Abstract

As climate change poses growing sustainability challenges worldwide, companies face unprecedented pressure to innovate in environmentally sustainable ways. This study examines the impact of extreme climate risks on corporate green innovation through the State-Pressure-Response framework, using data from Chinese A-share listed companies between 2014 and 2024. Results demonstrate that extreme climate risks significantly promote corporate green innovation levels. Mechanistically, climate risks exacerbate companies’ financing constraints, yet under evolving green finance architectures, this financial pressure can drive them toward green innovation to improve their access to preferential green financing channels. Media attention amplifies this sustainability-oriented response by heightening reputational stakes, while managerial myopia weakens it by prioritizing immediate performance over long-term sustainable development. The effect is most pronounced among heavily polluting industries and state-owned enterprises, revealing differential pathways toward sustainable transformation. These findings offer valuable guidance for policymakers seeking to harness climate pressures for sustainable transformation through targeted green finance expansion, mandatory climate risk disclosure frameworks, and corporate governance reforms that align executive incentives with long-term environmental performance.

1. Introduction

The year 2023 was termed by UN Secretary-General António Guterres as the inaugural year of “global boiling,” during which record-breaking high temperatures [1,2], devastating floods [3], and raging wildfires have been reshaping the global business environment [4]. From the Rhine River’s drought in Germany causing chemical enterprises to halt production [5,6], to extreme high temperatures in China’s Yangtze River basin affecting manufacturing supply chains [7], and to Australia’s wildfires severely damaging the tourism industry [8], extreme climate events are impacting corporate operations with unprecedented frequency and intensity. These impacts not only directly threaten production continuity but also compel enterprises to fundamentally reassess their development trajectories and strategic orientations [9,10].

As climate pressures intensify, enterprises must transition from passive adaptation to proactive transformation. Green innovation—encompassing environmentally friendly technologies, processes, and products—has emerged as a critical strategic response for enhancing environmental adaptability and reducing climate risk exposure [11]. This imperative intensifies within China’s national decarbonization framework, where the government’s commitment to achieving carbon peak by 2030 and carbon neutrality by 2060 creates systematic pressures that amplify corporate sensitivity to climate risk signals [12]. Operating under these explicit policy mandates, Chinese firms face dual pressures from both environmental deterioration and regulatory expectations, making them particularly responsive to climate threats through strategic innovation pivots. Understanding how climate risks translate into corporate green innovation thus holds significant theoretical value for advancing organizational adaptation theory and practical importance for guiding sustainable transformation policies.

Academic inquiry into climate risk–innovation relationships reveals a landscape marked by theoretical fragmentation and empirical inconsistencies. Scholars have documented divergent effects: some find that climate risks inhibit innovation by increasing operational uncertainty and inducing managerial risk aversion [13,14], while others observe promotional effects through crisis-driven motivation and adaptive search behaviors [15,16]. This theoretical tension reflects deeper conceptual challenges in understanding how environmental threats trigger organizational responses. Beyond directional debates, research has identified multiple transmission pathways through which climate pressures influence innovation decisions—including stakeholder pressure mechanisms [17], managerial cognitive processes [18,19], and governance structures [20]. Yet these insights remain dispersed across isolated studies, lacking integration within systematic frameworks that can explain when, why, and how climate risks produce particular organizational outcomes. The field thus confronts a fundamental challenge: existing theoretical architectures inadequately capture the complex, conditional nature of climate risk–innovation relationships, particularly the paradoxical mechanisms through which environmental pressures might simultaneously constrain resources yet catalyze strategic change.

Three critical gaps impede theoretical advancement and practical understanding. First, prevailing frameworks conceptualize climate risks as discrete external disturbances rather than systematic transformations triggering coordinated organizational adaptations. This conceptualization proves particularly inadequate for explaining the paradoxical role of financing constraints, which conventional wisdom treats uniformly as innovation impediments. Yet emerging institutional contexts—characterized by rapidly evolving green finance ecosystems—may fundamentally alter how financial pressures influence innovation decisions. When financial markets construct differentiated capital access structures that reward environmental capabilities, might financing constraints transform from barriers into catalysts? Existing frameworks cannot address this question because they lack theoretical apparatus for incorporating institutional contingencies that reshape constraint-innovation dynamics. Second, while research acknowledges financing constraints as potential transmission mechanisms, the operational logic remains undertheorized. Traditional innovation literature uniformly predicts that financing constraints suppress innovation through resource scarcity effects [21], yet this prediction rests on assumptions about financial market structures that may no longer hold in contexts where green finance products proliferate. The conditions under which financial pressure converts from impediment to motivation, the specific pathways through which this transformation occurs, and the institutional prerequisites enabling such inversions remain empirically unexamined and theoretically unexplained. This gap becomes increasingly consequential as policy interventions accelerate green finance development, creating institutional environments where conventional constraint-innovation predictions may systematically fail. Third, research examines moderating factors in isolation rather than integrating external supervision mechanisms and internal management characteristics within unified analytical structures. Studies document that media attention influences corporate environmental behavior and that managerial characteristics shape climate risk responses [18,19], yet these insights remain disconnected. How do information intermediaries amplify or dampen climate risk signals? How do managerial temporal orientations interact with external pressures to either facilitate or obstruct innovation responses? Without systematic examination of these boundary conditions within integrated frameworks, we cannot predict when climate pressures will generate innovation versus defensive retrenchment, limiting both theoretical understanding and practical guidance.

Addressing these gaps, this study investigates four progressive research questions. First, do extreme climate risks affect corporate green innovation, and if so, what magnitude and direction characterize this relationship? Second, does financing constraint serve as a transmission mechanism, and specifically, does a “forcing mechanism” exist whereby climate-induced financial pressures compel enterprises toward green innovation as a strategic pathway to accessing preferential green capital? Third, how do media attention and managerial myopia moderate this core relationship, functioning as external amplification and internal attenuation mechanisms, respectively? Fourth, do enterprises with different characteristics—particularly regarding pollution intensity and ownership structure—exhibit differentiated response patterns that reveal heterogeneous adaptation capacities and strategic orientations?

To systematically address these questions, we construct a State-Pressure-Response (SPR) theoretical framework that integrates transmission mechanisms with boundary conditions. Our contributions advance theory and practice across three dimensions. First, we develop an integrated analytical framework that explains how extreme climate risks, as external environmental state changes, trigger corporate green innovation through financing constraints as a key pressure transmission mechanism, while being moderated by external supervision and internal management factors. This framework moves beyond treating climate risks as discrete shocks to conceptualizing them as systematic transformations that activate coordinated organizational responses through specific institutional channels.

Second, we identify and validate a novel forcing mechanism wherein climate-induced financing constraints paradoxically promote rather than inhibit green innovation. This mechanism operates through a theoretically predictable yet empirically underexplored sequence: climate risks exacerbate financing constraints, which motivate strategic green innovation investments, which subsequently improve access to preferential green capital markets, creating self-reinforcing cycles that transform environmental pressures into competitive advantages. By demonstrating that financing constraints function as innovation catalysts rather than barriers when institutional infrastructures reward environmental performance, we challenge foundational assumptions in innovation literature and provide theoretical foundations for understanding how policy architectures can restructure incentive systems to align corporate interests with sustainability imperatives. The forcing mechanism reveals that the effectiveness of climate-driven innovation depends critically on institutional intermediaries that create differentiated financing structures rewarding environmental leadership, highlighting opportunities for policy interventions that amplify rather than merely accommodate market-based adaptation responses.

Third, we systematically examine how media attention and managerial myopia serve as critical boundary conditions that moderate the climate risk–innovation relationship. Media attention functions as an external amplification mechanism that heightens reputational stakes and stakeholder scrutiny, strengthening innovation incentives. Conversely, managerial myopia operates as an internal attenuation mechanism wherein short-term performance orientations weaken long-term innovation commitments. By integrating these moderating factors within a unified framework, we reveal how external information environments and internal cognitive orientations jointly determine whether climate pressures channel into innovation versus defensive responses, deepening understanding of contextual dependencies that govern organizational adaptation patterns.

Our empirical analysis examines Chinese A-share listed companies from 2014 to 2024, a period encompassing both intensifying climate events and rapid green finance development. China serves as a strategic research setting for testing our theoretical framework because Chinese firms operate under strong institutional pressures from national decarbonization commitments while experiencing significant climate risk exposure across diverse geographical and sectoral contexts. The findings likely extend to other emerging economies facing similar climate pressures and institutional environments characterized by government-led sustainability transitions and evolving green finance ecosystems.

The remainder of this paper proceeds as follows. Section 2 reviews relevant literature and develops research hypotheses grounded in SPR theory. Section 3 describes our research design, including data sources, variable measurements, and econometric specifications. Section 4 presents empirical results, including baseline estimations, validity assessments addressing endogeneity concerns, cross-sectional heterogeneity analyses, and mechanism investigations. Section 5 discusses theoretical and practical implications, situating our findings within broader scholarly debates. Section 6 concludes with policy recommendations for leveraging climate pressures to accelerate sustainable transformation through targeted interventions in green finance architecture, disclosure frameworks, and corporate governance structures.

2. Literature and Hypotheses

2.1. Literature Review

In recent years, as global climate change has intensified and extreme weather events have become more frequent, the relationship between climate risks and corporate innovation behavior has become an important research topic. However, existing research still exhibits significant divergence in directional judgments regarding the impact of climate risks on corporate innovation.

Academic exploration of the relationship between climate risks and corporate innovation presents a complex and divergent landscape, with such divergence primarily stemming from differences in research perspectives, contextual conditions, and measurement methods. The “inhibition theory” perspective argues that climate risks weaken corporate innovation capabilities, with its logic being that climate risks increase operational uncertainty, leading managers to adopt risk-averse strategies and thereby reducing investment in innovation [13]. Large-sample cross-country research based on 62 economies reveals a significantly negative correlation between climate risks and corporate innovation activities, with the mechanism primarily manifesting in climate risks increasing managers’ risk-averse tendencies, making enterprises more inclined toward conservative investment strategies when facing uncertainty [13]. Empirical research focusing on the Chinese context further confirms this argument, finding that abnormal temperatures significantly inhibit corporate green technology innovation output by crowding out R&D investment, with this inhibitive effect being particularly prominent in non-state-owned enterprises and manufacturing enterprises [14]. From the theoretical perspective of attention-based view, more in-depth explanation is provided, pointing out that high-temperature weather causes operational disruptions, which in turn diverts managerial attention and ultimately inhibits corporate green innovation activities [22]. These studies converge on a common logic: climate risks function as resource drains and attention disruptors that systematically suppress organizational capacity for innovation investment.

Conversely, the “promotion theory” perspective approaches from the angle of crisis-driven innovation, arguing that extreme climate events, as external shocks, can stimulate corporate innovation motivation and prompt them to seek technological solutions to address environmental challenges, although this promotional effect often exhibits conditional and temporary characteristics [15,16]. Studies examining European firms reveal that exposure to environmental impacts, including extreme weather events, can paradoxically spur firms’ green behaviors and innovativeness, though this relationship varies significantly across Central and Eastern European countries compared to Southern European nations [23]. Evidence from European studies suggests that supportive regulatory frameworks can stimulate green technology development, with research on EU emissions trading systems demonstrating that environmental policies may induce both adaptive and creative responses in energy-intensive firms [24]. Analysis of EU member states’ eco-innovation performance reveals significant variation in green technology adoption across different European regions, with Northern European countries consistently achieving superior long-term outcomes compared to their Southern and Eastern counterparts [25]. By distinguishing different dimensions of climate change, research finds that the speed of climate change can positively affect corporate green innovation, while the irregularity of climate change produces negative impacts, with this differentiated impact pattern revealing the complexity and conditionality of climate risk effects [16]. Research discovers that extreme precipitation events have positive promotional effects on green technology innovation, though these effects exhibit temporary characteristics [15]. These divergent perspectives reflect a deeper theoretical tension: climate risks simultaneously constrain resources while heightening threat perception, with the net effect depending on whether organizations interpret environmental pressures as controllable challenges amenable to strategic responses or as overwhelming threats necessitating defensive retrenchment.

Regarding theoretical elucidation and empirical testing of impact mechanisms, existing literature has explored transmission pathways through which climate risks affect corporate innovation from multiple perspectives, forming relatively rich research achievements. However, problems of insufficient theoretical integration and inadequate depth in mechanism analysis persist. From the external supervision mechanism perspective, research finds that public perception of climate risks can significantly promote corporate green investment, with media attention and environmental image playing important moderating roles [17]. International evidence supports the complexity of these transmission mechanisms. Research examining European firms demonstrates that country-level eco-innovation indices significantly reduce both direct and indirect CO2 emissions, with financial development creating supportive environments that cultivate corporate efforts toward emission reduction [26]. Studies of European carbon-intensive companies reveal that eco-innovation affects corporate environmental and financial performance through complex temporal dynamics, with productivity gains from green technologies often requiring extended implementation periods [27]. From the managerial characteristics angle, the crucial role of CEO green experience in mitigating negative impacts of climate change exposure has been revealed [19]. Research also finds that managerial political ideology divergence significantly affects corporate environmental innovation intensity, reflecting the important influence of managers’ personal characteristics on corporate environmental behavior [18]. Cross-national governance studies demonstrate that board demographic and structural diversity can promote eco-innovation by offsetting negative effects of political risk, with this relationship being particularly pronounced in firms operating under weak external monitoring environments [28]. Research on European listed companies reveals that green finance sources, particularly green bond issuance, are influenced by market-based characteristics and environmental technological innovation capabilities, serving as market signaling mechanisms for socially responsible corporate strategies [29]. However, these studies mostly focus on discussing single mechanisms and lack systematic analysis of multiple interactive effects, particularly lacking in-depth elucidation of the complete logical chain of how climate risks affect corporate behavior through internal transmission mechanisms while being moderated by external environmental and internal management factors.

However, these studies exhibit three fundamental limitations that constrain theoretical advancement. First, they predominantly examine transmission mechanisms in isolation, treating financing constraints, media attention, and managerial characteristics as independent pathways rather than interactive components of a comprehensive response system. This fragmentation obscures how external pressures and internal capabilities jointly determine organizational adaptation trajectories. Second, existing research implicitly assumes uniform effects of financing constraints across all institutional contexts, overlooking how evolving green finance ecosystems might fundamentally alter the functional role of financial pressure from impediment to catalyst. This theoretical blind spot becomes particularly problematic as financial markets increasingly integrate environmental criteria into capital allocation decisions, creating differentiated financing structures that reward green capabilities. Third, prior studies rarely specify the boundary conditions under which promotional versus inhibitive effects dominate, limiting our ability to predict organizational responses across varying contexts and to design interventions that systematically channel climate pressures toward innovation rather than retrenchment.

Based on the inadequacies identified above, existing literature reveals theoretical gaps that this study addresses through integrating the State-Pressure-Response (SPR) framework. While previous studies primarily adopt fragmented approaches—either focusing solely on internal capabilities or external pressures—this integrated framework captures the dynamic interplay between environmental states, internal pressures, and organizational responses. More critically, existing research treats financing constraints uniformly as innovation inhibitors, overlooking how emerging green finance ecosystems may transform financial pressure into innovation catalysts. Additionally, prior studies examine moderating factors in isolation rather than systematically incorporating both external supervision mechanisms and internal management characteristics within a unified analytical framework. This study addresses these gaps by constructing a comprehensive theoretical model that explains how climate risks transform from external threats into innovation drivers through specific transmission mechanisms while being moderated by contextual boundary conditions.

2.2. Research Hypotheses

Climate change is reshaping the global business environment, with the increasing frequency of extreme weather events not only threatening corporate daily operations but also becoming a key factor influencing corporate long-term development strategies [30]. In recent years, from Australia’s forest fires to Europe’s extreme high temperatures [31,32], from persistent heavy rains in southern China to severe droughts in the north [33,34], these extreme climate events have caused enormous economic losses to global enterprises. Faced with these challenges, enterprises are no longer passive victims but have begun to proactively seek response strategies, with green innovation gradually becoming an important choice for enterprises to address climate risks. The State-Pressure-Response (SPR) theory provides an effective analytical framework for understanding this phenomenon [35]. This theory was originally proposed by the Organization for Economic Cooperation and Development to analyze how state changes in environmental systems trigger subject response behavior through pressure mechanisms.

Under the SPR theoretical framework, extreme climate risks represent deterioration of corporate external environmental states, with such state changes exerting multiple pressures on enterprises and thereby prompting them to adopt corresponding adaptive responses. While climate risks can trigger various organizational responses including geographical diversification [10], insurance mechanisms [36], and operational adjustments [37], this study focuses specifically on green innovation as a strategic response pathway. The theoretical rationale for this focus lies in understanding the conditions and mechanisms through which climate pressure channels into innovation-based adaptation rather than purely risk-transfer or risk-avoidance strategies. This distinction is theoretically important because green innovation represents a different organizational logic—one that transforms environmental threats into organizational capabilities rather than merely managing or deflecting exposure. The threat-rigidity hypothesis suggests that organizations facing threats tend to restrict information processing [38,39,40,41], centralize control, and revert to well-learned routines, potentially leading to conservative responses such as increased insurance coverage or risk avoidance through operational curtailment. However, the competing threat-vigilance perspective argues that certain types of threats can heighten organizational alertness and stimulate proactive adaptation, particularly when threats are perceived as both severe and controllable through strategic action. Extreme climate risks occupy a unique position in this theoretical landscape because they combine three critical characteristics: high severity that commands managerial attention, systematic persistence that renders temporary fixes inadequate, and partial controllability through technological innovation that makes proactive responses feasible and rewarding. This combination of threat attributes makes extreme climate risks more likely to trigger vigilance rather than rigidity responses, channeling organizational energy toward capability-building innovations rather than merely defensive maneuvers. From a resource-based view under crisis conditions [42,43,44], green innovation emerges as a particularly rational strategic response to climate risks for several interconnected reasons that distinguish it from alternative adaptation pathways. First, unlike geographical diversification or insurance mechanisms that merely transfer or distribute risks across space or time, green innovation addresses the root cause of climate vulnerability by reducing environmental exposure at the source through enhanced resource efficiency, emissions reduction, and climate-resilient production processes. This capability-building approach creates sustainable competitive advantages that persist beyond individual climate events and become increasingly valuable as environmental pressures intensify. Second, green innovation generates multiple co-benefits that other adaptive strategies cannot provide simultaneously, including enhanced regulatory compliance under tightening environmental standards, improved corporate reputation among increasingly environmentally conscious stakeholders, preferential access to green financing channels that reward environmental performance, and entry into emerging markets for sustainable products and services. These benefits create positive feedback loops that justify the substantial upfront investments required for innovation activities, as the returns extend far beyond immediate climate risk mitigation. Third, the nature of climate risks as systematic and persistent threats alters the cost–benefit calculus of different response strategies, making reactive approaches increasingly insufficient. The cumulative costs of repeated operational disruptions, rising insurance premiums, and continuing exposure to climate-related damages can exceed the investment required for preventive innovation that transforms the enterprise’s environmental profile. This economic logic particularly favors innovation when firms possess sufficient absorptive capacity to implement new technologies and when institutional frameworks provide supportive infrastructure for green technology development.

Moreover, the institutional environment surrounding climate risks creates specific incentive structures that systematically channel organizational responses toward innovation rather than alternative adaptations. Regulatory trajectories across major economies increasingly favor proactive environmental strategies, with governments worldwide implementing comprehensive policy packages that reward green innovation through research and development subsidies, accelerated depreciation for environmental equipment, tax credits for clean technology adoption, and preferential treatment in government procurement processes. The financial sector’s rapid integration of environmental, social, and governance criteria into mainstream investment decisions further tilts the cost–benefit analysis toward innovation, as firms demonstrating strong green capabilities gain access to capital at more favorable terms through green bonds, sustainability-linked loans, and ESG-focused investment funds that have grown from niche products to significant capital sources. These institutional factors interact synergistically with the inherent threat characteristics of climate risks to create what we term a ‘strategic forcing corridor’ that narrows the range of viable adaptive responses and elevates green innovation from one option among many to the dominant rational strategy for forward-looking enterprises operating in contexts where environmental pressures are intensifying and institutional support for green transition is strengthening.

Building on this theoretical foundation that integrates threat perception dynamics, resource-based strategic logic, and institutional channeling mechanisms, we can now articulate our first hypothesis with greater theoretical precision. From the perspective of corporate risk management, extreme climate risks exhibit obvious systematic and persistent characteristics [9], making traditional risk transfer and avoidance strategies difficult to play effective roles in the long term. When enterprises frequently suffer extreme weather impacts, managers gradually recognize that merely relying on insurance compensation or post-event repairs is insufficient for ensuring organizational survival and prosperity; they must enhance corporate environmental adaptability from the source through fundamental transformations in production processes and product portfolios. Green innovation precisely provides such a forward-looking solution: through developing environmentally friendly technologies and products, enterprises can not only reduce their own environmental risk exposure but also gain competitive advantages under increasingly strict environmental regulations [45,46]. This risk-driven innovation motivation becomes stronger when facing extreme climate impacts, as real and tangible threats make it easier for managers to recognize the long-term value of green innovation and overcome organizational inertia that might otherwise resist costly strategic reorientation. Simultaneously, extreme climate events also influence corporate innovation decisions by changing external environmental expectations and stakeholder demands. When society witnesses the destructive power of extreme weather through visible disasters and mounting economic losses, public attention to environmental protection significantly increases, government environmental policies tend to become stricter with enhanced enforcement, and investors’ requirements for corporate environmental performance also become higher through both formal ESG screening criteria and informal reputational mechanisms. These converging pressures from multiple stakeholder groups reinforce the strategic logic favoring green innovation as the preferred organizational response to climate threats. Therefore, our first hypothesis predicts a positive relationship between extreme climate risks and corporate green innovation, with this relationship reflecting not merely a generic stress response or random organizational adjustment but rather a strategically rational adaptation that aligns organizational capabilities with environmental imperatives while simultaneously positioning enterprises to capture the institutional rewards increasingly attached to environmental leadership.

H1:

Extreme climate risks positively affect corporate green innovation.

However, the impact of extreme climate risks on corporate green innovation does not occur directly but operates through a series of internal mechanisms. We conceptualize this transmission process as the “forcing” mechanism of financing constraints, which operates through a transformation in how enterprises evaluate innovation investments under evolving green finance conditions. This mechanism challenges traditional theoretical assumptions about the relationship between financial constraints and innovation behavior [21]. According to SPR theory, changes in external environmental states need to trigger subject response behavior through specific pressure transmission mechanisms [47]. Among these, financing constraints play a key transmission role. When enterprises suffer extreme climate impacts, the most direct effect is deterioration of financial conditions, requiring them to bear not only direct losses and repair costs but also face uncertainty in future income [48]. This financial pressure quickly transmits to the financing arena, where banks and investors, when assessing corporate credit risks, consider climate risks as important factors and require higher risk premiums for enterprises with high climate risk exposure.

Interestingly, this exacerbation of financing constraints may conversely become an important driving force for corporate green innovation. In the current financial environment, green finance has become a rapidly developing field, with increasing numbers of financial institutions beginning to provide preferential financing products such as green loans and green bonds [49]. For enterprises facing financing difficulties, demonstrating green innovation capabilities becomes an important pathway to obtain these preferential funds. Some enterprises discover that by investing in green technologies and obtaining relevant certifications, they can not only improve financing conditions but also enter previously inaccessible green capital markets [50]. This phenomenon reveals a deeper theoretical mechanism that challenges conventional understanding [51,52]. The “forcing” mechanism of financing constraints represents a paradigm shift from traditional innovation-constraint relationships. In conventional financial environments, financing constraints typically reduce innovation investment through resource scarcity effects, where constraints directly diminish innovation capacity. However, under emerging green finance architectures, this relationship can become inverted when enterprises recognize that green innovation capabilities provide pathways to preferential financing access, creating a dynamic where constraints motivate green innovation which subsequently improves financing conditions. This forcing mechanism operates through a theoretically predictable sequence wherein climate-induced financing constraints incentivize enterprises to pursue green innovation as a strategic pathway to accessing preferential green financing products—including green bonds, sustainability-linked loans, and ESG-focused investment funds—that offer substantially more favorable terms than conventional financing alternatives. This creates a self-reinforcing dynamic where financing pressure motivates innovations that subsequently alleviate that pressure, transforming constraints from impediments into drivers.

H2:

Financing constraints play a transmission role between extreme climate risks and green innovation.

In this process, the role of external environment cannot be ignored, particularly the influence of media attention. Stakeholder theory indicates that enterprises need to balance the needs and expectations of multiple stakeholders [53], with media serving as an important bridge connecting enterprises and the public. Media, as important carriers of information dissemination, play a crucial role in shaping public perception of climate issues [54]. When extreme climate events occur, intensive media coverage significantly amplifies the social impact of events, making extreme weather that might otherwise be viewed as isolated incidents receive more attention [55]. This attention is reflected not only in the quantity of news reports but also in the depth and persistence of coverage.

In environments with high media attention, external pressure faced by enterprises significantly increases [56]. On one hand, media pay more attention to corporate performance in addressing climate risks, with enterprises demonstrating positive environmental actions more likely to receive favorable coverage, while those lacking environmental awareness may face negative questioning. On the other hand, media attention also influences the behavior of other stakeholders, with investors paying more attention to corporate environmental performance and consumers increasingly favoring environmentally friendly products. This multi-faceted external pressure strengthens corporate motivation for green innovation, making the promotional effect of extreme climate risks on green innovation more pronounced.

H3:

Media attention strengthens the promotional effect of extreme climate risks on green innovation.

Corresponding to external environmental factors, internal management characteristics of enterprises also significantly affect the intensity of this relationship. Behavioral theory suggests that managers’ cognitive limitations and behavioral preferences significantly influence their decision-making behavior [57,58]. Some managers possess strong myopic tendencies, focusing more on short-term financial performance and lacking sufficient patience for projects requiring long-term investment [59,60]. Green innovation precisely exhibits characteristics of large investment, long cycles, and uncertain returns, creating natural conflicts with the preferences of myopic managers.

When enterprises face extreme climate risks, myopic managers tend to adopt more direct and immediately effective response measures, such as purchasing insurance, strengthening equipment maintenance, or simply bearing losses [61]. Although these measures can alleviate risk impacts in the short term, they cannot enhance corporate environmental adaptability. More importantly, myopic managers may lack profound understanding of long-term trends in climate risks, tending to view extreme climate events as isolated external shocks rather than long-term challenges requiring systematic responses. This cognitive limitation weakens managers’ motivation for green innovation; even when facing obvious climate risk pressure, they may choose other more “convenient” solutions.

H4:

The degree of managerial myopia weakens the promotional effect of extreme climate risks on green innovation.

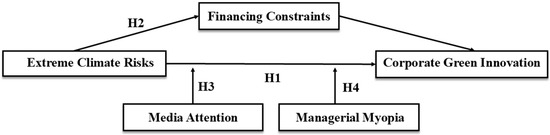

Based on the above theoretical analysis and hypothesis deduction, this study constructs a theoretical framework for how extreme climate risks affect corporate green innovation. This framework takes the State-Pressure-Response (SPR) theory as its core, systematically elucidating how extreme climate risks, as external environmental states, ultimately trigger corporate green innovation as adaptive response behavior through financing constraints as a key pressure transmission mechanism. Simultaneously, the framework incorporates two important contextual factors—media attention and managerial myopia—revealing boundary conditions that affect the intensity of this relationship from the perspectives of external supervision and internal management, respectively. The logical framework of this study is shown in Figure 1, with subsequent sections providing systematic empirical testing of this theoretical framework through real-world empirical data.

Figure 1.

Research Framework.

3. Methodology and Data

3.1. Sample Construction

This study employs Chinese A-share listed companies from 2014 to 2024 as the research sample, with data sources encompassing multiple authoritative databases to ensure research reliability and comprehensiveness. Corporate financial data, governance structure data, and patent data are primarily sourced from the China Stock Market & Accounting Research (CSMAR) database and the China Research Data Services Platform (CNRDS), both of which provide high-quality information on Chinese listed companies. Extreme climate risk data are constructed through integrating historical meteorological observation data from the China Meteorological Data Service Center, which, as a national-level authoritative meteorological data institution, provides long-term series and high-precision climate observation records. Media attention data are sourced from the media and public opinion module of the CNRDS database, which systematically collects and quantifies mainstream financial media coverage information on listed companies. During the sample screening process, this study excludes financial enterprises, ST and ST* companies, as well as observations with missing key variables, and applies 1% and 99% percentile winsorization to all continuous variables to eliminate the influence of extreme values. Ultimately, a dataset containing approximately 15,628 firm-year observations is obtained, providing a solid data foundation for subsequent empirical analysis.

3.2. Measurement Framework

The core explanatory variable of this study is extreme climate risk (ECRI), which comprehensively incorporates four sub-dimensions of extreme climate events: extreme high temperature days (ETD), extreme low temperature days (LTD), extreme rainfall days (ERD), and extreme drought days (EDD). Following established methodologies in climate risk measurement, this study employs equal weighting across the four dimensions to construct the comprehensive index [62,63]. Each sub-dimension is first standardized using min-max normalization to ensure comparability across different measurement scales, transforming raw counts into standardized scores ranging from 0 to 100. The final ECRI index is calculated as:

This equal weighting approach avoids subjective bias in relative importance assessment while ensuring that each type of extreme climate event contributes equally to capturing the multifaceted nature of regional climate risk exposure. We choose equal weighting over alternative approaches such as principal component analysis (PCA) based on theoretical and methodological considerations. Equal weighting avoids imposing subjective judgments about the relative severity of different extreme weather types, which may vary across industries, regions, and temporal contexts. While PCA extracts weights from statistical covariance patterns, such data-driven weights could be dominated by sample-specific variation rather than reflecting the underlying theoretical construct of comprehensive climate risk exposure. Additionally, equal weighting enhances transparency and cross-study comparability, as the index construction remains consistent and interpretable across different research contexts. For robustness testing, we additionally construct two alternative indices: ECRI_TEMP emphasizing temperature-related events (ETD and LTD receiving 40% each, ERD and EDD receiving 10% each) and ECRI_PRECIP emphasizing precipitation-related events (ERD and EDD receiving 40% each, ETD and LTD receiving 10% each). The comprehensive index design enables systematic assessment of extreme weather exposure across different geographical contexts, providing a balanced representation of diverse climate threats faced by enterprises in their respective regions. The dependent variable is corporate green innovation (GI), measured by the natural logarithm of total green patent applications plus one. This indicator effectively reflects corporate innovation output in environmentally friendly technologies. To ensure result robustness, this study simultaneously employs the natural logarithm of total green invention patent applications plus one as an alternative indicator for testing.

Financing constraints (FC) are measured using the classic KZ index, which comprehensively considers multiple financial indicators including cash flow, dividends, cash holdings, leverage ratio, and Tobin’s Q, enabling relatively accurate characterization of external financing difficulties faced by enterprises. Furthermore, media attention (MA) is measured using the total number of media report headlines quantified and statistically analyzed in the CNRDS database’s newspaper financial news section, with log transformation after adding one. This indicator reflects the degree of external supervision and social attention received by enterprises. Managerial myopia (MM) measurement is based on textual information from the Management Discussion and Analysis (MD&A) section of corporate annual reports, constructed by building a collection of 43 Chinese and English vocabularies reflecting short-term orientation such as “within days, several months, within year, as soon as possible, immediately, right away,” calculating the frequency ratio of these vocabularies appearing in MD&A texts and multiplying by 100. Higher values of this indicator indicate greater managerial myopia, with managers more inclined to focus on short-term gains while neglecting long-term development.

Control variable selection is based on main factors influencing corporate green innovation identified in existing literature, encompassing the following five key variables. Firm size (Size) is measured using the natural logarithm of year-end total assets, as large-scale enterprises typically possess stronger resource integration capabilities and innovation investment capabilities, enabling them to bear the high costs and uncertainty risks of green innovation. Profitability (ROA) is measured using the ratio of net profit to total assets, as enterprises with strong profitability possess more adequate internal funding to support green innovation activities while also facing greater environmental responsibility pressure. Financial leverage (Leverage) is measured using the ratio of total liabilities to total assets, as highly leveraged enterprises face stricter debt constraints that may affect their long-term investment decisions in green innovation. Firm age (Age) is measured using the natural logarithm of years since establishment, as younger enterprises often possess stronger innovation vitality and environmental adaptability, while mature enterprises may exhibit path dependence and organizational inertia. CEO-Chairman duality (Duality) is measured using a dummy variable, taking the value of 1 when the chairman concurrently serves as general manager, and 0 otherwise. This variable reflects the concentration degree of corporate governance structure, influencing corporate strategic decision efficiency and innovation investment willingness. The inclusion of these control variables can effectively control potential influences of enterprise heterogeneity on research results, improving model estimation accuracy and reliability.

Regarding temporal specification, we measure extreme climate risks and green innovation outcomes in the same year. This contemporaneous specification is theoretically appropriate because extreme climate events generate immediate operational disruptions and strategic pressures that trigger rapid organizational assessments. The high visibility and salience of extreme weather events mean their strategic implications are recognized quickly by managers and stakeholders, accelerating response timelines. While climate risk effects likely exhibit both immediate and delayed components, our specification captures the direct contemporary relationship between environmental shocks and innovation responses.

3.3. Econometric Specification

To examine the impact of extreme climate risks on corporate green innovation, this study constructs the following benchmark regression model:

where represents the green innovation level of firm i in year t, denotes the degree of extreme climate risk faced by firm i in year t, and represents a series of control variables. In the model, represents firm fixed effects, controlling for time-invariant firm-specific characteristics affecting green innovation; represents year fixed effects, controlling for time trend factors such as macroeconomic cycles and policy environment changes; represents industry-year interaction fixed effects (where j denotes industry and t denotes year), enabling more precise control of industry-specific temporal shocks and development trends that may confound the relationship between climate risks and green innovation. is the random disturbance term.

4. Empirical Analysis

4.1. Baseline Estimation

To validate the impact of extreme climate risks on corporate green innovation, this study first estimates the benchmark regression model. Table 1 reports the benchmark regression results, where Column 1 excludes control variables and only controls for firm fixed effects, year fixed effects, and industry-year interaction fixed effects; Column 2 incorporates all control variables based on Column 1. From the regression results, it can be observed that the coefficient of extreme climate risk (ECRI) is significantly positive in both models, with coefficient values and significance levels remaining relatively stable after adding control variables. This indicates that extreme climate risks indeed produce a positive promotional effect on corporate green innovation. Specifically, in the complete model of Column 2, the regression coefficient for extreme climate risk is 0.178, significant at the 5% level, meaning that when the extreme climate risk index in an enterprise’s region increases by 1 unit, corporate green innovation levels will improve by approximately 0.178 units. This finding aligns with the theoretical expectations of this study, supporting Hypothesis H1, namely that extreme climate risks positively affect corporate green innovation. The moderate effect magnitude (0.178) reflects institutional and organizational realities that shape climate-innovation relationships in practice. China’s comprehensive policy framework provides multiple risk management alternatives including disaster relief and insurance mechanisms that partially absorb climate shocks, enabling firms to manage disruptions through operational adjustments rather than requiring immediate innovation pivots. Additionally, firm-level resilience capabilities through diversified operations and financial reserves moderate the necessity for innovation responses, while uncertainty regarding climate pattern persistence may lead to measured rather than transformative strategic shifts. This moderate response suggests that while climate risks effectively incentivize green innovation, the relationship operates within existing institutional frameworks, highlighting opportunities for policy interventions that could amplify these innovation incentives.

Table 1.

Core Estimation Results.

4.2. Validity Assessment

4.2.1. Measurement Sensitivity

To ensure the reliability of our core findings, we first address measurement sensitivity by employing alternative variable specifications. We replace the original green innovation indicator with two alternative measures: the natural logarithm of green invention patent applications plus one (GII) and the natural logarithm of green utility model patent applications plus one (GIU). Green invention patents represent substantial technological innovations requiring higher novelty and inventiveness thresholds, while green utility model patents capture more incremental improvements and practical applications of existing technologies. Additionally, we test our findings using the two alternative climate risk indices constructed with different weighting schemes: ECRI_TEMP emphasizing temperature-related events and ECRI_PRECIP emphasizing precipitation-related events. As reported in Table 2, Column 1 shows that when using green invention patents as the dependent variable, the extreme climate risk coefficient is 0.164, significant at the 5% level, while Column 2 demonstrates that for green utility model patents, the coefficient is 0.132, significant at the 10% level. The smaller coefficient for utility models suggests that climate risks tend to have stronger effects on substantial innovations compared to incremental improvements, which appears consistent with the notion that external pressures drive more technological changes. Columns 3 and 4 present results for the alternative climate risk indices, where ECRI_TEMP yields a coefficient of 0.162 (significant at the 5% level) and ECRI_PRECIP produces a coefficient of 0.149 (significant at the 10% level). These results suggest that our main findings are robust across different measurement approaches and weighting schemes, indicating that the relationship between climate risks and green innovation appears not to be sensitive to specific variable construction choices.

Table 2.

Alternative Variables and Matching.

4.2.2. Selection Bias Control

Subsequently, this study employs propensity score matching (PSM) methodology to address sample selection bias issues. Using the median of extreme climate risk as the dividing point, the sample is divided into high-risk and low-risk groups, employing nearest neighbor matching to match each high-risk enterprise with a low-risk enterprise. The matching procedure uses five key covariates: firm size (Size), profitability (ROA), financial leverage (Leverage), firm age (Age), and CEO-Chairman duality (Duality), which capture fundamental firm characteristics that may simultaneously influence both climate risk exposure and innovation capabilities. The matched sample achieves good balance across all covariates. Column 4 of Table 2 reports regression results for the matched sample. The extreme climate risk coefficient is 0.156, significant at the 10% level. Although significance levels decrease somewhat, the direction and magnitude remain consistent with benchmark results.

4.2.3. Endogeneity Mitigation

Endogeneity concerns arise because firms may strategically locate in regions with specific climate characteristics or because unobserved regional factors could simultaneously influence both climate risks and innovation activities. We employ two complementary approaches to address these concerns. First, we use instrumental variable estimation with neighboring regions’ extreme climate events as the instrument for local extreme climate risk exposure. Specifically, we construct the instrumental variable (IV_NEIGHBOR) as the average extreme climate risk index of all other cities within the same province as the firm’s location, excluding the firm’s own city. This instrumental variable satisfies the relevance condition through strong spatial correlation in regional climate patterns, as neighboring areas typically experience similar meteorological conditions and weather systems. The exclusion restriction is met because firms cannot influence climate events in neighboring cities, and these external climate events primarily affect local firms through their correlation with local climate risks rather than through direct operational channels or strategic considerations. We acknowledge that establishing exclusion restrictions in IV estimation inherently involves untestable assumptions about the absence of omitted pathways. Neighboring regions’ climate events could theoretically affect local firms through channels beyond their correlation with local climate risks, such as supply chain disruptions or regional economic spillovers. However, several factors support our identification strategy as among the best available approaches. First, our firm and industry-year fixed effects absorb time-invariant regional characteristics and industry-specific temporal shocks that might correlate with both neighboring climate events and innovation outcomes. Second, the geographic scope of our instrument (province-level neighbors excluding own city) limits direct operational linkages while maintaining meteorological correlation. Third, alternative endogeneity concerns such as reverse causality or measurement error are less plausible explanations for our findings, as firms cannot influence regional weather patterns and measurement error would typically attenuate rather than generate spurious positive relationships. While no instrumental variable strategy is perfect, the convergent evidence from our IV estimation, GMM specification, and quasi-experimental Green Finance Pilot analysis (Section 4.3) collectively provides robust support for causal interpretation. The construction of IV_NEIGHBOR follows the formula:

where represents the number of neighboring cities within the same province as firm i’s location, Si denotes the set of these neighboring cities, and represents the extreme climate risk index of neighboring city j in year t. Our first-stage regression results in Table 3, Column 1, show that neighboring regions’ extreme climate events significantly predicts extreme climate risk with a coefficient of 0.156 and an F-statistic of 38.47, well above the conventional threshold of 10, confirming instrument strength. The second-stage results in Column 2 indicate that the instrumented extreme climate risk coefficient is 0.186, significant at the 5% level. The larger coefficient compared to OLS estimates suggests that measurement error or omitted variable bias may have attenuated the baseline results, with IV estimation providing a more accurate assessment of the causal effect.

Table 3.

Endogeneity and Additional Tests.

As a complementary approach, we employ system GMM estimation to control for potential dynamic endogeneity and unobserved heterogeneity. The GMM methodology treats extreme climate risk as the endogenous variable, using its lagged values (t-2 and t-3) as instruments to address concerns about reverse causality and persistent unobserved factors. The Hansen test for overidentifying restrictions yields a p-value of 0.216, indicating that our instruments appear valid, while the Arellano-Bond test for second-order serial correlation produces a p-value of 0.158, suggesting no evidence of problematic autocorrelation in the residuals. Column 3 of Table 3 presents GMM results, where the extreme climate risk coefficient is 0.171, significant at the 5% level, closely aligned with our benchmark findings. The consistency of results across instrumental variable and GMM approaches provides confidence that our findings are unlikely to be driven by endogeneity concerns.

4.2.4. Additional Tests

We conduct additional robustness tests to ensure our findings are not driven by specific sample characteristics or exceptional periods. First, we exclude the COVID-19 pandemic period (2020–2022) to verify that our results are not influenced by the extraordinary circumstances during this period, which may have altered both climate risk perceptions and innovation behaviors through unprecedented economic disruptions. Second, we exclude municipality-level observations to confirm that our findings hold across different administrative levels and are not driven by the unique characteristics of major metropolitan areas. Column 4 of Table 3 shows that excluding the pandemic period yields a coefficient of 0.169 (significant at the 5% level), while Column 5 demonstrates that excluding municipalities produces a coefficient of 0.174 (significant at the 5% level). These consistent results across various robustness checks strengthen our confidence in the reliability and generalizability of our core findings, demonstrating that the positive relationship between extreme climate risks and corporate green innovation is robust across different measurement approaches, sample compositions, and estimation methodologies.

4.3. Institutional Infrastructure: Evidence from Green Finance Policy Experiments

To provide direct empirical evidence for the institutional mechanisms underlying the financing constraint pathway identified in our mediation analysis, we examine the impact of exogenous variation in green finance infrastructure on corporate innovation behavior. This analysis moves beyond testing the robustness of our core findings to examining whether improvements in green finance accessibility directly promote green innovation, thereby validating a critical assumption underlying our theoretical interpretation of the forcing mechanism. We exploit the staggered implementation of China’s Green Finance Reform and Innovation Pilot Zones as a quasi-natural experiment. In June 2017, the State Council designated five provinces (Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang) encompassing eight specific locations as pilot zones for green finance innovation. These pilot zones received comprehensive policy support including authorization to develop innovative green financial products, establishment of risk compensation mechanisms for green lending, creation of regulatory sandboxes for green financial instruments, and implementation of preferential fiscal policies supporting green finance development. Critically, the selection of pilot locations was based primarily on geographical representation and prior policy experimentation rather than baseline levels of corporate green innovation, providing plausibly exogenous variation in access to green finance infrastructure.

We construct a quasi-experimental design by defining a policy treatment indicator (GFPILOT) that equals one for firms headquartered in pilot zone regions beginning in 2018 (allowing for one year of policy implementation), and zero otherwise. This specification enables us to estimate the causal effect of enhanced green finance infrastructure on corporate green innovation through a difference-in-differences framework that compares innovation trajectories of treated firms (those in pilot zones) with control firms (those in non-pilot regions) before and after policy implementation, while controlling for firm fixed effects, year fixed effects, and industry-year interaction effects that absorb time-invariant firm characteristics, common time trends, and industry-specific shocks, respectively.

The results presented in Column 6 of Table 3 provide compelling evidence that green finance infrastructure directly promotes corporate green innovation. The coefficient on GFPILOT reaches 0.187, significant at the 5% level, indicating that firms in pilot zones demonstrate green innovation levels approximately 18.7% higher than comparable firms in non-pilot regions following policy implementation. This substantial magnitude reflects the multifaceted channels through which enhanced green finance infrastructure facilitates innovation. Pilot zone firms gain access to diversified green financing instruments including green bonds with preferential interest rates, sustainability-linked loans with performance-based pricing mechanisms, and dedicated green investment funds managed by both public and private institutions. These financing channels not only reduce the cost of capital for green projects but also provide longer financing tenors that better match the extended payback periods characteristic of green innovation investments. Moreover, the pilot zone policies create supportive ecosystems that extend beyond pure financing to encompass technical assistance programs, environmental information disclosure platforms, and coordination mechanisms between financial institutions and innovative enterprises. The positive and significant effect of GFPILOT provides direct validation for our theoretical interpretation of the forcing mechanism. When green finance infrastructure is well-developed, enterprises facing climate-induced financing constraints can indeed access preferential green capital by demonstrating innovation capabilities, confirming that the institutional preconditions necessary for the forcing mechanism to operate are empirically present and consequential. This finding strengthens our interpretation of the mediation results by demonstrating that policy interventions enhancing green finance accessibility can effectively channel climate pressures into innovation-promoting pathways, supporting the broader policy implications we develop in our concluding discussion.

4.4. Cross-Sectional Variation

To deeply understand boundary conditions of extreme climate risk impacts on corporate green innovation, this study further examines heterogeneous performance of this relationship under different enterprise characteristics. Table 4 reports grouped regression results, revealing significant differences in the impact effects of extreme climate risks among different types of enterprises. First, examining industry pollution levels, according to the heavily polluting industry directory issued by the Ministry of Environmental Protection, sample enterprises are divided into heavily polluting industries and non-heavily polluting industries. Regression results show that in heavily polluting industries, the extreme climate risk coefficient is 0.247, significant at the 1% level; whereas in non-heavily polluting industries, the coefficient is 0.108, significant only at the 10% level. Inter-group difference testing yields a p-value of 0.028, indicating significant differences between the two group coefficients. This result supports Hypothesis H1, namely that extreme climate risks have stronger promotional effects on green innovation in heavily polluting industry enterprises. The pronounced response observed in heavily polluting industries reflects multiple reinforcing mechanisms that amplify the climate risk–innovation relationship. These sectors experience “double exposure” effects, where they simultaneously contribute to and suffer from environmental degradation, creating particularly acute vulnerability to climate events and associated regulatory responses. This heightened exposure translates into stronger innovation incentives through several channels. Regulatory authorities typically concentrate compliance monitoring and enforcement efforts on high-impact sectors, making green innovation a strategic necessity for maintaining operational licenses and market access. The visibility of these industries during climate events also subjects them to intensified public scrutiny and reputational pressure, amplifying the stakeholder-driven motivations for environmental improvements. Furthermore, heavily polluting industries often possess substantial marginal improvement opportunities, meaning that green innovation investments can yield more significant environmental and operational benefits compared to sectors with already-limited environmental footprints. Many of these industries also maintain established R&D capabilities and technical expertise that can be redirected toward environmental solutions, providing the organizational foundation necessary to translate climate pressure into innovation outcomes.

Table 4.

Cross-Sectional Analysis.

Subsequently, examining ownership nature, sample enterprises are divided into state-owned enterprises and non-state-owned enterprises for analysis. Results show that in state-owned enterprises, the extreme climate risk coefficient is 0.216, significant at the 5% level; in non-state-owned enterprises, the coefficient is 0.142, significant at the 10% level. Inter-group difference testing yields a p-value of 0.075, significant at the 10% level. This finding supports Hypothesis H1, namely that extreme climate risks have stronger promotional effects on state-owned enterprise green innovation. While our empirical design identifies this differential magnitude, we offer several institutional explanations for why SOEs exhibit stronger responses. SOEs operate under dual mandates that extend beyond profit maximization to encompass broader social and environmental objectives, creating organizational imperatives that make climate risks trigger not only economic concerns but also reputational and political pressures. The performance evaluation systems for SOE managers increasingly incorporate environmental metrics aligned with national sustainability goals, creating personal career incentives to respond proactively to climate risks through innovation initiatives. Additionally, SOEs typically enjoy preferential access to government-backed green financing programs, subsidized loans for environmental projects, and regulatory flexibility that substantially reduces the financial barriers to green innovation investments. Their role as policy implementation vehicles for national environmental strategies also means that climate events activate institutional channels for resource mobilization and strategic coordination that are less accessible to private enterprises. This institutional embeddedness enables SOEs to more rapidly translate climate risk recognition into concrete innovation actions, as they can leverage both internal capabilities and external support systems specifically designed to advance national sustainability objectives.

4.5. Transmission Pathways

To validate transmission and moderation mechanisms proposed in theoretical analysis, this study further conducts mechanism analysis. Table 5 reports testing results for transmission and moderation mechanisms, providing empirical evidence for understanding the internal logic of how extreme climate risks affect corporate green innovation. First, testing the transmission mechanism of financing constraints. Based on the SPR theoretical framework, extreme climate risks, as deterioration of external environmental states, require specific pressure transmission mechanisms to trigger enterprise response behavior. Financing constraints precisely constitute such a key transmission link. Regression results reveal a two-stage transmission process that operates through financing constraints. In the first stage, extreme climate risks significantly exacerbate enterprise financing constraints, as evidenced by the positive and significant coefficient of 0.124 (significant at the 5% level) in Column 2 of Table 5. This initial stage reflects how environmental risks translate into financial headwinds, as financial institutions incorporate climate risk assessments into their credit evaluation frameworks, leading to higher borrowing costs and reduced credit availability for firms with elevated climate exposure. In the second stage, enterprises facing these intensified financing constraints demonstrate elevated levels of green innovation activities, as shown by the positive coefficient of 0.189 (significant at the 5% level) on the financing constraint variable in Column 3. This positive association should be understood not as financing constraints mechanically causing innovation, but rather as reflecting a strategic organizational response. When enterprises confront deteriorating financing conditions in conventional capital markets, they actively pursue green innovation as a pathway to access preferential green financing channels that have emerged under evolving institutional frameworks.

Table 5.

Pathway Investigation Results.

This pattern is consistent with the theoretical conceptualization of the ‘forcing mechanism,’ wherein financing pressure transforms from a barrier into a catalyst specifically because the institutional environment has created differentiated financing structures that reward environmental innovation. The logic of this transformation operates as follows: when enterprises recognize that traditional financing channels have become constrained due to climate risk exposure, they simultaneously observe that an expanding ecosystem of green financial products—including green bonds, sustainability-linked loans, and ESG-focused investment funds—offers more favorable terms contingent upon demonstrated environmental capabilities. This recognition creates strategic incentives to invest in green innovation not merely as an operational necessity but as a financing strategy that can improve access to capital markets. The reduction in the direct effect of extreme climate risks on green innovation when financing constraints are included in the model, declining from 0.178 in Column 1 to 0.155 in Column 3, confirms that this strategic response to financing pressure serves as a key transmission pathway. The remaining significant direct effect indicates that additional mechanisms also operate alongside this channel, suggesting that climate risks influence green innovation through multiple pathways including risk management considerations, regulatory compliance pressures, and reputational incentives that function independently of the financing constraint mechanism. To quantify the mediating role more precisely, we calculate the indirect effect through financing constraints as the product of the path coefficients, which accounts for approximately 13.1% of the total effect of extreme climate risks on corporate green innovation. The Sobel-Goodman test confirms the statistical significance of this mediation pathway. While this proportion may appear modest, it reflects the multifaceted nature of organizational responses to climate risks, with financing constraints representing one critical channel among several complementary transmission mechanisms. The remaining 86.9% of the effect operates through direct pathways and alternative channels including risk perception, regulatory compliance, and stakeholder pressures, consistent with the SPR framework’s recognition of complex causal architectures.

Subsequently, testing the moderation mechanism of media attention. Based on stakeholder theory, media, as important information intermediaries and social supervisory forces, play crucial roles in corporate environmental behavior. Regression results show that the interaction term between media attention and extreme climate risks is significantly positive, indicating that media attention indeed strengthens the promotional effect of extreme climate risks on corporate green innovation, supporting Hypothesis H3. This finding deepens our understanding of external supervision mechanisms. In environments with high media attention, enterprises face not merely information disclosure pressure, but more importantly, the amplification effects of reputation risks. When extreme climate events occur, intensive media coverage significantly increases public attention to climate issues, making corporate environmental behavior more susceptible to social supervision. Enterprises that can actively respond to climate risks and demonstrate green innovation capabilities are more likely to receive positive media coverage and public recognition, thereby obtaining premiums in brand value, customer loyalty, and investor confidence. Conversely, enterprises lacking environmental awareness or responding inadequately may face more severe reputation losses and market punishment. This mechanism makes media attention an important factor amplifying extreme climate risk impacts, strengthening external motivation for corporate green innovation.

Finally, testing the moderation mechanism of managerial myopia. Based on behavioral theory, managers’ cognitive characteristics and decision preferences significantly influence corporate strategic choices. Regression results show that the interaction term between managerial myopia and extreme climate risks is significantly negative, indicating that managerial myopia weakens the promotional effect of extreme climate risks on corporate green innovation, supporting Hypothesis H4. Specifically, the negative and significant coefficient on the interaction term (−0.072, p < 0.10) confirms that higher levels of managerial myopia attenuate the positive relationship between extreme climate risks and green innovation, highlighting the critical role of managerial temporal orientation in shaping organizational responses to environmental pressures. This finding reveals the important influence of internal corporate management characteristics on environmental response behavior. Myopic managers are often influenced by short-term performance assessment pressure, paying more attention to quarterly or annual financial indicator improvements, lacking sufficient patience and support for green innovation projects characterized by large investments, long cycles, and uncertain returns. Even when facing obvious climate risk pressure, they may tend to adopt more direct and immediately effective response measures, such as purchasing insurance, strengthening equipment maintenance, or simply bearing losses. This short-term oriented decision-making pattern not only limits enterprise green innovation investment scale but also affects the continuity and systematicity of innovation activities. More profoundly, this mechanism reflects the importance of corporate governance structure and incentive mechanism design. Only by establishing long-term oriented assessment systems and incentive mechanisms can the negative impacts of managerial myopia on enterprise sustainable development be effectively overcome.

5. Discussion

Through constructing a State-Pressure-Response (SPR) theoretical framework, this study deeply explores the impact mechanisms and boundary conditions of extreme climate risks on corporate green innovation. Research findings provide new theoretical perspectives and empirical evidence for understanding relationships between climate risks and corporate environmental behavior. From a theoretical contribution perspective, core findings of this study form meaningful dialog and supplements with existing literature. First, regarding the promotional effects of extreme climate risks on corporate green innovation, this study’s conclusions resonate with some scholars’ viewpoints while also demonstrating unique theoretical insights. Through distinguishing different dimensions of climate change, research finds that the speed of climate change can positively affect corporate green innovation, while the irregularity of climate change produces negative impacts. This differentiated impact pattern reveals the complexity and conditionality of climate risk effects [16]. Simultaneously, existing research has also found that extreme precipitation events have positive promotional effects on green technology innovation, though these effects exhibit temporary characteristics [15]. Through constructing comprehensive extreme climate risk indicators, this study not only validates the promotional effects of climate risks but more importantly reveals deep mechanisms behind these effects. Namely, extreme climate risks, through exacerbating financing constraints—a seemingly negative transmission pathway—conversely compel enterprises to proactively seek green innovation solutions, forming a “pressure-to-motivation” transformation forcing mechanism. This finding enriches our understanding of the complexity of climate risk impacts on corporate behavior. Rather than operating through the traditional “risk-inhibition” logic where environmental threats uniformly suppress organizational activities, our results reveal an emerging “risk-opportunity” transformation logic wherein climate pressures channel into innovation-promoting pathways when institutional infrastructures reward environmental capabilities. This paradigm shift reflects the maturation of green finance ecosystems that have restructured incentive architectures, enabling forward-looking enterprises to convert environmental pressures into strategic advantages through innovation investments that simultaneously address climate vulnerabilities and improve capital market access.