Characteristic Analysis of the Evolution of the Temporal and Spatial Patterns of China’s Iron and Steel Industry from 2005 to 2023

Abstract

1. Introduction

2. Research Methodology and Data Sources

2.1. Research Methodology

2.1.1. Nearest Neighbour Index

2.1.2. Kernel Density Estimation

2.1.3. Regional Centres of Gravity

2.2. Data Sources

- 2005: 121 production-type, 27 service-type, 26 scientific research-type, 6 trade-type;

- 2010: 152 production-type, 35 service-type, 21 scientific research-type, 6 trade-type;

- 2014: 227 production-type, 52 service-type, 24 scientific research-type, 13 trade-type;

- 2020: 282 production-type, 49 service-type, 20 scientific research-type, 13 trade-type;

- 2023: 259 production-type, 57 service-type, 19 scientific research-type, 12 trade-type.

2.2.1. Processing of Enterprise Dynamics and CISA Membership Changes

- Enterprise relocation/closure: We cross-verify member units with registered address changes (relocation) or delisting from the China Iron and Steel Industry Yearbook (closure) with enterprise registration information from the National Enterprise Credit Information Publicity System and industry reports. Relocated enterprises are assigned new geographic coordinates based on their updated registered address, while closed enterprises are retained in the dataset for the years they were active but are excluded from subsequent years to ensure temporal accuracy.

- CISA membership changes: CISA membership adjustments (new admission or delisting) are confirmed using annual CISA membership bulletins. Newly admitted members are included in the dataset from the year of their admission (consistent with the annual increments recorded in the China Iron and Steel Industry Yearbook), while delisted members (due to failure to meet membership criteria or voluntary withdrawal) are excluded from the year of delisting. A consistency check is conducted across consecutive yearbooks to ensure that there are no missing or redundant records of membership changes.

2.2.2. Quantification of Dataset Representativeness and Bias Analysis

- Scale Representativeness: In 2023, CISA member units accounted for 82.3% and 76.5% of China’s crude steel output (data from the National Bureau of Statistics) and total industry revenue (data from the China Iron and Steel Industry Yearbook 2024), respectively. The proportion of production-type members in the total sample from 2005 to 2023 remained above 65% (121/180 and 259/347 in 2005 and 2023, respectively), aligning with the production-dominated structure of China’s steel industry; this indicates that the sample covers the majority of large and medium-sized steel enterprises that dominate industry production and operation.

- Bias from Excluding Non-CISA Members: Since CISA membership primarily targets large and medium-sized enterprises (with criteria including annual output, revenue, and industry influence), non-CISA members—mostly small-scale private steel enterprises, local foundries, and informal processing units—are underrepresented. This may lead to the agglomeration degree of large-scale, standardized enterprises and the dispersion characteristics of small-scale private enterprises in rural or underdeveloped regions being over- and underestimated, respectively. However, given that non-CISA members contribute less than 20% of national crude steel output (2023 data), their exclusion has a limited impact on the identification of overall industry spatial patterns and major agglomeration trends.

- Representation of Private and Small-Scale Enterprises: While CISA members include a growing number of large private steel enterprises (e.g., Jiangsu Shagang Group), small-scale private enterprises (with annual crude steel output below 1 million tons) are rarely included, resulting in an insufficient reflection of the spatial distribution of small-scale private enterprises concentrated in regions such as Hebei, Shandong, and Henan. We supplemented the analysis with provincial statistical yearbook data on small-scale steel enterprise distribution in key regions to mitigate this limitation, confirming that their dispersion does not alter the core spatial pattern of the industry.

2.2.3. Rationale for Time Node Selection

- 2005: The State Council issued the first document to curb blind expansion of steel capacity, marking the start of standardized industry regulation and thus serving as the baseline for tracking long-term spatial changes.

- 2010: Large-scale enterprise restructuring (e.g., Ansteel-Pangang, Baosteel-WISCO mergers) and the deepening of the “Eleventh Five-Year Plan” industrial adjustment were observed, reflecting the impact of policy-driven integration on spatial patterns.

- 2014: The “Twelfth Five-Year Plan” concluded, and the steel industry entered a period of structural overcapacity; this node captures spatial adjustments amid market-driven capacity optimization.

- 2020: The “Thirteenth Five-Year Plan” ended, and the “dual-carbon” goal was formally proposed, representing the shift to low-carbon-oriented spatial restructuring.

- 2023: This is the latest available year with complete data, reflecting the current state of spatial evolution under the “Fourteenth Five-Year Plan” and post-pandemic industry recovery.

2.2.4. Geographic Coordinate Acquisition and Spatial Matching

3. Analysis of Results

3.1. Characteristics of the Zonal Distribution of Chinese Iron and Steel Enterprises

3.2. Spatial Agglomeration Analysis

- Theoretical Basis

- Real-World Evidence and Cases

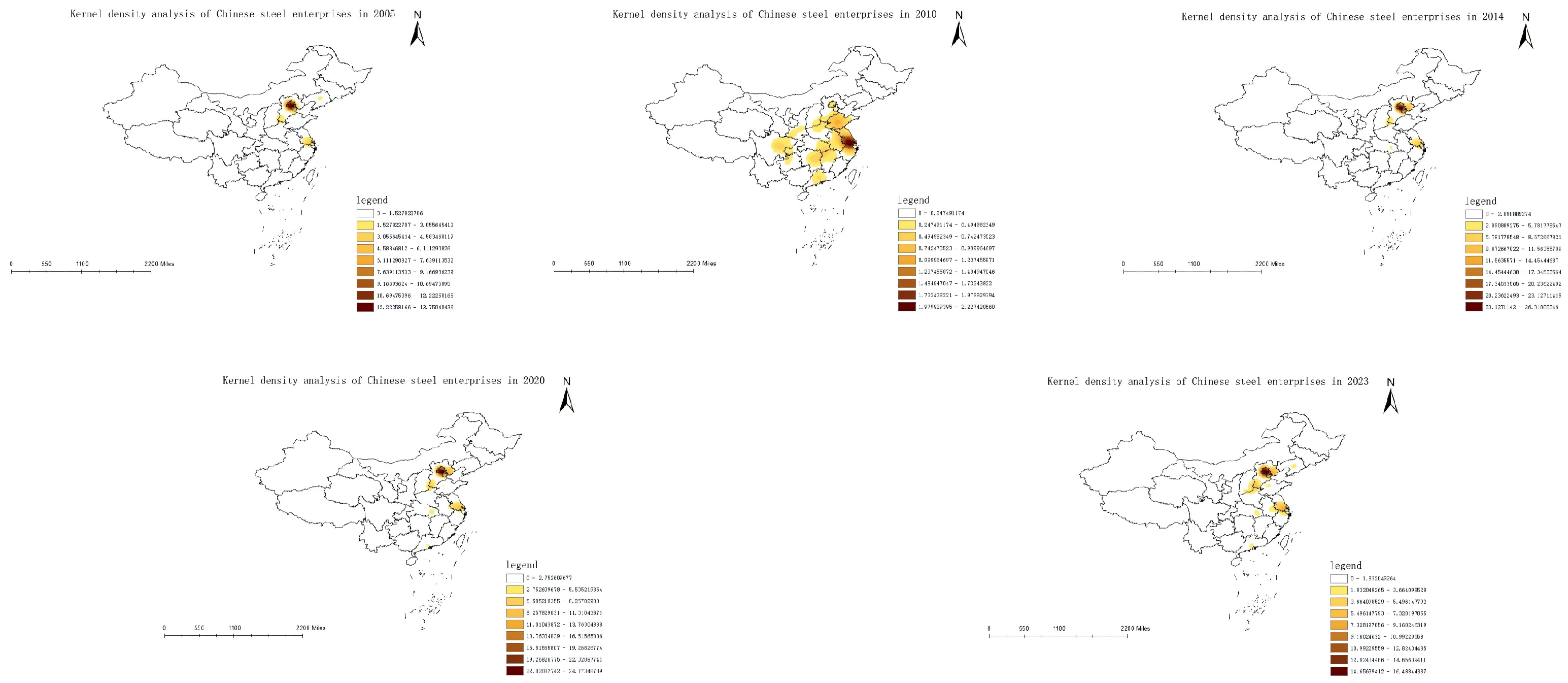

3.3. Kernel Density Analysis

- Market demand diversification: Trade enterprises require proximity to end markets in order to respond quickly to fluctuations in demand; for example, small and medium-sized trade firms targeting regional construction or manufacturing sectors are widely distributed across second- and third-tier cities, rather than being concentrated in core agglomerations. This is particularly evident in inland provinces like Sichuan and Hunan, where local trade firms focus on distributing steel and building materials for regional infrastructure projects.

- Logistics network expansion: The improvement of national transportation infrastructure—including high-speed railways, inland ports, and regional logistics hubs—has reduced the reliance of trade enterprises on coastal or central hubs. Inland cities such as Chongqing and Wuhan have attracted regional trade branches by leveraging their status as inland river ports and logistics centres, thus further dispersing the overall layout.

- Policy-driven regional balance: National strategies such as the Western Development and the Rise of Central China have introduced preferential policies (e.g., tax reductions for trade in border areas and subsidies for inland port construction) to encourage trade resources to move beyond eastern agglomerations. For instance, border cities like Manzhouli and Kashgar have seen growth in trade firms focused on cross-border commerce with Russia and Central Asia, as driven by policy support for border trade.

3.4. Standard Deviation Elliptic Analysis

3.5. Analysis of the Evolution of Regional Centres of Gravity

4. Conclusions, Discussion and Recommendations

4.1. Conclusions

- Distribution Differences on the Zonal Scale: There are obvious spatial zonal distribution differences on the zonal scale among steel enterprises, which are roughly consistent with the spatial pattern of social and economic development levels. The eastern coastal areas, with their large economic volume, high development level, convenient transportation, and sound market system and mechanism, have become the most concentrated areas in terms of the steel industry. The proportion of steel industry member units in the eastern, central, and western regions shows a spatial ratio of approximately 5:3:2. There are also significant differences in the spatial distribution of different types of member units, wherein the eastern region holds the advantage for all types of enterprise units.

- Differences in Enterprise Agglomeration Degree: There are certain differences in the agglomeration degree among different types of enterprise units. All types show spatial agglomeration except for trade-type enterprise units. During the period from 2005 to 2023, the agglomeration degree of the types of enterprises has shown an increasing trend, except for scientific research-type enterprise units, which have shown a trend of transformation from agglomerated to random distribution during this period, therefore reducing the degree of agglomeration. Trade-type enterprises showed a uniform distribution before 2014 and then transformed into an agglomerated type.

- Overall Spatial Distribution Trend: The overall spatial distribution pattern of China’s steel industry shows a “northeast–southwest” trend, with the central axis falling roughly on the “Tangshan–Jinan–Wuhan” line. Through the standard deviation ellipse analysis, it can be seen that the area inside the ellipse mainly covers the central and eastern provinces and that the difference between the long and short axes of the ellipse is large, with significant directionality. Although the differences in the gaps between the long and short axes of the ellipse in each year are not significant, in 2010, it showed a “northwest–southeast” spatial distribution trend as a result of the restructuring of Ansteel and Pangang, the former Baosteel Group, and the former Wuhan Iron and Steel Group.

- Evolution of the Centroid of Member Units: The centre of member units mainly moves along the junction of Shandong, Henan, Hubei, and Anhui provinces. Its moving direction and speed vary significantly in different time periods, with its moving trajectory being roughly divided into three stages and generally showing a southwest–northeast moving trend. This change is the result of the different stages and development levels of China’s steel industry, specifically those concerning its economic development pattern. To a certain extent, this reflects the national macro-regional policies but includes a certain time lag.

4.2. Discussion

- Correlation between Urban Hierarchy and Enterprise Distribution: At the national scale, many large-scale steel enterprises are concentrated in municipalities directly under the jurisdiction of central government and provincial capital cities, such as Beijing, Shanghai, and Guangzhou. These cities have complete infrastructures and numerous universities and research institutions, providing a large number of highly skilled professionals for steel enterprises. Simultaneously, within these cities, the urban economy is active and the demand for steel products is strong, providing a broad market space for enterprises. However, due to the limitations of resources and market scale, small and medium-sized cities find it difficult to attract large-scale steel enterprises; local steel enterprises are generally small-scale and face many difficulties in technological innovation and market expansion.

- Resource Dependence and Layout Changes: Most of China’s steel enterprises were once located in areas rich in iron ore and coal resources; for example, Ansteel grew and expanded by relying on the rich iron ore resources in Liaoning. However, with the gradual exploitation of resources, the reserves of resources in some areas have depleted, which, coupled with the development of transportation technology, has caused some enterprises to move to coastal areas. For example, by taking advantage of Shanghai’s superior port conditions, Baosteel can conveniently import iron ore and other resources, greatly reducing transportation costs and optimizing the enterprise’s layout.

- Layout Adjustment Oriented by Market Demand: The demand for steel is hugely exacerbated by the construction industry. In areas where the construction industry is prosperous, steel enterprises can obtain stable orders; for example, in the Yangtze River Delta and Pearl River Delta regions, the active construction market has attracted a large number of steel enterprises to relocate. In recent years, emerging industries such as new energy vehicles and aerospace have developed rapidly, increasing the demand for some special steels. Some steel enterprises have begun to move closer to areas where emerging industries gather in order to better understand market demands, respond quickly, and provide customized products.

- Layout Evolution under Policy Guidance: Driven by environmental protection policies, some high-pollution and high-energy-consuming steel enterprises face rectification or relocation; for example, some steel enterprises located in the main urban areas of cities have moved to suburban areas or other regions with a stronger environmental carrying capacity due to improved environmental protection requirements. At the same time, the industrial support policies introduced by various regions have also impacted the layout of the steel industry. Some economic development zones attract steel enterprises through policies such as tax preferences and land concessions, thus promoting the formation of industrial clusters and driving the development of the regional steel industry.

- Comparison of Structural Adjustment with Major Steel-Producing Countries: From the perspective of enterprise type evolution, China’s steel industry structural adjustment presents a “comprehensive upgrading of multi-type enterprises” feature driven by both policy and market, marking significant differences from major producing countries:

- 6.

- Support for China’s “Dual-Carbon” Goals: This study’s findings on the spatial layout and agglomeration evolution of the steel industry provide practical support for achieving the “dual-carbon” commitments. On the one hand, the relocation of high-pollution production-type enterprises from urban centres to suburban and coastal areas (with stronger environmental carrying capacity) facilitates centralized treatment of pollutants and reduces regional environmental pressure, while on the other hand, the dispersion of scientific research-type enterprises promotes the cross-regional diffusion of low-carbon technologies (e.g., energy-saving production processes and clean energy applications) and the agglomeration of production enterprises enables low-carbon infrastructure sharing (e.g., waste heat recovery systems), thereby collectively reducing the industry’s overall carbon emission intensity and laying a foundation for reaching peak carbon emissions by 2030 and achieving carbon neutrality by 2060.

- 7.

- Impact on Regional Inequality: This study’s findings indicate that the steel industry’s layout evolution does not lead to the sustained backwardness of central and western provinces, as cluster models are expected to promote regional convergence. Although eastern regions still dominate regarding the number of enterprise units, the “5:3:2” spatial ratio of eastern, central, and western distribution shows a narrowing gradient gap. As central and western regions undertake industrial transfers guided by policies and leverage local resource advantages to form specialized clusters (e.g., steel raw material supply clusters or regional service-type enterprise clusters), alongside the dispersion of scientific research-type enterprises bringing innovation resources, the central and western steel industry is gradually moving from “scale expansion” to “quality improvement,” helping narrow the development gap with eastern regions.

- 8.

- Implications for Supply Chain Resilience and Risk Management: Against the backdrop of global steel demand fluctuations, this study’s findings on the steel industry’s spatial pattern and agglomeration characteristics provide key insights for enhancing supply chain resilience. The multi-regional agglomeration of trade-type enterprises (e.g., Beijing–Tianjin–Hebei, Yangtze River Delta) reduces dependence on a single trade hub and mitigates supply chain disruptions caused by regional risks. The coastal layout of production-type enterprises facilitates the diversification of raw material import channels and thus avoids supply shortages resulting from a fluctuating single source. Additionally, the coordinated development of production, research, service, and trade enterprises enables rapid adjustment of production and sales strategies in response to global demand changes, thereby improving the industry’s resistance to market risks.

4.3. Recommendations

- Optimize Regional Layout Based on Agglomeration Advantages and Industrial Upgrading

- 2.

- Adjust Enterprise Layout by Functional Type to Link Industrial Upgrading

- 3.

- Align Layout Optimization with “Dual-Carbon” Goals and National Strategies

- 4.

- Integrate Foreign Direct Investment (FDI) and Overseas Business into Spatial Layout Planning

- 5.

- Adapt Spatial Logic to Digitalization, Industry 4.0, and Green Transformation Technologies in the Next Decade

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ma, H.Q.; Huang, G.T.; Wang, R.; Shen, G.J. Analysis of the Causes and Ownership Differences of Overcapacity in China’s Steel Enterprises. J. Econ. Res. 2018, 53, 94–109. [Google Scholar]

- Hu, A.G.; Zhou, S.J.; Ren, H. Supply side structural reform—Adapting to and leading the new normal of the Chinese economy. J. Tsinghua Univ. (Philos. Soc. Sci. Ed.) 2016, 31, 17–22+195. [Google Scholar]

- World Steel Association. Steel Statistics Yearbook 2018; World Steel Association: Belgium, Brussels, 2019. [Google Scholar]

- Xu, J.M.; Yu, Q.F.; Hou, X.Y. Sustainability Assessment of Steel Industry in the Belt and Road Area Based on DPSIR Model. Sustainability 2023, 15, 11320. [Google Scholar] [CrossRef]

- Wang, J. Construction and Application of Overseas Data Cloud Platform for Iron and Steel Industry. Hebei Metall. 2022, 84–86. [Google Scholar] [CrossRef]

- Zhang, L.Q. Standards support the green, low-carbon, and high-quality development of the steel industry. J. Stand. Eng. Constr. 2022, 9, 36–38. [Google Scholar] [CrossRef]

- Wang, G.D. Technological innovation and development direction in the steel industry. J. Steel 2015, 50, 1–10. [Google Scholar]

- Tian, X.; Li, Z.L.; Geng, Y. Resource and Environmental Impacts of Carbon Emission Reduction in China’s Iron and Steel Industry under the Carbon Neutrality Goal. Resour. Sci. 2024, 46, 700–716. [Google Scholar]

- Bobenic, T.; Hintosová, A.B.; Hliboká, L.; Vasková, I. Effects of changes in steel industry concentration. Metalurgija 2015, 54, 571–574. [Google Scholar]

- Zhu, S.L.; Gao, C.K.; Song, K.H.; Gao, W.G.; Guo, Y.H.; Gao, C.B. The changes in spatial layout of steel industry in China and associated pollutant emissions: A case of SO2. J. Environ. Manag. 2022, 302, 9. [Google Scholar] [CrossRef]

- Mousa, E.; Wang, C.; Riesbeck, J.; Larsson, M. Biomass applications in iron and steel industry: An overview of challenges and opportunities. Renew. Sustain. Energy Rev. 2016, 65, 1247–1266. [Google Scholar] [CrossRef]

- Quader, M.A.; Ahmed, S.; Ghazilla, R.A.R.; Ahmed, S.; Dahari, M. A comprehensive review on energy efficient CO2 breakthrough technologies for sustainable green iron and steel manufacturing. Renew. Sustain. Energy Rev. 2015, 50, 594–614. [Google Scholar] [CrossRef]

- Rechberger, K.; Spanlang, A.; Conde, A.S.; Wolfmeir, H.; Harris, C. Green Hydrogen-Based Direct Reduction for Low-Carbon Steelmaking. Steel Res. Int. 2020, 91, 2000110. [Google Scholar] [CrossRef]

- Zhao, X.L.; Zhao, Y.; Zeng, S.X.; Zhang, S.F. Corporate behavior and competitiveness: Impact of environmental regulation on Chinese firms. J. Clean. Prod. 2015, 86, 311–322. [Google Scholar] [CrossRef]

- Zhao, J.; Zuo, H.B.; Wang, Y.J.; Wang, J.S.; Xue, Q.G. Review of green and low-carbon ironmaking technology. Ironmak. Steelmak. 2020, 47, 296–306. [Google Scholar] [CrossRef]

- Wang, R.R.; Zhao, Y.Q.; Babich, A.; Senk, D.; Fan, X.Y. Hydrogen direct reduction (H-DR) in steel industry-An overview of challenges and opportunities. J. Clean. Prod. 2021, 329, 129797. [Google Scholar] [CrossRef]

- Arens, M. Policy support for and R&D activities on digitising the European steel industry. Resour. Conserv. Recycl. 2019, 143, 244–250. [Google Scholar] [CrossRef]

- Lopez, G.; Galimova, T.; Fasihi, M.; Bogdanov, D.; Breyer, C. Towards defossilised steel: Supply chain options for a green European steel industry. Energy 2023, 273, 127236. [Google Scholar] [CrossRef]

- Ohman, A.; Karakaya, E.; Urban, F. Enabling the transition to a fossil-free steel sector: The conditions for technology transfer for hydrogen-based steelmaking in Europe. Energy Res. Soc. Sci. 2022, 84, 102384. [Google Scholar] [CrossRef]

- Shahabuddin, M.; Brooks, G.; Rhamdhani, M.A. Decarbonisation and hydrogen integration of steel industries: Recent development, challenges and technoeconomic analysis. J. Clean. Prod. 2023, 395, 136391. [Google Scholar] [CrossRef]

- Zhang, Q.; Xu, J.; Wang, Y.J.; Hasanbeigi, A.; Zhang, W.; Lu, H.Y.; Arens, M. Comprehensive assessment of energy conservation and CO2 emissions mitigation in China’s iron and steel industry based on dynamic material flows. Appl. Energy 2018, 209, 251–265. [Google Scholar] [CrossRef]

- Zhang, X.Y.; Jiao, K.X.; Zhang, J.L.; Guo, Z.Y. A review on low carbon emissions projects of steel industry in the World. J. Clean. Prod. 2021, 306, 127259. [Google Scholar] [CrossRef]

- Hasanbeigi, A.; Arens, M.; Cardenas, J.C.R.; Price, L.; Triolo, R. Comparison of carbon dioxide emissions intensity of steel production in China, Germany, Mexico, and the United States. Resour. Conserv. Recycl. 2016, 113, 127–139. [Google Scholar] [CrossRef]

- He, K.; Wang, L.; Zhu, H.L.; Ding, Y.L. Energy-Saving Potential of China’s Steel Industry According to Its Development Plan. Energies 2018, 11, 948. [Google Scholar] [CrossRef]

- Song, L.L.; Wang, P.; Hao, M.; Dai, M.; Xiang, K.Y.; Li, N.; Chen, W.Q. Mapping provincial steel stocks and flows in China: 1978–2050. J. Clean. Prod. 2020, 262, 121393. [Google Scholar] [CrossRef]

- Harpprecht, C.; Naegler, T.; Steubing, B.; Tukker, A.; Simon, S. Decarbonization scenarios for the iron and steel industry in context of a sectoral carbon budget: Germany as a case study. J. Clean. Prod. 2022, 380, 134846. [Google Scholar] [CrossRef]

- Gao, Y. Empirical Research on the International Transfer of the Steel Industry and Its Influencing Factors. Doctoral Dissertation, Fudan University, Shanghai, China, 2007. [Google Scholar]

- Jiang, B. Intelligent Quality Application Based on Industrial Big Data: Taking the Steel Industry as an Example. J. Shanghai Quality 2023, 11, 23–25. [Google Scholar]

- Huang, D.; Chen, L.Y.; Zhang, L.F. Promoting the Upgrading of Energy—Saving and Environmental Protection Technology Management to Facilitate the Green Transformation of the Steel Industry. J. Iron Steel 2015, 50, 1–10. [Google Scholar]

- Liu, L.W. Analysis of Iron and Steel Intelligent Manufacturing System Architecture Based on Big Data. Plant Maint. Eng. 2024, 1–3. [Google Scholar] [CrossRef]

| Location | The Number of Member Units of the China Iron and Steel Association |

|---|---|

| Eastern Region | 242 |

| Central Region | 114 |

| Western Region | 93 |

| Vintages | NNI | Z Score | Confidence Level (Math.) | Type of Spatial Distribution |

|---|---|---|---|---|

| 2005 | 0.40 | −15.32 | 0 | assemble |

| 2010 | 0.53 | −8.96 | 0 | assemble |

| 2014 | 0.33 | −22.72 | 0 | assemble |

| 2020 | 0.35 | −22.66 | 0 | assemble |

| 2023 | 0.36 | −22.73 | 0 | assemble |

| Vintages | NNI | Z Score | Confidence Level (Math.) | Type of Spatial Distribution |

|---|---|---|---|---|

| 2005 | 0.58 | −8.84 | 0 | assemble |

| 2010 | 0.50 | −11.69 | 0 | assemble |

| 2014 | 0.44 | −16.00 | 0 | assemble |

| 2020 | 0.42 | −18.53 | 0 | assemble |

| 2023 | 0.46 | −16.67 | 0 | assemble |

| Vintages | NNI | Z Score | Confidence Level (Math.) | Type of Spatial Distribution |

|---|---|---|---|---|

| 2005 | 0.82 | −1.83 | 0.07 | assemble |

| 2010 | 0.80 | −2.21 | 0.03 | assemble |

| 2014 | 0.67 | −4.5 | 0 | assemble |

| 2020 | 0.64 | −7.78 | 0 | assemble |

| 2023 | 0.68 | −4.64 | 0 | assemble |

| Vintages | NNI | Z Score | Confidence Level (Math.) | Type of Spatial Distribution |

|---|---|---|---|---|

| 2005 | 1.75 | 3.50 | 0 | evenness |

| 2010 | 1.80 | 3.77 | 0 | evenness |

| 2014 | 0.67 | −2.30 | 0.02 | assemble |

| 2020 | 0.55 | −3.07 | 0 | assemble |

| 2023 | 0.86 | −0.90 | 0.37 | stochastic |

| Vintages | NNI | Z Score | Confidence Level (Math.) | Type of Spatial Distribution |

|---|---|---|---|---|

| 2005 | 0.66 | −3.28 | 0 | assemble |

| 2010 | 0.63 | −3.20 | 0 | assemble |

| 2014 | 0.93 | −0.62 | 0.53 | stochastic |

| 2020 | 0.88 | −1.06 | 0 | stochastic |

| 2023 | 0.82 | −1.54 | 0.12 | stochastic |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, D.; Dong, W.; Hou, Z.; Wang, H.; Duan, Y. Characteristic Analysis of the Evolution of the Temporal and Spatial Patterns of China’s Iron and Steel Industry from 2005 to 2023. Sustainability 2025, 17, 8623. https://doi.org/10.3390/su17198623

Li D, Dong W, Hou Z, Wang H, Duan Y. Characteristic Analysis of the Evolution of the Temporal and Spatial Patterns of China’s Iron and Steel Industry from 2005 to 2023. Sustainability. 2025; 17(19):8623. https://doi.org/10.3390/su17198623

Chicago/Turabian StyleLi, Di, Wanjin Dong, Zhaowei Hou, Hongye Wang, and Ye Duan. 2025. "Characteristic Analysis of the Evolution of the Temporal and Spatial Patterns of China’s Iron and Steel Industry from 2005 to 2023" Sustainability 17, no. 19: 8623. https://doi.org/10.3390/su17198623

APA StyleLi, D., Dong, W., Hou, Z., Wang, H., & Duan, Y. (2025). Characteristic Analysis of the Evolution of the Temporal and Spatial Patterns of China’s Iron and Steel Industry from 2005 to 2023. Sustainability, 17(19), 8623. https://doi.org/10.3390/su17198623