Abstract

Green transformation is becoming key for corporate sustainability in the context of global carbon neutrality goals and China’s “dual carbon” strategy (peak carbon emissions and carbon neutrality). Digital transformation, particularly supply chain digitization, plays a significant role in green transformation. Corporations could improve environmental performance through appropriate resource allocation. Much academic and practical attention is drawn to this area to motivate corporate green transformation. This research proposes to explore the incentive effect of supply chain digitization on corporate green transformation and analyze the mediation mechanism of carbon information disclosure and the regulatory effect of external investor supervision. The study samples Chinese A-share listed firms between 2012 and 2024, constructs a moderated mediation effect model, and arrives at the following conclusions: (1) The digitization of the supply chain significantly stimulates the green transformation of public firms, indicating that digital technology promotes the green development of enterprises through optimizing supply chain management and improving environmental governance efficiency; (2) Carbon information disclosure plays a partial intermediary role between supply chain digitization and corporate green transformation, that is, supply chain digitization enhances the quality of carbon information disclosure and further strengthens the willingness and ability of enterprises to undergo green transformation; (3) The positive regulatory effect of external supervision on carbon information disclosure by investors indicates that external regulatory pressure can enhance the transmission effect of carbon information disclosure on corporate green transformation; (4) Heterogeneity analysis shows that supply chain digitization has a more significant incentive effect on green transformation for manufacturing firms, state-owned enterprises, and high-polluting enterprises, indicating that industry attributes, property rights, and environmental regulation intensity affect the effectiveness of digital green transformation.

1. Introduction

The increasing environmental issues and toughening regulations are driving corporate green transformation to achieve sustainable development. The Chinese government has been actively promoting green economic development at the policy level in recent years. It has set the “dual carbon” target (peaking carbon emissions before 2030 and achieving carbon neutrality before 2060), which largely depends on green transformation of Chinese enterprises [1,2]. Meanwhile, the Chinese government has introduced a series of policies to encourage corporate green transformation through technological innovation and digital transformation. With the support of low-carbon policies, over 6000 national-level green factories have been established in China by 2025 [3,4]. The supply chain is an important component of enterprise management, with carbon emissions accounting for more than half of the total emissions of the enterprise; some manufacturing enterprises can even reach up to 90% [2,3,4,5]. However, supply chain digitization can effectively improve companies’ carbon disclosure efficiency, thereby enhancing their environmental performance. Additionally, carbon information disclosure, an essential reflection of corporate environmental responsibility, has become a key indicator for investors and regulators to assess a company’s sustainable development capabilities [4,5,6]. Carbon information disclosure of Chinese A-share listed companies is transitioning from “voluntary exploration” to “mandatory regulation”. According to official data from the China Securities Regulatory Commission, 412 companies were required to disclose carbon information in 2023, of which 391 meet the disclosure requirements [7,8,9,10]. It can be seen that under the guidance of government regulation and low-carbon policies, the quality of carbon information disclosure by enterprises is constantly improving. In the context of these policies, exploring the incentive effects of digital supply chain, carbon information disclosure, and investor external monitoring on corporate green transformation holds significant theoretical and practical importance.

Under the high regulatory pressure of China’s carbon tax policy, investors are paying more attention to the carbon risks of enterprises. Bloomberg’s data for 2024 shows that companies with higher-quality carbon disclosure can have an average price-to-earnings ratio premium of 3% compared to their peers [4,5,6]. Enterprises need to disclose carbon information to meet investors’ expectations for environmental compliance and avoid reputation risks. After companies disclose their carbon data, they must rely on advanced digital technologies and tools to ensure the authenticity of their environmental performance [2]. Digital technology collects real-time data on carbon emissions, logistics efficiency, and other aspects of the entire supply chain, helping enterprises identify high pollution and energy-consuming nodes and promote green transformation. According to data released by the China Academy of Information and Communications Technology in 2024, over 80% of Chinese listed companies mention concepts such as “digital tools,” “digital transformation,” and “intelligent manufacturing” in their annual reports [5,6]. For example, Haier monitors the energy consumption of production lines through the industrial Internet platform, dynamically adjusts equipment operating parameters, and reduces energy waste by 15% [3]. Walmart uses the blockchain to trace the fresh food supply chain and reduce food corruption and carbon emissions in the transportation link [4]. In other words, green practices supported by supply chain digitization, such as carbon footprint labeling, can enhance corporate ESG ratings, attract green investors and consumers, and form an economic return loop. For example, Unilever reduces packaging waste through a digital supply chain, and its “sustainable brand” growth rate is 50% faster than traditional brands [5]. Therefore, supply chain digitization is not only a tool upgrade but also a core infrastructure for restructuring corporate green strategies. Enterprises lacking digitalization are difficult to cope with precise regulations and market elimination under the future “dual carbon” goals.

After the above discussion, the key research approach of this study is how supply chain digitization incentivizes corporate green transformation, and the role of carbon information disclosure and investor external monitoring in this process. Firstly, supply chain digitization provides technical support and data foundation for enterprises’ green transformation by enhancing the transparency and efficiency of the digital supply chain [6]. However, the digital supply chain does not directly lead to green transformation, and its role needs to be achieved through the intermediary variable of corporate environmental performance. Carbon information disclosure, as a public expression of corporate environmental performance, can transform the results of supply chain digitization into quantifiable environmental data, thereby enhancing corporate environmental responsibility and external supervision pressure [7]. In addition, investor external monitoring plays an important regulatory role in this process. Research has shown that investors are increasingly valuing the environmental performance of companies, and high attention can aggravate the incentive effect of carbon information disclosure on companies’ green transformation [8]. Thus, this study aims to reveal the interaction mechanism among supply chain digitization, carbon information disclosure, and investor external monitoring, providing theoretical contribution and practical suggestion for Chinese public firms. We creatively break down our investigation into the four following four research questions:

- (1)

- Considering accelerating the green transformation process, how does supply chain digitization promote the development of corporate green innovation?

- (2)

- When companies are committed to enhancing green innovation, can digital supply chain significantly promote carbon information disclosure by improving data transparency, optimizing processes, and enhancing collaboration?

- (3)

- In the process of corporate green innovation, external pressures need to be considered. Can investor external monitoring play a significant moderating role between carbon information disclosure and corporate green transformation?

- (4)

- Does investor external monitoring indirectly affect the level of green transformation by regulating the connection between supply chain digitization and carbon information disclosure?

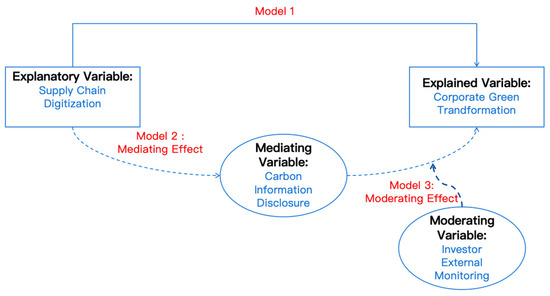

By addressing the above research questions, we opted to provide an in-depth understanding of the implication of supply chain digitization on corporate green transformation, as well as the importance of carbon information disclosure and investor external monitoring. This study builds the conceptual framework diagram and contributes to the following (Figure 1).

Figure 1.

The conceptual framework diagram.

- (1)

- Most previous scholars focus on researching the green transformation of enterprises from a single perspective [6,7,8,9]. This research creatively considers the influence of supply chain digitization on enterprise green transformation from the multiple angles of investors, enterprises, and supply chains. This article finds that investor attention can raise the performance of carbon information disclosure and enhance the digital level of supply chain, thereby promoting the process of green innovation. These findings provide significant insight into the effect of supply chain digitization on corporate green transformation.

- (2)

- This article regards the innovation and application of supply chain pilot policies as quasi-natural experiments, which can effectively solve the problems that national policies cannot quantify and thus reasonably evaluate the influence of supply chain digitization on the green transformation of Chinese public firms. This finding offers a valuable reference for firms when considering the supply chain digitization.

- (3)

- By comparison, this article reveals that supply chain digitization may affect green transformation of different enterprises from both horizontal and vertical perspectives. This discovery provides a more targeted reference for listed firms of different industry types and equity types.

- (4)

- This research highlights the external impact of the digital supply chain on the improvement of green transformation. Especially for public firms with good performance of carbon information disclosure, the external regulatory effect on investors is more significant. Hence, this study aims to comprehensively evaluate the external and internal factors of supply chain digitization and corporate green transformation.

The structure of this research is described as follows: This paper starts with a literature review and hypotheses development in Section 2. After that, the methodology is described from the data collection, variable description, and detailed model explanation in Section 3. Then, the empirical analysis in Section 4 includes variable descriptive statistics, parallel trend testing, double difference regression results, robustness testing, and enterprise heterogeneity analysis. To clearly demonstrate the contribution of the research, detailed discussions and implications are presented in Section 5. Finally, limitations and suggestions for future studies are discussed in Section 6.

2. Literature Review and Hypotheses Development

In the context of global carbon neutrality goals, corporate green transformation has become a major concern for scholars, governments, and businesses. Existing research has analyzed the driving factors of green transformation from the perspectives of technological innovation, institutional pressure, and market-oriented mechanisms, but has not fully revealed the synergistic mechanism between digital technology, information disclosure, and external regulation [7,8,9,10]. Firstly, as a key component of corporate green transformation, supply chain digitization refines resource allocation through data integration and intelligent technology [9,10]. However, its impact path on enterprise green transformation has not been clarified yet. Secondly, carbon information disclosure, as a bridge connecting internal operations and external supervision, which is proven to alleviate information asymmetry and guide green investment, still lacks systematic verification in its intermediary role between digitalization and green transformation [11]. In addition, external regulation by investors, as an important source of institutional pressure, has been proven to strengthen corporate environmental responsibility, but its regulatory effect on digital carbon management systems has not been fully discussed [6,11]. This research constructs a tripartite analysis framework of “technology-information-system” by integrating Resource-Based View, signal theory, and institutional theory, aiming to reveal how supply chain digitization directly drives green transformation; how carbon information disclosure mediates this process; and how investor regulation can regulate the environmental benefits of digital technology by changing the quality of carbon information disclosure. This study not only fills the theoretical gap in the existing literature on digital green collaboration mechanisms but also provides practical advice for enterprises to optimize digital technology applications and regulatory agencies to improve environmental governance policies.

2.1. The Transmission Mechanism of Supply Chain Digitization on Corporate Green Transformation

Supply chain digitization refers to the use of digital technologies including data analysis, the Internet of Things, blockchain, and artificial intelligence by enterprises to develop supply chain operations, enhance resource utilization efficiency, and reduce carbon emissions [12]. Existing studies indicated that digital technology can obviously improve the environmental performance of public firms [13,14]. Huawei has deployed a supply chain digital platform to achieve real-time monitoring of global supplier carbon emissions data and optimize procurement decisions, accordingly, ultimately increasing its green supplier ratio to 45% in 2022 [15]. This case demonstrates that digital technology can help companies more accurately identify high carbon emission links and take targeted measures to improve environmental performance. However, this previous study only unilaterally demonstrates the correlation between digital technology and corporate environmental performance based on linear regression. Thus, this study will focus on elucidating the impact path of the digital supply chain on the green transformation of enterprises. Theoretically, the theory of Resource-Based View holds that digital technology is an important resource for enterprises to establish green competitive advantages [16,17]. The digital supply chain can not only improve operational efficiency but also reduce resource waste through data-driven decision-making. For example, Lenovo has shortened the traceability time of product carbon footprint from 7 days to 2 h through digital supply chain management and optimized production processes, accordingly, achieving a reduction of 300,000 tons in emissions by 2023. In addition, JD Logistics utilizes AI algorithms to optimize delivery routes and reduce transportation mileage, successfully reducing carbon emissions by 20% in 2022 [18,19,20]. These cases all indicate that digitalization of the supply chain can directly promote the green transformation of enterprises [18,19,20]. However, the promoting effect of digitalization on green transformation does not occur automatically but depends on how enterprises utilize data to optimize decision-making. Therefore, supply chain digitization needs to be combined with other mechanisms (such as carbon information disclosure) to maximize its environmental benefits. Based on the above discussion, this study proposes the following:

H1.

Supply chain digitization significantly affects the green transformation of listed firms.

2.2. The Mediating Effect of Carbon Information Disclosure and Supply Chain Digitization for Corporate Green Transformation

Carbon information disclosure (CID) refers to the announcement of carbon emission data and emission reduction measures by listed companies to stakeholders such as regulatory agencies, the public, and investors [14]. According to signal theory, high-quality information revelation can reduce the probability of information asymmetry in listed companies, thereby helping investors more effectively evaluate the environmental performance of the company and promote its green transformation [15]. In addition, based on Information Processing Theory, previous research has shown that companies need to enhance their information processing capabilities through digital technology in an uncertain carbon regulatory environment [11,12,13]. The application of digital technology can improve the efficiency of enterprises in processing carbon information [14,15]. In addition, previous studies have found that companies comply with external regulations and meet the legitimacy requirements of their business activities by improving the quality of carbon information disclosure, based on institutional theory and legitimacy theory [18,19,20,21]. Subsequently, other scholars comprehensively considered stakeholder theory and signal theory and found that digital technology can help companies meet the regulatory requirements of investors and regulatory agencies for corporate environmental performance. Proactive and public disclosure of carbon information by enterprises can convey their outstanding environmental performance capabilities to the market, thereby helping them achieve low-carbon competition [16,17,20,21].

However, these previous studies only analyzed the external regulatory effects of investors on the quality of corporate carbon information disclosure from a theoretical perspective and did not demonstrate their scientific validity through empirical analysis. The digitization of the supply chain provides a data foundation for carbon information disclosure [2]. For example, Apple’s suppliers can share carbon emission data through digital platforms and release supplier clean energy plans, thereby achieving a 15% reduction in enterprise supply chain emissions [21,22]. Similarly, Tesla uses blockchain technology to record carbon emissions data during battery production, ensuring data is tamper-proof and regularly disclosed to investors [23,24]. Although the above research further demonstrates the incentive effect of carbon information disclosure on the digital transformation of enterprises, these cases do not focus specifically on Chinese companies. Therefore, this study will focus on Chinese listed companies and conduct further differentiation analysis by industry type and equity nature [14,15,21,22,23,24]. This indicates that digital technology can help improve the quality of carbon information disclosure for enterprises, thereby strengthening corporate environmental governance. Based on the above discussion, this research proposes the following:

H2.

Carbon information disclosure plays a mediating role in supply chain digitization and green transformation of listed firms.

2.3. The Mediating Effect of Strengthening Carbon Information Disclosure Through External Investor Regulation

External investor regulation refers to the practice where institutional investors, stock exchanges, or government agencies exert pressure on enterprises through policies, investment decisions, or shareholder proposals, demanding them to enhance the quality of carbon information disclosure and promote green transformation [2]. According to the institutional pressure theory [25,26], external regulation can alter the behavioral logic of enterprises, prompting them to respond more actively to environmental governance requirements. For example, in 2022, Goldman Sachs implemented a “carbon data disclosure red line” policy for its holding companies, requiring invested companies to publicly disclose complete carbon emission data, otherwise they face the risk of reducing their holdings. After the implementation of this policy, the installation rate of digital carbon monitoring systems in relevant enterprises has increased by 60% [27,28]. Similarly, EU organizations require member state listed companies to disclose carbon emission data from 2024 onwards. Afterwards, regulated listed companies showed a 38% increase in efficiency in digital green transformation compared to unregulated companies [29,30,31]. These cases demonstrate that external regulation can better incentivize corporate carbon information disclosure, thereby accelerating the application of digital technology in corporate green transformation. However, these cases only focus on individual enterprises for research and have not quantitatively analyzed the incentive effect of investor regulation on digital transformation of enterprises. In addition, existing research further supports this viewpoint [27,28,29,30,31]. Moradi et al. (2023) found that when institutional investors hold more than 5% of the shares, the response speed of a company’s carbon disclosure is doubled [9]. For example, BlackRock investment firm exercised voting rights in 2022 against three companies that did not meet carbon disclosure standards, forcing them to improve digital technology and enhance green transformation efficiency [13]. This indicates that investor regulation not only directly affects carbon information disclosure, but also further promotes green transformation by enhancing the application of digital technology [9,10,11,12,13,27,28,29,30,31]. Overall, existing studies have studied the impact of investor regulation and carbon disclosure on corporate green transformation from a single perspective but have not comprehensively studied the mediating effect of investor regulation in carbon disclosure and corporate green transformation processes. Based on the above analysis, this article proposes the following:

H3.

External regulation positively regulates the mediating effect of carbon information disclosure on investors. The stronger the supervision, the more significant influence of supply chain digitization on the path of green transformation through carbon information disclosure.

3. Methodology

A multiple linear regression model has been used to evaluate the incentive effect of digital supply chain on corporate green transformation and innovatively analyzed the mediating effect of carbon information disclosure on the model and the moderating effect of external investor regulation. The next section will explain the data collection, sample analysis, variable description, and empirical analysis of the moderated mediation model.

3.1. Data Collection

The data used in this study were collected from Csmar and CNRDS (Chinese Research Data Services) Database, covering A-share listed companies in China from 2012 to 2024. To ensure the authenticity of research data, the following steps of a data filtering process were taken:

- (1)

- Sample firms with missing data were eliminated from the model analysis.

- (2)

- ST (Special Treatment) companies facing financial difficulties or delisting risks have been delisted.

- (3)

- Financial companies were excluded due to their unique operational characteristics and accounting standards.

After the above screening, this study selected 29,543 sample data for model analysis. This dataset provides a comprehensive and representative sample for examining the incentive effects between digital supply chains and corporate green transformation, the mediating effects of carbon information disclosure, and the moderating effects of external investor supervision.

3.2. Sample Analysis

In order to explore the heterogeneity of the sample, this study further classified the sample data according to industry type, ownership structure, and pollution level:

- (1)

- Industry type: This study divides Chinese listed companies into manufacturing and non-manufacturing industries. This classification method can better distinguish the different impacts of the digital supply chain on manufacturing and non-manufacturing corporate green transformation, especially considering the important role of manufacturing in corporate environmental performance [32,33].

- (2)

- Ownership structure: The sample firms are divided into state-owned enterprises and non-state-owned enterprises. This classification verifies the influence of green supply chain policies on listed companies. Compared to non-state-owned enterprises, state-owned enterprises may deal with more severe regulatory pressure and resource allocation, so the implementation effect of green transformation strategies on state-owned firms would be more significant [6,7,8].

- (3)

- Pollution level: According to the “Industry Classification Guidelines for Listed Companies” issued by the China Securities Regulatory Commission, the sample companies are divided into 6428 high polluting enterprises and 22,225 non-high polluting enterprises. For high polluting enterprises, investors have higher requirements for the quality of carbon information disclosure. Therefore, strong supervision will be more conducive to the incentive influence of supply chain digitization on green transformation of public firms [34,35].

3.3. Variable Description

- (1)

- Explained Variable: Corporate green transformation. Referring to the previous research, Zhang et al. (2021) pointed out that corporate green transformation was measured by the level of Ongoing Innovation Performance in Green Practices (OIP) [1]. OIP is calculated by comparing the number of pre- and post-Ongoing Innovation in Green Patent Applications (OIN). The green patent application of Chinese listed firms comes from the Corporate Green Patent Data in the CNRDS database. The calculated formula of OIP is as follows.

Note: t represents the year.

- (2)

- Explanatory Variable: Digitization of Supply Chain through Digital Identification (DID). Chen et al. (2019) explained that DID emphasized the use of digital technology to improve the transparency, traceability, and efficiency of the supply chain [8]. In 2018, the Chinese government announced a batch of pilot listed companies participating in supply chain digitization [6,7,8]. This study refers to Zhang’s view (2021) of the supply chain policy as a quasi-natural experiment and applies the double difference approaches to divide the pilot enterprises and the pilot policy time separately and multiply them to represent the explanatory variable of DID, which is the interaction variable between time and treat [6]. In the empirical process, if the enterprise is on the pilot list, the dummy variable “treat” is 1 and classified as the treatment group; on the contrary, if it is 0 then it is classified as the control group. Similarly, if the observation sample is after the implementation of the pilot policy, the dummy variable “time” is 1, otherwise it is 0. The model coefficient of the DID variable reflects the policy effect of supply chain digitization. If the coefficient is positive, it indicates that supply chain digitization has improved the sustained green innovation level of enterprises. Otherwise, it will reduce the sustained green innovation level of enterprises.

- (3)

- Mediating Variable: Carbon information disclosure (CDP). Based on stakeholder theory and signal theory, carbon information disclosure is a significant signal for public firms to communicate their environmental performance, which can influence their green transformation decisions and behaviors. This study uses CDP as a mediator variable to explain how supply chain digitization promotes the internal path of green transformation for enterprises by increasing data transparency and external supervision pressure. The data for carbon disclosure indicators comes from publicly released corporate social responsibility reports of listed companies in the Csmar database.

- (4)

- Moderating Variable: investor external monitoring (IEM). This study selects IEM as the moderating variable to reveal how the external governance environment affects the mechanism of supply chain digitization to promote green transformation of enterprises through carbon information disclosure. The data for investor supervision of listed companies comes from the digital data of investor Q&A in the CNRDS database. The higher investor Q&A represents the greater regulatory intensity of investors on listed companies.

- (5)

- Control Variable: This study refers to the research of Li. (2020), Zhang et al. (2021), and Wessel et al. (2021) and selects the following variables that may affect corporate green transformation, including asset liability ratio (Lev), dual, total asset growth rate (assetgrowth), the value of Tobin’s Q (tobinq), and the equity of Herfindahl3 (herfindahl3) [6,11,19]. The variable description of this research is described in Table 1.

Table 1. Variable description.

Table 1. Variable description.

3.4. Moderated Mediation Model

To examine the complex relationships among the digital supply chain, carbon information disclosure, investor external monitoring, and corporate green transformation, a mediated moderation model was constructed. This model allows for simultaneous analysis of direct, indirect, and moderating effects, providing a comprehensive understanding of the mechanisms driving green transformation.

The model is specified as follows:

- (1)

- Two-way fixed effects difference-in-differences model

This study constructs a benchmark model for Formula (2) to evaluate the impact of supply chain digitization on green transformation of Chinese enterprises.

OIPit is an explained variable, representing the level of green transformation of enterprise i in year t. DIDit reflects the level of supply chain digitization, and α1 reflects the effectiveness of supply chain digitization. If α1 is positive, it indicates that the digitization of the supply chain has improved the level of corporate green transformation, otherwise it will decrease. Controlsit is a set of control variables of enterprises; ηi is individual fixed effects; λt is time fixed effect; and εit is a random disturbance term.

- (2)

- Mediation effect model

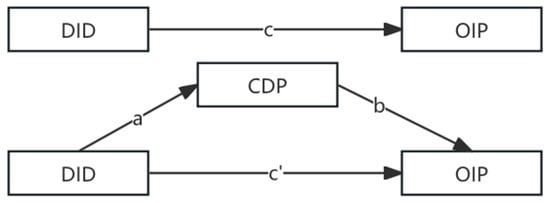

As we can see from Figure 2, C represents the total effect of the explanatory variable DID on the dependent variable OIP of green transformation in enterprises. C’ represents the direct impact of supply chain digitization on corporate green transformation. The value of a*b represents the mediating influence of supply chain digitization (DID) on corporate green transformation (OIP) considering the mediating variable of carbon information disclosure (CDP).

Figure 2.

Mediation effect model.

- (3)

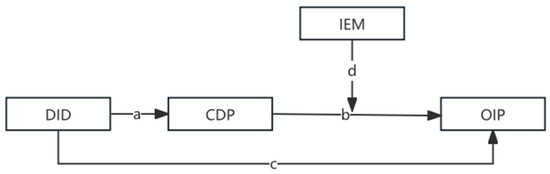

- Moderated mediation effect model

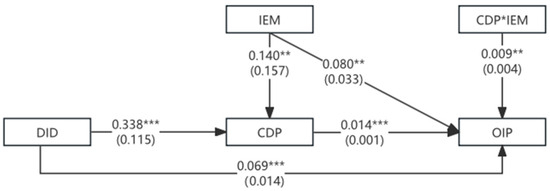

To further prove the influenced path of supply chain digitization on corporate green transformation, a moderated mediation effect model is adopted for further testing. This model can test the moderating effect of investor external monitoring (IEM) in the mediating path between independent variables and dependent variables. Based on the theory of mediation effect model, the moderated mediation effect is tested by including an interaction term between CDP and OIP. From Figure 3, d represents the moderating impact of the moderating variable IEM on the mediating variable CDP and the explained variable OIP.

Figure 3.

Moderated mediation effect model.

This model is supported by prior research, which highlights the role of the digital supply chain in raising the corporate environmental performance [6,7,8], the mediating role of carbon information disclosure in translating digitization efforts into green outcomes [12,13], and the amplifying effect of investor external monitoring on the relationship between carbon information disclosure and corporate green transformation [7,8,9].

In summary, this article constructs the following testing model.

4. Empirical Results

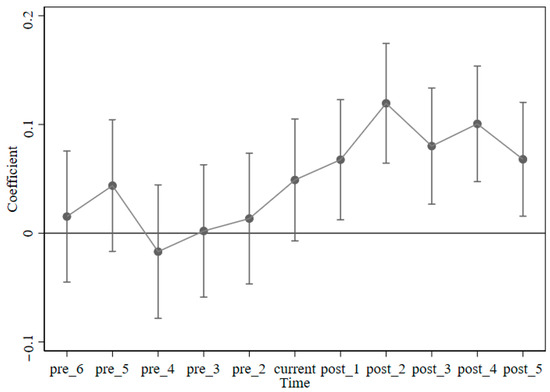

4.1. Parallel Trend Test

This study collected sample data from 2012 to 2024 for comparative analysis of the differences in supply chain transformation and pilot policies before and after implementation and observed the differences between the treatment group and the control group. As shown in Figure 4, before carrying out the policy, the confidence interval of the treatment effect coefficient crosses the X-axis, indicating that there is no obvious difference between the treatment group and the control group. After the implementation of the pilot policy for supply chain digitization in 2018, the confidence interval gradually deviated from the X-axis, and the parallel trend test was validated.

Figure 4.

Parallel trend test.

4.2. Two-Way Fixed Effects Difference-in-Differences Regression

In Table 2, all models used the two-way fixed effects double difference regression method, with column (6) as the reference benchmark. Column (1) does not include any control variables, and the coefficient of supply chain digitization is significantly positive at the 1% level. By sequentially adding control variables in columns (2) to (6), the results remained stable, confirming the positive impact of supply chain digitization on the green transformation of enterprises.

Table 2.

Regression model results.

4.3. Robustness Test

4.3.1. Placebo Test

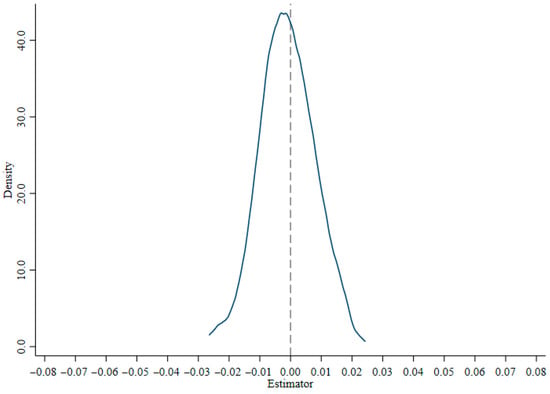

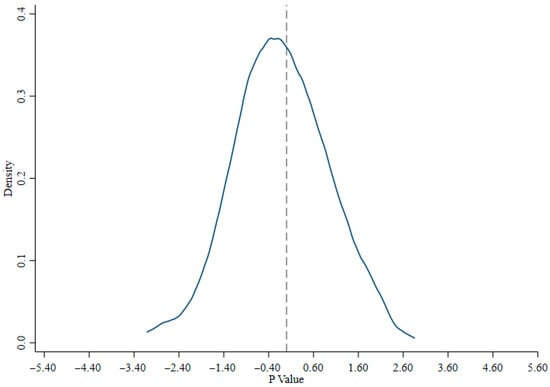

This study conducted a regression model according to column (6) in Table 2 and judged the reliability of the results based on the probability of obtaining the estimation coefficients of the Two-Way Fixed Effects Difference-in-Differences Regression model through virtual experiments. To further enhance the efficacy of placebo testing, 500 random samples of interaction terms were selected from the raw data to test whether there are significantly different results between the DID coefficient and the results of the two-way fixed difference-in-differences regression. Finally, we plotted the estimated coefficient distribution of DID (Figure 5) and the T-value plot (Figure 6). In (Figure 5), it is shown that the random sampling coefficient is usually distributed with a mean of 0, and the T-values of the random sampling results are all around zero, indicating that the Two-Way Fixed Effects Difference-in-Differences Regression results are robust.

Figure 5.

Placebo test—estimated coefficient.

Figure 6.

Placebo test—T value.

4.3.2. Increase Control Variables

According to the research of Zhang et al. (2021) and Flick et al. (2023), long-term debt-to-asset ratio (dler), cashflow, and ownership structure of enterprises (property) also affect corporate green transformation [6,13]. Thus, this research added dler, cashflow, and property into the set of control variables, and the regression results showed the robustness of column (2) in Table 3.

Table 3.

Robust test.

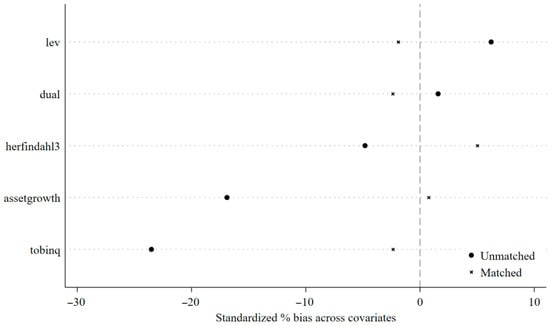

4.3.3. PSM-DID

To address the issues of self-systematic differences and selection bias in the samples, the PSM-DID method with nearest neighbor matching was chosen to re-regress the treatment group and control group. Figure 7 shows that the differences in control variables between the two sample groups have significantly decreased, and column (3) in Table 3 shows that the regression model results are robust.

Figure 7.

Deviation of control variables before and after matching.

4.3.4. Replace the Explained Variable

To further verify the efficiency of the model, the dependent variables were replaced with the amount of green invention applications (OIP*). As we can see from Table 3, the new regression results showed robustness.

4.3.5. Instrumental Variable Test

To solve potential internal issues in the model, the independent variable with the lag of a period is used as the instrumental variable for regression analysis. Columns (4) and (5) in Table 3 show the research results, indicating the obviously positive correlation between instrumental variables and explanatory variables, while the second stage of supply chain digitization remains significant. The Kleiberen–Paaprk LM statistic rejects the null hypothesis at the 1% significance level, with a test value of 10,324.164, greater than 10, indicating that the instrumental variable satisfies identifiability. The Cragg Donald WaldF statistic is 15,534.376, exceeding the critical value of the variable test at the 10% significance level. Through the weak instrumental variable test, the validity of the instrumental variable is demonstrated.

4.4. Analysis of Enterprise Heterogeneity

4.4.1. Horizontal Heterogeneity Analysis

The development of corporate green transformation is influenced by internal factors such as corporate scale, operational capacity, ownership nature, equity structure, industry type, and pollution level. This study aims to explore the impact of supply chain digitization on the green transformation of different types of enterprises. Therefore, this research takes the horizontal nonhomogeneity of enterprise size, operating capacity, ownership nature, and equity structure association, and the vertical heterogeneity of the industry and pollution level, to conduct heterogeneity research on enterprises.

- (1)

- Corporate scale

This study uses the annual asset liability ratio to measure the corporate scale and uses the median scale as the dividing line to divide the enterprise sample into large, small, and medium-sized enterprises to examine the heterogeneous impact of supply chain digitization on the sustained green transformation level of enterprises of different sizes. As shown in columns (1) and (2) of Table 4, the digitization of supply chains in large enterprises is significantly positive at the 1% level, while the coefficient for small and medium-sized enterprises is negative, indicating that the impact of supply chain digitization in large enterprises is more significant. Large enterprises usually have stronger policy adaptability, can fully utilize economies of scale, effectively coordinate and integrate various links of the supply chain, reduce overall costs, and also accelerate the development of green transformation.

Table 4.

Horizontal heterogeneity analysis.

- (2)

- Operational capacity

Resource-based theory of enterprises holds that their sustainable competitive advantage derives from their characteristics to imitate resources and capabilities. Under this framework, the operational capabilities of enterprises cover multiple aspects such as management level, technological innovation, and market development. Enterprises with strong business capabilities can better integrate, allocate, and manage resources in supply chain innovation, improving innovation efficiency and success probability. This article divides the sample of enterprises into two categories based on the median book-to-market ratio: those with strong operational capabilities and those with weak operational capabilities. As shown in columns (3) and (4) of Table 4, when an enterprise has strong operational capabilities, the coefficient of supply chain digitization is significantly positive at the 1% level, while when an enterprise has weak operational capabilities, the coefficient is not significant. This indicates that pilot policies for enterprises with strong operational capabilities have a more significant policy effect on their green transformation.

- (3)

- Ownership nature

Due to the differences in organizational structure, decision-making mechanisms, and market positioning between state-owned (SOE) and non-state-owned enterprises (NSOE), there are significant differences in the impact of pilot policies on the green transformation of enterprises. Divide the enterprise sample into SOEs and NSOEs and study the differentiated impact of supply chain digitization on the green transformation of the two types of enterprises. Columns (5) and (6) in Table 4 show that the policy effect coefficient of SOEs is significantly positive at the 1% level, while the sample coefficient of NSOEs is not significant. Compared to NSOEs, SOEs usually have strong industrial foundations, complete production line layouts, and mature production technologies. Digitization of the supply chain is more advantageous for SOEs to leverage their advantages in resource aggregation and integration, thereby improving their degree of green transformation.

- (4)

- Equity structure association

Shareholder affiliation can promote the flow of information within a company by reducing information asymmetry, thereby more effectively integrating green innovation resources and promoting the realization of the company’s green transformation. In addition, equity linkage can prevent conflicts of interest between corporate managers and shareholders, enabling companies to focus more on long-term sustainable green innovation goals. The empirical results of columns (7) and (8) in Table 4 represent that when there is a correlation between corporate equity structure, the policy coefficient is significantly positive, while when there is no correlation between corporate equity structure, the policy coefficient is positive but not significant. This means that pilot policies for enterprises with equity structures are more effective in promoting green transformation.

4.4.2. Vertical Heterogeneity Analysis

Vertically, there are some variances in resource allocation and green transformation among different industries; therefore, the influence of supply chain digitization on enterprises may also reveal heterogeneity between industries. So, this study aims to investigate the industry heterogeneity of supply chain digitization, enabling policy makers to design more targeted policy frameworks to promote green transformation and maximize economic benefits.

- (1)

- Manufacturing and non-manufacturing enterprises

There are differences in supply chain structure between manufacturing and non-manufacturing enterprises, with non-manufacturing enterprises having relatively simple supply chains. In Table 5, columns (1) and (2) show that the policy effect of manufacturing enterprises is significantly positive at the 1% level, while the policy effect of non-manufacturing enterprises is not significant. From an external perspective, manufacturing is the mainstay of the real economy and an important member of green innovation and transformation. In the sample pilot policies in this study, there were 18,512 manufacturing industries, accounting for 62.67%. The promotion of supply chain innovation pilot projects can achieve technological upgrading in the manufacturing industry, increase overall industry profits, and stimulate economic growth. From an internal perspective, the manufacturing supply chain is more complex, and enterprises in different links need to better collaborate and leverage synergies. However, in comparison, the supply chain of non-manufacturing companies is relatively simple, and the difficulty of achieving synergies is greater. Therefore, the policy effects of green transformation on manufacturing enterprises are more obvious.

Table 5.

Vertical heterogeneity analysis.

- (2)

- Polluting and non-polluting firms

Referring to “Classification and Management List of Environmental Verification Industries for Listed Companies” issued by the China Securities Regulatory Commission and the environmental protection department, 6428 samples in this study were defined as heavily polluting industries and subjected to grouped regression. The results are shown in columns (3) and (4) of Table 5. The policy effect of polluting industries is significantly positive at the 10% level, while the regression coefficient of non-polluting industries is significantly positive at the 1% level. This study found that supply chain innovation in non-polluting industries under government guidance can help break path dependence, promote the adoption of new technologies, and find environmentally friendly technological solutions. However, polluting industries are susceptible to path dependence limitations, making it difficult to quickly adjust production methods. Therefore, supply chain digitization has more important influence on green transformation of non-polluting enterprises.

4.5. Empirical Analysis of the Impact Path

4.5.1. Mediation Effect Test

The empirical results of the intermediary transmission regression are shown in Table 6. Column (1) indicates that the total effect of supply chain digitization on corporate green transformation is significant at the 1% level, representing that pilot policies can effectively promote corporate green transformation. From column (2), it can be seen that the effect coefficient of the pilot policy is significantly positive at the 1% level, showing that the pilot policy can effectively improve corporate carbon information disclosure and that hypothesis 2 holds true. In column (3), the estimated coefficient of policy effect is 0.014, and it is significantly positive at the 1% level, indicating that the improvement of carbon information disclosure helps to enhance the influence of supply chain digitization on corporate green transformation.

Table 6.

Moderated mediation effect test.

4.5.2. Moderated Mediation Effect Test

From column (4) in Table 6, it shows that the estimated coefficient of investor external monitoring is significantly positive at the 1% level, indicating that IEM has positive influence on corporate green transformation. In addition, the coefficient of the interaction between CDP and IEM is also obviously positive at the 1% level, indicating that investor external monitoring positively regulates the impact of carbon information disclosure on corporate green transformation. Therefore, hypotheses 3 and 4 are valid. From this, it can be seen that under the regulation of external supervision by investors, the greater the effectiveness of external supervision, the higher the quality of carbon information disclosure by enterprises, thus promoting their green transformation. The specific impact path of the moderated mediation effect in this study is presented in Figure 8.

Figure 8.

The impact path of the moderated mediation effect. Note: ***, **, * indicate 1%, 5%, and 10% significant levels, respectively.

5. Theoretical, Practical, and Managerial Implications

This current study has examined the moderated mediation model comprising several variables, namely supply chain digitization and carbon information disclosure, and how they interactively affect the corporate green transformation under the moderated impact of investor external supervision. Combining the institutional theory, legitimacy theory, and stakeholder theory, our research comprehensively discussed how the identified variables correlate. After that, the empirical results for the hypotheses proposed have been discussed in detail.

5.1. Theoretical and Research Implications

This research deepens the theoretical exploration of the driving mechanism for corporate green transformation by integrating a multidimensional framework of supply chain digitization, carbon information disclosure, and external investor supervision. Firstly, the study reveals that supply chain digitization is not only a manifestation of technological upgrading but also an institutionalized carrier of corporate green strategy. Compared to previous studies that focused solely on correlation analysis, this study validates its intermediary path of indirectly promoting green transformation through optimizing the quality of carbon information disclosure, enriching the integration and application of resource-based view and institutional theory in the field of environmental management. Secondly, research has found that carbon information disclosure plays an intermediary role between supply chain digitization and green transformation. Previous studies have mostly directly discussed the interrelationship between digital technology and carbon information disclosure, or between digital technology and corporate green transformation [22,23,24,25,26]. However, based on the theory of signal transmission, its theoretical value lies in elucidating how digital technology can enhance information transparency (reduce environmental information asymmetry) and strengthen internal carbon management (force upstream and downstream supply chain cooperation to reduce emissions), thereby amplifying the incentive effect of digitization on green transformation. In addition, previous studies have mostly focused on the impact of investor regulation on corporate environmental performance [31,32,33,34,35]. On this basis, this study introduced external investor regulation as a moderating variable which expands the interactive logic of “external supervision internal response” in corporate governance theory. Moreover, this study also confirms the boundary condition role of market supervision on the efficiency of the digital environment, providing a creative research perspective for the intersection of green finance and sustainable supply chains.

5.2. Practical Implications

The research conclusion provides important insights for policy formulation and corporate practice. Compared to previous single-case studies [3,4,5,7,8,9,10,11], this enriched empirical analysis ensures the scientific validity of the research and provides technical support for government and corporate policymaking. On the one hand, the Chinese government can accelerate the process of industrial green transformation by expanding the pilot scope of supply chain digitization and supporting mandatory carbon information disclosure regulations. On the other hand, enterprises need to recognize that supply chain digitization is not only an efficient tool but also a strategic choice for gaining green competitive advantages. Enterprises can integrate carbon data through digital platforms (such as blockchain traceability of carbon emissions), which can significantly enhance the credibility of information disclosure, attract green preference investors, and reduce financing costs. This study also creatively found the practical value of investor regulation. When external investors participate in governance or pressure (such as requiring companies to disclose their supply chain carbon footprint), it can effectively curb the risk of “green washing” that digitization may cause, thereby ensuring that technology investment is transformed into real emission reduction performance [35,36,37]. This has direct reference value for coordinating economic growth and green environmental performance.

5.3. Managerial Implications

The mediation effect of carbon information disclosure indicates that supply chain digitization improves carbon information traceability through data integration and real-time monitoring. High quality carbon disclosure can reduce the decision-making uncertainty of green technology investment (such as accurately identifying high energy consuming links), transforming the incentive for digital transformation from “technological possibility” to “management feasibility”. However, this process relies on the deep coupling of digital infrastructure and carbon management systems by enterprises, otherwise digitization may only remain at the level of process optimization.

This study employs the moderated mediation model to demonstrate the regulatory logic of investor regulation. Investors can strengthen the relation between digital technology and green transformation through two paths: One is the pressure transmission effect, where institutional investors use green ratings, shareholder proposals, and other methods to force companies to allocate the resources saved by digitization to emissions reduction (such as requiring pilot companies to disclose digital emission reduction data). The second is the signal enhancement effect. The valuation premium of high carbon disclosure companies in the capital market will amplify the green reputation effect brought by digitization, forming a positive cycle of “digital investment—disclosure improvement—financing convenience—transformation acceleration”.

6. Conclusions, Suggestions, and Limitations for Future Studies

Based on a large number of previous case studies and theoretical research, this study scientifically collected data from Chinese A-share market enterprises [6,7,8,9,37,38,39,40]. Conversely previous studies tend to directly analyze the incentive effects of digital supply chains on corporate green transformation [22,23,24,25,41,42,43,44,45]. This study provides a more intuitive analysis on the impact path of the digital supply chain on corporate green transformation from the dual perspectives of external investor regulation and carbon information disclosure. Thus, this study is innovative in both the scientific nature of sample collection and from a research perspective.

This study collected data from listed companies from 2012 to 2024 to empirically investigate the influence and mechanism of supply chain digitization on corporate green transformation. The results of this study indicate that supply chain digitization can significantly improve the level of green transformation of public firms in China, and the results still hold true after a series of robustness tests. Regarding heterogeneity testing, from a horizontal perspective, supply chain digitization is helpful for larger, state-owned, more capable, and equity-structured enterprises to improve their level of green transformation. Vertically, the digitization effect of supply chains is more significant in manufacturing and non-heavy-polluting firms. The impact mechanism indicates that carbon information disclosure plays a partial intermediary role, and external regulation by investors plays a positive regulatory role in promoting corporate green transformation under carbon information disclosure.

According to the above research discussion, the following practical recommendations are suggested:

- (1)

- Listed firms should attach great importance to the policy effects of supply chain innovation in the process of corporate green transformation, especially the digital effects of supply chains in state-owned enterprises, manufacturing enterprises, and heavy-polluting enterprises.

- (2)

- The Chinese government should pay attention to the significantly positive influence of supply chain innovation policies on the green transformation of manufacturing firms while also enhancing the carbon information disclosure of enterprises. Relevant government departments can formulate clear environmental regulations and adopt differentiated supervision for different types of enterprises.

- (3)

- Investors of highly polluting listed companies need to strengthen external supervision of their environmental performance, recognizing the significance of improving supply chain digitization for green transformation and focusing on the quality of carbon information disclosure in annual reports.

While this research has produced several encouraging results, there are some limitations that should be pointed out. First, this research currently only collected relevant data on A-share listed companies from 2012 to 2024 in China. Future research could expand the dataset by collecting data from different countries with several governmental policies of supply chains and corporate green transformation. Second, the heterogeneity analysis in this study can further classify enterprise types, such as regional division and product types. Third, this study only considers internal and external factors such as supply chain digitization, carbon information disclosure, and investor supervision in the process of corporate green transformation. In addition to the above factors, cultural, institutional, and technological factors can also be considered when analyzing the influencing factors of corporate green transformation. Finally, this study used a moderated mediation model to investigate the influence of supply chain digitization on corporate green transformation. In addition to quantitative research, it would be helpful to conduct a typical case study and longitudinal research to evaluate the effect of supply chains on corporate green transformation from an innovative perspective.

Author Contributions

Conceptualization, J.X.; Methodology, J.X. and P.G.; Software, H.X.; Validation, H.X.; Data curation, H.X.; Writing—original draft, J.X.; Writing—review&editing, P.G. and Y.H.; Supervision, Y.H.; Funding acquisition, P.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Projects of Philosophy and Social Science Research in Colleges and Universities in Jiangsu Province: [2025SJYB0912]; Jiangsu Provincial Social Science Fund Project: [24GLB015].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

Author Hanyang Xu was employed by the company NARI Group (China). The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- Abdalla, S.; Nakagawa, K. The interplay of digital transformation and collaborative innovation on supply chain ambidexterity. Technol. Innov. Manag. Rev. 2021, 11, 45–56. [Google Scholar] [CrossRef]

- Fischer, M.; Imgrund, F.; Janiesch, C.; Winkelmann, A. Strategy archetypes for digital transformation: Defining meta objectives using business process management. Inf. Manag. 2020, 57, 103262. [Google Scholar] [CrossRef]

- Golmohammadi, A.; Kraft, T.; Monemian, S. Setting the deadline and the penalty policy for a new environmental standard. Eur. J. Oper. Res. 2024, 315, 88–101. [Google Scholar] [CrossRef]

- Shahzad, K.; Cheema, I.I. Low-carbon technologies in automotive industry and decarbonizing transport. J. Power Sources 2024, 591, 233888. [Google Scholar] [CrossRef]

- Schöggl, J.P.; Baumgartner, R.J.; O’Reilly, C.J.; Bouchouireb, H.; Göransson, P. Barriers to sustainable and circular product design—A theoretical and empirical prioritisation in the European automotive industry. J. Clean. Prod. 2024, 434, 140250. [Google Scholar] [CrossRef]

- Zhang, Y.; Liu, X.; Chen, J. The impact of supply chain digitalization on corporate green transformation: Evidence from Chinese manufacturing firms. J. Clean. Prod. 2021, 315, 128234. [Google Scholar]

- Li, H.; Wang, Q. Carbon information disclosure and corporate environmental performance: A mediating role of stakeholder pressure. Sustainability 2020, 12, 2105. [Google Scholar]

- Chen, X.; Zhang, L.; Gao, Y. Investor attention and corporate environmental responsibility: Evidence from China. J. Bus. Ethics 2019, 158, 621–640. [Google Scholar]

- Moradi, M.; Sadani, M.; Shahsavani, A.; Bakhshoodeh, R.; Alavi, N. Enhancing anaerobic digestion of automotive paint sludge through biochar addition. Heliyon 2023, 24, e17640. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Qi Dong, J.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Wessel, L.; Baiyere, A.; Ologeanu-Taddei, R.; Cha, J.; Blegind Jensen, T. Unpacking the difference between digital transformation and IT-enabled organizational transformation. J. Assoc. Inf. Syst. 2021, 22, 102–129. [Google Scholar] [CrossRef]

- Gupta, S.; Modgil, S.; Gunasekaran, A.; Bag, S. Dynamic capabilities and institutional theories for Industry 4.0 and digital supply chain. Supply Chain. Forum Int. J. 2020, 21, 139–157. [Google Scholar] [CrossRef]

- Flick, D.; Vruna, M.; Bartos, M.; Ji, L.; Herrmann, C.; Thiede, S. Machine learning based internal and external energy assessment of automotive factories. CIRP Ann. 2023, 72, 21–24. [Google Scholar] [CrossRef]

- Dacin, M.T.; Goodstein, J.; Scott, W.R. Institutional theory and institutional change: Introduction to the special research forum. Acad. Manag. J. 2002, 45, 45–56. [Google Scholar] [CrossRef]

- Darnall, N.; Henriques, I.; Sadorsky, P. Adopting Proactive Environmental Strategy: The Influence of Stakeholders and Firm Size. J. Manag. Stud. 2010, 47, 1072–1094. [Google Scholar] [CrossRef]

- Kazemitash, N.; Fazlollahtabar, H.; Abbaspour, M. Rough Best-Worst Method for Supplier Selection in Biofuel Companies based on Green criteria. Oper. Res. Eng. Sci. Theory Appl. 2021, 4, 1–12. [Google Scholar] [CrossRef]

- Chiou, T.Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Williams, B.D.; Roh, J.; Tokar, T.; Swink, M. Leveraging supply chain visibility for responsiveness: The moderating role of internal integration. J. Oper. Manag. 2013, 31, 543–554. [Google Scholar] [CrossRef]

- Li, F. Leading digital transformation: Three emerging approaches for managing the transition. Int. J. Oper. Prod. Manag. 2020, 40, 809–817. [Google Scholar] [CrossRef]

- Lampón, J.F.; Muñoz-Dueñas, P. Are sustainable mobility firms reshaping the traditional relationships in the automotive industry value Chain? J. Clean. Prod. 2023, 413, 137522. [Google Scholar] [CrossRef]

- Ahmed, W.; Moazzam, M.; Sarkar, B.; Rehman, S.U. Synergic effect of reworking for imperfect quality items with the integration of multi-period delay-in-payment and partial back ordering in global supply chains. Engineering 2021, 7, 260–271. [Google Scholar] [CrossRef]

- AlNuaimi, B.K.; Khan, M. Public-sector green procurement in the United Arab Emirates: Innovation capability and commitment to change. J. Clean. Prod. 2019, 233, 482–489. [Google Scholar] [CrossRef]

- Xue, J.; He, Y.; Liu, M.; Tang, Y.; Xu, H. Incentives for corporate environmental information disclosure in China: Public media pressure, local government supervision and interactive effects. Sustainability 2021, 13, 10016. [Google Scholar] [CrossRef]

- Porfrio, J.A.; Carrilho, T.; Felcio, J.A.; Jardim, J. Leadership characteristics and digital transformation. J. Bus. Res. 2021, 124, 610–619. [Google Scholar] [CrossRef]

- Wolff, S.; Brönner, M.; Held, M.; Lienkamp, M. Transforming automotive companies into sustainability leaders: A concept for managing current challenges. J. Clean. Prod. 2020, 276, 124179. [Google Scholar] [CrossRef]

- Ardi, A.; Djati, S.; Bernarto, I.; Sudibjo, N.; Yulianeu, A.; Nanda, H.; Nanda, K. The relationship between digital transformational leadership styles and knowledge- based empowering interaction for increasing organisational innovativeness. Int. J. Innov. Creat. Change 2020, 11, 259–277. [Google Scholar]

- Biggart, N.W.; Hamilton, G.G. An institutional theory of leadership. J. Appl. Behav. Sci. 1987, 23, 429–441. [Google Scholar] [CrossRef]

- Dey, B.K.; Pareek, S.; Tayyab, M.; Sarkar, B. Autonomation policy to control work-in-process inventory in a smart production system. Int. J. Prod. Res. 2021, 59, 1258–1280. [Google Scholar] [CrossRef]

- Granadero, D.; Garcia-Muñoz, A.; Adam, R.; Omil, F.; Feijoo, G. Evaluation of abatement options to reduce formaldehyde emissions in vehicle assembly paint shops using the Life Cycle methodology. Clean. Environ. Syst. 2023, 11, 100139. [Google Scholar] [CrossRef]

- Seman, N.A.A.; Govindan, K.; Mardani, A.; Zakuan, N.; Saman, M.Z.M.; Hooker, R.E.; Ozkul, S. The mediating effect of green innovation on the relationship between green supply chain management and environmental performance. J. Clean. Prod. 2019, 229, 115–127. [Google Scholar] [CrossRef]

- Bresciani, S.; Huarng, K.H.; Malhotra, A.; Ferraris, A. Digital transformation as a springboard for product, process and business model innovation. J. Bus. Res. 2021, 128, 204–210. [Google Scholar] [CrossRef]

- Bucay-Valdiviezo, J.; Escudero-Villa, P.; Paredes-Fierro, J.; Ayala-Chauvin, M. Leveraging Classical Statistical Methods for Sustainable Maintenance in Automotive Assembly Equipment. Sustainability 2023, 15, 15604. [Google Scholar] [CrossRef]

- Hinings, B.; Gegenhuber, T.; Greenwood, R. Digital innovation and transformation: An institutional perspective. Inf. Organ. 2018, 28, 52–61. [Google Scholar] [CrossRef]

- Scuotto, V.; Nicotra, M.; Del Giudice, M.; Krueger, N.; Gregori, G.L. A microfoundational perspective on SMEs’ growth in the digital transformation era. J. Bus. Res. 2021, 129, 382–392. [Google Scholar] [CrossRef]

- Del Giudice, M.; Scuotto, V.; Papa, A.; Tarba, S.Y.; Bresciani, S.; Warkentin, M. A Self-Tuning Model for Smart Manufacturing SMEs: Effects on Digital Innovation. J. Prod. Innov. Manag. 2021, 38, 68–89. [Google Scholar] [CrossRef]

- Correani, A.; De Massis, A.; Frattini, F.; Petruzzelli, A.M.; Natalicchio, A. Implementing a digital strategy: Learning from the experience of three digital transformation projects. Calif. Manag. Rev. 2020, 62, 37–56. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, K.; Xie, J. Bad greenwashing, good greenwashing: Corporate social responsibility and information transparency. Manag. Sci. 2020, 66, 3095–3112. [Google Scholar] [CrossRef]

- Xu, X.; Choi, T.M. Supply chain operations with online platforms under the cap-and-trade regulation: Impacts of using blockchain technology. Transp. Res. Part E Logist. Transp. Rev. 2021, 155, 102491. [Google Scholar] [CrossRef]

- Zhang, W.; Wang, H. Optimal contract design for live streaming platforms under dual asymmetric information considering corporate social responsibility. Manag. Decis. Econ. 2023, 44, 3537–3555. [Google Scholar] [CrossRef]

- Zhuge, D.; Wang, S.; Zhen, L. Shipping emission control area optimization considering carbon emission reduction. Oper. Res. 2024, 72, 1333–1351. [Google Scholar] [CrossRef]

- Yang, M. Green investment and e-commerce sales mode selection strategies with cap-and-trade regulation. Comput. Ind. Eng. 2023, 177, 109036. [Google Scholar] [CrossRef]

- McWilliams, B.; Sgaravatti, G.; Tagliapietra, S.; Zachmann, G. How would the European Union fare without Russian energy? Energy Policy 2023, 174, 113413. [Google Scholar] [CrossRef]

- Shen, B.; Dong, C.; Minner, S. Combating copycats in the supply chain with permissioned blockchain technology. Prod. Oper. Manag. 2022, 31, 13456. [Google Scholar] [CrossRef]

- Zhao, Q.; Fan, Z.P.; Sun, M. Manufacturer blockchain technology adoption strategies for different sales channels in an e-commerce platform supply chain. Transp. Res. Part E Logist. Transp. Rev. 2024, 185, 103507. [Google Scholar] [CrossRef]

- Nygaard, A.; Silkoset, R. Sustainable development and greenwashing: How blockchain technology information can empower green consumers. Bus. Strategy Environ. 2023, 32, 3801–3813. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).