1. Introduction

The escalating challenges of climate change are exerting unprecedented pressure on the international community to reconcile economic development with environmental sustainability. Since the Industrial Revolution, persistent reliance on fossil fuels and resource-intensive production patterns have led to a sharp increase in carbon dioxide emissions, exacerbating global warming and ecological degradation [

1,

2,

3]. This tension is particularly acute for developing economies. Foreign direct investment (FDI) has traditionally been regarded as a crucial engine of economic growth, facilitating capital accumulation, industrial upgrading, and knowledge spillovers [

4]. However, the environmental impact of FDI remains contentious. A substantial body of research indicates that FDI tends to relocate energy-intensive industries to regions with less stringent environmental regulations, thereby increasing carbon emissions—a phenomenon consistent with the “Pollution Haven Hypothesis” [

5,

6,

7,

8]. Consequently, developing countries face a dual challenge: harnessing the economic benefits of FDI while mitigating its potential negative environmental externalities.

Concurrently, the digital economy has emerged as a transformative force in reshaping global production networks, trade structures, and patterns of resource allocation. Encompassing digital technologies, data-driven processes, and platform-based interactions, the digital economy not only stimulates productivity but also has profound implications for environmental performance [

9,

10,

11]. Its effects, however, are inherently ambivalent. On the one hand, the proliferation of digital infrastructure, such as data centers and broadband systems, may contribute to rising energy demand and emissions. On the other hand, digitalization enhances allocative efficiency, accelerates the diffusion of low-carbon technologies, and enables systemic improvements in energy utilization [

12,

13]. Recent empirical research even documents nonlinear dynamics between digitalization and emissions, suggesting an inverted U-shaped trajectory akin to the Environmental Kuznets Curve (EKC) [

14].

Despite these insights, the literature has predominantly focused on domestic digital development, paying relatively little attention to digital economy imports as a distinctive channel of technological diffusion. For many developing countries with constrained innovation capacity, cross-border imports of digital services, information and communication technology (ICT) products, and digital platforms constitute a critical mechanism for accessing frontier technologies and managerial practices [

15]. These digital imports may augment absorptive capacity, facilitate the integration of green innovation into local industries, and enhance the environmental benefits of FDI inflows. In this context, digital economy imports hold the potential to attenuate the carbon-intensive trajectory commonly associated with FDI, thereby transforming it from a liability into an enabler of sustainable growth.

Nevertheless, systematic examinations of the interaction between FDI, digital economy imports, and environmental outcomes remain sparse. Prior studies demonstrate that the environmental consequences of FDI depend heavily on host-country conditions, with insufficient absorptive capacity amplifying the likelihood of emission increases (Zheng, 2023) [

16]. The infusion of imported digital technologies may fundamentally alter this dynamic, enabling host economies to capture the “pollution halo” effect of FDI rather than succumbing to the pollution haven outcome. Bridging these two strands of research, the environmental impacts of FDI and the sustainability implications of digitalization offer a novel perspective on the conditions under which developing economies can achieve low-carbon growth in the context of globalization.

This study seeks to address this gap by investigating whether digital economy imports mitigate the environmental costs of FDI in developing economies. The contributions are threefold. First, the analysis introduces digital economy imports as a moderating factor in the FDI–emissions nexus, advancing the discourse beyond the conventional pollution haven framework. Second, it provides cross-country empirical evidence using data from developing economies, thereby moving beyond the limitations of single-country case studies. Third, it integrates insights from the pollution hypothesis, the Environmental Kuznets Curve, and digital spillover theory into a comprehensive framework that links international investment, digital transformation, and carbon emissions.

Accordingly, this paper addresses a central research question: Can digital economy imports enable developing countries to reconcile the growth benefits of FDI with carbon reduction imperatives? By providing both theoretical and empirical insights, the study contributes to ongoing debates on globalization, digitalization, and sustainability, while offering actionable implications for policymakers seeking to attract investment without compromising environmental objectives.

2. Review of Existing Literature

The relationship between foreign direct investment (FDI) and environmental pollution has been a topic of academic discussion for a long time, giving rise to two major research directions. One body of literature argues that FDI exacerbates environmental degradation, a view summarized as the “pollution haven hypothesis”; another emphasizes the “pollution halo effect,” asserting that FDI facilitates the transfer of advanced technologies and generates positive green spillover effects, thereby contributing to improved environmental performance. Additionally, the rise of the digital economy in recent years has introduced new dimensions to the study of the relationship between FDI and the environment.

First, regarding the pollution effects of FDI, classical literature generally emphasizes that differences in environmental regulations lead to capital flows toward developing countries, thereby transferring pollution-intensive industries to countries with lower environmental standards. Copeland and Taylor propose a theoretical model suggesting that when trade liberalization and environmental regulations differ, Southern countries are more likely to become hubs for pollution-intensive industries [

17]. This view has been supported by extensive empirical evidence. For example, Dean et al. used interprovincial data from China to find a significant positive correlation between foreign investment inflows and pollution emissions, particularly in regions with lax regulations [

18]. He studied sulfur dioxide emissions and confirmed that some coastal regions in China experienced severe environmental degradation following FDI concentration [

19]. In reality, China’s status as the “world’s factory” in the 1990s is a classic example: numerous multinational corporations established high-energy-consuming, high-emission factories in Guangdong, Jiangsu, and other regions, bringing employment and foreign exchange income but also causing air pollution and water resource shortages. Similar phenomena have emerged in Southeast Asian countries, such as the large-scale inflow of foreign investment into Vietnam’s textile and dyeing industries, which once caused severe water pollution around Ho Chi Minh City [

20,

21,

22].

In contrast, the “pollution halo effect” emphasizes the technological spillover effects of FDI. Borensztein et al. found that FDI can enhance the productivity of host countries through the combination of capital and knowledge, thereby reducing pollution under certain conditions [

23]. Perkins and Neumayer conducted a cross-national study and found that the environmental efficiency practices of multinational corporations often spill over to local firms, improving overall green standards [

24]. Pao and Tsai found in their study of BRICS countries that there is a long-term cointegration relationship between FDI and carbon emissions, but the technology spillover effect has improved energy efficiency to some extent. In real-world cases, foreign investment in Mexico’s automotive industry brought advanced emission control technologies, helping the country upgrade its industry and gradually move away from the “high-pollution, low-technology” dilemma [

25]. China’s wind power and photovoltaic industries also grew rapidly due to the influx of substantial foreign investment from Europe and Japan, indicating that FDI does not necessarily exacerbate pollution, and its effects are closely related to the host country’s absorption capacity [

26,

27,

28].

Meanwhile, the digital economy has emerged as a transformative force reshaping global production networks, trade structures, and resource allocation patterns. The digital economy encompasses digital technologies, data-driven processes, and platform-based interactions, which not only stimulate productivity but also have profound implications for environmental performance [

29,

30,

31]. However, its impacts are inherently contradictory [

32]. On the one hand, the proliferation of digital infrastructure such as data centers and broadband systems may lead to increased energy demand and emissions [

33]. On the other hand, digitalization enhances allocation efficiency, accelerates the dissemination of low-carbon technologies, and achieves systemic improvements in energy utilization [

34,

35,

36]. Recent empirical studies have even confirmed a nonlinear dynamic relationship between digitalization and emissions, suggesting an inverted U-shaped trajectory similar to the Environmental Kuznets Curve [

37,

38].

Despite these insights, existing literature has primarily focused on domestic digitalization efforts, with limited attention given to digital economy imports as a unique channel for technology diffusion. For many developing countries with constrained innovation capabilities, cross-border imports of digital services, Information and Communication Technology (ICT) products, and digital platforms constitute a critical mechanism for accessing cutting-edge technologies and management practices [

39,

40]. These digital imports can enhance absorptive capacity, facilitate the integration of green innovation into local industries, and strengthen the environmental benefits of foreign direct investment inflows [

41]. In this context, digital economy imports have the potential to mitigate the carbon-intensive trajectories typically associated with FDI, thereby transforming it from a burden into a driver of sustainable growth.

However, systematic research on the interactions between FDI, digital economy imports, and environmental outcomes remains scarce. Previous studies have shown that the environmental consequences of FDI are largely dependent on the host country’s conditions, with insufficient absorption capacity amplifying the likelihood of increased emissions [

42,

43,

44]. The infusion of imported digital technologies may fundamentally alter this dynamic, enabling host country economies to capture the “pollution halo” effect of foreign direct investment rather than becoming pollution havens [

45]. Combining the research directions of the environmental impacts of foreign direct investment with the sustainable impacts of digitalization offers a new perspective on the conditions under which developing economies can achieve low-carbon growth in the context of globalization [

46].

Despite extensive research on carbon emissions and digital transformation, several critical questions remain inadequately addressed in the existing literature: First, digital factors are predominantly treated as domestic digitalization levels, overlooking the cross-border absorption channel of imported digital economy elements technology and datthereby underestimating their potential moderating effect on the environmental impact of FDI. Second, the mixed use of emission metrics without a mechanistic explanation for differences in “total emissions by sector” leads to divergent conclusions that are difficult to apply to specific industrial contexts. Third, variables and statistical definitions lack standardized norms, failing to fully align with international definitions of “digitally deliverable services/digital trade,” thereby weakening cross-country comparisons and knowledge accumulation. Fourth, discussions on the contextual dependence of absorption capacity and the digital divide remain insufficient, leaving unanswered the question of “under what developmental stages and industrial structures” digital factors can more effectively transform the environmental costs of FDI into green gains.

Based on this, this study aims to explore whether digital economy imports can reduce the environmental costs of foreign direct investment in developing economies, thereby bridging this gap. Its contributions are threefold. First, this analysis introduces digital economy imports as a moderating factor in the relationship between foreign direct investment and emissions, thereby expanding the relevant discussion beyond the traditional pollution haven framework. Second, this study provides cross-country empirical evidence using data from developing economies, thereby overcoming the limitations of single-country case studies. Third, this study integrates insights from the pollution hypothesis, the Environmental Kuznets Curve (EKC), and the digital spillover theory into a comprehensive framework linking international investment, digital transformation, and carbon emissions.

Therefore, this paper explores a core research question: Can digital economy imports help developing countries balance the growth benefits of foreign direct investment with carbon reduction targets? This study contributes to ongoing debates on globalization, the digital economy, trade, and investment by providing theoretical and empirical insights.

3. Theoretical Analysis and Research Hypothesis

Developing economies often face significant constraints in terms of infrastructure and technical capacity, which limit their ability to reduce carbon emissions while pursuing industrial growth. Weak digital infrastructure, low levels of technological innovation, and insufficient absorption capacity hinder the dissemination of clean technologies and the adoption of energy-efficient production practices [

47,

48]. In such circumstances, inflows of foreign direct investment may exacerbate reliance on energy-intensive processes, thereby intensifying environmental pressures and validating the predictions of the “pollution haven hypothesis” [

49].

However, the cross-border flow of digital technology is reflected in digital economy trade, such as information and communication technology products, software, and digitally delivered services, which provide an important corrective mechanism. Digital technology imports provide host economies with access to cutting-edge technologies and advanced management practices that would otherwise be inaccessible due to domestic innovation gaps [

50]. By integrating digital solutions into local production systems, developing countries can compensate for infrastructure deficiencies and accelerate the transition to low-carbon development.

Additionally, the import of digital technologies can promote knowledge spillovers, thereby enhancing the absorption capacity of local firms, enabling them to capture the pollution halo effect of FDI rather than becoming pollution havens [

51]. Empirical research indicates that the integration of digital technology imports can significantly improve energy efficiency, optimize resource allocation, and reduce carbon intensity [

52,

53]. In this sense, digital technology imports can serve as a catalyst to offset the structural disadvantages faced by developing economies in pursuing sustainable industrialization.

Based on this, we believe that the interaction between FDI and digital economy imports will produce a conditional path: when domestic conditions are weak, FDI itself may increase emissions, while the injection of digital technology imports enhances the host country’s ability to mitigate such impacts. Therefore, this paper proposes the following theoretical model:

Assuming that carbon emissions in developing countries are determined by output, energy consumption, and technological level, a generalization can be given by Formula (1):

where

is output,

is energy input, and

is technology level. Assume that the function satisfies

,

, and

, i.e., output and energy expansion will increase emissions, while technological progress can reduce emission intensity. This assumption is consistent with the basic assumptions of the Environmental Kuznets Curve (EKC) and green growth literature.

In an open economy, output is driven not only by domestic capital and labor, but also by FDI. Assuming that the production function is given by Formula (2):

where

is domestic capital,

_ it is foreign direct investment,

is

is technological level.

in developing countries often concentrated on energy-intensive industries in the early stages, so its entry was usually accompanied by an increase in emission intensity. Let carbon emission intensity

, and assume that its form is given by Formula (3):

This means that the more FDI is invested, the greater the unit emissions of output. Under this assumption, the carbon emission level can be expressed by Formula (4):

Taking the partial derivative of

in Equation (4) yields Equation (5):

This shows that in the absence of external technology absorption capacity, the inflow of exacerbates carbon emissions, which is a typical example of the “pollution haven effect”. In other words, due to insufficient digitalization in the early stages of development, in developing countries it is more likely to take the form of energy-intensive production methods, thereby increasing carbon emissions.

However, FDI may also promote emissions reductions through technology spillovers, provided that the host country is able to effectively absorb these foreign technologies. Let the level of technology be given by Formula (6):

Among them, represents digital economy imports, is a monotonically increasing function that satisfies . This reflects that the more digital economy imports there are, the more it helps the host country improve its information infrastructure and knowledge absorption capabilities, thereby increasing the efficiency of utilizing foreign green technologies.

Thus, carbon emission intensity can be rewritten as Formula (7):

The last item represents the interaction between digital economy imports and

: as imports of digital economy products and services increase, foreign green technology spillovers are absorbed more effectively, thereby weakening the pollution effect of

. Substituting the expression into the carbon emission function, we obtain:

Further taking the partial derivative of FDI:

If , the result is significantly positive, meaning that in the absence of digital economy imports, FDI exhibits a pollution haven effect on carbon emissions; when DEIM is large, if the following condition is satisfied: , Then the marginal effect turns negative, indicating that digital economy imports can transform FDI from a source of pollution into a green driving force.

The derivation process provides direct theoretical support for the research hypothesis: first, in the absence of digital economy imports, the early role of FDI manifests as a pollution haven effect; second, digital economy imports can directly reduce emission levels; third, there is a complementary relationship between digital economy imports and FDI, which can weaken or even reverse the pollution effect of FDI.

Based on this, this paper proposes the following research hypotheses:

H1. In the absence of digital economy imports, FDI will significantly increase carbon emissions.

H2. Digital economy imports can directly reduce carbon emission intensity.

H3. Digital economy imports weaken the pollution effect of FDI and promote its green transformation.

4. Data and Econometric Model

To study the impact of Foreign Direct Investment (FDI) on , this study uses five indicators of carbon dioxide emissions in developing countries as dependent variables, namely total carbon dioxide emissions () per capita carbon dioxide emissions (), carbon intensity per unit of GDP (), carbon dioxide emissions from industrial combustion (), and carbon dioxide emissions from industrial processing (), with foreign direct investment inflows as the core independent variable.

We focus on analyzing whether the coefficient

of the core independent variable

is significantly negative to verify the relationship between carbon dioxide emissions and FDI in developing countries. Based on the assumptions, our model generally looks like this:

And consider the interaction term between digital economy imports (

) and the suppression of FDI’s impact on

emissions:

where

denotes country,

denotes year,

represents individual fixed effects, and

represents time fixed effects.

variables encompass energy structure, industrialization levels, and geopolitical risks which elevate carbon emissions by disrupting energy supply and pricing, severing supply chains, altering investment and industrial structures, increasing energy intensity per unit output, and delaying the diffusion of low-carbon technologies. Trade openness acts as a control variable for carbon emissions through the combined effects of scale economies from expanded production and transportation, structural effects from reshaping industrial structures, and technological effects from introducing new technologies. Among them,

represents the inflow of foreign direct investment at actual prices. The level of industrialization is measured by the proportion of industrial output in GDP, while the level of trade openness is measured by the proportion of trade in GDP. Additionally, to more closely approximate the actual net absorption intensity of exogenous digital elements, imports represent cross-border platform-based inputs of technology and data, while subtracting exports eliminates domestic digital supply capacity. This approach thus better reflects the degree of digitalization “sourced from abroad”. The core interaction variable, digital economy imports (

), is represented by the difference between digital economy imports and digital economy exports. For ease of explanation, except for geographical risk, all variables are expressed as natural logarithms, and all amounts are actual prices after being divided by the consumer price index. All variable data are sourced from the World Bank. Descriptive statistics for each variable are shown in

Table 1.

We selected panel data covering both low-income and middle-income countries from 2010 to 2022. The sample countries are listed in

Appendix A,

Table A1.

Table 1 shows the descriptive statistics of the main variables. Overall, carbon emission-related indicators show significant heterogeneity. The standard deviations of total carbon emissions (ln

e) and per capita carbon emissions (ln

pc) are both high, reflecting significant differences in emission scale and intensity among developing countries. Foreign direct investment (lnFDI) and digital economy imports (lnDENI) both exhibit significant fluctuations, revealing uneven distribution in capital inflows and access to digital factors. Meanwhile, energy structure (lnES), industrial structure (lnIND), and trade openness (lnTO) indicate differences in economic development paths and openness levels. Statistical characteristics indicate that there are significant structural differences within the sample, providing a solid data foundation for further testing the moderating effect of digital economy imports on the relationship between FDI and carbon emissions.

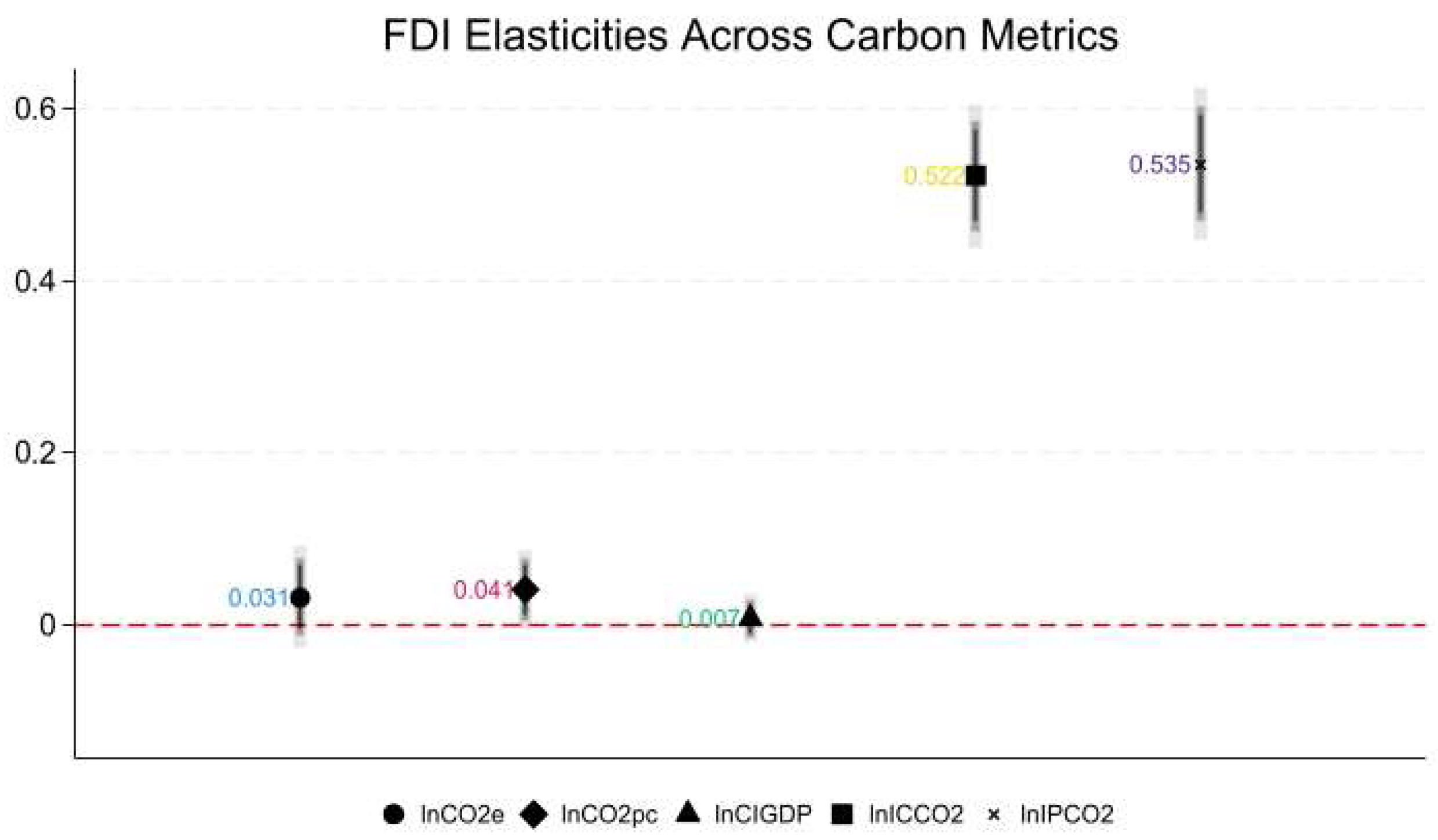

Table 2 reports the regression results of foreign direct investment on five carbon emission indicators. The results show that FDI has a positive relationship with total carbon emissions, but it is not statistically significant. However, it has a positive and significant impact on per capita carbon emissions, indicating that FDI inflows tend to increase the emission pressure per capita in the host country. In contrast, although the coefficient of FDI on carbon emissions intensity per unit of GDP is positive, it is not significant, suggesting that FDI does not play a stable role in carbon emission efficiency and has limited effect on improving the relationship between economic output and carbon emissions. In terms of structural emission indicators, FDI has a highly significant positive effect on both consumer-end carbon emissions and production-end carbon emissions, indicating that FDI mainly exacerbates carbon emission pressures by promoting the expansion of production and consumption in energy-intensive sectors. Overall, the environmental effects of FDI are not robust in terms of scale and efficiency but exhibit a significant emission-promoting effect in terms of structure, which is consistent with the “pollution haven effect” hypothesis and reveals that FDI may exacerbate the carbon emission burden of developing countries in the absence of effective absorption mechanisms.

Figure 1 intuitively shows the elasticity effect of foreign direct investment (FDI) on different carbon emission dimensions. The results indicate that the impact of FDI on overall carbon emissions and carbon intensity per unit of GDP is close to zero and not statistically significant, suggesting that FDI does not have a stable effect on overall scale or efficiency. However, FDI exhibits a significant and relatively high positive elasticity effect in terms of per capita carbon emissions, industrial combustion carbon emissions, and production-end carbon emissions, particularly in structural indicators. This result reveals that FDI primarily drives carbon emissions through consumption expansion on the demand side and production aggregation on the supply side, rather than through improving output efficiency to achieve emission reductions. In theory, these three types of indicators correspond to the per capita emission characteristics emphasized by the environmental Kuznets curve, the demand effect in the consumption-driven emission theory, and the production spillover effect described by the “pollution haven hypothesis”. Therefore, they can better reflect the true environmental consequences of FDI on carbon emissions than simply examining total emissions of carbon intensity.

Table 3 compares the impact of lnNFDI on per capita carbon emissions (ln

pc) under different panel model settings and determines the optimal model through a series of statistical tests. First, the Breusch–Pagan LM test results were significant (LM = 3824.43,

p < 0.01), rejecting the assumption that pooled OLS is superior, indicating that a random effects or fixed effects model should be used. Further Hausman test results were also significant (χ

2 = 25.18,

p < 0.01), indicating that individual effects were correlated with explanatory variables. Therefore, random effects should be discarded in favor of fixed effects. In addition, the likelihood ratio (L-R) test results were significant (77.47,

p < 0.01), indicating that introducing the time effect into the fixed-effects model can effectively improve the model’s goodness of fit and robustness. In summary, based on the statistical logic of stepwise testing, the two-way fixed effects model was identified as the optimal setting. This choice allows for the simultaneous control of unobservable heterogeneity between countries and annual macroeconomic shocks, thereby ensuring the reliability and consistency of the estimation results.

The regression results show that lnNFDI has a significant positive effect on various carbon emission indicators, indicating that foreign direct investment has a “pollution effect” on carbon emissions in the initial stage. Specifically, the coefficient of lnNFDI on per capita carbon emissions lnpc is positive and significant at the 1% level, indicating that FDI inflows significantly increase per capita carbon emissions in developing countries. The results are consistent with H1, i.e., transnational capital expands production activities in developing countries with relatively lax environmental regulations, thereby exacerbating local environmental pressures.

Furthermore, lnNFDI also has a significant positive impact on industrial combustion carbon emission intensity ln- and industrial processing carbon emission intensity ln-, with relatively large coefficient values, which are significant at the 5% and 10% levels, respectively. This means that FDI inflows not only directly increase carbon emissions, but also further increase carbon intensity through industrial structures that favor high-energy-consuming sectors and inefficient energy use. In summary, FDI exhibits significant environmental “negative externalities” in developing countries, and its role in driving carbon emissions highlights the environmental costs associated with capital-driven growth paths, providing empirical support for explaining the complex relationship between FDI and carbon emissions.

Table 4 presents the regression results for the interaction term incorporating digital economy imports. The estimated results of the interaction term further reveal the moderating effect of digital economic development on the relationship between FDI and carbon emissions. The empirical results show that the interaction term between lnNFDI and lnDENI exhibits a significant negative coefficient in the regression of ln

-

and ln

-

and is valid at the 1% or 5% significance level. It shows that as the level of the digital economy improves, the promotional effect of FDI on carbon emission intensity significantly weakens, demonstrating the “digital suppression effect”. In other words, although FDI inflows themselves may increase carbon emissions, the expansion of digital economy imports can mitigate the environmental burden of FDI by improving the efficiency of information technology applications, optimizing energy allocation, and promoting industrial digital transformation. This finding is consistent with the theory of “green spillover effects of the digital economy” and satisfies our proposed H2 and H3, emphasizing that digital technology can act as a “buffer” between capital inflows and environmental governance. Especially in terms of industrial carbon emissions and energy-related emissions, the development of the digital economy has significantly curbed the negative externalities of FDI, meaning that the digitalization process has provided developing countries with a new path to attract foreign investment while achieving carbon emission reductions.

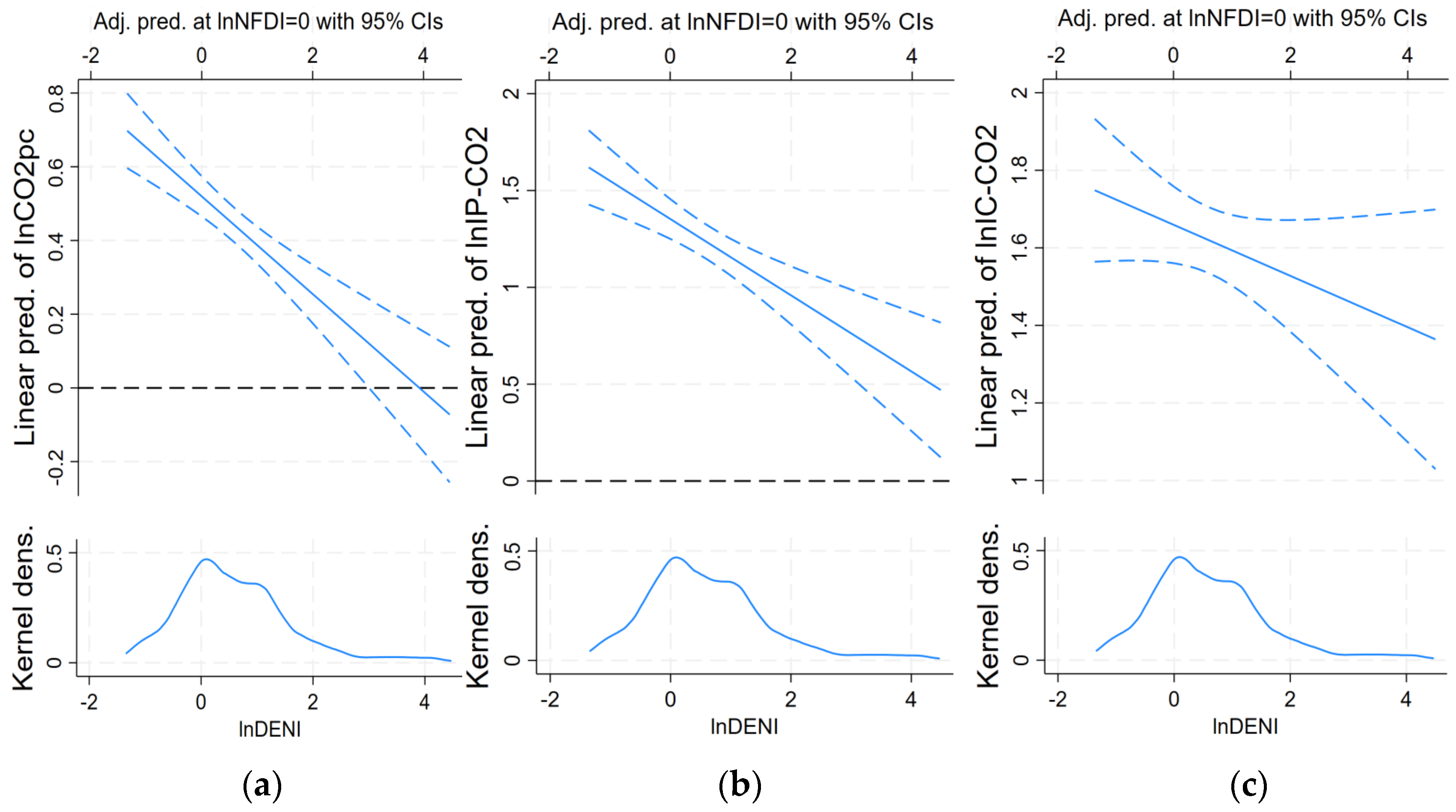

Figure 2 illustrates the marginal effect of FDI and digital economy interaction on carbon emissions. From the results of per capita carbon emissions ln

pc, although the interaction term did not reach statistical significance, the marginal effect curve showed a monotonically decreasing trend. As the level of the digital economy improved, the positive marginal effect of FDI on per capita emissions gradually converged and approached zero. The evidence shows that the impact of FDI on the environment is not linear and fixed, but rather regulated by the level of digital development.

Although the null hypothesis cannot be completely rejected in the significance test, the trend of the effect function indicates that digitalization has a potential buffering effect, which to a certain extent mitigates the impact of emissions growth caused by foreign capital inflows. In the model of industrial combustion carbon emissions (ln-) and industrial production carbon emissions (ln-), the interaction term coefficient is significantly negative, and the marginal effect curve declines to zero or even negative values in higher digital economy intervals, indicating that the digital economy can significantly weaken or even reverse the pollution effects of FDI in both statistical and economic terms. When the level of digital economy imports is high, the promotional effect of FDI on carbon emissions is no longer significant, and in some cases, it even turns into a reduction effect. In other words, the relationship between FDI and carbon emissions has undergone structural changes in the context of the digital economy. The environmental costs brought about by FDI are effectively absorbed and rebalanced under digital import conditions. In other words, digital economy imports can effectively curb the impact of FDI inflows on carbon emissions in developing countries.

Endogeneity, Heterogeneity, and Robustness Issues

Table 5 uses the instrumental variables two-stage least squares (IV-2SLS) method to identify the potential endogeneity of the relationship between FDI and carbon emissions. The results of the first stage regression indicate that the instrumental variables are significantly correlated with FDI, and the C-D Wald F test value (2166.81,

p < 0.01) is much higher than the commonly used threshold, indicating that there is no weak identification problem with the instrumental variables. The results of the second stage regression show that FDI still has a significant positive impact on multidimensional carbon emission indicators (ln

pc, ln

-

, ln

-

), and the coefficient scale and significance level are highly consistent with the benchmark regression. This means that the promotional effect of FDI on carbon emissions is not driven by endogenous bias but rather has robust causal explanatory power. At the same time, the interaction term between FDI and digital economy imports still shows a significant negative relationship in the ln

-

and ln

-

2 models, further validating the role of the digital economy in alleviating foreign investment environmental pressures. It shows that digital economy imports can effectively improve energy efficiency and weaken the carbon emission expansion caused by FDI.

In addition, the model incorporates fixed effects for year and individual in the estimation process to control for unobservable time shocks and regional heterogeneity. The results indicate that the positive effect of FDI on carbon emissions remains stable under different settings and is not driven by specific years or regions. This not only reinforces the robustness of the results but also enhances their extrapolation and policy implications. Overall, the IV-2SLS estimation alleviates potential endogeneity issues and simultaneously validates the moderating role of digital economy imports in the relationship between FDI and carbon emissions in both statistical and economic terms. This finding is highly consistent with recent research conclusions on the interaction between global production networks and environmental governance [

54,

55,

56].

In summary, the empirical results are highly consistent with the research hypotheses proposed in this paper. FDI shows a significant positive impact under different carbon emission indicators, indicating that foreign capital inflows still exhibit a strong pollution effect in the context of developing countries, which is consistent with the core expectation of H1. At the same time, digital economy imports played an important regulatory role, with their marginal effects significantly weakening the driving force of FDI on carbon emissions. This indicates that the diffusion and application of digital technologies can effectively alleviate the environmental pressure brought about by foreign investment by improving energy efficiency, promoting green innovation, and optimizing industrial structure.

These findings collectively validate the core hypotheses H2 and H3 of this paper, namely that FDI exacerbates carbon emissions in the short term, but the increase in digital economy imports can effectively mitigate its negative environmental effects and exhibit an uneven regulatory mechanism across industries.

5. Discussion of Findings

This paper examines the relationship between foreign direct investment (FDI), digital economic development, and carbon emissions through theoretical modeling and empirical analysis, revealing important new mechanisms in the context of developing countries. The research findings indicate that FDI does indeed exacerbate carbon emissions in the short term, a finding that validates the effectiveness of the “pollution haven hypothesis”. However, the deepening development of digital economy imports can significantly mitigate the carbon emissions resulting from FDI. This mechanism not only enriches the research framework on the relationship between FDI and the environment but also provides a new theoretical perspective for the interdisciplinary field of international economics and environmental economics.

At the policy level, the findings of this study underscore the strategic significance of the digital economy in achieving the dual goals of openness and sustainability. For developing countries, weak infrastructure and limited technological capabilities often exacerbate the environmental pressures associated with FDI. However, in the short term, importing digital economy products and services can help alleviate this contradiction to some extent. Digital economy imports not only help address deficiencies in domestic digital infrastructure and technological capabilities but also enhance energy efficiency, promote the diffusion of green innovation, and strengthen environmental constraints on foreign-invested enterprises through external digital tools such as big data, artificial intelligence, and blockchain. Therefore, developing countries should concurrently advance digital economy development and fully leverage digital product imports when formulating foreign investment strategies to avoid falling into a “path dependence” where environmental pollution is traded for capital inflows. Compared with other studies, the findings of this paper regarding evidence that “FDI boosts carbon emissions in the short term” align with those of Wei et al. (2022) and Kayeni et al. (2024) [

57,

58], and resonate with the “pollution refuge” mechanism. Simultaneously, this study identifies that digital economy imports exert a significant buffering effect on the FDI emissions relationship, aligning directionally with Li et al. (2024) and Zhu et al. (2024) [

59,

60] on the overall emission-reducing effects of digital trade. However, unlike those studies that treat digitalization as a direct explanatory variable, this paper constructs digital economy imports using the “digitally deliverable services” metric and places it in an interaction term. This reveals that the buffering effect is more robust under the industrial combustion and industrial processing metrics but is not significant at the per capita level. This implies that digital factors primarily mitigate scale- and structure-driven emissions increases induced by FDI through production-side process optimization, energy management, and equipment control. Their impact on aggregate per capita emissions improvements exhibits lagged effects, offering a structural explanation for the divergence in “aggregate-sector” literature. To ensure comparability and verifiability, we propose a phased policy approach: “short-term reliance on digital imports to buffer FDI pollution pressures, long-term consolidation of domestic digital infrastructure and green innovation capabilities”. This avoids path dependence toward “pollution-for-capital trade-offs”.

The innovation of this paper lies in three aspects. First, this paper introduces “digital economy imports” as a moderating variable, re-examining the relationship between foreign direct investment (FDI) and carbon emissions from a new perspective, thereby breaking away from the previous research paradigm that primarily focused on the “pollution haven hypothesis” and the “pollution halo effect”. Second, this paper reveals the compensatory mechanisms of digital economy imports in developing countries, explaining how they mitigate structural constraints such as inadequate infrastructure and limited technological capabilities to reduce the environmental costs associated with FDI. Third, this paper offers practical policy insights, emphasizing that developing countries can rely on digital imports in the short term to mitigate the environmental pressures of FDI, while in the long term, they should strengthen their domestic digital infrastructure and green innovation capabilities to avoid falling into the “pollution-for-capital” development trap.

Of course, this study still has certain limitations. Due to data availability constraints, this paper mainly uses macro-level digital economy indicators. Future research can further combine micro-level enterprise data to examine the emission reduction behavior paths of foreign-invested enterprises under digital conditions. In addition, the digital economy itself may also bring about energy consumption and carbon emission rebound effects. This “double-edged sword” effect is worth further exploration in future research.

In summary, this study not only verifies the mechanism by which the digital economy mitigates the negative environmental effects of FDI, but also provides policy insights for developing countries to achieve coordinated development between openness and green growth. Developing countries are likely to explore a sustainable development path under the dual pressures of global economic integration and the “dual carbon goals”.