A SCOR-Based Two-Stage Network Range-Adjusted Measure Data Envelopment Analysis Approach for Evaluating Sustainable Supply Chain Efficiency: Evidence from the Korean Automotive Parts Industry

Abstract

1. Introduction

1.1. Background and Motivation

1.2. Literature Review

2. Materials and Methods

2.1. Network RAM DEA Model Formulation

- Stage 1 efficiency: , where are the optimal input slacks for DMU . Essentially, this is 1 minus the average normalized input slack. If DMU has no input excess ( for all ), then (fully efficient in Stage 1). Any non-zero slack will reduce below 1.

- Stage 2 efficiency: , using optimal output slacks. This is 1 minus the average normalized output shortfall. No shortfall ( for all ) means (fully efficient in Stage 2). If a firm cannot attain the outputs achieved by any combination of peers (thus needing positive ), will drop below 1.

- Overall efficiency: We take a weighted average of the two stages’ scores (weighted by the proportion of the number of variables in each stage) as: . Substituting the definitions of and , this simplifies to . Thus, the overall efficiency directly corresponds to the optimized objective value in Model (1). An overall indicates the DMU is on the network efficiency frontier (no slack in any constraint, so it is best practice in both stages). Any value indicates the proportion by which the DMU could, in theory, improve its outputs and/or reduce its inputs without hurting either stage’s performance.

2.2. Performance Variables

2.2.1. Stage 1 Inputs (Operational Resource Expenditures)

- Cost of Goods Sold (COGS): COGS represents the direct production and sourcing costs for goods sold, reflecting how efficiently a supplier manages procurement and manufacturing expenses [26]. In SCOR terms, COGS is a component of total supply chain cost; minimizing COGS is crucial for cost efficiency. A lower COGS indicates leaner operations and less resource waste, which contributes to economic sustainability. Prior studies note that most supply chain costs reside in COGS, making it a fundamental indicator of supply chain efficiency [26]. Thus, COGS is included as a Stage 1 input to capture the cost dimension of sustainable supply chain management.

- Transportation Cost: This variable captures the logistics cost of delivering products, aligning with the SCOR Deliver process. Transportation cost is a major element of “cost to serve” in supply chains. Reducing transport expenses (e.g., via route optimization or load consolidation) improves overall supply chain cost efficiency. By including Transportation Cost as an input, we account for the efficiency of distribution activities—a key concern in sustainable supply chains, as efficient logistics not only cut costs but also reduce fuel usage and emissions [28,29]. It reflects the SCOR cost performance attribute by emphasizing the need to minimize total delivery-related process costs without sacrificing service.

- Cash-to-Cash Cycle Time: Cash-to-cash cycle time (measured in days) is a Level 1 SCOR metric for asset management efficiency [5,26,27]. It tracks the duration between paying for raw materials and receiving customer payment, encompassing inventory, receivables, and payables periods. We treat cash-to-cash time as an input (to be minimized) because a shorter cycle frees up working capital and indicates a more agile, financially sustainable supply chain [26]. A low cash-to-cash cycle implies the company quickly converts its expenditure into revenue, improving liquidity and reducing the capital tied up in operations. This is not only financially beneficial but also aligns with sustainability goals by reducing the buffer stock and storage needs. By including cash-to-cash time, our model captures the efficiency of working capital management, consistent with SCOR’s asset management focus (e.g., SCOR AM1.1 cash-to-cash KPI).

2.2.2. Intermediate Measures (Stage 1 Outputs → Stage 2 Inputs)

- Inventory Turnover: Inventory turnover (inventory “turns” per year) is a classic supply chain efficiency KPI indicating how many times a firm sells and replaces its stock in a period. A higher turnover signifies that inventory is managed tightly—products move faster through the pipeline, and excess stock (waste) is minimized. This metric directly reflects lean supply chain practices [30]: frequent inventory turns mean the company operates with less idle stock, which is both cost-effective and reduces obsolescence and storage resource usage. The SCOR model highlights Inventory Days of Supply/Inventory Turns as key asset metrics [27], and notes that improving inventory turns shortens the cash-to-cash cycle [26]. Indeed, a faster inventory turnover means cash invested in inventory is recovered more quickly, improving liquidity. We include inventory turnover as the output of Stage 1 (and input to Stage 2) to indicate how effectively the Stage 1 inputs (costs and capital) are transformed into throughput. It captures internal operational performance in terms of inventory management efficiency—a critical aspect of sustainable supply chains, since lean inventories can reduce holding costs and environmental footprint (through lower warehousing and spoilage).

- Property, Plant & Equipment (PPE) Turnover: PPE turnover is defined as revenue generated per unit of fixed assets (annual sales ÷ net PPE, for example). This metric gauges how efficiently a firm utilizes its fixed assets—factories, machines, vehicles, etc.—to produce output. The automotive parts supplier industry is highly capital-intensive, so effective use of facilities and equipment is vital for both competitiveness and sustainability (idle capacity represents wasted capital and energy). SCOR’s Level 1 asset metrics explicitly include Return on Supply Chain Fixed Assets [27], which measures profit or revenue relative to fixed assets invested. Our use of PPE turnover aligns with this concept of asset utilization: a higher PPE turnover indicates that the supplier is generating more output (sales) per dollar of asset investment, implying productive, efficient use of its capital infrastructure. By treating PPE turnover as an intermediate output of Stage 1, we capture the outcome of internal process efficiency in terms of asset usage [31]. Together with inventory turns, it represents the internal operational excellence (fast inventory cycle and high asset productivity) that forms the input to Stage 2. In other words, these intermediates are the capabilities developed in Stage 1 that will drive financial performance in Stage 2. This approach resonates with the Resource-Based View: efficient use of resources (short cash cycle, low costs, high asset turnover) builds operational capabilities, which then translate into better outcomes in the next stage.

2.2.3. Stage 2 Outputs (Final Performance Outcomes)

- Revenue: We use Revenue (annual sales) as one final output of Stage 2 to represent the market success of the supply chain. Revenue reflects how well the firm’s upstream supply chain performance is translated into customer demand fulfillment and sales generation. In the SCOR framework, the culmination of Plan/Source/Make/Deliver processes is the delivery of a product to the customer; Revenue captures the monetary value of these delivered products. A higher revenue, given on the same operational base, indicates greater efficiency in responding to market needs and exploiting demand opportunities. Including Revenue allows the network DEA model to evaluate each supplier’s ability to convert operational efficiency into top-line performance. Notably, prior two-stage DEA studies often treat a “sales generation” stage separate from a “profit generation” stage to assess both market efficiency and cost management efficiency [17,31]. By explicitly considering Revenue, we acknowledge that a sustainable supply chain must not only run efficiently internally but also effectively drive sales in the marketplace.

- Net Income: Net Income (profit) is the second Stage 2 output, reflecting the bottom-line financial performance and profitability of the supply chain’s operations. Profitability is a key aspect of the economic dimension of sustainability, ensuring the long-term viability of the supplier. Net Income effectively measures how efficiently the firm’s supply chain operations and revenues are converted into earnings. By including both Revenue and Net Income, we distinguish between efficiency in generating sales and efficiency in controlling costs to yield profit [31]. This distinction has theoretical and empirical support: for example, some network DEA studies evaluate the first stage that produces revenue and the second stage that yields profit from that revenue. In our context, a high revenue coupled with a modest profit would signal issues in cost management or value addition, whereas strong performance in both indicates a truly efficient and sustainable supply chain. Thus, Net Income serves as a comprehensive outcome metric, encapsulating the impacts of cost efficiency, asset utilization, and market performance on the firm’s financial health. It aligns with SCOR’s emphasis on value (Return on Assets and Return on Working Capital ultimately manifest in profit) and has been used in prior sustainable DEA models as an ultimate performance indicator.

2.3. Data Source and Preprocessing

3. Results

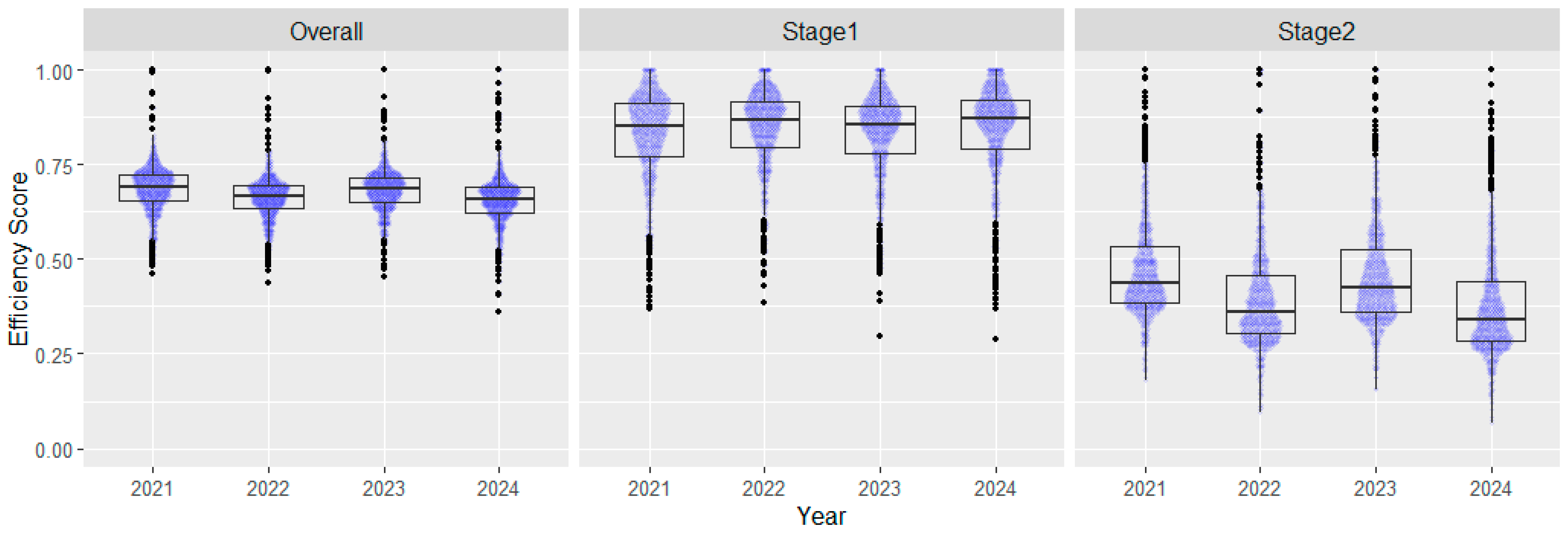

3.1. Descriptive Statistics

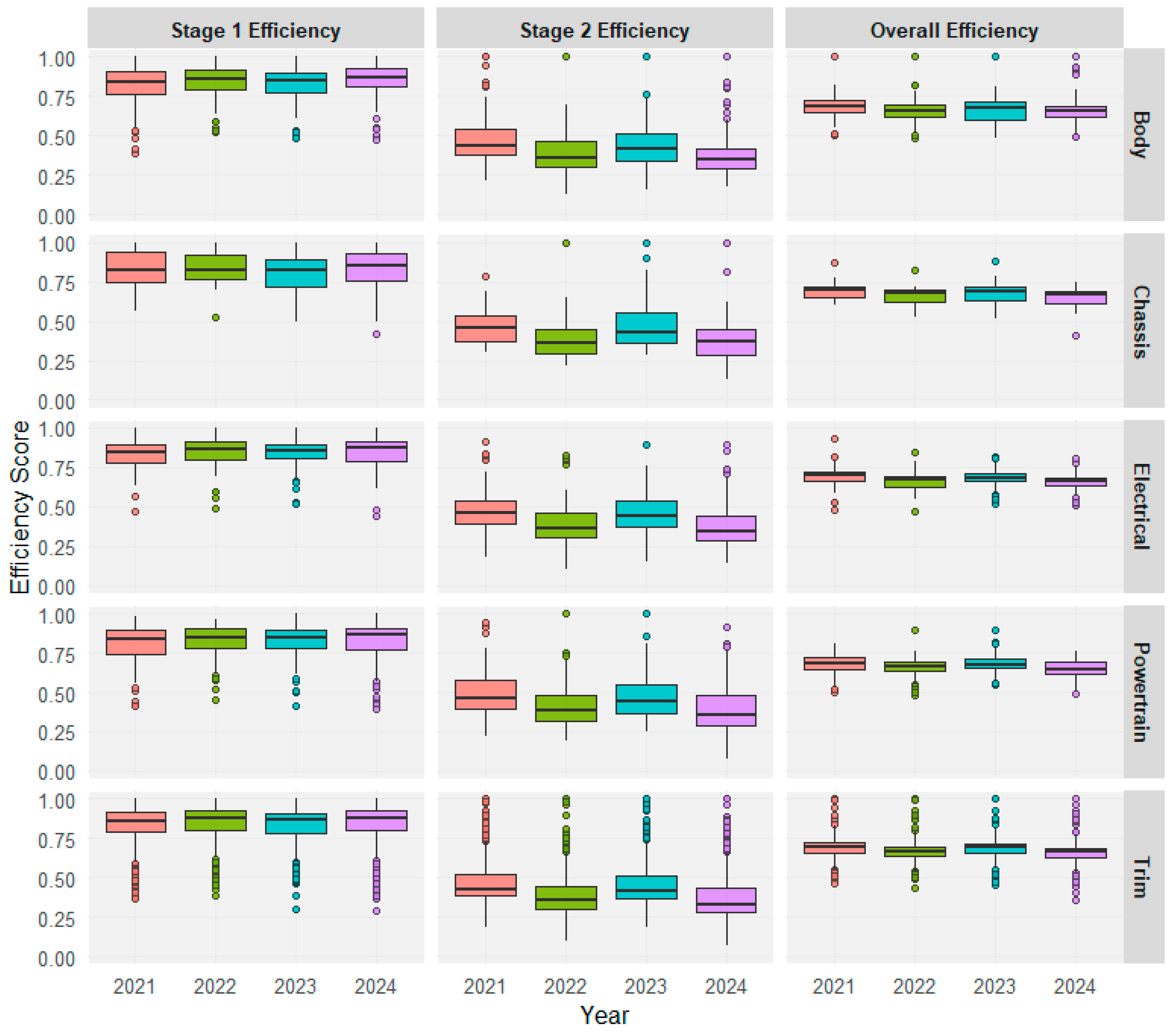

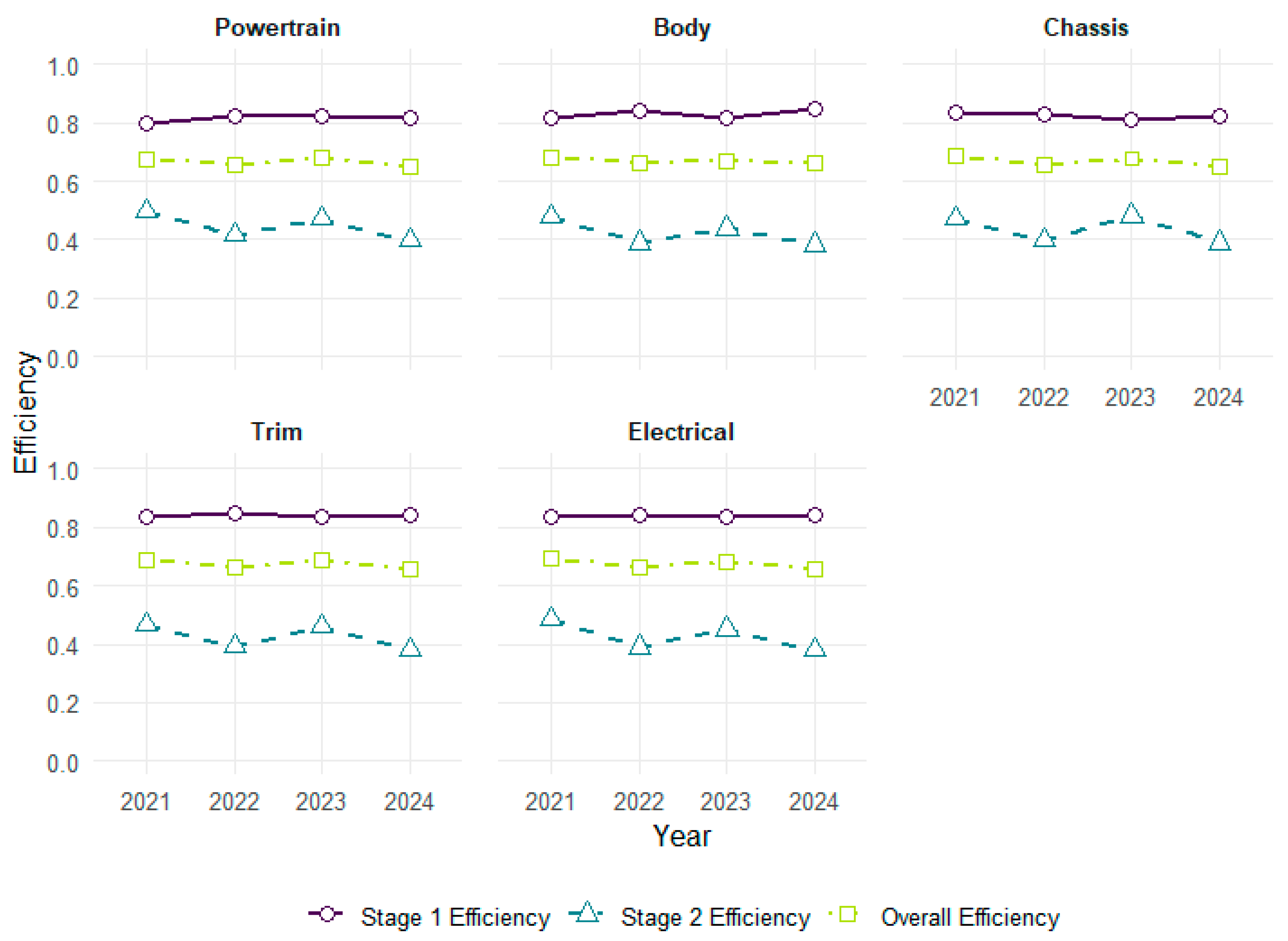

3.2. Sectoral Efficiency Comparison

3.3. Time-Series Trend Analysis (2021–2024)

3.4. Statistical Significance Testing

3.5. Robustness Checks

4. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Carter, C.R.; Rogers, D.S. A framework of sustainable supply chain management: Moving toward new theory. Int. J. Phys. Distrib. Logist. Manag. 2008, 38, 360–387. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Kang, A.; Oh, J. The configuration and evolution of Korean automotive supply network: An empirical study based on k-core network analysis. Oper. Manag. Res. 2023, 16, 1251–1270. [Google Scholar] [CrossRef]

- Kim, I.; Kim, C. Supply Chain Efficiency Measurement to Maintain Sustainable Performance in the Automobile Industry. Sustainability 2018, 10, 2852. [Google Scholar] [CrossRef]

- Huan, S.H.; Sheoran, S.K.; Wang, G. A review and analysis of supply chain operations reference (SCOR) model. Supply Chain Manag. Int. J. 2004, 9, 23–29. [Google Scholar] [CrossRef]

- Azadi, M.; Jafarian, M.; Saen, R.F.; Mirhedayatian, S.M. A new fuzzy DEA model for evaluation of efficiency and effectiveness of suppliers in sustainable supply chain management. Comput. Oper. Res. 2015, 54, 274–285. [Google Scholar] [CrossRef]

- Liang, L.; Yang, F.; Cook, W.D.; Zhu, J. DEA models for supply chain efficiency evaluation. Ann. Oper. Res. 2006, 145, 35–49. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Network DEA: A slacks-based measure approach for two-stage systems. Eur. J. Oper. Res. 2009, 197, 243–252. [Google Scholar] [CrossRef]

- Lockamy, A.; McCormack, K. Linking SCOR planning practices to supply chain performance: An exploratory study. Int. J. Oper. Prod. Manag. 2004, 24, 1192–1218. [Google Scholar] [CrossRef]

- Akyuz, G.A.; Erkan, T.E. Supply chain performance measurement: A literature review. Int. J. Prod. Res. 2010, 48, 5137–5155. [Google Scholar] [CrossRef]

- Cooper, W.W.; Park, K.S.; Pastor, J.T. RAM: A range-adjusted measure of inefficiency for use with additive models and relations to other models and measures in DEA. J. Prod. Anal. 1999, 11, 5–42. [Google Scholar] [CrossRef]

- Stewart, G.V. Supply-chain operations reference model (SCOR): The first cross-industry framework for integrated supply-chain management. Logist. Inf. Manag. 1997, 10, 62–67. [Google Scholar] [CrossRef]

- Li, S.; Ragu-Nathan, B.; Ragu-Nathan, T.S.; Rao, S.S. The impact of supply chain management practices on competitive advantage and organizational performance. Omega 2006, 34, 107–124. [Google Scholar] [CrossRef]

- Liker, J.K.; Choi, T.Y. Building deep supplier relationships. Harv. Bus. Rev. 2004, 82, 104–113. [Google Scholar]

- Dyer, J.H. Specialized supplier networks as a source of competitive advantage: Evidence from the auto industry. Strateg. Manag. J. 1996, 17, 271–291. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S. Network DEA. Socio-Econ. Plan. Sci. 2000, 34, 35–49. [Google Scholar] [CrossRef]

- Kao, C. Network data envelopment analysis: A review. Eur. J. Oper. Res. 2014, 239, 1–16. [Google Scholar] [CrossRef]

- Cook, W.D.; Liang, L.; Zhu, J. Measuring performance of two-stage network structures by DEA: A review and future perspective. Omega 2010, 38, 423–430. [Google Scholar] [CrossRef]

- Chen, C.; Yan, H. Network DEA model for supply chain performance evaluation. Eur. J. Oper. Res. 2011, 213, 147–155. [Google Scholar] [CrossRef]

- Tavana, M.; Mirzagoltabar, H.; Mirhedayatian, S.M.; Saen, R.F.; Azadi, M. A new network epsilon-based DEA model for supply chain performance evaluation. Comput. Ind. Eng. 2013, 66, 501–513. [Google Scholar] [CrossRef]

- Tavana, M.; Kaviani, M.A.; Di Caprio, D.; Rahpeyma, B. A two-stage data envelopment analysis model for measuring performance in three-level supply chains. Measurement 2016, 78, 322–333. [Google Scholar] [CrossRef]

- Izadikhah, M.; Saen, R.F. Evaluating sustainability of supply chains by two-stage range directional measure in the presence of negative data. Transp. Res. D Transp. Environ. 2016, 49, 110–126. [Google Scholar] [CrossRef]

- Izadikhah, M.; Saen, R.F. Assessing sustainability of supply chains by chance-constrained two-stage DEA model in the presence of undesirable factors. Comput. Oper. Res. 2018, 100, 343–367. [Google Scholar] [CrossRef]

- Saranga, H. The Indian auto component industry–Estimation of operational efficiency and its determinants using DEA. Eur. J. Oper. Res. 2009, 196, 707–718. [Google Scholar] [CrossRef]

- Portela, M.C.A.S.; Thanassoulis, E.; Simpson, G. Negative data in DEA: A directional distance approach applied to bank branches. J. Oper. Res. Soc. 2004, 55, 1111–1121. [Google Scholar] [CrossRef]

- Farris II, M.T.; Hutchison, P.D. Cash-to-Cash: The New Supply Chain Management Metric. Int. J. Phys. Distrib. Logist. Manag. 2002, 32, 288–298. [Google Scholar] [CrossRef]

- APICS. Supply Chain Operations Reference (SCOR) Model, version 12.0; APICS: Chicago, IL, USA, 2017.

- Dekker, R.; Bloemhof, J.; Mallidis, I. Operations Research for Green Logistics—An Overview of Aspects, Issues, Contributions and Challenges. Eur. J. Oper. Res. 2012, 219, 671–679. [Google Scholar] [CrossRef]

- Browne, M.; Allen, J.; Nemoto, T.; Patier, D.; Visser, J. Reducing Social and Environmental Impacts of Urban Freight Transport: A Review of Some Major Cities. Procedia—Soc. Behav. Sci. 2012, 39, 19–33. [Google Scholar] [CrossRef]

- Kwak, J.K. Analysis of Inventory Turnover as a Performance Measure in Manufacturing Industry. Processes 2019, 7, 760. [Google Scholar] [CrossRef]

- Kao, C.; Hwang, S.-N. Efficiency Decomposition in Two-Stage Data Envelopment Analysis: An Application to Non-Life Insurance Companies in Taiwan. Eur. J. Oper. Res. 2008, 185, 418–429. [Google Scholar] [CrossRef]

- NICE Information Service Co., Ltd. Value Search; NICE Information Service Co., Ltd.: Seoul, Republic of Korea, 2024; Available online: https://www.valuesearch.co.kr (accessed on 10 August 2025).

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Christopher, M.; Peck, H. Building the resilient supply chain. Int. J. Logist. Manag. 2004, 15, 1–14. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A. Viability of intertwined supply networks: Extending the supply chain resilience angles towards survivability. Int. J. Prod. Res. 2020, 58, 2904–2915. [Google Scholar] [CrossRef]

- Ponomarov, S.Y.; Holcomb, M.C. Understanding the concept of supply chain resilience. Int. J. Logist. Manag. 2009, 20, 124–143. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone: Oxford, UK, 1997. [Google Scholar]

- Simar, L.; Wilson, P.W. A general methodology for bootstrapping in non-parametric frontier models. J. Appl. Stat. 2000, 27, 779–802. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Estimation and inference in two-stage, semi-parametric models of production processes. J. Econom. 2007, 136, 31–64. [Google Scholar] [CrossRef]

- Alnafrah, I. Evaluating efficiency of green innovations and renewables for sustainability goals. Renew. Sustain. Energy Rev. 2025, 209, 115137. [Google Scholar] [CrossRef]

- Alnafrah, I. Efficiency evaluation of BRICS’s national innovation systems based on bias-corrected network data envelopment analysis. J. Innov. Entrep. 2021, 10, 26. [Google Scholar] [CrossRef]

| Study | Industry/Scope | Model Type | Stage Definitions | Indicators | Sample & Period | Notable Features | Limitations |

|---|---|---|---|---|---|---|---|

| Liang et al. [7] | Buyer–Seller supply chain (generic) | Network DEA (two-stage) | Buyer → Seller | Abstract variables: inputs (labor, capital, materials), intermediates (generic), outputs (final products, sales) | Numerical illustration (no large empirical dataset) | First DEA model tailored to buyer–seller SC efficiency | Abstract indicators; illustrative only |

| Färe and Grosskopf [16] | General production systems | Network DEA | Multi-stage production | Generic inputs, intermediates, value-added outputs | Conceptual/case-based | Foundational network DEA concept | Not SC-specific; no large empirical data |

| Chen and Yan [19] | Supply chains (SCs) | Network DEA | Supplier–Manufacturer linkage | Case-specific input/output sets (supplier resources; manufacturer performance) | Empirical example (case-based; limited size) | Shows advantage vs. separate evaluations | Limited scope; not large-scale |

| Tavana et al. [20] | Multi-tier SC | Network DEA (NEBM) | Supplier → Manufacturer → Distributor | Case-based: inputs (labor, capital, materials), intermediates (semi-finished goods), outputs (service, delivery, revenue) | Case-based validation | Introduced NEBM for SC performance | Mainly methodological; not a large panel |

| Tavana et al. [21] | Three-level SC | Network DEA (multi-echelon) | Supplier–Manufacturer–Customer | Tier-specific inputs/outputs across echelons | Cross-sectional, limited size | Multi-echelon benchmarking | No longitudinal panel |

| Izadikhah and Saen [22,23] | Sustainable SC | Two-stage DEA (RDM; chance-constrained) | Stage 1: operations; Stage 2: outcomes | Includes undesirable outputs (emissions/waste); uncertainty via chance constraints | Cross-sectional | Sustainability indicators; uncertainty handling | Not longitudinal |

| Saranga [24] | Indian automotive components | DEA (black-box) | Firm-level | Inputs (labor, capital, materials); outputs (sales, value added) | Cross-sectional sample of Indian firms | Heterogeneity in efficiency drivers | Regional scope; limited generalizability |

| Kim and Kim [4] | Korean automotive suppliers | DEA + Network DEA | Firm vs. SC system | Inputs (costs, assets, labor); outputs (sales, profit, ratios) | 139 firms, single year | Korean case with network DEA | Small dataset; no time series; no sectoral comparison |

| This study | Korean automotive suppliers (5 sectors) | Two-stage NRAM DEA | Stage 1 = SCOR Plan/Source/Make/Deliver; Stage 2 = market outcomes | Stage 1 inputs (COGS, transport, C2C); intermediates (inventory & PPE turns); Stage 2 outputs (revenue, net income) | 770–790/year, 2021–2024 | Large-scale longitudinal panel; non-parametric tests; sectoral benchmarking | Economic dimension only (no env./social yet) |

| Year | Efficiency Type | Mean | Median | Std | Min | Max |

|---|---|---|---|---|---|---|

| 2021 (N = 776) | Stage 1 Efficiency | 0.826 | 0.851 | 0.120 | 0.370 | 1.000 |

| Stage 2 Efficiency | 0.475 | 0.437 | 0.140 | 0.181 | 1.000 | |

| Overall Efficiency | 0.686 | 0.693 | 0.064 | 0.462 | 1.000 | |

| 2022 (N = 767) | Stage 1 Efficiency | 0.842 | 0.870 | 0.107 | 0.383 | 1.000 |

| Stage 2 Efficiency | 0.395 | 0.361 | 0.117 | 0.095 | 1.000 | |

| Overall Efficiency | 0.663 | 0.663 | 0.057 | 0.438 | 1.000 | |

| 2023 (N = 776) | Stage 1 Efficiency | 0.830 | 0.858 | 0.114 | 0.296 | 1.000 |

| Stage 2 Efficiency | 0.459 | 0.426 | 0.128 | 0.155 | 1.000 | |

| Overall Efficiency | 0.682 | 0.682 | 0.055 | 0.453 | 1.000 | |

| 2024 (N = 791) | Stage 1 Efficiency | 0.839 | 0.872 | 0.106 | 0.289 | 1.000 |

| Stage 2 Efficiency | 0.383 | 0.340 | 0.121 | 0.065 | 1.000 | |

| Overall Efficiency | 0.657 | 0.657 | 0.072 | 0.362 | 1.000 |

| Sector | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Body | 0.839 (N = 109) | 0.863 (N = 99) | 0.849 (N = 96) | 0.872 (N = 97) |

| Chassis | 0.824 (N = 34) | 0.826 (N = 34) | 0.821 (N = 35) | 0.848 (N = 37) |

| Electrical | 0.847 (N = 91) | 0.865 (N = 93) | 0.854 (N = 93) | 0.874 (N = 91) |

| Powertrain | 0.832 (N = 108) | 0.85 (N = 105) | 0.846 (N = 112) | 0.864 (N = 117) |

| Trim | 0.859 (N = 434) | 0.876 (N = 436) | 0.867 (N = 440) | 0.875 (N = 449) |

| Sector | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Body | 0.436 (N = 109) | 0.357 (N = 99) | 0.416 (N = 96) | 0.35 (N = 97) |

| Chassis | 0.455 (N = 34) | 0.365 (N = 34) | 0.425 (N = 35) | 0.369 (N = 37) |

| Electrical | 0.458 (N = 91) | 0.366 (N = 93) | 0.436 (N = 93) | 0.341 (N = 91) |

| Powertrain | 0.465 (N = 108) | 0.387 (N = 105) | 0.442 (N = 112) | 0.357 (N = 117) |

| Trim | 0.429 (N = 434) | 0.354 (N = 436) | 0.419 (N = 440) | 0.333 (N = 449) |

| Sector | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Body | 0.685 (N = 109) | 0.661 (N = 99) | 0.673 (N = 96) | 0.656 (N = 97) |

| Chassis | 0.698 (N = 34) | 0.676 (N = 34) | 0.686 (N = 35) | 0.672 (N = 37) |

| Electrical | 0.699 (N = 91) | 0.671 (N = 93) | 0.684 (N = 93) | 0.662 (N = 91) |

| Powertrain | 0.684 (N = 108) | 0.663 (N = 105) | 0.678 (N = 112) | 0.647 (N = 117) |

| Trim | 0.694 (N = 434) | 0.668 (N = 436) | 0.691 (N = 440) | 0.662 (N = 449) |

| Comparison | Test | p-Value |

|---|---|---|

| Stage 1 vs. Stage 2 (efficiency scores) | Wilcoxon signed-rank (paired) | <0.001 ** |

| Stage 1 vs. Overall efficiency | Wilcoxon signed-rank (paired) | <0.001 ** |

| Stage 2 vs. Overall efficiency | Wilcoxon signed-rank (paired) | <0.001 ** |

| 2021–2024 (Stage 2 efficiency) | Kruskal–Wallis (df = 3) | <0.001 ** |

| 2021–2024 (Overall efficiency) | Kruskal–Wallis (df = 3) | <0.001 ** |

| Among sectors (Overall efficiency, 2024) | ANOVA F (4786) = 0.54 | 0.71 (n.s.) |

| 2021 vs. 2024 (Stage 2, Overall efficiency) | Mann–Whitney U (unpaired) | <0.001 ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lim, S.; Luo, Y. A SCOR-Based Two-Stage Network Range-Adjusted Measure Data Envelopment Analysis Approach for Evaluating Sustainable Supply Chain Efficiency: Evidence from the Korean Automotive Parts Industry. Sustainability 2025, 17, 8607. https://doi.org/10.3390/su17198607

Lim S, Luo Y. A SCOR-Based Two-Stage Network Range-Adjusted Measure Data Envelopment Analysis Approach for Evaluating Sustainable Supply Chain Efficiency: Evidence from the Korean Automotive Parts Industry. Sustainability. 2025; 17(19):8607. https://doi.org/10.3390/su17198607

Chicago/Turabian StyleLim, Sungmook, and Yue Luo. 2025. "A SCOR-Based Two-Stage Network Range-Adjusted Measure Data Envelopment Analysis Approach for Evaluating Sustainable Supply Chain Efficiency: Evidence from the Korean Automotive Parts Industry" Sustainability 17, no. 19: 8607. https://doi.org/10.3390/su17198607

APA StyleLim, S., & Luo, Y. (2025). A SCOR-Based Two-Stage Network Range-Adjusted Measure Data Envelopment Analysis Approach for Evaluating Sustainable Supply Chain Efficiency: Evidence from the Korean Automotive Parts Industry. Sustainability, 17(19), 8607. https://doi.org/10.3390/su17198607