Abstract

Reducing energy intensity is a critical measure for promoting sustainable industrial development and achieving high-quality economic growth. Based on enterprise survey data provided by the World Bank from 2011 to 2013, this paper empirically examines the impact and underlying mechanisms of technological innovation capability on the energy intensity of manufacturing enterprises in China and India. The study finds that an improvement in an enterprise’s technological innovation capability can significantly reduce its energy intensity. Specifically, when an enterprise’s technological innovation capability increases from the 25th to the 75th percentile of its distribution, its energy intensity decreases by an average of 11.22%. This conclusion remains robust after a series of robustness checks. Heterogeneity analysis reveals that the energy-saving effect of technological innovation is significant only in the Chinese sample, but not in the Indian sample. Furthermore, this effect is more pronounced in larger, more capital-intensive enterprises. Further mechanism analysis indicates that improvements in production efficiency and enhancements in operational flexibility are effective mediating channels through which technological innovation reduces energy intensity. This study provides micro-level evidence for the theoretical proposition of a green transition driven by technological innovation in the context of emerging markets. It also offers policy implications for China and India to formulate differentiated energy conservation and emission reduction policies and to promote the green upgrading of their manufacturing sectors.

1. Introduction

Global climate change and energy security have become severe challenges facing all countries in the 21st century [1]. How to balance economic growth with energy consumption and promote a green and low-carbon transition of the economy and society is a critical issue that urgently needs to be addressed. Energy intensity, a key metric for gauging energy efficiency and the level of sustainable economic development, is of paramount strategic importance, particularly for developing countries facing tightening resource constraints. A reduction in energy intensity signifies achieving greater economic output with less energy input. Against this backdrop, an in-depth exploration of the driving mechanisms of energy intensity is not only an intrinsic requirement for formulating national energy and climate policies but also a crucial entry point for tackling global energy and environmental crises.

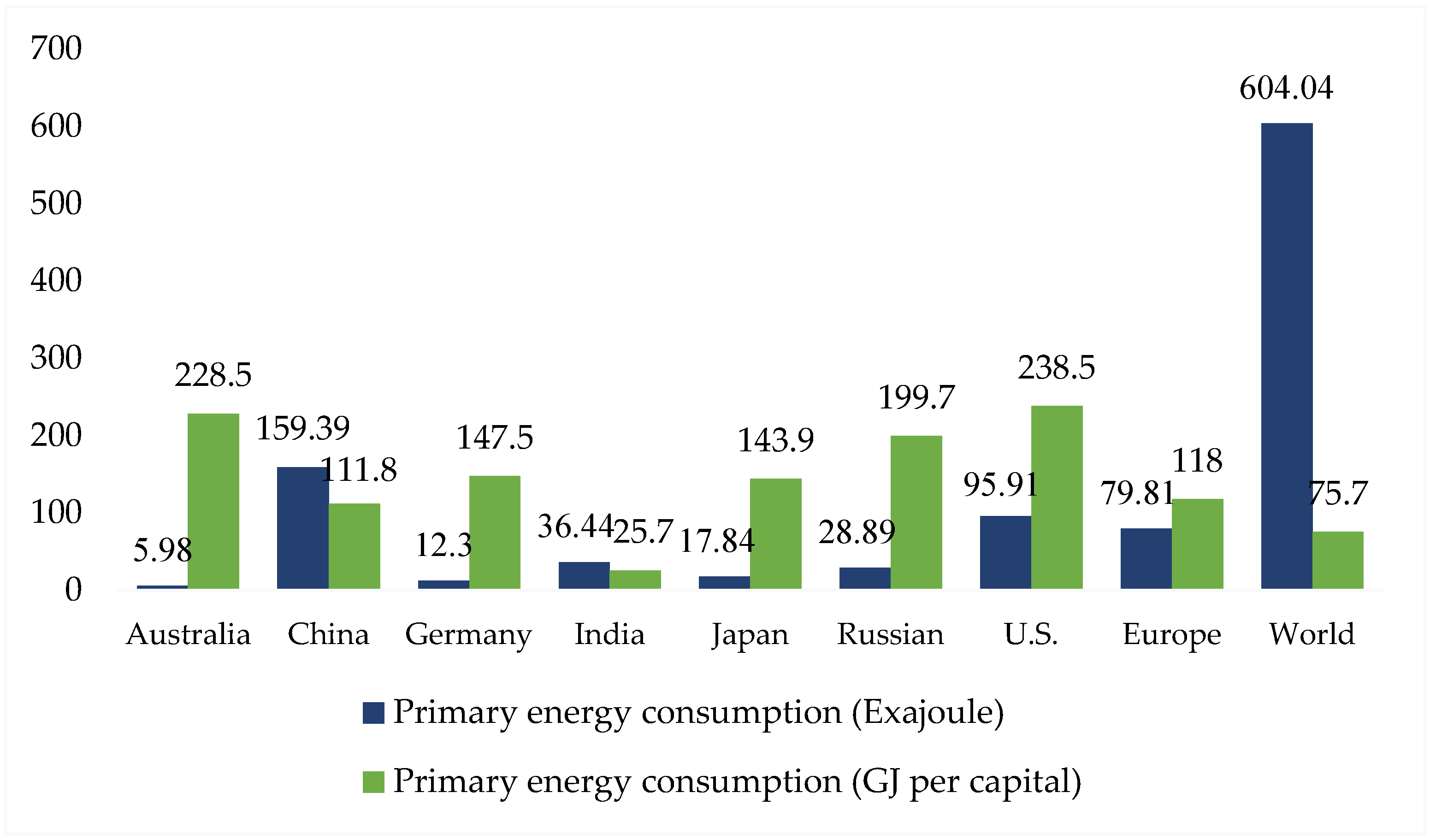

As the world’s two most populous and rapidly growing developing nations, China and India rely on their manufacturing sectors as primary engines for industrialization and modernization. However, these sectors are also the main sources of their energy consumption and carbon emissions. According to data from the Energy Institute [2], in 2022, China was the world’s largest energy consumer in 2022, with its primary energy consumption reaching 159.39 exajoules (EJ), India ranked as the third-largest consumer, with a primary energy consumption of 36.44 EJ in the same year (Figure 1). Both nations face severe pressures from the imbalance between energy supply and demand, as well as the need for environmental protection. In response, China has proposed its “dual carbon” targets and is vigorously promoting a green transformation of its manufacturing sector. Similarly, India is actively encouraging industrial upgrading and energy efficiency improvements through strategies such as “Make in India”.

Figure 1.

Primary Energy Consumption and Corresponding Per Capita Energy Consumption by Country or Region, Source: Energy Institute, 2023.

Technological innovation capability is a key ability for enterprises to effectively absorb, improve, and create new technologies [3]. It encompasses product innovation capability and process innovation capability, among others, and represents a holistic systemic capacity of the enterprise [4]. While existing research widely recognizes technological innovation capability as a key factor influencing energy intensity [5,6], the conclusions remain contested and reveal several research gaps: First, there is no consensus on the impact of technological innovation capability on energy intensity. Some studies suggest that corporate technological innovation can reduce energy intensity [7,8], while others find that an enhancement in technological innovation capability does not necessarily lead to a decrease in energy intensity [9]. Second, the existing literature predominantly focuses on single-country contexts [6,10,11], lacking a systematic comparison that places different countries within the same analytical framework. Third, most studies either use single indicators like R&D investment or patent counts to measure technological innovation capability [12,13], which fail to fully capture the actual innovation activities of firms, or they focus on meso- and macro-level analyses at the national or industry level [11,14,15], lacking direct evidence from the micro-level of individual firms.

To address these research gaps, this paper focuses on the following core questions: First, does the technological innovation capability of Chinese and Indian firms have a significant impact on their energy intensity? Second, are there systematic differences in this impact between manufacturing firms in China and India? Third, does the impact of technological innovation capability on energy intensity exhibit heterogeneity across different industries and types of enterprises? Fourth, what are the underlying mechanisms through which technological innovation capability affects energy intensity in Chinese and Indian firms? To this end, this paper uses firm survey data from the World Bank for 2011–2013 to construct an econometric model and empirically test the impact and mechanisms of technological innovation capability on energy intensity in Chinese and Indian firms.

Compared to the existing literature, the marginal contributions of this paper are as follows: First, it breaks through the limitations of single-country studies by taking China and India, two major developing manufacturing powers, as research subjects. Through comparative analysis, it clarifies the context-dependent and universal patterns of the “technological innovation capability-energy intensity” relationship, enriching the cross-national comparative perspective of innovation theory and environmental economics. Second, it constructs a composite indicator system for technological innovation capability, comprehensively incorporating multi-dimensional indicators such as equipment upgrades, technology licensing, and production process improvements. Compared to traditional single indicators (e.g., R&D investment, patent counts), this system can more comprehensively and accurately characterize a firm’s actual innovation capability. Third, focusing on the micro-enterprise level and based on World Bank enterprise survey data, it provides direct empirical evidence from firm behavior for the relationship between technological innovation and energy intensity, avoiding the masking of micro-level heterogeneity that can occur with meso- and macro-level data, thus making the research conclusions and policy recommendations more targeted and actionable.

The remainder of the paper is structured as follows: in Section 2, a review of the related literature is presented. In Section 3, the data sources, selection and construction of variables, and specifying the research methodology are elucidated. In Section 4, the empirical results are reported, including baseline regression, robustness checks, heterogeneity analysis, and mechanism tests. In Section 5, a further economic benefit analysis is performed, and all the results are discussed. In Section 6, a conclusion is offered, and the research shortcomings of this study are explained.

2. Literature Review

2.1. Technological Innovation Capability

For the definition of technological innovation capability, the academic community has not yet reached a unified conclusion. Lall [3] defined technological innovation capability as the skills and knowledge needed to effectively absorb, master and strengthen existing technologies and create new technologies. According to Barton [16], the core of an enterprise’s technological innovation capability is constituted by its individuals who possess professional knowledge, technological systems, managerial systems, and the values embodied by the enterprise. According to Hansen and Ockwel [17], technological innovation capability refers to the organizational systems, knowledge, skills, and expertise required to create and manage technological change. Ghisetti et al. [18] suggested that technological innovation capability is the result of the combination of human capital and knowledge gained via research and development (R&D) activities. According to Wang et al. [19], technological innovation capability is the ability of an entity to apply novel ideas to production and convert them into economic value through the integration of its innovation resources. In conclusion, it encompasses the entire spectrum of elements within the innovation process, constituting a systemic organizational capability.

This study aims to investigate the correlation between corporate-level energy intensity and technological innovation capability. Therefore, it is crucial to measure and analyse technological innovation capability. Among the many approaches, the single-indicator approach has been adopted by some scholars. Under this approach, the measurement of technological innovation capability is based on two main perspectives. The first perspective is based on the R&D investment perspective, where R&D investment is used to measure the technology indicator [12,20]. In the innovation literature, scholars have focused more on whether an increase in R&D investment indeed leads to more technological innovation [21]. Boly et al. [22] argued that R&D investment not only represents the financial investment of a company into innovation but also provides insights into its strategic activities, which are crucial for enhancing technological innovation capability. Through a study of 139 Greek manufacturing small-to-medium size enterprises (SMEs), Rothaermel and Hill [23] found that sustained investment in R&D promotes the creation and expansion of technological knowledge, which enables firms to stay abreast of cutting-edge technologies, leading to the enhancement and development of technological innovation capability [24]. However, R&D investment reflects only the inputs to the technological innovation process and does not measure outputs; thus, reliance on a single indicator when measuring technological innovation capability is limiting.

The second approach involves using patent data to measure the level of technological innovation capability from the perspective of R&D output [25]. Researchers believe that patent data can better reflect the current technological innovation capability of a firm and can effectively enable the delineation of process innovation from product innovation in R&D investment [26]. However, using R&D output alone to represent technological development may lead to inaccuracies because the development of technological innovation capability can occur at any stage of the production process [27]. Some smaller technological activities, such as engineering, research, quality management and design, are more important than R&D activities. Therefore, R&D output, as a key indicator of technology, may underestimate the importance of learning and innovation activities [28].

Thankfully, some studies have examined other comprehensive technology indicators to assess firms’ technological innovation capability. For example, Lall [3,29] and Wignaraja [28] advocated the construction of a comprehensive evaluation index system for firm technological innovation capability from nine dimensions, including technological linkage, process improvement, R&D activities, and equipment upgrading. Yam et al. [30] proposed a framework for analysing technological innovation capability from seven dimensions based on a functional perspective; these dimensions include organization, strategic planning, learning and R&D. Forés and Camisón [31], based on the results of the system dynamic model, considered four aspects—R&D capability, resource capability, organizational management capability and financial capability—when measuring technological innovation capability. Camisón and Villar-Lópe [32] chose to measure technological innovation capability from seven dimensions, including learning capability, R&D capability, and resource operation capability.

2.2. Energy Intensity and Its Influencing Factors

To a certain extent, energy intensity can reflect energy efficiency [33,34]. At the macro level, the predominant definition of energy intensity in existing studies is the ratio of energy consumption to total industrial value added [35]. At the micro level, there are three main views on the definition of energy intensity: Bu et al. [36] Huang and Chen [37] considered energy intensity as the amount of energy consumed per unit of output, while Haider et al. [38] and Chen et al. [39] defined energy intensity as the ratio of the energy input to the energy output of a production process. Unlike the former two, Golder and Sahu et al. [5,6] argued that energy intensity is more reasonably gauged by the ratio of electricity and fuel expenditures to net sales.

In recent years, the increase in greenhouse gas emissions has propelled a growing emphasis on enhancing energy efficiency and attaining sustainable economic development, garnering particular attention in developing nations such as China and India. In the literature on energy intensity reduction, scholars have recognized that technological advancements [40,41], effective firm management practices [1,34,42], and other firm-specific characteristics play pivotal roles in elucidating the dynamics of energy intensity transformation. In this context, we provide a concise overview of these influencing factors while placing particular emphasis on the paramount significance of technological advancements.

2.2.1. Impact of Technological Innovation on Energy Intensity

Technological innovation serves as the most efficacious instrument for firms to address climate challenges and facilitate the implementation of low-carbon development. The utilization of cutting-edge technology can effectively curtail pollutant emissions per unit of output while enhancing resource efficiency [43,44]. Consequently, extensive investigations have been carried out on technological innovation. Fisher-Vanden et al. [11] used data from Chinese firms to explore the correlation between technological development and energy intensity. Their findings suggest that the primary driving forces behind China’s decrease in energy consumption during 1997–1999 were rising energy prices, R&D expenditure, corporate sector ownership reform, and changes in industrial structure. Huang and Chen [37] used 30 provincial-level data sets in China from 2000 to 2016 to examine the impact of technological factors on energy intensity and noted that local R&D play a leading role in reducing energy intensity. Voigt et al. [15] reached a comparable conclusion through an examination of energy data from 40 major economies, explaining the reasons behind the global decrease in total energy intensity. Sun et al. [13] examined the impact of domestic and foreign technological innovation on energy intensity based on data from 24 innovative countries over the period from 1994 to 2013. Their findings also suggested that technological innovation is one of many factors contributing to energy efficiency improvement across different nations, with foreign innovation exerting a greater influence than domestic innovation. Therefore, it is imperative to encourage national policymakers to promote indigenous innovation and technological upgrading while enhancing their ability to assimilate novel technology.

Although most studies affirm the positive role of technological progress on energy intensity, some research has also revealed that the effect of technological innovation capability on energy intensity is characterized by significant heterogeneity and uncertainty. Notably, the impact varies considerably across different types of technologies (or sources of R&D funding) [9]. This conclusion was subsequently supported by the theoretical analysis of Mashhadi Rajabi [45] and the empirical results of Steren et al. [46]. Given these theoretical controversies, this paper proposes the following hypothesis:

Hypothesis 1.

A firm’s technological innovation capability can significantly reduce its energy intensity.

For manufacturing enterprises, the introduction of technological innovation can systematically reshape a firm’s production model by enhancing production efficiency and increasing operational flexibility, ultimately leading to a sustained reduction in energy intensity. Regarding the enhancement of production efficiency, Hilty and Aebischer [47] pointed out that technological innovation not only directly improves a firm’s output capacity but, more critically, significantly enhances energy utilization efficiency and reduces energy consumption per unit of product by improving production processes and optimizing product design. Furthermore, technological innovation provides the necessary support for the optimization and reorganization of a firm’s production resources. For instance, by introducing advanced production management systems (such as MES) and automation technology, it can reduce idling, energy waste, and process redundancies, thereby promoting an overall increase in total factor productivity. The direct result of this process is a significant reduction in the input of energy and other production factors required to maintain the same level of output, leading to a corresponding decrease in energy intensity [48,49]. Regarding the enhancement of operational flexibility, with the development of smart manufacturing technologies, modern manufacturing systems are transitioning from traditional rigid production models to more flexible and intelligent ones. The upgrading of a firm’s technological innovation capability has broken through the limitations of single equipment units and has begun to permeate the entire industrial chain, including R&D, procurement, production, sales, and supply chain collaboration [50]. A flexible production system built on technologies like the Internet of Things and big data can respond rapidly to market fluctuations and order changes. This is manifested in the ability to quickly adjust production plans, accurately match capacity with demand, and achieve economical production of small batches and multiple varieties. This flexible response capability can effectively avoid the structural energy waste caused by overproduction, inventory backlog, and equipment idling, which are common in traditional mass production models. Thus, the restructuring of production processes and system optimization driven by technological innovation are key to achieving improvements in energy efficiency and reductions in energy intensity for manufacturing enterprises.

Based on the above arguments, we propose the following hypotheses:

Hypothesis 2.

Technological innovation capability reduces energy intensity by enhancing firm production efficiency.

Hypothesis 3.

Technological innovation capability reduces energy intensity by increasing production and operational flexibility.

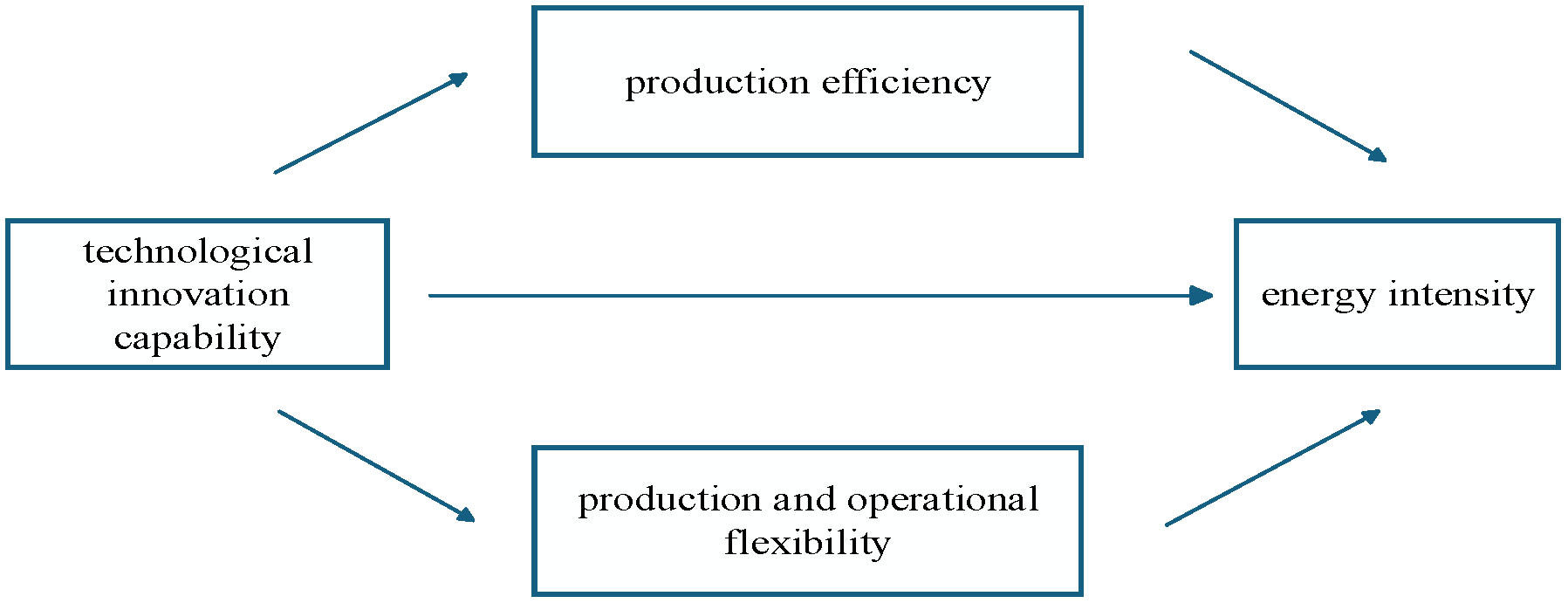

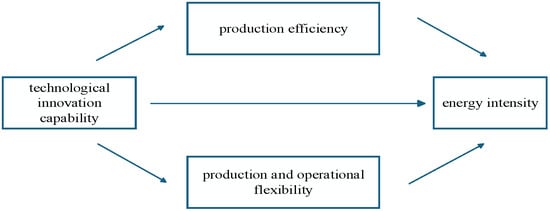

Based on the research hypotheses proposed above, this paper constructs an empirical model (as shown in Figure 2) to investigate the mechanism through which technological innovation capability affects energy intensity, focusing on the mediating roles of firm production efficiency and production and operational flexibility in this relationship.

Figure 2.

This framework diagram illustrates the mediating roles of firm production efficiency and production and operational flexibility in the relationship between technological innovation capability and energy intensity.

In the literature investigating the relationship between technological innovation capability and energy intensity, researchers have predominantly focused on national-level innovation processes and learning mechanisms [51,52,53]. Particularly for energy-consuming powerhouses such as China and India, it is imperative to explore the relationship between firm-level technological innovation and environmental performance, as the energy savings generated by technologies depend on the accumulation, assimilation, and employment of relevant technological knowledge. Simultaneously, the transnational transfer of technological knowledge is not as smooth as that of physical products, as it contains many tacit elements [54], which are difficult to explicitly normalize and directly transfer. Furthermore, the process of developing technological capability within firms often does not occur independently but is significantly advanced through close and profound technological interactions with other firms and organizations within the National Innovation System (NIS). Based on the above arguments, we believe that China and India may have different levels of effectiveness in utilizing technological innovation to reduce energy intensity due to the lag in knowledge interaction and the complexity of capability construction. In addition, variations in ownership patterns and management practices may give rise to potential disparities in the impact of energy intensity between firms from both countries with parallel technological innovation capability [42]. In this regard, we propose two contrasting hypotheses:

Hypothesis 4a.

Improvements in the technological innovation capability significantly reduce the energy intensity of Chinese firms relative to those of Indian firms.

Hypothesis 4b.

Improvements in the technological innovation capability significantly reduce the energy intensity of Indian firms relative to those of Chinese firms.

2.2.2. Impact of Other Firm Characteristics on Energy Intensity

The size and age of a firm are nonnegligible influences in inducing a reduction in energy intensity. However, there has been controversy regarding the effect of firm age on energy intensity. Prasad and Mishra [55] argued that older firms generally have a sound financial base and can afford to invest in the development of energy-efficient technology, which may result in lower energy consumption. On the other hand, Golder [5] contended that a robust positive correlation exists between the age of a firm and its energy intensity. He noted that older firms are often prone to inertia, which slows the adoption of energy-efficient measures. Haider et al. [38] confirmed this view by analysing data from 67 major pulp and paper firms in India. Firm size, as one of the factors affecting the energy efficiency of firms, has also been frequently studied in the past literature. The general literature argues that due to economies of scale, larger firms possess superior technological innovation capabilities and are generally more adept at conserving energy consumption [56]. However, Haider et al. [38] came to a different conclusion. Their research revealed that expanding the size of a firm within a certain threshold would lead to a reduction in energy intensity; however, further expansion beyond this range would result in increased energy consumption. Management practices associated with firm size or age also constitute a factor influencing energy intensity. The empirical analysis reveals that firms’ general management practices [57], climate-friendly management [1], and energy-centric management practices [34] exert significant negative effects on energy intensity.

Furthermore, the ratio of capital to labour allocation in production activities is a key determinant of energy consumption patterns. Kumar et al. [58] used firm-level data for India from 2010 to 2021 to determine that increasing labour intensity leads to an increase in energy intensity. We find that there is a dearth of comparative analyses of the impact of energy intensity between capital-intensive and labour-intensive industries in the literature. To fill this gap, we further explore the impact of capital-intensive and labour-intensive industries on energy intensity.

Based on the above analysis, we propose Hypothesis 5 and Hypothesis 6:

Hypothesis 5.

The energy-saving effect of technological innovation capability is more significant for larger firms.

Hypothesis 6.

The energy-saving effect of technological innovation capability is more significant for capital-intensive firms.

3. Methodology and Data Sources

3.1. Regression Model

Drawing on the literature on firms’ energy intensity [1,34,42], we establish the following regression equation:

where denotes the energy intensity (ee) of j firms in c cities, industries. refers to technological innovation capability at the firm level. is a firm-level control variable that includes establishment age, per capita capital stock, size, general manager’s gender, average educational level of employees, percentage of foreign investment in the company’s shares, and exports. is the random error term. In Model (1), is the most interesting coefficient in this paper, and if is statistically significantly negative, then an increase in the firm’s technological capability index will help reduce the firm’s energy intensity. To further mitigate the possible heteroscedasticity in the model, the natural logarithmic treatment is used for continuous numerical variables.

3.2. Variable Selection

(1) Explained variables

Energy intensity (ee). The questionnaire collected information on firm expenditures for fuel and electricity from 2011 to 2013 (Fuel expenditures are measured based on the “total annual cost of fuel”. Electricity expenditure is measured on the basis of the “total annual cost of electricity”). Accordingly, we draw on Martin et al. [1], Boyd and Curtis [34], and Bloom et al. [57] and sum the two expenditures together to represent the total energy consumption of the company. The firm’s total output is expressed by the total sales revenue. Therefore, ee = (electricity expenditure + fuel expenditure)/sales revenue) × 100. In the robustness test, we also employ the methodology proposed by Bloom et al. [57], where the sum of the two expenditures is divided by the sum of the firm’s raw materials and other intermediate inputs and the firm’s labour cost expenditures as an alternative measure, i.e., ee = ((Electricity Expenditures + Fuel Expenditures)/(Other Intermediate Inputs + Labour Costs Expenditures)) × 100.

(2) Core explanatory variables

Technological innovation capability (tic). Technological innovation capability is a special asset of a firm that needs to be studied at a wide range and at different levels due to its complexity and multidimensionality. For this reason, a composite innovation index is usually constructed using the categorization of multiple practices related to technology and is scored according to Likert scale types. For example, Machikita and Ueki [59] created a proxy variable for innovation capability by using survey data from firms. They classified 12 dummy variables on process improvement into four types and standardized the unweighted sum of these dummy variables to obtain a z value for innovation capability. To help firms evaluate and improve their technological innovation capability more comprehensively, we adopt a similar approach by utilizing firm survey data to construct proxy indicators of technological innovation capability. By drawing on Wignaraja’s [28] and Lall’s [3,29] measures of technological innovation capability, we breakdown firm technological innovation capability into nine specific indicators, including equipment upgrading, technology licensing, process improvement, and technological routes (see Appendix A for details). Then, we sum these nine indicators for each company to obtain a total capacity index ranging from 0 to 9. Finally, standardization is applied to obtain a value between 0 and 1.

(3) Control variables

① Establishment age (age). Generally, systematic differences in management and production between long-established firms and newly established ones can have an impact on energy consumption. This study measures the years of establishment of surveyed firms as of the end of 2011 via the natural logarithm.

② Per capita capital stock (In_capital). Capital stock exerts both positive and negative influences on firm energy consumption. On the one hand, the capital intensity of a firm plays a crucial role in improving productivity, which potentially increases energy consumption. On the other hand, high capital intensity often indicates the adoption of advanced production equipment by firms, which may result in reduced energy intensity. To address the survey question concerning the value of machinery and equipment after depreciation as of the end of 2011, we calculate the ratio between the net value of fixed assets and the number of formal employees. We then take the natural logarithm of this ratio for our analysis.

③ Size (size). Haider et al. [38] used data envelopment analysis with radial and nonradial variables to assess feasible energy saving targets at current output levels. They found that the larger the firm is, the lower the energy intensity. In other words, economies of scale can have an impact on both productivity and energy consumption in firms. Therefore, we use the natural logarithm of the number of formal employees in 2011 to measure and analyse the differences in energy efficiency between firms of various sizes.

④ General manager’s gender (mgr_gen). Tonoyan and Boudreaux [60] pointed out that gender diversity plays an important role in the technological innovation process of firms, which further has an indirect impact on the reduction in energy intensity. A value of 1 is assigned if the gender of the general manager is female and 0 otherwise.

⑤ Average educational level of employees (wkr_edu). The greater the level of human capital of a firm’s employees is, the better the firm will be able to assimilate new technology, which will help reduce energy intensity [61]. In this paper, we use the “average number of years of education of a typical production worker” as the measure.

⑥ Percentage of foreign investment in the company’s shares (for_own). In this paper, we utilize the natural logarithm of the ratio of foreign investment to corporate shares of the surveyed firms as of the end of 2011 as the measure. For firms in developing countries, foreign investment has a certain degree of technological spillover effect on production, which may also reduce energy intensity [36].

⑦ Exports (exports). The literature suggests that exports have dual effects. On the one hand, exports can generate technology spillover effects, thereby potentially increasing energy consumption and enhancing energy intensity [37]. On the other hand, exports can encourage firms to invest in innovation, leading to a potential reduction in energy intensity [36]. This paper uses the “Indirect exports (sold domestically to third party that exports products) + Direct Exports” as a proportion of firms’ sales.

3.3. Data Sources

The data utilized in this study are derived from the World Bank Enterprise Surveys conducted in China and India between 2011 and 2013. The World Bank’s survey used a stratified random sampling methodology to gather data on the manufacturing, service, and IT sectors in 25 cities across China and 23 cities throughout India. The survey questionnaire encompassed various firm attributes, including their fundamental information, infrastructure and services, import-export activities, innovation and technology, financing mechanisms, government relations, financial indicators and employment status. Particularly noteworthy is that the questionnaire also asked firms about technological innovation in detail. The survey was used to collect data from firms in the above aspects during 2011 to 2013. The World Bank’s survey data was used for empirical analysis because these data have unique advantages; the World Bank’s questionnaire collects data on the fuel and electricity consumption of firms. Finally, the sample utilized for this analysis consists of 4383 manufacturing companies, comprising 1397 Chinese firms and 2986 Indian firms.

3.4. Descriptive Statistical Analysis

Table 1 reports the descriptive statistics of the main variables (This study also analyzed the quantiles of the core variables. The results show that for energy intensity (as a percentage), the 25th percentile is 1.5955% and the 75th percentile is 7.2182%; for technological innovation capability, the 25th percentile is −0.8902 and the 75th percentile is 1.0355). For the core variables, the mean of energy intensity (ee) is 5.475 with a standard deviation of 5.689, indicating significant variation in energy efficiency among different manufacturing enterprises. The mean of technological innovation capability (tic) is 0.061, but its standard deviation is 0.956, which is higher than the mean, suggesting that the overall innovation level of the sample firms is limited, but there is significant internal heterogeneity. Furthermore, the distribution characteristics of the control variables are consistent with typical facts. For example, firm size (size) and age (age) are relatively concentrated, while the export ratio (exports) and foreign ownership (for_own) show high dispersion, implying uneven levels of internationalization among firms.

Table 1.

Descriptive statistics for the main variables.

To further reveal the differences in firm characteristics between China and India, Table 2 compares the means of the main variables for the two country samples and conducts group difference tests. The results show that Chinese firms have higher mean values for energy intensity, technological innovation capability, firm size, employee education level, and foreign ownership percentage than Indian firms. In contrast, Indian firms are significantly older and more capital-intensive than their Chinese counterparts. These structural differences provide a preliminary basis for the subsequent analysis of the heterogeneous impact of technological innovation on energy intensity in the two countries.

Table 2.

Results of the comparison of sample means.

Table 3 presents the correlation matrix between the variables. It is evident that technological innovation capability has a significant correlation with most firm characteristic variables, which provides initial support for including them in the regression model for further examination. At the same time, the correlation coefficients among the explanatory variables are generally within a reasonable range, indicating that multicollinearity is not a serious issue.

Table 3.

Correlation matrix of the variables.

4. Results

4.1. Baseline Results

Table 4 shows the relationship between energy intensity and firm technological innovation capability (To further mitigate the heteroscedasticity problem in the model, this paper treats continuous numerical variables such as firm energy intensity by shrinking the tails (Winsorize) at the 1% quantile and 99% quantile). In column 1, controlling for industry fixed effects, we find that energy intensity is significantly negatively related to technological innovation capability. In column 2, we control for more firm-level control variables and still find that the coefficient remains significantly negative at the 10% level, indicating that firms with greater technological innovation capability utilize energy more efficiently. Column 3 incorporates industry fixed effects and city fixed effects, and the coefficient on technological innovation capability shifts from −0.2483 to −0.3189, which is statistically significant at the 5% level. Clearly, the finding that improved technological innovation capability significantly reduces firms’ energy intensity is robust, and the research hypothesis is confirmed. Drawing on Bloom et al.’s [57] measure, we can calculate the economic significance of the energy-saving effect generated by technological innovation capability. Taking the regression results in column 3 as an example, the coefficient of −0.3189 indicates that for manufacturing firms in China and India with a mean energy intensity of 5.475, an increase in technological innovation capability from the 25th percentile to the 75th percentile (an increase in technological capability of 1.9257) would lead to a decrease in energy intensity of 11.22% () (The mean value of energy intensity is in Table 1).

Table 4.

Baseline Regression Results (tic represents technological innovation capability. ln_capital represents Per capita capital stock, and mgr_gen represents general manager’s gender. wkr_edu represents average educational level of employees. for_own represents percentage of foreign investment in the company’s shares.).

4.2. Robustness Test

To guarantee the dependability of the regression results, we conducted three robustness tests.

(1) Replacement of explained variables. We measure energy intensity by dividing the cost of energy factor inputs by the sum of the firm’s raw material and labour costs. The advantage of this measure is that it eliminates the problem of reduced energy inputs costs associated with product price controls, which can be implemented by firms with competitive advantages or monopoly positions [57]. The regression results, presented in column 1 of Table 5, demonstrate a statistically significant negative correlation (p < 0.01) between the technological innovation capability and energy intensity of firms when controlling for other factors. This finding also suggests that increasing a firm’s technological innovation capability contributes to a reduction in its energy intensity, regardless of whether or not the firm has a monopoly position in the market. Hypothesis 1 of this paper is again validated.

Table 5.

Robustness test.

(2) Replacement of core explanatory variables. R&D activities, as one of the core elements of technological innovation, are often used as a measure of technological innovation capability [6]. This is because R&D activities can promote the innovation of knowledge within firms, thereby improving their technology absorption capability and amplifying the technology spillover effects of other firms, which in turn helps to reduce energy consumption [13]. On the other hand, Solnørdal and Thyholdt [61] have shown that R&D activities can breakdown information barriers, develop more energy-efficient technologies, and reduce energy intensity. To confirm the dependability of the estimation results, Sun et al. [13] and Sahu et al. [6] are referenced for measuring technological innovation capability. For a survey question asking whether the company has invested in R&D activities over the past three years, a value of ‘1’ is assigned for an affirmative response and ‘0’ is assigned otherwise. The estimation results are reported in column 2 of Table 5, which shows that after replacing the core explanatory variables, the coefficient of the variable of whether the firm has invested in R&D activities is significantly negative, and research Hypothesis 1 is confirmed again. The conclusions of this paper are consistent with the findings in the literature. For instance, Huang and Chen [37] analysed panel data from 34 industrial zones in China from 2000 to 2010 and found that a 1% increase in R&D activities led to a 0.306% reduction in energy intensity. Sun et al. [13] also identified the significant role of R&D activities in reducing energy intensity.

(3) Replacement of the regression method of the model. Due to the existence of censored features in energy intensity, the Tobit model for regression analysis is adopted; the results are reported in column 3 of Table 5. The conclusions obtained after replacing the regression method are the same as those obtained using OLS regression. Specifically, there is a significant negative correlation between firms’ technological innovation capability and energy intensity, which once again suggests that improving technological innovation capability in the production process may be an effective way for firms to reduce energy intensity.

4.3. Heterogeneity Analysis

The results of the empirical analysis of the whole sample prove the rationality of Hypothesis 1, revealing a significant negative correlation between technological innovation capability and energy intensity. However, considering the heterogeneous characteristics of countries, industries and firms, we cannot tell whether this conclusion still holds in different subsamples, so we conduct the following heterogeneity analysis.

4.3.1. Cross-Country Heterogeneity Analysis

The significant differences between China and India in terms of economic structure, level of industrialization, energy mix, and policy and institutional environments have shaped the unique impact of technological innovation capability on energy intensity in each country [15]. Especially in the manufacturing sector, China has established a relatively well-developed industrial chain and technological base compared to India, which is still at a relatively low level of industrialization [38]. This difference may lead to a difference in the effectiveness of energy intensity reduction between the two countries, even with the same technology. Therefore, we investigate whether improvements in technological innovation capability impact firm energy intensity in different ways in the two countries. According to the findings presented in columns 1 and 2 of Table 6, the influence of technological innovation capability on the energy intensity of Chinese and Indian firms exhibits heterogeneity. Specifically, the coefficient for China is significantly negative, implying that an increase in firm technological innovation capability from the 25th percentile to the 75th percentile (an increase in technological innovation capability of 1.9257) results in a remarkable reduction of 38.62% in energy intensity for Chinese manufacturing firms () (Mean values of energy intensity derived from Table 2). The regression results, as anticipated, reveal that the coefficient of technological innovation capability lacks statistical significance in the subsample regression analysis conducted for India. This may stem from the existence of a technology lock-in effect in India, making it difficult to alter energy usage behavior in the short term [62]. Consequently, the impact of technological innovation capability on energy intensity fails to manifest effectively. This finding substantiates research Hypothesis 4a posited in this study.

Table 6.

Heterogeneity test.

4.3.2. Industry Heterogeneity Analysis

From the perspective of capital intensity, different industries exhibit varying levels of capital intensity in their production processes. For instance, the precision instruments and equipment manufacturing industry tends to employ automation equipment more extensively to ensure product quality, whereas labour-intensive industries may lean towards utilizing labour rather than capital for production. Therefore, based on the classification method proposed by the National Bureau of Statistics of China, the sample firms are categorized into capital-intensive (Capital-intensive industries: Processing of Food from Agricultural Products; Manufacture of Foods; Manufacture of Liquor; Beverages and Refined Tea; Manufacture of Tobacco; Printing and Reproduction of Recording Media; Processing of Petroleum, Coking and Processing of Nuclear Fuel; Manufacture of Raw Chemical Materials and Chemical Products; Manufacture of Medicines; Manufacture of Chemical Fibers; Smelting and Pressing of Non-ferrous Metals; Manufacture of Metal Products) and labour-intensive (Labor-intensive industries: Manufacture of Textile, Wearing Apparel and Accessories; Manufacture of Leather, Fur, Feather and Related Products and Footwear; Processing of Timber, Manufacture of Wood, Bamboo, Rattan, Palm and Straw Products; Manufacture of Furniture; Manufacture of Articles for Culture, Education, Arts and Crafts, Sport and Entertainment Activities; Manufacture of Rubber and Plastics Products; Manufacture of General Purpose Machinery; Manufacture of Special Purpose Machinery; Other Manufacture; Utilization of Waste Resources) groups for regression analysis. The results in Table 6 show that, when other conditions are unchanged, the coefficient of capital-intensive firms’ technological innovation capability is significantly negative, supporting Hypothesis 6. However, in labour-intensive firms, although the technical innovation capability coefficient exhibits a negative trend, it has not yet reached statistical significance.

4.3.3. Size Heterogeneity Analysis

In the decision-making process regarding energy efficiency targets, scale emerges as a crucial factor that cannot be disregarded [38,63]. The relationship between scale and energy intensity remains a topic of ongoing debate among researchers both in China and internationally. It is widely acknowledged that larger firms possess stronger financial foundations, enabling them to allocate more resources to the R&D of innovative technologies. Simultaneously, in comparison to small and medium-sized firms, large-scale firms possess relative advantages in perceiving external information and mitigating obstacles related to behaviour and technology due to their greater complexity in production processes and exposure to a more innovative external environment. Consequently, these factors lead to higher energy efficiency for these firms [63]. The size of a corporation is calculated using the natural logarithm of its official staff count, the firms are differentiated into two categories—large firms and small and medium-sized firms—based on the 50th percentile criterion, and then the regression is run. The findings are presented in columns 5 and 6 of Table 6, revealing significant variations in the technological innovation capability coefficients across firms of different sizes. Specifically, within large firms, the technological innovation capability coefficient shows a negative and statistically significant association, supporting Hypothesis 5. Conversely, for small and medium-sized firms, the technological innovation coefficient demonstrates a positive but nonsignificant relationship.

4.4. Mechanism Analysis

Based on the preceding analysis and following the approach of Nunn and Wantchekon [64], this paper further examines the intrinsic mechanisms through which technological innovation capability affects energy intensity. Table 7 reports the corresponding regression results. The dependent variables are, respectively: in column (1), firm production efficiency measured by “sales per employee,” and in column (2), a binary dummy variable measuring whether the “firm improved production and operational flexibility or logistics, delivery, and distribution methods through innovation” (coded as 1 for “yes” and 0 for “no”).

Table 7.

Mediating effect.

The results in column (1) show that the regression coefficient for technological innovation capability is significant at the 1% level, indicating that technological innovation capability suppresses energy intensity by promoting firm production efficiency. Specifically, the advancement of technological innovation is often accompanied by the renewal of production equipment and the upgrading of management techniques [15]. Advanced processes and technologies themselves typically possess energy-saving characteristics, thereby reducing energy consumption per unit of output while increasing production efficiency. Hypothesis 2 is thus verified.

The results in column (2) show that the regression coefficient for technological innovation capability is significant at the 1% level, indicating that technological innovation capability reduces energy intensity by enhancing a firm’s production and operational flexibility. Specifically, technological innovation capability helps to strengthen a firm’s ability to optimize and restructure its production processes and operational models, thereby increasing its operational flexibility [65]. A more elastic production system enables the firm to flexibly respond to changes in operational rhythm, reducing energy waste caused by process rigidity, and thus lowering overall energy intensity. Hypothesis 3 is thus verified.

4.5. Dynamic Effects Test

To further investigate the long-term dynamic relationship between a firm’s technological innovation capability and its energy intensity, this paper attempts to merge the latest enterprise survey data for China and India with the 2011–2013 survey data (China: 2013 and 2024; India: 2014 and 2022). In the dynamic effects test, we control for year, country, and industry fixed effects in the model. It should be noted that due to differences in survey questionnaires and data across multiple rounds, we have adjusted some of the indicators used to measure technological innovation capability. We selected four indicators that are strongly associated with technological innovation capability and were included in multiple surveys. Specifically, these are: whether the firm has obtained ISO quality certification; whether the firm engages in R&D activities; whether the firm has acquired technology licenses from foreign companies; and whether the firm has undertaken process improvements and introduced new products. Additionally, since the latest World Bank enterprise survey questionnaire no longer includes a question about the average years of education of employees, this study uses the proportion of employees with a high school diploma as a proxy variable for the average education level of workers (wkr_edu) in the dynamic effects test.

Table 8 reports the regression results for the dynamic effects. The results show that after controlling for year fixed effects and other control variables, the coefficient of our variable of interest—technological innovation capability (tic)—is −0.1033 and is significant at the 10% level. This indicates that technological innovation capability has a sustained reducing effect on a firm’s energy intensity. Hypothesis 1 is once again validated. Furthermore, the significance of other control variables, such as firm size (size), manager’s gender (mgr_gen), and employee education level (wkr_edu), is consistent with the baseline regression, further supporting the robustness of the baseline regression model.

Table 8.

Dynamic Effect Regression.

5. Economic Benefit Analysis and Discussion

5.1. Economic Benefit Analysis

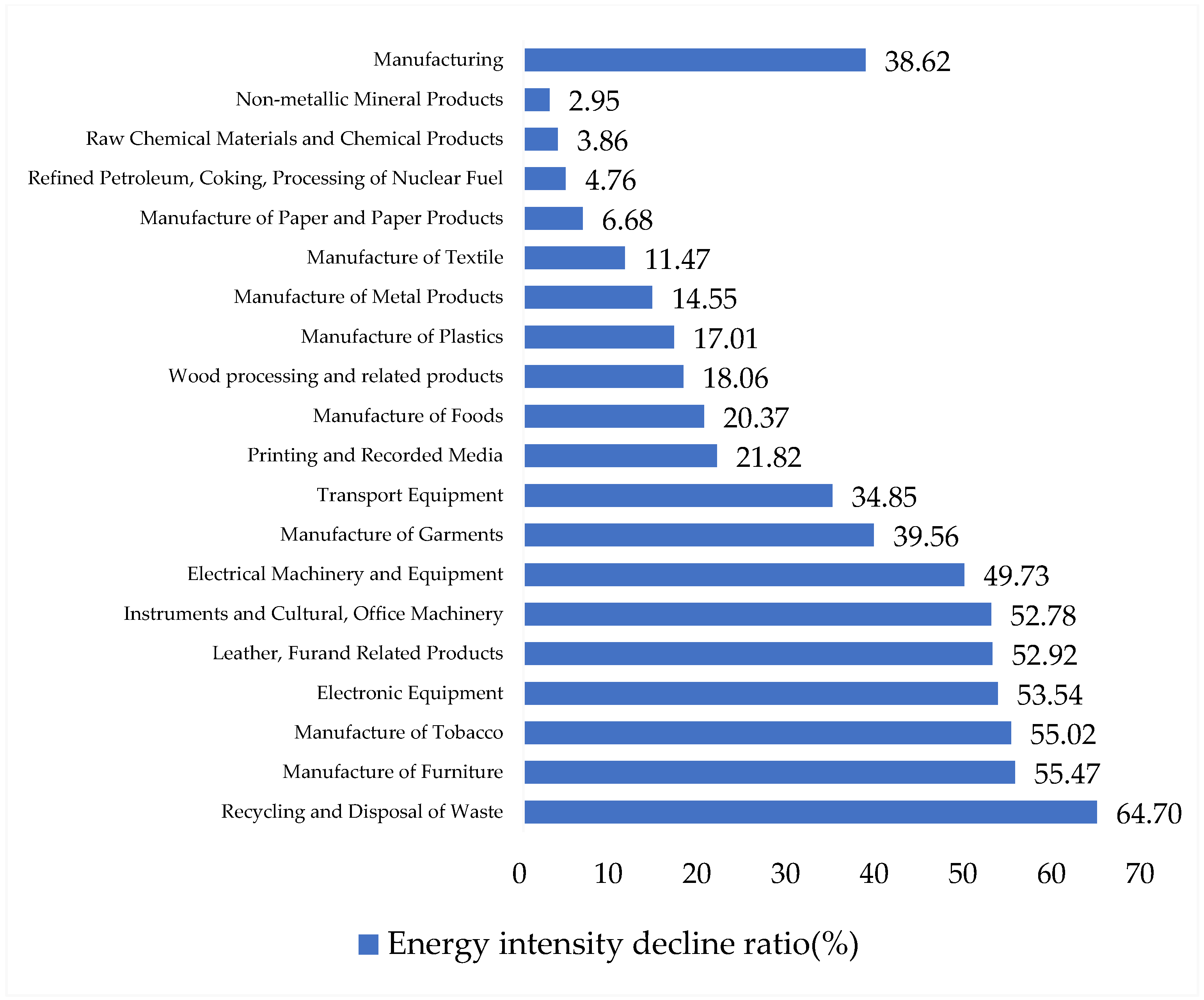

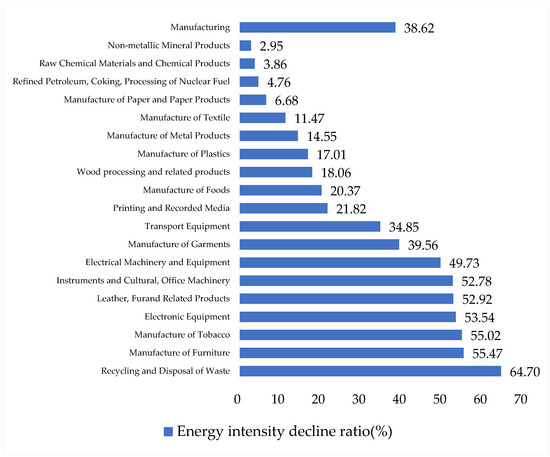

The results of the cross-country heterogeneity analysis in this paper reveal that in the Chinese manufacturing sector, technological innovation capability plays an important role in the optimization of production processes and resource allocation. This capability effectively reduces energy intensity by improving energy utilization efficiency, which in turn promotes the realization of energy conservation goals. Utilizing information derived from the 2012 China Statistical Yearbook [66] (The China Statistical Yearbook 2012 reports data for 2011), we further explore the specific role and contribution of technological innovation capability in reducing energy intensity within China’s manufacturing sector as a whole (China’s manufacturing energy consumption is generally based on World Bank data) and within its secondary industries (China’s manufacturing secondary industries’ energy consumption is based on the China Statistical Yearbook). Figure 3 illustrates the rate of reduction in energy intensity for firms in the manufacturing sector and its second category of industries when their technological innovation capability improves from the 25th percentile to the 75th percentile.

Figure 3.

Energy intensity reduction ratio of firms in China’s manufacturing industry and its secondary industries.

Overall, the energy intensity of manufacturing firms decreased by 38.62% (−1.1432 × 1.9257)/5.70 × 100%) (−1.1432 and 5.7 are from column 1 of Table 6 and column 4 of Table 2, respectively. 1.9257 is the value of technological innovation capacity from the 25th to 75th percentile), while the national manufacturing industry’s energy consumption reached approximately 2.0 × 109 tonnes of standard coal, which, when converted to a specific value, resulted in a reduction in the national manufacturing industry’s energy consumption of approximately 7.7 × 108 tonnes of standard coal (=2.0 × 109 × 0.3862). Among the subsectors, the nonmetallic mineral products industry exhibited the lowest rate of reduction in energy intensity, representing a mere 2.95%. This translates to a decrease of approximately 8.9 × 106 tonnes of standard coal (=3 × 108 × 0.0295). The industrial structure within this sector continues to be dominated by high levels of energy consumption and emissions. Furthermore, as the economic scale expands incessantly, the detrimental impact of the scale effect becomes increasingly pronounced. Thus, any advancements in energy efficiency resulting from technological innovation may be counteracted by increased output. Consequently, overall performance regarding reducing energy intensity remains unsatisfactory. In contrast, the second type of industry with the greatest contribution to energy intensity is the waste resources and waste materials recycling and processing industry, whose improvement in technological innovation has led to a reduction in energy consumption of 64.70%, saving approximately 5.8 × 105 tonnes of standard coal.

In summary, the data demonstrate a strong negative relationship between technological innovation capability and energy intensity in Chinese manufacturing firms, suggesting that technological innovation capability is vital for curtailing energy usage. By drawing lessons from China’s experience and implementing similar strategies and policies, India’s manufacturing industry should witness a significant reduction in energy intensity through enhanced technological innovation capability, thereby realizing the goals of energy conservation and sustainable development.

5.2. Discussion

The findings of this study demonstrate that an increase in a firm’s technological innovation capability (tic) from the 25th to the 75th percentile is associated with a reduction in energy intensity of approximately 11.22%. This demonstrates the pivotal role of technological innovation capability in reducing energy intensity. Our findings are consistent with those of Voigt et al. [15], who investigated energy-influencing factors in 40 major economies from 1995 to 2007 via WIOD database analysis. Their study showed that the decrease in global energy intensity is mainly due to the improvement in technological innovation capability. According to this finding, firms should pay more attention to investment in technology R&D during the production process and promote technological innovation and application. This approach will not only contributes to the goal of reducing energy intensity but also effectively mitigates the risk of “carbon lock-in” that may arise from long-term reliance on existing technological pathways [62].

Considering that the impact of technological innovation capability on energy intensity may vary depending on characteristics such as the firm’s country, industry, and size, this study further conducts a heterogeneity analysis across three dimensions: cross-country, inter-industry, and firm size. Regarding country-level differences, the study finds that the inhibitory effect of technological innovation capability on energy intensity is significantly stronger among Chinese manufacturing firms than among their Indian counterparts. This disparity may stem from the different developmental stages of the two countries in terms of technological foundations, industrial structure, and policy implementation [38]. In recent years, China has implemented a wide arrange of polices to curb energy use. For instance, Top 1000 Enterprises Energy-Saving Program was introduced in 2006 as part of the Eleventh Five-Year Plan [67]. Top 10,000 program was put in place as part of the 12th Five-Year Plan starting in 2012 [68]. Simultaneously, China has actively integrated into global industrial chains, driving technological spillovers and industrial upgrading by attracting high-quality foreign investment. In contrast, India’s economic liberalization reforms began in 1991, and systematic energy efficiency policies, such as the programs implemented by the Bureau of Energy Efficiency (BEE), were only gradually launched after 200 [38]. Consequently, China has developed a relatively mature system for accumulating technological innovation capability and enhancing energy efficiency, while India still faces a technological and structural energy efficiency gap.

In terms of inter-industry differences, the study reveals that, compared to those in labor-intensive industries, the technological innovation capability of firms in capital-intensive industries has a more significant negative impact on energy intensity. Firstly, capital-intensive firms typically possess substantial capital strength and stable cash flows, which provide ample financial support for their technological innovation activities in areas such as energy conservation and process innovation, thereby facilitating the enhancement of their technological innovation capability. Secondly, a firm’s technological innovation capability can be further translated into large-scale, systematic investment in and application of advanced production equipment and high-efficiency energy-saving technologies, leading to a significant improvement in energy utilization efficiency and a reduction in energy intensity.

Regarding differences in firm size, the study finds that, compared to small enterprises, the technological innovation capability of large enterprises has a more pronounced negative effect on energy intensity. First, large enterprises possess more abundant internal resources and a solid financial foundation, making them more inclined to engage in various technological innovation activities, including innovations in energy-saving technologies. This, in turn, has a significant impact on reducing energy intensity [55]. Second, large enterprises have more mature management systems, which strengthen the application, diffusion, and continuous improvement of technological innovation outcomes within the organization. This ensures the stable realization and continuous enhancement of energy-saving benefits. Third, due to economies of scale, the energy-saving effects of TIC in large enterprises are further amplified, resulting in a more significant inhibitory effect on energy intensity [56].

6. Conclusions and Research Limitations

6.1. Conclusions

This study, based on the World Bank’s 2011–2013 enterprise survey data for China and India, constructs a technological innovation capability evaluation system with three dimensions and nine specific indicators to systematically examine the impact and mechanisms of manufacturing firms’ technological innovation capability on their energy intensity. The main conclusions are as follows:

Controlling for other factors, there is a robust negative relationship between a firm’s technological innovation capability and its energy intensity. Specifically, when a firm’s technological innovation capability increases from the 25th to the 75th percentile of its distribution, its energy intensity decreases by an average of approximately 11.22%. Dynamic effects test further confirm that firms’ technological innovation capability exerts a long-term dynamic influence on energy intensity. Mechanism analysis further reveals that technological innovation capability primarily reduces energy intensity through two pathways: improving firm production efficiency and enhancing production and operational flexibility.

Heterogeneity analysis shows that the impact of technological innovation capability on energy intensity exhibits significant differences across countries, industries, and firm characteristics. Compared to India, this effect is more prominent in Chinese manufacturing firms; an increase of 50 percentile points in technological innovation capability will reduce the energy intensity of Chinese manufacturing firms by 38.62%. At the same time, this energy-saving effect is more significant in capital-intensive and larger firms. In the subsequent analysis of economic benefits, we find that within China’s manufacturing sector, firms in the waste resource and scrap material recycling and processing industry show the most significant effect of reducing energy intensity through technological innovation, while the performance of the non-metallic mineral products industry is relatively weaker.

The conclusions of this paper support the negative impact of technological innovation capability on energy intensity and its corresponding boundary conditions, providing micro-level empirical evidence for the integration of innovation theory and environmental economics. At the same time, it offers practical pathways for Chinese and Indian manufacturing firms to achieve energy conservation and consumption reduction by enhancing their technological innovation capabilities, thereby promoting green industrial transformation and contributing to global climate governance and energy security.

6.2. Research Limitations

The focus of this study is on examining the connection between the technological innovation capability and energy intensity of manufacturing firms in China and India. However, the study still has some shortcomings. First, the use of cross-sectional data instead of panel data restricts our ability to investigate the dynamic impact of technological innovation capability on the energy intensity of manufacturing firms. Second, given the lack of good instrumental variables to solve the possible endogeneity problem in the regression model, our empirical results confirm only a significant negative association between technological innovation capability and energy intensity among manufacturing firms. Further studies are needed for an in-depth exploration of the causal relationships between these factors.

Author Contributions

Conceptualization, T.L.; Methodology, S.Z.; Software, S.Z.; Validation, M.J.; Formal analysis, T.L.; Investigation, T.L.; Resources, S.Z.; Data curation, T.L.; Writing—original draft, M.J.; Writing—review & editing, M.J.; Visualization, M.J.; Supervision, S.Z.; Project administration, S.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This paper is financially supported by General Project of Social Science Fund of Jiangsu Province: Chain Group Coordination to Promote Industrial Division Adjustment and Realization Path of Yangtze River Delta under the Background of Double Cycle (Grant number 22EYB025).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. The Technological Innovation Capability (tic)

According to Wignaraja (2012) [28] and Lall (1992, 1987) [3,29], technological innovation capability are divided into three categories: investment, production and linkages. On this basis, it is subdivided into 9 dimensions, including R&D activities, equipment upgrade, the improvement of process, subcontracting, new product introduction, minor product adjustments, technology licensing, technical connection and International Organization for Standardization (ISO) quality certification (ISO).

References

- Martin, R.; Muûls, M.; de Preux, L.B.; Wagner, U.J. Anatomy of a paradox: Management practices, organizational structure and energy efficiency. J. Environ. Econ. Manag. 2012, 63, 208–223. [Google Scholar] [CrossRef]

- Energy Institute. Statistical Review of World Energy. Available online: https://www.energyinst.org/statistical-review (accessed on 26 June 2023).

- Lall, S. Technological capabilities and industrialization. World Dev. 1992, 20, 165–186. [Google Scholar] [CrossRef]

- Jiang, W.; Wu, H. Connotation & Structure of Enterprise’s Technological Innovation Capability and Its Correlation with Core Competence. Sci. Res. Manag. 1998, 19, 6. (In Chinese) [Google Scholar]

- Golder, B. Energy Intensity of Indian Manufacturing Firms: Effect of Energy Prices, Technology and Firm Characteristics. Sci. Technol. Soc. 2011, 16, 351–372. [Google Scholar] [CrossRef]

- Sahu, S.K.; Bagchi, P.; Kumar, A.; Tan, K.H. Technology, price instruments and energy intensity: A study of firms in the manufacturing sector of the Indian economy. Ann. Oper. Res. 2021, 313, 319–339. [Google Scholar] [CrossRef]

- Garrone, P.; Grilli, L.; Mrkajic, B. The role of institutional pressures in the introduction of energy-efficiency innovations. Bus. Strategy Environ. 2018, 27, 1245–1257. [Google Scholar] [CrossRef]

- Wurlod, J.-D.; Noailly, J. The impact of green innovation on energy intensity: An empirical analysis for 14 industrial sectors in OECD countries. Energy Econ. 2018, 71, 47–61. [Google Scholar] [CrossRef]

- Zhiqing, D.; Jing, Z. Different technology sources, technological progress bias, and energy intensity. J. Southeast Univ. (Philos. Soc. Sci.) 2017, 19, 10. (In Chinese) [Google Scholar]

- Chatterjee, D.; Sahasranamam, S. Technological Innovation Research in China and India: A Bibliometric Analysis for the Period 1991–2015. Manag. Organ. Rev. 2017, 14, 179–221. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Jefferson, G.H.; Liu, H.; Tao, Q. What is driving China’s decline in energy intensity? Resour. Energy Econ. 2004, 26, 77–97. [Google Scholar] [CrossRef]

- Jin, B. Country-level technological disparities, market feedback, and scientists’ choice of technologies. Res. Policy 2019, 48, 385–400. [Google Scholar] [CrossRef]

- Sun, H.; Edziah, B.K.; Kporsu, A.K.; Sarkodie, S.A.; Taghizadeh-Hesary, F. Energy efficiency: The role of technological innovation and knowledge spillover. Technol. Forecast. Soc. Change 2021, 167, 120659. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Jefferson, G.H.; Jingkui, M.; Jianyi, X. Technology development and energy productivity in China. Energy Econ. 2006, 28, 690–705. [Google Scholar] [CrossRef]

- Voigt, S.; De Cian, E.; Schymura, M.; Verdolini, E. Energy intensity developments in 40 major economies: Structural change or technology improvement? Energy Econ. 2014, 41, 47–62. [Google Scholar] [CrossRef]

- Leonard-Barton, D. Core capabilities and core rigidities: A paradox in managing new product development. Strateg. Manag. J. 1992, 13, 111–125. [Google Scholar] [CrossRef]

- Hansen, U.E.; Ockwell, D. Learning and technological capability building in emerging economies: The case of the biomass power equipment industry in Malaysia. Technovation 2014, 34, 617–630. [Google Scholar] [CrossRef]

- Ghisetti, C.; Marzucchi, A.; Montresor, S. The open eco-innovation mode. An empirical investigation of eleven European countries. Res. Policy 2015, 44, 1080–1093. [Google Scholar] [CrossRef]

- Wang, C.; Xiong, J.; Wang, L. Research on the Construction of Evaluation Index System of Key Core Technology Innovation Capability of Major Projects—Take the Tiangong Space Station as an Example. Soft Sci. 1–16.

- Zhou, K.Z.; Wu, F. Technology Capability, Strategic Flexibility, and Product Innovation. Strateg. Manag. J. 2010, 31, 547–561. [Google Scholar] [CrossRef]

- Baumann, J.; Kritikos, A.S. The Link between R&D, Innovation and Productivity: Are Micro Firms Different? Res. Policy 2016, 45, 1263–1274. [Google Scholar] [CrossRef]

- Boly, V.; Morel, L.; Assielou, N.D.G.; Camargo, M. Evaluating innovative processes in french firms: Methodological proposition for firm innovation capacity evaluation. Res. Policy 2014, 43, 608–622. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Hill, C.W.L. Technological Discontinuities and Complementary Assets: A Longitudinal Study of Industry and Firm Performance. Organ. Sci. 2005, 16, 52–70. [Google Scholar] [CrossRef]

- Cassiman, B.; Veugelers, R. In search of complementarity in innovation strategy: Internal R&D and external knowledge acquisition. Manag. Sci. 2006, 52, 68–82. [Google Scholar] [CrossRef]

- Nagaoka, S.; Motohashi, K.; Goto, A. Patent statistics as an innovation indicator. In Handbook of the Economics of Innovation; Elsevier: Amsterdam, The Netherlands, 2010; Volume 2, pp. 1083–1127. [Google Scholar]

- Popp, D. The effect of new technology on energy consumption. Resour. Energy Econ. 2001, 23, 215–239. [Google Scholar] [CrossRef]

- Lerner, J.; Seru, A. The use and misuse of patent data: Issues for finance and beyond. Rev. Financ. Stud. 2022, 35, 2667–2704. [Google Scholar] [CrossRef]

- Wignaraja, G. Innovation, learning, and exporting in China: Does R&D or a technology index matter? J. Asian Econ. 2012, 23, 224–233. [Google Scholar] [CrossRef]

- Lall, S. Learning to Industrialize; Macmillan Press: London, UK, 1987. [Google Scholar]

- Yam, R.C.M.; Guan, J.; Pun, K.F.; Tang, E.P.Y. An audit of technological innovation capabilities in chinese firms: Some empirical findings in Beijing, China. Res. Policy 2004, 33, 1123–1140. [Google Scholar] [CrossRef]

- Forés, B.; Camisón, C. Does incremental and radical innovation performance depend on different types of knowledge accumulation capabilities and organizational size? J. Bus. Res. 2016, 69, 831–848. [Google Scholar] [CrossRef]

- Camisón, C.; Villar-López, A. Organizational innovation as an enabler of technological innovation capabilities and firm performance. J. Bus. Res. 2014, 67, 2891–2902. [Google Scholar] [CrossRef]

- Ang, B.W. Monitoring changes in economy-wide energy efficiency: From energy–GDP ratio to composite efficiency index. Energy Policy 2006, 34, 574–582. [Google Scholar] [CrossRef]

- Boyd, G.A.; Curtis, E.M. Evidence of an “Energy-Management Gap” in U.S. manufacturing: Spillovers from firm management practices to energy efficiency. J. Environ. Econ. Manag. 2014, 68, 463–479. [Google Scholar] [CrossRef]

- Shao, S.; Yang, Z.; Yang, L.; Ma, S. Can China’s energy intensity constraint policy promote total factor energy efficiency? Evidence from the industrial sector. Energy J. 2019, 40, 101–128. [Google Scholar] [CrossRef]

- Bu, M.; Li, S.; Jiang, L. Foreign direct investment and energy intensity in China: Firm-level evidence. Energy Econ. 2019, 80, 366–376. [Google Scholar] [CrossRef]

- Huang, J.; Chen, X. Domestic R&D activities, technology absorption ability, and energy intensity in China. Energy Policy 2020, 138, 111184. [Google Scholar] [CrossRef]

- Haider, S.; Danish, M.S.; Sharma, R. Assessing energy efficiency of Indian paper industry and influencing factors: A slack-based firm-level analysis. Energy Econ. 2019, 81, 454–464. [Google Scholar] [CrossRef]

- Chen, D.; Chen, S.; Jin, H.; Lu, Y. The impact of energy regulation on energy intensity and energy structure: Firm-level evidence from China. China Econ. Rev. 2020, 59, 101351. [Google Scholar] [CrossRef]

- Foray, D.; Grubler, A. Technology and the environment: An overview. Technol. Forecast. Soc. Change 1996, 53, 3–13. [Google Scholar] [CrossRef]

- Popp, D.; Newell, R.G.; Jaffe, A.B. Chapter 21—Energy, the Environment, and Technological Change. In Handbook of the Economics of Innovation; Hall, B.H., Rosenberg, N., Eds.; Elsevier: Amsterdam, The Netherlands, 2009; Volume 2, pp. 873–937. [Google Scholar]

- Bloom, N.; Genakos, C.; Sadun, R.; Van Reenen, J. Management practices across firms and countries. Acad. Manag. Perspect. 2012, 26, 12–33. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M. Corporate governance and green innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Huang, J.B.; Cheng, X.; Yu, K.Z.; Cai, X.C. Effect of technological progress on carbon emissions: New evidence from a decomposition and spatiotemporal perspective in China. J. Environ. Manag. 2020, 274, 110953. [Google Scholar] [CrossRef] [PubMed]

- Mashhadi Rajabi, M. Dilemmas of energy efficiency: A systematic review of the rebound effect and attempts to curb energy consumption. Energy Res. Soc. Sci. 2022, 89, 102661. [Google Scholar] [CrossRef]

- Steren, A.; Rubin, O.D.; Rosenzweig, S. Energy-efficiency policies targeting consumers may not save energy in the long run: A rebound effect that cannot be ignored. Energy Res. 2022, 90, 102600. [Google Scholar] [CrossRef]

- Hilty, L.M.; Aebischer, B. ICT Innovations for Sustainability; Springer: Berlin/Heidelberg, Germany, 2015; Volume 310. [Google Scholar]

- Cai, S.; Chen, X.; Bose, I. Exploring the role of IT for environmental sustainability in China: An empirical analysis. Int. J. Prod. Econ. 2013, 146, 491–500. [Google Scholar] [CrossRef]

- Khuntia, J.; Saldanha, T.J.; Mithas, S.; Sambamurthy, V. Information technology and sustainability: Evidence from an emerging economy. Prod. Oper. Manag. 2018, 27, 756–773. [Google Scholar] [CrossRef]

- May, G.; Stahl, B.; Taisch, M.; Kiritsis, D. Energy management in manufacturing: From literature review to a conceptual framework. J. Clean. Prod. 2017, 167, 1464–1489. [Google Scholar] [CrossRef]

- Allcott, H.; Greenstone, M. Is There an Energy Efficiency Gap? J. Econ. Perspect. 2012, 26, 3–28. [Google Scholar] [CrossRef]

- Bell, M.; Pavitt, K. Technological Accumulation and Industrial Growth: Contrasts Between Developed and Developing Countries. Ind. Corp. Change 1993, 2, 157–210. [Google Scholar] [CrossRef]

- Iammarino, S.; Padilla-Pérez, R.; Von Tunzelmann, N. Technological Capabilities and Global-Local Interactions: The Electronics Industry in Two Mexican Regions. World Dev. 2008, 36, 1980–2003. [Google Scholar] [CrossRef]

- Leonard, D.A.; Sensiper, S. The Role of Tacit Knowledge in Group Innovation. Calif. Manag. Rev. 1998, 40, 112–132. [Google Scholar] [CrossRef]

- Prasad, M.; Mishra, T. Low-carbon growth for Indian iron and steel sector: Exploring the role of voluntary environmental compliance. Energy Policy 2017, 100, 41–50. [Google Scholar] [CrossRef]

- Fisher-Vanden, K. Management structure and technology diffusion in Chinese. Energy Policy 2003, 31, 247–257. [Google Scholar] [CrossRef]

- Bloom, N.; Genakos, C.; Martin, R.; Sadun, R. Modern Management: Good for the Environment or Just Hot Air? Econ. J. 2010, 120, 551–572. [Google Scholar] [CrossRef]

- Kumar, A.; Mittal, A.; Pradhan, A.K. Magnitude and determinants of energy intensity: Evidence from Indian firms. Environ. Sci. Pollut. Res. 2023, 30, 3270–3281. [Google Scholar] [CrossRef] [PubMed]

- Machikita, T.; Ueki, Y. Measuring and Explaining Innovative Capability: Evidence from Southeast Asia. Asian Econ. Policy Rev. 2015, 10, 152–173. [Google Scholar] [CrossRef]

- Tonoyan, V.; Boudreaux, C.J. Gender diversity in firm ownership: Direct and indirect effects on firm-level innovation across 29 emerging economies. Res. Policy 2023, 52, 104716. [Google Scholar] [CrossRef]

- Solnørdal, M.T.; Thyholdt, S.B. Absorptive capacity and energy efficiency in manufacturing firms—An empirical analysis in Norway. Energy Policy 2019, 132, 978–990. [Google Scholar] [CrossRef]

- Steffen, B.; Karplus, V.; Schmidt, T.S. State ownership and technology adoption: The case of electric utilities and renewable energy. Res. Policy 2022, 51, 104534. [Google Scholar] [CrossRef]

- Trianni, A.; Cagno, E.; Worrell, E. Innovation and adoption of energy efficient technologies: An exploratory analysis of Italian primary metal manufacturing SMEs. Energy Policy 2013, 61, 430–440. [Google Scholar] [CrossRef]

- Nunn, N.; Wantchekon, L. The slave trade and the origins of mistrust in Africa. Am. Econ. Rev. 2011, 101, 3221–3252. [Google Scholar] [CrossRef]

- Nightingale, P.; Brady, T.; Davies, A.; Hall, J. Capacity utilization revisited: Software, control and the growth of large technical systems. Ind. Corp. Change 2003, 12, 477–517. [Google Scholar] [CrossRef]

- National Bureau of Statistics. China Statistical Yearbook. Available online: https://www.stats.gov.cn/sj/ndsj/2012/indexch.htm (accessed on 7 January 2012).

- NDRC. Announcement of the Implementation of the Top 1000 Energy Conservation Program; Technical Report; National Development and Reform Commission: Beijing, China, 2006. [Google Scholar]

- NDRC. Announcement of the Implementation of the Top 10,000 Energy Conservation and Carbon Reduction Program; Technical Report; National Development and Reform Commission: Beijing, China, 2011. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).