1. Introduction

In the context of the global response to climate change challenges and the promotion of sustainable development, fostering sustainable supply chain development has emerged as a critical way for companies to strengthen their core competitive edge and realize social value. This perspective has gained widespread recognition within the academic community [

1,

2,

3]. Traditional supply chains are often caught in the predicament of “local environmental compliance and overall unsustainability” due to fragmented information and inefficient synergy [

4]. Due to the divergence in objective functions across supply chain segments [

5], upstream suppliers’ short-term emission reduction efforts often fail to align with downstream customers’ long-term green demands. This mismatch frequently leads to resource wastage and excessive carbon emissions throughout the entire chain, underscoring the urgent need for supply chain sustainability to be “long-term, collaborative, and systemic”. The fast advancement of digital technology has offered a novel solution to address this predicament: artificial intelligence, blockchains, the Internet of Things, and other tools are reshaping the value creation mode of supply chains by breaking information barriers, optimizing resource allocation, and strengthening process control. It is pushing the sustainability goal from “fragmented practice” to “whole-chain synergy”. The proliferation of emerging technologies like the Internet of Things, blockchains, and quantum computing has intensified the complexity of supply chain conflicts while simultaneously providing stronger support for green supply chain management [

6,

7].

Despite the potential environmental benefits of digital transformation, how enterprises can effectively transform digital capabilities into sustained green innovation is still a key topic that needs to be investigated. Current research is mostly centered on the digital transformation of core enterprises themselves yet pays little attention to its ripple effects on upstream and downstream supply chain partners. Meanwhile, existing studies largely stop at analyzing whether green innovation occurs or not, without offering a systematic explanation for how to overcome short-termism and establish a long-term, stable iterative mechanism. From the perspective of dynamic capability theory, this is essentially the process where enterprises utilize digital technologies to reconstruct their resource integration and innovation iteration capabilities [

8]. Institutional theory suggests that the long-term viability of green innovation is contingent upon the long-term transmission of coercive and imitative pressures within supply chains, along with normative isomorphism [

9]. At the end of 2018, Xiaomi Group established a strategic partnership with upstream suppliers TCL Science and Technology Group Company Limited through the Xiaomi ecosystem’s Internet of Things (IoT), accelerating the iteration and upgrading of TCL’s products with the help of digital tools. TCL’s product enhancement through digital technologies has not only given rise to innovative smart products but has also facilitated broader green innovation resource acquisition across supply chain networks. This case demonstrates how digital transformation can integrate supply chain resources and sustain green innovation, offering a practical framework for analyzing the “digital transformation–green innovation” linkage. Green innovation serves as the cornerstone of supply chain sustainability, representing not isolated corporate actions but a systemic process of continuous technological advancement and operational optimization across the entire supply chain. By fostering resource efficiency, environmental responsibility, and social impact, its sustainability determines whether supply chains can transcend short-term compliance and achieve holistic, long-term sustainable operations.

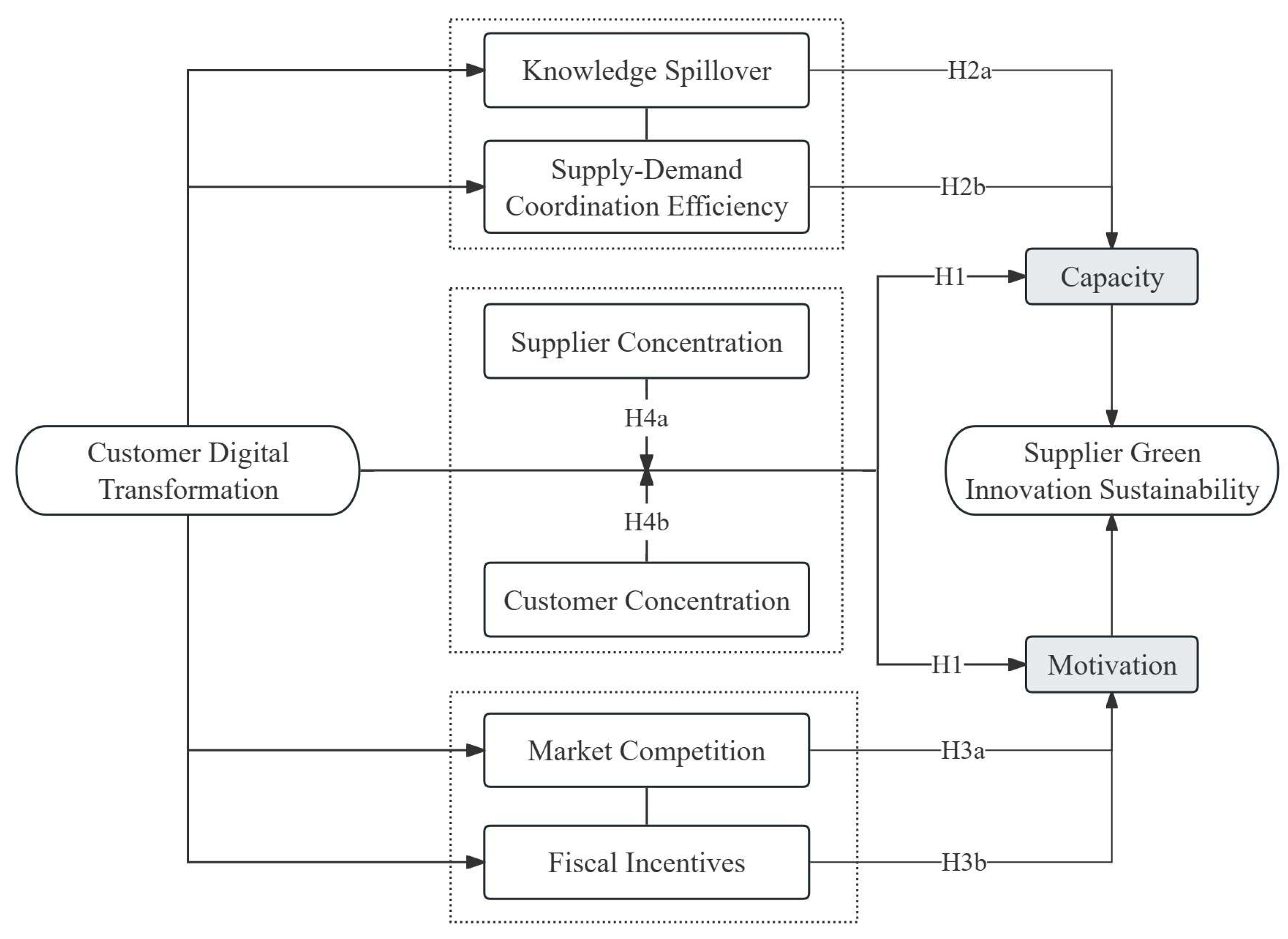

This study investigates how downstream enterprises’ digital transformation influences upstream suppliers’ green innovation sustainability. Utilizing A-share listed company data (2011–2023), we analyze customer-driven digital transformation’s role in sustaining suppliers’ green innovation motivation. By mapping inter-firm supply chain relationships, we further examine the underlying mechanisms and interaction effects between these dynamics. This study is specifically designed to investigate the following research questions: Does downstream digital transformation enhance the green innovation sustainability of upstream enterprises and how? Are there any differences in the specific paths of this enhancement effect on the dimensions of sustainability and sustainability dynamics? How do supply chain concentration characteristics modulate the dual mechanism of downstream digitalization spillovers on upstream green innovation sustainability? By addressing the aforementioned issues, this paper anticipates making threefold contributions at both theoretical and practical levels. Theoretically, it establishes a conceptual framework that connects digital transformation to the sustainability of green innovation, revealing their synergistic relationship from a supply chain perspective. Methodologically, it provides a more refined empirical pathway for quantifying the sustainability of green innovation by segmenting the “capability–motivation” dimension and introducing moderating variables. Practically, it provides policymakers and corporate managers with empirical evidence regarding key moderating factors in the digital transformation process, thereby optimizing resource allocation and implementation pathways for green innovation strategies.

5. Empirical Analysis

5.1. Descriptive Statistics

The descriptive analysis of primary variables is documented in

Table 3.

The data in the table shows that the average growth rate of the stock of green patents (GI_C) is 9.081, indicating that enterprises have a certain sustainable ability for green innovation and development. However, its standard deviation is 4.306, suggesting that there are significant differences in the sustainable ability of green innovation among enterprises, and the distribution span is large. The average growth rate (GI_M) of enterprises’ green R&D investment is 3.610, which is lower than the average of the sustainability capacity, where the measure of spread equals 5.135. The findings reveal a moderately inadequate momentum for sustainable technological innovation at the organizational level, and the degree of the dispersion of the driving force level is higher, with an uneven performance among enterprises. Therefore, a deeper investigation into the drivers of these differences and their varying levels is warranted in order to help enterprises enhance their continuous performance in green innovation. The mean score for the digital transformation attainment is 2.427, and the data exhibits substantial dispersion, indicating a polarization in the digitalization levels of enterprises. Leading enterprises have achieved deep transformation, while those at the bottom are still in the basic stage. In conclusion, exploring the differentiated mechanism of digital transformation on the sustainability of enterprises’ green innovation and its boundary conditions carries both profound theoretical implications and pressing practical relevance. The data shows no obvious bias, indicating that the processing is relatively reasonable. The operationalization of control variables mirrors extant theoretical specifications.

5.2. Baseline Regression

Table 4 presents the Hausman test results, which prove the rationality of the model specification, and also shows the key regression estimates.

Univariate regression analyses (columns 1 and 5) reveal a statistically robust positive relationship (p < 0.01) between DT and dual dimensions of corporate green innovation—GI_C and GI_M—prior to the covariate adjustment. Per one-standard-deviation rise in the digital transformation level, the sustainability capability of corporate green innovation significantly increases by 0.034 standard deviations, while the driving force increases by 0.091 standard deviations. This preliminary finding suggests that digital transformation positively influences both dimensions. To mitigate confounding effects arising from firm-specific heterogeneity and exogenous environmental variations, our extended model incorporates comprehensive control variables encompassing the firm age, firm size, and total asset turnover. As evidenced in columns (2) and (6), this multivariate adjustment attenuates the estimated marginal effects of digital transformation at 0.023 and 0.061. This change indicates that certain confounding factors do indeed affect the strength of the association between the two, but the core conclusion remains unchanged. The robust positive causality between DT and persistent green innovation survives stringent econometric tests. Quantitatively, DT’s marginal effect on the green innovation impetus exceeds its impact on sustainability by a statistically significant margin. This result not only validates hypothesis H1 but also reveals that digital transformation exerts a stronger influence on GI_M than on GI_C. This may be related to the fact that digital tools are more likely to activate corporate innovation willingness through market signals. To mitigate potential endogeneity concerns arising from the simultaneity bias and contemporaneous omitted variables, and accounting for the endogenous selection pattern where environmentally proactive firms tend to accelerate digital adoption, our empirical strategy introduces first- and second-order lagged digital transformation indicators. The statistically consistent estimates (p < 0.05 across lagged terms) corroborate the primary regression outcomes.

5.3. Endogeneity Test

5.3.1. Reverse Causality Test

To mitigate endogeneity concerns arising from the interrelationship between firms’ digitalization levels and sustainable innovation activities, which may lead to endogeneity problems, the research design incorporates an IV framework to further mitigate the impact of this reverse causal relationship on the research results. Firstly, drawing on Lewbel’s [

61] research, the instrumental variable (DT_IV1) is developed using the digital transformation intensity of peer enterprises within the same provincial administrative region. The justification for this variable is that digital transformation across enterprises in the same province is often shaped by common external factors like regional policies, thus showing a strong correlation with the firm’s own digital transformation level. However, the cubic term of this difference employs a nonlinear transformation to isolate the firm-level heterogeneity, significantly weakening its direct association with the firm’s green innovation persistence and thus satisfying the exogeneity requirement. Secondly, considering the validity of DT_IV1, this study constructs DT_IV2 by deriving the industry–year averaged digital transformation index from peer firms [

62]. The instrument’s validity stems from industry-level homogeneity, where firms sharing the same sector face isomorphic technological trajectories and competitive landscapes, while the industry digitalization mean maintains strong predictive power for individual firms’ transformation levels. At the same time, this variable reflects the overall characteristics of the industry rather than the innovation decisions of individual enterprises themselves and thus has a weaker endogenous relationship with the sustainability of green innovation within the enterprise. The two together form the instrumental variable group. After numerous tests, the empirical analysis confirms the validity of our instrumental variables, with no evidence of weak identification or overidentification issues. As presented in

Table 5, the second-stage IV regression results—controlling for both the year and firm fixed effects—demonstrate statistically significant positive effects of the instruments on firms’ green innovation sustainability and motivation. These robust findings further validate our core hypothesis.

5.3.2. Excluding Sample Selection Bias

Considering that the research samples may have non-random selection phenomena, which could lead to bias in the estimation results, this paper adopts a dual strategy to correct the potential problems. On the one hand, utilizing Heckman’s selection model framework with dual estimation stages comprising both selection and outcome equations, systematic biases caused by the self-selection behavior of samples are identified and corrected. On the other hand, combined with the PSM-DID regression, based on covariate information, control samples with similar characteristics are matched for the treatment group samples. While balancing the differences in observable variables between groups, the interference of the sample selection bias on the estimation of causal effects is weakened. The two methods complement each other, effectively alleviating the endogeneity problem caused by the non-random sample selection from different perspectives and enhancing the reliability of the research conclusions and the accuracy of the causal inference.

Firstly, extending the methodological framework of Lan et al. [

63], we implement Heckman’s two-stage procedure to correct for the selection bias. In the initial stage, the dummy variable of digital transformation (DT_Dum1) is set as the dependent variable. A binary indicator is created, where 1 represents above-median digital transformation and 0 denotes below-median levels annually. At the same time, considering that enterprise-level factors, including the firm age, size, asset turnover, financing constraints, board independence, cash flow position, resource allocation efficiency, and market concentration, may systematically influence digital transformation, the Probit regression framework enters these factors as dependent covariates. The inverse Mills ratio (IMR) derived from the first-stage Probit estimation was systematically integrated into the second-stage OLS specification. As demonstrated in

Table 6, the core findings remain robust to this correction for selection bias.

Secondly, we further construct the virtual variable of digital transformation (DT_Dum2) and represent it as follows: firms are classified into the treatment group (D = 1) when their digital assets’ value-added proportion exceeds the 75th percentile of intangible assets in the current year, with remaining firms as controls (D = 0). Using Model 1’s covariates as matching dimensions, we implement nearest neighbor propensity score matching for the analysis [

64]. This approach not only screens out enterprise groups with more comprehensive digital adoption through a quantile division, providing a clear group definition for the subsequent causal effect assessment, but also enables the counting of matched control firms to exhibit greater statistical significance than that in the treatment group, thus allowing for more a precise screening of samples with smaller deviations during matching. In this paper, nearest neighbor matching, the PSM balance test, and the kernel density distribution are adopted. Following the application of inverse probability weighting, the distributional alignment across experimental conditions demonstrates a marked enhancement. The subsequent DID estimation using the matched sample reconfirms the statistical significance of key coefficients, as evidenced in columns (3)–(4) of

Table 6, thereby validating our baseline findings.

5.3.3. Placebo Test

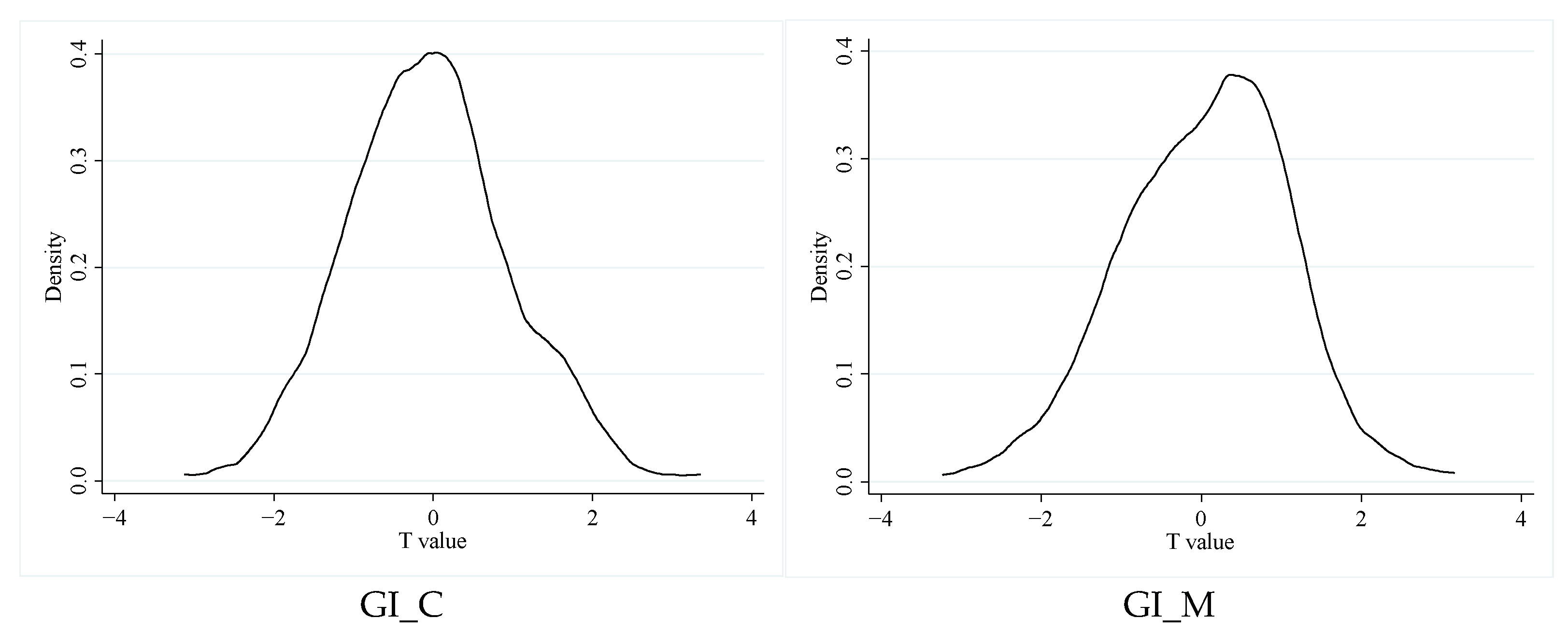

To mitigate potential confounding effects from latent variables, we conduct a placebo test based on randomly assigned values of explanatory variables. Without changing the control variables and the explained variables, the original assignment of digital transformation indicators is disrupted and randomly assigned, and then the benchmark model is re-estimated.

Figure 2 depicts the distribution and statistical significance levels of the predictor’s regression coefficients. The figure demonstrates that randomly assigned explanatory variables yield coefficient means near zero, following an approximately normal distribution with mostly insignificant estimates. The regression results pass the placebo test, indicating that the benchmark conclusion does not result from unobservable variables.

5.4. Robustness Test

5.4.1. Replacement of Important Variables

To rigorously validate the consistency of our empirical findings, multiple complementary verification procedures were systematically implemented. Regarding the dependent variables, this study addresses the significant disparities in innovation thresholds and the legal validity between green patent applications and granted patents. We substitute application counts with granted green patent counts as the core metric. This methodological shift—transitioning from the application to the grant stage—strengthens the robustness of the conclusions (see column 1,

Table 7). To capture the persistent dynamics of green innovation, we employ the green patent citation frequency as a proxy for R&D investment (see column 2,

Table 7). Such an approach provides a more precise quantification of the long-term value creation in green technological innovation, overcoming the limitations of traditional R&D expenditure metrics in assessing innovation quality.

Among the independent variables, since organizational digitization constitutes a strategic initiative yielding substantial benefits, enterprises have the subjective motivation to strategically overestimate the degree of their transformation, which makes it difficult for a keyword capture based on text analysis to completely avoid measurement biases. We use the mean annual digital transition subsidy as the proxy variable for the further examination of digital transformation. As a policy incentive tool, government fiscal support intensity correlates positively with the organizational technological capability to obtain resources and carry out transformation activities, which can effectively eliminate the overestimation of digital transformation. The estimation findings appear in columns (3)–(4) of

Table 7.

The re-estimated models under alternative specifications yield coefficients aligned with the baseline estimates, confirming the statistical reliability of our findings.

5.4.2. Eliminate Confounding Factors

As symbiotic elements of regional economic ecosystems, digital transformation and green innovation demonstrate mutually reinforcing interdependencies. They are not only constrained by external conditions such as the financial ecological environment, industrial policy orientation, and market supervision rules of the enterprise’s location but also interact with internal elements as seen in the business’s own resource endowment and governance structure, making the exploration of the intrinsic connection between the two face multiple interferences. To strip away the influence of confounding factors and accurately reveal their causal logic, this study implemented the following experimental protocols:

First, to ensure analytical consistency, cities exhibiting advanced digital transformation levels were excluded from the sample [

65]. Regional disparities in digital development are well-documented, with the “China Urban Digital Economy Development Report 2022” identifying Beijing, Shanghai, Shenzhen, Guangzhou, and Hangzhou as the top five cities based on annual digital competitiveness metrics. These five cities have demonstrated significant leading advantages in areas such as the construction of an R&D and innovation paradigm, the aggregation of high-end elements, and policy coordination and guarantees. The efficiency of their digital-driven development is accelerating its transformation into the core driving force for enhancing the city’s capacity, and the technological transition produces more substantial measurable effects. Therefore, we excluded enterprises headquartered in these five cities (as shown in

Table 8, columns 1–2) and re-estimated the regression model.

Secondly, we eliminate samples from computer-related industries. As a core and cutting-edge field of digital transformation, the computer industry has distinct industry characteristics in terms of the pace of technological iteration, the construction of an innovation ecosystem, and the logic of market evolution. Its inherently highly digitalized industrial attribute may enable it to present unique patterns in its digital transformation path and green innovation model that are different from those of traditional industries. Therefore, this paper excludes three industry samples: “ICT manufacturing sectors”, “digital technology services”, and “web-based service industries”. The corresponding regression outcomes are displayed in columns (3)–(4) of

Table 8.

Finally, enterprises with zero green patent citations and applications during the sample period are excluded. Some enterprises may not yet have carried out green innovation activities, and the inclusion of samples would interfere with the identification of the true causal relationship between variables. By eliminating such samples, we restrict our analysis to firm cohorts with verified green technology development activities, enhance the economic significance of the variables, and refine the assessment of how technologies enable green technology development. The regression analysis is repeated in columns (5) and (6) of

Table 8, confirming the initial findings.

After reconstructing the sample through tripartite robustness checks and performing renewed econometric estimations, the outputs presented in

Table 8 consistently demonstrate that corporate digitalization continues to exert statistically significant positive effects on the persistence of eco-innovation activities. These findings confirm the robustness of our core thesis against potential confounding variables.

5.4.3. Employing an Alternative Regression Method

The sensitivity of the model setting exerts a direct causal effect on the reliability of the key takeaways. Owing to the differences among various econometric models in terms of the variable relationship setting, error term distribution assumptions, and parameter estimation methods, significant variations in estimation results may occur. To enhance the credibility of our findings, we perform robustness analyses to validate our findings by employing alternative econometric specifications. While preserving the operational definitions of core covariates (independent/dependent variables and controls), the Tobit regression framework is introduced to address potential censoring characteristics of the data. As evidenced in

Table 9 of the regression analysis, the coefficient signs and significance levels remain materially unchanged from our baseline estimates.

5.5. Heterogeneity Analysis

5.5.1. Nature of Supplier Ownership

From the perspective of the heterogeneity of suppliers’ property rights, there are significant differences in the innovation-driven mechanisms between non-state-owned and state-owned enterprises, as shown in

Table 10.

For non-state-owned enterprises (columns (2) and (4)), the coefficient of DT on GI_C is larger than GI_M. Due to resource constraints in external financing and policy support, non-state-owned enterprises are more dependent on external resources, such as customer digital transformation, to enhance their innovation capabilities. The lack of such resource acquisition strengthens their willingness to break through innovation bottlenecks through external cooperation. Their green innovation stems more from the need to improve efficiency under environmental protection pressure. This market makes sustaining innovation a crucial way to maintain competitiveness. Thus, customer digital transformation, by providing a stable external impetus for knowledge and resource acquisition, has a more pronounced impact on ensuring the continuity of their green innovation efforts.

For state-owned enterprises (columns (1) and (3)), the coefficient of DT on both GI_C and GI_M is significantly positive, and the driving effect of customer digital transformation on GI_M is more pronounced than that on GI_C. Strategy-driven innovation often prioritizes achieving large-scale, impactful breakthroughs to align with macro-policy requirements. Customer digital transformation provides state-owned enterprises with targeted resource support that matches these strategic demands, thereby exerting a stronger impetus on the motivation of green innovation. In contrast, their innovation continuity is more secured by stable institutional guarantees and long-term policy support rather than external digital empowerment, resulting in a relatively weaker driving effect of DT on GI_C compared to GI_M.

5.5.2. Customer Market Influence

To explore the heterogeneity of the customer market influence, we divided the sample into two groups based on the proportion of customer sales, those with a stronger downstream customer market influence and those with a weaker influence, and conducted a regression analysis. As presented in

Table 11.

The results reveal that downstream customers’ market position significantly affects the transmission of suppliers’ innovation effects, and specifically, the digital transformation of customers with greater market influence has a more obvious promoting effect on the green innovation continuity of upstream suppliers. It can be attributed to how high-influence customers act on the core facets of innovation persistence. Firstly, these customers, via supply chain collaboration and technical standard dissemination, transfer systematic and advanced knowledge. This knowledge does not just offer immediate solutions to suppliers’ technical bottlenecks (fueling short-term innovation motivation) but also gets internalized into suppliers’ institutionalized knowledge management systems and operational routines. Over time, this helps build the long-term capability for sustained green innovation (GI_C). Secondly, the resource support they provide, such as funds, cutting-edge technologies, and market access, is not limited to project-specific, short-term goals. Instead, it often comes with long-term collaboration commitments, enabling suppliers to make continuous investments in R&D infrastructure and talent development, which are crucial for maintaining green innovation over an extended period. Thirdly, the strict innovation requirements from high-influence customers create a “reverse driving mechanism” that pushes suppliers to not only increase the short-term innovation input but also establish internal processes for continuous improvement and optimization. These processes, like regular R&D reviews and talent training programs, are essential for the enduring capability of green innovation. In contrast, for customers with weak market influence, due to insufficient knowledge and resource input, their digital transformation fails to bring about such comprehensive and lasting impacts on suppliers’ innovation systems, resulting in a less significant boost to green innovation continuity. All the above findings regarding the heterogeneity of customer market influence are detailed and supported in

Table 11.

5.5.3. Regional Development Disparities

From the perspective of suppliers’ regional heterogeneity, we analyze the differential effects by combining regional development endowments and institutional environment differences, and the results are shown in

Table 12.

For the eastern region (columns (1) and (4)), the coefficient of DT on GI_C and GI_M is 0.180 and 0.285, respectively, which is significantly positive and has a relatively large magnitude. This indicates that suppliers in the eastern coastal areas, benefiting from sound digital infrastructure, the dense agglomeration of innovation factors, and an open market environment, have lower digital access costs and richer knowledge absorption channels. The green innovation empowerment effect caused by downstream customers’ digital transformation is stronger, and they are more likely to realize secondary knowledge spillover through intra-regional industrial clusters, forming a virtuous cycle of “empowerment–diffusion”.

In contrast, for the central region (columns (2) and (5)), the coefficient of DT on GI_C is 0.009, and on GI_M it is 0.023, which are both smaller in magnitude compared to the eastern region. For the western region (columns (3) and (6)), although the coefficient of DT on GI_C is 0.168 and on GI_M it is 0.260, considering the overall model fit and the potential limitations in digital infrastructure and high-end technical talent, suppliers in central and western regions are limited by weak digital infrastructure and a shortage of high-end technical talents. They may face the attenuation of the empowerment effect caused by the “digital divide” and need to rely on government-led digital assistance policies and targeted technical support from chain-leading enterprises, with their green innovation persistence being more dependent on digital knowledge.

Overall, these results confirm that the stronger impact of customer digital transformation on the motivation pathway than the capability pathway is not universal but is moderated by supplier ownership attributes, customer market power, and regional development conditions, with external resource dependence, short-term customer pressure, and market environment constraints being the core driving factors for the pathway gap.

5.6. Mechanism Test

As mentioned above, digital transformation may affect an enterprise’s sustainable capacity and driving force for green innovation through multiple paths. This section, based on the findings of Dai et al. [

66], is used to construct the following model to test the above-mentioned mechanism of action. Among them, Med functions as the mediator variable, with other variables’ specifications fully aligned with the original regression model (1).

and

are the objects of concern in this paper. Only when both are significant can it be indicated that the mechanism is established.

5.6.1. Mechanism Testing of Green Innovation Sustainability Capability

Firstly, inspired by the approaches of Yi et al. [

67] and Brav et al. [

68], we employ the count of collaborative patent filings (NPA) in critical industries as a proxy for the knowledge spillover effect. Professional joint applications in key industries are a direct manifestation of knowledge sharing and collaboration among different entities within specific industries to achieve technological breakthroughs or the output of innovative achievements. Through a quantitative examination of collaborative patents in the sector, the scale and frequency of the knowledge spillover within the industry can be quantified more intuitively and accurately, providing a reliable quantitative basis for studying the degree, trend, and impact of the knowledge spillover at the industry level, effectively reflecting the level of the knowledge diffusion outward through joint collaboration within the travel industry. Secondly, when the efficiency of the supply and demand coordination is low, each link in the supply chain lacks an effective information exchange and joint decision-making mechanism. The real demands of downstream customers are difficult to accurately convey to the upstream. Each entity often makes predictions and decisions based on its own local information, resulting in the distortion of demand signals layer by layer and the intensification of the bullwhip effect. This further leads to problems such as production plan chaos, inventory overstock, or shortages among upstream suppliers. Conversely, if the efficiency of the supply and demand coordination is enhanced—and each link can grasp the real demand from a global perspective, reducing the blindness of the individual decision-making—the degree of the distortion of demand signals will be significantly reduced, and the bullwhip effect will be alleviated. The efficiency of supply and demand coordination is directly reflected in the bullwhip effect. Therefore, this paper adopts the bullwhip effect as its measurement index. Building upon the method of Shan et al. [

69], we use the ratio of the enterprise production and demand fluctuations as the proxy variable for the bullwhip effect, as shown below:

Among them, σ (∙) represents the standard deviation of the variable, Production represents the production volume of the enterprise, Inventory represents the net inventory value of the enterprise, and Cost is the main business cost of the enterprise and serves as a proxy variable for the Demand of the enterprise.

The bullwhip effect, as a classic phenomenon of distorted and amplified demand signals in supply chains, is typically measured through indirect indicators. While this alternative approach reflects certain characteristics of supply–demand mismatches, it struggles to directly capture the core efficiency level of supply–demand coordination. The Inventory Turnover Ratio (ITR), as a core metric for measuring inventory monetization efficiency, can more accurately capture the dynamic equilibrium state of supply–demand coordination. When the coordination efficiency improves, demand signals transmit more smoothly, and inventory management becomes more precise. Upstream suppliers can achieve on-demand stocking, leading to a steady optimization of the ITR. Conversely, insufficient coordination often results in abnormal fluctuations in the ITR. Therefore, supplementing existing analyses with the inventory turnover rate (calculated here as cost of goods sold divided by ending inventory balance) provides a tangible representation of supply–demand coordination effectiveness from an inventory operational efficiency perspective. This makes it a crucial complementary metric for evaluating supply–demand coordination efficiency.

Table 13 validates the mediating roles of knowledge diffusion and supply–demand synergy in sustaining green innovation. By comparing the coefficients and model fits, the knowledge diffusion pathway and supply–demand synergy are complementary in driving green innovation sustainability. The ITR mechanism, as seen in column (6) with a relatively higher impact and a higher R-squared compared to columns (4) and (5), seems to play a more dominant role under the influence of digital transformation in facilitating the virtuous cycle for innovation persistence in this context. Specifically, the mitigation of information asymmetry and the improvement of inventory turnover, coupled with cross-organizational learning opportunities, collectively create this cycle, and among them, inventory turnover enhancement appears more pivotal. Thus, hypotheses H2a and H2b were verified, with the supply chain stabilization mechanism, particularly inventory turnover, showing a more prominent role alongside the complementary knowledge diffusion mechanism.

5.6.2. Mechanism Testing of Green Innovation Sustainability Motivation

Firstly, drawing on Jin’s approach [

70], the Herfindahl Index (HHI) is selected to measure industry competitiveness. This index is calculated by weighting the market shares of all enterprises within the industry. The framework incorporates the market concentration of industry leaders while accounting for competitive dynamics among niche players, accurately reflecting the market concentration of enterprises within the industry and thereby demonstrating the competitive landscape. This concentration ratio ranges from 0 to 1, where values approaching 0 reflect perfect competition with fragmented firm sizes, while values tending toward 1 indicate a monopolistic dominance with suppressed competitive intensity. This characteristic enables it to visually and comprehensively depict the degree of the concentration of industry competition. Secondly, the intensity of tax incentives is measured as the ratio of refunded tax amounts to aggregate fiscal obligations, computed as the ratio between refund amounts and aggregate tax payments (refunds plus taxes paid) in the cash flow statements, following the methodology established in He et al. [

71].

The regression results in

Table 14 show that industry competitiveness (HHI) and tax incentives (Tax) exert partial mediating effects in the process of DT influencing GI_D, thus verifying H3a and H3b. From the regression results, in column (3), when both DT and HHI are included, DT still has a significant positive effect on GI_D, and HHI also shows a significant positive impact. In column (4), with DT and Tax included, DT remains significantly positive, and Tax also has a significant positive effect. By comparing the R-squared values, column (4) has a higher R-squared than column (3) (0.039), indicating that the tax incentive mechanism explains more variance in the green innovation accumulation. Regarding the interaction between these mechanisms, both the industry competitiveness mechanism and the tax incentive mechanism play a role in facilitating green innovation accumulation and are to a certain extent complementary. However, the tax incentive pathway accounts for more of the variance in green innovation accumulation, suggesting it may be more dominant in enabling digital transformation to drive green innovation accumulation in this context.

5.7. Analysis of Regulatory Effects

Furthermore, we examine whether the supply chain concentration will affect the extent to which digitalization in the downstream boosts green innovation in the upstream and conduct an interaction effect analysis from the perspectives of the supplier and customer concentration. Supply chain focalization represents both structural dominance and network interdependencies [

72]. As the supply chain concentration increases, cooperation among enterprises becomes more stable. A stable cooperative relationship can not only promote the spillover of information and technology among enterprises but also foster an enabling green regulatory climate for enterprises. Therefore, the supply chain density significantly alters the effect size of corporate digitalization on sustainable innovation outcomes. To empirically examine this moderation mechanism, we introduce an interaction term (Mod) in the model specification, while maintaining consistency in variable definitions with the benchmark regression framework.

5.7.1. Supplier Concentration

The supplier concentration (SC) reflects the degree to which suppliers rely on a few customers [

73]. This article measures the concentration of suppliers by calculating the annual procurement proportion attributable to the top five vendors [

74].

Table 15 reports the regression outcomes of the interaction effect. As evidenced in columns (1)–(2), the digital transformation–supplier concentration interaction (DT × SC) exhibits a statistically positive association at conventional levels, indicating that the supplier concentration positively moderates DT’s effect on the sustainability of green innovation. Under a high concentration of suppliers, the cooperation between enterprises and core suppliers is more stable and in-depth. Digital transformation can more efficiently drive suppliers to continuously improve and upgrade green technologies, processes, etc., facilitating the progressive development of green innovation and gradually advancing from basic green production to high-end green manufacturing. Meanwhile, the centralized supplier resources enable enterprises to more easily integrate the green resources and capabilities of suppliers under the empowerment of digitalization and reserve key elements such as technology, talent, and funds for their own green innovation, such as accumulating green patents and cultivating green R&D teams, to enhance the subsequent development potential of green innovation. Thus, H4a is verified.

5.7.2. Customer Concentration

The customer concentration (CC) denotes the level of dispersion of a customer’s own suppliers. If the customer concentration is low, the requirements for the green innovation of a certain supplier in its digital transformation may be relatively weak. If the customer concentration is high, customers will be more motivated to drive suppliers to continuously carry out green innovation through digital means to uphold circularity within supply chains. At this time, the sustainability of suppliers’ green innovation may be more easily stimulated. The client focus index is computed by normalizing major accounts’ sales, which is achieved by dividing the total sales of the top five accounts demonstrating peak annual expenditures [

75]. Columns (3) and (4) in

Table 15 indicate that the customer concentration moderates the relationship between customer digital transformation and green sustainability capabilities and motivation, with all corresponding moderation coefficients being significantly positive. In scenarios with a high customer concentration, enterprises are more driven by the green demands of key customers. Digital transformation can precisely align with changes in customer needs, prompting enterprises to continuously optimize the green innovation value chain to escalate sustainable innovation stages. On the other hand, when the customer concentration is high, for the purpose of satisfying the long-term green demands of core customers, enterprises will leverage digital transformation to lay out green innovation resources in advance and conduct forward-looking sustainable energy R&D and technological stockpiling to elevate their green innovation storage capacity and ensure its continuous development. This proves H4b.

Figure 3 synthesizes empirical evidence from the mediation analysis, confirming the hypothesized transmission pathways and visually presenting the effect directions and coefficient magnitudes of each pathway.

6. Conclusions and Implications

6.1. Discussion

This study methodically analyzes the influence of downstream enterprises’ digital transformation on the sustainability of upstream enterprises’ green innovation from a supply chain perspective, along with its underlying mechanisms. The empirical analysis yields a series of key findings. This section synthesizes the research discoveries and elucidates their conceptual contributions and managerial applications, while delineating investigational directions and acknowledging existing limitations.

- (1)

Summary of Key Results

The empirical evidence confirms that downstream firms’ digital permeation generates transboundary impacts, which systematically enhance upstream green innovation sustainability. This manifests specifically in enhanced green innovation sustainability and strengthened driving forces, with the latter exhibiting a greater impact intensity. This conclusion remains robust after the stability testing and endogeneity treatment. Mechanism tests further reveal differentiated pathways between the two effects: the enhanced sustainability capacity primarily stems from knowledge spillovers and improved supply–demand coordination efficiency, while strengthened motivation relies on intensified market competition and heightened sensitivity to tax incentives. The interaction effect analysis indicates that the structural empowerment from the upstream market density and downstream market consolidation simultaneously enhances the sustainability, as evidenced in Chinese clusters.

- (2)

Comparison and Extension of Current Literature

Current academic studies largely focus their attention on the short-term outputs of green innovation and the influence of individual actors, such as concentrating on short-term indicators like the quantity of green patent rights or examining the role of a company’s own digital transformation and unidirectional supply chain interactions. However, they often overlook the sustainability of innovation and multi-tier ripple effects across supply networks. This paper centers on the sustainability of green innovation, examining not only whether innovative actions occur but also focusing on the long-term persistence of innovation capabilities and the continuous supply of driving forces. It simultaneously reveals how downstream digital transformation exerts a sustained influence on upstream entities through dual pathways, while also considering supply chain spillover effects and refining their differentiated mechanisms. This approach addresses existing research gaps in dynamic evolution and cross-actor interactions, thereby enriching the theoretical framework.

- (3)

Theoretical Contributions

By constructing a dual-pathway analytical framework, this study deconstructs the sustainability of green innovation into two dimensions, sustaining capability and sustaining motivation, identifying differentiated transmission mechanisms and offering a new analytical perspective for conceptual investigations of the dynamic evolution of innovation. Moving beyond the traditional single-firm analytical paradigm, this research centers on the spillover effects of downstream digitalization on upstream entities. It reveals the intrinsic logic of cross-firm green innovation coordination within supply chains, providing fresh empirical evidence for interdisciplinary research where supply chain management intersects with sustainability. Furthermore, by analyzing the differentiated moderating role of the supplier and customer concentration, it elucidates how supply chain structural characteristics influence the spillover efficiency of digital transformation, broadening research into the contextual mechanisms of interorganizational relationships in shaping innovation effects.

- (4)

Practical Implications

For managers, upstream enterprises should proactively capture spillover benefits from downstream digital transformation: on one hand, by participating in downstream digital collaboration to absorb knowledge spillovers and elevate innovation capabilities for green sustainability; on the other hand, by leveraging market competitive pressures and policy incentive windows to strengthen long-term investment momentum in green innovation. For policymakers, efforts should focus on promoting supply chain digital collaboration policies; simultaneously, differentiated incentive policies can be designed for highly concentrated supply chains.

- (5)

Research Limitations and Future Directions

The constraints associated with this research are primarily reflected in three aspects: First, the enterprise-level analysis concentrates on manufacturing activities within China, which could potentially restrict the applicability of conclusions to the service sector or multinational supply chains. Second, it fails to carry out a comprehensive examination of the differentiated spillover effects of various digital technologies. Third, the measurement dimensions of tax incentive measures remain insufficiently comprehensive, with existing indicators struggling to fully capture implicit subsidies or non-institutionalized support from local governments. Recognizing this limitation facilitates a more nuanced and objective interpretation of research findings. Future research may expand in two directions: First, conducting international comparative studies to investigate how structural environment differences influence the spillover effects of supply chain digitalization. Second, integrating carbon neutrality objectives to investigate the interactive effects between supply chain carbon footprint constraints and digital transformation, thereby providing more precise theoretical support for green supply chain governance.

6.2. Conclusions

The sustainability of corporate green innovation holds dual significance, extending beyond sustained capability development to encompass sustained motivation propagation throughout industrial ecosystems. This investigation adopts a supply chain perspective to examine how technological transformation influences enduring environmental innovation patterns. Through analyzing the cumulative and progressive characteristics of sustainable inventive processes, this study develops a dual-axis framework encompassing both the innovation maintenance capacity and momentum generation mechanisms, yielding the following key findings.

(1) Downstream digital diffusion exerts catalytic governance over upstream green innovation ecosystems, with measurable enhancements in both the sustainability preservation capacity and innovation momentum generation. The effect size differential confirms stronger digital institutionalization impacts on dynamic capability formation. These causal inferences withstand rigorous falsification testing, including instrumental variable approaches.

(2) The mechanistic pathways exhibit statistically divergent coefficients when transmitting downstream digitalization effects to distinct innovation sustainability dimensions: sustained capability is strengthened by promoting knowledge spillover and improving the efficiency of supply and demand coordination, and sustained motivation is enhanced by intensifying market competition and increasing tax incentives.

(3) The interaction effect analysis shows that the supplier and customer concentration can constructively regulate the mechanism of downstream digital transformation on the sustainability of upstream green innovation. The positive regulation of the supplier concentration is reflected in the accelerated implementation of the progressive effect and the promotion of the targeted investment of energy storage resources. The positive adjustment of the customer concentration is manifested in the rapid adjustment of the progressive rhythm and the continuous accumulation of energy to consolidate the stickiness of cooperation.

Table 16 summarizes the test results of all hypotheses, clearly presenting the content of each hypothesis, the corresponding null hypothesis, the adopted test methods, the significance level, and the final conclusion. All hypotheses reach statistical significance at the 1% level, comprehensively and intuitively evidencing the verification status of each hypothesis.

6.3. Policy Recommendations

This article reveals the intrinsic logic of how digitalization empowers supply chains to shift from “passive compliance” to “active sustainability”, directly responding to the core demands of sustainable supply chains with regard to resource efficiency, environmental friendliness, and collaborative governance. As evidenced by this investigation into digital sustainability enhancement mechanisms across extended green innovation, the present paper offers the following policy implications, aiming to assist enterprises at all links of the industrial chain to achieve green and sustainable development through digital collaboration.

(1) Embed blockchain-based reward mechanisms to accelerate intelligent transitions while securing circular innovation longevity.

First, establish a certification mechanism for “Green Digital Transformation Benchmark Enterprises.” Governments can set up dedicated support funds to prioritize funding for core enterprises in the downstream of industrial chains to undertake a “green + digital” integrated transformation, such as building industrial Internet platforms that integrate carbon footprint tracking and real-time energy consumption monitoring. Simultaneously, mandate benchmark enterprises to open supply chain data interfaces and establish unified standards for green data exchange within supply chains. This will reduce technical and cost barriers for upstream suppliers to access these platforms. Second, incorporate “supply chain green empowerment performance” as a mandatory metric in large enterprises’ ESG assessments. Require chain-leading enterprises with annual revenues exceeding RMB 10 billion to disclose quantifiable indicators in their ESG reports, such as the “number of green patents generated by upstream suppliers” and “percentage reduction in energy consumption per unit of supplier output.” Grant preferential procurement points to compliant enterprises, guiding them to achieve precise spillover effects through physical entities like “joint R&D laboratories” and “green technology training bases”, thereby disseminating digital knowledge and green technologies. Finally, promote the chain leader–supplier innovation alliance model. Select key industries like new energy and automotive manufacturing to support chain leader enterprises in establishing cross-entity innovation alliances. Implement intellectual property revenue-sharing mechanisms for knowledge exchange within these alliances to accelerate the commercialization of collaborative innovation outcomes.

(2) Smooth the transmission path of environmental technology leapfrogging.

For enhancing the sustainable capacity for green innovation, establish an “industry-level digital platform for green technologies.” For pollution-intensive sectors such as chemicals and textiles, the government will spearhead the creation of a digital platform integrating a “green technology repository, demand-matching platform, and expert consultation system.” This platform will consolidate green patented technologies from research institutes with environmental demand data from downstream enterprises. Through AI algorithms, it will achieve precise supply–demand matching, providing upstream suppliers with “customized green technology solutions.” To strengthen the sustained motivation behind green innovation, establish a “tiered tax incentive system for green patent output.” Refine the “carbon labeling and green procurement” linkage mechanism by mandating full-lifecycle carbon labeling on end products like home appliances and furniture. Incorporate the proportion of green-labeled products purchased into procurement evaluations for government- and state-owned enterprises. This approach leverages end market pressure to compel upstream suppliers to continuously invest in green innovation.

(3) Optimize the supply chain architecture to leverage the regulatory effect of the concentration.

On one hand, policies should encourage core downstream enterprises to establish long-term, stable strategic partnerships with key upstream suppliers, appropriately guiding the formation of a more deeply collaborative supplier structure. Supply chain alliances committed to green collaborative innovation may receive corresponding policy preferences. For core supplier groups, provide customized support for green transformation and digital capability enhancement, strengthening their capacity to effectively absorb downstream digital spillover effects and sustainably invest in green innovation resources. On the other hand, promote and support upstream–downstream enterprises in signing long-term contracts that include explicit green innovation targets, technical collaboration mechanisms, and cost/risk-sharing clauses. This provides stable institutional safeguards for sustained energy accumulation and deepened cooperation. Drive the establishment of supply chain data-sharing infrastructure based on trusted technologies like blockchains to reduce information asymmetry, enhance mutual trust in collaboration, and foster a stable cooperative environment for long-term resource investment in green innovation.

6.4. Limitations and Future Research

This article has the following deficiencies:

Firstly, we examined the impact of digital transformation on green innovation based on microdata at the enterprise level. In future research, we can focus on a specific industry for a more detailed exploration. Secondly, if the research scenarios are expanded to a cross-border context and the supply chain characteristics and institutional environments of different countries are included for comparative analysis, the global applicability and practical significance of the conclusions will be further enhanced. In addition, exploring and constructing a more scientific method for measuring the degree of the enterprise digital transformation is also a research direction worthy of in-depth exploration in the future.