Mitigating Involutionary Competition Through Corporate ESG Adoption: Evidence from the Consumer Electronics Manufacturing Industry

Abstract

1. Introduction

2. Literature Review

2.1. Research on ESG Strategy for Corporations

2.2. Research on Corporate Price Competition

2.3. Research on the Correlation Between ESG and Corporate Competitiveness

2.4. Literature Summary and Commend

3. Measurement of Involutionary Competition and Its Relation with ESG

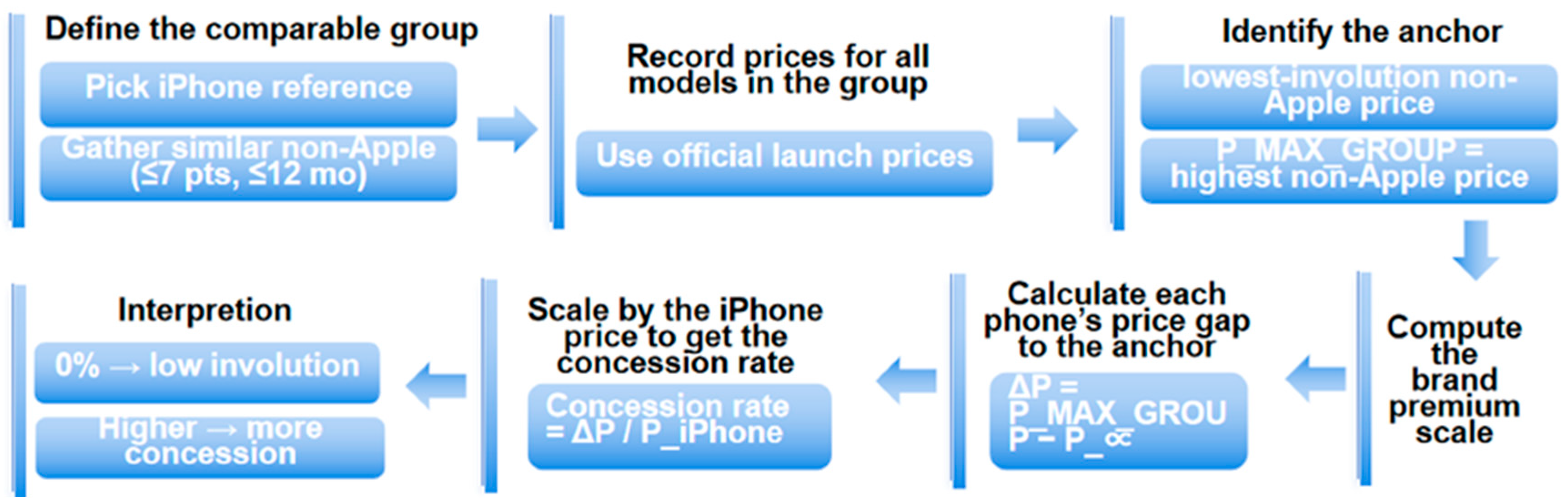

3.1. Construction of a Comparative Scoring System

3.1.1. Product Performance Parameter Evaluation

3.1.2. Derivation of Corporate ESG Scores

3.2. Measuring the Degree of Involutionary Competition Based on Profit Erosion

3.3. Empirical Analysis

4. Feasibility Analysis of ESG Engagement as a Mitigation Pathway for Involutionary Competition

4.1. Alleviating Price Competition

4.1.1. Environmental Dimension (E)

4.1.2. Social Dimension (S)

4.1.3. Governance Dimension (G)

4.2. Mitigating Homogeneous Competition

4.3. Mitigating Inefficient R&D (Duplicative Research)

5. Spiral Progressive Pathways of ESG Mitigating Involutionary Competition

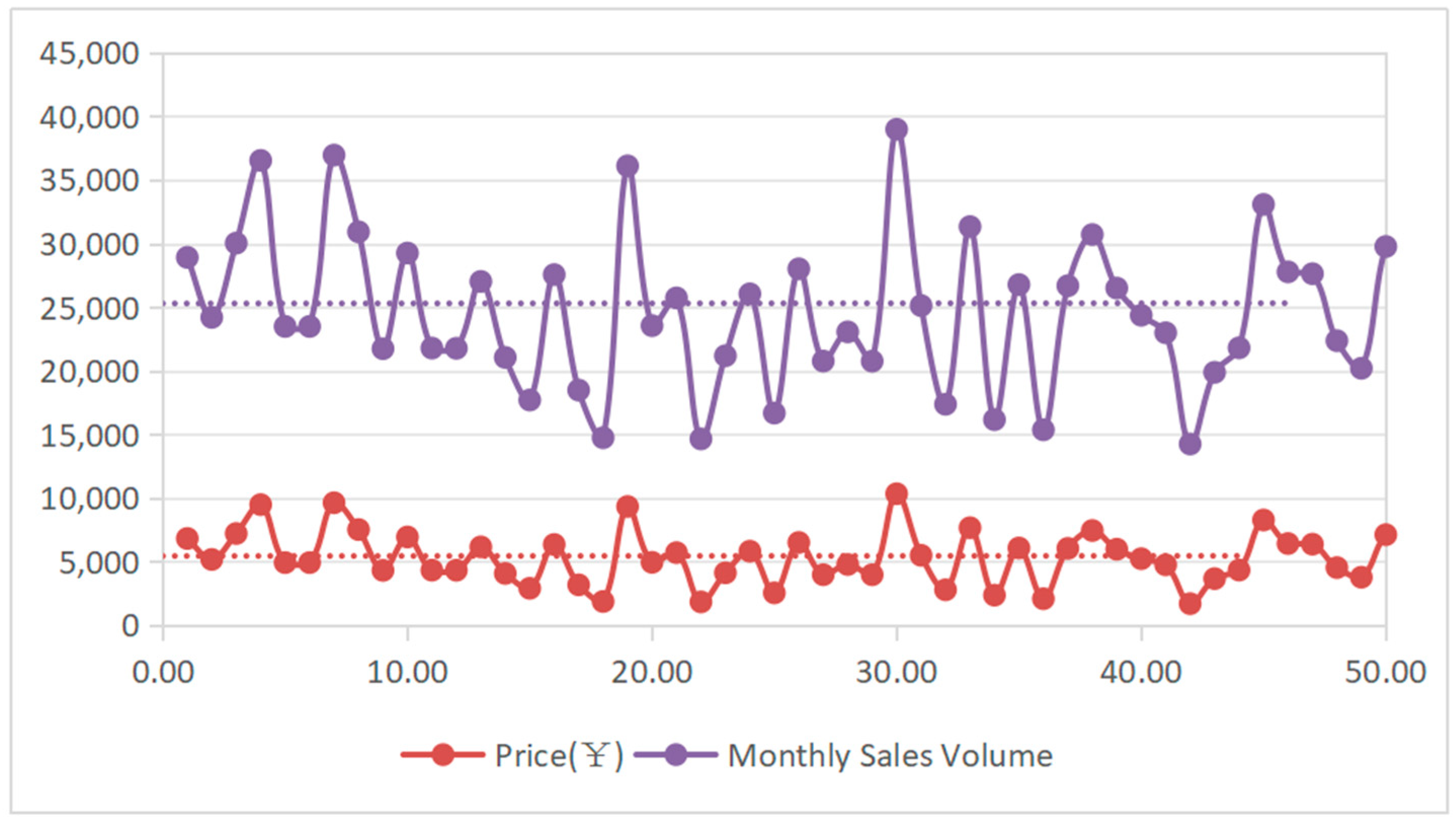

5.1. Stochastic Time-Series Analysis of Apple and Huawei Price–Demand Relations

5.2. Optimizing the Relationship Between Sales Volume and Price Using Generalized Additive Model (GAM)

5.2.1. The Feasibility and Shortcomings of Linear Relationships

5.2.2. Generalised Additive Model (GAM)

- (i)

- Data distribution characteristics

- (ii)

- Applicability of Economic Principles

- (iii)

- Parameter calibration process

5.2.3. Economic Drivers of Function Shape Transformation

5.3. Sales Volume Change Simulation and the Ultimate Trajectory of Corporate ESG Engagement

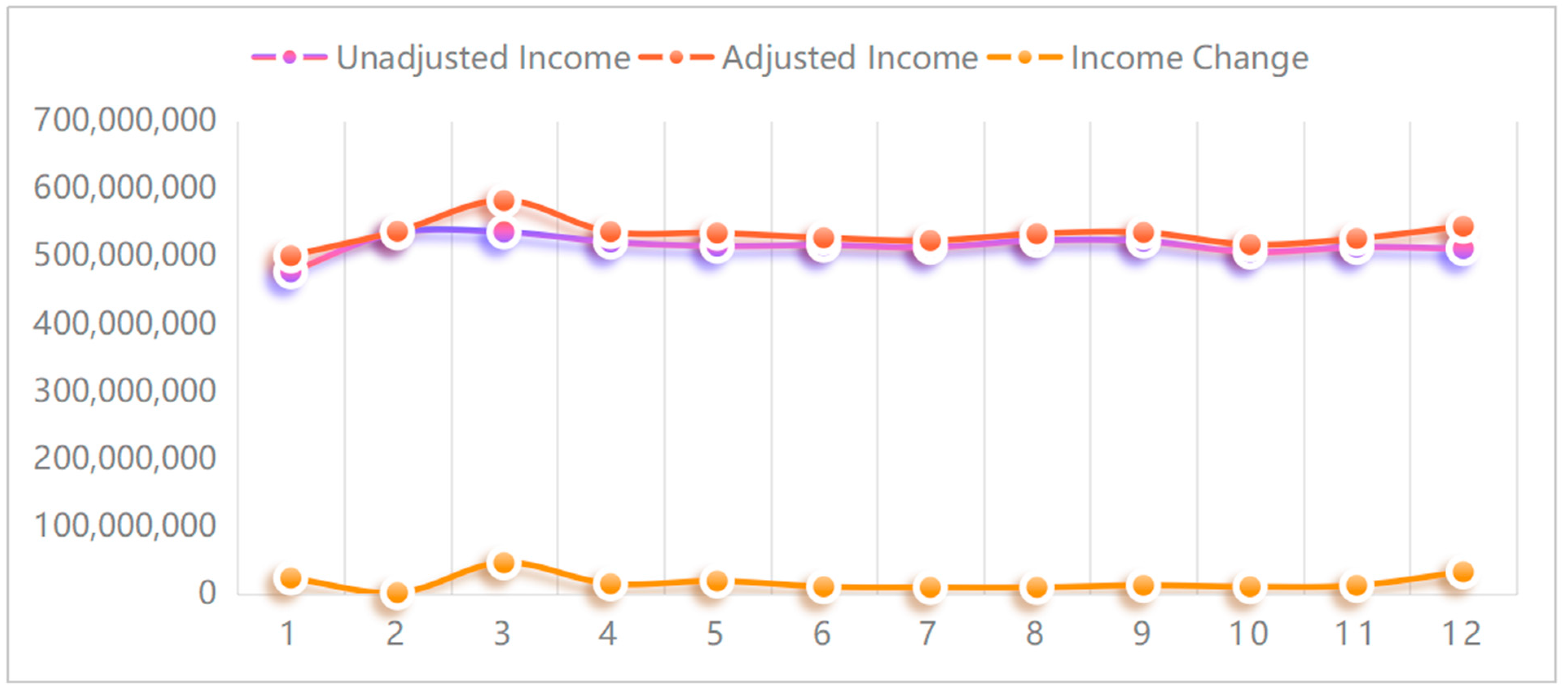

5.3.1. The Overall Impact of Price Increases on Corporate Revenue

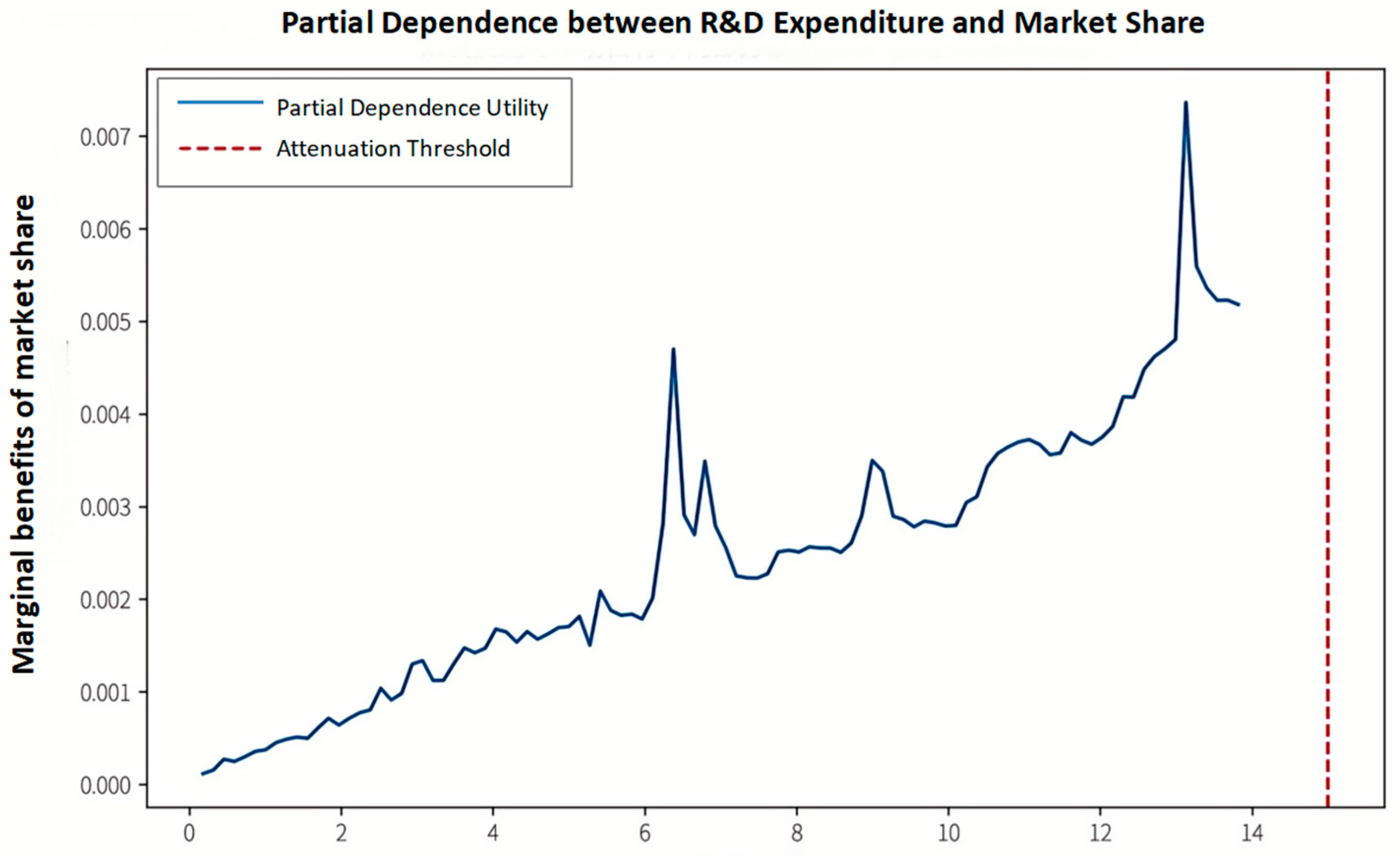

5.3.2. The Relationship Between R&D Expenditures and Corporation Market Share

5.3.3. Future Sales Trajectories Under Counter-Involutionary Competition Strategies

5.3.4. ESG’s Gradual Upward Cycle Route to Alleviate Involutionary Competition

6. Summary and Outlook

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Cell Phone Model | Affiliated Corporation | Year | Profit Decline Rate Due to Involutionary Competition | Corresponding Corporate Quarterly ESG Scores | Years Since Establishment | Industry Lerner Index | Corporation Size |

|---|---|---|---|---|---|---|---|

| Transsion TECNO Phantom X3 (83 points) | Transsion Holdings Co., Ltd., Shenzhen, China | 2024 | 43.07% | 6.65 | 25 | 0.113825 | 620 |

| OPPO Reno4 Pro (83 points) | Guangdong Oppo Holdings Co., Ltd., Dongguan, China | 2020 | 3.16% | 6.70 | 20 | 0.126929 | 1290 |

| OPPO Find X7 Ultra (90 points) | Guangdong Oppo Holdings Co., Ltd. | 2024 | 5.00% | 8.20 | 20 | 0.113825 | 1210 |

| Huawei P40 Pro (96 points) | Huawei Technologies Co., Ltd., Shenzhen, China | 2020 | 0% | 7.70 | 37 | 0.126929 | 4800 |

| Huawei Mate 50 Pro (81 points) | Huawei Technologies Co., Ltd. | 2022 | 6.25% | 8.60 | 37 | 0.125683 | 1160 |

| Huawei P60 Pro (91 points) | Huawei Technologies Co., Ltd. | 2023 | 0% | 8.90 | 37 | 0.117904 | 1050 |

| Meizu 17 Pro (89 points) | Meizu Technology Co., Ltd., Zhuhai, China | 2020 | 19.87% | 4.80 | 21 | 0.126929 | 98 |

| Motorola edge s pro (85 points) | Motorola (China) Electronics Co., Ltd., Tianjin, China | 2021 | 38.75% | 5.40 | 33 | 0.139781 | 118 |

| Nubia Z20 (88 points) | Nubia Technology Co., Ltd., Shenzhen, China | 2020 | 29.29% | 4.60 | 12 | 0.126929 | 52 |

| Nubia Z30 Pro (80 points) | Nubia Technology Co., Ltd. | 2021 | 21.67% | 5.10 | 12 | 0.139781 | 65 |

| Nubia Z50 (80 points) | Nubia Technology Co., Ltd. | 2022 | 15.00% | 5.70 | 12 | 0.125683 | 72 |

| ZTE Nubia Z60 Ultra (88 points) | Nubia Technology Co., Ltd. | 2023 | 31.25% | 5.80 | 12 | 0.117904 | 78 |

| Honor Magic3 (86 points) | Honor Device Co., Ltd., Shenzhen, China | 2021 | 11.25% | 7.70 | 4 | 0.139781 | 800 |

| Honor Magic4 Pro (87 points) | Honor Device Co., Ltd. | 2022 | 6.25% | 7.90 | 4 | 0.125683 | 980 |

| Honor Magic7 Pro (89 points) | Honor Device Co., Ltd. | 2024 | 12.00% | 8.90 | 4 | 0.113825 | 1180 |

| realme X50 Pro (88 points) | Shenzhen Realme Mobile Communications Co., Ltd., Shenzhen, China | 2020 | 6.33% | 5.40 | 6 | 0.126929 | 210 |

| realme GT (80 points) | Shenzhen Realme Mobile Communications Co., Ltd. | 2021 | 23.34% | 5.80 | 6 | 0.139781 | 310 |

| realme GT2 Pro (91 points) | Shenzhen Realme Mobile Communications Co., Ltd. | 2022 | 0% | 6.10 | 6 | 0.125683 | 390 |

| realme GT3 (82 points) | Shenzhen Realme Mobile Communications Co., Ltd. | 2023 | 61.49% | 6.60 | 6 | 0.117904 | 480 |

| OnePlus 9 Pro (96 points) | Shenzhen OnePlus Technology Co., Ltd., Shenzhen, China | 2021 | 6.25% | 6.00 | 4 | 0.139781 | 380 |

| OnePlus 11 (94 points) | Shenzhen OnePlus Technology Co., Ltd. | 2023 | 49.82% | 6.80 | 11 | 0.117904 | 340 |

| iQOO 3 (84 points) | Vivo Mobile Communications Co., Ltd., Dongguan, China | 2020 | 0% | 6.70 | 15 | 0.126929 | 1380 |

| vivo X70 Pro+ (95 points) | Vivo Mobile Communications Co., Ltd. | 2021 | 0% | 7.40 | 15 | 0.139781 | 1480 |

| vivo X90 Pro+ (98 points) | Vivo Mobile Communications Co., Ltd. | 2023 | 0% | 7.80 | 15 | 0.125683 | 1420 |

| vivo X200 Pro (98 points) | Vivo Mobile Communications Co., Ltd. | 2024 | 0% | 8.60 | 15 | 0.113825 | 1480 |

| Xiaomi 10 Pro (98 points) | Xiaomi Technology Co., Ltd., Beijing, China | 2020 | 11.64% | 6.00 | 14 | 0.126929 | 1502 |

| Xiaomi 12 Pro (92 points) | Xiaomi Technology Co., Ltd. | 2021 | 0% | 7.00 | 14 | 0.125683 | 1670 |

| Xiaomi 12S Ultra (98 points) | Xiaomi Technology Co., Ltd. | 2022 | 0% | 7.32 | 14 | 0.125683 | 1670 |

| Xiaomi 13 Ultra (95 points) | Xiaomi Technology Co., Ltd. | 2023 | 6.25% | 7.98 | 14 | 0.117904 | 1550 |

| Xiaomi 14 Ultra (95 points) | Xiaomi Technology Co., Ltd. | 2024 | 0% | 8.17 | 14 | 0.113825 | 1720 |

References

- Song, C.; Ma, W. ESG and green innovation: Nonlinear moderation of public attention. Humanit. Soc. Sci. Commun. 2025, 12, 667. [Google Scholar] [CrossRef]

- Chen, M.; Tan, X.; Zhu, J.; Dong, R.K. Can supply chain digital innovation policy improve the sustainable development performance of manufacturing companies? Humanit. Soc. Sci. Commun. 2025, 12, 307. [Google Scholar] [CrossRef]

- Liu, D.; Sun, N.; Zhu, X. ESG ratings empower high-quality development of logistics enterprises through digital transformation and green innovation. Sci. Rep. 2025, 15, 22861. [Google Scholar] [CrossRef] [PubMed]

- Hassan, M.M.; Wei, S.; Xu, Y.; Zareef, M.; Li, H.; Sayada, J.; Chen, Q. Ascorbate functionalized Au@AgNPs SERS sensor combined random frog-partial least squares for the prediction of chloramphenicol in milk. J. Food Compos. Anal. 2024, 129, 106106. [Google Scholar] [CrossRef]

- Cheng, J.; Sun, J.; Yao, K.; Xu, M.; Wang, S.; Fu, L. Hyperspectral technique combined with stacking and blending ensemble learning method for detection of cadmium content in oilseed rape leaves. J. Sci. Food Agric. 2022, 103, 2690–2699. [Google Scholar] [CrossRef] [PubMed]

- Wu, R.; Li, M.; Liu, F.; Zeng, H.; Cong, X. Adjustment strategies and chaos in duopoly supply chains: The impacts of carbon trading markets and emission reduction policies. Int. Rev. Econ. Financ. 2024, 95, 103482. [Google Scholar] [CrossRef]

- Ding, Y.; Wang, X.; Wu, L. Environmental tax law and greenwashing: The moderating role of digitization. Humanit. Soc. Sci. Commun. 2025, 12, 518. [Google Scholar] [CrossRef]

- Liu, W.; Yan, H. The evaluation of ESG strategy implementation effect based on performance prism: Evidence from the industrial and commercial bank of China. Humanit. Soc. Sci. Commun. 2025, 12, 395. [Google Scholar] [CrossRef]

- Gao, D.; Tan, L.; Chen, Y. Smarter is greener: Can intelligent manufacturing improve enterprises’ ESG performance? Humanit. Soc. Sci. Commun. 2025, 12, 529. [Google Scholar] [CrossRef]

- Wang, S.; Gao, M.; Zhang, H. Strengthening SMEs competitiveness and performance via industrial internet: Technological, organizational, and environmental pathways. Humanit. Soc. Sci. Commun. 2024, 11, 1366. [Google Scholar] [CrossRef]

- Cenci, S.; Burato, M.; Rei, M.; Zollo, M. Assessing the effectiveness of interdependent corporate sustainability choices. Npj Clim. Action. 2025, 4, 25. [Google Scholar] [CrossRef]

- Moldovan, E.; Cort, T.; Goldberg, M.; Marlon, J.; Leiserowitz, A. The evolving climate change investing strategies of asset owners. Npj Clim. Action. 2024, 3, 82. [Google Scholar] [CrossRef]

- Li, X.; Gallagher, K.P. Assessing the climate change exposure of foreign direct investment. Nat. Commun. 2022, 13, 1451. [Google Scholar] [CrossRef] [PubMed]

- Li, F.; Wang, N.; He, X.; Detng, M.; Yuan, X.; Zhang, H.; Nzihou, A.; Tsang, D.C.W.; Wang, C.-H.; Ok, Y.S. Biochar-based catalytic upgrading of plastic waste into liquid fuels towards sustainability. Commun. Earth Environ. 2025, 6, 329. [Google Scholar] [CrossRef]

- Huang, Y.; Huang, S.; Chen, X. Predictive model on employee stock ownership impacting corporate performance. Sci. Rep. 2025, 15, 22133. [Google Scholar] [CrossRef]

- Liu, H.; Wang, J.; Liu, M. Can digital finance curb corporate ESG decoupling? Evidence from Shanghai and Shenzhen A-shares listed companies. Humanit. Soc. Sci. Commun. 2024, 11, 1613. [Google Scholar] [CrossRef]

- Grabs, J.; Carodenuto, S.; Jespersen, K.; Adams, M.A.; Camacho, M.A.; Celi, G.; Chandra, A.; Dufour, J.; zu Ermgassen, E.K.H.J.; Garrett, R.D.; et al. The role of midstream actors in advancing the sustainability of agri-food supply chains. Nat. Sustain. 2024, 7, 527–535. [Google Scholar] [CrossRef]

- Yang, W.; Zhang, Y. Standardization catch-up strategy of latecomer enterprises: A longitudinal case of Huawei. Humanit. Soc. Sci. Commun. 2025, 12, 150. [Google Scholar] [CrossRef]

- Ojong, N. Energizing entrepreneurship. Nat. Energy 2022, 7, 392–393. [Google Scholar] [CrossRef]

- Luo, S.; Liu, J. Enterprise service-oriented transformation and sustainable development driven by digital technology. Sci. Rep. 2024, 14, 10047. [Google Scholar] [CrossRef]

- Chen, X.; Wan, P.; Ma, Z.; Yang, Y. Does corporate digital transformation restrain ESG decoupling? Evidence from China. Humanit. Soc. Sci. Commun. 2024, 11, 407. [Google Scholar] [CrossRef]

- Chen, D.; Wang, S. Digital transformation, innovation capabilities, and servitization as drivers of ESG performance in manufacturing SMEs. Sci. Rep. 2024, 14, 24516. [Google Scholar] [CrossRef] [PubMed]

- Xu, H.; Li, Y.; Lin, W.; Wang, H. ESG and customer stability: A perspective based on external and internal supervision and reputation mechanisms. Humanit. Soc. Sci. Commun. 2024, 11, 981. [Google Scholar] [CrossRef]

- Lai, H.; Quan, L.; Wu, F.; Tang, S.; Guo, C.; Lai, X. Corporate environmental publicity and green innovation: Are words consistent with actions? Humanit. Soc. Sci. Commun. 2025, 12, 514. [Google Scholar] [CrossRef]

- Dai, Q.; He, J.; Guo, Z.; Zheng, Y.; Zhang, Y. Green finance for sustainable development: Analyzing the effects of green credit on high-polluting firms’environmental performance. Humanit. Soc. Sci. Commun. 2025, 12, 854. [Google Scholar] [CrossRef]

- Zhang, T.; He, Q.; Zhao, W.; Wei, M. Sustainable closed-loop supply chain network planning considering price competition using particle chaotic ant colony algorithm. Sci. Rep. 2025, 15, 17964. [Google Scholar] [CrossRef]

- Wang, X.; Liu, J.; Zhang, Q. Water-pesticide integrated micro-sprinkler design and influence of key structural parameters on performance. Agriculture 2022, 12, 1532. [Google Scholar] [CrossRef]

- Molino, S.; De Lellis, L.F.; Morone, M.V.; Cordara, M.; Larsen, D.S.; Piccinocchi, R.; Piccinocchi, G.; Baldi, A.; Di Minno, A.; El-Seedi, H.R.; et al. Improving irritable bowel syndrome (IBS) symptoms and quality of life with quebracho and chestnut tannin-based supplementation: A single-centre, randomised, double-blind, placebo-controlled clinical trial. Nutrients 2025, 17, 552. [Google Scholar] [CrossRef]

- Li, X.; Wang, X.; Zhao, Z.; Zhao, Q. ESG ratings, executive pay-for-performance sensitivity and within-firm pay gap. Humanit. Soc. Sci. Commun. 2025, 12, 599. [Google Scholar] [CrossRef]

- Chen, Q.; Chen, M.; Liu, Y.; Wu, J.; Wang, X.; Ouyang, Q.; Chen, X. Application of FT-NIR spectroscopy for simultaneous estimation of taste quality and taste-related compounds content of black tea. J. Food Sci. Technol. 2018, 55, 4363–4368. [Google Scholar] [CrossRef]

- Yang, N.; Hu, J.; Zhou, X.; Wang, A.; Yu, J.; Tao, X.; Tang, J. A rapid detection method of early spore viability based on AC impedance measurement. J. Food Process Eng. 2020, 43, 13520. [Google Scholar] [CrossRef]

- Sun, L.; Feng, S.; Chen, C.; Liu, X.; Cai, J. Identification of eggshell crack for hen egg and duck egg using correlation analysis based on acoustic resonance method. J. Food Process Eng. 2020, 43, e13430. [Google Scholar] [CrossRef]

- Wu, R. Forecasting the European Union allowance price tail risk with the integrated deep belief and mixture density networks. Chaos Solitons Fractals 2025, 199, 116786. [Google Scholar] [CrossRef]

- Zhu, Y.; Zou, X.; Shen, T.; Shi, J.; Zhao, J.; Holmes, M.; Li, G. Determination of total acid content and moisture content during solid-state fermentation processes using hyperspectral imaging. J. Food Eng. 2016, 174, 75–84. [Google Scholar] [CrossRef]

- Tahir, H.E.; Zou, X.; Shen, T.; Shi, J.; Mariod, A.A. Near-infrared (NIR) spectroscopy for rapid measurement of antioxidant properties and discrimination of Sudanese honeys from different botanical origin. Food Anal. Methods 2016, 9, 2631–2641. [Google Scholar] [CrossRef]

- Shen, T.; Zou, X.; Shi, J.; Li, Z.; Huang, X.; Xu, Y.; Chen, W. Determination geographical origin and flavonoids content of goji berry using near-infrared spectroscopy and chemometrics. Food Anal. Methods 2016, 9, 68–79. [Google Scholar]

- Wu, X.; He, F.; Wu, B.; Zeng, S.; He, C. Accurate classification of Chunmee tea grade using NIR spectroscopy and fuzzy maximum uncertainty linear discriminant analysis. Foods 2023, 12, 541. [Google Scholar] [CrossRef]

- Zhu, R.; Wu, X.; Wu, B.; Gao, J. High-accuracy classification and origin traceability of peanut kernels based on near-infrared (NIR) spectroscopy using Adaboost—maximum uncertainty linear discriminant analysis. Curr. Res. Food Sci. 2024, 8, 100766. [Google Scholar] [CrossRef]

- Hou, F.; Ding, W.; Qu, W.; Oladejo, A.O.; Xiong, F.; Zhang, W.; He, R.; Ma, H. Alkali solution extraction of rice residue protein isolates: Influence of alkali concentration on protein functional, structural properties and lysinoalanine formation. Food Chem. 2017, 218, 207–215. [Google Scholar] [CrossRef]

- Wu, X.-H.; Zhu, J.; Wu, B.; Huang, D.-P.; Sun, J.; Dai, C.-X. Classification of Chinese vinegar varieties using electronic nose and fuzzy Foley-Sammon transformation. J. Food Sci. Technol. 2019, 57, 1310–1319. [Google Scholar] [CrossRef]

- Chen, Y.; Chen, H.; Zhang, W.; Ding, Y.; Zhao, T.; Zhang, M.; Mao, G.; Feng, W.; Wu, X.; Yang, L. Bioaccessibility and biotransformation of anthocyanin monomers following in vitro simulated gastric-intestinal digestion and in vivo metabolism in rats. Food Funct. 2019, 10, 6052–6061. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, J.; Li, J.; Wu, X.; Dai, C. Quantitative analysis of cadmium content in tomato leaves based on hyperspectral image and feature selection. Appl. Eng. Agric. 2018, 34, 789–798. [Google Scholar] [CrossRef]

- Li, Y.; Sun, J.; Wu, X.; Lu, B.; Wu, M.; Dai, C. Grade identification of Tieguanyin tea using fluorescence hyperspectra and different statistical algorithms. J. Food Sci. 2019, 84, 2234–2241. [Google Scholar] [CrossRef]

- Ge, X.; Sun, J.; Lu, B.; Chen, Q.; Xun, W.; Jin, Y. Classification of oolong tea varieties based on hyperspectral imaging technology and BOSS-LightGBM model. J. Food Process Eng. 2019, 42, e13289. [Google Scholar] [CrossRef]

- Jiang, H.; He, Y.; Chen, Q. Determination of acid value during edible oil storage using a portable NIR spectroscopy system combined with variable selection algorithms based on an MPA-based strategy. J. Sci. Food Agric. 2020, 101, 3328–3335. [Google Scholar] [CrossRef] [PubMed]

- Sun, J.; Cong, S.; Mao, H.; Wu, X.; Yang, N. Quantitative detection of mixed pesticide residue of lettuce leaves based on hyperspectral technique. J. Food Process Eng. 2018, 41, e12654. [Google Scholar] [CrossRef]

- He, P.; Wu, Y.; Wang, J.; Ren, Y.; Ahmad, W.; Liu, R.; Ouyang, Q.; Jiang, H.; Chen, Q. Detection of mites Tyrophagus putrescentiae and Cheyletus eruditus in flour using hyperspectral imaging system coupled with chemometrics. J. Food Process Eng. 2020, 43, e13386. [Google Scholar] [CrossRef]

- Jiang, W.; Huang, S.; Ma, S.; Gong, Y.; Fu, Z.; Zhou, L.; Hu, W.; Mao, G.; Ma, Z.; Yang, L.; et al. Effectiveness of companion-intensive multi-aspect weight management in Chinese adults with obesity: A 6-month multicenter randomized clinical trial. Nutr. Metab. 2021, 18, 35. [Google Scholar] [CrossRef]

- Zheng, W.; Lan, R.; Zhangzhong, L.; Yang, L.; Gao, L.; Yu, J. A hybrid approach for soil total nitrogen anomaly detection integrating machine learning and spatial statistics. Agronomy 2023, 13, 2669. [Google Scholar] [CrossRef]

- Zhuang, X.; Li, Y. Segmentation and angle calculation of rice lodging during harvesting by a combine harvester. Agriculture 2023, 13, 1425. [Google Scholar] [CrossRef]

- Tian, Y.; Sun, J.; Zhou, X.; Wu, X.; Lu, B.; Dai, C. Research on apple origin classification based on variable iterative space shrinkage approach with stepwise regression-support vector machine algorithm and visible-near infrared hyperspectral imaging. J. Food Process Eng. 2020, 43, e13432. [Google Scholar] [CrossRef]

- Bonah, E.; Huang, X.; Yang, H.; Aheto, J.H.; Ren, Y.; Yu, S.; Tu, H. Detection of Salmonella Typhimurium contamination levels in fresh pork samples using electronic nose smellprints in tandem with support vector machine regression and metaheuristic optimization algorithms. J. Food Sci. Technol. 2020, 58, 3861–3870. [Google Scholar] [CrossRef] [PubMed]

- Yao, K.; Sun, J.; Zhang, L.; Zhou, X.; Tian, Y.; Tang, N.; Wu, X. Nondestructive detection for egg freshness based on hyperspectral imaging technology combined with harris hawks optimization support vector regression. J. Food Saf. 2021, 41, e12888. [Google Scholar] [CrossRef]

- Zhou, X.; Sun, J.; Zhang, Y.; Tian, Y.; Yao, K.; Xu, M. Visualization of heavy metal cadmium in lettuce leaves based on wavelet support vector machine regression model and visible-near infrared hyperspectral imaging. J. Food Process Eng. 2021, 44, e13897. [Google Scholar] [CrossRef]

- Yang, N.; Qian, Y.; El-Mesery, H.S.; Zhang, R.; Wang, A.; Tang, J. Rapid detection of rice disease using microscopy image identification based on the synergistic judgment of texture and shape features and decision tree-confusion matrix method. J. Sci. Food Agric. 2019, 99, 6589–6600. [Google Scholar]

- Lian, Y.; Chen, J.; Guan, Z.; Song, J. Development of a monitoring system for grain loss of paddy rice based on a decision tree algorithm. Int. J. Agric. Biol. Eng. 2021, 14, 224–229. [Google Scholar] [CrossRef]

| Calculation Items | Key Events | Assessment Stratification | Score Breakdown | Project Proportion | Project Score |

|---|---|---|---|---|---|

| E | Greenhouse Gas Emissions | Data Performance | Total carbon emissions amounted to 85,000 metric tons of carbon dioxide equivalent (t CO2e), with a carbon emissions intensity of 3.2 t CO2e per million dollars of revenue. Compared to the previous quarter, this represents a decrease of 4.5%. | 30% | 6.5 |

| Industry Comparison | Compared to industry peers such as Samsung Electronics and ZTE Corporation, the carbon emissions intensity remains at a relatively high level; Samsung Electronics’ carbon emissions intensity for the quarter was 2.8 t CO2e per million USD in revenue, while ZTE Corporation’s was 2.5 t CO2e per million USD in revenue. | ||||

| Goal Achievement | The corporation plans to reduce carbon emissions per unit of revenue by 40% over the next 10 years. | ||||

| Energy Management | Venue Energy-Saving Measures | Over 70% of the lighting systems in the headquarters office area have been upgraded, resulting in a 22% reduction in lighting energy consumption compared to the previous quarter. Additionally, intelligent temperature control technology has been introduced in the air conditioning systems, reducing energy consumption in office spaces by 15%. | 40% | 7.5 | |

| Data Center Energy Optimization | Self-developed intelligent energy management systems have been deployed in multiple large-scale data centers, with energy utilization rates in these data centers increasing by 8% compared to the previous quarter, and energy consumption per unit of computing power decreasing by 6%. | ||||

| Renewable Energy Utilization | In a data center in a European country, a long-term power purchase agreement was signed with a local renewable energy supplier, increasing the proportion of renewable energy used from 30% to 45% in this quarter. In China, distributed solar photovoltaic power generation equipment has also been installed in some office buildings and data centers, with photovoltaic power generation accounting for 12% of total electricity consumption in this quarter. | ||||

| Resource Recycling and Utilization | Green Product Design | The new smartphone series features a modular design that facilitates disassembly and component recycling at the end of the product life cycle. In terms of raw materials, 35% of the phone casings are made from recycled plastic. Material substitution technology has been used to reduce resource consumption during the production process. According to an assessment, the green design ratio of the new smartphone series has increased by 15% compared to the previous generation. | 30% | 7 | |

| Resource Optimization in Production Process | In the manufacturing process, Huawei has optimized production processes and supply chain management to reduce raw material waste; introduced advanced production management systems to achieve fine-grained control; and worked closely with suppliers to promote optimization of raw material packaging and reduce the use of packaging materials. This quarter, the amount of raw materials used per unit of product in the manufacturing process decreased by 5% compared to the previous quarter. | ||||

| Recycling System Construction | Continuously improved the product recycling system: In China, established in-depth partnerships with a number of professional recycling corporations to expand recycling channels; online, set up convenient recycling access points on Huawei’s official website and mobile app; offline, set up recycling points in Huawei stores in major cities; overseas, cooperated with well-known local recycling organizations to carry out electronic product recycling, with a waste product recycling rate of 28%, an increase of 3 percentage points over the previous quarter. | ||||

| S | Protection of Employees’ Rights and Interests | Training and Development | We have enriched and improved the employee training system, with the average training time per employee reaching 28 h, an increase of 5 h compared to the previous quarter. We have provided customized leadership training courses for employees with promotion potential. | 40% | 8 |

| Compensation, Benefits and Satisfaction | The corporation’s compensation levels are competitive within the industry, with the addition of supplementary commercial insurance and flexible working arrangements. Employee satisfaction survey results show that employee satisfaction has increased by 3% compared to the previous quarter, reaching 85%. | ||||

| Health and Safety Assurance | Installed advanced fire alarm systems and emergency evacuation equipment; strengthened employee safety training, organized regular safety drills to enhance employees’ safety awareness and emergency response capabilities; provided health consultation and psychological counseling services to employees; and established health stations in some office locations. | ||||

| Supply Chain Social Responsibility | Supplier Audit | Social responsibility audits were conducted on 80% of first-tier suppliers, covering areas such as labor rights, environmental protection, and workplace safety. Audit results revealed that 8 suppliers had instances of overtime work, and 4 suppliers had insufficient investment in environmental protection facilities. | 30% | 6.5 | |

| Rectification and Assistance | For suppliers with overtime issues, Huawei collaborated with them to analyze production processes and personnel allocation, and reasonably scheduled employee working hours. For suppliers with insufficient environmental protection facility investments, Huawei organized expert teams to provide environmental protection technical solutions and assist suppliers in upgrading and renovating their equipment. | ||||

| Community Participation and Public Welfare Activities | Educational Public Welfare Projects | Active educational welfare programs globally. In a certain African country, Huawei collaborated with local governments and educational institutions to launch a digital education empowerment program (the project donated communication equipment, smart teaching terminals, and online education platform services to 20 schools), benefiting over 5000 students | 30% | 7 | |

| Environmental Public Welfare Activities | Large-scale environmental public welfare activities were organized. With the theme of “Green Action, Guarding Our Home”, the total number of trees planted in this quarter reached 15,000. At the same time, garbage classification publicity activities were carried out through a combination of online and offline methods, covering 80 communities, and the number of directly benefited residents exceeded 30,000. These activities have enhanced the public’s environmental awareness and promoted the improvement of the local ecological environment. | ||||

| G | Corporate Governance Structure | Operation of Governance Entities | All governance entities in the corporate governance structure operate in a standardized and efficient manner. In this quarter, the board of directors conducted in-depth discussions on major issues such as the corporation’s business development direction and market expansion strategies; the board of supervisors earnestly performed its supervisory duties to ensure that the corporation’s operations comply with laws, regulations and the articles of association. | 30% | 8 |

| Transparency of Decision-Making Process | The decision-making process is highly transparent. When formulating a new product research and development strategy, opinions are widely collected through internal forums, expert consultation meetings, etc., and after multiple rounds of demonstration and evaluation, it is submitted to the board of directors for deliberation. The corporation promptly discloses decision results and related information to internal employees and external stakeholders. | ||||

| Risk Management and Compliance | Risk Identification and Assessment | Through the risk early warning mechanism and regular risk assessment meetings, various risks including market risks, technical risks, compliance risks, etc., have been identified; the risk of declining market competitiveness caused by lagging technological innovation has been identified; the compliance risks brought by differences in laws and regulations in different countries and regions have been identified. | 40% | 7.5 | |

| Risk Response Measures | In this quarter, through effective risk response measures, some potential risks were successfully resolved, and the impact of policy adjustments in a certain country on the corporation’s business was dealt with in advance, avoiding major losses. | ||||

| Effectiveness of Compliance Management | Compliance training was organized for all employees, with a training coverage rate of 100%. The corporation actively cooperated with the inspections and audits of government departments in various countries, and no major compliance issues occurred. | ||||

| Information Disclosure and Transparency | ESG Report Quality | The content of the report is comprehensive and detailed, covering goals, strategies, practices and achievement data in various aspects such as environment, society and governance. | 30% | 8 | |

| Other Information Disclosure | The corporation’s major information is promptly disclosed through various channels such as the official website, press conferences, and investor relations platforms. | ||||

| Overall score | 7.46 | ||||

| Group Number | Year Quarter | Apple Model | Comparable Model | Profit Decline Rate due to Involutionary Competition |

|---|---|---|---|---|

| 1 | 2020 Q4 | iPhone 12 Pro | Huawei P40 Pro | 0.00% |

| Xiaomi 10 Pro | 11.64% | |||

| Meizu 17 Pro | 19.87% | |||

| Nubia Z20 | 29.29% | |||

| 2 | 2020 Q4 | iPhone 12 | iQOO 3 | 0.00% |

| realme X50 Pro | 6.33% | |||

| OPPO Reno4 Pro | 3.16% | |||

| 3 | 2021 Q4 | iPhone 13 Pro | vivo X70 Pro+ | 0.00% |

| OnePlus 9 Pro | 6.25% | |||

| Honor Magic3 | 11.25% | |||

| Motorola edge s pro | 38.75% | |||

| 4 | 2021 Q4 | iPhone 13 | Xiaomi 12 Pro | 0.00% |

| realme GT | 23.34% | |||

| Nubia Z30 Pro | 21.67% | |||

| 5 | 2022 Q4 | iPhone 14 Pro | Xiaomi 12S Ultra | 0.00% |

| iQOO 9 Pro (Vivo Mobile Com-munications Co., Ltd., Dongguan, China) | 12.50% | |||

| Honor Magic4 Pro | 6.25% | |||

| Huawei Mate 50 Pro | 6.25% | |||

| 6 | 2022 Q4 | iPhone 14 | realme GT2 Pro | 0.00% |

| Nubia Z50 | 15.00% | |||

| 7 | 2023 Q4 | iPhone 15 Pro | vivo X90 Pro+ | 0.00% |

| Xiaomi 13 Ultra | 6.25% | |||

| ZTE Nubia Z60 Ultra | 31.25% | |||

| 8 | 2023 Q4 | iPhone 15 | Huawei P60 Pro | 0.00% |

| OnePlus 11 | 49.82% | |||

| realme GT3 | 61.49% | |||

| 9 | 2024 Q4 | iPhone 16 Pro | vivo X200 Pro | 0.00% |

| OPPO Find X7 Ultra | 5.00% | |||

| Honor Magic7 Pro | 12.00% | |||

| 10 | 2024 Q4 | iPhone 16 | Xiaomi 14 Ultra | 0% |

| Transsion TECNO Phantom X3 | 43.07% |

| Notation | yit | xit | x1it | x2it | x3it |

|---|---|---|---|---|---|

| Meaning | Value of internal interest rate | ESG score | years since establishment | Industry Lerner Index | corporation size |

| y | x | x1 | x2 | x3 | |

|---|---|---|---|---|---|

| y | 1 | ||||

| x | −0.445 ** | 1 | |||

| x1 | −0.087 | 0.226 | 1 | ||

| x2 | −0.068 | −0.465 *** | −0.11 | 1 | |

| x3 | −0.508 *** | 0.566 *** | 0.400 ** | −0.169 | 1 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | y | y | y | y |

| x | −0.059 *** | −0.060 *** | −0.082 *** | −0.053 ** |

| (0.012) | (0.013) | (0.020) | (0.021) | |

| x1 | 0.000 | 0.000 | 0.002 | |

| (0.003) | (0.003) | (0.003) | ||

| x2 | −6.749 * | −5.845 | ||

| (3.836) | (3.489) | |||

| x3 | −0.688 * | |||

| (0.338) | ||||

| _cons | 0.546 *** | 0.545 *** | 1.542 ** | 1.272 ** |

| (0.100) | (0.102) | (0.598) | (0.556) | |

| N | 31 | 31 | 31 | 31 |

| R2 | 0.198 | 0.199 | 0.295 | 0.382 |

| (1) | |

|---|---|

| Variable | y |

| x | −0.045 ** |

| (0.021) | |

| x1 | 0.001 |

| (0.003) | |

| x2 | −5.723 |

| (4.935) | |

| x3 | −0.635 * |

| (0.341) | |

| _cons | 1.210 * |

| (0.692) | |

| N | 26 |

| R2 | 0.343 |

| Pursuit Category Actions Conditions Affecting Internal Roll-Up | Increase R&D Expenses | Decrease Inventory Turnover Rate | Improve Unit Profit Margin | Increase Product Prices | Rising Labor Costs | Increased Capital Expenditures | Taxes Reduced on a Project-by-Project Basis | |

|---|---|---|---|---|---|---|---|---|

| E | Green material research and development | |||||||

| Carbon-neutral factory certification | ||||||||

| Low-carbon construction initiatives | ||||||||

| Purchase of environmentally friendly equipment | ||||||||

| Water recycling systems | ||||||||

| S | Employee salary increases | |||||||

| Barrier-free production line construction | ||||||||

| Enhanced privacy protection | ||||||||

| Rural education partnerships | ||||||||

| G | Rural education partnerships Blockchain-based anti-corruption systems | |||||||

| Circular business models | ||||||||

| ESG data platforms | ||||||||

| Open-source technology patents | ||||||||

| Price Range | Dominant Decision-Making Factors | Average Activation Intensity of the Prefrontal Cortex (μV) | Pro Max Model’s Neuro-Response Intensity for Status-Seeking Consumption |

|---|---|---|---|

| <8000 yuan | Functional value assessment | 12 | 1 |

| ≥8000 yuan | Symbolic Value | 280 | 2.3 |

| Price Range | Main Competitors | Substitution Elasticity | Demand Curve Characteristics |

|---|---|---|---|

| <8000 yuan | Xiaomi 14 Ultra | 0.8 | Flat |

| ≥8000 yuan | Huawei Mate X5 Foldable Screen (12% market share) | 0.19 | Steepening |

| Sales Stage | Price Elasticity | Decay Characteristics | Fitting Function |

|---|---|---|---|

| Initial Sales Period (January–February) | −5.2 | Linear Decay | Linear function |

| Steady-state period (≥3 months) | −15.1 | Exponential Decay (New Product Replacement Pressure) | e−βt function |

| Price Range | Product Positioning | Price Elasticity Characteristics | Price Reduction Effect |

|---|---|---|---|

| <8000 yuan | Volume-driven models | Maintain market share, with inelastic demand | - |

| ≥8000 yuan | The Pro Max series of technological luxury items | Dramatic increase in demand elasticity | Sales growth reached 25% (linear model predicted only 9.2%) |

| Corporation | Estimation Parameter Model | Influence of Price Increase in 2024 on Annual Sales | R&D Investment Ratio | Change in R&D Investment | Forecast of Market Share Change | Sales 2025 | Sales 2026 | Sales 2027 |

|---|---|---|---|---|---|---|---|---|

| Huawei Terminal, Dongguan, China | be the same as the Formula (7) | ¥0.361 billion | 20.80% | 75,088,000.00 | 0.0293% | 1,392,775,500 | 5,373,472,558 | 79,983,953,824 |

| Xiaomi Group-W, Beijing, China | Q = −4.01P + 34,020.42 | ¥0.090873 billion | 6.57% | 5,970,400.00 | 0.00261% | 123,930,264.7 | 169,011,671.1 | 314,336,875.9 |

| Guangdong Ouga Holdings, Dongguan, China | Q = −5.08P + 41,112.66 | ¥0.28295 billion | 6.50% | 18,392,100.00 | 0.007856% | 373,454,228.8 | 492,897,709.6 | 858,609,396.9 |

| Lenovo Group, Beijing, China | Q = −5.35P + 41,100.52 | ¥0.11874 billion | 3.60% | 4,274,700.00 | 0.001872% | 88,990,305.33 | 66,693,307.12 | 37,459,447.38 |

| Haier Group, Qingdao, China | Q = −2.14P + 48,300.09 | ¥0.10537 billion | 4.14% | 4,362,500.00 | 0.001911% | 90,818,399.58 | 78,273,110.02 | 67,460,776.46 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shao, M.; Liu, Y.; Zhao, G.; Sun, H.; Zhao, P. Mitigating Involutionary Competition Through Corporate ESG Adoption: Evidence from the Consumer Electronics Manufacturing Industry. Sustainability 2025, 17, 8998. https://doi.org/10.3390/su17208998

Shao M, Liu Y, Zhao G, Sun H, Zhao P. Mitigating Involutionary Competition Through Corporate ESG Adoption: Evidence from the Consumer Electronics Manufacturing Industry. Sustainability. 2025; 17(20):8998. https://doi.org/10.3390/su17208998

Chicago/Turabian StyleShao, Menghan, Yue Liu, Guanbing Zhao, Haitao Sun, and Peiyuan Zhao. 2025. "Mitigating Involutionary Competition Through Corporate ESG Adoption: Evidence from the Consumer Electronics Manufacturing Industry" Sustainability 17, no. 20: 8998. https://doi.org/10.3390/su17208998

APA StyleShao, M., Liu, Y., Zhao, G., Sun, H., & Zhao, P. (2025). Mitigating Involutionary Competition Through Corporate ESG Adoption: Evidence from the Consumer Electronics Manufacturing Industry. Sustainability, 17(20), 8998. https://doi.org/10.3390/su17208998

_Li.png)