How Does the Green Credit Policy Influence Corporate Carbon Information Disclosure?—A Quasi-Natural Experiment Based on the Green Credit Guidelines

Abstract

1. Introduction

2. Literature Review

3. Theoretical Analysis and Research Hypotheses

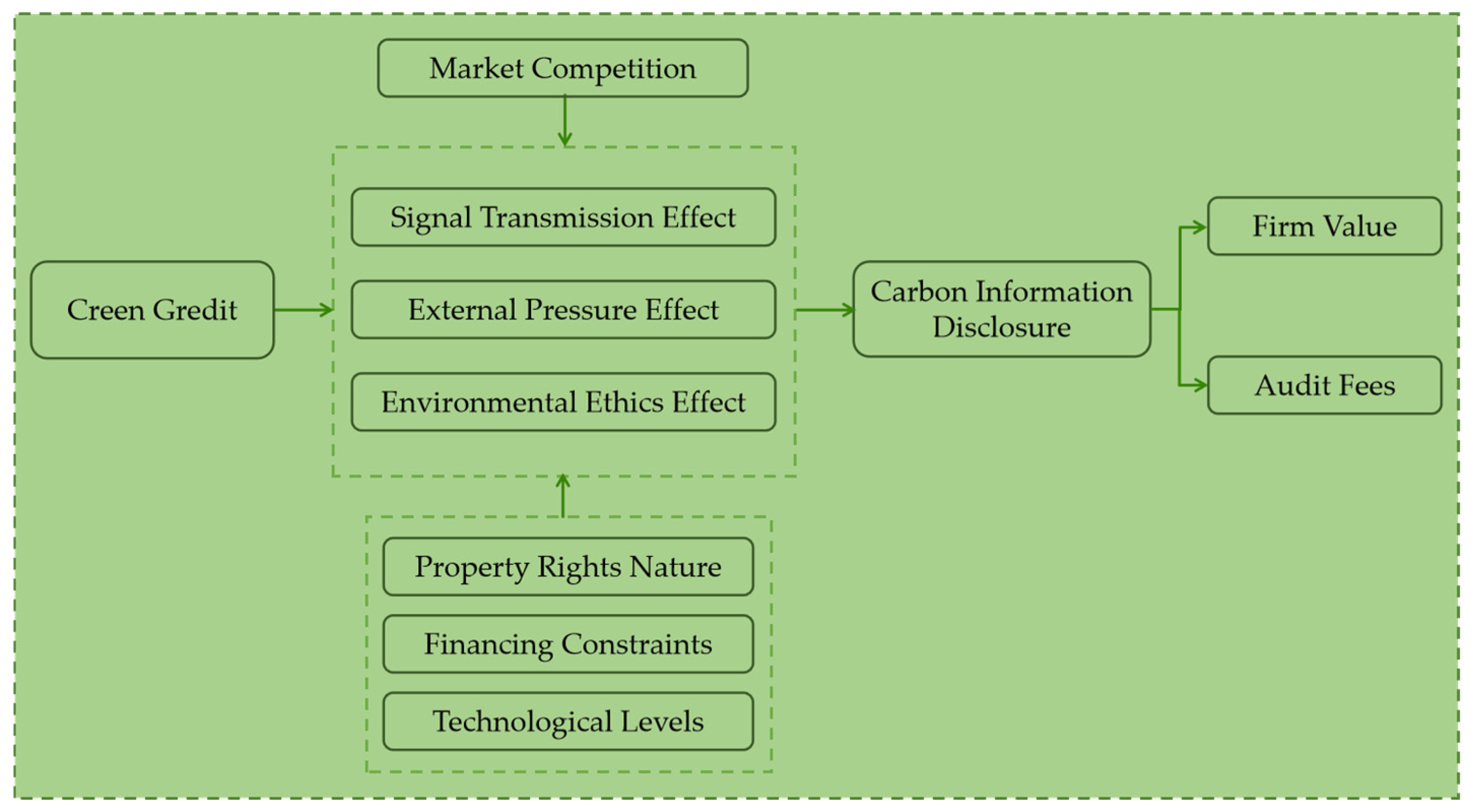

3.1. Green Credit Policies and Corporate Carbon Information Disclosure

3.2. The Impact of Green Credit Policies on Corporate Carbon Information Disclosure

3.2.1. The Signal Transmission Effect of Green Credit Policies

3.2.2. The External Pressure Effect of Green Credit Policies

3.2.3. The Environmental Ethics Effect of Green Credit Policies

3.3. Moderating Effect of Market Competition

4. Research Design

4.1. Data Source

4.2. Variable Definitions

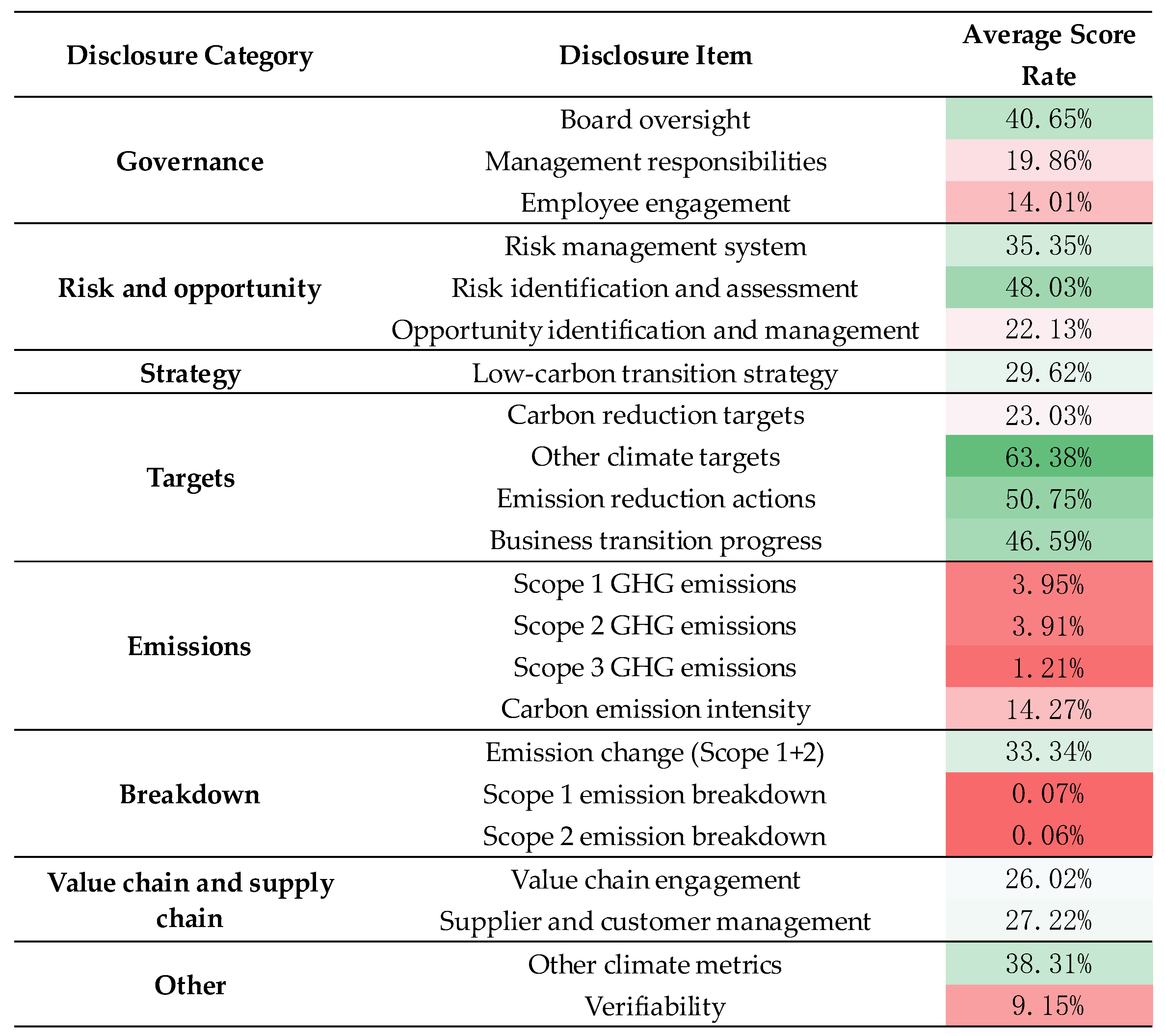

4.2.1. Dependent Variable

4.2.2. Explanatory Variable

4.2.3. Control Variables

4.3. Model Construction

5. Empirical Results

5.1. Descriptive Statistics

5.2. Benchmark Regression Analysis

5.3. Robustness Testing

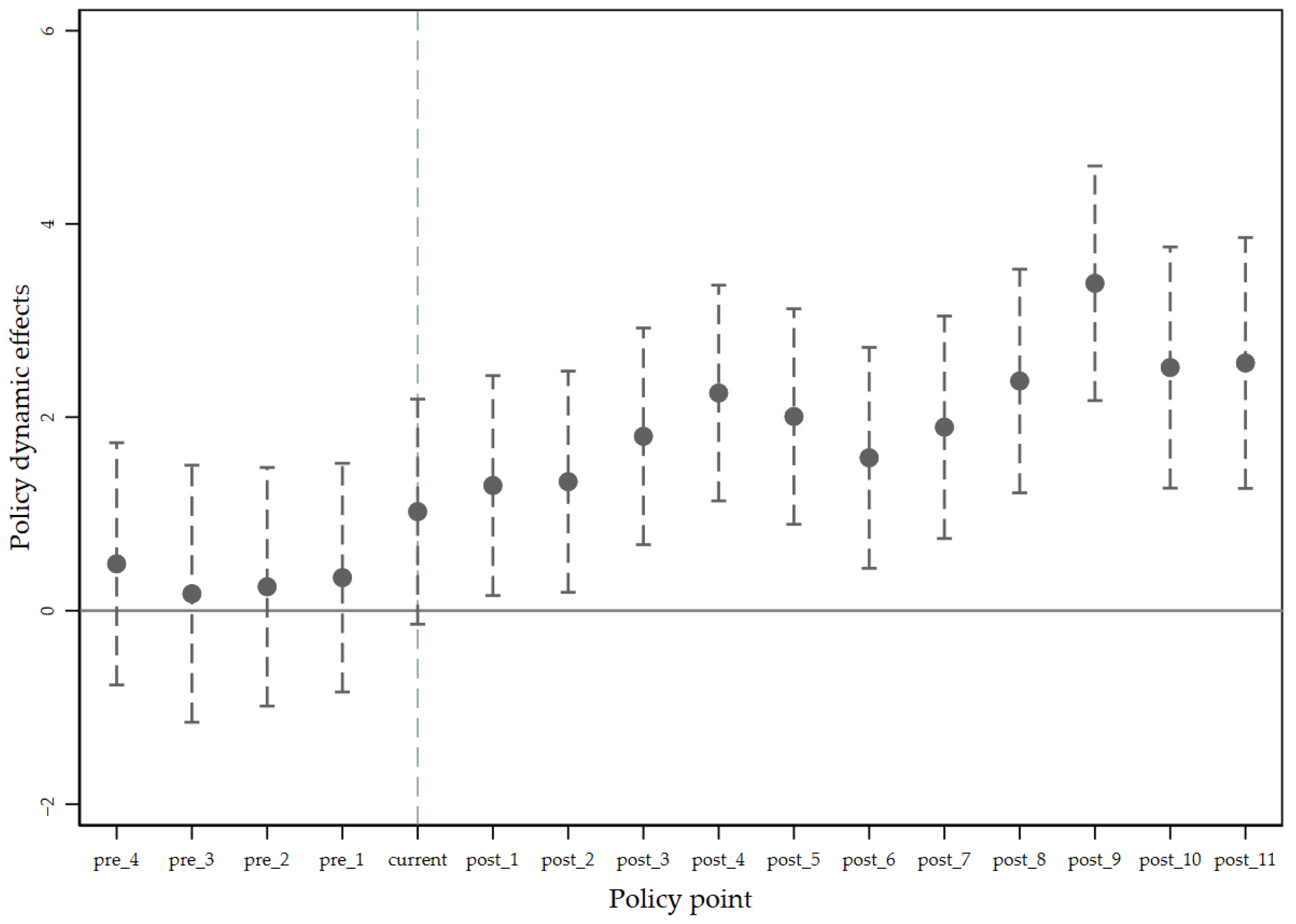

5.3.1. Parallel Trend Test

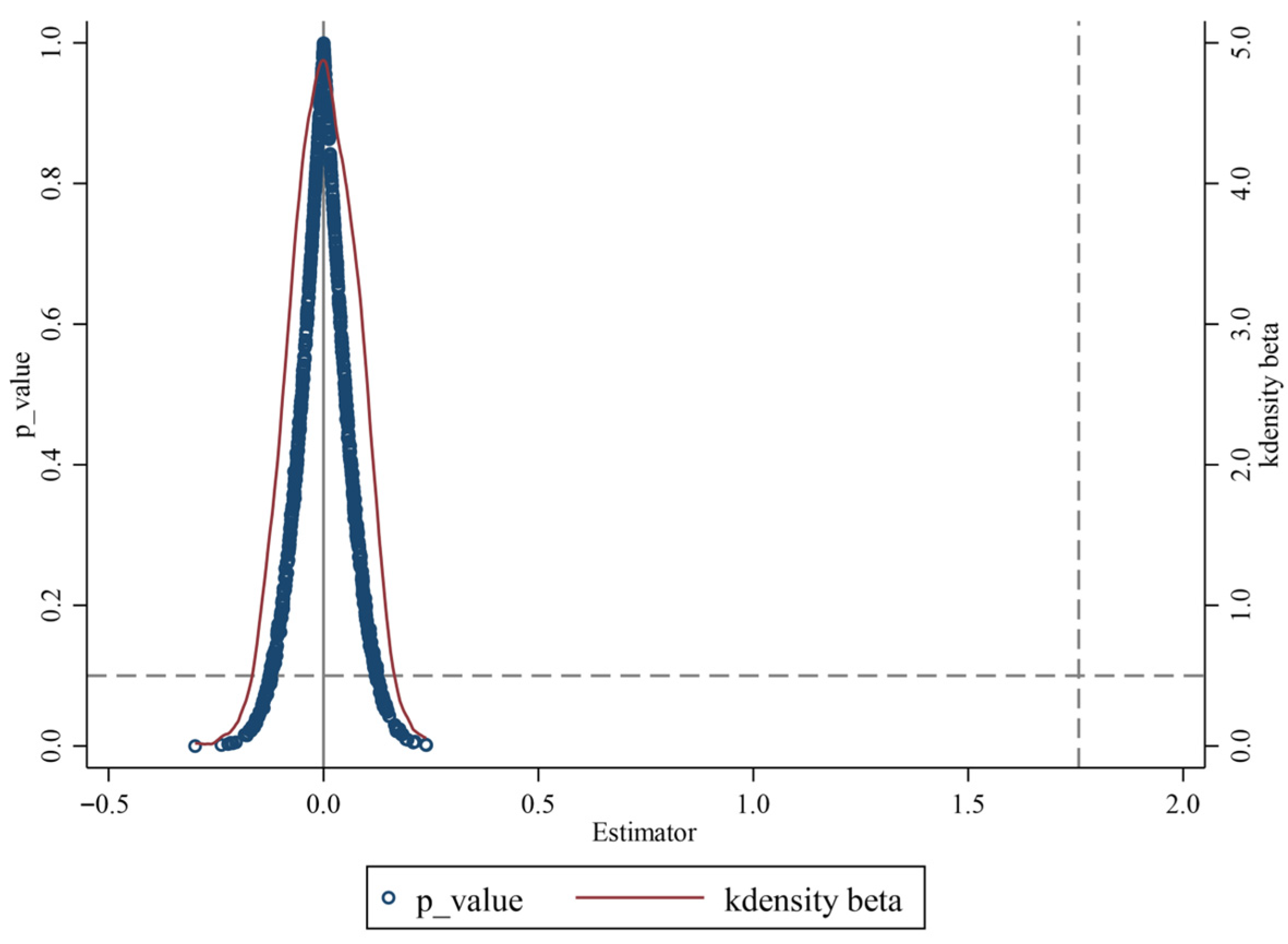

5.3.2. Placebo Test

5.3.3. PSM-DID

5.3.4. Shortening the Sample Period

5.3.5. Triple Difference Test

5.3.6. Replacement of Measurement Standards for the Experimental Group

6. Mechanism Testing

6.1. Testing the Signal Transmission Effect

6.2. Testing the External Pressure Effect

6.3. Testing the Environmental Ethics Effect

7. Further Analysis

7.1. The Role of Market Competition

7.2. Heterogeneity Analysis

7.2.1. Analysis of Heterogeneity in Property Rights Nature

7.2.2. Analysis of Heterogeneity in Financing Constraints

7.2.3. Analysis of Heterogeneity in Technological Levels

7.3. The Economic Consequences of Corporate Carbon Information Disclosure

8. Conclusions and Recommendations

8.1. Research Findings

8.2. Research Suggestions and Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hong, H.; Wang, N.; Yang, J. Welfare consequences of sustainable finance. Rev. Financ. Stud. 2023, 36, 4864–4918. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lee, C.-C. How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 2022, 107, 105863. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Liu, J.-Y. Overview of research on carbon information disclosure. Front. Eng. Manag. 2020, 7, 47–62. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- Hong, M.; Li, Z.; Drakeford, B. Do the green credit guidelines affect corporate green technology innovation? Empirical research from China. Int. J. Environ. Res. Public Health 2021, 18, 1682. [Google Scholar] [CrossRef] [PubMed]

- Fang, X.; Liu, M.; Li, G. Can the green credit policy promote green innovation in enterprises? Empirical evidence from China. Technol. Econ. Dev. Econ. 2024, 30, 899–932. [Google Scholar] [CrossRef]

- Xu, B.; Lin, B. How does green credit effectively promote green technology innovation? Int. Rev. Financ. Anal. 2025, 102, 104089. [Google Scholar] [CrossRef]

- Liu, X.; Wang, E.; Cai, D. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Cai, H.; Wang, X.; Tan, C. Green credit policy, incremental bank loans and environmental protection effect. Acc. Res 2019, 3, 88–95. [Google Scholar]

- Xu, X.; Li, J. Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 2020, 264, 121574. [Google Scholar] [CrossRef]

- Wang, C.; Wang, L. Green credit and industrial green total factor productivity: The impact mechanism and threshold effect tests. J. Environ. Manag. 2023, 331, 117266. [Google Scholar] [CrossRef]

- Li, B.; Zhang, J.; Shen, Y.; Du, Q. Can green credit policy promote green total factor productivity? Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 6891–6905. [Google Scholar] [CrossRef]

- Li, G.; Jia, X.; Khan, A.A.; Khan, S.U.; Ali, M.A.S.; Luo, J. Does green finance promote agricultural green total factor productivity? Considering green credit, green investment, green securities, and carbon finance in China. Environ. Sci. Pollut. Res. 2023, 30, 36663–36679. [Google Scholar] [CrossRef]

- Freedman, M.; Jaggi, B. Global warming, commitment to the Kyoto protocol, and accounting disclosures by the largest global public firms from polluting industries. Int. J. Account. 2005, 40, 215–232. [Google Scholar] [CrossRef]

- Rankin, M.; Windsor, C.; Wahyuni, D. An investigation of voluntary corporate greenhouse gas emissions reporting in a market governance system: Australian evidence. Account. Audit. Account. J. 2011, 24, 1037–1070. [Google Scholar] [CrossRef]

- Cotter, J.; Najah, M.M. Institutional investor influence on global climate change disclosure practices. Aust. J. Manag. 2012, 37, 169–187. [Google Scholar] [CrossRef]

- Luo, L.; Lan, Y.C.; Tang, Q. Corporate incentives to disclose carbon information: Evidence from the CDP Global 500 report. J. Int. Financ. Manag. Account. 2012, 23, 93–120. [Google Scholar] [CrossRef]

- Amran, A.; Periasamy, V.; Zulkafli, A.H. Determinants of climate change disclosure by developed and emerging countries in Asia Pacific. Sustain. Dev. 2014, 22, 188–204. [Google Scholar] [CrossRef]

- Liao, L.; Luo, L.; Tang, Q. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Jaggi, B.; Allini, A.; Macchioni, R.; Zagaria, C. The factors motivating voluntary disclosure of carbon information: Evidence based on Italian listed companies. Organ. Environ. 2018, 31, 178–202. [Google Scholar] [CrossRef]

- He, P.; Shen, H.; Zhang, Y.; Ren, J. External pressure, corporate governance, and voluntary carbon disclosure: Evidence from China. Sustainability 2019, 11, 2901. [Google Scholar] [CrossRef]

- Prado-Lorenzo, J.M.; Rodríguez-Domínguez, L.; Gallego-Álvarez, I.; García-Sánchez, I.M. Factors influencing the disclosure of greenhouse gas emissions in companies world-wide. Manag. Decis. 2009, 47, 1133–1157. [Google Scholar] [CrossRef]

- Faisal, F.; Andiningtyas, E.D.; Achmad, T.; Haryanto, H.; Meiranto, W. The content and determinants of greenhouse gas emission disclosure: Evidence from Indonesian companies. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1397–1406. [Google Scholar] [CrossRef]

- Luo, L.; Tang, Q. Does voluntary carbon disclosure reflect underlying carbon performance? J. Contemp. Account. Econ. 2014, 10, 191–205. [Google Scholar] [CrossRef]

- Guenther, E.; Guenther, T.; Schiemann, F.; Weber, G. Stakeholder relevance for reporting: Explanatory factors of carbon disclosure. Bus. Soc. 2016, 55, 361–397. [Google Scholar] [CrossRef]

- Qian, W.; Schaltegger, S. Revisiting carbon disclosure and performance: Legitimacy and management views. Br. Account. Rev. 2017, 49, 365–379. [Google Scholar] [CrossRef]

- He, R.; Cheng, Y.; Zhou, M.; Liu, J.; Yang, Q. Government regulation, executive overconfidence, and carbon information disclosure: Evidence from China. Front. Psychol. 2021, 12, 787201. [Google Scholar] [CrossRef]

- Li, L.; Liu, Q.; Tang, D.; Xiong, J. Media reporting, carbon information disclosure, and the cost of equity financing: Evidence from China. Environ. Sci. Pollut. Res. 2017, 24, 9447–9459. [Google Scholar] [CrossRef]

- Li, D.; Huang, M.; Ren, S.; Chen, X.; Ning, L. Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. J. Bus. Ethics 2018, 150, 1089–1104. [Google Scholar] [CrossRef]

- Cohen, S.; Kadach, I.; Ormazabal, G. Institutional investors, climate disclosure, and carbon emissions. J. Account. Econ. 2023, 76, 101640. [Google Scholar] [CrossRef]

- Kolk, A.; Levy, D.; Pinkse, J. Corporate responses in an emerging climate regime: The institutionalization and commensuration of carbon disclosure. Eur. Account. Rev. 2008, 17, 719–745. [Google Scholar] [CrossRef]

- Dragomir, V.D. The disclosure of industrial greenhouse gas emissions: A critical assessment of corporate sustainability reports. J. Clean. Prod. 2012, 29, 222–237. [Google Scholar] [CrossRef]

- Stanny, E. Voluntary disclosures of emissions by US firms. Bus. Strategy Environ. 2013, 22, 145–158. [Google Scholar] [CrossRef]

- Peng, J.; Sun, J.; Luo, R. Corporate voluntary carbon information disclosure: Evidence from China’s listed companies. World Econ. 2015, 38, 91–109. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Rasheed, A.K.; Chang, Y.; Taghizadeh-Hesary, F. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 2021, 153, 112256. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Y. The impact of environmental governance policy on green innovation: Evidence from China’s quasi-natural experiment. J. Financ. Res. 2021, 10, 134–152. [Google Scholar]

- He, L.; Zhang, L.; Zhong, Z.; Wang, D.; Wang, F. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 2019, 208, 363–372. [Google Scholar] [CrossRef]

- Li, L.; Qiu, L.; Xu, F.; Zheng, X. The impact of green credit on firms’ green investment efficiency: Evidence from China. Pac. Basin Financ. J. 2023, 79, 101995. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, C.; Zhou, S.; Zhang, Y. Research on the impact of green credit policy on environmental information disclosure. Stat. Res. 2022, 39, 73–87. [Google Scholar]

- Geng, L.; Yin, W.; Wu, X.; Lu, X.; Zhang, C. How green credit affects corporate environmental information disclosure: Evidence from new energy listed companies in China. Front. Ecol. Evol. 2023, 11, 1301589. [Google Scholar] [CrossRef]

- Thompson, P.; Cowton, C.J. Bringing the environment into bank lending: Implications for environmental reporting. Br. Account. Rev. 2004, 36, 197–218. [Google Scholar] [CrossRef]

- Zhang, B.; Yang, Y.; Bi, J. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. J. Environ. Manag. 2011, 92, 1321–1327. [Google Scholar] [CrossRef]

- Yao, S.; Pan, Y.; Sensoy, A.; Uddin, G.S.; Cheng, F. Green credit policy and firm performance: What we learn from China. Energy Econ. 2021, 101, 105415. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Xing, C.; Zhang, Y.; Tripe, D. Green credit policy and corporate access to bank loans in China: The role of environmental disclosure and green innovation. Int. Rev. Financ. Anal. 2021, 77, 101838. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, Y.; Wang, H.; Ouyang, X.; Xie, Y. Can green credit policy promote low-carbon technology innovation? J. Clean. Prod. 2022, 359, 132061. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Fernando, C.S. Environmental risk management and the cost of capital. Strateg. Manag. J. 2008, 29, 569–592. [Google Scholar] [CrossRef]

- Bharath, S.T.; Sunder, J.; Sunder, S.V. Accounting quality and debt contracting. Account. Rev. 2008, 83, 1–28. [Google Scholar] [CrossRef]

- John, K.; Reisz, A.S. Temporal resolution of uncertainty, disclosure policy, and corporate debt yields. J. Corp. Financ. 2010, 16, 655–678. [Google Scholar] [CrossRef]

- Donghua, Z.; Hua, Z. Do Green Bonds Attract Investor Preference? From the Perspective of Credit Spreads. Foreign Econ. Manag. 2023, 45, 19–34. [Google Scholar]

- Ding, X.; Qu, Y.; Shahzad, M. The impact of environmental administrative penalties on the disclosure of environmental information. Sustainability 2019, 11, 5820. [Google Scholar] [CrossRef]

- Sengupta, P. Corporate disclosure quality and the cost of debt. Account. Rev. 1998, 73, 459–474. [Google Scholar]

- He, Y.; Tang, Q.; Wang, K. Carbon performance versus financial performance. China J. Account. Stud. 2016, 4, 357–378. [Google Scholar] [CrossRef]

- Connelly, B.; Certo, S.; Ireland, R.; Reutzel, C. Signaling theory: A review and assessment. J. Manag. 2010, 37, 39–67. [Google Scholar] [CrossRef]

- Li, S.; Zhao, Y.; Tong, J. Can corporate social responsibility report reduce cost of equity capital? Evidence from Chinese stock market. Account. Res. 2013, 9, 64–70. [Google Scholar]

- Ben-Amar, W.; Chang, M.; McIlkenny, P. Board gender diversity and corporate response to sustainability initiatives: Evidence from the carbon disclosure project. J. Bus. Ethics 2017, 142, 369–383. [Google Scholar] [CrossRef]

- Jiang, G.; Lu, J.; Li, W. Do green investors play a role? Empirical research on firms’ participation in green governance. J. Financ. Res. 2021, 5, 117–134. [Google Scholar]

- Cheng, H.; Cao, A.; Hong, C.; Liu, D.; Wang, M. Can green investors improve the quality of corporate environmental information disclosure? Int. Rev. Econ. Financ. 2025, 98, 103901. [Google Scholar] [CrossRef]

- Dyck, A.; Lins, K.V.; Roth, L.; Wagner, H.F. Do institutional investors drive corporate social responsibility? International evidence. J. Financ. Econ. 2019, 131, 693–714. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Gray, R.; Kouhy, R.; Lavers, S. Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Account. Audit. Account. J. 1995, 8, 47–77. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M. The role of environmental disclosures as tools of legitimacy: A research note. Account. Organ. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Verrecchia, R.E. Essays on disclosure. J. Account. Econ. 2001, 32, 97–180. [Google Scholar] [CrossRef]

- Zhao, S.; Wu, Q.; Zhou, X. Impact of green credit on financing constraints of energy-consuming firms. Financ. Res. Lett. 2025, 74, 106801. [Google Scholar] [CrossRef]

- Sun, X.; Che, T.; Ma, X. Catering behavior of firms’ carbon information disclosure: Identification, premium loss and mechanisms. China Ind. Econ. 2023, 1, 132–150. [Google Scholar]

- Garriga, E.; Melé, D. Corporate social responsibility theories: Mapping the territory. J. Bus. Ethics 2004, 53, 51–71. [Google Scholar] [CrossRef]

- Su, C.-W.; Umar, M.; Gao, R. Save the environment, get financing! How China is protecting the environment with green credit policies? J. Environ. Manag. 2022, 323, 116178. [Google Scholar] [CrossRef]

- Liu, H. Sustainable development of Dayong denim garment industry cluster from the perspective of environmental social responsibility. Wool Text. J. 2019, 47, 95–100. [Google Scholar]

- Bowen, H.R. Social Responsibilities of the Businessman; University of Iowa Press: Iowa City, IA, USA, 2013. [Google Scholar]

- Sun, C.; Zeng, Y. Does the green credit policy affect the carbon emissions of heavily polluting enterprises? Energy Policy 2023, 180, 113679. [Google Scholar] [CrossRef]

- Yi, X.; Bai, C.; Lyu, S.; Dai, L. The impacts of the COVID-19 pandemic on China’s green bond market. Financ. Res. Lett. 2021, 42, 101948. [Google Scholar] [CrossRef]

- Li, L.; Liu, Q. The Impact of News and Government Supervising on Enterprise Carbon Information Disclosure. J. Guizhou Univ. Financ. Econ. 2016, 34, 30. [Google Scholar]

- Tan, X. Industry competition, ownership and disclose of corporate society responsibility information: Based on signaling theory. Ind. Econ. Res. 2017, 3, 15–28. [Google Scholar]

- Clayton, M.J. Debt, investment, and product market competition: A note on the limited liability effect. J. Bank. Financ. 2009, 33, 694–700. [Google Scholar] [CrossRef]

- Yi, Z.; Jiang, F.; Qin, Y. The market competition in products, the corporate governance and the quality of information disclosure. Manag. World 2010, 1, 133–141. [Google Scholar]

- Bates, T.W.; Kahle, K.M.; Stulz, R.M. Why do US firms hold so much more cash than they used to? J. Financ. 2009, 64, 1985–2021. [Google Scholar] [CrossRef]

- Hoberg, G.; Phillips, G.; Prabhala, N. Product market threats, payouts, and financial flexibility. J. Financ. 2014, 69, 293–324. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Brammer, S.; Pavelin, S. Building a good reputation. Eur. Manag. J. 2004, 22, 704–713. [Google Scholar] [CrossRef]

- Jones, T.M. Instrumental stakeholder theory: A synthesis of ethics and economics. Acad. Manag. Rev. 1995, 20, 404–437. [Google Scholar] [CrossRef]

- Pan, A.-L.; Liu, X.; Qiu, J.-L.; Shen, Y. Can green M&A of heavy polluting enterprises achieve substantial transformation under the pressure of media. China Ind. Econ. 2019, 2, 174–192. [Google Scholar]

- Lu, J.; Yan, Y.; Wang, T. The microeconomic effects of green credit policy—From the perspective of technological innovation and resource reallocation. China Ind. Econ. 2021, 1, 174–192. [Google Scholar]

- Wang, H.; Lin, W.; Xie, R. Environmental backgrounds of executives and green investor entry. J. Quant. Technol. Econ. 2022, 39, 173–194. [Google Scholar]

- Jiang, T. Mediating effects and moderating effects in causal inference. China Ind. Econ. 2022, 5, 100–120. [Google Scholar]

- Yu, L.; Zhang, W.; Bi, Q. Can the reform of environmental protection fee-to-tax promote the green transformation of high-polluting enterprises?—Evidence from quasi-natural experiments implemented in accordance with the environmental protection tax law. China Popul. Resour. Environ. 2021, 31, 109–118. [Google Scholar]

- Wen, Z.; Ye, B. Analyses of mediating effects: The development of methods and models. Adv. Psychol. Sci. 2014, 22, 731. [Google Scholar] [CrossRef]

- Tyteca, D. On the measurement of the environmental performance of firms—A literature review and a productive efficiency perspective. J. Environ. Manag. 1996, 46, 281–308. [Google Scholar] [CrossRef]

- Hrouga, M.; Michel, S. Towards a new supply chain manager dashboard under circular economy constraints: A case study on France textile and clothing industry. Bus. Strategy Environ. 2023, 32, 6074–6093. [Google Scholar] [CrossRef]

- Zor, S. A neural network-based measurement of corporate environmental attention and its impact on green open innovation: Evidence from heavily polluting listed companies in China. J. Clean. Prod. 2023, 432, 139815. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial constraints risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

| Research Questions | Corresponding Hypotheses |

|---|---|

| RQ1: Does green credit policy influence corporate carbon information disclosure? | H1: Green credit policies can significantly enhance corporate carbon information disclosure. |

| RQ2: Is the signal transmission pathway a mechanism through which green credit policy affects corporate carbon information disclosure? | H2: Green credit policies increase the holdings of green investors through the signal transmission effect, thereby promoting carbon information disclosure. |

| RQ3: Is the external pressure pathway a mechanism through which green credit policy affects corporate carbon information disclosure? | H3: Green credit policies strengthen environmental legitimacy pressure on companies through the external pressure effect, thereby promoting their disclosure of carbon information. |

| RQ4: Is the environmental ethics pathway a mechanism through which green credit policy affects corporate carbon disclosure? | H4: Green credit policies enhance corporate environmental attention through the environmental ethics effect, thereby increasing the voluntary disclosure of carbon information. |

| RQ5: Does market competition affect the implementation effectiveness of green credit policy? | H5: In the process of green credit policy affecting corporate carbon information disclosure, market competition plays a positive moderating role. |

| Disclosure Category | Disclosure Item | Scoring Criteria |

|---|---|---|

| Governance | Board oversight | Scores 1 if the company discloses environmental philosophy, policies, management structure, circular economy development model, or green transition initiatives; otherwise 0. |

| Management responsibilities | Scores 0 if no information on climate change management at executive level; scores 1 if disclosed. | |

| Employee engagement | Scores 1 for disclosing mechanisms promoting employee participation in carbon reduction (e.g., training); scores 1 for disclosing participation in environmental initiatives; Max 2 points | |

| Risk and opportunity | Risk management system | Scores 1 if the company discloses systems for identifying, assessing, and managing climate-related risks and opportunities; otherwise 0. |

| Risk identification and assessment | Scores 0 if climate-related risks affecting financials or business are not disclosed; scores 1 if disclosed. | |

| Opportunity identification and management | Scores 0 if climate-related opportunities affecting financials or business are not disclosed; scores 1 if disclosed. | |

| Strategy | Low-carbon transition strategy | Scores 0 if no low-carbon transition strategy; scores 1 if mentioned. |

| Targets | Carbon reduction targets | Scores 0 if no target; 2 points for qualitative disclosure; 4 points for quantitative targets. |

| Other climate targets | Scores 0 if no other climate targets disclosed; 2 points if disclosed. | |

| Emission reduction actions | Scores 0 if no actions; 2 points for qualitative disclosure; 4 points for quantitative actions. | |

| Business transition progress | Scores 0 if no classification of low-carbon products or services; 2 points for qualitative disclosure; 4 points for quantitative disclosure. | |

| Emissions | Scope 1 GHG emissions | Scores 0 if not reported; 2 points for qualitative disclosure; 4 points for quantitative disclosure. |

| Scope 2 GHG emissions | Scores 0 if not reported; 2 points for qualitative disclosure; 4 points for quantitative disclosure. | |

| Scope 3 GHG emissions | Scores 0 if not reported; 2 points for qualitative disclosure; 4 points for quantitative disclosure. | |

| Carbon emission intensity | Scores 0 if no metric disclosed; 2 points for qualitative disclosure; 4 points for quantitative disclosure. | |

| Breakdown | Emission change (Scope 1 + 2) | Scores 0 if no disclosure; 2 points for qualitative change; 4 points for quantitative change. |

| Scope 1 emission breakdown | Scores 2 points if disaggregated by gas type, geography, or business unit; otherwise 0. | |

| Scope 2 emission breakdown | Scores 2 points if disaggregated by gas type, geography, or business unit; otherwise 0. | |

| Value chain and supply chain | Value chain engagement | Scores 1 if discloses engagement with value chain partners (e.g., collecting climate data from suppliers and customers); otherwise 0. |

| Supplier and customer management | Scores 1 if discloses management of climate risk behavior of relevant entities in the supply chain, including whether suppliers’ compliance with climate-related requirements is part of the purchasing process; otherwise, 0. | |

| Other | Other climate metrics | Scores 1 if discloses any other climate-related indicators relevant to the business; otherwise 0. |

| Verifiability | Scores 1 if emissions data is third-party verified (e.g., ISO 14001 or carbon assurance); otherwise 0. |

| Types of Variables | Variable Name | Variable Description |

|---|---|---|

| Dependent variable | CID | Total score for carbon information disclosure index |

| Explanatory variable | DID | The interaction term between the policy dummy variable Time and the group dummy variable Treat |

| Control variables | Size | Natural logarithm of annual total assets |

| Lev | Total liabilities at year-end divided by total assets at year-end | |

| ROA | Net profit divided by the average total assets balance | |

| Growth | Current year operating revenue divided by previous year operating revenue minus 1 | |

| Board | Natural logarithm of the number of board members | |

| Indep | Number of independent directors divided by the total number of directors | |

| Dual | If the chairman and the CEO are the same person, the value is 1; otherwise, the value is 0 | |

| Top1 | Number of shares held by the largest shareholder divided by the total number of shares | |

| ListAge | The natural logarithm of (current year minus listing year plus 1) |

| Variable | N | Mean | Min | Median | Max | S.D. |

|---|---|---|---|---|---|---|

| CID | 34,521 | 11.567 | 0.000 | 9.000 | 45.000 | 9.317 |

| Treat | 34,521 | 0.216 | 0.000 | 0.000 | 1.000 | 0.411 |

| Time | 34,521 | 0.884 | 0.000 | 1.000 | 1.000 | 0.320 |

| Size | 34,521 | 22.258 | 19.755 | 22.047 | 26.535 | 1.290 |

| Lev | 34,521 | 0.409 | 0.033 | 0.405 | 0.887 | 0.195 |

| ROA | 34,521 | 0.043 | −0.308 | 0.041 | 0.256 | 0.061 |

| Growth | 34,521 | 0.149 | −0.657 | 0.102 | 3.224 | 0.334 |

| Board | 34,521 | 8.518 | 5.000 | 9.000 | 15.000 | 1.679 |

| Indep | 34,521 | 0.376 | 0.250 | 0.364 | 0.600 | 0.054 |

| Dual | 34,521 | 0.291 | 0.000 | 0.000 | 1.000 | 0.454 |

| Top1 | 34,521 | 0.341 | 0.078 | 0.319 | 0.758 | 0.148 |

| ListAge | 34,521 | 2.060 | 0.693 | 2.079 | 3.434 | 0.771 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variable | CID | CID | CID |

| DID | 5.213 *** | 4.219 *** | 1.757 *** |

| (41.36) | (36.74) | (6.02) | |

| Size | 3.630 *** | 2.604 *** | |

| (77.83) | (16.10) | ||

| Lev | −3.162 *** | −1.964 *** | |

| (−10.79) | (−3.59) | ||

| ROA | −3.305 *** | 4.136 *** | |

| (−3.90) | (4.46) | ||

| Growth | −1.223 *** | −0.455 *** | |

| (−8.63) | (−4.34) | ||

| Board | −0.342 *** | −0.050 | |

| (−10.51) | (−0.81) | ||

| Indep | −2.528 *** | 1.049 | |

| (−2.60) | (0.69) | ||

| Dual | 0.374 *** | −0.175 | |

| (3.66) | (−1.15) | ||

| Top1 | −2.611 *** | 2.853 *** | |

| (−8.37) | (2.84) | ||

| ListAge | −1.018 *** | −1.326 *** | |

| (−14.89) | (−5.94) | ||

| _cons | 10.602 *** | −61.641 *** | −44.259 *** |

| (195.51) | (−64.05) | (−12.05) | |

| Id | NO | NO | YES |

| Year | NO | NO | YES |

| N | 34,521 | 34,521 | 34,102 |

| R2 | 0.047 | 0.221 | 0.733 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | CID | CID | CID | CID |

| DID | 1.480 *** | 0.853 *** | 1.207 *** | |

| (3.94) | (3.11) | (3.22) | ||

| Treat ×Time ×Credit | 1.537 *** | |||

| (2.80) | ||||

| DID_Robust | 1.214 *** | |||

| (1.98) | ||||

| _cons | −37.085 *** | −14.485 ** | −44.273 *** | −42.919 *** |

| (−7.22) | (−2.13) | (−15.97) | (−19.36) | |

| Controls | YES | YES | YES | YES |

| Year | YES | YES | YES | YES |

| Id | YES | YES | YES | YES |

| N | 11,334 | 7203 | 23,519 | 34,102 |

| R2 | 0.763 | 0.775 | 0.745 | 0.733 |

| (1) | (2) | |

|---|---|---|

| Variable | GIH | GIM |

| DID | 0.061 *** | 0.064 *** |

| (2.67) | (2.80) | |

| _cons | 0.125 | 0.632 *** |

| (0.54) | (2.63) | |

| Controls | YES | YES |

| Year | YES | YES |

| Id | YES | YES |

| N | 32,488 | 32,488 |

| R2 | 0.308 | 0.307 |

| F | 23.99 | 24.07 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variable | EI1 | CID | EI2 | CID | EI3 | CID |

| DID | 1.387 *** | 1.526 *** | 0.072 *** | 1.623 *** | 0.111 *** | 1.640 *** |

| (8.13) | (5.37) | (9.48) | (5.61) | (8.99) | (5.65) | |

| EI1 | 0.167 *** | |||||

| (15.53) | ||||||

| EI2 | 1.866 *** | |||||

| (7.52) | ||||||

| EI3 | 1.058 *** | |||||

| (7.85) | ||||||

| _cons | −1.213 | −44.057 *** | 0.126 * | −44.494 *** | 0.097 | −44.362 *** |

| (−0.73) | (−12.16) | (1.93) | (−12.14) | (0.94) | (−12.10) | |

| Controls | YES | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES | YES |

| Id | YES | YES | YES | YES | YES | YES |

| N | 34,102 | 34,102 | 34,102 | 34,102 | 34,102 | 34,102 |

| R2 | 0.307 | 0.737 | 0.298 | 0.734 | 0.287 | 0.734 |

| F | 12.18 | 57.44 | 11.58 | 39.93 | 10.67 | 40.84 |

| (1) | (2) | |

|---|---|---|

| Variable | CEA | CID |

| DID | 0.044 *** | 1.636 *** |

| (4.92) | (5.37) | |

| CEA | 1.987 *** | |

| (6.67) | ||

| _cons | −0.059 | −44.229 *** |

| (−0.54) | (−12.09) | |

| Controls | YES | YES |

| Year | YES | YES |

| Id | YES | YES |

| N | 34,048 | 34,048 |

| R2 | 0.778 | 0.734 |

| F | 7.371 | 40.24 |

| Effect Type | Signal Transmission Pathway | External Pressure Pathway | Environmental Ethics Pathway |

|---|---|---|---|

| Direct effect | 1.720 | 1.526 | 1.636 |

| Indirect effect | 0.006 | 0.231 | 0.087 |

| Proportion of mediating effect | 0.35% | 13.15% | 5.05% |

| (1) | (2) | |

|---|---|---|

| Variable | CID | CID |

| C_DID | 1.773 *** | 1.768 *** |

| (6.04) | (6.01) | |

| C_HHI1 | −3.130 *** | |

| (−2.85) | ||

| C_HHI1 × C_DID | −4.343 * | |

| (−1.76) | ||

| C_HHI2 | −2.484 ** | |

| (−2.29) | ||

| C_HHI2 × C_DID | −9.367 *** | |

| (−2.89) | ||

| _cons | −44.040 *** | −44.217 *** |

| (−12.04) | (−12.08) | |

| Controls | YES | YES |

| Year | YES | YES |

| Id | YES | YES |

| N | 34,067 | 34,067 |

| R2 | 0.734 | 0.734 |

| (1) | (2) | |

|---|---|---|

| Variable | State-Owned Enterprises | Non-State-Owned Enterprises |

| DID | 1.078 *** | 2.245 *** |

| (2.69) | (5.39) | |

| _cons | −37.040 *** | −49.306 *** |

| (−6.25) | (−9.75) | |

| Controls | YES | YES |

| Year | YES | YES |

| Id | YES | YES |

| N | 11,275 | 20,020 |

| R2 | 0.739 | 0.734 |

| F | 8.729 | 21.00 |

| Empirical p-value | 0.004 *** | |

| (1) | (2) | |

|---|---|---|

| Variable | Low Financing Constraint Enterprises | High Financing Constraint Enterprises |

| DID | 0.715 * | 1.769 *** |

| (1.69) | (4.76) | |

| _cons | −48.962 *** | −24.778 *** |

| (−7.40) | (−4.77) | |

| Controls | YES | YES |

| Year | YES | YES |

| Id | YES | YES |

| N | 14,595 | 14,236 |

| R2 | 0.755 | 0.743 |

| F | 10.86 | 10.02 |

| Empirical p-value | 0.004 *** | |

| (1) | (2) | |

|---|---|---|

| Variable | Non-High-Tech Enterprises | High-Tech Enterprises |

| DID | 1.975 *** | 0.976 * |

| (5.32) | (1.94) | |

| _cons | −43.932 *** | −48.925 *** |

| (−7.93) | (−10.01) | |

| Controls | YES | YES |

| Year | YES | YES |

| Id | YES | YES |

| N | 15,048 | 19,026 |

| R2 | 0.741 | 0.739 |

| F | 17.37 | 24.87 |

| Empirical p-value | 0.005 *** | |

| (1) | (2) | |

|---|---|---|

| Variable | TobinQ | AuditFee |

| CID | 0.004 *** | −0.003 *** |

| (3.62) | (−6.39) | |

| _cons | 12.169 *** | 5.956 *** |

| (21.40) | (22.03) | |

| Controls | YES | YES |

| Year | YES | YES |

| Id | YES | YES |

| N | 33,719 | 33,616 |

| R2 | 0.665 | 0.912 |

| F | 109.7 | 119.8 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, X.; Peng, J. How Does the Green Credit Policy Influence Corporate Carbon Information Disclosure?—A Quasi-Natural Experiment Based on the Green Credit Guidelines. Sustainability 2025, 17, 9256. https://doi.org/10.3390/su17209256

Chen X, Peng J. How Does the Green Credit Policy Influence Corporate Carbon Information Disclosure?—A Quasi-Natural Experiment Based on the Green Credit Guidelines. Sustainability. 2025; 17(20):9256. https://doi.org/10.3390/su17209256

Chicago/Turabian StyleChen, Xiuxiu, and Jing Peng. 2025. "How Does the Green Credit Policy Influence Corporate Carbon Information Disclosure?—A Quasi-Natural Experiment Based on the Green Credit Guidelines" Sustainability 17, no. 20: 9256. https://doi.org/10.3390/su17209256

APA StyleChen, X., & Peng, J. (2025). How Does the Green Credit Policy Influence Corporate Carbon Information Disclosure?—A Quasi-Natural Experiment Based on the Green Credit Guidelines. Sustainability, 17(20), 9256. https://doi.org/10.3390/su17209256