1. Introduction

Establishing a reasonable and accurate corporate financing capability assessment system has always been a focus of attention in both the practical and academic communities. With changes in capital market and economic development concepts, the existing corporate financing capability assessment system has gradually revealed certain shortcomings. On the one hand, the indicators of the existing assessment system are too outdated to be applicable to the emerging capital markets of today. On the other hand, subjective assessment methods, such as fuzzy comprehensive evaluation, AHP, etc., are influenced by personal experience and judgment, making it difficult to achieve objectivity and accuracy in assessment.

In recent years, as the concept of sustainable development has gained increasing prominence; environmental, social, and corporate governance factors, collectively known as ESG factors, have had an increasingly significant impact on a company’s financing capabilities. Numerous studies have shown that a company’s ESG performance is not only related to the fulfillment of its social responsibilities but also a key factor influencing corporate financing costs [

1], market valuation [

2], and investor decision-making [

3], gradually becoming an important indicator for assessing a company’s sustainable financing capabilities [

4].

Although research has established a corporate financing capability assessment system, there are significant gaps. First, existing assessment systems lack consideration of companies’ ESG performance. Second, the scope of application of each assessment system is limited, and there has been no research on assessment systems for large-scale listed companies. Finally, while research has demonstrated that ESG performance influences a company’s financing capabilities, mainstream models have not distinguished the differences in the ESG impact mechanisms between companies listed on the main board (asset-intensive) and those listed on the STAR Market and GEM (innovation-driven).

Against this backdrop, this paper innovatively incorporates ESG performance indicators and combines them with thirteen other indicators (one additional indicator for the Growth Enterprise Market and the Science and Technology Innovation Board) to construct a financing capability evaluation system for listed companies. To overcome the subjectivity of traditional evaluation methods, this paper employs cooperative game theory for weighting featuring the entropy weight method and a BP neural network to assign weights to the TOPSIS method, combining the two methods to fully exploit the inherent characteristics of the data and enhance the objectivity and scientificity of the evaluation system. This study uses panel data from listed companies on the Shanghai and Shenzhen stock exchanges in 2023 to conduct empirical research, analyze the impact of each evaluation indicator on financing capacity, determine the weights of each indicator in the evaluation process, and calculate the financing capacity scores of each company.

The study not only provides a new research approach in theory—classifying listed companies and conducting comparative analyses within their respective categories—but also introduces BP neural networks and cooperative game theory for TOPSIS evaluation, offering a new weighting method for the TOPSIS evaluation model. In practice, the study reveals the differences in the factors influencing the financing capabilities of listed companies across different markets, such as the market-specific characteristics exhibited by companies listed on the main board, STAR Market, and Growth Enterprise Market in terms of financing capability factors. This provides financial institutions with market-customized assessment tools. Additionally, the weights of the various indicators in the assessment model can be dynamically adjusted based on annual data changes to train a model suitable for the current year.

The article is structured firstly with the construction of the specific algorithms for the evaluation model, followed by an analysis of the performance of the Back Propagation Neural Network (BPNN), an analysis of the weightings of each evaluation indicator in 2023, the specific evaluation results for each listed company in 2023, and the conclusions.

2. Literature Review

2.1. TOPSIS

TOPSIS is a classic multi-criteria decision-making model that has been widely applied in evaluation problems. Sun et al. [

5] utilized TOPSIS to evaluate irrigation methods and selected the optimal irrigation method. Su et al. [

6] employed an improved TOPSIS model to assess the ESG performance of mining companies. Therefore, it can also be applied to evaluate corporate financing capabilities and measure the financing capabilities of listed companies.

Initially, TOPSIS was based on equally weighted indicators and used only deterministic data. However, this model has limitations, such as its inapplicability to fuzzy data and the issue of how to assign weights to each indicator. As more refined solutions have been developed, the applicability of TOPSIS has expanded significantly. SARAL D [

7] introduced Fuzzy Analytic Hierarchy Process to handle fuzzy data sets, addressing the quantification problems of fuzzy data; Bajaj R K et al. [

8] incorporated a new triangular information measure into TOPSIS, resolving the quantification challenges of high-uncertainty data. Their contributions enabled TOPSIS to be applied to fuzzy data. Faced with specific issues, Song Y et al. [

9,

10] modified TOPSIS to make it suitable for specific research problems. In this study, the main issue is how to assign weights to each evaluation indicator. Liu H Y [

11], Zhang X D [

12], and others used the entropy weight method to assign weights to the TOPSIS model, achieving satisfactory results. However, the entropy weight method also has shortcomings in the weighting process. If the differences between the indicators are extremely large, using the entropy weight method will result in the allocation of weights for indicators with smaller range being too small. Chen C H et al. [

13] combined AHP with the entropy weight method for weighting, which solved this problem, but the weighting results are still influenced by personal experience. Recently, some scholars [

14,

15] have combined TOPSIS with machine learning to further enhance the applicability of TOPSIS. For example, Nafei A et al. [

16] introduced a new decision-making framework that combines the TOPSIS with neutral triples (NTs) to address the limitations of decision-making methods in handling uncertain information.

2.2. BPNN

The Back Propagation Neural Network (BPNN), as a classic type of multi-layer feedforward network, has become an important model in the field of machine learning since Rumelhart et al. [

17] made a major breakthrough in this field in 1986. With the rise of deep learning, BPNNs and their improved models have been widely applied in various fields such as industrial diagnosis, energy prediction, and data analysis due to their structural flexibility and function approximation universality. After years of algorithmic improvements [

18,

19,

20], various algorithms have demonstrated advantages such as fast computation speed, high output accuracy, and strong generalization capabilities in various application scenarios.

Cui L [

21] et al. improved the BPNN by targeting multiple outputs, thereby achieving the goal of using the BPNN for classification. Wang W, Ling X, and others [

22,

23,

24] improved the BPNN, establishing prediction models based on the BPNN in multiple fields and achieving excellent prediction results. He F et al. [

25] first used Principal Component Analysis (PCA) to screen out the main factors, then used the PCA results as the output of BPNN to train the prediction model. The results showed that the prediction accuracy of the stepwise regression method was inferior to that of BPNN based on PCA. All of the above indicates that BPNN has a wide range of applications. This study uses BPNN in the TOPSIS weighting process to solve the problem of unreasonable weight distribution that may occur when using the entropy weight method for TOPSIS weighting.

2.3. Analysis of Current Situation

First, the current evaluation system has limited applicability, targeting only one category, such as science and technology innovation [

26,

27], sports [

28], industry [

29], etc., and there is no system for evaluating the financing capabilities of large-scale listed companies. Second, the widespread use of subjective evaluation methods (such as the Analytic Hierarchy Process [

30] and grey correlation model [

31]) makes the weighting of evaluation indicators susceptible to expertise and scoring biases, leading to evaluation results that are difficult to free from human interference and thereby weakening the objectivity and scientificity of the evaluation.

Finally, existing financing capability evaluation systems are relatively outdated and do not consider the impact of ESG performance. Increasing research indicates that ESG performance can enhance a company’s financing capability [

32,

33,

34,

35], which will reduce the accuracy of existing financing capability evaluation systems. Additionally, due to carbon neutrality goals, companies’ environmental impacts will be closely scrutinized, and financing channels for high-pollution industries will continue to narrow. Companies with high pollution levels also face uncertainties regarding their ability to sustain operations, which is closely linked to the environmental indicators in ESG performance. Related studies have further demonstrated that environmental factors have a significant impact on a company’s financing capabilities [

36,

37]. In addition, relevant studies further demonstrate that ESG performance has a substantial impact on a company’s sustainable operations [

38,

39,

40].

To address the above issues, we first selected over ten indicators, including ESG performance, to establish a new evaluation indicator system. Second, we comprehensively utilized the entropy weight method, BPNN, and cooperative game theory to assign weights to the TOPSIS evaluation model to avoid subjective weighting. Finally, we used listed companies on the Shanghai and Shenzhen stock exchanges as samples for model training to expand the scope of application, thereby deriving a model for evaluating the financing capabilities of listed companies.

The marginal contribution of this study lies in the following: (1) it breaks through the limitations of Liu, Sun, and others’ assessment models, which are highly subjective and have a narrow scope of application; (2) it improves on the shortcomings of the entropy weight method, which only focuses on data differences, and it introduces a BP neural network for TOPSIS, making the final assessment indicator weight allocation process more reasonable.

2.4. Research Hypothesis

In this study, all the selected indicator data are deterministic data, so there is no need to address the issue of TOPSIS being unsuitable for the data used in this study. However, by analyzing the data used in this study, we can reveal significant differences in the ranges of total assets and total operating revenue compared to those of net profit growth rate and current ratio. If only the entropy weight method is used to assign weights to TOPSIS, there is a high likelihood of unreasonable weight allocation. Therefore, to address this issue, this study employs BPNN for the weighting process, using cooperative game theory to combine the weights of the entropy weight method with the weights of BPNN. Thus, hypothesis H1 is derived.

H1. The final weights of the combination should be more balanced and reasonable than those obtained by the entropy weight method.

Liu L et al. indicate that environmental factors should have a greater impact on a company’s financing capabilities among the various ESG factors. Therefore, in the final weighting of each indicator in this assessment model, the E score indicator should have a greater weight among the ESG-related indicators. Hypothesis H2 is derived.

H2. The E score should be a heavily weighted indicator in ESG performance.

In existing assessments of corporate financing capabilities, various studies analyze companies in specific industries, and research results differ across industries. This indicates that in assessing the financing capabilities of listed companies, assessments based on various markets may result in different weights for each indicator across different markets. Hypothesis H3 is derived.

H3. Factors affecting the financing capabilities of companies in different markets exhibit market-specific characteristics.

3. Model Building

3.1. Entropy Weight Method TOPSIS

3.1.1. Evaluation Indicators

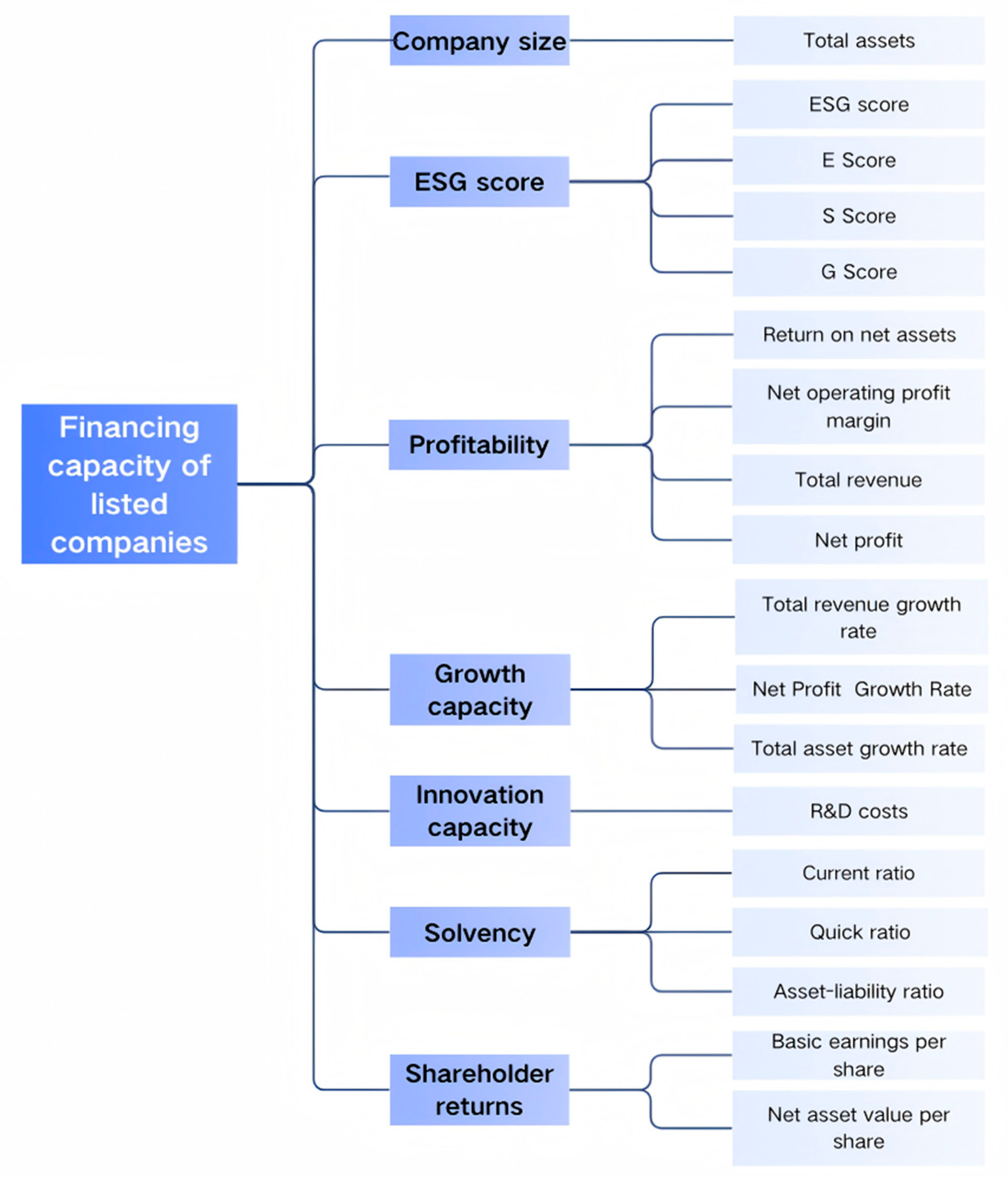

TOPSIS is a comprehensive evaluation model that utilizes the index data of the evaluation object for evaluation, and its core idea is that the optimal solution should be the closest to the ideal solution and at the same time the furthest away from the least ideal solution. Using TOPSIS to calculate the financing ability score of each listed company can avoid evaluation subjectivity. The factors affecting the financing ability of listed companies can be categorized into internal and external factors, and the internal factors are mainly considered when constructing the evaluation index system, and the principles of comprehensiveness, representativeness and relevance are followed [

41]. In this paper, the indicators are divided into six dimensions—ESG score, solvency, growth capacity, profitability, shareholder return, and company size—and, in addition, an innovation capability indicator is added for STAR Market and GEM companies [

42], and the specific breakdown indicators are shown in

Figure 1. Each indicator is an assessment variable, with 17 variables for the main board and 18 variables for the STAR Market and the GEM.

After establishing a comprehensive evaluation indicator system, relevant company data was collected from the CNRDS website. Since ST and ST* companies all have significant financial problems or other abnormal situations, these noise data will reduce the accuracy of BPNN. Furthermore, as can be seen from the indicator weight calculation process, the large number of outliers will result in unreasonable weight distribution. Financial companies lack data on liquidity ratios and other indicators. Therefore, after excluding ST companies, ST* companies, and financial companies, the remaining 4590 companies were used as the sample.

3.1.2. Data Normalization

According to the type of indicators, the collected indicators are positively normalized, and all the indicators are transformed into very large indicators, so that each indicator is positively correlated with the financing ability. The indicator system in this article only requires the treatment of the asset–liability ratio. Companies in all markets use this calculation method to treat the asset–liability ratio. The data for other indicators does not need to be normalized. The optimal asset–liability ratio range is defined as 0.4–0.6. The normalization calculation function is as follows:

In Equation (1), is the asset–liability ratio, [a, b] is the optimal interval, and is the normalized data.

3.1.3. Data Standardization

In order to eliminate the effect of dimensions between indicators, it is necessary to standardize the data after normalization and ensure that the processed data are non-negative to apply to BPNN and entropy weight method. The collected data are a matrix, named X; the standardization calculation function is as follows:

3.1.4. Entropy Weight Method for Initial Weight

When the score is initially calculated, the entropy weight method is used to assign weight to TOPSIS [

43]; the entropy weight method assigns weight with the characteristics of the data itself, and the basic principle is that when a set of data is less varied, the amount of information it reflects also decreases, and its corresponding weight should also be smaller. That is to say, for the indicators with more concentrated data, meaning that the standards of each company are not very different, for the comprehensive evaluation, the value of its reference is relatively small. The specific calculation steps are as follows:

First, the weight of the

ith sample under the

jth indicator is calculated and regarded as the probability used in the relative entropy calculation to obtain the probability matrix

P. Each element

in

P is calculated as follows:

After that, the information entropy of each indicator is calculated, and the information utility value is calculated and normalized to get the entropy weight of each indicator; the specific calculation steps are as follows:

Finally, the entropy weight method weights of each indicator are obtained by normalization.

3.1.5. TOPSIS Calculates the Initial Score for Financing Capacity

Find the optimal solution for each metric, i.e., the maximum value of each column of data [

44,

45,

46], denoted as

, to form the row vector.

where

represents the most desirable company for each indicator; similarly, the least desirable company for each indicator should be found, denoted as

, to form a vector.

Define the distance between the

ith (

i = 1, 2, …,

n) firm and the optimal solution, calculated as

Similarly, the gap between the

ith (

i = 1, 2, …,

n) firm and the worst solution is defined and calculated as

Thus, the initial scores of each company utilizing the entropy weight method are calculated:

Obviously, ∈(0,1), and the closer each enterprise score is to the ideal solution, the smaller is, the larger is, and thus the higher (composite score) is, and the stronger the enterprise’s ability to finance.

3.2. BP Neural Network

3.2.1. BPNN

The initial score for the financing ability of listed companies was derived in the previous section, considering that deep neural networks have powerful data feature learning abilities and the ability to analyze the laws between data [

47], of which BPNN’s fitting ability is extremely strong. This paper adopts the BPNN to mine the relationship between the initial financing ability score and various indicators, so as to assign the weights to TOPSIS again through linear operation of neuron weights. The BPNN consists of an input layer, hidden layer, and output layer; when the BPNN works, the input layer imports the data samples. The algorithm obtains the laws between the data through a series of mathematical calculations, and finally uses these laws to compute all the predicted data sets to obtain the prediction results. During the computation, the neural network propagates forward to obtain the weighted sum of each neuron and transmits the data on the neuron to the next layer of neurons through an activation function. The neurons in the output layer also apply the activation function to complete one forward propagation of the neural network, and calculate the error between the output value of the output layer and the actual output value, and adjust the model parameters according to the error loss function.

3.2.2. BPNN Construction

The model is trained using the Levenberg–Marquardt(L-M) algorithm, the Quantized Conjugate Gradient Algorithm, and the Bayesian regularization algorithm, and it is found that the model performance is optimal when trained with Bayesian regularization, which enables the network to better learn the laws in the data, and at the same time avoids overfitting to the noise in the training data, so as to more accurately predict the financing ability of enterprises in different cases, and to improve the prediction accuracy and reliability of the model.

The number of neurons affects the accuracy and performance of the model [

48]; this paper mainly uses the neural network for data analysis and data feature mining, so it adopts a wide neural network with only a single hidden layer and a large number of neurons. First of all, the number of neurons is initially quantified by the following formula [

49,

50]:

In Equation (10), represents the number of neurons in the hidden layer, I is the number of neurons in the input layer, and O is the number of neurons in the output layer, and it is found through the training experiments that the model accuracy is optimal when the hidden layer has 17 neurons for the main board companies and 24 neurons for GEM and STAR Market companies.

The learning rate determines the convergence speed of BPNN, which acts on the gradient descent process; i.e., a neuron weight update process that is too large or too small is not conducive to model convergence [

51]. According to the empirical value, the learning rate is selected as 0.01. The specific weight update formula is as follows:

In Equation (11), is the weights between neurons, η is the learning rate, and is the gradient of the loss function E with respect to the weights . By continuously updating the weights iteratively, the error function is gradually reduced and convergence is finally achieved.

The loss function has cross-entropy loss, mean square error, root mean square error, etc. [

52]. In this paper, BPNN is mainly used for data analysis, which can be regarded as a regression problem, and according to the applicable conditions, the mean square error is selected as the loss function [

53], which is calculated as follows:

In Equation (12), n is the number of samples, is the ith sample predicted value, and is the ith sample true value.

3.2.3. BPNN Weighting

The BPNN obtains the weights from the input-layer neurons to the hidden-layer neurons and from the hidden-layer neurons to the output-layer neurons, and the size of each neuron reflects the degree of its influence on the forward propagation of the whole model, while the output is the initial financing ability score; i.e., the larger the absolute value of the weights, the greater the degree of its influence on the financing ability. Therefore, the weights of the input-layer neurons to the hidden-layer neurons and the weights of the hidden-layer neurons to the output-layer neurons are linearly combined to derive the influence of each indicator on the financing ability, which can be normalized to assign weights to TOPSIS. The specific calculation process is as follows:

In Equation (13), denotes the size of the impact of the ith indicator on the initial financing ability score, n is the number of hidden-layer neurons, denotes the weight of the jth hidden-layer neuron to the output-layer neuron, and denotes the weight of the ith input-layer neuron to the jth hidden-layer neuron.

The weights assigned by BPNN for TOPSIS are obtained by normalizing the magnitude of the impact of each indicator on the initial financing capacity score. The calculation method is as follows:

3.3. Cooperative Game Theory Weight Combinations

After calculating the weights of TOPSIS indicators using BPNN and entropy weight method, respectively, it is found that there are certain differences in the results obtained by the two methods, so in order to avoid unreasonable weights that may be generated by a single weighting method, the two results are combined and the combined weights are used in the calculation of the final assessment results. Using cooperative game theory [

54,

55,

56] to combine the two weights makes the final weights come from the data itself, which is in line with the principle of objectivity in assessment. The optimization model is constructed to find the weight value that minimizes the difference between the final weight and the two weights. The calculation process is as follows:

Define the objective function of the optimization model:

In Equation (15), n is the total number of indicators, is the final weight of the ith indicator, is the weight obtained from the entropy weight method of the ith indicator, and is the weight obtained from the BPNN of the ith indicator.

Constraints: .

4. Results and Analysis

The data collected for each indicator of the 4590 companies in 2023 was used in the above model to calculate the financing capacity scores for each company. In addition, the BPNN performance, weighting results, and financing capacity scores of this model were analyzed.

4.1. Analysis of BPNN Algorithm Capability

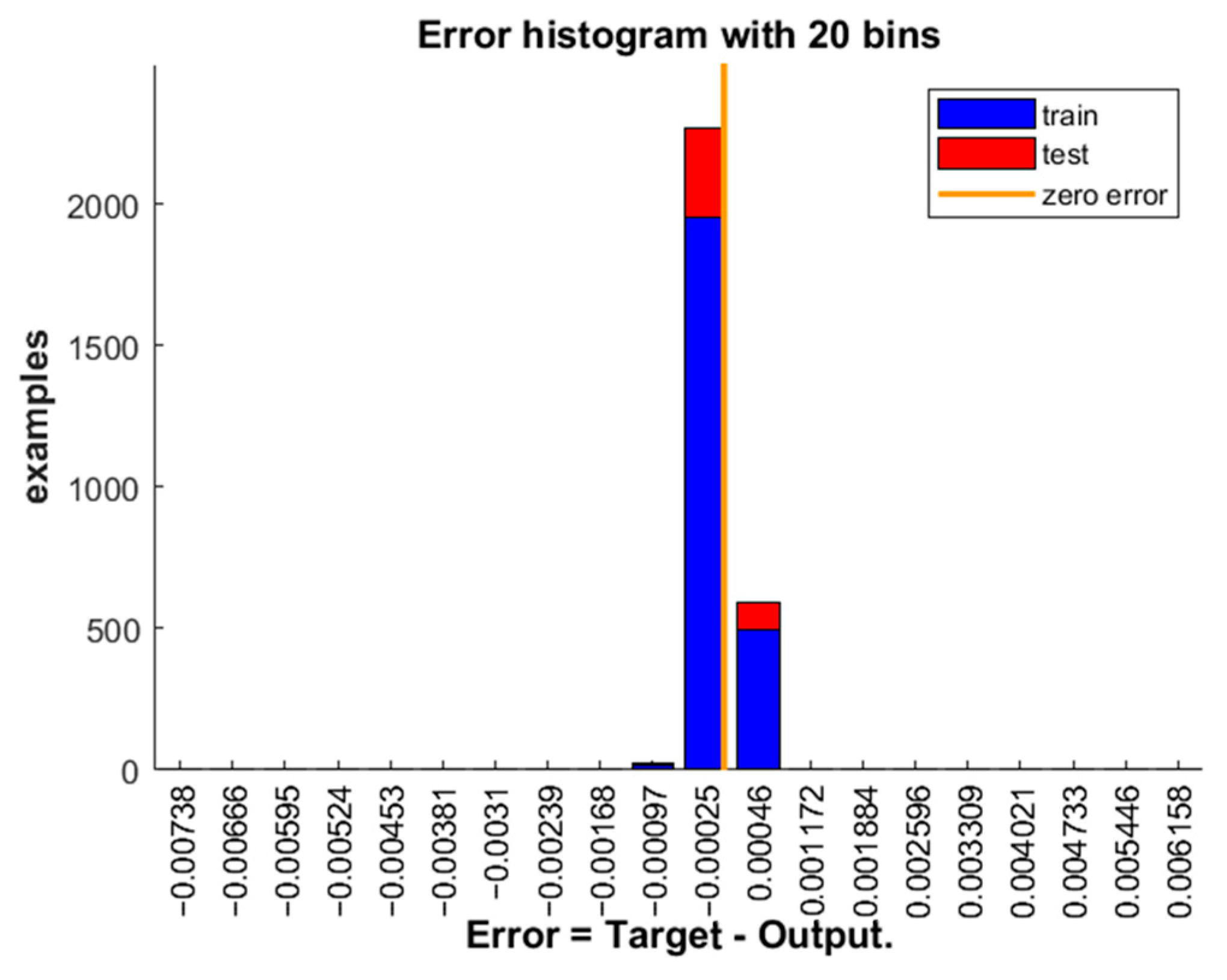

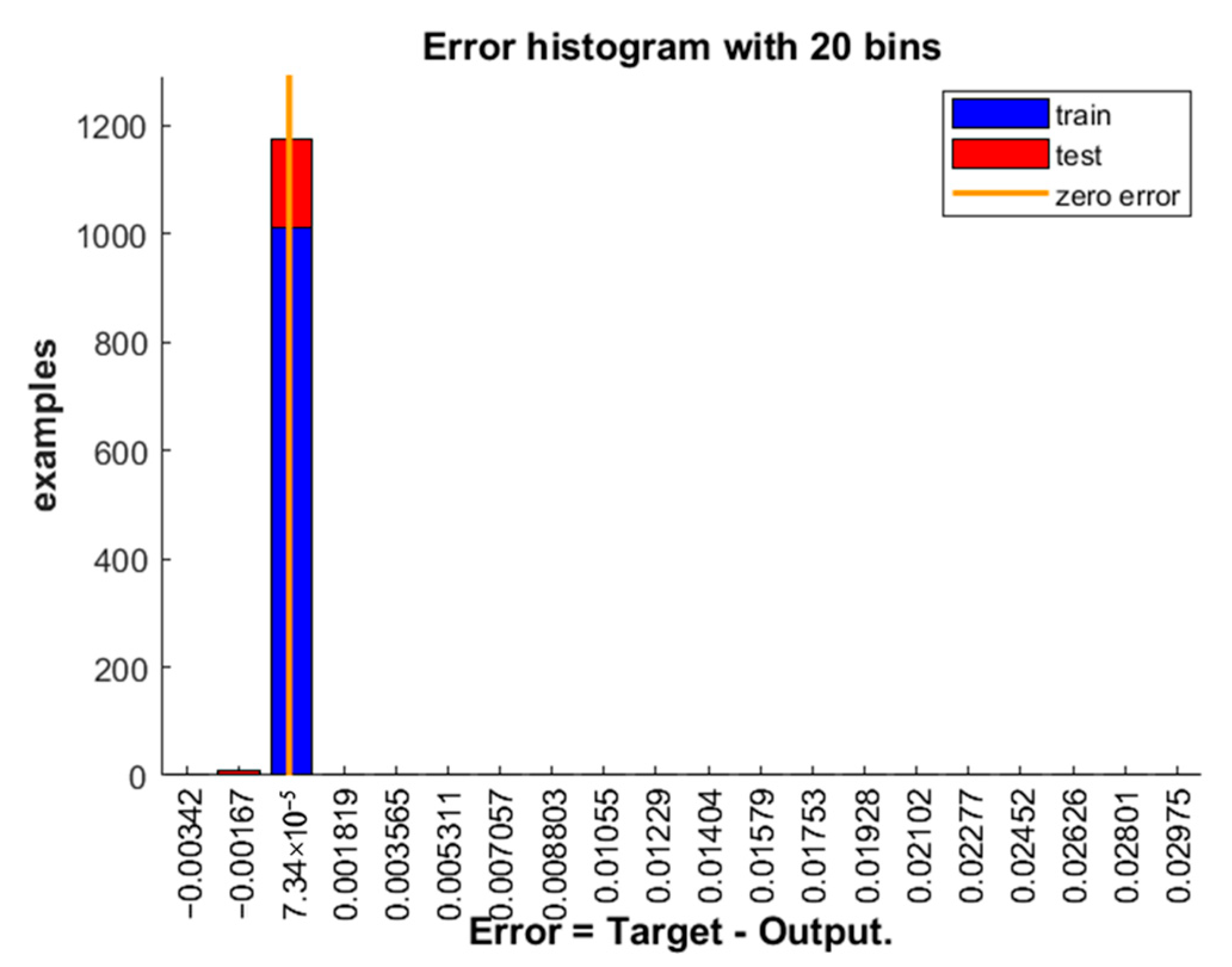

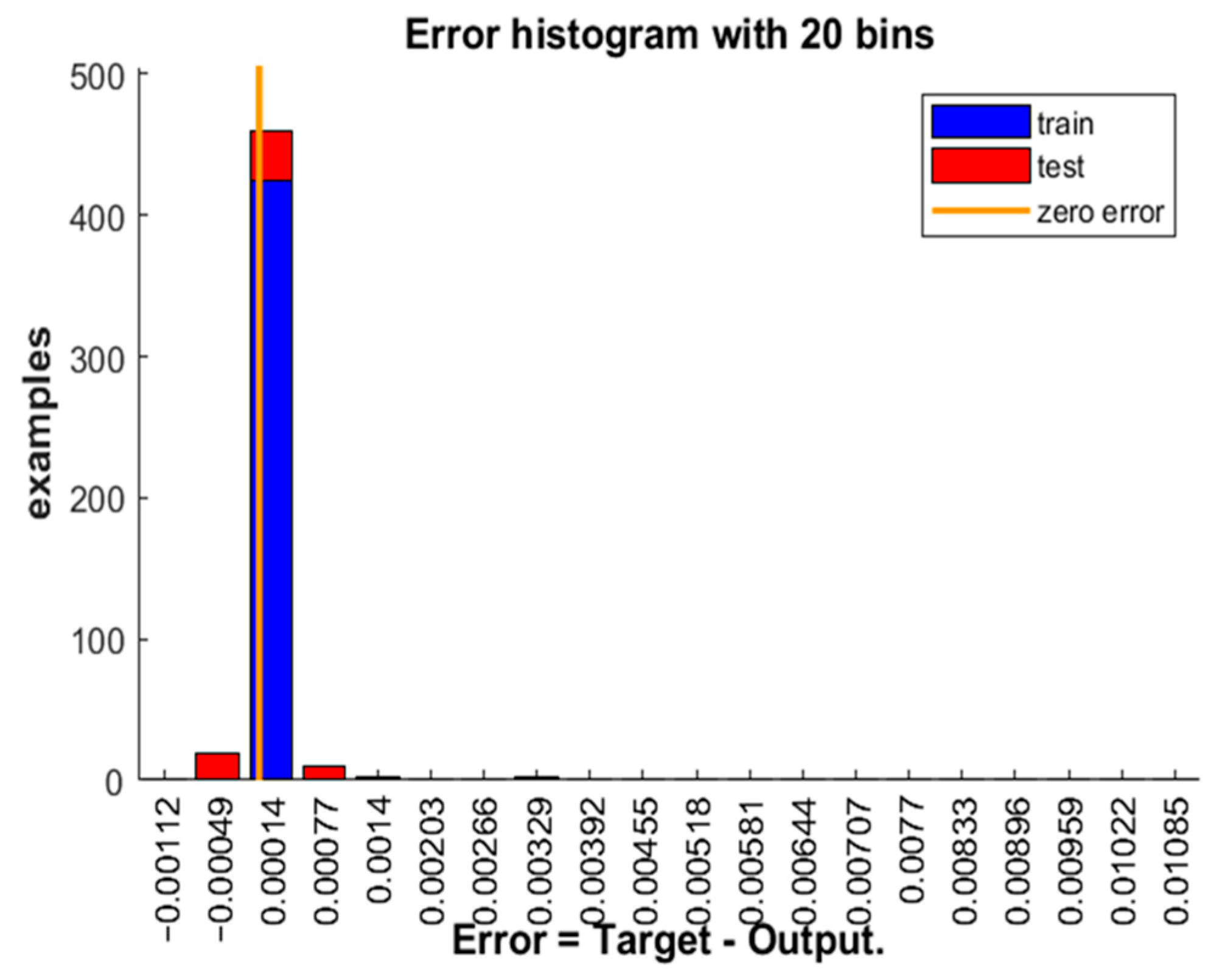

The processed data is divided into a training set and test set for BPNN training and the expected output of the algorithm is compared with the actual values to plot the error histogram with 20 bins. The results of the three panels are shown in

Figure 2,

Figure 3 and

Figure 4.

Figure 2,

Figure 3 and

Figure 4 show that after training with BPNN, the errors of the model are all less than 0.1%, and almost all the errors of the three boards are located in the range [−0.001,0.001]. Among them, the error of the GEM is the smallest, and a large number of samples can achieve zero error, which indicates that the model has very strong fitting ability to fully analyze the characteristics between the data, which can be seen by using the BPNN to give a high degree of credibility to the weights.

4.2. Analysis of Evaluation Indicator Shares

The final weights were calculated using the above weight method for the comprehensive assessment of the financing ability of listed companies.

Table 1,

Table 2 and

Table 3 show the distribution of the weights of each indicator for main board, GEM and STAR Market companies respectively.

By comparing the weights of the indicators in each table, it is found that the main board companies have entered the mature stage, the overall growth space is small, and it is difficult for the company structure to undergo a major change. The financing ability is mainly affected by the total assets and total operating income, and the main board companies should focus on improving their own scale, expanding their own output, increasing income, and then improving the financing ability. There is a certain commonality between GEM and STAR Market companies, most of which are science and innovation companies, and R&D expenses occupy a greater weight in the evaluation system, which shows that the innovation ability of these two types of companies has a greater impact on the financing ability. In addition, in the growth ability of STAR Market companies, total revenue growth rate occupies the largest weight, which shows that the revenue growth of STAR Market companies is of vital importance. If we combine the weights of the indicators of each segment, total revenue accounts for a larger proportion, so it can be seen that the profitability of each company is extremely important, and the ESG score also occupies a larger weight in the assessment, which is of great significance for the sustainable development of the company, and a good ESG score can rapidly enhance the financing ability of the company. Through the analysis, it can be seen that the listed companies should find the right positioning and appropriately improve their ability to reduce the difficulty of financing, which forms a relatively large proportion of weight.

In the process of selecting evaluation indicators, this study adopts a multi-level, segmented indicator pattern to construct an evaluation indicator system, similar to other evaluation models. However, in the calculation of specific evaluation results, this study fully utilizes indicator data to calculate the final financing capacity score, thereby avoiding subjectivity in the evaluation process. Additionally, through a comparison with the entropy weight method, it is revealed that relying solely on the entropy weight method to assign weights to each indicator has limitations in this study. For certain indicators with smaller data values, the inherent constraints of their smaller data values result in relatively small variability across the indicator data. Consequently, when assigning weights using information utility values, the weights assigned to these indicators become excessively small. This study employs BPNN to identify the marginal contributions of each indicator to financing capacity and combines the weights derived from BPNN with those from the entropy weight method using cooperative game theory. On the one hand, this establishes the dominant role of information entropy in the evaluation process; on the other hand, it addresses the shortcomings of the entropy weight method in this study by optimizing the weight allocation process. The comparison between the final weights and the entropy weight method weights is shown in

Table 4.

4.3. Analysis of Financing Capacity Score

Through calculation of the weight of each indicator in the constructed assessment system, after determining the final weights, they are reused in TOPSIS calculation to finally determine the scores of the financing ability of companies in each segment. The whole model takes into account the influence of emerging factors, which makes the assessment more comprehensive, and the weights are obtained from the data itself, which is in line with the principle of objectivity and accuracy of assessment. The scores of the top 12 and bottom 6 companies in each segment are summarized in

Table 5,

Table 6 and

Table 7.

The distribution of scores shows that the scores of main board companies are more dispersed, with more companies in both the high- and low-scoring segments, and large differences between companies. The differences between companies on the STAR Market are relatively small, and the same applies to the GEM, with most of the companies scoring centrally and individual companies having extremely strong or poor financing abilities, among which the GEM company CATL presents an extremely strong financing advantage and scores the highest. By comparing the operating conditions and board characteristics of each company, we analyze the reasons for presenting such score distribution. Main board: (1) A wide range of industries are involved and the company has a long lifespan. Companies with longer operating time and stable profitability are more likely to obtain financing, so the differentiation of operating time makes the financing ability of main board companies differ significantly. (2) All companies are more mature, with significant differences in business model and ESG performance, which in turn leads to the obvious differentiation of their financing ability. (3) The size of the company is the main factor affecting its financing ability, and the huge difference in the size of each company also makes its financing ability show obvious differentiation. (4) Traditional industries are subject to environmental protection, production capacity removal and other policy constraints, and some enterprises are restricted in financing, leading to the differentiation between high scores (those who succeed in transformation) and low scores (those who fail to meet the standards). GEM and STAR Market: (1) Mainly in emerging industries such as science and technology, new energy, biomedicine, etc., enterprises are mostly in the growth period, with similar business models (e.g., R&D-driven) and smaller differences in operation. (2) Benefiting from the national strategy of strengthening the country with science and technology, many innovative companies can obtain financing more easily. (3) Financing channels are similar (e.g., government subsidies, investors’ venture capital), which leads to a convergence in financing ability. CATL: (1) As an industry super leader, this holds the number-one global power battery market share (41% in 2024). (2) With differentiated operation, in the GEM, most of the companies are still highly R&D-driven with low-profit business, whereas CATL has achieved higher profits and opened many business channels. (3) Evaluation system key indicators are outstanding (such as R&D expenses, total revenue), which makes it far superior to other companies’ financing ability. (4) The new energy automobile industry chain has been listed as a national strategy and has received targeted support such as government subsidies and green bonds, while the main suppliers of its products are new energy automobile companies. Based on the above analysis, hypotheses H1, H2, and H3 of this paper have all been confirmed.

4.4. Robustness Test

4.4.1. Secondary Variable Exclusion Test

Based on the above model, an evaluation result is obtained. As to validate the evaluation result, secondary indicators are removed. The following example uses data from companies listed on the main board. Based on the weightings of the main board indicators, the total asset growth rate has the lowest weighting among all main board indicators. After removing it, the remaining 16 indicators are re-evaluated using the above model. A comparison with weight allocation of the original indicator system is shown in

Table 8. It can be seen that after removing the total asset growth rate, the weights of each remaining indicator are not significantly different from those before removal, indicating that the weighting results have good stability. Additionally, a correlation test was conducted between the financing capacity scores obtained after removing the indicators and the original scores. The Pearson correlation coefficient between the two was 0.998 (significant at the 0.01 level). On the one hand, removing secondary indicators has a relatively small impact on the weighting results of the remaining indicators. Most indicators show only minor changes in their values and rankings. On the other hand, removing secondary indicators has virtually no effect on the assessment results of financing capacity, and the two results have an extremely strong correlation. Therefore, this model demonstrates strong resistance to interference from secondary indicators, and the assessment system is relatively stable.

4.4.2. Sample Period Replacement Test

Using data from the 2023 annual reports of various companies, three hypotheses were tested, and relevant conclusions were drawn. To verify the robustness of the conclusions, data from the 2023 semi-annual reports of various companies was again used to train the aforementioned model, and the weights of each indicator were compared and analyzed. The results of the weight comparison are shown in

Table 9. As can be seen from

Table 9, although there are some differences between the weights of each indicator and the results trained using the 2023 annual reports, the overall results are still quite similar. First, by comparing the weights of each market, it can be observed that the weights of each indicator still reflect market characteristics, consistent with the results obtained from the 2023 annual reports, indicating that the conclusion regarding market characteristics is relatively reliable. Second, compared with other ESG indicators, the E indicator still holds a higher weight in the results trained using the 2023 semi-annual report. This indicates that among the various ESG indicators, environmental indicators have a greater impact on financing capabilities, and this conclusion is also relatively reliable. Finally, a comparison between the entropy weight method and the weighting method proposed in this study is conducted again. It is evident that the combination weighting method proposed in this study has a significant advantage in the weight allocation process. The weights obtained using the combination weighting method are more reasonable than those obtained using the entropy weight method, with no extremely small weight values appearing. This conclusion remains consistent with the findings from the 2023 annual report.

5. Discussion

Firstly, a comparison of the weighted results shows that the final weights are more reasonable than those allocated using the entropy weight method alone. For indicators with smaller extremes but a greater impact on financing capacity, the weighting method proposed in this study still assigns them relatively large weights, thereby validating Hypothesis 1. Secondly, an analysis of the weights assigned to indicators across different markets reveals that the E indicators are the indicators with the largest weights among all ESG indicators, thereby validating Hypothesis 2. Finally, by comparing the weights of the indicators across the three markets, it can be observed that there are significant differences in the weights of the indicators across the markets. Among them, the differences between the main board and the other two markets are the most pronounced, while the STAR Market and the Growth Enterprise Market exhibit both similarities and differences. Hypothesis 3 is thus validated.

6. Conclusions

6.1. Research Conclusions

This paper focuses on the financing ability of listed companies. In recent years, ESG performance has had a certain impact on the sustainable development of a company and the investment decision of investors, so it is included and combined with other indicators to build a new assessment system for the financing ability of listed companies. Using listed companies in Shanghai and Shenzhen as the empirical objects, the initial weights are calculated using the entropy weight method after data processing, and the initial financing ability score is calculated. The initial score is used as the output of BPNN, and the linear combination of neuron weights yields the BPNN weights. The results show that the error can be reduced to less than 0.1% by using BPNN, which shows that this BPNN has excellent performance and can fully analyze the relationship between input and output. The two weights are combined by using cooperative game theory, and a score for the financing ability of listed companies is obtained by using TOPSIS calculation again. The assessment results focus on the financial and ESG scores and other data of each company, which can completely avoid subjectivity in evaluating or calculating scores compared with methods such as AHP. The single use of the entropy weight method may lead to small differences in the final weight or the important indicators being too small. Due to noise data, the single use of BPNN weighting may make the final weight distribution not reasonable enough; i.e., the indicators where the noise data exist are assigned too many weights. The use of cooperative game theory combine the results of the two, which can weaken the possible adverse effects of the two weight calculation methods. Therefore, this model is more suitable for solving the problem of assessing the financing ability of listed companies.

The final assessment results also further reveal the differences in the impact of the financing ability of companies in each segment, as well as the specific financing ability scores of each company. ESG scores account for a significant weight in the factors influencing the financing capabilities of companies across all boards, further validating the conclusion that ESG performance impacts a company’s financing capabilities. Additionally, E scores carry relatively high weights, particularly in the STAR Market, where E scores have the highest weight among the three ESG factors. This further underscores the close relationship between a company’s environmental performance and its financing capabilities.

6.2. Policy Recommendations

- (1)

For financial institutions, a segmented credit pricing model can be developed based on the research approach outlined in this article, incorporating ESG indicators into performance evaluations and linking financing costs to ESG performance. This will encourage companies to focus on their own sustainable development capabilities during their growth process and improve their ESG scores.

- (2)

For stock exchanges, the ESG performance of companies that are about to go public can be assessed to evaluate their sustainable development capabilities. Companies with strong sustainable development capabilities can be granted a fast-track listing process, thereby promoting sustainable development among non-listed companies.

- (3)

For regulatory authorities, minimum requirements for ESG performance can be established for listed companies, particularly regarding environmental performance. As demonstrated by the assessment model trained using 2023 data in this article, environmental indicators hold significant weight in various indicators of sustainable development capacity in various markets. By setting minimum thresholds for ESG performance, companies can be gradually encouraged to enhance their sustainability capabilities.

6.3. Limitations and Future Directions

6.3.1. Limitations

- (1)

The article employs models such as BPNN and TOPSIS for evaluation, yet the interpretability of its empirical analysis falls short of traditional regression analysis models. Furthermore, the evaluation model established in the paper never utilizes regression analysis during the empirical process, rendering robustness tests for regression analysis inapplicable. Consequently, the paper contains relatively few robustness tests.

- (2)

The study did not include companies listed on the Beijing Stock Exchange (BSE), thus failing to establish an evaluation system for the BSE, resulting in limited applicability.

- (3)

The indicators for sustainable development capability are not sufficiently detailed, with only ESG-related performance indicators selected for evaluating listed companies’ financing capability.

6.3.2. Future Directions

- (1)

Further refine the sustainable development capability indicators by introducing metrics such as carbon emissions that are related to sustainability to improve the assessment model.

- (2)

Conduct research on the characteristics of companies listed on the Beijing Stock Exchange and develop an assessment model tailored to their financing capabilities.

- (3)

Under this evaluation mechanism, the article lays the groundwork for using regression analysis to further explore the nuanced relationships between listed companies’ financing capabilities and various assessment indicators.