1. Introduction

The rapid advancement of artificial intelligence has triggered a surge in global demand for computing power. The escalating volumes of data and increasingly complex algorithms necessitate enhanced large-scale computing capabilities. As a General-Purpose Technology (GPT), computing power is integral to sustainable growth, emerging as a crucial element for nations seeking competitive advantages and industrial innovation. Consequently, computing power and its associated components have garnered significant attention from both the international community and academia [

1,

2].

The predictive reliability of Moore’s Law in forecasting computing power growth has diminished [

3], while the role of computing power as a catalyst for economic output has underscored its importance as a strategic production asset. Computing power is now pivotal in fostering innovation-driven development and economic expansion. As the backbone of China’s economy, the manufacturing sector faces the challenge of overcoming the “low-end lock-in” [

4], amid global value chain restructuring and escalating technological competition. It is imperative for China’s manufacturing industry to advance in innovation-driven and sustainable development and to enhance its standing in the global innovation network. However, a significant gap remains between China’s manufacturing innovation levels and those of leading international manufacturers, primarily due to deficiencies in core technologies and the need for improved research and development (R&D) quality [

5,

6]. Thus, evaluating the impact of computing infrastructure on manufacturing enterprise innovation is both an immediate practical concern and a theoretical necessity.

Computing power is pivotal for countries aiming to lead in development. To secure strategic advantages, developed nations and regions globally are intensifying efforts to enhance computing infrastructure, supporting sustainable growth and industrial transformation in areas like artificial intelligence, industrial software, and complex simulations [

7,

8,

9]. Emerging economies are similarly accelerating their computing infrastructure development. China, for instance, has introduced the “Action Plan for High-quality Development of Computing Infrastructure,” which forms the policy backdrop for this study.

While major global regions are rapidly developing computing infrastructure, there is scant literature on its impact on manufacturing enterprise innovation. Existing research primarily addresses infrastructure’s influence on enterprise innovation through traditional and new infrastructure lenses [

10]. Traditional infrastructure, such as railways [

11] and highways [

12], fosters innovation by reducing costs and enhancing factor flow and knowledge diffusion [

13,

14,

15]. However, these mechanisms fall short in elucidating the R&D and innovation models propelled by data and algorithms. In the digital economy’s computing era, traditional infrastructure inadequately meets enterprises’ growing data and computing needs, prompting the need for accelerated new infrastructure development. China categorizes new infrastructure into information, integrated, and innovation infrastructure [

16].

Information infrastructure encompasses communication networks, emerging digital technologies, and computing infrastructure. Studies indicate that communication infrastructures like 5G, industrial Internet, and broadband networks [

17,

18,

19], along with technological infrastructures such as artificial intelligence, cloud computing, and blockchain [

20,

21,

22], enhance enterprise innovation. These infrastructures primarily reduce R&D costs [

23], ease financing constraints [

24,

25], and facilitate knowledge spillover [

26]. Unlike communication and digital technology infrastructures, computing infrastructure directly supports complex model training and large-scale data processing via high-performance computing, fundamentally altering enterprise R&D and innovation boundaries. Nonetheless, the specific impact of computing infrastructure on enterprise innovation remains underexplored.

Converged infrastructure integrates technologies like the Internet, big data, and artificial intelligence to modernize traditional systems, such as intelligent transportation and logistics [

27] and energy infrastructure [

28]. Studies indicate that it enhances enterprise logistics efficiency, fosters industrial and supply chain collaboration, and indirectly supports innovation [

29]. In contrast, computing infrastructure operates more directly. As a strategic infrastructure with general-purpose technology attributes, it is embedded in enterprises’ R&D and knowledge creation through extensive computing and algorithmic support, differing functionally from converged infrastructure.

Innovation infrastructure encompasses public-welfare systems that bolster scientific research and technological advancement, including major scientific and technological facilities [

30] and science and education infrastructure [

31]. Studies indicate that these facilities enhance enterprises’ technical support and innovation by strengthening industry-university-research collaborations and scientific research networks [

32]. Conversely, computing infrastructure transcends merely providing external research conditions. It is directly integrated into enterprises’ R&D processes and knowledge creation stages via extensive computing and algorithm environments, serving as a core driver for enhancing innovation quality and efficiency. This mechanism contrasts with the “external support” function of traditional innovation infrastructure.

Computing infrastructure exhibits characteristics of general-purpose technology (GPT), policy exogeneity, and regional variation. Yet, its innovation impact has not been systematically explored within a unified framework. Current research reveals three main gaps: Theoretically, computing infrastructure is not integrated into the GPT framework, nor are theories like absorptive capacity and the resource-based view employed to elucidate how manufacturing enterprises convert external computing resources into innovation. Empirically, there is a lack of analysis using the exogenous shock of national supercomputing centers to assess the effects of computing infrastructure on innovation quantity, quality, and enterprise heterogeneity. Mechanistically, the influence of factors such as enterprises’ R&D investment and market share on the relationship between computing infrastructure and innovation remains insufficiently examined. This paper addresses these deficiencies by constructing a unified analytical framework.

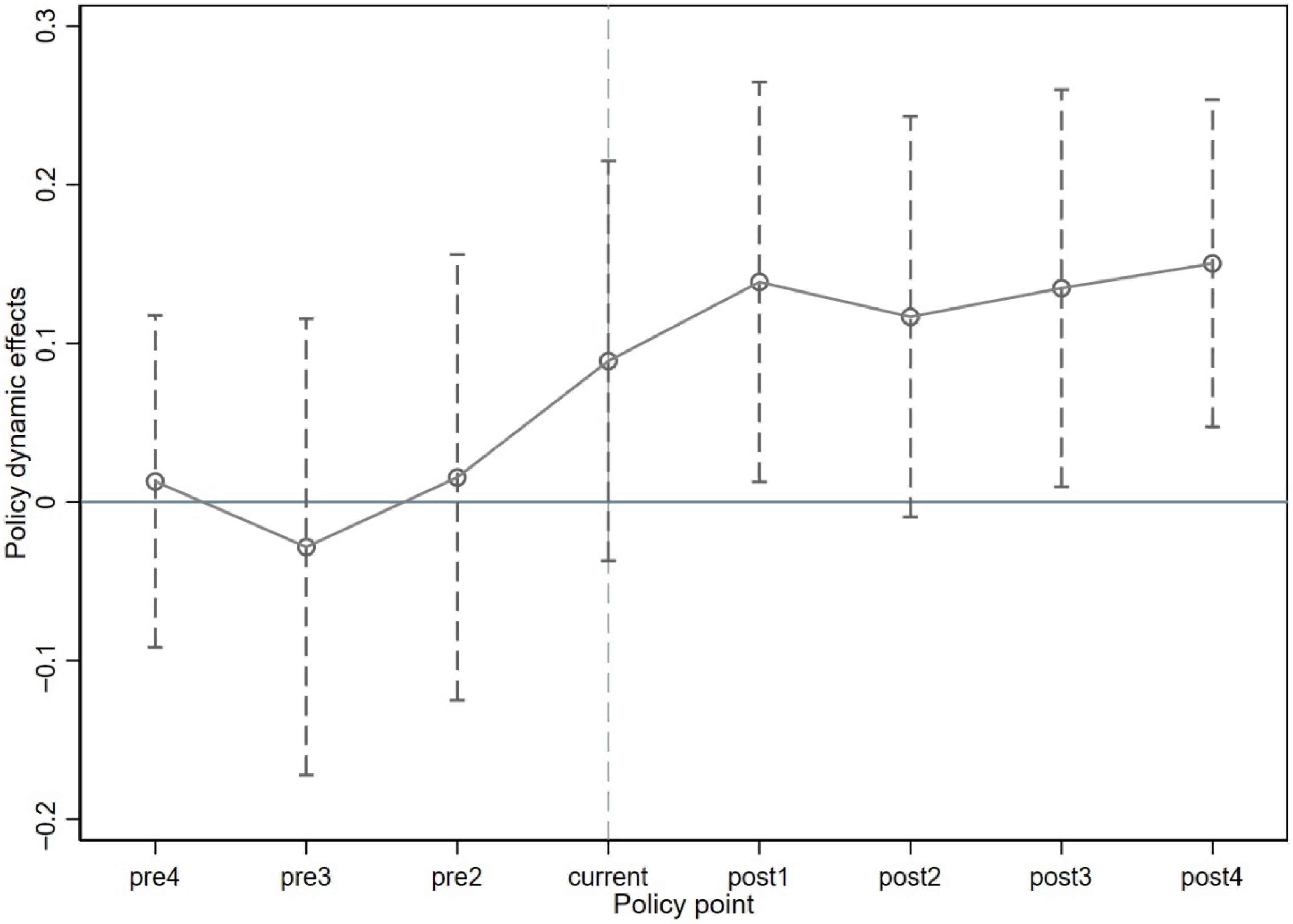

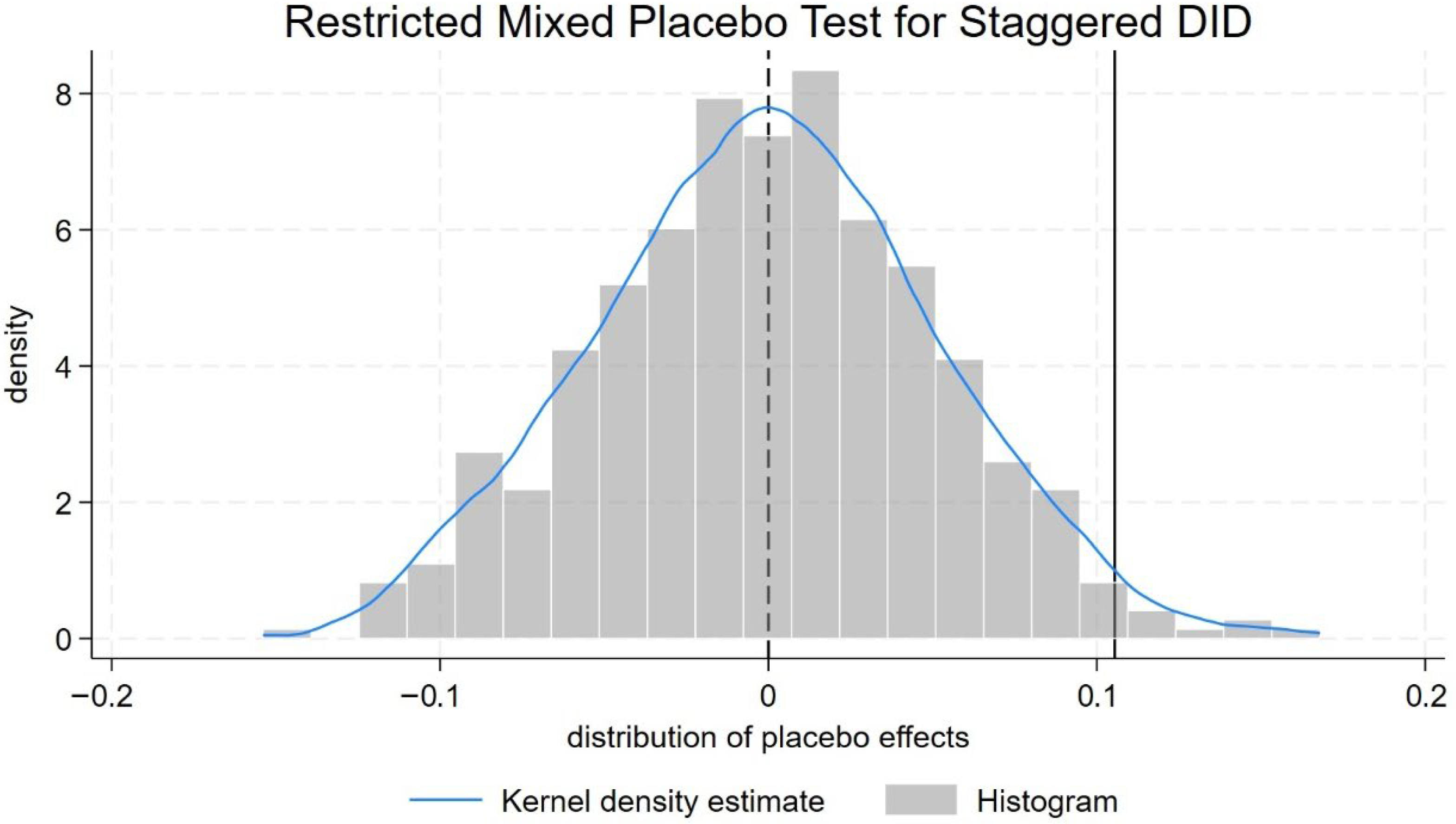

This paper develops a theoretical framework for leveraging computing infrastructure to enhance innovation in manufacturing enterprises, drawing on General-Purpose Technology (GPT), Absorptive Capacity Theory, and the Resource-Based View (RBV). GPT theory underscores the influence of the ubiquity, continuous advancement, and broad complementarity of computing infrastructure on fostering enterprise innovation. Absorptive Capacity Theory emphasizes the importance of R&D investment in enabling enterprises to identify, assimilate, and utilize external computing resources. Meanwhile, RBV illustrates how market share, as an indicator of scarce resources and competitive advantage, influences enterprises’ capacity to harness computing resources for innovation. This study examines data from Chinese listed manufacturing enterprises between 2003 and 2023, using the establishment of national supercomputing centers as a quasi-natural experiment. Employing a multi-period difference-in-differences (DID) approach, it assesses the impact of computing infrastructure on manufacturing innovation. The findings are: First, the development of computing infrastructure, exemplified by national supercomputing centers, significantly enhances manufacturing innovation, a conclusion supported by robustness tests. Second, both internal R&D investment and external market share positively influence the innovation effects of computing infrastructure on these enterprises. Third, the impact of computing infrastructure on innovation is more pronounced in non-state-owned manufacturing enterprises, those in the eastern region, and those with low equity concentration. Lastly, computing infrastructure not only increases the scale of innovation but also enhances its quality.

This paper offers several key contributions: Firstly, it integrates computing infrastructure into General-Purpose Technology (GPT) theory, highlighting its innovation effects through general applicability, continuous improvement, and extensive complementarity. Additionally, it applies absorptive capacity theory and the resource-based view to examine how enterprises’ R&D investments and market share moderate the impact of computing infrastructure on manufacturing innovation. This approach broadens the theoretical scope of information infrastructure research and provides a systematic framework for analyzing the relationship between new production factors and enterprise innovation in the digital economy era.

This paper employs the exogenous policy shock of establishing China’s national supercomputing centers to construct a multi-period difference-in-differences (DID) model, examining the impact of computing infrastructure on manufacturing innovation. Unlike most studies that use high-speed railways, the Broadband China initiative, or 5G policies as quasi-natural experiments, this research focuses on computing infrastructure, exemplified by national supercomputing centers. Unlike traditional or other digital infrastructure, computing infrastructure is both strategic and systematic. As a general-purpose technology (GPT), it spans industries and complements data, algorithms, and organizational processes, reshaping enterprise R&D models and providing novel insights into infrastructure’s influence on innovation.

This study empirically examines the innovation effects of computing infrastructure by assessing both innovation quantity and quality. Unlike previous research that often relies on patent counts, potentially neglecting the issue of “high quantity but low quality,” this paper emphasizes a dual focus. By systematically evaluating the utility and impact of innovation outcomes, it offers a more comprehensive understanding of computing power’s effects. This approach addresses the limitation of equating innovation with mere scale expansion and meets the manufacturing industry’s need to shift from growth to high-quality development. It also provides new micro-evidence on how computing fosters long-term enterprise competitiveness through high-quality achievements.

The paper is structured as follows:

Section 2 reviews the policy background of computing infrastructure, exemplified by National Supercomputing Centers, and theoretically examines its impact on innovation in Chinese manufacturing enterprises.

Section 3 outlines the data, variables, and empirical models.

Section 4 presents the empirical results, including analyses of the moderating mechanism, robustness, and heterogeneity tests;

Section 5 provides a further examination of how computing infrastructure construction influences the quality of innovation in manufacturing enterprises.

Section 6 presents the discussion, and

Section 7 provides the conclusions.

6. Discussion

While existing research has explored the effects of traditional, communication, and digital infrastructures on enterprise innovation, micro-level evidence on how computing infrastructure influences manufacturing innovation remains scarce. This paper addresses this gap by using the establishment of national supercomputing centers as a quasi-natural experiment to systematically investigate the impact of computing infrastructure on manufacturing enterprise innovation. Research shows that computing infrastructure significantly enhances both the quantity and quality of innovation in the manufacturing sector, aligning with existing literature that underscores the role of digital infrastructure in boosting corporate innovation efficiency [

55]. However, some studies suggest that while upgrading information infrastructure increases innovation input and output, it may suppress innovation quality [

56]. This discrepancy highlights distinct mechanisms of different infrastructure types: information infrastructure primarily boosts quantity by lowering information acquisition costs and expanding R&D scale, whereas computing infrastructure, through high-performance computing and complex modeling, supports high-value R&D and complex process optimization, thereby substantially improving innovation quality. This study revises the notion that infrastructure mainly promotes innovation in quantity, emphasizing the unique role of computing power infrastructure in enhancing quality.

The test of the moderating mechanism shows that R&D investment and market share positively influence the impact of computing infrastructure on manufacturing innovation. This finding confirms the relevance of absorptive capacity theory and the resource-based view in the digital economy context. It underscores the critical roles of various stakeholders: policymakers must foster a supportive institutional and competitive environment, enterprise managers should strengthen R&D capabilities and market positions, and infrastructure providers need to offer efficient, demand-aligned computing. The effective transformation of computing into manufacturing innovation relies on the synergy of these elements.

The impact of computing infrastructure on innovation in manufacturing is more pronounced in non-state-owned enterprises, those located in the eastern region, and enterprises with lower equity concentration. Existing research consistently shows that digital infrastructure significantly enhances innovation, particularly in non-state-owned enterprises and those in the eastern region [

57]. However, existing research presents conflicting views on the relationship between equity concentration and corporate innovation. High equity concentration can enhance major shareholder oversight and mitigate agency problems, thereby fostering innovation [

58]. Conversely, it can also curtail R&D investment, inhibiting innovation [

59]. Some studies propose an inverted U-shaped relationship, where moderate concentration is most conducive to innovation [

60]. This paper aligns with the perspective that “high concentration inhibits innovation” and supports the notion within the inverted U-shaped framework that “excessive concentration is unfavorable to innovation,” but it does not corroborate the idea that “high concentration promotes innovation.” This suggests that the impact of equity structure on innovation is context-dependent: in environments with strong externalities and high complementarity, such as computing infrastructure, firms with low equity concentration can more flexibly leverage external resources, thereby enhancing their innovation potential. This study not only deepens the understanding of the equity structure-innovation relationship but also offers new empirical insights into the innovation effects of computing infrastructure across different governance environments.

7. Conclusions

7.1. Main Conclusions

Computing power has emerged as a critical productive force driving the transformation, upgrading, and sustainable development of the manufacturing sector. Prior research has predominantly examined the effects of traditional or general digital infrastructure on innovation, neglecting a systematic analysis of computing infrastructure, a novel form of information infrastructure. This study develops a comprehensive analytical framework grounded in General-Purpose Technology (GPT) theory, integrating absorptive capacity theory and the resource-based view. Utilizing the establishment of China’s National Supercomputing Centers as an exogenous policy shock, and analyzing data from Chinese listed manufacturing enterprises between 2003 and 2023, this paper applies the multi-period Difference-in-Differences (DID) approach to systematically assess the impact of computing infrastructure on manufacturing enterprise innovation.

The findings reveal that the establishment of computing infrastructure, exemplified by the National Supercomputing Centers, fosters innovation within manufacturing enterprises, a conclusion confirmed by robustness tests. Additionally, this innovation effect is positively influenced by enterprises’ internal R&D investment and external market share. The impact of computing infrastructure on innovation is more pronounced in non-state-owned manufacturing enterprises, those located in the eastern region, and those with low equity concentration. Furthermore, such infrastructure development enhances both the quantity and quality of innovation in manufacturing enterprises.

7.2. Theoretical and Practical Implications

This paper’s theoretical contribution lies in integrating computing infrastructure into the General-Purpose Technology (GPT) framework. By combining absorptive capacity theory with the Resource-Based View, it elucidates how computing infrastructure affects manufacturing enterprises’ innovation through the moderating roles of internal R&D investment and market share. This research extends the understanding of infrastructure’s impact on innovation and deepens insights into enterprise innovation mechanisms in the digital economy era. Empirical findings indicate that computing infrastructure enhances both the quantity and quality of innovation, with its effects shaped by factors such as ownership types, regional differences, and ownership concentration. This suggests that future models should avoid simplistic linear assumptions and incorporate the dual dimensions of quantity and quality, alongside market environment and enterprise characteristics, to improve the explanatory power and applicability of existing theories.

The practical significance of this study lies in showing that the construction of computing infrastructure can significantly promote innovation in the manufacturing sector, with particularly pronounced effects among non-state-owned enterprises, those in the eastern region, and those with lower ownership concentration. These findings highlight the importance of considering enterprise characteristics and regional disparities when the government strategizes regional computing deployment. Additionally, the results offer guidance for infrastructure developers regarding resource allocation and application scenario expansion. Furthermore, the research reveals that R&D investment and market share positively influence this dynamic, offering a foundation for enterprises to enhance R&D investment and develop market strategies.

7.3. Policy Recommendations

Research indicates that developing computing infrastructure can significantly boost manufacturing innovation, suggesting that initiatives like the “East-West Computing” project are feasible and can address regional disparities in computing supply and demand. Establishing a resource-sharing market and differential subsidy mechanisms can reduce entry barriers for small and non-state enterprises. However, building such infrastructure demands substantial investment and has a long timeline, making nationwide coverage challenging in the short term, and regional imbalances may persist.

Research findings indicate that manufacturing enterprises can fully harness the innovation potential of computing infrastructure only when they possess robust R&D capabilities and a significant market share. This underscores the need for increased R&D investment and the use of supercomputing centers or regional computing platforms for applications like digital twins and complex simulations, thereby enhancing innovation scale and quality. Nonetheless, the long-term and uncertain nature of R&D investment may constrain some enterprises, particularly small- and medium-sized ones, due to challenges in funding and talent acquisition.

This study reveals that computing infrastructure significantly boosts both the quantity and quality of innovation in manufacturing enterprises. Thus, optimizing the allocation of computing resources on the supply side holds practical importance for developers. Notably, enterprises in the eastern region and non-state-owned enterprises experience greater benefits. Developers should therefore focus on regional coordination and the specific needs of different enterprises. This involves increasing the supply of high-performance and intelligent computing resources, enhancing the integration of computing, network, and cloud services, and fostering resource sharing. Additionally, establishing joint R&D mechanisms with manufacturing enterprises to create tailored application solutions is crucial. However, challenges remain in cross-regional coordination and standardization, and regional disparities may temporarily limit the efficient use of computing resources.

7.4. Limitations and Future Research

This paper has several limitations. One limitation concerns the data and measurement methods. The distribution and number of China’s National Supercomputing Centers are limited. Although using these centers as a quasi-natural experiment provides some representativeness, it does not fully capture the extent of computing infrastructure development. To address this, robustness tests and heterogeneity analysis were conducted in this study. Nonetheless, future research should develop a more systematic computing index encompassing dimensions such as scale, industrial foundation, development environment, and application scenarios for a more comprehensive assessment.

Another limitation lies in the explanation of mechanisms. It primarily verifies the moderating effect through enterprise R&D investment and market share. However, it falls short in deeply exploring the specific pathways through which computing infrastructure influences manufacturing enterprise innovation. To address this, the paper employs a moderation test as a partial remedy. Future research could enhance theoretical explanatory power by integrating analyses of micro-mechanisms, such as organizational structure adjustments, factor allocation efficiency improvements, knowledge spillover, and collaborative innovation.

A further limitation is related to the generalizability of the findings. This study primarily centers on listed manufacturing enterprises in China, rendering its conclusions less universal in an international context. While this focus aids in identifying policy shocks, future research should expand to include small and medium-sized enterprises and draw comparisons with developed economies like the United States, the European Union, and Japan. Such comparisons would illuminate the similarities and differences in computing infrastructure across various institutional and market environments, thereby increasing the international relevance of the findings.