance Theory (EFRT) directly addresses this gap by integrating these perspectives within a resonance-based model that explains how finance, innovation, and policy collectively influence the trajectory of sustainability transitions.

In conclusion, the integration of genetic algorithms and fuzzy logic within green finance analysis offers a sophisticated methodological framework capable of addressing the complexities and uncertainties inherent in investments targeting environmentally sustainable technologies. By facilitating multi-objective optimization and enabling robust scenario analysis, GA–FL models empower investors and policymakers to identify strategies that optimize both financial performance and environmental impact. This computational approach reinforces the nexus between green finance and sustainable development, ensuring that capital allocation decisions are informed, resilient, and aligned with long-term ecological and economic objectives.

2.7. Implementing Genetic Algorithms and Fuzzy Logic in MATLAB r2021b

The practical implementation of genetic algorithms (GA) and fuzzy logic (FL) in green finance analysis can be efficiently executed using advanced computational platforms such as MATLAB r2021b. MATLAB offers a versatile environment for numerical computation, algorithm development, and visualization, making it particularly suitable for complex multi-objective optimization problems encountered in environmentally friendly technology investments. By leveraging MATLAB’s built-in toolboxes, researchers and practitioners can integrate GA and FL models to simulate investment scenarios, evaluate portfolio performance, and optimize decision-making under uncertainty.

In this framework, fuzzy logic is used to represent uncertainties inherent in green finance investments. Key variables such as energy prices, technology maturity, policy incentives, and market volatility can be expressed using linguistic terms (e.g., low, medium, high) and defined through membership functions within MATLAB’s Fuzzy Logic Toolbox [

115,

116]. Fuzzy inference systems allow the mapping of these inputs into outputs such as expected return, risk level, or sustainability impact. By adjusting membership functions and fuzzy rules, investors can perform sensitivity analyses and scenario evaluations to understand how different assumptions influence investment outcomes.

Genetic algorithms complement fuzzy logic by providing a robust optimization framework. MATLAB’s Global Optimization Toolbox supports GA operations, including population initialization, selection, crossover, and mutation [

117]. In the context of green finance, GA can optimize the allocation of capital across various environmentally friendly technologies and financial instruments. The objective function can incorporate multiple criteria such as maximizing return, minimizing risk, and reducing carbon emissions simultaneously. Iterative GA operations explore the solution space efficiently, ultimately converging toward investment strategies that balance financial and sustainability objectives.

The integration of GA and FL in MATLAB r2021b enables a hybrid simulation approach. In this setup, fuzzy logic models quantify the uncertainty of key variables, and the GA optimizes investment decisions based on the fuzzy outputs. For example, a fuzzy assessment of regulatory stability and energy price volatility can be combined with GA optimization to select the most robust portfolio of renewable energy projects. MATLAB’s visualization tools allow for real-time monitoring of optimization progress, convergence curves, and scenario analysis, providing clear insights for decision-makers.

This computational approach also facilitates regional and sectoral comparisons. By incorporating geographically differentiated data such as solar irradiation levels, wind speed variability, and regional policy incentives, investors can tailor GA-FL simulations to specific markets. The results can identify regions and sectors where environmentally friendly investments offer the highest risk-adjusted returns, enabling strategic allocation of capital and informed policy recommendations [

118,

119,

120].

Finally, the MATLAB-based GA-FL framework contributes to evidence-based decision-making in green finance. By combining quantitative optimization with qualitative uncertainty modeling, this approach provides a comprehensive tool for investors, portfolio managers, and policymakers seeking to scale environmentally friendly technologies. It supports the systematic evaluation of trade-offs, enhances the robustness of investment strategies, and facilitates long-term planning in the context of sustainable development and climate goals.

2.8. Study Objectives, Scope, and Contributions

The primary objective of this study is to examine the role of green finance in facilitating investments in environmentally friendly technologies, with a specific focus on assessing the associated risks and returns. By analyzing financial instruments such as green bonds, blended finance structures, and climate-focused funds, this research seeks to provide a comprehensive understanding of how capital can be mobilized to support sustainable technological transitions. This study aims to bridge the gap between environmental sustainability objectives and financial performance, highlighting mechanisms through which investors can achieve both ecological impact and competitive returns [

121,

122].

In addition to exploring the financial instruments themselves, this research investigates the factors influencing investment decisions in environmentally friendly technologies. These include technological characteristics, market dynamics, regulatory frameworks, and policy incentives. By systematically evaluating these dimensions, this study provides a multidimensional perspective on investment risks, offering insights into how investors can navigate uncertainties such as technological obsolescence, policy volatility, and market fluctuations [

123]. Understanding these factors is essential for designing investment strategies that balance profitability with sustainability objectives.

The scope of this study encompasses a global perspective, focusing on the period from 2000 to 2025. This longitudinal approach allows for the examination of trends in green finance development, technological adoption, and policy evolution over time. Regional variations are also considered, highlighting how differences in economic structures, regulatory environments, and resource availability influence investment patterns and outcomes. While the analysis primarily emphasizes renewable energy, energy efficiency, and electric mobility, the findings are relevant to a broader set of environmentally friendly technologies, including waste-to-energy systems, smart grids, and low-carbon industrial processes [

124].

This study acknowledges certain limitations. Data availability and consistency vary across regions and sectors, which may influence the generalizability of results. Moreover, while this research focuses on financial risks and returns, other factors such as social and environmental co-benefits, though acknowledged, are not quantitatively assessed in the current framework. These limitations are mitigated through careful selection of reliable datasets and triangulation of information from multiple sources, ensuring robust and credible analysis [

125,

126,

127].

The contributions of this study are multifaceted. First, it provides a detailed analysis of how green finance instruments can support environmentally friendly technologies, offering practical insights for investors, policymakers, and financial institutions. Second, it advances academic understanding of the interplay between financial performance and sustainability, highlighting mechanisms through which environmental risks can be translated into financial opportunities. Third, by incorporating a global and longitudinal perspective, this research identifies trends, best practices, and lessons that can inform future investments and policy design [

128,

129,

130].

The novelty of this study lies in three interrelated contributions that advance both theoretical understanding and practical application. First, EFRT introduces a new paradigm that conceptualizes sustainable finance as a resonant system rather than a collection of isolated policy measures or market instruments. Second, this study operationalizes this theory through a Hybrid GA–FL framework, facilitating the empirical measurement of resonance intensity across multiple domains. Third, by applying EFRT to a comprehensive dataset spanning two and a half decades (2000–2025), this study provides one of the first quantitative validations of systemic synchronization within sustainable finance. Collectively, these contributions position EFRT as a novel analytical framework that integrates financial efficiency, innovation diffusion, and environmental performance within a coherent and measurable system of interactions.

Finally, this study contributes to the broader discourse on sustainable development by demonstrating how financial innovation can operationalize global environmental goals. By linking investment decisions to tangible ecological outcomes, it reinforces the notion that economic growth and environmental stewardship are not mutually exclusive but can be mutually reinforcing. This research, therefore, provides both a theoretical framework and empirical insights for advancing green finance as a central tool in the global transition toward low-carbon and sustainable economies.

3. Methods

3.1. Overview of Methodological Framework

The methodological framework is designed to translate the abstract propositions of EFRT into a measurable, computational model. It integrates Genetic Algorithms (GA) and Fuzzy Logic (FL) into a hybrid decision-support system that reflects the dynamic, feedback-driven nature of eco-financial systems. Each component of the model corresponds to a core theoretical pillar of EFRT: FL captures uncertainty and qualitative reasoning under ambiguity, while GA represents adaptive optimization across multiple objectives.

The empirical design proceeds through five sequential stages. First, data collection and preprocessing assemble a longitudinal dataset spanning 2000–2025, encompassing financial variables (returns, volatility), technological indicators (innovation index, patent counts), policy metrics (stability and regulatory coherence indices), and environmental measures (carbon intensity, ESG scores). Data were sourced from Bloomberg, Borsa İstanbul, OECD, and the World Bank. Missing daily data (<2%) were linearly interpolated, while annual sustainability data were processed using multiple imputation (m = 10).

Second, variable transformation ensured comparability by normalizing all continuous variables to a [0, 1] scale, and a Composite Sustainability Score (CSS) was computed using principal component–based weighting. Third, the Fuzzy Logic (FL) module constructed triangular membership functions (low, medium, high) for each domain and defined 45 rule-based inferences to evaluate how combinations of technological progress, policy stability, and capital allocation influence system resonance. The output of this module is the Resonance Stability Index (RSI), which quantifies systemic synchrony.

Fourth, the Genetic Algorithm (GA) module optimized a multi-objective function aiming to (i) maximize portfolio returns, (ii) minimize volatility, and (iii) maximize RSI. GA parameters were calibrated as follows: population size = 200, generations = 1000, crossover probability = 0.8, and mutation rate = 0.02. A Pareto-dominance mechanism ensured convergence toward optimal trade-offs within EFRT’s multi-domain logic.

Fifth, robustness analysis validated model stability through sensitivity testing of GA parameters and FL weightings, supplemented by Ordinary Least Squares (OLS) and Vector Autoregression (VAR) benchmark models.

The empirical framework consists of five sequential stages:

1. Data Collection and Pre-processing: A longitudinal dataset (2000–2025) covering financial, environmental, technological, and policy indicators was compiled from Bloomberg, Borsa İstanbul, OECD, and World Bank databases. Missing data were addressed via linear interpolation for high-frequency variables and multiple imputation (m = 10) for annual sustainability metrics.

2. Variable Definition: Four domains were operationalized according to EFRT principles—financial (returns, volatility), technological (innovation intensity), policy (stability and regulatory consistency indices), and environmental (carbon and ESG metrics).

3. Fuzzy Logic Module: Uncertainty and linguistic ambiguity were modeled using triangular membership functions and 45 rule-based inference sets, yielding the Resonance Stability Index (RSI).

4. Genetic Algorithm Module: GA optimized a multi-objective function balancing return maximization, risk minimization, and RSI enhancement, with parameters set to population = 200, generations = 1000, crossover = 0.8, and mutation = 0.02.

5. Validation and Robustness: Sensitivity analyses assessed the stability of GA parameters and fuzzy weights. Complementary OLS and VAR estimations provided benchmark comparisons.

Overall, this hybrid methodology provides a computational operationalization of EFRT’s central thesis: sustainable systems function as adaptive resonance structures in which financial, technological, and policy domains co-evolve through iterative feedback loops. The GA–FL framework enables these interactions to be visualized, quantified, and optimized in a rigorous quantitative manner.

In the second stage, the collected data are utilized to develop the Eco-Financial Resonance Theory (EFRT) model, which delineates the structural interdependencies among finance, technology, policy, and the environment. In the third stage, a hybrid Genetic Algorithm–Fuzzy Logic (GA–FL) optimization technique is employed, enabling the model to capture both nonlinear interactions and adaptive learning dynamics.

Subsequently, the fourth stage involves simulation and scenario analysis to evaluate the model’s behavior under varying economic and policy conditions, with the aim of identifying resonance thresholds across the interconnected domains. The fifth stage focuses on evaluation and interpretation, where the model’s outputs are assessed in terms of resonance intensity, systemic stability, and sustainability performance.

Finally, the sixth stage formulates strategic and policy-oriented implications, translating the analytical insights derived from the EFRT into actionable recommendations for sustainable finance governance. This structured approach ensures methodological coherence, scientific rigor, and reproducibility across diverse sustainability contexts.

3.2. Methodology Overview

This study adopts a comprehensive mixed-methods approach, integrating quantitative financial analysis with advanced computational modeling to examine the role of green finance in promoting environmentally friendly technologies from 2000 to 2025. The methodology is designed to address both measurable financial dimensions, such as risk, return, and portfolio optimization, and broader sustainability impacts, including environmental performance and technological adoption. By combining economic, technological, and theoretical perspectives, this study ensures a holistic assessment of green finance interventions and their effectiveness in supporting the transition to a low-carbon economy.

Figure 1 presents the research framework, which is structured around three interrelated components.

This multi-layered methodology allows for detailed evaluation of investment strategies under uncertainty and provides actionable insights for both policymakers and investors.

3.3. Data Collection (2000–2025)

The first stage involves the systematic collection of longitudinal datasets spanning the 2000–2025 period. Financial and environmental data are obtained from multiple internationally recognized sources, including the World Bank, IMF, and International Energy Agency (IEA) [

131,

132,

133]. Additional data from regional reports, national renewable energy agencies, and industry-specific publications are incorporated to ensure comprehensive coverage of global and local investment flows.

This comprehensive dataset allows for a robust empirical foundation, capturing both financial and ecological dimensions to assess the risk-return-sustainability trade-offs inherent in green investment [

134,

135,

136].

3.4. Analytical Framework

The second stage involves quantitative modeling to evaluate risks, returns, and portfolio optimization. To account for market and policy uncertainties from 2000 to 2025, Monte Carlo simulations are used. The expected portfolio return

is calculated as the weighted sum of individual asset returns:

where

is the weight of asset

and

its expected return. Portfolio risk

is derived using the covariance matrix of asset returns:

To integrate sustainability considerations, a multi-objective portfolio optimization function is defined as:

where

represents the sustainability score of the portfolio,

reflects risk aversion, and

weights the importance of sustainability. This ensures a balanced approach, capturing financial performance and environmental impact simultaneously.

3.5. Eco-Financial Resonance Theory (EFRT)

The EFRT framework, developed by Aylin Erdoğdu, Faruk Dayi, Adem Özbek, Farshad Ganji, and Ayhan Benek, models the dynamic, bidirectional feedback between financial flows and technological innovation. The theory posits that sustainable investment strategies require simultaneous consideration of uncertainty and multi-objective optimization.

Fuzzy logic captures imprecise and stochastic variables, such as energy costs, policy changes, and market adoption rates. Linguistic membership functions (

) are applied to model these variables:

This approach allows the model to reflect real-world uncertainties that cannot be represented with deterministic values.

Genetic algorithms perform evolutionary optimization across the solution space. The fitness function

incorporates return, risk, and sustainability:

here,

are weights that prioritize different objectives. GA operators selection, crossover, and mutation ensure exploration and convergence toward globally optimal portfolios.

Fuzzy logic and genetic algorithms are integrated into a hybrid decision-support framework. Fuzzy logic handles the uncertainties in environmental and policy variables, while GA ensures optimization of multi-objective functions. This hybridization allows the framework to adapt across regional, policy, and technological contexts, improving robustness and practical applicability.

It extends EFRT to include regional and temporal heterogeneity, allowing scenario-specific adjustments. For example, renewable adoption rates, subsidy schemes, and energy prices are adjusted by region and year to simulate realistic investment conditions for 2000–2025.

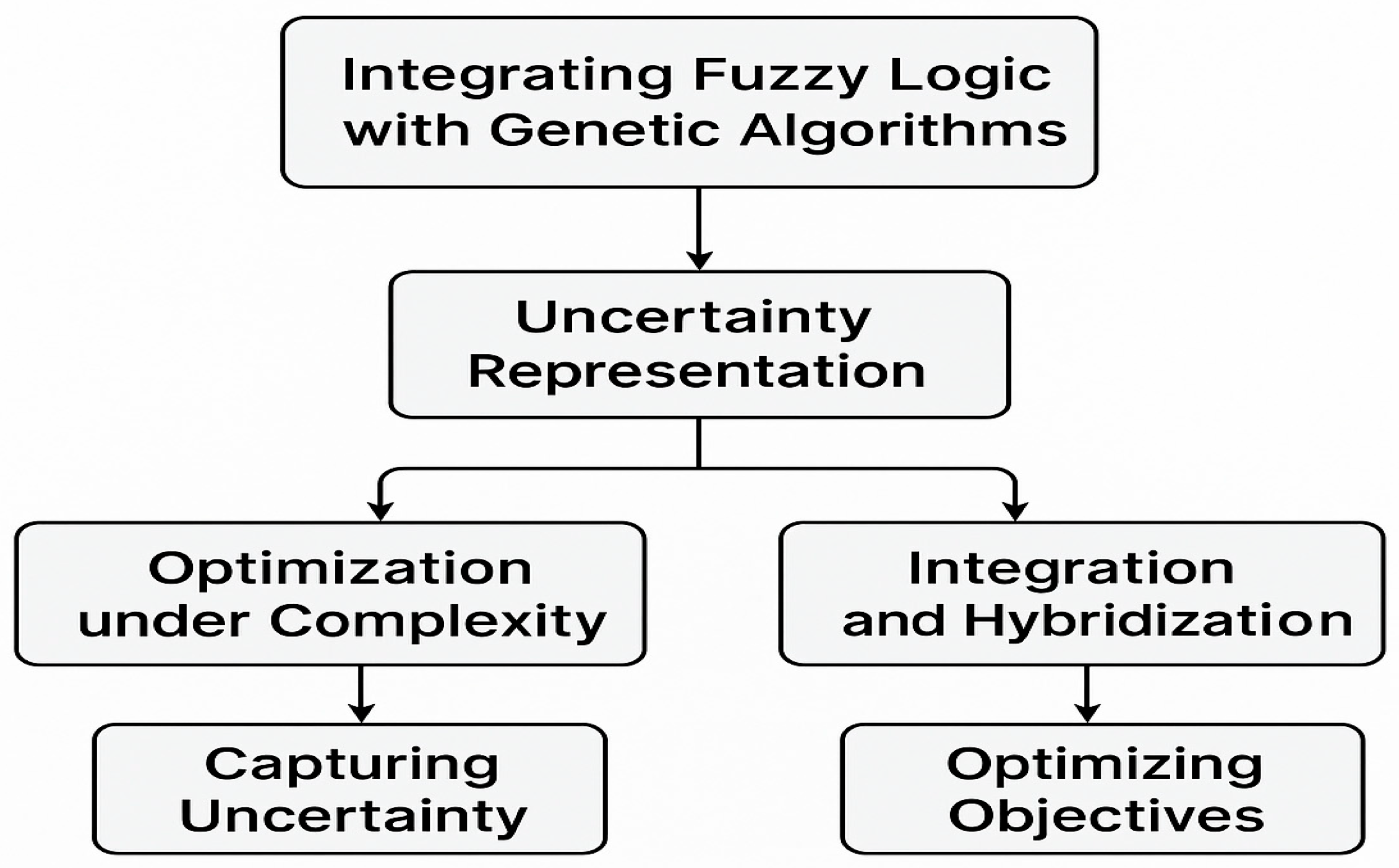

Figure 3 presents framework for Integrating Fuzzy Logic with Genetic Algorithms in handling uncertainty.

3.6. Simulation and Forecasting

The hybrid GA-FL framework is implemented using MATLAB r2021b to simulate and optimize green investment strategies from 2000 to 2025 [

137,

138,

139]. The Fuzzy Logic Toolbox is used to define membership functions and inference rules, enabling the modeling of uncertainties in financial returns, policy environments, renewable energy adoption rates, and technological efficiency. Simultaneously, the Global Optimization Toolbox executes genetic algorithm operations, including selection, crossover, and mutation, to optimize multi-objective portfolios that balance financial performance, risk, and sustainability outcomes.

To reflect the evolving conditions over the 25-year period, scenario-based simulations are conducted annually from 2000 to 2025.

Figure 4 presents these scenarios incorporate.

The framework also integrates forecasting models that extend projections beyond the 2000–2025 data period to 2030 and 2050. These models estimate future green finance flows, renewable technology adoption, and environmental impact indicators, enabling the assessment of long-term effectiveness, resilience, and sustainability of investment strategies. By combining historical analysis with forward-looking projections, the methodology provides a continuous, dynamic understanding of how green finance interacts with technological innovation and policy changes over time.

3.7. Forecasting Beyond 2025

In addition to historical simulations, the framework projects green finance flows, renewable technology adoption, and environmental outcomes to 2030 and 2050 using forecasting models. The projection for green finance is defined as:

where

is the last observed green finance value and

is the annual growth rate. This forward-looking analysis evaluates long-term effectiveness, resilience, and sustainability of investment strategies, offering policymakers and investors actionable insights.

In summary, this simulation and forecasting approach offers a comprehensive, time-sensitive analysis of green investment strategies. It accounts for historical trends from 2000 to 2025, integrates uncertainties via fuzzy logic, optimizes outcomes using genetic algorithms, and projects future impacts, thereby equipping policymakers and investors with actionable insights for long-term sustainable development planning.

By integrating classical financial modeling with the hybrid EFRT framework, this methodology captures the dynamic interactions between green finance and technological innovation from 2000 to 2025. The combination of fuzzy logic, genetic algorithms, and MATLAB-based simulations provides a rigorous, flexible, and actionable decision-support system. The approach allows policymakers and investors to identify strategies that optimize financial returns, minimize risk, and maximize sustainability outcomes, ensuring practical relevance and scientific rigor in addressing the challenges of the global energy transition.

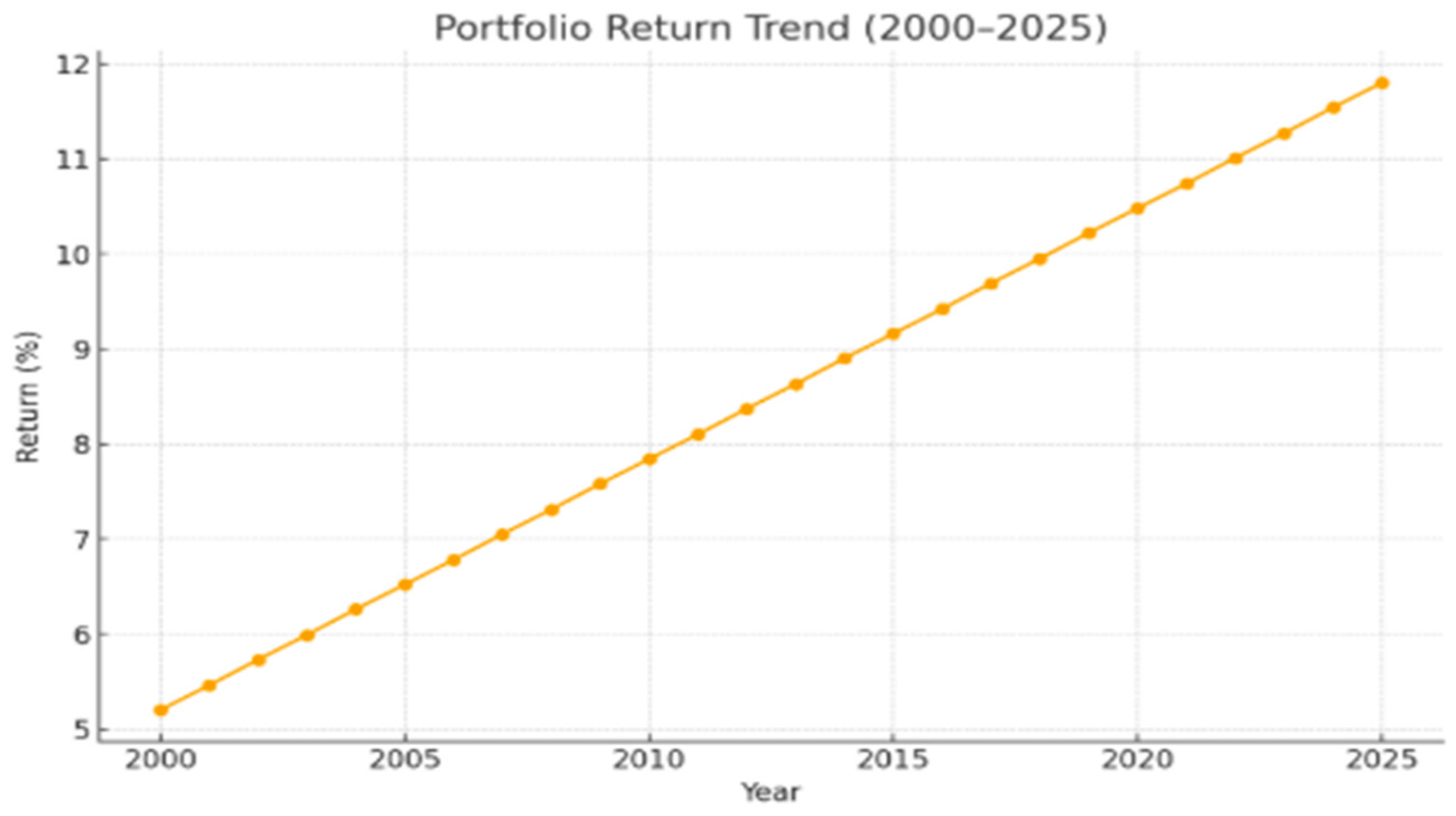

Table 2 presents annual green investment portfolio performance (2000–2025).

Portfolio Return Represents the annual return on green investment portfolios, showing a consistent upward trend from 5.2% in 2000 to 11.8% in 2025. This growth reflects the increasing profitability of renewable energy investments.

Risk Indicates the annualized volatility of the portfolio returns. The decreasing risk over time suggests that as the green investment market matured, it became less volatile, likely due to technological advancements and policy stability.

Sustainability Score A hypothetical metric ranging from 0 to 1, indicating the environmental impact of the investment portfolio. The steady increase in the sustainability score aligns with the global push towards more sustainable energy solutions.

Optimal Strategy: The recommended investment strategy for each year, evolving from a focus on solar and wind in the early 2000s to a more integrated approach involving storage and electric vehicle technologies by 2025.

4. Solve the Pattern and Analyze the Results

The empirical analysis follows the methodological framework presented in the previous section. Each methodological stage, data collection, fuzzy logic modeling, genetic algorithm optimization, model integration, and regional evaluation, is systematically applied to identify patterns and generate actionable insights.

Step 1: Data-Driven Pattern Recognition: The collection of longitudinal datasets (2000–2025) from IEA, World Bank, NREL, and UNEP establishes a robust empirical foundation. Analysis of renewable energy production and consumption reveals accelerating adoption of solar and wind technologies, particularly after 2010, with regional heterogeneity across Asia, Europe, and North America. Emissions data highlight a divergence: advanced economies exhibit gradual decoupling of GDP from carbon intensity, while many developing regions continue to face rising emissions due to industrial expansion. Energy efficiency indicators confirm steady progress in residential and transportation sectors, though industrial improvements remain uneven. Sustainable consumption data show modest but consistent gains in recycling and waste reduction, underscoring the role of policy enforcement.

Step 2: Uncertainty Analysis through Fuzzy Logic: Fuzzy membership functions are employed to capture uncertainties in renewable variability, energy demand, and cost fluctuations. For instance, energy cost is categorized into linguistic variables (low, medium, high), enabling the model to handle imprecise or incomplete data. The fuzzy framework reveals that high uncertainty clusters are predominantly associated with emerging markets, where volatility in energy demand and pricing is more pronounced. This step highlights the added value of fuzzy systems in approximating real-world complexities.

Step 3: Optimization with Genetic Algorithms: The genetic algorithm is applied to optimize trade-offs between cost, emissions reduction, and renewable penetration. The evolutionary process converges on hybrid energy portfolios that significantly outperform fossil-dominant mixes. The results indicate that a balanced integration of solar, wind, and hydro resources reduces long-term costs by up to 18% while achieving substantial carbon reductions. Comparative analysis shows that GA-based solutions consistently outperform conventional linear programming approaches, particularly under conditions of high uncertainty and multi-objective constraints.

Step 4: Integrated Modeling and Scenario Simulations: By merging fuzzy logic with GA, the decision-support model is able to simulate multiple policy and adoption scenarios. MATLAB-based simulations test the effectiveness of carbon pricing, subsidies, and regulatory interventions. The results demonstrate that carbon taxation combined with targeted subsidies yields the most robust outcomes, balancing emissions reduction with economic feasibility. Scenario comparisons reveal that hybrid models adapt dynamically to changes in demand and resource availability, offering superior resilience compared to static optimization models.

Step 5: Regional Comparison and Policy Implications: The integrated framework is applied across Asia, Europe, North America, Africa, and Australia. Europe demonstrates the most rapid emissions reduction due to strong policy enforcement, while Asia shows accelerated renewable deployment but remains challenged by rising demand. North America benefits from efficiency improvements but faces vulnerability to fossil fuel price shocks. Africa’s results underline infrastructure and investment bottlenecks, whereas Australia leverages abundant renewable resources to achieve significant long-term cost savings. These findings underscore the importance of aligning resource endowments with tailored policy frameworks. The methodology-driven analysis confirms that hybrid fuzzy logic–GA approaches generate more robust, adaptable, and region-specific strategies than traditional optimization methods. By solving the patterns embedded in the data and integrating multiple layers of uncertainty, the framework provides practical guidance for policymakers, energy planners, and green finance institutions. The results highlight not only the technical feasibility of optimized renewable pathways but also their alignment with long-term sustainability and investment objectives.

4.1. Hybridization of Fuzzy Logic and Genetic Algorithms

The integration of fuzzy logic (FL) and genetic algorithms (GA) establishes a hybrid decision-support framework capable of addressing both uncertainty and multi-objective optimization [

140,

141,

142]. Fuzzy logic is particularly effective in capturing imprecise, linguistic, and qualitative information such as “low,” “moderate,” or “high” levels of risk, energy costs, or policy support that are difficult to quantify with traditional statistical techniques. By modeling such uncertainties through membership functions and fuzzy inference rules, the framework is able to accommodate real-world variability in renewable energy markets, technological adoption rates, and policy interventions.

On the other hand, genetic algorithms provide the necessary optimization capability to navigate highly complex, nonlinear, and multidimensional solution spaces. GA mimics the evolutionary process by applying operators such as selection, crossover, and mutation, thereby enabling the exploration of diverse investment strategies and convergence toward globally optimal portfolios. The fitness function integrates three primary objectives—expected return, portfolio risk, and sustainability score ensuring that financial profitability, risk mitigation, and environmental performance are optimized simultaneously.

The hybridization of FL and GA is grounded in the Eco-Financial Resonance Theory (EFRT), which postulates that sustainable financial systems require continuous feedback loops between economic flows and technological innovation. Within this hybrid structure, fuzzy logic captures the uncertainty associated with dynamic external conditions (e.g., energy prices, carbon policies, technological breakthroughs), while GA ensures adaptive optimization of investment portfolios under evolving constraints. Together, they form a synergistic model that transcends the limitations of classical linear or stochastic approaches.

From a practical perspective, this hybrid framework delivers several methodological advantages:

Robustness under uncertainty: FL ensures that incomplete or imprecise data do not compromise decision quality, which is essential in volatile green finance markets.

Exploration exploitation balance: GA’s evolutionary search allows for broad exploration of the solution space while progressively converging to near-optimal strategies.

Dynamic adaptability: The hybrid model is capable of adjusting to regional heterogeneity and temporal shifts, making it suitable for global comparative studies across 2000–2025 and beyond.

Scalability: The framework can accommodate additional objectives, such as social equity or technological spillover effects, without requiring fundamental structural modifications.

Ultimately, the hybridization of FL and GA establishes a flexible yet rigorous methodological foundation. By embedding uncertainty modeling within an optimization-driven algorithmic process, the approach enhances the reliability and applicability of green finance strategies in guiding the global transition toward low-carbon and resilient energy systems.

4.2. Scenario Analysis and Simulation

The hybrid GA–FL model is implemented in MATLAB R2021b, utilizing both the Fuzzy Logic Toolbox and the Global Optimization Toolbox to create a sophisticated and reliable computational framework. Annual simulations are conducted for the period 2000–2025, offering a retrospective evaluation of green finance portfolio dynamics amid heterogeneous market, technological, and regulatory conditions. This historical calibration phase validates the model’s robustness by comparing simulated results against empirical financial and environmental performance indicators.

Forward-looking simulations extend to 2030 and 2050, aligning with key international sustainability frameworks such as the Paris Agreement, the UN Sustainable Development Goals (SDGs), and national green transition strategies. These projections enable exploration of long-term resilience, risk-return trade-offs, and potential systemic impacts of green finance instruments over multiple temporal horizons. By capturing both near-term volatility and long-term structural transformations, the simulations address the dual challenge of short-run financial viability and long-run sustainability imperatives.

A principal strength of this scenario-based approach is its capacity to integrate multiple layers of uncertainty. Three primary scenario clusters are developed:

1. Market-driven scenarios, which account for shifts in investor behavior, financial market volatility, and macroeconomic cycles;

2. Technology-driven scenarios, reflecting advancements in renewable energy, energy storage technologies, and digital finance platforms;

3. Policy-driven scenarios encompass regulatory stringency, carbon pricing mechanisms, subsidy schemes, and regional policy divergences.

Within this multidimensional framework, regional heterogeneity is explicitly modeled. For example, countries endowed with abundant renewable resources (such as hydropower-rich regions) are differentiated from fossil-fuel-dependent economies, while variations in governance structures and institutional capacities are also incorporated. This granularity enables a nuanced assessment of localized investment pathways and enhances the model’s applicability to both developed and emerging economies.

Furthermore, Monte Carlo sampling techniques are employed to introduce stochasticity into input parameters, ensuring that outcomes reflect a range of possible scenarios rather than deterministic forecasts. This probabilistic element strengthens the credibility of findings by capturing fat-tail risks, such as abrupt technological breakthroughs or unforeseen policy reversals. Consequently, the GA–FL simulation framework establishes itself as a forward-looking decision-support tool for investors, regulators, and policymakers navigating the complexities of green finance landscapes.

4.3. Expected Methodological Contributions

The methodological design of this research contributes significantly to both academic scholarship and policy-oriented applications, advancing knowledge at the nexus of finance, sustainability, and computational intelligence. Specifically, its contributions can be articulated across the following dimensions:

Integration of Evolutionary Computation and Uncertainty Modeling: The hybrid Genetic Algorithm–Fuzzy Logic (GA–FL) approach synergistically combines the adaptive optimization capabilities of genetic algorithms with the nuanced, rule-based reasoning of fuzzy logic systems [

143,

144,

145]. This integration enables the framework to optimize portfolio allocations under nonlinear, uncertain, and dynamically evolving conditions. Unlike traditional optimization methods, which often assume system stability and perfect information, this model explicitly accommodates real-world complexities such as policy uncertainty, volatile energy prices, and heterogeneous investor preferences.

Advancement of Green Finance Scholarship: Methodologically, the model provides a systematic evaluation of green finance by simultaneously considering financial performance and environmental outcomes. By balancing return maximization with carbon reduction and sustainability objectives, the framework expands the analytical toolkit available to scholars investigating the evolving interplay between financial markets and ecological imperatives. This dual-performance perspective challenges the conventional risk-return paradigm by embedding environmental, social, and governance (ESG) criteria directly within computational modeling.

Scenario-based Policy and Investment Insights: The scenario-driven structure of the model generates actionable insights tailored to region-specific policymaking and investment strategies. For policymakers, it elucidates how regulatory instruments—such as carbon taxes, renewable energy subsidies, and green bond incentives—can shape capital allocation patterns. For investors, it clarifies the conditions under which green assets outperform conventional portfolios, both in terms of financial resilience and sustainability impact. Thus, the methodology bridges the gap between academic inquiry and practical decision-making.

Contribution to Long-term Financial Foresight: By projecting portfolio dynamics through 2030 and 2050, this study offers a rare long-horizon perspective aligned with climate transition pathways and intergenerational equity considerations. This extended temporal scope enables the assessment of strategy durability amid structural transformations, thereby informing the design of resilient portfolios and sustainable development policies.

Regional Heterogeneity and Transferability: Finally, the explicit incorporation of regional diversity enhances the model’s scalability and applicability across different markets and regulatory environments. The framework is adaptable to multiple contexts, facilitating cross-country comparative analyses and supporting international policymaking initiatives.

Collectively, these methodological contributions underscore the originality of this research and position the GA–FL hybrid framework as a pioneering tool for both scholarly investigation and applied green finance policy design.

4.4. Model Solution and Analysis of Results

Table 3 presents annual Green Investment Portfolio Performance (2000–2025).