Following the implementation of the novel method, the direct-relation matrices of environmental and financial criteria obtained through the reverse DEMATEL approach are presented below. In this study, the criterion weights that were originally derived through the Entropy method by processing sustainability performance data were further utilized as the foundation for constructing direct impact matrices. To enable a meaningful comparison, these matrices, which are essential for reproducing the DEMATEL methodology, were generated using the proposed inverse DEMATEL model. The resulting outputs are compiled and reported in the subsequent section.

This approach not only provides a robust analytical framework but also ensures that both subjective and objective perspectives converge—allowing for a holistic assessment of sustainability performance within the context of corporate innovation strategies.

3.1. Compilation and Evaluation of DEMATEL Direct Impact Matrices for Companies’ Environmental and Financial Sustainability Criteria

The interaction dynamics of environmental sustainability criteria for AKSA, as revealed through the DEMATEL analysis, present notable findings. R&D Expenditures emerge as the central determinant within the system, possessing both the highest total influence score (D + R = 6.66) and the most prominent “cause” role (D − R = 0.90). This indicates a strong capacity of R&D spending to influence other sustainability dimensions within the company. Similarly, Total Greenhouse Gas Emissions holds a strategically important position, with a high total impact value (D + R = 6.07) and a positive cause–effect score (D − R = 0.32), demonstrating the wide-reaching implications of the company’s carbon footprint policies and practices (

Table 3).

In contrast, Total Water Consumption and Amount of Reused Waste are characterized by negative D − R values (−0.83 and −0.44, respectively), classifying them as “effect” criteria within the system—i.e., they are more likely to be influenced by other criteria rather than drive change themselves. Total Waste Amount, with its relatively low total influence (D + R = 3.47), appears to occupy a marginal position within the systemic structure.

These findings suggest that strategic investments in R&D and effective control of greenhouse gas emissions act as key leverage points for shaping overall sustainability performance. On the other hand, water consumption and waste reutilization are more likely to emerge as outcomes of broader environmental strategies. Accordingly, prioritizing criteria with strong causal power in resource allocation and policy development is essential for managing environmental sustainability in a holistic and impactful manner.

In the criterion interaction analysis table generated for the company ARCLK (

Table 4), each sustainability-related criterion is evaluated using the DEMATEL method based on its total influence value (D + R), cause/effect role (D − R), and priority ranking. According to this analysis, Total Greenhouse Gas Emissions, with a D − R score of 2.73, functions as both a cause and an effect criterion and holds the highest total influence value (D + R = 5.46) among all evaluated criteria. This highlights its central role within the sustainability structure of the system.

R&D Expenditures ranks second in terms of total influence, indicating a high degree of interaction with both cause and effect criteria. Amount of Reused Waste and Total Energy Consumption display D − R values close to zero, suggesting that they simultaneously exert influence and are influenced—thus acting as both causal and resultant variables within the system.

In contrast, Total Water Consumption exhibits the lowest total influence value (D + R = 2.35), signifying a relatively marginal role in terms of interaction with other criteria. The values in the D − R (Cause/Effect Role) column reflect each criterion’s structural position in the system. Positive D − R scores indicate a cause role, while negative values reflect an effect role. In this case, all D − R values are relatively close to zero, implying the absence of a strong causal hierarchy and instead suggesting a structure characterized by high mutual interdependence.

According to the DEMATEL results for ARCLK, the interactions between the criteria are distributed in a balanced manner. The Total Greenhouse Gas Emissions criterion, with a D − R of 2.73, emerges as both the strongest cause and the most significantly affected criterion, placing it at the core of the system. Similarly, R&D Expenditures, with a D − R value of 2.34, is highly interconnected, both as a cause and as an effect, underlining the strong relationships between environmental sustainability performance, technological investments, and emissions management.

As most D − R values are close to zero, the system demonstrates a symmetrical structure with reciprocal influences rather than a unidirectional cause–effect pattern. For instance, Total Waste Amount, with a D − R value of 0.11, assumes a relatively stronger cause role, while Total Water Consumption, at −0.11, behaves more as an effect variable.

From the perspective of total influence (D + R), Total Greenhouse Gas Emissions again holds the highest score (5.46), reinforcing its pivotal position. The considerable total influence of R&D Expenditures demonstrates its capacity to directly affect both environmental inputs and outputs. Although the remaining criteria have comparatively lower impact values, they play a complementary role in maintaining systemic balance.

These findings indicate that sustainability strategies should particularly prioritize emissions control and R&D investments, while also ensuring systemic coherence through comprehensive management of water usage and waste treatment processes.

The following analysis presents the results of a DEMATEL-based evaluation of the interaction dynamics among CIMSA’s environmental sustainability criteria. The criteria included in the analysis are: Total Energy Consumption, Total Water Consumption, Amount of Reused Waste, Total Waste Amount, Total Greenhouse Gas Emissions, and R&D Expenditures. In the DEMATEL methodology, the D value represents the extent to which a criterion influences others, while the R value reflects the degree to which a criterion is influenced by the rest of the system (

Table 5).

Total Water Consumption emerges as the most influential criterion, holding the highest D + R value (5.00) and occupying the top priority ranking. It is followed by Total Energy Consumption (4.80) and R&D Expenditures (4.24). This indicates that Total Water Consumption plays a central role in the system, functioning as both an influencer and a recipient of influence from other criteria.

On the other hand, Total Greenhouse Gas Emissions (2.16) and Amount of Reused Waste (2.62) are identified as criteria with relatively lower levels of influence and interaction within the system. A noteworthy finding is that the D − R values for all criteria are exactly zero. This suggests the presence of a balanced structure in which each criterion exerts and receives an equal amount of influence, pointing to a system characterized by reciprocal and symmetrical interdependence.

In conclusion, the DEMATEL results imply that resource-related factors such as water and energy consumption occupy a central position in CIMSA’s sustainability framework. Improvements in these areas are likely to generate broader impacts across the entire system. The findings offer valuable insights for corporate decision-makers regarding the prioritization of environmental sustainability efforts and the strategic allocation of resources.

According to the DEMATEL analysis conducted on ENJSA’s environmental sustainability criteria, “Total Energy Consumption” is identified as the criterion with the highest total effect value (D + R), indicating its central role within the system. This criterion exhibits both a high degree of influence on other criteria (D) and a high degree of being influenced by others (R). Following closely are “Total Greenhouse Gas Emissions” and “R&D Expenditures”, which also hold significant positions in terms of total impact. These findings suggest that investments in R&D can play a strategically powerful role in mitigating the firm’s environmental impacts, particularly in the domains of energy use and greenhouse gas emissions (

Table 6).

Conversely, “Total Water Consumption” and “Amount of Reused Waste” demonstrate relatively lower total effects, implying that these criteria occupy more marginal roles within the system and engage less intensively in cause–effect relationships. The fact that the D − R values of all criteria are close to zero indicates a balanced structure in which each criterion both affects and is affected by others to a comparable extent.

These results provide a valuable roadmap for decision-makers in identifying and prioritizing key areas in the formulation of environmental sustainability strategies.

According to the DEMATEL analysis conducted for the FROTO company, the criterion with the highest total effect value (D + R) is “Total Greenhouse Gas Emissions.” This indicates that this criterion both influences and is influenced by other criteria, underscoring its central role in the system. Ranked second is “R&D Expenditures,” which reflects the firm’s emphasis on research and development in the context of sustainability practices. Third in significance is “Total Energy Consumption,” which assumes a notable role by affecting not only direct environmental outcomes but also other operational criteria (

Table 7).

“Amount of Reused Waste” and “Total Water Consumption” are considered to be moderately influential criteria. In contrast, “Total Waste Amount” exhibits the lowest total effect, positioning it as the least impactful element within the system.

In terms of cause–effect distinction, “Total Greenhouse Gas Emissions” and “R&D Expenditures” are located in the effect group, suggesting that they are outcomes of the system dynamics. On the other hand, criteria such as “Total Energy Consumption” and “Total Water Consumption” act as causal factors, exerting direct influence over other elements.

This analysis not only highlights which areas FROTO should prioritize strategically in terms of environmental sustainability but also clarifies the directionality of internal relationships among criteria. Such interaction-based assessments serve as a critical decision-support tool for enhancing strategic planning and environmental policy effectiveness.

According to the DEMATEL analysis results conducted for the SISE company, the levels of interaction among the criteria and their priority rankings have been clearly identified. The “Amount of Reused Waste” criterion emerges as both the most influential (D = 1.96) and the most influenced (R = 1.96) variable. This finding highlights the central role of this criterion in the system and its strong bidirectional relationships with other environmental indicators (

Table 8).

“Total Waste Amount” (D + R = 1.90) and “Total Energy Consumption” (D + R = 1.84) also demonstrate high total influence values, indicating their importance as key components of the sustainability framework. In contrast, “Total Greenhouse Gas Emissions” (D + R = 1.64) and “Total Water Consumption” (D + R = 1.72) show relatively lower levels of total impact, suggesting that they occupy more peripheral positions in the system.

The D − R values for all criteria are very close to zero, indicating that each criterion simultaneously acts as both a cause and an effect to a nearly equal extent. This reflects a balanced and strongly interconnected structure among environmental sustainability indicators in the SISE case.

In conclusion, prioritizing criteria with higher impact power—especially “Amount of Reused Waste” and “Total Waste Amount”—in the formulation of sustainability strategies may lead to overall system improvement. Such multi-criteria analyses serve as strategic guides for achieving corporate sustainability goals through more informed and balanced decision-making.

According to the DEMATEL analysis of TKFEN’s environmental performance criteria, the “R&D Expenditures” criterion has the highest total impact score (D + R = 5.00). This indicates that R&D investments both strongly influence other criteria and are significantly influenced by them. The second most impactful criterion is “Total Waste Amount” (D + R = 4.52), suggesting that the company’s waste management strategies are highly interactive with other sustainability factors. Ranked third is “Amount of Reused Waste” (D + R = 3.96), which appears to assume a dual role as both an influencing and influenced criterion (

Table 9).

Interestingly, all criteria have a D − R value of zero, indicating a perfectly balanced structure where each criterion functions equally as a cause and an effect. “Total Greenhouse Gas Emissions” (D + R = 3.64) also emerges as an environmentally critical factor, highlighting its systemic influence. “Total Energy Consumption” (D + R = 3.34) and “Total Water Consumption” (D + R = 2.82) demonstrate more limited, yet still notable levels of interaction.

These results suggest that TKFEN’s sustainability policies are predominantly shaped by R&D and waste management, positioning these domains as strategic priorities. The symmetric nature of interactions among the criteria further illustrates that the company’s environmental governance is built upon a balanced and mutually influential system. In this context, decision-makers are encouraged to increase R&D investments while also considering the broader environmental repercussions of such expenditures.

The findings provide valuable guidance for restructuring sustainability strategies and offer a basis for comparative assessments across similar firms. Overall, this multi-criteria analysis approach presents a robust method for quantitatively unraveling complex interdependencies within sustainability performance systems.

According to the DEMATEL-based analysis conducted for TOASA, the interactions among environmental sustainability criteria are clearly delineated. The “R&D Expenditures” criterion emerges as both the most influential (D = 2.50) and the most influenced (R = 2.09) parameter, yielding the highest total impact score (D + R = 4.59) among all evaluated factors. This finding highlights the central role that R&D investments play in shaping TOASA’s environmental sustainability strategies (

Table 10).

“Total Water Consumption,” “Amount of Reused Waste,” and “Total Waste Amount” demonstrate closely aligned total impact scores (D + R = 1.90 and 1.78, respectively), ranking second and third in terms of overall influence. Notably, the D − R values for these three criteria are all zero, indicating a balanced interaction in which each functions equally as both a cause and an effect within the system.

“Total Energy Consumption” ranks fifth with a total impact score of 1.57 and a D − R value of −0.39, suggesting that it operates primarily as a reactive or result-oriented criterion. Similarly, “Total Greenhouse Gas Emissions” registers the lowest total impact (D + R = 1.56) and a marginally negative D − R value (−0.02), indicating its comparatively limited influence and somewhat passive role in the system.

Overall, the analysis reveals that “R&D Expenditures” function as a pivotal element within TOASA’s sustainability framework, while other criteria serve more supportive or responsive roles. To enhance resource efficiency and improve environmental performance, it is recommended that the company prioritize the integration of R&D-driven strategies alongside targeted improvements in water and waste management. These efforts are likely to yield synergistic benefits across the broader sustainability system.

According to the DEMATEL analysis conducted for TCELL, the criterion with the highest total impact is “Total Energy Consumption” (D + R = 5.14). This indicates that the criterion significantly influences other factors while also being influenced by them. Its cause/effect value (D − R = +0.06) suggests that it plays a slightly more active “cause” role in the system (

Table 11).

Ranked second is “Total Greenhouse Gas Emissions” (D + R = 3.90), which demonstrates a strong interaction profile, especially in relation to external environmental influences. With a positive D − R value of +0.38, it can be interpreted as a dominant driver within the decision-making system.

“R&D Expenditures” ranks third in terms of total impact (D + R = 1.98), yet its negative cause/effect score (D − R = −0.44) reveals a predominantly “effect” (influenced) role. In other words, it is more responsive to other sustainability factors than directive.

The criteria “Total Water Consumption,” “Amount of Reused Waste,” and “Total Waste Amount” all share the same total impact score (D + R = 1.88) and have a D − R value of 0, indicating a neutral stance within the system. These factors neither substantially influence nor are significantly influenced by other variables, suggesting they serve as passive elements with low connectivity in the sustainability network.

The relatively low total impact of “R&D Expenditures” places it lower in the priority ranking, implying a secondary role in short-term environmental decision-making. Conversely, the high influence and clear causal role of energy consumption highlight the need for increased focus in this area within TCELL’s sustainability strategy.

In conclusion, this DEMATEL-based analysis provides decision-makers with a scientifically grounded basis for resource allocation and strategic prioritization, emphasizing the central role of energy-related policies in enhancing environmental performance.

According to the DEMATEL analysis conducted for ULKER, the criterion with the highest total impact is “Total Greenhouse Gas Emissions” (D + R = 6.65), highlighting its central and pivotal role within the system. This indicates that the emission levels not only affect other sustainability criteria but are also highly influenced by them, positioning this factor as a key integrative component in the firm’s environmental strategy (

Table 12).

The second most influential criterion is “R&D Expenditures” (D + R = 3.73), revealing a strong interaction between innovation activities and other elements of sustainability. This finding underscores the importance of technological development and research in shaping ULKER’s environmental performance.

“Amount of Reused Waste” ranks third (D + R = 2.41), emphasizing the company’s efforts toward environmental efficiency and waste recovery. Its strategic value lies in its contribution to the circular economy practices within the organization.

In terms of D − R values (cause/effect roles), the highest positive value is observed in “Total Water Consumption” (D − R = +0.10), indicating that it plays a more prominent causal role in the system by influencing other sustainability criteria. Conversely, “Amount of Reused Waste” has a negative D − R score (−0.11), identifying it as an effect criterion—more influenced by other elements than influencing them. Meanwhile, “Total Energy Consumption” exhibits a D − R value of 0, suggesting a balanced role, acting both as a cause and an effect in the network of interactions.

This analysis demonstrates that greenhouse gas emissions constitute the most critical component in ULKER’s sustainability structure, with R&D expenditures serving as a fundamental driver of environmental performance. Additionally, the causal role of water consumption highlights the strategic importance of resource management in achieving long-term sustainability goals.

According to the DEMATEL analysis of AKSA’s financial sustainability performance, the most influential criterion by a significant margin is “Net Profit”. This criterion holds the highest total impact score (D + R = 0.695) and plays a decisive role both as a cause and an effect within the system. Following this, “Operating Profit” emerges as a crucial indicator, reflecting the company’s core operational efficiency. Although “Sales Revenue” ranks third, it remains a critical component in terms of market performance and the company’s ability to generate income. The prominence of these three criteria indicates that AKSA’s financial health is primarily shaped by profitability and revenue generation (

Table 13).

Ranked fourth, “R&D Expenditures” highlights the company’s strategic commitment to long-term competitive advantage and innovation-led growth. While “Equity” and “Total Assets” represent the company’s passive structure and balance sheet strength, their relatively lower total impact scores suggest a more indirect role within the financial system.

Interestingly, all criteria exhibit D − R values of zero, indicating a high degree of systemic balance—each criterion influences and is influenced by others to an equal extent. This symmetry reflects a well-integrated financial structure, where no single criterion dominates the direction of causality.

These findings reveal that AKSA’s financial strategies prioritize profitability and operational efficiency, aligning with a consistent approach toward sustainable growth. Furthermore, the notable position of R&D expenditures underscores the firm’s innovative orientation. In conclusion, the DEMATEL analysis provides a robust structural evaluation that can guide decision-makers in enhancing AKSA’s financial sustainability.

According to the financial impact analysis of ARCLK, the criterion with the highest total impact (D + R) value is Sales Revenue (0.449), positioning it as the most influential factor within the system—both as an influencer and as one being influenced. Sales Revenue demonstrates strong reciprocal relationships with all other criteria and occupies a central position in the financial structure. Ranking second is Net Profit (0.424), which also plays a prominent role in both receiving and exerting influence across the network. The third most influential criterion is Total Assets (0.392), indicating that the firm’s asset structure serves as a significant leverage point for financial sustainability (

Table 14).

Despite representing direct operational performance, Operating Profit has a relatively lower total impact (0.272), suggesting that other criteria exhibit more extensive and balanced interrelations. Equity (0.228) and R&D Expenditures (0.236) are found at the lower end of the ranking, implying that their mutual influence within the system is more limited. However, this limited interaction should not be interpreted as an absence of absolute importance; rather, it reflects a lower degree of connectivity within the system.

The fact that the D − R (causal role) values are very close to zero across all criteria reveals a highly symmetric structure, where each criterion interacts with others in a mutually balanced manner. These findings suggest that ARCLK’s financial system does not operate under a centralized dominance but instead reflects a more equitable and balanced interaction framework. Therefore, strategic decisions should not be based on a single dominant criterion, but rather be evaluated within the context of system-wide integration and interdependence.

This analysis summarizes the causal relationships among the financial sustainability criteria of CIMSA, as examined using the DEMATEL method. In this study, each criterion’s total impact (D + R) and cause/effect role (D − R) were calculated. The Net Profit criterion emerged as the most dominant factor within the system, with a high total impact value of 1.055573, indicating its central role as both a causal and affected variable. It is followed by Operating Profit (0.275445), Sales Revenue (0.265442), Equity (0.204215), and Total Assets (0.128769), respectively (

Table 15).

The D − R values for all criteria are equal to zero, reflecting a highly symmetric structure in which each criterion mutually influences and is influenced by the others. The prominent role of Net Profit as both a cause and effect highlights its significance as a primary indicator of financial health for the company. Likewise, Operating Profit and Sales Revenue appear as critical inputs that should be carefully considered in decision-making processes.

In contrast, balance sheet-based indicators such as Equity and Total Assets exhibit relatively lower influence, suggesting that CIMSA’s financial structure is more sensitive to operational performance than to passive financial indicators. This analysis provides valuable insights into which criteria should be prioritized in financial decision-making and strategy formulation, contributing to a more informed and effective sustainability planning process.

According to the analysis of the direct-relation matrix for ENJSA, the Net Profit criterion holds the highest total impact value (D + R), emerging as the primary determinant exerting the most influence over other financial indicators within the system. This finding indicates that the company’s overall profitability drives other financial metrics and directly shapes its financial sustainability performance (

Table 16).

The second most influential criterion, Sales Revenue, demonstrates the pivotal role of company revenues in determining both operational profitability and capital structure.

In third place, Equity stands out due to its strategic importance in reducing dependency on external financing and reflecting the firm’s internal funding capacity. R&D Expenditures, ranked fourth, are associated with innovation and long-term growth potential. Although its direct impact is relatively limited, it holds significance in terms of its indirect influence across the system.

Operating Profit and Total Assets rank fifth and sixth, respectively. These criteria exhibit relatively weaker influence but are more strongly affected by other variables. This suggests that they are more responsive to external financial conditions and internal strategic decisions rather than serving as primary drivers.

In conclusion, the analysis reveals that Net Profit plays the most critical role in shaping ENJSA’s financial sustainability, while operational and investment-related criteria appear more as resultant variables. These insights serve as a valuable guide for strategic decision-making processes, especially in establishing priorities within corporate financial management and sustainability frameworks.

The DEMATEL-based evaluation conducted to analyze the financial sustainability structure of FROTO has revealed the interaction dynamics among six key financial criteria: Sales Revenue, Operating Profit, Net Profit, Total Assets, Equity, and R&D Expenditures. Within this analysis, the Net Profit criterion stands out as having both the highest total influence (D + R) and the strongest causal influence (D − R), thereby playing a significant and directive role over all other criteria in the system. This finding demonstrates that net profit functions not only as a result-oriented indicator but also as a fundamental input shaping the overall financial system (

Table 17).

Ranked second, Operating Profit serves as a strong determinant of operational performance and directly influences both net profit and sales revenue. This underscores the critical importance of operational efficiency in the company’s sustainability strategy. Total Assets and Equity, which display similar levels of interaction, simultaneously occupy both causal and effect positions in the system, assuming dual roles as both influencing and influenced variables.

In contrast, the Sales Revenue criterion, while having a relatively limited impact, operates as a vital complementary component, particularly in supporting operational profitability. R&D Expenditures, despite exhibiting the lowest total influence in the analysis, retain strategic importance as they reflect forward-looking investment priorities.

Overall, FROTO’s financial sustainability structure demonstrates a profitability-oriented and performance-based framework, where net profit, operating profit, and asset management emerge as dominant factors. The DEMATEL findings clearly identify which financial indicators should be prioritized in the company’s strategic planning processes, offering decision-makers a comprehensive and system-oriented analytical perspective.

The interactions among the financial performance criteria of SISE have been analyzed using the DEMATEL method. According to the results, the “Net Profit” criterion exhibits the highest total influence value (D + R = 0.4295), positioning it as the most central and decisive factor within the system. This indicates that net profit, as a key indicator of profitability, is both significantly influenced by other criteria and exerts a substantial influence on them in return (

Table 18).

Ranked second is “Operating Profit” (D + R = 0.3718), highlighting the strategic importance of operational efficiency in the financial structure. “Sales Revenue” (D + R = 0.3523) also plays a substantial role, demonstrating that the firm’s revenue-generating capacity has a direct impact on its overall financial sustainability. “Equity” (D + R = 0.3052) reflects the strength of the company’s internal capital structure, while “Total Assets” (D + R = 0.2753) appears to be a relatively less influential criterion in this context.

Given that the D − R (cause/effect role) values of all criteria are very close to zero, it can be inferred that the causal and resultant roles of the criteria are nearly balanced. This suggests that SISE’s financial indicators interact with each other in a mutually influential and structurally integrated manner, rather than through a unidirectional cause–effect hierarchy.

In conclusion, net profit, operating profitability, and sales revenue emerge as the most strategic criteria that should be prioritized in assessing the financial sustainability of SISE. This analysis provides valuable guidance to decision-makers in terms of resource allocation and the development of performance improvement strategies.

According to the DEMATEL analysis conducted to evaluate the financial sustainability of TKFEN, the “Net Profit” criterion ranks first in terms of total impact value (D + R), exhibiting the highest values in both influence (D) and being influenced (R). This finding indicates that Net Profit is positioned at the core of the system and maintains strong interactions with other financial sustainability indicators (

Table 19).

Ranked second, the “Operating Profit” criterion also demonstrates a significant network of interrelations, underlining the pivotal role of operational efficiency in shaping the financial structure. “R&D Expenditures”, which ranks third, highlights the strategic importance of innovation activities in supporting long-term financial performance.

In contrast, the “Total Assets” and “Sales Revenue” criteria occupy relatively less central roles within the system. These criteria are more likely to be indirectly associated with other components, rather than exerting a strong direct influence.

The D − R (cause/effect) scores for all criteria are very close to zero, suggesting a balanced structure in which each criterion acts both as a cause and an effect. This reflects a multidimensional and interdependent nature of financial performance, wherein no single criterion operates in isolation. The results of the analysis suggest that decision-makers should prioritize performance-oriented indicators such as Net Profit and Operating Profit when formulating financial strategies. The DEMATEL approach proves to be a valuable tool in uncovering causal relationships within complex decision-making structures and offers a robust basis for strategic prioritization.

According to the DEMATEL-based analysis of TOASO’s financial sustainability criteria, the importance ranking of the indicators was established based on their total influence values (D + R). The criterion with the highest total influence was identified as “Net Profit”, with a value of 0.491, indicating that it is the most influential and central component within the system. This result highlights that net profitability plays a pivotal role in shaping TOASO’s overall financial sustainability structure (

Table 20).

The second most influential criterion is “Operating Profit” with a D + R value of 0.474, closely followed by “R&D Expenditures” at 0.468, which ranks third. These findings suggest that TOASO places considerable emphasis not only on profitability derived from core business operations but also on innovation-driven investments, thereby balancing short-term performance with long-term strategic growth.

In contrast, the “Sales Revenue” criterion, with a total influence score of 0.232, occupies a moderate position within the system. Meanwhile, “Total Assets” (0.168) and “Equity” (0.165) exhibit the lowest total effect values, indicating that they play a more peripheral role in the overall financial influence network.

Interestingly, all criteria show a D − R (cause–effect) score of zero, which indicates a perfectly balanced structure where each criterion exerts and receives influence in equal measure. This symmetrical configuration implies a high degree of mutual interdependence among the financial indicators and reflects a systemic coherence within TOASO’s financial performance model.

The analysis provides valuable insights for decision-makers, suggesting that strategic efforts should primarily focus on enhancing Net Profit and Operating Profit, as these metrics have the greatest leverage in optimizing financial performance. Furthermore, the prominent role of R&D Expenditures demonstrates the firm’s commitment to sustaining competitive advantage and innovation capacity through forward-looking investments.

Overall, the DEMATEL methodology proves instrumental in mapping the complex interrelations among financial sustainability indicators. For TOASO, this approach not only reveals the hierarchical significance of each financial component but also supports evidence-based prioritization in financial planning and resource allocation strategies. These findings offer a robust analytical framework for guiding sustainable financial management practices and long-term value creation.

In the financial sustainability analysis of TCELL, the interrelationships among key financial criteria were thoroughly assessed using the DEMATEL (Decision-Making Trial and Evaluation Laboratory) method. Based on the findings, the criterion with the highest total impact value (D + R) is “Net Profit”, scoring 0.4084, which positions it as the most influential factor within the company’s financial sustainability structure (

Table 21).

Following Net Profit, “Operating Profit” (D + R = 0.3736) and “Total Assets” (D + R = 0.3254) rank second and third, respectively. These results indicate that TCELL’s operational efficiency and asset size substantially influence the overall financial system. Notably, “Sales Revenue” ranks fourth in terms of total impact, implying that although revenue generation plays a meaningful role, it is not as central as profitability and asset management within the system.

“Equity” and “R&D Expenditures” occupy the fifth and sixth positions, respectively. This suggests that capital structure and innovation-oriented investments exert relatively lower centrality compared to other financial dimensions.

The D − R (cause–effect) values for all criteria are found to be very close to zero, signaling a high degree of mutual interdependence among the financial variables. In other words, each criterion simultaneously acts as both a cause and an effect, reflecting a systemic balance within the financial sustainability framework. This reinforces the notion that decision-makers must consider all financial criteria in a holistic and integrated manner rather than in isolation.

In conclusion, the results of this DEMATEL-based analysis highlight the strategic importance of Net Profit and Operating Profit in enhancing TCELL’s financial sustainability. Prioritizing these criteria in policy formulation and strategic planning is likely to yield the most substantial overall impact. The systemic structure revealed by this analysis serves as a valuable decision support tool for developing evidence-based financial sustainability strategies.

In the financial sustainability analysis of ULKER, the ranking of criteria based on their total impact (D + R) values reveals notable insights. The criterion with the highest total impact value is “Operating Profit”, with a score of 0.509, indicating that operational profitability is a key determinant in the company’s sustainable financial management. This is followed by “R&D Expenditures” with a total impact value of 0.456, highlighting the strong influence of innovation investments on overall corporate performance. Ranked third is “Net Profit” (D + R = 0.435), suggesting that profitability plays a significant role in shaping both internal and external financial decision-making processes (

Table 22).

The “Sales Revenue” criterion, with a total impact value of 0.324, ranks fourth, suggesting that while sales performance is important, it does not exert as strong an influence as profitability indicators. “Total Assets” (D + R = 0.205) and “Equity” (D + R = 0.069) appear at the lower end of the ranking, indicating that balance sheet components have a relatively limited influence compared to income-based measures.

In light of these findings, it can be concluded that ULKER should prioritize strategies aimed at enhancing operating profit, sustaining R&D investments, and maintaining profitability in order to strengthen its financial sustainability. This analysis underscores the necessity for strategic financial planning to be guided by performance-oriented decisions, offering a structured approach for managerial focus and resource allocation.

These firm-level results set the stage for

Section 3.2, where the bidirectional interactions between R&D expenditures and sustainability criteria are analysed more systematically.

3.2. Analyzing the Interaction Between Criteria, Centered on R&D Expenses

The visual representations derived from the direct-relation matrices of selected firms systematically depict the bidirectional interaction dynamics between environmental and financial sustainability indicators and R&D expenditures. The analysis employs a dual-axis DEMATEL-based framework, wherein the impact of each sustainability criterion on R&D expenditures is visualized through orange bars, while the reciprocal influence of R&D expenditures on these criteria is represented in yellow. This two-way interaction structure allows for a nuanced understanding of causal dependencies within the sustainability innovation nexus.

The underlying data were generated using a novel inverse-modeling software developed specifically for this study, which employs a reverse-engineered DEMATEL algorithm driven by artificial neural networks. This approach mathematically reconstructs the direct-relation matrix from known criterion weights and integrates it into the classical DEMATEL causal structure. As a result, it becomes possible to simulate how observed sustainability performance metrics could emerge from underlying inter-criteria influences, particularly those mediated by R&D investments.

By leveraging this analytical structure, the model captures both the upstream drivers and downstream outcomes of R&D within a corporate sustainability context. Specifically, the framework highlights how environmental parameters such as total greenhouse gas emissions, energy consumption, and waste reuse exert substantial influence on R&D intensity—while also being shaped by the technological and process innovations facilitated through R&D investments. Similarly, financial criteria such as net profit and operational earnings exhibit lower causal impact on R&D decisions but are significantly affected by R&D-driven efficiency gains.

In sum, this integrative approach positions R&D not merely as a passive expenditure item but as a systemic moderator within the sustainability architecture of the firm. The bidirectional interactions revealed through this enhanced DEMATEL analysis offer actionable insights for strategic resource allocation, innovation policy design, and long-term sustainability planning.

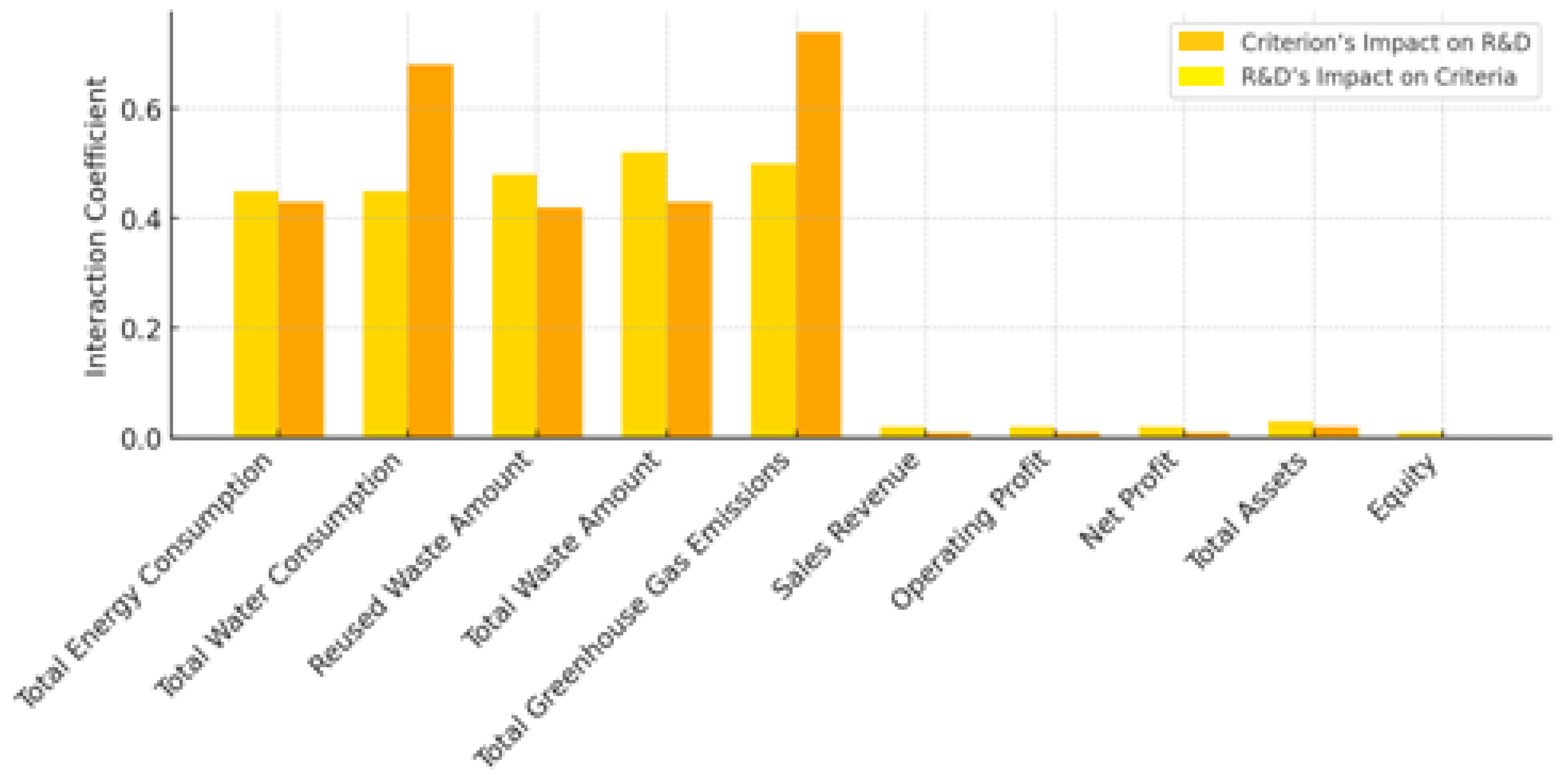

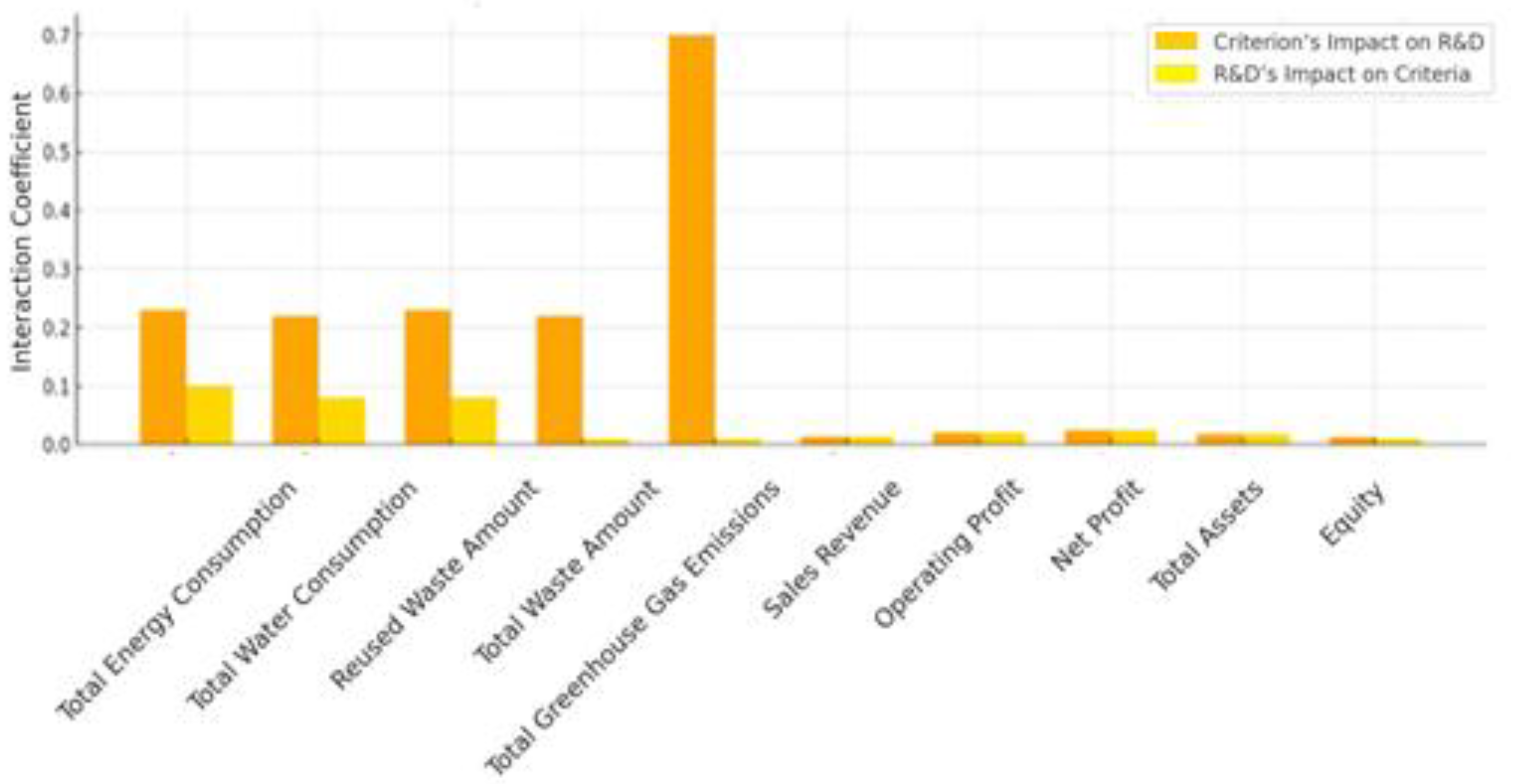

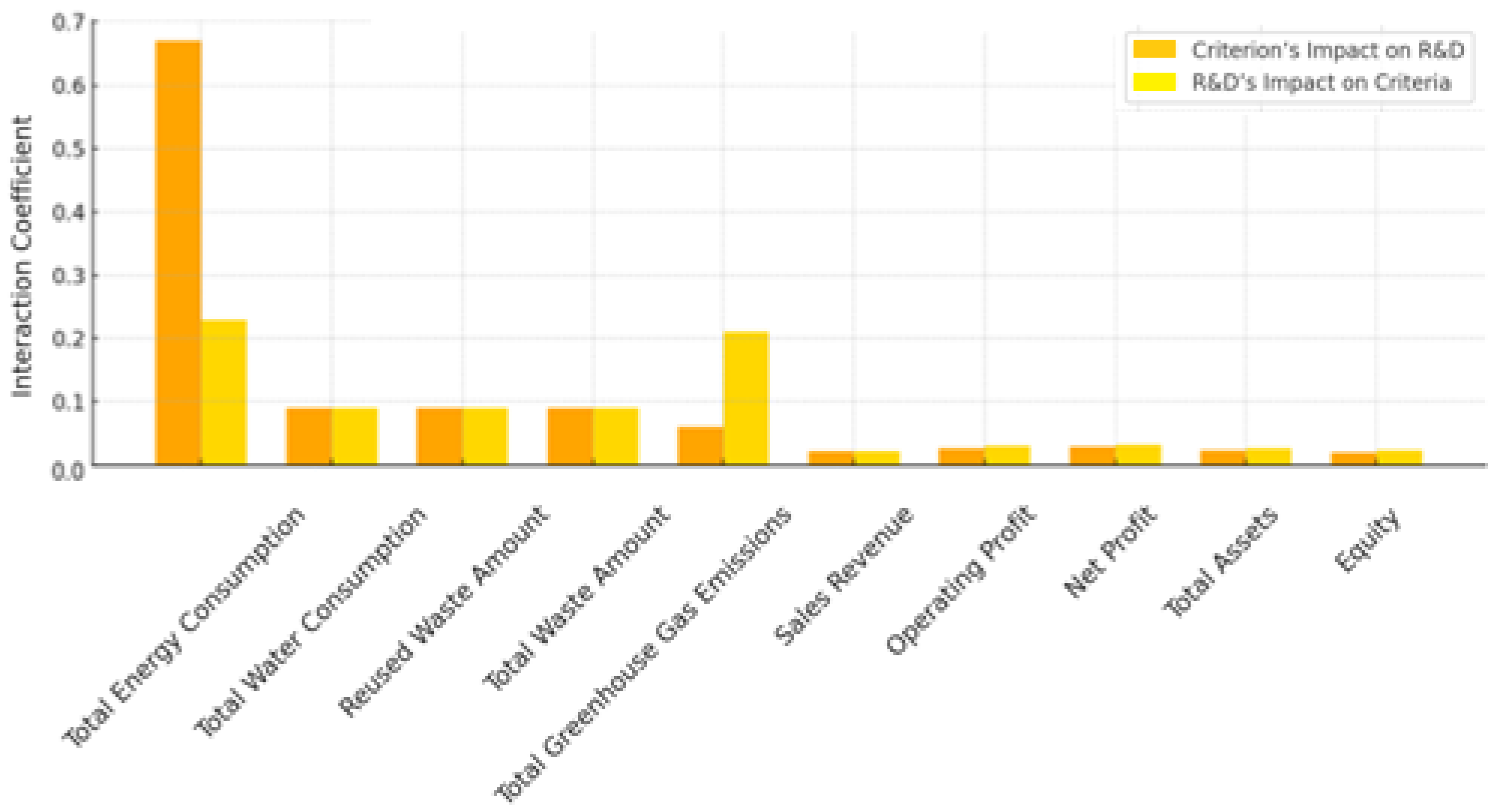

In the graphical analysis pertaining to AKSA’s sustainability structure at

Figure 1, the most prominent bidirectional interaction is observed in the criterion of “Total Greenhouse Gas Emissions.” This environmental factor demonstrates the highest degree of mutual influence with Research and Development (R&D) expenditures. Not only does R&D investment exert a substantial impact on reducing greenhouse gas emissions, but this criterion also significantly stimulates further R&D activities within the firm. This finding highlights the reinforcing feedback loop between environmental targets and innovation-driven corporate behavior.

Following this, “Total Energy Consumption” and “Reused Waste Amount” emerge as other environmental parameters with strong mutual interactions with R&D. The results indicate that emission-reduction strategies have a catalyzing effect on innovation, while the resulting innovative outcomes—particularly in the domain of energy efficiency—contribute to further environmental performance improvements. This mutually reinforcing mechanism underscores the strategic importance of R&D in achieving environmentally sustainable operations.

In contrast, within the set of financial criteria, indicators such as “Net Profit,” “Sales Revenue,” and “Operating Profit” appear to be more heavily influenced by R&D expenditures than they influence R&D in return. This asymmetry suggests that R&D investments are instrumental in enhancing financial outcomes, yet the financial indicators themselves play a relatively weaker role in shaping the firm’s R&D agenda. These findings reveal a unidirectional flow of causality from innovation activities to financial performance, emphasizing the value-generating capacity of R&D.

Meanwhile, “Total Assets” and “Equity” demonstrate relatively weaker reciprocal relationships with R&D, indicating that balance sheet items are less dynamic in responding to or influencing innovation investment decisions. These elements may play a more passive role in the R&D-finance nexus, serving primarily as structural financial foundations rather than active drivers of innovative transformation.

Overall, the analysis suggests that AKSA’s innovation strategy—particularly its R&D investments—serves as a central lever for improving both environmental and financial sustainability outcomes. The positive impact of innovation on profitability is mediated through enhanced energy efficiency and cost reduction, which in turn reinforces the company’s financial resilience. Thus, prioritizing R&D within corporate sustainability strategies can be considered not only an environmental imperative but also a prudent financial decision that yields long-term value creation across multiple dimensions.

As a leading global producer of acrylic fiber, AKSA operates in a sector characterized by high energy intensity and carbon emissions, making its sustainability strategies particularly critical. The firm has invested substantially in clean energy integration, including cogeneration systems and renewable sourcing, to reduce reliance on conventional fuels. In parallel, AKSA channels its R&D resources toward developing low-carbon acrylic products, energy-efficient fiber technologies, and waste valorization processes, aligning with circular economy principles. These initiatives not only mitigate the environmental footprint of production but also enhance the firm’s competitiveness in international markets, where regulatory and customer pressures increasingly demand greener materials. Furthermore, AKSA’s collaborations with global textile consortia and sustainability certification bodies demonstrate its commitment to meeting international standards such as ISO 14064 [

47] for greenhouse gas management and Global Reporting Initiative (GRI) frameworks. Collectively, these sector-specific R&D and sustainability investments position AKSA as a benchmark company in transitioning energy-intensive chemical manufacturing toward a low-emission and innovation-driven trajectory.

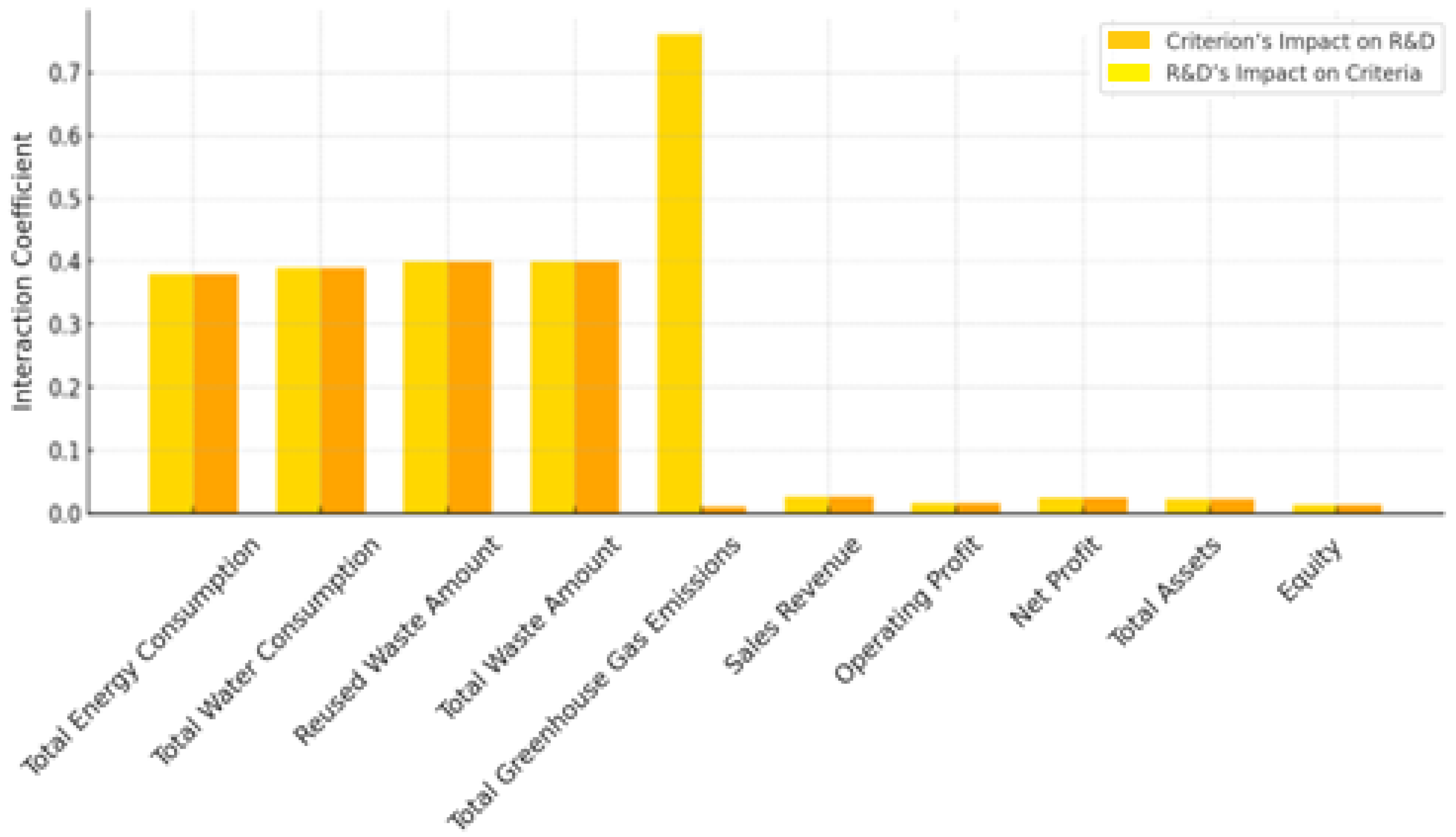

In

Figure 2, the interaction between ARCLK’s environmental sustainability indicators and R&D expenditures reveals a set of strong bidirectional relationships, highlighting the firm’s strategic alignment between innovation and environmental performance. Among the environmental criteria, “Total Greenhouse Gas Emissions” (0.76) and “Total Waste Amount” (0.40) emerge as the most influential drivers of R&D investment decisions. These figures suggest that the firm allocates substantial research and innovation resources toward mitigating emissions and improving waste management practices.

Conversely, the influence of R&D activities on environmental outcomes is most pronounced in the areas of “Greenhouse Gas Emissions” (0.50) and “Reused Waste Amount” (0.40). This indicates that the technological outputs of R&D projects are effectively contributing to the company’s decarbonization and circular economy goals. Interactions with “Total Energy Consumption” and “Total Water Consumption” are moderate, reflecting a focused environmental innovation strategy that prioritizes emission control and resource recovery over general resource efficiency.

From a financial perspective, “Net Profit” (0.0250) and “Sales Revenue” (0.0263) are identified as the most significant criteria influencing R&D expenditures. These results suggest that profitability and revenue generation provide the financial basis or justification for R&D investments. On the reverse side, R&D expenditures show meaningful effects on “Net Profit” (0.0250), “Total Assets” (0.0231), and “Sales Revenue” (0.0263), underlining the role of innovation in supporting firm growth, asset expansion, and overall financial capacity. Meanwhile, the relatively limited mutual influence observed for “Equity” and “Operating Profit” implies that R&D’s financial contributions are more long-term and structural rather than immediately reflected in short-term operational gains.

Overall, the analysis illustrates that ARCLK’s R&D strategy is not only economically motivated but also deeply embedded in the company’s environmental sustainability objectives. The firm adopts a holistic innovation policy that fosters synergies between environmental responsibility and financial resilience—contributing to a balanced and sustainable corporate development model.

As one of the world’s largest white goods and consumer electronics manufacturers, ARÇELİK (ARCLK) operates in a highly competitive global sector where energy efficiency, eco-design, and sustainable production have become central performance benchmarks. The company has consistently invested in R&D for energy-saving household appliances, low-emission cooling technologies, and advanced waste-reduction solutions, aligning with the EU Ecodesign Directive and Energy Labelling regulations. Moreover, ARCLK’s flagship “Green Innovation” program emphasizes the use of recyclable materials, closed-loop production, and digital solutions for smart energy management in appliances, thereby directly linking innovation expenditures with environmental outcomes. On the financial side, the company’s global footprint and partnerships with international brands provide strong revenue streams that are reinvested in sustainability-oriented R&D. ARCLK’s alignment with global initiatives such as the UN Sustainable Development Goals (SDGs) and its integration into international sustainability indices underscore its commitment to balancing environmental responsibility with financial resilience. Taken together, these targeted R&D efforts not only reduce the ecological footprint of its operations but also reinforce the firm’s competitiveness in international markets where consumer preferences and regulatory frameworks increasingly prioritize low-carbon, resource-efficient technologies.

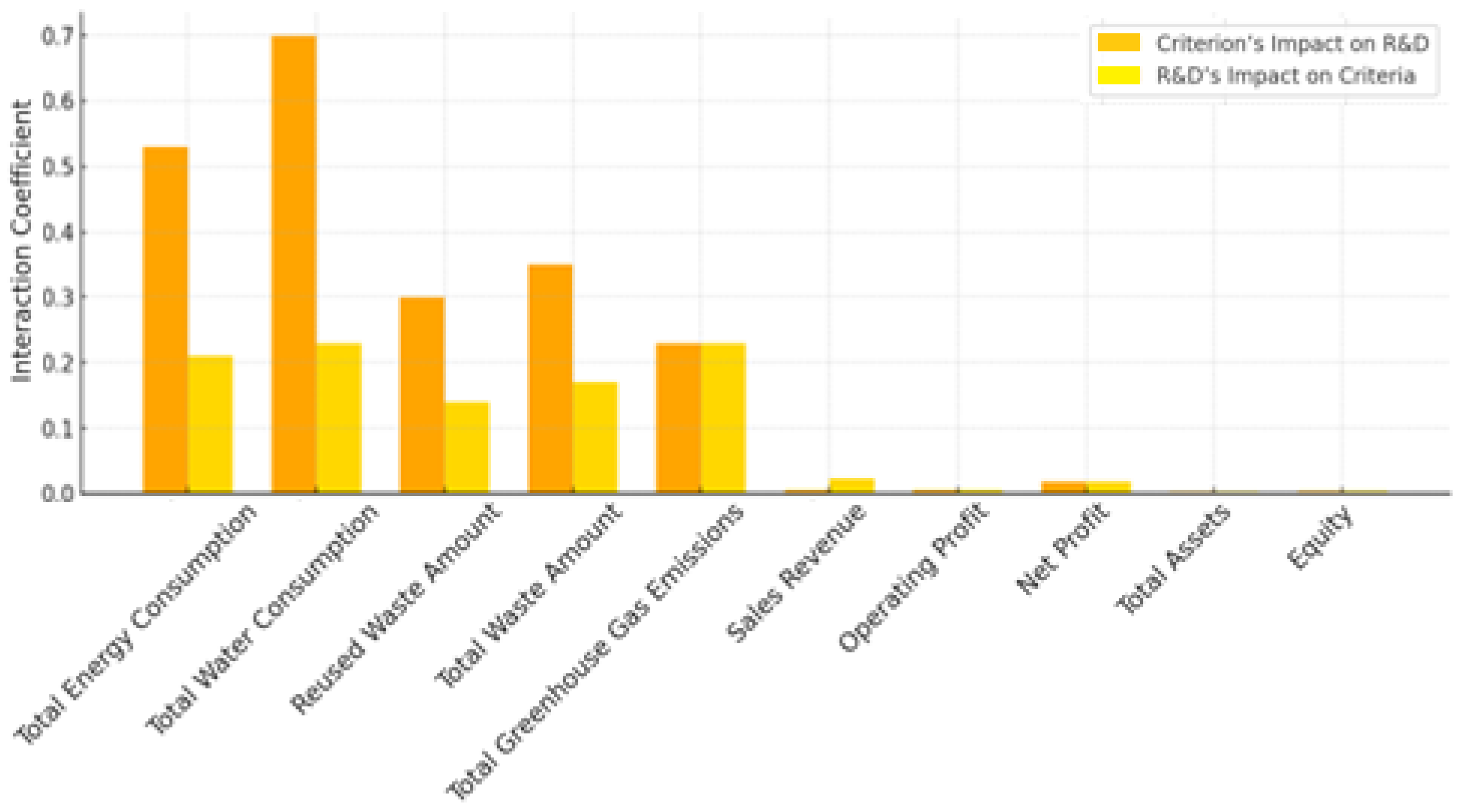

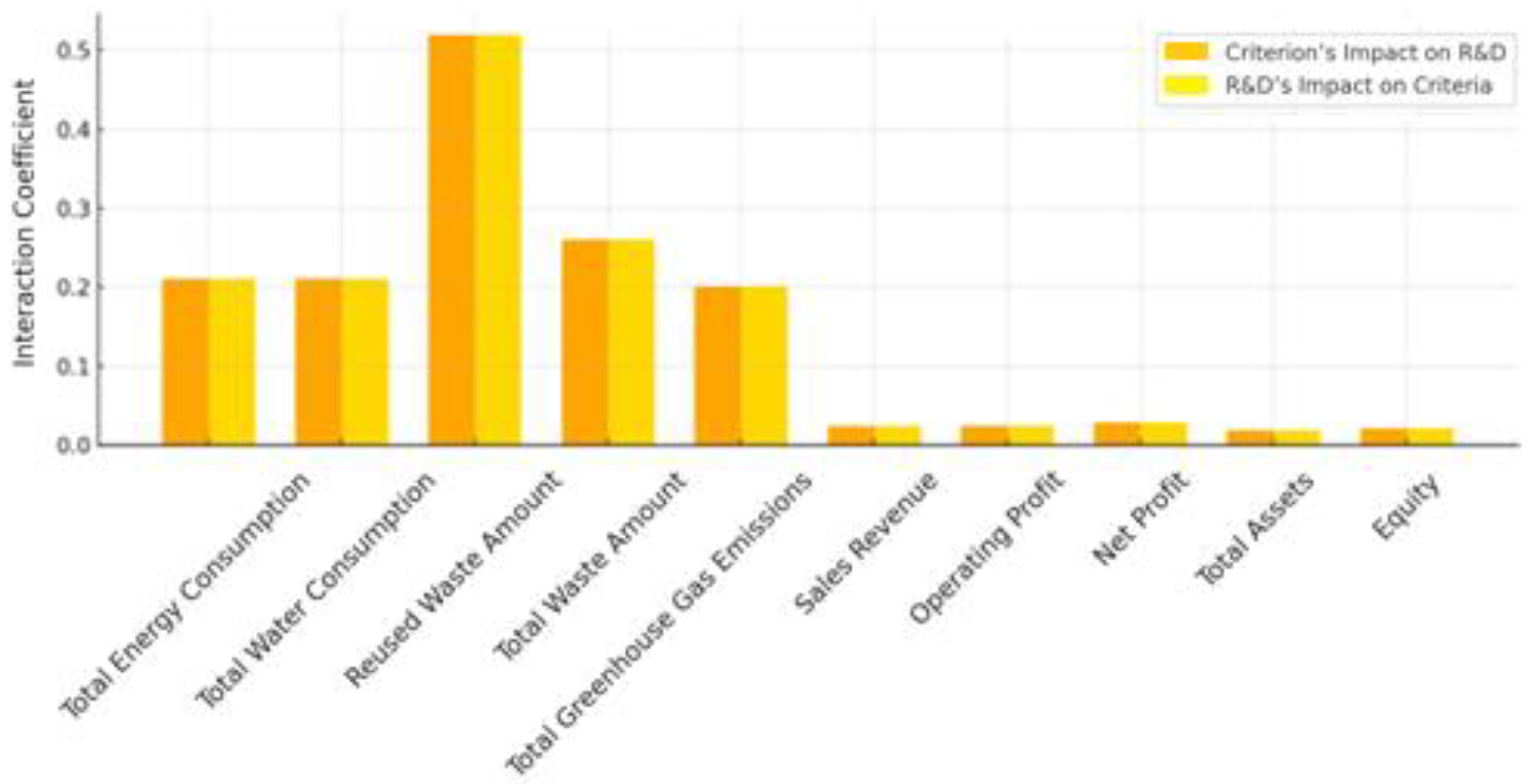

As we can see in

Figure 3, an analysis of CIMSA’s data reveals that among the environmental sustainability indicators, “Total Water Consumption” and “Total Greenhouse Gas Emissions” demonstrate the strongest bidirectional interactions with R&D expenditures. These criteria appear to function both as influential determinants of R&D allocation and as key recipients of technological innovation outcomes. Specifically, the capacity of “Total Energy Consumption” and “Reused Waste Amount” to influence R&D strategies is clearly pronounced, reflecting the company’s prioritization of environmental concerns in guiding innovation agendas. However, the impact of R&D investments on these criteria appears to be in a developmental phase, suggesting that while innovation efforts are underway, their measurable environmental benefits are still emerging.

From a financial standpoint, the criteria “Net Profit” and “Sales Revenue” show significant two-way relationships with R&D expenditures. This implies a dynamic interaction in which changes in profitability and revenue performance have a notable influence on R&D investment decisions, while at the same time, R&D initiatives hold substantial potential to enhance the company’s financial performance. Such mutual reinforcement indicates a feedback loop whereby successful innovation leads to financial growth, which in turn enables further innovation.

On the other hand, financial indicators such as “Equity” and “Total Assets” exhibit relatively weaker interactions with R&D expenditures. This suggests that while these structural financial components are foundational to corporate stability, they are less immediately responsive to fluctuations in R&D activity. Nevertheless, the presence of any influence—however modest—supports the idea that R&D investments contribute to the firm’s long-term financial sustainability by gradually reinforcing asset growth and capital structure.

In summary, CIMSA’s innovation strategy reflects a multifaceted and systemic approach, where R&D activities are strategically aligned with both environmental and financial objectives. The observed bidirectional influences underscore the integrative role of R&D in shaping sustainable corporate performance, reinforcing the firm’s capacity to navigate and adapt to evolving internal and external sustainability demands.

As a leading player in the world’s cement and construction materials sector, CIMSA operates within one of the most resource- and emission-intensive industries globally, where sustainability challenges are particularly acute. Cement production is heavily associated with high water consumption, significant CO2 emissions, and intensive energy use, which explains the strong bidirectional interactions of these criteria with R&D in the analysis. CIMSA has actively invested in low-clinker cements, alternative fuels, and waste heat recovery technologies, aiming to reduce its carbon footprint while improving operational efficiency. Recent initiatives include the development of innovative white cement products designed for enhanced durability and lower environmental impact, reflecting the firm’s strategy to couple profitability with ecological responsibility. Moreover, CIMSA’s partnerships in carbon capture pilot projects and its emphasis on circular economy practices, such as co-processing industrial by-products as alternative raw materials, demonstrate its commitment to systemic environmental innovation. Financially, sustained profitability and sales growth provide the foundation for these investments, while in return, R&D-driven eco-efficiency measures improve competitiveness in both domestic and international markets. Thus, CIMSA’s sector-specific innovation agenda reinforces its role as a benchmark firm in aligning financial sustainability with the pressing environmental imperatives of the cement industry.

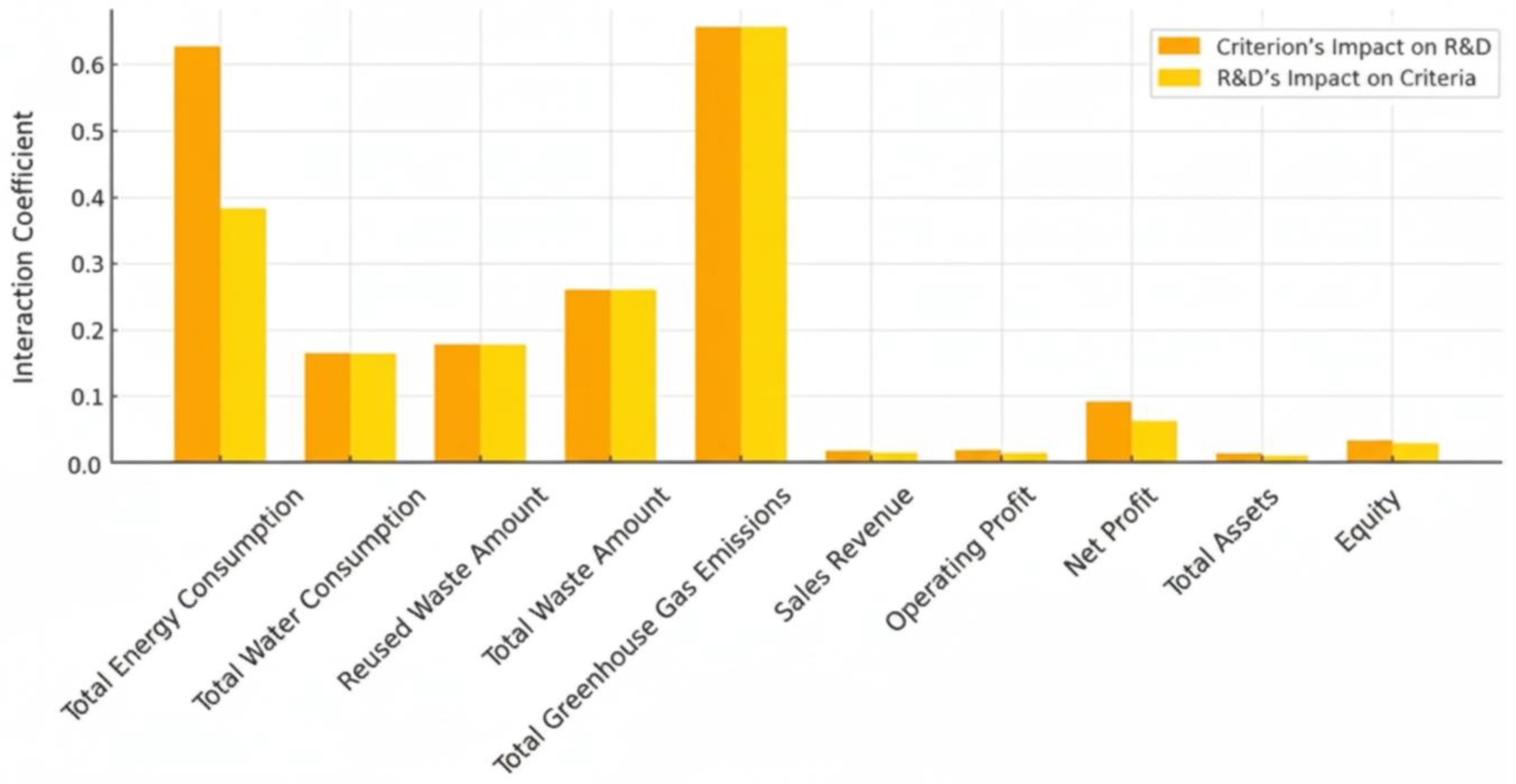

According to data in

Figure 4, an in-depth evaluation of the bidirectional interaction graph between ENJSA’s R&D expenditures and its environmental and financial sustainability criteria reveals a nuanced relationship pattern. Among the environmental indicators, “Total Greenhouse Gas Emissions” stands out as the most influential factor affecting R&D investments, exhibiting a notably high interaction coefficient (0.65). This strong linkage is also reciprocated, as R&D activities exert an equally significant impact on greenhouse gas emissions (0.65), underscoring a tightly integrated feedback mechanism aimed at emission reduction through innovation.

In addition, “Total Energy Consumption” (0.56) and “Total Waste Generated” (0.29) emerge as other key environmental parameters shaping R&D spending. These results suggest that the company’s innovation agenda is highly sensitive to environmental pressures, particularly those related to climate and resource efficiency.

In contrast, financial indicators appear to have a comparatively moderate influence on R&D expenditures. Among them, “Net Profit” is the most significant financial driver of R&D investments (0.0802), followed by “Sales Revenue” (0.0244) and “Equity” (0.0153). However, the effect of R&D spending on financial outcomes remains relatively limited in the short term. The highest such impact is observed again on “Net Profit” (0.0480), suggesting that while innovation contributes positively to profitability, its influence may not yet be fully realized or maximized.

Structural financial indicators such as “Total Assets” and “Equity” display a weaker bidirectional relationship with R&D expenditures, which implies that these capital-intensive metrics are less immediately responsive to innovation efforts. This may reflect the nature of long-term investments, where the tangible effects of R&D on financial structure accumulate progressively over time.

Overall, these findings indicate that ENJSA’s R&D strategy is predominantly shaped by environmental imperatives rather than immediate financial incentives. The strong influence of ecological criteria highlights a sustainability-oriented innovation framework, whereas the relatively weaker financial feedback loops suggest that the fiscal benefits of R&D are still in the process of maturation. It can be inferred that, over time, as environmental innovations yield tangible operational efficiencies and market advantages, their impact on financial performance is expected to intensify, making R&D a more central lever of integrated sustainability.

ENJSA operates in a sector that is both capital-intensive and highly exposed to sustainability pressures. The strong interaction of R&D with greenhouse gas emissions and energy consumption reflects the company’s strategic commitment to decarbonization and efficiency. ENJSA has been investing in smart grid technologies, renewable integration projects, and advanced energy storage systems, which directly address emission reduction and optimize electricity distribution. Additionally, the company has pioneered digitalization initiatives in energy monitoring and customer services, enabling more efficient demand-side management and contributing indirectly to sustainability outcomes. From an environmental standpoint, ENJSA’s pilot projects in electric vehicle (EV) charging infrastructure and distributed solar energy solutions demonstrate how R&D is aligned with both regulatory expectations and market trends. Financially, while the immediate returns of these initiatives may appear moderate, they establish long-term value through operational cost reduction, regulatory compliance, and positioning in the emerging low-carbon energy economy. By systematically linking R&D expenditures to ecological imperatives, ENJSA illustrates how energy-sector firms can convert sustainability pressures into innovation-driven growth opportunities, reinforcing their role in national and international climate transition goals.

The analysis conducted for FROTO, according to

Figure 5, reveals a robust bidirectional interaction between R&D expenditures and environmental sustainability criteria. Among these, “Total Greenhouse Gas Emissions” emerges as the most influential environmental factor affecting R&D investments, with a remarkably high interaction coefficient of 0.70. This suggests that the company strategically channels its technological innovation efforts toward climate-oriented solutions, aligning its R&D agenda with sustainability-driven imperatives.

Furthermore, the influence of R&D expenditures on environmental parameters is notably stronger than their impact on financial criteria. Significant effects are observed particularly in areas such as “Total Energy Consumption,” “Water Usage,” and “Reused Waste Amount,” where R&D investments appear to drive measurable improvements. These findings indicate that FROTO’s innovation strategies are deeply intertwined with its ecological responsibility initiatives, potentially aimed at reducing environmental footprint and complying with emerging green regulations.

From a financial perspective, indicators such as “Net Profit” and “Operating Profit” exhibit the highest sensitivity to R&D expenditures. This underscores the strategic value of R&D as a contributor to corporate profitability and suggests that innovative activities are effectively translated into financial performance gains. However, the reverse relationship—namely, the influence of financial indicators on R&D investment levels—is relatively weak. This asymmetry implies that R&D decisions within FROTO are less contingent upon short-term financial outcomes and are instead treated as independent, forward-looking strategic investments.

In summary, the interaction patterns indicate that the company adopts a sustainability-oriented innovation model in which R&D serves primarily as a driver of environmental performance, while its connection to financial indicators remains more limited and largely unidirectional. The stronger bidirectional interaction between R&D and environmental criteria, as compared to the weaker and one-sided links with financial measures, illustrates a deliberate focus on leveraging innovation to reduce environmental impact. This approach not only reinforces the firm’s commitment to corporate sustainability but also contributes to establishing a long-term competitive advantage in environmentally conscious markets.

As a leading automotive manufacturer, Ford Otosan (FROTO) operates in a sector with high environmental impact and intense global competition. The strong linkage between R&D expenditures and greenhouse gas emissions reflects the firm’s focus on electrification, hybrid propulsion systems, and fuel efficiency improvements in line with international automotive trends. In recent years, FROTO has made significant investments in electric vehicle (EV) development, battery technologies, and lightweight material applications, all of which aim to lower lifecycle emissions and enhance energy efficiency. The company has also introduced closed-loop waste management systems and water recycling projects at its production plants, demonstrating concrete steps toward circular economy integration. From a financial standpoint, while immediate R&D costs may weigh on operating margins, these expenditures strategically position the firm to capture long-term market advantages through compliance with EU emission standards, increased competitiveness in export markets, and alignment with global green mobility shifts. Sector-specific pressures, particularly in the high-pollution automotive industry, make FROTO’s R&D-driven sustainability strategy not only a regulatory necessity but also a critical enabler of global competitiveness. By channeling innovation toward decarbonization and resource efficiency, the company sets a clear example of how automotive firms can simultaneously meet sustainability demands and secure future growth opportunities.

When we examine

Figure 6, the interaction analysis conducted for the SISE company reveals a significant correlation between R&D expenditures and various sustainability criteria, particularly within the environmental dimension. Among the environmental indicators, the “Amount of Reused Waste” stands out as the most influential factor affecting R&D investments, with a high interaction coefficient of 0.52. This finding highlights the strategic importance of recycling processes as a major driver of innovation activities within the firm. Additional environmental criteria such as “Total Waste Amount” (0.33), “Total Energy Consumption” (0.21), and “Total Water Consumption” (0.21) also exert meaningful influence on R&D spending, albeit to a lesser extent.

Conversely, when evaluating the impact of R&D on environmental parameters, the “Amount of Reused Waste” again emerges as the most affected criterion, with an interaction coefficient of 0.37. This mutual reinforcement suggests that the company’s innovation strategies are tightly aligned with enhancing environmental efficiency, particularly through improved waste recovery and circular economy initiatives. The findings underscore that R&D plays a pivotal role in supporting eco-efficient production practices and sustainable resource use.

In terms of financial indicators, “Net Profit” is identified as the most significant driver of R&D expenditures (0.0285), indicating that higher profitability levels enable the firm to allocate more substantial resources to innovation. On the reverse path, R&D investments exhibit their strongest financial impact on “Net Profit” and “Total Assets,” both with an interaction coefficient of approximately 0.0285. This implies a moderate yet structurally important role of R&D in enhancing corporate profitability and asset growth. Additionally, R&D appears to have a noteworthy influence on other core financial metrics such as “Equity” (0.0208) and “Operating Profit,” suggesting its contribution extends beyond short-term gains and influences broader organizational performance.

Overall, the analysis indicates that SISE’s R&D efforts are more intensively shaped by environmental considerations than by financial dynamics. While financial indicators do interact with innovation expenditures, the environmental criteria demonstrate stronger and more direct bidirectional relationships. These results advocate for a sustainability strategy in which the company continues to prioritize environmental imperatives in shaping its R&D policies. Such an approach not only reinforces the ecological responsibility of the firm but also positions it for long-term competitive resilience within an increasingly sustainability-oriented market landscape.

As one of the world’s largest glass and chemicals producers, Şişecam (SISE) operates in an energy- and resource-intensive industry where waste recovery and recycling have critical importance for sustainability. The strong linkage between R&D and the “Amount of Reused Waste” reflects the company’s long-standing leadership in closed-loop recycling systems, particularly in glass cullet reuse and industrial by-product valorization. Recent R&D programs have focused on developing low-carbon glass production technologies, alternative raw material sourcing, and energy efficiency improvements in high-temperature furnaces. These initiatives align with EU Green Deal targets and international sustainability reporting frameworks. Beyond environmental performance, SISE’s R&D expenditures also extend into innovative product development, such as lightweight glass for the automotive sector and solar glass for renewable energy projects, both of which reduce lifecycle emissions. Financially, while R&D constitutes a significant capital investment, it positions the company for long-term competitiveness by strengthening export potential, enhancing operational efficiency, and meeting the stringent sustainability demands of global partners and institutional investors. In an industry traditionally challenged by high carbon intensity, SISE’s innovation-driven sustainability agenda demonstrates how environmental imperatives and industrial modernization can be effectively integrated into a globally competitive strategy.

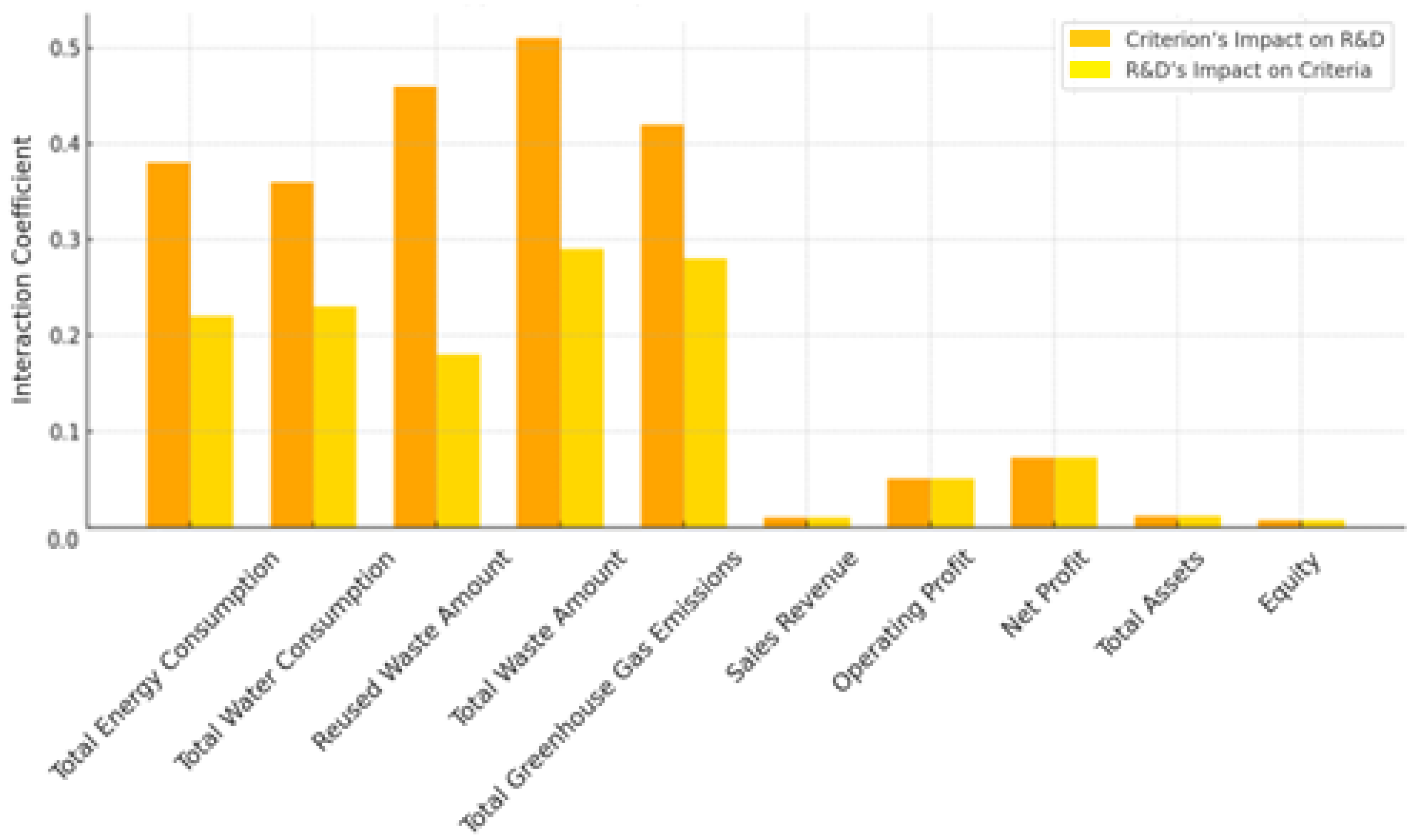

The sustainability interaction analysis conducted for TKFEN, according to

Figure 7, reveals that R&D expenditures maintain strong bidirectional relationships with both environmental and financial performance indicators. This dual interaction highlights the strategic integration of technological innovation within the company’s overall sustainability and profitability frameworks.

Among the environmental criteria, the “Total Waste Amount” exhibits the highest impact on R&D expenditures, with an interaction coefficient of 0.51. This indicates that effective waste management is a central component driving TKFEN’s innovation agenda. Other significant environmental indicators influencing R&D include “Total Energy Consumption” (0.38) and “Greenhouse Gas Emissions” (0.42), which also reflect the company’s increasing sensitivity to resource efficiency and environmental compliance. When analyzing the reverse interaction—i.e., the impact of R&D on environmental metrics—“Greenhouse Gas Emissions” emerges as the most affected parameter (0.28), underscoring the firm’s inclination toward investing in low-carbon technologies and decarbonization efforts.

From a financial perspective, the metrics of “Net Profit” (0.0727) and “Operating Profit” (0.0505) are identified as the most influential drivers of R&D investments. These same indicators are also significantly affected by R&D spending, indicating a mutually reinforcing relationship between profitability and innovation. Such symmetrical interactions suggest that R&D efforts not only depend on financial resources but also actively contribute to enhancing financial performance. Other financial indicators such as “Total Assets” and “Equity” demonstrate moderate levels of interaction with R&D, reflecting a more structural and long-term influence.

These findings emphasize that TKFEN strategically aligns its R&D investments to achieve both environmental sustainability and financial efficiency. Particularly, the motivation to initiate R&D activities stemming from environmental concerns—such as energy usage and waste management—appears to play a pivotal role in guiding the company’s technological transformation. This approach facilitates the development of innovative solutions that support both compliance with environmental regulations and the achievement of competitive advantage.

Overall, TKFEN’s R&D strategy demonstrates a holistic orientation, effectively integrating environmental imperatives with financial objectives. The balanced and reciprocal influence among the evaluated criteria suggests that the company views innovation as a cross-cutting enabler of sustainability, serving as a lever for both ecological responsibility and economic performance. This positions TKFEN as a forward-looking organization capable of navigating complex sustainability challenges through technology-driven solutions.

As a leading engineering, procurement, and construction firm operating across energy, petrochemical, and infrastructure projects, TKFEN functions in sectors that are both highly resource-intensive and environmentally impactful. The strong R&D linkage with “Total Waste Amount” mirrors the company’s strategic focus on developing innovative construction materials, low-carbon cement technologies, and efficient waste treatment systems that reduce project-level environmental footprints. TKFEN has also invested in digital construction management platforms and energy optimization models for large-scale infrastructure projects, enabling significant reductions in both material consumption and greenhouse gas emissions. From a sustainability perspective, the firm participates in global climate initiatives and aligns its reporting with international frameworks such as the Global Reporting Initiative (GRI) and UN Sustainable Development Goals (SDGs). Financially, the observed synergy between Net Profit and R&D indicates that TKFEN reinvests operational gains into forward-looking innovation projects, including renewable energy EPC solutions and hydrogen-ready infrastructure development. This dual commitment highlights TKFEN’s role not only as a major contractor but also as a pioneer of sustainability-oriented engineering solutions, reinforcing both its market competitiveness and its contribution to global decarbonization efforts.

According to

Figure 8, the analysis of TOASO’s sustainability performance reveals that its R&D expenditures maintain a robust and bidirectional interaction with both financial and environmental criteria. In particular, R&D spending demonstrates a significant impact on key financial indicators such as Net Profit (0.0575), Operating Profit (0.0555), and Total Assets (0.0198). These findings suggest that TOASA strategically employs R&D investments as an effective tool to enhance revenue-generating activities and to reinforce its capital structure. The alignment between R&D expenditures and financial outcomes underlines the firm’s commitment to leveraging innovation as a driver of economic growth and operational resilience.

From an environmental perspective, strong interactions have been observed between R&D expenditures and key sustainability indicators, most notably Greenhouse Gas Emissions (0.43) and Water Consumption (0.50). This indicates that the company’s innovation efforts are yielding direct results in mitigating environmental impact and improving sustainability performance. The considerable influence of R&D in these domains reflects a strategic focus on developing technologies that support environmental stewardship and resource efficiency.

When examining the inverse relationship—how environmental and financial indicators influence R&D investments—the analysis shows that environmental pressures are also key drivers of innovation. Greenhouse Gas Emissions (0.48), Total Waste (0.48), and Reused Waste Amount (0.10) emerge as the most influential environmental parameters impacting R&D decision-making. These findings suggest that increasing environmental constraints are prompting the firm to pursue R&D-based solutions as part of its adaptive response to sustainability challenges.

On the financial side, Net Profit (0.0603) and Operating Profit (0.0583) are identified as the most significant contributors influencing R&D expenditures. This reciprocal interaction emphasizes that the company’s profitability structure plays a decisive role in shaping its innovation agenda, indicating that R&D activities are not only reactive to profitability but also proactively designed to enhance it.

Overall, TOASO’s R&D strategy embodies a balanced and multidimensional approach that aims to simultaneously optimize financial performance and environmental responsibility. The observed bidirectional interactions across both domains reinforce the notion that the firm’s innovation policies are deeply rooted in sustainable development objectives. By integrating financial resilience and environmental responsiveness, TOASO positions itself as a forward-thinking enterprise committed to long-term value creation through sustainability-driven innovation.

As one of the world’s leading automotive manufacturers and a joint venture between global automotive groups, TOASO operates in a sector where emissions reduction, fuel efficiency, and mobility innovation are critical competitive drivers. The strong bidirectional interactions between R&D and environmental indicators—particularly greenhouse gas emissions and water consumption—mirror TOASO’s ongoing investments in low-emission vehicles, lightweight materials, and water-efficient production processes at its facilities. The firm has been at the forefront of developing hybrid and electric vehicle platforms, aligning with both EU environmental regulations and the global transition toward sustainable mobility. On the financial side, the reinforcement between profitability and R&D reflects TOASO’s strategy of channeling operational gains into advanced manufacturing technologies, including automation, digital twin applications, and eco-friendly supply chain innovations. Furthermore, TOASO participates in international automotive R&D collaborations and complies with standards such as the EU End-of-Life Vehicle Directive and ISO 14001 [

48] Environmental Management Systems, ensuring global benchmarking of its sustainability practices. Taken together, these commitments position TOASO as a regional innovation hub in sustainable mobility, balancing financial resilience with ecological stewardship and providing sector-specific pathways for reducing the environmental impact of automotive production.

When we examine

Figure 9, an in-depth analysis of TCELL’s sustainability interaction graph reveals a significant two-way relationship between R&D expenditures and both environmental and financial performance indicators. Among environmental criteria, Total Energy Consumption emerges as the most influential factor impacting R&D investments, with a notably high interaction coefficient of 0.67. This suggests that TCELL’s innovation strategies are strongly shaped by energy efficiency considerations. In the reverse direction, R&D activities most substantially influence Total Energy Consumption, with an effect coefficient of 0.23, indicating that the company’s technological initiatives are actively contributing to the reduction in energy usage and enhancement of operational sustainability.

Another important environmental criterion, Greenhouse Gas Emissions, also displays a noteworthy interaction, particularly in terms of its responsiveness to R&D activities (0.21), underlining the firm’s engagement with environmentally conscious technologies. This pattern of interaction reflects a strategic orientation toward low-emission innovation and the integration of environmental performance goals within the R&D portfolio.

From a financial perspective, Net Profit and Operating Profit are identified as the most significant financial indicators influencing R&D spending. Specifically, the impact coefficient of Net Profit on R&D expenditures (0.0326) signals that profitability plays a critical role in shaping the company’s capacity to invest in innovation. Conversely, R&D spending demonstrates its most substantial financial impact on Net Profit (0.0288) and Operating Profit (0.0264), confirming that R&D investments contribute directly to the firm’s bottom line and financial resilience.

Other financial metrics such as Sales Revenue and Total Assets show relatively lower bidirectional interaction coefficients, suggesting a more indirect relationship with R&D. This indicates that while these indicators are relevant to overall business operations, they do not play a central role in driving or being driven by R&D activities in the context of TCELL’s current innovation ecosystem.

In conclusion, TCELL’s R&D strategy reflects a holistic and dynamic framework wherein innovation is both influenced by and exerts influence upon key environmental and financial performance parameters. As a telecommunications firm operating in a rapidly evolving technological landscape, TCELL’s prioritization of energy efficiency and financially integrated sustainability highlights its forward-looking approach. The findings demonstrate that the company leverages R&D not only as a mechanism for profitability enhancement but also as a proactive tool in advancing its environmental stewardship and sustainable development goals.

As a key player in the global telecommunications sector, TCELL operates in an industry characterized by high energy demand, digital infrastructure expansion, and rapid technological turnover. The strong bidirectional interactions between R&D and energy consumption underscore the company’s major investments in renewable energy sourcing for base stations, energy-efficient data centers, and next-generation 5G infrastructure. In recent years, TCELL has pioneered green data centers designed with cutting-edge cooling systems that minimize energy waste, aligning with ISO 50001 [

49] energy management standards. On the innovation side, the firm’s R&D activities extend to artificial intelligence-driven energy optimization, network virtualization, and smart grid integration, which directly reduce operational carbon intensity. Financially, the reinvestment of profitability into digital innovation enables TCELL to sustain competitive leadership while complying with international ESG benchmarks, such as the UN Global Compact and SASB telecommunications standards. These commitments not only reinforce environmental stewardship but also highlight sector-specific pathways—such as expanding green ICT services, cloud solutions, and IoT platforms—that integrate sustainability with technological transformation. Thus, TCELL’s R&D portfolio is both a driver of digital competitiveness and a lever for systemic energy efficiency and decarbonization, setting benchmarks applicable across the global telecom industry.

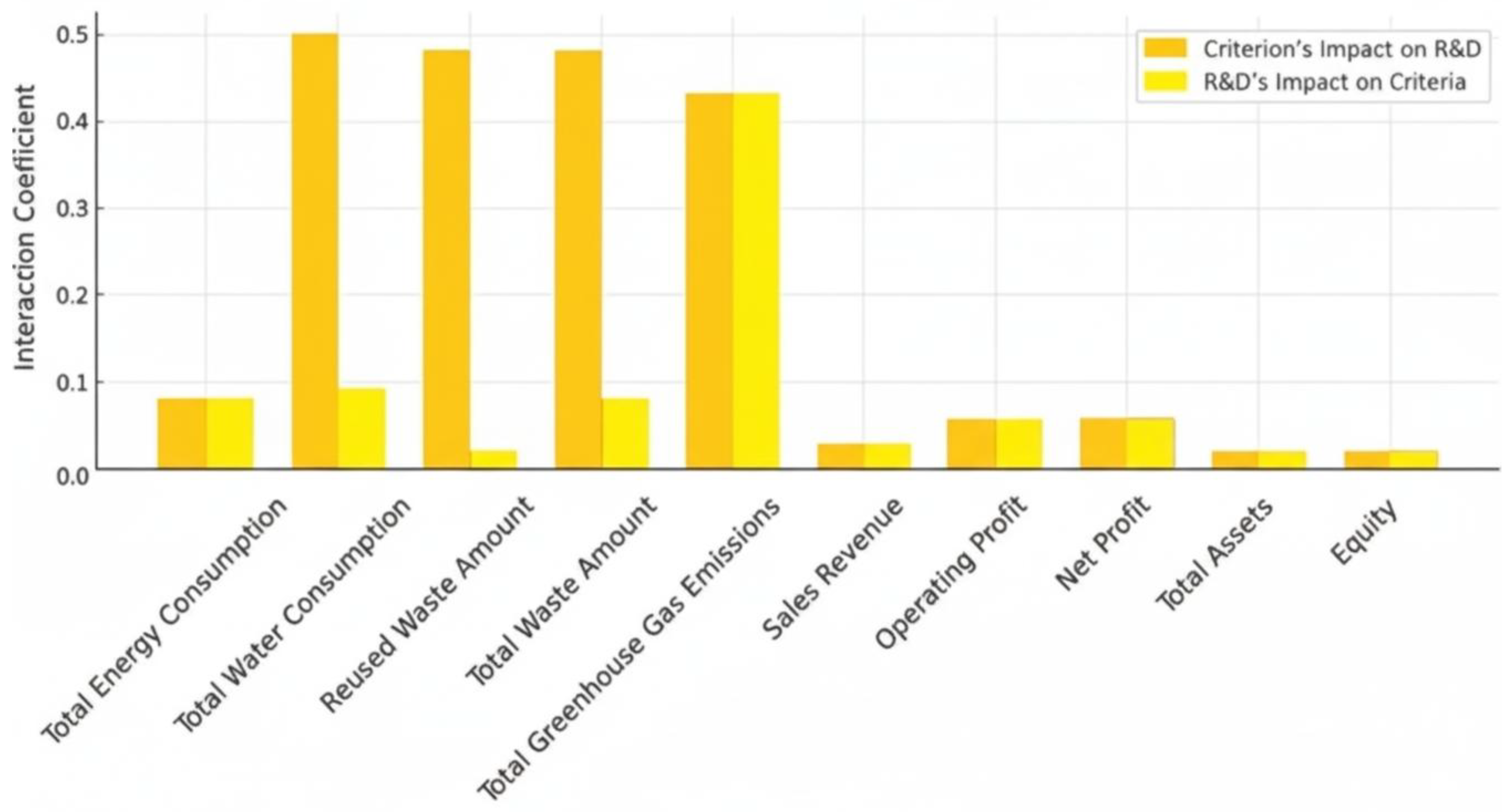

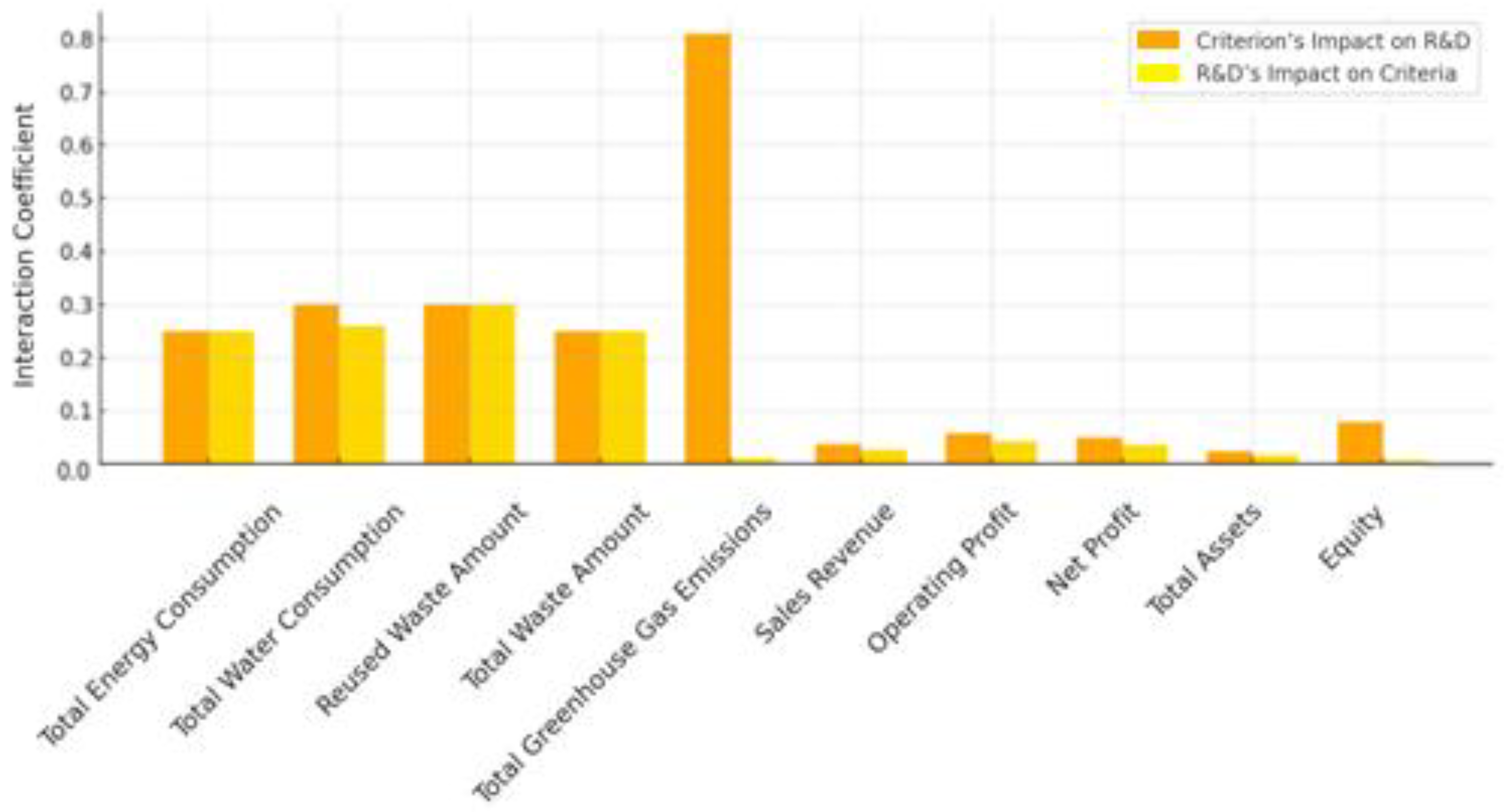

In light of the information provided by

Figure 10, the DEMATEL-based analysis of the ULKER company reveals a noteworthy interaction structure between R&D expenditures and both environmental and financial sustainability criteria. Among the environmental factors, Greenhouse Gas Emissions exert the strongest influence on R&D spending, with an interaction coefficient of 0.81. This substantial value highlights the extent to which environmental sustainability pressures guide and shape the company’s innovation-oriented investments. In addition, other environmental indicators such as Water Consumption (0.26) and Reused Waste Amount (0.30) also demonstrate significant impacts on R&D, emphasizing the firm’s sensitivity to broader ecological factors beyond just emissions.

On the financial side, Operating Profit (0.0582), Net Profit (0.0497), and Revenue (0.0370) emerge as the most influential criteria shaping R&D expenditure. These findings indicate that ULKER’s innovation strategies are directly informed by its profitability structure, with a strong correlation between financial capacity and the scope of technology investment. Notably, profitability appears to serve as both a driver and an enabler of innovation.

Conversely, when examining the effect of R&D on financial performance, it is evident that R&D spending positively influences Net Profit (0.0497), Total Assets (0.0234), and Revenue (0.0263). This underscores the role of R&D as a strategic lever, not only enhancing the firm’s sustainability outcomes but also contributing meaningfully to its financial growth and competitiveness. The bidirectional influence signifies the feedback loop between innovation and financial value creation.