The Synergy of Pollution and Carbon Reduction by Green Fiscal Policy: A Quasi-Natural Experiment Utilizing a Pilot Program from China’s Comprehensive Demonstration Cities of Energy Conservation and Emission Reduction Fiscal Policy

Abstract

1. Introduction

2. Literature Review

2.1. The Synergistic Effect of PCR

2.2. Concerning Green Fiscal Policy and Its Relationship with the Environment

3. Theoretical Analysis and Research Hypotheses

4. Materials and Methods

4.1. Policy Overview

4.2. Construction of Empirical Models

4.3. Variable Selection

4.4. Data Description and Descriptive Statistics

5. Results and Discussion

5.1. Benchmark Regression

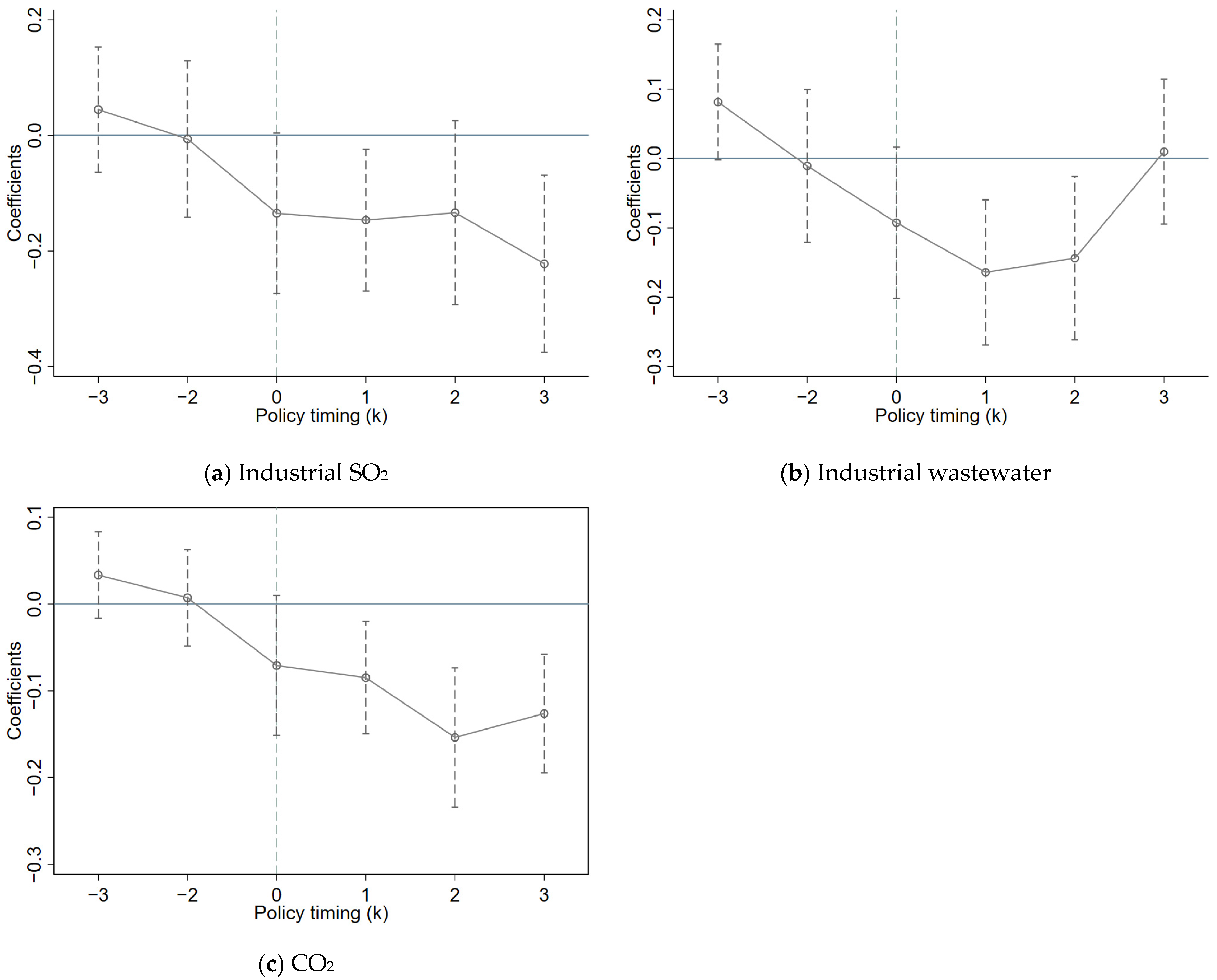

5.2. Parallel Trend Test

5.3. Robustness Tests

5.4. Mechanism Tests

5.5. Heterogeneity Analysis

6. Conclusions

7. Implications and Limitations

7.1. Implications

7.2. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bergquist, P.; Marlon, J.R.; Goldberg, M.H.; Gustafson, A.; Rosenthal, S.A.; Leiserowitz, A. Information about the human causes of global warming influences causal attribution, concern, and policy support related to global warming. Think. Reason. 2022, 28, 465–486. [Google Scholar] [CrossRef]

- Peng, S.G.; Wang, L.; Xu, L. Impact of the marketization of industrial land transfer on regional carbon emission intensity: Evidence from China. Land 2023, 12, 984. [Google Scholar] [CrossRef]

- Preston, B.J. The influence of the Paris agreement on climate litigation: Legal obligations and norms (Part I). J. Environ. Law 2021, 33, 1–32. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, S.S. Preventing carbon emission retaliatory rebound post-COVID-19 requires expanding free trade and improving energy efficiency. Sci. Total Environ. 2020, 746, 141158. [Google Scholar] [CrossRef]

- Jiang, S.Q.; Lin, X.Y.; Qi, L.L.; Zhang, Y.Q.; Sharp, B. The macro-economic and CO2 emissions impacts of COVID-19 and recovery policies in China. Econ. Anal. Policy 2022, 76, 981–996. [Google Scholar] [CrossRef]

- Figueres, C.; Landrigan, P.J.; Fuller, R. Tackling air pollution, climate change, and NCDs: Time to pull together. Lancet 2018, 392, 1502–1503. [Google Scholar] [CrossRef]

- Dong, Z.Y.Z.; Xia, C.Y.; Fang, K.; Zhang, W.W. Effect of the carbon emissions trading policy on the co-benefits of carbon emissions reduction and air pollution control. Energy Policy 2022, 165, 112998. [Google Scholar] [CrossRef]

- Nam, K.M.; Waugh, C.J.; Paltsev, S.; Reilly, J.M.; Karplus, V.J. Carbon co-benefits of tighter SO2 and NOx regulations in China. Glob. Environ. Chang. 2013, 23, 1648–1661. [Google Scholar] [CrossRef]

- Zhao, X.; Guo, Y.F.; Liu, Z.; Xiu, A.T. Boosting green recovery: The impact of green fiscal policy on green total factor productivity. Econ. Chang. Restruct. 2023, 56, 2601–2619. [Google Scholar] [CrossRef]

- Hu, J.B.; Chen, H.; Dinis, F.; Xiang, G. Nexus among green finance, technological innovation, green fiscal policy and CO2 emissions: A conditional process analysis. Ecol. Indic. 2023, 154, 110706. [Google Scholar] [CrossRef]

- Fang, M.; Chang, C.L. Nexus between fiscal imbalances, green fiscal spending, and green economic growth: Empirical findings from E-7 economies. Econ. Chang. Restruct. 2022, 55, 2423–2443. [Google Scholar] [CrossRef]

- Miao, N.; Sharif, A.; Ozturk, I.; Razzaq, A. How do the exploitation of natural resources and fiscal policy affect green growth? Moderating role of ecological governance in G7 countries. Resour. Policy 2023, 85, 103911. [Google Scholar] [CrossRef]

- Liu, H.Y.; Pata, U.K.; Zafar, M.W.; Kartal, M.T.; Karlilar, S.; Caglar, A.E. Do oil and natural gas prices affect carbon efficiency? Daily evidence from China by wavelet transform-based approaches. Resour. Policy 2023, 85, 104039. [Google Scholar] [CrossRef]

- Kartal, M.T.; Pata, U.K. Impacts of renewable energy, trade globalization, and technological innovation on environmental development in China: Evidence from various environmental indicators and novel quantile methods. Environ. Dev. 2023, 48, 100923. [Google Scholar] [CrossRef]

- Jia, W.L.; Li, L.; Lei, Y.L.; Wu, S.M. Synergistic effect of CO2 and PM2.5 emissions from coal consumption and the impacts on health effects. J. Environ. Manag. 2023, 325, 116535. [Google Scholar] [CrossRef]

- Ma, X.N.; Wei, X.L.; Yang, B.J.; Zhao, J.Y. Analysis of carbon pollution synergistic effect of different underlying surface spaces in Xi’an high residential area. Sustain. Energy Technol. Assess. 2023, 56, 103022. [Google Scholar] [CrossRef]

- Nie, C.F.; Lee, C.C. Synergy of pollution control and carbon reduction in China: Spatial-temporal characteristics, regional differences, and convergence. Environ. Impact Assess. Rev. 2023, 101, 107110. [Google Scholar] [CrossRef]

- Zeng, Q.H.; He, L.Y. Study on the synergistic effect of air pollution prevention and carbon emission reduction in the context of “dual carbon”: Evidence from China’s transport sector. Energy Policy 2023, 173, 113370. [Google Scholar] [CrossRef]

- Chae, Y. Co-benefit analysis of an air quality management plan and greenhouse gas reduction strategies in the Seoul metropolitan area. Environ. Sci. Policy 2010, 13, 205–216. [Google Scholar] [CrossRef]

- Yang, X.; Teng, F. Air quality benefit of China’s mitigation target to peak its emission by 2030. Clim. Policy 2018, 18, 99–110. [Google Scholar] [CrossRef]

- Wang, B.; Wang, Y.F.; Zhao, Y.Q. Collaborative Governance Mechanism of Climate Change and Air Pollution: Evidence from China. Sustainability 2021, 13, 6785. [Google Scholar] [CrossRef]

- Chen, H.; Chen, W.Y. Potential impacts of coal substitution policy on regional air pollutants and carbon emission reductions for China’s building sector during the 13th Five-Year Plan period. Energy Policy 2019, 131, 281–294. [Google Scholar] [CrossRef]

- Du, W.J.; Li, M.J. Assessing the impact of environmental regulation on pollution abatement and collaborative emissions reduction: Micro-evidence from Chinese industrial enterprises. Environ. Impact Assess. Rev. 2020, 82, 106382. [Google Scholar] [CrossRef]

- Zhu, J.P.; Wu, S.H.; Xu, J.B. Synergy between pollution control and carbon reduction: China’s evidence. Energy Econ. 2023, 119, 106541. [Google Scholar] [CrossRef]

- Gao, X.W.; Liu, N.; Hua, Y.J. Environmental protection tax law on the synergy of pollution reduction and carbon reduction in China: Evidence from a panel data of 107 cities. Sustain. Prod. Consum. 2022, 33, 425–437. [Google Scholar] [CrossRef]

- Hu, J. Synergistic effect of pollution reduction and carbon emission mitigation in the digital economy. J. Environ. Manag. 2023, 337, 117755. [Google Scholar] [CrossRef]

- Shen, Y.; Yang, Z.H. Chasing green: The synergistic effect of industrial intelligence on pollution control and carbon reduction and its mechanisms. Sustainability 2023, 15, 6401. [Google Scholar] [CrossRef]

- Goenka, A.; Liu, L.; Nguyen, M.H. COVID-19 and a green recovery? Econ. Model. 2021, 104, 105639. [Google Scholar] [CrossRef]

- Zhao, L.H.; Chau, K.Y.; Tran, T.K.; Sadiq, M.; Xuyen, N.T.M.; Phan, T.T.H. Enhancing green economic recovery through green bonds financing and energy efficiency investments. Econ. Anal. Policy 2022, 76, 488–501. [Google Scholar] [CrossRef]

- Tan, X.J.; Dong, H.M.; Liu, Y.S.; Su, X.; Li, Z.X. Green bonds and corporate performance: A potential way to achieve green recovery. Renew. Energy 2022, 200, 59–68. [Google Scholar] [CrossRef]

- Wang, H.T.; Qi, S.Z.; Zhou, C.B.; Zhou, J.J.; Huang, Y.Y. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Lv, C.C.; Fan, J.F.; Lee, C.C. Can green credit policies improve corporate green production efficiency? J. Clean. Prod. 2023, 397, 136573. [Google Scholar] [CrossRef]

- Scholtens, B. Borrowing green: Economic and environmental effects of green fiscal policy in The Netherlands. Ecol. Econ. 2001, 39, 425–435. [Google Scholar] [CrossRef]

- Lin, B.Q.; Zhu, J.P. Impact of energy saving and emission reduction policy on urban sustainable development: Empirical evidence from China. Appl. Energy 2019, 239, 12–22. [Google Scholar] [CrossRef]

- Meng, Z.S.; Sun, H.K.; Liu, X.T. Impact of green fiscal policy on the investment efficiency of renewable energy enterprises in China. Environ. Sci. Pollut. Res. 2022, 29, 76216–76234. [Google Scholar] [CrossRef]

- Hidayat, A.; Manurung, A.B.U.S.; Liliana, L.; Rohima, S.; Pertiwi, R.; Andaiyani, S.; Shodrokova, X. Green bonds and the Sustainable Development Index in Asian countries: Panel data evidence. Argum. Oeconomica 2024, 53, 107–119. [Google Scholar] [CrossRef]

- Hu, Y.F.; Ding, Y.Q.; Liu, J.; Zhang, Q.Z.; Pan, Z.J. Does carbon mitigation depend on green fiscal policy or green investment? Environ. Res. Lett. 2023, 18, 045005. [Google Scholar] [CrossRef]

- Dong, W.; Hou, X.M.; Qin, G.W. Research on the carbon emission reduction effect of green taxation under china’s fiscal decentralization. Sustainability 2023, 15, 4591. [Google Scholar] [CrossRef]

- Lin, B.Q.; Zhu, J.P. Is the implementation of energy saving and emission reduction policy really effective in Chinese cities? A policy evaluation perspective. J. Clean. Prod. 2019, 220, 1111–1120. [Google Scholar] [CrossRef]

- Jin, H.; Yang, J.; Chen, Y.Y. Energy saving and emission reduction fiscal policy and corporate green technology innovation. Front. Psychol. 2022, 13, 1056038. [Google Scholar] [CrossRef]

- Yan, Z.M.; Zou, B.L.; Du, K.R.; Li, K. Do renewable energy technology innovations promote China’s green productivity growth? Fresh evidence from partially linear functional-coefficient models. Energy Econ. 2020, 90, 104842. [Google Scholar] [CrossRef]

- Xie, F.M.; Zhang, B.; Wang, N. Non-linear relationship between energy consumption transition and green total factor productivity: A perspective on different technology paths. Sustain. Prod. Consum. 2021, 28, 91–104. [Google Scholar] [CrossRef]

- Huang, S.Z. Do green financing and industrial structure matter for green economic recovery? Fresh empirical insights from Vietnam. Econ. Anal. Policy 2022, 75, 61–73. [Google Scholar] [CrossRef]

- Guo, W.; Lin, X.R. Market fragmentation of energy resource prices and green total factor energy efficiency in China. Resour. Policy 2022, 76, 102580. [Google Scholar] [CrossRef]

| Variables | Definitions | Obs. | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|---|

| C_Sit | Natural logarithm of total emissions of industrial SO2 | 3041 | 10.5441 | 1.0807 | 4.3175 | 13.4345 |

| C_Wit | Natural logarithm of total emissions of industrial wastewater | 3041 | 8.5764 | 0.9890 | 4.4773 | 11.4773 |

| C_Cit | Natural logarithm of total emissions of CO2 | 3041 | 3.2233 | 0.9206 | 0.1583 | 6.0306 |

| Policyit | Dummy variable of pilot cities | 3041 | 0.0437 | 0.2045 | 0.0000 | 1.0000 |

| GTIit | GTI | 3041 | 0.3943 | 1.0126 | 0.0000 | 17.6220 |

| IUit | IU | 3041 | 38.4590 | 9.4436 | 10.1500 | 83.5200 |

| PGDPit | Economic development | 3041 | 10.3578 | 0.7586 | 4.5951 | 13.0557 |

| Opit | Openness | 3041 | 3.4602 | 1.6289 | 0.0000 | 8.4707 |

| Govit | Government size | 3041 | 0.1488 | 0.0744 | 0.0313 | 1.4852 |

| Finit | Financial development | 3041 | 0.8729 | 0.5543 | 0.1122 | 7.4502 |

| Sciit | Science input | 3041 | 0.0148 | 0.0149 | 0.0000 | 0.2068 |

| Popit | Population density | 3041 | −3.3123 | 0.8305 | −6.9061 | −1.3287 |

| Variables | C_Sit | C_Wit | C_Cit | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Policyit | −0.2136 *** | −0.2068 *** | −0.1115 *** | −0.1303 *** | −0.1344 *** | −0.1375 *** |

| (0.0483) | (0.0469) | (0.0371) | (0.0363) | (0.0252) | (0.0256) | |

| CONSTANT | 10.6762 *** | 9.0550 *** | 9.1572 *** | 11.0778 *** | 4.0073 *** | 2.3013 *** |

| (0.1954) | (1.0555) | (0.0781) | (1.0362) | (0.0617) | (0.5540) | |

| Control variables | Without | With | Without | With | Without | With |

| City dummy variables | With | With | With | With | With | With |

| Year dummy variables | With | With | With | With | With | With |

| Obs. | 3041 | 3041 | 3041 | 3041 | 3041 | 3041 |

| R2 | 0.8739 | 0.8749 | 0.8710 | 0.8722 | 0.9372 | 0.9382 |

| Variables | Total Emissions | ||

|---|---|---|---|

| (1) C_Sit | (2) C_Wit | (3) C_Cit | |

| Policyit | −0.1566 *** | −0.0616 *** | −0.1528 *** |

| (0.0425) | (0.0325) | (0.0233) | |

| CONSTANT | 9.9684 *** | 11.0179 *** | 2.1037 *** |

| (0.9000) | (0.7715) | (0.5813) | |

| Control variables | With | With | With |

| City dummy variables | With | With | With |

| Year dummy variables | With | With | With |

| Obs. | 3041 | 3041 | 3041 |

| R2 | 0.8708 | 0.8725 | 0.9368 |

| Variables | Total Emissions | ||

|---|---|---|---|

| (1) C_Sit | (2) C_Wit | (3) C_Cit | |

| Policyit | −0.1701 *** | −0.1098 *** | −0.1368 *** |

| (0.0482) | (0.0385) | (0.0286) | |

| CONSTANT | 11.0278 *** | 11.7811 *** | 2.8601 *** |

| (0.9841) | (1.0112) | (0.5292) | |

| Control variables | With | With | With |

| City dummy variables | With | With | With |

| Year dummy variables | With | With | With |

| Obs. | 2974 | 2974 | 2974 |

| R2 | 0.8712 | 0.8649 | 0.9339 |

| Variables | (1) GTIit | (2) IUit |

|---|---|---|

| Policyit | 0.4768 *** | 0.7146 * |

| (0.0980) | (0.3676) | |

| CONSTANT | 19.9285 *** | 131.6982 *** |

| (2.7141) | (12.9996) | |

| Control variables | With | With |

| City dummy variables | With | With |

| Year dummy variables | With | With |

| Obs. | 3041 | 3041 |

| Adj R2 | 0.7821 | 0.9174 |

| Variables | Total Emissions | ||

|---|---|---|---|

| (1) C_Sit | (2) C_Wit | (3) C_Cit | |

| Policyit | −0.1351 ** | −0.1228 ** | −0.0944 *** |

| (0.0573) | (0.0505) | (0.0331) | |

| Policyit × Ei | −0.1612 * | −0.0169 | −0.0970 ** |

| (0.0908) | (0.0695) | (0.0490) | |

| CONSTANT | 9.3053 *** | 11.1041 *** | 2.4519 *** |

| (1.0380) | (1.0672) | (0.5607) | |

| Control variables | With | With | With |

| City dummy variables | With | With | With |

| Year dummy variables | With | With | With |

| Obs. | 3041 | 3041 | 3041 |

| R2 | 0.8750 | 0.8722 | 0.9383 |

| Variables | Total Emissions | ||

|---|---|---|---|

| (1) C_Sit | (2) C_Wit | (3) C_Cit | |

| Policyit | 0.0341 | −0.2024 *** | −0.1372 ** |

| (0.0920) | (0.0604) | (0.0676) | |

| Policyit × Ri | −0.3086 *** | 0.0923 | −0.0004 |

| (0.1036) | (0.0701) | (0.0711) | |

| CONSTANT | 9.1645 *** | 11.0451 *** | 2.3014 *** |

| (1.0513) | (1.0378) | (0.5550) | |

| Control variables | With | With | With |

| City dummy variables | With | With | With |

| Year dummy variables | With | With | With |

| Obs. | 3041 | 3041 | 3041 |

| R2 | 0.8752 | 0.8722 | 0.9382 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, L.; Peng, S.; Wang, L. The Synergy of Pollution and Carbon Reduction by Green Fiscal Policy: A Quasi-Natural Experiment Utilizing a Pilot Program from China’s Comprehensive Demonstration Cities of Energy Conservation and Emission Reduction Fiscal Policy. Sustainability 2025, 17, 667. https://doi.org/10.3390/su17020667

Xu L, Peng S, Wang L. The Synergy of Pollution and Carbon Reduction by Green Fiscal Policy: A Quasi-Natural Experiment Utilizing a Pilot Program from China’s Comprehensive Demonstration Cities of Energy Conservation and Emission Reduction Fiscal Policy. Sustainability. 2025; 17(2):667. https://doi.org/10.3390/su17020667

Chicago/Turabian StyleXu, Lei, Shiguang Peng, and Le Wang. 2025. "The Synergy of Pollution and Carbon Reduction by Green Fiscal Policy: A Quasi-Natural Experiment Utilizing a Pilot Program from China’s Comprehensive Demonstration Cities of Energy Conservation and Emission Reduction Fiscal Policy" Sustainability 17, no. 2: 667. https://doi.org/10.3390/su17020667

APA StyleXu, L., Peng, S., & Wang, L. (2025). The Synergy of Pollution and Carbon Reduction by Green Fiscal Policy: A Quasi-Natural Experiment Utilizing a Pilot Program from China’s Comprehensive Demonstration Cities of Energy Conservation and Emission Reduction Fiscal Policy. Sustainability, 17(2), 667. https://doi.org/10.3390/su17020667