1. Introduction

Achieving business sustainability represents both a challenge and an opportunity for every business indifferently to the industry it operates in. The theorization of business sustainability has evolved over time starting from corporate sustainability through managing the triple bottom line (people, planet, and profits) to a truly sustainable business [

1]. Customer loyalty and business sustainability are closely linked, as high-order loyal customers have a general tendency to recommend the company’s offer [

2] and its sustainable business practices. Moreover, loyal customers play a vital role for businesses in achieving economic sustainability through generating a constant and predictable revenue stream, thus allowing the companies to provide more effective resource allocation.

The aforementioned premise is substantiated by evidence from both academic literature and industry reports. For instance, the 2024 Global Customer Loyalty Report developed by Antavo loyalty cloud [

3] indicates that more than half of the surveyed companies managing a loyalty program acknowledge that customer loyalty contributes to sales growth and supports overall business growth despite ongoing economic difficulties. Similarly, a recent McKinsey article [

4] emphasizes that modern loyalty programs, which integrate pricing and customization instruments, drive business growth and facilitate revenue stream prediction. Such a constant revenue stream is critical in times characterized by intense competition or macroeconomic factors (e.g., COVID-19 pandemic) which profoundly influence consumer behavior. Completing these findings, academic research performed by Jin [

5] found that there is a positive association between the customers’ return probability and the companies’ stable revenues and earnings, thereby reinforcing the theoretical link between customer loyalty and business sustainability. Further empirical evidence supporting this relationship has been found by Belas [

6] in the banking industry and Neringa [

7] in the airline industry.

As such, the purpose of the present paper is to test the BG/NBD prediction model for its potential validation as a practical tool in estimating the buying behavior of customers of a self-service car washing company before and within the COVID-19 pandemic period. There are several reasons for which the fulfillment of the above-mentioned purpose has theoretical and practical relevance.

Firstly, the chosen industry is part of the self-service sector in which the customer co-creates value [

8] alongside the company by engaging in effort-based activities. Research conducted on businesses which use self-service technologies encompasses a high variety of industries, from hospitality [

9,

10,

11] to retail [

12], banking and financial services [

13], and transportation and airlines [

14]. In their majority, these articles study psychological (perceived) dimensions of consumer behavior, like customer satisfaction [

9,

11] or consumer preferences [

10], but not actual buying behavior based on transaction data.

Secondly, relative to the self-service car wash industry, researchers study operational aspects of such a business [

15,

16], its environmental impact [

17,

18], and customers’ perceived quality [

19] or buying intention [

20]. From our knowledge, there are few scientific articles [

21] which examine the customers’ buying behavior in a self-service car wash context.

Thirdly, the analyzed period is 2019–2020, a timespan which recorded the customers’ buying behavior before the beginning of the COVID-19 pandemic and within the pandemic. Having this data allowed the authors to test the used prediction model’s (BG/NBD model) effectiveness for the whole customer base (year 2019) and for the loyal customers (2020/2019).

On this basis, the fourth reason can be advanced as researching customer loyalty within the COVID-19 pandemic. Customer loyalty has been and still is a subject of extensive empirical and theoretical research. A research stream for customer loyalty was performed during the COVID-19 pandemic period which tested known relationships (e.g., the link between perceived quality, customer satisfaction, and customer loyalty) and proved new ones; maybe one of the most impactful results being that loyal customers have a more intense buying intention [

22] and behavior [

21,

23] than non-loyal customers, despite being exposed to the COVID-19 pandemic risks.

Considering the above-mentioned, the present article fills the research gap of studying and predicting the consumers’ buying behavior (including loyal customers) before and within the COVID-19 pandemic period in a self-service car wash context. For achieving this, the paper starts by reviewing the specific scientific literature through a funnel approach, that advances from database marketing and customer data to transaction data and customer loyalty, and eventually to the marketing models used for estimating customer buying frequency—all converging towards the goals of customer loyalty and business sustainability. In the materials and methods part, the research type, data source and type, as well as the statistical indicators and methods are presented. Further, the research results, followed by the article’s, are displayed in

Section 5.

2. Literature Review

Grounded in the premise that customer loyalty represents an important factor for businesses’ sustainability—primarily through its role in generating stable and predictable revenue streams–and that accurately predicting it may help companies to allocate their resources more effectively. The theoretical part reviews, in a progressive manner, the specific literature regarding customer loyalty and its effects on business sustainability. Within this context, database marketing is introduced as an overreaching framework through which companies systematically collect and use customer data to improve marketing effectiveness, with transaction data occupying a central position. Due to its objective and quantifiable nature, transaction data is presented further as the foundation of customer behavioral loyalty, enabling companies to understand future buying behavior and allocate resources according to their business and marketing objectives—if accurately predicted (through various statistical methods). Ultimately, customer loyalty is conceptualized in a double role—both as an outcome of sustainable business practices, and as a driving force for business sustainability.

2.1. Database Marketing and Customer Data

One of the most cited definitions of database marketing is that of Blattberg et al. [

24] who consider database marketing as the use of customer databases for enhancing marketing productivity through more effective acquisition, retention, and development of customers. Customer databases are systems that store, (mostly) in digital format, data related to the company’s actual customers and prospects. Usually, this data is grouped into several categories, like identification, demographic, psychographic, and transaction data. According to the company’s (database) marketing objectives, each customer data category can be used as input for different statistical techniques which, if correctly applied, may result in improved customer segmentation and response modeling [

25]. In this regard, by applying two different clustering methods, Brito [

26] used a shirts manufacturer’s database to create segments (based on ordered shirts and their features) and further subsegments according to the demographic, biometric, geographic, psychographic, and behavioral data of the company’s customers. The demographic and psychographic customer data were collected and modeled by Khodabandehlou [

27] and resulted in improving the effectiveness of an online apparel store’s recommendation system. For developing, calibrating, and testing their prediction methods, the authors combined demographic data like age, gender, marital status, level of education, and occupation and psychographic data (BF personality model), as well as the recent interests and needs of over 3000 customers of an online apparel store. Within the same industry, Yldiz [

28] used data on the buying behavior of customers from an online fashion retailer, along with their location, to create customer segments and, by developing association rules, to propose and test a new recommendation system.

Customer data can also be analyzed to validate existing (or new) theoretical associations and/or causalities which further can be considered for future marketing actions. In this sense [

29], identification data (customer name and e-mail) was retrieved from the customer database of a building supply company and used for obtaining other (primary) customer-related information (perceived online experience and in-store experience) for testing how the in-store experience influences the online experience and furthers the brand’s resonance and the customers’ co-creation actions. Similarly, Blömker [

30] gathered primary data from customers by using the commercial newsletter tool of a large German cross-channel retailer; using customer IDs to match the collected survey data with existing secondary data (retailer’s CRM data, such as gender, education, household size, occupation, and customer journey data), the authors tried to predict the psychological traits of the company’s customers based on their past buying behavior. In the same manner, Gajanova [

31] retrieved primary data from 500 customers using the contact information of a telecommunication company; the data was then analyzed to check the dependence between demographic (age, gender, and lifecycle) and psychographic variables (social class and generation) and the customers’ perceived brand loyalty.

2.2. Transaction Data and Customer Loyalty

In a broader sense, transaction data is data collected by a company from every interaction point with its customers during the customer journey [

24]. More specifically, transaction data refers to the observed buying behavior of customers in a certain period, such as items purchased, monetary value spent, purchase date, vouchers (discount or free items) used, and payment method. These data are of utmost importance for both practitioners and researchers. On one hand, these data are proxies for revenue generation for businesses; on the other hand, from a theoretical and research perspective, such data are relevant for a better understanding of the consumer behavior through their actual buying behavior.

One heavily studied concept that relies on the consumer’s actual buying behavior, and thus on transaction data (but not only), is that of customer loyalty. Dawes [

32] considers customer loyalty as the repeated buying behavior of a customer over a certain period. This definition is aligned within the theory (and practice) of understanding customer loyalty through its behavioral dimension which, as every understanding, has its advantages and disadvantages. In this regard, one advantage is related to the ease and relevance of the (transaction) data needed for building up this concept. In terms of ease, transaction data can be obtained through instruments specific to customer retention, like client/customer cards, loyalty cards, client/customer online accounts, and mobile app accounts, which, when used, store these data digitally. As to the relevance of this data, transaction data captures the actual buying behavior, which is observable and objective in nature while generating revenues (for companies). Moreover, some of the transaction data (e.g., spent monetary value, buying frequency, buying recency) are measured through the ratio scale, which brings us to the second advantage of a more accurate prediction of the customers’ future buying behavior. In this regard, Martinez [

33] used several machine learning algorithms to predict a large manufacturer’s B2B customers’ purchases for the upcoming month. Buying recency as a single prediction variable was extensively analyzed and conditioned by Artinger [

34] in their extensive study containing the datasets of 27 retail business. Buying frequencies of an Australian resin producer’s industrial customers were estimated by Wilkinson [

35] by using the NB distribution. The same NB distribution was used by Dawes [

32] to predict the buying frequency of UK customer segments (with an emphasis on light customers) for 10 consumer goods brand categories selected by their penetration rate. An influential work for estimating the customer-level future monetary value spent is the paper of Fader [

36] which introduces the gamma-gamma estimation model. Quantity ordered and price paid (money spent) by customers were used alongside other customer-specific variables by Wu [

37] to forecast the sales for a multichannel dining business. Similarly, customers’ future spending habits on day-to-day goods were estimated by Jhamtani [

38] by using quantile regression analysis. Another strong point/benefit of transaction data is its use for business development, like creating cross-selling and up-selling opportunities based on recommendation systems [

39,

40], personalized offers for stimulating future buys [

41,

42], and/or optimizing the market offer [

43].

There are several limitations in considering customer loyalty only through its behavioral dimensions, one being not knowing what triggered the buying behavior, namely the deduced (endo- and exogenous) factors which may influence the buying behavior [

44,

45]. In this sense, the customer’s attitude towards the company’s brand, relative to other desirable brands, was included alongside the customers’ buying frequency as a forming dimension of customer loyalty [

46,

47,

48]. Another limitation relies on the static/opaque nature of behavioral loyalty, meaning that no evolution of the customer’s loyalty state can be spotted (e.g., one heavy customer is differentiated from a light customer only by the number of complete transactions). To overcome this, Oliver [

49] proposed a four-stage process of loyalty formation which echoed in the research environment [

50,

51].

2.3. Marketing Models Used for Estimating Buying Frequency

Out of all the transaction data, the customers’ buying frequency will be modeled in the current paper. Buying frequency can be simply defined as the number of transactions a customer completes in a certain period (e.g., in a week, trimester, semester, or a year). One of the first influential papers which modeled the buying frequency of US households for consumer goods is that of Ehrenberg [

52], who considered that the buying frequency follows a negative binomial distribution (NBD) with two parameters: the mean purchase rate (m) and the shape parameter (k). Additionally, the model assumes that one customer’s buying variation follows a Poisson distribution (for the considered period) and that the mean purchasing rates of all customers follows a Gamma distribution [

52,

53], meaning that customers achieve a buying frequency for the considered period in a random way. This model still proves its effectiveness [

32] when applied to consumer goods [

54], fresh fruit and vegetable categories [

55], sport and cultural events attendance [

53,

56], and telecommunication subscription services [

57,

58].

One important development of the NBD model was performed by Schmittlein, Morrison and Colombo [

59]; their model (named Pareto/NBD model) adds to the NBD model’s assumptions the lifetime of customers, which follows an exponential distribution with churn rates that follow a Gamma distribution. This model was replicated successfully for predicting mobile app downloads [

60], online grocery shopping [

61,

62], retail transactions [

63,

64], and microblog users’ behavior [

65].

Fader [

66] modified the Pareto/NBD model in terms of the moment a customer drops out, considering instead that a customer can drop out immediately after a transaction, not at any moment in time (Pareto/NBD). This drop-out probability is modeled as a Beta-Geometric distribution (BG). BG/NBD’s predictive accuracy is validated by research performed in industries like mobile apps [

60], online grocery stores [

61,

62], financial institutions like retail banks [

67], online retailers [

68,

69], exhibition companies [

70], and hotel chains [

71].

2.4. Customer Loyalty and Business Sustainability

Business sustainability is considered an evolutionary concept, with its phases being described clearly by Dyllick [

1]. In this regard, the first view of business sustainability is associated with corporate sustainability in which the main objective of creating shareholder value is based also on decisions and actions which consider environmental and social concerns stated by external stakeholders like the government, media, or NGOs. A second phase of business sustainability relies on managing the triple bottom line. This view expands the companies’ value creation process by integrating social and environmental values alongside shareholder value. By managing financial, environmental, and social risks and opportunities (profits, planet, and people), sustainability issues can be aimed at and measured in the companies’ operations. The third view of a truly sustainable business is an outside-in approach in which companies look at the big external environmental challenges (e.g., climate change, pollution) and try to positively impact them by using their resources and competences. As such, addressing sustainability challenges represents the main objective of these companies which dedicate their value creation to the common good of society and the planet.

Research on customer loyalty and business sustainability considers two main perspectives: the first views a sustainable business as a factor (or cause) for customer loyalty while the second examines customer loyalty as strengths (premises) for long-term business sustainability.

In relation to the first perspective, a meta-analysis performed by Chi [

50] revealed that CSR practices positively influence customer loyalty. Industry-related research performed in the hospitality industry validates that green hotel practices have a positive effect on customer loyalty [

51,

72,

73]. In the same sense, green practices of supermarkets positively impact customer loyalty [

74]. Moreover, green-based strategies developed in the apparel industry increase purchasing behavior [

75,

76], intention to visit, and positive recommendation [

77]. To conclude, there is hardly any industry in which companies’ sustainability initiatives do not stimulate or reinforce customer loyalty, the effective size of these practices varying according to factors like age, culture, income, and education level.

The few scientific articles that approach the second perspective of considering customer loyalty as a premise for long-term business sustainability are written under the general discourse of customer loyalty benefits. Adamska [

78] proposes that benefits of having loyal customers—like reduced retention costs, positive brand perception, less price sensitivity, and repeated buying—may also increase the company’s performance in terms of sustainable sales. Knowing the repeated buying behavior of loyal customers, Panzone [

79] experimented with how loyalty programs can improve a healthy lifestyle through stimulating fruit and vegetables consumption. The results showed that there were increased sales only from reward-redeemers for fruit and vegetables and for other categories within the promotional period, thus indicating how customer loyalty generates benefits for both society and the company if properly stimulated. In their article, Ryglová et al. [

80] conclude that tourists’ loyalty towards a rural destination is a pre-condition for the sustainable development of such destinations which relies on (unspoiled) natural areas. Similarly, Carvache-Franco et al. [

81] analyzed the underlying motivations of customers for experiencing the local gastronomy of a coastal destination and recommended that obtaining customer loyalty helps preserve the local gastronomy. Our research aligns with this second perspective, posting that a loyal customer base is vital for the (economic) sustainability of a self-service car washing SME particularly in ensuring constant sales. It can be presumed that constant sales encourage sustainable initiatives, like optimized water management, usage of eco-friendly products, and investing in renewable energy sources.

3. Materials and Methods

Based on the stated research purpose of testing the BG/NBD prediction model for its potential validation as a practical tool in estimating the buying behavior of customers a self-service car washing company before and within the COVID-19 pandemic period, the following three research objectives are derived:

Research objective 1 (RO1): To analyze customers’ repeated transactions for the years 2019 and 2020.

Research objective 2 (RO2): To estimate customers’ repeated transactions for the year 2020 based on data from the year 2019.

Research objective 3 (RO3): To estimate the loyal customers’ repeated transactions for the year 2020 based on data from the year 2019.

For achieving the paper’s research purpose and objectives, the authors conducted typical conclusive, descriptive research [

82] which seeks to understand in depth, and predict, a marketing phenomenon: the observed rebuying behavior of customers. An SME’s internal information system database operating in the town of Sibiu, Romania, was used as a data source; thus, secondary data was considered as input for data analysis and prediction. The company’s information system stores data every time a customer uses their client card for washing their car by using the company’s settings.

Central tendency indicators (mean, median, and mode), variation indicators (standard deviation, range, and coefficient of variation) and distribution indicators (Skewness and Kurtosis) were used to describe the customers’ buying and (more in depth) rebuying behavior for the years 2019 and 2020. The rebuying behavior is defined as repeated transactions a customer performs in a specific year and is measured through a ratio scale, these values were retrieved from the company’s internal information system. Additionally, adaptations of Lorenz curves were performed for visualizing the analyzed data.

For the current research, the authors retrieved customer data from the years 2019 and 2020 specifically for the BG/NBD model [

77] denoted by X = x, t

x, T

x where

x—number of repeated transactions observed for each customer for the considered years (2019 and 2020). It is worth mentioning that both years were measured in weeks (not in days).

tx—time between the customer’s first and last transaction (in weeks) for the two years (2019 and 2020).

Tx—time between the customer’s first transaction and the end of the analyzed period. The analyzed period is a calendar year measured in weeks; thus, Tx represents the difference between the 53rd week and the week of the customer’s first transaction.

All BG/NBD model assumptions developed by Fader [

66] were respected in the current study:

- (1)

The number of transactions made by an active customer follows a Poisson process with a transaction (constant average) rate of λ:

- (2)

Heterogeneity in λ follows a Gamma distribution with the probability density function:

- (3)

After any transaction, there is a probability of p for a customer to become inactive. In this regard, the drop-out moment of the customer follows a shifted geometric distribution with the probability mass function:

- (4)

Heterogeneity in p follows a Beta distribution with the probability density function:

where B(a,b) is a beta function which is expressed in terms of gamma functions:

- (5)

Both transaction rate (λ) and drop-out probability (p) vary independently across customers.

To the best of our knowledge, there is no rule of thumb regarding the sample size required for applying the BG/NBD model. Consequently, sample size considerations can only be addressed by comparison with previous studies in which the model was successfully applied. For instance, within the gaming industry (game downloads), Enache [

60] used a sample size of 4239 unique customers who made 10,093 purchases over a period of 188 days. Similarly, Tudoran [

61] used data from 39,657 customers who placed 436,927 orders on a Danish online platform between January 2017 and March 2022. It is important to note that the used data is (real) business data. Given that the car self-service business is area-specific, the findings of the present study should be interpreted as company-specific, and their generalization to other companies within the same industry or to other industries at regional or global level should be approached with caution.

4. Results

4.1. RO1: To Analyze Customers’ Repeated Transactions for the Years 2019 and 2020

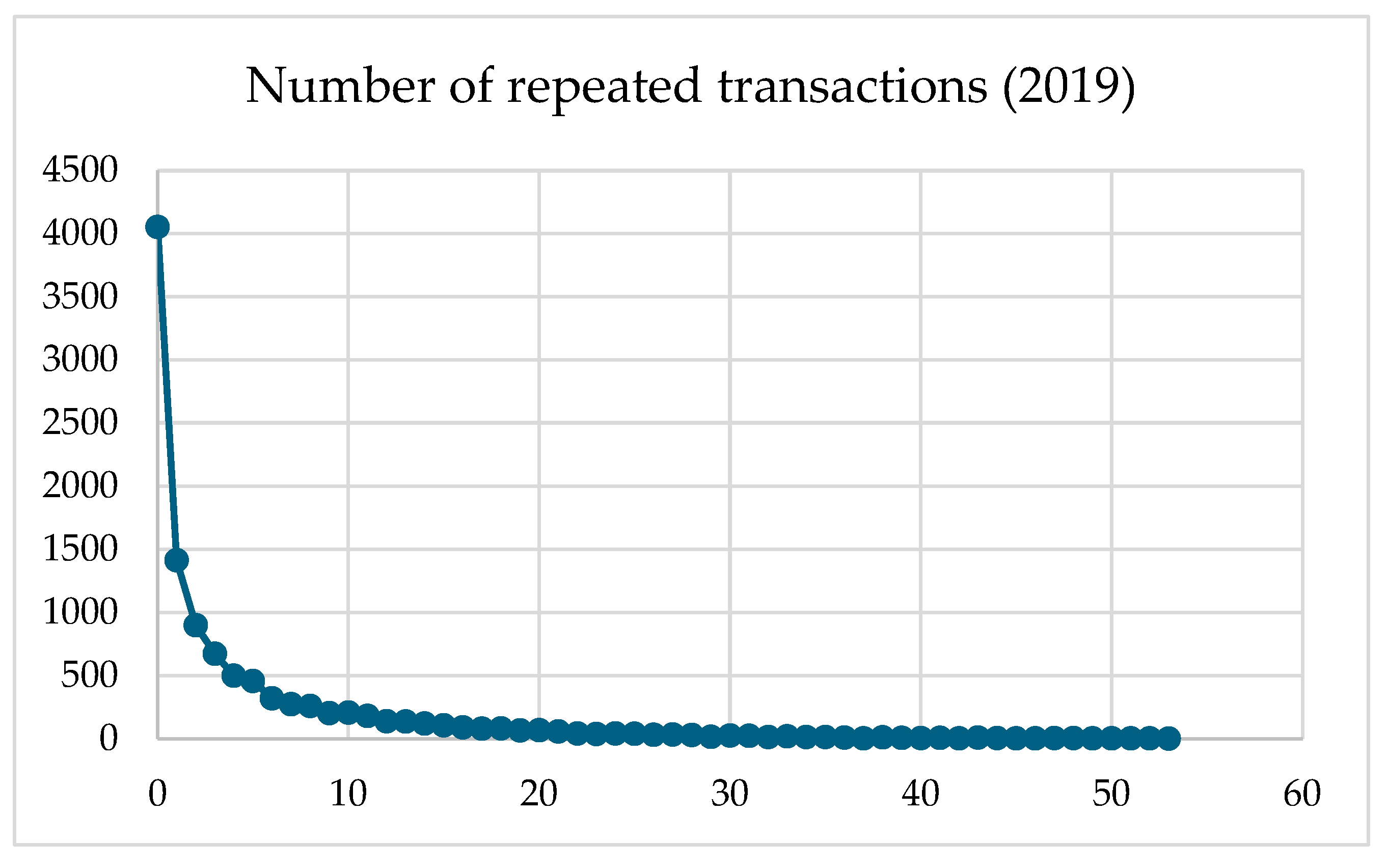

For the year 2019, there were 10,759 unique customers who have used the company’s washing facilities 58,371 times. Out of the whole number of 58,371, there were 47,612 repeated transactions (or washes), distributed according to their frequencies, as follows.

From the

Figure 1 and

Table 1 (median = 1) it can be observed that half of the repeated transactions (50.79%) are attributable to customers whose buying behavior involved at most one additional transaction beyond their initial one (0 or 1 repeated transaction) and 0.5% of them are equal to or above 36 repeated transactions. More information about the frequency distribution of repeated transactions for the year 2019 is visualized in the adapted Lorenz curve (

Figure 1). This information is important, at least for the company’s management, providing the insight that for the year 2019 more than half of the customers returned at least once to use its services and 80% of repeated transactions have a frequency of zero to seven.

Moreover, each customer reused the company’s services on average 4.43 times for the year 2019 and most of the customers reused them once (mode = 1). The high standard deviation (6.929) relative to the mean (4.43) indicates a high variability within the variable, with its extreme values being high values of repeated transactions. This high variability is denoted also by the variable’s range (52) while the positive values of Skewness (2.455) and Kurtosis (7.212) characterize a positively skewed and leptokurtic distribution of the variable.

The year 2020 followed a similar pattern as the year 2019 regarding repeated transactions given the fact that the COVID-19 pandemic (and the accompanying restrictions) negatively affected society and business alike. In the analyzed company’s case, there were 9641 unique customers (decrease 10.39%) which used the company’s services 51,864 times (decrease 11.15%), out of which 42,223 (decrease 11.31%) were repeated transactions (

Figure 2).

In terms of descriptive statistics (

Table 1) for the repeated transactions of 2020, the median of two is different than in 2019, signifying that half of the customers reused the company’s services zero, one or two times in the year 2020. Otherwise, the variable is characterized by high variability relative to its mean (variation coefficient value of 1.52) and its distribution is peaked (Kurtosis = 7269) and positively skewed (Skewness = 2.45).

4.2. RO2: To Estimate Customers’ Repeated Transactions for the Year 2020 Based on Data from the Year 2019

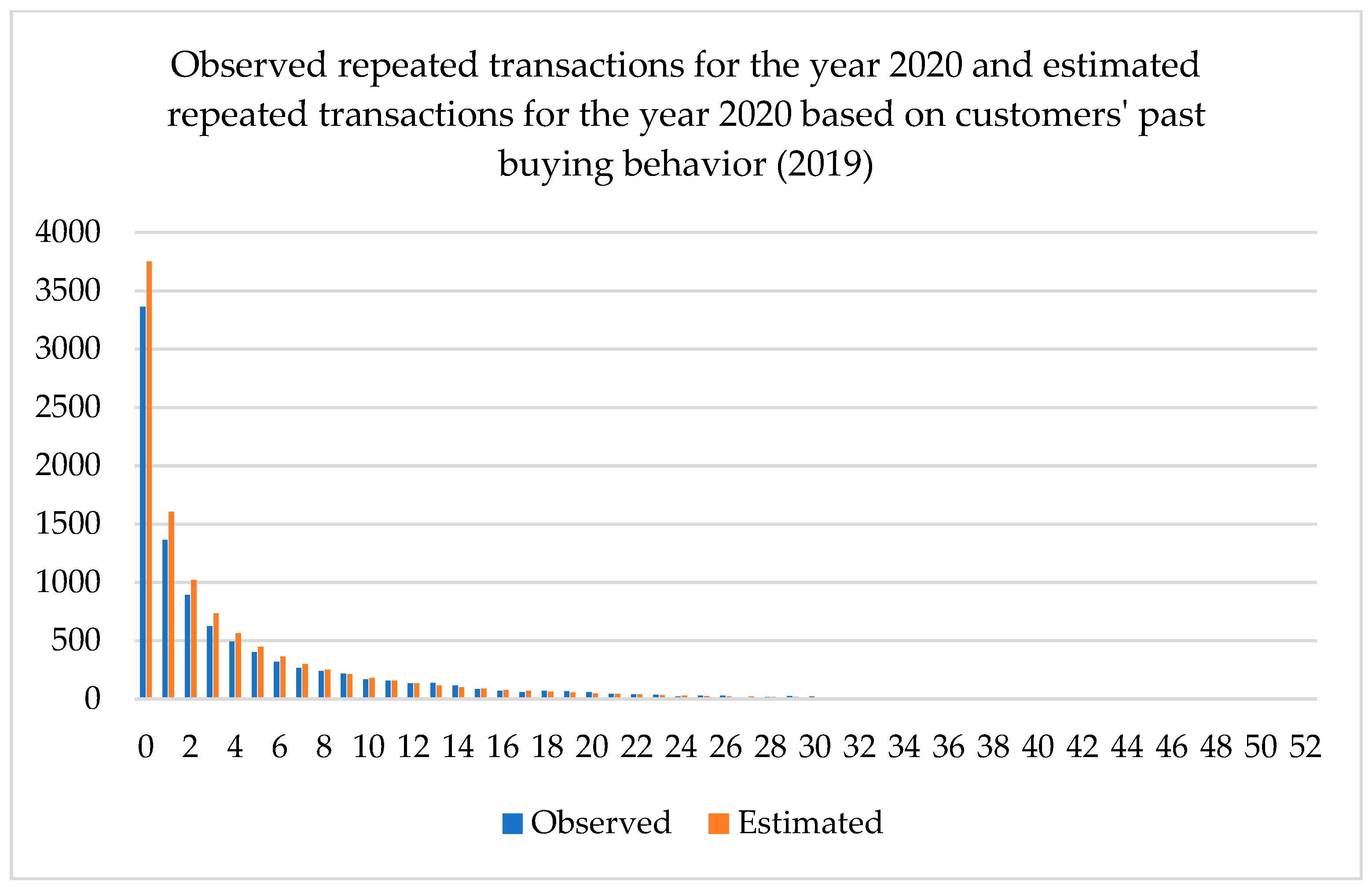

The parameter values obtained after minimizing the LL function are r = 0.53, α = 3.77, a = 2.16, and b = 182.4, these values being used for estimating the cumulated repeated transactions for the year 2020. The model estimated a total of 42,794 repeated transactions for the year 2020, slightly above the observed repeated transactions of 42,223 (1.4% overestimation).

Having a small overestimation of 1.4% for the whole 2020 customer base may validate the model’s application for this self-service industry. The authors proceeded to categorize the repeated transactions according to their observed frequencies (for the year 2020) and the estimated ones.

The model’s estimation accuracy decreases after splitting the observed and estimated repeated transactions according to their (absolute) frequency (

Figure 3). A

t-test was applied to check if the mean of the difference between the observed and estimated repeated transactions differs statistically from zero. The results (

t-test value = 0.162, df. = 52,

p-value = 0.872) maintained the null hypothesis of the test, concluding that on average the observed repeated transactions do not differ statistically from the estimated ones even after categorizing them based on their frequencies.

A Chi-Square Goodness of Fit test was performed to check if there is a statistically significant difference between the observed and estimated repeated transactions according to their absolute frequencies. The test’s computed value is 179.5 above the theoretical value of 67.505 (significance level of 0.05 and 51 degrees of freedom), thus rejecting the null hypothesis and supporting the alternative one, that of the statistically significant differences between the observed and estimated repeated transactions for the year 2020 according to their frequencies. Even after eliminating zero (), one (), two (), and three () repeated transactions, these differences persist.

4.3. RO3: To Estimate the Loyal Customers’ Repeated Transactions for the Year 2020 Based on Data from the Year 2019

Spring 2020 marked for Romania the starting point for restrictions imposed by the government for reducing the negative effects of the spreading and devastating COVID-19 pandemic. The COVID-19 pandemic together with the imposed movement restrictions can be considered as external, unpredictable, and uncontrollable factors which influenced every human’s social behavior, in general, and their consumer behavior, in particular. Such factors appear rarely, and their impact is mostly profound. This is an important motivation for the authors in choosing the 2019–2020 period for testing and applying the BG/NBD model on a customer base to check if it predicts better or worse the buying behavior of loyal customers which reuse the company’s services despite the unfavorable external factors.

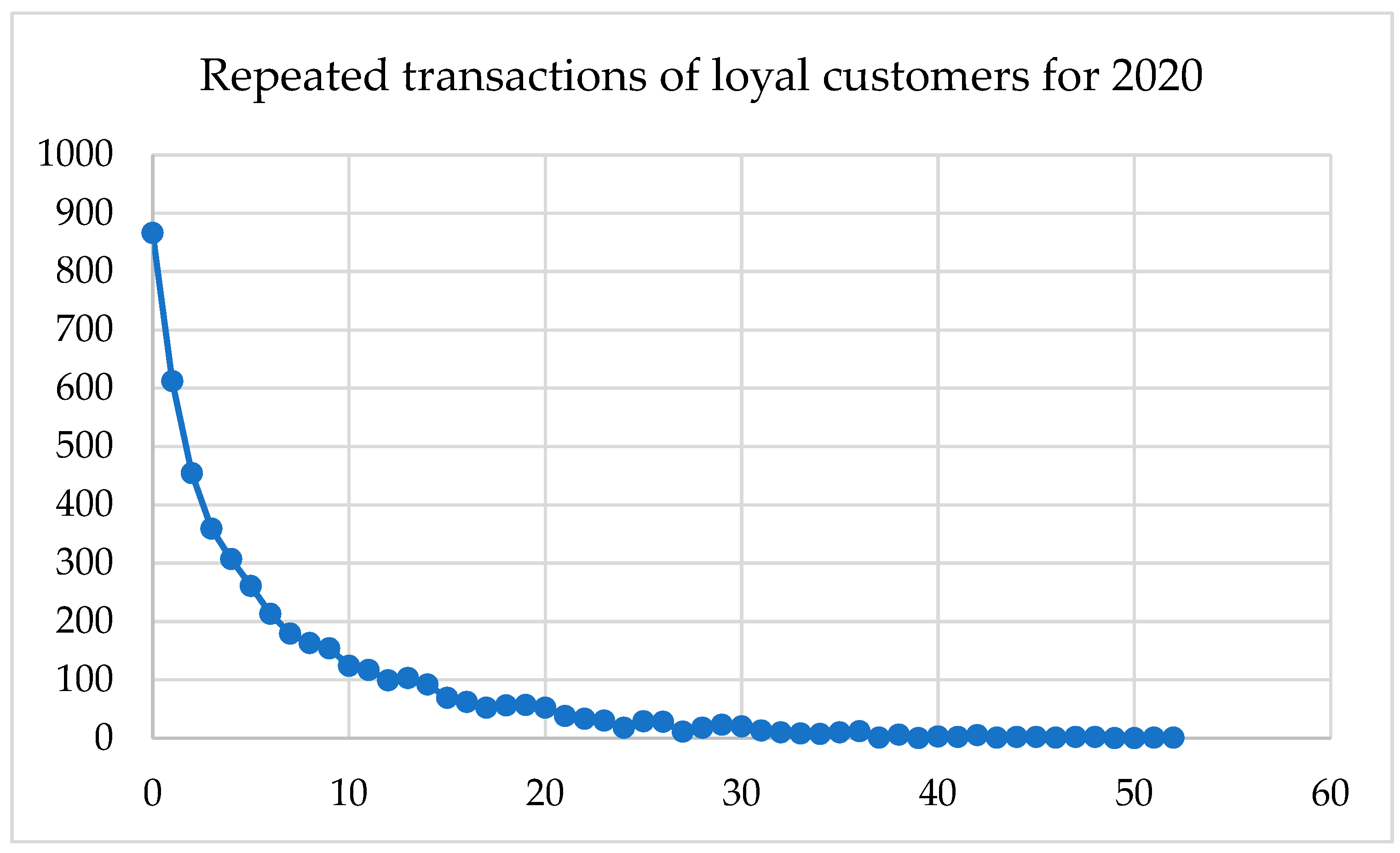

For the analyzed period (2019–2020), customer loyalty is approached from a behavioral perspective and measured as repeated service usage; specifically, a loyal customer is defined as one who has used the company’s services at least once in both years, 2019 and 2020, respectively. There were 9641 unique IDs (total unique customers) for the year 2020 out of which 4788 had used the company’s services at least once in the previous year (2019), resulting in a loyalty rate of 49.66%. This high loyalty rate should be understood in the broader context of the general business decrease of approximately 11% in 2020/2019, mainly due to the COVID-19 pandemic.

These loyal customers have generated a total of 36,934 transactions out of which 32,146 were repeated transactions. Based on

Figure 4 and

Table 2, the authors can assert that the repeated buying behavior of loyal customers is more intense than that of non-loyal customers. Hereof, the average repeated transaction is 6.71 times/year (greater than 53.2% of the average repeated transactions of all customers in 2020), with a median of 4 (>2 as for all customers in 2020), and a mode of 0 repeated transactions (same as for all customers in 2020). Although still high, the heterogeneity decreases for loyal customers relative to all the customers in 2020 (variation coefficient value = 1.18 < 1.52). So does the peakness (Kurtosis = 3.627 < 7.269) and (positive) Skewness (Skewness = 1.804 < 2.450) of its distribution.

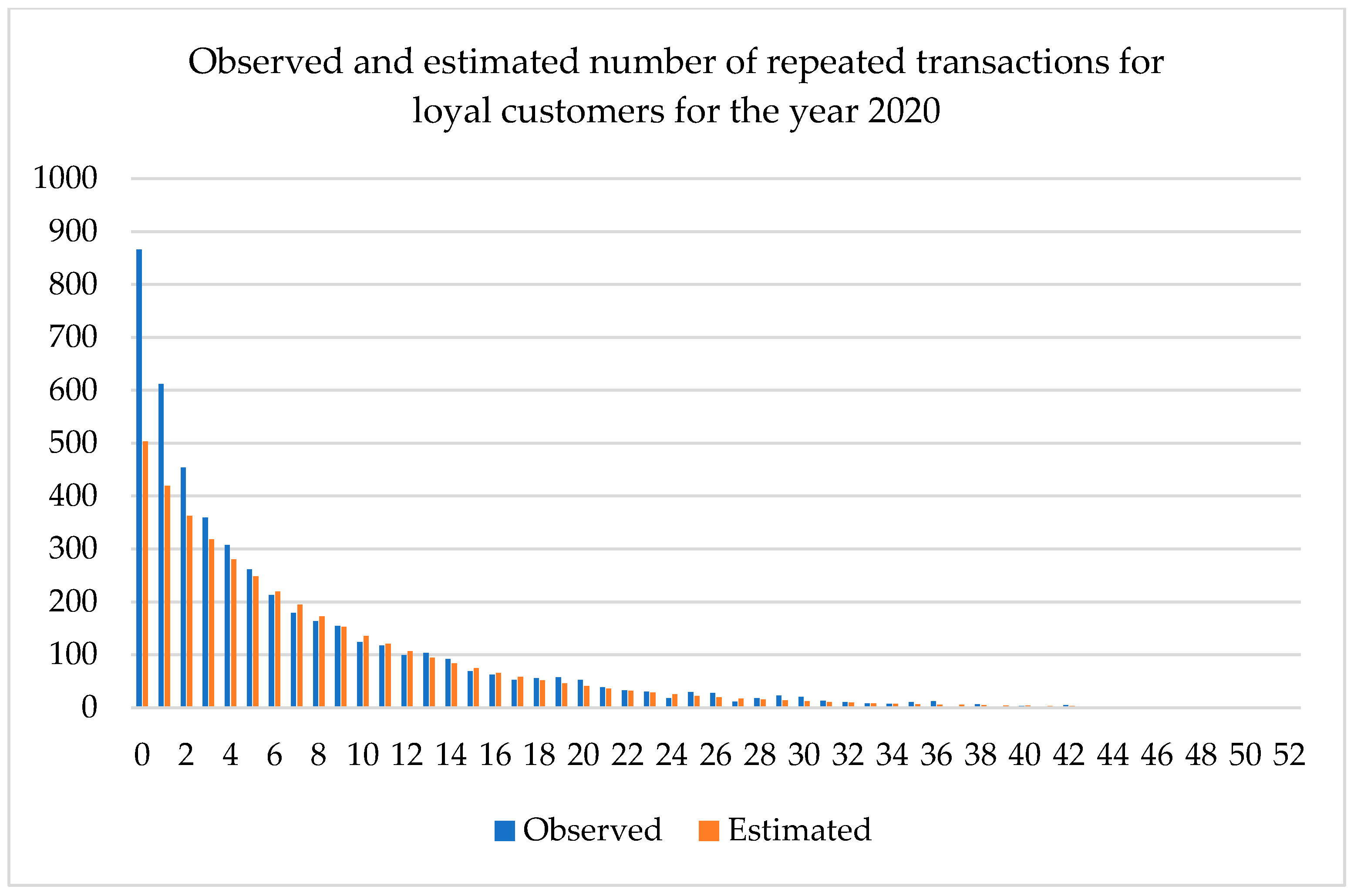

The loyal customers’ buying behavior for 2019 (x, tx, and Tx) has been used as input for estimating the BG/NBD model’s parameters. The results indicate a small difference between the estimated repeated sales (34.396) and the actual repeated sales (32.146) of the loyal customers.

The overlap of the estimated repeated transactions with the observed ones based on the repeated transactions frequencies of the loyal customers for the year 2020 provides interesting results (

Figure 5) in terms of the prediction accuracy. In this regard, the obtained results (

t-test value = 1.753, df. = 52,

p-value = 0.085), for testing if the mean of the difference between the observed and estimated repeated transactions differs significantly from zero, confirm that on average the estimated and observed repeated transactions (based on their frequencies) do not differ statistically from each other. This statistical significance increases if we exclude the zero repeated transactions (

p-value = 0.98), one repeated transaction (

p-value = 0.114), and two repeated transactions (

p-value = 0.186). Thus, we can conclude that the used model’s accuracy increases for higher numbers of repeated transactions.

Chi-Square Goodness of Fit test was applied to check if the model’s prediction accuracy is also valid at the level of the repeated transactions frequencies. The calculated value of 439.85 is way above the theoretical value of 67.505 (significance level of 0.05 and 51 degrees of freedom), certifying that there is a between-group statistical difference between the observed and estimated repeated transactions. If we once again exclude the zero, one, and two repeated transactions, the computed Chi-Square value is 66.89 below the theoretical one of 67.505 (significance level of 0.05 and 49 degrees of freedom), implying that there is no statistically significant difference between the observed and estimated repeated transactions considering the repeated transactions frequencies.

5. Discussion

The paper’s purpose was to test the BG/NBD prediction model for its potential validation as a practical tool in estimating the buying behavior of customers in a self-service car wash context for the period 2019–2020. In accordance with the three research objectives derived from the research purpose, the statistical methods and models used resulted in important insights for both theory and practice. As such, based on the company’s transaction data (customers’ repeated transactions specifically), it can be stated that the customer base can be split following Pareto-rule fashion into high-frequency customers and low-frequency ones for both years considered (25% had over seven repeated transactions in 2019 while 13% had over seven repeated transactions in 2020). This is an insight into the self-service car wash industry and is in line with the existing literature on database marketing/customer segmentation [

83,

84].

Despite the negative effects of the COVID-19 pandemic (number of customers decreased by 10.39%), the BG/NDB model proved its effectiveness when estimating the total number of repeated transactions for the year 2020 based on the 2019 data, having an overestimation of only 1.4%. As such, this finding extends to the industries in which the BG/NBD has been validated as effective (e.g., mobile apps [

60], online grocery stores [

61,

62], financial institutions like retail banks [

67], online retailers [

68,

69], exhibition companies [

70], and hotel chains [

71]) as well as the self-service car wash industry. The model’s accuracy decreases when estimating the frequencies of repeated transactions, with a lack of association being identified between the observed and estimated repeated transactions frequencies. This may be due to model-specific factors (e.g., BG/NBD model’s drop-out hypothesis states that a customer has a probability of becoming inactive immediately after a transaction not randomly at any moment in time) or external ones (seasonality of the demand, increased competition and thus the appearance of customer switching behavior). The following important practical implication can be deduced based on this result: an accurate prediction of the future repeated transactions at company level can help the decision maker to better estimate future revenues and thus optimize resource allocation for achieving their price objective.

When considering only the loyal customers as input for applying the BG/NBD model, the results showed, once again, a good prediction accuracy of the model at aggregate level (overestimation of 6.9% of the total number of repeated transactions of loyal customers for the year 2020). A difference can be spotted in the estimations of the repeated transactions frequencies which do not differ from the observed ones if the (predicted) zero, one, and two repeated transactions are excluded. In other words, the model’s prediction accuracy increases with higher frequencies of repeated transactions. An explanation for this can be found in the understanding of the repeated buying behavior of loyal customers which does not correspond to zero, one, or two repeated transactions. Several relevant practical insights may arise from this finding that the loyal customers’ buying behavior is more predictable than that of normal customers in terms of frequencies of repeated transactions: (1) a better forecast of the constant revenue stream generated by loyal customers [

85,

86]; (2) optimizing the marketing expenditures such as to target loyal customers; (3) better estimate the loyal customers’ reaction to a new product or service marketed by the company [

87].

The following research limitations should be considered when interpreting these findings. Firstly, the seasonality of the service (self-service car wash) was not considered in the model. Secondly, the data was retrieved from the company’s internal information system and was based on unique IDs (client cards). The authors developed the research variables but what could not be controlled was the real number of users with the same client card (e.g., more family members could use the same client card). A third research limitation is related to the year 2020 (starting with spring) during which government-imposed restrictions aimed at reducing the COVID-19 pandemic effects significantly influenced consumer behavior. Consequently, for our dataset, it can only be deduced that the COVID-19 effects on the consumers’ behavior are embedded in the loyalty construct defined as repeated buying behavior (despite external negative influence factors). Accordingly, the model’s applicability during the COVID-19 period remains valid under this interpretation. Operationalizing a loyal customer as one that has used the company’s services at least once in both years may constitute a fourth research limitation in the sense that one repeated transaction may not reflect the intended loyalty—although this assumption aligns with the behavioral loyalty perspective.

Considering the research limitations mentioned, future research may include the COVID-19 pandemic as a covariate in the BG/NBD model to empirically test the effect of the COVID-19 pandemic on the model’s application and accuracy. Additionally, increasing the threshold of repeated transactions for the two years and reapplying the prediction model may yield valuable results. Also, combining transaction data with attitude data (survey-based) will allow the exploration of the customers’ loyalty states according to Dick and Basu’s theoretical framework [

46].

Other avenues for future research to consider are (a) different methodologies— e.g., applying and testing the effectiveness of other marketing models used to predict customer buying behavior (e.g., Pareto/NBD model and its developments) in the same industry and (b) different timeframes and/or contexts—e.g., the BG/NBD model’s effectiveness can be tested in the same self-service car wash context after the end of the COVID-19 pandemic, as well as on repeated transactions of other self-services, like car aspiration, wheel rim cleaner, tire cleaner, and car perfume.

Author Contributions

Conceptualization, M.Ț., M.-T.Ț., O.D., D.-M.M. and C.O.; methodology, M.Ț., M.-T.Ț., O.D., D.-M.M. and C.O.; formal analysis, M.Ț.; writing—original draft preparation, M.Ț., M.-T.Ț., O.D., D.-M.M. and C.O.; writing—review and editing, M.Ț. and C.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Lucian Blaga University of Sibiu, grant number 2943/18.07.2022.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Dyllick, T.; Muff, K. Clarifying the Meaning of Sustainable Business: Introducing a Typology From Business-as-Usual to True Business Sustainability. Organ. Environ. 2016, 29, 156–174. [Google Scholar] [CrossRef]

- Correa, C.; Alarcón, D.; Cepeda, I. “I Am Delighted!”: The Effect of Perceived Customer Value on Repurchase and Advocacy Intention in B2B Express Delivery Services. Sustainability 2021, 13, 6013. [Google Scholar] [CrossRef]

- Antavo Global Customer Loyalty Report; Antavo: London, UK, 2024.

- Alderman, K.; Eizenman, O.; Hamdan, J.; Reasor, E.; Harr, J.; Wilkie, J. McKinsey&Company. 4 March 2024; p. 6. Available online: https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/members-only-delivering-greater-value-through-loyalty-and-pricing#/ (accessed on 6 October 2025).

- Jin, H.; Stubben, S.; Ton, K. Customer Loyalty and the Persistence of Revenues and Earnings. SSRN J. 2021. [Google Scholar] [CrossRef]

- Belás, J.; Gabčová, L. The Relationship among Customer Satisfaction, Loyalty and Financial Performance of Commercial Banks. E+M 2016, 19, 132–147. [Google Scholar] [CrossRef]

- Vilkaite-Vaitone, N.; Papsiene, P. Influence of Customer Loyalty Program on Organizational Performance: A Case of Airline Industry. EE 2016, 27, 109–116. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Evolving to a New Dominant Logic for Marketing. J. Mark. 2004, 68, 1–17. [Google Scholar] [CrossRef]

- Wu, X.; Xiang, H.; Wang, Y.; Huo, Y. How Does Customer Satisfaction Change after Hotels Start Using Self-Service Kiosks? Int. J. Hosp. Manag. 2024, 122, 103872. [Google Scholar] [CrossRef]

- Gore, S. A Review of Self-Service Technology Adoption in the Tourism and Hospitality Industry. In Review of Technologies and Disruptive Business Strategies; Singh Kaurav, R.P., Mishra, V., Eds.; Emerald Publishing Limited: Leeds, UK, 2024; pp. 117–135. ISBN 978-1-83797-457-3. [Google Scholar]

- Rastegar, N.; Flaherty, J.; Liang, L.; Choi, H. The Adoption of Self-Service Kiosks in Quick-Service Restaurants. EJTR 2021, 27, 2709. [Google Scholar] [CrossRef]

- Cho, H.; Fiorito, S.S. Self-Service Technology in Retailing. The Case of Retail Kiosks. Symphonya. Emerg. Issues Manag. 2010, 43–55. [Google Scholar] [CrossRef]

- Zungu, N.P.; Amegbe, H.; Hanu, C.; Asamoah, E.S. AI-Driven Self-Service for Enhanced Customer Experience Outcomes in the Banking Sector. Cogent Bus. Manag. 2025, 12, 2450295. [Google Scholar] [CrossRef]

- Wongyai, P.H.; Suwannawong, K.; Wannakul, P.; Thepchalerm, T.; Arreeras, T. The Adoption of Self-Service Check-in Kiosks among Commercial Airline Passengers. Heliyon 2024, 10, e38676. [Google Scholar] [CrossRef]

- Geca, M.J. Mathematical Analysis of a Self-Service Car Wash in the Aspect of Application of Renewable Energy Sources. J. Phys. Conf. Ser. 2021, 2130, 012004. [Google Scholar] [CrossRef]

- Peng, S. Design of Self-Service Car Washing Machine Control System Based on ARM. J. Phys. Conf. Ser. 2020, 1605, 012025. [Google Scholar] [CrossRef]

- Firmansyah, I.; Santoso, A.D.; Nuha, N.; Sahwan, F.L.; Suryanto, F.; Wahyono, S. Environmental Impact of Car Wash Services by Performing Life Cycle Perspective. Glob. J. Environ. Sci. Manag. 2025, 11. [Google Scholar] [CrossRef]

- Kuan, W.-H.; Hu, C.-Y.; Ke, L.-W.; Wu, J.-M. A Review of On-Site Carwash Wastewater Treatment. Sustainability 2022, 14, 5764. [Google Scholar] [CrossRef]

- Keya, F.; Ash, B.; Gerry, B. Effect of Service Quality on Customer Satisfaction in Car Wash Business in Mkolani Ward; Nyamagana District, Mwanza City, Tanzania. Glob. Sci. Acad. Res. J. Econ. Bus. Manag. 2023, 2, 202–212. [Google Scholar]

- Chuang, S.-S.; Lai, H.-M. Understanding Consumers’ Continuance Intention Toward Self-Service Stores: An Integrated Model of the Theory of Planned Behavior and Push-Pull-Mooring Theory. In Knowledge Management in Organizations; Uden, L., Ting, I.-H., Corchado, J.M., Eds.; Communications in Computer and Information Science; Springer International Publishing: Cham, Switzerland, 2019; Volume 1027, pp. 149–164. ISBN 978-3-030-21450-0. [Google Scholar]

- Țichindelean, M.; Ogrean, C.; Herciu, M. Do Loyal Customers Buy Differently? Examining Customers’ Loyalty in a Self-Service Setting. Stud. Bus. Econ. 2024, 19, 350–367. [Google Scholar] [CrossRef]

- Ju, Y.; Jang, S. The Effect of COVID-19 on Hotel Booking Intentions: Investigating the Roles of Message Appeal Type and Brand Loyalty. Int. J. Hosp. Manag. 2023, 108, 103357. [Google Scholar] [CrossRef] [PubMed]

- Li, J.; Hallsworth, A.G.; Coca-Stefaniak, J.A. Changing Grocery Shopping Behaviours Among Chinese Consumers At The Outset Of The COVID-19 Outbreak. Tijdschr. Voor Econ. En Soc. Geogr. 2020, 111, 574–583. [Google Scholar] [CrossRef] [PubMed]

- Blattberg, R.C.; Kim, B.-D.; Neslin, S.A. Database Marketing: Analyzing and Managing Customers; International Series in Quantitative Marketing; Springer: New York, NY, USA, 2008; ISBN 978-0-387-72578-9. [Google Scholar]

- Verhoef, P.C.; Spring, P.N.; Hoekstra, J.C.; Leeflang, P.S.H. The Commercial Use of Segmentation and Predictive Modeling Techniques for Database Marketing in the Netherlands. Decis. Support Syst. 2003, 34, 471–481. [Google Scholar] [CrossRef]

- Brito, P.Q.; Soares, C.; Almeida, S.; Monte, A.; Byvoet, M. Customer Segmentation in a Large Database of an Online Customized Fashion Business. Robot. Comput.-Integr. Manuf. 2015, 36, 93–100. [Google Scholar] [CrossRef]

- Khodabandehlou, S.; Hashemi Golpayegani, S.A.; Zivari Rahman, M. An Effective Recommender System Based on Personality Traits, Demographics and Behavior of Customers in Time Context. Data Technol. Appl. 2020, 55, 149–174. [Google Scholar] [CrossRef]

- Yıldız, E.; Güngör Şen, C.; Işık, E.E. A Hyper-Personalized Product Recommendation System Focused on Customer Segmentation: An Application in the Fashion Retail Industry. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 571–596. [Google Scholar] [CrossRef]

- Suh, T.; Moradi, M. Transferring In-Store Experience to Online: An Omnichannel Strategy for DIY Customers’ Enhanced Brand Resonance and Co-Creative Actions. J. Bus. Res. 2023, 168, 114237. [Google Scholar] [CrossRef]

- Blömker, J.; Albrecht, C.-M. A Path from Multichannel Customer Data to Real-Time Personalization: Predicting Customers’ Psychological Traits through Machine Learning. J. Retail. Consum. Serv. 2025, 87, 104349. [Google Scholar] [CrossRef]

- Gajanova, L.; Nadanyiova, M.; Moravcikova, D. The Use of Demographic and Psychographic Segmentation to Creating Marketing Strategy of Brand Loyalty. Sci. Ann. Econ. Bus. 2019, 66, 65–84. [Google Scholar] [CrossRef]

- Dawes, J.G.; Trinh, G. Category and Brand Purchase Rates (Still) Follow the NBD Distribution. SSRN J. 2017. [Google Scholar] [CrossRef]

- Martínez, A.; Schmuck, C.; Pereverzyev, S.; Pirker, C.; Haltmeier, M. A Machine Learning Framework for Customer Purchase Prediction in the Non-Contractual Setting. Eur. J. Oper. Res. 2020, 281, 588–596. [Google Scholar] [CrossRef]

- Artinger, F.M.; Gigerenzer, G.; Kozodoi, N.; Wangenheim, F.V. Recency: Prediction with a Single Data Point. SSRN J. 2023. [Google Scholar] [CrossRef]

- Wilkinson, J.W.; Trinh, G.; Lee, R.; Brown, N. Can the Negative Binomial Distribution Predict Industrial Purchases? J. Bus. Ind. Mark. 2016, 31, 543–552. [Google Scholar] [CrossRef]

- Fader, P.; Hardie, B. The Gamma-Gamma Model of Monetary Value. 2013; pp. 1–9. Available online: https://www.brucehardie.com/notes/025/gamma_gamma.pdf (accessed on 14 August 2025).

- Wu, J.; Liu, H.; Yao, X.; Zhang, L. Unveiling Consumer Preferences: A Two-Stage Deep Learning Approach to Enhance Accuracy in Multi-Channel Retail Sales Forecasting. Expert Syst. Appl. 2024, 257, 125066. [Google Scholar] [CrossRef]

- Jhamtani, A.; Mehta, R.; Singh, S. Size of Wallet Estimation: Application of K-Nearest Neighbour and Quantile Regression. IIMB Manag. Rev. 2021, 33, 184–190. [Google Scholar] [CrossRef]

- Lee, M.; Cho, J.; Kim, Y.; Kim, H.-J. Extracting Offline Retail Shopping Patterns: A Restricted Boltzmann Machines Approach to Customer Segmentation and Cross-Selling. Expert Syst. Appl. 2025, 294, 128797. [Google Scholar] [CrossRef]

- Chang, V.; Hahm, N.; Xu, Q.A.; Vijayakumar, P.; Liu, L. Towards Data and Analytics Driven B2B-Banking for Green Finance: A Cross-Selling Use Case Study. Technol. Forecast. Soc. Chang. 2024, 206, 123542. [Google Scholar] [CrossRef]

- Wang, P.; Guo, J.; Lan, Y. Modeling Retail Transaction Data for Personalized Shopping Recommendation. In Proceedings of the 23rd ACM International Conference on Conference on Information and Knowledge Management, Shanghai, China, 3–7 November 2014; ACM: New York, NY, USA, 2014; pp. 1979–1982. [Google Scholar]

- Ettl, M.; Harsha, P.; Papush, A.; Perakis, G. A Data-Driven Approach to Personalized Bundle Pricing and Recommendation. M&SOM 2020, 22, 461–480. [Google Scholar] [CrossRef]

- Yu, Y.; Wang, B.; Zheng, S. Data-Driven Product Design and Assortment Optimization. Transp. Res. Part E Logist. Transp. Rev. 2024, 182, 103413. [Google Scholar] [CrossRef]

- Schiffman, L.G.; Kanuk, L.L.; Wisenblit, J. Consumer Behavior, 10th ed.; Pearson Education: Boston, MA, USA; Munich, Germany, 2010; ISBN 978-0-13-700670-0. [Google Scholar]

- Cătoiu, I.; Teodorescu, N. Comportamentul Consumatorului, 2nd ed.; Uranus: București, Romania, 2004; ISBN 978-973-7765-09-3. [Google Scholar]

- Dick, A.S.; Basu, K. Customer Loyalty: Toward an Integrated Conceptual Framework. J. Acad. Mark. Sci. 1994, 22, 99–113. [Google Scholar] [CrossRef]

- Ngobo, P.V. The Trajectory of Customer Loyalty: An Empirical Test of Dick and Basu’s Loyalty Framework. J. Acad. Mark. Sci. 2017, 45, 229–250. [Google Scholar] [CrossRef]

- Wiśniewska, A.; Liczmańska-Kopcewicz, K. Components of the Loyalty Attitudes as Antecedents of Young Adults’ Potential for Innovation Process on the Example of Polish Cosmetics Market. In Proceedings of the Education Excellence and Innovation Management through Vision, Granada, Spain, 10 April 2019; pp. 9583–9594. [Google Scholar]

- Oliver, R.L. Whence Consumer Loyalty? J. Mark. 1999, 63, 33. [Google Scholar] [CrossRef]

- Chi, H.-K.; Phan, H.-T. Revealing the Role of Corporate Social Responsibility, Service Quality, and Perceived Value in Determining Customer Loyalty: A Meta-Analysis Study. Sustainability 2025, 17, 4304. [Google Scholar] [CrossRef]

- Tran, N.K.H. Green Hotel Practices and Their Effect on Green Brand Loyalty: A Study in Vietnam. J. Hosp. Tour. Insights 2025, 1–21. [Google Scholar] [CrossRef]

- Ehrenberg, A.S.C. The Pattern of Consumer Purchases. Appl. Stat. 1959, 8, 26. [Google Scholar] [CrossRef]

- Trinh, G.T. The Attendance at Sporting Events: A Generalized Theory and Its Implications. Int. J. Mark. Res. 2018, 60, 232–237. [Google Scholar] [CrossRef]

- Trinh, G.; Khan, H.; Lockshin, L. Purchasing Behaviour of Ethnicities: Are They Different? Int. Bus. Rev. 2020, 29, 101519. [Google Scholar] [CrossRef]

- Anesbury, Z.W.; Talbot, D.; Day, C.A.; Bogomolov, T.; Bogomolova, S. The Fallacy of the Heavy Buyer: Exploring Purchasing Frequencies of Fresh Fruit and Vegetable Categories. J. Retail. Consum. Serv. 2020, 53, 101976. [Google Scholar] [CrossRef]

- Trinh, G.; Lam, D. Understanding the Attendance at Cultural Venues and Events with Stochastic Preference Models. J. Bus. Res. 2016, 69, 3538–3544. [Google Scholar] [CrossRef]

- Lee, R.; Rungie, C.; Wright, M. Regularities in the Consumption of a Subscription Service. J. Prod. Brand Manag. 2011, 20, 182–189. [Google Scholar] [CrossRef]

- Anesbury, Z.W.; Stocchi, L.; Naami, T. Sales Concentrations of Digital Brands. J. Mark. Manag. 2025, 41, 535–554. [Google Scholar] [CrossRef]

- Schmittlein, D.C.; Morrison, D.G.; Colombo, R. Counting Your Customers: Who-Are They and What Will They Do Next? Manag. Sci. 1987, 33, 1–24. [Google Scholar] [CrossRef]

- Enache, A.; Friberg, R.; Wiklander, M. Customer Lifetime Value Applied to Mobile Apps. Inf. Econ. Policy 2025, 70, 101131. [Google Scholar] [CrossRef]

- Tudoran, A.A.; Hjerrild Thomsen, C.; Thomasen, S. Understanding Consumer Behavior during and after a Pandemic: Implications for Customer Lifetime Value Prediction Models. J. Bus. Res. 2024, 174, 114527. [Google Scholar] [CrossRef]

- Xie, S.-M.; Huang, C.-Y. Systematic Comparisons of Customer Base Prediction Accuracy: Pareto/NBD versus Neural Network. Asia Pac. J. Mark. Logist. 2020, 33, 472–490. [Google Scholar] [CrossRef]

- Batislam, E.P.; Denizel, M.; Filiztekin, A. Empirical Validation and Comparison of Models for Customer Base Analysis. Int. J. Res. Mark. 2007, 24, 201–209. [Google Scholar] [CrossRef]

- Kim, T.; Kim, D.; Ahn, Y. Instant Customer Base Analysis in the Financial Services Sector. Expert Syst. Appl. 2022, 202, 117326. [Google Scholar] [CrossRef]

- Jin, J.; Chen, X.; Geng, R.; Cai, S. Microblog Users’ Life Time Activity Prediction. In Proceedings of the 2013 10th International Conference on Service Systems and Service Management, Hong Kong, China, 17–19 July 2013; pp. 481–486. [Google Scholar]

- Fader, P.S.; Hardie, B.G.S.; Lee, K.L. “Counting Your Customers” the Easy Way: An Alternative to the Pareto/NBD Model. Mark. Sci. 2005, 24, 275–284. [Google Scholar] [CrossRef]

- Mammadzada, A.; Alasgarov, E.; Mammadov, A. Application of BG / NBD and Gamma-Gamma Models to Predict Customer Lifetime Value for Financial Institution. In Proceedings of the 2021 IEEE 15th International Conference on Application of Information and Communication Technologies (AICT), Baku, Azerbaijan, 13–15 October 2021; pp. 1–6. [Google Scholar]

- Van Oest, R.; Knox, G. Extending the BG/NBD: A Simple Model of Purchases and Complaints. Int. J. Res. Mark. 2011, 28, 30–37. [Google Scholar] [CrossRef]

- Jasek, P.; Vrana, L.; Sperkova, L.; Smutny, Z.; Kobulsky, M. Comparative analysis of selected probabilistic customer lifetime value models in online shopping. J. Bus. Econ. Manag. 2019, 20, 398–423. [Google Scholar] [CrossRef]

- Zhang, J.; Luo, Q. Empirical Validation and Applicability of the BG/NBD Model in the Exhibition Industry: Example of Clock and Watch Exhibitors at the Canton Fair. J. China Tour. Res. 2013, 9, 163–179. [Google Scholar] [CrossRef]

- Van Leeuwen, R.; Do, H.D.; Koole, G. Churn Management in Hospitality. J. Big Data 2025, 12, 145. [Google Scholar] [CrossRef]

- Moise, M.-S.; Gil-Saura, I.; Ruiz-Molina, M.-E. Effects of Green Practices on Guest Satisfaction and Loyalty. Eur. J. Tour. Res. 2018, 20, 92–104. [Google Scholar] [CrossRef]

- González-Viralta, D.; Veas-González, I.; Egaña-Bruna, F.; Vidal-Silva, C.; Delgado-Bello, C.; Pezoa-Fuentes, C. Positive Effects of Green Practices on the Consumers’ Satisfaction, Loyalty, Word-of-Mouth, and Willingness to Pay. Heliyon 2023, 9, e20353. [Google Scholar] [CrossRef] [PubMed]

- Barbosa, B.; Shabani Shojaei, A.; Miranda, H. Packaging-Free Practices in Food Retail: The Impact on Customer Loyalty. Balt. J. Manag. 2023, 18, 474–492. [Google Scholar] [CrossRef]

- Noh, M.; Johnson, K.K.P. Effect of Apparel Brands’ Sustainability Efforts on Consumers’ Brand Loyalty. J. Glob. Fash. Mark. 2019, 10, 1–17. [Google Scholar] [CrossRef]

- Dabija, D.-C. Enhancing Green Loyalty towards Apparel Retail Stores: A Cross-Generational Analysis on an Emerging Market. J. Open Innov. Technol. Mark. Complex. 2018, 4, 1–16. [Google Scholar] [CrossRef]

- Jung, J.; Kim, S.J.; Kim, K.H. Sustainable Marketing Activities of Traditional Fashion Market and Brand Loyalty. J. Bus. Res. 2020, 120, 294–301. [Google Scholar] [CrossRef]

- Malgorzata, A. A Model of the Impact of Customer Loyalty Motives on Sustainable Enterprise Value. In Proceedings of the Tackling the Challenges & Seizing the Opportunities of Tomorrow, Aveiro, Portugal, 30 July 2022; pp. 1–10. [Google Scholar]

- Panzone, L.A.; Tocco, B.; Brečić, R.; Gorton, M. Healthy Foods, Healthy Sales? Cross-Category Effects of a Loyalty Program Promoting Sales of Fruit and Vegetables. J. Retail. 2024, 100, 85–103. [Google Scholar] [CrossRef]

- Ryglová, K.; Rašovská, I.; Šácha, J.; Maráková, V. Building Customer Loyalty in Rural Destinations as a Pre-Condition of Sustainable Competitiveness. Sustainability 2018, 10, 957. [Google Scholar] [CrossRef]

- Carvache-Franco, M.; Villagómez-Buele, C.; Orden-Mejía, M.; Carvache-Franco, W.; Ricaurte-Párraga, R.; Carvache-Franco, O.; Poveda-Anchundia, T.; Baquerizo-Anastacio, M. Motivation, Satisfaction, and Loyalty to Local Gastronomy for Tourism: A Study in Montañita, Ecuador. Int. J. Gastron. Food Sci. 2025, 41, 101245. [Google Scholar] [CrossRef]

- Malhotra, N.K. Marketing Research: An Applied Orientation, 7th ed., global ed.; Pearson: Harlow, UK; New York, NY, USA; Munich, Germany, 2020; ISBN 978-1-292-26563-6. [Google Scholar]

- Tanusondjaja, A.; Romaniuk, J.; Nenycz-Thiel, M.; Sakashita, M.; Viswanathan, V. Examining Pareto Law across Department Store Shoppers. Int. J. Mark. Res. 2023, 65, 581–596. [Google Scholar] [CrossRef]

- Tom, M.A.; LaPlante, D.A.; Shaffer, H.J. Does Pareto rule internet gambling? problems among the “vital few” & “trivial many”. J. Gambl. Bus. Econ. 2014, 8, 73–100. [Google Scholar] [CrossRef]

- Chaudhuri, M.; Voorhees, C.M.; Beck, J.M. The Effects of Loyalty Program Introduction and Design on Short- and Long-Term Sales and Gross Profits. J. Acad. Mark. Sci. 2019, 47, 640–658. [Google Scholar] [CrossRef]

- Nishio, K.; Hoshino, T. Joint Modeling of Effects of Customer Tier Program on Customer Purchase Duration and Purchase Amount. J. Retail. Consum. Serv. 2022, 66, 102906. [Google Scholar] [CrossRef]

- Kato, R.; Hoshino, T. Unplanned Purchase of New Products. J. Retail. Consum. Serv. 2021, 59, 102397. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).