1. Introduction

Over the past few decades, rapid development has led to severe environmental pollution, posing a threat to human survival and safety. Green development is now an imperative trend driving global sustainable economic growth [

1]. China is the world’s largest carbon emitter and a rapidly growing economy. It has committed to the “dual-carbon” goals and actively promotes ecological civilization. China employs measures such as industrial restructuring, the deployment of clean technology, and stringent environmental policies, demonstrating its role as a responsible major player in global environmental governance [

2]. Enterprises play a key role in the green transition. They now face growing scrutiny from governments, investors, and the public regarding their environmental strategies and practices [

3]. Traditional production modes, characterized by high energy use and pollution, no longer meet the requirements of sustainable development. Firms must integrate ecological responsibility with economic performance and pursue transformation through green innovation [

4].

Green innovation (GI) serves as a critical pathway for firms to achieve sustainable development [

5]. It enhances efficiency and reduces emissions through the use of green technologies, thereby helping firms achieve both economic and environmental benefits [

6]. Based on organizational ambidexterity theory, GI can be categorized into breakthrough green innovation (BGI) and progressive green innovation (PGI) [

7]. BGI emphasizes disruptive technologies that break existing path dependencies and comprehensively transform a firm’s technologies, products, and services [

8], whereas PGI focuses on improving and upgrading existing green technologies and products to facilitate the efficient translation of innovation outcomes into green productivity [

9]. However, GI generally entails high Investments, long cycles, and significant uncertainties. It also exhibits positive externalities through knowledge spillovers and negative externalities from environmental governance, which collectively dampen firms’ motivation to innovate and exacerbate resource constraints [

10]. Consequently, a single innovation mode can hardly strike a balance between short-term performance and long-term development. Firms thus need to pursue dual green innovation (Dual_GI) to orchestrate both BGI and PGI activities, thereby sustaining their competitive advantage in the market.

In this context, Dual_GI has become a critical strategy for firms to integrate internal and external resources and achieve green transformation. It refers to the synergistic advancement of both BGI and PGI under the guidance of sustainable development principles, aiming to optimize or reconfigure production modes and achieve comprehensive greening across technological systems, product portfolios, service frameworks, and management paradigms [

11]. While existing studies have predominantly emphasized macro-level drivers such as environmental regulations [

12], market competition [

13], and stakeholder pressure [

14], the pivotal role of managers as micro-level decision-makers within China’s institutional context has often been overlooked. As the core unit of strategic formulation and implementation, the top management team (TMT) exerts a profound influence on innovation decisions and type selection through its characteristics and cognitive structure [

15]. Although prior research has examined the effects of TMT demographic attributes (e.g., age, gender, tenure) [

16], personality traits (e.g., overconfidence, perfectionism) [

17], or leadership styles (e.g., green transformational leadership) [

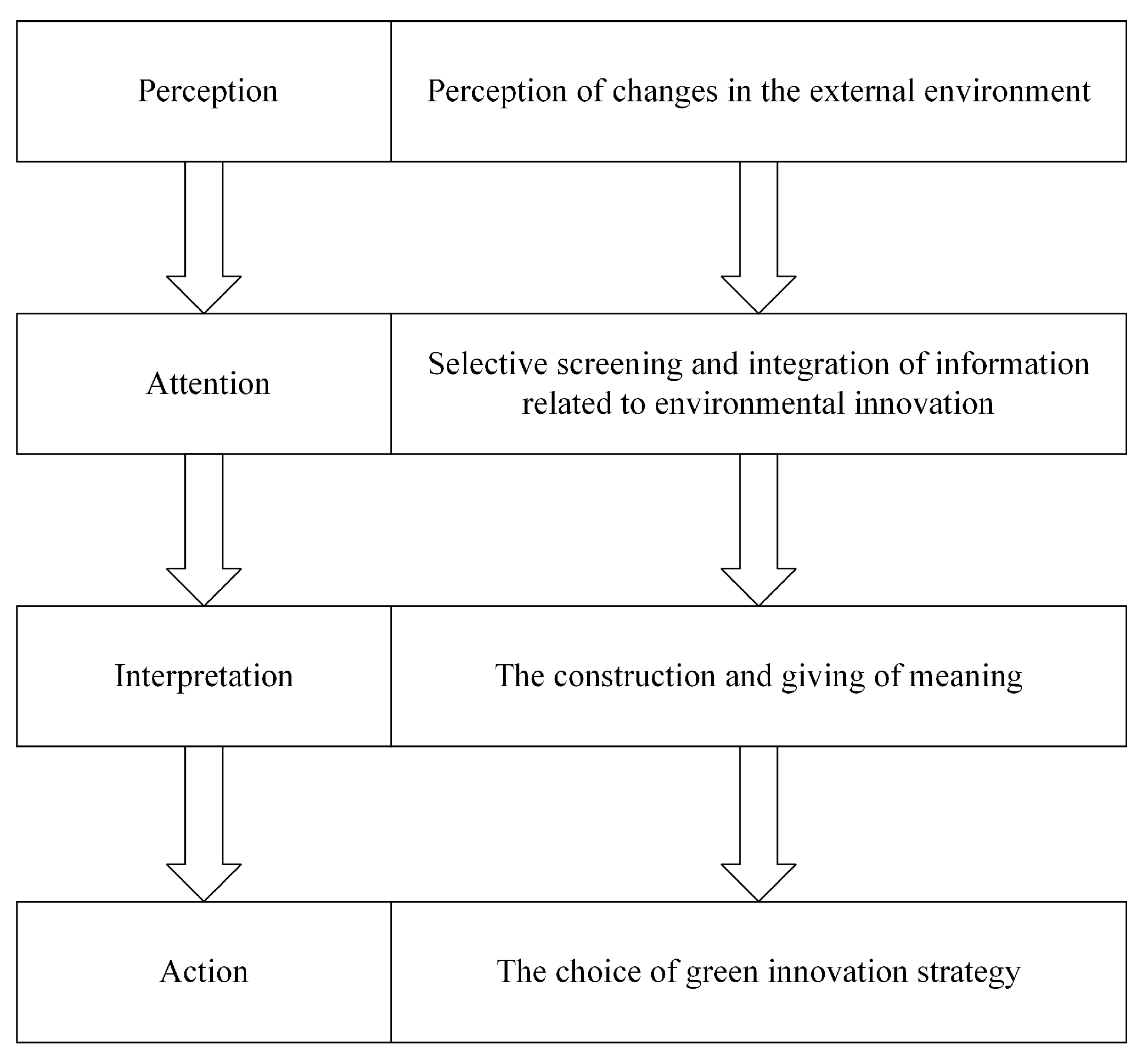

18] on GI, studies exploring the relationship between executives’ psychocognitive factors and GI remain scarce. According to the Attention-Based View (ABV) [

19,

20], attention serves as a key reflection of cognition; when executives focus their attention on relevant issues, their cognitive processes deepen, thereby shaping subsequent decisions. TMT environmental attention (TMTEA), defined as the extent of TMTs’ focus on environmental issues and their solutions, including environmental concerns, impact assessment, and the formulation and implementation of environmental strategies [

21], constitutes an essential cognitive mechanism that reveals how cognitively driven agency within TMTs coordinates GI practices through resource allocation [

22,

23]. Therefore, investigating the influence of TMTEA on Dual_GI in Chinese enterprises holds substantial theoretical and practical significance.

Existing research on TMTEA and GI has mainly focused on two aspects. First, the relationship between TMTEA and corporate green behavior and performance transformation, as exemplified by studies such as Zor (2023) [

3], Wang and Liu (2024) [

21], and Liu and Cao (2025) [

24]. These studies, however, often conceptualize GI as a monolithic construct without disentangling its subtypes, thereby overlooking the differential impact of TMT characteristics on various categories of GI and lacking systematic comparative analysis. Different types of GI impose distinct resource and capability requirements, which may also lead to varied demands on the TMT. Second, another strand of literature examines TMTEA and the choice of corporate environmental strategy. Although these studies recognize differences in innovation patterns to some extent, most adopt a content-based classification, such as green product innovation and green process innovation [

8]. Such categorization often results in dimensional overlap and impairs discriminative validity in measurement [

8], thus failing to fully reveal how cognitive differences within TMTs translate into divergent investment strategies. In the context of China’s economic transition, TMTEA stems from executives’ ongoing perception of macro policies, industry competition, and changes in societal attitudes, combined with their internal green knowledge structure, thereby forming contextually embedded green cognition. Driven by different innovation motivations, cognitive differences within the TMT may emerge, leading to a comprehensive trade-off between opportunities and risks [

25] and resulting in two distinct attention allocation strategies, namely “attention focus” or “attention distraction” [

19,

26], which ultimately shape differentiated investment decisions. Dual_GI imposes distinct demands on the TMTs’ ability to perceive and respond to environmental issues, making it particularly relevant to the institutional and resource constraints faced by firms in emerging economies, such as China. Nevertheless, the theoretical mechanisms underlying TMTs’ inclination toward promoting either BGI or PGI remain underexplored. Therefore, this study aims to systematically elucidate the influence mechanisms between TMTEA and Dual_GI to address this research gap.

Furthermore, the ABV emphasizes that executive attention allocation is influenced by situated attention [

19]. Although this theory posits that the conversion of environmental attention into innovation behavior depends on the joint effects of internal and external conditions, existing studies have predominantly examined single perspectives, such as external regulation or internal resources. They fail to systematically reveal the differential impact of attention configuration on resource allocation and capability utilization under varying contextual conditions [

27]. To address this gap, this study integrates external government environmental regulation (GER) and internal absorptive capacity (AC) into a research framework to investigate how they jointly moderate the effect of TMTEA on Dual_GI and to elucidate the underlying differentiated pathways. On the one hand, prior research indicates that GER influences corporate decision-making through dual mechanisms of pressure and incentive effects [

28], prompting TMTs to weigh innovation risks and returns and thereby affecting their innovation mode choices. The question remains as to how GER guides TMT to adjust investment strategies under conditions of imbalanced pressure and incentives. On the other hand, AC relies on the organization’s existing knowledge base [

29] and provides critical resource support for Dual_GI, helping firms overcome organizational inertia and mitigate innovation risks. However, when internal resources are scarce or capabilities are weak, whether AC can still effectively facilitate green innovation or even exert counterintuitive moderating effects remains underexplored. By integrating internal and external situational factors, this study aims to address empirical gaps in the mechanism that translates attention into innovation, particularly revealing how GER and AC collectively shape unique pathways for corporate differentiated green investment strategies within China’s institutional context.

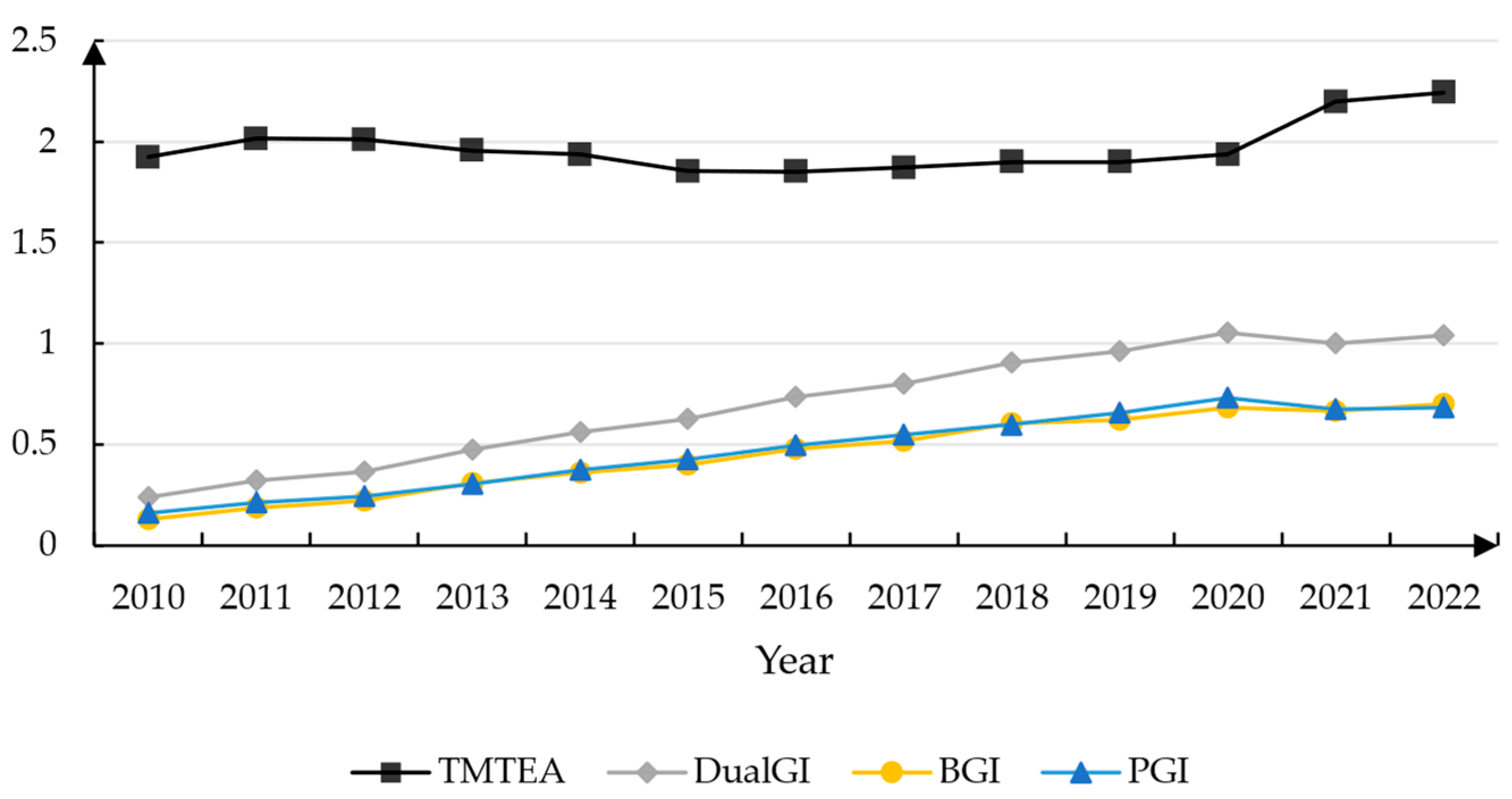

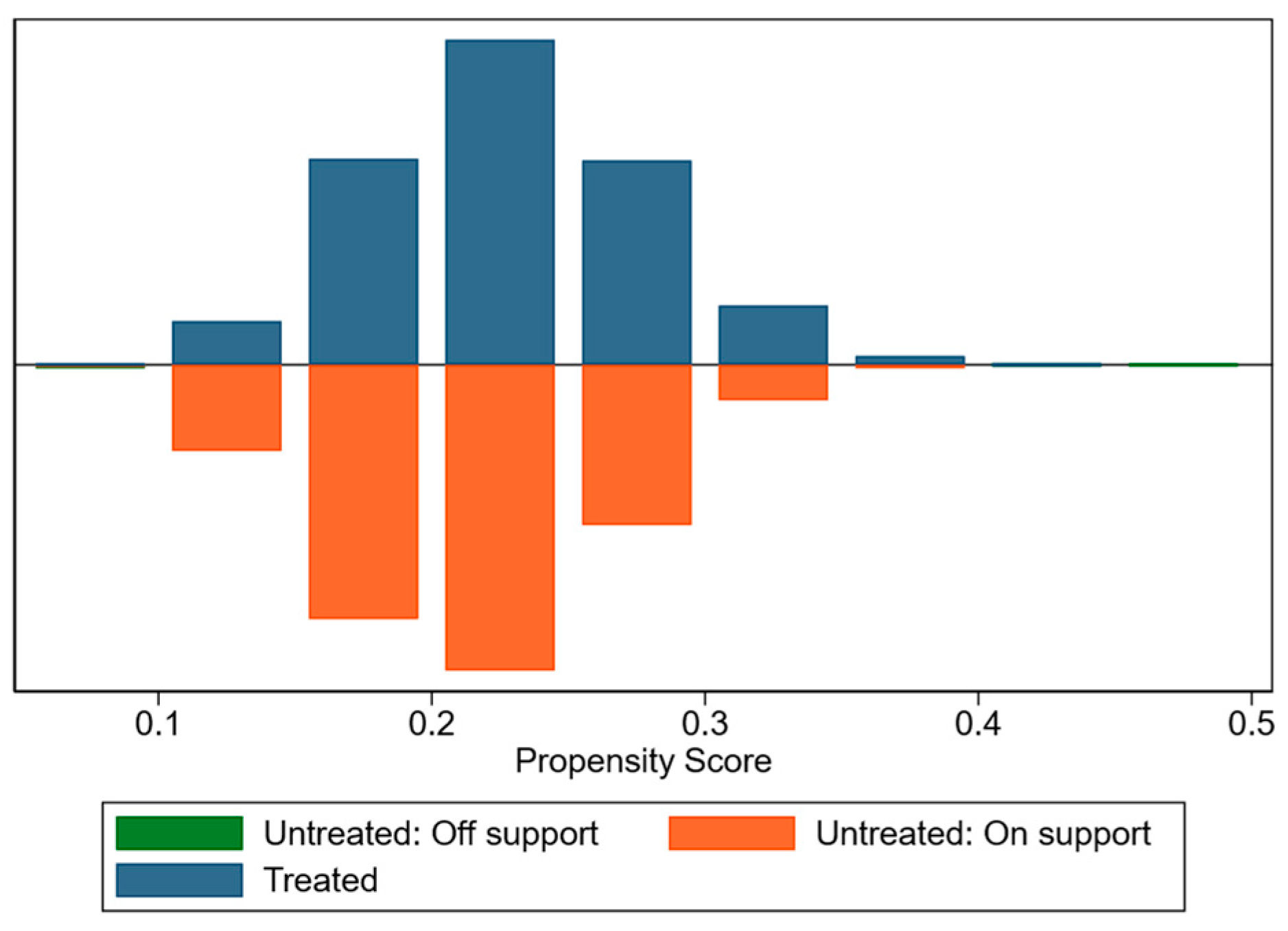

In summary, although existing research has yielded substantial insights, three main limitations remain. First, studies exploring the relationship between executives’ psychocognitive factors and GI are still scarce. Second, there is a lack of research that reveals the influence mechanisms of TMTs’ cognitive differences on different categories of GI and their corresponding differentiated investment strategies. Third, the differential effects of attention allocation on resource distribution and capability utilization under varying contextual conditions have not been systematically identified. To address these gaps, this study utilized a sample of A-share listed companies in Shanghai and Shenzhen Stock Exchanges of China from 2010 to 2022. Grounded in the ABV and organizational ambidexterity theory, we employed multiple regression analysis to examine the impact mechanism of TMTEA on Dual_GI. Furthermore, GER and AC were introduced as moderators to clarify the boundary conditions under which TMTEA influences Dual_GI. This study addresses three key questions: (1) Can Dual_GI be effectively achieved when the TMT allocates attention to environmental issues? (2) Does TMTEA exert a differentiated impact on Dual_GI? (3) What roles do external GER and internal AC play in moderating the relationship between TMTEA and Dual_GI?

This study makes four main contributions. First, by examining the influence of TMTEA on Dual_GI, it reveals the micro-level cognitive mechanisms through which firms promote GI practices, thereby expanding the application scope of the ABV in environmental management research. Second, building on organizational ambidexterity theory, it distinguishes between BGI and PGI, elucidating the heterogeneous effects of TMTEA on these two categories and addressing a prior research gap regarding how TMTs’ cognitive differences shape GI types and investment strategies. Third, by introducing external GER and internal AC as moderating variables, it clarifies how attention allocation differentially influences resource distribution and innovation capability under varying contextual conditions, expanding the boundary conditions and contextual mechanisms of TMTEA-driven Dual_GI. Fourth, it systematically proposes concrete pathways for Chinese firms to implement differentiated environmental management and resource allocation strategies, identifies core risks during innovation implementation, and suggests corresponding mitigation mechanisms, thereby offering a theoretical and practical framework for the implementation of green innovation management in emerging economies.

The rest of this study is structured as follows:

Section 2 elaborates the theoretical basis and research hypotheses, and constructs the theoretical model.

Section 3 introduces the data and methods.

Section 4 presents the empirical results.

Section 5 elaborates on the heterogeneity analysis and economic consequence analysis. In

Section 6, this study is summarized.

6. Conclusions and Implications

6.1. Results Discussion

Based on the ABV, this study uses the data of 1722 listed companies in China from 2010 to 2022 to not only test the relationship between TMTEA and Dual_GI but also reveal the moderating role of government environmental regulation and absorptive capacity. We obtain the following core conclusions:

- (1)

TMTEA directly impacts Dual_GI. Research confirms that this impact does not stem from environmental changes themselves but rather depends on TMTs’ attention to the external environment [

19], underscoring that environmental attention serves as a key driver of green innovation [

3]. When TMT consistently focuses on ecological issues, it enables strategic responses to external changes, facilitates timely adjustments in strategic direction to seize opportunities and mitigate risks, and supports the restructuring of internal processes through resource allocation and cultural shaping, thereby providing necessary support for Dual_GI.

Notably, this facilitating effect is amplified for PGI. Although direct empirical evidence remains limited, existing studies suggest such a tendency [

38]. Grounded in the context of an emerging economy such as China, this study highlights the dual challenges faced by Chinese firms: insufficient internal innovation capacity and external institutional pressures [

39]. These practical constraints trigger innovation motivations, leading to cognitive divergence within the TMT. This leads to an attention allocation strategy characterized by resource optimization and risk control, which consequently favors investments in more secure and efficient PGI. This is because cognitive divergence is directly associated with preferences for innovation modes [

25]. When processing information, TMT must strategically balance opportunities and threats to ensure effective decision-making. Different innovation motivations lead to distinct strategic trade-offs: profit-seeking motives drive TMT to prioritize short-term benefits, while responsibility motives compel improvements in environmental legitimacy [

28]. As BGI emphasizes disruptive technological change with longer cycles and higher risks, TMT tends to focus more attention on PGI, which involves marginal improvements to existing technologies and organizational routines that can more promptly enhance firm performance.

- (2)

GER strengthens the positive relationship between TMTEA and Dual_GI, and has a stronger moderating role on PGI. Extensive research suggests that effective environmental regulation fosters innovation through both coercive pressures and incentives, aligning with the Porter Hypothesis [

84]. When policy institutions change, TMTs adapt promptly and make responsive decisions [

77]. GER heightens the salience of environmental issues in TMT cognition. Consequently, TMTs proactively align with policies, redirecting firm resources towards Dual_GI.

However, uncertainty in environmental policies makes it challenging to balance pressures and incentives, leading TMTs of Chinese firms to remain relatively conservative in green innovation decisions [

21]. In recent years, the continuous rollout of mandatory policies has significantly increased firms’ institutional costs, confining TMTs’ attention to addressing legitimacy threats over the long term. Concurrently, to capture opportunities embedded in policies, TMTs strive to quickly establish compliant green management systems, thereby securing more green subsidies. Under resource constraints and benefit trade-offs, TMTs, driven by loss aversion, have to allocate limited resources to PGI to achieve short-term benefits or mitigate legitimacy pressures. This practice helps firms consolidate their resource bases, creating conditions for the implementation of long-cycle BGI in the future.

- (3)

AC positively moderates the relationship between TMTEA and Dual_GI, consistent with Pacheco et al. (2018) [

85], indicating AC can positively moderate the link between organizational internal factors and Dual_GI. AC enables executives to better identify green resources during the knowledge reconnaissance and cognition phase, and facilitates TMTs in assimilating green knowledge during the internalization phase, ultimately converting it into outputs [

57].

Notably, this study finds that AC can better moderate the relationship between TMTEA and PGI, which contrasts with previous studies. AC, serving as a critical bridge that integrates internal and external knowledge, has often been considered more conducive to BGI, which demands substantial heterogeneous resources [

41]. In fact, AC consists of two dimensions: potential AC and realized AC, each focusing on the exploration and exploitation of external knowledge, respectively [

62]. From this perspective, China’s unique resource and institutional context helps elucidate the observed discrepancy. On the one hand, facing structural deficiencies in specialized human capital and potential knowledge leakage risks, firms struggle to fully leverage their potential AC to acquire and transform green knowledge critical for BGI. On the other hand, under intense institutional environmental pressures, firms prioritize utilizing their realized AC, integrating existing explicit knowledge bases with local search strategies to rapidly meet short-term demands through a “pressure-response” mode of PGI. Thus, the role of AC is contingent upon the synergistic alignment between knowledge bases and search strategies within specific contexts.

- (4)

Heterogeneity analysis reveals that property rights, pollution intensity, and firm lifecycle moderate the influence of TMTEA on Dual_GI. This positive effect is significantly more substantial in state-owned (SOEs), heavily polluting (HPEs), and mature-period enterprises. Economic consequences analysis further demonstrates that TMTEA enhances sustainable development performance (SDP) through Dual_GI. We propose four mechanisms. First, the prioritization of social services by SOEs, coupled with robust political ties, substantial resource endowments, and heightened risk resilience [

78], empowers their TMTs to implement environmental decisions flexibly. Second, NHPEs experience attenuated external pressures and environmental scrutiny, affording TMTs greater strategic discretion in environmental responses. At the same time, their market-driven focus on reputation and competitiveness enables them to address environmental demands and secure green financing. Third, mature-period enterprises leverage abundant resources, superior access to funding, stable profitability, and risk-mitigating R&D experience [

21], collectively bolstering the TMTs’ propensity for high-risk, disruptive innovation. Fourth, SDP emerges as an outcome of TMTEA and Dual_GI, wherein environmental awareness enables TMTs to assess externalities accurately, formulate context-appropriate environmental strategies, and mobilize resources for green ambidexterity, ultimately capturing market opportunities and securing enduring competitive advantages [

11].

6.2. Implications

6.2.1. Theoretical Implications

The theoretical implications of this study are manifested in several aspects:

First, this study advances micro-level cognitive mechanisms in green innovation by identifying how TMTEA translates into Dual_GI through resource allocation. While existing research has predominantly focused on macro-level drivers such as environmental regulations and market competition, or examined the relationship between static TMT characteristics (e.g., demographics, personality traits) and GI, it has inadequately explored the dynamic role of agency-driven TMT cognitive differences in shaping GI practices. Grounded in the Attention-Based View, this research systematically elucidates the mechanism through which TMTEA affects Dual_GI from the dual perspectives of external environmental adaptation and internal organizational restructuring, uncovering the micro-process by which cognitive focus is transformed into strategic green outcomes. Thereby, it directly responds to and empirically validates the call by Wu et al. (2024) [

10], Wang and Liu (2024) [

21], and Liu and Cao (2025) [

24] for further investigation into the micro-psychological cognitive mechanisms driving GI, providing an important theoretical foundation at the micro level.

Second, this study fills the research gap regarding how TMT cognitive differences shape distinct GI categories and their associated investment strategies. Existing research has primarily treated GI as a unitary construct, emphasizing TMTEA’s macro-level effects on corporate green behavior and performance while overlooking its multidimensional heterogeneity. Another strand of research, which examines the relationship between TMTEA and environmental strategy selection, relies on content-based taxonomies (e.g., green product vs. process innovation). However, these taxonomies suffer from dimensional overlap and an insufficient mechanistic explanation. To address these limitations and contextualize China’s institutional and resource constraints, this study applies ambidexterity theory to decompose Dual_GI into BGI and PGI, clarifying their distinct theoretical mechanisms and resource demands. It further reveals how TMT cognitive divergence under these conditions drives the development of differentiated investment strategies. Specifically, TMTs develop motivation-driven cognitive differences through environmental sensing, leading to strategic trade-offs: profit-seeking motives prioritize short-term gains, while responsibility motives focus on mitigating legitimacy threats. Given BGI’s high investment and risk profile, TMTs adopt an “attention focus” strategy, allocating scarce cognitive resources to PGI, leveraging specialized knowledge to enhance innovation efficiency. Thus, clarifying Dual_GI drivers and interactions enables firms to strategically implement environmental strategies tailored to contextual demands, fostering sustainable development in China.

Third, this study extends understanding of boundary conditions for TMT micro-cognition driving Dual_GI, empirically supporting the situational attention principle. While this principle posits that translating TMTEA into Dual_GI requires internal and external catalysts, research on differential resource allocation and capability effects during cross-context attentional shifts remains limited [

27]. Integrating GER and AC, we demonstrate their joint amplification of TMTEA’s influence on Dual_GI. Crucially, GER steers utility-maximizing firms towards PGI through deterrence and subsidies, while firms constrained by China-specific institutional barriers (e.g., deficient human capital, knowledge leakage risks) exhibit a preference for PGI when utilizing AC. Our results bridge an empirical gap regarding the differential moderating roles of contextual factors in the attention-innovation nexus and delineate the mechanism whereby GER pressure and internal AC collectively foster a corporate PGI bias over BGI in China. These findings deepen our understanding of policy efficacy in guiding corporate environmental strategy and innovation selection, providing critical managerial implications for optimizing green innovation under prevailing GER and AC constraints.

Fourth, offer actionable guidance for innovation management practices. It delineates how firms in China can implement effective environmental management and adopt differentiated resource allocation strategies. The research clearly identifies the various innovation risks enterprises encounter and proposes concrete solutions to mitigate them. These insights directly respond to the scholarly calls by Javed et al. (2025) [

55], Pacheco et al. (2018) [

85], and Ritter-Hayashi et al. (2021) [

86] to integrate emerging economies into mainstream theoretical frameworks. Ultimately, this study offers a valuable framework for firms in emerging economies to better adapt to dynamic institutional pressures and successfully implement green innovation practices.

6.2.2. Managerial Implications

Managerial implications for enterprises: First, enhance TMTEA. Given the scarcity of TMTEA, TMT must transcend rhetorical commitments to integrate proactive environmental concerns into strategic actions. Concrete measures include: (a) delivering customized training workshops during senior executive development to enhance green cognition; (b) regularly convening industry experts for cutting-edge practice seminars to strengthen environmental decision-making capabilities; (c) embedding environmental objectives into long-term strategies via quantifiable time-bound green innovation plans to secure resource allocation and implementation.

Second, focus on Dual_GI construction. Effective Dual_GI necessitates sustained strategic attention from TMT, adapting dynamically based on phased outcomes and environmental contingencies. Specifically, (a) TMTs should establish cross-departmental environmental information-sharing mechanisms to enhance Dual_GI cognition and mitigate cognitive inertia in decision-making systematically. (b) TMTs must precisely evaluate their operational status and resource endowments to allocate innovation investments scientifically; this involves dedicated funding, balanced resource allocation between BGI and PGI to avoid excessive pursuit of difficulty or quantity, and distinct strategies tailored to each innovation mode to enhance green ambidextrous capability through phased adaptation. (c) Crucially, under resource constraints, strategically leveraging the competitive value of corporate social responsibility strengthens stakeholder synergy to secure innovation resources.

Third, proactively formulating environmental strategies that respond dynamically while operating beyond compliance with government policies. GER provides support for green innovation while simultaneously imposing significant legitimacy pressure and public scrutiny. Specifically, (a) TMT must internalize national green directives, enhance environmental literacy, and formulate Dual_GI strategies aligned with resource endowment. (b) Given policy uncertainty, firms must establish policy monitoring and rapid response mechanisms to maintain strategic flexibility against potential shocks. (c) Tailored environmental disclosure systems should address industry-institutional-firm contexts. Superior environmental performance yields legitimacy relief, reputational benefits, and green investment opportunities. Therefore, firms should transcend short-term PGI through long-term operational transformations that concurrently address institutional pressures. This requires proactive TMT implementing systematic BGI for sustainable advantage.

Fourth, improve AC. AC is a key variable affecting Dual_GI, enabling firms to integrate knowledge. However, Chinese firms that enhance AC under resource constraints and environmental pressures often encounter structural bottlenecks, fears of knowledge leakage, and stress, leading to a bias towards PGI. Overcoming this requires building structured, risk-managed AC: (a) Strengthen internal knowledge management (e.g., green repositories, cross-departmental communication, training, environmental scanning teams) with phased small-scale piloting to reduce risk; (b) Expand institutionally guaranteed collaborative networks (e.g., government-endorsed industry-university-research partnerships) with dedicated IP protection and risk controls; (c) Implement differentiated resource allocation and incentives. TMTs should guide AC to optimize PGI while allocating resources to agile units that explore the recombination of assimilated and peripheral knowledge in controlled settings to foster BGI potential, enabling synergistic co-evolution of Dual_GI.

Fifth, heterogeneity-driven proactive adaptation and active restructuring dynamically configure eco-innovative transformations. The impact of TMTEA on Dual_GI varies across enterprise types. (a) From ownership, SOEs embed eco-imperatives strategically via institutional advantages, launch TMT-led breakthrough mechanisms, while supporting PGI systematically; NSOEs link eco-actions to profits via incentives, prioritize cost-effective PGI, and bridge resource gaps externally. (b) From pollution intensity, HPEs pursue substantive transformation through transparent disclosure and green tech initiatives, converting regulations into systemic innovation sans greenwashing; NHPEs leverage TMTEA for sustainable value chains, integrating green investments with BGI. (c) From the lifecycle, growth firms drive PGI via legitimacy pressures; mature firms convert slack resources into BGI engines; recession firms activate TMTEA only when aligned with strategic restructuring.

Managerial implications for policymakers: The government should pay closer attention to environmental issues and actively guide enterprises to undertake environmental innovation. First, implement precisely targeted policy incentives. Precision-targeted policy incentives must optimize green subsidies, credit, and tax instruments to alleviate specific resource constraints and talent shortages, thereby enhancing corporate green capabilities and core talent cultivation. Concurrently, governments must establish rapid mechanisms for protecting intellectual property related to green innovation to mitigate the risks of knowledge leakage.

Second, adopt differentiated environmental supervision and performance evaluation frameworks. Differentiated supervision requires routine regulatory oversight and integration of substantive green innovation outputs into evaluation frameworks. Authorities must enforce stringent penalties for fraudulent environmental claims, accompanied by robust traceability mechanisms. Environmental regulatory standards should be tiered by enterprise proper rights, pollution intensity, and lifecycle, augmented with tailored compliance guidance to improve policy alignment.

Third, advance public–private collaboration and cultivate collective efficacy. Collaborative capacity building necessitates leveraging industry-academic platforms and sectoral innovation alliances for knowledge sharing. Governments must tailor environmental sustainability awareness campaigns and systematic capacity-building initiatives to firm heterogeneity, such as providing startups with market access guidance while focusing on deep emission reduction synergies for mature firms. This fosters environmental awareness, enhancing the efficacy of governance.

6.3. Limitations and Future Research Directions

We consider the study’s limitations and the direction of future research from several aspects.

First, this study relies exclusively on quantitative data from Chinese listed companies. On the one hand, it focuses solely on the aggregate characteristics of the sample firms, potentially overlooking more nuanced firm-level influences and contextual factors that shape innovation decisions, which may undermine the persuasiveness of the conclusions. Future research should adopt qualitative approaches (e.g., longitudinal case studies, executive interviews) to investigate the micro-level mechanisms of Dual_GI longitudinally, particularly TMT cognitive processes and decision-making logics, thereby constructing more robust causal pathways. On the other hand, the exclusive focus on Chinese listed firms may limit the generalizability of the findings, as regional, institutional, and industry-specific cultural factors could influence the outcomes. Future studies should expand the sample coverage to include countries or industries not examined in this research, thereby testing whether the conclusions hold across different cultural and contextual settings.

Second, although TMTEA is gauged through corporate annual reports consistent with extant literature, this approach risks social desirability bias and affective distortions. It fails to distinguish between substantive disclosures and symbolic greenwashing. Refined measurements, including field experiments, are necessary to dissect TMTEA dimensions such as attention depth and breadth, thereby elucidating how heterogeneous environmental cognitions distinctly shape Dual_GI.

Third, this paper discusses the direct effect of TMTEA on Dual_GI, without examining the mechanism of action between the two. Although we theoretically elaborate how TMTEA may affect resource allocation at the organizational level through certain factors, no specific mediating variables were proposed or hypothesized. Therefore, future research could further investigate how TMTEA facilitates Dual_GI by shaping internal governance mechanisms such as resource allocation and employee behavior, and empirically test the mediating effects of these variables through hypothesis testing.

Fourth, our contingency analysis of GER and AC overlooks their internal heterogeneity. While it offers a general overview of GER’s moderating effect and briefly discusses the mechanistic roles of AC dimensions from a theoretical perspective, future research should rigorously dissect how specific types of GER (e.g., command-based, market-based) and forms of AC (e.g., potential, realized) moderate the relationship between TMTEA and Dual_GI. This examination should be supported by empirical modeling to validate the underlying theoretical mechanisms. Furthermore, in the digital transformation era, exploring how big data capabilities reconfigure the effects of TMTEA allocation on Dual_GI represents a critical frontier.