Green Light or Green Burden: ESG’s Dual Effect on Financing Constraints in China’s Heavily Polluting Industries

Abstract

1. Introduction

- (1)

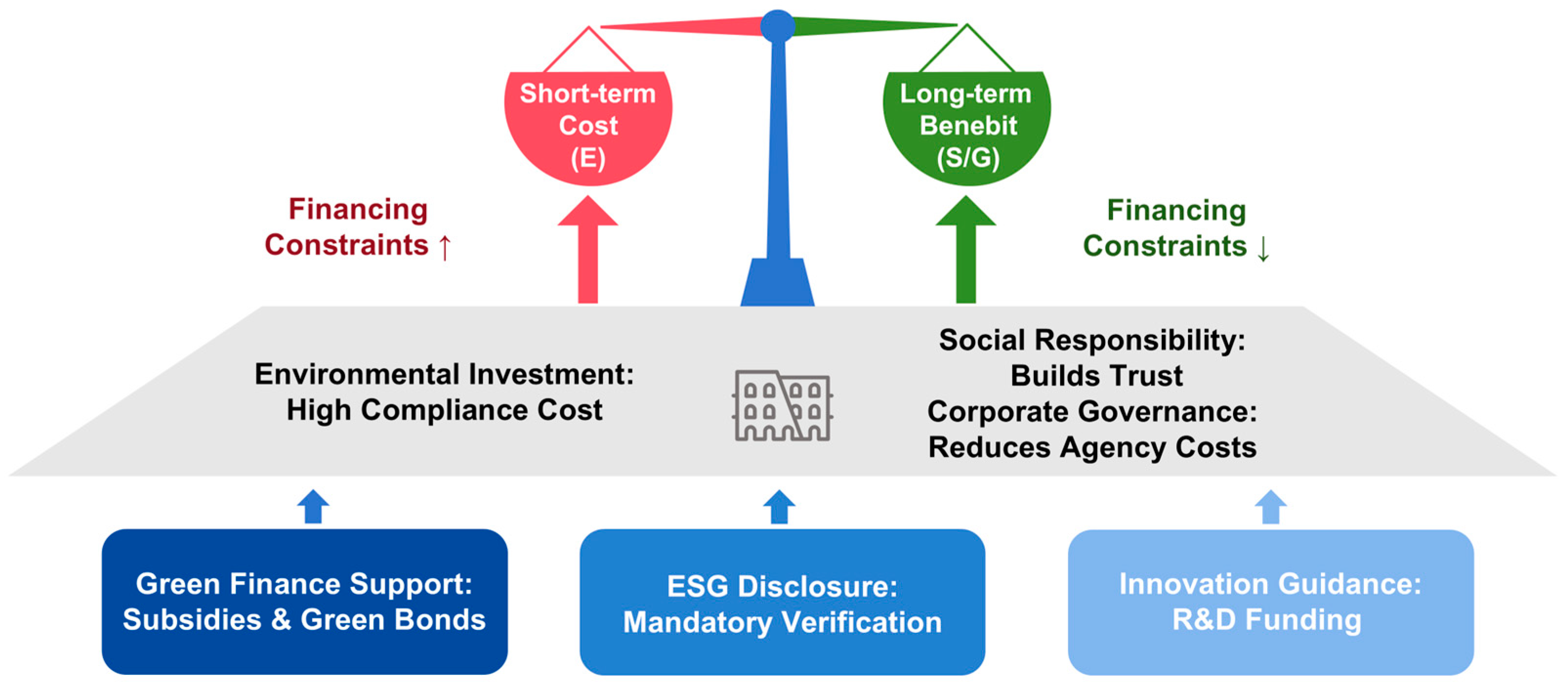

- It identifies a financing paradox of ESG. Based on firm-level data from 2014 to 2023, the results show that overall ESG performance alleviates financing constraints, while the environmental dimension aggravates them.

- (2)

- It introduces theoretically grounded moderating factors. Environmental regulation intensity and innovation output sustainability reduce the positive financial impact of ESG and explain when ESG benefits become weaker or reversed.

- (3)

- It verifies three mediating mechanisms. ESG performance alleviates financing constraints by improving corporate reputation and lowering green agency costs.

- (4)

- It demonstrates heterogeneity in the ESG–finance relationship. The tightening effect of environmental performance is stronger in state-owned enterprises, in eastern provinces, and in regions with lower emerging productivity. These results indicate that ownership structure and regional development conditions significantly influence the effectiveness of ESG practices.

2. Literature Review and Research Hypotheses

2.1. ESG and the Financing Constraint Paradox

2.2. The Regulatory Role of Environmental Regulation

2.3. The Moderating Role of Firms’ Sustainability of Innovation Outputs

2.4. Multi-Theory-Based Mediating Mechanism

2.5. Map of Impact Mechanisms

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Selection of Variable

3.2.1. Dependent Variable: Financing Constraints (KZ)

3.2.2. Independent Variable: ESG Performance (ESG)

3.2.3. Control Variables

3.2.4. Moderating Variables

3.2.5. Mechanism Variables

3.3. Regression Models

3.3.1. Baseline Regression Model

3.3.2. Moderating Effects Model

3.3.3. Mechanism Model

4. Empirical Analysis

4.1. Descriptive Statistics

4.2. Baseline Regression

4.3. Robustness Tests

4.3.1. Variable Lag

4.3.2. Regressions on the Pre-2020 Sample

4.3.3. Substitution of Explanatory Variables

4.3.4. Endogeneity Test

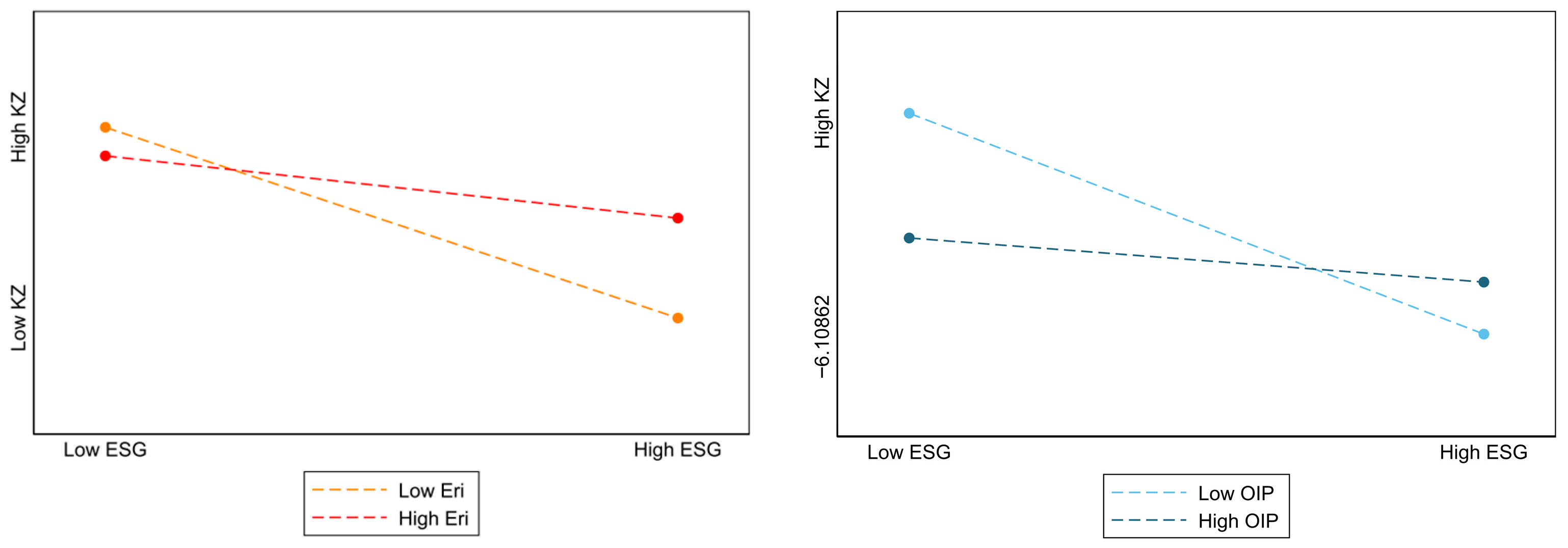

4.4. Moderating Effects Test

4.5. Mechanism Tests

4.5.1. Mechanism Effects of Reputation

4.5.2. Mechanism Effects of Green Agency Cost

5. Heterogeneity Analysis

5.1. Heterogeneity of Enterprise Ownership

5.2. Regionalization

5.3. Emerging Productivity

6. Conclusions and Recommendations

6.1. Conclusions and Discussion

6.2. Recommendations

6.3. Future Perspectives and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

- (1)

- SA Index

- (2)

- WW Index

- (3)

- KZ Index

References

- Li, H.; Gao, X.; Zhang, X.; Zhai, K.; Ling, Y.; Cao, M. The Impacts of China’s Sustainable Financing Policy on Environmental, Social and Corporate Governance (ESG) Performance. Environ. Dev. Sustain. 2025. [Google Scholar] [CrossRef]

- Ding, H.; Han, W.; Wang, Z. Environmental, Social and Corporate Governance (ESG) and Total Factor Productivity: The Mediating Role of Financing Constraints and R&D Investment. Sustainability 2024, 16, 9500. [Google Scholar] [CrossRef]

- Peng, Y.; Bai, R.; Guan, Y. Impact of Green Taxes and Fees on Corporate ESG Performance. Int. Rev. Financ. Anal. 2025, 100, 103957. [Google Scholar] [CrossRef]

- Xu, X.; Li, Z.; Liu, F. Greenwashing in ESG Information Disclosure: An Intertemporal Signaling Game Approach. Int. J. Prod. Econ. 2025, 287, 109674. [Google Scholar] [CrossRef]

- Hu, S.; Chen, P.; Zhang, C. How Does Green Finance Reform Affect Corporate ESG Greenwashing Behavior? Int. Rev. Financ. Anal. 2025, 102, 104037. [Google Scholar] [CrossRef]

- Wu, L.; Zhai, Z.; Lv, Y. A Cross-cultural Study of ESG Impact on Corporate Performance and Equity. Account. Financ. 2024, 64, 4771–4788. [Google Scholar] [CrossRef]

- Bekaert, G.; Rothenberg, R.; Noguer, M. Sustainable Investment—Exploring the Linkage between Alpha, ESG, and SDGs. Sustain. Dev. 2023, 31, 3831–3842. [Google Scholar] [CrossRef]

- Wang, W.; Sun, M. How Does Financial Accessibility Affect the Resource Allocation of Enterprises? Micro-Evidence from the Financial Geographical Structure of Investment-Oriented Enterprises. Financ. Res. Lett. 2025, 84, 107820. [Google Scholar] [CrossRef]

- Ma, D.; Li, L.; Song, Y.; Wang, M.; Han, Q. Corporate Sustainability: The Impact of Environmental, Social, and Governance Performance on Corporate Development and Innovation. Sustainability 2023, 15, 14086. [Google Scholar] [CrossRef]

- Christensen, D.M.; Serafeim, G.; Sikochi, A. Why Is Corporate Virtue in the Eye of the Beholder? The Case of ESG Ratings. Account. Rev. 2022, 97, 147–175. [Google Scholar] [CrossRef]

- Liu, B.; Cifuentes-Faura, J.; Ding, C.J.; Liu, X. Toward Carbon Neutrality: How Will Environmental Regulatory Policies Affect Corporate Green Innovation? Econ. Anal. Policy 2023, 80, 1006–1020. [Google Scholar] [CrossRef]

- Ren, S.; Zhou, Q.; Zhang, X.; Zeng, H. How Do Heavily Polluting Firms Cope with Dual Environmental Regulation? A Study from the Perspective of Financial Asset Allocation. Energy Econ. 2024, 139, 107915. [Google Scholar] [CrossRef]

- Xu, Y.; Dong, Z.; Wu, Y. The Spatiotemporal Effects of Environmental Regulation on Green Innovation: Evidence from Chinese Cities. Sci. Total Environ. 2023, 876, 162790. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Y.; Gao, Y.; Hong, D. Sustainable Innovation and Economic Resilience: Deciphering ESG Ratings’ Role in Lowering Debt Financing Costs. J. Knowl. Econ. 2024, 16, 4309–4343. [Google Scholar] [CrossRef]

- Raimo, N.; Caragnano, A.; Zito, M.; Vitolla, F.; Mariani, M. Extending the Benefits of ESG Disclosure: The Effect on the Cost of Debt Financing. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1412–1421. [Google Scholar] [CrossRef]

- Carlsson Hauff, J.; Nilsson, J. Is ESG Mutual Fund Quality in the Eye of the Beholder? An Experimental Study of Investor Responses to ESG Fund Strategies. Bus. Strategy Environ. 2023, 32, 1189–1202. [Google Scholar] [CrossRef]

- Liu, Z.; Chen, L.; Jiang, H.; Yan, Z.; Li, T. Corporate Innovation and ESG Performance: The Role of Government Subsidies. J. Clean. Prod. 2025, 498, 145209. [Google Scholar] [CrossRef]

- Fang, C.; Wang, Z.; Zhao, L. Environmental Regulations and the Greenwashing of Corporate ESG Reports. Econ. Anal. Policy 2025, 87, 1469–1481. [Google Scholar] [CrossRef]

- Shi, Y.; Li, Y. An Evolutionary Game Analysis on Green Technological Innovation of New Energy Enterprises under the Heterogeneous Environmental Regulation Perspective. Sustainability 2022, 14, 6340. [Google Scholar] [CrossRef]

- Hazaea, S.A.; Cai, C.; Khatib, S.F.A.; Hael, M. The Moderating Role of Audit Quality in the Relationship between ESG Practices and the Cost of Capital: Evidence from the United Kingdom. Borsa Istanb. Rev. 2025, 25, 1085–1099. [Google Scholar] [CrossRef]

- Chen, W.; Chen, S.; Wu, T. Research of the Impact of Heterogeneous Environmental Regulation on the Performance of China’s Manufacturing Enterprises. Front. Environ. Sci. 2022, 10, 948611. [Google Scholar] [CrossRef]

- Zhang, D. Environmental Regulation and Firm Product Quality Improvement: How Does the Greenwashing Response? Int. Rev. Financ. Anal. 2022, 80, 102058. [Google Scholar] [CrossRef]

- Shi, J.; Zhou, Y.; Wang, Q. Is Green an Effective Signal for Investors? Impacts of Corporate Environmental Performance on Debt Financing Cost. J. Environ. Manag. 2025, 389, 126152. [Google Scholar] [CrossRef]

- Zhao, M.; Xu, Y.; Dai, Z.; Lian, Y.; Zhang, Z.; Feng, L.; Nie, M.; Liu, C.; Li, D.; Wu, D. Study on the Regulation of Lutein Release and Bioaccessibility by 3D Printing Interval Multi-Layer Structure of Lutein Emulsion Gel. Food Bioprocess Technol. 2025, 18, 5497–5509. [Google Scholar] [CrossRef]

- Ge, Y.; Zhang, R.; Zhu, H. Green Investors and ESG Ratings Divergence. Sci. Rep. 2025, 15, 20410. [Google Scholar] [CrossRef]

- Andrieș, A.M.; Sprincean, N. ESG Performance and Banks’ Funding Costs. Finance Res. Lett. 2023, 54, 103811. [Google Scholar] [CrossRef]

- Liu, X.; Wang, L. Digital Transformation, ESG Performance and Enterprise Innovation. Sci. Rep. 2025, 15, 23874. [Google Scholar] [CrossRef]

- Nwoba, A.C.; Donbesuur, F.; Olabode, O.; Adefe, K.; Adusei, C.; Adeola, O. Institutional Stimulus and Firm Innovativeness: Examining the Roles of Digital Technologies Adoption and Inbound Openness. R&D Manag. 2025, 55, 1533–1545. [Google Scholar] [CrossRef]

- Solimene, S.; Coluccia, D.; Fontana, S.; Bernardo, A. Formal Institutions and Voluntary CSR/ESG Disclosure: The Role of Institutional Diversity and Firm Size. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 5147–5166. [Google Scholar] [CrossRef]

- Han, L.; Shi, Y.; Zheng, J. Can Green Credit Policies Improve Corporate ESG Performance? Sustain. Dev. 2024, 32, 2678–2699. [Google Scholar] [CrossRef]

- Song, C.; Ma, W. ESG and Green Innovation: Nonlinear Moderation of Public Attention. Humanit. Soc. Sci. Commun. 2025, 12, 667. [Google Scholar] [CrossRef]

- Zhang, Z.; Hou, Y.; Li, Z.; Li, M. From Symbolic to Substantive Green Innovation: How Does ESG Ratings Optimize Corporate Green Innovation Structure. Financ. Res. Lett. 2024, 63, 105401. [Google Scholar] [CrossRef]

- Yang, P.; Sun, W.; Dai, Y. The Effect of ESG Ratings on Corporate Green Innovation Strategies: Evidence from China. J. Asia Pac. Econ. 2024, 1–20. [Google Scholar] [CrossRef]

- Liao, Y.; Marquez, R.; Cheng, Z.; Li, Y. Can ESG Performance Sustainably Reduce Corporate Financing Constraints Based on Sustainability Value Proposition? Sustainability 2025, 17, 7758. [Google Scholar] [CrossRef]

- Wang, X.; Yao, L. Can Enterprise ESG Practices Ease Their Financing Constraints? Evidence from Chinese Listed Companies. Heliyon 2024, 10, e38923. [Google Scholar] [CrossRef]

- Tang, H. The Effect of ESG Performance on Corporate Innovation in China: The Mediating Role of Financial Constraints and Agency Cost. Sustainability 2022, 14, 3769. [Google Scholar] [CrossRef]

- Chai, S.; Zhang, K.; Wei, W.; Ma, W.; Abedin, M.Z. The Impact of Green Credit Policy on Enterprises’ Financing Behavior: Evidence from Chinese Heavily-Polluting Listed Companies. J. Clean. Prod. 2022, 363, 132458. [Google Scholar] [CrossRef]

- Yang, Y.L. Incentive Policy in Agency Theory: A Review. Socio-Econ. Plann. Sci. 1991, 25, 283–293. [Google Scholar] [CrossRef]

- Liu, Y.; Pham, H.; Mai, Y. Green Investment Policy and Maturity Mismatch of Investment and Financing in China’s Heavily Polluting Enterprises. Int. Rev. Econ. Financ. 2024, 93, 1145–1158. [Google Scholar] [CrossRef]

- Cui, X.; Mohd Said, R.; Abdul Rahim, N.; Ni, M. Can Green Finance Lead to Green Investment? Evidence from Heavily Polluting Industries. Int. Rev. Financ. Anal. 2024, 95, 103445. [Google Scholar] [CrossRef]

- Zhang, H.; Wei, S. Green Finance Improves Enterprises’ Environmental, Social and Governance Performance: A Two-Dimensional Perspective Based on External Financing Capability and Internal Technological Innovation. PLoS ONE 2024, 19, e0302198. [Google Scholar] [CrossRef] [PubMed]

- Wei, Z.H.; Zeng, A.M.; Li, B. Financial ecological environment and corporate financing constraints: An empirical study based on Chinese listed companies. Account. Res. 2014, 73–80+95. [Google Scholar]

- Khan, I.; Iqbal, B.; Khan, A.A.; Inamullah; Rehman, A.; Fayyaz, A.; Shakoor, A.; Farooq, T.H.; Wang, L. The Interactive Impact of Straw Mulch and Biochar Application Positively Enhanced the Growth Indexes of Maize (Zea mays L.) Crop. Agronomy 2022, 12, 2584. [Google Scholar] [CrossRef]

- Wang, J.; Zareef, M.; He, P.; Sun, H.; Chen, Q.; Li, H.; Ouyang, Q.; Guo, Z.; Zhang, Z.; Xu, D. Evaluation of Matcha Tea Quality Index Using Portable NIR Spectroscopy Coupled with Chemometric Algorithms. J. Sci. Food Agric. 2019, 99, 5019–5027. [Google Scholar] [CrossRef]

- Wu, S.; Li, Y. A Study on the Impact of Digital Transformation on Corporate ESG Performance: The Mediating Role of Green Innovation. Sustainability 2023, 15, 6568. [Google Scholar] [CrossRef]

- He, Y.B.; Zhang, S. Study on the impact of technological innovation persistence on corporate performance. Sci. Res. Manag. 2017, 38, 1–11. [Google Scholar]

- Tan, J.; Chen, X.C. Analysis of the impact of government environmental regulation on low-carbon economy from the perspective of industrial structure. Economist 2011, 91–97. [Google Scholar] [CrossRef]

- Yan, W.J.; Guo, S.L.; Shi, Y.D. Environmental regulation, industrial structure upgrading and employment effect: Linear or non-linear? Econ. Sci. 2012, 23–32. [Google Scholar] [CrossRef]

- You, Z.; Hou, G.; Wang, M. Heterogeneous Relations among Environmental Regulation, Technological Innovation, and Environmental Pollution. Heliyon 2024, 10, e28196. [Google Scholar] [CrossRef]

- Kwong, C.; Bhattarai, C.R.; Bhandari, M.P.; Cheung, C.W.M. Does Social Performance Contribute to Economic Performance of Social Enterprises? The Role of Social Enterprise Reputation Building. Int. J. Entrep. Behav. Res. 2023, 29, 1906–1926. [Google Scholar] [CrossRef]

- Zhang, D. Does Green Finance Really Inhibit Extreme Hypocritical ESG Risk? A Greenwashing Perspective Exploration. Energy Econ. 2023, 121, 106688. [Google Scholar] [CrossRef]

- Cheng, J.; Sun, J.; Yao, K.; Xu, M.; Zhou, X. Nondestructive Detection and Visualization of Protein Oxidation Degree of Frozen-Thawed Pork Using Fluorescence Hyperspectral Imaging. Meat Sci. 2022, 194, 108975. [Google Scholar] [CrossRef] [PubMed]

- Jiang, H.; Xu, W.; Chen, Q. Evaluating Aroma Quality of Black Tea by an Olfactory Visualization System: Selection of Feature Sensor Using Particle Swarm Optimization. Food Res. Int. 2019, 126, 108605. [Google Scholar] [CrossRef] [PubMed]

- Guo, J.; Dong, X.; Qiu, B. Analysis of the Factors Affecting the Deposition Coverage of Air-Assisted Electrostatic Spray on Tomato Leaves. Agronomy 2024, 14, 1108. [Google Scholar] [CrossRef]

- Li, Y.; Pan, T.; Li, H.; Chen, S. Non-invasive Quality Analysis of Thawed Tuna Using near Infrared Spectroscopy with Baseline Correction. J. Food Process Eng. 2020, 43, e13445. [Google Scholar] [CrossRef]

- Fordjour, A.; Zhu, X.; Yuan, S.; Dwomoh, F.A.; Issaka, Z. Numerical Simulation and Experimental Study on Internal Flow Characteristic in the Dynamic Fluidic Sprinkler. Appl. Eng. Agric. 2020, 36, 61–70. [Google Scholar] [CrossRef]

- Guo, Q.; Li, Y.; Cai, J.; Ren, C.; Farooq, M.A.; Xu, B. The Optimum Cooking Time: A Possible Key Index for Predicting the Deterioration of Fresh White-Salted Noodle. J. Cereal Sci. 2023, 109, 103627. [Google Scholar] [CrossRef]

- Liu, J.; Yuan, S.; Darko, R.O. Characteristics of Water and Droplet Size Distribution from Fluidic Sprinklers. Irrig. Drain. 2016, 65, 522–529. [Google Scholar] [CrossRef]

- Tchabo, W.; Ma, Y.; Kwaw, E.; Zhang, H.; Xiao, L.; Tahir, H.E. Aroma Profile and Sensory Characteristics of a Sulfur Dioxide-Free Mulberry (Morus Nigra) Wine Subjected to Non-Thermal Accelerating Aging Techniques. Food Chem. 2017, 232, 89–97. [Google Scholar] [CrossRef]

- Jun-ping, L.; Shou-qi, Y.; Hong, L.; Xingye, Z. Experimental and Combined Calculation of Variable Fluidic Sprinkler in Agriculture Irrigation. Ama Agric. Mech. Asia Afr. Lat. Am. 2016, 47, 82–88. [Google Scholar]

- Jiang, Y.; Tang, Y.; Li, H. A Review of Trends in the Use of Sewage Irrigation Technology from the Livestock and Poultry Breeding Industries for Farmlands. Irrig. Sci. 2022, 40, 297–308. [Google Scholar] [CrossRef]

- Feng, Y.; Wang, N.; Xie, H.; Li, J.; Li, G.; Xue, L.; Fu, H.; Feng, Y.; Poinern, G.E.J.; Chen, D. Livestock Manure-Derived Hydrochar Is More Inclined to Mitigate Soil Global Warming Potential than Raw Materials Based on Soil Stoichiometry Analysis. Biol. Fertil. Soils 2023, 59, 459–472. [Google Scholar] [CrossRef]

- Wu, X.; Wu, B.; Sun, J.; Yang, N. Classification of Apple Varieties Using near Infrared Reflectance Spectroscopy and Fuzzy Discriminant C-means Clustering Model. J. Food Process Eng. 2017, 40, e12355. [Google Scholar] [CrossRef]

- Huan, J.; Cao, W.; Liu, X. A Dissolved Oxygen Prediction Method Based on K-Means Clustering and the ELM Neural Network: A Case Study of the Changdang Lake, China. Appl. Eng. Agric. 2017, 33, 461–469. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, J.; Li, J.; Wu, X.; Dai, C. Quantitative Analysis of Cadmium Content in Tomato Leaves Based on Hyperspectral Image and Feature Selection. Appl. Eng. Agric. 2018, 34, 789–798. [Google Scholar] [CrossRef]

- Li, Y.; Sun, J.; Wu, X.; Lu, B.; Wu, M.; Dai, C. Grade Identification of Tieguanyin Tea Using Fluorescence Hyperspectra and Different Statistical Algorithms. J. Food Sci. 2019, 84, 2234–2241. [Google Scholar] [CrossRef]

- Ge, X.; Sun, J.; Lu, B.; Chen, Q.; Xun, W.; Jin, Y. Classification of oolong tea varieties based on hyperspectral imaging technology and BOSS-LightGBM model. J. Food Process Eng. 2019, 42, e13289. [Google Scholar] [CrossRef]

- Wang, J.; Wang, Z.; Wang, H.; Chen, T. Does the New Environmental Protection Law Hinder the Development of New Quality Productive Forces in Industrial Enterprises? A Quasi-Natural Experiment in China. J. Clean. Prod. 2025, 517, 145870. [Google Scholar] [CrossRef]

| Index | Constituent Indicators | Theoretical Basis |

|---|---|---|

| KZ Index | Operating Net Cash Flow, Tobin’s Q, Debt-to-Assets, Dividends, Cash Holdings | Based on indicators related to firms’ internal fund availability and external debt financing capacity. |

| WW Index | Debt-to-Assets, Cash Flow, Tobin’s Q, Dividend Payout, Sales Growth | Derived from the Euler equation estimates of investment. |

| SA Index | Firm Size, Firm Age | Relative to mature industry players, emerging firms exhibit intensified financing constraints. |

| Year | t − 2 | t − 1 | t |

|---|---|---|---|

| patent | 10 | 15 | 20 |

| Variable Type | Variable Name | Variable Symbol | Variable Definition |

|---|---|---|---|

| Explanatory Variable | Financing constraints | KZ | Financing constraints based on operating cash flow, cash dividends, cash holdings, gearing, Tobin’s Q |

| Explanatory Variable | ESG performance | ESG | The Huazheng ESG rating is assigned from low to high as “1 to 9” (1 = CCC, 9 = AAA) |

| E performance | E | The Huazheng E rating is assigned from low to high as “1 to 9” (1 = CCC, 9 = AAA) | |

| S performance | S | The Huazheng S Rating is assigned from low to high as “1 to 9” (1 = CCC, 9 = AAA) | |

| G performance | G | The Huazheng G rating is assigned from low to high as “1 to 9” (1 = CCC, 9 = AAA) | |

| Moderator Variable | Sustainability of innovation outputs | OIP | OIP denotes the firm’s innovation output persistence in year t |

| Intensity of environmental regulation | Eri | Completed investment in industrial pollution control/industrial value added | |

| Mechanism Variables | Corporate reputation | CR | The natural logarithm of the sum of a firm’s annual negative news reports from online platforms and newspapers plus 1 |

| Green Agency Cost | GAC | Environmental Governance Expenses/Total Operating Revenue | |

| Control Variable | Enterprise size | Size | Natural logarithm of total assets for the year |

| cash flow ratio | Cashflow | Net cash flows from operating activities/total assets | |

| Years of Establishment | FirmAge | Natural logarithm of the difference between the current year and the year the enterprise was established, plus 1 | |

| Percentage of the largest shareholders | Top1 | Number of shares held by the largest shareholder/total number of shares | |

| Revenue growth rate | Growth | Current year’s operating income/previous year’s operating income) − 1 | |

| Percentage of independent directors | ID | Number of independent directors/directors | |

| Industry | Industry | Industry fixed effect | |

| Year | Year | Annual fixed effect |

| Variable | Obs | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| KZ | 6513 | 0.934 | 2.220 | −5.702 | 6.151 |

| ESG | 6513 | 4.088 | 1.036 | 1.000 | 6.000 |

| E | 6513 | 2.228 | 1.212 | 1.000 | 8.000 |

| S | 6513 | 4.557 | 1.625 | 1.000 | 9.000 |

| G | 6513 | 5.205 | 1.300 | 1.000 | 8.000 |

| Size | 6513 | 22.593 | 1.393 | 20.122 | 26.518 |

| Cashflow | 6513 | 0.062 | 0.063 | −0.115 | 0.246 |

| FirmAge | 6513 | 3.028 | 0.273 | 2.197 | 3.555 |

| Top1 | 6513 | 0.344 | 0.150 | 0.092 | 0.756 |

| FIXED | 6513 | 0.321 | 0.164 | 0.027 | 0.758 |

| Growth | 6513 | 0.143 | 0.366 | −0.460 | 2.282 |

| ID | 6513 | 0.378 | 0.065 | 0.188 | 0.750 |

| OIP | 5528 | 4.119 | 1.518 | 0.118 | 7.678 |

| Eri | 6513 | 0.002 | 0.002 | 0.000 | 0.009 |

| CR | 6513 | 4.711 | 1.348 | 0.693 | 12.687 |

| GAC | 6513 | 0.763 | 3.786 | −14.009 | 164.721 |

| (1) | (2) | (3) | |

|---|---|---|---|

| KZ | KZ | KZ | |

| ESG | −0.429 *** (−16.76) | −0.345 *** (−16.47) | |

| E | 0.0766 *** (4.16) | ||

| S | −0.0870 *** (−6.28) | ||

| G | −0.355 *** (−21.41) | ||

| Size | 0.280 *** (14.81) | 0.248 *** (13.19) | |

| Cashflow | −21.21 *** (−57.16) | −21.07 *** (−57.78) | |

| FirmAge | 0.579 *** (6.72) | 0.575 *** (6.71) | |

| Top1 | −0.870 *** (−5.72) | −0.683 *** (−4.58) | |

| Growth | −0.365 *** (−5.10) | −0.367 *** (−5.23) | |

| ID | −0.587 * (−1.82) | −0.158 (−0.50) | |

| Constant | 2.688 *** (24.91) | −3.846 *** (−8.02) | −2.696 *** (−5.60) |

| Industry FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 6513 | 6513 | 6513 |

| Adj r2 | 0.100 | 0.470 | 0.492 |

| Lag 1 | Lag 2 | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| L.ESG | −0.269 *** (−12.00) | |||

| L.E | 0.0729 *** (3.50) | |||

| L.S | −0.0541 *** (−3.74) | |||

| L.G | −0.292 *** (−16.21) | |||

| L2.ESG | −0.229 *** (−10.24) | |||

| L2.E | 0.0710 *** (3.16) | |||

| L2.S | −0.0446 *** (−2.93) | |||

| L2.G | −0.244 *** (−12.85) | |||

| Size | 0.248 *** (11.90) | 0.224 *** (10.73) | 0.204 *** (9.01) | 0.184 *** (8.06) |

| Cashflow | −21.75 *** (−52.78) | −21.71 *** (−53.22) | −21.82 *** (−49.13) | −21.80 *** (−48.92) |

| FirmAge | 0.435 *** (4.53) | 0.441 *** (4.58) | 0.356 *** (3.26) | 0.357 *** (3.26) |

| Top1 | −0.794 *** (−4.78) | −0.631 *** (−3.84) | −0.600 *** (−3.35) | −0.453 ** (−2.55) |

| Growth | −0.417 *** (−5.21) | −0.412 *** (−5.19) | −0.410 *** (−4.75) | −0.408 *** (−4.74) |

| ID | −0.437 (−1.23) | −0.198 (−0.57) | −0.689 * (−1.82) | −0.409 (−1.07) |

| Constant | −3.040 *** (−5.72) | −2.172 *** (−4.06) | −1.860 *** (−3.19) | −1.178 ** (−2.02) |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 5466 | 5466 | 4633 | 4633 |

| Adj r2 | 0.467 | 0.482 | 0.467 | 0.478 |

| (1) | (2) | (3) | |

|---|---|---|---|

| KZ | KZ | KZ | |

| ESG | −0.369 *** (−12.36) | −0.301 *** (−11.85) | |

| E | 0.0989 *** (4.15) | ||

| S | −0.105 *** (−6.23) | ||

| G | −0.273 *** (−13.28) | ||

| Size | 0.294 *** (11.79) | 0.273 *** (10.99) | |

| Cashflow | −18.82 *** (−38.73) | −18.86 *** (−39.15) | |

| FirmAge | 0.708 *** (6.48) | 0.703 *** (6.39) | |

| Top1 | −0.339 * (−1.71) | −0.260 (−1.32) | |

| Growth | −0.364 *** (−4.14) | −0.369 *** (−4.24) | |

| ID | −0.779 * (−1.80) | −0.457 (−1.07) | |

| Constant | 2.419 *** (19.14) | −4.948 *** (−7.97) | −4.162 *** (−6.71) |

| Industry FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 3479 | 3479 | 3479 |

| Adj r2 | 0.090 | 0.439 | 0.454 |

| (1) | (2) | (3) | |

|---|---|---|---|

| WW | WW | WW | |

| ESG | −0.0212 *** (−25.68) | −0.00527 *** (−13.80) | |

| E | 0.00101 *** (3.06) | ||

| S | −0.00218 *** (−8.20) | ||

| G | −0.00435 *** (−14.28) | ||

| Size | −0.0457 *** (−137.21) | −0.0460 *** (−137.93) | |

| Cashflow | −0.163 *** (−25.93) | −0.164 *** (−26.08) | |

| FirmAge | 0.00699 *** (4.58) | 0.00653 *** (4.26) | |

| Top1 | −0.0109 *** (−4.04) | −0.00939 *** (−3.49) | |

| Growth | −0.0487 *** (−28.58) | −0.0486 *** (−28.44) | |

| ID | −0.00752 (−1.32) | −0.00306 (−0.54) | |

| Constant | −0.954 *** (−274.83) | 0.0246 *** (2.88) | 0.0394 *** (4.58) |

| Industry FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 5669 | 5669 | 5669 |

| Adj r2 | 0.290 | 0.867 | 0.870 |

| Variable | First Stage ESG | Second Stage KZ |

|---|---|---|

| IV.ESG | 0.661 *** (22.75) | |

| ESG | −0.573 *** (−7.89) | |

| Size | 0.166 *** (15.68) | 0.329 *** (13.10) |

| Cashflow | 1.045 *** (5.23) | −20.928 *** (−54.70) |

| FirmAge | −0.221 *** (−4.46) | 0.499 *** (5.46) |

| Top1 | 0.275 *** (3.27) | −0.798 *** (−5.16) |

| Growth | −0.055 (−1.63) | −0.383 *** (−5.36) |

| ID | 0.875 *** (4.88) | −0.330 (−0.99) |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| N | 6508 | 6508 |

| Kleibergen–Paap rk LM statistic | 374.502 *** | |

| Kleibergen–Paap rk Wald F statistic | 517.438 | |

| Weak instrumental variables test | 63.51 *** | |

| Critical values: 10% | 16.38 |

| (1) | (2) | |

|---|---|---|

| KZ | KZ | |

| ESG | −0.349 *** (−16.09) | −0.315 *** (−13.81) |

| ESG × Eri | 31.17 *** (3.44) | |

| ESG × OIP | 0.0578 *** (4.05) | |

| Size | 0.278 *** (14.74) | 0.297 *** (12.73) |

| Cashflow | −21.18 *** (−57.16) | −21.29 *** (−54.53) |

| FirmAge | 0.584 *** (6.80) | 0.366 *** (4.03) |

| Top1 | −0.850 *** (−5.63) | −0.661 *** (−3.98) |

| Growth | −0.363 *** (−5.05) | −0.441 *** (−5.47) |

| ID | −0.519 (−1.61) | −0.379 (−1.11) |

| Constant | −5.277 *** (−10.90) | −5.166 *** (−9.01) |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| N | 6513 | 5528 |

| Adj r2 | 0.472 | 0.477 |

| (1) Reputation | (2) GAC | |

|---|---|---|

| ESG | 0.0448 *** (4.55) | −0.162 ** (−2.44) |

| Size | 0.395 *** (39.43) | −0.0323 (−1.07) |

| Cashflow | 1.342 *** (8.06) | −1.218 (−1.11) |

| FirmAge | −0.124 *** (−2.91) | 0.108 (0.49) |

| Top1 | −0.266 *** (−3.22) | 0.165 (0.76) |

| Growth | 0.162 *** (5.14) | −0.397 *** (−3.08) |

| ID | 0.394 ** (2.44) | 0.814 (0.83) |

| Constant | −4.203 *** (−16.00) | 1.595 * (1.70) |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| N | 6513 | 6513 |

| Adj r2 | 0.626 | 0.021 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| State Owned | Nonstate Owned | State Owned | Nonstate Owned | |

| ESG | −0.384 *** (−13.03) | −0.278 *** (−9.94) | ||

| E | 0.131 *** (5.00) | 0.0305 (1.25) | ||

| S | −0.0945 *** (−4.74) | −0.0427 ** (−2.35) | ||

| G | −0.423 *** (−18.74) | −0.313 *** (−13.08) | ||

| Size | 0.207 *** (6.92) | 0.243 *** (9.43) | 0.138 *** (4.68) | 0.225 *** (8.67) |

| Cashflow | −21.96 *** (−44.82) | −19.03 *** (−34.80) | −21.62 *** (−44.90) | −18.95 *** (−35.40) |

| FirmAge | 0.405 *** (3.58) | 0.212 (1.50) | 0.369 *** (3.29) | 0.224 (1.61) |

| Top1 | −1.298 *** (−5.73) | −0.995 *** (−4.73) | −1.172 *** (−5.36) | −0.773 *** (−3.72) |

| Growth | −0.368 *** (−3.71) | −0.185 * (−1.82) | −0.350 *** (−3.56) | −0.187 * (−1.91) |

| ID | −0.178 (−0.39) | −0.976 ** (−2.32) | 0.180 (0.41) | −0.421 (−1.01) |

| Constant | −1.797 ** (−2.43) | −1.756 ** (−2.42) | 0.375 (0.51) | −1.010 (−1.38) |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 3752 | 2676 | 3752 | 2676 |

| Adj r2 | 0.458 | 0.483 | 0.489 | 0.503 |

| Empirical p-value | 0.006 *** | 0.004 *** | ||

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| East | Midwest | East | Midwest | |

| ESG | −0.326 *** (−11.82) | −0.387 *** (−11.74) | ||

| E | 0.0892 *** (3.81) | 0.0311 (1.04) | ||

| S | −0.0645 *** (−3.59) | −0.127 *** (−5.85) | ||

| G | −0.377 *** (−17.11) | −0.314 *** (−12.24) | ||

| Size | 0.301 *** (13.00) | 0.221 *** (6.67) | 0.267 *** (11.47) | 0.200 *** (6.06) |

| Cashflow | −21.59 *** (−45.82) | −20.02 *** (−33.06) | −21.31 *** (−46.29) | −20.07 *** (−33.38) |

| FirmAge | 0.385 *** (3.77) | 0.941 *** (5.91) | 0.406 *** (4.00) | 0.893 *** (5.62) |

| Top1 | −1.055 *** (−5.53) | −0.646 ** (−2.57) | −0.746 *** (−3.96) | −0.614 ** (−2.48) |

| Growth | −0.425 *** (−4.53) | −0.297 *** (−2.72) | −0.419 *** (−4.61) | −0.309 *** (−2.84) |

| ID | −0.255 (−0.63) | −0.796 (−1.55) | 0.124 (0.31) | −0.350 (−0.69) |

| Constant | −3.969 *** (−6.61) | −3.356 *** (−4.14) | −2.786 *** (−4.62) | −2.359 *** (−2.87) |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 3986 | 2526 | 3986 | 2526 |

| Adj r2 | 0.475 | 0.474 | 0.501 | 0.487 |

| Empirical p-value | 0.072 * | 0.062 * | ||

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| High | Low | High | Low | |

| ESG | −0.272 *** (−6.93) | −0.349 *** (−13.94) | ||

| E | 0.0523 (1.39) | 0.0872 *** (4.17) | ||

| S | −0.0717 *** (−2.66) | −0.0839 *** (−5.23) | ||

| G | −0.268 *** (−8.92) | −0.376 *** (−19.08) | ||

| Size | 0.258 *** (6.74) | 0.279 *** (12.60) | 0.221 *** (5.73) | 0.251 *** (11.37) |

| Cashflow | −19.60 *** (−26.75) | −21.59 *** (−49.96) | −19.55 *** (−27.15) | −21.37 *** (−50.27) |

| FirmAge | 0.641 *** (3.22) | 0.579 *** (6.01) | 0.609 *** (3.09) | 0.582 *** (6.08) |

| Top1 | −1.409 *** (−4.28) | −0.773 *** (−4.42) | −1.318 *** (−4.08) | −0.558 *** (−3.26) |

| Growth | −0.242 ** (−2.06) | −0.419 *** (−4.78) | −0.251 ** (−2.15) | −0.416 *** (−4.84) |

| ID | −1.072 * (−1.75) | −0.365 (−0.98) | −0.723 (−1.19) | 0.0909 (0.25) |

| Constant | −3.314 *** (−3.39) | −3.982 *** (−7.13) | −2.045 ** (−2.04) | −2.883 *** (−5.17) |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 1510 | 5002 | 1510 | 5002 |

| r2_a | 0.522 | 0.456 | 0.536 | 0.481 |

| Empirical p-value | 0.054 * | 0.572 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.; Liu, Y.; Zou, B.; Ji, T. Green Light or Green Burden: ESG’s Dual Effect on Financing Constraints in China’s Heavily Polluting Industries. Sustainability 2025, 17, 9263. https://doi.org/10.3390/su17209263

Wang J, Liu Y, Zou B, Ji T. Green Light or Green Burden: ESG’s Dual Effect on Financing Constraints in China’s Heavily Polluting Industries. Sustainability. 2025; 17(20):9263. https://doi.org/10.3390/su17209263

Chicago/Turabian StyleWang, Jingnan, Yue Liu, Boyan Zou, and Tonghai Ji. 2025. "Green Light or Green Burden: ESG’s Dual Effect on Financing Constraints in China’s Heavily Polluting Industries" Sustainability 17, no. 20: 9263. https://doi.org/10.3390/su17209263

APA StyleWang, J., Liu, Y., Zou, B., & Ji, T. (2025). Green Light or Green Burden: ESG’s Dual Effect on Financing Constraints in China’s Heavily Polluting Industries. Sustainability, 17(20), 9263. https://doi.org/10.3390/su17209263