2. Literature Review and Hypothesis Development

Corporate financial strategy (CFS) refers to the systematic management of financial resources to achieve organizational goals. It includes preparing, allocating, and utilizing working capital, as well as making strategic decisions on investment, financing, and risk management. And these practices improve financial efficiency and create stakeholder value [

17,

18]. Prior research shows that CFS influences firms’ ability to achieve sustainable development goals (SDGs). Companies typically develop their core values and operational approaches within this strategic framework [

19]. Those integrating financial planning with corporate social responsibility have shown positive impacts on both profit levels and SDG attainment, particularly excelling in achieving key performance indicators (KPIs) and specific objectives [

20].

Recent studies demonstrate a significant correlation between corporate financial strategies and sustainable performance (SP). Financial approaches that emphasize transparency, efficiency, and responsible disclosure enhance long-term effectiveness [

21]. By reducing information asymmetry and strengthening stakeholder trust, transparent sustainability reporting helps improve financial performance [

22]. Furthermore, under appropriate disclosure levels, the governance-related disclosure is likewise associated with higher profitability and efficiency [

23].

CFS determines the SP as reflected through economic, social, and environmental metrics. In strategic management, the RBV (Resource-Based View) helps explain how a firm can take advantage of its financial assets and resources to achieve competitive and sustainable benefits [

24]. Studies highlight that corporate finance allocates appropriate funds for sustainability programs [

25]. In particular, capital expenditure and R&D investment are key drivers of sustainability strategies [

26]. Research has demonstrated that R&D spending fosters environmental innovation and value creation, while capital investment supports long-term growth and firm value [

27]. Research on the RBV indicated that environmental performance has positive returns for firms, particularly in high-growth sectors.

Beyond direct investment, financial risk management is essential for aligning corporate strategy with sustainability. Studies show that firms use risk assessment processes and tools such as sustainability-linked loans and green bonds to balance profitability with social and environmental responsibility [

28,

29]. These studies emphasize adaptive financial strategies as a mechanism for embedding sustainability into corporate governance structures [

30]. Accordingly, corporate financial strategy (CFS) directly influences sustainability performance (SP) by shaping the financial structure, improving risk management, optimizing financial instruments, addressing transactions and operational issues, and aligning the corporate life cycle with long-term sustainability goals [

31]. Thus, this research proposes the following hypothesis:

Hypothesis 1. Corporate Financial Strategy affects Sustainability Performance.

Corporate culture (CC) integrates sustainable practices, values, and responsibilities into organizational structures and daily operations [

32]. Unlike short-term profit orientation, CC emphasizes long-term impacts on employees, communities, and the environment, aligning business activity with sustainability performance (SP) objectives [

33]. Importantly, this approach seeks to embed sustainability authentically in employee behavior and organizational strategy [

34].

A sustainability-oriented culture promotes reduced resource use, environmental awareness, diversity, inclusion, and ethical conduct [

35]. These values link sustainability to financial success and social wellbeing [

36]. CC sustainability is also an evolving field that encompasses risk perception, mitigation, and adaptation to global challenges such as climate change, resource depletion, and societal inequalities [

37]. It emphasizes the importance of cultural assets, community cohesion, and inclusive strategies for building sustainable futures [

38].

Aligning financial strategies with sustainability initiatives enables businesses to realize significant advantages essential for sustained growth and resilience. These benefits include improved brand reputation, heightened stakeholder trust, and increased organizational adaptability [

39]. Strategic integration of ESG priorities and effective knowledge management not only fosters a sustainable corporate culture but also enhances credibility among both internal and external stakeholders [

40]. This alignment promotes greater accountability across all levels of the organization and supports collaborative efforts and innovation in achieving sustainability objectives [

41].

Moreover, employees also benefit directly from working in organizations that emphasize ethical decision-making and genuine social contribution. This, in turn, strengthens their commitment to organizational goals and motivates them to pursue them with greater dedication and energy [

42]. By cultivating a culture centered on sustainability, organizations become more adaptable to evolving markets and regulatory demands while also remaining responsive to social expectations [

34]. Such adaptability enhances not only performance but also competitiveness. Furthermore, embracing open innovation helps organizations build dynamic capabilities, equipping them to manage uncertainty effectively and supporting long-term sustainable development and growth [

43].

Integrating sustainability into financial planning and strategic decision-making reinforces firms’ commitment to responsible business practices. In today’s competitive environment, sustainability has become a key driver of organizational success [

44]. Companies that consistently uphold sustainability performance (SP) principles cultivate a proactive and engaged workforce. Increasingly, job seekers are attracted to organizations that champion sustainability and demonstrate genuine commitment to social and environmental outcomes. Aligning personal values with corporate missions not only strengthens employer brand appeal but also influences career choices [

45]. Eventually, such initiatives foster trust, stimulate innovation, and support continuous growth and resilience, granting firms a competitive edge while ensuring meaningful contributions to both people and the planet [

46].

Hypothesis 2. Corporate Financial Strategy affects Corporate Culture.

Corporate culture (CC) is essential in shaping a firm’s sustainability performance (SP). When sustainability becomes part of corporate identity, it fosters ethical behavior and social responsibility [

32]. Organizations that intentionally foster a sustainability-oriented culture are better equipped to respond to broader societal expectations and make more meaningful progress toward their SP objectives [

32]. Research consistently indicates that firms with strong cultural commitments to sustainability tend to adopt behaviors that enhance environmental outcomes and improve overall performance [

47]. Other findings further support a positive relationship between a company’s internal commitment to sustainability and its ability to reduce environmental impact [

32].

Emphasizing cultural values such as innovation, collaboration, and quality significantly increases the likelihood of successful sustainability initiatives. When these values are embedded within an organization, employees at all levels are more inclined to work collectively toward common environmental and social objectives [

36]. This alignment enables companies to make tangible progress in key areas of sustainability performance, including reducing carbon emissions, enhancing supply chain transparency, and fostering inclusive workplace practices [

36]. Furthermore, a strong sustainability-oriented culture provides a solid foundation for ongoing innovation and cross-functional collaboration, equipping organizations to achieve measurable and enduring environmental and social impacts [

48].

Firms that embed sustainability into their corporate culture (CC) not only strengthen sustainability performance (SP) and reputation but also achieve financial and operational gains [

49]. Employees who feel aligned with their company’s sustainable values perform at a higher level, which creates advantages for the organization, its stakeholders, and investors [

32]. This interconnected improvement of SP metrics, morale, and financial success positions the company for long-term success in the modern business environment [

50]. Building a corporate culture (CC) that prioritizes sustainability is a key strategy for organizations aiming to strengthen their sustainability performance (SP). By making sustainability a core value and integrating it into daily practices and decisions, firms create a framework for long-term operational and strategic success [

51]. This approach improves competitiveness and reputation in global markets while delivering tangible benefits for employees, stakeholders, and society [

40].

Hypothesis 3. Corporate Culture affects Sustainability Performance.

Focusing solely on financial sustainability does not capture the essence of integrating corporate financial strategy (CFS) into sustainability performance (SP) [

44]. Embedding sustainability into financial decisions allows firms to develop proactive strategies that treat SP as intrinsic, engaging stakeholders and prioritizing social and environmental goals over short-term gains. This integrated approach strengthens long-term corporate growth and ethical business practices [

52]. As a result, businesses can achieve financial benefits while boosting operational efficiency. Companies that adopt such strategies are better equipped to address urgent challenges, enhance their public image, and build reputations as socially responsible leaders [

53]. At the same time, these efforts help organizations cultivate a stronger public image, showcasing them as socially responsible leaders in their industry. A positive reputation that reflects commitment to SP principles is invaluable; it strengthens trust and respect among key stakeholders such as investors, customers, business partners, and employees. Over time, this trust-building process forms the foundation for better financial performance, deeper and more meaningful stakeholder relationships, and sustainable growth for the organization [

54].

Beyond the external advantages, cultivating a strong corporate culture (CC) also generates significant internal benefits for organizations [

55]. Employees are more motivated when they see their organization making genuine commitments to environmental and social responsibility [

56]. This alignment between personal values and organizational mission instills a deeper sense of purpose [

57]. At the same time, the increasing morale and engagement lead to improved productivity, thus fostering a work environment that inspires individuals to contribute to their fullest potential [

58]. Companies that demonstrate a clear dedication to sustainability also strengthen employee loyalty, supporting retention and workplace stability [

59]. These internal benefits enhance financial performance and embed SP more firmly in long-term strategy [

60].

By aligning financial strategies with sustainability, organizations create a unified approach that secures both profitability and meaningful SP outcomes [

61]. This unified approach positions businesses to thrive by balancing ethical, social, and environmental goals with their financial imperatives [

44]. It provides them with a framework to succeed in today’s increasingly competitive and socially conscious global economy, setting the stage for lasting organizational success [

62].

Hypothesis 4. Corporate Financial Strategy integration affects Sustainability Performance via Corporate Culture.

With the widespread adoption of “carbon neutrality” initiatives, sustainability performance (SP) investments have grown rapidly in recent decades. Within the broader framework of globalization, SP has drawn increasing attention from both industry and academia [

63]. Closely related to “sustainable development” and “corporate social responsibility” (CSR), SP goes beyond traditional CSR reporting by adding greater structure and rigor to disclosure practices [

64].

SP includes three key aspects: environment, society, and governance. Driven by climate change, firms now recognize environmental protection as essential for long-term growth [

65]. Many are prioritizing cleaner energy, emission reduction, and resource efficiency. At the same time, social issues such as human rights, equality, and community development have gained prominence [

66]. Both consumers and investors have developed a strong interest in corporate social responsibility, demanding that companies take positive actions to address social issues. Enterprises have found that actively assuming social responsibility is conducive to improving corporate reputation and market competitiveness [

67]. Furthermore, governance issues have become a key area of concern for companies [

68]. Effective corporate governance structures and practices are essential to ensure transparency, accountability, and compliance [

69]. In today’s globalized and digital context, companies face rising governance expectations from shareholders, investors, and regulators alike [

70].

Sustainability performance (SP) rests on three fundamental dimensions: environment, society, and governance. From an environmental standpoint, Ren and Ren [

71] highlight that rising public awareness of ecological issues can substantially enhance corporate SP. Similarly, Chien [

72] shows that R&D investment and ecological innovation strengthen enterprise innovation capacity, offering guidance for green development strategies. From a social perspective, Song [

68] demonstrates that strong SP enhances corporate reputation, which improves the efficiency of human capital investment. Higher SP not only elevates reputation but also boosts workforce productivity, thereby contributing to competitive advantage. Meanwhile, from a governance perspective, Ruan et al. [

73] find that SP is associated with solvency, with stronger effects in high-polluting firms. This highlights the importance of governance quality for sustainability outcomes. SP has also been shown to reduce stock pledge risks, particularly in non-state-owned enterprises [

74].

The environmental dimension of sustainability performance (SP) evaluates how effectively firms manage emissions, resource efficiency, and green innovation. Performance in this area is gauged by the degree to which firms meet their environmental responsibilities, including reducing carbon footprints, enhancing energy efficiency, and adopting sustainable technologies [

31]. Within both social and corporate governance frameworks, environmental scoring is a central component of the overall assessment system. For instance, advancements in green technology and carbon management have been shown to significantly increase corporate valuations in the industrial sector, particularly across emerging Asian markets. These findings suggest that ESG-driven clean technology investments are positively associated with both profitability and market value, demonstrating the direct and indirect contributions of environmental performance to firm outcomes [

75].

The social dimension of SP emphasizes employee satisfaction, diversity and inclusion, and stakeholder relations [

76]. It covers factors such as working conditions, workplace satisfaction, health and safety, human rights, and community engagement. Research has shown that employee satisfaction not only strengthens the overall firm’s performance but also serves as a buffer against financial distress. In addition, gender diversity and inclusive governance practices are positively associated with stronger green collaborations and improved financial outcomes [

77]. Stakeholder engagement also moderates the link between CSR initiatives and sustainable value creation, particularly under rising environmental and social pressures [

78]. Overall, the social dimension consistently demonstrates a positive relationship with firm profitability and market value, underscoring its pivotal role in advancing corporate sustainability [

30].

The governance dimension of SP assesses how firms are managed, the relationship between managers and shareholders, and the integrity of corporate conduct. It includes management structure, shareholder rights, board composition, corporate ethics, and CSR approaches [

79]. Key governance considerations include management effectiveness, transparency, stakeholder accountability, and the alignment of corporate strategies with widely accepted governance principles [

80]. Refinitiv’s SP scoring framework identifies governance as one of the central pillars in assessing a company’s sustainability performance, offering measurable indicators of leadership quality and strategic direction [

81]. Strong governance practices ensure that organizational actions and processes remain consistent, transparent, and trustworthy, leading to more efficient resource allocation. Firms with high governance scores typically demonstrate effective management and responsible stakeholder relations, thereby fostering long-term sustainability and resilience [

82].

Recent research has emphasized the role of ecological innovation and digital transformation in advancing corporate sustainability. However, most studies focus on technology-related resources, paying relatively little attention to financial strategies. A few emerging studies highlight the role of organizational culture in integrating sustainability into corporate practices and promoting comprehensive reporting, but culture is usually treated as an independent factor rather than an interaction with financial strategy. Meanwhile, the research linking financial resources with sustainable development performance remains limited, and the mediating role of organizational culture has not been examined. In summary, three gaps remain. First, few studies conceptualize corporate financial strategy (CFS) as a strategic intangible resource in sustainability research. Second, limited attention has been given to the synergy between hard resources (CFS) and soft resources (corporate culture, CC). Third, although China’s automotive industry is central to the national green transition, empirical studies in this context remain scarce.

Despite growing interest in corporate financial strategy (CFS), corporate culture (CC), and sustainability performance (SP), significant research gaps remain. Much of the existing literature treats these constructs in isolation, often viewing CFS as a static mechanism rather than as a dynamic strategic resource. The mediating role of CC in the relationship between CFS and SP has rarely been explored, resulting in an incomplete understanding of how firms mobilize resources to meet sustainability objectives. Furthermore, few studies have sought to integrate the Resource-Based View (RBV), Stakeholder Theory, and Institutional Theory within a unified analytical framework, leaving the field fragmented, especially regarding empirical evidence from emerging economies like China’s automotive industry. Addressing these limitations, this study proposes an integrated model that investigates the impact of CFS on SP through the mediating influence of CC, grounded in a multi-theoretic perspective. By reconceptualizing CFS as a strategic capability and emphasizing CC as a critical transmission channel, this research offers a triangulated theoretical approach to better capture the dynamics of sustainability in transitional markets.

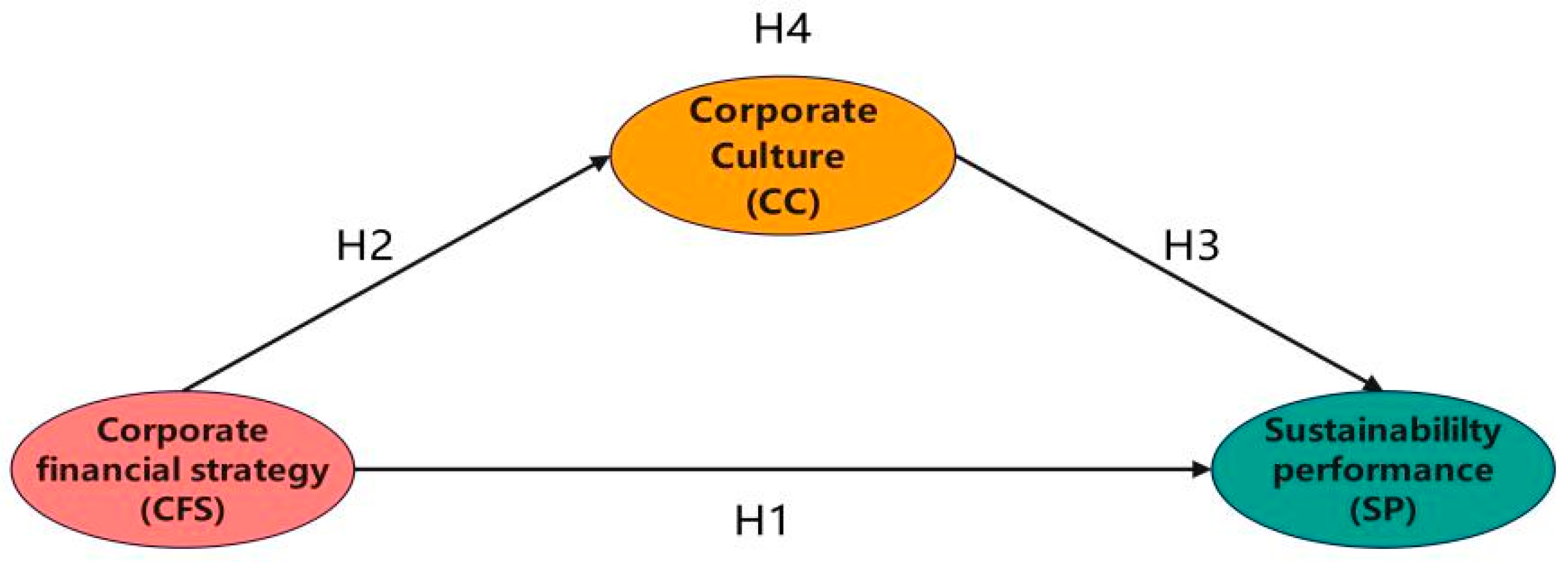

This study employs the Resource-Based View (RBV), Stakeholder Theory, and Institutional Theory to analyze Guangxi’s automobile industry and construct a comprehensive theoretical framework. RBV highlights the role of internal resource allocation, while stakeholder theory explains how firms align these resources with external expectations. Institutional theory complements these perspectives by emphasizing the influence of regulatory and normative environments. Integrating these three lenses offers a holistic understanding of how internal capabilities and external pressures interact to shape sustainability performance. The framework offers practical insights for managers and policymakers: firms should not only design robust financial strategies but also foster a sustainability-oriented culture to enhance competitiveness, legitimacy, and regulatory compliance in dynamic contexts. Within this framework, the study examines the relationships among corporate financial strategy (CFS), corporate culture (CC), and sustainability performance (SP), and proposes a model in which CC mediates the link between CFS and SP. The logic of this model is outlined as follows:

Figure 1 conceptual framework explores the relationships among key variables in corporate sustainability and SP. Drawing on RBV, we argue that as companies grow, they establish robust financial strategies. These strategies not only optimize tangible financial resources but also cultivate intangible assets such as organizational norms, risk awareness, values, and long-term orientation. Ultimately, these efforts lead to a comprehensive financial strategy and an excellent CC, which are unique resources that form the core competitiveness of the company. This approach enables firms to maintain an edge and continually optimize resources in a highly competitive and uncertain environment. By refining financial strategies, companies can positively shape CC, thereby ensuring the achievement of sustainability goals. As strategic resources, cultural attributes enhance performance, strengthen market position, and contribute to long-term competitive advantages in line with RBV.

Prior research has often examined corporate financial strategy (CFS), corporate culture (CC), and sustainability performance (SP) in isolation, focusing on financial planning or cultural influence without integrating the two. The mediating role of CC between CFS and SP also remains underexplored, particularly in emerging markets such as China’s automotive sector. To address these gaps, this study proposes a triadic model grounded in RBV, Stakeholder Theory, and Institutional Theory, offering a holistic view of how internal strategies and soft capabilities jointly drive sustainability.

5. Discussion

This study contributes to sustainability strategy research in three key ways. First, it extends the Resource-Based View (RBV) by reconceptualizing corporate financial strategy (CFS) as a strategic intangible asset and a valuable, rare, inimitable, and organizational (VRIO) resource, thereby emphasizing its role in developing long-term sustainability capabilities. Second, the study identifies corporate culture (CC) as a critical mediating variable that facilitates the translation of financial strategies into sustainability outcomes. By linking hard (financial) and soft (cultural) resources, CC bridges internal capabilities within the RBV framework. Third, the study integrates RBV, Stakeholder Theory, and Institutional Theory into a cohesive analytical model. This multi-theoretical approach offers a more comprehensive understanding of how firms mobilize internal resources while simultaneously responding to external legitimacy pressures and evolving stakeholder expectations.

Grounded in the RBV, internal resources such as financial strategies and corporate culture serve as critical drivers of sustainability performance, valued for their rarity, inimitability, and strategic importance [

88]. As VRIO resources, financial strategies enhance sustainability by optimizing resource allocation and embedding risk management, consistent with Fernandes’ [

89] finding that transparent financial strategies improve sustainability outcomes. Financial strategies also play a formative role in shaping CC by fostering long-term orientations and cultivating a sense of responsibility. This aligns with Brafh and Melin’s [

90] view that financial transformation drives cultural adaptation, positioning culture as an intangible yet critical strategic asset within the RBV framework [

25].

A sustainability-oriented culture, in turn, encourages cross-departmental collaboration through shared values such as environmental responsibility, supporting Bai et al.’s [

91] finding that values-driven cultures reinforce ESG integration. When financial strategies are mediated by culture, they are more effectively translated into sustainable practices, echoing Hart’s [

92] perspective that embedding environmental responsibility into financial planning fosters an adaptive and resilient corporate culture.

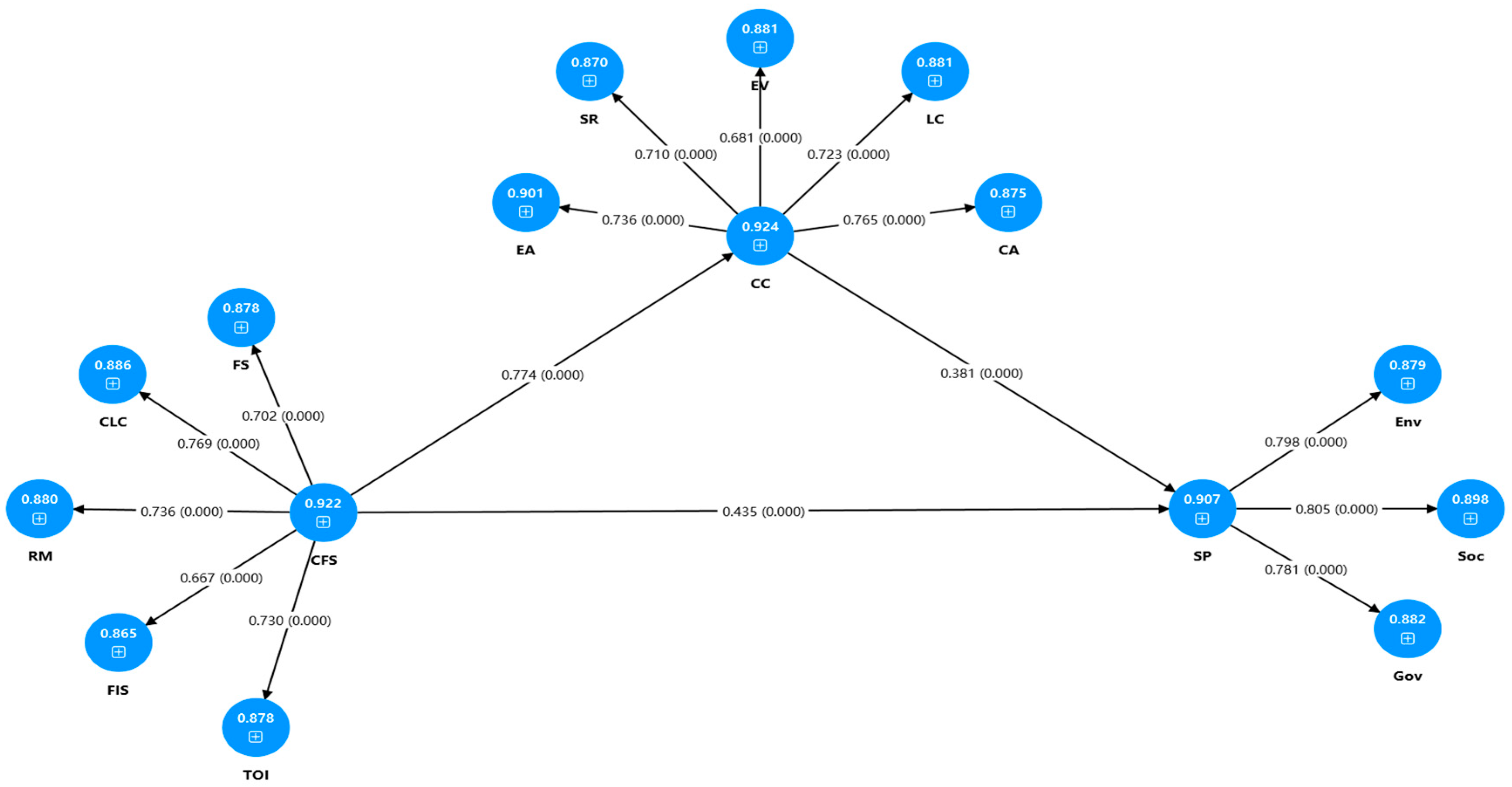

In the context of Chinese automobile manufacturers, CFS has a significant positive impact on SP (H1: β = 0.729,

p < 0.05). This supports the RBV, which emphasizes that firms must effectively leverage and redeploy internal resources and capabilities to achieve competitive advantage in dynamic environments [

93].

As an internal strategic resource, CFS contributes to sustainability by enhancing resource efficiency, facilitating long-term investment planning, and integrating risk management into core decision-making. These capabilities enable the firm to meet evolving stakeholder expectations while maintaining financial and operational stability.

This finding is consistent with Fernandes [

89], who emphasized that financial strategies embedded within sustainability practices enable firms to enhance accountability and transparency, both essential foundations of sustainable performance. Similarly, Barney [

24] asserts that valuable, rare, inimitable, and organizationally embedded (VRIO) resources, such as robust financial strategies, are critical for sustaining long-term competitive advantage. Hart [

92] further emphasizes the value of resource alignment, noting that integrating financial, environmental, and social resources is vital for achieving not only strong economic outcomes but also broader sustainability goals. Unlike these prior studies, which focused mainly on environmental metrics, our model incorporates social and governance dimensions, providing a more comprehensive view of SP. This broader scope may explain the stronger effect size observed.

Moreover, CFS was found to have a significant positive impact on CC (H2: β = 0.774,

p < 0.05). This suggests that financial strategies, beyond serving operational and economic purposes, play a vital role in shaping an organization’s cultural fabric. From the perspective of the Resource-Based View (RBV), strategic capabilities such as financial management sustain competitive advantage because they are valuable, rare, and difficult to imitate [

25]. Well-formulated financial strategies not only enhance stability and risk management but also foster a long-term orientation, key conditions for building a resilient and enduring corporate culture. In addition, CFS supports internal value alignment, transparency, and effective communication, thereby promoting openness and trust among stakeholders while reinforcing shared norms across organizational levels. Extending this logic, Hart [

92] integrates the natural-resource-based view into RBV, emphasizing that financial strategies incorporating environmental and social responsibility can further shape organizational values, ethical standards, and leadership behaviors. This integration helps cultivate a corporate culture that is forward-looking, accountable, and responsive to evolving societal expectations.

Research further demonstrates how financial strategies act as cultural transformation agents. Brafh and Melin [

90] show that financial transformation underpins both e-leadership and value-based decision-making, particularly in uncertain environments. Just as financial strategy evolves in response to market and environmental pressures, corporate culture must adapt in parallel. The results of this study support that CFS is used as a transformation agent shaping an adaptive, responsible, innovative, and learning CC.

In Chinese automobile manufacturers, CC has a significant positive effect on SP(H3: β = 0.381, p < 0.05). CC refers to the set of shared values, norms, and behavioral practices within an organization that shape decision-making, stakeholder engagement, and long-term strategic orientation. A strong CC that emphasizes accountability, environmental responsibility, and innovation can drive collective action toward sustainability goals.

From the RBV perspective, organizational culture is a valuable, rare, and hard-to-imitate intangible asset that contributes to sustainable competitive advantage. Companies integrating sustainability values such as ethical behavior, stakeholders’ recognition, and ecological consciousness into their cultural values tend to follow long-term environmental and social strategies, improving their SP.

The findings of this study are consistent with recent findings that value-driven organizational culture can effectively promote the integration of sustainability principles into corporate strategy and daily operations [

44]. Such cultural frameworks foster internal consensus on sustainability, enhance cross-departmental collaboration, and motivate employees across all organizational levels to engage in sustainable development initiatives.

In Chinese automobile manufacturers, CFS exerts its positive influence on SP through CC (H4, effect size = 0.294,

p < 0.05), thus supporting our hypothesis that CFS affects SP via CC, which further verifies the RBV, i.e., organizations endow their own strategic culture through investing in internal capability building, where strategic culture, an intangible asset, is a driver that spurs a company’s internal resources to effectively generate sustained competitive advantage [

24].

To enrich the theoretical foundation, this study extends the resource-based view (RBV) by showing how financial strategies (CFS) and corporate culture (CC) interact to generate sustainable performance (SP). CFS plays an important role in creating stable, long-term, and forward-looking corporate values, influencing behavior. Such stable behavior facilitates the development of an enterprise’s responsible culture in line with our aims, which in turn brings the corporate activities in line with sustainable business goals. Further, financial strategies influence executive routines around efficiency, accountability, and resilience, thereby steering firms toward sustainable models both directly and indirectly.

A notable insight emerges from the comparison between the descriptive and structural results. Although the structural equation modeling reveals strong and statistically significant path coefficients among corporate financial strategy (CFS), corporate culture (CC), and sustainability performance (SP), the relatively low mean values across these constructs suggest that sustainability-oriented practices are not yet fully institutionalized. This discrepancy indicates that although managers may recognize the theoretical value of sustainability strategies, practical adoption remains limited—likely due to financial, technological, or policy-related constraints. Consequently, the findings illustrate both the potential and the underdeveloped state of sustainability implementation in Guangxi’s automotive industry. These results demonstrate the need for future longitudinal studies to evaluate whether statistically significant relationships translate into lasting organizational improvements. Furthermore, the study highlights a critical yet previously underexplored mechanism: the mediating role of CC between CFS and SP. The empirical evidence demonstrates that corporate culture functions as a behavioral conduit, transforming financial strategies into sustainability-oriented actions. This insight enriches the current understanding of sustainability drivers in China’s automotive sector, suggesting that internally driven strategies, particularly financial and cultural, serve as more robust predictors of sustainability performance than external stakeholder pressures.